Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, how to create a financial forecast for a startup business plan.

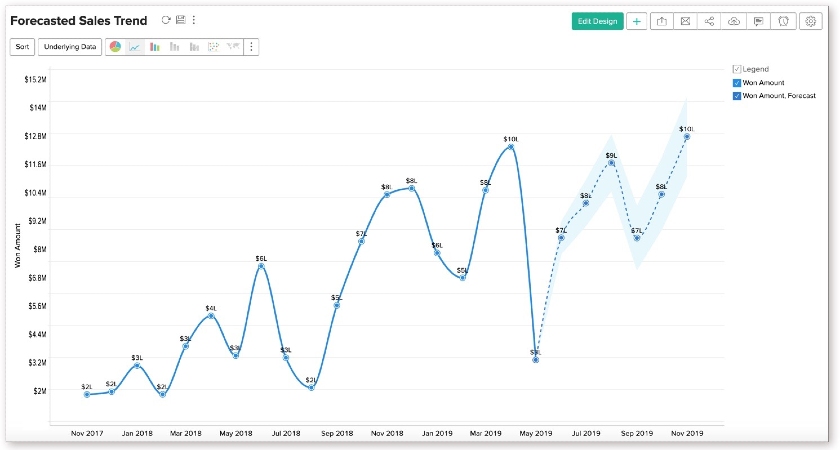

Financial forecasting allows you to measure the progress of your new business by benchmarking performance against anticipated sales and costs.

When starting a new business, a financial forecast is an important tool for recruiting investors as well as for budgeting for your first months of operating. A financial forecast is used to predict the cash flow necessary to operate the company day-to-day and cover financial liabilities.

Many lenders and investors ask for a financial forecast as part of a business plan; however, with no sales under your belt, it can be tricky to estimate how much money you will need to cover your expenses. Here’s how to begin creating a financial forecast for a new business.

[Read more: Startup 2021: Business Plan Financials ]

Start with a sales forecast

A sales forecast attempts to predict what your monthly sales will be for up to 18 months after launching your business. Creating a sales forecast without any past results is a little difficult. In this case, many entrepreneurs make their predictions using industry trends, market analysis demonstrating the population of potential customers and consumer trends. A sales forecast shows investors and lenders that you have a solid understanding of your target market and a clear vision of who will buy your product or service.

A sales forecast typically breaks down monthly sales by unit and price point. Beyond year two of being in business, the sales forecast can be shown quarterly, instead of monthly. Most financial lenders and investors like to see a three-year sales forecast as part of your startup business plan.

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign.

Tim Berry, president and founder of Palo Alto Software

Create an expenses budget

An expenses budget forecasts how much you anticipate spending during the first years of operating. This includes both your overhead costs and operating expenses — any financial spending that you anticipate during the course of running your business.

Most experts recommend breaking down your expenses forecast by fixed and variable costs. Fixed costs are things such as rent and payroll, while variable costs change depending on demand and sales — advertising and promotional expenses, for instance. Breaking down costs into these two categories can help you better budget and improve your profitability.

"Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Tim Berry, president and founder of Palo Alto Software, told Inc . "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such."

Project your break-even point

Together, your expenses budget and sales forecast paints a picture of your profitability. Your break-even projection is the date at which you believe your business will become profitable — when more money is earned than spent. Very few businesses are profitable overnight or even in their first year. Most businesses take two to three years to be profitable, but others take far longer: Tesla , for instance, took 18 years to see its first full-year profit.

Lenders and investors will be interested in your break-even point as a projection of when they can begin to recoup their investment. Likewise, your CFO or operations manager can make better decisions after measuring the company’s results against its forecasts.

[Read more: Startup 2021: Writing a Business Plan? Here’s How to Do It, Step by Step ]

Develop a cash flow projection

A cash flow statement (or projection, for a new business) shows the flow of dollars moving in and out of the business. This is based on the sales forecast, your balance sheet and other assumptions you’ve used to create your expenses projection.

“If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months,” wrote Inc . The cash flow statement will include projected cash flows from operating, investing and financing your business activities.

Keep in mind that most business plans involve developing specific financial documents: income statements, pro formas and a balance sheet, for instance. These documents may be required by investors or lenders; financial projections can help inform the development of those statements and guide your business as it grows.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

Applications are open for the CO—100! Now is your chance to join an exclusive group of outstanding small businesses. Share your story with us — apply today.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Become a small business member and save!

Become an integral voice in the world’s largest business organization when you join the U.S. Chamber of Commerce as a small business member. Members also receive exclusive discounts from B2B partners, including a special offer from FedEx that can help your business save hundreds a year on shipping. Become a member today and start saving!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

What is ai price optimization, what is enterprise resource planning, choosing an enterprise resource planning tool for your small business.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing a Business Plan—Financial Projections

Spell out your financial forecast in dollars and sense

Creating financial projections for your startup is both an art and a science. Although investors want to see cold, hard numbers, it can be difficult to predict your financial performance three years down the road, especially if you are still raising seed money. Regardless, short- and medium-term financial projections are a required part of your business plan if you want serious attention from investors.

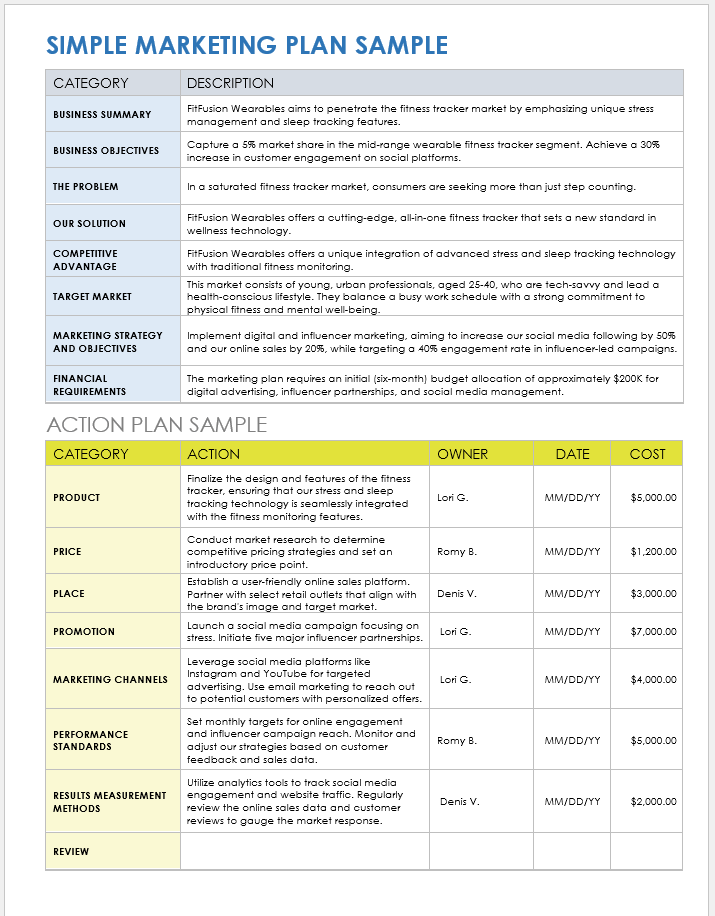

The financial section of your business plan should include a sales forecast , expenses budget , cash flow statement , balance sheet , and a profit and loss statement . Be sure to follow the generally accepted accounting principles (GAAP) set forth by the Financial Accounting Standards Board , a private-sector organization responsible for setting financial accounting and reporting standards in the U.S. If financial reporting is new territory for you, have an accountant review your projections.

Sales Forecast

As a startup business, you do not have past results to review, which can make forecasting sales difficult. It can be done, though, if you have a good understanding of the market you are entering and industry trends as a whole. In fact, sales forecasts based on a solid understanding of industry and market trends will show potential investors that you've done your homework and your forecast is more than just guesswork.

In practical terms, your forecast should be broken down by monthly sales with entries showing which units are being sold, their price points, and how many you expect to sell. When getting into the second year of your business plan and beyond, it's acceptable to reduce the forecast to quarterly sales. In fact, that's the case for most items in your business plan.

Expenses Budget

What you're selling has to cost something, and this budget is where you need to show your expenses. These include the cost to your business of the units being sold in addition to overhead. It's a good idea to break down your expenses by fixed costs and variable costs. For example, certain expenses will be the same or close to the same every month, including rent, insurance, and others. Some costs likely will vary month by month such as advertising or seasonal sales help.

Cash Flow Statement

As with your sales forecast, cash flow statements for a startup require doing some homework since you do not have historical data to use as a reference. This statement, in short, breaks down how much cash is coming into your business on a monthly basis vs. how much is going out. By using your sales forecasts and your expenses budget, you can estimate your cash flow intelligently.

Keep in mind that revenue often will trail sales, depending on the type of business you are operating. For example, if you have contracts with clients, they may not be paying for items they purchase until the month following delivery. Some clients may carry balances 60 or 90 days beyond delivery. You need to account for this lag when calculating exactly when you expect to see your revenue.

Profit and Loss Statement

Your P&L statement should take the information from your sales projections, expenses budget, and cash flow statement to project how much you expect in profits or losses through the three years included in your business plan. You should have a figure for each individual year as well as a figure for the full three-year period.

Balance Sheet

You provide a breakdown of all of your assets and liabilities in the balances sheet. Many of these assets and liabilities are items that go beyond monthly sales and expenses. For example, any property, equipment, or unsold inventory you own is an asset with a value that can be assigned to it. The same goes for outstanding invoices owed to you that have not been paid. Even though you don't have the cash in hand, you can count those invoices as assets. The amount you owe on a business loan or the amount you owe others on invoices you've not paid would count as liabilities. The balance is the difference between the value of everything you own vs. the value of everything you owe.

