How to Start a Healthcare Consulting Business

Below you will learn the key steps to starting a healthcare consulting business.

Download the Ultimate Consulting Business Plan Template

10 Steps to Starting a Healthcare Consulting Business

1. conduct market research to determine demand.

An important step to starting a healthcare consulting business is conducting market research. To begin, you must learn what services your clients want and how much they are willing to pay for them. There are two ways you can go about conducting this research:

- Survey your target market . This can be done through online surveys, focus groups, or interviews with potential clients.

- Perform a competitive analysis . This involves studying your competition and understanding the consulting services they offer, as well as what prices they charge.

Once you have analyzed the survey data, determine which types of businesses are likely to hire you and how much they are willing to pay. Use this information to set your consulting prices.

2. Name Your Healthcare Consulting Firm

Once you have analyzed your market and determined what services clients want, it’s time to name your business. While naming a business can be difficult, there are a few rules of thumb to keep in mind:

- Keep it Short : Your business name needs to be short enough for clients to remember and say.

- Keep it Relevant : Your business name should be relevant to the healthcare consulting services you offer and your ideal client’s needs.

- Keep it Memorable : Using clever ideas and words, help your audience connect with your business.

- Focus on Your Target Audience : Make sure that whoever sees or hears your company name understands who you are targeting as clients.

Read our article about choosing the right business name .

3. Choose Your Business Structure and Set-Up Your Company’s Legal Entity

As with any business, the type of legal entity you set up is critical. After all, you want your company to be treated as a separate entity, not just an extension of yourself. There are several types of structures in which you can start your healthcare consulting company. Three popular options are sole proprietorship, S-corporation and LLC (limited liability company).

- Sole Proprietorship : A sole proprietorship is one in which the business and the owner are considered to be one entity. Therefore, you are personally responsible for all debts and liabilities your healthcare consulting firm may incur. One benefit of this type of structure is that it’s easy to set up and there are no formal filings required.

- S-Corporation : An S corporation is a type of C Corporation that was designed by the IRS to help small corporations minimize their paperwork while still gaining many of the tax benefits of incorporating. It also offers protection for business owners in case of lawsuits and other liabilities.

- Limited Liability Company (LLC) : An LLC is a structure in which the company is considered a separate legal entity from its owners. This means that the company is responsible for its own debts and liabilities. This type of structure offers protection for business owners in case of lawsuits.

Read our article comparing the most common consulting business structures .

4. Write a Healthcare Consulting Business Plan

A business plan is a document that outlines your business goals, strategies, and how you plan to achieve them. For a healthcare consulting company, your business plan should include the following:

- Business Description : Describe what your company does, who your target market is, and how you will differentiate yourself from the competition.

- Industry & Market Analysis : Detail your research on the healthcare industry and what consulting services clients are most likely to want.

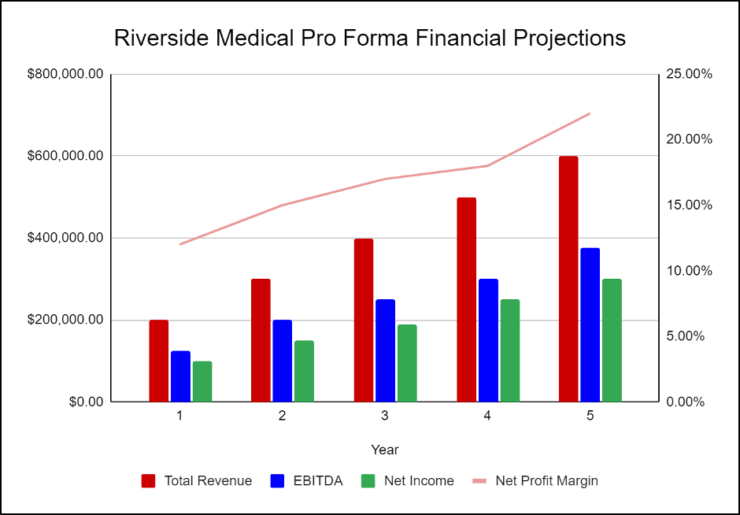

- Financial Plan : Outline your estimated income and expenses for the next three to five years.

Other sections of your plan will answer other key questions such as the following:

- What are your areas of expertise?

- What services can you offer your clients?

- Who is your target audience?

- How will you differentiate yourself from the competition?

Your business plan should also include several sections that detail your company’s history, current financial situation, and future goals. These sections will allow an investor to learn more about your company before they commit to investing in it.

Read our article about how to write a consulting business plan .

5. Apply for a Business License and Necessary Health Licenses

You must register your healthcare consulting company as a legal entity with the state in which you plan to do business.

To file your business with the state, obtain the necessary forms from the Secretary of State’s website or local County Clerk’s office. You will be required to pay a small fee for filing your business with the state.

Registering with the federal government may or may not be required. You can register your business on the federal level by obtaining an Employer Identification Number (EIN) from the IRS.

Read our article about obtaining the proper consulting business licenses .

6. Determine Your Budget & Apply for Funding as Needed

As with any business, you will need to use your own capital to finance the initial stages of your health consulting business. Your budget may also include several other costs including marketing expenses and the salary you wish to pay yourself.

After determining how much money you will invest in starting your business, review some options for financing your business. Here are several financing options that may be available to you:

- SBA Loans : The Small Business Administration (SBA) is a government agency that provides financial assistance to small businesses in the U.S.

- Bank Loans : Many small business owners are able to secure loans from their local banks. Often, you can borrow money for any purpose that relates to the growth of your company.

- Friends and Family : You can consider getting loans and/or equity investments from friends and family members..

- Angel investors : Angel investors may provide debt or equity funding to you.

Read our article about the costs associated with starting a consulting business to help you determine if funding is needed.

7. Get the Technology & Software Needed to Run Your Healthcare Consulting Company Efficiently

As a healthcare consulting firm, you will need different types of technology to complete projects and keep track of your company’s operations. To simplify the process of starting a consulting business, we’ve provided a list below detailing some items that you’ll need:

Computers : Even if most of your work is done remotely with clients on the other side of the country or world, you will need at least one computer that is dedicated to your healthcare consulting company.

Software : Software is an essential component of any consulting business. The right software can help you manage projects, track expenses, and communicate with clients more effectively.

Here are some popular software platforms that may be beneficial to your business:

- Microsoft Office : This software suite includes a variety of applications that can help you manage your company, including Word, Excel, and PowerPoint.

- QuickBooks : This software is designed for small businesses and can help you track income and expenses, create invoices, and manage payroll.

- Basecamp : This project management software can help you manage multiple projects simultaneously and keep track of deadlines and milestones.

- Gmail : Google’s email platform offers several features that can be helpful for consulting firms, including the ability to access the same email from multiple devices.

- CRM : Customer relationship management software can help you track customer communication, manage leads, and create reports that detail your sales activities.

Additional software specific to healthcare consulting may include:

- EHR software : This software is used by healthcare providers to manage patient data.

- HIPAA compliance software : This software helps organizations comply with the Health Insurance Portability and Accountability Act (HIPAA).

