Get expert advice delivered straight to your inbox.

How to Create a Basic Business Budget

8 Min Read | May 16, 2024

You’d never intentionally set your business up to fail, right? But if you don’t know your numbers and how to make a business budget, that’s exactly what you’re doing. Money problems and bad accounting are two reasons why many small businesses don’t make it past their first five years. 1

Talking about budgets can feel overwhelming. We get it. For a lot of business leaders, it’s a lot more comfortable dreaming up big ideas and getting stuff done than digging into numbers. But you can’t set yourself up for steady growth until you have a handle on the money flowing in and out of your company. You also can’t enjoy financial peace in your business.

Not a numbers person? That’s okay. Follow the simple steps below to learn how to create a budget for a business and manage your finances with confidence. We’ll even give you a link to an easy-to-use small-business budget template in the EntreLeader’s Guide to Business Finances .

But before we get to that, let’s unpack what a budget is and why you need one.

Don't Let Your Numbers Intimidate You

With the EntreLeader’s Guide to Business Finances, you can grow your profits without debt—even if numbers aren’t your thing. Plus, get a free business budget template as part of the guide!

What Is a Business Budget?

A business budget is a plan for how you’ll use the money your business generates every month, quarter and year. It’s like looking through a windshield to see the expenses, revenue and profit coming down the road. Your business budget helps you decide what to do with business profit, when and where to cut spending and grow revenue, and how to invest for growth when the time comes. Leadership expert John Maxwell sums it up: “A budget is telling your money where to go instead of wondering where it went.”

But here’s what a business budget is not: a profit and loss (P&L) report you read at the end of the month. Your P&L is like a rearview mirror—it lets you look backward at what’s already happened. Your P&L statement and budget are meant to work together so you can see your financial problems and opportunities and use those findings to forecast your future, set educated goals, and stay on track.

Why Do I Need to Budget for My Business?

Creating a budget should be your very first accounting task because your business won’t survive without it. Sound dramatic? Check this out: There are 33.2 million small businesses in the United States. Out of the small businesses that opened from 1994 to 2020, 67.7% survived at least two years. But less than half survived past five years. 2 The top reasons these businesses went under? They hit a wall with cash-flow problems, faced pricing and cost issues, and failed to plan strategically . 3

As a business owner, one of the worst feelings in the world is wondering whether you’ll be able to make payroll and keep your doors open. That’s why we can’t say it enough: Make a business budget to stay more in control and have more financial peace in running your business.

A budget won’t help you earn more money, but it will help you:

- Maximize the money you’ve got

- Manage your cash flow

- Spend less than your business earns

- Stay on top of tax payments and other bills

- Know if you’re hitting your numbers so you can move at the true speed of cash

How to Create a Budget for a Business

Your ultimate goal is to create a 12–18-month business budget—and you will get there! But start by building out your first month. Don’t even worry about using a fancy accounting program yet. Good ol’ pen and paper or a simple computer document is fine. Just start! Plus, setting up a monthly budget could become a keystone habit that helps kick-start other smart business habits.

Here’s how to create your first budget for business:

1. Write down your revenue streams.

Your revenue is the money you earn in exchange for your products or services. You’ll start your small- business budget by listing all the ways you make money. Look at last month’s P&L—or even just your checking account statement—to help you account for all your revenue streams. You’re not filling in numbers yet. Just list what brings in revenue.

For example, if you run an HVAC business, your revenue streams could be:

- Maintenance service calls

- Repair services and sales

- New unit installation

- Insulation installation

- Air duct cleaning

2. Write down the cost of goods sold (if you have them).

Cost of goods is also called inventory. These expenses are directly related to producing your product or service. In the HVAC example, your cost of goods would be the price you pay for each furnace and air conditioning unit you sell and install. It could also include the cost of thermostats, insulation and new ductwork.

3. List your expense categories.

It’s crazy how much money can slip through the cracks when we’re not careful about putting it in the budget. Think through all your business expenses—down to the last shoe cover your technicians wear to protect your customers’ flooring during house calls. Here’s a list of common business budget categories for expenses to get you started:

- Office supplies and equipment

- Technology services

- Training and education

Related articles : Product Launch: 10 Questions to Ask Before You Launch a New Product New Product Launch: Your 10-Step Checklist

4. Fill in your own numbers.

Now that you have a solid list of revenue and expense categories, plug in your real (or projected) numbers associated with them. It’s okay if you’re not sure how much you’ll sell just yet or exactly how much you’ll spend. Make an educated guess if you’re just starting out. If your business has been earning money for a while, use past P&L statements to guide what you expect to bring in. Your first budget is about combining thoughtful guesswork with history and then getting a more realistic picture month over month.

5. Calculate your expected profit (or loss).

Now, number nerds and number haters alike—buckle in. We’re about to do some basic accounting so you know whether you have a profit or loss. This is your chance to figure out exactly how much you’re spending and making in your business.

Take your gross revenue (the total amount of money you expect to make this month) and subtract your expenses and cost of goods sold to find your profit or loss. Here’s what that calculation looks like:

Revenue - Expenses - Cost of Goods Sold = Profit or Loss

Don’t freak out if your first budget shows a loss. That actually happens a lot with your first few monthly budgets. You’re learning and getting context on what’s coming in and going out so you can make adjustments. Keep doing your budget, and before you know it, you’ll be a rock star at telling your money where to go, planning for emergencies , investments and opportunities , and building momentum.

6. Review your budget often.

Whew! Once you get that first business budget under your belt, take a deep breath and celebrate. You’ve just done something huge for your business! (You’ll also be happy to know, budgeting gets easier from here since you can copy and paste your first one and tweak your income and expenses each month.)

But here’s the thing: Your budget can’t just sit in a drawer or on your computer. You’ve got to look at it consistently to make sure you’re actually following it.

Weekly Review

At least once a week, someone in your business (whether it’s you, a qualified team member or a bookkeeper) needs to track your transactions so you know what’s happening with your money all month. Then you can make adjustments before you have more month than money.

Every time you review your budget, ask yourself these three questions:

- Are we on target to hit our revenue goal this month?

- If not, what we can change to get there?

- Are there any expenses we can cut or minimize?

Monthly Review

You also need to review your business budget when you close your books every month to compare it to your actuals—your P&L. Otherwise, how can you know how you’re doing?

7. Work toward a 12–18-month budget.

Now that you’ve created your first month’s budget, move on to the next one. You’ve got this! The more budget-building reps you get in, the better you’ll be at looking forward and planning for growth. In no time, you’ll reach that ultimate goal of a 12–18-month budget. Just keep adjusting as you go based on all you’re learning about getting an accurate road map for your finances.

As you start owning your numbers, remember: It’s okay if you’re a little intimidated by the process of accounting and making a budget for business. But it’s not okay to avoid the financial details that will make or break you. So just keep applying the basics we covered and keep moving forward.

Follow the steps above to create your budget, and review it often to stay on track.

Want a tool to make budget building simpler? Check out the EntreLeader’s Guide to Business Finances. It includes an easy-to-use small-business budget template in the extra resources section.

What are the benefits of budgeting?

A business budget will help you:

- Make informed, strategic decisions

- Invest in under-resourced areas

- Trim over-resourced areas

- Plan for the future

- Set goals and track your progress

Does using a small-business budget template save time?

Yes! Using a small-business budget template helps you plug in the numbers you need to operate with more confidence and fewer wrong turns. Check out the small-business-budget template inside our EntreLeader’s Guide to Business Finances .

How do I budget if I own a seasonal business?

Just like farmers put extra hay in the barn to cover leaner months, if you’re a seasonal business owner, you need to set aside resources in times of plenty to cover months your business turns down. Use your P&L statements to go back in time and look at financial performance year over year. Then, create your business budget based on what you learn and on any changes you see coming. You can also go to trade conferences to get an idea of your industry’s seasonal benchmarks.

Did you find this article helpful? Share it!

About the author

EntreLeadership

EntreLeadership is the part of Ramsey Solutions that exists to help small-business owners thrive by mastering themselves, rallying their teams, and imposing their will on the marketplace. Thousands of leaders use our proven EntreLeadership System and resources to develop as leaders and grow their businesses. These resources include The EntreLeadership Podcast , EntreLeadership Elite digital membership , books, live events, coaching sessions and business workshops. Learn More.

7 Tips for How to Run a Business Debt-Free

True or false: Running a business requires debt. The answer? False. The truth is, you can’t run a business if you’re broke—and debt increases your risk of going broke when a storm hits. Here’s how to run a business debt-free.

How to Create a Profit-Sharing Plan

It's easy to feel discouraged when trying to compete for top talent and keep your team happy. Learn how a profit-sharing plan can help you build and keep an awesome team even when the market shifts.

Accounting | How To

How To Create a Small Business Budget [+Free Template]

Published June 20, 2023

Published Jun 20, 2023

REVIEWED BY: Tim Yoder, Ph.D., CPA

WRITTEN BY: Eric Gerard Ruiz, CPA

This article is part of a larger series on Bookkeeping .

- 1. Create a Budget Process

- 2. Determine Key Assumptions in Budgeting

- 3. Create the Sales Budget

- 4. Create the Inventory and Purchases Budget

- 5. Create the COGS Budget

- 6. Create the Sales & Administrative Budget

- 7. Create the Capital Budget

- 8. Create the Cash Budget

- 9. Assemble Proforma Financial Statements

Common Problems in Budgeting

Bottom line.

