Profitable Business Models > Business models of large companies

Apple Business Model Canvas: How it became the King of Innovation

- by Joanne Moyo

- September 23, 2021

Unless you’ve been living under a rock, you probably know just how big Apple, Inc. is. Over the last few decades, Apple has become one of the most recognized brands in the world. It’s been dominating the technology industry, becoming one of the most valued companies in the world.

As of August 2021, Apple had a market cap of around $2.43 trillion. With a business model based on innovation and consumer-centric devices, Apple can retain a loyal customer base through user-friendly designs, easy data migration to new product lines, and integration between Apple devices. Every time Apple drops a new iPhone, the long winding queues are proof of how successful its business model is.

But how did the company manage to create such a fierce love for the brand?

Apple created an entire technological ecosystem, often referred to as the Apple Ecosystem Lock. The company’s insistence on integrating its products makes it easier for customers to keep using new Apple products. Thus, it is more challenging to switch to a competitor’s product.

In terms of hardware and high-end gadget sales, Apple created brand loyalty in the early 2000s by radically aiming to put a computer in every pocket. Unlike the then-dominant Microsoft, whose focus was on putting a computer on every person’s desk. This nonconformist business model is what propelled Apple to the top of the technological food chain.

However, every success story also has a couple of failures along the way. Over the last 40 years, Apple has faced disappointing product releases, continued leadership, and legal issues. Nevertheless, its profitable business model has ensured Apple’s success.

Let’s take a look at how this giant was born.

1971-1989: The birth of Apple

1971: the beginning of personal computers.

In the 70s, computers were big and expensive machines, and the industry was dominated by IBM. Additionally, only a handful of enthusiasts knew how to manage and use these technologies aside from the big corporations.

The idea for microcomputers began to take root among computer enthusiasts in Silicon Valley. Several people were building personal computers using parts such as the first chips manufactured by Intel.

During this time, the founders of Apple, Steve Jobs, and Steve Wozniak, first met through a mutual friend, Bill Fernandez, in 1971. They began their first business partnership later that year when Wozniak, who had experience in electronics, started to build his original invention called the “blue boxes.”

These boxes made it possible for people to make free long-distance phone calls. Jobs convinced Wozniak to sell some two hundred blue boxes for $150 each, and they split the profits. Wozniak was also working on several other inventions, one of them being a video terminal that he could use to log on to minicomputers.

1975: The first commercial, personal computer

In 1975, the Altair 8800 became the first computer to achieve commercial success. It, however, required the user to assemble the different components, so it had no real appeal to the average person. It mostly captured the hearts of electronic hobbyists and computer geeks who would have the know-how.

At the time, Wozniak could not afford to buy the microcomputer CPUs that were on the market. Instead, he decided to learn as much as he could, designing computers on paper. This paid off tremendously, and by 1975, Jobs and Wozniak had withdrawn from Reed College and UC Berkeley, respectively.

They started attending different meetings and conferences to gain more knowledge about the computer industry. One specific meeting they went to at the Homebrew Computer Club inspired Wozniak to build a microprocessor into his video terminal and have a complete computer.

1976: Apple Computer Inc. was born

In April, along with Ronald Wayne (who worked with Jobs at Atari), Jobs and Wozniak formed Apple Computer. Wayne designed the first company’s logo and prepared the first partnership agreement with a 10% stake. However, just twelve days later, he relinquished his stake to avoid any potential financial risk.

Wozniak finished working on his hand-built personal computer kit that was named the Apple I. It was a circuit board that lacked basic features like a keyboard, monitor, and case. Jobs had to sell his Volkswagen Type 2 minibus for a few hundred dollars. Wozniak sold his HP-65 programmable calculator for $500 to raise money to pay for the parts.

They used Job’s parent’s garage in Los Angeles, California, as their office and factory. The first public launch of the Apple I was at the Homebrew Computer Club. The computer received a warm reception convincing the pair to go commercial.

Wozniak offered the design to Hewlett-Packard (HP), where he worked at the time, but they turned him down. So he decided to sell the Apple I for a little more than the cost of the parts. All he wanted was to recover the money they had put into making the computer.

Partnership with Byte Shop

Jobs, on the other hand, had bigger plans. He approached a local computer store called The Byte Shop to sell them 50 units of the Apple I. It was a considerable risk for the shop for several reasons. First, there was not enough Apple I to fulfill the order, and Apple Computer Inc. didn’t have the money to produce them.

Atari, where Jobs worked, required cash for the components it sold him, and a bank he had approached for a loan had turned him down. While Job’s friend’s father had offered to loan him $5,000, it wasn’t going to be enough.

Fortunately, Paul Terrell, Byte Shop’s owner, decided to grant Apple the $500/unit purchase deal anyway. Jobs hoped that Wozniak could produce enough working computers to settle the bill from the proceeds (they were selling the Apple I for $666.66).

They roped in family and friends at a kitchen table to help solder parts they had bought from Cramer Electronics (a national electronic parts distributor). Once the computers had been tested, Jobs drove them over to Byte Shop. All in all, 200 Apple I units are sold.

1977-1978: Apple’s First Investor & the Apple II

On January 3, Apple Computer Inc. was incorporated. Wozniak designed the Apple II, an upgraded personal computer intended for mass-market production. Meanwhile, Jobs and Wozniak meet Mike Markkula, who invests $250,000 in the company.

Markkula was pivotal in securing credit and additional venture capital for Apple. He also recruits Michael Scott, who acted as Apple’s first CEO.

Wozniak and Jobs wanted to create a computer that would fit into the average person’s everyday life. Thus the Apple II was released in June of that year at a retail price of $1,298. The Apple II had a completely redesigned TV interface, with a simple text display and graphics.

Other competitors & Partnerships

However, it wasn’t the only personal computer of its kind on the market. Its rivals, the Commodore PET 2001 and the Tandy TRS-80 were launched at the same time. All three machines were designed to make personal computers as straightforward as possible.

Users didn’t need to have the computer skills required to start using one. However, the Apple II had something different; a color video connection and presentable packaging. The Apple II had no visible boards and wires. Additionally, Apple partnered with programmers Dan Bricklin and Bob Frankston, and the Apple II became the official carrier of the new VisiCalc spreadsheet program in 1978.

VisiCalc opened the way for Apple to enter the business market. Moreover, the fact that the Apple II was starting to have corporate clients attracted more software and hardware developers like Microsoft to the machine. In fact, Apple’s home user customer segment grew because of the Apple II’s compatibility with Microsoft Office’s basic program.

The value proposition of the Apple II was its flawless design and high performance. It’s no wonder that the product exploded in popularity. By the end of the year, Apple had made $750,000 in revenue.

1980: The Third Generation Computer & Going Public

After riding off the success of the Apple II for two years, Apple announced the arrival of the Apple III in May of 1980 during the National Computer Conference (NCC) in Anaheim, California.

Apple rented Disneyland for a day and commissioned bands to play in the Apple III’s honor. This third-generation PC was meant to solidify Apple’s hold in the business environment. Despite the success of the Apple II, IBM was still dominating the corporate computing market.

The Apple III was released in November at a retail price ranging from $4,340 to $7,800. While it was a relatively conservative design for computers of the era, it had some fantastic features that corporations enjoyed. For example, it had a typewriter-style upper and lower case keyboard and an 80 column display.

The following month in December, Apple went public. Selling 4.6 million shares at $22 per share.