- EMR software : This software is used by healthcare providers to manage patient information and track medical appointments.

Read our article about the technology and software you need to run a consulting business .

8. Market Your Healthcare Consulting Firm to Potential Clients

Once you’ve established your healthcare consulting company, the next step is to market it to potential clients.

Here are some common marketing strategies used for healthcare consulting firms:

- Website : A website is an essential component of any marketing strategy. It provides potential clients with information about your company, including the consulting services you offer and the team of professionals who work for you.

- Online marketing : Marketing your business online, such as through a business website and pay-per-click and/or social media marketing, can help you reach a larger audience looking for your services.

- Direct Mail : Direct mail is a traditional marketing strategy that can be used to reach potential clients. You can send flyers, brochures, or letters to potential clients that provide information about your company and the services you offer.

- Trade Shows : Trade shows are a great way to connect with potential clients in person. You can exhibit at healthcare-focused trade shows or attend trade shows in other industries to reach potential clients who may need your services.

- Networking Events : Networking events are a great way to meet potential clients and connect with other professionals in your industry. Attending events such as Chamber of Commerce meetings or breakfast meetings can help you build relationships with potential clients.

You should also consider ways to incentivize potential clients to choose you over another healthcare consulting firm. Some incentives that work well include:

- Lower rates : Many healthcare consulting firms offer lower rates on their consulting services to attract new clients.

- Discounts on services : Offering discounts on certain projects may help you win bids against other healthcare consulting firms.

- Free consultation : Providing potential clients with a free consultation can help them determine if your company is the best one for their needs.

Learn more about how to market your consulting business .

9. Establish a Price Structure and Billing System

There are a few factors to consider when establishing your price structure:

- Hourly rates : Charging by the hour is a common way to price consulting services. This allows clients to budget for your services and gives you the flexibility to charge more for complex projects.

- Project rates : Charging a flat fee for a project can be beneficial for both the client and the consultant. It ensures that clients know what they are paying up front, and it allows healthcare consultants to charge more for more complex projects.

- Retainers : A retainer is a set amount of money that the client pays upfront for consulting services. This can be a good option for clients who need regular consulting services.

No matter which pricing structure you choose, be sure to clearly communicate it to your clients. Additionally, have a detailed invoice template that includes all the healthcare services you provided so the client knows exactly what they are paying for.

10. Manage Client Relationships and Deliver Projects

After finding new clients and marketing your healthcare consulting business, you should begin delivering the projects and getting paid. This means managing client relationships and making sure that clients are happy with your work. Some of the ways to manage relationships with your healthcare clients include:

- Regular communication : Make sure to stay in touch with your clients, even if there is not a lot of work to be done. By keeping in touch regularly, you can ensure that they know you are available and that they will be the first ones you contact when new projects arise.

- Project updates : Keep your clients updated on the progress of each project. This can be done in a variety of ways, such as through emails, reports, or presentations.

- Frequent contact : In some cases, it may be necessary to contact your clients more often than usual. If there are major changes to the project, for example, or if you need additional information from them.

Delivering projects on time and within budget is essential for a healthcare consulting business. It can be beneficial to create a project management plan that outlines how each project will be completed. This will help ensure that all deadlines are met and that the client is happy with the final product.

Learn more about how to effectively manage client relationships .

Starting a Healthcare Consulting Business FAQs

Why start a healthcare consulting business.

Healthcare consulting is a growing industry, and there are many reasons why starting a healthcare consulting business might be the right move for you. Some of the benefits of owning a healthcare consulting company include:

- You get to be your own boss

- The work is interesting and varied

- There is potential for high income

- You can help people

What is Needed to Start a Healthcare Consulting Business?

There are a few things you will need in order to start a healthcare consulting company. These include:

- A clear understanding of the healthcare industry

- Marketing materials

- An office space or home office

- Healthcare consulting software

What are Some Tips for Starting a Healthcare Consulting Company?

The following tips can help you to start a healthcare consulting company:

- Do your research : Before you launch your business, be sure to do your research and understand the industry inside and out. This will help you to develop a strong strategy and provide valuable services to your clients.

- Establish relationships with healthcare professionals : One of the best ways to grow your business is to establish relationships with healthcare professionals. Attend conferences, meet-ups, and other events where you can network with these individuals.

- Offer a range of services : In order to be successful, it is important to offer a variety of services to your clients. This will help you to meet the needs of a wider range of clients.

- Keep up with industry changes : The healthcare industry is constantly evolving, so it is important to keep up with the latest changes. This will help you to stay ahead of the competition and provide valuable services to your clients.

- Market your business : Marketing is key when it comes to a successful healthcare consulting company. Be sure to create a strong marketing strategy and use a variety of marketing channels to reach your target audience.

Limited time: Try B12 $1/mo for 3 months.

Build an AI website in 60 seconds

AI generates your personalized website instantly with built-in scheduling, payments, email marketing, and more.

How to start a health care consulting business

Are you interested in becoming a healthcare consultant? Do you want to start your own healthcare consulting business?

Healthcare consulting is a fast-growing industry that requires individuals with strong analytical and problem-solving skills, healthcare expertise, and business acumen. In the US, there are over 35,000 healthcare consultants. As a healthcare consultant, you'll work with healthcare providers, insurance companies, government agencies, and other stakeholders. You’ll help them improve their operations, reduce costs, and provide better healthcare to patients.

This blog post will guide you on how to start your own healthcare consulting business. We’ll provide you with the guidance and resources you need to succeed in healthcare consulting. Let’s get started!

Starting a healthcare consulting business: an overview

Starting a healthcare consulting business can be a fulfilling and exciting career. But it can also be challenging. The healthcare industry is constantly evolving. And there’s always a need for experienced consultants who can help navigate the changes and provide valuable insights.

Whether you are a recent graduate or an experienced healthcare professional looking for a new challenge, starting a healthcare consulting business is a viable option. With the high demand for healthcare consultants, the industry offers many opportunities for growth and career advancement.

Understanding healthcare consulting

Healthcare consulting is a rapidly growing industry that helps healthcare organizations solve complex problems and improve their overall performance.

What is healthcare consulting?

Healthcare consulting involves helping healthcare organizations improve their operations, financial performance, and patient care. Healthcare consultants work with hospitals, clinics, physician practices, insurance companies, and other healthcare organizations. They provide a wide range of services, including strategic planning, process improvement, revenue cycle management, and health information technology implementation.

Why healthcare consulting is a growing industry

Healthcare consulting is a growing industry due to the increasing complexity of the healthcare landscape. Healthcare organizations are facing unprecedented challenges, including rising costs, evolving regulations, and changing patient needs. Healthcare consultants help organizations navigate these challenges by providing expert advice and innovative solutions.

Benefits of being a healthcare consultant

There are many benefits to being a healthcare consultant. One of these is having a fulfilling career with opportunities for growth and advancement. Healthcare consultants can make a significant impact on the healthcare industry by helping organizations improve patient care and reduce costs. Additionally, healthcare consulting provides a rewarding work-life balance, with opportunities for remote work and flexible schedules. Finally, healthcare consulting offers competitive salaries and benefits packages, with opportunities for professional development and continuing education.

