Investment Company Business Plan Template

Written by Dave Lavinsky

Investment Company Business Plan

You’ve come to the right place to create your Investment Company business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Investment Companies.

Below is a template to help you create each section of your Investment Company business plan.

Executive Summary

Business overview.

NovaGrowth Investments is a startup investment company located in Aurora, Colorado. The company is founded by Thom Anderson, an investment broker from Colorado Springs, Colorado, who has amassed millions of dollars for his clients over ten years while working at Clear River Investments. Because Thom has gained an extensive following of clients who have already indicated they will follow him to his new investment company, he has made the initial steps into forming NovaGrowth Investments. Thom plans on recruiting a team of highly-qualified professionals to help manage the day-to-day operations of a premier investment company in every aspect of marketing and advising in the land acquisition investment company.

NovaGrowth Investments will provide a wide array of services for investors, in particular those related to the optimal attention and time needed to secure valuable investments on their behalf. Investors can feel confident and secure, knowing that Thom and his team are looking out for their interests in every aspect of the land acquisition process. What’s more, NovaGrowth offers customized guarantees of investment performance that are singular within the investment company industry.

Product Offering

The following are the services that NovaGrowth Investments will provide:

- Analysis and expansive vetting of land acquisition opportunities up to 5M acres

- Extensive market research that secures in-depth findings

- Consistent and competitive returns while managing risk effectively

- Full spectrum wealth management

- Comprehensive array of software tools/programs to capture critical intelligence

- Unique strategies tailored for each individual client

- “New investor” welcome package with goal-setting seminar included

- “Boots on the Ground” team of investment analysts who visit each location under consideration and offer a full report plus video capture of the land

- Oversight and management of each portfolio and customized suggestions

Customer Focus

NovaGrowth Investments will target individual investors. They will also target corporate investors who are seeking land acquisitions. They will target fast-growing companies known to be seeking additional tracts of land. NovaGrowth Investments will target industry partners (cattle ranchers, horse breeders, etc) that could benefit from land acquisition as an investment.

Management Team

NovaGrowth Investments will be owned and operated by Thom Anderson. He recruited Jackson Byers and Kylie Carlson to manage the day-to-day operations of the investment company and oversee human resources.

Thom Anderson is a graduate of Cambridge University in the U.K., where he graduated with an International Business bachelor’s degree. He spent five years in the U.K. sourcing land for a large investment firm as an entry-level investment advisor.

Upon his return to the U.S.,Thom obtained his investment broker’s license and was employed by Clear River Investments in Colorado Springs, Colorado. Within one year, Thom secured over 5M in investments for his clients and, within five years, he amassed over 25M in land acquisition investments on behalf of his clients.

Jackson Byers is a graduate of the University of Illinois, where he graduated with a master’s degree in Accounting. His former role at Clear River Investments was as the Associate Accountant, where he managed the normal business accounting processes for the firm. He will serve as the Staff Accountant in the startup company and will assist in overseeing the day-to-day operations of the firm.

Kylie Carlson was hired by Thom Anderson as his Assistant and worked for him at Clear River Investments for over ten years. Her new role will be the Human Resources Manager, overseeing personnel and the processes that are regulated and required by Colorado.

Success Factors

NovaGrowth Investments will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of NovaGrowth Investments

- “Boots on the Ground” team of investment analysts who visit each location under consideration and offer a full report plus video capture of the land.

- NovaGrowth Investments offers outstanding value for each client in both their management fees and land acquisition percentages. Their pricing denotes quality and value and their results continually substantiate it.

Financial Highlights

NovaGrowth Investments is seeking $200,000 in debt financing to launch its NovaGrowth Investments. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

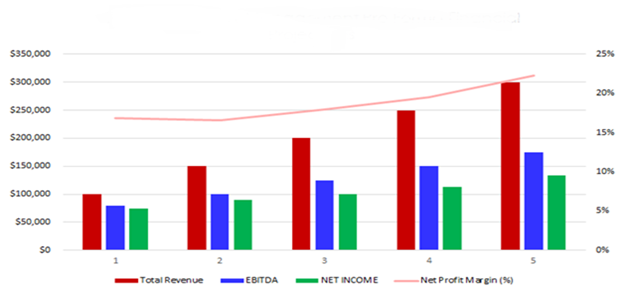

The following graph outlines the financial projections for NovaGrowth Investments.

Company Overview

Who is novagrowth investments.

NovaGrowth Investments is a newly established, full-service investment company in Aurora, Colorado. NovaGrowth Investments will be the most reliable, effective and value-driven choice for private and commercial investors in Aurora and the surrounding communities. NovaGrowth Investments will provide a comprehensive menu of portfolio and land acquisition services for any potential investor to utilize. Their full-service approach includes a comprehensive seminar and helpful introductory information for first-time investors.

NovaGrowth Investments will be able to manage the investments and acquire new investments for their clients. The team of professionals are highly qualified and experienced in investment brokerage and land acquisitions. NovaGrowth Investments removes all headaches and issues of trying to locate safe and secure investments and ensures all issues are taken care of expeditiously while delivering the best customer service.