Break-Even Projection

If you've done a good job projecting your sales and expenses and inputting the numbers into a spreadsheet, you should be able to identify a date when your business breaks even—in other words, the date when you become profitable, with more money coming in than going out. As a startup business, this is not expected to happen overnight, but potential investors want to see that you have a date in mind and that you can support that projection with the numbers you've supplied in the financial section of your business plan.

Additional Tips

When putting together your financial projections, keep some general tips in mind:

- Get comfortable with spreadsheet software if you aren't already. It is the starting point for all financial projections and offers flexibility, allowing you to quickly change assumptions or weigh alternative scenarios. Microsoft Excel is the most common, and chances are you already have it on your computer. You can also buy special software packages to help with financial projections.

- Prepare a five-year projection . Don’t include this one in the business plan, since the further into the future you project, the harder it is to predict. However, have the projection available in case an investor asks for it.

- Offer two scenarios only . Investors will want to see a best-case and worst-case scenario, but don’t inundate your business plan with myriad medium-case scenarios. They likely will just cause confusion.

- Be reasonable and clear . As mentioned before, financial forecasting is as much art as science. You’ll have to assume certain things, such as your revenue growth, how your raw material and administrative costs will grow, and how effective you’ll be at collecting on accounts receivable. It’s best to be realistic in your projections as you try to recruit investors. If your industry is going through a contraction period and you’re projecting revenue growth of 20 percent a month, expect investors to see red flags.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

7 Financial Forecasting Methods to Predict Business Performance

- 21 Jun 2022

Much of accounting involves evaluating past performance. Financial results demonstrate business success to both shareholders and the public. Planning and preparing for the future, however, is just as important.

Shareholders must be reassured that a business has been, and will continue to be, successful. This requires financial forecasting.

Here's an overview of how to use pro forma statements to conduct financial forecasting, along with seven methods you can leverage to predict a business's future performance.

What Is Financial Forecasting?

Financial forecasting is predicting a company’s financial future by examining historical performance data, such as revenue, cash flow, expenses, or sales. This involves guesswork and assumptions, as many unforeseen factors can influence business performance.

Financial forecasting is important because it informs business decision-making regarding hiring, budgeting, predicting revenue, and strategic planning . It also helps you maintain a forward-focused mindset.

Each financial forecast plays a major role in determining how much attention is given to individual expense items. For example, if you forecast high-level trends for general planning purposes, you can rely more on broad assumptions than specific details. However, if your forecast is concerned with a business’s future, such as a pending merger or acquisition, it's important to be thorough and detailed.

Access your free e-book today.

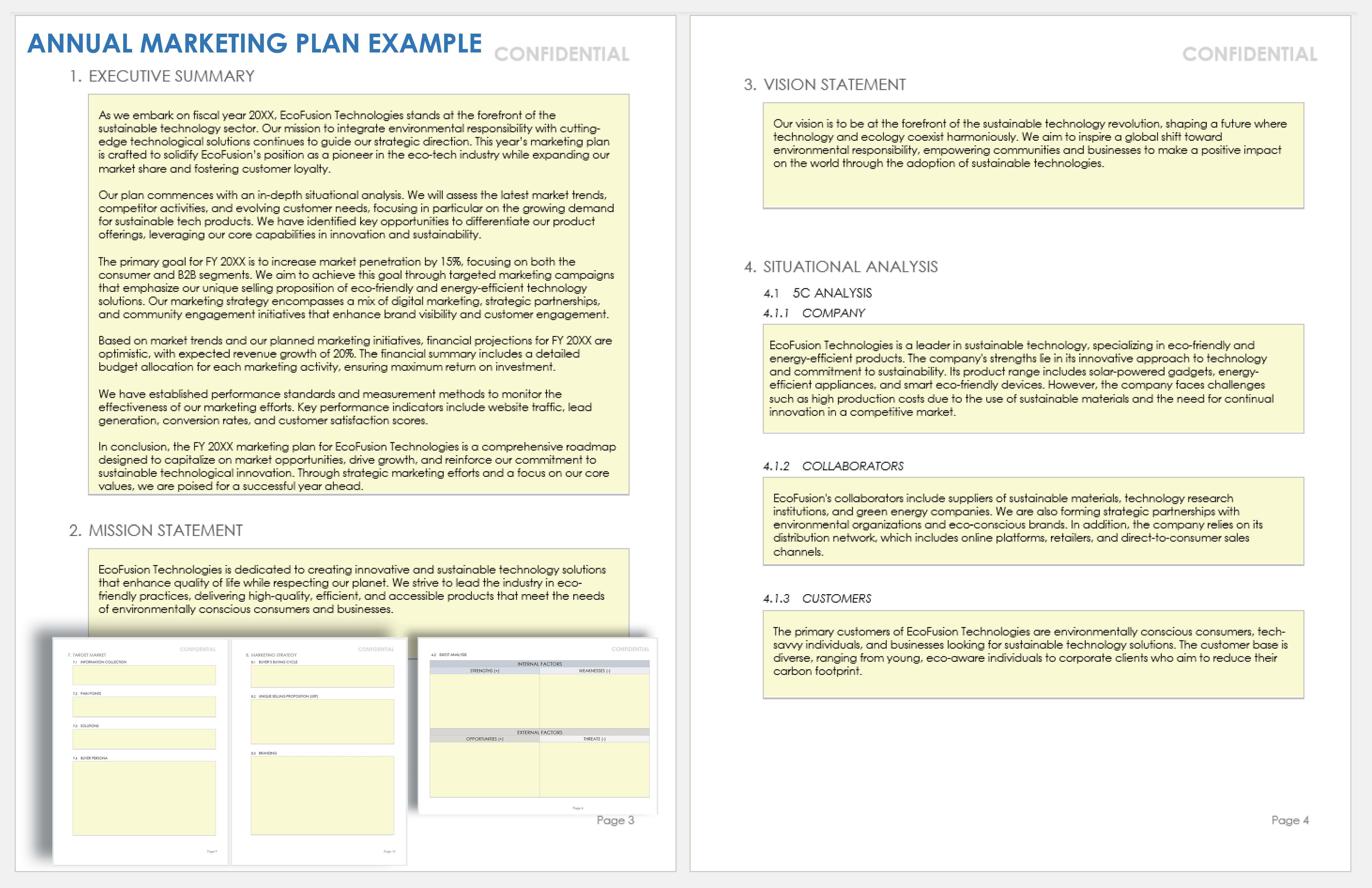

Forecasting with Pro Forma Statements

A common type of forecasting in financial accounting involves using pro forma statements . Pro forma statements focus on a business's future reports, which are highly dependent on assumptions made during preparation, such as expected market conditions.

Because the term "pro forma" refers to projections or forecasts, pro forma statements apply to any financial document, including:

- Income statements

- Balance sheets

- Cash flow statements

These statements serve both internal and external purposes. Internally, you can use them for strategic planning. Identifying future revenues and expenses can greatly impact business decisions related to hiring and budgeting. Pro forma statements can also inform endeavors by creating multiple statements and interchanging variables to conduct side-by-side comparisons of potential outcomes.

Externally, pro forma statements can demonstrate the risk of investing in a business. While this is an effective form of forecasting, investors should know that pro forma statements don't typically comply with generally accepted accounting principles (GAAP) . This is because pro forma statements don't include one-time expenses—such as equipment purchases or company relocations—which allows for greater accuracy because those expenses don't reflect a company’s ongoing operations.

7 Financial Forecasting Methods

Pro forma statements are incredibly valuable when forecasting revenue, expenses, and sales. These findings are often further supported by one of seven financial forecasting methods that determine future income and growth rates.

There are two primary categories of forecasting: quantitative and qualitative.

Quantitative Methods

When producing accurate forecasts, business leaders typically turn to quantitative forecasts , or assumptions about the future based on historical data.

1. Percent of Sales

Internal pro forma statements are often created using percent of sales forecasting . This method calculates future metrics of financial line items as a percentage of sales. For example, the cost of goods sold is likely to increase proportionally with sales; therefore, it’s logical to apply the same growth rate estimate to each.

To forecast the percent of sales, examine the percentage of each account’s historical profits related to sales. To calculate this, divide each account by its sales, assuming the numbers will remain steady. For example, if the cost of goods sold has historically been 30 percent of sales, assume that trend will continue.

2. Straight Line

The straight-line method assumes a company's historical growth rate will remain constant. Forecasting future revenue involves multiplying a company’s previous year's revenue by its growth rate. For example, if the previous year's growth rate was 12 percent, straight-line forecasting assumes it'll continue to grow by 12 percent next year.

Although straight-line forecasting is an excellent starting point, it doesn't account for market fluctuations or supply chain issues.

3. Moving Average

Moving average involves taking the average—or weighted average—of previous periods to forecast the future. This method involves more closely examining a business’s high or low demands, so it’s often beneficial for short-term forecasting. For example, you can use it to forecast next month’s sales by averaging the previous quarter.

Moving average forecasting can help estimate several metrics. While it’s most commonly applied to future stock prices, it’s also used to estimate future revenue.

To calculate a moving average, use the following formula:

A1 + A2 + A3 … / N

Formula breakdown:

A = Average for a period

N = Total number of periods

Using weighted averages to emphasize recent periods can increase the accuracy of moving average forecasts.