Apple Business Model Canvas: The Early Days

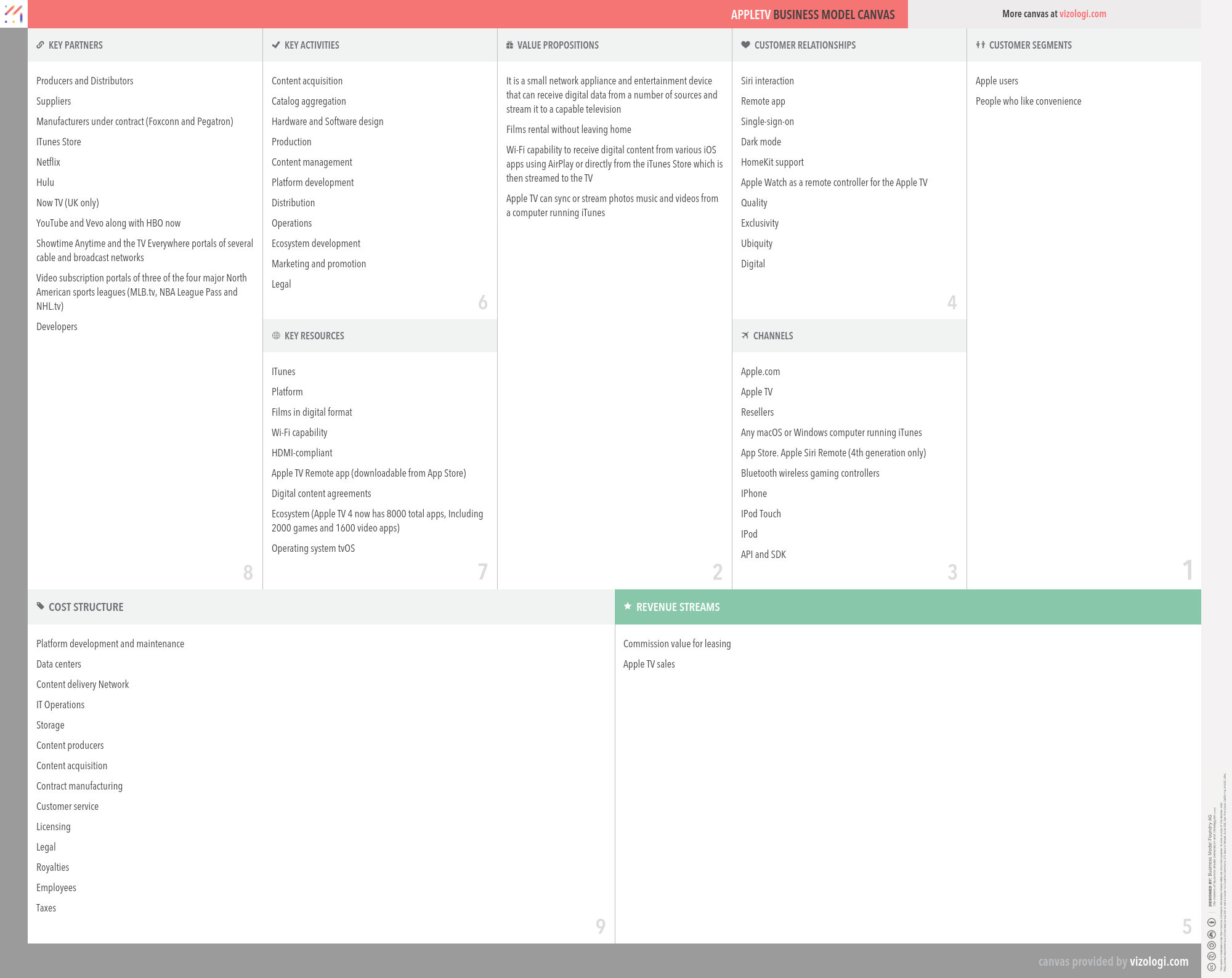

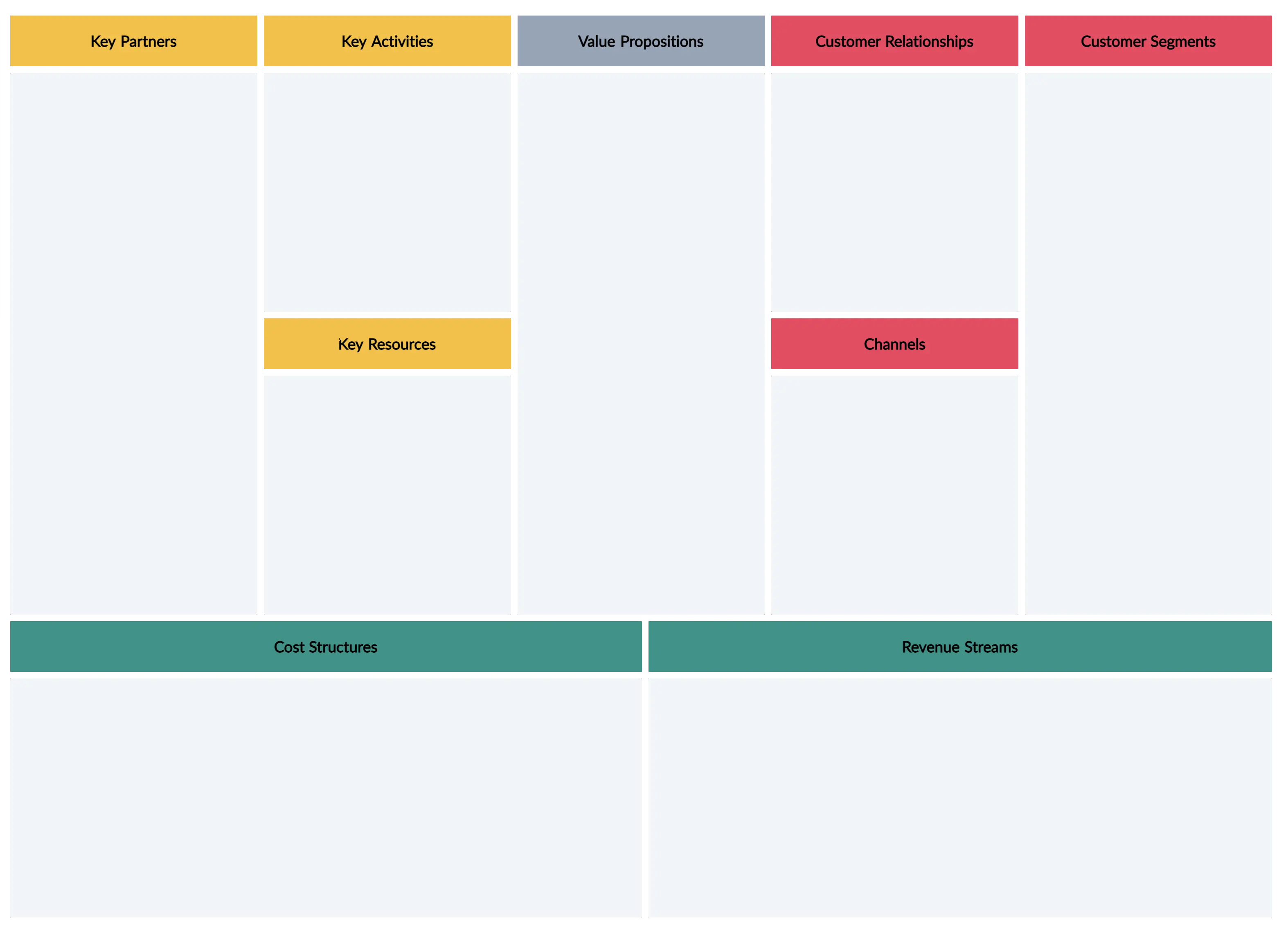

At this point, Apple’s Business Model Canvas looked like this:

1981-1990: Product Failures & Fierce Competition

1981-1982: competition from the ibm pc & failure of the apple iii.

By August, Apple was among the largest microcomputer companies in the industry. It was slowly overtaking giants like IBM and revenue in the first half of the year had already exceeded 1980’s $118 million.

In fact, the lack of production capacity was constraining growth. The pairing of the Apple II and VisiCalc ensured that businesses kept purchasing Apple’s PCs. When IBM discovered that all its corporate customers wanted VisiCalc, the computer giant quickly launched its own personal computer in August 1981.

However, Apple had many advantages over IBM PC. Firstly, Apple established a strong network of dealers in the US who provided them with parts for their hardware. Apple also had partnerships with hundreds of independent software developers and had an established international distribution network. Additionally, the Apple II had more than 250,000 customers.

The IBM PC had none of that. Fortunately for IBM, the failure of the Apple III would prove to be its saving grace. The Apple III had significant flaws and was prone to overheat, glitches, and minimal software. By 1982 Apple had to recall 14,000 Apple III computers, and Apple’s reputation for producing flawless computers tanked. It was a significant blow.

1983: The Apple Lisa

By 1983, Apple was losing ground to IBM. Revenue from the Apple II was dwindling, and Apple hadn’t released a successful product since 1977. Jobs had to act fast if Apple was to compete with the expanding personal computer market.

To gain a competitive advantage, Apple decided to move away from the text-based format that PCs were coming in. Jobs discovered a new technology by a company called Xerox that developed a demo PC with a graphic user interface and a mouse. He convinced Xerox to grant Apple’s Engineer access to the technology. In exchange, Xerox bought 100,000 Apple shares at a discounted price of $10 each.

The Apple Lisa was launched in January 1983. It was a high-end business machine that was targeted at business users. It retailed for $10,000, but unfortunately, it was a commercial failure. It had a lackluster software library and an unreliable floppy disk.

There were simply better and cheaper computers on the market, and the Apple Lisa failed to sell.

Problems with Apple Leadership Begins

Jobs had gotten so involved in the development of the Lisa that he had started bypassing the management structure of the company. This caused significant problems for him when the Apple Lisa failed to take off.

Michael Scott, the then CEO, and president and Mark Markkula created a new corporate structure that sidelined Jobs and stripped him of any responsibility for research and development within Apple. Looking for a new project, Jobs turned his sites to the Apple Macintosh, which had been in development for a couple of years.

1984: The Iconic Macintosh

Apple needed another hit to guarantee its future and target the lower end of the market as the Lisa. The Apple III had failed to make waves in the high-end market. This hit came in the form of the Macintosh. It combined the low production cost of the Apple II with the Apple Lisa’s features.

Before the launch of the Macintosh, Apple decided to increase its marketing budget. All the previous launches had been somewhat reserved. This time they wanted to create a buzz because they believed that much in their product.

Apple put a call to its ad agency and tasked them with securing sixty seconds during the third quarter break of Super Bowl XVIII. The production budget of this new campaign stood somewhere between $350,000 and $900,000. The commercial featured a sportswoman in red shorts in a sea of pale men, all dressed in grey clothing sitting down on benches in front of a big screen.

The woman is holding a sledgehammer and is being chased by police-like figures as she runs towards the screen. The commercial ends with the woman throwing the hammer at the screen and a voice-over announcing:

On January 24th, Apple Computer will introduce Macintosh.

And you’ll see why 1984 won’t be like “1984”.

It was an indirect reference to how IBM was dominating the PC industry and how Apple was trying to break the monopoly. The “1984” phrase was taken from a novel by George Orwell where the earth is controlled by “Big Brother”.

The ad was a hit and the Mac went on sale in January 1984 at a retail price of $2,495. While it wasn’t cheap, it was good value for money, and sales skyrocketed.

The Mac fails to make significant traction.

Although the Macintosh was received well, it still needed a killer application, as VisiCalc had been on the Apple II.

The PageMaker was a desktop publishing computer program that helped users create ads, brochures, newsletters, and books was Mac’s golden ticket. It was backed up by the revolutionary Apple LaserWriter printer. It would establish the Mac as a contender in the low-end market. The LaserWriter was the first mass-market laser printer, even though it wasn’t the first laser printer.

Unfortunately, the Mac was three times more expensive than the average PC. Moreover, the new graphic user interface required much more effort for existing software developers to make new programs compatible with the Mac. This resulted in very limited programs and applications for the Mac.

Apple was also against IBM in the home customer segment. IBM had a stronghold in the corporate world. Many customers who used IBM computers at work simply decided to go with what they knew when they bought their first home computers.

The IBM PC came with a range of software and included the hugely popular VisiCalc spreadsheet program and the EasyWriter word processor. Within a few months, sales began to dwindle as consumers were not interested in an expensive PC that was not compatible with anything. This led to conflict within Apple’s leadership.

1985: Jobs is forced out of Apple

Although Steve Jobs was Apple’s most public face and the company’s co-founder, he wasn’t its CEO. Apple’s leadership has changed hands a few times since 1976. In the mid-80s, John Sculley was hired by Apple to run the company.

At first, Sculley and Jobs got along; however, Jobs had the vision to create a computer for the mass market. He wanted a computer that would cost $1000 or less; unfortunately, production costs had doubled the price.

Jobs and the development team had pegged the Mac at $1,995. Still, Sculley, who needed to ensure profitability, insisted on hiking the price by an additional $500. This caused a lot of friction between the two men.

The tanking sales of the Mac increased the tension, and the board urged Sculley to reign in Jobs. They felt that he was taking unnecessary risks, putting the company at risk financially. Again Jobs was stripped of his duties with the Macintosh team and given a ceremonial role as Chairman. Jobs was not happy about this demotion at all and decided to launch a coup.

Unfortunately, Sculley got wind of it, and Jobs was forced to resign. He took with him a few Apple employees and went on to start a company called Next.

1986-1997: The decline of Apple

1986-1992: an identity crisis.

The departure of Steve Jobs signaled the beginning of an immense identity crisis for Apple. Up until now, Jobs had driven the company’s direction towards one single goal; making low and high-end PCs at a consumer-friendly price.

Sculley and the board wanted to go in a different direction. They wanted Apple to be a premium computer company that sold cutting-edge products. Since Apple already appealed to creative business users, they figured that the most logical step was to target the high-end market. They settled for more powerful and thus more expensive Macs.

Apple raised the price of the Mac at a time when competing PCs from Microsoft and IBM were becoming cheaper. The strategy was to create demand by selling fewer units at a higher price, resulting in higher profits. Boy, were they wrong! Despite the unique user interface that created brand loyalty, Apple’s stock prices and market share continued to decline.

They introduced several products such as the Centris PC line, a low-end Quadra offering, and the ill-fated Performa PC line. These products were sold with many configurations and software bundles to avoid competing with consumer outlets such as Sears, Price Club, and Wal-Mart. They were the primary dealers for these models.

1993-1997: The Dark Years

In 1993 Michael Spindler replaced Sculley as CEO. Spindler completely restructured Apple, laying off 15% of the workforce and splitting up the product development team according to the market. He wanted to focus on building as many cheap products as possible.

Not only did this weaken the product development team, but it also caused a lot of confusion. The product line was so complicated that no one could identify which product was best for which market.

Apple experimented with several failed consumer targeted products that included digital cameras, portable CD audio players, speakers, video consoles, and TV appliances. Unfortunately, none of these products helped, the company continued to experience challenges. None of its products were seeing the success that the Apple II had enjoyed. There were simply better alternatives on the market.

1994: Microsoft: The New Giant in Town

At this time, Microsoft began making significant strides in the market. Its Windows software was proving to be highly reliable, and it came at an affordable price. Microsoft continued to gain market share.

To address Microsoft’s growing dominance, Apple joined forces with IBM and Motorola in the AIM alliance. The aim was to create a new computing platform that would use IBM and Motorola’s hardware and Apple’s software. The AIM alliance hoped that the new platform would replace the PC and thus counter Microsoft.

The same year, Apple launched the Power Macintosh, the first of Apple’s computers to use Motorola’s PowerPC processor. The following year Apple decided to license the Mac Operating System and Macintosh ROMs to 3rd party manufacturers to produce Macintosh “clones.” They wanted to achieve deeper market penetration and earn extra revenue for the company. However, this backfired as the clones were competing with Apple’s Macs and reduced Apple’s own sales.

1996-1997: Steve Jobs Saves the Day

In 1996, Spindler was replaced by Gill Amelio. Amelio implemented more layoffs and cost-cutting measures to try and keep the company afloat. It was clear that Apple was dying a slow and painful death. They just could not keep up with how quickly the tech industry was changing.

While Apple had experienced initial success with the Apple II, once competitors developed similar and more stable technologies, Apple could do little to stop the inevitable. It had lost the element of surprise.

Realizing this, Amelio tried to improve Mac OS, but nothing was working. In a last-ditch effort, he chose to approach Steve Job’s NeXT and its operating system. He also decided to bring Steve Jobs back to Apple as an advisor.

In July 1997, Gil Amelio was fired, and Jobs became the interim CEO. He began restructuring the company’s product line, creating a dream team to drive up innovation. They decided to launch just four computers, the iMac, Power Mac, iBook, and the PowerBook.

Furthermore, he partnered with Microsoft agreeing to release new versions of Microsoft Office for the Macintosh. In exchange, Microsoft made a $150 million investment in non-voting Apple stock.

