- Overview Architecture Enterprise Models Business Area Models Data Warehouse Models

- Industry Models Communications & Media CDMA Wireless GSM / 3G / 4G / 5G Wireless Internet & Data Services Landline Communications Radio Broadcasting Television Broadcasting Financial Services Brokerage Card Services Commercial Banking Corporate & Investment Banking Credit Unions Mortgage Services Mutual Funds & Fund Management Payment Services Retail Banking Govt & Information Services Credit Reporting Services Government Services IT Services National Postal Services Smart Cities High Tech Products Computers High Tech Components Medical Systems Mobile Wireless Devices Networking Equipment Semiconductors Software Manufacturing Apparel & Footwear Automotive Products Aviation Products Consumer Packaged Goods (CPG) Beauty Products Cleaning Products Food & Beverage Products Home Healthcare Products Durable Medical Equipment Heavy Vehicle Manufacturing Luxury Goods Pharmaceuticals Tire Manufacturing Insurance & Healthcare Healthcare Insurance Healthcare Providers Life Insurance & Annuities Property & Casualty Insurance Petroleum, Chemicals & Mining Agricultural Chemicals Coal Mining Copper Mining Industrial Chemicals Iron Ore Mining Oil Sands Mining Oil & Gas - Upstream Natural Gas Processing & Fractionation Oil & Gas - Midstream Petroleum Refining Oil & Gas - Downstream Polypropylene Production Methanol Production Retailing & Distribution Apparel & Footwear Beauty Products Building Materials Grocery Jewelry Optical Products Pharmacy Transportation, Travel & Leisure Airlines Car Rental Services Freight & Logistics Gaming & Betting Hotel Services Lotteries Parcel & Mail Delivery Quick Service Restaurants Restaurant Services Travel Services Utilities Gas & Electric Utilities Water Utilities

- Solution Models Energy & Utilities Desalination - Multi-Effect Distillation (MED) ** --> Desalination - Multi-Stage Flash Distillation (MSF) Desalination - Reverse Osmosis (RO) Electricity Generation - Biomass Electricity Generation - Coal Electricity Generation - Gas & Oil Electricity Generation - Hydro Electricity Generation - Nuclear Electricity Generation - Solar Electricity Generation - Wind Energy & Commodity Trading Financial Services Basel III STP / Securities Back Office Healthcare & Life Sciences ePedigree Genomics R&D and Clinical Trials

- Business Area Models Accounting & Financial Reporting Bookings / Billings / Backlog Budget Business Metrics Channel Contract Customer Service Geography Human Resources Individual Customer Individual Customer Credit & Collections Inventory Legal Entity Customer Legal Entity Customer Credit & Collections Manufacturing / Shop Floor Control Marketing & Advertising Order Party Products & Services Property & Equipment Purchasing Training & Education

- Downloads Data Model Datasheet Data Model Product Brochure --> ADRM Named to Banking CIO Outlook Top 10 The Best-Practice Vertical-Industry Enterprise Model

- About Company Partners Events News --> FAQs Contact

Industry Data Model

Upstream oil & gas.

The upstream segment of oil and gas industry encompasses exploration and production (E&P) activities related to exploring for, recovery and production of crude oil, natural gas, and natural gas liquids (NGLs).

ADRM Software's Upstream Oil & Gas data model set consists of Enterprise , Business Area , and Data Warehouse logical data models that address the information requirements of upstream oil and gas companies engaged in any or all of the three primary upstream functions:

- Exploration

The primary emphasis of exploration relates to wells: determining appropriate locations, depths and drilling and management techniques. Exploration also involves the operator obtaining leases and permission to drill from the owners of onshore or offshore property and/or drilling rights in areas considered prospective to contain oil and/or gas

Drilling involves the creation of a borehole in the ground to become an oil or gas well. Wells can be simple or extremely complex requiring considerable planning, resources and risk as with 'deviated wells' that emanate from original or 'mother' wells. Drilling work is typically done by contractors and services companies with as many as 30-40 different service contractors providing expertise and services.

Production is bringing oil and gas to the surface via one or more techniques that might include:

- Horizontal drilling

- Hydraulic fracturing

Oil and gas which is produced and brought to the surface is either temporarily stored locally or immediately offloaded into midstream infrastructure or transportation options such as trucks or railcars. Upstream oil and gas activities entail high risk and are information and capital intensive. Upstream oil and gas activities are also highly regulated in terms of pricing, taxation, drilling rights and reserve calculations. The primary participants are the major oil companies, national oil companies (NOC's), Independents, and oilfield services companies.

Many upstream oil and gas organizations are also involved in trading activities, often for the purpose of hedging their anticipated future production, and may therefore be interested to learn more about ADRM's Energy & Commodity Trading Solution Model .

- Vision & Strategy

- Board of Directors

- Board Nominations Committee

- PPDM Association ByLaws

- Conflict of Interest Policy

- CPDA Exam Accommodations and Provisions

- PPDM Access Policy

- PPDM Anti-Corruption and Bribery Policy

- PPDM Association Sanction Policy

- PPDM Competition Policy (Anti-Trust)

- PPDM Membership Agreement and IP Policy

- PPDM Privacy Policy

- PPDM Services and Website Terms and Conditions

- PPDM Voting Policy

- The PPDM Way

- PPDM Overview Videos

- Regional Leadership Teams

- Editorial Committee

- Council of Chairs

Banff Protocol

Data objects.

- Hydraulic Fracturing

- Reference Values List Committee

- Rules Committee

What is Seismic?

- Compliance with Teeth

What is a Facility

- What is a Well Milestone

- Competency-Based Learning

- Professional Development Committee

- Education Advisory Committee

- Certification Committee

- Upcoming Events

- Sponsorship & Exhibiting

- Advertising

- Abstract Submissions

- Past Events

- Industry Events Guidelines

- Data Model Compliance

- PPDM 3.9 Data Model

- PPDM 3.8 Data Model

- PPDM Lite 1.1 Data Model

- Sample Data Sets

- Architecture Terminology Glossary

- Reference Values List

- Taxonomy Dimensions Info

- US Well Number Standard

- Canadian Well Identification System Standard

- Global Framework for Well Identification

Well Status & Classification

- What is a Completion?

- What is a Well Application

- WITSML Mapping

- Who Should Certify

- How to Apply

- How to Prepare

- Credential Registry

- Credential Maintenance

- Sample Questions

- CPDA Resources

- CPDA Spotlight

- Ethical Integrity Policy

- Private Training Request

- Job Descriptions

- Job Families Grid

- Competency Framework

- Job Competency Mapping Tool

- Job Market Survey

- Job Market Survey Report

- Training Catalogue

- Certification Committee Information

- Professional Development Committee Information

- Volunteer Now

- Annual Reports

- Technical Publications

- Editorial Guidelines

- Foundations Index

- Useful Resources

- PPDM Future

- Well Numbering

- Data Management What is it?

- Data Management as a Career

- Data Examiner

- Marketplace Spot Reservation

- How to Become a Volunteer

- Volunteer Opportunities

- Volunteer Resources

- Volunteer Recognition

- Tracking your Volunteer Hours

- Award Winners

- Testimonials

IEDS (International Energy Data Standards)

The ppdm association defines and creates standards to help oil and gas companies manage exploration and production data..

The members of the PPDM Association provide critical input and help to set the strategic direction for the organization. Under member direction, the PPDM Association has come to represent much more than the world’s leading petroleum data model. Our organization has also been instrumental in developing and introducing oil and gas data management standards that are built around business rules and best practices.

PPDM - WITSML Mapping

Reference values, taxonomy dimensions, well identification, what is a completion, what is a well, ppdm data model compliance.

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- More options

- StumbleUpon

- Choosing the data use cases that are important to the business

- Unlocking the key data assets that power those use cases

- Governing the data and updating the architecture that makes the data assets accessible

A Ninety-Day Plan to Build a Data and Digital Strategy

Digital Acceleration Is Just a Dream Without a New Approach to Tech

Is Your Company Gaining Momentum in Data?

Data and Digital Platform

/ article, harnessing the power of data in oil and gas.

By Håvard Holmås , Marie-Hélène Ben Samoun , Sylvain Santamarta , Lucas Quarta , and Johan Stockmann

Key Takeaways

As the world strives for a sustainable future, no industry is more in the crosshairs than oil and gas. Every new project is scrutinized and more difficult to get underway than the next, so it’s critical that O&G companies maximize value from existing operations. One clear opportunity to manage this feat is to do more with the mountains of data that O&G companies have at their disposal by applying emerging analytics and AI capabilities to unlock new sources of value and cost savings.

Harnessing data to improve efficiencies and unlock value requires transformative change and close coordination between the business side and IT—two groups that do not always work together well. Focusing on data and digital innovation as well as on cross-functional collaboration could also help attract young, tech-savvy talent looking for an innovative and inspiring work environment.

Finding the Value

To align the business and IT, we recommend that both sides jointly define a North Star for their data and digital architecture. Key to this exercise is the creation of a data trinity : the data use cases that are important to the business, the data assets that enable those use cases, and the architecture that makes the data assets accessible. Proper prioritization of high-value use cases and data projects shapes the architecture modernization initiatives necessary to implement them.

This is a complex exercise, but turning to data and AI to unlock value is critical and real examples from the O&G industry do exist. Moreover, BCG analysis shows that investors recognize data as a rich vein of potential profits and cost savings. For example, HSBC has stated that “the opportunity for the digital oilfield to have a major impact across most parts of the value chain is significant.” Barclays estimates that digital could lower the cost of production by more than $3 per barrel, amounting to about $150 billion in value. And the World Economic Forum estimates that “operations optimization” could unlock as much as $275 billion in value, with 90% of it coming from optimizing drilling and production and from leveraging the data from end-to-end connected assets to feed advanced analytics algorithms.

Subscribe to our Digital, Technology, and Data E-Alert.

