The Evolution of The Low-Cost Airline Business Model

Low-cost carriers have proven to be fierce, resilient airlines that have found massive success across the world, particularly in the United States. Annually, millions of passengers take advantage of the low fares and affordable travel opportunities these airlines offer. However, despite their success, the low-cost business model that is dominant in today’s marketplace contrasts with the strategy low-cost pioneers utilized when first introducing a bare-bones product to America.

One of the first airlines to successfully and sustainably implement the low-cost business model was Southwest Airlines. Launched prior to the Airline Deregulation Act of 1978, at first Southwest was only permitted to fly within the state of Texas. The close proximity of the cities it served presented the carrier with a unique opportunity: despite competing with other airlines, Southwest’s main competition came from buses and the options travelers held to drive themselves between city pairs throughout Texas. This meant that in order to make money and stay in business flying solely within Texas, the carrier would have to offer fares so low that they could undercut the fares of ground transportation options.

To achieve this, Southwest had to examine the standard airline business model and find methods to reduce costs. First, it turned to its onboard product. It filled its fleet (which exclusively consisted of 737 aircraft) with coach seats. By offering only an economy class cabin, the airline avoided the costs associated with a first-class cabin: it fit more seats into their airplanes, only served snacks instead of meals, and offered an open seating policy that encouraged passengers to show up on time for their flight.

After the airline launched, it focused on increasing its productivity. Because of its simplified product, Southwest employees had the ability to turn its aircraft around in 10 to 15 minutes. With their aircraft capable of performing more flights daily because of lessened time at the gate, the carrier utilized its assets more productively, which allowed for reduced costs that were passed on to the customer. Additionally, even after the carrier expanded outside of Texas, Southwest focused on serving smaller, underutilized airports rather than major hub airports. Not only did this allow them to save money on airport costs, but thanks to smaller runways and less congestion, it also allowed their aircraft to remain more productive while still serving major metropolitan areas.

While Southwest continued to grow its presence across the United States by relying on the tactics that first allowed them to become successful, another carrier, JetBlue Airways, built off of some aspects of its business model when it launched in 2000. Like Southwest, JetBlue operated a fleet of all-economy configured aircraft. It utilized only one type of aircraft to save on maintenance and training costs, much like Southwest. However, JetBlue used the A320 family while Southwest used the 737. However, unlike Southwest, JetBlue did not stray away from major hubs: rather, it set up its base at one of the nation’s busiest airports, John F. Kennedy International Airport in New York, believing there was an opportunity to undercut competitors in the Big Apple. Additionally, JetBlue strove to create an onboard product with more amenities (like more legroom and live, seatback TV) while still offering low fares.

For several years, the two low-cost carriers, despite a significant difference in how they achieved their low fares, found success as they expanded their offering across America. However, another radical shift in the low-cost model came to America in 2005, when Spirit Airlines made headlines for dramatically unbundling its fares. Now, passengers on Spirit enjoyed fares significantly lower than that of Southwest or JetBlue, however, they would be forced to pay additional fees for perks that came included with a ticket on the other carriers. Additionally, Spirit crammed more seats into their aircraft, leading to some of the worst legroom in the industry.

Despite the controversy, Spirit Airlines experienced massive success and rapid growth following its transformation to what people began calling an “ultra-low-cost carrier”. Its impact has been felt across the industry, as low-cost and legacy carriers alike began adopting traits of Spirit’s pricing model to entice budget customers. Now, almost every major airline has begun offering significantly different ticket classes through unbundling fares and reserving certain perks for certain ticket classes. Something like checking a bag, which was a perk formerly included in virtually all tickets, became an additional fee. Ancillary revenue became the key to Spirit Airlines’ success.

Additionally, Spirit focused on expanding its presence in some of the nation’s busiest hubs: airports other low-cost airlines avoided. With base fares so low, Spirit began focusing on markets dominated by legacy carriers and undercut its fares on countless routes, especially ones to leisure destinations. The success its business model found encouraged two other U.S. airlines, Allegiant and Frontier, to transform into ultra-low-cost carriers as well.

Today, each low-cost airline has changed at least slightly in response to the shift in product and pricing strategies now utilized in America. Southwest has expanded to serve busier hub airports, such as Denver (now its largest city), Philadelphia, Boston, New York-LaGuardia, and San Francisco, and has used offerings like their Earlybird Check In to boost ancillary revenue. Despite these changes, the carrier still offers only an economy product, simple onboard service, and two free checked bags for any customers flying the airline.

JetBlue has changed certain aspects of its product as well. While still mainly targeting the leisure traveler, the carrier offers several ticket classes onboard (depending on the route), such as its Mint Business Class. Depending on the ticket class, the carrier also now charges for checked bags and even carry-ons. The airline has also strayed away from its one aircraft type strategy, now operating both the Embraer E190 and Airbus A220-300 along with the A320 family it began with. Spirit, while still focused on offering the lowest possible base fares, has changed too. It offers options like the Big Front Seat, a more expensive option that offers more legroom, seat padding, and additional frills.

Low-cost travel has changed dramatically since its start in the 1970s in Texas. Many of these changes, however, have proven to be successful and popular with travelers in America. As the competitive dynamic within America shifts as demand returns, there could be more changes in store for the business model that brought flying to the masses.

Comments (0)

Add your comment.

RECENTLY PUBLISHED

FOLLOW US ONLINE

- Search Search Please fill out this field.

The Changing Face of Air Travel

The rise of low-cost carriers, why low-cost carriers soared, pandemic symptoms, the biggest lccs in the u.s., the bottom line.

- Fundamental Analysis

- Sectors & Industries

An Economic Analysis of the Low-Cost Airline Industry

:max_bytes(150000):strip_icc():format(webp)/elvis_picardoimg_1978__e_pic-5bfc2629c9e77c0026b3f1d0.jpg)

Occasional recessions , market crashes, and COVID-19 notwithstanding, there is little doubt that life has improved steadily in recent decades. Products and services that were once the province of the rich became widely available as living standards rose. No business better exemplified the democratization of services than the airline industry. Low-cost carriers (LCCs) were at the forefront of that movement. Here we will take a closer look at that segment of the industry.

Key Takeaways

- The deregulation of the U.S. airline industry accelerated the use of low-cost carriers in the U.S., and the trend spread worldwide between 1990 and 2020.

- Low-cost carriers offer lower fares but travellers have to pay an extra fee for additional services.

- The average price of a domestic round-trip ticket in the U.S. fell from $647.94 in 1990 to $420.70 in 2019 (adjusted for inflation)

- Airlines also went from filling about 54% of seats in 1975 to using 85% of their seating capacity in 2019.

- The COVID-19 pandemic dramatically impacted the airline industry, causing a cut in demand for air travel. However, the number of flights, seating occupancy, and revenue in the industry have since then rebounded to almost pre-pandemic levels.

- Southwest Airlines, JetBlue, and Spirit are some examples of popular LCCs.

In the old days, flying was a luxury experience. Airlines primarily catered to the affluent and business travelers . Flyers were a pampered lot, plied with food and wine. In those days, flights were seldom full. One could stretch out on the adjacent empty seat and enjoy a nap in the hushed passenger cabin.

Air travel grew in popularity, with the industry offering more flights and lower fares after deregulation, as the passenger traffic swelled, air travel's cachet faded just as low-cost carriers arrived, pushing fares even lower. It now costs extra to secure more leg room or glass of wine in a business or first-class section of the cabin. All too often, air travelers have been forced to put up with long delays, overcrowded flights, lengthy security procedures and noisy cabins.

While many bemoaned the decline in quality, the number of complaints was not exceptionally high compared to the greater number of air travelers. That was because airfares dropped substantially after adjusting for inflation . Consumers have always known that you get what you pay for. Paying cheap fares for no-frills air travel was a bargain accepted by the majority of air travelers. Those who pined for the glamour days of flying always had the option of paying more for first class.