NovaGrowth Investments History

Thom Anderson is a graduate of Cambridge University in the U.K., where he graduated with an International Business bachelor’s degree. He spent five years in the U.K. sourcing land for a large investment firm as an entry-level investment advisor. Upon his return to the U.S.,Thom obtained his investment broker’s license and was employed by Clear River Investments in Colorado Springs, Colorado. Within one year, Thom secured over 5M in investments for his clients and, within five years, he amassed over 25M in land acquisition investments on behalf of his clients.

Since incorporation, NovaGrowth Investments has achieved the following milestones:

- Registered NovaGrowth Investments, LLC to transact business in the state of Colorado.

- Has a contract in place for a 10,000 square foot office at one of the midtown buildings

- Reached out to numerous contacts to sign on with NovaGrowth Investments.

- Began recruiting a staff of seven and four office personnel to work at NovaGrowth Investments

NovaGrowth Investments Services

The following will be the services NovaGrowth Investments will provide:

Industry Analysis

The investment company industry is expected to grow over the next five years to over $1.3 trillion. The growth will be driven by ongoing vast opportunities for individuals and organizations seeking to grow their wealth The growth will be driven by new technology that navigating the complexities of the financial markets The growth will be driven by an increase in the interest of individuals in “making their own way” in the world The growth will be driven by the stability of land ownership as an on-going and important element in investment portfolios.

Costs will likely be reduced as technology continues to advance, allowing better-informed acquisition interest and supplemental risk mitigation Costs will likely be reduced as younger investors, such as Gen Z and millennials, continue to express an interest and desire for land acquisition investments, which indicates an increased number of sellers will enter the market due to favorable conditions.

Customer Analysis

Demographic profile of target market.

NovaGrowth Investments will target those potential individual investors in Aurora, Colorado. They will target businesses with a track record of land investments or a need for land due to company growth. NovaGrowth Investments will target industry partners (cattle ranchers, horse breeders, etc) that could benefit from land acquisition as an investment.

Customer Segmentation

NovaGrowth Investments will primarily target the following customer profiles:

- Individual investors

- Businesses with a record of land investments or those seeking land due to internal growth

- Industry partners seeking additional land for livestock or farming purposes

Competitive Analysis

Direct and indirect competitors.

NovaGrowth Investments will face competition from other companies with similar business profiles. A description of each competitor company is below.

CapitalMax Advisors

CapitalMax Advisors is a startup investment company in Colorado Springs, Colorado. The owner, Barry Jackson, is a graduate of Purdue University and has been an investment advisor for over ten years. He recently launched Capital Max Advisors to meet what he coined, “The Great Asset Allocation” investment opportunities within the city of Colorado Springs. Barry has hired ten associates from his former employer’s company to seek investors who are primarily interested in asset allocation investments and the company is promising reduced portfolio management rates for the first six months of business.

CapitalMax Advisors is a full-service investment company with a strong following of investors who were delighted by Barry’s performance on their behalf at his former employer. The expectation is that CapitalMax Advisors will live up to their primary purpose, which is to oversee and direct asset allocation to maximize returns in substantial numbers.

WealthWise Investments

Owned by Tamara and Loren Downs, WealthWise Investments is known for it’s assertive actions on behalf of clients. The company was founded in 2010 and currently offers a diverse range of investment products and services. They specialize in ETFs, mutual funds, and alternative investments. WealthWise Investments is known for its expertise in risk management, technology-driven investment strategies, and statewide reach beyond it’s home city of Colorado Springs.

WealthWise Investments offers excellent services to clients; however, clients have noted publicly that the fees and service charges are high in tandem with the asset allocation gains. There have been two complaints noted with the state regulatory agencies. Meanwhile, Tamara and Loren Downs continue to employ efforts to bring technology-driven tools into the investment company that will trim staff and distribute higher rates on behalf of investors.

FinTech Capital Management

FinTech Capital Management is a five-year-old company located in Denver, Colorado. The focus of the company is on financial technology investments on behalf of their client investors. Currently, the company has recorded stable and growing levels of profitability and has been tagged as an investment management firm known for its expertise in mutual funds and retirement planning They offer a sizable range of investment strategies, including equity, fixed income, and asset allocation funds. They are tech-driven and focus on research-driven investment decisions to fulfill the goals of their clients in long-term wealth creation.

In addition to tech acquisitions, FinTech Capital Management is also directed toward senior investors, with brokerage, retirement planning, wealth management, and mutual funds in their services offered. They provide a range of investment options, from individual stocks and bonds to managed portfolios and retirement accounts, many of which are perfect for those investors who have amassed a sizable portfolio, but are becoming risk-averse as they age. FinTech Capital Management is owned by The Thurgood Family Trust with the Thurgood brothers, Jonathan and Regis, responsible for day-to-day management. It has been recently suggested that the firm may be sold if the right buyers were to approach.