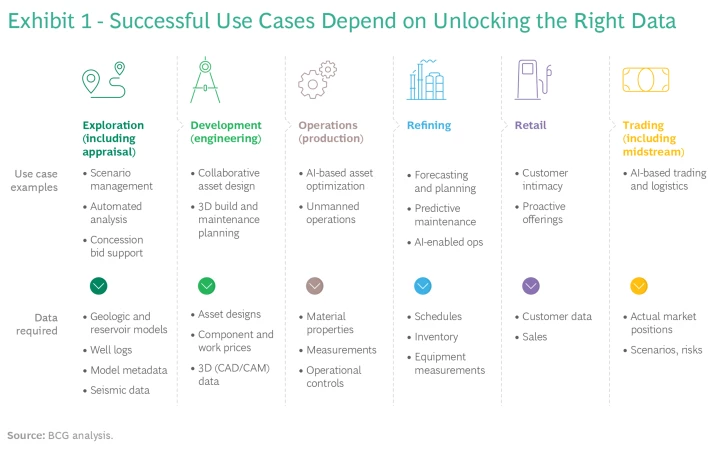

Choosing data use cases.

The first step is selecting the data use cases that are most important to the business. High-value use cases cover a range of value pools and methods that address many of the challenges that O&G companies face today, such as the following:

- Applying AI based on existing data (such as in exploration, reservoir modeling, or drilling activities) to improve exploration success rates, maintain asset yields, or reduce cost

- Improving workforce effectiveness and reducing risks with, for example, remote and unmanned operations and monitoring or better resource planning and scheduling

- Reducing carbon footprints (such as by optimizing refining or transportation)

- Leveraging industry networks by, for example, collaborating online for engineering, procurement, or construction

- Streamlining labor-intensive processes, whether in administration (such as by using e-procurement) or smart automation of order processing

What these use cases all have in common is that they depend on data from a variety of processes—many of them AI enabled. Mastering that data gives O&G companies a “right to win” in today’s marketplace. Recently, we worked on cases that illustrate this well:

- A Middle Eastern company combining geological and engineering data into an optimized, automated drilling sequence that avoids collisions with existing wellbores

- A major European O&G company using an AI engine to optimize the production schedule based on a broad variety of data, maximizing returns from the company’s production assets

- A major integrated oil company leveraging smart maintenance with a combination of equipment, operations, and maintenance data, drastically reducing maintenance budgets and downtime

Successful implementation of data-driven use cases requires reimagining the end-to-end value chain with data and digital technologies. Creating a joint business and IT view of the value chain shows where key business capabilities reside and helps clarify which use cases are enabled by those capabilities. Developing strong, reusable, and shared capabilities helps launch successful use cases.

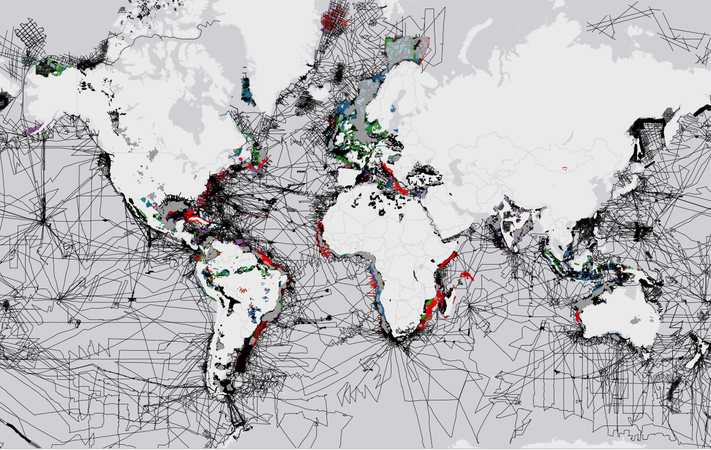

Unlocking Key Data Assets

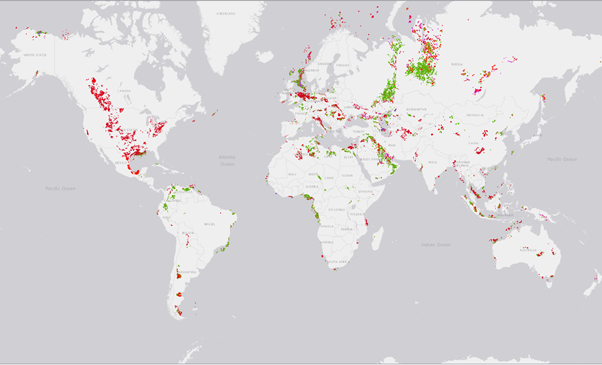

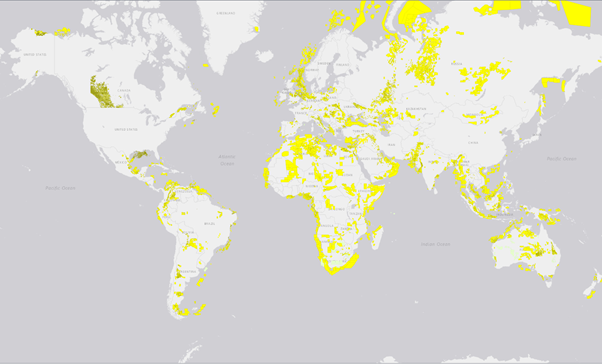

Based on this initial assessment, companies must identify the specific data assets needed to fuel their use cases. (See Exhibit 1.) Success ultimately depends on unlocking existing data assets along the O&G value chain and then applying analytics and AI within a consistent, robust, and scalable architecture.

Then—and this is critical—companies need to plan the rollout of use cases so that, to the extent possible, the first wave leverages and improves data assets in a way that will benefit subsequent use cases, accelerating their deployment and business impact over time.

To unlock their data assets, companies must manage eight data challenges that are largely specific to the industry:

- Variety of Data . O&G data ranges from the very technical (such as drilling, log, seismic, lab, and sensor data) to complex models (reservoir models and wellbore shapes, for example) to 3D engineering designs to logistics (regarding people and equipment as well as hydrocarbons). All of this on top of the business’s “normal” transactional or master data.

- Proprietary or Inaccessible Formats. Data comes in proprietary sensor- or system-defined formats (such as 3D geological and reservoir models) that require conversion and might not be accessible through direct means. Similarly, engineering design data tends to be quite specific to the software that generated it.

- Dataset Sizes and Volumes . Datasets tend to be huge—up to petabytes for a single seismic survey. This stretches the capabilities of even cloud service providers.

- Scarcity and Interpretation. Technical data is often limited, incomplete, and even inconsistent, making it subject to interpretation. There is not always a “single source of truth.”

- Stakeholder Requirements . Governments, regulators, subcontractors, and joint venture partners all provide and use data. Often they have specific contractual commitments (such as export constraints and confidentiality guidelines) regarding what they can share and how. These requirements must be properly managed.

- Ambiguous Definitions. Internal and external organizations apply different data definitions and standards, impeding reuse and sharing of datasets. Uniform definitions are the goal, but reliable metadata to facilitate interpretation is the second-best option.

- Organizational Complexity . Typical O&G companies have decentralized structures with local joint ventures. The latter often have IT priorities that compete with central IT directives. If not resolved, these competing priorities could compromise data ownership and the ability to use data.

- Location and Geography . Data is often generated and used in locations with little bandwidth, preventing O&G companies from using cloud technology effectively and requiring smart replication methods.

Governing the Data and Updating the Architecture

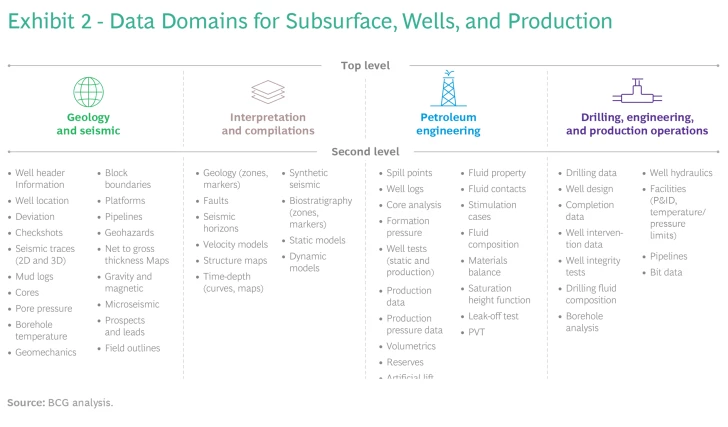

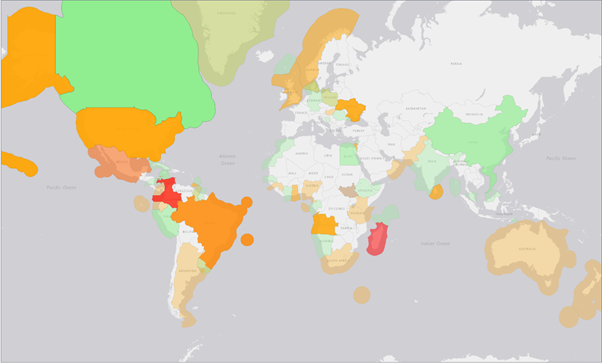

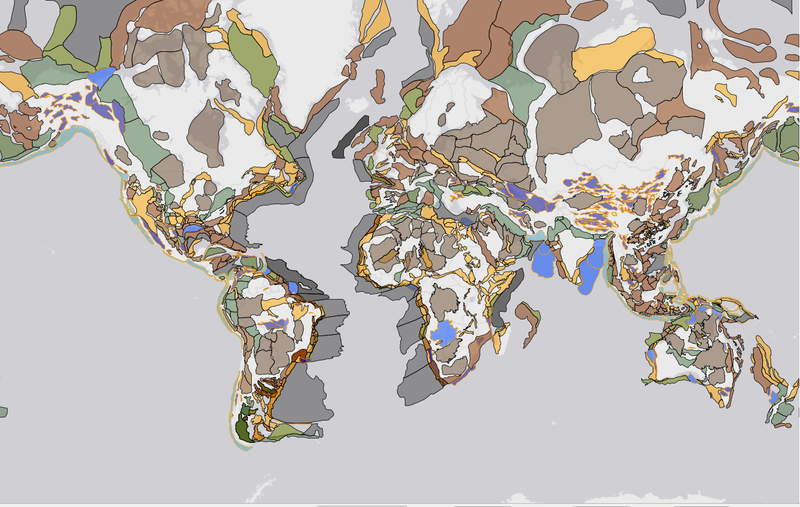

These challenges require a mature approach to data governance covering the life cycle of different data types and addressing the constraints and complexities intrinsic to each one. Governance should be based on a system-agnostic view built on a single, company-wide categorization of all data into “data domains.” The level of detail may be different for different companies, reflecting variations in organizational levels and functional ownership. Data domains are the basis for any initiative regarding data definition, data quality, data access, or data-specific business rules, including concerns such as data privacy and confidentiality. Exhibit 2 shows an illustrative subset of a data domain map.