In November, Apple introduced the Apple Online Store launching a new build-to-order manufacturing strategy. They closed off the year, having sold 80,000 units of their four products, creating a constant income stream for the cash-strapped company.

Apple Business Model Canvas: The Dark Days

1998-Present: Return to Profitability

1998-2007: moving beyond the pc & key acquisitions.

In August 1998, Apple introduced a new all-in-one computer similar to the Macintosh 128K: the iMac. The iMac had modern technology and a unique design. Within 5 months, it had sold almost 800,000 units.

Apple made several vital acquisitions throughout this period:

- In 1998, Apple bought Macromedia’s Final Cut software. This was a move into the digital video editing market.

- In 2001 they bought Spruce Technologies, a DVD authoring company that had developed a software called DVDMaestro. This software was a direct competitor to Apple’s own newly released DVD Studio Pro 1.0. Apple wanted to incorporate the features of DVDMaestro into its new DVD Studio Pro 2.0 software.

- In 2002, Apple purchased Nothing Real’s Shake app. It was a high-end video compositing software application that enabled Apple to integrate it into their computers for better video quality.

2001-2003: First Official Store, iPod, and iTunes

In 2001 after years of development, Apple released the Mac OS X aimed at the average consumer and the professionals. In May that same year, Apple opened the first official Apple Retail Stores in Virginia and California.

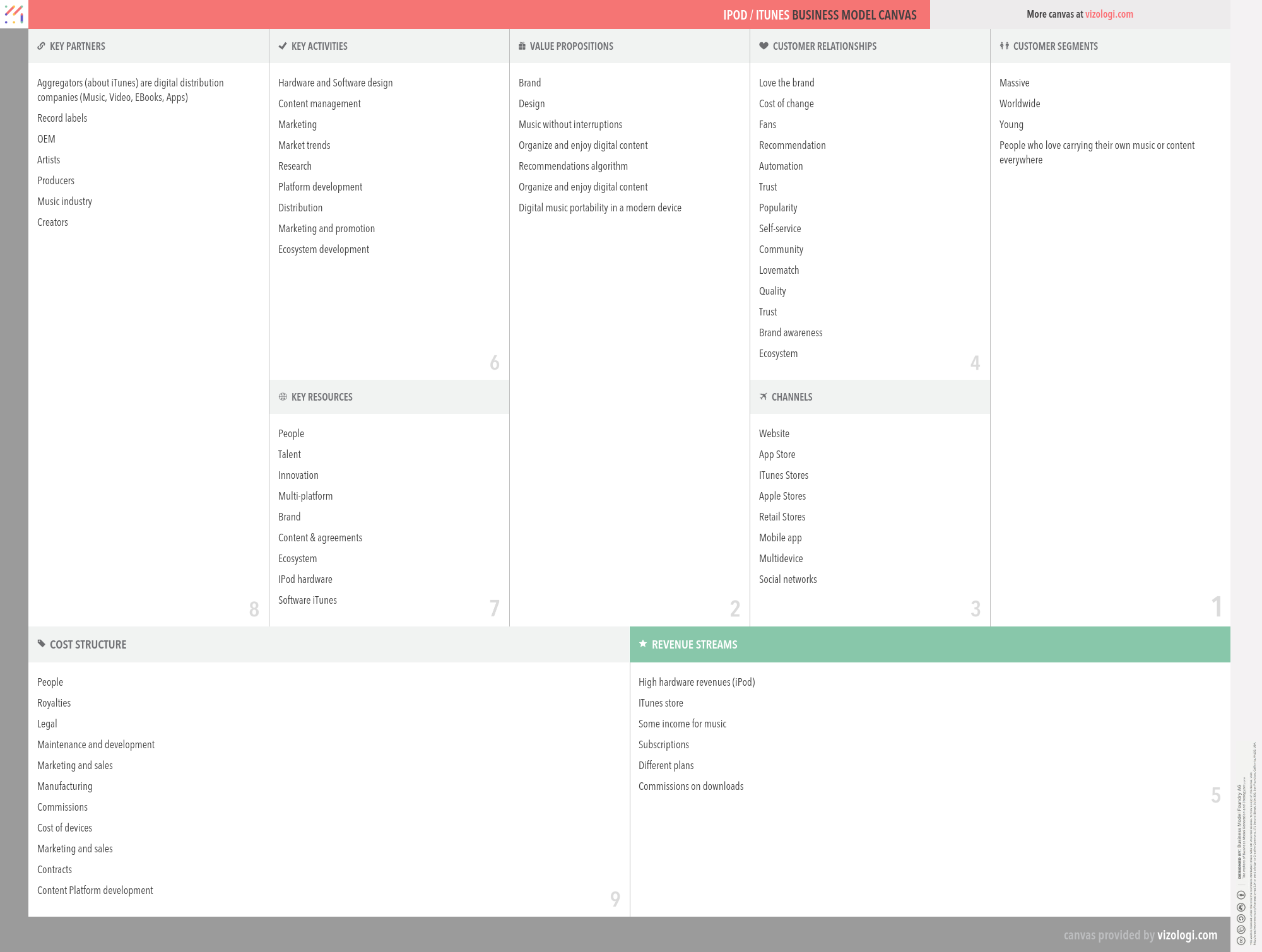

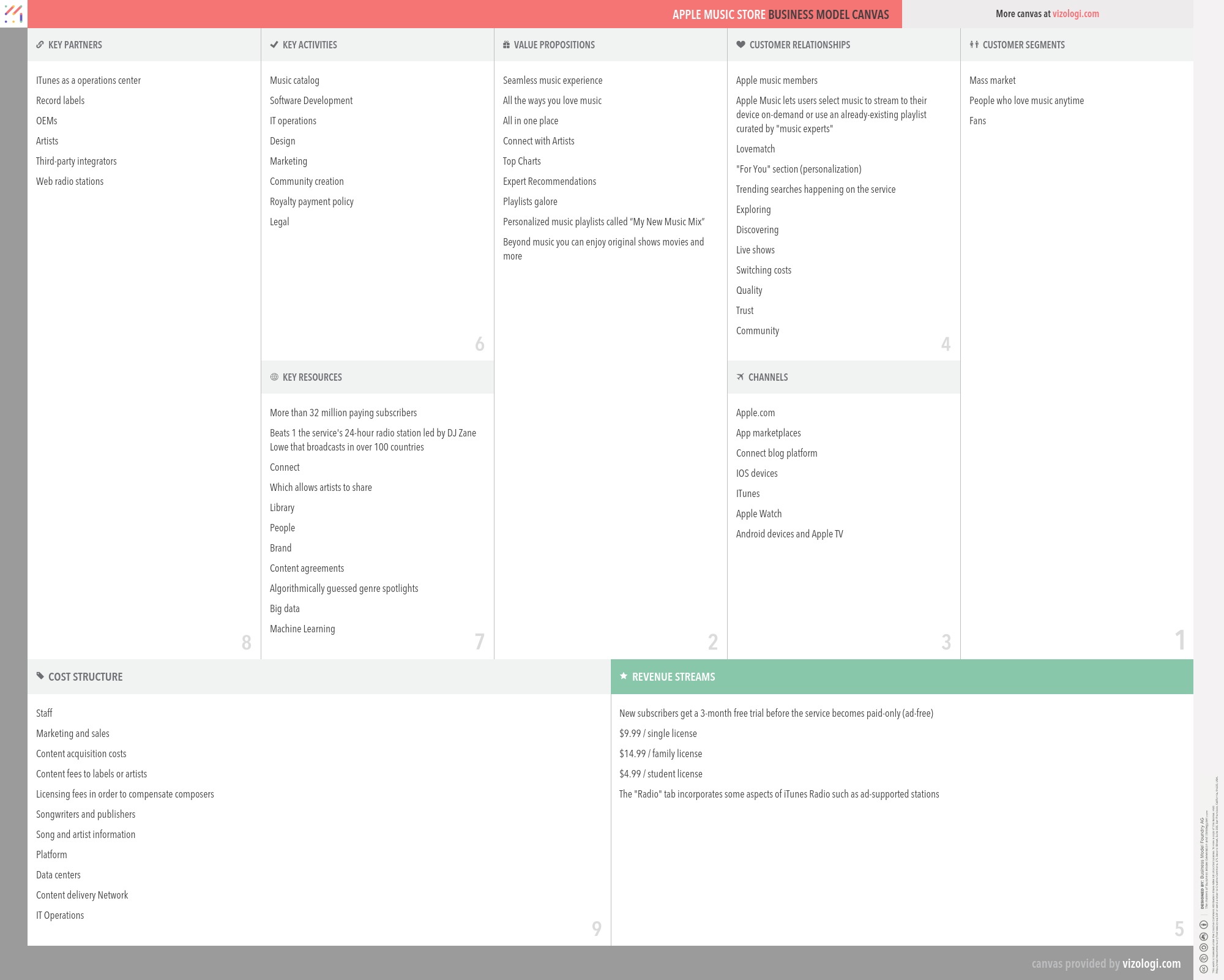

A few months later, in October, Apple announced the iPod portable digital audio player and started selling it on November 10. The iPod was a phenomenal success. In 2003, Apple’s iTunes Store was launched, offering online music downloads for $0.99 a song. Users could integrate iTunes and the iPod.

Soon Apple became the market leader in online music services.

2007-2011: The iPhone, App Store, iPad & iCloud

In June, Apple introduced what was to be their best-selling product yet, the iPhone. During the Macworld Expo, Jobs announced that Apple Computer Inc. would now be called Apple Inc. The reason was that the company was now focusing on mobile electronic devices and not just PCs.

This led to the development of the iPhone, iPod Touch, and the iPad. Apple became the first to achieve a mass-market adoption of the touch screen user interface with pre-programmed gestures. Additionally, Apple expanded its business model and introduced its App Store to purchase third-party software applications.

The iCloud was launched in 2011. The online storage and syncing service for music, photos, files, and software solidified Apple’s Ecosystem. Users of Apple products could seamlessly move from one device to another and still have access to their data. This signaled the beginning of the Apple we know today.

Unfortunately that same year, Steve Jobs passed away and with his passing Apple began to lose some of its competitive edge and innovation.

Apple Business Model Canvas: The Profitable Days

The Apple we see today is a far cry from the highly rebellious, non-conformists start-up it was under the guidance of Jobs. Jobs’ greatest skill was relentless internal competition. While Tim Cook (who now leads Apple) has focused on making the company profitable, it’s clear that he follows a more conservative approach.

The danger for Apple now is that 90% of its business is now centered on one product; the iPhone. Apple has fallen into the classic monopoly trap where because of its dominance they’ve stopped innovating and are now focusing instead on protecting their core business.

History is clear, monopoly is never a good place to get comfortable. Just look at Microsoft, it was late to the internet, late to the cloud, and late to portable music players, all because it was trying to protect its Windows software.

Time will tell whether Apple will survive a post-mobile phone era with this strategy.

- https://finance.yahoo.com/quote/AAPL/

- https://www.marketing91.com/business-model-of-apple/

- https://www.bailiwickexpress.com/jsy/life/technology/apple-timeline-key-milestones-companys-40-year-history/

- https://www.nydailynews.com/news/national/apple-turns-40-timeline-tech-giant-evolution-article-1.2581048

- https://www.macworld.co.uk/feature/history-of-apple-steve-jobs-mac-3606104/

- https://www.investopedia.com/articles/personal-finance/042815/story-behind-apples-success.asp

- https://www.nytimes.com/2015/01/30/business/how-and-why-apple-overtook-microsoft.html

- https://www.investopedia.com/articles/markets/111015/apple-vs-microsoft-vs-google-how-their-business-models-compare.asp

- https://medium.com/age-of-awareness/what-made-apples-1984-advert-so-successful-dc5af1b073f3

- Tags: apple , business model canvas , cloud services , ibm , itunes , microsoft , steve jobs , wal-mart

Most Popular

Netflix’s Business Model Canvas Evolution (2021)

McDonald’s: Business Model Canvas, its evolution and company’s history

18 Must-Read Business Books

Check how Amazon’s main focus allowed the company to thrive. Amazon’s Business Model Canvas and how it changed from the very beginning.