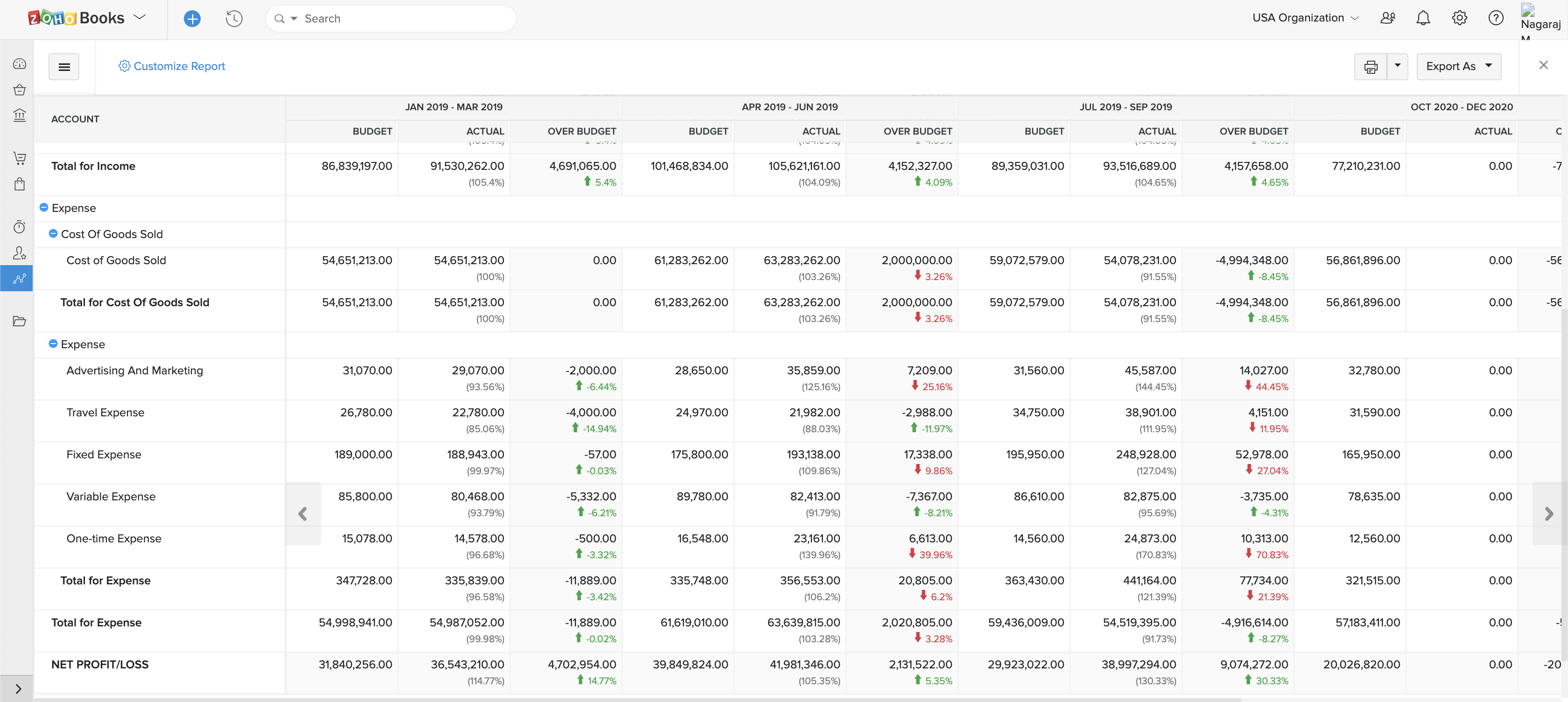

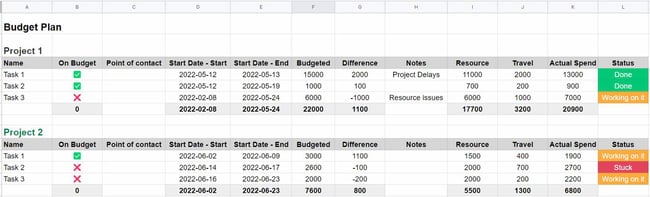

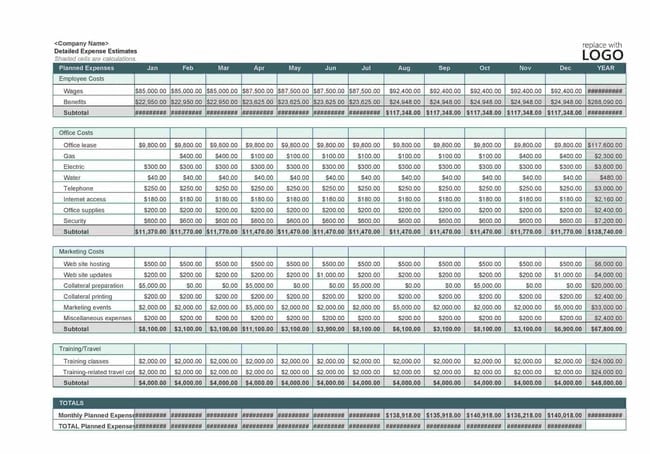

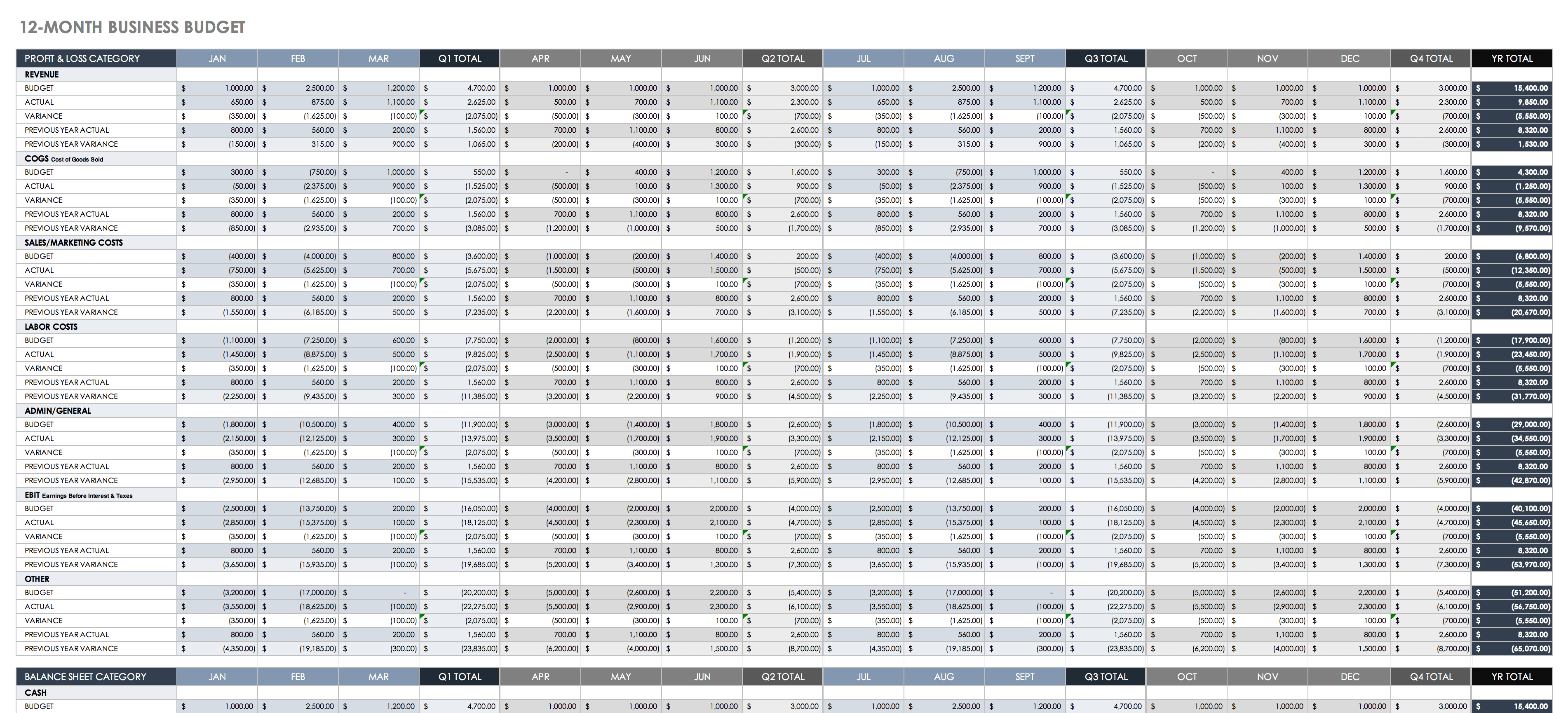

Creating a business budget is an important step in planning. A small business budget starts with creating the budgeting process, the operating budgets, such as sales, inventory and purchases, cost of goods sold (COGS), and sales and administrative, and ends with the financial budgets, such as cash, capital, and proforma financial statements.

