Refine Results By

Common budgetary terms explained.

This guide briefly explains—in plain language—the differences between some common budgetary terms. (For detailed definitions, see CBO’s Glossary .)

What’s the Difference Between . . .

. . . budget authority, obligations, and outlays.

Budget authority, obligations, and outlays are related terms that describe the funds provided, committed, and used for a program or activity.

Often called funding, budget authority is the amount of money available to a federal agency for a specific purpose. The authority to commit to spending federal funds is provided to agencies by law. The amount of budget authority provided can be specific—such as when the Congress provides a set amount for a program or activity—or indefinite. For example, the federal crop insurance program uses indefinite budget authority to provide insurance products to farmers and ranchers at subsidized rates.

Once budget authority has been provided for a given purpose, an agency can incur an obligation —a legally binding commitment. For example, the Department of Defense incurs an obligation when it enters into a contract to purchase equipment. Often, the funds must be obligated within a specified period—typically one or several years—although some funds are available indefinitely. If funds are not obligated within the specified period, they expire (or lapse) and are no longer available for use.

In general, outlays occur when a federal agency issues checks, disburses cash, or makes electronic transfers to liquidate (or settle) an obligation. That occurs, for example, when a federal agency deposits grant funds into recipients’ accounts or the Social Security Administration disburses payments to beneficiaries. (For more information about how the Congressional Budget Office estimates outlays, see CBO’s Waterfall Model for Projecting Discretionary Spending, March 2021 .)

. . . Authorization Acts and Appropriation Acts?

Authorization acts and appropriation acts provide the legal authority for the government to operate and fund programs or activities.

Authorization acts establish or continue the authority for agencies to conduct programs or activities. Such laws delineate a program’s terms and conditions—often, its duration and eligibility rules. When an authorization act provides funding directly from the Treasury (so that the program does not require an annual appropriation), that amount is classified as mandatory spending.

Other authorization laws establish or continue discretionary programs, which receive their funding in appropriation acts. Those authorization laws may include language such as “there is authorized to be appropriated [a certain amount of money],” indicating that any funding for the program must be provided in subsequent appropriation acts. (For more information, see Expired and Expiring Authorizations of Appropriations: Fiscal Year 2021 .)

Appropriation acts make funding available to federal programs and activities by providing budget authority to federal agencies, usually by specifying an amount of money for a given fiscal year. In the absence of an authorization act, an appropriation act—by providing funding—can also authorize agencies to operate a program or to undertake an activity. The Congress may consider multiple regular appropriation bills in a given year or provide all discretionary appropriations in one omnibus bill. When regular appropriations are not in place by October 1, the start of the fiscal year, a continuing resolution can be enacted to provide temporary budget authority for a specified period, typically in amounts equal to appropriations for the previous year.

The Congress can also supplement regular appropriations that have already been enacted. In 2020, for example, lawmakers enacted four laws that provided supplemental appropriations in response to the coronavirus pandemic to give financial assistance to individuals, businesses, and other entities.

. . . Discretionary and Mandatory Spending?

The labels discretionary and mandatory identify the process by which the Congress provides funds for federal programs or activities. The distinction is generally made at the time a law creates a program or provides authority to undertake an activity. The Congressional rules and statutory procedures that govern budget enforcement differ for those two types of spending.

Discretionary spending results from budget authority provided in appropriation acts. (A few mandatory programs are also funded through appropriation acts; those programs are discussed below.) Through the appropriation process, the Congress decides on the amount of funding for a program (such as veterans’ health care) or an activity (such as collecting entrance fees at national parks). Administrative costs—to pay salaries, for example—are usually covered through those appropriations.

As a share of all federal outlays, discretionary spending has dropped from 60 percent in the early 1970s to 30 percent in recent years. Almost all defense spending is discretionary, and about 15 percent of pandemic-related spending was classified as discretionary.

Although statutory limits (often referred to as caps) on most types of discretionary budget authority were in place in many years, none are in effect now. The Budget Control Act of 2011 established caps for fiscal years 2012 to 2021; no caps were established for subsequent years.

Mandatory spending (also called direct spending) consists of outlays for certain federal benefit programs and other payments to individuals, businesses, nonprofit institutions, and state and local governments. That spending is generally governed by statutory criteria and, in most cases, is not constrained by the annual appropriation process. Social Security, Medicare, and Medicaid are the three largest mandatory programs.

Funding amounts for a mandatory program can be specified in law or, as is the case with Social Security, determined by complex eligibility rules and benefit formulas. The authorization laws that specify the amount of funding for mandatory programs may use language such as “there is hereby appropriated [a particular amount of money].”

Funding for some mandatory programs—for example, the Supplemental Nutrition Assistance Program, veterans’ disability compensation and pensions, and Medicaid—is appropriated annually. Spending on those programs is called appropriated mandatory spending. Those programs are mandatory because authorization acts legally require the government to provide benefits and services to eligible people or because other laws require that they be treated as mandatory; however, appropriation acts provide the funds to the agencies to fulfill those obligations.

As discretionary spending’s share of total federal spending has declined, mandatory spending’s share has grown, from about 30 percent in the early 1970s to 60 percent in recent years. The remaining 10 percent of total federal outlays consists of net spending on interest (primarily interest payments on the federal debt).

Under the Statutory Pay-As-You-Go Act of 2010 (often called S-PAYGO), the Congress established budgetary reporting and enforcement procedures for legislation that affects mandatory spending or revenues. That act can trigger across-the-board cuts in funding (known as sequestration) for mandatory programs. (For more information, see The Statutory Pay-As-You-Go Act and the Role of the Congress .)

. . . Rescissions and Reappropriations?

Rescissions and reappropriations are used by the Congress to change the availability of unused (that is, unobligated) budget authority.

Rescissions cancel previously provided budget authority before it expires under current law.

Reappropriations extend the originally specified period of availability for unused budget authority that has expired or that would otherwise expire. Generally, that reappropriated budget authority is for the originally stated purpose, but sometimes it can be used for a different purpose.

. . . Cash Accounting, Accrual Accounting, and Fair-Value Accounting?

Cash, accrual, and fair-value accounting are ways to estimate and record the cost of government activities in the federal budget. Those methods differ in terms of when the commitment or the collection of budgetary funds is recorded in the budget and whether they measure the market value of the government’s obligations. (For more information, see How CBO Produces Fair-Value Estimates of the Cost of Federal Credit Programs: A Primer and Cash and Accrual Measures in Federal Budgeting .)

Cash accounting records costs when payments are made and revenues when receipts are collected. Most spending in the federal budget is recorded on a cash basis.

Accrual accounting records costs when goods are received or services are performed (rather than when they are paid for) and revenues when they are earned (rather than when actual payments are received). Under that accounting method, the estimated cost of budgetary activities is the sum of all cash flows associated with that activity, expressed in a single number called a present value. The present value depends on the rate of interest, known as the discount rate, that is used to translate future cash flows into current dollars. (Interest on the public debt is recorded on an accrual basis but not as a discounted present value.)

The Federal Credit Reform Act of 1990 (or FCRA) requires the costs of federal credit programs—namely, the costs of the government’s direct loans and loan guarantees—to be recorded as a present value at the time a loan is made. FCRA also requires the discount rate to be the interest rate on Treasury securities with the same term to maturity as the associated cash flow. For example, cash flows in the second year of a federal loan or loan guarantee are discounted using two-year Treasury rates. Federal credit programs include certain housing programs, postsecondary education loans, commercial loans, and loans to small businesses.

Like FCRA accounting, fair-value accounting is a form of accrual accounting, but it uses market prices to measure the costs of loans and loan guarantees. Fair-value accounting reflects the fact that the government’s risk of loss from defaults on loans tends to increase when the economy is weak. Current and future generations bear the costs of such losses, which can result in higher taxes, reductions in spending, or larger debt. Although FCRA accounting is required by law to be used for recording outlays in the budget, fair-value accounting can be used to analyze credit programs, insurance programs, and retirement benefits. In general, the fair-value cost that private institutions would assign to credit assistance on the basis of market prices is greater than the cost reported in the federal budget under FCRA procedures.

. . . Revenues, Offsetting Collections, and Offsetting Receipts?