- Business books reviews (27)

- Business Ideas (8)

- Business Model Canvas (9)

- Business models of large companies (26)

Business Tools

Download Free Business Model Canvas Template in Word / docx / PDF / SVG format

Inspire yourself with Business Ideas Generator

Get INSPIRING stories and TIPS on making your business model PROFITABLE!

- Recently trending business ideas

- Inspiring business models

- Examples of profitable businesses from all over the world

Related Posts

Twitter: Becoming The World’s Fastest Information Hub

Today, Twitter is one of the most recognizable and influential social media platforms on the planet. As of February 2022, Twitter is valued at $27.48

The Business Model Canvas Explained: Cost Structure

The last (but not least) segment on the Business Model Canvas is the cost structures. In this segment, you must ask yourself, how much will

The Business Model Canvas Explained: Key Partners

No man is an island; the same goes for your business. They are other companies, 3rd parties, and people that you will need to achieve

The Business Model Canvas Explained: Key Resources

On the Business Model Canvas, the Key Resources segment refers to the supplies, assets, and materials required to deliver your value proposition to your customer

Privacy Overview

Apple iPhone

In 2007, apple launches the iPhone and combines an internet browser, a music player, and a mobile phone in one high-end, multitouch device without a keyboard. It ushers in the era of the smartphone.

In 2007, Apple founder Steve Jobs famously introduced the iPhone at the Macworld 2007 convention as a revolutionary device that “would change everything.” Its initial selling price was a hefty $499, but 270 thousand units sold its first weekend and 6 million units in its first year of production.

Apple’s iPhone ushered in the era of the smartphone, the world of mobile-first and constant connection, leading the way for mobile technology to dominate and reform day-to-day existence. Apple’s iPhone has consistently been more expensive than competing devices. However, Apple continually packs new features and technology into its iPhone in order to keep its products from seeming like a commodity.

Despite high prices, Apple maintains a high degree of control over production costs in its supply chain. This combination of controlled costs, high-end positioning, and continuous technology innovation have resulted in gross margins of 60 to 70% in the last 10 years.

1. Delight and surprise the high end of the market

Apple positions the iPhone at the high end of the spectrum, knowing that the price will put it out of reach for the majority of the market. The phone combines an aspiration feel with design, technology, and simplicity, and capitalizes on its love-mark brand.

2. Control costs

Apple does not manufacture the iPhone, but keeps its production costs low by controlling its supply chain. Due to the popularity of the device, Apple forces its suppliers to keep costs low as well as maintain privacy and secrecy over their devices.

3. Maximize margins and profits from high end market share

The iPhone’s profit margins have remained between 60 to 70% over the past 10 years. At its peak, Apple captured 94% of the smartphone industry’s profits, despite only accounting for 14.5% of sales.

4. Continuously reinvent and surprise the high end of the market

Since 2007, Apple has released 12 generations of iPhones. While Apple isn’t always the first to develop many of the iPhone’s technological innovations, it often delivers the best: multi-touch screen, dual cameras, Apple Pay, Siri, iMessage, FaceTime, facial recognition.

+ The App Store

The iPhone initially launched without the App Store, which was opened in 2008 with 500 applications. As of 2019, the store featured over 1.8 million apps. The available applications and number of developers provide Apple with an additional competitive advantage as described in the Resource Castle Platform.

About the speakers

Download your free copy of this whitepaper now, explore other examples, get strategyzer updates straight in your inbox.

- Skip to primary sidebar

- Skip to content

- Skip to footer

Denis Oakley & Co

I HELP BOLD LEADERS TRANSFORM THEIR BUSINESSES AND THE INDUSTRIES THEY COMPETE IN

September 13, 2018 By Denis Oakley

What is the Apple Business Model Canvas?

What is Apple’s business model? In this video, I describe how Apple makes money by working through all 9 components of Apple’s business model canvas.

Apple creates consumer electronic products that have amazing design and usability and bundles them with software products to lock consumers in. Because they are so attractive they deliver great status and productivity to users leading to a premium price.

Customer Segments in the Apple Business Model

Apple’s business model targets mass-market consumers. That is hundreds of millions of consumers. They may be middle class and fairly affluent. It may be marketed as a premium product but it is a mass-market electronic good.

There are smaller customer segments that it focuses on for non-handheld products. Designers and entrepreneurs both use and love Mac products but in 2019 this is a relatively small proportion of Apple’s revenue.

In the tables below Apple’s customer segments are broken down across a number of different measures, geographic, demographic, behavioural and psychographic

Apple’s Customer Segmentation – Geographic

Apple’s customer segmentation – demographic, apple’s customer segmentation – behavioural, apple’s customer segmentation – psychographic, value proposition.

The Apple Value Proposition revolves around three core concepts.

Think Different

- Tech That Works

Your Privacy is Safe with Us

“Think different” sets Apple apart. In the years since the original advert, shown below, it has developed into a philosophy that spawned the design style

The value proposition is that Apple is for the people who Think Differently , who see the world differently, who change it. Creatives, Entrepreneurs and Hipsters.

Their Apple devices are a way of letting them make their statement about who they are and what they are doing. The design, which many people say is important, is an outward and visible sign of the value proposition. Not the value proposition itself

Tech that Works

Living in a Microsoft environment before I got my first iPhone I remember how difficult it was to get things to work. It took me a day once to install a printer for an insurance company. I spent hours trying to get music onto my Creative music player. Technology promised lots of gains, but you had to put the hours in to get the technology to work to get those gains.

What Apple brought, brings, to the table, is technology that is seamless and integrated. Play around with Google for a while and you quickly discover that their products aren’t really integrated. Google Plus is dead but I still had to go somewhere that looked a lot like Google Plus to change my YouTube channel name today. Microsoft Windows has a UI that is half sleek and modern , and then suddenly jumps you back 20 years due to legacy coding issues.

The Apple business model is in large part the experience of using Apple products. Google’s is to consume advertising – which is why the experience isn’t nearly so good.

This is a major differentiation between it and it’s Android competitors. Apple controls the software, the hardware and the content. This means that it is able to finely tune the experience that users have.

In contrast, Samsung and other users of Android OS have to face the fact that they control the hardware, have some control over the version of Android that they use and have little control over the apps on the Play Store. This results in a far less joined up, or easy, experience for users.

Because Apple is the only company able to offer this it is major support for the premium that it is able to charge.

Apple sells Software and Hardware. It doesn’t sell advertising or make a market in data. It also builds all of its products into a single consistent eco-system or walled garden.

Once you are in you are safe. You stay safe. Apple doesn’t take your data. Apple makes sure that no one else takes your data unless you explicitly give them permission to do so.

This creates a core value proposition that separates them from Google. Google’s whole business model is based on taking your data and selling it to other people.

We can break these down into a number of smaller value propositions which Apple delivers to customers through its hardware and software products

Sense of Achievement

For many, there is a sense of achievement in getting an Apple Phone. When billions have a $50 smartphone being able to afford a phone that can cost over $1,000 is important. This is especially so for those who started off with an Android phone and were able to, through hard work or endeavour, to be able to achieve one. It’s a visible mark of success and is treated as such.

Self Expression

The self-expression component of Apple’s value proposition is an identification of the user with Apple’s brand values. Having an Apple product makes you hip, cool, an entrepreneur, creative, individual, someone who thinks different, successful. Any of the or all of these may apply to particular individuals. Invariably, individuals use Apple products to show to the world that these are important truths about them

Speed of Service

Speed of service is an important value proposition for Apple’s customers. This is not really about how fast your new Apple phone is delivered. It’s about how fast you can set it up and start using it. It’s about how quickly you can learn to use it. It’s about how smoothly the product has an impact on what is important in your life and how it makes you more efficient and effective.

“I waste less time trying to do stuff now that I have an Apple”

The efficiency component is deeply related to Apple’s speed of service value proposition. It’s not about the tech. Apple is notoriously behind many other hardware manufacturers in its tech.

It’s about how the tech interacts with your life. Is there friction between the tech and you? If there is then the technology is not really delivering the value that the hardware claims. This is a big part of ‘design’. It’s about ergonomics and usability. It’s stripping waste, or muda , out of every customer interaction. Those milliseconds and seconds stack up to a far more efficient customer experience

Advanced Features & Capabilities

This is all the cool tech stuff. Retina displays. Multiple Cameras. Fingerprint sensors. They are important but other manufacturers have them – and often better

So despite Apple entering the smartphone and tablet categories first, it is happier to be a fast second. The value proposition is a hygiene factor. Not a critical success factor.

Finally recreation. People play lots of games on Apple devices. They watch lots of videos. But the consumers who buy them are predominantly wealth successful business people.

Recreation on Apple devices is a much lower importance value proposition for many of them. For example, I have Netflix on my iPhone, no games and almost every app contributes to me doing my job better.

Apple Products

Apple has four groups of products

Operating Systems

Accessories.

- iPhone smartphone

- iPad tablet computer

- Mac personal computer

- iPod portable media player

- Apple Music

- Airpods – wireless headphones

- Apple Watch – Smartwatch

- AppleTV – digital Media player

- HomePod – smart speaker

Distribution Channels

Apple uses a number of powerful promotional channels in the Apple business model, several of which have now been copied so much that they no longer differentiate Apple. These include the packaging of Apple products and the genius bar layout of apple stores.

These include:

- Apple Stores

- Apple’s websites

- Third Party Stores

- Telecom Companies

Apple Stores make a statement in a way that their competitors do not

Apple also controls the distribution of its products through its own website

Third-party stores have their brand and image tightly controlled so that they support the Apple brand.

Finally, Apple phones and tablets are sold through telecoms companies – bundled with the SIM and data required to make the most out of the device.

Marketing Channels

Apple generates an immense amount of PR and this is supported by strong brand awareness campaigns ‘shot with iPhone’ is a classic and long-running campaign.

Just as importantly – more so even – is the word of mouth. Because of the importance of self-expression and achievement in Apple’s value proposition users need and want to talk about their ownership of an Apple product.

If no one knows that they own an Apple device then they don’t get as much benefit from it. So they talk and often evangelise.

The final component of Apple’s word of mouth is the importance of groups.

“People like us do things like this” Seth Godin – Marketing Guru

Creatives, entrepreneurs, hipsters and business people have all adopted Apple products as part of their definition of group membership.

You can’t really be a ‘proper’ designer unless you use an Apple product. This isn’t true, but to members of a group, and especially to aspiring members of a group it can seem so.

Customer Relationships

With over 1.6 billion devices sold Apple is a mass-market consumer company by any definition.

Apple has a number of channels where they manage customer relationships

Telephone Customer Support

Chat and Online Customer Support

These are all great and are typically much better than competitors. Staff are onshore, rather than offshore, and as can be seen often match the demographics of target customers. Compare this to a lowest cost outsourced customer service department at Verizon.

However what makes the biggest difference in Apple’s customer relationships are:

- Evangelists

The evangelists have been mentioned in the section on Marketing Channels. They provide a similar service in the customer relationships – advocating for Apple, as unpaid salespeople. They will often also provide a front line level of support for other users.

Design is critical. Because Apple is a product-led company – they focus on building great products and expect success and scale to be based on the product – a great deal of the need for customer support is designed out.

In many ways, customer support, an important part of customer relationships in the business model canvas, is a failure of product design. Consumers contact support when something goes wrong. If you can design out failures…. then you need far less customer support.

Revenue in Apple’s Business Model

Apple’s business model is hugely cash generative. It makes more profits and has a stronger cash flow than Amazon, Google and Facebook combined.

Apple’s $60B of TTM operating income was nearly 50% more than the combined operating income of Alphabet ($24B), Facebook ($15), and Amazon ($3B). Above Avalon

So what does Apple sell? How does Apple monetise its business model?

- Apple Watch

- iTunes Store,

- Garage Band

Almost all of those are large enough to be a large company in their own right.

Key Resources in the Apple Business Model

The most important key resources in the Apple Business model are:

- Product First Design Philosophy

Supply Chain

- Walled Garden

Apple’s Product First Design Philosophy

If you look at Apple’s products you will find that they are often not better, on a technical sense

If you look at Apple’s products you will find that they are often not better, on a technical sense than its competitors. They are also priced similarly to the competitors’ premium products.

Apple, despite this, manages to extract far more profit from its products and services than its competitors.

This is a key feature of the Apple business model. When you charge the same price for a similar service and make a lot more money from it something must be going on under the hood.