Deregulation

Pioneers, including Southwest Airlines, ushered in mass air travel in the U.S. during the 1970s. In that same decade, the deregulation of the U.S. airline industry accelerated the widespread use of low-cost carriers. The 1978 Airline Deregulation Act partly shifted control over air travel from the government to the private sector. That led to the termination of the once all-powerful Civil Aeronautics Board (CAB) in 1984.

The CAB previously had an iron grip on critical aspects of the U.S. airline industry. It controlled the pricing of airline services, agreements between carriers, and mergers within the industry. Airlines were only able to compete on tangible factors, such as food, service quality, and cabin crew. Their hands were tied concerning the most crucial consideration for most consumers—ticket price.

The Results of Deregulation

The liberalization of the airline industry yielded spectacular results. The number of U.S. air traveler enplanements soared from 209 million in 1975 to a record 930 million by 2019. The figure dropped to less than 370 million the following year due to COVID-19 but has recovered to 857 million as of 2022. Adjusting for inflation, the average price of a domestic round-trip ticket in the U.S. fell from $647.94 in 1990 to $420.70 in 2019. That's a decline of about 35%, but the drop mostly took place between 1990 and 2005. Airlines also went from filling about 54% of seats in 1975 to using 85% of their seating capacity in 2019. The following year, the seating capacity dropped to 58.3% and has since rebounded to almost pre-pandemic levels.

Around the World

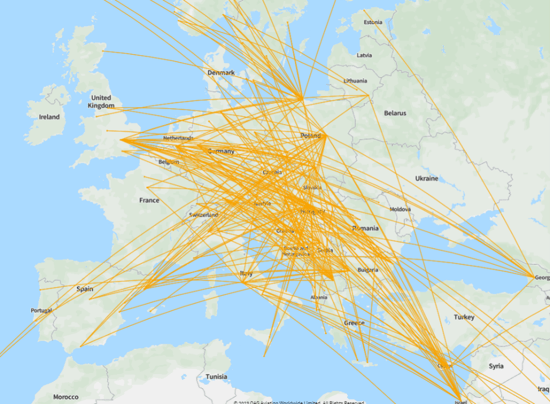

The low-cost carrier revolution spread worldwide between 1990 and 2020. The LCCs came to Europe in the 1990s and Asia in the 2000s. Flagship national airlines still exist in most countries. Italy even renationalized Alitalia during the coronavirus crisis. Low-cost carriers had been making progress for years. However, the extreme stress of dealing with the coronavirus put their survival at stake, especially in newer markets.

The success of low-cost carriers before 2020 can be attributed to many innovations and developments since the 1970s.

The Point-to-Point Model

Many large airlines were quick to adopt the hub-and-spoke model after deregulation. In that model, a major airport becomes the hub, and other destinations become the spoke. However, LCCs abandoned that system in favor of the point-to-point model.

The hub-and-spoke system allows airlines to consolidate their passengers at the hub and then fly on to their ultimate destinations (the spokes) in smaller aircraft. That boosts the percentage of seats filled, which helps to drive down fares. Furthermore, the hub-and-spoke system increases the number of possible destinations. However, it also has some drawbacks , such as the high costs required to maintain such a complex infrastructure. The hub-and-spoke system also imposes longer travel times on customers who must transit through the hubs. Finally, it is vulnerable to cascading flight delays caused by hub congestion.

The point-to-point system, on the other hand, connects each origin and destination via nonstop flights. That provides substantial cost savings by eliminating the intermediate stop at the hub, which gets rid of costs related to hub development. The point-to-point system also reduces total travel time and enables better aircraft utilization. Limited geographical reach is the major constraint of the point-to-point model. Unfortunately, direct flights are not economically viable for many city pairs.

Discount Pricing

The higher efficiency and better fleet utilization of LCCs, coupled with their reduced costs, enable them to offer significant airfare discounts. Ticket pricing is now the biggest competitive factor for airlines. Most consumers want to reach their destinations quickly and economically, and are willing to give up in-flight food and entertainment to save money. This drive for economy also extends to business travelers as companies increasingly clamp down on travel costs.

Technology Adoption

The widespread adoption of ticketless travel and Internet distribution has been a boon for LCCs. It decreases the need for complex and expensive ticketing systems used by legacy airlines to handle their complicated pricing structures. The emergence of the internet as the primary medium for booking tickets has dramatically increased the transparency of ticket pricing. That works in favor of the low-cost carriers because of their lower fares.

Fleet Uniformity

A significant benefit of the point-to-point model is that LCCs can use a single fleet type. They frequently do not have much variability in passenger demand between the major city pairs that they serve. Traditional carriers often need larger planes to carry passengers between hubs, and smaller ones for flights to the spokes. The fleet uniformity of low-cost carriers leads to lower training and maintenance costs.

Motivated Staff

Several LCCs prided themselves on the high motivation levels of their employees. They motivated employees with competitive compensation, incentives like profit-sharing, and a strong corporate brand identity. Additionally, most LCCs tend to fly shorter routes. That means employees might only be away from home for a few hours, as opposed to a couple of days or longer for long-haul flights. More time at home can also be good for morale.

Fewer Flyers

The COVID-19 pandemic dramatically cut demand for air travel. In the final week of March 2020, commercial traffic had declined 62.9% from the same period in 2019. For year 2020, there was an overall wordlwide reduction of 50% of seats offered by airlines (compared to 2019 levels) and an overall reduction of 2,703 million passengers ( a 60% drop compared to 2019 levels)

The Bailout

In March 2020 the airline industry secured nearly $60 billion in U.S. government funding under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, saving the industry from bankruptcy. However, there were strings attached that have significant consequences for potential investors. The airlines had to agree to forego layoffs , stock buybacks , and dividend payments. The dire situation for airline earnings was already highly unfavorable to buybacks and dividends, so those restrictions mattered little. The prohibition of layoffs, on the other hand, limited the companies; flexibility in adapting to a dramatically different business environment. Nonetheless, the aid represented a significant win for the airlines and their employees.

Buffett Departs

Legendary investor Warren Buffett sold in 2020 all the airline stocks owned by his company Berkshire Hathaway Inc. ( BRK.A ). Berkshire Hathaway's holdings were in the larger airlines, including a substantial stake in the large low-cost carrier Southwest . Buffett's company paid $7 billion to $8 billion for its stakes in the airlines, but they were worth closer to $4 billion when sold amid the COVID-19 pandemic, marking a rare loss for Buffett and his firm. "I don't know that three, four years from now, people will fly as many passenger miles as they did last year," Buffett said. "You've got too many planes."

Startup Success Stories?

The economic environment after the pandemic could be extremely favorable to new entrants in the low-cost carrier space. Fear of the virus is likely to decline dramatically under most scenarios, unleashing repressed demand. The industry's contraction during the pandemic promises to leave many older planes on the market, along with additional gates and take-off slots at some airports. That, in turn, could lower startup costs for new low-cost carriers. New LCCs would also be free of the massive debt and restrictive agreements with governments weighing down the incumbent carriers.

While startups seem likely to emerge in the future, large established low-cost carriers are not going away. The top U.S. low-cost carriers are listed below.

Southwest Airlines Co.

Dallas-based Southwest Airlines ( LUV ) began operations in 1971. It became the largest U.S. carrier in terms of originating domestic passengers boarded and also operates one of the world's largest fleet of Boeing aircraft. Southwest had a 16.9% share of the domestic U.S. air travel market in the 12 months through April 2023, behind Delta's 17.2% and American Airline's 17.5%. As of July 18, 2023, Southwest had a market capitalization of $21.79 billion.

JetBlue Airways Corp.

JetBlue ( JBLU ) launched in 2000 and grew to become one of the largest U.S. passenger carriers by focusing on some of the top U.S. travel markets. JetBlue differentiated itself by offering the most legroom in coach class, as well as free TV and broadband Internet service on its flights. JetBlue had a 5.5% share of domestic U.S. air travel in the 12 months through April 2023. The company had a market capitalization of $2.73 billion as of July 18, 2023.

Spirit Airlines, Inc.