Revenues, offsetting collections, and offsetting receipts are funds received by the federal government for various purposes and activities. Those funds are designated in the budget either as governmental receipts (revenues) or as reductions in spending (offsetting collections and offsetting receipts). The implications of those designations for legislative and budget processes differ.

Revenues are funds that the federal government collects from the public using its sovereign power. About 90 percent of federal revenues come from individual income taxes, corporate income taxes, and social insurance taxes (which fund Social Security, Medicare, and other social insurance programs). Other sources include excise taxes, estate and gift taxes, duties on imported goods, remittances from the Federal Reserve, and various fees and fines.

Offsetting collections and offsetting receipts are funds that government agencies receive from the public and from other federal agencies (in what are known as intragovernmental transactions) for businesslike or market-oriented activities. Both are shown in the budget as offsets to spending (that is, as negative budget authority and outlays).

Offsetting collections are used for specific spending programs and are credited to the accounts that record outlays for such programs. For example, the U.S. Fish and Wildlife Service issues permits to import or export some species of game animals. The fees for the permits are considered offsetting collections because they cover program costs. (The authority for the agency to spend the fees is granted in annual appropriation acts . ) Similarly, the money that the Department of Defense collects from sales at military commissaries is used to cover operating expenses.

Offsetting receipts are recorded in stand-alone accounts that are separate from spending accounts. Such receipts are not automatically available for an agency to spend but are generally considered to offset mandatory spending. The largest offsetting receipts are Medicare premiums. In addition, much of the income generated from federal oil and gas leases is counted as offsetting receipts, as are the intragovernmental transfers from agencies’ accounts to the civil service and military retirement trust funds. (Because those transfers are recorded as outlays by the agencies and as offsetting receipts to the trust funds, they have no net effect on the deficit.)

. . . Deficit and Debt?

The amount by which government outlays exceed revenues in a fiscal year is the deficit . Because the government borrows to finance deficits, a deficit adds to federal debt —the total amount borrowed by the government at a given point in time. Alternatively, a surplus exists when revenues exceed outlays; a surplus reduces federal debt.

Federal debt can be defined in several different ways. Two common measures of the amount that the federal government owes are debt held by the public and gross debt . (For more information, see Federal Debt: A Primer . )

Debt held by the public is the measure used most often in CBO’s reports on the budget. It is the amount that the government owes to other entities (such as individuals, corporations, state or local governments, the Federal Reserve Banks, and foreign governments). It consists mostly of IOUs in the form of securities—the bills, notes, and bonds that the Treasury issues to fund government operations.

Debt held by the public is the amount that the government has borrowed over time to finance the costs of programs and activities that revenues were insufficient to cover. Thus, it largely reflects the total cumulative deficit that the government has incurred. (To a lesser degree, that debt reflects other factors, such as the cumulative net cash disbursements for credit programs and the cash balances held by the government.)

Gross debt is debt held by the public plus intragovernmental debt, which is the amount that the government owes to its own accounts, primarily the trust funds for Social Security, Medicare, military retirement, and civil service retirement. When those programs’ collections exceed their spending, the Treasury uses the surplus cash flows to fund other federal activities, and the trust funds are credited with a corresponding amount of Treasury securities.

Intragovernmental debt is not a meaningful benchmark for future costs of benefits because it represents the cumulative total of the difference between a program’s past collections and expenditures. An increase in intragovernmental debt means that the programs credited with Treasury securities are running a surplus—the larger the intragovernmental debt, the bigger the cumulative surplus. The intragovernmental debt held by the Social Security trust funds is projected to decrease as the aging of the population and slow growth in the workforce cause the funds’ outlays to outpace their collections; the amounts in the trust funds will be insufficient to cover that projected gap between their collections and outlays in future decades.

Nearly all gross debt is constrained by a statutory debt limit—commonly referred to as the debt ceiling.

To make comparisons of deficits and federal debt over time, CBO typically measures them as a percentage of gross domestic product (or GDP)—the total market value of all goods and services produced domestically in a given period.

. . . On-Budget and Off-Budget?

Most public discussion and reports about the budget address the unified budget, which encompasses all the activities of the federal government. For certain budget enforcement purposes, budget accounts are divided into two categories: on-budget and off-budget . Under federal law, the budget authority, outlays, and revenues of most programs are on-budget —that is, they are included in budget totals—and on-budget activities are subject to the normal budget process and to budget enforcement procedures.

The revenues and outlays of the Social Security trust funds and transactions of the Postal Service are classified as off-budget . Most activities for those programs are not subject to caps, sequestration, or reporting and enforcement procedures under S-PAYGO. The budget resolution (the Congress’s budget plan) generally excludes off-budget programs.

. . . Cost Estimates, Dynamic Analysis, and Scorekeeping?

Cost estimates, dynamic analysis, and scorekeeping are used by the legislative and executive branches to measure and track the budgetary effects of legislation—that is, the changes in federal outlays, revenues, and deficits that result from enacting a particular piece of legislation.

Cost estimates explain how legislation would change federal spending and revenues over the next 5 or 10 years in relation to CBO’s projections of budgetary outcomes under current law. When CBO prepares estimates, it considers a range of responses that people or businesses might have to legislation and accounts for the possible budgetary effects of those responses. For example, a cost estimate for a bill that would raise or lower coinsurance for Medicare could change the number of people who chose to receive health care. As a result, CBO’s estimate of spending for that program could rise or fall in relation to the agency’s projection of such spending under current law.

CBO is required by law to produce a formal cost estimate for nearly every bill that is approved by a full committee of either the House or the Senate. The agency may, on occasion, produce estimates at other points in the legislative process. Cost estimates are advisory only. The Congress can use them to enforce budgetary rules and targets. (For more information, see How CBO Prepares Cost Estimates .)

Dynamic analysis incorporates the same kind of information found in conventional cost estimates but also includes CBO’s assessments of budgetary feedback—that is, the changes in spending and revenues caused by the changes in the nation’s economic output that would result from enacting the legislation. Although some major legislative proposals could significantly affect the economy—by affecting consumer prices or the labor supply, for example—most would not. By long-standing convention, CBO’s cost estimates typically do not account for the possible effects of legislation on GDP. Occasionally, however, the Congress asks CBO to provide a dynamic analysis of proposed legislation.

Scorekeeping is the process of developing and recording consistent measures of the budgetary effects of proposed and enacted legislation. Cost estimates are a tool used in that process. The scorekeeping process is governed by law, precedent, and rules. It addresses jurisdictional boundaries between authorization and appropriation acts and preserves the distinctions among the major budgetary categories—mandatory spending, discretionary spending, and revenues—by using different rules and procedures to analyze legislation’s effects on them. A key purpose is to attribute budgetary effects to the legislation that causes them so that rules and procedures established by the Congress for budget enforcement can be applied. (For more information, see CBO Explains Budgetary Scorekeeping Guidelines .)

. . . Calendar Year and Federal Fiscal Year?

The terms calendar year and federal fiscal year describe periods in which funds are made available or spent, changes are made to certain benefit amounts, and taxes are assessed or collected.

Calendar years begin on January 1 and end on December 31. Although most federal programs operate on a fiscal year basis, some aspects of programs are set to the calendar year. Cost-of-living adjustments for Social Security and other programs, for example, are set on a calendar year basis. In addition, individual income taxes are levied on a calendar year basis, and economic data are typically reported for calendar years.

Federal fiscal years run from October 1 to September 30 and are designated by the calendar year in which they end: Fiscal year 2021 began on October 1, 2020, and ended on September 30, 2021. Funding for federal programs is provided on a fiscal year basis, and federal budget data and CBO’s cost estimates and budget projections identify spending and revenues by fiscal year.

This document is part of the Congressional Budget Office’s efforts to promote wider understanding of its work. In keeping with CBO’s mandate to provide objective, impartial analysis, it makes no recommendations.

Kathleen FitzGerald, Ann E. Futrell, Susanne Mehlman, and Emily Stern prepared the report with assistance from Avi Lerner and with guidance from Theresa Gullo, Leo Lex, and Sam Papenfuss. Kate Kelly provided technical assistance. Nathaniel Frentz, Kathleen Gramp, John McClelland, and David Torregrosa of CBO offered comments, as did Kim P. Cawley and Jim Hearn, both formerly of CBO.