4. Simple Linear Regression

Simple linear regression forecasts metrics based on a relationship between two variables: dependent and independent. The dependent variable represents the forecasted amount, while the independent variable is the factor that influences the dependent variable.

The equation for simple linear regression is:

Y = Dependent variable (the forecasted number)

B = Regression line's slope

X = Independent variable

A = Y-intercept

5. Multiple Linear Regression

If two or more variables directly impact a company's performance, business leaders might turn to multiple linear regression . This allows for a more accurate forecast, as it accounts for several variables that ultimately influence performance.

To forecast using multiple linear regression, a linear relationship must exist between the dependent and independent variables. Additionally, the independent variables can’t be so closely correlated that it’s impossible to tell which impacts the dependent variable.

Qualitative Methods

When it comes to forecasting, numbers don't always tell the whole story. There are additional factors that influence performance and can't be quantified. Qualitative forecasting relies on experts’ knowledge and experience to predict performance rather than historical numerical data.

These forecasting methods are often called into question, as they're more subjective than quantitative methods. Yet, they can provide valuable insight into forecasts and account for factors that can’t be predicted using historical data.

6. Delphi Method

The Delphi method of forecasting involves consulting experts who analyze market conditions to predict a company's performance.

A facilitator reaches out to those experts with questionnaires, requesting forecasts of business performance based on their experience and knowledge. The facilitator then compiles their analyses and sends them to other experts for comments. The goal is to continue circulating them until a consensus is reached.

7. Market Research

Market research is essential for organizational planning. It helps business leaders obtain a holistic market view based on competition, fluctuating conditions, and consumer patterns. It’s also critical for startups when historical data isn’t available. New businesses can benefit from financial forecasting because it’s essential for recruiting investors and budgeting during the first few months of operation.

When conducting market research, begin with a hypothesis and determine what methods are needed. Sending out consumer surveys is an excellent way to better understand consumer behavior when you don’t have numerical data to inform decisions.

Improve Your Forecasting Skills

Financial forecasting is never a guarantee, but it’s critical for decision-making. Regardless of your business’s industry or stage, it’s important to maintain a forward-thinking mindset—learning from past patterns is an excellent way to plan for the future.

If you’re interested in further exploring financial forecasting and its role in business, consider taking an online course, such as Financial Accounting , to discover how to use it alongside other financial tools to shape your business.

Do you want to take your financial accounting skills to the next level? Consider enrolling in Financial Accounting —one of three courses comprising our Credential of Readiness (CORe) program —to learn how to use financial principles to inform business decisions. Not sure which course is right for you? Download our free flowchart .

About the Author

- Search Search Please fill out this field.

- Corporate Finance

- Financial Analysis

What Is Business Forecasting? Definition, Methods, and Model

:max_bytes(150000):strip_icc():format(webp)/andy__andrew_beattie-5bfc262946e0fb005143d642.jpg)

What Is Business Forecasting?

Business forecasting involves making informed guesses about certain business metrics, regardless of whether they reflect the specifics of a business, such as sales growth, or predictions for the economy as a whole. Financial and operational decisions are made based on economic conditions and how the future looks, albeit uncertain.

Key Takeaways:

- Forecasting is valuable to businesses so that they can make informed business decisions.

- Financial forecasts are fundamentally informed guesses, and there are risks involved in relying on past data and methods that cannot include certain variables.

- Forecasting approaches include qualitative models and quantitative models.

Understanding Business Forecasting

Companies use forecasting to help them develop business strategies. Past data is collected and analyzed so that patterns can be found. Today, big data and artificial intelligence has transformed business forecasting methods. There are several different methods by which a business forecast is made. All the methods fall into one of two overarching approaches: qualitative and quantitative .

While there might be large variations on a practical level when it comes to business forecasting, on a conceptual level, most forecasts follow the same process:

- A problem or data point is chosen. This can be something like "will people buy a high-end coffee maker?" or "what will our sales be in March next year?"

- Theoretical variables and an ideal data set are chosen. This is where the forecaster identifies the relevant variables that need to be considered and decides how to collect the data.

- Assumption time. To cut down the time and data needed to make a forecast, the forecaster makes some explicit assumptions to simplify the process.

- A model is chosen. The forecaster picks the model that fits the dataset, selected variables, and assumptions.

- Analysis. Using the model, the data is analyzed, and a forecast is made from the analysis.

- Verification. The forecast is compared to what actually happens to identify problems, tweak some variables, or, in the rare case of an accurate forecast, pat themselves on the back.

Once the analysis has been verified, it must be condensed into an appropriate format to easily convey the results to stakeholders or decision-makers. Data visualization and presentation skills are helpful here.

Types of Business Forecasting

There are two key types of models used in business forecasting—qualitative and quantitative models.

Qualitative Models

Qualitative models have typically been successful with short-term predictions, where the scope of the forecast was limited. Qualitative forecasts can be thought of as expert-driven, in that they depend on market mavens or the market as a whole to weigh in with an informed consensus.

Qualitative models can be useful in predicting the short-term success of companies, products, and services, but they have limitations due to their reliance on opinion over measurable data. Qualitative models include:

- Market research : Polling a large number of people on a specific product or service to predict how many people will buy or use it once launched.

- Delphi method : Asking field experts for general opinions and then compiling them into a forecast.

Quantitative Models

Quantitative models discount the expert factor and try to remove the human element from the analysis. These approaches are concerned solely with data and avoid the fickleness of the people underlying the numbers. These approaches also try to predict where variables such as sales, gross domestic product , housing prices, and so on, will be in the long term, measured in months or years. Quantitative models include:

- The indicator approach : The indicator approach depends on the relationship between certain indicators, for example, GDP and the unemployment rate remaining relatively unchanged over time. By following the relationships and then following leading indicators, you can estimate the performance of the lagging indicators by using the leading indicator data.

- Econometric modeling : This is a more mathematically rigorous version of the indicator approach. Instead of assuming that relationships stay the same, econometric modeling tests the internal consistency of datasets over time and the significance or strength of the relationship between datasets. Econometric modeling is applied to create custom indicators for a more targeted approach. However, econometric models are more often used in academic fields to evaluate economic policies.

- Time series methods : Time series use past data to predict future events. The difference between the time series methodologies lies in the fine details, for example, giving more recent data more weight or discounting certain outlier points. By tracking what happened in the past, the forecaster hopes to get at least a better than average view of the future. This is one of the most common types of business forecasting because it is inexpensive and no better or worse than other methods.

Criticism of Forecasting

Forecasting can be dangerous. Forecasts become a focus for companies and governments mentally limiting their range of actions by presenting the short to long-term future as pre-determined. Moreover, forecasts can easily break down due to random elements that cannot be incorporated into a model, or they can be just plain wrong from the start.

But business forecasting is vital for businesses because it allows them to plan production, financing, and other strategies. However, there are three problems with relying on forecasts:

- The data is always going to be old. Historical data is all we have to go on, and there is no guarantee that the conditions in the past will continue in the future.

- It is impossible to factor in unique or unexpected events, or externalities . Assumptions are dangerous, such as the assumption that banks were properly screening borrowers prior to the subprime meltdown . Black swan events have become more common as our reliance on forecasts has grown.

- Forecasts cannot integrate their own impact. By having forecasts, accurate or inaccurate, the actions of businesses are influenced by a factor that cannot be included as a variable. This is a conceptual knot. In a worst-case scenario, management becomes a slave to historical data and trends rather than worrying about what the business is doing now.

Negatives aside, business forecasting is here to stay. Appropriately used, forecasting allows businesses to plan ahead for their needs, raising their chances of staying competitive in the markets. That's one function of business forecasting that all investors can appreciate.

Kesh, Someswar and Raja, M.K. "Development of a Qualitative Reasoning Model for Financial Forecasting." Information Management & Computer Security, vol. 13, no. 2, 2005, pp. 167-179.

Infiniti Research. " Business Forecasting: The Challenges in Knowing the Unknown ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-699097865-5914251597ff43a1b2e59a0c3cecc660.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Financial forecast example for new businesses and startups

The financial forecast is an essential step when creating a business plan. The financial forecast allows you to anticipate the revenues and expenses of your new business over a given period.

Even if the exercise is sometimes delicate to carry out, it is nevertheless essential for any entrepreneur. Indeed, it allows you to define quantified objectives, which, if meticulously tracked, will allow you to grow your business in good conditions.

To help you, here's a financial forecast example as well as tools you can use to create yours.

Financial forecast examples for new businesses

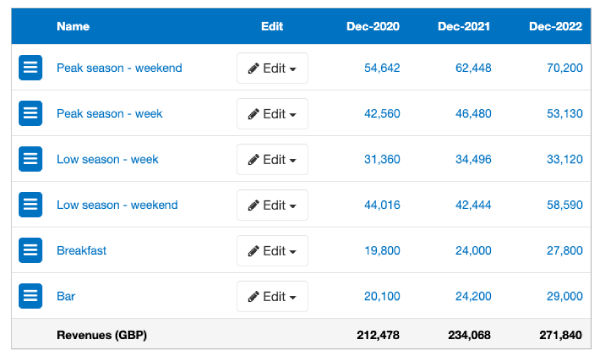

Example of a sales forecast.

The sales forecast is used to estimate the company's turnover. It is generally presented by category of products and services, types of customers, or time slots.

In our financial forecast example, we have included below a sales forecast for a hostel, organised by categories of services with the bed's occupancy forecast broken down based on seasonality:

To ensure a fair and realistic evaluation of your company's revenues, You will need to base your forecast on thorough and reliable market analysis, including an analysis of what your competition offers. You will also need to think carefully about your pricing policy and distribution strategy beforehand.