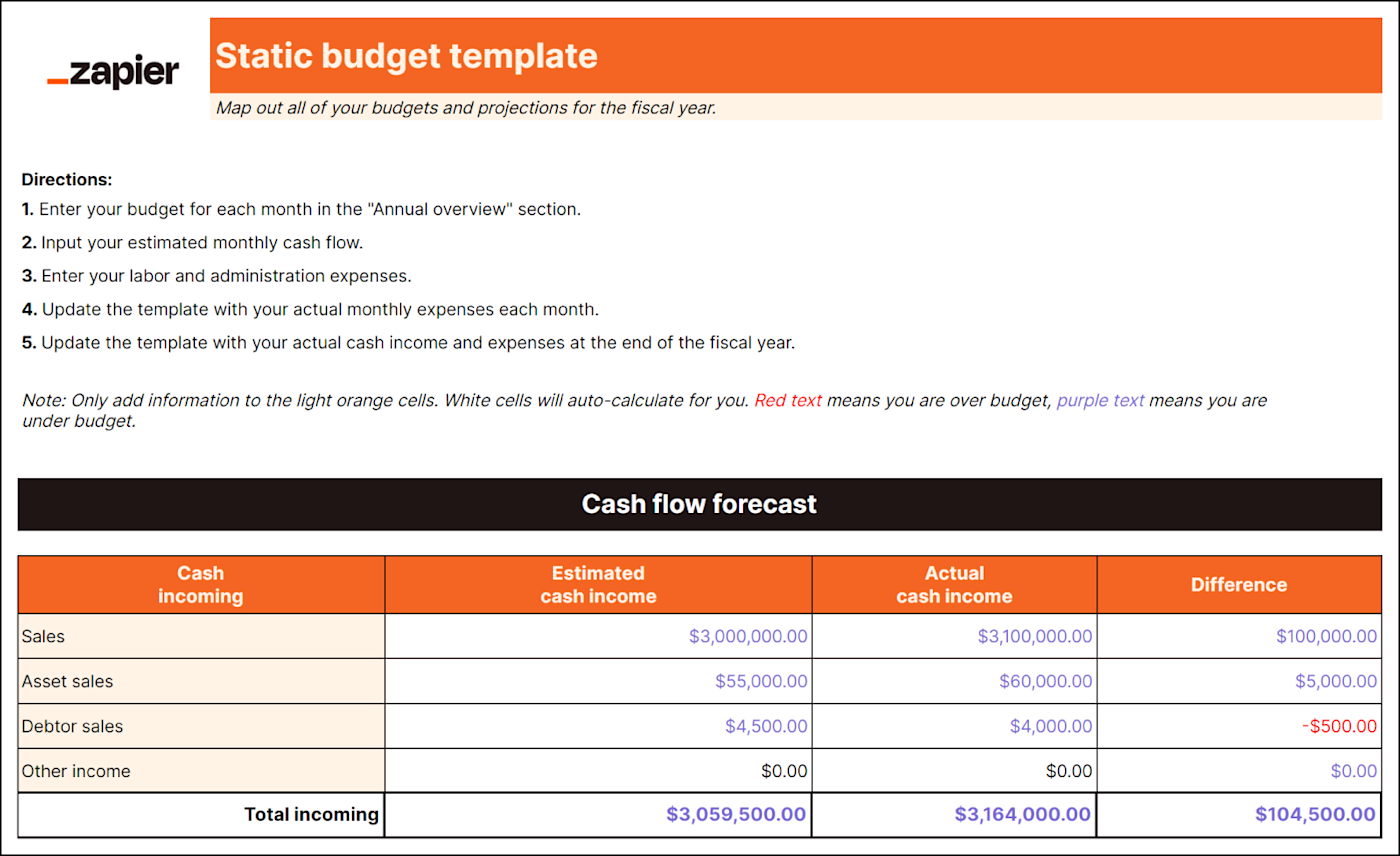

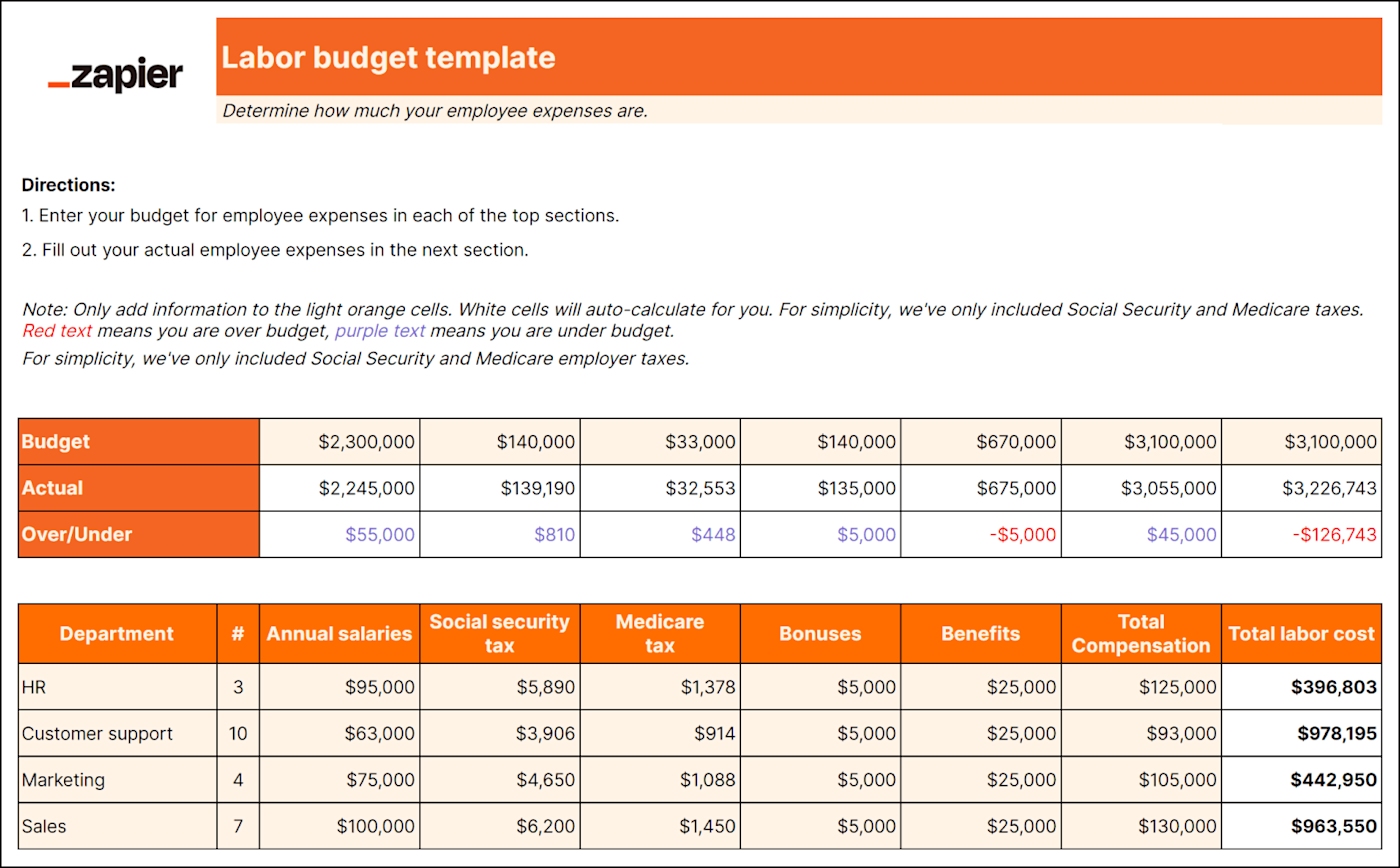

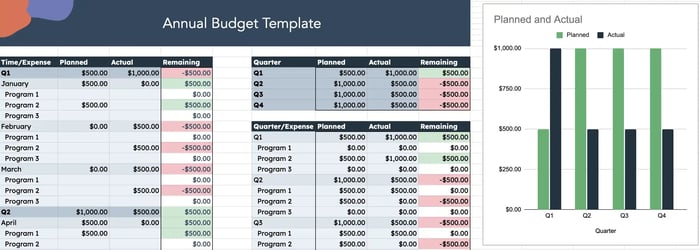

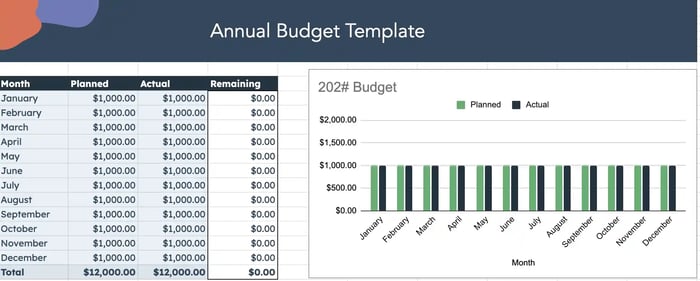

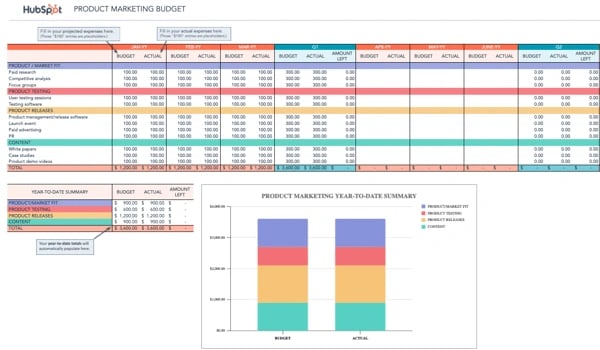

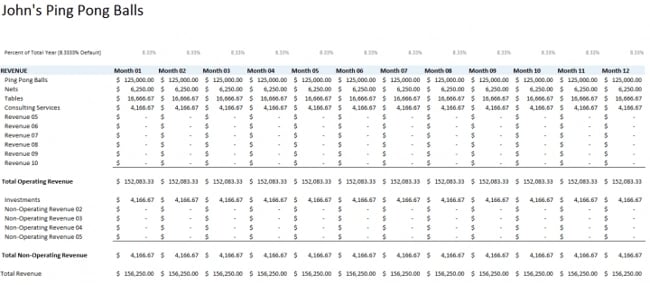

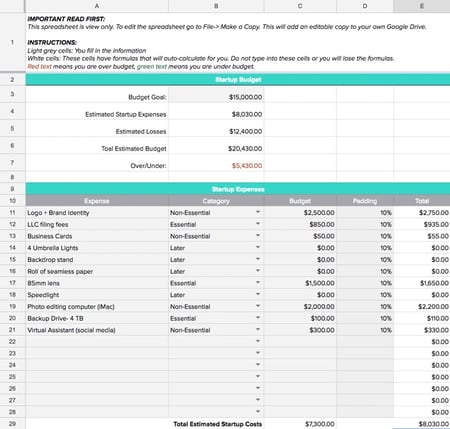

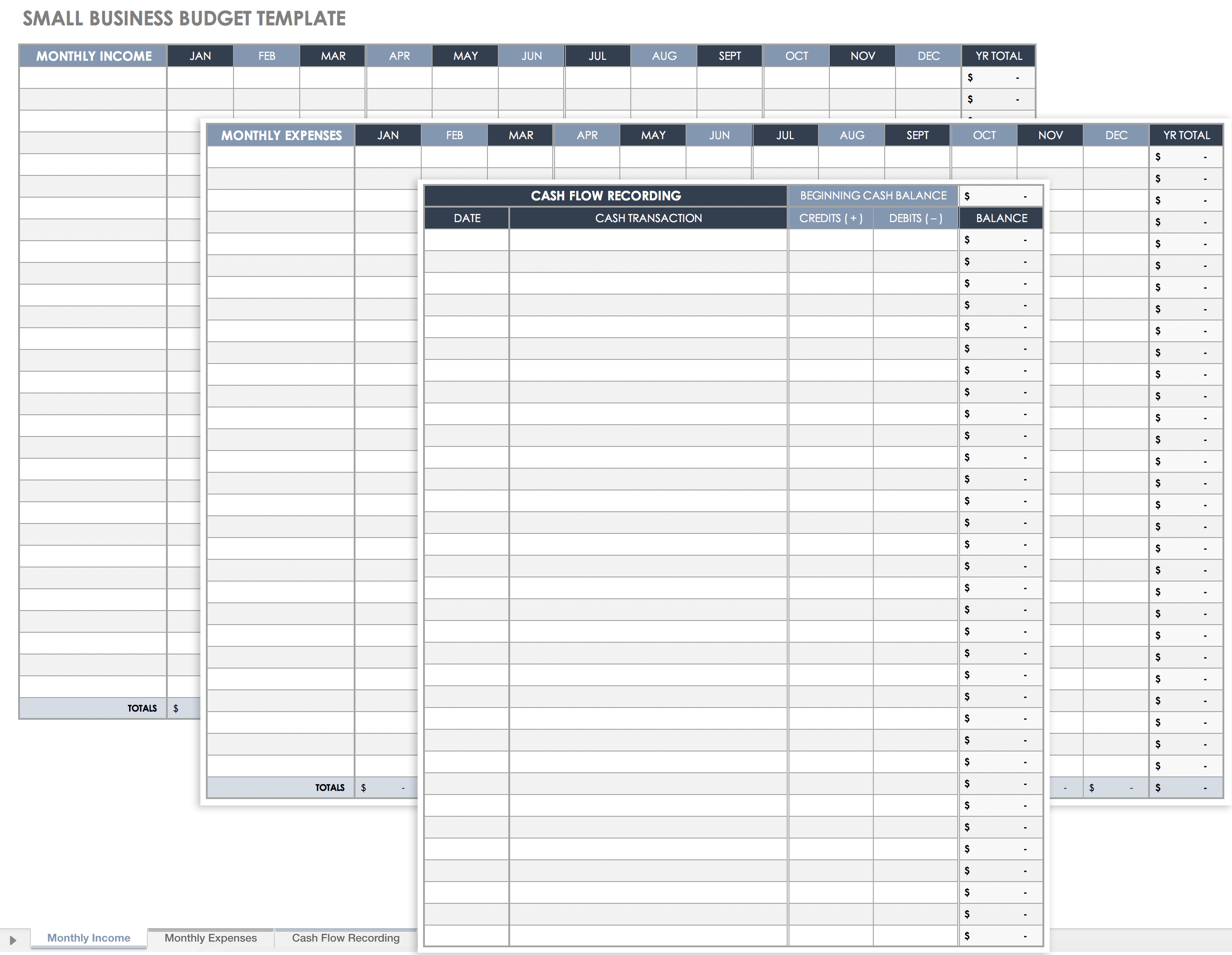

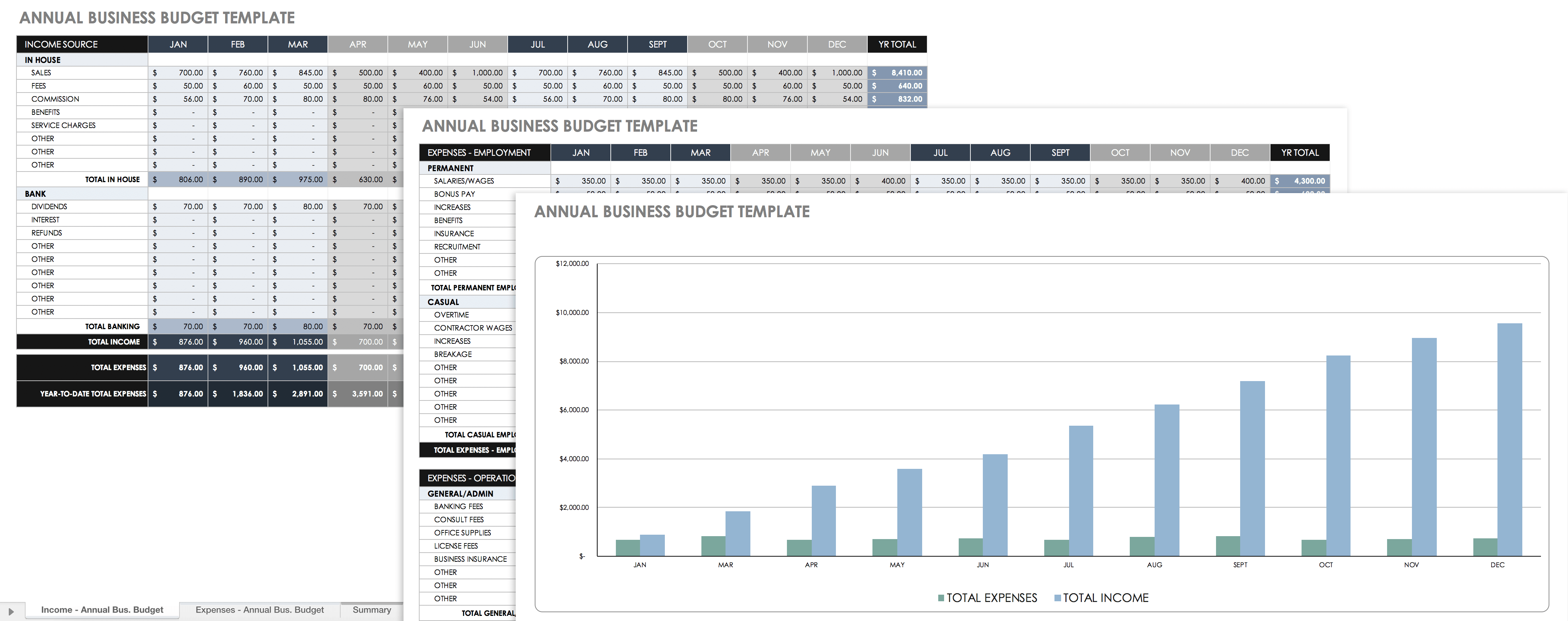

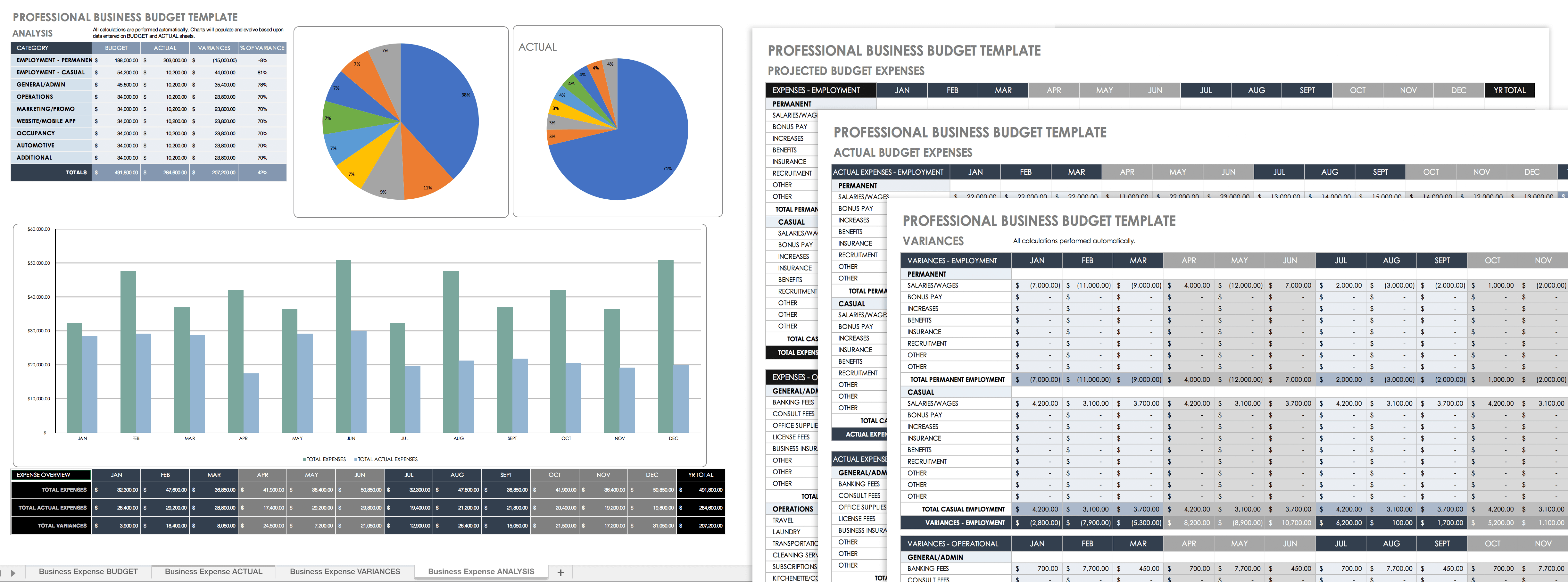

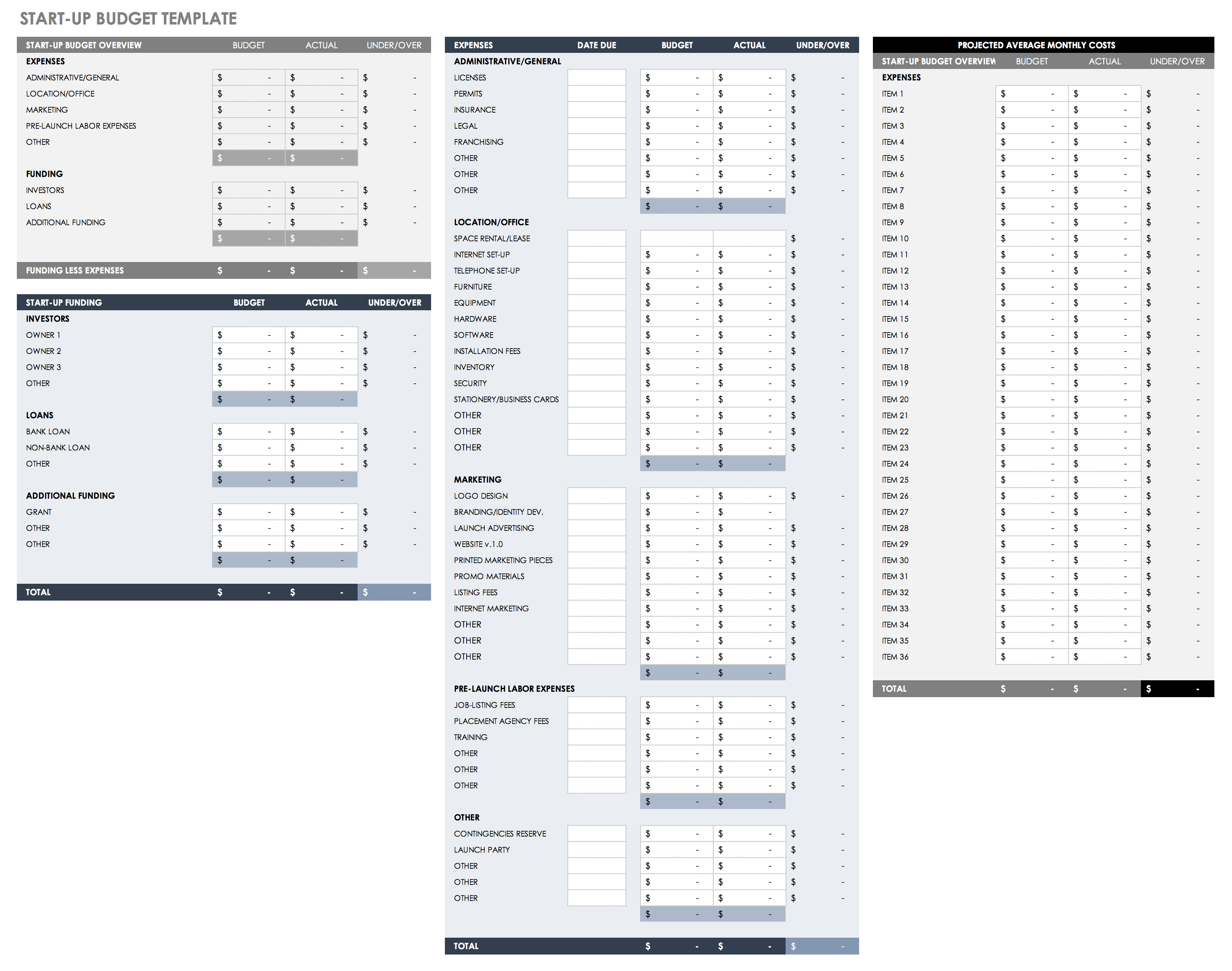

To help you get started, we’ve provided a very simplified version of a budget spreadsheet to illustrate how information from each area of your business is combined to form an annual budget. We’ll discuss how to use this spreadsheet throughout our article.