How to become a health care consultant

Becoming a healthcare consultant requires several qualifications, including education, experience, and essential skills. Below are the requirements and steps on how to become a healthcare consultant.

Education and certifications needed

One of the basic requirements for a healthcare consultant is a bachelor's degree in healthcare management or other related programs. A master’s degree in healthcare administration, health services administration, or business administration is preferred by many employers. However, a bachelor’s degree in a related field is also acceptable.

To advance your healthcare consultant career, certifications are important. Certifications like Certified Management Consultant (CMC) or Professional in Healthcare Risk Management (CPHRM) demonstrate your expertise and knowledge in the field.

Essential skills for healthcare consultants

Healthcare consulting requires several skills to be successful in the industry. Some essential skills you should develop include communication skills, analytical skills, and problem-solving skills. Strong interpersonal and management skills are also important in this profession. The ability to work with different teams and clients is also necessary.

How to get into healthcare consulting

Getting into healthcare consulting requires several steps. You can work in healthcare first, gain experience, and develop your skills. You can also do internships, attend networking events, and take part in relevant programs or workshops. For those who already have experience in healthcare but want to switch to consulting, it is beneficial to obtain relevant certifications and qualifications.

Finding healthcare consultant jobs

Job opportunities for healthcare consultants can be found in various settings. These include hospitals, clinics, consulting firms, and health insurance companies. Networking, building your professional profile, and attending career fairs can help you find job opportunities. Online job search engines and professional association websites like the National Society of Certified Healthcare Business Consultants (NSCHBC) can also help you find job opportunities.

Starting your healthcare consulting business

Starting a healthcare consulting business requires careful planning and preparation. Here are the key steps to get your healthcare consulting business off the ground.

Creating a business plan

A business plan outlines your business goals, target audience, marketing strategies, and financial projections. Your business plan should also include a detailed analysis of your competition. It should include a plan for how you will differentiate your business from theirs. Developing a comprehensive plan will help you stay focused as you start your business.

Legal considerations

Before starting your healthcare consulting business, consider its legal aspects. This includes registering your business, obtaining any necessary licenses and permits, and getting liability insurance. You will also need to decide on a legal structure for your business. For instance, you could opt for a sole proprietorship, partnership, or limited liability corporation (LLC). Seeking the advice of a lawyer or accountant can help you navigate these important legal considerations.

Marketing your services

Marketing your healthcare consulting services is crucial for attracting potential clients. Your marketing strategy should include creating a website, networking with other healthcare professionals, attending events and conferences, and utilizing social media platforms. You should also consider creating a referral program and asking satisfied clients for testimonials. By promoting your business effectively, you can establish your credibility and attract more clients.

Finding your niche

As a healthcare consultant, you can focus on a specific area of expertise. For instance, healthcare technology, hospital management, or public health. By specializing in a particular niche, you can differentiate yourself from other competitors and target specific clients. However, you must conduct market research. You must ensure there’s a demand for your services in your chosen niche. By identifying your niche, you can tailor your services. This way, you can meet your target audience’s specific needs and challenges.

Growing your healthcare consulting business

Imagine your healthcare consulting business continues to expand. In that case, you must have a plan in place for growth.

Expanding your services

One way to grow your healthcare consulting business is to expand your services. This can be done by offering new areas of expertise, or by branching out into new markets or geographies. Conduct market research to identify areas of potential growth, and invest in the necessary resources to develop new services.

Building your team

As your business grows, it may become necessary to build a team of consultants to handle increased demand. When hiring new talent, focus on finding individuals with the skills and experience needed to support your business goals. Develop a strong onboarding and training program. This is to ensure that new team members are fully integrated into the company culture.

Managing your finances

Have systems in place for tracking expenses, invoicing clients, and managing cash flow. Consider hiring a financial advisor or accountant. They’ll be able to help you manage your finances effectively.

Starting and growing a healthcare consulting business takes dedication, hard work, and a commitment to excellence. By understanding the industry, developing a unique niche, and focusing on delivering exceptional services, you can build a successful consulting practice. With the right strategies in place for growth and financial management, you can create a fulfilling career while helping others to improve their healthcare organizations.

Advancing your career in healthcare consulting

As a healthcare consultant, the career possibilities are endless. You can advance your career in several different directions. This all depends on your interests and expertise.

Public health consulting

Public health plays an essential role in ensuring the overall health of communities and populations. As a public health consultant, you will work with organizations and government agencies. You will help them identify health problems and implement solutions to improve the health of the public. This can include initiatives such as disease prevention, health promotion, and policy development.

Physician consulting

Physician consulting involves working with healthcare providers to improve patient care and outcomes. This can involve identifying inefficiencies in healthcare systems and streamlining processes. This can also be implementing new technologies to improve patient care and their healthcare facilities. Physician consulting can also involve working with healthcare organizations to develop new models of care that can improve patient outcomes.

Healthcare IT consulting

Healthcare organizations are becoming increasingly reliant on technology to improve patient outcomes and streamline workflows. Health IT consulting involves working with healthcare organizations to implement new technologies. For instance, electronic health records, telemedicine, and patient monitoring systems. As a health IT consultant, you will use your expertise to help healthcare organizations leverage technology to improve patient care and outcomes.

Top healthcare certifications to have

Obtaining healthcare certifications can help you stand out in a crowded job market and demonstrate your expertise in a particular area. Some of the top healthcare certifications to have include the Project Management Professional (PMP) certification and Certified Health Education Specialist (CHES) certification. You may also go for the Certified Professional in Healthcare Information and Management Systems (CPHIMS) certification.

Advancing your career in healthcare consulting requires dedication and expertise. It requires a willingness to adapt to changing healthcare trends. By considering these different paths, obtaining relevant certifications, and gaining specialized knowledge, you can grow your career and become a leader in the field.

Promote your healthcare consulting business with a solid website

Get your healthcare consulting business off the ground and make it more visible to potential clients with a solid online presence. Through a professional website, you can get your business in front of more customers, expanding your visibility and reach.

With B12, you can create, design, and launch a professional website in 30 days or less. Our AI website builder enables you to generate your site and crucial web pages complete with your branding. Choose from a vast library of templates, colors, fonts, and images specifically geared for the industry you’re in.

B12 is the all-in-one platform that helps professional service small businesses launch an online presence with tools like payments , scheduling, email marketing, and contracts. See your new site for free in 60 seconds to start winning, attracting, and serving clients in no time.

Attract, win, and serve more clients

Receive helpful resources directly to your inbox to help you succeed online.

Related posts

Spend less time on your website and more time growing your business

Let B12 set up your professional online presence with everything you need to attract, win, and serve clients.

How we help clients in your region

Middle east & africa.

McKinsey Health Institute

Center for US Healthcare Improvement

Business Building in Healthcare

Featured capabilities.

Healthcare Analytics

Actuarial Analytics

Nebula platform

Creating value beyond the hype.

Shubham Singhal

Senior partnerdetroit.

Drew Ungerman

Senior partnerdallas, featured insights.