Spirit ( SAVE ) has operations in the U.S., Latin America, and the Caribbean. The airline's strategy is to offer an unbundled, stripped-down "Bare Fare" and charge customers for options like baggage, seat assignments, and refreshments. Spirit launched its initial public offering in May 2011 and had a market capitalization of about $2 billion as of July 18, 2023. Spirit held a 5.0% share of the domestic U.S. air travel in the year through April 2023.

On July 28, 2022, Spirit Airlines and JetBlue Airways Corporation announced that their boards of directors had approved a merger agreement under which JetBlue would acquire Spirit for $3.8 billion. The combined airline would be the fifth-largest in the U.S.

Allegiant Travel Co.

Allegiant Travel ( ALGT ) is the parent company of Allegiant Air, which was founded in 1997. Allegiant focuses on the U.S. domestic market, flying passengers from small and mid-sized cities to top holiday destinations like Las Vegas and Honolulu. Allegiant Travel had a market capitalization of $3.2 billion as of July 18, 2023.

What Are the Best Low-Cost Airlines Worldwide?

AirAsia received the World Airline Award 2023 in the best low-cost airline category for its excellence in providing the best service and experience to guests at a minimum fare. Other companies at the top of the world’s best low-cost airlines are Scoot, IndiGo, Flynas, and Volotea. Singapore Airlines was awarded the world’s best first-class airline and Qatar Airways was awarded the world's best business-class airline.

What Is the Low-Cost Airline Strategy?

The low-cost airline strategy consists of minimizing operations costs to offer the cheapest tickets possible. This is achieved, among others, by offering one single service class: only one type of passenger service exists within the company, and services like seat allocation or onboard meals are provided at an additional fee. Also, low-cost airlines usually cover shorter routes which allows them to operate a larger volume of flights per day. In order to reduce fuel costs, low-cost airlines use younger fleets of fuel-efficient fleets, and they usually operate at smaller airports.

What Are Some Challenges That Low-Cost Airlines Face?

According to the World Bank, low-cost airlines face considerable obstacles such as a limited existing network, high levels of economic inequality hampering demand, high infrastructure costs, limited human resources, high fuel costs, and restrictive Air Service Agreements.

Whether one calls them low-cost carriers or LCCs, budget airline stocks are risky investments. However, high risks sometimes give investors high returns. While the stocks have already rallied impressively from their 2020 lows, the rebound in air travel as the COVID-19 pandemic subsides may drive additional gains for the shares of low-cost carriers.

Smithsonian National Air and Space Museum. " Airline Deregulation: When Everything Changed ."

Mercatus Center, George Mason University. " Unleashing Innovation: The Deregulation of Air Cargo Transportation ."

Airlines for America. " Domestic Round-Trip Fares and Fees ."

Airlines for America. " U.S. Airline Traffic and Capacity ."

Zhang, Anming and et al. " Low-Cost Carriers in Asia: Deregulation, Regional Liberalization and Secondary Airports ." Research in Transportation Economics , vol. 24, no. 1, 2008, pp. 36-50.

Barrett, Sean D. " Airport Competition in the Deregulated European Aviation Market ." Journal of Air Transport Management , vol. 6, no. 1, 2000, pp. 13-27.

Library of Congress. " Italy: Law Authorizing Emergency Rescue Loan to Alitalia Takes Effect ."

fightradar24. " Tracking March’s historic drop in air traffic ."

International Civil Aviation Organization. " Effects of Novel Coronavirus(COVID-19) on Civil Aviation: Economic Impact Analysis ," Page 6.

U.S. Department of Transportation, Bureau of Transportation Statistics. " COVID-19 Stimulus Funding for Transportation in the CARES Act and Other Supplemental Bills ."

Warren Buffett Archive. " 2020 Berkshire Hathaway Annual Meeting - Part 1: 23. Buffett: Buying Airline Stocks Was a Mistake ."

Southwest Investor Relations. " Southwest Airlines Co. 2022 Annual Report ," PDF Page 7.

U.S. Department of Transportation, Bureau of Transportation Statistics. " Airline Domestic Market Share ."

Southwest Investor Relations. " Stock Quote & Chart ."

JetBlue Investor Relations. " Corporate Overview ."

JetBlue Investor Relations. " Stock Info ."

Spirit Airlines Investor Relations. " Company Profile ."

TradingView. " Spirit Airlines, Inc.: Financials ."

Spirit Airlines Investor Relations. " FAQ ," Select "When was Spirit's initial public offering?"

JetBlue-Spirit. " JetBlue and Spirit to Create a National Low-Fare Challengerto the Dominant Big Four Airlines ."

Allegiant Travel Company. " About Allegiant ."

TradingView. " Allegiant Travel Company: Financials ."

World Airline Awards. " World’s Best Low-Cost Airlines 2023 ."

Skytrax. " Singapore Airlines is named the World’s Best Airline at the 2023 World Airline Awards ."

Amadeus for Developers. " What is a low-cost carrier (LCC): budget airline model overview ."

- World Bank Group. " Opportunities and Challenges for LCC Development:: The Case of East Africa ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1833764008-546fac96d43141eb9b328d9c6e15948c.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Click through the PLOS taxonomy to find articles in your field.

For more information about PLOS Subject Areas, click here .

Loading metrics

Open Access

Peer-reviewed

Research Article

Flying high on low cost: Success in the low-cost airline industry

Roles Data curation, Formal analysis, Methodology, Project administration, Software

Affiliation Faculty of Economics and Administration, Department of Business Management, Masaryk University, Brno, Czech Republic

Roles Conceptualization, Funding acquisition, Methodology, Supervision, Visualization, Writing – original draft, Writing – review & editing

* E-mail: [email protected]

- Veronika Majerová,

- Michal Jirásek

- Published: December 21, 2023

- https://doi.org/10.1371/journal.pone.0294638

- Peer Review

- Reader Comments

Low-cost airlines have embraced diverse business models, yielding varying degrees of success. In our study, we apply a configurational approach that allows us to evaluate business models not as isolated components but as intricate business configurations. Through this lens, we identify two distinct models that successful low-cost airlines adopt: the pure low-cost model and the hybrid model. Each model has its own specific, often contradictory, attributes. Most significantly, our findings indicate that low-cost airlines must choose between offering a broad spectrum of additional services or focusing on high productivity and on-time performance. Our analyses reveal that low-cost airlines cannot sidestep this trade-off, as a simultaneous offering of both models does not lead to success.

Citation: Majerová V, Jirásek M (2023) Flying high on low cost: Success in the low-cost airline industry. PLoS ONE 18(12): e0294638. https://doi.org/10.1371/journal.pone.0294638

Editor: Baogui Xin, Shandong University of Science and Technology, CHINA

Received: December 8, 2022; Accepted: November 6, 2023; Published: December 21, 2023

Copyright: © 2023 Majerová, Jirásek. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Data Availability: All relevant data are within the paper and its Supporting information files.

Funding: The research was supported by the Masaryk University research project MUNI/A/1233/2022 Organizations in the era of uncertainty.

Competing interests: The authors have declared that no competing interests exist.

Introduction

Navigating the turbulent skies of the air transportation industry places the business models of airlines under constant pressure [ 1 ]. Therefore, scholars have devoted considerable attention to identifying the critical factors in their success [ 2 , 3 ]. However, such studies often fall into the trap of analyzing success factors in isolation, overlooking the fact that these attributes are interrelated components of more comprehensive business models [ 4 , 5 ]. This underscores the need for a holistic evaluation that takes into account the synergistic effects and relational aspects of the business model attributes–an area in which conventional correlational methods fall short. A more appropriate tool for this task is Qualitative Comparative Analysis (QCA, [ 6 , 7 ]), which allows for a nuanced exploration of the complex interactions within business models ([ 8 ]–and illustrated by, e.g., [ 9 ]).

Our research focuses on a specific category of airlines—low-cost carriers (LCCs). Characterized by their streamlined, all-economy configurations and their use of secondary airports, these airlines offer a narrowed down service at reduced cost [ 10 ]. Despite their potential to disrupt the air transport market [ 11 ], LCCs face their own competitive pressures, prompting the ongoing evolution and diversification of their business models [ 12 ]. In this respect, determining what truly contributes to the success or failure of LCCs is paramount. Moreover, given the recent trend of traditional full-service carriers (FSCs) launching low-cost subsidiaries [ 13 ], understanding the conditions for success has become increasingly important.