FILE TO DOWNLOAD OR INTEGRATE

FILE TO DOWNLOAD

Thank you for downloading!

Budgeting is an important subset of managerial accounting. Read our small business guide to managerial accounting and learn how managerial accounting concepts can be applied in a small business setup.

Step 1: Create a Budget Process

The budget process shows how the different departments of the business create a budget. Without a process, budgeting would be chaotic, and it would result in inefficiencies. In the budget process, you need to consider the following:

- Budget period: When are budgets created, reviewed, implemented, and evaluated against actual performance?

- Budgeting method: How are budgets created? Is it created from scratch (zero-based budgeting)? Is it based on actual results with adjustments (incremental budgeting)?

- Budget involvement: Who creates the budgets?

- Budget committee: Who oversees and approves the budgets?

- Budget manual: What are the guidelines for creating budgets?

Budget Period

The first thing to consider in the budget process is the budget period. How long should budgets be prepared? When will it be implemented? The budget period can be any time before the next business year begins. Hence, you can create next year’s budget three months prior to the end of the current year.

The crucial periods for budget planning are as follows:

- Budget preparation : The time at which managers and heads create a budget for their department.

- Budget review and approval : The time at which top management will review and approve all lower-level budgets.

- Budget implementation : The time at which all concerned parties will act upon planned activities stated in the budget. This phase runs until the effectiveness of the budget lasts.

- Budget accountability : The time at which top management will assess if the business is meeting its budgetary goals. This phase runs intermittently during the year, such as monthly, quarterly, or semiannually, especially during performance evaluation and review.

As a small business, you need not be particular about the phases. You can modify the phases depending on small business needs.

Budgeting Method

There are four different types of budgeting methods, but for small businesses, we picked only two, as they are the most appropriate for the setup:

- Zero-based budgeting : This is a budgeting technique that starts from scratch. It doesn’t use information from past budgets. Instead, departments and managers need to justify every dollar in the budget without referring to past performance or past budgeting practices.

- Incremental budgeting : This is a budgeting technique that uses actual figures from the past years and adjusts with a certain percentage. For example, if actual sales last year is $20,000, the incremental budgeted sales could be 10 percent more or $22,000.

Budget Involvement

Small businesses must consider what kind of involvement is needed during the budgeting process, given that budgets can be used to measure the performance of departments and managers. There are two kinds of budget involvement—for small businesses, authoritative budgeting is suitable if the small business owner is heavily involved in daily operations. Alternatively, participatory budgeting applies if the owner delegates decision-making to managers.

1. Authoritative budgeting

Also known as top-down budgeting, this budget involvement strategy only includes top management in the budgeting process, where operating personnel and lower-level employees have little to no say in the budget. It takes less time to create since there are fewer employees involved.

However, some operating personnel and lower-level employees may disagree with top management’s estimates in the budget. At the least, this strategy creates discord between top management and operating personnel due to conflicting views. But if prepared appropriately, authoritative budgeting reflects the business’ vision, mission, and goals better.

2. Participatory budgeting

This is also called bottom-up budgeting, and this budget involvement strategy includes operating personnel and lower-level employees in creating a budget. It is a budget co-created by everyone involved or affected by the budget being created.

It enhances the relationship between top management and operating personnel since everyone has a say in the budget. However, this strategy can take time since more employees are involved in the budgeting process. Also, some lower-level managers can use this opportunity to insert some budgetary slack so that they look good during performance.

Budget Committee

The budget committee is responsible for compiling all lower-level budgets and assembling them into one package called the master budget and reviewing and approving budgets from different departments. For small businesses, the composition of the budget committee can be the small business owners, chief executive officer (CEO), treasurer, budget coordinator, and chief accountant.

The role of the budget coordinator is to reach out to lower-level managers and communicate the wishes of the budget committee. If you’re a family-grown small business, family members, including the small business accountant or finance officer, can be committee members.

Budget Manual

The first order of business of the budget committee is to create a budget manual, which outlines the budgeting process. Lower-level managers and department heads will use the budget manual when creating lower-level budgets. The budget committee may also set specific budget formats and deadlines.

A budget manual standardizes the budgeting process—it ensures fairness and comparability among departments and managers. With this manual in place, you can prevent the instance of inserting unfamiliar line items in the budget or using different sources in forecasting budgeted figures.

The budget manual should include the following:

- Statements of budgetary purpose

- Budgetary activities, such as budget preparation, budget hearing and evaluation, budget approval, budget execution, and budget accountability

- Schedule of budgetary activities and deadlines

- Sample budgets

- Key assumptions used in budgeting

You can create a budget easily using QuickBooks Online. Its budgeting functions create budgets per account in the chart of accounts. Read our QuickBooks Online review for detailed information on our recommendation.

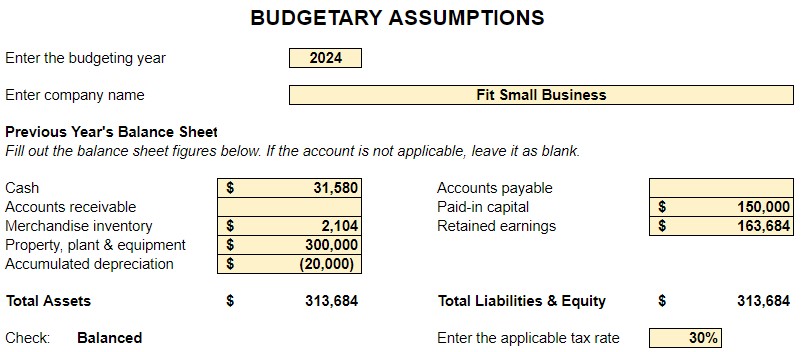

Step 2: Determine Key Assumptions in Budgeting

After performing the groundwork for budgeting, the next step is determining the key assumptions. These assumptions make it easy to prepare budgets since not all information is readily available until it happens. These assumptions are not arbitrary because they must be based on past experience and good business practices.

Examples of assumptions are:

- Sales forecast

- Selling price per unit

- Cost per unit

- Estimated discounts given to customers

- Estimated sales returns

- Desired ending inventory per month or quarter

- Number of raw materials used to produce one good unit

- Number of labor hours needed to produce one good unit

- Number of overhead hours (if any) needed to produce one good unit

- Inventory cost flow method used, such as first-in, first-out (FIFO), last-in, first-out (LIFO), or average cost

- Cash collection patterns

- Cash payments patterns

- Cash retention policies

Input your assumptions in the second tab of our downloadable spreadsheet. When done, all of the reports will automatically populate. It’s the quality of your assumptions that will determine if your budget is realistic. As you improve your budgeting process, you’ll come up with additional assumptions to include in the process.

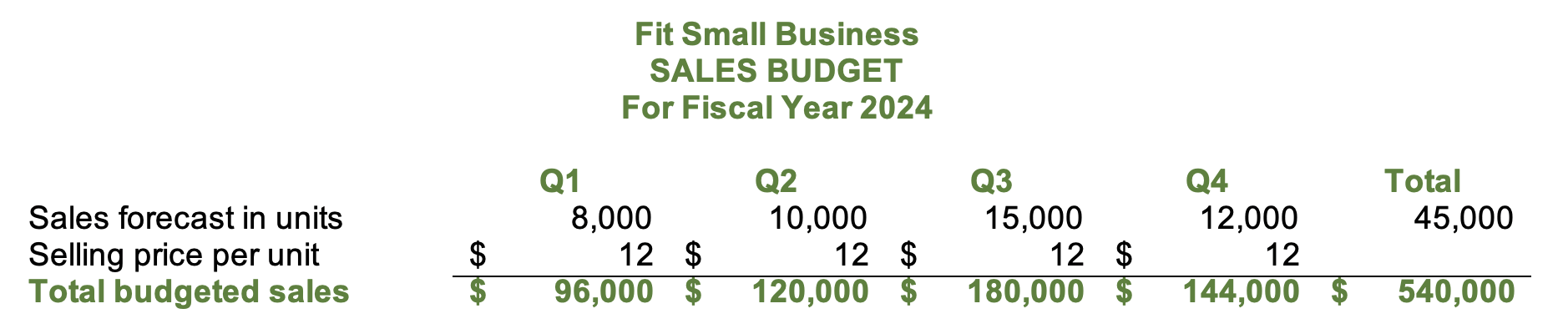

Step 3: Create the Sales Budget

The sales budget is the first budget that should be prepared because almost all budgets will depend on the information in it. It is the responsibility of the sales department to forecast and create the sales budget of the company, and it is crucial that the department forecast sales reasonably using the appropriate forecasting method. Our article about sales forecasting discusses the method of sales forecasting and shows how CRM software can help.

Below is an example of the sales budget taken from our small business master budget template.

Sales budget

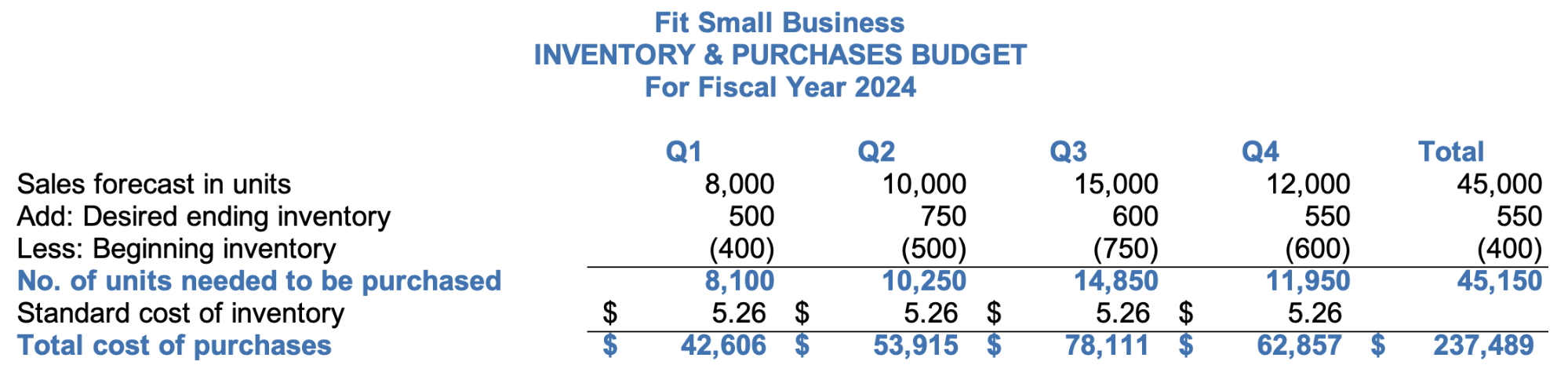

Step 4: Create the Inventory & Purchases Budget

There are two ways to call this budget: merchandising companies can call it inventory and purchases budget while manufacturing companies can call it production budget. However, the information shown in this budget remains the same. The inventory or production budget shows the number of units needed to meet the sales demand.

Inventory budget

The image above shows the sample inventory budget in our free template. One of our assumptions is that the business intends to keep 5% of next quarter’s sales forecast as current quarter’s ending inventory. In Q1, desired ending inventory is 500 units, which is 5% of 10,000 units of Q2’s sales forecast.

After determining the number of units needed, multiply them to the standard cost of inventory to get the total cost of inventory. The standard inventory cost is also the budgeted cost of inventory. Since some inventory prices fluctuate, setting standard costs makes it easy for us to budget.

When adding values in the total column, do not sum up the values in the beginning and desired ending inventory rows. Instead, the total beginning inventory in the total column should be the Q1 beginning inventory, while the total ending inventory should be the Q4 ending inventory.

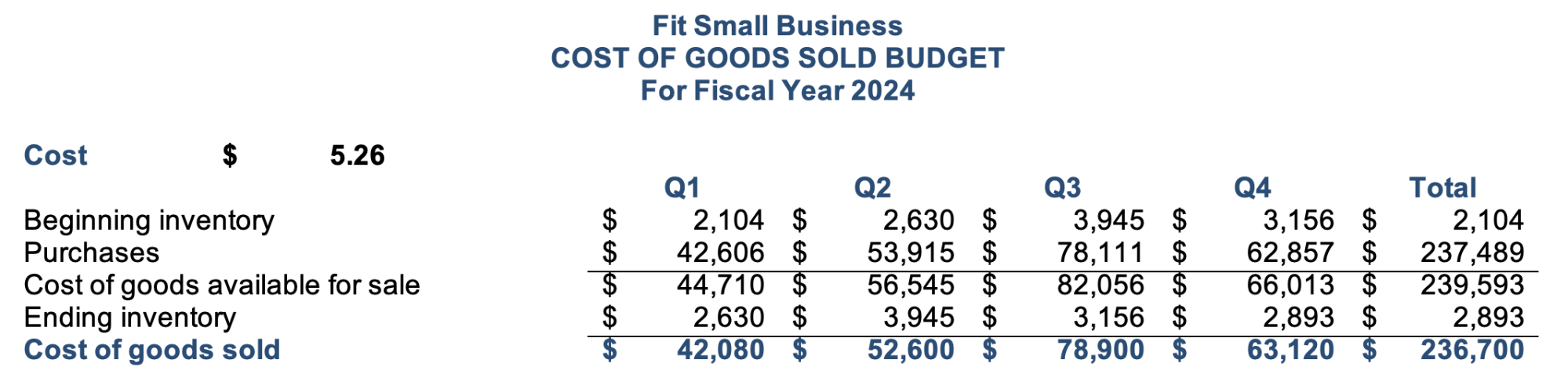

Step 5: Create the COGS Budget

The next logical step after budgeting inventory and purchases is to determine the COGS. Through the COGS budget, we can estimate the level of COGS per quarter. This budget is necessary for preparing the proforma income statement.