Competitive Advantage

NovaGrowth Investments will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

NovaGrowth Investments will offer the unique value proposition to its clientele:

- Unique investment strategies tailored for each individual client

Promotions Strategy

The promotions strategy for NovaGrowth Investments is as follows:

Word of Mouth/Referrals

Thom Anderson has built up an extensive list of contacts over the years by providing exceptional service and expertise to former clients and potential investors. The contacts and clients will follow him to his new company and help spread the word of NovaGrowth Investments.

Professional Associations and Networking

The executives within NovaGrowth Investments will begin networking in professional associations and at events within the city-wide industry groups. This will bring the new startup into focus for other companies, providing a path to increased clients and strategic partnerships within the city.

Social Media Marketing

NovaGrowth Investments will target their primary and secondary audiences with a series of text announcements via social media. The announcements will be invitations to the opening of the company, with a champagne reception and information regarding the services available at NovaGrowth Investments. The social media announcements will continue for the three weeks prior to the launch of the company.

Website/SEO Marketing

NovaGrowth Investments will fully utilize their website. The website will be well organized, informative, and list the services that NovaGrowth Investments provides. The website will also list their contact information and biographies of the executive group. The website will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “Investment company” or “Investment opportunities near me,” NovaGrowth Investments will be listed at the top of the search results.

The pricing of NovaGrowth Investments will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for NovaGrowth Investments. Operation Functions:

- Thom Anderson will be the owner and President of the company. He will oversee all staff and manage client relations. Thom has spent the past year recruiting the following staff:

- Jackson Byers will provide all client accounting, tax payments and monthly financial reporting. His title will be Staff Accountant.

- Kylie Carlson will provide all employee onboarding and oversight as she assumes the role of Human Resources Manager.

Milestones:

NovaGrowth Investments will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for NovaGrowth Investments

- 6/1/202X – Finalize contracts for NovaGrowth Investments clients

- 6/15/202X – Begin networking at industry events

- 6/22/202X – Begin moving into NovaGrowth Investments office

- 7/1/202X – NovaGrowth Investments opens its doors for business

Financial Plan

Key revenue & costs.

The revenue drivers for NovaGrowth Investments are the fees they will charge to clients for their investment acquisition and portfolio management services.

The cost drivers will be the overhead costs required in order to staff NovaGrowth Investments. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

NovaGrowth Investments is seeking $200,000 in debt financing to launch its investment company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Clients Per Month: 175

- Average Revenue per Month: $437,500

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, investment company business plan faqs, what is an investment company business plan.

An investment company business plan is a plan to start and/or grow your investment company business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Investment Company business plan using our Investment Company Business Plan Template here .

What are the Main Types of Investment Company Businesses?

There are a number of different kinds of investment company businesses , some examples include: Closed-End Funds Investment Company, Mutual Funds (Open-End Funds) Investment Company, and Unit Investment Trusts (UITs) Investment Company.

How Do You Get Funding for Your Investment Company Business Plan?

Investment Company businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Investment Company Business?

Starting an investment company business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Investment Company Business Plan - The first step in starting a business is to create a detailed investment company business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your investment company business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your investment company business is in compliance with local laws.

3. Register Your Investment Company Business - Once you have chosen a legal structure, the next step is to register your investment company business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your investment company business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Investment Company Equipment & Supplies - In order to start your investment company business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your investment company business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful investment company business:

- How to Start an Investment Company

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Business Plan for an Investment Company

DEC.20, 2022

1. Investment company Business Plan For Starting Your Own Business

The sample business plan for an investment company outlines the creation of an investment company. The company’s mission is to provide clients with access to a wide range of investment opportunities, including stocks, bonds, mutual funds, and alternative investments. The company will also provide financial planning and wealth management services, including portfolio design, asset allocation, and risk management strategies.

The Investment Company’s business plan includes strategies for marketing and advertising, financial projections, and a detailed description of the company’s services and fees. This is the business Plan for Investors who want to invest in a company with a significant probability of success.

2. Sources Of Financing For Investment Firms

In writing a business plan for an investment company, the sources of financing for investment firms typically include private investors, venture capital firms, angel investors, crowdfunding, and debt capital. Private investors are individuals or groups who invest in the company in exchange for equity or a portion of the profits. Venture capital firms provide financing and advice to companies in exchange for equity. Angel investors are wealthy individuals or groups who invest in companies in exchange for equity. Crowdfunding involves the collection of small amounts of money from a large group of people. Debt capital is a loan secured by the company’s assets and must be repaid with interest.

The most common sources of financing for investment firms are debt financing, equity financing, and derivatives. Debt financing involves loans from banks, other lending institutions, or private investors. Equity financing involves the issuance of stock to raise capital. Derivatives are contracts between two parties that derive their value from an underlying asset or benchmark.

The most important source of financing for an investment company in the business plan investment company is the capital that the company brings in from its own operations.

3. Executive Summary Of Investment Company Business Plan

The business.

The new investment company business plan for an Investment Company is designed to provide an overview of our company’s mission and objectives. We are a full-service investment firm that specializes in providing comprehensive financial advice and services to individuals, families, and business owners. We aim to maximize investment returns and increase our clients’ net worth.