Examples of financial statements to include in your forecast

Your forecast will need to include 3 financial statements:

- The P&L statement

- The cash flow statement

- The balance sheet

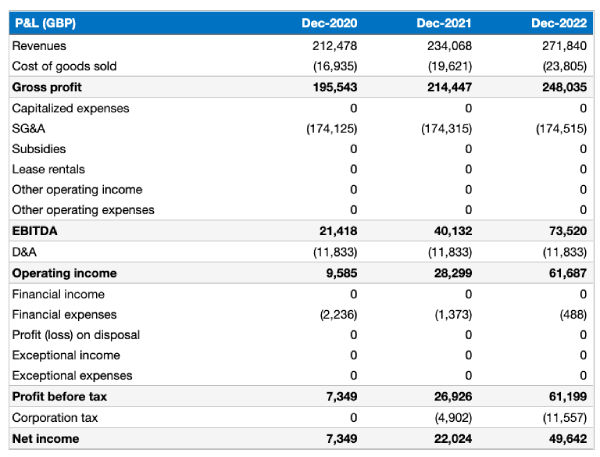

P&L statement

The profit and loss statement enables you to assess:

- the growth of the company by analyzing the evolution of the turnover over several years;

- the profitability of the company by looking at the difference between the expected revenues and the costs which will need to be incurred to generate these sales.

The main shortcoming of the projected income statement is that it does not take into account cash flows. Your profits should turn into cash at some point, but based on when your clients pay you, how much inventory you keep, or when you pay your suppliers, the cash flow could be very different from your profit.

To overcome this shortcoming, we need to look at the forecasted cash flow statement included in our financial forecast example.

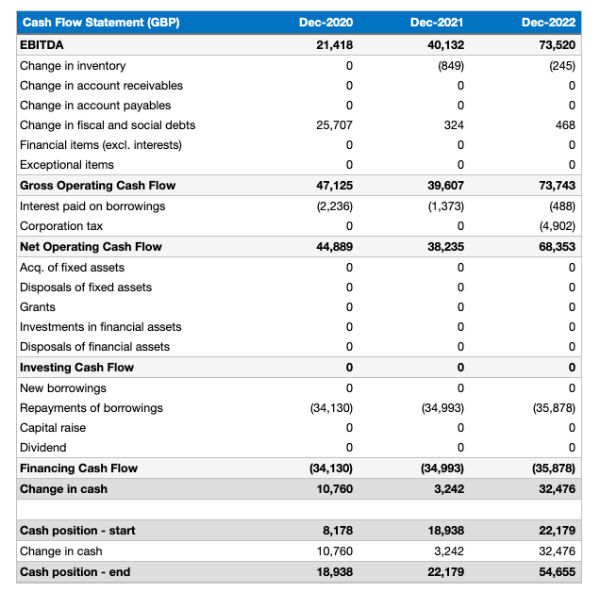

Cash flow statement

The cash flow statement shows all anticipated cash movements for a given year.

It enables you to evaluate:

- the ability to generate operating cash flow;

- the company's investment and financing policies.

The cash flow statement is highly complementary to the P&L statement. Together they provide a clear view of the company's profitability, the cash generated by the operations, the investments made and the financing flows.

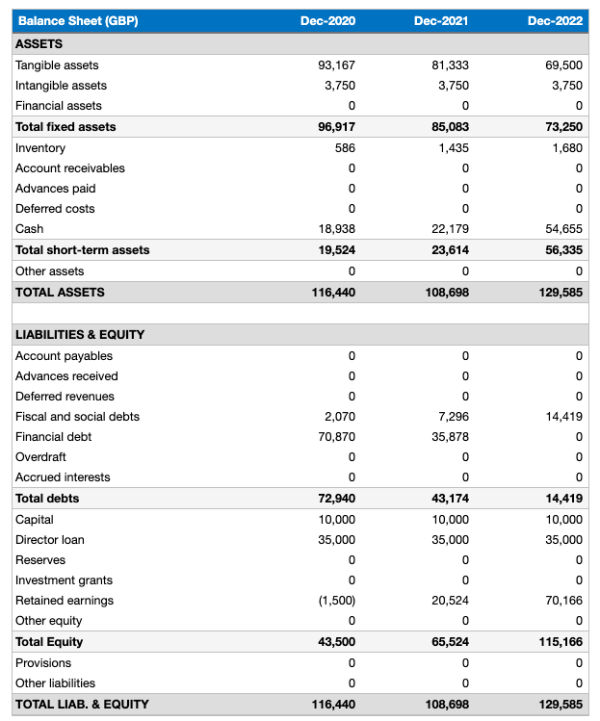

Balance sheet

The forecasted balance sheet, the last link in the chain, provides an overview of the company's net worth at a given moment in time and is part of our financial forecast example. It enables you to evaluate:

- the value of the company's assets;

- the weight of its working capital;

- the level of financial indebtedness;

- the book value of shareholders' equity.

The forecasted balance sheet complements the other two tables. Nevertheless, it has two weak points:

- It provides a snapshot of the company's net worth at a specific moment in time - giving a very static view of the company. Especially given the balance sheet is usually produced several months after the end of the financial year (and therefore the information it contains is already stale!)

- It gives an accounting vision of the company, based on historical cost, and not a financial vision, based on market value.

Where can I find other financial forecast examples?

At The Business Plan Shop, we offer an online software that includes a financial forecasting tool and helps you throughout the drafting of the business plan on top of financial forecast examples included in our business plan templates .

Using a software like ours to realize your business plan has several advantages:

- You can easily create your financial forecast by letting the software take care of the calculations and financial aspects for you.

- You are guided in the drafting process by detailed instructions and examples for each part of the plan.

- You get a professional document, formatted and ready to be sent to your bank or investors.

If you are interested in our solution, you can try our software for free here .

Our article is coming to an end. We hope that our financial forecast example has given you a better understanding of what this exercise is all about.

The forecast is a crucial element of a business plan that will be of particular interest to your financial partners if you are looking for financing; but don't forget that it is also a mean for you, as an entrepreneur, to evaluate the viability of your new business idea.

Also on The Business Plan Shop

- How to do financial projections for a new business?

- How to establish a Profit & Loss forecast in your business plan?

- How to do a financial forecast for a restaurant?

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

Financial projections are forecasted analyses of your business’ future that include income statements, balance sheets and cash flow statements. We have found them to be an crucial part of your business plan for the following reasons:

- They can help prove or disprove the viability of your business idea. For example, if your initial projections show your company will never make a sizable profit, your venture might not be feasible. Or, in such a case, you might figure out ways to raise prices, enter new markets, or streamline operations to make it profitable.

- Financial projections give investors and lenders an idea of how well your business is likely to do in the future. They can give lenders the confidence that you’ll be able to comfortably repay their loan with interest. And for equity investors, your projections can give them faith that you’ll earn them a solid return on investment. In both cases, your projections can help you secure the funding you need to launch or grow your business.

- Financial projections help you track your progress over time and ensure your business is on track to meet its goals. For example, if your financial projections show you should generate $500,000 in sales during the year, but you are not on track to accomplish that, you’ll know you need to take corrective action to achieve your goal.

Below you’ll learn more about the key components of financial projections and how to complete and include them in your business plan.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

Sample Income Statement

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

How to write a sales forecast for a business plan

Table of Contents

What is a sales forecast?

Why do you need a sales forecast, how do you write a sales forecast, top-down or bottom-up, writing your sales forecast, calculating a sales forecast, how can countingup help manage your forecasting.

Sales forecasts are an important part of your business plan . If done correctly, they can give accurate projections of your business’ cash flow, and let you better prepare for the year ahead. They can also make it easier to find the right investors . While it’s easier for existing businesses with plenty of data, you can still calculate a sales forecast for a new business .

In this guide, we’ll explore:

- How can you manage your forecasting?

A sales forecast is a prediction of your business’ future revenue. In order to be an accurate prediction, the forecast is based on previous sales, current economic trends, and industry performance. Having a sales forecast is a useful tool, because it gives you a better idea of how to manage your business.

Having a sales forecast is like using the past to have a peek into the future of your company. It might not be 100% accurate, but it can help you plan any future spending, or prevent any cash flow issues from occurring.

You can also use your sales forecast to monitor your business’ progress. For instance, if your business regularly performs better than your forecast, it could be a sign that your business is continuing to grow. On the other hand, if your actual sales are frequently less than expected, this could be a sign that your business is struggling and needs adjustment.

It’s important to remember that any projections you make aren’t guaranteed, there can be advantages and disadvantages of financial forecasting .

Now we’ve run through why having a sales forecast can help you run your business, let’s look at how to write one.