Below is the COGS budget from our small business budget template:

COGS budget

Step 6: Create the Sales & Administrative Budget

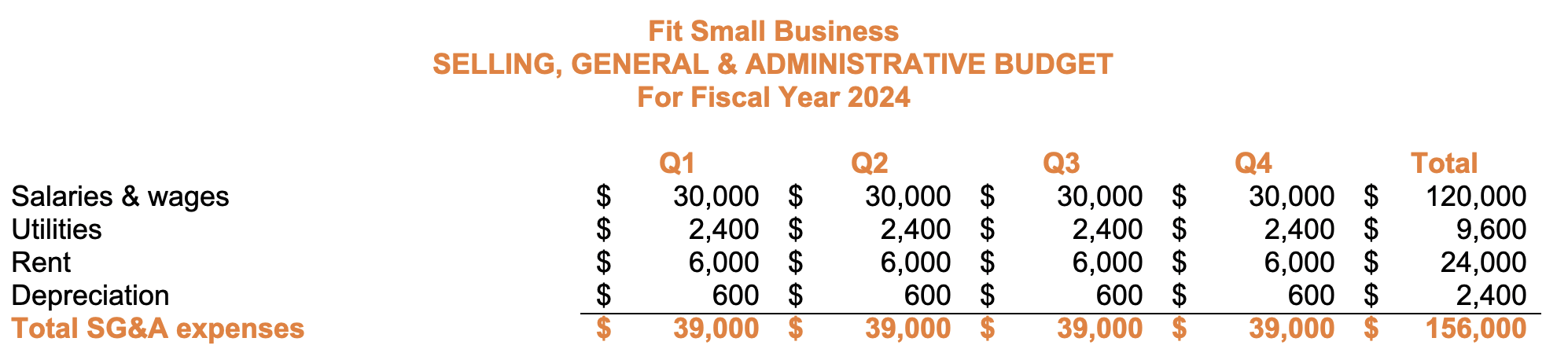

The sales and administrative (S&A) budget presents the budgeted costs for sales expenses, office expenses, and administrative expenses. This is necessary for budgeting the salaries of employees and other fixed expenses. The image below shows the sales and administrative budget from our template:

S&A budget

Most expenses in this budget are fixed costs. That’s why the amounts are the same for every quarter. Manufacturing companies may also call this budget a “fixed overhead budget.”

Step 7: Create the Capital Budget

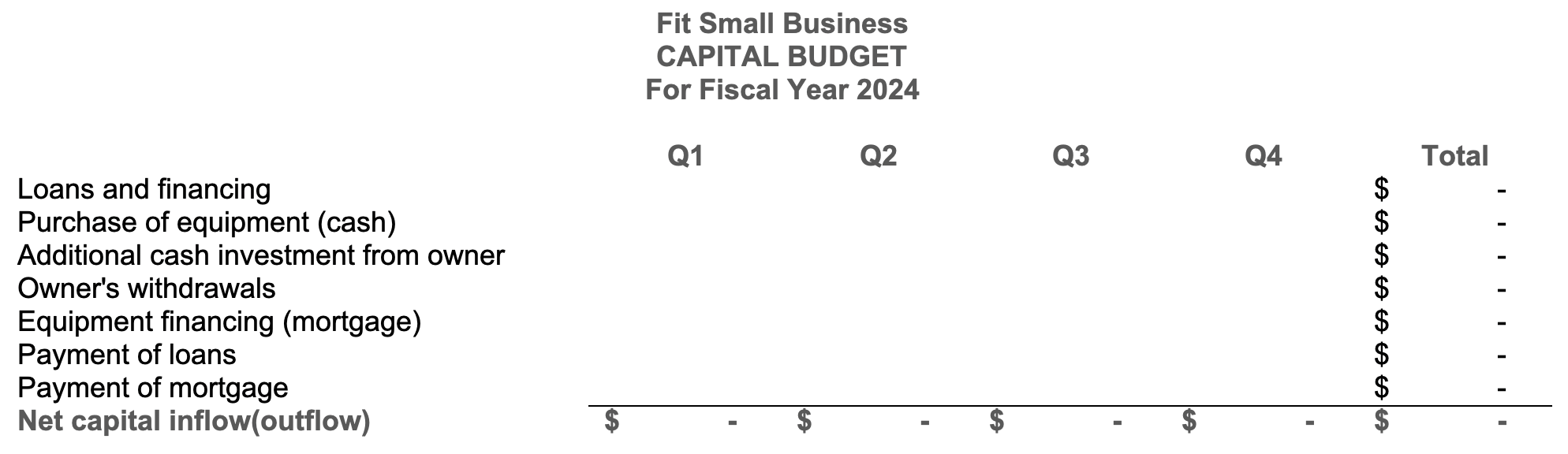

A capital budget shows all the planned capital expenditures during the year. In our capital budget example below, there are no figures because the sample company didn’t plan any capital decisions for 2024. However, we’ve included common capital decisions for you to fill out when you use our template. For instance, a bank loan is a capital inflow while the purchase of equipment is a capital outflow.

Capital budget

The capital budget in our downloadable spreadsheet does not auto-populate from the assumptions tab. Instead, enter your budgeted loans and purchases directly in the report.

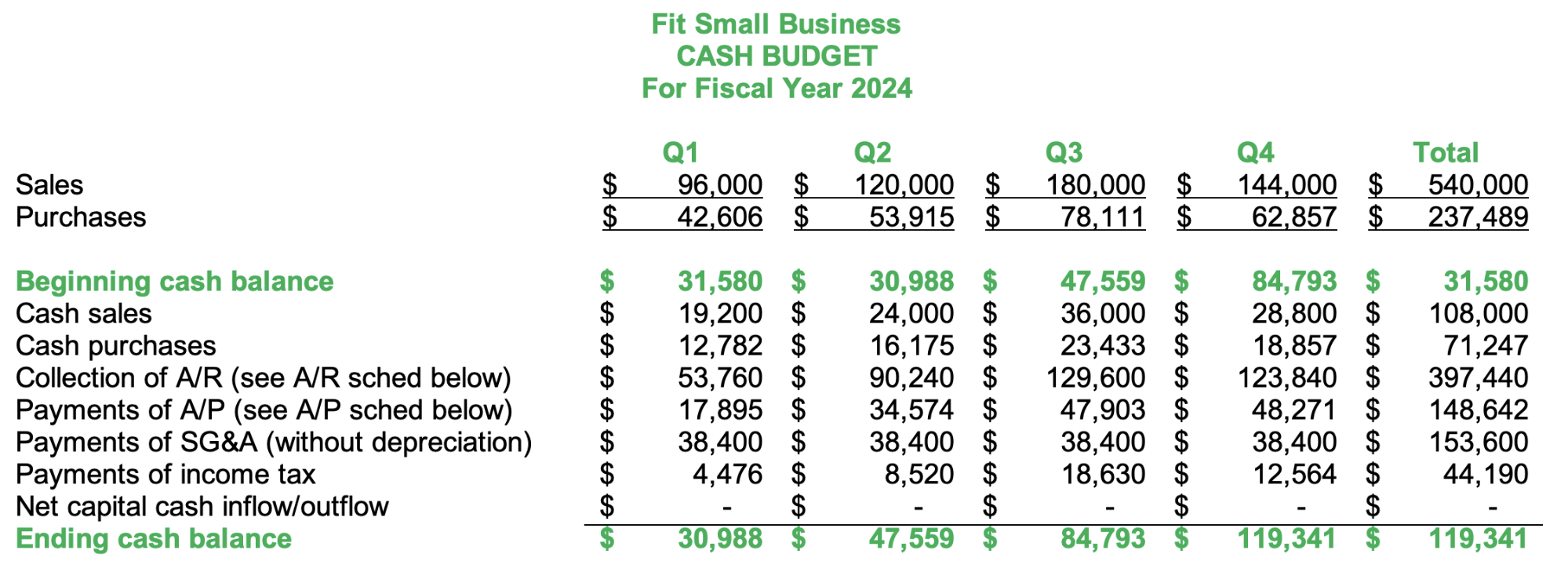

Step 8: Create the Cash Budget

The last budget that you need to prepare is the cash budget, which shows all the cash inflows and outflows from all budgets. Almost all budgets above affect cash flow. For example, the sales budget can show all cash inflows from cash sales and subsequent cash collections from credit sales.

Cash budget

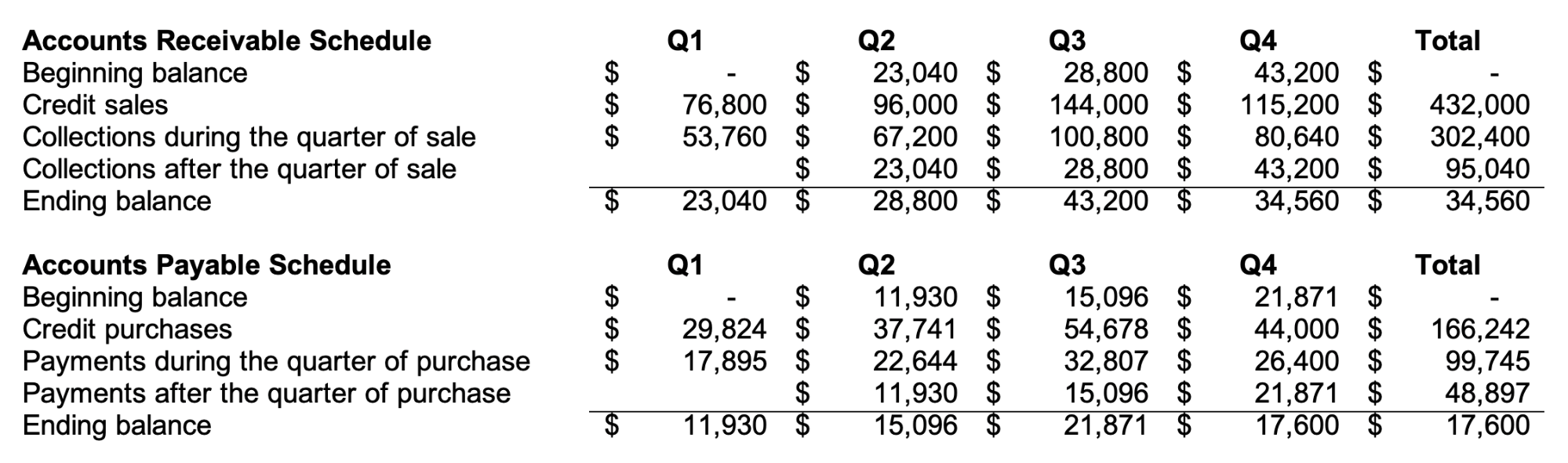

Accounts Receivable & Accounts Payable Schedule

Collections from accounts receivables (A/R) and payments of accounts payable (A/P) are integral parts of the cash budget. Creating the A/R and A/P schedules helps in computing the ending balance of A/R and A/P and the amount of cash collections and payments per quarter. Below are the supporting A/R and A/P schedules for our cash budget above:

A/R and A/P schedules

Step 9: Assemble the Proforma Financial Statements Based on Budgeted Figures

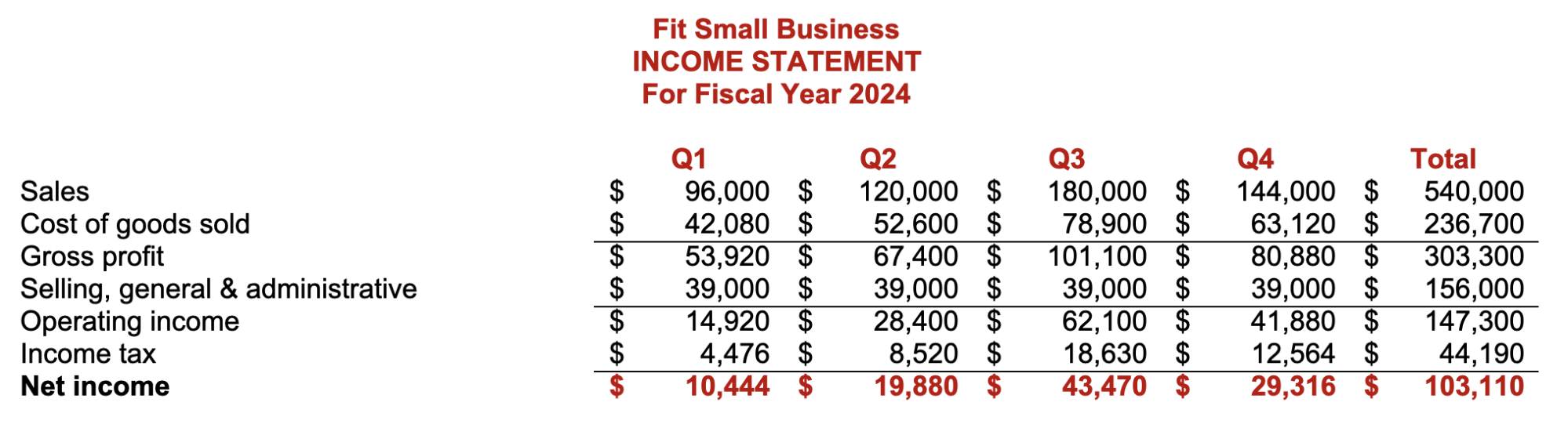

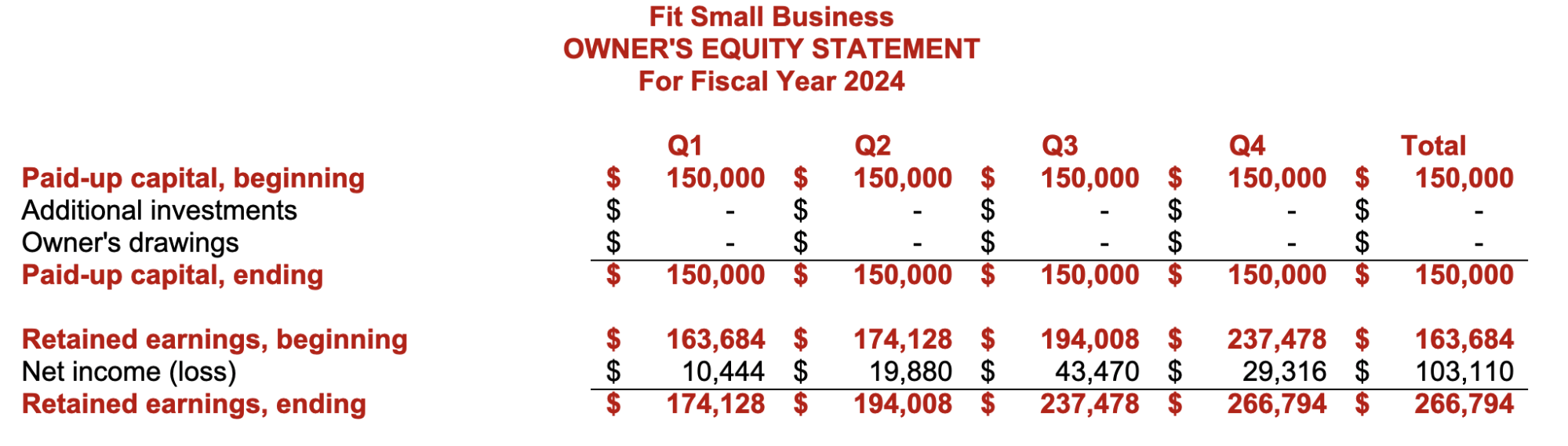

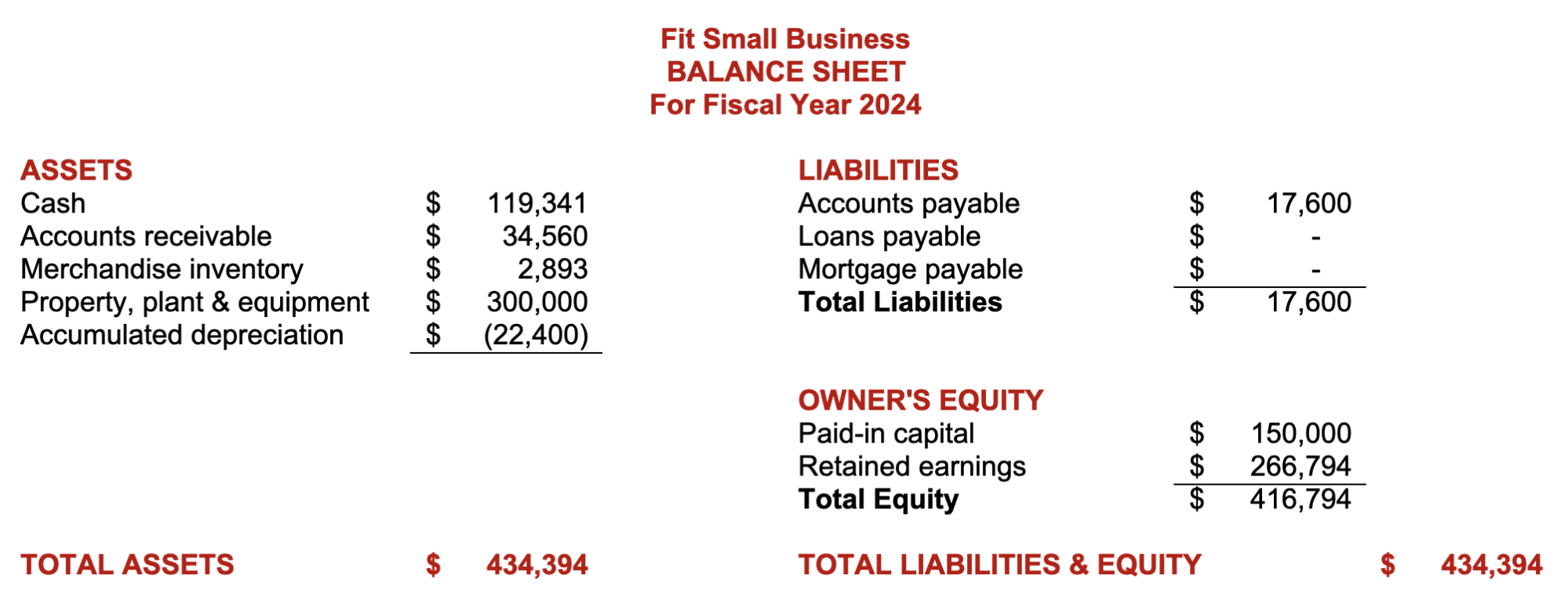

The ultimate result of the budgeting process is the proforma financial statements, which are the budgeted or projected results of planned activities. If the budget goes as planned, the actual financial statements should be near the proforma financial statements. Below are the proforma income statement and balance sheet in our small business budget template.

Proforma Income Statement

Proforma Owner’s Equity Statement

Proforma Balance Sheet

Budgeting helps businesses plan on future events and meet company goals. However, it is likely that you will experience difficulties and problems during the budgeting process. The four problems we’ll discuss are budgetary slack, goal incongruence, budget myopia, and standard setting.

Budgetary slack and goal incongruence occur when managers are not aligned with the business’s overall goals and objectives, while budget myopia happens when the business forgets to consider the impact of short-term decisions in the long run. Lastly, standard setting often poses a problem when standards are too high or ideal. Let’s discuss each of them in greater detail below.

Budgetary Slack

Sometimes, managers and heads can use budgets to preempt results to their favor. This unethical practice is called budgetary slack or budget padding. Budget slacks occur when managers underestimate revenue goals and overestimate expense goals and when the business follows the participatory budget involvement strategy.

When time for evaluation arrives, budget slacks will make the manager’s performance as exemplary. Managers tend to include budgetary slacks when top management is too strict and punitive whenever budgets aren’t met.

For example, the sales manager underestimates the sales forecast at $50,000 for the first quarter, knowing that they can achieve actual sales of $70,000. This example shows how budgetary slack can affect performance evaluation and create a false reflection of the company’s ability to generate revenue.

Goal Incongruence

Budgets are goals. When goals of management and employees don’t meet, the budget will not reflect the results that’s best for the business as a whole. Preventing goal incongruence enhances the quality of the budget. The goal of employees should be aligned with the business’s goals, and top management should provide opportunities for employees to pursue their career growth within the business.

Improper communication of business goals and ineffective leadership are the common causes of goal incongruence. As a small business owner or manager, you should show employees that you are committed to them with respect to their professional goals and that you expect them to align themselves with the business’s overall goals.

Budget Myopia

Budget myopia occurs when budgeting focuses only on short-term goals without considering how these goals will affect the company in the future. Managers become “myopic” in budgeting when they see budgets as measures for performance—they forget that the main objective of budgeting is to plan, organize, and manage the firm’s resources. As a result, budget realignments occur because there is a failure to plan future events.

Standard Setting

Another hurdle in budgeting is setting standards, which are tools for planning and controlling. If used inappropriately, they can cause problems in the budgeting process. It is important that you have to set your standards at a practical level.

Practical standards allow room for error or inefficiencies. It gives employees a chance to learn and improve their outputs without affecting performance. Unwise managers often impose ideal standards or standards that require optimum performance and perfection.

As a result, imposing ideal standards results in employee burnout, decreased productivity, and negative employee morale. Discouraged employees might also result in dysfunctional behavior that might be detrimental to the company.

Frequently Asked Questions (FAQs)

Why is budgeting important.

Budgets help in planning and managing business resources. Since plans and goals require an outflow of resources, budgets help the business determine the right amount of resources needed to achieve the goal.

Who should have an active participation in the budgeting process for small businesses?

The small business owner should have an active role in helping managers and supervisors craft their budgets. As the owner, you should guide your employees to align their goals with the business’ overall goals.

With our small business budget guide and template, you can create a small business master budget. We hope that the template will help you understand why budgeting is crucial to the planning, organizing, and controlling business operations.

About the Author

Find Eric Gerard On LinkedIn

Eric Gerard Ruiz, CPA

Eric is an accounting and bookkeeping expert for Fit Small Business. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. Since joining FSB, Eric has used his expertise and authority in curating and writing content about small business accounting and bookkeeping, accounting software, financial accounting and reporting, managerial accounting, and financial management.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

A How-To Guide for Creating a Business Budget

Amanda Smith

Reviewed by

September 23, 2022

This article is Tax Professional approved

Most business owners know how important a business budget is when it comes to managing expenses and planning for the future—but in a challenging economic environment like the one we’ve been experiencing, your business budget takes on even greater significance.

With inflation running rampant and the possibility of a recession looming, business owners need to be able to forecast their cash flow, manage their expenses, and plan for the future. Creating a detailed business budget is the first step.

Whether you want to revamp your budgeting method, or you’ve never created a business budget before, this guide will walk you through the process.

I am the text that will be copied.

What is a business budget?

A budget is a detailed plan that outlines where you’ll spend your money monthly or annually.

You give every dollar a “job,” based on what you think is the best use of your business funds, and then go back and compare your plan with reality to see how you did.

A budget will help you:

- Forecast what money you expect to earn

- Plan where to spend that revenue

- See the difference between your plan and reality

What makes a good budget?

The best budgets are simple and flexible. If circumstances change (as they do), your budget can flex to give you a clear picture of where you stand at all times.

Every good budget should include seven components:

1. Your estimated revenue

This is the amount you expect to make from the sale of goods or services. It’s all of the cash you bring in the door, regardless of what you spent to get there. This is the first line on your budget. It can be based on last year’s numbers or (if you’re a startup ), based on industry averages.

2. Your fixed costs

These are all your regular, consistent costs that don’t change according to how much you make—things like rent, insurance, utilities, bank fees, accounting and legal services, and equipment leasing.

Further reading: Fixed Costs (Everything You Need to Know)

3. Your variable costs

These change according to production or sales volume and are closely related to “ costs of goods sold ,” i.e., anything related to the production or purchase of the product your business sells. Variable costs might include raw materials, inventory, production costs, packaging, or shipping. Other variable costs can include sales commission, credit card fees, and travel. A clear budget plan outlines what you expect to spend on all these costs.

The cost of salaries can fall under both fixed and variable costs. For example, your core in-house team is usually associated with fixed costs, while production or manufacturing teams—anything related to the production of goods—are treated as variable costs. Make sure you file your different salary costs in the correct area of your budget.

Further reading: Variable Costs (A Simple Guide)

4. Your one-off costs

One-off costs fall outside the usual work your business does. These are startup costs like moving offices, equipment, furniture, and software, as well as other costs related to launch and research.

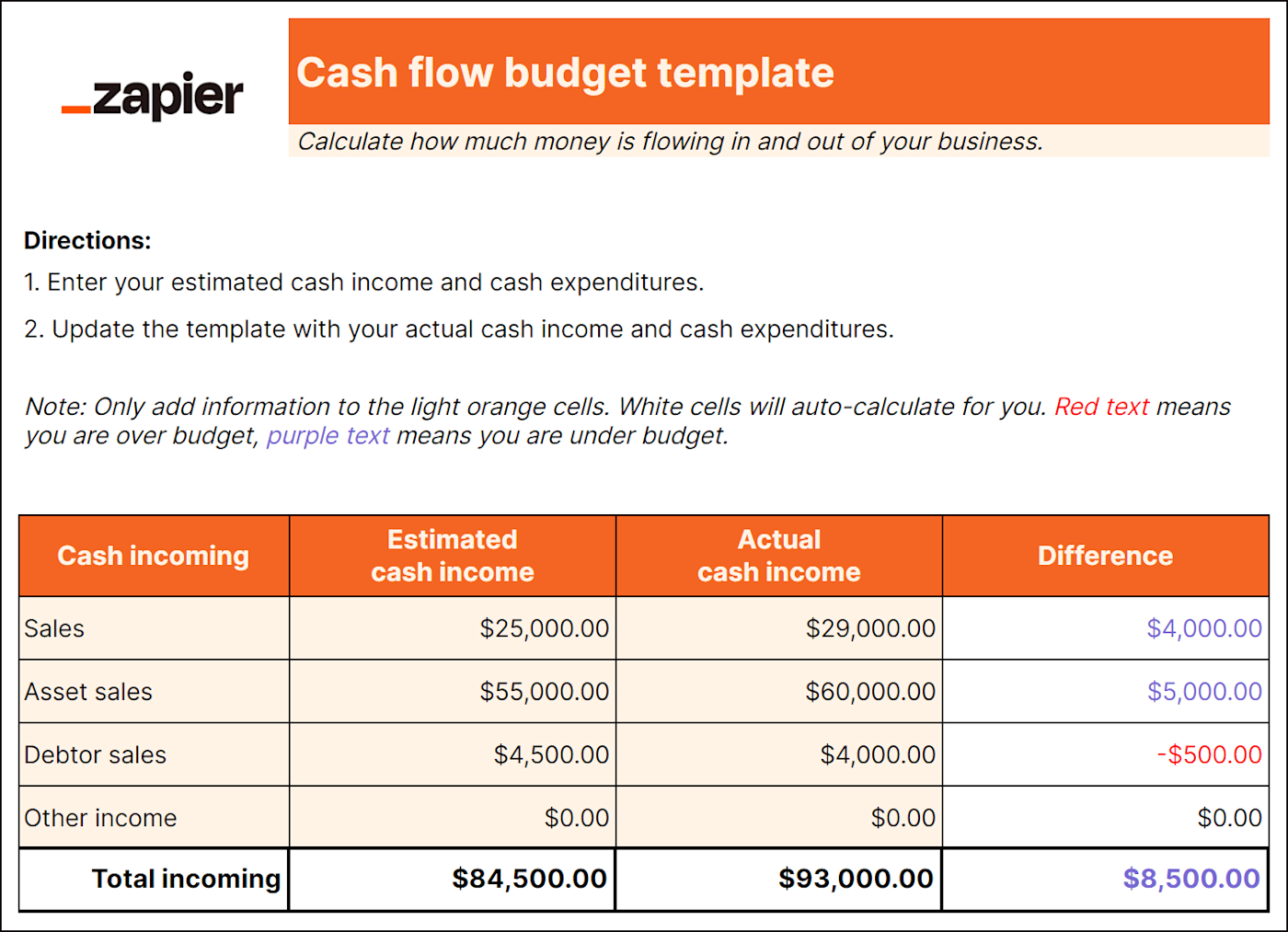

5. Your cash flow

Cash flow is all money traveling into and out of a business. You have positive cash flow if there is more money coming into your business over a set period of time than going out. This is most easily calculated by subtracting the amount of money available at the beginning of a set period of time and at the end.