Next, O&G companies must move from a monolithic to a modular technology stack in order to free up their data and take advantage of new technologies. A data and digital platform lowers costs and improves speed and agility by decoupling front-end capabilities from data, liberating data from core transactional systems, and enabling smart-business engines with machine-learning and AI capabilities.

With this goal of a decoupled architecture in mind, O&G companies need to build a reference architecture to access and use the data assets. As with the data use cases, companies must prioritize and sequence their architecture modernization initiatives so that the first wave of improvements provides a foundation for the upgrades necessary to enable future use cases. Ultimately, O&G leaders must build a data platform that can scale horizontally to leverage the data sources in a consistent way across a variety of cases and potentially complex local IT landscapes. Horizontal scaling combined with a multicloud approach is necessary in order to cope with the huge amount of data and to allow geographically dispersed teams to collaborate effectively.

Successful Implementation

The final challenge is to get the execution right. Digital is, to a large degree, a change management effort. As a rule of thumb, typically 10% of success depends on architecture, 20% on data, and 70% on change management. There must be an integrated, multidisciplinary effort across digital app development, data governance, and architecture and operating model changes. To realize value at scale, digital needs to enable fundamental changes in how people work and how decisions are made in new end-to-end workflows. Starting with a few powerful lighthouse use cases—with well-defined value potential and a high degree of management support—is a tested way to move forward and ensure organizational learning and buildup of momentum. This, in the end, is what ensures that value is actually delivered.

O&G companies are currently reaping large profits from their operations, but it’s important that they innovate to stay relevant and competitive in a rapidly changing economic environment. They will need to become much more data driven, leveraging data and AI to drive high-value use cases. But successfully leveraging data is a complex effort that cannot be done by IT alone. It is a major change to how companies work. Setting up the basic data governance, defining a new data and digital architecture, and driving the first use case pilots require significant time, effort, and commitment.

Partner and Associate Director

Managing Director & Partner

Managing Director & Senior Partner

Partner and Associate Director, Data and Digital Platform

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2024. All rights reserved.

For information or permission to reprint, please contact BCG at [email protected] . To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com . Follow Boston Consulting Group on Facebook and X (formerly Twitter) .

What Is Next

Read more insights from BCG’s teams of experts.

Use next-generation IT architectures to build digital-ready tech functions.

To swiftly achieve the goals of a transformation, the business and IT sides must jointly match the business strategy to the company’s data assets and architecture.

To accelerate a digital and IT transformation and build value faster, focus on business outcomes and decouple the digital transformation from core system replacement.

Data is increasingly valuable, yet some organizations lack the capabilities to capitalize on it. A key first step is setting realistic ambitions to improve data maturity.

Petroleum Data Analytics - Engineering Application of Artificial Intelligence & Machine Learning

Disciplines: Completions | Production and Operations | Reservoir

Course Description

Artificial Intelligence and Machine Learning is revolutionizing many industries. This technology is becoming an important point of competitive differentiation in the upstream oil and gas industry. Since optimization of production and enhanced recovery is the important issue for the petroleum industry, companies are realizing that reality and actual field measurements play much more important role in success of decision making than traditional assumptions, interpretations, and preconceived notions.

“Data” representing the actual field measurements, can provide much needed insight. Petroleum Data Analytics provides a set of tools and techniques for both conventional and unconventional resources to extract patterns and trends from data and construct predictive models to assist decision making and optimization. The most important part of Engineering Application of Artificial Intelligence and Machine Learning in the Petroleum Industry is the realistic and scientific understanding of this technology, its differences with traditional statistics and its non-engineering applications. This short course covers all such details to generate the interest in becoming Petroleum Data Analytics Engineers.

- Artificial Neural Networks (Deep Learning)

- Fuzzy Set Theory

- Evolutionary Computation

- Engineering & Non-Engineering Problem Solving using AI&ML

- Traditional Statistics versus AI&ML

- Data-Driven Reservoir Modeling - Top-Down Modeling (TDM)

- Actual Case Studies

- Multiple Case Studies

Learning Level

Intermediate to Advanced

Course Length

Petroleum Data Analytics is fairly new. A handful of domain experts have dedicated extensive amounts of time and effort to develop and present the next generation of tools that incorporate these technologies in the petroleum industry. Unfortunately, hypes, buzz words, and marketing ploys around data analytics have overwhelmed the petroleum industry in the past few years, specifically in the United States and most recently throughout the world. Many with little to no understanding and knowledge of the physics and the geology and other with very superficial understanding of AI and Machine Learning have been marketing these hypes.

This course will demonstrate the power of Artificial Intelligence and Machine Learning and the difference this technology can make for informed decision making when it comes to accomplishing important short-term, mid-term and long-term objectives. This course will also show how to distinguish between realistic application of AI and Machine Learning versus marketing ploys.

Who Attends

This course is designed for geo-scientists, engineers, and managers. Specifically, those involved with geology, drilling, reservoir, completion, and production in operating and service companies. In general, those involved in planning, completion, and operation in assets are the main target audience.

0.8 CEUs (Continuing Education Units) are awarded for this 1-day course.

Cancellation Policy

All cancellations must be received no later than 14 days prior to the course start date. Cancellations made after the 14-day window will not be refunded. Refunds will not be given due to no show situations.

Training sessions attached to SPE conferences and workshops follow the cancellation policies stated on the event information page. Please check that page for specific cancellation information.

SPE reserves the right to cancel or re-schedule courses at will. Notification of changes will be made as quickly as possible; please keep this in mind when arranging travel, as SPE is not responsible for any fees charged for cancelling or changing travel arrangements.

We reserve the right to substitute course instructors as necessary.

Dr. Shahab D. Mohaghegh , a pioneer in the application of Artificial Intelligence and Machine Learning in the Exploration and Production industry, is Professor of Petroleum and Natural Gas Engineering at West Virginia University and the president and CEO of Intelligent Solutions, Inc. (ISI). He is the director of WVU-LEADS (Laboratory for Engineering Application of Data Science).

Including more than 30 years of research and development in the petroleum engineering application of Artificial Intelligence and Machine Learning, he has authored three books (Shale Analytics – Data Driven Reservoir Modeling – Application of Data-Driven Analytics for the Geological Storage of CO2), more than 200 technical papers and carried out more than 60 projects for independents, NOCs and IOCs. He is a SPE Distinguished Lecturer (2007 and 2020) and has been featured four times as the Distinguished Author in SPE’s Journal of Petroleum Technology (JPT 2000 and 2005). He is the founder of SPE’s Technical Section dedicated to AI and machine learning (Petroleum Data-Driven Analytics, 2011).

He has been honored by the U.S. Secretary of Energy for his AI-based technical contribution in the aftermath of the Deepwater Horizon (Macondo) incident in the Gulf of Mexico (2011) and was a member of U.S. Secretary of Energy’s Technical Advisory Committee on Unconventional Resources in two administrations (2008-2014). He represented the United States in the International Standard Organization (ISO) on Carbon Capture and Storage technical committee (2014-2016).

Other courses by this instructor

Numerical Reservoir Simulation is a “Bottom-Up” Reservoir Modeling, while AI-based Reservoir Simulation is a “Top-Down” Reservoir Modeling. AI-based Reservoir Simulation is NOT a “Hybrid Model” through incorporation of the realistic, engineering applic...

Disciplines: Data Science and Engineering Analytics | Reservoir

Engineering application of Artificial Intelligence & Machine Learning will significantly address Climate Change in the next several decades. The main reason of positive and important contribution of Artificial Intelligence to Climate Change has muc...

Disciplines: Data Science and Engineering Analytics | Production and Operations | Reservoir

Data-Driven Reservoir Modeling (Reservoir Analytics) is defined as the application of Artificial Intelligence and Machine Learning in fluid flow through porous media. Data-Driven Reservoir Modeling (Reservoir Analytics) is the manifestation of the digi...

Disciplines: Completions | Data Science and Engineering Analytics | Drilling | Production and Operations | Reservoir

It is very important to learn what are the main characteristics and requirements in applying Artificial Intelligence and Machine Learning to solve Engineering related problems. To learn and apply Science and Engineering, Homo Sapiens must take a seriou...

Disciplines: Data Science and Engineering Analytics

Combining petroleum engineering domain expertise with computer programming using "Python" as the most popular coding language for data science, artificial intelligence and machine learning, this course enables petroleum engineering professionals to bui...

Disciplines: Completions | Data Science and Engineering Analytics | Drilling | Health, Safety, Environment, and Sustainability | Production and Operations | Projects, Facilities, and Construction | Reservoir

Data-driven analytics is becoming an important point of competitive differentiation in the upstream oil and gas industry. When it comes to production from shale, companies are realizing that they possess a vast source of important facts and information...

Smart Proxy Modeling is the application of Artificial Intelligence and Machine Learning in Numerical Simulation. Smart Proxy Modeling has already been successfully applied to Numerical Reservoir Simulation and Computational Fluid Dynamic. Details of Sm...

Petroleum Data Analytics is the application of Artificial Intelligence and Machine Learning in the oil and gas industry. Future of our industry will be highly influenced by Petroleum Data Analytics. Engineering-domain experts who become highly skilled ...

Real-time data streaming supports drilling automation, moving decision roles to centralized facilities for increased safety, lower costs and more eyes on the data.

Preserve data integrity during collection to ensure that business-critical data analysis and processing always uses trustworthy data.

The upstream industry is rapidly transitioning to digital; industry-sourced data standards play a critical role in the success of this endeavor.