Jeffrey Kling and Robert Sunshine reviewed the report. Bo Peery edited it, and R. L. Rebach designed the layout and prepared the text for publication. This document is available at www.cbo.gov/publication/57420 .

CBO seeks feedback to make its work as useful as possible. Please send comments to [email protected] .

Phillip L. Swagel

What Is a Budget Allocation?

by RachelBennett

Published on 26 Sep 2017

Budget allocation is an important part of all business and not-for-profit financial plans. Budgets are typically set annually and involve allocating anticipated income and resources between different departments and business interests. The amount of funding allocated to each area imposes restrictions on the scope of a department’s development. For example, if there is a reduction in funding, then some staff may have to be made redundant.

Budgets are normally reviewed annually and set for a 12- to 24-month period. Budgets are normally set on the basis of the previous year’s expenditures, plus or minus any changes in spending, such as the recruitment of new staff or adjustments in staff salaries. For example, in a university or school, each department or faculty is given a set amount of money to spend over the course of the year. The department head normally takes responsibility for allocating the funding to his staff. A budget aims to take into account all expenditures, including staff salaries, the cost of buying resources as well as miscellaneous expenses for any unforeseen needs. In an educational institution, the expenditure is normally calculated at a cost per child for the purposes of grant writing and funding.

Typically, budgets are divided into allocation components. These are often based on the business' or institution's core priorities. For example, in a university setting, typical components are student enrollment and research. Many institutions also include performance incentives in the budget to boost staff morale. The components are divided into a matrix, and a monetary value is allocated for each component. This is further divided into a value for the subcomponents.

Budgets normally include a percentage rate of adjustment, which is typically between 2 and 5 percent. This allows for unforeseen expenses and under or over estimation of expenditures. Budgets are reviewed and adjusted periodically throughout the year to account for changes in expenditures and income.

Geographic Differential

If a business or educational institution operates in multiple geographic areas, a geographic location adjustment is included in the budget. This accounts for different living costs and wage levels in different areas, often including a hardship allowance for those living in developing countries. Typically, a cost-of-living index is used to calculate the typical cost in each area and the budget is adjusted accordingly.

What Is Budget Allocation and How to Allocate Budget Correctly

George Fullerton

Strategy & Operations

Get Our Financial Planning Blueprint

Your budgeting process requires strong collaboration from department heads and executive leadership. Yet if you’re only going to each department once, asking them what they need, and simply saying, “Here you go” once you get executive approval, then you haven’t done enough testing around your top-line goal metrics.

If you want to pave a path toward sustainable growth, you need to embrace agility and proactivity — and one way to do that is through budget allocation. Running a budget variance analysis and rolling forecast helps you set baselines and growth goals, but these processes can still take weeks to gather and manipulate data from multiple departments and source systems.

Here, we explore how quarterly budget allocation creates a path for more agile, strategic planning and spend.

Table of Contents

What Are Budget Allocations?

Budget allocations refer to the amount of money each department receives from the general fund to execute their strategic plans. Budget allocation breaks department spend down into an approved maximum amount each department can spend per resource, whether it’s on software, contractor or freelance assistance, or ad spend for a marketing campaign.

The Importance of Allocating Budgets

Budgeting, at its core, is an optimization and constraint problem. You need to optimize operational efficiency yet understand your constraints to ensure ample runway and team support as you track the company’s growth trajectory.

You dictate the company roadmap based on expected return on investment (ROI), which has to tie out at the department level. The R&D department is integral for Seed and Series A companies, yet once the product is ready to launch, you want to allocate budget to your sales and marketing teams. Once the budget goes toward sales and marketing, and you begin acquiring customers, you now have new constraints that impact your budget: your customer acquisition cost (CAC), CAC payback period , and your annual recurring revenue (ARR).

Budget allocation fuels overall efficiency, in that department leaders don’t need to ask for approval to expense individual tools, assign projects to freelancers, or add seats for software. By allocating budget to general categories, each department can cherry-pick when and how to apply the budget. Of course, departments need to ensure they use their budget. While saving money is generally seen as positive, departments may not receive the same budget allotment in the next cycle — which may be detrimental to department-level goals and planning.

If departments experience strain, such as requiring more seats on a specific tool or running into production issues, you run into employee retention issues that stem from operational efficiency and satisfaction. To hire more employees costs more, which digs into your runway. By keeping an eye on your goals and constraints, you can then proactively figure out where you’ll get the highest ROI.

How to Optimize Budget Allocations in 6 Steps

Knowing your startup costs (for each employee and desk space), fixed costs, and variable costs and how they impact your total budget is one thing — but to optimize budget management and allocation requires ample cross-collaboration to keep goals top of mind and realistic.

Your budget allocation strategy will depend on your industry, your growth stage, and overall macroeconomic environment. But here’s how you can optimize your budget allocation with more strategic and agile decision-making from everyone involved regardless of stage.

1. Set Company Goals and Priorities

While knowing your total budget is technically the first step, the real strategic insights begin with a simple question: What are your North Star metrics?

Naming your company goals and priorities is the key to driving how you think about and create departmental budgets across the company.

In ideal market conditions, many executive leaders say that their top priority is to grow at all costs. Yet during a market downturn, priorities shift toward keeping a closer eye on burn and preserving runway. Depending on how those priorities shake out, there’s two ways to approach budgeting:

- Growth goals: A focus on growth goals requires high confidence in achieving them. Your growth goal is the starting point, then you work backwards to allocate your budget to achieve that goal. A focus on top-line revenue growth leads to creating a sales and marketing budget around cost per lead and win rates/conversions. The question becomes “How much do I have to spend in order to get this growth goal?” which then spits out your sales and marketing budget.

- Capital efficiency : A more conservative approach begins by asking, “How much can I spend in order to only burn X number of dollars a month, or to make sure I have runway for 24 months into the future?” You can also focus on a certain set of unit economics, meaning you’d build your budget to hit a particular CAC number or set a payback period within a particular period of time.

Regardless of your approach, tying your budget back to goals (i.e. strategic budgeting ) and target metrics is critical. If you believe growth goals are most important, for example, then your ROI on spending additional sales and marketing dollars could be higher than hiring a different engineer where you may have a longer-term payoff.

2. Set Your Constraints

Your goals establish whether you’re approaching budget allocations from a bottom-line or top-line growth perspective. Utilizing both allows you to gain a sense of customer retention (with your top line) alongside expenses (bottom line), which helps you strike the right balance or priorities. Applying constraints to your goals allows you to set realistic expectations.

Company-wide, you want to keep an eye on runway and burn multiple. Yet when diving deeper into department budgets, you’ll need to focus on different metrics. For example, CAC payback period impacts your sales and marketing budget.

Your CAC payback period sets a precedent for how long potential customers stay in the sales funnel. Incorporating sales funnel metrics into this equation provides invaluable insights — and setting constraints around your payback period requires sales and marketing to scrutinize and optimize these metrics within the funnel.