This study aims to contribute to this understanding by highlighting the distinguishing features and limitations of successful LCC business models. While there have been many previous studies on airline (and LCC) business models (see below), most have relied on traditional correlation methods that assess the business model attributes in isolation. Although one study [ 9 ] has used configurational methods to look at other aspects of business models (i.e., configurations of different innovative activities), it differs from our research, which is focused on general attributes of LCC business models. Furthermore, by identifying distinct business models–the pure low-cost and hybrid models–and their specific attributes, our research provides invaluable insight into strategic decision-making in existing and emerging LCCs. Our findings thus advance the academic discourse on airlines’ business models and offer practical implications for industry stakeholders seeking to navigate the complexities of the low-cost market.

Theoretical overview

Airline business models.

As in other industries, distinctive business models constitute the basis of competition between individual airlines [ 10 ]. While some scholars have distinguished two [ 14 ] or more [ 10 , 15 , 16 ] categories of airline business models, others have argued for a more fluid understanding, suggesting that there is a spectrum of business models rather than simple categories [ 1 ].

Despite this ongoing debate, classifying business models still facilitates our understanding of airlines’ operations. A standard classification [ 10 , 14 ] divides airlines into low-cost carriers (LCC) and full-service carriers (FSC). The business models of LCCs are characterized by numerous key attributes, including direct sales, significant outsourcing, high-density seating, high public awareness, and a focus on short-haul travel [ 10 , 17 , 18 ].

Moreover, FSCs and LCCs differ significantly in the design of their networks. FSCs often rely on a hub-and-spoke system, considered the most effective logistical system for moving passengers [ 19 ]. The hub is the airline’s main base and is located in its country of origin. The airline operates direct lines from its hub to other destinations (i.e., the spokes). There is no direct connection between the spoke airports, and it is only possible to travel between them by transferring to another flight at the hub [ 20 ]. Thanks to the higher frequency of flights, this system offers economies of scale on connections and at hubs [ 21 ].

In contrast, LCCs typically operate on a point-to-point basis [ 10 ]. This system affords certain advantages, such as direct connections between airports, resulting in potential savings and convenience for passengers [ 14 ]. Nevertheless, it also has drawbacks, such as the low frequency of flights on routes, the need for a higher number of airplanes, low yields per seat, and the need for a high-density market to operate point-to-point flights [ 20 ].

In reality, distinguishing between business models is not black and white. As Lohmann and Koo [ 1 ] suggest, business models can be visualized on a continuum rather than as distinct entities. Today, many airlines adopt attributes from both FSC and LCC business models, creating a hybrid model that better caters to demand and competitive pressures [ 5 , 22 ].

A further convergence in business models can be observed in cases where FSCs establish or acquire low-cost subsidiaries [ 3 , 10 , 23 ]. However, these ventures often fail due to inappropriate role identification for the subsidiary LCC, overlaps in management, inadequate operational knowledge of the low-cost model, and other issues [ 13 ].

Identification of business models

There are several approaches to identifying the business models of airlines [ 5 ]. For instance, Sengur and Sengur [ 24 ] base their conceptualization on multiple general business model frameworks, such as the Business Model Canvas. However, such broad applications may present challenges in subsequent empirical studies. Daft and Albers’ [ 25 ] approach is more tailored to empirical research and provides a comprehensive framework for describing the business models of airlines by means of three main components: corporate logic, value chain structure, and assets.

Yet it is the framework of Mason and Morrison [ 2 ] that seems to have attracted the most attention of researchers [ 5 ]. Their “Product and Organizational Architecture” (POA) offers a standardized method for categorizing key attributes, facilitating differentiation between airline models and their effects on profitability. Nevertheless, the POA framework also has shortcomings, one of which is that it assesses the relationship between components and profitability in isolation. Furthermore, subsequent studies have indicated difficulties in applying this framework due to data unavailability and the need for model adaptation (e.g., [ 1 , 26 ]).

In line with previous literature, we argue that business models are composites of various interrelated attributes that contribute to a complex structure that distinguishes each airline. A piecemeal assessment of the significance of these components (as in [ 2 ]) may mask their actual effects. Therefore, we view business models as exemplifying causal complexity and as defined by three features [ 27 ]: conjunction (the outcomes are not the product of a single cause but combinations of multiple conditions), equifinality (there can be more than one combination that leads to a particular outcome), and asymmetry (the conditions may have varying–or even contradictory–roles in different combinations).

One example of causal complexity is network types. There are successful airlines that operate either hub-and-spoke or point-to-point networks (e.g., Lufthansa and Ryanair), while others using the same network type do not fare as well (e.g., Eurowings and Thomas Cook). Although the network is crucial for success, it works best in conjunction with other conditions. There is also equifinality, as airlines with different network types can both succeed. However, a specific network type that is beneficial to one business model may not work for another, which is an illustration of asymmetry (e.g., an LCC using a hub-and-spoke network while maintaining low prices would not be sustainable due to the added transfer costs).

Methodology

Our study concentrated on European airlines that followed various versions of the low-cost business model. We derived our sample of low-cost European airlines from a list provided by ICAO [ 28 ], subsequently analyzing 21 airlines that met our criteria and had adequate data for 2019. Our primary interest was to identify the business model attributes (conditions) that, when combined, either facilitated the airlines’ success or hindered it.

To scrutinize the complex causality inherent in our case, we deployed a crisp-set Qualitative Comparative Analysis (QCA, e.g., [ 6 ]). Unlike conventional correlational approaches that examine conditions individually, QCA evaluates conditions collectively, highlighting their synergistic effects. This configurational approach embraces the asymmetry of conditions, indicating that the causes for an outcome do not necessarily mirror the causes for the absence of the said outcome [ 29 ]. Therefore, separate analyses need to be done for combinations leading to success and combinations leading to the absence of success among airlines.

A key feature of QCA is that it offers valid results with a moderate number of cases (10–100). Relative to qualitative methods, QCA accommodates more cases while preserving benefits such as in-depth case knowledge. Moreover, its variable-oriented approach promotes the identification of generalized variable relationships [ 6 ]. We used FsQCA 3.0 software for all the calculations.

Qualitative comparative analysis in brief

QCA operates on principles based on Boolean algebra and Mill’s methods [ 7 ]. Firstly, the selection of conditions (independent variables), the outcome (dependent variable), and the cases must be grounded in theoretical understanding. The data used in the analysis may be either qualitative or quantitative, but it must be convertible into binary codes (where 1 signifies the presence of a condition and 0 its absence). This is relevant for crisp-set QCA, which is the form of QCA we employed in our research.

QCA analysis involves multiple stages [ 6 ]. A critical step in the process is the creation of a “data matrix” and, subsequently, a “truth table.” The data matrix is a simplified summary of binary values for each case, from which the truth table is derived. The truth table encompasses all empirically observed combinations of causal conditions. The following step involves the logical minimization of all combinations leading to the presence of the outcome (and, separately, combinations leading to the absence of the outcome). Logical minimization refers to the simplification of complex expressions into “prime implicants” according to Boolean algebra rules, which form the basis for interpreting the results. The findings are presented in three solutions–parsimonious, intermediate, and complex–which differ in the degree of simplification they offer.

Business model attributes

Our study concentrates on the business models of LCCs and their connection to business success. We formulated six conditions (attributes of the business model) that differentiate various business models and might contribute to success or the absence of it: (i) operational size, (ii) membership in an airline group, (iii) breadth of services, (iv) focus on on-time service; (v) productivity, and (vi) provision of long-haul flights. The choice of these conditions was informed by the POA framework [ 2 ], other discussed business model frameworks, and a deep understanding of the individual cases. We focused on conditions that differentiate between the various LCC business models and excluded features which are commonly found in LCC models, such as paid onboard refreshments, the use of secondary airports, tight seat pitches, and limited seat widths. These conditions are common to all LCCs and, therefore, not decisive in distinguishing between successful and not successful ventures. We also did not include conditions (or their indicators) for which there are no openly available data for a sufficient number of airlines or where this data is largely incomplete (e.g., data related to the competition an airline is facing).