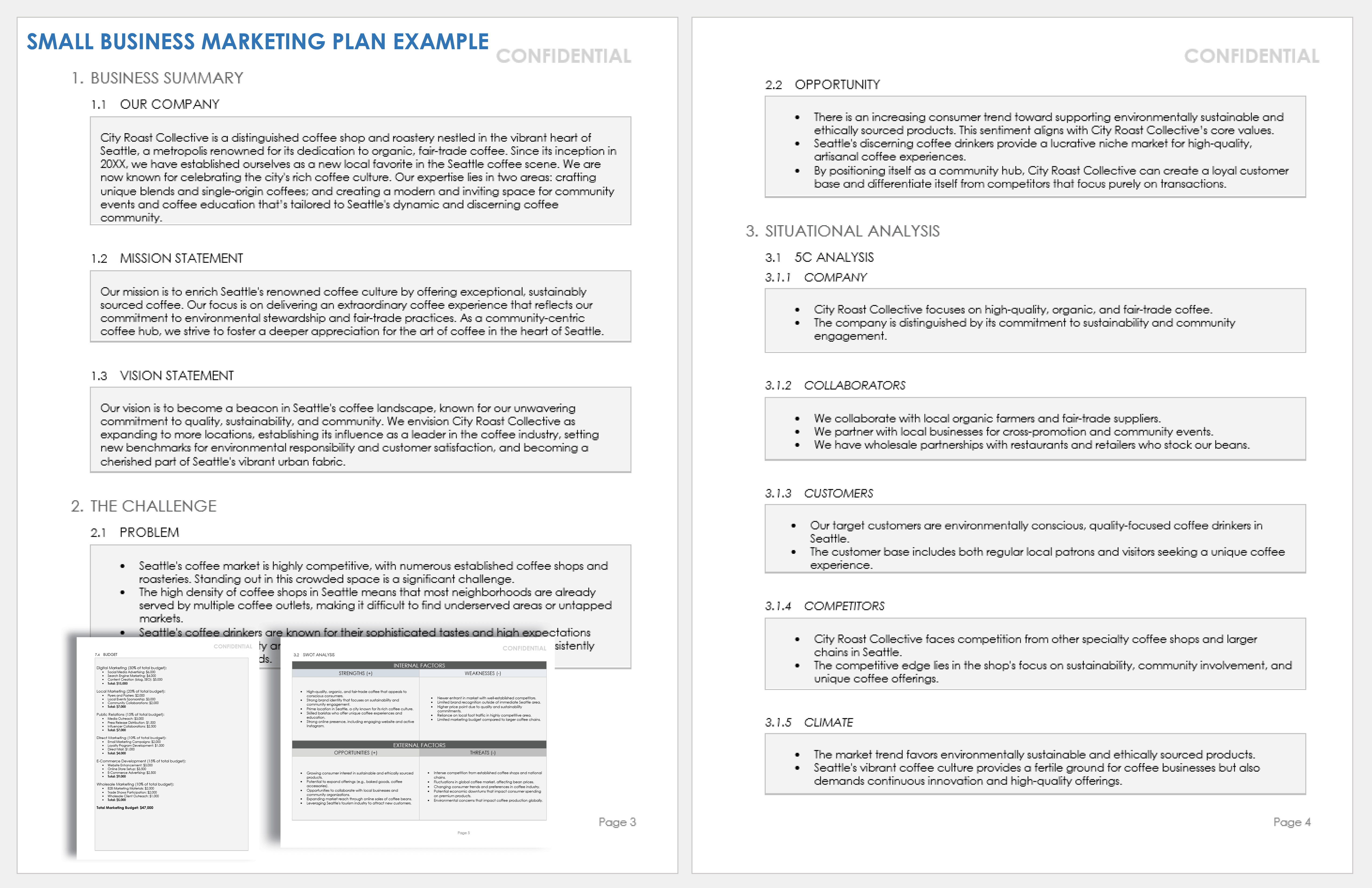

While there are two types of sales forecasting (top-down and bottom-up), one is a lot more accurate for small businesses than the other. A top-down forecast looks at the market as a whole and attributes a portion of the market to your business.

A top-down approach may work for large businesses that already own a significant chunk of the market. When forecasting for a small business, it’s easy to overestimate your market share. For example, a 1% market share may not seem like a lot, but a small restaurant owning 1% of the £89.5 billion UK market is extremely unrealistic.

The alternative to top-down is bottom-up. A bottom-up sales forecast starts with existing company data (like customer or product information) and works up to revenue. Since this starts with the company, it’s easier to

Your sales forecast is ultimately a prediction of your revenue over a set period. It considers the amount you think you’ll sell, and the cost of those sales. We’ve included how to calculate a sales forecast below.

A sales forecast consists of three separate values: revenue, cost of goods sold, and gross profit. For estimating values in the calculations below, it’s best to use any existing business data to be as accurate as possible.

To calculate your predicted revenue:

- Make a list of your available goods and services

- Note the price of each of your goods and services

- Estimate the expected sales of each good or service

- Multiply the price by the estimated sales to get your estimated revenue

- Add them all together to get your total revenue

For example, if your food truck business sold pizzas at £10 and burgers at £5, you would multiply these values by how much you expected to sell. For calculating a weekly sales forecast, you might estimate selling 60 pizzas and 80 burgers. Your predicted revenue for that week would be £600 for pizzas and £400 for burgers — giving £1,000 total.

In order to figure out how much profit you’ll make, you also need to calculate your costs for those predicted sales. To calculate your predicted costs:

- Figure out how much each good or service will cost per unit

- Multiply each cost by the projected sales

Using the same example as above, assume a single pizza cost £3.50 to make and a burger cost £2. Using the estimated sales, the total cost for your pizzas (3.5 x 60) would be £210, and £160 for your burgers (2 x 80). Combining these two figures gives you a total cost of £370.

The last step is to work out your gross profit , and it’s a relatively simple calculation.

- Subtract the total predicted cost from your total predicted revenue

Continuing with the example above, your revenue (£1,000) minus your costs (£370), leaves you with a projected gross profit of £630 for the week. Using this estimate, you can then plan how much working capital your business should have access to. It’s important to remember that these are only estimates, and your actual values can be higher or lower than your forecast.

If you want your forecasts to be as accurate as possible, you need to refer to all of your business’ financial data. Since collecting and collating this data can be challenging, you may want to use financial management software like the Countingup app.

When trying to calculate your sales forecasts, having an up-to-date log of your current sales can be hugely beneficial. By combining a business current account with accounting software, Countingup is the only software that provides real-time cash flow tracking.

The Countingup app also provides business owners with access to automatically generated profit and loss statements. These can prove invaluable when trying to stay aware of all your business’ costs.

Start your three-month free trial today. Find out more here .

- Counting Up on Facebook

- Counting Up on Twitter

- Counting Up on LinkedIn

Related Resources

Business insurance from superscript.

We’re partnered with insurance experts, Superscript to provide you with small business insurance.

How to register a company in the UK

There are over five million companies registered in the UK and 500,000 new

How to set up a TikTok shop (2024)

TikTok can be an excellent platform for growing a business, big or small.

Best Side Hustle Ideas To Make Extra Money In 2024 (UK Edition)

Looking to start a new career? Or maybe you’re looking to embrace your

How to throw a launch party for a new business

So your business is all set up, what next? A launch party can

10 key tips to starting a business in the UK

10 things you need to know before starting a business in the UK

How to set up your business: Sole trader or limited company

If you’ve just started a business, you’ll likely be faced with the early

How to register as a sole trader

Running a small business and considering whether to register as a sole trader?

How to open a Barclays business account

When starting a new business, one of the first things you need to

6 examples of objectives for a small business plan

Your new company’s business plan is a crucial part of your success, as

How to start a successful business during a recession

Starting a business during a recession may sound like madness, but some big

What is a mission statement (and how to write one)

When starting a small business, you’ll need a plan to get things up

Planning, Startups, Stories

Tim berry on business planning, starting and growing your business, and having a life in the meantime., standard business plan financials: how to forecast sales.

Real Goals of Sales Forecast

Your sales forecast won’t accurately predict the future. We know that from the start. What you want is to understand the sales drivers and interdependencies, to connect the dots, so that as you review plan vs. actual results every month, you can easily make course corrections.

Sure, people shy from doing forecasts, because it can feel like real numbers and you can think only the numbers people can do it. Don’t believe that. You don’t have to have an MBA degree or be a CPA. You don’t need sophisticated financial models or spreadsheets. I was a vice president of a market research firm for several years, doing expensive forecasts, and I saw many times that there’s nothing better than the educated guess of somebody who knows the business well. All those sophisticated techniques depend on data from the past. And the past, by itself, isn’t the best predictor of the future. You are. So let’s look at how to forecast sales, step by step.

If you think sales forecasting is hard, try running a business without a forecast. That’s much harder. Your sales forecast is also the backbone of your business plan. People measure a business and its growth by sales, and your sales forecast sets the standard for expenses, profits and growth. The sales forecast is almost always going to be the first set of numbers you’ll track for plan vs. actual use, even if you do no other numbers.

If nothing else, just forecast your sales, track plan vs. actual results, and make corrections; that’s already business planning.

Match Your Forecast to Your Accounting

It should be obvious: Make sure the way you organize the sales forecast in rows or items or groups matches the way your accounting (or bookkeeping) tracks them.

Match your chart of accounts, which is what accountants call your list of items that show up in your financial statements.

If the accounting divides sales into meals, drinks, and other, then the business plan should divide sales into meals, drinks, and other. So if your chart of accounts divides sales by product or service groups, keep those groups intact in your sales forecast. If bookkeeping tracks sales by product, don’t forecast your sales by channel instead.

If you’re planning for a startup business, coordinate the bookkeeping categories with the forecasting categories.

Get your last Income Statement (also called Profit & Loss) and keep it in view while you develop your future projections.

If you don’t have more than 20 or so each rows of sales, costs, and expenses, then make the rows in the projected statement match the rows in the accounting.

If your accounting summarizes categories for you – most systems do – consider using the summary categories in your business plan. Accounting needs detail, while planning needs a summary.

If your categories in the projections don’t match the accounting output, you’re not going to be able to track plan vs. actual well. It will take retyping and recalculating. And you’ll lose the most valuable business benefit of business planning: management, steering your company.