3. Check Your Goals Around Budget Allocation Benchmarks

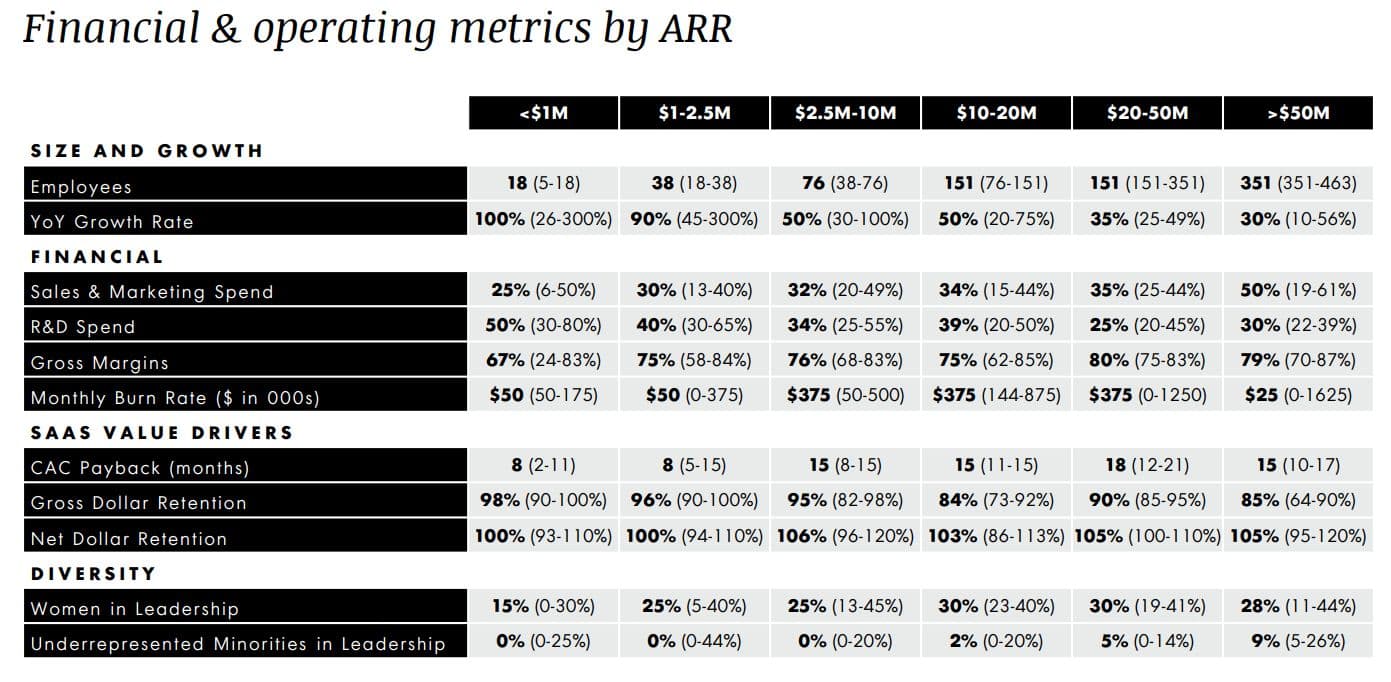

Your company’s growth stage impacts where your goals and constraints stay relevant and applicable to ensure strategic growth. OpenView runs a SaaS Benchmarks Survey that explores budgetary benchmarks in correlation with your growth stage. Here’s their chart from 2021:

OpenView SaaS Benchmarks Survey 2021 Results, courtesy of Curtis Townshend , Senior Director of Growth at OpenView.

The top row indicates the stage of the business per million dollar revenue. The numbers in bold represent a median, with percentages assigned for how much each company would allocate per category. For example, a company with $1-2.5 million in revenue would allocate 30% of their budget to sales and marketing and 40% in R&D, while aiming for 75% in gross margins.

While the above table does not mention a ratio for general and administrative costs , the standard spend for SaaS companies is about 10-12% of your total budget.

After you establish your goals and constraints to ensure financial efficiency , you can approach your budget and measure against these benchmarks.

4. Establish Your Headcount Plans

Headcount accounts for 70% of overall company spend in SaaS, and each department has different ROI.

Sales and marketing headcount should directly produce returns — but to drive the sales and marketing machine, you need to continuously spend. You need to ensure you have a strong control and understanding of your product-market fit to keep the engine running. If the company is not at the point of understanding the output of each dollar spent across the sales funnel, the budget should focus on product or internal system process data.

Work closely with human resources partners to decide how much to set aside for workforce growth in every department. Decide how many full-time hires you’ll need in the next budget year, where it might be appropriate to hire out to contractors, and where your stakeholders need the most help.

5. Conduct Scenario Planning with Mosaic

Optimizing budget allocation helps you optimize ROI of operational initiatives by forcing you to constantly check where you think you’ll get the most out of your dollars and how that spend relates to company-level goals.

Mosaic’s financial modeling and scenario planning tool integrates with your source systems to offer scenario analysis that elevates the strategy behind your budget allocation. Scenario analysis examples include looking at how cutting a fixed cost (like office space) impacts your runway, or how your product release plan may hinge on engineer headcount or come down to asking, “ How much should you spend on ads to promote the product — and when?”

Being able to quickly see how adjustments to specific budgets affects your downstream metrics is extremely helpful. Mosaic syncs in real time so you can easily integrate your historical and actual data into your scenarios. If you want to see how increasing spend by $500,000 impacts your sales and marketing budget, you can simply apply the change in one model to see how it affects your CAC, CAC payback, burn multiple, and other key metrics.

You don’t need to build entirely new models or scenarios — instead, you can tweak your budget assumptions in different scenarios and see the immediate downstream effects on the metrics that you want to employ as your constraints.

Keep in mind that your strongest models align on two or three metrics: Too many inputs leads to an overlap in ideology, which causes clutter and slows you down.

6. Make Cross-Department Collaboration a One-Stop Shop

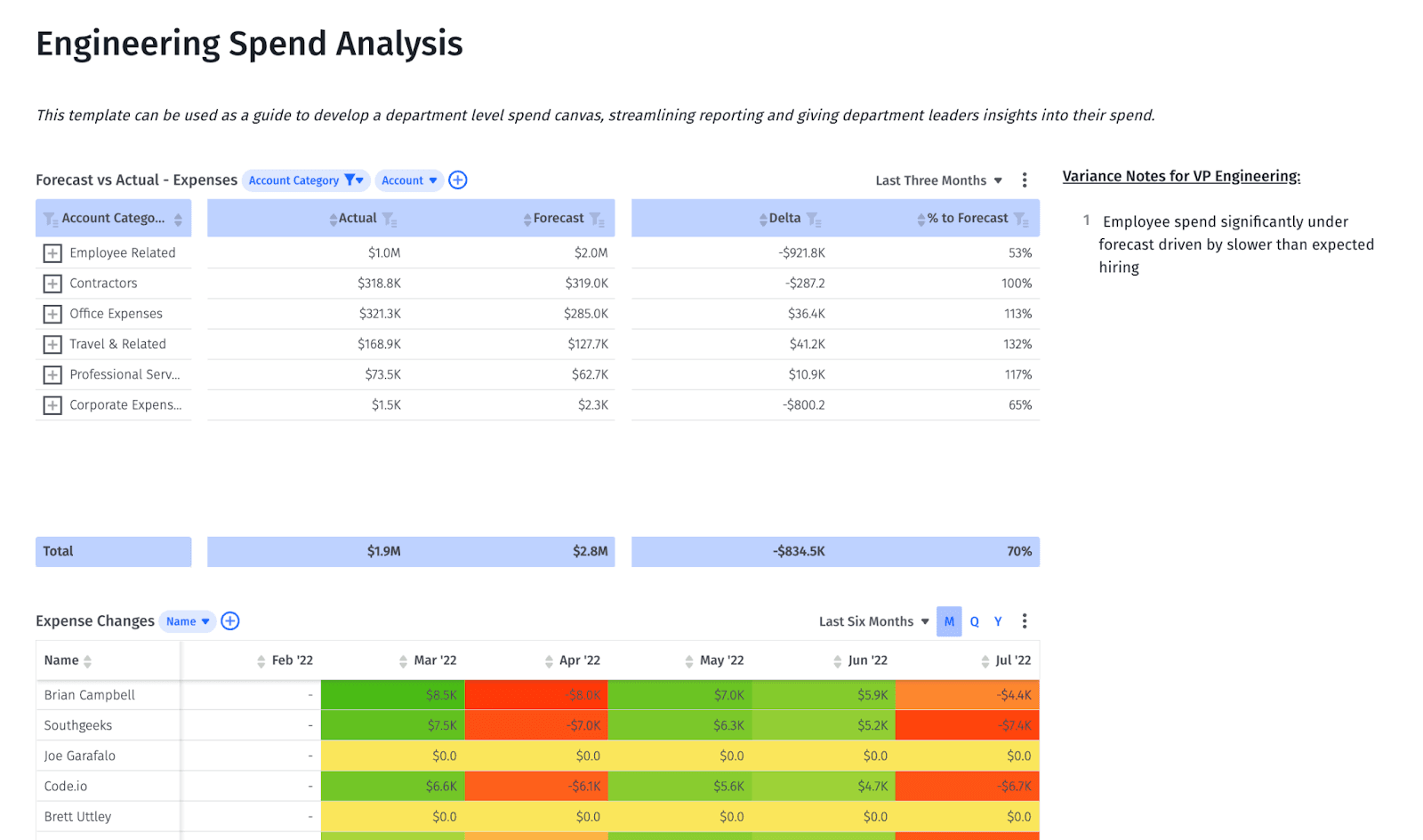

The budgeting process is notorious for multiple Excel sheets and communication across multiple emails or Zoom meetings. Mosaic allows you to create department-level dashboards that align leaders and give them one place to stay updated on budget allocation and spend.