We plan to provide a wide range of services, including portfolio management, asset allocation, retirement planning, estate planning, tax planning, and general financial planning.

Management Of Investment Company

The investment company business plan outlines the management team of experienced financial and legal professionals committed to providing the highest quality of investment management services. Our goal is to create a fully integrated, world-class investment company that provides our clients with a range of innovative and tailored investment solutions.

Customers Of Investment Company

In the investment company business plan template, the customers of our investment company will be individuals, small businesses, and institutions that are looking for a trusted financial partner to help them manage and grow their wealth. We will offer our clients a wide range of services, including portfolio management, retirement planning, estate planning, tax planning, and philanthropic planning. Our goal is to provide our clients with the best advice, products, and services to help them meet their financial goals.

Business Target

The business target for our investment company is to create long-term capital appreciation and wealth for our investors by making prudent investments in start-up and established businesses. Our goal is to be a reliable and trusted partner for our investors and maximize their investment return.

4. Investment Company Summary

Company owner.

Our investment company, JS Investment Group, is owned and operated by John Smith. John Smith is a highly experienced investor and entrepreneur who has successfully founded and managed several small investment company business plans. He deeply understands the investment industry and is passionate about helping others achieve success through strategic investments.

Why The Investment Company Is Being Started

The primary reason for starting an investment company in an investment company business plan sample is to provide clients with a safe and secure place to invest their money. With a wide range of investment options available, our team of experienced financial professionals can help clients make informed decisions about their investments. We also plan to provide clients with up-to-date market analysis and research.

How The Investment Company Will Be Started

The company will seek to raise capital through debt and equity financing. Equity financing will come from the founders and outside investors. The company will also seek to raise capital through debt financing, which will be used to fund the startup costs and ongoing operations of the company. In the business plan for the investment holding company, the company will focus on providing quality investment advice and services to its clients.

The Investment company owner John Smith estimates startup costs based on assets, investments, loans, and expenses in collaboration with financial experts.

JS Investment Group’s start-up requirements include total startup expenses, total assets, total start-up funding, total funding requirements, total assets, total liabilities, total planned investment, total capital, total liabilities, and total funding.

5. Services of Investment Company

The product description section in a business plan for an investment banking company includes services. However, below are the all services offered by our investment company include:

- Investment Advisory: Providing tailored advice and strategies to meet individual, business, and corporate clients’ investment goals.

- Investment Management: The business plan for an investment banking company provides services of designing, constructing, and managing bespoke portfolios for clients, as well as providing ongoing monitoring and rebalancing services.

- Mutual Fund Management: The business plan for an investment management company offers selecting and monitoring mutual funds for clients, as well as providing risk management and portfolio diversification services.

- Estate Planning: Developing strategies for both tax and non-tax-related estate planning objectives.

- Retirement Planning: Assisting clients with the creation of retirement plans and investments to meet their retirement income needs.

- Financial Planning: Helping clients to prepare for their financial future by creating strategies that integrate their investment, tax, insurance, and estate planning goals.

- Risk Management: Identifying and managing investment risks to help clients reach their financial goals.

- Portfolio Analysis: Examining and evaluating portfolios to ensure they are in line with the client’s investment objectives.

- Tax Planning: Developing strategies to minimize the client’s tax liability and maximize after-tax returns.

- Asset Allocation: Designing and implementing asset allocation strategies to help clients meet their long-term financial goals.

6. Marketing Analysis

A marketing analysis is an important part of a sample business plan for an investment company. This analysis provides information on the market in which the company operates, including the size and growth of the market, the competition, and potential growth opportunities.

The investment company market is highly competitive, as investors have a wide range of options when it comes to deciding where to invest their money.

The company will face competition from both traditional and online investment companies. Traditional investment companies offer services such as portfolio management and financial planning. Online investment companies offer services such as stock trading and portfolio management.

In addition to traditional investment companies, investors can choose from online brokers, mutual funds, and other alternative investments. As a result, it is important for an investment company to differentiate itself from the competition and to create a strong value proposition for its customers.

The investment industry is expected to continue to grow as people become more aware of the need for financial planning and the importance of investing.

Market Trends

Excellent work.

excellent work, competent advice. Alex is very friendly, great communication. 100% I recommend CGS capital. Thank you so much for your hard work!

In order to compete effectively in the investment company market, it is important to understand the current market trends and identify areas of opportunity.

In the investment company business plan example, one of the most important trends to consider is the shift towards more technology-driven investment strategies. This trend is driven by advancements in technology and increased access to data, which has enabled more sophisticated portfolio management techniques.

Additionally, many investors are increasingly looking to alternative investments such as cryptocurrency, venture capital, and private equity as a way of diversifying their portfolios. Furthermore, an increasing number of investors are turning to online trading platforms as a way of managing their investments. Finally, it is important to consider the potential impact of environmental, social, and governance (ESG) investing on the industry, as ESG-focused investments are gaining traction in the financial markets.