The math is simple

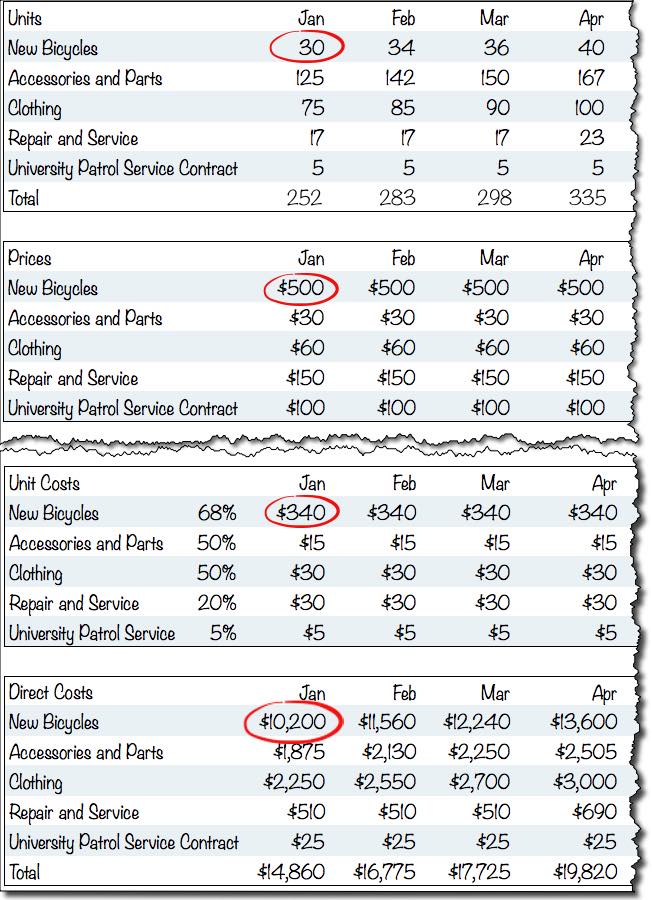

Normally your sales forecast will group sales into a few manageable rows of sales and show projected units, prices, and sales monthly for the next 12 months and annually for the second and third years in the future. Here’s a quick example from a bicycle retailer named Garrett (with columns for April-November hidden on purpose, to make viewing easier):

If you’re a LivePlan customer, don’t worry about this spreadsheet view, which is generic. LivePlan will guide you through the sales forecast assumptions and do the calculations automatically. For the generic spreadsheet option, shown here, you multiply units times prices to calculate sales. For example, unit sales of 36 new bicycles in March multiplied by $500 average revenue per bicycle means an estimated $18,000 of sales for new bicycles for that month.

Total Unit Sales is the sum of the projected units for each of the five categories of sales.

Total Sales is the sum of the projected sales for each of the five categories of sales.

Calculate Year 1 totals from the 12 month columns. Units and sales are sums of the 12 columns, and price is the average, calculated by dividing sales by units.

The numbers for Year 2 and Year 3 are just single columns; unless you have a special case, projecting monthly results for two and three years hence is overkill. It’s a problem of diminishing returns; you don’t get enough value to justify the time it takes. Other experts will disagree, by the way; and there may be special cases in which extended monthly projections are worth the effort.

Estimate Direct Costs

A normal sales forecast includes units, price per unit, sales, direct cost per unit, and direct costs. Direct costs are also called COGS, cost of goods sold, and unit costs.

COGS stands for Cost of Goods Sold, and applies to businesses that sell goods. COGS for a manufacturer include raw materials and labor costs to manufacture or assemble finished goods. COGS for a bookstore include what the storeowner pays to buy books. COGS for Garrett are what he paid for the bicycles, accessories, and clothing he sold during the month. Direct costs are the same thing for a service business, the direct cost of delivering the service. So, for example, it’s the gasoline and maintenance costs of a taxi ride.

Direct costs are specific to the business. The direct costs of a bookstore are its COGS, what it pays to buy books from a distributor. The distributor’s direct costs are COGS, what it paid to get the books from the publishers. The direct costs of the book publisher include the cost of printing, binding, shipping, and author royalties. The direct costs of the author are very small, probably just printer paper and photocopying; unless the author is paying an editor, in which case what the editor was paid is part of the author’s direct costs.

The costs of manufacturing and assembly labor are always supposed to be included in COGS. And some professional service businesses will include the salaries of their professionals as direct costs. In that case, the accounting firm, law office, or consulting company records the salaries of some of their associates as direct costs.

The illustration below shows how Garrett uses estimated margins to project the direct costs for his bicycle store. For the highlighted estimates, the direct entry for bicycles unit cost is the product of multiplying the price by 68 percent. The total direct costs for bicycles in January are the result of multiplying 30 units by $340 per unit. And here again, LivePlan users don’t need to do these calculations; your software does it automatically.

Some Quick Notes About Standards

Timing matters.

Standard accounting and financial analysis have rules about sales and direct costs and timing. A sale is when the ownership of the goods changes hands, or the service is performed. That seems simple enough but what happens sometimes is people confuse promises with sales. In the bike store example, if a customer tells Garrett in May that he is definitely going to buy 5 bicycles in July, that transaction should not be part of sales for May. Garrett should put those 5 bicycles into his July forecast and then they will actually be recorded as sales in the bookkeeping actual sales in July when the transaction takes place. In a service business, when a client promises in November to start a monthly service in January, that is not a November sale.

Direct costs also happen when the goods change hands. Technically, according to accounting standards (called accrual accounting), when Garrett the bike storeowner buys a bicycle he wants to sell, the money he spent on it remains in inventory until he sells it. It goes from inventory to direct costs for the income statement in the month in which it was sold. If it is never sold, it never affects profit or loss, and remains an asset until some day when the accountants write off old never-sold obsolete inventory, at which time its lowered value becomes an expense. In that case it was never a direct cost.

Most of this has to do with proper accounting. My standard business plan financials series includes What’s Accrual Accounting and Why Do You Care , which is directly related. When in doubt, please read that one.

Gross Margin

The distinction isn’t always obvious. For example, manufacturing and assembly labor are supposed to be included in direct costs, but factory workers are paid sometimes when there is no job to work on. And some professional firms put lawyers’ accountants’ or consultants’ salaries into direct costs. These are judgment calls. When I was a young associate in a brand-name management consulting firm, I had to assign all of my 40 hour work week to specific consulting jobs for cost accounting.

Garrett can easily calculate the gross margin he’s projecting with his sales forecast. The illustration below shows his simple calculation of gross margin using his sales and direct costs.

How do I know what numbers to use?

But how do you know what numbers to put into your sales forecast? The math may be simple, yes, but this is predicting the future; and humans don’t do that well. Don’t try to guess the future accurately for months in advance. Instead, aim for making clear assumptions and understanding what drives sales, such as web traffic and conversions, in one example, or the direct sales pipeline and leads, in another. And you review results every month, and revise your forecast. Your educated guesses become more accurate over time.

Use experience and past results

- Experience in the field is a huge advantage . In the example above, Garrett the bike storeowner has ample experience with past sales. He doesn’t know accounting or technical forecasting, but he knows his bicycle store and the bicycle business. He’s aware of changes in the market, and his own store’s promotions, and other factors that business owners know. He’s comfortable making educated guesses. In another example that follows, the café startup entrepreneur makes guesses based on her experience as an employee.

- Use past results as a guide . Use results from the recent past if your business has them. Start a forecast by putting last year’s numbers into next year’s forecast, and then focus on what might be different this year from next. Do you have new opportunities that will make sales grow? New marketing activities, promotions? Then increase the forecast. New competition, and new problems? Nobody wants to forecast decreasing sales, but if that’s likely, you need to deal with it by cutting costs or changing your focus.

- Start with your best guess , and follow up. Update your forecast each month. Compare the actual results to the forecast. You will get better at forecasting. Your business will teach you.

How to Forecast a New Business or New Product

What? You say you can’t forecast because your business or product is new? Join the club. Lots of people start new businesses, or new groups or divisions or products or territories within existing businesses, and can’t turn to existing data to forecast the future.

Think of the weather experts doing a 10-day forecast. Of course they don’t know the future, but they have some relevant information and they have some experience in the field. They look at weather drivers such as high and low pressure areas, wind directions, cloud formations, storms gathering elsewhere. They consider past experience, so they know how these same factors have generally behaved in the past. And they make educated guesses. When they project a high of 85 and low of 55 tomorrow, those are educated guesses.

You do the same thing with your new business or new product forecast that the experts do with the weather. You can get what data is available on factors that drive your sales, equivalent to air pressure and wind speeds and cloud formations. For example:

- To forecast sales for a new restaurant first draw a map of tables and chairs and then estimate how many meals per mealtime at capacity, and in the beginning. It’s not a random number; it’s a matter of how many people come in. So a restaurant that seats 36 people at a time might assume it can sell a maximum of 50 lunches when it is absolutely jammed, with some people eating early and some late for their lunch hours. And maybe that’s just 20 lunches per day the first month, then 25 the second month, and so on. Apply some reasonable assumption to a month, and you have some idea.

- To forecast sales for a new mobile app, you might get data from the Apple and Android mobile app stores about average downloads for different apps. And a good web search might reveal some anecdotal evidence, blog posts and news stories perhaps, about the ramp-up of existing apps that were successful. Get those numbers and think about how your case might be different. And maybe you drive downloads with a website, so you can predict traffic on your website from past experience and then assume a percentage of web visitors who will download the app.