Department leaders can look at a graph or table in Mosaic’s variance analysis software to see where their budget currently is and where it was spent. Mosaic can immediately generate a budget analysis that allows them to make strategic decisions on what they want to do with their remaining budget or where they need to cut back to hit their budget for the month or quarter.

Mosaic also allows reports to be easily accessible for department leaders. Since Mosaic offers real-time updates, finance teams can help establish one report that automatically updates so department leaders can make plans with actual numbers. This leads to not just saving time between going back and forth to establish numbers, but more proactive decision-making that keeps leader engagement high into understanding the “why” behind their budgeting line items.

Focus more on telling the story behind your numbers with this Financial Waterfall Template Bundle.

When to review budget allocations — and why you’re not doing it enough.

A “one and done” annual budget process doesn’t work for high-growth companies. A more adaptable or flexible budget approach is essential, especially for those experiencing rapid changes. Keeping it to even twice a year causes everyone to miss out on key drivers for overall success. Proactive budget development should happen at least on a quarterly schedule, where you can change resource allocation based on historical data from the previous year to last quarter.

While establishing a quarterly financial plan review is good in practice, you also need to allow for some flexibility. Here are some other reasons to perform financial audits on budget allocation:

- Macroeconomic events. Anything from a market downturn or industry collapse signals immediate action. Budget allocation should transition into a monthly schedule to stay as ahead as possible.

- Not hitting topline goals. You may need to redistribute your budget to ensure you get as high of an ROI as possible. You may need to allocate more budget toward supporting sales and marketing than hiring another engineer, for example.

- Runway cost. If you predict that you’ll burn $5 million, but realize that headcount needs to increase in the second half of the year, you need to factor that cost in. You also need to keep track of your burn and when it occurs: If it increases from $2 to $3 million in one month due to headcount, you carry this cost throughout the rest of the year. You can then take budget away to make up the costs — it’s much harder to try and get the budget back once people start spending it.

- Capital efficiency metrics are off. Analyzing capital efficiency metrics like burn multiple on a regular basis can help you proactively address inefficiencies in the business. Drill down into your expenses and see how you can reevaluate spend.

Embrace a Smarter Way to Allocate Budgets with Mosaic

Mosaic offers preloaded, out-of-the-box metrics, templates, and dashboards that allow you to cut the budget allocation and planning process from two weeks to two days. Mosaic offers a SaaS acquisition metrics dashboard that considers CAC and CAC payback alongside other important metrics, like your SaaS magic number , to gain granular insights that craft your company’s growth narrative. You can also customize financial reports to include other key metrics, such as your burn multiple and runway, to help establish and keep your benchmarks in mind.

With Mosaic, budget planning can be a quicker, more collaborative, strategic process that keeps your company moving along toward its goals. Request a personalized demo today .

Give Department Leaders Deep Financial Insights for Better Budgeting

Budget allocation FAQs

Why is budget allocation important.

Understanding your budget allocations and appropriations can help your company maximize ROI. Knowing where your money goes ahead of time reduces discretionary spending and leaves a strategic roadmap for spending and expenditures . And, since this is done ahead of time, departments can run more efficiently on their allocated budget.

What is an example of a budget allocation?

An example of budget allocation is a predetermined percentage of company funding that goes to research and development, or sales and marketing. This can be done monthly, per quarter, or per fiscal year . The percentage of the allocated budget is based on importance, productivity, company profits, and other considerations. If the department needs more funding, they can submit a budget request , but ultimately, the budget allocation should be taken care of beforehand.

What is the best way to allocate your budget?

There’s no one-size-fits-all answer here. To optimize your budget allocation you need to proactively and periodically review how you’re allocating resources and reassess your priorities. What are your goals? What are your budget constraints? What ROI are you getting on your current allocations? These are all questions you need to ask in collaboration with different teams and departments to ensure your budgets are allocated properly at all times.

Related Content

- The 12 Most Important Operational Metrics & KPIs to Track in SaaS

- How To Choose the Best Pricing Model for Your SaaS Business

- What Is Spend Forecasting and How Can It Benefit Your Business?

Never miss new content

Subscribe to keep up with the latest strategic finance content.

The latest Mosaic Insights, straight to your inbox

Own the of your business.

- Dictionaries home

- American English

- Collocations

- German-English

- Grammar home

- Practical English Usage

- Learn & Practise Grammar (Beta)

- Word Lists home

- My Word Lists

- Recent additions

- Resources home

- Text Checker

Definition of allocation noun from the Oxford Advanced American Dictionary

Take your English to the next level

The Oxford Learner’s Thesaurus explains the difference between groups of similar words. Try it for free as part of the Oxford Advanced Learner’s Dictionary app

Allocations: Understanding Their Crucial Role in Financial Management

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Allocations Definition

Allocations in finance refer to the distribution or assignment of resources, including capital or assets, to specific operations, departments, or investment opportunities. This involves determining where funds or other resources will be placed to achieve maximum efficiency, performance, or returns.

Types of Financial Allocations

Financial assets and resources in a company or an investment portfolio are typically distributed in three main categories: Capital allocation, operational allocation, and risk allocation. Understanding these types of allocations can give you a broader perspective on how companies use their resources and manage risk to maximize efficiency and returns.

Capital Allocation

Companies use capital allocation to distribute financial resources for long-term investment purposes. These may include equity investments, mergers and acquisitions, debt repayments, or even reinvestments in the company's own operations.

Capital allocation plays a crucial role in shaping a company's growth trajectory and driving profit growth. A company that allocates its capital well is likely to generate significant shareholder value over time.

Operational Allocation

Operational allocation, on the other hand, is focused on the distribution of resources for day-to-day business operations. These might include marketing and advertising costs, salaries and benefits for employees, rent and office expenses, and cost of goods sold, among others.

Companies need to effectively manage their operational allocations to ensure they remain solvent and able to operate smoothly. Mismanagement of these resources can lead to cash flow problems and insolvency, limiting the chances for a company's growth and expansion.

Risk Allocation

Risk allocation is related to how organizations distribute potential risks among different investment opportunities. This includes the identification, assessment, and management of potential risks in an investment portfolio or a business.

Risk allocation is crucial for financial stability and for minimising potential losses. Investors can use risk allocation to manage their investment portfolios, diversifying their investments to reduce exposure to any single risk.

Each of these types of allocations has implications for business and investment strategy, success, and stability. Capital allocation decisions directly impact a company's growth and shareholder value. Operational allocation determines the ability of a company to smoothly run its day-to-day operations, while risk allocation shapes an investor's portfolio risk and potential returns.

In fact, these three types of allocations are interrelated. Mismanagement in any single category can lead to issues in the others. For instance, poor capital allocation might limit the funds available for operational needs or increase investment risk. Therefore, it's vital to understand their interconnected nature and importance in financial decision-making.

Basis for Allocation Decisions

Factors influencing allocation decisions.

Several factors come into play when making allocation decisions. These include budgeting, company objectives, and market conditions.

Budgeting plays a crucial role as it dictates how much money is available to allocate towards various areas of the company. It provides a financial plan that shows a breakdown of expected income and expenses within a specific period, helping businesses prioritize their spending and manage their resources better. An effective budget can provide a roadmap for financial decision-making and guide the allocation process significantly.

Company Objectives

The company's strategic and operational objectives also greatly influence allocation decisions. Companies commonly allocate resources to projects or departments that significantly contribute to achieving their set goals. Understanding the organization's long-term objectives helps in determining the areas that need more investment and resources.