The difference is Apple’s Product First Design philosophy.

This starts from the premise that they are going to make the best possible product for their market segment. Unlike competitors, they don’t initially think about scale and volume.

The focus is on how to make a product that will delight and inspire its users.

Those are the design constraints. Most other companies use budget and manufacturability as design constraints.

For them, a functional product is good enough. Customers understand that it is a functional product and treat it as one. In contrast, Apple’s focus is on creating a product that excels.

This is captured in their core values

- We believe that we’re on the face of the Earth to make great products.

- We believe in the simple, not the complex.

- We believe that we need to own and control the primary technologies behind the products we make.

- We participate only in markets where we can make a significant contribution.

- We believe in saying no to thousands of projects so that we can really focus on the few that are truly important and meaningful to us.

- We believe in deep collaboration and cross-pollination of our groups, which allow us to innovate in a way that others cannot.

- We don’t settle for anything less than excellence in every group in the company, and we have the self-honesty to admit when we’re wrong and the courage to change.

The result of this is that Apple’s business model creates products that work well. I mean well on a very deep level. They are hard to design, easy to manufacture and easy to use.

There is a significant amount of risk in doing this. If their idea of a product is wrong, if it doesn’t gel with the times, then they could lose a lot of money.

It’s a philosophy of perfection and, after their market entries, means that they will rarely be at the forefront of technology.

Design perfection means that they take longer to bring products to market. If they didn’t then they would lose the ease of use and many of the subtle components of the value proposition that makes the Apple business model so successful.

This key resource is composed of hugely talented people and a number of research and development labs working to bring products and services to fruition.

The second key resource that Apple has is its supply chain. In some ways, this is a misnomer as Apple, as part of the design of its business model, has positioned itself as a designer of products

It has decided to buy the manufacturing of its products as a key resource delivered by key partners (ie Foxconn) rather than make them itself.

In contrast, many computer hardware manufacturers are, well, computer hardware manufacturers.

They have to spend a great deal of cash building and running factories, and then even more time focusing on the management of their supply chain to make sure that it works efficiently.

Imagine we have a management team that has a limited amount of time and attention.

It can decide to spend some of its time on manufacturing and some on design. That’s what most companies do. They produce good products as a result.

What Apple does in its business model is to focus ‘all’ its time on design. It then gets Foxconn to spend ‘all’ its time on manufacturing and supply chain.

As a result, it gets far better outcomes in both design and manufacturing than other computer hardware manufacturers do.

This also nicely ties in with the design focus of Apple’s business model.

Much of the visible design is focused on the consumer experience. A great deal of the invisible design is focused on the manufacturability of the product.

Because Apple gives another party critical control over a key part of its business model there is a huge risk of things going wrong.

The manufacturing design, done in Cupertino, work hard to design out as many faults as possible in the product. They are easier to manufacture as a result, and this, in turn, reduces the number of issues of product failure and reduces the need for customer support.

The Walled Garden

The final resource that the Apple Business Model has is the walled garden. This could also be called the Apple Ecosystem

Everything works smoothly together.

This delivers a key part of Apple’s value proposition. It’s easy, unlike Windows or Android

If we look back into history Microsoft Windows created a platform that worked with any piece of hardware and allowed almost any software to run on it.

The operating system was the middleware that allowed everything to happen. The problem was that hardware designers and software developers cared only about their own products and didn’t often follow standards.

That meant that Windows was often a frustrating product to use as software and devices didn’t work, couldn’t be installed easily or crashed with the famous blue screen of death

Apple in an attempt to differentiate itself from Microsoft kept tight control of the ecosystem – perhaps because early users were creatives and not good at IT (Slanderous assertion I know) – and ensured it was user-friendly in a way that Microsoft did not.

This was rolled over into the Apple Store when the first iPods and iPhones were released. It then became an increasing part of the Apple experience. Everything played nicely together.

That then provided additional benefits.

Because Apple made its money from hardware sales it has no need to mine customer data and sell it to other people.

Apple can give users privacy. It also provides them with safety and security from many of the threats on the internet.

Finally, the more Apple products you use the greater the synergy you have. With each product, you add you get fewer irritations and hitches in your electronic life.

Key Activities in the Apple Business Model

Apple has two key activities in its business model. The first is the design. The second is branding.

We’ve spoken a great deal about design already, so I won’t go into too much detail there.

Why did I talk about branding being a key activity rather than marketing?

Apple is fundamentally about associating their products and services with emotional feelings in its users.

Apple wants its users to feel successful. Apple wants them to feel that they have achieved. It wants them to feel different. It wants them to be special

This is not something that can be done with traditional feature-based product marketing.

Branding thus connects people who want to be a ‘Mac’ and creates the need to buy the product in them.

It is all about who they can be and the lifestyle that they will become part of if only they buy into the Apple lifestyle.

Branding also works well because Apple controls a big chunk of its direct distribution channels – the Apple Stores.

Key Partnerships in Apple’s Business Model

There are two groups of key partners in the Apple business model.

These are the:

- Contract manufacturers

- Telecoms companies

Telecoms Companies in the Apple Business Model

Whilst Apple does have 500 shops worldwide this is a small number compared to the shops of other mobile phone companies, telecoms companies and resellers.

Expanding this network to enable everyone who wants to buy a phone would be cost prohibitive.

Apple’s key sales channel is selling phones through telecoms companies. They bundle the Apple iPhone with a subscription and let consumers pay for the phone over a couple of years. They provide the consumer financing that lets many people afford an expensive phone.

Apple outsource sales to the phone companies and uses their distribution networks and million of direct customers to achieve scale far faster than it could through its own store and website distribution service.

Contract Manufactures

Apple made the decision to buy manufacturing services rather than making its own. It derisked this by focusing on its design and quality control. As a result it freed up a huge amount of cash on its balance sheet.

It thought, correctly, that by using a manufacturer that it had a deep long term relationship with that it could get lower prices, a lower cost per unit, than if it ran factories itself.

Costs in the Apple Business Model

Apple employs some of the most expensive designers in the world in one of the most expensive locations in the world.

Equally, it spends a great deal on branding and on sourcing high-quality components.

Does it make sense then to say that Apple is a cost-driven company?

I think it does.

The expensive designers mean that Apple’s products hit the value proposition sweet spot demanded by their customers. As a result, Apple makes more $ per designer’s time than competitors.

The expensive branding means that it has to spend far less on tactical marketing and sales.

The expensive components deliver a superior user experience that generates intense loyalty and significantly reduces the retention cost and churn of apple users.

As a result, this focus on spending a lot on very valuable activities means that the actual cost of making Apple products is remarkably low and this is the fundamental reason for Apple’s incredible profitability.

Cost is a strategic goal, not a tactical one in the Apple business model

That’s the secret of Apple’s business model!

- Marketing Experimentation

- What is the Tencent Business Model?

- Business Model Design & Customer Value

- Value Proposition Design Questionaire

- Should a Brand be Desirable?

About Denis Oakley

Explorer | Trail Runner | Mountain Lover

'Big' companies are civilisation. I stay in the wilderness guiding entrepreneurs and startups on their journey to becoming 'Big'.

Then I head back to the frontier

Strategy | Marketing | Operations

Ready to start?

I help entrepreneurs transform their industries through wiser choices

Outcome : More Traction, Bigger Rounds, Better Products

Method : Problems, Customers, Business Models, Strategy

Apple Business Model (2023) | How Does Apple Make Money

5 minutes read

How does the Apple business model canvas continue to find success in the market? One of the world’s most popular brands, Apple dominates the tech industry with its top-quality products and software. Users choose to upgrade their iOS-powered devices year after year thanks to the company’s effective marketing and production tactics. This article reviews the inner workings of the Apple business model.

A Brief History of Apple

Apple founders Steve Jobs and Steve Wozniak officially launched the brand on April 1, 1976. The partnership of the two college dropouts brought forth sweeping ideas to motion. Working from Job’s garage, the pair aimed to create computers that didn’t take up much space in homes and offices. They introduced the hand-built Apple I computer as their first product, featuring only hardware modules.

Jobs and Wozniak later presented the Apple II in 1977, shifting to a fully assembled personal computer. It retailed for $1,298 during release and featured a redesigned TV interface that displayed simple text and graphics. It bested some of that year’s competition and became a bestseller in the tech industry. They opened the product to the public and amassed a whopping $118 million in 1980.

Wozniak left the company in 1983, followed by Jobs in 1985 after an attempted coup against then-president John Sculley. However, Steve Jobs bought back Apple in 1997 to save the brand’s dropping market shares. His revolutionary tactics improved the numbers, eventually paving the way for the first iPhone to be introduced in 2007.

The Apple business model canvas stayed unbeatable through it all, allowing the company to reach the trillion-dollar mark in 2018. iOS devices and software became a household name, doubling its market cap in 2020. Today, aspiring businesses can take pointers from the highly successful Apple business model.