The Future of Healthcare

Tackling healthcare’s biggest burdens with generative AI

Reimagining the nursing workload: Finding time to close the workforce gap

The future of Medicare Advantage

New at mckinsey blog.

Responding to COVID-19: Adi Kumar

Related practices.

Public & Social Sector

Life Sciences

McKinsey Digital

Financial Services

McKinsey’s work for social sector, healthcare, and public entities

Connect with our healthcare practice.

Healthcare Consulting: What It Is & How to Succeed in It

Published: June 19, 2023

It’s surprising how the healthcare industry is complex and yet rewarding at the same time. Just one sector — for example, healthcare consulting — can unlock great opportunities. But what is healthcare consulting, and if it's so good of a career option, how can you become a healthcare consultant?

With constant developments in treatments, medication, and technology, healthcare organizations have much to keep track of — and doing so thoroughly and professionally is vital to their success and patients' health. But it isn’t as easy as it sounds. That’s where a healthcare consultant can take the responsibility to help these organizations balance patient care with patient experience.

This post will teach you why healthcare consulting is a job with a greater purpose, what options you have, and how to start working in the field.

Table of Contents

- What is healthcare consulting?

Types of Healthcare Consulting

Why healthcare consulting, how to get into healthcare consulting.

As the primary job of healthcare organizations is to cure their patients, they can fall behind in many areas when ignored. And since healthcare is a competitive industry, they can’t afford that.

Therefore, these organizations need healthcare consultants who can analyze the organization’s position, diagnose shortcomings, and create solutions to help overall growth.

.png)

8 Free Consulting Templates

Access 8 templates for consultants in The Complete Consultant's Success Kit.

- Management Consulting Plan Template

- Business Plan Template

- Sales Plan Template

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

A healthcare organization is a business with many minor sectors to look after; therefore, you can either choose to become a generalist to solve minor problems or specialize in one area to become a known expert and serve specific clients.

Here are the various types of healthcare consulting you can master to help organizations grow.

Strategy Consulting

For a healthcare organization to survive in a competitive market, it should stay at the top of its patients‘ (customers’) minds. As a strategy consultant, you’ll have diverse business knowledge and a deep understanding of your target audience’s pain points.

You’ll mainly conduct well-rounded assessments to find glitches in its business strategy and create solutions. Your job would be to ensure the healthcare organization grows its revenue and delivers excellent patient care.

Marketing Consulting

With the internet almost irreplaceable in customers’ lives, traditional marketing ways to attract customers no longer work. And as customers have many options, it’s far more important to appear as an expert and the only one who can diagnose their problem.

A marketing consultant will create smart digital marketing strategies to help healthcare organizations show up in front of the right target audience as the best option. You’ll be required to stay up-to-date with the latest marketing trends and develop creative campaigns to acquire new customers for these organizations.

Technology Consulting

Technology is ever-changing in the medical space. New equipment, improved medicine, and better treatment procedures are introduced every day.

For healthcare organizations to remain effective, they must leverage efficient technology paired with the right treatment and medication for their patients. The problem is they’re not very well-versed in testing, installing, and working with the latest technological equipment.

As a technology consultant, you’ll evaluate an organization’s technological needs and introduce and test new solutions. You’ll determine if a piece of new equipment is a good fit and will positively help the organization's growth.

HR and Operations Consulting

Like any business, healthcare organizations must ensure that each member adds value. But since they’re dealing with precious lives, they have to be extra careful. An HR and operations consultant will regularly analyze each staff member’s performance and guide them to help advance in their career.

Your duties will include:

- Creating job descriptions and responsibilities.

- Workplace standards.

- Hiring new staff.

- Promoting a healthy workplace culture.

- Ensuring staff members feel recognized when they deliver outstanding performance.

Legal and Regulatory Consulting

To run a healthcare organization legally, it’s required to abide by laws. But getting a license once isn’t enough because the laws and regulations constantly change. They also affect day-to-day operations, patient information management, treatment contracts, and more.

A legal and regulatory consultant is an expert who ensures that the organization abides by changing laws. Your job would include:

- Updating yourself with the recent legal modifications.

- Monitoring your organization’s condition regularly.

- Implementing the changes.

Working as a healthcare consultant is a highly regarded profession. Because you have a higher level of business expertise than an average employee, you’re a priceless resource to the organization.

In addition to developing creative solutions as a healthcare consultant, here are some benefits:

- As it’s a competitive industry with many players, your unique advice will help your client's healthcare organization stay on top.

- You’ll provide insights and expertise regarding company decisions directly impacting customers, patients, and other external stakeholders.

- You’ll get to work with various healthcare organizations and hospitals.

- You’ll maintain job security — as the industry constantly changes, healthcare organizations, pharmaceutical companies, government agencies, and hospitals will always need your expertise.

- You’ll earn an average salary ranging between $63K and $112K yearly.

- You’ll gain employment freedom — as you decide to work in full- or part-time positions or be self-employed.

Since consulting firms can employ hundreds of consultants, they can offer specialized support within various industry sectors. As a consultant at a firm within one of these specialties or sectors, you’ll develop greater expertise and put yourself in an even more desirable position to work with premium clients.

Here are some of the sectors that healthcare consulting firms specialize in:

- Healthcare systems and processes (strategy, technology, revenue, performance, finance, sustainability, etc.)

- Clinical operations

- Federal and state government agencies

- Hospitals, physicians, and physician groups

- Payer or insurance provider strategies

- Delivery systems

- Medical technology

Whether or not you think a firm is right for you, working in the healthcare consulting field requires the same background. Let’s review the typical steps for anyone looking to get into a healthcare consulting role next.

Your education is the most important part of your experience and background when trying to kickstart your career. You need a relevant bachelor’s degree to begin working as a healthcare consultant.

1. Earn a bachelor’s degree.

To ensure your bachelor’s degree is relevant to your desired position in healthcare consulting, choose a field of study related to the industry, such as public health, business, or even nursing. Since healthcare is a complex industry, a bachelor’s degree in a relevant subject will provide you with the necessary background you need to assist your clients and meet their needs effectively.

And speaking of this field's complexity, a master’s degree is something many of the top firms look for when hiring consultants.

2. Obtain a master’s degree (optional).

Having a master‘s degree isn’t necessarily essential to begin your career. A bachelor‘s degree alone qualifies you to get hired as a healthcare consultant. So, if you want to get experience quickly, you may just need a bachelor’s degree. You can always get a master‘s degree whenever you’re ready to upscale.

That being said, an advanced degree will make you more desirable among employers and clients and allow you to land positions with higher salaries and greater responsibilities. You might need a Master of Business Administration (MBA) or a Master of Public Health (MPH).

3. Determine which type of healthcare consultant you want to become.

Next, think about whether you want to be self-employed, work for a company as an internal consultant, or work for a consulting firm. There’s no right or wrong answer here. It’s all a matter of preference based on your goals, aspirations, and work style.

For example, if you thrive in a structured work environment alongside other employees, you might enjoy being at a major firm like McKinsey . But if you’d rather have complete flexibility to make your hours and choose your clients, working for yourself — or even a small firm — might be the way to go.