Market Conditions

Current market conditions and industry trends greatly affect the allocation of resources too. During periods of market volatility or recession, an entity may decide to allocate more resources toward defensive strategies, such as improving existing products or cost-cutting. On the other hand, during periods of high growth and bullish markets, companies may allocate more resources towards offensive strategies like new product development or market expansion.

Role of CSR and sustainability

Corporate Social Responsibility (CSR) and sustainability have become integral parts of modern business decisions, including resource allocation. Companies are increasingly recognizing that they have a role to play in addressing societal challenges and environmental preservation.

CSR projects and initiatives usually require resources that need to be factored in during the decision-making process. Additionally, companies might allocate more resources towards developing sustainable practices, like investing in energy-efficient operations or waste reduction initiatives.

Similarly, companies might consider sustainable investing, where allocation decisions go towards investments that generate a social and environmental impact alongside a financial return. These mediums can positively resonate with stakeholders, build a company’s reputation and ultimately contribute to overall profitability.

Role of Allocation in Financial Planning and Strategy

The role of allocations in both long-term financial planning and strategic objectives can't be overstated. This process reflects strategic thinking in investment and spending. It serves as the backbone for action plans ensuring that resources are used effectively while accommodating future market fluctuations and risks.

The Impact on Long-Term Financial Planning

Allocations in financial planning, which ought to span over multiple years, are primarily concerned with an individual’s financial goals and investment portfolio. An effectively managed allocation can make a significant difference on how your investments can grow. For example, a balanced mix of low and high-risk investments can offer a safety net during volatile market seasons while still providing opportunities for growth.

You might diversify your portfolio further by distributing your assets amongst stocks, bonds and real estate. This diversification can mitigate risks associated with investing all your resources into a single channel.

Wealth Maximization with Allocations

When resources are effectively allocated, they have the potential to lead to wealth maximization. If you invest wisely, your wealth doesn’t only increase but it has the chance to compound significantly over the years. Consistent re-evaluation of your financial plan, and tweaking your allocations accordingly, can maximize your returns and help you build significant wealth.

Achieving Financial Stability

Proper allocations also promote financial stability. By ensuring that all investment areas are adequately funded, the risks are evenly spread out. This prevents any massive losses from affecting your entire portfolio. Rapid market downturns will be less overwhelming, and your finances more secure.

Moreover, when you plan allocations in budgeting, it helps control excessive spending in one area over the another. This balance enables you to maintain stability and meet long term financial objectives, such as retirement plans, premium payments or even funding your child's education.

In brief, the critical role of allocations in financial planning and strategy aids in wealth creation, risk management and eventually achieving financial stability. It provides a strategic path for financial growth and sustainability over time.

Challenges in Allocation Decisions

Allocating resources effectively is key in the world of finance, but it's a task that is fraught with challenges and potential pitfalls.

Here are a few key issues to consider:

Uncertainty About Return on Investment

One of the most significant difficulties is the high level of uncertainty about return on investment. An allocation decision is essentially an educated guess about which investments will yield the highest returns. Various factors, from market volatility to shifts in industry trends, can drastically affect actual returns and make precise prediction difficult. As a result, even with the most careful analysis, there's always the risk of making allocation decisions that don't produce the anticipated return on investment.

Pressure to Meet Short-term Objectives

Another challenge comes in the form of pressure to meet short-term objectives. This pressure can lead to rushed decisions or a focus on immediate gains at the expense of long-term growth. For example, in an attempt to quickly increase profits, a company might allocate resources to projects or investments that yield immediate returns, but don't contribute to the company's strategic growth goals in the long-term. Balancing short-term objectives with long-term strategic plans is a constant challenge in allocation decisions.

Balancing Risk and Reward

In every allocation decision, there's a need to balance risk and reward. Investments with the potential for high returns often come with high risk, while lower-risk investments typically offer lower returns. Therefore, making allocation decisions often involves deciding the level of risk that's acceptable, which can be a tough call.

Information Asymmetry and Inaccuracy

Information plays a crucial role in allocation decisions. However, the information available is often incomplete, outdated or inaccurate, leading to decisions based on faulty data. This challenge of information asymmetry and accuracy can lead to sub-optimal allocation decisions.

Understanding these challenges can help in strove more effective decision-making, but overcoming these obstacles often requires careful analysis, strategic thinking, robust risk management and, in many cases, a dash of good luck.

Impact of Allocation on Profitability and Efficiency

When companies make effective use of their resources, they make what we refer to as allocation decisions which can significantly influence their profitability and overall efficiency.

The Profitability Angle

A judicious allocation of financial resources can bolster profitability. For example, let's take an instance where a company chooses to allocate more funds to a high-earning department, thereby boosting revenues and overall profits.

On the other hand, misallocating resources could lead to a drop in revenue. Imagine a scenario where a profitable branch is deprived of necessary funding in favor of a less productive division. This could result in losses, negatively impacting the firm's bottom-line.

Efficiency and Allocation

Efficiency is another critical factor that could be influenced by allocation decisions. Firms that prudently allocate their resources often operate more efficiently and have a better capacity to avoid or minimize waste. Inefficient allocation of resources may lead to duplication of efforts, over-capacity or under-utilization, all of which reduce profitability.

For instance, a production company that allocates its resources efficiently could streamline its operational processes, minimize waste, and ultimately lower production costs.

Conversely, a poor allocation strategy, such as assigning an over-abundance of human resources to a task that requires fewer hands, could result in inefficiencies leading to increased operation costs and reduced profitability.

Linking Profitability and Efficiency

In a nutshell, both profitability and efficiency are interlinked, and they heavily depend on how a company chooses to allocate its resources. A firm making wise allocation decisions could enjoy high profitability due to increased revenue and reduced costs, leading to enhanced efficiency. Conversely, inefficient allocation often results in poor efficiency, which in turn affects the firm's profitability.

To maximize both efficiency and profitability, firms should continuously analyze the effectiveness of their allocation strategies, making necessary adjustments in response to evolving business landscapes and changing market conditions.

Allocation Auditing and Governance

The function of allocation auditing plays a vital part in sustaining transparency and accountability in the financial sector. This auditing process involves evaluating the distribution of resources to verify compliance with strategic goals and regulatory standards. It primarily focuses on the effectiveness of the allocation process, examining whether the resources allotted are being executed efficiently and achieving the intended outcomes.

An in-depth audit analysis can pinpoint any discrepancies or inefficiencies, such as wasteful spending or misappropriation of funds, in the system. By conducting regular audits, an organization can ensure transparency in its financial operations leading to efficient resource management. More importantly, this allows stakeholders to have a clear view of how resources are being used, building trust and reinforcing accountability.

The role of governance in monitoring allocation decisions cannot be understated. In an institutional context, governance refers to the system of rules, practices, and processes by which an organization is directed and controlled. Through this framework, an entity's board or executive management makes decisions concerning resource allocations and has the last say in case of any disputes.

H3 An Embedded Part of Governance: Monitoring and Control

Process monitoring and control are integral facets of governance that ensure allocations are made accurately and function as intended. This can be through a series of mechanisms such as periodic assessments, budgetary reviews, risk assessments, and compliance checks. They provide a 'helicopter view' of the entity's operations, enabling quick decision-making and strategic alignment.

As part of governance, control mechanisms are established to prevent wastage or misuse of allocated resources. This could include checks and balances, separation of duties, and setting up approval authorities for significant resource allocation decisions. These mechanisms fortify the entity’s accountability and transparency, bolstering stakeholder confidence.

Therefore, a robust allocation auditing process paired with efficient governance practices ultimately propels good financial health and sustainable growth within an organization, strengthening its foothold in the financial sector.

Allocation in Portfolio Management

Dividing and Conquering Risk

Through the allocation process, a portfolio manager divides the total fund or investment into various assets or asset classes such as stocks, bonds, mutual funds, or real estate. This diversification is a rudimentary risk management strategy that plays a significant role in reducing the potential losses a portfolio might incur in case a single investment does not perform as expected.

Risk and Reward Balance

Allocations come into play in striking the right balance between risk and reward. A prudent portfolio manager does not just randomly assign funds to different asset classes. Instead, allocations are based on an investor's risk tolerance level and financial goals. A portfolio with a higher proportion allocated towards equities, for example, might be suitable for those willing to accept higher risk in return for potentially greater returns. On the other hand, a more risk-averse investor might have a larger portion of their portfolio allocated towards relatively stable bonds.