Since cash flow is the oxygen of every business, make sure you monitor this weekly, or at least monthly. You could be raking it in and still not have enough money on hand to pay your suppliers.

6. Your profit

Profit is what you take home after deducting your expenses from your revenue. Growing profits mean a growing business. Here you’ll plan out how much profit you plan to make based on your projected revenue, expenses, and cost of goods sold. If the difference between revenue and expenses (aka “ profit margins ”) aren’t where you’d like them to be, you need to rethink your cost of goods sold and consider raising prices .

Or, if you think you can’t squeeze any more profit margin out of your business, consider boosting the Advertising and Promotions line in your budget to increase total sales.

7. A budget calculator

A budget calculator can help you see exactly where you stand when it comes to your business budget planning. It might sound obvious, but getting all the numbers in your budget in one easy-to-read summary is really helpful.

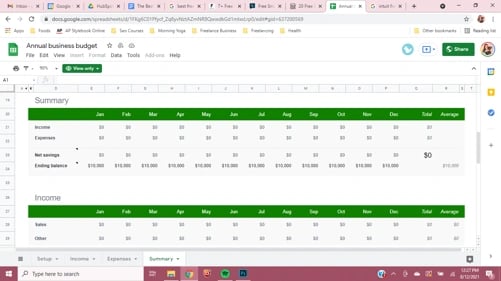

In your spreadsheet, create a summary page with a row for each of the budget categories above. This is the framework of your basic budget. Then, next to each category, list the total amount you’ve budgeted. Finally, create another column to the right—when the time period ends, use it to record the actual amounts spent in each category. This gives you a snapshot of your budget that’s easy to find without diving into layers of crowded spreadsheets.

See the sample below.

Pro tip: link the totals on the summary page to the original sums in your other budget tabs . That way when you update any figures, your budget summary gets updated at the same time. The result: your very own budget calculator.

You can also check out this simple Startup Cost Calculator from CardConnect. It lays out some of the most common expenses that you might not have considered. From there, you can customize a rough budget for your own industry.

Small business budgets for different types of company

While every good budget has the same framework, you’ll need to think about the unique budgeting quirks of your industry and business type.

Seasonal businesses

If your business has a busy season and a slow season, budgeting is doubly important.

Because your business isn’t consistent each month, a budget gives you a good view of past and present data to predict future cash flow . Forecasting in this way helps you spot annual trends, see how much money you need to get you through the slow months, and look for opportunities to cut costs to offset the low season. You can use your slow season to plan for the next year, negotiate with vendors, and build customer loyalty through engagement.

Don’t assume the same thing will happen every year, though. Just like any budget, forecasting is a process that evolves. So start with what you know, and if you don’t know something—like what kind of unexpected costs might pop up next quarter— just give it your best guess . Better to set aside money for an emergency that doesn’t happen than to be blindsided.

Ecommerce businesses

The main budgeting factor for ecommerce is shipping. Shipping costs (and potential import duties) can have a huge impact.

Do you have space in your budget to cover shipping to customers? If not, do you have an alternative strategy that’s in line with your budget—like flat rate shipping or real-time shipping quotes for customers? Packaging can affect shipping rates, so factor that into your cost of goods sold too. While you’re at it, consider any international warehousing costs and duties.

You’ll also want to create the best online shopping experience for your customers, so make sure you include a good web hosting service, web design, product photography, advertising, blogging, and social media in your budget.

Inventory businesses

If you need to stock up on inventory to meet demand, factor this into your cost of goods sold. Use the previous year’s sales or industry benchmarks to take a best guess at the amount of inventory you need. A little upfront research will help ensure you’re getting the best prices from your vendors and shipping the right amount to satisfy need, mitigate shipping costs, and fit within your budget.

The volume of inventory might affect your pricing. For example, if you order more stock, your cost per unit will be lower, but your overall spend will be higher. Make sure this is factored into your budget and pricing, and that the volume ordered isn’t greater than actual product demand.

You may also need to include the cost of storage solutions or disposal of leftover stock.

Custom order businesses

When creating custom ordered goods, factor in labor time and cost of operations and materials. These vary from order to order, so make an average estimate.

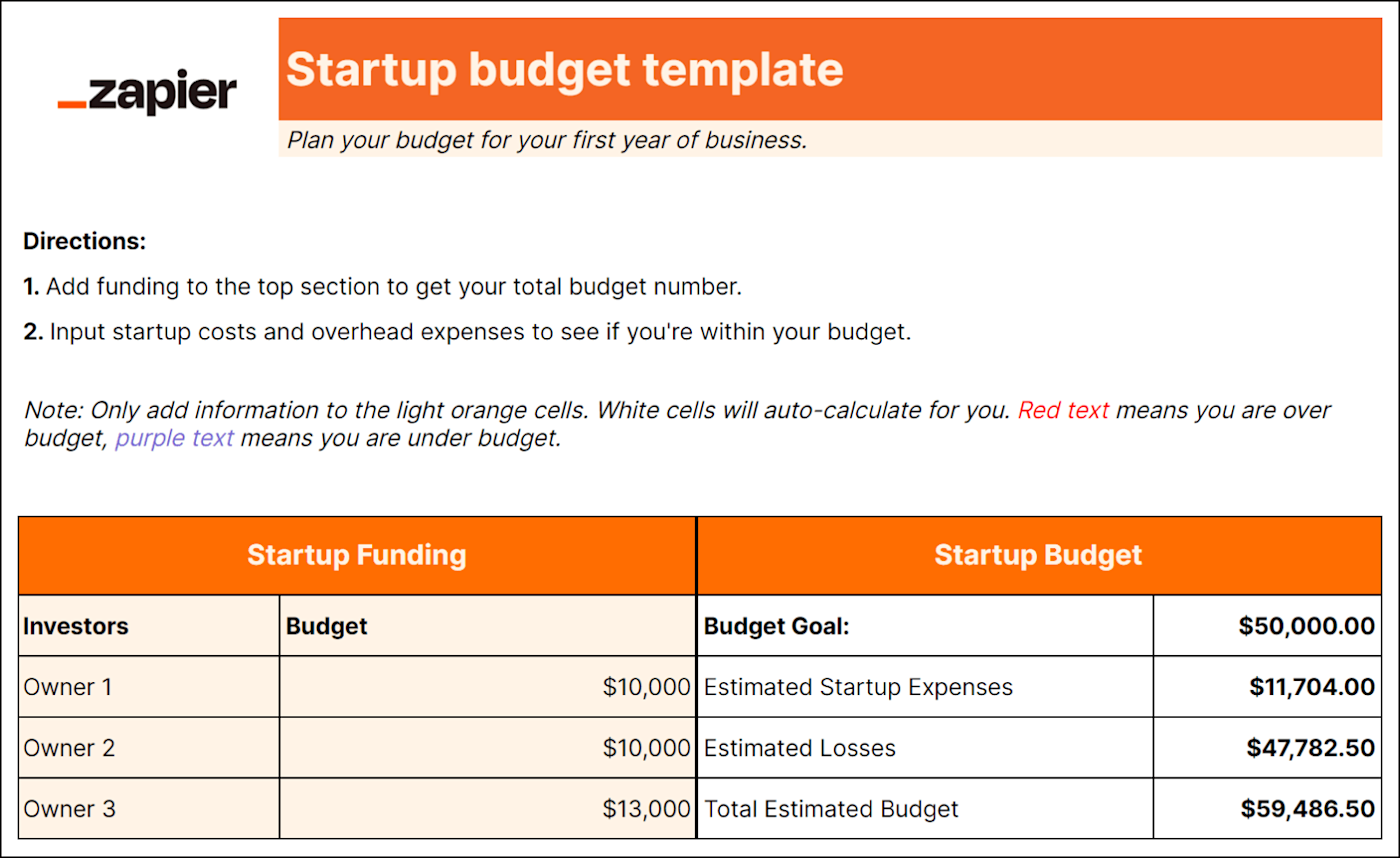

Budgeting is tricky for startups—you rarely have an existing model to use. Do your due diligence by researching industry benchmarks for salaries, rent, and marketing costs. Ask your network what you can expect to pay for professional fees, benefits, and equipment. Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. A few thousand dollars upfront could save you thousands more in legal fees and inefficiencies later on.

This is just scratching the surface, and there’s plenty more to consider when creating a budget for a startup. This business startup budget guide from The Balance is a great start.

Service businesses

If you don’t have a physical product, focus on projected sales, revenue, salaries, and consultant costs. Figures in these industries—whether accounting, legal services, creative, or insurance—can vary greatly, which means budgets need flexibility. These figures are reliant on the number of people required to provide the service, the cost of their time, and fluctuating customer demand.