WITSML™ drilling and wellsite data standard, includes all the downhole data, MWD / LWD, mud logging, perforation, fracing and other stimulation data for a comprehensive oversight of drilling operations in real time.

PRODML™ production, fluid analysis and field monitoring data standard, covers all the data needed to report production volumes, describe production facilities, PVT, WFT, DAS and DTS data.

RESQML™ reservoir and structural interpretation data standard, allows for the comprehensive transfer between applications of a reservoir model, geocellular model, properties and structural information. It can transfer the whole data, or incremental modifications.

Modern E&P requires operators to work with a wide variety of partners and providers; our data exchange standards support collaboration, multi-vendor remote operations and automation. The open environment accelerates the integration of innovative technologies.

Service providers are being asked to work together on customer-focused solutions. Standards facilitate the reliable flow of data across many systems, minimizing headaches and accelerating deployment.

Developing innovative digital products and software systems is made easier and more cost-effective using standard data interfaces to connect to integration platforms or other data ports.

Data standards greatly simplify the collection and archiving of the technical data that is mandated by government bodies. The data is needed to support the exploration, development and production of a country’s hydrocarbon assets.

© Copyright 2022 | Energistics Consortium | All Rights Reserved

- Case Studies

- Product News

- Compliance Corner

Data Modeling in the Oil & Gas Industry

The Oil and Gas Industry faces a number of new challenges in the coming years. From the obvious challenge of managing a finite resource to ever-changing environmental regulations and the consequent competitive pressures, it’s easy to understand why industry leaders are continually striving to find ways to optimize and improve operational efficiency.

The new digital landscape of the industry has led to a proliferation of data, with greater frequency, at every stage of the business lifecycle. This abundance of data has led to new ideas about how this data can best be managed to maximize its value. The standards introduced by PPDM 3.8 include 53 subject areas intended to give executives a model for a Master Data Management solution.

A data management model is necessary largely because of the separate data sets that must be monitored – such as location data, well data and production data – which have traditionally been grouped and viewed separately. Now, research is showing that the proliferation of these information “silos” and the lack of a unified view can lead to a number of undesirable consequences, including:

- Project delays

- Escalating costs

- Lack of regulatory compliance

- Inability to utilize full production capacity (missed revenue opportunities)

If an integrated data management system can increase efficiency and productivity, improve safety, ensure regulatory compliance, and reduce costs, it becomes obvious that data integration is well worth the investment.

Data Modeling Tools

The OPC Foundation first introduced the Unified Architecture specification in 2006, taking a major step toward a cross-platform service-oriented architecture for process control. The OPC UA information model provides a logical framework for an integrated data management system. Additionally, other software tools have been engineered to facilitate the transition toward a more integrated model.

Recently, SCADA (Supervisory Control and Data Acquisition) and HMI (Human Machine Interface) software has made progress toward allowing a fully integrated data visualization system that aligns with the needs and expectations of the modern oil and gas industry. Some of the ways that SCADA has embraced the notion of integration include:

- OPC UA Compatibility Many HMI/SCADA developers have embraced OPC Unified Architecture, giving their software the ability to communicate with hundreds of different devices. The enhanced security and multi-platform support of the latest OPC specification helps facilitate an integrated information management system.

- Data Modeling Although data modeling in an HMI/SCADA system is still quite rare, some innovative developers have developed software with integration in mind. Finding a powerful HMI/SCADA system that incorporates the concept of data modeling is an essential step toward creating a fully integrated data management system.

- Mobile Device Support Not quite as rare as data modeling, but still not fully embraced, several software developers or ISVs have added mobile device support to their product offerings. As the oil and gas industries begin transitioning toward a unified system of data visualization, the benefits of mobility become more apparent.

Using the right SCADA system can significantly reduce unplanned downtime or unexpected delays, while simultaneously improving efficiency and safety.

B-Scada’s Status Enterprise HMI/SCADA software provides a perfect example of how a modern SCADA system can truly embrace the modern, data-driven industrial landscape. Learn more at http://scada.com .

- Reference Manager

- Simple TEXT file

People also looked at

Original research article, data governance facilitate digital transformation of oil and gas industry.

- 1 School of Economics and Management, China University of Petroleum, Qingdao, China

- 2 Research Institute of Petroleum Exploration and Development, Beijing, China

Data gradually becomes a critical concern for the strategic resources in enterprises. Massive amounts of data with different types involved in the oil and gas industry can be obtained through IoT (Internet of Things) devices, supported by Blockchain technology with characteristics of immutability and credibility in distributed storage. Hence, credible data will be rationally used in Big Data analysis and Artificial Intelligence implementation. The global mutual trust protocol of Blockchain technology is the bridge among IoT devices, Big Data analysis and Artificial Intelligence implementation, and enables effective coordination of participation of multiple parties and ultimately break isolated island of information. Data governance is the prerequisite for data sharing. As a basic project, Data Sharing breaks data islands and business barriers, improving Data Governance capabilities in Digital Transformation and promoting high-quality development of the oil and gas industry) From the perspective of Digital Transformation, this paper reviews the current situation and problems of Data Governance by evaluating the Data Governance ability of oil and gas enterprises. Furthermore, a proposal is put forward to apply Blockchain technology to improve the Data Governance system and capabilities as the overall program of the oil and gas industry Data Governance system.

Recently the digital economy has embarked on a major era of transformation. The in-depth integration of industrial technology and information technology innovates production organization and operation methods, triggering industrial resolution and traditional industrial upgrading with new industries, new formats and new models continuing to emerge. As a traditional industry, the oil and gas industry faces a new situation of the energy revolution to be accelerated. Digital technologies, such as Cloud Computing, Internet of Things (IoT), 5G, Big Data, Artificial Intelligence and Blockchain, should be adopted effectively to drive business model restructuring, management model reform, business model innovation and core competence enhancement to achieve industrial transformation and upgrading with value growth. At the same time, only when oil and gas companies systematically and thoroughly redefine their business, including all aspects of the organization, process, business model and employee capabilities, can Digital Transformation succeed.

In 2013, Tallon considered data to be a special asset ( Tallon, 2013 ). With the advent of the Big Data era, “data as an asset” has become the core trend of the industry. The definition of data assets in the “Data Asset Management Practice White Paper 4.0”: What is owned or controlled by an enterprise includes not only the internal data of the enterprise, but also the external data obtained by the enterprise through purchase, which can bring future economic benefits to the enterprise, or data resources recorded electronically. The core of Digital Transformation is data sharing, and data sharing requires Data Governance as the foundation. Therefore, Data Governance has become an important basic project related to Digital Transformation and high-quality development.

Urgent Requirements for Data Governance in Digital Transformation of Oil and Gas Industry

The core of digital transformation is to achieve full data sharing.

With the rapid development of Informatization, Big Data, and Intelligence, people usually compare cash flow to the blood of an enterprise. Data is an information record that identifies various resources and activities of an enterprise, with each datum as a neuron of an enterprise. Data has become a significant strategic resource that enterprises and society pay attention to as an important carrier of production, operation and management activities with highlights from all people. If data cannot be fully shared and used efficiently, other sharing will be impossible, and Digital Transformation will not be realized. For the oil and gas industry, data sharing has huge space, great potential and great value, including the business data such as internal enterprise planning, procurement, production, sales, and finance, and the oil and gas value chain data such as production, refining, transportation, sales, storage and marketing, as well as other data from all aspects of data on changes in external market supply and demand, price adjustments, and policy environment. Through full sharing of these data, the value of data assets is comprehensively improved, and business operations and decision-making methods are transformed from traditional manual statistical calculation and empirical analysis to accurate analysis based on systems, data and models, which effectively supports the optimal allocation of resources, efficient market operation forecasts, and Scientific connection of production, refining, transportation, sales, storage, and trade links to maximize the company’s overall benefits ( Liu, 2019 ; Dai, 2020 ).

Data sharing embodies three aspects of value in the oil industry. Firstly, it contributes to oil exploration and development management, realizing the most scientific decision-making and efficient productivity. Then, data sharing could analyze the trend and potential demand of oil resource consumers. Thus it encourages the industry to innovate pragmatically and develop potential markets steadily. For instance, data analysis and detection systems are set up in gas and petrol stations to record every customer demand in the country. It could formulate timely service and new product suggestions to retain high-quality customers and expand the market. Finally, data sharing could monitor the production and safety of oil fields through network detection. After all, intelligent detection is more efficient and safer than manual detection.

The Premise and Foundation of Data Sharing is Scientific and Effective Data Governance

As information technology continues to deepen application integration and innovation, various applications have gradually penetrated all walks of life. The authority, authenticity, validity, and compliance of data with business requirements are critical to cross-business data analysis. Data management with the unified criterium and quality will be the institutional guarantees for sharing applications among various businesses. Bhansali also elaborated on the value of Data Governance in the book, believing that the norms of Data Governance can help organizations manage data more effectively, reduce the cost of information use, improve the effectiveness of law compliance and control, and promote the generation of high-quality data ( Bhansali, 2013 ). Only through Data Governance can the high quality of data be improved. The main purpose of Data Governance is to improve the effectiveness of data sharing applications and work around how data is transformed into assets. Trope, etc. all believe that Data Governance should be integrated with various business departments ( Trope and Power, 2005 ), not just the IT department. At present, the business information systems of oil and gas companies have multiple data collections, repeated data entry, inconsistent data standards, and low data quality, which severely restrict the level of data sharing and application of oil and gas companies and hinder the company’s Digital Transformation ( Dai, 2020 ).