- So you take the information related to what I’m calling sales drivers, and apply common sense to it, human judgment, and then make your educated guesses. As more information becomes available — like the first month’s sales, for example – you add that into the mix, and revise or not, depending on how well it matches your expectations. It’s not a one-time forecast that you have to live with as the months go by. It’s all part of the lean planning process.

Sales forecast depends on product/service and marketing

Never think of your sales forecast in a vacuum. It flows from the strategic action plans with their assumptions, milestones and metrics. Your marketing milestones affect your sales. Your business offering milestones affect your sales. When you change milestones — and you will, because all business plans change — you should change your sales forecast to match.

Thank you for this great informations I really learn a lot. Thanks

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Sales | Templates

9 Free Sales Forecast Template Options for Small Business

Published March 7, 2023

Published Mar 7, 2023

REVIEWED BY: Jess Pingrey

WRITTEN BY: Jillian Ilao

This article is part of a larger series on Sales Management .

- 1 Simple Sales Forecast Template

- 2 Long-term Sales Forecast Template

- 3 Budget Sales Forecast Template

- 4 Month-to-month Sales Forecast Template

- 5 Individual Product Sales Forecast Template

- 6 Multi-product Sales Forecast Template

- 7 Retail Sales Forecast Template

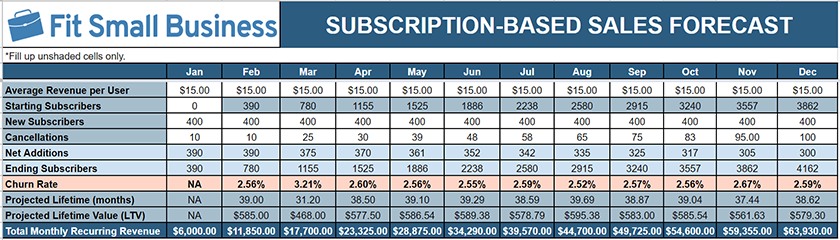

- 8 Subscription-based Sales Forecast Template

- 9 B2B Lead Sales Forecast Template

- 10 CRMs with Built-in Sales Forecasting

- 11 Frequently Asked Questions (FAQ)

- 12 Bottom Line

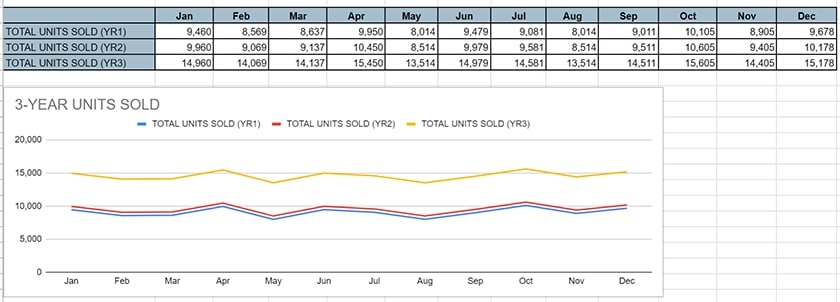

Using a sales forecast, business owners can create realistic projections about incoming revenue and business performance based on their current data and how they have performed in the past. Sales forecasts may cover weekly, monthly, annual, and multi-annual projections, and can be done using Google Sheets or Excel templates, as well as through customer relationship management (CRM) software.

We’ve compiled nine free sales projection templates you can download. Each downloadable file contains an example forecast you can use as a reference. We also included a blank template you can copy and fill in with your own sales data.

Did you know? Sales forecasts create projections you can use for things like goal setting, performance measurement, budgeting, projecting growth, obtaining financing, and attracting investors. This is why it is important to use software tools or a CRM system that gives you realistic, data-driven forecasts.

1. Simple Sales Forecast Template

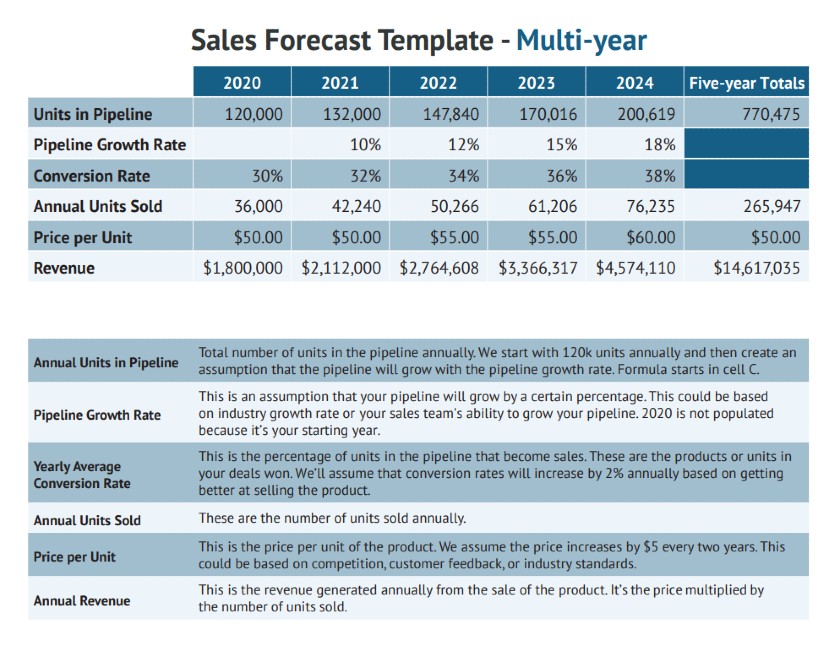

Our free simple sales forecast template will help you get started with sales estimates to plan and grow your business. You can modify this multi-year projection sheet in either Google Sheets or Excel. It can also generate future revenue estimates based on units sold, pipeline growth percentages, lead conversion rates, and your product pricing. This gives you an idea of how much your business can grow sales-wise in the next few years.

Sales projection template for multiple years

FILE TO DOWNLOAD OR INTEGRATE

FREE Sales Forecasting Template - One-Year

Thank you for downloading!

FREE Sales Forecasting Template - Multi-Year

2. Long-term Sales Projection Forecast

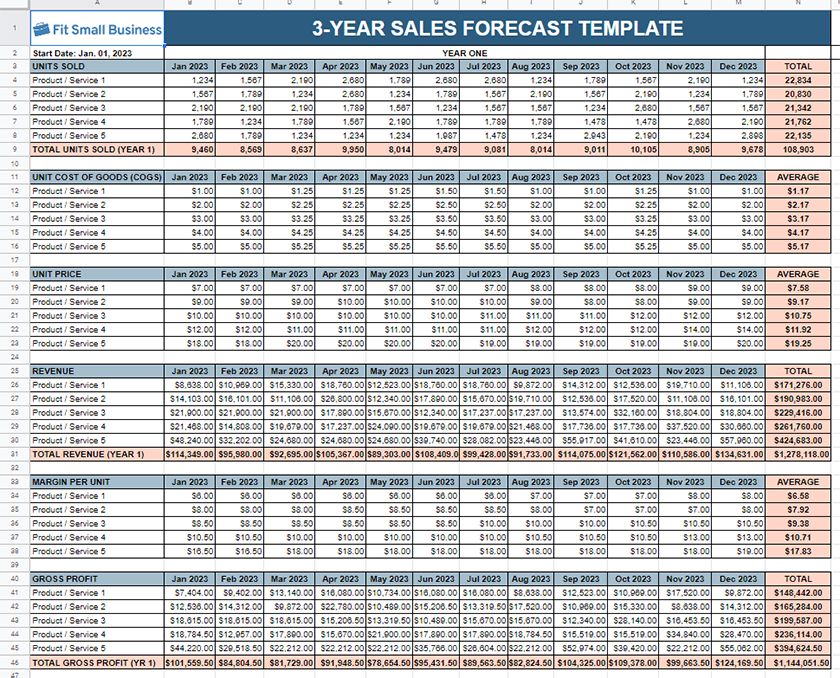

Part of creating a sales plan is forecasting long-term revenue goals and sales projections, then laying out the strategies and tactics you’ll use to hit your performance goals. Long-term sales projection templates usually provide three- to five-year projections. These templates are accessible in both Excel and Google Sheets.

Long-term sales prediction templates are best for businesses looking to scale and want insights about how much working capital they can expect to be able to tap into for growth initiatives. This type of sales projection template is also often required when applying for commercial loans or through other channels such as outside investors or crowdfunding.