It should also be noted that we chose to work with these attributes regardless of whether they were found to be correlated to LCC success or its absence in previous studies. As we argued in the theoretical overview, findings from studies using correlational methods would be misleading, since they do not assess business model attributes as configurations (i.e., they do not assess how they work together and instead focus on their effects “in isolation”).

We chose operational size (i) and airline group membership (ii) due to their potentially significant impact on business models, as they heavily influence management decisions and capital structure. Breadth of services (iii), on-time performance (iv), and productivity (v) are integral to the POA analysis and they are directly adjustable by airlines and leave room for innovation ([ 19 ] also supporting their critical role in LCC business models). We added (vi) the provision of long-haul flights as an additional feature that can distinguish between LCCs.

Table 1 displays the indicators for the individual conditions. The third column presents the criteria used for calibration, with the level of each quantitative condition derived from industry data (values that clearly divide the airlines into two subsets) or from the authors’ knowledge of the industry and individual cases. We used the first approach (values that divide the airlines) where there is no (however abstract) threshold indicating the presence or absence of a condition. The best example for this case is the Size condition that works with airline-specific indicators. With six indicators, all airlines, apart from one, satisfy either a maximum of one criterion or five or six of them (the only exception, Jet2, satisfies two criteria). In most other cases, we combined our knowledge of where the threshold might be with insight into the actual criterion values (case and industry data).

- PPT PowerPoint slide

- PNG larger image

- TIFF original image

https://doi.org/10.1371/journal.pone.0294638.t001

Where appropriate, we employed several indicators to ensure the condition’s validity and to decrease dependence on individual calibration criteria. Where there were multiple indicators, we marked the condition as present when any majority of the criteria of corresponding indicators was satisfied. We obtained the data for the analysis from various sources, including individual airlines’ websites, other published documents and from industry sources. When data for any indicator was missing, we worked with the remaining indicators, the majority of which decided the presence or absence of a given condition.

Breadth of services includes the offer of through-ticketing (guaranteed compensation for missed connecting flights), a frequent flyer program, and business class quality. Although typically associated with FSCs, some LCCs have recently adopted these attributes. The focus on punctual service can be directly measured by OAG [ 30 ] statistics, with on-time flights defined as those that depart or arrive within 15 minutes of the scheduled time. High on-time performance enhances customer satisfaction while simultaneously improving the utilization of ground staff, aircrews, and aircraft.

We measured fleet and labor productivity by means of five indicators. The fleet is considered uniform if a single type of aircraft comprises over 80% of the fleet, which has a significant impact on operating costs and productivity. The second attribute is maximum seat capacity, which reflects the extent to which an airline utilizes its predominant aircraft type’s maximum seat capacity. For example, the Boeing 737–800 has a maximum certified configuration of 189 seats [ 31 ]. A fleet operating at maximum seat capacity typically provides a single travel class and can sell more tickets per flight. Available seat kilometers per employee and passengers per employee are used interchangeably, given their high correlation in POA analysis [ 2 ].

Table 2 displays the indicators and corresponding criteria for the outcome. We identified seven indicators signifying success. However, we did not include any financial indicators due to the unavailability of data. For many of the observed airlines, financial reports are consolidated and fail to offer detailed information about subsidiaries. Thus, we chose alternative indicators with better availability of data. As before, we set the calibration criteria based on industry data.

https://doi.org/10.1371/journal.pone.0294638.t002

In QCA analysis, reporting the inputs (the data matrix and the truth table) and outputs (analyses) in a research paper is standard. In the following section, we adopt QCA notation to streamline the textual presentation. More precisely, we use the symbol “~” to signify the absence of a condition or outcome (for example, an airline not offering long-haul flights is denoted as “~Long-haul”) and the symbol “*” to indicate a combination of conditions (e.g., “~Long-haul*Group” signifies an airline that does not offer long-haul flights and which is a subsidiary of another airline).

Data matrix and truth table

Table 3 represents the data matrix that serves as the starting point for QCA. It concisely summarizes the condition and outcome values for the 21 airlines examined. In the table “1” indicates the presence of a condition or outcome, while a “0” signifies its absence (marked as “~” in the text).

https://doi.org/10.1371/journal.pone.0294638.t003

Table 4 presents the truth table that includes the 14 combinations of causal conditions and outcomes observed in our data. Given that there are six conditions, there are 64 (2 6 ) theoretically possible combinations, for which it is clearly impossible for 21 airlines to represent. However, as Ragin [ 32 ] points out, limited diversity is natural, as the empirical world seldom depicts all logically conceivable combinations.

https://doi.org/10.1371/journal.pone.0294638.t004

Analysis of necessary conditions

In addition to identifying combinations of conditions sufficient for the outcome, QCA also allows for the analysis of the necessary conditions. It is important to understand that the necessary conditions can be sufficient or insufficient for the outcome. The results for both success and its absence are displayed in Table 5 , which are based on two separate analyses. Consistency denotes the ratio of cases that have both the condition and the outcome. According to Ragin [ 32 ], a consistency of 0.9 indicates a necessary condition. Coverage, on the other hand, reveals the empirical relevance of a condition in the sample, computed as the ratio of cases possessing the condition in the total number of cases. None of the conditions in this analysis can be deemed necessary, as they fail to pass the consistency threshold of 0.9. Only the consistencies of the ~Long-haul (outcome: Success) and ~Size (outcome: ~Success) conditions come close to this figure, both of which recorded consistencies of 0.857.

https://doi.org/10.1371/journal.pone.0294638.t005

Analysis of sufficient conditions

To simplify the QCA output, we will now concentrate on the intermediate solutions, which are typically those most frequently interpreted [ 6 ]. The intermediate solutions for the presence and absence of success are presented in Tables 6 and 7 , while the complex and parsimonious solutions can be found in the supporting information section ( S1 – S4 Tables). Each table is divided into four columns: the first outlines the combinations of conditions determined by the analysis; the second presents the raw coverage (the ratio of cases with the outcome possessing this combination); the third presents the unique coverage (the ratio of cases with the outcome possessing this combination and none of the others); and the fourth pertains to consistency (the proportion of cases with a combination that also exhibits the outcome).

https://doi.org/10.1371/journal.pone.0294638.t006

https://doi.org/10.1371/journal.pone.0294638.t007

Intermediate solutions (Success)

Some unexpected findings were revealed regarding the combinations of conditions linked to success ( Table 6 ). Despite the potential correlational-logic supposition that the On-time condition would be present in the Success outcomes, we identified three combinations where this condition was absent. However, these only accounted for 29% of the Success outcome. By contrast, a single solution featuring the On-time condition covered 43% of the Success outcome. As we will discuss later, this potentially indicates that LCCs face a trade-off. Specifically, maintaining on-time flights appears incompatible with offering a broad range of services (the presence of the Services condition).

Notably, it seems that being a subsidiary does not play a significant role. The combinations that include the presence and absence of this condition (Group) appear equally in combinations leading to success, and the condition is absent in combination with the highest coverage (0.429, ~Services*On-time*Productivity*~Long-haul). Productivity is present in two combinations (~Services*On-time*Productivity*~Long-haul and Size*Group*~Services*Productivity*~Long-haul) covering 50% of cases. Its absence does not feature in any of the combinations. We are cautious when interpreting the role of long-haul flights, given that this condition only appears in four cases. Nevertheless, it seems that successful European LCC airlines tend not to have this condition (and therefore only operate within Europe and its neighboring regions).

Intermediate solutions (~Success)

The combinations of conditions leading to the absence of success ( Table 7 ) support the general trade-off between on-time performance and breadth of services. All of the airlines that were not successful exhibited either both or neither of these two conditions (see all six combinations of conditions in Table 7 ). The airlines that were not successful were typically small (~Size feature in five out of six combinations that are part of the intermediate solution for ~Success), although this may not apply to airlines that are subsidiaries (Group). It could be argued that for airlines that are failing, maintaining their size is challenging unless they have a parent company to provide financial support.