4. Develop the right skills.

You’ll need to develop various skills to become an effective healthcare consultant. Here are some of the technical and interpersonal skills that will help you do your job well:

- Communication skills. You’ll interact with many clients, coworkers, and patients throughout your career, so you should be a fluent and compelling speaker.

- Problem-solving. One of your most critical jobs would be identifying and solving problems in the healthcare organization. Therefore, you must be a keen observer to find problems and develop innovative solutions.

- Analytical skills. A part of your job will require you to analyze data to determine patterns or loopholes. You should be able to process a large amount of data or information.

- Financial knowledge. As an advisor, you must guide healthcare organizations to help them grow their revenue. You should quickly identify problems with their finances and suggest better solutions.

- Business expertise. If you decide to work as a strategic healthcare consultant, having business knowledge is the most required. Ideally, you should be able to figure out why the healthcare organization as a business isn’t growing.

- Medical expertise. As you’re working in the healthcare industry, it’s a no-brainer you should know about it. Teach yourself about healthcare laws, policies, legislation, practices, etc.

5. Gain experience in the field and grow your network.

After honing the right skills, it’s time to gain real work experience. In your beginning years, you should take as much work as possible as it will allow you to expand your knowledge and grow your professional network.

It’s also a good idea to build connections with other experts in the industry. So it’s easier for you to move up the ranking ladder (or gain more clients), expand your responsibilities, become well-known and highly regarded among clients, and achieve greater career aspirations.

6. Fine-tune your skills and stay up to speed with industry trends.

As both the healthcare industry and your clients are ever-changing, you, as a consultant, should consistently keep your industry knowledge updated and keep improving your skills.

For instance, you know that technology and laws are fast changing and that you’ll be left behind if you’re unaware of the recent changes. If you can't guide organizations to make adjustments based on these changes, you’d no longer be a valuable asset to the industry.

That’s why you should consistently update your knowledge to remain in demand.

Begin your healthcare consulting career.

Healthcare consulting is an impactful, well-regarded, and lucrative career path. You can educate various client types on improving operations, work within the boundaries of healthcare policies and laws, and streamline company processes and strategies. You’re bound to have an exciting and rewarding road ahead working as a healthcare consultant.

Don't forget to share this post!

Related articles.

![medical consulting business plan How to Write a Consulting Proposal [Templates & Examples]](https://knowledge.hubspot.com/hubfs/ft-consulting.webp)

How to Write a Consulting Proposal [Templates & Examples]

30 Consulting Buzzwords that Work (and Don't Work) in Conversation

![medical consulting business plan Start a Consulting Business in 6 Steps [+Ideas for Your Venture]](https://www.hubspot.com/hubfs/image1-Apr-06-2023-09-15-56-0028-PM.png)

Start a Consulting Business in 6 Steps [+Ideas for Your Venture]

What a Retainer-Based Approach Can Do for a Consulting Business

9 Essential Certificates for Consultants

Building a Career in Consulting — The Ultimate Guide

Innovation Consulting: Everything You Need to Know

![medical consulting business plan 15+ Interview Questions for Consultants [+ Sample Responses]](https://53.fs1.hubspotusercontent-na1.net/hubfs/53/Consultant%20Interview.png)

15+ Interview Questions for Consultants [+ Sample Responses]

Consultative Selling: 7 Ways to Win Deals With Consultative Sales

How to Network in Consulting (+6 Tips)

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

How to Start an Online Healthcare Consultation Business?

Wondering why you might have to think about starting a healthcare consulting business ?

COVID-19 has taken a staggering toll affecting almost all industries, including healthcare. When we speak about healthcare, the industry is complex. Medical organizations have a lot to keep track of, consisting of hundreds of laws, regulations, a wide range of potential jobs, diagnoses, treatments, and medication. And all of these are absolutely critical to the success of the healthcare organization and the health of the patients. That is why medical consultants or healthcare consultants are valuable.

According to Brand essence market research, the healthcare industry is expected to exceed $20 billion by 2025 . And indeed, now is the right time to switch from conventional medical consultation to an online medical consultation business through a powerful conversational marketplace.

What does a medical consultation business do?

Before getting into how to start a healthcare consulting business , let’s understand more about the medical consultation business. Medical consulting is offering advice and guidance to medical institutions to make critical business decisions that influence their growth.

Medical consultants are experts in the healthcare industry- they have the right educational qualification and background on medical laws and policies to help healthcare organizations and hospitals run their businesses the most effectively. Medical consultants advise pharmaceutical businesses, biotech start-ups, health insurance companies, and governments on the most efficient and effective healthcare delivery methods.

Why Online healthcare consulting?

If you want to learn about how to start a healthcare consulting business , you must know more about healthcare consulting and why it is necessary. Creating a healthcare consulting business allows you to work closely with a wide range of medical institutions and organizations. Healthcare organizations, government agencies, hospitals, and pharmaceutical companies will always need industry expertise and advice. So you get to work with amazing clients from different industries. Every client has different needs, expectations, products, and services, so medical consultants can oversee projects of various types.

Working as an online medical consultant is a reputed career as it requires a certain level of academic qualification and expertise to be successful, which isn’t necessarily essential in other fields. You can offer insights and expertise regarding the business decisions of hospitals and medical institutions that directly impact patients, customers, and other stakeholders by launching an online consultation platform .

Here are some advantages of becoming an online health consultant :

Gain a competitive edge

As the healthcare industry is one of the sectors to go digital last, you will have an opportunity to gain a competitive advantage over your competitors. When other healthcare consulting businesses are working on transforming their business, you can emerge as a pioneer in your niche, which would provide a substantial competitive edge.

Flexibility in working hours

Becoming a medical consultant comes with the advantage of having the flexibility of creating your own schedule. With an online consulting website set up, consultant opportunities can be undertaken at your own pace. One of the main online consulting perks is creating a balance between your need between your consulting business and your personal life.

Reduced travel

As you can shift your medical consultation from offline to online, the travel requirements are eliminated, saving you more time and money. Through video conferencing tools, you can communicate and collaborate with medical professionals without having to travel to meet them.

Easy and quick communication

Considering the modern technology available today, customers expect incredible speed and quick response from healthcare consultants. With the fierce competition available in the industry, customers expect to receive value for the money they spent right away. With a healthcare consulting website for your consulting firm, you can quickly connect with customers.

New channel to find new customers

Shifting your medical consulting services online provides consulting firms with new ways to find customers. With an online consulting platform in place, geographical restrictions don’t even exist. Moreover, by launching a medical consulting business , you will have a new client who prefers getting their consulting services online. And with each year passing by, the number of clients preferring online services is increasing considerably.

Convenience and security

Work in either full-time or part-time positions for hospitals and medical organizations, or be self-employed. The traditional way of storing confidential information is not safe for both your clients and your consulting firm.

To offer a safe environment for your customers, your consulting business must have a secure place to keep all the sensitive information. Typically, it’s the database that is linked to your medical consulting website.

Building a successful online medical consultation business

With your expertise and experience in the field, you can start building a thriving online medical consultation business .

Now, let’s look into the steps to building a successful healthcare consulting business.