Achieving Financial Objectives

The allocation strategy is directly related to an investor's financial objectives. For someone saving for retirement in 30 years, the portfolio might have a heavy allocation towards stocks for long-term growth. As the investor moves closer to retirement, the allocation strategy may shift, reducing the proportion of riskier assets and increasing the weight of more stable ones.

Importance of Rebalancing

Allocations aren't a one-time decision. Over time, changes in market values can disrupt the initial balance and risk exposure of the investment portfolio, a phenomenon referred to as portfolio drift. Regular review and rebalancing of allocations is crucial to maintain the desired risk and reward balance. For example, if the stock market has had a great year and equities now represent a larger portion of a portfolio than originally intended, the excess can be sold off and the proceeds reinvested in other under-weighted asset categories.

Strategic and Tactical Allocation

Finally, it's essential to understand the difference between strategic and tactical allocation. Strategic allocation is a long-term approach that sets and maintains a fixed mix of assets based on an investor's risk tolerance and objectives. In contrast, tactical allocation allows more flexibility, enabling investors to make short-term adjustments to their portfolio's asset mix in response to market conditions or investment opportunities. Both methods play a key role in portfolio management and involve regularly reviewing and adjusting allocations as necessary.

Changes in Allocation Practices Over Time

Just as every other sector of economy, financial sphere has also experienced a significant transformation in its allocation practices over time. This change was a direct impact of several factors, including tech advancement, globalization and the increasing focus on an environment-friendly operations – sustainability.

Impact of Technology

It's undeniable that the biggest shifts in allocation practices have been brought about by the rapid expansion of technology. The rise of big data analytics and artificial intelligence (AI) have changed the way assets are allocated across various industries. Advanced algorithms now assist in not just monitoring performance and predicting risks, but also in making informed decisions related to optimally allocating resources.

Another crucial development has been the increasing use of computerized trading and robo-advisors that utilize modern Portfolio Theory (MPT) to allocate assets in an efficient manner. This has enhanced the precision and speed of allocation processes, reducing human error, and facilitating the better handling of complex securities.

Role of Globalization

Globalization has significantly widened the scope of allocations by breaking down geographic boundaries. The interconnectedness of world economies has spurred asset allocation on a global scale – setting the stage for diversification across international markets, and thus lowering risks associated with investments.

Globalization has also resulted in an increased access to information which invariably impacts allocation decisions. For instance, financial managers now have to constantly adapt to global macroeconomic trends and fluctuations in overseas markets when strategizing allocation plans.

Sustainability Trends and Allocation Practices

In recent years, the increasing focus on sustainable investing is shaping allocation practices. This growing trend is based on Environmental, Social and Governance (ESG) criteria that consider company’s impact on environment, its relations with employees, and transparency in governance. As a result, financial managers and investors are shifting their allocation towards companies that adhere to ESG, favouring responsible investments.

The rise of Impact investing, which aims to generate a measurable social/environmental impact alongside a financial return, is further changing allocation strategies. Investors are exploring innovative financial instruments like Green Bonds, integrating ESG issues into their allocation decisions.

As these trends continue, we see allocation practices dynamically evolving. It is an exciting scenario as novel ideas and strategies continue to replace older paradigms, leveraging technology, global dynamics and sustainable considerations for optimization of returns.

Share this article with a friend:

About the author.

Inspired Economist

Related posts.

Accounting Close Explained: A Comprehensive Guide to the Process

Accounts Payable Essentials: From Invoice Processing to Payment

Operating Profit Margin: Understanding Corporate Earnings Power

Capital Rationing: How Companies Manage Limited Resources

Licensing Revenue Model: An In-Depth Look at Profit Generation

Operating Income: Understanding its Significance in Business Finance

Cash Flow Statement: Breaking Down Its Importance and Analysis in Finance

Human Capital Management: Understanding the Value of Your Workforce

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Start typing and press enter to search

- More from M-W

- To save this word, you'll need to log in. Log In

Definition of allocate

transitive verb

Examples of allocate in a Sentence

These examples are programmatically compiled from various online sources to illustrate current usage of the word 'allocate.' Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. Send us feedback about these examples.

Word History

borrowed from Medieval Latin allocātus, past participle of allocāre "to place, stow, hire out, place on hire, allow, admit, credit," from Latin ad- ad- + locāre "to place, situate" — more at locate

1616, in the meaning defined at sense 1

Phrases Containing allocate

- sub - allocate

Dictionary Entries Near allocate

Cite this entry.

“Allocate.” Merriam-Webster.com Dictionary , Merriam-Webster, https://www.merriam-webster.com/dictionary/allocate. Accessed 16 May. 2024.

Kids Definition

Kids definition of allocate, more from merriam-webster on allocate.

Nglish: Translation of allocate for Spanish Speakers

Britannica English: Translation of allocate for Arabic Speakers

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Can you solve 4 words at once?

Word of the day.

See Definitions and Examples »

Get Word of the Day daily email!

Popular in Grammar & Usage

More commonly misspelled words, your vs. you're: how to use them correctly, every letter is silent, sometimes: a-z list of examples, more commonly mispronounced words, how to use em dashes (—), en dashes (–) , and hyphens (-), popular in wordplay, birds say the darndest things, the words of the week - may 10, a great big list of bread words, 10 scrabble words without any vowels, 12 more bird names that sound like insults (and sometimes are), games & quizzes.

- Cambridge Dictionary +Plus

Meaning of allocation in English

Your browser doesn't support HTML5 audio

- Initially the problem was in the allocation of seats on the flight .

- There needs to be more efficient allocation of financial resources .

- Board members disagree over the budget allocations.

- The government has made supplementary allocations to food and fuel subsidies .

- corporately

- distribution

- distributive

- distributively

- portion something out

- ration something out

- redistribute

allocation | American Dictionary

Allocation | business english, examples of allocation, collocations with allocation.

These are words often used in combination with allocation .

Click on a collocation to see more examples of it.

Translations of allocation

Get a quick, free translation!

Word of the Day

troubleshoot

to discover why something does not work effectively and help to improve it

Searching out and tracking down: talking about finding or discovering things

Learn more with +Plus

- Recent and Recommended {{#preferredDictionaries}} {{name}} {{/preferredDictionaries}}

- Definitions Clear explanations of natural written and spoken English English Learner’s Dictionary Essential British English Essential American English

- Grammar and thesaurus Usage explanations of natural written and spoken English Grammar Thesaurus

- Pronunciation British and American pronunciations with audio English Pronunciation

- English–Chinese (Simplified) Chinese (Simplified)–English

- English–Chinese (Traditional) Chinese (Traditional)–English

- English–Dutch Dutch–English

- English–French French–English

- English–German German–English

- English–Indonesian Indonesian–English

- English–Italian Italian–English

- English–Japanese Japanese–English

- English–Norwegian Norwegian–English

- English–Polish Polish–English

- English–Portuguese Portuguese–English

- English–Spanish Spanish–English

- English–Swedish Swedish–English

- Dictionary +Plus Word Lists

- English Noun

- American Noun

- Business Noun

- Collocations

- Translations

- All translations

To add allocation to a word list please sign up or log in.

Add allocation to one of your lists below, or create a new one.

{{message}}

Something went wrong.

There was a problem sending your report.

Definition of 'allocation'

allocation in American English

Allocation in british english, allocation in finance, allocation in accounting, examples of 'allocation' in a sentence allocation, related word partners allocation, trends of allocation.

View usage over: Since Exist Last 10 years Last 50 years Last 100 years Last 300 years

In other languages allocation

- American English : allocation / æləˈkeɪʃən /

- Brazilian Portuguese : distribuição

- Chinese : 分配决定 尤指经费

- European Spanish : asignación

- French : allocation

- German : Zuteilung

- Italian : assegnazione

- Japanese : 配当

- Korean : 할당액

- European Portuguese : distribuição

- Spanish : asignación

- Thai : การจัดสรร

Browse alphabetically allocation

- allocate resources

- allocate space

- allocate time

- allocation decision

- allocation of funding

- allocation of responsibility

- All ENGLISH words that begin with 'A'

Related terms of allocation

- cost allocation

- fund allocation

- allocation policy

- allocation process

- allocation scheme

- View more related words

Quick word challenge

Quiz Review

Score: 0 / 5

Wordle Helper

Scrabble Tools

- BOOK A FREE DEMO

A Comprehensive Guide to Allocation Planning in Modern Supply Chains

.webp)

Our world is changing and becoming increasingly more volatile, uncertain, complex, and ambiguous ( VUCA ). What does this mean for top-performing supply chains? To maintain a sustainable competitive advantage over competitors, they need to excel in three qualities:

- They’re agile and can react speedily to sudden changes in demand or supply.