Interpretation of results

Our analysis reveals two distinct business models that contribute to the success of LCCs (see Table 6 ). The first, which we term the “hybrid model”, closely resembles an FSC in its broad range of services. However, this model tends to compromise when it comes to on-time performance (Services*~On-time). In our study, airlines such as easyJet and Norwegian exemplify this model.

The second successful business model, which we term the “pure low-cost model”, is characterized by a limited range of services and the absence of long-haul flights (~Services*~Long-haul). A limited offer of services, such as catering, enabling rapid aircraft turnaround and improved on-time performance facilitates this business model’s efficiency [ 33 ]. The model aligns with Mason and Morrison’s [ 2 ] characterization of a successful LCC. In our sample, Ryanair and WizzAir are examples of this model.

While successful airlines cannot simultaneously offer a broad range of services and maintain a highly productive/on-time business model (see Table 7 and its interpretation above), they must adopt one of these approaches. Either they can copy aspects of the FSC business model or focus on delivering the core product with cost efficiencies. To illustrate the trade-offs airlines face, we have constructed a trade-off triangle, which is depicted in Fig 1 .

https://doi.org/10.1371/journal.pone.0294638.g001

According to the notional trade-off triangle, LCCs cannot afford the absence of productivity (~Productivity; see also the argument by [ 19 ]). As they compete on low prices, they need to maintain business efficiencies, particularly when they do not offer additional services (~Services), as is the case for the pure low-cost model. The hybrid model allows for some flexibility in this area but does so at the expense of on-time performance (~On-time) and, potentially, the core product itself. In both models, LCCs must appeal to customers by offering additional services (Services) or delivering high on-time performance (On-time). However, they cannot provide both without jeopardizing their overall success. Such an offering would essentially mean adopting a traditional FSC model while retaining low prices, which is an untenable strategy in the long term. This is reflected in our analysis of LCCs that were not successful ( Table 7 ).

Finally, being a subsidiary seems to be somewhat of a liability for LCCs (and as Gillen and Gados, [ 19 ], argue, most such ventures have failed). This observation is supported by the frequent exits of LCC subsidiaries from the market segment [ 34 ]. Overlapping management and unclear subsidiary roles may contribute to this issue [ 13 ].

Discussion and conclusion

The configurational logic guiding our research enables us to evaluate LCC business models as complex combinations of diverse attributes [ 8 ]. We argue that this study reflects the three features of causal complexity [ 27 ]. Firstly, our results uphold the conjunction principle–success or failure cannot be traced back to a single attribute. Instead, it results from various business model attributes operating in conjunction. Secondly, we observed equifinality in our findings, having identified two prevalent approaches adopted by successful airlines: the pure low-cost and hybrid business models. Finally, we found asymmetry, which means that the individual attributes exerted different effects when combined with others. We view this last characteristic as the fundamental strength of our approach, contrasting with traditional correlational logic (as adopted in, for instance, [ 2 ]).

To illustrate the asymmetry, consider the attribute of a broad range of services. This feature is common throughout our sample and appears with successful and unsuccessful airlines. Thus, a correlation or regression analysis would likely yield a non-significant or a slightly significant relationship. However, we demonstrated that a broad range of services is a critical element in one business model of successful LCCs: the hybrid model. While this attribute might be overlooked in a correlational analysis, it is crucial to one of the pathways to success.

Hence, we argue that our research sheds additional light not on the attributes of business models, which are widely acknowledged in the industry, but on the relationships between these attributes. The correlational approach calls for the adoption of individual best practices. However, our study suggests that the ill-considered adoption of industry practices could potentially harm an organization if these practices are incompatible with its current business model. This observation probably accounts for why some FSC low-cost subsidiaries have succeeded while others have exited the sector [ 34 ].

Our study employed crisp-set Qualitative Comparative Analysis (QCA), chosen for its straightforward interpretation and communication of results. Nevertheless, this approach is constrained by its binary value system, which acknowledges a condition as either present or absent. Fuzzy set QCA offers a more nuanced approach that accommodates the subtleties observed in real life [ 6 ]. This is a promising avenue for future research that may lead to more robust findings than one which relies on crisp-set QCA.

Our analysis concentrated on attributes that distinguish between alternative LCC business model features. Given that many attributes are incorporated into most LCC models (e.g., paid onboard refreshments, use of secondary airports, small seat pitches and seat width), we argue that they play a minimal role in differentiating between success and failure. Therefore, these attributes were excluded from our analysis, which allowed us to focus on differentiating LCC features. However, this might inadvertently suggest that these attributes are unimportant. While we recognize that some business model attributes might be redundant, many others must be present in every LCC business model. Identifying these conditions would be a suitable task for the related Necessary Condition Analysis method [ 35 ], in the case where it was supplemented with more detailed data on these attributes. Such an analysis could yield important insights for LCCs considering abandoning or limiting these practices.

Finally, our analysis was based on European LCCs. Given the differences in regional air transportation markets (reflected in, e.g., [ 18 ]), our study would require replication in other markets to extend its findings to them.

In conclusion, our research identified two distinct business models adopted by successful LCCs: the pure low-cost model and the hybrid model. Specifically, LCCs must choose between offering a broad range of additional services and focusing on their core product, represented by on-time performance and high productivity. While they must select one of these models to attract customers, they cannot adopt both without rendering their model unworkable. By employing a configurational approach, we examined the fundamental attributes of business models holistically, rather than treating them as separate factors. We believe this approach is particularly beneficial when investigating such complex phenomena.

Supporting information

S1 table. complex solution (success)..

https://doi.org/10.1371/journal.pone.0294638.s001

S2 Table. Parsimonious solution (success).

https://doi.org/10.1371/journal.pone.0294638.s002

S3 Table. Complex solution (~success).

https://doi.org/10.1371/journal.pone.0294638.s003

S4 Table. Parsimonious solution (~success).

https://doi.org/10.1371/journal.pone.0294638.s004

https://doi.org/10.1371/journal.pone.0294638.s005

- View Article

- Google Scholar

- 6. Rihoux B, Ragin CC. Configurational Comparative Methods: Qualitative Comparative Analysis (QCA) and Related Techniques. Thousand Oaks: Sage; 2008.

- 7. Ragin CC. The Comparative Method: Moving Beyond Qualitative and Quantitative Strategies. First Edition, With a New Introduction. Oakland: University of California Press; 2014.

- 9. Hvass KA. A Boolean Approach to Airline Business Model Innovation. Copenhagen Business School; 2012. https://research-api.cbs.dk/ws/portalfiles/portal/58900738/Kristian_Hvass_WP_2012.pdf .

- 10. Whyte R, Lohmann G. Airline business models. 2nd ed. In: Budd L, Ison S, editors. Air Transport Management. 2nd ed. Routledge; 2020. pp. 107–121.

- 12. Klophaus R, Fichert F. From low-cost carriers to network carriers without legacy? Evolving airline business models in Europe. Airline Economics in Europe. Emerald Publishing Limited; 2019. pp. 57–75.

- 13. CAPA. How the legacy full service airlines have responded to rising LCC competition. In: CAPA [Internet]. 2009 [cited 29 Mar 2021]. https://centreforaviation.com/analysis/reports/how-the-legacy-full-service-airlines-have-responded-to-rising-lcc-competition-14504 .

- 21. Rodrigue J-P. The Geography of Transport Systems. Abingdon-on-Thames: Routledge; 2020.

- 23. CAPA. The airline cost equation: strategies for competing with LCCs. In: CAPA [Internet]. 2018 [cited 29 Mar 2021]. https://centreforaviation.com/analysis/reports/the-airline-cost-equation-strategies-for-competing-with-lccs-416644 .

- 28. ICAO. List of Low-Cost-Carriers (LCCs). ICAO; 2017. https://www.icao.int/sustainability/Documents/LCC-List.pdf .