Marketing Segmentation

In the private investment company business plan, the company will target a wide range of potential customers, including individual investors, high-net-worth individuals, family offices, and institutional investors. Each of these customer segments will require different strategies and services, so the company will tailor its marketing and services accordingly.

For individual investors, the company will focus on providing personalized services that are tailored to the specific needs and investment goals of each client. The company will also provide educational resources and tools to help clients make informed decisions about their investments.

For high-net-worth individuals, the company will focus on providing personalized portfolio construction and asset management services.

We plan to target high-net-worth, individuals and institutional clients who are looking for a more personalized approach to investing. We will use a combination of traditional and alternative investment strategies to provide our clients with the best return on their investments. We plan to use our extensive network of banks and other financial institutions to secure the most attractive terms for our clients.

We have identified three key areas of focus when it comes to our business plan. First, we plan to build a strong customer base by offering superior customer service and customer education. Second, we plan to develop our own proprietary financial products and services to offer our clients. Finally, we plan to focus on developing relationships with banks and other financial institutions to ensure that we can offer the best terms for our clients.

Product Pricing

JS Investment Group will use a combination of fixed fees and performance-based fees for our services. For our portfolio management and asset allocation services, we will charge a flat fee of 1% of the total assets under management. For our investment research and risk management services, we will charge a fixed fee of $250 per hour.

For our performance-based fees, we will charge a 20% fee on any profits earned by our clients. This fee will be applied on a quarterly basis and will be calculated based on the performance of the portfolio during that period.

7. Marketing Strategy Of Investment Company

Competitive analysis, eb5 business plan.

The business plan for an investment company covers the company analysis in which the company’s competitive landscape is large and diverse. There are a number of large and well-established firms that have been in the industry for many years. Additionally, there is a large number of small, independent firms that have emerged in recent years.

Sales Strategy

Our sales strategy is to target potential customers through a variety of outlets, including direct mail, email marketing, social media campaigns, and online advertising. We will focus our efforts on targeting potential customers who are likely to be interested in our services, such as high-net-worth individuals, small business owners, and those with an interest in investing. We will also work to build relationships with local financial advisors and other industry professionals in order to develop a strong referral network.

Sales Monthly

The company’s primary source of revenue will be from the sales of investment products, with a focus on monthly sales. The company will also offer financial advice and portfolio management services, for which it will charge a fee. Experts predict the following sales each month for our company.

Sales Yearly

The JS Investment Group will generate revenue by selling various services. Experts predict the following sales yearly for our company.

Sales Forecast

Our sales forecast for the next three years predicts a steady increase in revenue. Below is a forecast of sales for our company:

8. Personnel Plan Of Investment Company

Company staff.

The Company Staff will be responsible for the overall management and operation of the investment company. They will be responsible for recruiting and managing a team of qualified and experienced professionals to ensure the success of the business. The JS Investment Group operations will require the following employees:

The management staff includes:

- Marketing Manager

- Operation Manager

- Investment Manager

The operational team includes:

- Front Desk Coordinator

- Investment Advisor

- Security Guards

Other Staff includes:

- Administrative Assistant

- Tax Planner

- Receptionist

Average Salary of Employees

The investment holding company business plan includes the average salary of employees, which varies according to the role of employees and services. We will offer competitive salaries to all our employees to ensure we attract and retain the best talent. The average salary of our employees will be approximately $40,000 per year.

9. Financial Plan For Investment Company

In collaboration with financial experts, John Smith assessed the company’s financial needs and developed a financial plan for sample of investment company business plan. A three-year financial plan outlines the company’s development.

Important Assumptions

The following are important assumptions for the financial plan of the investment company:

Deviations, however, are expected to be limited to levels that do not impact the investment company’s major financial goals.

Brake-even Analysis

The following is a breakdown of the investment company’s fixed and variable costs:

The following table shows an analysis of monthly break-evens of an investment company

Projected Profit and Loss

The following is the projected profit and loss for an investment company.

Profit Monthly

Profit Yearly

Gross Margin Monthly

Gross Margin Yearly

Projected Cash Flow

The following column diagram shows cash flow projections.

The following table shows the pro forma cash flow of an private equity firm business plan . The cash flow statement includes cash received from operations, cash received from operations, and general assumptions.

Projected Balance Sheet

Below is a projected balance sheet of an investment holding Company Business Plan that shows data about the pro forma balance sheet, total current assets, total long-term assets, total assets, current subtotal liabilities, total liabilities, total capital, and total liabilities.

Business Ratios

The following table shows business ratios, ratio analysis, and total assets.

10. Get the Expertise to Create a Winning Business Plan!

“Start Your Investment Company with Professional Assistance: Get the Support of OGS Capital’s Expert Team!”

At OGS Capital, our experienced consultants provide professional assistance to help you start and grow your investment company. Our team has in-depth knowledge and expertise in launching businesses, and we understand the complexities of the investment industry. We can provide expert advice and guidance to help you create and execute a custom sample business plan for investment holding company that will ensure your investment company’s success.