1. Crafting a Healthcare consulting business plan

Preparing a healthcare consulting business plan involves creating a document that defines your services and how you intend to run your business.

So here is a sample healthcare consulting business plan :

Executive summary : Give a clear description of your medical consulting business and a market analysis summary.

Company analysis : The company analysis section explains how your healthcare business would run, its current stage, legal structure, and related info.

Industry analysis : Conduct industry analysis and elaborate on current trends and market projections that directly affect your niche.

Customer analysis : In this section, understand who will your healthcare business service. Make sure you narrow down the demographics as well and find out the unique needs and how you can fulfill them.

Competitive analysis : When conducting a competitive analysis, include direct competitors whose businesses fulfill your needs and indirect competitors who target a different market.

Operations plan : The operation plans section elaborates on your methods of meeting the goals you have defined. Add both short-term goals and long-term goals, like expanding to a new market.

Management team : Define the team and backgrounds of key members of your team. Focus on your team’s ability to build and run a successful healthcare business.

Financial plan : The financial plan needs you to detail your individual revenue streams, cash flow statements, future income statements, balance sheets, etc.

2. Business models of online consulting business

The business model is an important aspect that plays a significant role in the success of any online consulting business. While medical consultants are usually hired for a one-time consultancy, medical consulting businesses can adopt several business models. You can build a consulting website which is basically a consulting platform that connects consultants with clients.

Here are some of the business models you can adopt:

- Live one-one consulting

One-one consulting is one of the common business models which allows clients to have one-one sessions with you. You can offer personal consulting sessions to professionals in the medical field where you work with them individually. One-one coaching allows your customers to get individual consultations, and the session is catered to offer personalized solutions to customer problems.

- Group Coaching

This is another popular business model where you deliver consultation sessions to a closed group that attends the sessions together. The medical consultants can offer support to several clients of the group at a time. As with any other type of consultation, it is carried out remotely through audio and video calls. By offering group classes, you can enhance productivity by spending your time with several customers at a single time.

- Subscription model

In a subscription business model, you allow your clients to access your consulting, along with the supporting materials and tools for a monthly or yearly subscription fee. You can create subscription packages on your online medical consultation platform and allow customers to book private or group consulting sessions as long as they subscribe to your plan.

3. Launch an online healthcare consultation website for your services

One of the significant benefits of running an online healthcare consultation business is that you can connect with your clients, virtually eliminating the need to meet them in person. This adds to the convenience, especially during the times of the COVID-19 pandemic, as social distancing has become a new norm.

Setting up a consultation site allows your clients to communicate with you through the platform to avail your services. While building a consultation site is mandatory, you don’t have to spend a fortune right away. You can quickly start using professional tutoring software to set up your online consulting site the most rapidly and affordably perfectly for a single and multi-tutor consulting business. You can connect with your clients through video conferencing, live one-one consultations, webinars, group classes, and videos.

4. Choose your preferred payment methods

If you ask about the main benefit of becoming a medical consultant and setting up your own consultation website, it is having complete control of your online consulting business. Having your own consultation platform offers you the flexibility to introduce the consultation fee according to your business requirements and goals. You can choose to charge upfront once the consultation is over or go for pre-billing consultations. However, you choose to charge your clients, integrate multiple payment gateways to offer the flexibility of selecting the preferred payment option for your clients.

5. Set your unique selling propositions and core values

Online healthcare consultation has a lot to do with your profound expertise, inspiring ideas, and value. Clients approach you for your valid expertise, expert suggestions and advice you can offer them. That is why it is critical to establish your unique selling propositions. Make sure your core values align with that of your potential services so that you can offer the best service to them.

6. Marketing strategies to adopt to promote your consulting business

Devising effective ways to promote your medical consultation business is as important as thinking about how to get into medical consulting . Leverage online marketing to find ideal customers and reach out to them with your online healthcare consulting services. The best market strategy you can follow to grow a client base is to build a powerful presence on social platforms like Twitter, Linked In, Facebook, Instagram, etc. Though a traditional form of marketing, email marketing is also very powerful. It can be easy to start with if you already have an email list of potential clients ready for you.

Online Medical consulting is an impactful and lucrative career choice. You can share your expertise and educate clients on improving their operations, work within the boundaries of healthcare laws and policies, and streamline company strategies. Moving your healthcare consultation business operations online and building your own healthcare consultation platform can facilitate smart and remote interaction.

If you want expert assistance in starting a healthcare consulting business , we are always at your service. Please get in touch with us right away!

Book a Free consultation Now!

Srivathsan GK

Free ebook- learn from udemy’s success story.

- Market & Sell

- Online Courses

- Product update

- Success Stories

- Uncategorized

You may also like

How to Create a Coaching Program? (Free Coaching Program Template)

Essential Checklist for Starting a Coaching Business

How to Become an Online Fitness Coach

How to Start a Healthcare Consulting Business

By: Author Tony Martins Ajaero

Home » Business ideas » Healthcare and Medical

Do you want to start a healthcare consulting firm? If YES, here is a complete guide to starting a healthcare consulting business with NO money and no experience .

It is no longer news that the healthcare sector sells like wild fire all over the world. This is one of the reasons why investors are willing to pump in a whole lot of money in order to be sure that they get good returns on their investments.

If you are a wishful entrepreneur with an experience in human resources and healthcare, one way you can launch your way into the business world is to start your own healthcare consulting firm.

You can be rest assured that your services would always be in demand not only by small healthcare organizations, but also big healthcare corporations and related businesses.

Healthcare consulting firms are organizations that specialize in providing business consulting services (healthcare administration or healthcare management) to the healthcare industry in areas such as finance, accounting, marketing, insurance, efficient operational process and other related areas.

Just like most businesses, the healthcare consulting services industry is open to as many people that are interested in the industry as long as they have what it takes to run a healthcare consulting services firm. Opening a healthcare consulting firm is not too expensive except for the money required to rent and furnish an office space.

Running this type of business requires that you should be trained as a consultant and it is indeed a very lucrative business in the United States, Canada, Australia and the United Kingdom because of the desire for continuous growth in the healthcare industry.

If you have decided to start a healthcare consulting services firm, then you must make sure that you carry out thorough feasibility studies and also market survey.

This will enable you properly locate the business in a community or city with the right demography; a location that can readily accept your services.

So, if you have done the required feasibility studies and market research, then you might want to venture into this business. If you have been pondering on starting your own healthcare consulting services firm but do not know how to go about it, then you should consider going through this article; it will sure give you the needed guide and direction.

18 Steps to Starting a Healthcare Consulting Business

1. understand the industry.

Players in the healthcare consulting services industry provide specialist advice to businesses involved in healthcare fields such as hospitals, physicians, pharmaceutical companies, healthcare related organizations, health management organizations and healthcare insurance providers et al.

These services include advice related to financial management, human resources, information technology and other operations.

More than ever before, the demand for healthcare consulting services has increased as a result of technological advances in the healthcare sector and of course the ever – changing regulatory environment in the united states.

Besides, the 2010 Patient Protection and Affordable Care Act expanded access to healthcare to millions of Americans, driving growth in the overall healthcare sector and stimulating demand for the services of healthcare consulting firms.