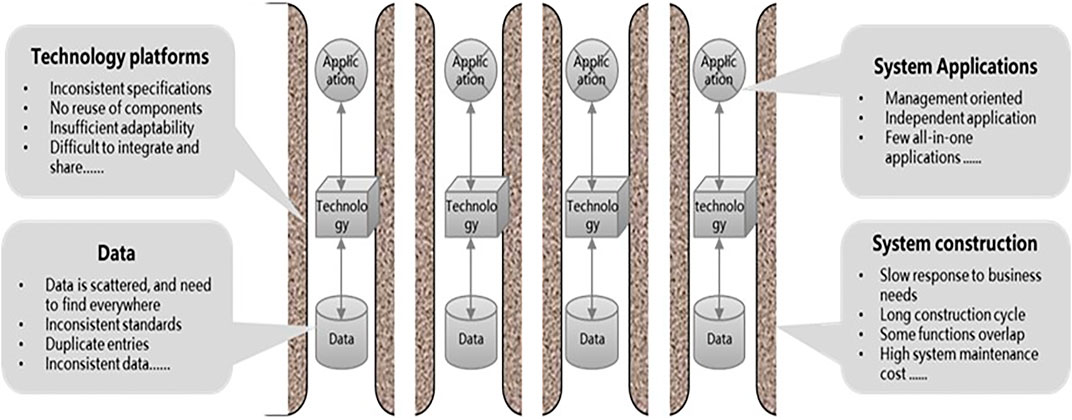

Technology platforms have inconsistent specifications, no reuse of components, insufficient adaptability, and are difficult to integrate and share.

Data is scattered and need to find everywhere, inconsistent standards, duplicate entries and inconsistent data.

System applications are management-oriented, independent applications and few all-in-one applications.

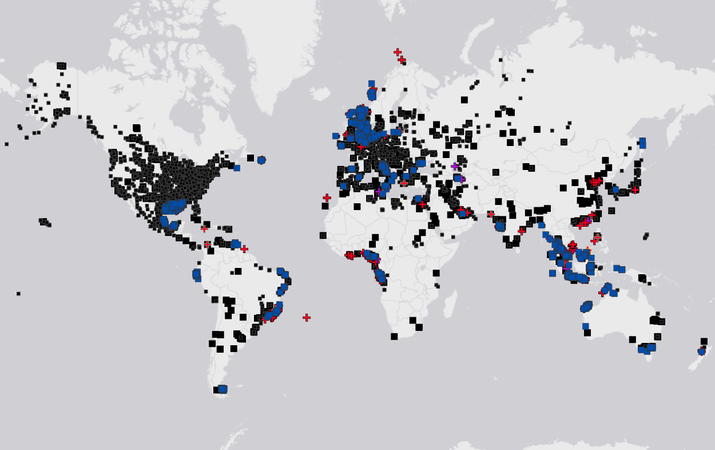

The following phenomena exist in system construction: slow response to business needs、long construction cycle、some functions overlap、high system maintenance costs. As shown in Figure 1 , the realization path of consistency, integrity, authenticity and validity of business data is the implementation of Data Governance.

FIGURE 1 . Current system status of data sharing.

Data governance helps to identify the current situation and problems of data management. Unify the enterprise business system’s data governance system, data structure, and data standards to form a company-level data resource directory. Guided by the concept of data co-construction, sharing and co-governance, Data Governance advocates data management of standard, quality, security and sharing. It guarantees the operation of organization, system and process. It is also crucial to organize relevant parties to carry out Data Governance activities together, promote all parties to build the company’s Data Governance system jointly, and improve Data Governance capabilities. Data governance activities should be divided into front-line information systems and data warehouses, embedded in the whole life cycle of the system, jointly manage and highlight data problems, improve the quality of data resources from the source. In this way, all parties involved could share high-quality Data Governance achievements and create a new enterprise Data Governance model of “co-construction, co-management and sharing”.

The Connotation of Data Governance in the Oil and Gas Industry and the Key Issues to be Addressed

The connotation of data governance in the oil and gas industry.

Informatic defines Data Governance as “the functional alignment and definition of processes, policies, standards, technologies and people across the organization to manage data as a corporate asset, enabling the availability of accurate, consistent, secure and timely data and controlled growth to make better business decisions, reduce risk and improve business processes”.

The essence of Data Governance in the oil and gas industry is to treat data as an asset of the company, and to develop a set of systems for the “collection, storage, management and application” of data across the organization, including both decision-making and executive levels, and both business and IT departments. Data governance is a long-term process that integrates business and IT throughout the business process.

All data sources are generated by its business front-end transaction process, and those who generate data and input data. In other words, all data depends on the business, and it is meaningless to discuss data governance and business separately. Therefore, the analysis of data sources and their business distribution is the foundation of Data Governance.

Key Issues in Data Governance at Oil and Gas Industry

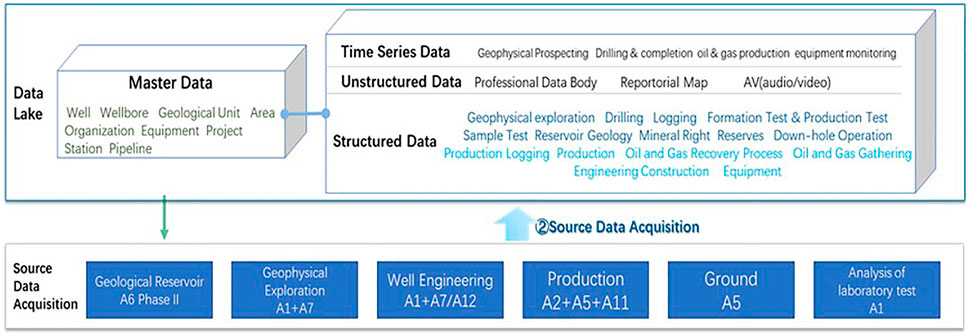

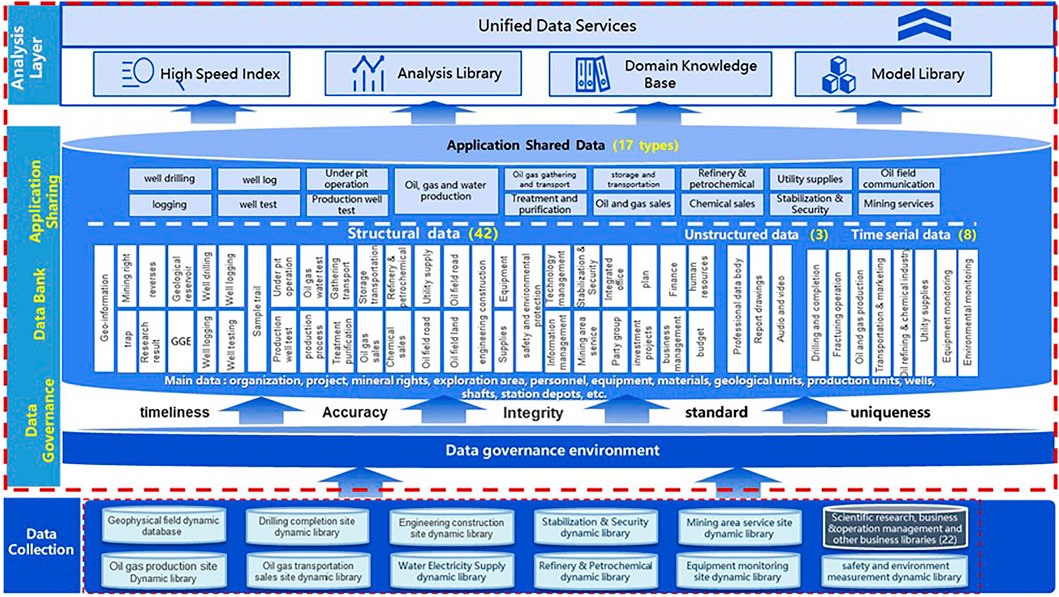

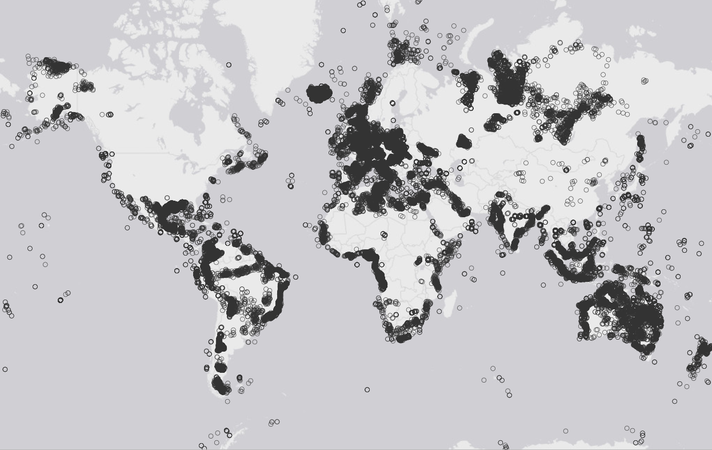

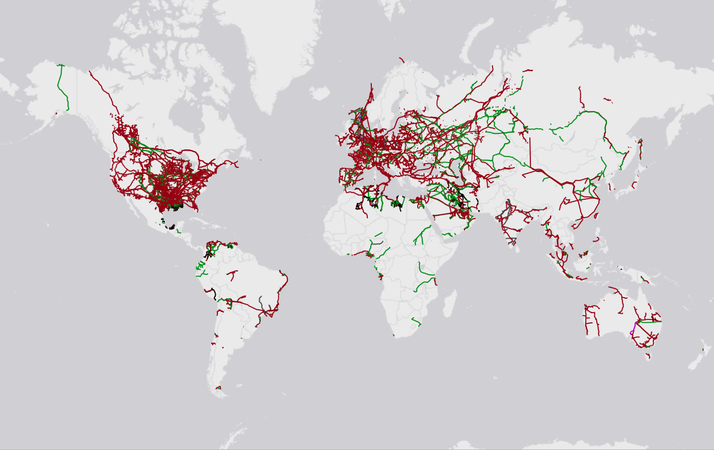

The dynamic and static data of oil and gas field enterprises are massive. Taking the unified upstream system as an example, the data management mode segmented from A1 to An has accumulated massive data resources, including exploration and production technology data management system, oil and gas water well production data management system, oil recovery and surface engineering operation management system, engineering technology production operation management system, exploration and production scheduling command system, oil and gas production IoT system, engineering technology IoT system, etc. It has built nine major types of data asset libraries, covering nearly 450,000 exploration and evaluation development wells, managing more than 1.08 million logging data body files, 600 oil and gas reservoirs, more than 7,000 work areas of seismic data, more than 3.67 million documents, etc., and storing more than 1.7 petabytes of data in total. As shown in Figure 2 , with such a huge amount of data and the continuous growth of data diversity, “data island” are growing, and data quality varies, greatly hindering the digital transformation process, and Data Governance is urgently needed to address the following issues.