We can help you with the entire process of developing your business, from crafting a comprehensive financial plan to finding appropriate funding sources. With our knowledge and resources, we can help you create a detailed business plan that will serve as a roadmap for your business.

- What is the main business of an investment company? The main business of an investment company is to manage investments and provide financial advice and solutions to their clients. They may provide services such as portfolio management, asset allocation, retirement planning and financial planning. They may also offer a variety of other services such as stock and bond trading, insurance, estate planning and tax planning.

- Can I create my own investment company? Yes, you can create your own investment company. The process involves registering the company with the SEC, registering with the state in which you will be doing business, setting up the necessary accounts and paperwork, and finding clients. You should also consult a qualified accountant, lawyer, and financial adviser to ensure you have all the appropriate information and documents in place.

- How much does it cost to start an investment firm? The cost of starting an investment firm will vary depending on the type of firm you are looking to establish and the services you plan to provide. Typically, startup costs can range from $5,000 to $50,000, depending on the complexity of the business. Costs may include office equipment, legal and accounting fees, licensing fees, technology costs, marketing costs, and other miscellaneous costs.

Download Investment Company Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

How to Write a Successful Investment Company Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for investment businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every investment company business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is an Investment Company Business Plan?

An investment business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Investment Company Business Plan?

An investment business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Investment Company Business Plan

The following are the key components of a successful investment company business plan:

Executive Summary

The executive summary of an investment company business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your investment company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your investment business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your investment firm, mention this.

You will also include information about your chosen investment company business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of an investment company business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the investment industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an investment business may include:

- Individuals

- small businesses

- other investment firms

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or investment services with the right marketing .

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your investment business may have:

- You have a team of experienced investment professionals.

- You offer a wide range of investment products and services.

- You have a proven track record of successful investments.

- You use cutting-edge technology to support your investment decisions.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service: Detail your product/service offerings here. Document their features and benefits.

- Price: Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place: Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion: How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your investment business via speaking engagements, trade shows, or networking events.

Operations Plan

This part of your investment company business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an investment business include reaching $X in sales. Other examples include adding X number of new clients or launching a new investment product line.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific investment industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue: how much revenue you generate.

- Cost of Goods Sold: These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss): Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Investment Company

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Investment Company

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup investment business.

Sample Cash Flow Statement for a Startup Investment Company

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your investment company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

In addition, a well-crafted business plan can help you secure funding from investors and lenders.

Despite all the advantages that come with writing a business plan, it doesn’t have to be a daunting task. You can start by using a template (like the one included in this article) and then customize it to fit your specific investment company.

Finish Your Investment Company Business Plan in 1 Day!

Other helpful articles.

How to Start an Investment Company

How to Write a Convincing Business Plan for Investors

Noah Parsons

9 min. read

Updated April 8, 2024

Raising money for your business is a major effort. You need lists of investors to reach out to and you need to be prepared for your investor meetings to increase your chances of getting funded . You need to practice your pitch and be ready to intelligently answer any number of questions about your business. A key to making this entire process much easier is to invest a little time and write a business plan . It’s true — not all investors will ask to see your business plan. But the process of putting together a business plan will ensure that you’ve thought through every aspect of your business and you’re ready to answer any questions that come up during the fundraising process.

- Why do investors want to see a business plan?

The business plan document itself isn’t what’s important to investors. It’s the knowledge that you’ve generated by going through the process that’s important. Having a business plan shows that you’ve done the homework of thinking through how your business will work and what goals you’re trying to achieve.

When you put together a business plan, you have to spend time thinking about things like your target market , your sales, and marketing strategy , the problem you solve for your customers, and who your key competitors are . A business plan provides the structure for thinking through these things and documents your answers so you’re prepared for the inevitable questions investors will ask about your business.

Even if investors never ask to see your business plan, the work you’ve done to prepare it will ensure that you can intelligently answer the questions you’ll get. And, if an investor does ask for your business plan, then you’re prepared and ready to hand it over. After all, nothing could be worse than arriving at an investor meeting and then getting a request for a business plan and not having one ready.

Beyond understanding your business strategy, investors will also want to understand your financial forecasts. They want to know how your business will function from a financial standpoint — what is typically called your “ business model .” They’ll also want to know what it will take for your business to be profitable and where you anticipate spending money to grow the business. A complete financial plan is part of any business plan, so investing a little time here will serve you well.

- What do investors want to see in a business plan?

There’s no such thing as a perfect business plan and investors know this. After all, they’ve spent years, and often decades, hearing business pitches, reading business plans, investing in companies, and watching them both succeed and fail. As entrepreneur and investor Steve Blank likes to say, “No business plan survives first contact with a customer.”

If this is true, then why bother writing a business plan at all? What’s the value of planning and why do investors want them if they know the plan will shortly be outdated?

The secret is that it’s the planning process, not the final plan, that’s valuable. Investors want to know that you’ve thought about your idea, documented your assumptions, and are on track to validate those assumptions so that you can remove risk from your business.