Nevertheless, budgets remained tight for many industry customers due to the lingering effects of the recession. Going forward, the revenue generated by the healthcare consulting services industry is projected to continue on its upward flight.

The Healthcare Consulting services Industry is indeed a large industry and pretty much active in countries such as United States of America, United Kingdom, France, Germany, Italy, Holland, Switzerland, Australia and Canada et al.

Statistics has it that in the United States of America alone, there are about 17,521 registered and licensed healthcare consulting firms scattered all across the United States responsible for employing about 26,479 and the industry rakes in a whooping sum of $6 billion annually.

The industry is projected to grow at a 7.1 percent annual growth within 2011 and 2016. It is important to state that Accenture, Advisory Board Company, Deloitte, Huron Consulting Group Inc. and PwC have the largest available market share in the industry.

A recent report shows that healthcare consultants have benefited from many factors over the five years to 2017. The report states that healthcare reforms in the United States has driven hospitals and other care providers to realign their operations to accommodate millions of previously uninsured Americans and comply with new regulatory requirements.

The report also noted that declining Medicare and Medicaid reimbursement rate and the rising cost of care have pushed healthcare providers to look for cost savings and engage industry consultants, thereby boosting industry revenue over the five years to 2017.

Coupled with the recovering economy and the passage and implementation of healthcare reforms, demand for healthcare consultants is expected to boom over the period, with total industry revenue forecast to grow an annualized 7.1 percent.

The fact that healthcare consulting firms can easily be found in cities in the United States of America, does not in any way make the industry to be over saturated. The fact that there are people and organizations out there who would always need professional healthcare consulting services from time to time to sort out business related issue et al makes the business evergreen.

Some of the factors that encourage entrepreneurs to start their own healthcare consulting business despite the fact that the business is risky is that the business is highly thriving and profitable and can be started in any part of the world.

Over and above, starting a healthcare consulting firm requires professionalism and a good grasp of the healthcare industry. Besides, you would need to get the required certifications and license and also meet the standard for such business before you can be allowed to start a healthcare consulting firm in the United States.

One good thing about the healthcare consulting industry is that there is a readily available market for their services because individuals and even organizations naturally would want to improve and effectively manage their business. So, if you are well positioned and you know how to deliver results as a healthcare consultant, you will always smile to the bank.

2. Conduct Market Research and Feasibility Studies

- Demographics and Psychographics

The demographic and psychographic arrangement of persons who need the services of healthcare consulting firms cut across businesses involved in healthcare fields such as hospitals, physicians, pharmaceutical companies, healthcare related organizations, health management organizations and healthcare insurance providers et al who need advice and guidance to sort out business related issues.

If you are defining the demographics for your healthcare consulting business, then you should make it all encompassing.

It should include businesses involved in healthcare fields such as hospitals, physicians, pharmaceutical companies, healthcare related organizations, health management organizations and healthcare insurance providers et al within and outside the city you are operating in who have the capacity to pay for your services.

3. Decide Which Niche to Concentrate On

Most healthcare consulting services firms tend to operate general services that involve every business activities that a standard healthcare consulting firm is expected to offer. That is why it seems like there are no niche areas in the industry.

But on the other hand, some healthcare consulting firms may decide to major in some key or niche area such as;

- Strategic management consulting

- Financial management consulting

- Information technology consulting

- Human resource consulting

- Process and logistics consulting services

- Marketing consulting services

The Level of Competition in the Industry

The competitions that exist in the healthcare consulting line of business goes beyond competitions amongst healthcare consulting firms in your location; you are expected to compete with other consulting firms that have the capacity to consult and proffer business solutions to healthcare organizations. Thus, it will be right to say the competition in the healthcare consulting line of business is tough.

The reality is that no matter the level of competition in an industry, if you have done your due diligence and you brand and promote your services or business properly, you will always make headway in the industry. Just ensure you can proffer business solutions to your clients, you can deliver excellent customer care services, get testimonials from your clients and you know how to attract and reach out to your target market.

Above and beyond, there are several healthcare consulting firms and general consulting firms that have the capacity to consult for healthcare organizations scattered all around the United States. So, if you choose to start your own healthcare consulting business in the United States, you will definitely meet stiffer competitions amongst healthcare consulting firms and general consulting firms that have the capacity to consult for healthcare organizations. Besides, there are larger healthcare consulting firms – brands that determine the trends in the industry and you should be ready to compete with them for customers.

4. Know Your Major Competitors in the Industry

In every industry, there are always brands that perform better or are better regarded by customers and the general public than others. Some of these brands are those that have been in the industry for a long time, while others are best known for how they conduct their businesses and the results they have achieved over the years.

These are some of the leading healthcare consulting services firms in the United States of America and also in the globe;

- Advisory Board Company

- Huron Consulting Group Inc.

- Bain & Company

- Deloitte Consulting

- The Chartis Group

- Simione Healthcare Consultants

- FTI Consulting

- Health Advances, LLC

- Pinnacle Healthcare Consulting

- Cynosure Health Solutions

- CTG Health Solutions

- Healthcare Strategy Group

- QHR (Quorum Health Resources)

- Alvarez & Marsal Healthcare Industry Group

- ECG Management Consultants

- Health Care Network Associates

- Healthcare Management & Consulting Services

- Healthplex Associates

Economic Analysis

When it comes to starting a business such as healthcare consulting services firm, you just have to get your feasibility studies and market research right before venturing into the business. It is good to mention that the healthcare consulting services business is not for rookies; it is for professionals who have gathered the required experience and expertise to proffer solutions to people and organizations.

Starting this kind of business definitely entails that you acquire the required degree and professional certifications and also build good working relationship with stakeholders in the healthcare industry. If you are already a major player in the healthcare consulting services industry before venturing out to start your own healthcare consulting services firm, this might not be an issue.

Depending on the scale at which you want to start from, you might require as much as multiple thousands of dollars to strike this off and at the same time you might need far less than that if you choose to start the business from your house, a virtual office or a shared office space.

You will be expected to hire the services of experts that will help you with a comprehensive economic and cost analysis of the business within the location that you intend launching it. If you get your economic and cost analysis right before launching the business, you may not have to stay the long before you breakeven.

5. Decide Whether to Buy a Franchise or Start from Scratch

When it comes to starting a business of this nature, it will pay you to buy the franchise of a successful healthcare consulting services firm as against starting from the scratch. Even though it is relatively expensive and difficult to buy the franchise of an established healthcare consulting services firm, but it will definitely pay you in the long run.

But if you truly want to build your own brand after you must have proved your worth in the financial services industry, then you might just want to start your own healthcare consulting services firm from the scratch. The truth is that it will pay you in the long run to start your healthcare consulting services firm from the scratch. Starting from the scratch will afford you the opportunity to conduct thorough market survey and feasibility studies before choosing a location to launch the business.

Please note that most of the big and successful healthcare consulting services firms round started from the scratch and they were able to build a solid business brand. It takes dedication, hard work and determination to achieve business success and of course you can build your own healthcare consulting services firm to become a successful brand with corporate and individual clients from all across the length and breadth of the United States of America and other countries of the world.