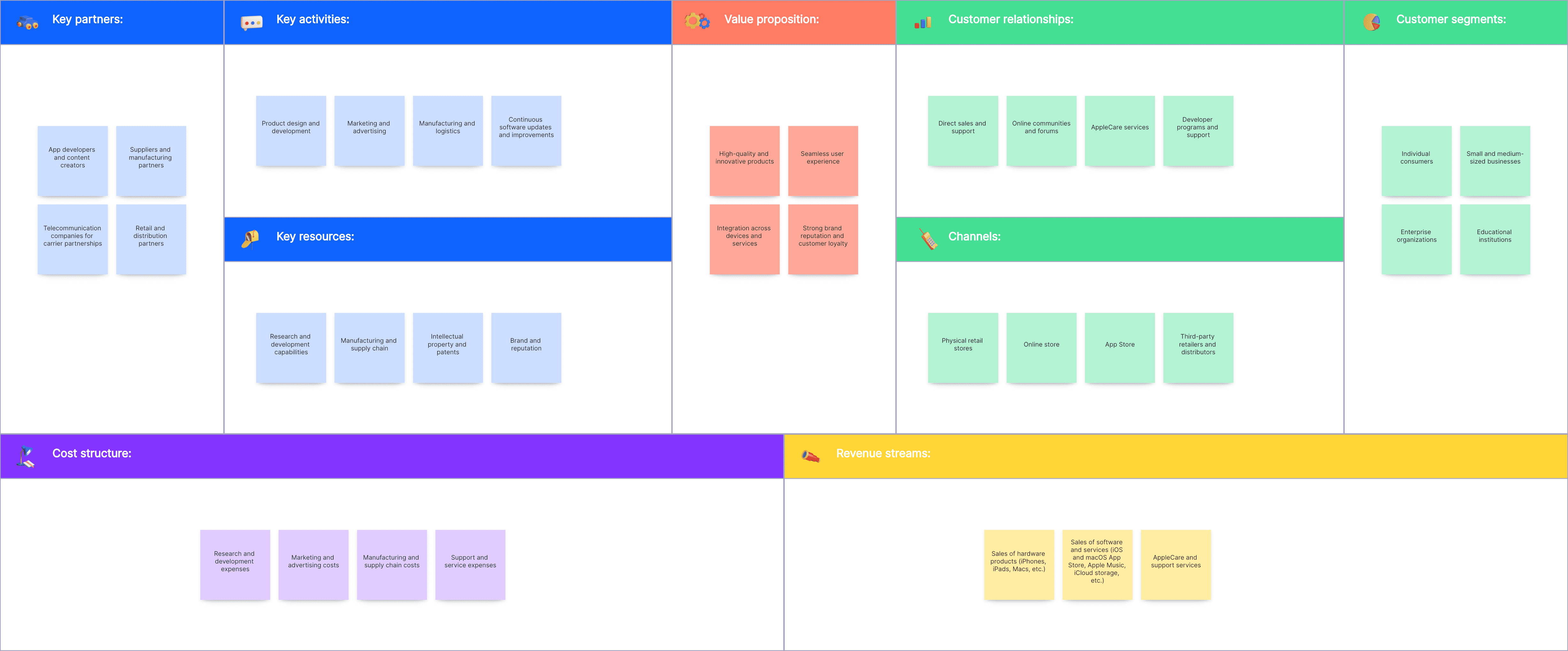

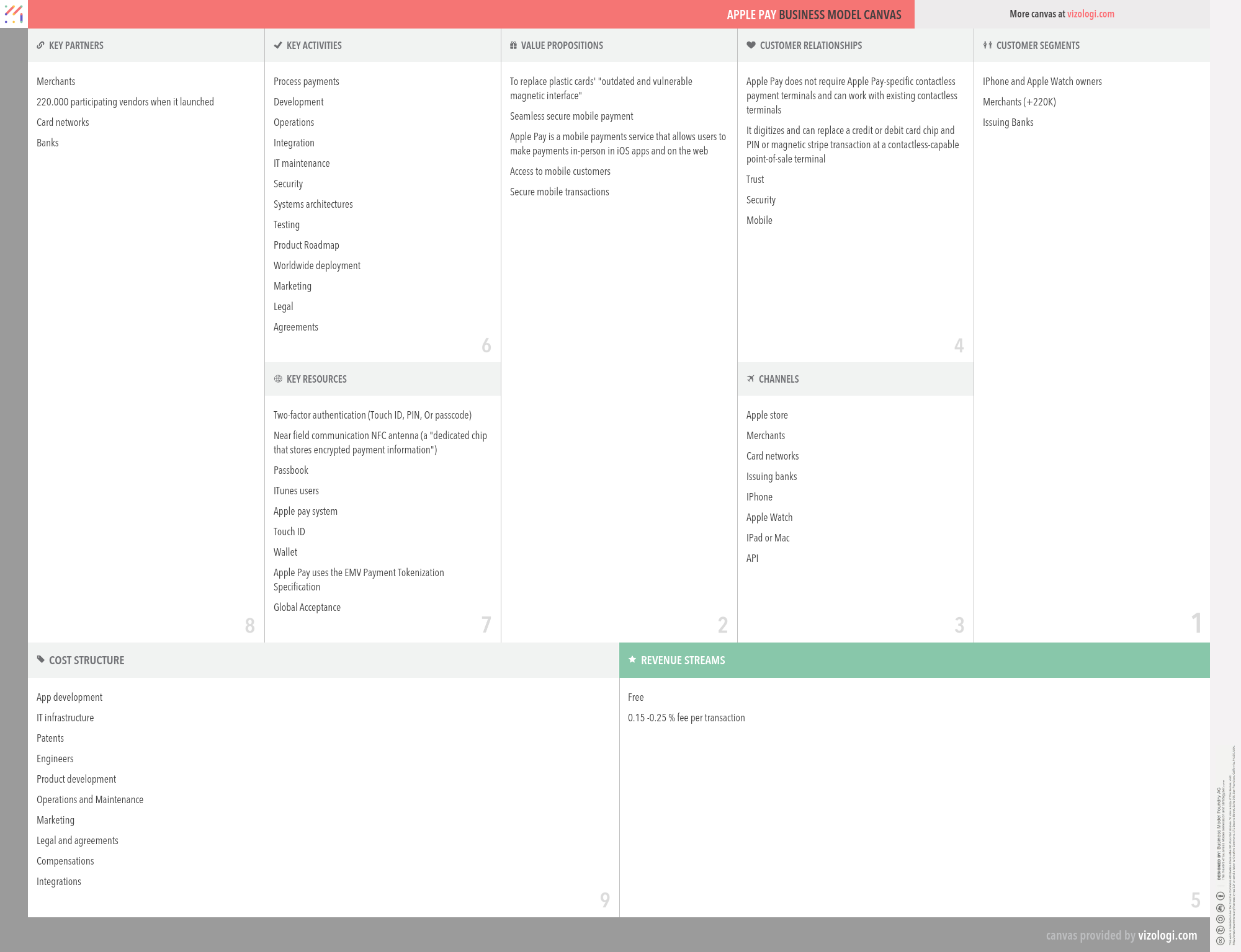

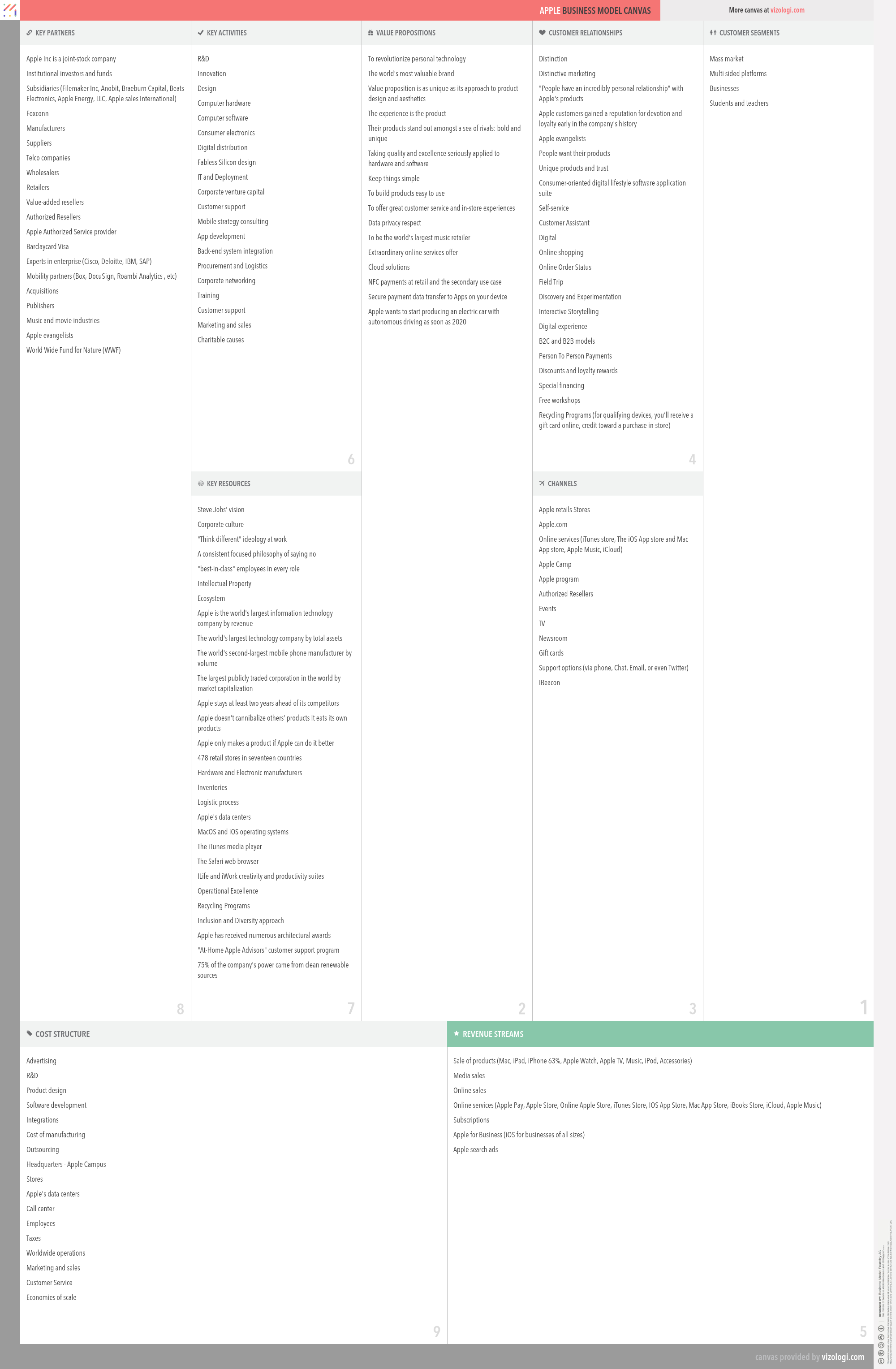

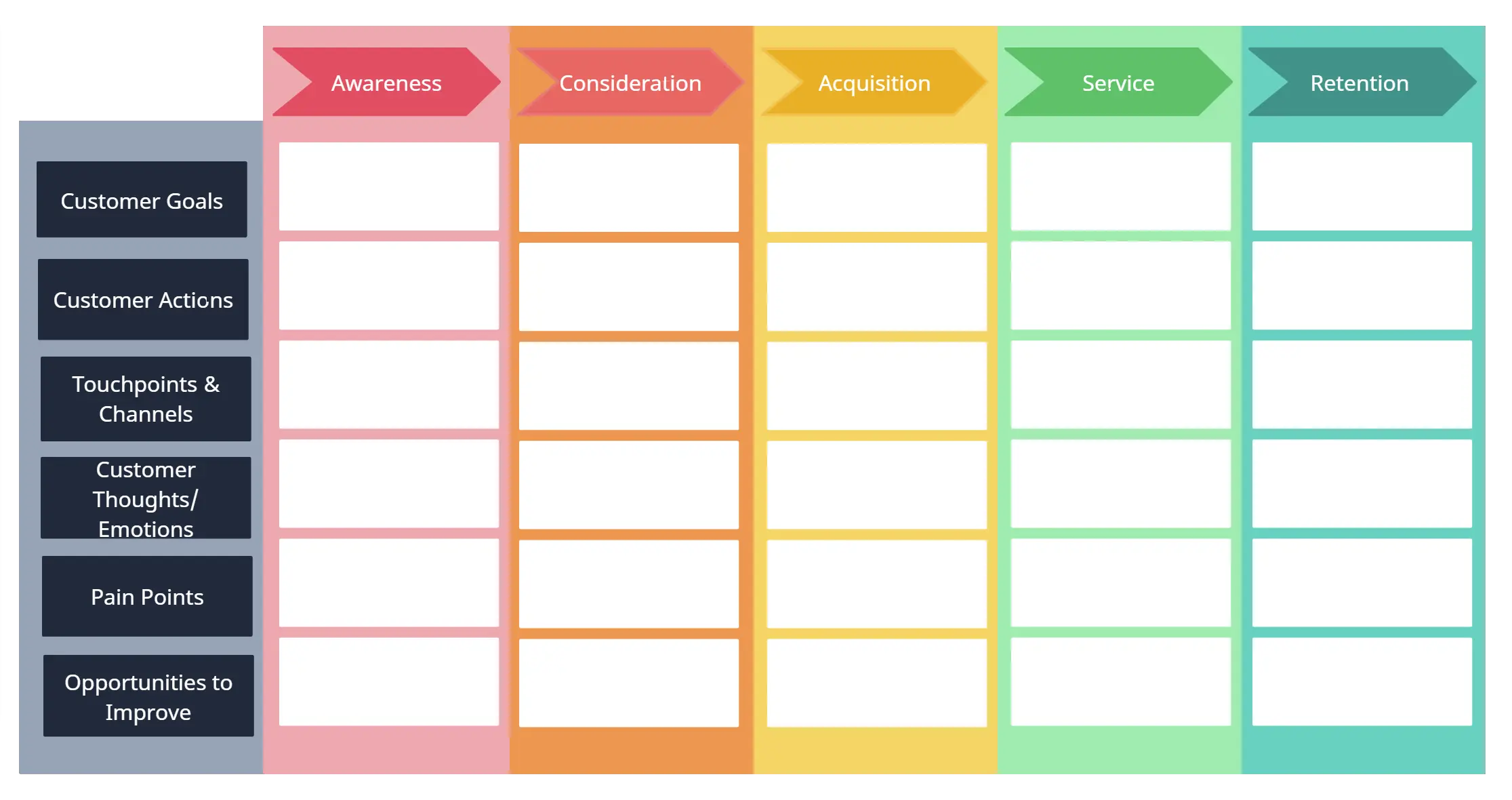

Apple Business Model Canvas

Apple Inc. is a world-renowned technology company that delivers creative and aptly differentiated products for a global audience. The business model utilizes an effective framework, ensuring that the brand maintains its reputation as an industry leader.

This section presents the canvas for Apple’s business model created using the Boardmix productivity platform.