FIGURE 2 . Source collection of exploration and development data.

The First question lies in the management mode of compartmentalization that caused a large number of “data island”. At present, oil and gas field enterprises contain several compartmentalized departments or systems, each of which has its own data, and the data of each department or system is often stored separately, forming its own system. The raw data of the same study may exist in multiple systems, multiple databases, and even in the computers of various researchers. It cannot ensure the authority of the raw data in each study, affecting the accuracy of the research results and failing to guide E&P research and production effectively. The core problem of such data is that there are many databases, platforms and isolated applications, leading to the serious problem of “data island”. Firstly the data standards are not uniform, and the data patterns do not match. There is no unified, timely updated and shared oil and gas well geological database and engineering foundation database, which is easy to cause data conflicts and data redundancy, and there is no consulting service company with compatibility and neutrality to classify and secondary development, which is later applied to data sharing, mining and analysis. Secondly, the specifications of the technical platform are inconsistent. The components are not reusable, have insufficient adaptability, and are difficult to integrate and share. Thirdly the number of system applications is large, and there are many management-oriented independent applications but few integrated applications. Fourthly, system construction is slow in response to business needs with a long construction cycle, duplication of some functions, and high system maintenance costs ( Li et al., 2019 ).

There are two main direct negative effects brought by data silos: First, investment waste. Geological data has multiple interpretations, and the results need to be verified according to the back-end works, with continuously revised and optimized geological model and parameters should be to gradually approach the real underground situation. If the back-end engineering construction results cannot be fed back to the geological department timely, the reservoir model will not be corrected in time. If some ideas that have been proved to be wrong by predecessors are tried again by others, low-level mistakes will be repeated continuously, which resulting in extreme waste.

The second is reduced efficiency. The multi-solution of geological knowledge also causes different disciplines and different teams to choose inconsistent parameter parameters when working on the same reservoir, which makes the research results lack uniformity and comparability. Different disciplines or teams often repeat simple and low-level data collection, data screening and understanding and digestion after taking over the same target work, which seriously affects work efficiency.

The second issue is data quality. It is necessary to verify the authenticity and integrity of the data, because of the inconsistency of data collection methods, statistical methods and control measures over the past 60 years. In particular, the current IoT in the old upstream oil fields is not fully covered, and the degree of automated data collection is not yet high, which affects the validity and accuracy of data. Moreover, data comes from various sources and involves multiple participating subjects in their life cycle. Issues such as whether data are authentically generated, data tampering, and inconsistent standards and types of data from multiple sources can affect data quality and, thus, the data decision outcomes of data users. Therefore, Data Governance needs to support the traceability of big data throughout its lifecycle.

Goals and Directions of Digital Transformation in the Oil and Gas Industry

As a traditional industry, the oil and gas industry faces an opportunity of accelerated energy revolution and energy transformation. It requires to make effective use of digital technologies (such as cloud computing, Internet of Things, 5G, big data, artificial intelligence) to promote business model reconstruction, management model reform, business model innovation and core competency enhancement, so as to achieve industrial transformation, upgrading and value growth. At the same time, digital transformation can only succeed if oil and gas companies systematically and thoroughly redefine their business, including all aspects of the organization, processes, business models and employee capabilities.

Overall Objectives

It is necessary to use automatic sensing to collect real-time operation data in the oil and gas industry chain, use comprehensive interconnection to widely obtain internal and external data, and use digital technology to optimize business execution and operational efficiency continuously. We will build a closed-loop system for the integration and interaction between the physical oil and gas enterprise and the digital twin, and promote the two-way connection between the physical business and the digital world, so as to form an internal and external connection, sharing and collaboration mechanisms, and finally realize cost reduction and efficiency increase, collaboration and sharing, continuous innovation, risk pre-control and intelligent decision-making, and continuously improve the productivity of all employees and the ability to create assets.

Main Directions

It is important to integrate digital technology into the products, services and processes of the oil and gas industry chain, thus promoting changes in the company’s development philosophy, working model, operation and management, scientific and technological research and development and management system mechanism to build new capabilities such as intelligent production, networked collaboration and personalized services and create new business models, new production methods and new industrial ecologies driven by users, data and innovation.

Internet of Things, Blockchain Technology in Data Governance

Data integrity, accuracy, consistency and timeliness guaranteed by iot technologies.

The oil and gas industry is characterized by high asset density, long operating distances and dangerous production environments. Establishing an industrial IoT can effectively streamline processes, enrich decision-making tools and improve operational efficiency. The IoT of the oil and gas industry usually consists of three layers: sensing, transmission, and application. The sensing layer consists of sensors and radio identification frequency devices (RIFD) installed in each key production link, which is used to collect data information in oil and gas exploration, development and production in real-time. The transmission layer is composed of networks such as the Internet and mobile communication networks, which are responsible for data transmission. And the application layer refers to the system management platform, which realizes the analysis and processing of oil and gas data. It establishes a comprehensive, interconnected information network among reservoirs, wellbores, individual wells, field stations, pipeline networks, equipment and personnel, realizes the comprehensive sensing capability of the oil and gas exploration, development and production management system, and provides a basic platform for intelligent production and decision management of oil and gas systems.

The IoT technology enables a unified automatic and standardized collection of data sources through data quality control tools. These tools guarantee data quality by building a high-quality data mode, allowing collected data to directly flow into the lake to realize the standardized docking of data lake and sensors. In this way, redundant data like repeated and multiple collections are avoidable. So that the data quality control tools could not only ensure the integrity, accuracy, consistency, and timeliness of data acquisition, enrichment, conversion, storage, and application.

IoT collects production data formed “four unification”. Unification of data entrance - is a uniform data acquisition interface that allows automatic production data collection and guarantees uniqueness and timeliness. Unification of the data model—provides developing and producing functions and facilitates data sharing. Unification of data quality control - equips by combining big data, artificial intelligence algorithm judgment and manual sampling to ensure accuracy, and improves efficiency while reducing the labour intensity and workload of data entry personnel. Unification of data services—provides reliable data services for unified construction systems and personalized oilfield systems through cloud platforms to ensure data consistency and integrity.

The IoT system construction of oil and gas fields has created significant economic and social benefits in optimizing the production process and organizational structure, improving production efficiency and management level, and reducing labour intensity (especially for front-line workers) and production costs and safety risk. It has generated a cumulative direct economic benefit of 1.16 billion yuan and cut 24660 in the number of front-line workers.

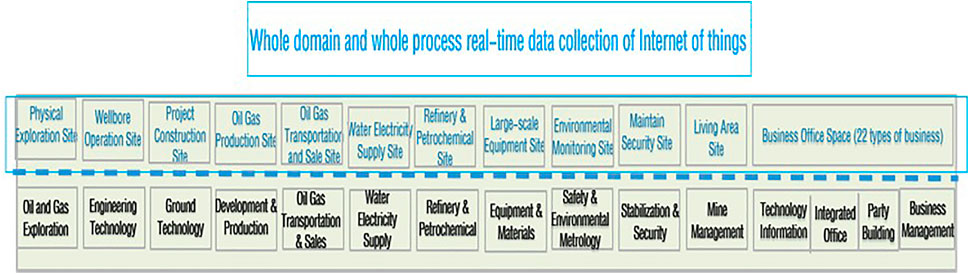

The Changning shale gas field, which is the first in China in terms of daily shale gas production, is a typical case of successful digital transformation empowered by Data Governance with IoT technology as a grip, As shown in Figure 3 .

FIGURE 3 . Whole domain and whole process real-time data collection of Internet of things.

IoT technology supports a lot in oil and gas production process management. It realizes real-time data collection, transmission and monitoring of oil and gas production sites, including wells, workshops, stations and processing plants. Besides, it promotes the transformation of production methods—optimizes production processes, management processes, and organization and improves production efficiency and management level. Furthermore, IoT technology energizes intelligent analysis of production devices, electrical facilities, energy consumption and self-control equipment during the production process. The production process realizes intelligent application of data in four fields, covering intelligent analysis of production devices, intelligent analysis of power facilities, intelligent analysis of energy consumption correlation, and intelligent analysis of self-control equipment, to realize lean and safe production with high timeliness and considerable economy. Timeliness is reflected in the automatic data collection at the minute level and early warning at the hourly level. The economy is reflected in the timely detection of abnormalities in plant conditions, accurate prediction of the probability of accidents and events, scientific evaluation of the health of key plants and reduction of plant daily management costs by more than 20%.

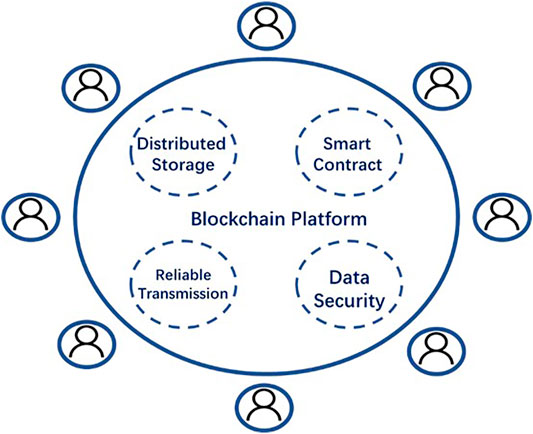

Elimination of “Data Island” by Blockchain Technology to Ensure True and Safe Data Sharing

Blockchain integrates cryptography and distributed database technologies, which can effectively and securely solve the problem of data sharing across organizations and eliminate the phenomenon of “data island”. With its decentralized, open, transparent, and tamper-evident characteristics, Blockchain is compatible with the transparency requirement of Big Data value realization and can overcome the authenticity problem of current Data Governance, providing a new solution for Data Governance.

Blockchain technology can be used during data circulation to strengthen data quality control and ensure data traceability and immutability. The distributed storage can be used to realize data sharing, break “data island”, and promote integrated data integration.