So what do investors want to see in your business plan? Beyond the typical sections , here are the most important things that investors want to see in your plan.

A vision for the future

Investors, particularly those investing in early-stage startups, want to understand your vision . Where do you see your company going in the future? Who will your customers be and what problems will you solve for them? Your vision may take years to execute — and it’s likely that the vision will change and evolve over time — but investors want to know that you’re thinking beyond tomorrow and into the future.

Product/market fit and traction

Investors want more than just an idea. They want evidence that you are solving a problem for customers. Your customers have to want what you are selling for you to build a successful business and your business plan needs to describe the evidence that you’ve found that proves that you’ll be able to sell your products and services to customers. If you have “traction” in the form of early sales and customers, that’s even better.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Funding needed and use of funds

When you’re pitching investors, you need to know how much you’re asking for. Your financial forecast should help you figure this out. You’ll want to raise enough money to cover planned expenses and cash flow requirements plus some additional funding as a safety net. In addition, you’ll want to specify exactly how you plan on using your investment . In a business plan, this section is often called “sources and uses of investment.”

A strong management team

A good idea is really only a small part of the equation for a successful business. In fact, lots of people have good business ideas — it’s the people that can execute well that generally succeed. Investors will pay a lot of attention to the section of your plan where you talk about your management team because they want to know that you can transform your idea into a successful business. If you have gaps and still need to hire key employees, that’s OK. Communicating that you understand what your needs are is the most important thing.

An exit strategy

When investors give you money to start and grow your business, they are looking to eventually make a return on their investment. This could happen by eventually selling your business to a larger company or even by going public. One way or another, investors will want to know your thoughts about an eventual exit strategy for your business.

- What documents do investors want to see?

Even if investors never ask for a detailed business plan, your business planning process should produce a few key documents that investors will want to see. Here’s what you need to be prepared to pitch investors:

Cover letter

These days, a lot of fundraising outreach is done over email and you’ll need a concise cover letter that sparks investor interest. Your cover letter needs to be very brief, but describe the problem you’re solving for your target market.

Great cover letters are sometimes in a “story” format that hooks readers with a real-world, relatable example of the problems your customers face and how our product or service The goal of the cover letter isn’t to explain every aspect of your business. It’s just to spark interest and get a meeting with an investor where you’ll have more time to actually pitch your business. Keep your cover letter brief, engaging, and to the point.

If you get an investor meeting, you’ll almost certainly need a pitch deck to present your idea in more detail and showcase your business idea. Your pitch deck will cover the problem you’re solving, your solution, your target market, and key market trends.

Further Reading: What to include in your pitch deck

Executive summary and/or one-page plan

You might not get a meeting right away. Your cover letter may generate a request for additional information and this is where a solid executive summary or one-page business plan comes in handy. This document, while still short, is more detailed than your cover letter and explains a bit more about your business in a page or two.

Read more about what goes into a great executive summary and how to build a lone-page business plan.

Financial forecasts

Investors will inevitably want to see your financial forecasts. You’ll need a sales forecast, expense budget , cash flow forecast , profit and loss, and balance sheet . If you have historical results, you should plan on sharing those too as well as any other key metrics about your business. Investors will always look deep under the hood of your business, so be prepared to share all the details of how your business will work from a financial perspective.

- What to include in your investor business plan

When you put together a detailed business plan for investors, you’ll follow a fairly standard format. Of course, feel free to customize your plan to fit your business needs. Remember: your business plan isn’t about the plan document that you create — it’s about the planning process that helps you think through and develop your business strategy. Here’s what most investor business plans will include:

Executive Summary

Usually written last, your executive summary is an overview of your business. As I mentioned earlier, you might use the executive summary as a stand-alone document to provide investors more detail about your business in a concise form. Read our guide on executive summaries here .

Opportunity

The opportunity section of your plan covers the problem you are solving, what your solution is, and highlights any data you have to prove that people will spend money on what you’re offering. If you have customer validation in any form, this is where you highlight that information.

Market Analysis

Describe what your target market is and key trends that are occurring in this market . Is the market growing? Are buying patterns changing? How is your business positioned to take advantage of these changes? Be sure to spend some time discussing your competition and how your target market solves their problems today and how your solution is superior.

Marketing & Sales Plan

Most businesses need to figure out how to get the word out and attract customers. Your business plan should include a marketing plan that describes how you’re going to reach your target market and any key marketing initiatives that you’re going to undertake. You should also spend time describing your sales plan, especially if your sales process takes time to close customers.

Milestones / Roadmap

Outline key milestones you hope to achieve and when you plan on achieving them. This section should cover key dates for product development, key partnerships you need to create, and any other important goals you plan on achieving.

Company & Management

Here’s where you describe the nuts and bolts of your business. How is your organization structured? Who is on your team and what are their backgrounds? Are there any important positions that you still need to recruit for?

Financial Plan

As I mentioned, you’ll need to create a profit and loss, cash flow, and balance sheet forecast. Your financial plan should be optimistic, yet realistic. This is a tough balance and your forecast is certain to be wrong, but you need to document your assumptions and plans for the business.