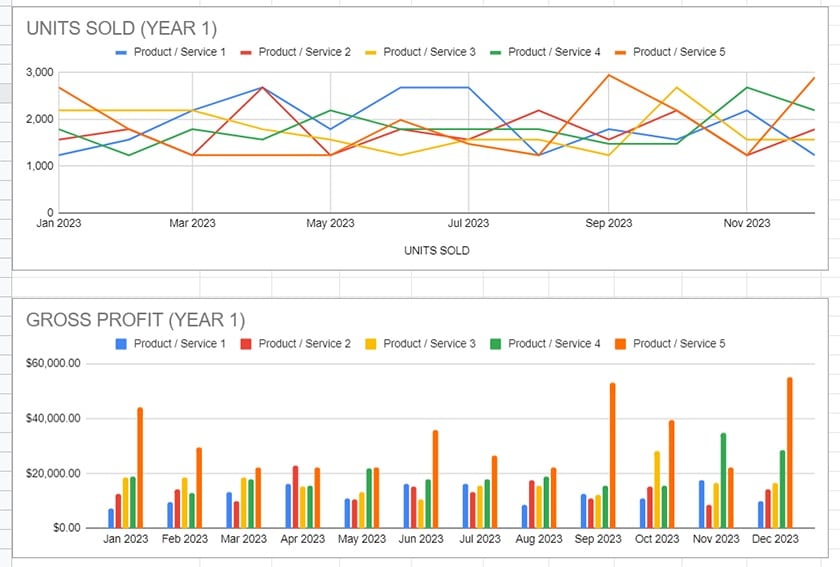

Three-year forecast template

Projection of units sold and gross profit from a three-year forecast template

Three-year projection of units sold

FREE 3-Year Forecast Template

FREE 5-Year Forecast Template

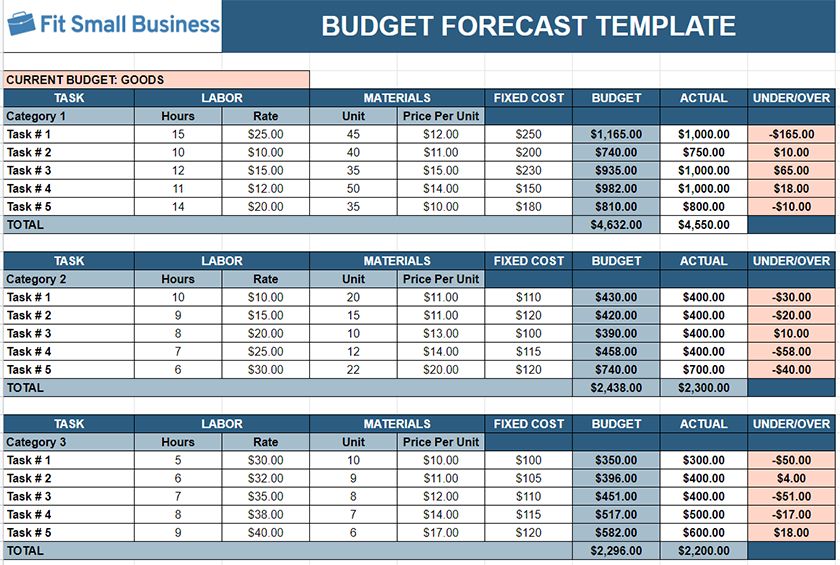

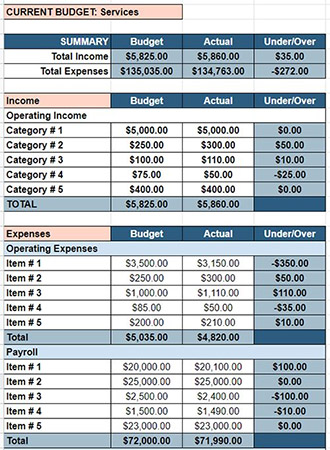

3. Budget Sales Projection Template

A budget sales forecast template shows expense estimates in relation to revenue, allowing you to calculate how much you can spend during a specified period. Budget templates will enable you to enter income projections and available cash to indicate your spending capabilities for that time frame.

This type of template is best for new and growing businesses trying to figure out their future available expenditures. Additionally, businesses interested in making a large asset purchase, such as a company vehicle, piece of equipment, or commercial real estate, can use this template to see how much of the asset can be self-financed.

Budget forecast template example

Budget forecast template for services example

FREE Budget Sales Forecast Template

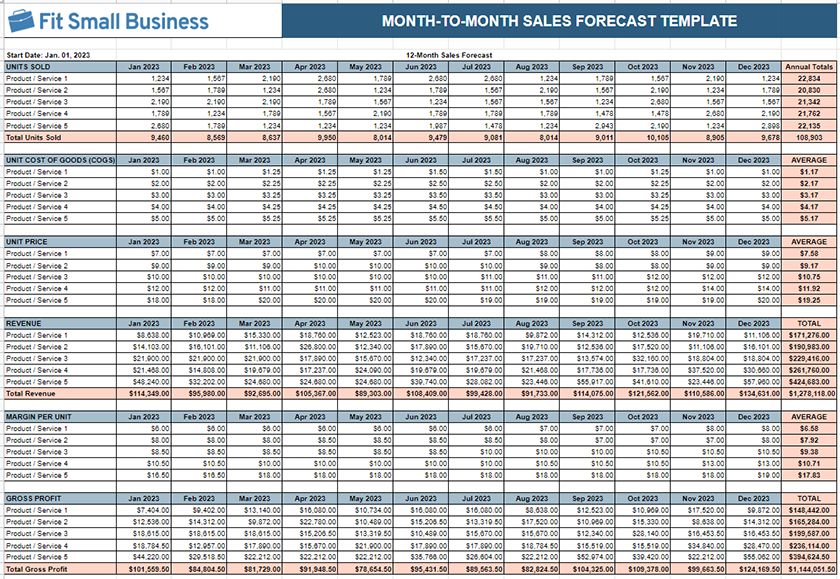

4. Month-to-Month Sales Forecast Template

The month-to-month (or monthly) sales projection template shows sales projections for a year divided into monthly increments. This type of revenue forecast template makes it easier to estimate your incoming revenue. This is because you can break down your pricing model, such as the average number of units sold, on a monthly rather than an annual basis.

This monthly sales projection example is best for seasonal businesses that experience significant revenue fluctuations in some months compared to others. It’s also appropriate for businesses that want to view rolling 12-month projections as a key performance indicator (KPI). You can also use it to project one-year sales estimates before implementing major campaigns or initiatives, such as a growth strategy.

Month-to-month forecast template example

FREE Month-to-Month Forecast Template

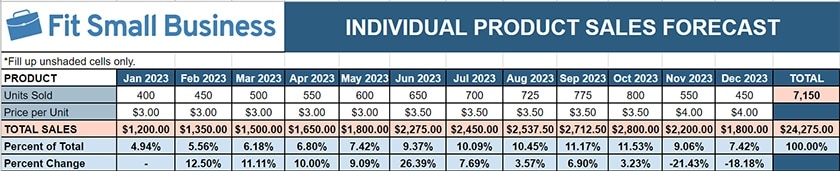

5. Individual Product Sales Forecast Template

An individual product sales projection template can be used by businesses that sell one product or service or for projecting sales of a new (or any single) product or service. This forecast indicates how you expect the product to perform based on units sold and the price per unit monthly.

An individual product forecast template benefits businesses that sell products through a storefront or ecommerce medium. It helps businesses that are adding a new product to their arsenal in estimating sales exclusively for that product. It is also recommended for companies that need to track individual performance for the most popular or profitable products.

Individual product forecast template example

FREE Individual Product Forecast Template

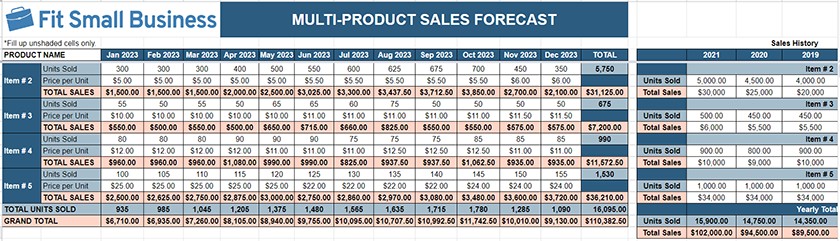

6. Multi-product Sales Forecast Template

Use this revenue projection template to generate sales projections if your business sells multiple products. Through this type of template, you can compare the estimated performance of specific products by tracking the units sold and the price per unit. In turn, this will yield a total sales revenue estimate.

The multi-product forecasting template is best for retail or wholesale businesses selling various products. You can also use it to project the revenue of multiple product categories. Here, each “item” represents a category rather than an individual product, and the price per unit is calculated in aggregate.

Multi-product sales forecast template example

FREE Multi-product Forecast Template

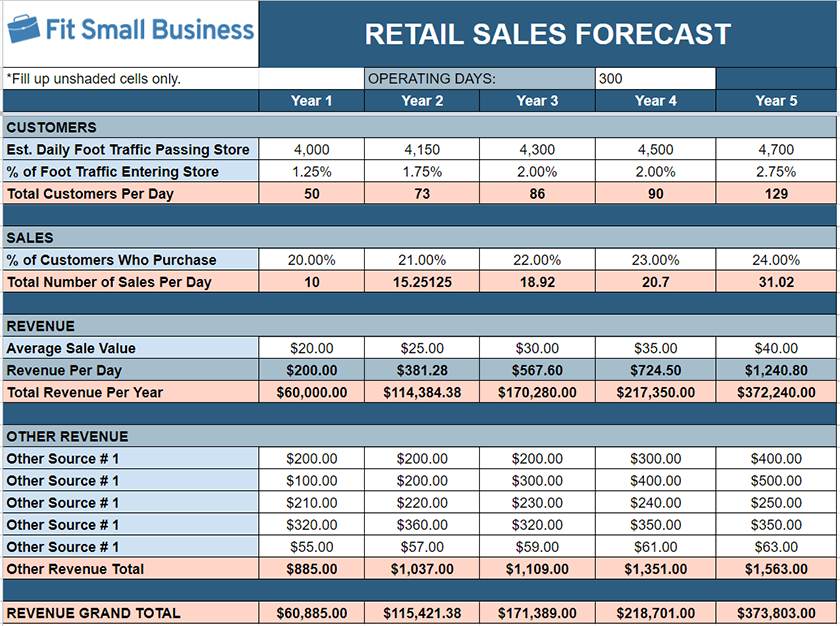

7. Retail Sales Forecast Template