- 29. Verhoeven M. A brief introduction to QCA. Methodische Zugänge zur Erforschung von Medienstrukturen, Medienorganisationen und Medienstrategien. Nomos Verlagsgesellschaft mbH & Co. KG; 2016. pp. 173–196.

- 30. OAG Aviation OA. Flight Database & Statistics | Aviation Analytics | OAG. In: OAG [Internet]. 2020 [cited 29 Mar 2021]. https://www.oag.com .

- 31. Boeing. Boeing: Next-Generation 737. In: Boeing [Internet]. 2020 [cited 29 Mar 2021]. https://www.boeing.com/commercial/737ng/ .

- 32. Ragin CC. User’s Guide to Fuzzy-Set/Qualitative Comparative Analysis. 2017. http://www.socsci.uci.edu/~cragin/fsQCA/download/fsQCAManual.pdf .

- 33. Doganis R. Airline Business in the 21st Century. 1st edition. London; New York: Routledge; 2000.

- 34. Bouwer J, Carey R, Riedel R. Salvation or misleading temptation—low-cost brands of legacy airlines. In: McKinsey [Internet]. 2017 [cited 29 Mar 2021]. https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/salvation-or-misleading-temptation-low-cost-brands-of-legacy-airlines

- 35. Dul J. Conducting Necessary Condition Analysis for Business and Management Students. Thousand Oaks: Sage; 2020.

The Leading Source of Insights On Business Model Strategy & Tech Business Models

The Southwest Airlines Business Model In A Nutshell

- Southwest Airlines is a low-cost American commercial airline company founded by Herbert Kelleher and Rollin King in 1967. The company began operations in Texas at a time when interstate travel was heavily regulated.

- Southwest Airlines makes money across three categories: passenger revenue , transport revenue , and revenue for ancillary services such as early check-in.

- Southwest Airlines recorded profits for 47 straight years, with the streak only broken by the coronavirus pandemic. The success of the company in an industry with slim to non-existent profits is due to intelligent route selection, flexible seating, free checked baggage, and a point-to-point destination strategy .

Table of Contents

Southwest Airlines origin story

Southwest Airlines is a low-cost American commercial airline company founded by Herbert Kelleher and Rollin King in 1967.

Kelleher and King developed the concept for Southwest Airlines in a San Antonio hotel bar. The original business plan was illustrated on a cocktail napkin with a triangle connecting the Texan cities of San Antonio, Dallas, and Houston.

Initially, the company operated flights within the state of Texas only. Federal authorities controlled interstate air travel in the United States at the time, deciding where an airline could fly and how much it could charge. This turned out to be a blessing in disguise for Southwest Airlines, enabling it to establish a strong presence in Texas where it was free to undercut competitors including Braniff and Texas International. During those early years, the company was also known for its ability to turn planes around in just ten minutes.

When President Jimmy Carter signed the Airline Regulation Act on October 24, 1978, the company began introducing routes around the United States. A service between Houston and New Orleans was the first such route, with additional flights to Tulsa, Oklahoma City, and Albuquerque following in 1979. That same year, the company introduced self-ticketing machines to make the check-in process more efficient.

Over the following decades, Southwest Airlines stayed true to its low-fare brand . For a customer checking in two bags, the company claims its fares will be the lowest on offer in 87% of cases . Competition-beating prices are possible because Southwest operates Boeing 737s exclusively, enabling it to save money on training mechanics and pilots on a range of different aircraft. The company also prefers routes between smaller airports where taxes and gate access are more affordable.

Third-quarter operating revenue for 2021 was $4.7 billion , representing a 161% year-over-year increase. The company now services routes to over 100 destinations across the United States, Mexico, Central America, and the Caribbean.

Southwest Airlines’ Value Proposition:

- Affordable Travel: Southwest is known for its low-cost airfare, making air travel accessible to a broader range of travelers, including budget-conscious individuals and families.

- No Change Fees: The airline allows passengers to change their flights without incurring change fees, providing flexibility and convenience, which is especially valuable for business and leisure travelers.

- No Baggage Fees: Southwest offers free checked baggage, reducing the overall cost of travel for passengers and eliminating the need to pay additional fees for luggage.

- Open Seating: Southwest’s open seating policy means passengers can choose their seats upon boarding, promoting a stress-free and egalitarian boarding process.

- Point-to-Point Routes: The airline’s point-to-point route strategy minimizes layovers and streamlines travel, reducing the chances of delays and making travel more efficient.

- Customer-Centric Approach: Southwest places a strong emphasis on customer service and satisfaction, striving to create a positive and enjoyable flying experience.

Customer Segments:

- Budget-Conscious Travelers: Passengers seeking affordable airfare options and the ability to save on travel expenses .

- Business Travelers: Professionals who value flexibility and the option to change flights without incurring hefty fees.

- Families: Families appreciate the affordability and baggage policy of Southwest, which can reduce the overall cost of family travel.

- Leisure Travelers: Vacationers who prioritize cost -effective travel options and a hassle-free experience.

- Travelers Seeking Convenience: Passengers who prefer direct flights and streamlined travel experiences without extensive layovers.

Distribution Strategy:

- Official Website: The airline’s official website serves as a primary distribution channel , allowing customers to search for flights, make reservations, and manage their bookings online.

- Mobile App: Southwest offers a mobile app for easy booking, check-in, and access to travel information, enhancing the convenience for travelers.

- Travel Agencies: While Southwest primarily sells tickets directly, it also works with travel agencies and platforms to reach a broader audience.

- Customer Service: Southwest Airlines maintains a strong customer service presence, providing support for travelers through various channels, including phone and email.

Marketing Strategy:

- Low-Cost Messaging: The airline consistently promotes its low fares as a central marketing message, highlighting affordability as a key selling point.

- Transparency: Southwest emphasizes transparency in pricing and policies, ensuring that customers are aware of the airline’s no-change-fee and no-baggage-fee policies.

- Customer-Centric Messaging: Southwest markets itself as a customer-focused airline, emphasizing its commitment to providing a positive and enjoyable travel experience.

- Advertising Campaigns: The airline runs advertising campaigns to showcase its low fares, flexibility, and the benefits of flying with Southwest.

- Community Engagement: Southwest engages with communities through sponsorships and partnerships, fostering a positive brand image and connection with local markets.

- Social Media Presence: The airline actively uses social media platforms to interact with customers, share travel updates, and address inquiries.

Southwest Airlines revenue generation

Southwest Airlines generates revenue by providing domestic and international airline services.

Revenue is spread across three categories:

- Passenger revenue – or the sale of domestic and international airline tickets to travelers.

- Transportation revenue – encompassing shipping and freight services, and

- Other revenue – derived from the sale of ancillary services such as early check-in and in-flight purchases. Unlike other airlines, Southwest does not charge premium seating fees and offers light refreshments such as peanuts and crackers for free.

Profitability

While the company uses a revenue generation strategy common to many airlines, its successful business model deservers further mention. Before the COVID-19 pandemic grounded planes around the world, Southwest Airlines made a profit for 47 consecutive years between 1973 and 2019.

Despite operating in an industry where it is notoriously difficult to do so, the company has managed to not only survive but thrive.

This has been achieved in the following ways:

- Intelligent route selection – as noted in the previous section, the airline prefers to operate routes where airport taxes are minimal. It also chooses routes where it is more likely to sell every seat.

- Flexible seating – Southwest doesn’t assign seat numbers to passengers. This means that if a plane is swapped out with a different seating configuration, the company doesn’t have to reissue boarding passes.

- Free checked baggage – while most airlines charge for checked baggage, Southwest does not. Former Vice President of ground operations Chris Wahlenmeier explained the reasoning: “ When you charge people to check bags they try to carry more on, sometimes more than can fit in the overhead bins. That results in more bags being checked at the gate, right before departure. And that wastes time. ”

- Point-to-point destinations – lastly, Southwest flights are point-to-point. This means the plane lands, turns around, and travels back to where it came from. The point-to-point strategy is seen as less vulnerable to delays than flying into major hubs, which are connected to hundreds of different airports and experience heavy air traffic as a result. A simpler network also means the company wastes less time searching for lost luggage, with Southwest boasting a bag completion rate of 99.6%.