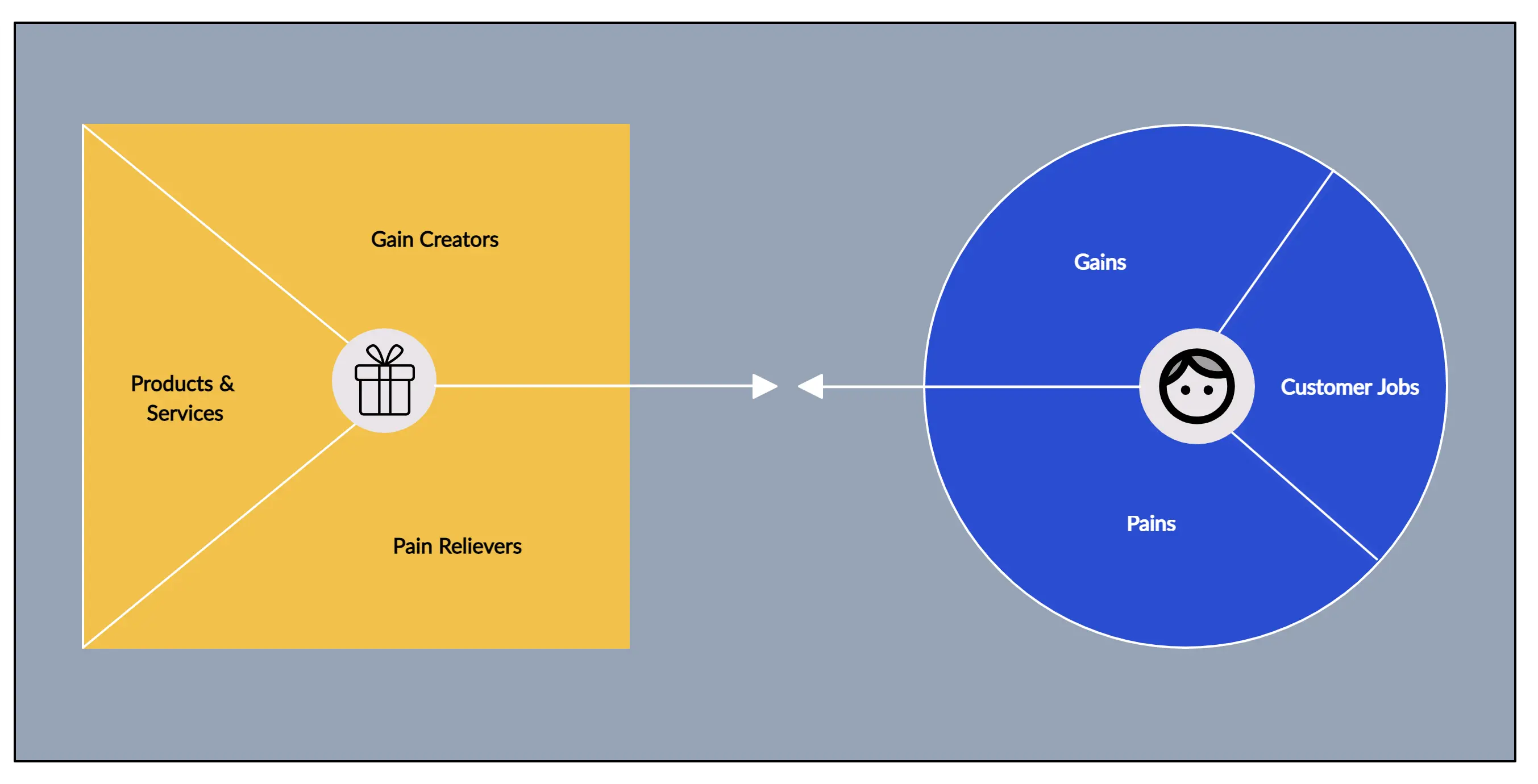

Value Proposition of Apple

The brand's value proposition lies heavily in design, branding, and innovation. Banking on creativity, the brand sets its products and services apart using aesthetics, advanced technology, and user experience. The build quality and sleek appearance of the iPhone, for example, makes the device recognizable in an instant. Additionally, the superior interface makes the gadget suitable for people of all ages.

In terms of the hardware to software to services ecosystem, Apple manages to provide seamless integration across all these aspects. As a result, the user can switch between devices without losing their work or progress. Adding to its strengths is the user-friendly operating system, iOS. It’s intuitive and easy to navigate, which helps customers manage their usage effectively.

Customer Segments of Apple

The diverse clientele of the brand is a testament to the effectiveness of the Apple business model canvas. Its customer segment primarily consists of product buyers and service subscribers who utilize Apple TV, iCloud, and other products. There are also product developers looking to monetize their creations using the platform.

Key Partners of Apple

At the core of Apple's business model lie crucial partnerships that uphold the brand's impeccable standards and product quality. Key collaborators encompass suppliers and manufacturers who meticulously provide and assemble components. Additionally, strategic alliances with content providers are integral to ensuring users access the exceptional service and quality they expect. These symbiotic relationships underpin Apple's commitment to delivering top-tier products and experiences to its global customer base.

Key Activities of Apple

Apple focuses on several key activities that boost business performance, including design, development, and manufacturing. The company invests significantly in research and development (R&D) to leverage new and up-and-coming technologies. The engineering and production teams collaborate to create seamless products that meet customer expectations and needs.

In addition, Apple strengthens its marketing efforts by implementing strong branding tactics. The market is always abuzz with the company’s latest products. With a global network of distributors, the brand is a household name in all parts of the world.

Customer Relationships of Apple

The brand sells billions of devices, making it a mass-market provider in the tech industry. Its customer relations teams cater to consumers through various avenues like social media and the official website. It also maintains a loyal customer base by offering services via the Apple Store and a robust reward system.

Key Resources of Apple

Apple’s supply chain enables a more streamlined production scaling, with different teams working seamlessly to create high-standard products. Besides its strong brand image, Apple also banks on its pool of engineering and design talents. Additionally, the company has a healthy portfolio of trademarks and patents that boost the value of the brand.

Channels of Apple

Apple's business model encompasses a diverse array of distribution channels to cater to its extensive customer base. Boasting over 500 retail stores worldwide, customers have the opportunity to experience and test devices firsthand before making their purchase decisions. This brick-and-mortar presence complements its robust online presence, ensuring accessibility and convenience for consumers.

The company also has an excellent e-commerce platform that enables customers to select pick-up or home delivery for their purchases. Lastly, the brand enlists authorized carriers and sellers to make Apple products widely available for different types of customers.

Cost Structure of Apple

It’s a known fact that the Apple business model canvas relies heavily on R&D. As such, it incurs a huge expense in this aspect, including marketing and advertising. However, despite this heavy investment, the company has a commendable supply chain management. Its efficiency, strong branding, and product pricing allow Apple to offset costs effectively.

As of 2022, the company has over 160,000 employees, which means salaries take a significant cut of the expenditures. The company also pays for platform maintenance and payment processing fees, ensuring ease and convenience for customers.

Revenue Streams of Apple

Apple Inc.'s primary revenue stream predominantly derives from product sales, notably the iconic iPhone, iPad, Apple Watch, Mac, and an array of innovative devices. In tandem with its hardware offerings, the brand provides an array of complementary services, encompassing Apple Music and the seamless convenience of Apple Pay.

Beyond these core channels, Apple enjoys supplementary income from royalties stemming from its rich reservoir of intellectual properties. Additionally, the sale of accessories and peripherals, including chargers and cables, contributes significantly to the company's diverse revenue portfolio. This multifaceted approach underscores Apple's robust financial ecosystem.

How Does Apple Make Money?

The Apple business model reveals the brand's dedication to designing and innovating products and services for a diverse clientele. The company understands customer expectations and needs and answers every demand effectively. In return, Apple loyalists continue to patronize their devices, accessories, and software year after year.

Apple's strong value proposition paired with a deep understanding of its customer segments helps the company generate a sizable revenue. On top of the price tag on products and services, the company makes money off device care like warranties. Customers are willing to add a few more dollars to acquire brand-recommended apps and third-party accessories.

With respect to gross margin, subscription services take the highest revenue across all channels. However, the most profitable source is understandably the product sales.

Key Takeaways

The Apple business model canvas is highly successful, and it can be attributed to the company’s emphasis on design, innovation, and optimized user experience. The company leads the market with its strong branding, backed by the guaranteed quality of products and services.

Apple has a streamlined supply chain and a network of stakeholders that provide expertise and resources. As a result, the brand continues to dominate the tech industry in different parts of the world. Since its inception, the brand managed to stay on top and generate significant revenue by selling top-notch products and services. Overall, Apple has a framework worth emulating.

You can get an in-depth view of the Apple business model canvas when you use the Boardmix platform. The productivity app provides outstanding insight regarding the tech powerhouse, which you can take inspiration from for your project. Get the Boardmix application and find the canvas template without hassle!

References:

https://worktheater.com/explaining-the-apple-business-model/

https://businessmodelanalyst.com/apple-business-model/#Apple%E2%80%99s_Customer_Relationships

https://blog.gitnux.com/companies/apple/

Join Boardmix to collaborate with your team.

Walmart PESTLE Analysis: A Deep Dive into External Influences

Coca-Cola PESTLE Analysis Demystified: Unveiling Growth Strategies

Zara PESTLE Analysis: Unlocking Success

Presentations made painless

- Get Premium

Apple: Business Model, SWOT Analysis, and Competitors 2023

Inside This Article

In this blog article, we will delve into Apple's business model, conduct a SWOT analysis, and explore its competitors in the year 2023. Apple, a renowned multinational technology company, has established a unique business model that focuses on innovation and premium products. By analyzing its strengths, weaknesses, opportunities, and threats, we can gain valuable insights into Apple's current and future position in the market. Additionally, we will examine the competitive landscape to understand the challenges Apple faces from its rivals. Join us as we explore Apple's strategies and its outlook for the coming years.

What You Will Learn:

- Who owns Apple and the structure of the company's ownership.

- The mission statement of Apple and its guiding principles.

- How Apple generates revenue and the sources of its income.

- An explanation of the Apple Business Model Canvas and how it applies to the company.

- An overview of Apple's main competitors and the industry landscape.

- A comprehensive SWOT analysis of Apple, examining its strengths, weaknesses, opportunities, and threats.

Who owns Apple?

Major shareholders.

Apple is one of the most valuable companies in the world, but who exactly owns it? Let's take a closer look at the major shareholders of Apple.

At the top of the list is typically institutional investors, such as mutual funds, pension funds, and other large investment firms. These institutions own a significant portion of Apple's shares. Some of the major institutional shareholders include The Vanguard Group, BlackRock, and State Street Corporation. These organizations manage funds on behalf of millions of investors, including individuals and retirement accounts.

Another notable group of shareholders is Apple's executive team, including the CEO, CFO, and other key executives. These individuals often receive stock options and grants as part of their compensation package. As a result, they have a vested interest in the company's success and hold a considerable number of shares.

Additionally, individual investors also own a portion of Apple's stock. These investors can range from small retail investors to high-net-worth individuals. While their ownership may not be as significant as institutional investors, they collectively contribute to the overall ownership structure of the company.

Founders and Inheritance

Apple was founded by Steve Jobs, Steve Wozniak, and Ronald Wayne in 1976. However, Ronald Wayne sold his shares back to Jobs and Wozniak just a few weeks after the company was formed, making Jobs and Wozniak the primary founders and shareholders.

Over the years, Steve Jobs became the face of Apple and played a pivotal role in its success. However, he sold all of his shares in the company in 1985 after being ousted from Apple. Jobs returned to the company in 1997 and was instrumental in its turnaround, but he did not initially own any shares. As part of his return, he negotiated a deal to buy back a significant number of shares, which eventually made him the largest individual shareholder of Apple.

Following Steve Jobs' passing in 2011, his shares were transferred to the Steve Jobs Trust, managed by his widow, Laurene Powell Jobs, and other family members. The Trust remains a major shareholder in Apple, representing the late co-founder's vision and legacy.

While Apple is a public company with shares traded on the stock market, its ownership is widely distributed among institutional investors, executive team members, individual investors, and the Steve Jobs Trust. This diverse ownership structure reflects the broad interest and confidence in Apple's future, as well as the company's commitment to delivering value to its shareholders.

What is the mission statement of Apple?

The mission statement of apple: innovate and inspire.

Apple's mission statement is concise, yet powerful: "To bring the best user experience to its customers through innovative hardware, software, and services." This statement encapsulates the essence of Apple's purpose and the driving force behind its success.

Apple's commitment to innovation is evident in every product they release. From the iconic iPhone to the sleek MacBook and the intuitive Apple Watch, Apple consistently pushes the boundaries of technology. Their innovative approach not only sets them apart from competitors but also shapes the industry as a whole.