Finally, you can include an appendix for any key additional information you want to share. Product diagrams, additional details on how you deliver your service, or additional research can all be included.

- What comes next?

Writing a business plan for investors is really about preparing you to pitch your business . It’s quite likely that you’ll never get asked for the actual business plan document. But, the process will prepare you better than anything else to answer any questions investors may have.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

Related Articles

7 Min. Read

5 Steps to Optimize Your Website to Attract Investors

1 Min. Read

What’s the Difference Between Angel Investors and Venture Capitalists?

5 Min. Read

Make Sure You See Eye to Eye With Your Investors

2 Min. Read

How Much of My Company Do I Offer Investors?

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Discover the world’s #1 plan building software

5+ SAMPLE Investment Company Business Plan in PDF

Investment company business plan, 5+ sample investment company business plan, what is an investment company business plan, what’s in an investment company business plan, steps in creating an investment company business plan, what is an unit investment trust, what is a mutual fund, what is the purpose of a business plan.

Investment Company Annual Business Plan

Investment Company Business Plan Format

Editable Investment Company Business Plan

Investment Company Small Business Plan

Investment Company Business Plan Example

1. describe the investment company, 2. state the goals of the investment company, 3. detail the services and write the marketing plan, 4. conduct a competitive analysis, 5. create appendices, 6. create the summary, share this post on your network, file formats, word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates, you may also like these articles, 41+ sample unit plan templates in pdf | ms word.

As a teacher, you might know about every school policy, the steps to keep classrooms safe for intellectual development, how to set up an organized classroom, and the proposed…

23+ SAMPLE Employee Development Plan in PDF | MS Word | Google Docs | Apple Pages

Have you ever considered the people who have aided your career? Perhaps an instructor piqued your curiosity about a new subject. An employer who saw your potential and gave…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

Real Estate Investment Business Plan Template

Written by Dave Lavinsky

Real Estate Investment Business Plan

Over the past 20+ years, we have helped over 5,000 entrepreneurs and business owners create business plans to start and grow their real estate investment businesses. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a real estate investing business plan template step-by-step so you can create your plan today.

Download our Ultimate Real Estate Investment Business Plan Template here >

What Is a Business Plan?

A business plan provides a snapshot of your real estate investing business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan

Source of Funding for Real Estate Investment Companies

With regards to funding, the main sources of funding for a real estate investment business are personal savings, credit cards, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a real estate investment business is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan.

Finish Your Business Plan Today!

How to write a business plan for a real estate investment company.

Your business plan should include 10 sections as follows:

Executive Summary

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of real estate investing business you are operating and the status; for example, are you a startup, do you have a business that you would like to grow, or are you operating a chain of real estate investment companies.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the real estate investment industry. Discuss the type of real estate investment business you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of real estate investment business you are operating.

For example, you might operate one of the following types: Real estate investment companies do two basic things: invest in real estate and trade in real estate.

- Real estate investment is a long-term investment wherein you purchase real estate with the intent of keeping properties to rent out.

- Real estate trading is a short-term investment, wherein you buy a property that needs fixing up and flip it for a higher price soon after.

In addition to explaining the type of real estate investment company you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new store openings, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

While this may seem unnecessary, it serves multiple purposes.

First, researching the real estate investment industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, if there was a trend towards increasing foreclosures in a particular city, it would be helpful to ensure your plan calls for an increased focus in this market.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your real estate investing business plan:

- How big is the real estate investment industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your real estate investment business. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your real estate investing business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: mortgage holders, home buyers, renters, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of real estate investment business you operate. Clearly first-time home buyers would want different pricing and product options, and would respond to different marketing promotions than banks.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most real estate investment businesses primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Real Estate Investment Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Real Estate Investment Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Direct competitors are other real estate investment businesses.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes property management companies, realtors, and DIY home fixer-uppers. You need to mention such competition to show you understand that not everyone who purchases or leases real estate uses a real estate investment business to do so.

With regards to direct competition, you want to detail the other real estate investment businesses with which you compete. Most likely, your direct competitors will be real estate investment businesses located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What products do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you specialize in a particular real estate type or market?

- Will you provide services that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your real estate?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a real estate investment business plan, your marketing plan should include the following:

Product : in the product section you should reiterate the type of real estate investment company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, will you offer residential properties, or commercial properties?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the types of real estate you offer and the current price ranges.

Place : Place refers to the location of your business. Document your location and mention how the location will impact your success. For example, is your real estate investment business located in a market with a high foreclosure rate, or with a low inventory of office space. Discuss how your location might provide a steady stream of customers.

Promotions : the final part of your real estate investing marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Social media advertising

- Local radio advertising

- Banner ads at local venues

Operations Plan

Everyday short-term processes include all of the tasks involved in running your real estate investment business such as finding properties to acquire, marketing completed properties, overseeing renovations, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to flip your 25th house, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch in a new market.

Management Team

To demonstrate your real estate investment business’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in real estate. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.