Key Takeaways

- Southwest Airlines is a low-cost American commercial airline founded in 1967 by Herbert Kelleher and Rollin King.

- Initially, the company operated within Texas due to heavy regulation on interstate travel, which allowed it to establish a strong presence in the state by undercutting competitors.

- President Jimmy Carter’s signing of the Airline Regulation Act in 1978 enabled Southwest Airlines to expand its routes throughout the United States.

- The company stayed true to its low-fare brand , operating exclusively Boeing 737s to save costs on training and preferring routes between smaller airports.

- Southwest Airlines has been profitable for 47 consecutive years, with its streak only interrupted by the coronavirus pandemic.

- Revenue generation includes passenger revenue from airline ticket sales, transportation revenue from shipping and freight services, and other revenue from ancillary services like early check-in and in-flight purchases.

- The airline’s success can be attributed to intelligent route selection, flexible seating arrangements, offering free checked baggage, and using a point-to-point destination strategy .

- Southwest Airlines has expanded its services to over 100 destinations across the United States, Mexico, Central America, and the Caribbean.

- The company’s point-to-point flight strategy contributes to a high bag completion rate of 99.6% and reduced vulnerability to delays compared to flying into major hubs.

- Southwest Airlines places a strong emphasis on cost -saving measures and customer-friendly policies, which have contributed to its long-term profitability and success in the highly competitive airline industry .

Main Free Guides:

- Business Models

- Business Strategy

- Business Development

- Digital Business Models

- Distribution Channels

- Marketing Strategy

- Platform Business Models

- Revenue Models

- Tech Business Models

- Blockchain Business Models Framework

More Resources

About The Author

Gennaro Cuofano

Discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- 70+ Business Models

- Airbnb Business Model

- Amazon Business Model

- Apple Business Model

- Google Business Model

- Facebook [Meta] Business Model

- Microsoft Business Model

- Netflix Business Model

- Uber Business Model

Simple Flying

Ultra low-cost carriers: who are they & what sets them apart.

Ultra-low-cost carriers (ULCCs) may offer a budget experience, but their business models prove that some travelers prefer this type of flying.

There are low-cost carriers, and there are ultra-low-cost carriers (ULCCs). These terms are not synonymous, and each category has its distinctions. These low-budget airlines sometimes get a bad rap because of well-publicized stories where passengers claim they are treated like second-class citizens.

While the experience is undoubtedly no-frills, there are some benefits to flying in the low-cost world. We take a look at some of the more common ULCCs and their successful business models, giving their legacy carrier counterparts a run for their aeronautical money.

Defining ultra-low-cost carriers

An ultra-low-cost carrier is an airline that operates with a low-cost business model, with marketing focusing on offering its customers airfare at much lower costs than competing legacy carriers. These airlines offered unbundled fares, which do not include seat assignments, check-in or carry-on baggage fees, or in-flight meals. Each of these services incurs an additional cost, allowing passengers to determine which options they are willing to pay for.

This bare-bones approach is one differing factor from ULCCs and low-cost airlines. While low-cost airlines are not focused on passenger perks, ultra-low-cost carriers have minimal inclusions in the fare and a more significant number of add-on fees.

The following sampling of ULCCS shows some of the most successful airlines in this category. As you’ll notice, many are in The United States, partly because domestic flights there are shorter, have fewer frills, and therefore are cheaper to operate.

Las Vegas-based Allegiant is the 9th largest commercial airline in the United States. It only flies domestic routes within the United States and primarily focuses on tourism-heavy destinations.

With its headquarters at Denver International Airport, Frontier Airlines’ service has branched out to new domestic and international locations. It has moved into competitive markets (like Miami), traditionally serving as legacy-dominated hubs. The airline was founded 25 years ago, in 1994.

Frontier Airlines

When it comes to European ULCCs, Ryanair usually is one of the first to come to mind. This Irish airline is the continent’s largest carrier. Its business model is based on low fares for short to medium-haul routes, and everything over and above the seat on the plane is chargeable. Like Southwest Airlines, Ryanair operates a fleet of all Boeing 737s, which keeps its maintenance and operational costs lower than a mixed-aircraft fleet.

Spirit Airlines

Spirit is the seventh-largest commercial airline in the United States and will become much larger if its proposed merger with JetBlue occurs. This airline was founded in 1983, and its route structure serves the United States, Latin America, Mexico, South America, and the Caribbean.

Sun Country Airlines

Like Allegiant, Sun Country targets the tourism market. However, unlike Allegiant, its main hub at Minneapolis-Saint Paul Airport allows this airline to serve a variety of domestic and medium-haul international destinations such as Dallas Fort Worth, Las Vegas, Mexico, Jamaica, Costa Rica, Aruba, and Belize.

This relatively new airline was founded in 2017 and is owned by low-cost carrier Canadian WestJet. With hubs at Hamilton Airport and Edmonton Airport, the carrier flies to over 15 destinations domestically in Canada, but also to North America and the Caribbean.

The pros and cons of flying an ULCC

These are just a sampling of some of the most prominent ULCC. Passengers who have never flown on such an airline may wonder if this type of flying is for them. It all depends on several factors. If assigned seating and no carry-on fees are your preference, then these airlines are not a good choice. These will charge you for nearly everything except the guarantee that you will sit somewhere on an aircraft flying from A to B. If that's your goal, ULCCs are the travel option worth exploring.

- Airline Business

- Aviation Safety

- _Flight Safety

- _Airports Safety

- _Safety Management

- _Human Factors

- _Air Cargo Marketing

- _Air Cargo Rates

- _Air Cargo Handling

- _Dangerous Goods

- Aviation Regulations

- General Articles

Low Cost Carrier | Business Model

What is a Low-Cost Carrier?

Low-cost airlines business models.

The best low-cost carriers 2021

- Southwest Airlines

- Scoot

- Vueling Airlines

- EasyJet [ According to AirlineRatings it is on the list of top 10 safest low-cost airlines for 2022]

- Jetstar Airways

- Ryanair [ According to Airline Ratings it is on the list of top 10 safest low-cost airlines for 2022]

- Jetstar Asia

- Eurowings

- Air Canada rouge

- Jet2.com

- Spring Airlines

- Wizz Air [ According to AirlineRatings it is on the list of top 10 safest low-cost airlines for 2022]

Our website uses cookies to improve your experience. Learn more

Contact Form

Ultra low-cost carriers (ULCCs): Ultimate guide

- Post author: Andrew D'Amours

- Post published: April 7, 2022

- Post category: Flight tips / Travel tips

- Post comments: 0 Comments

The overall price of plane tickets has never been lower in the history of air travel, which is obviously amazing for those who love to travel more for less, as I do (and hopefully you do too). You can thank ultra low-cost carriers (ULCCs) for this: they are almost entirely responsible for flights now being so much cheaper in general… including on other airlines!

ULCCs are airlines whose unique business model is to give you the option to fly for less if you want to. I’ve been on more ULCC flights than most, and I paid as low as $10 for flights. That’s how cheap it can be! ULCCs are truly amazing!

Here is Flytrippers’ ultimate guide to ultra low-cost carriers — we’ll add to it soon to help you even more since they’re growing so quickly in Canada (including with a review of my experience on the inaugural flight of Lynx Air, Canada’s newest ULCC).

Basics: What is a ULCC?

ULCC is the acronym for u ltra l ow- c ost c arrier.

The key element about ULCCs is very simple : you just get no-frills air tickets and à la carte pricing for everything else, which allows you to fly for the lowest possible price.

Almost no extras are included in the basic price so that you can get a plane ticket for less. It gives you the option to save money (an option you just don’t have with other airlines) and having more options when booking travel is always better for consumers.

ULCCs get you from point A to point B with a seat, a small bag, and a safe ride. That’s it though, nothing else is typically included. No add-ons.

Everywhere else in the world, ULCCs have been around for decades. We are just very late to the game here in Canada. The largest airline in Europe is a ULCC! They’re great.