- They can easily adapt to evolving market structures and strategies.

- They always align the interests of all stakeholders to optimize the chain’s performance while also maximizing each stakeholder’s interests.

Allocation planning plays a key role in these three processes. This detailed guide discusses allocation planning, why it’s important in supply-constrained supply chains, and how it can help supply chains achieve agility, adaptability, and alignment in a challenging post-COVID world.

Supply Chains: Supply-Constrained vs Demand-Constrained

In an ideal world, demand and supply would match perfectly, and both customers and suppliers would get what they wanted at the price that suited them both. But in the real world, supply chains are either supply-constrained or demand-constrained .

Supply-Constrained Supply Chain

In 2020, the COVID-19 pandemic shook the world. It caused a global medical crisis that stretched healthcare systems to the breaking point and interrupted supply chains , leading to shortages in everything from toilet paper, sanitizer sprays, and ramen noodles to steel, semiconductors, and electronics components. As many countries adapt to a “new normal” in the post-COVID era , these shortages continue to play a role in global supply chains. And China is once again at the center of these challenges.

As it slowly recovers from the crisis, China’s manufacturing-oriented economy is once again picking up pace. As a result, the country’s appetite for certain raw materials and goods like steel and electronic components is exponentially increasing, causing supply shortages elsewhere. This limits the ability of global producers and supply chains to produce and supply the goods demanded in other markets, resulting in supply-constrained supply chains, where supply is unable to keep up with demand.

Demand-Constrained Supply Chain

Low demand and high supply characterize a demand-constrained supply chain. Since supply overshoots demand, all the demand can be fulfilled, plus there is some unutilized production capacity. This is usually what happens in the modern capitalist world, where demands are met by enough supply for virtually every kind of good, and there’s always some unutilized production capacity – even in a pronounced “boom” period.

A demand-constrained supply chain should move towards the supply-constrained mode to improve its revenue-generating capacity in the long term, either by curtailing its ability to generate excess supply or by increasing demand.

Supply-Constrained Supply Chains in a Post-COVID World

In a post-COVID world characterized by China’s accelerating production and supply-constrained supply chains, the rules of demand/supply are changing very rapidly. Suppliers need to keep up with customers’ evolving demands despite raw material shortages. So how can they fulfill their customers’ demands when they cannot produce enough ?

To address this concern in today’s supply-constrained supply chains, producers must think about three critical key aspects:

- Products : Which product should we produce with the raw materials currently available?

- Customers : Which customer’s demand should we fulfill with the products we create?

- Sales channels : What is the best way to sell our products to these customers?

Producers trying to function within a constrained supply chain must make conscious, data-driven decisions based on these three factors to ensure that they optimize the supply chain, meet customers’ demands to the fullest extent possible, and generate the maximum value (i.e. revenues and profits) for themselves and their stakeholders. These decisions are known as allocation decisions .

In our VUCA post-COVID world where demand overshoots supply, only agile, adaptable, and aligned organizations will be able to satisfy customers’ expectations. And to meet this goal, good allocation decisions are crucial. So, if they cannot fulfill all the demands of all their customers , they must determine how many demands of how many customers they can realistically fulfill. For instance, if they aim to serve all customers, they may have to reduce the supply to each. This way, they will serve 100% of their customers, but each customer will have only part of their orders delivered.

We will explore allocation planning in detail a little later. But first, a quick review of allocation in a supply chain.

What is “Allocation” in a Supply Chain?

The SCM portal defines allocation as:

“The practice of rationing customer orders at times of supply shortage.”

Allocation is one of the most important aspects of a supply chain because many business processes rely on smart allocation, including inventory management, sales, order fulfillment , and customer service. That’s why it’s essential to get it right.

Hard allocation: This is when supply is committed to demand and cannot be modified for any reason. It is execution-oriented and more common when delivery dates are not too far away.

Soft allocation : In this scenario, supply quantities and orders can shift as required, depending on demand changes. Since supply is flexible, it is more planning-oriented and usually undertaken when delivery is still a long way off.

Example: Allocation Decisions in the Global Airline Industry

The airline industry provides a great example of allocation decisions in a supply chain to optimize results for the supplier. Here’s how it works.

In any airline, passengers sitting in the same section on the same flight (e.g. economy) often pay different prices for their seats. The airline tries to maximize its revenue by offering a mix of full-fare and various discounted tickets (e.g., part of a special marketing campaign) and, more importantly, by trying to get this mix right . If demand is weak and the airline doesn’t provide enough discounts, it risks too many empty seats and loses revenue.

On the other hand, too many discounted tickets can sell out a flight far in advance. This closes the opportunity to sell tickets to last-minute flyers who might be willing to pay higher fares and thus increase its revenues. To get the balance right, the airline has to decide how many full-fare tickets to offer versus discounted tickets. Here’s where allocation planning plays a vital role.

As the flight date approaches, if many Economy seats are still open, the airline drops its ticket prices to encourage more people to book seats. Since Economy seats account for 80% of the seats on the plane, the airline would like to sell as many of these as possible because if it sells too few, it loses money on that flight. However, this sales push often leads to overbooking on Economy seats. When this happens, the airline may reallocate or “bump” some Economy passengers up to Business class (if seats are available).

The airline’s primary aim is to maximize the potential revenue it can earn from each flight. And to make this possible, it plays around with seat allocation and reallocation based on factors like prices, demand, and time.

In the airline industry, the “target” is usually to maximize its margin from each ticket sold. This is one way of making allocation decisions. However, there are other ways, which might be better suited for supply chains in other industries. We explore these next.

Allocation Decisions in Supply Chains

Every allocation decision starts with identifying the target or goal: what do we want to optimize?

As with the airline industry, maximizing the margin could be one target.

Another could be to prioritize some customers based on specific strategic considerations (e.g. important customers). For example, a supply chain could be set up first to fulfill all orders of frequent repeat customers, then fulfill 50% of orders of occasional but loyal customers, and finally fulfill 25% of orders of first-time customers. By fulfilling the orders of already loyal customers first, the supplier increases its chances of retaining that customer and returning for more repeat orders.

A third way to make allocation decisions is to apply dynamic rules, like profit velocity. This involves looking for bottlenecks in the supply chain, such as constrained capacity, raw materials, components, etc. Then, try to optimize the margin that’s possible to earn from 1 hour of this constrained capacity.

Allocation Planning in Supply-Constrained Supply Chains

In every customer “demand fulfillment” process, the goal is to generate a promise date for a customer order, influencing the order’s lead time and determining whether it will be delivered on time. In today’s competitive buyer’s market, fast order promises and short lead times can ensure customer retention and improve competitiveness. But is it possible to meet these goals in the supply-constrained supply chains of today?

In supply chains where supply cannot fulfill all demand, an old-fashioned first come, first serve demand fulfillment policy is not optimal. When all orders are treated the same, it risks the business’ profitability, customer relationships, and the supply chain’s ongoing performance. That’s why it’s critical to consider the three key factors we mentioned earlier – Products, Customers and Sales Channels to determine allocation planning in a supply-constrained supply chain.

Requirements and Input for Allocation Planning

Allocation planning requires two primary inputs:

- A good forecast (demand plan) of possible future demand

- A strong master plan (master production schedule) created from the forecast

The master plan includes all capacities, status and constraints in the supply chain. It has two critical functions in the supply chain.

First, it provides a strong foundation to optimize all operations and decisions in the supply chain, including decisions related to procurement, production and scheduling (converted into production orders), inventory planning, transportation planning, and distribution.

Second, once a master plan is created, allocation planning starts.