However, Apple's mission goes beyond mere technological advancements. They strive to inspire their customers by creating products that seamlessly integrate into their lives. Apple products are designed to be intuitive and user-friendly, providing an unparalleled user experience. This dedication to simplicity and usability is a testament to Apple's mission of delivering the best experience to its customers.

Apple's mission statement also emphasizes the importance of hardware, software, and services working together harmoniously. This holistic approach is evident in their ecosystem of devices, operating systems, and services, which seamlessly integrate and enhance each other. By creating this ecosystem, Apple aims to provide a cohesive and seamless experience for its customers, regardless of the device they are using.

Moreover, Apple's mission statement highlights their commitment to service excellence. Beyond offering innovative products, Apple understands the importance of customer support and satisfaction. Their extensive network of Apple Stores, online resources, and customer service channels ensures that customers receive the assistance they need promptly and efficiently.

In conclusion, Apple's mission statement reflects their dedication to innovation, user experience, integration, and exceptional service. It serves as a guiding principle for the company, driving their continuous pursuit of excellence and inspiring their customers worldwide.

How does Apple make money?

Sales of iphones.

One of the primary ways Apple makes money is through the sales of its flagship product, the iPhone. With each new release, Apple generates significant revenue from the sale of these smartphones. The company's ability to consistently innovate and deliver cutting-edge technology has created a loyal customer base that eagerly awaits new iPhone models. Apple's iPhones are known for their premium quality, sleek design, and advanced features, which allows the company to command a premium price and generate substantial profits from each device sold.

App Store and Services

Another major source of revenue for Apple is its App Store and various services. The App Store offers a vast selection of applications and games, both free and paid, which users can download onto their iPhones, iPads, and Macs. Apple takes a 30% cut from the sales of paid apps, in-app purchases, and subscriptions, thereby generating significant revenue. Additionally, Apple's services such as Apple Music, iCloud storage, Apple Pay, and Apple TV+ also contribute to the company's revenue stream.

Mac Computers and iPads

While iPhones may be the most popular product, Apple also earns a substantial amount of money from the sale of Mac computers and iPads. Macs are renowned for their performance, user-friendly interface, and seamless integration with other Apple devices, making them a preferred choice among professionals, creatives, and students. Similarly, iPads have become increasingly popular due to their versatility, powerful features, and compatibility with a wide range of apps. The sales of these devices contribute significantly to Apple's overall revenue.

Wearables, Home, and Accessories

Apple's wearables, home, and accessories segment is another lucrative revenue stream for the company. This category includes products such as the Apple Watch, AirPods, HomePod, and various accessories like cases, chargers, and cables. The Apple Watch, in particular, has gained immense popularity as a leading smartwatch in the market. The seamless integration with other Apple devices, health tracking capabilities, and a vast array of apps make it a sought-after accessory. The sales of these products contribute to Apple's overall profitability.

Other Products and Services

In addition to the main revenue sources mentioned above, Apple also generates income from other products and services. This includes sales of iPods, Apple TV, iTunes content, licensing fees from third-party manufacturers, and more. While these may not be as significant as the primary revenue streams, they collectively contribute to Apple's overall financial success.

In conclusion, Apple's ability to generate substantial revenue stems from its diversified product and services portfolio. The sales of iPhones, along with the App Store and services, remain the primary sources of income. Additionally, Mac computers, iPads, wearables, home, and accessories, as well as other products and services, all contribute to Apple's overall financial performance.

Apple Business Model Canvas Explained

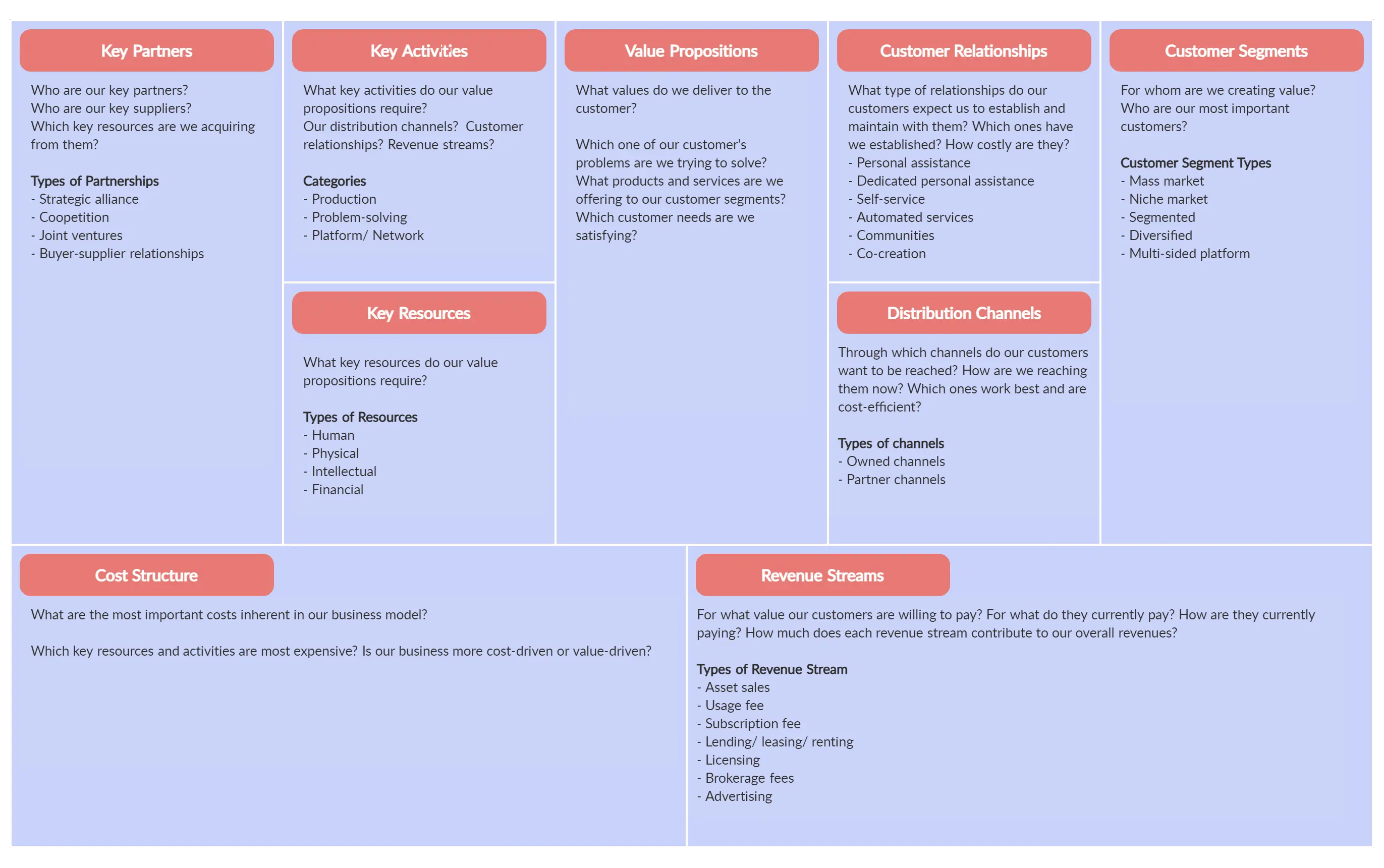

What is a business model canvas.

A Business Model Canvas is a strategic management tool that allows businesses to visually describe, analyze, and design their business models. It provides a comprehensive framework to understand the key components of a business and how they interact with each other to create value for the company.

Key Components of the Apple Business Model Canvas

Customer Segments : Apple primarily targets premium customers who value quality, design, and innovation. They focus on different customer segments such as individual consumers, businesses, educational institutions, and creative professionals.

Value Proposition : Apple's value proposition centers around creating user-friendly, innovative, and aesthetically pleasing products. They emphasize the seamless integration of hardware, software, and services to deliver a unique user experience. The company positions itself as a premium brand that offers superior quality and design.

Channels : Apple utilizes a multi-channel approach to reach its customers. They have a strong retail presence with Apple Stores worldwide, online sales through their website, and partnerships with authorized resellers. Additionally, Apple leverages advertising campaigns, product launches, and word-of-mouth to promote its products.

Customer Relationships : Apple focuses on building long-term relationships with its customers. They achieve this through excellent customer service, providing regular software updates, and offering warranty and repair services. Apple also encourages customer engagement through its Apple Support Communities and feedback channels.

Revenue Streams : Apple generates revenue through various sources, including the sale of hardware products such as iPhones, iPads, Macs, and wearables like Apple Watch. They also earn revenue from digital services like the App Store, Apple Music, iCloud, and Apple Pay. Additionally, Apple generates income from licensing agreements and partnerships.

Key Activities : Apple's key activities revolve around product design, development, and manufacturing. They invest heavily in research and development to create innovative products and maintain a competitive edge. Apple also focuses on marketing, supply chain management, and retail operations to ensure efficient delivery of their products.

Key Resources : Apple's key resources include its intellectual property, patents, trademarks, and brand reputation. They have a strong supply chain network that ensures a steady flow of high-quality components. Apple's human capital, including skilled designers, engineers, and marketing professionals, also contributes to its success.

Key Partnerships : Apple collaborates with a range of partners to enhance its business model. They work closely with suppliers to ensure the availability of quality components. Additionally, Apple has partnerships with software developers, content providers, and other technology companies to expand the ecosystem of its products and services.

Cost Structure : Apple's cost structure is mainly driven by research and development, manufacturing, marketing, and distribution expenses. They incur significant costs in designing and developing new products, as well as maintaining a global supply chain. Apple also invests in marketing campaigns to create brand awareness and promote its products.

The Apple Business Model Canvas provides a comprehensive overview of how Apple creates, delivers, and captures value in the market. By analyzing each component, it becomes clear that Apple's success stems from its focus on innovation, design, and delivering a superior user experience. Understanding the intricacies of the Apple Business Model Canvas can provide valuable insights for entrepreneurs and businesses looking to learn from Apple's success.

Which companies are the competitors of Apple?

Samsung is one of the biggest competitors of Apple in the global smartphone market. Known for its flagship Galaxy series, Samsung offers a wide range of smartphones that compete directly with Apple's iPhone. With a loyal customer base and innovative features, Samsung has managed to capture a significant market share, posing a tough challenge to Apple.

Google, with its Android operating system, is another major competitor of Apple. Android is the dominant mobile operating system worldwide, powering a multitude of smartphones from various manufacturers. Google's Pixel smartphones, in particular, directly compete with Apple's iPhone, offering similar features and capabilities. Additionally, Google's ecosystem of apps and services provides a compelling alternative to Apple's offerings.

While primarily known for its software and operating systems, Microsoft has been making inroads into the hardware market, directly competing with Apple. Microsoft's Surface lineup of devices, including the Surface Pro and Surface Laptop, offers a unique blend of tablet and laptop functionality, challenging Apple's iPad and MacBook range. With its focus on productivity and versatility, Microsoft aims to attract consumers looking for an alternative to Apple's products.

As a Chinese telecommunications giant, Huawei has emerged as a strong competitor to Apple, particularly in the global smartphone market. Known for its high-quality cameras and cutting-edge technology, Huawei's flagship smartphones, such as the P and Mate series, directly compete with Apple's iPhone. Despite facing some challenges in recent times, Huawei continues to innovate and expand its market presence, posing a significant threat to Apple's dominance.

While not traditionally seen as a direct competitor in terms of smartphones, Amazon competes with Apple in various other areas. With its Kindle e-readers and Fire tablets, Amazon offers affordable alternatives to Apple's iPad and other tablet devices. Additionally, Amazon's smart speakers, such as the Echo series with Alexa voice assistant, compete with Apple's HomePod. As Amazon continues to expand its product portfolio, its competition with Apple is likely to increase in the future.

Apple faces tough competition from various companies in different sectors of the technology industry. Samsung, Google, Microsoft, Huawei, and Amazon are just some of the major competitors vying for market share and consumer attention. As the competition intensifies, Apple will need to continue innovating and delivering exceptional products and services to maintain its position as a leading player in the highly competitive tech market.

Apple SWOT Analysis

Strong brand image: Apple has a powerful brand reputation that is associated with quality, innovation, and premium pricing. This allows the company to command a loyal customer base and maintain a competitive advantage in the market.