Data decision-making permeates all aspects of production and operation. Due to the involvement of multiple stakeholders, there are problems such as data tampering, data falsification, and differences in the types and standard rules of data from different sources in the process of storage, processing and sharing, which will affect the quality of decision-making data. Therefore, data users need to audit the decision data. Blockchain, as a decentralized distributed database, enables data storage and processing that supports auditing. In addition, by building a decentralized distributed database system among different interest subjects based on Blockchain, data is quickly broadcasted to each interest subject through the whole network, ensuring the authenticity and timeliness of data sharing and circulation.

Each node in the Blockchain network stores data, and once the data is stored in the Blockchain, it will not be tampered with or lost. Even if there are problems such as communication failures and deliberate attacks, the correctness of the data storage can still be guaranteed, and the data users can audit it. In addition, storing data in the Blockchain also supports the audibility of the data treatment process and results.

As a decentralized distributed database, Blockchain supports historical status query of data to confirm whether the current data status is correct. For a traditional database management system, the current data state is stored and maintained in the database, and only the information such as the data processing process is stored in the database log for failure recovery, and does not support the historical state query of data.

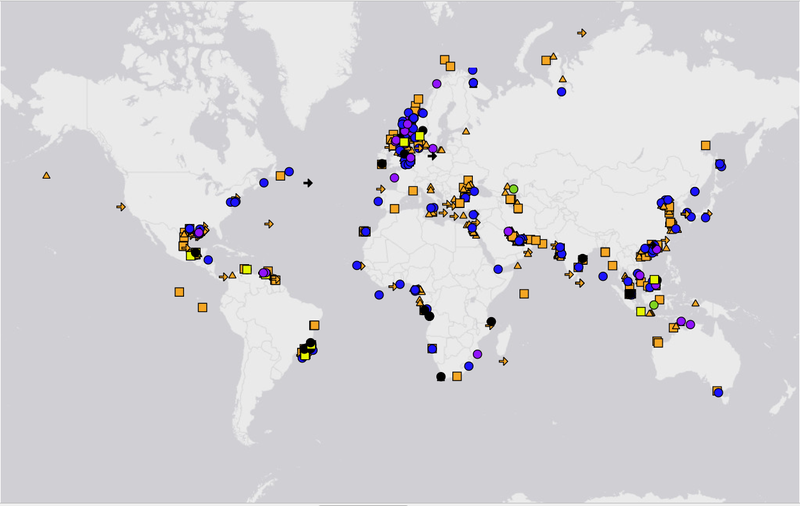

Blockchain technology allows data to be stored and shared more conveniently and safely, which is of great significance in the oil and gas field with high data integrity requirements. Blockchain technology has strong practicality for data protection and management. By building a Blockchain-based data storage and sharing platform, the data can be safely stored on the chain, but all data can be kept interrelated and connected with each other. As shown in Figure 4 , in the data storage sharing platform, relevant business organizations will join the data storage sharing platform as nodes in the Blockchain system to realize the utilization and sharing of data resources. At the same time, the distributed storage, consensus mechanism and smart contracts in Blockchain technology provide guarantees for data management, safe storage and sharing and data users can audit decision data and perform analysis and make decisions on trusted data ( He et al., 2017 ; Zhao et al., 2018 ; Fu, 2019 ; Gong et al., 2019 ).

FIGURE 4 . Blockchain-based data storage sharing platform.

For problems such as inconsistent types and standard rules for data from different sources, uniform data types and standard rules can be developed based on the Blockchain and smart contracts. Smart contracts will be stored and synchronized in various nodes of the Blockchain, and the Blockchain will automatically execute validation based on the code on the smart contracts. Since the execution process of smart contracts is open and transparent, the execution process and execution results are audible, which can improve the efficiency of multi-source data sharing and there is no single point of failure.

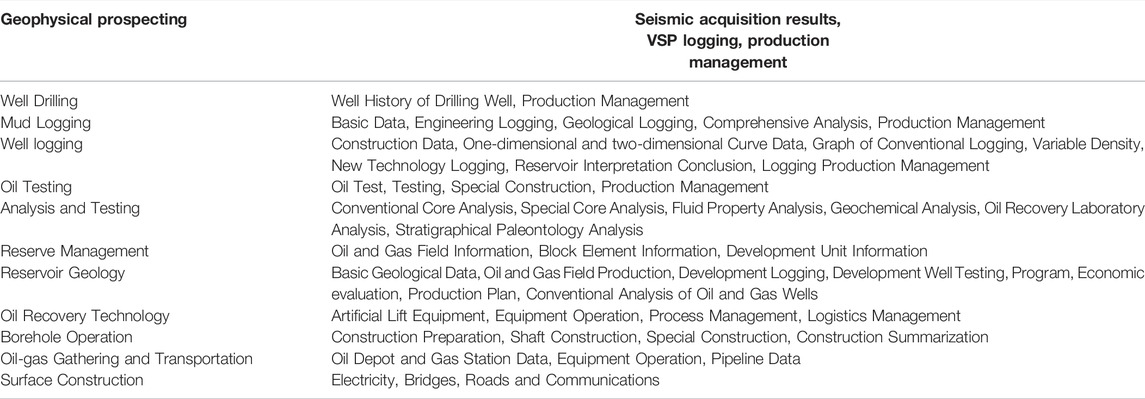

At present, in * oilfield, Blockchain technology supports various E&P business fields of shale gas to store the structured raw data. These data cover 12 categories: geophysical exploration, drilling, mud logging, well logging, oil testing, analysis and testing, reserve management, reservoir geology, oil recovery technology, borehole operation, oil-gas gathering and transportation and surface construction, as shown in Table 1 .

TABLE 1 . Blockchain data storage item of shale gas.

On account of the authenticity data before uploading the chain, a Blockchain-based data management platform is established to record the site data and operation information of reservoir exploration, oil and gas extraction and other aspects in real-time and accurately. In addition, this platform digitizes real-time and data sharing of site supervision, significantly improves data security, site supervision effectiveness, and production risk control. It also optimizes the construction process and supervision measures and takes full advantage of Blockchain. The advantages of Blockchain technology will drive the oil and gas industry towards digital business innovation and provide a guarantee for safe and efficient production and cost reduction and efficiency in the oil and gas sector.

The shale gas master Data Governance based on Blockchain is the core task to realize centralized management and sharing of shale gas data. Master data refers to relatively static, core and high-value data shared by multiple application systems across the enterprise, also known as enterprise benchmark data. Master data can create and maintain the consistency, completeness, relevance and accuracy of data of each business and system in the related fields.

Master data scope determination: the use of shale gas business data in each business system is sorted out, and then analyzed by the Data Governance expert group in conjunction with actual shale gas data use and shale gas characteristic business to form consistent, complete and accurate company-wide core business data of shale gas.

Master data standard specification: based on Blockchain and Smart Contracts, unified data types and standard rules can be established for master data naming specification of shale gas, model standard specification, coding specification, master data association relationship and master data accuracy and integrity business logic rules to develop a quality management in the whole life cycle process.

The Data Governance technical team can load the confirmed authoritative master data information from the temporary environment to the Blockchain through the ETL tool, and distribute the master data information of shale gas to all business systems. So far, the integrity, uniqueness, standardization, consistency and correlation of shale gas master data of all company business systems were realized; the data-sharing mechanism was realized and improved, thus helping the oilfield reduce cost and improve efficiency through data analysis and reuse.

The Overall Plan for a Data Governance System

At present, the oil and gas industry has many problems in the process of data generation, processing, and application due to many reasons. It is necessary to accelerate the construction of the Data Governance system from a group lever, including the clarification of the centralized Data Governance department, the data management of standardization, metadata and master data and regular evaluation of data maturity of governance capabilities. It is necessary to strengthen the dynamic data collection of the entire industry chain and establish a data collection, transmission and aggregation system covering the entire business chain. In order to improve Data Governance capabilities comprehensively, we should adopt systematic thinking and systematic solutions, and implement policies from the concept, organization, management, and technology dimensions. A comprehensive Data Governance system could provide high-quality data foundation guarantees for the Digital Transformation of the oil and gas industry.

Most foreign scholars have proposed a Data Governance framework system during their research. For example, the draft framework model proposed by Wende defined various decision-making fields and corresponding role divisions ( Wende, 2007 ). The most significant contribution of this framework model is to help organizations build data quality responsibilities. The decision domains and roles it proposed can be used as the structural configuration of Data Governance, but there is still a lack of use verification under different organizational scenarios. Among them, the most influential is the decision domain model of Data Governance proposed by Khatri and Brown ( Khatri and Brown, 2010 ). Their framework includes five decision domains: data criteria, quality, metadata, access, and life cycle, and expounds the type and scope of decision domains. This model proposed different centralized, decentralized and shared decision-making power levels in the same organizational decision-making domain. At the same time, it provides a common framework of standard terms, which makes it widely adopted in subsequent studies.

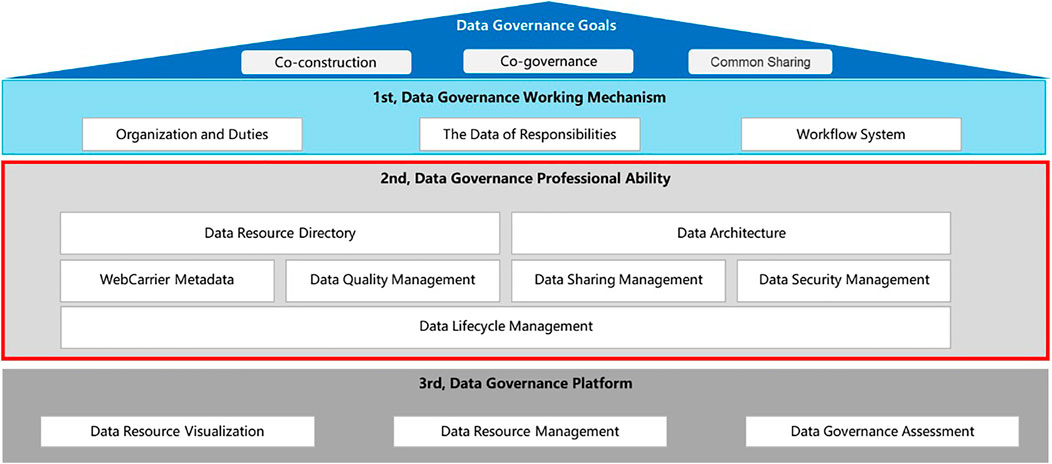

Combined with foreign design concepts and the characteristics of the oil and gas industry ( Fisher, 2008 ), the author summarizes the Data Governance system elements as follows. Under the data co-construction, sharing and co-governance guidelines, the Data Governance system concentrates on data standards, quality, security and sharing, and guarantees the operation of organizations, institutions and processes. Supported by the Data Governance platform, this system innovates the data integration analysis and sharing exchange mechanism. So that, Blockchain technology is able to promote the construction of Data Governance systems and governance capabilities in the oil and gas industry. *Oil field regional data lake as shown in Figure 5 .