6. Know the Possible Threats and Challenges You Will Face

If you decide to start your own healthcare consulting services firm today, one of the major challenges you are likely going to face is the presence of well – established healthcare consulting services firms and also other related consulting firms and advisory businesses who are offering same services that you intend offering. The only way to avoid this challenge is to create your own market.

Some other threats that you are likely going to face as a healthcare consulting services firm operating in the United States are unfavorable government policies , the arrival of a competitor within your location of operation and global economic downturn which may affect businesses. There is hardly anything you can do as regards these threats other than to be optimistic that things will continue to work for your good.

7. Choose the Most Suitable Legal Entity (LLC, C Corp, S Corp)

Generally, you have the option of either choosing a general partnership, or limited liability Company which is commonly called an LLC for a healthcare consulting services firm. Ordinarily, general partnership should have been the ideal business structure for a small – scale healthcare consulting services firm especially if you are just starting out with a moderate start – up capital.

But people prefer limited liability Company for obvious reasons. If your intention is to grow the business and have clients both corporate and individual from all across the United States of America and other countries of the world, then choosing general partnership is not an option for you. Limited Liability Company , LLC will cut it for you.

Setting up an LLC protects you from personal liability. If anything goes wrong in the business, it is only the money that you invested into the limited liability company that will be at risk. It is not so for general partnerships. Limited liability companies are simpler and more flexible to operate and you don’t need a board of directors, shareholder’s meetings and other managerial formalities.

These are some of the factors you should consider before choosing a legal entity for your healthcare consulting services firm; limitation of personal liability, ease of transferability, admission of new owners, investors’ expectation and of course taxes.

If you take your time to critically study the various legal entity to use for your healthcare consulting services firm, you will agree that limited liability company; an LLC is most suitable. You can start this type of business as limited liability company (LLC) and in future convert it to a ‘C’ corporation or an ‘S’ corporation especially when you have the plans of going public.

8. Choose a Catchy Business Name

Generally, when it comes to choosing a name for a business, it is expected that you should be creative because whatever name you choose for your business will go a long way to create a perception of what the business represents. Usually it is the norm for people to follow the trend in the industry they intend operating from when naming their business.

If you are considering starting your own healthcare consulting services firm, here are some catchy names that you can choose from;

- McIntosh Jason & Co® Healthcare Consulting, LLC

- J K Randel® Healthcare Consulting Services, LLC

- Sage Group® Healthcare Advisors, LLP

- Clarkson McFarlane® Healthcare Consulting Services, LLP

- Innocent Thompson© Healthcare Consulting Services Company, Inc.

- Harrow Smiths & Associates® Healthcare Advisers, LLP

- Silver House® Healthcare Consulting Services Group

- East Coast® Healthcare Consulting Services, LLC

- Phil Nelson & Co Healthcare Advisors, LLP

- Flint Fingers® Healthcare Consulting Services, Inc.

- Shavonne Pearce Healthcare Consulting Services, Inc.

- Shannon & Shaun® Healthcare Consulting Services, LLP

9. Discuss with an Agent to Know the Best Insurance Policies for You

In the United States of America and in most countries of the world, you can’t operate a business without having some of the basic insurance policy covers that are required by the industry you want to operate from. So, it is imperative to create a budget for insurance policy covers and perhaps consult an insurance broker to guide you in choosing the best and most appropriate insurance policies for your healthcare consulting services firm.

Here are some of the basic insurance policy covers that you should consider purchasing if you want to start your own healthcare consulting services firm in the United States of America;

- General insurance

- Risk Insurance

- Financial reinsurance

- Health insurance

- Liability insurance

- Workers Compensation

- Overhead expense disability insurance

- Business owner’s policy group insurance

- Payment protection insurance

10. Protect your Intellectual Property With Trademark, Copyrights, Patents

If you are considering starting your own healthcare consulting services firm, usually you are required to file for intellectual property protection/trademark. This is so because the nature of the business makes it possible for you to challenge organizations and individuals in court for illegally making use of your company’s intellectual properties.

So also, if you want to protect your company’s logo and other documents or software that are unique to you or even jingles and media production concepts, then you can go ahead to file for intellectual property protection. If you want to register your trademark, you are expected to begin the process by filing an application with the USPTO. The final approval of your trademark is subjected to the review of attorneys as required by the USPTO.

11. Get the Necessary Professional Certification

Aside from the results you produce as it relates to timely and result oriented finance, accounting, marketing, insurance, and efficient operational process advice to your clients, professional certification is one of the main reasons why some healthcare consulting services firm stand out.

If you want to make an impact in the healthcare consulting services industry, you should work towards acquiring all the needed certifications in your area of specialization. Certification validates your competency and shows that you are highly skilled, committed to your career and up-to-date in this competitive market.

These are some of the certifications you can work towards achieving if you want to run your own healthcare consulting services firm;

- Certified Healthcare Business Consultant (CHBC)

- ACHC Certified Consultants

- Chartered Financial Analyst (CFA®)

- Chartered Financial Consultant (ChFC)

- Chartered Market Technician (CMT)

- Degree in Management and Healthcare Related Courses

Please note that you cannot successfully run a healthcare consulting services firm in the United States and in most countries of the world without necessarily acquiring professional certifications and business license even if you have adequate experience cum background in the healthcare consulting services industry.

12. Get the Necessary Legal Documents You Need to Operate

The essence of having the necessary documentation in place before launching a business in the United States of America cannot be overemphasized especially a business such as healthcare consulting services firm. It is a fact that you cannot successfully run any business in the United States without the proper documentations. If you do, it won’t be too long before the law catches up with you.

These are some of the basic legal documents that you are expected to have in place if you want to legally run your own healthcare consulting services firm in the United States of America;

- Certificate of Incorporation

- Federal Tax Payer’s ID

- State Permit

- Business License and Certification

- Business Plan

- Non – disclosure Agreement

- Employment Agreement (offer letters)

- Operating Agreement for LLCs

- Insurance Policy

- Consulting contract documents

- Online Terms of Use

- Online Privacy Policy Document

- Apostille (for those who intend operating beyond the United States of America)

- Company Bylaws

- Memorandum of Understanding (MoU)

13. Raise the Needed Startup Capital

Aside from the required certifications and hands-on experience, starting a healthcare consulting services firm can be cost effective. Securing a standard office in a good business district, equipping the office and paying your employees are part of what will consume a large chunk of your start – up capital.

When it comes to financing a business, one of the first things that you should consider is to write a good business plan . If you have a good and workable business plan document in place, you may not have to labor yourself before convincing your bank, investors and your friends to invest in your business or to partner with you.

Here are some of the options you can explore when sourcing for start – up capital for your healthcare consulting services firm;

- Raising money from personal savings and sale of personal stocks and properties

- Raising money from investors and business partners

- Sell of shares to interested investors

- Applying for loan from your bank/banks

- Pitching your business idea and applying for business grants and seed funding from donor organizations and angel investors

- Source for soft loans from your family members and your friends

14. Choose a Suitable Location for your Business