FIGURE 5 . *oil field Regional data lake.

Framework of Oil and Gas Data Governance System

Data management activities should be carried out with all relevant parties jointly in combination with “top-level design plus partial landing” with effective results to promote the company’s Data Governance system, as shown in Figure 6 , to improve data management capabilities. The Data Governance activities should fall into the front-line information system, data warehouse and be embedded in the full life cycle of the system to jointly manage outstanding data problems to improve the quality of data resources from the source. As a result, all parties involved can share high-quality Data Governance results, and create a new Data Governance pattern of “co-construction, co-governance, and sharing” for the company.

FIGURE 6 . Framework of oil and gas data governance system.

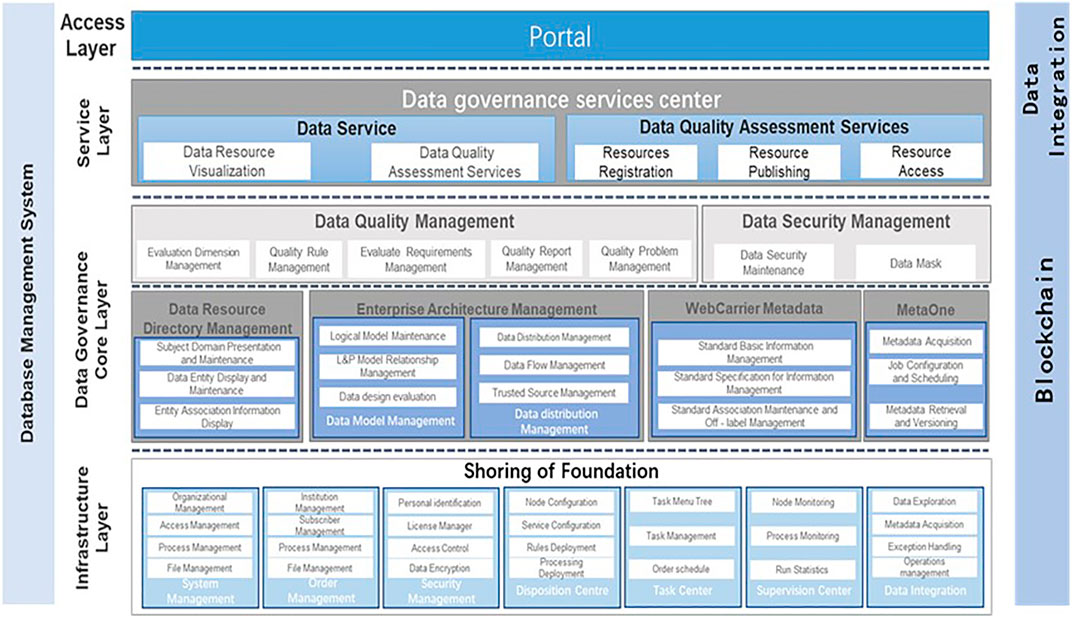

Data Governance Platform

Martijn et al. proposed a Data Governance platform that includes a three-tier system of technical architecture, process architecture, and business architecture ( Martijn et al., 2015 ); and Seine proposed a five-tier system that includes executive tier, strategic tier, tactical tier, operation tier and support tier ( Seiner, 2016 ). The system’s Data Governance platform also elaborated on the respective roles, processes, communication, indicators and tools at the five levels. With reference to the above design ideas, combined with the characteristics of the oil and gas industry’s entire industry chain, a Data Governance platform for the oil and gas industry has been built to follow the Data Governance system and implement relevant policies, procedures and methods as platform functions, realizing data consolidation, data maintenance and data application to improve the efficiency and effectiveness of all aspects of Data Governance. As shown in Figure 7 , the data management platform can be divided into the database, data management core, data service, and user access layers.

FIGURE 7 . Data governance platform.

Application Effectiveness of Data Governance Platform Pilot Construction

The pilot construction of *oilfield Data Governance platform covers the core activities and data management in shale gas exploration and production (E&P), reaching a plethora of achievements in multiple dimensions.

- Established an integrated data model covering *oilfield E&P core activities, to fundamentally realize the transparent sharing of cross-professional data;

- Established a unified data resource management system, to implement asset-based exploration and exploration data management;

- Established a unified data acquisition system based on Iot, to achieve unique source site, one-time acquisition and global shared;

- Established a unified E&P Data Blockchain storage system, to scientifically preserve valuable data assets which obtained at great expense;

- Established a unified E&P Data Governance platform, to realize the integrated application of E&P data;

- Automatic data quality check with high availability rate;

- Data application across departments and professions, integration and collaboration;

- Comprehensive research “one-click access” and significant improvement in work efficiency.

With oil and gas reservoir as the core, it realizes parameter interaction and optimization adjustment, professional mutual synergy and promotion, and builds connections for different professions and departments to communicate and break obstacles. Furthermore, it records instantly during the run process, gradually accumulates experience, continuously learns and iterates, forms efficient templates, and finally achieves maximum benefits.

*Oilfield Data Governance platform has stored the primary data of five business domains and 41 businesses of E&P, which fully supports all applications of E&P. Currently, the data content covers 608 exploratory wells and 575 development wells in 29 oil and gas fields, with a total of 1994 categories, more than 160 million entries, and about 1T data information (excluding seismic body data). Overall data normalization reaches more than 90%, providing use for seven professional databases and application systems, including dynamic exploration database, development production database, mud logging database, well logging database, geological reservoir library, target database and logging decision support system.

In the Digital Transformation development of the oil and gas industry, it is necessary to support the research and development of Blockchain technology vigorously, continuously upgrade and improve it through iterative construction, create a “sample room”, ensure the quality and efficiency of Data Governance and advocate the formation of a concept and culture of data co-construction, sharing and co-governance. The Digital Transformation of the industry can be carried out from the three aspects: technology development, scenario application, and standard formulation to promote the standardized and large-scale application of Blockchain technology in the oil and gas industry, and continue to implement all elements of the Data Governance system in place. Each element of the Data Governance system should be executed continuously to a full extent one by one with multi-party coordination, comprehensive policy implementation and long-term contributions to achieve collaborative innovation, efficient operation and value enhancement of the entire business chain of the oil and gas industry.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

JS: performed the data analyses and wrote the manuscript; SY: contributed significantly to analysis and manuscript preparation; HL: helped perform the analysis with constructive discussions.

National Natural Science Foundation of China/Basic Science Center Project “The theory and application of resource and environment management in the digital economy era” (72088101).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Autonomous, Author. (2012). All the Ingredients for success: Data Governance, Data Quality and Master Data Management. Available at: https://tdwi.org/whitepapers/2012/03/all–the–ingredients–for–success–data–governance–data–quality–and–master–data–management.aspx .

Google Scholar

Autonomous, Author. (2010). See Course Materials from EWSolutions, enterprise Data Governance and Stew Ardship[EB/OL]. Available at: http://www.EW-Solutions.com .

Bhansali, N. (2013). Data Governance: Creating Value from Information Assets . CRC Press , 28–122.

Dai, H. (2020). PetroChina: Drive the High-Quality Development of the Oil and Gas Industry with Digital Transformation . Website of State-owned Assets Supervision and Administration Commission of the State Council .

Fisher, T. (2008). The Four Stages of Data Maturity, Data Flux[EB/OL]. Available at: http://www.sas.com/news/sascom/2007q4/column_tech.html (Accesssed 10 05, 2008).

Fu, Rao. (2019). When the Oil and Gas Industry Meets the Block Chain . Ta Kung Pao , 11–13.

Gong, R., Yang, R., and Lan, M. (2019). Application Prospects of Block Chain Technology in the Petroleum Industry[J]. Inf. Syst. Eng. (11), 62–65.

He, P., Yu, G., Zhang, Y. F., et al. (2017). Survey on Blockchain Technology and its Application Prospect[J]. Comput.Sci 44 (4), 1–7.

IBM Data governance council (2008). IBM Data Governance council. Available at: http://www–01.ibm.com/software/tivoli/governance .

Khatri, V., and Brown, C. V. (2010). Designing Data Governance. Commun. ACM 53 (1), 148–152.

CrossRef Full Text | Google Scholar

Li, G., Wang, F., Xuejun, P., and Liu, H. (2019). Optimized Application of Geology-Engineering Integration Data of Unconventional Oil and Gas Reservoirs[4]. China Petroleum Exploration 24 (1), 147–152.

Liu, S. (2019). Research on Data Governance System in "Share China Petroleum. [J] No.6, 21–29.

Martijn, N., Hulstijn, J., Bruijne, M., and Tam, Y.-H. (2015). “Determining the Effects of Data Governance on the Performance and Compliance of Enterprises in the Logistics and Retail Sector,” in Conference on e-Business, e-Services and e-Society , 454–466.

Seiner, R. S. (2016). Noninvasive Framework for Data Governance Implementation: Details, Part 2[EB/OL]. Available at: http://tdan.com/non–invasive–framework–for–datagovernance–implementation–details–part–2/20130 (Accesssed 01 24, 2016).

Tallon, P. (2013). Corporate Governance of Big Data Perspectives on Value, Risk and Cost. Computer (46), 32–38.

Trope, R. L., and Power, M. (2005). Lessons in Data Governance: A Survey of Legal Developments in Data Management, Privacy and Security. Business Lawyer 61, 471–516.