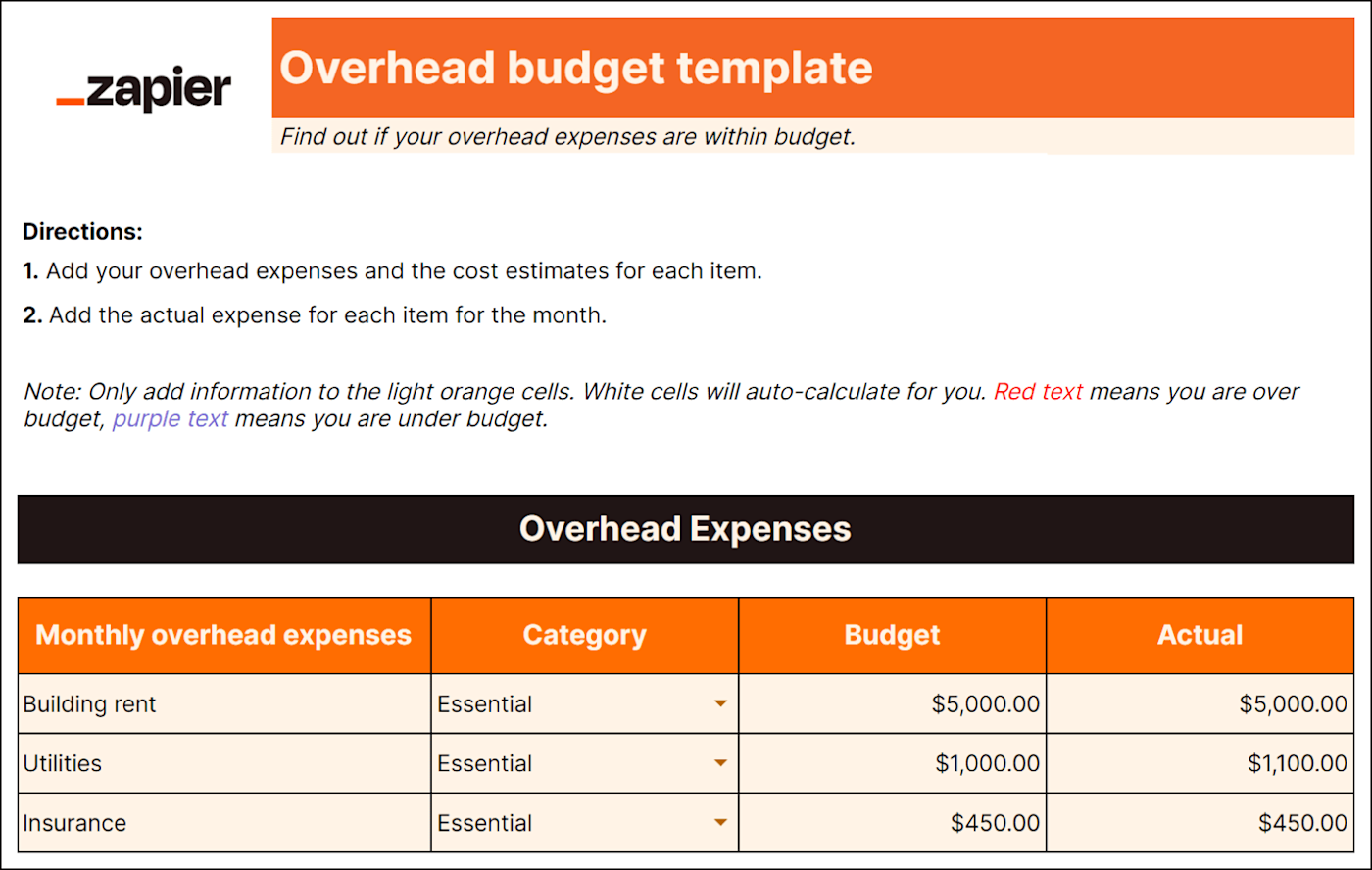

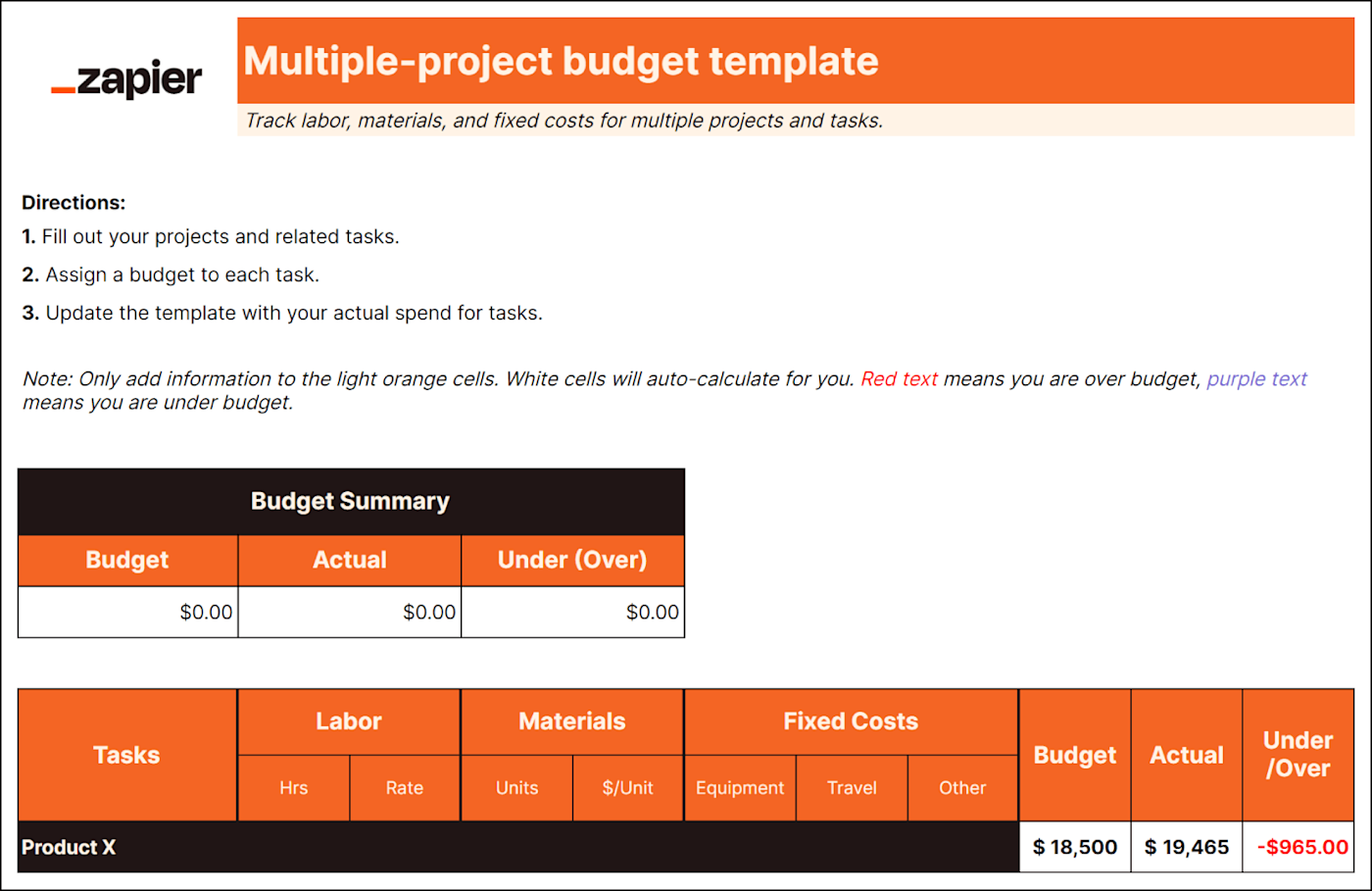

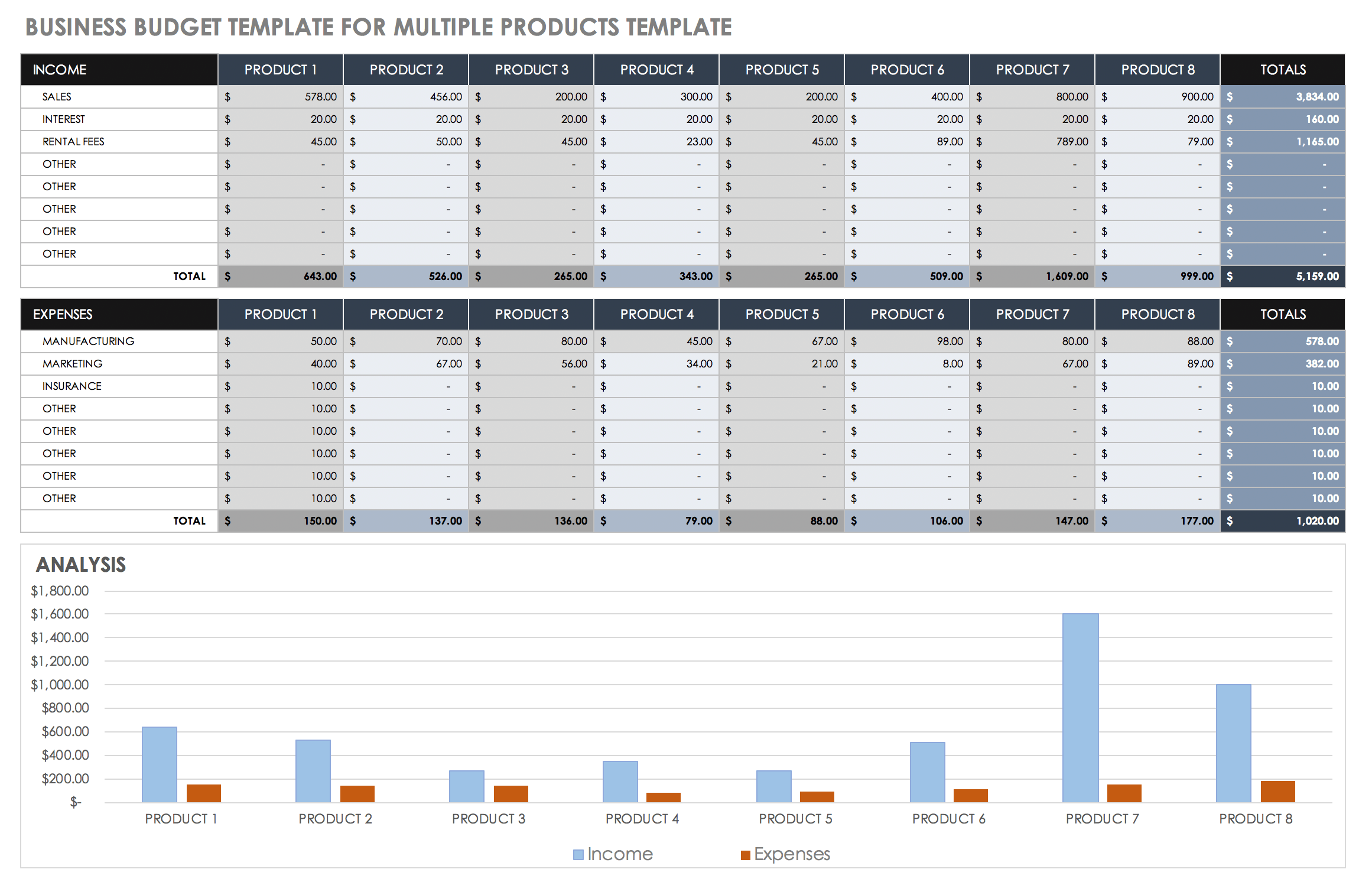

Small business budgeting templates

A business budget template can be as simple as a table or as complex as a multi-page spreadsheet. Just make sure you’re creating something that you’ll actually use.

Create your budget yearly—a 12-month budget is standard fare—with quarterly or monthly updates and check-ins to ensure you’re on track.

Here are some of our favorite templates for you to plug into and get rolling.

- The Balance has a clear table template that lists every budget item, the budgeted amount, the actual amount, and the difference between the two. Use this one if you’re looking to keep it simple.

- Capterra has both monthly and annual breakdowns in their Excel download. It’s straightforward, thorough, and fairly foolproof.

- Google Sheets has plenty of budget templates hiding right under your nose. They’re easy to use, and they translate your figures into clear tables and charts on a concise, visual summary page.

- Smartsheet has multiple resources for small businesses, including 12-month budget spreadsheets, department budget templates, projection templates, project-by-project templates, and startup templates. These templates are ideal if you’re looking for a little more detail.

- Scott’s Marketplace is a blog for small businesses. Their budget template comes with step-by-step instructions that make it dead simple for anyone.

- Vertex42 focuses on Excel spreadsheets and offers templates for both product-based and service-based businesses, as well as a business startup costs template for anyone launching a new business.

Budgeting + bookkeeping = a match made in heaven

Making a budget is kind of like dreaming: it’s mostly pretend. But when you can start pulling on accurate historical financials to plan the upcoming year, and when you can check your budget against real numbers, that’s when budgets start to become useful.

The only way to get accurate financial data is through consistent bookkeeping.

Don’t have a regular bookkeeping process down pat? Check out our free guide, Bookkeeping Basics for Entrepreneurs . We’ll walk you through everything you need to know to get going yourself, for free.

If you need a bit more help, get in touch with us. Bookkeeping isn’t for everyone, especially when you’re also trying to stay on top of a growing business—but at Bench, bookkeeping is what we do best.

Related Posts

How Revenue Recognition Works: A 5-Step Guide

What is revenue recognition and does it affect your business?

Best Free Accounting Software for Small Businesses

Accounting software can be your secret weapon when it comes to managing your small business finances. But you don't have to spend big for features you won't use.

Why Your Small Business Should Invest in Accounts Payable Software

Accounts payable software is an important tool for your business. It can help you manage bill pay, track vendor payments, and maintain cash flow.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

How to Create a Small Business Budget in 5 Simple Steps

Want to protect the financial health of your small business? You need a business budget. Here's how to create one.

When you build a business, there are a lot of things to stay on top of, from marketing and finding new clients to building a website and establishing your digital presence. But there’s one element that you want to stay on top of from the very beginning—and that’s your business budget.

Having a detailed and accurate budget is a must if you want to build a thriving, sustainable business. But how, exactly, do you create one? What are the steps for business budget planning?

As a small business owner, let’s take a look at how to create a business budget in five simple, straightforward steps.

What’s a Business Budget—and Why Is It Important?

Before we jump into creating a business budget, let’s quickly cover what a business budget is—and why it’s so important for small businesses.

A business budget is an overview of your business funds. It outlines key information on both the current state of your finances (including income and expenses) and your long-term financial goals. Because your budget will play a key role in making sound financial decisions for your business, it should be one of the first tasks you tackle to improve business success.

And, as a financially savvy owners, you’ll also want to have a budget in place to help you:

- Make sound financial decisions. In many ways, your business budgets are like a financial road map. It helps you evaluate where your business finances currently stand—and what you need to do to hit your financial goals in the future for business growth.

- Identify where to cut spending or grow revenue. Your business budgets can help you identify areas to decrease your spending or increase your revenue, which will increase your profitability in the process, outline unexpected costs, and help your sustain your business goals.

- Land funding to grow your business. If you’re planning to apply for a business loan or raise funding from investors, you’ll need to provide a detailed budget that outlines your income and expenses.

Now that you understand why budget creation is so important to your business decisions, let’s jump into how to do it.

Business Budget Step 1: Tally Your Income Sources

First things first. When building a small business budget, you need to figure out how much money your business is bringing in each month and where that money is coming from – this will hep create an operating budget based on your business income.

Your sales figures (which you can access using the Profit & Loss report function in FreshBooks) are a great place to start. From there, you can add any other sources of income for your business throughout the month.

Your total number of income sources will depend on your business model.

For example, if you run a freelance writing business, you might have multiple sources of income from:

- Freelance writing projects

- A writing course you sell on your website

- Consulting with other writers who are starting small businesses

Or, if you run a brick-and-mortar retail business, you may only have one source of income from your store sales.

However many income sources you have, make sure to account for any and all income that’s flowing into your business—then tally all those sources to get a clear picture of your total monthly income to build your master business budget template.

Business Budget Step 2: Determine Fixed Costs

Once you’ve got a handle on your income, it’s time to get a handle of your costs—starting with fixed costs.

Your fixed costs are any expenses that stay the same from month to month. This can include expenses like rent, certain utilities (like internet or phone plans), website hosting, and payroll costs.

Review your expenses (either via your bank statements or through your FreshBooks reports) and see which costs have stayed the same from month to month. These are the expenses you’re going to categorize as fixed costs.

Once these costs are determined, add them together to get your total fixed and variable costs expense for the month.

TIP: If you’re just starting your business and don’t have financial data to review, make sure to use projected costs. For example, if you’ve signed a lease for office space, use the monthly rent you will pay moving forward.

Business Budget Step 3: Include Variable Expenses

Related articles.

Variable costs don’t come with a fixed price tag—and will vary each month based on your business performance and activity. These can include things like usage-based utilities (like electricity or gas), shipping costs, sales commissions, or travel costs.

Variable expenses will, by definition, change from month to month. When your profits are higher than expected, you can spend more on the variables that will help your business scale faster. But when your profits are lower than expected, consider cutting these variable costs until you can get your profits up.

At the end of each month, tally these expenses. Over time, you’ll get a sense of how these expenses fluctuate with your business performance or during certain months, which can help you make more accurate financial projections and budget accordingly.

Business Budget Step 4: Predict One-Time Spends

Many of your business expenses will be regular expenses that you pay for each month, whether they’re fixed or variable costs. But there are also costs that will happen far less frequently. Just don’t forget to factor those expenses when you create a budget as well.

If you know you have one-time spends on the horizon (for example, an upcoming business course or a new laptop), adding them to your budget can help you set aside the financial resources necessary to cover those expenses—and protect your business from unexpected costs in the form of a sudden or large financial burden.

On top of adding planned one-time spends to your budget, you should also add a buffer to cover any unplanned purchases or expenses, like fixing a damaged cell phone or hiring an IT consultant to deal with a security breach. That way, when an unexpected expense pops up (and they always do), you’re prepared!

Business Budget Step 5: Pull It All Together

You’ve gathered all of your income sources and all of your revenue and expenses. What’s next? Pulling it all together to get a comprehensive view of your financial standing for the month.

On your businesses master budget, you’ll want to tally your total income and your total expenses (i.e., adding your total fixed costs, variable expenses, cost of goods, and one-time spends)—then compare cash flow in (income) to cash flow out (expenses) to determine your overall profitability.

Having a hard time visualizing what a business budget looks like in action? Here’s an operating budget example to give you an idea of what your new business budget might look like each month:

A Client Hourly Earnings: $5,000 B Client Hourly Earnings: $4,500 C Client Hourly Earnings: $6,000 Product Sales: $1,500 Loans: $1,000 Savings: $1,000 Investment Income: $500

Total Income: $19,500

Fixed Costs

Rent: $1,000 Internet: $50 Payroll costs: $5,000 Website hosting: $50 Insurance: $50 Government and bank fees: $25 Cell phone: $50 Accounting services : $100 Legal services: $100

Total Fixed Costs: $6,425

Variable Expenses

Sales commissions: $2,000 Contractor wages: $500 Electricity bill: $125 Gas bill: $75 Water bill: $125 Printing services: $300 Raw materials: $200 Digital advertising costs: $750 Travel and events: $0 Transportation: $50

Total Variable Expenses: $4,125

One-Time Spends

Office furniture: $450 Office supplies for new location: $300 December business retreat: $1,000 New time tracking software: $500 Client gifts : $100

One-Time Spends: $2,350

Expenses: $12,900

Total Income ($19,500) – Total Expenses ($12,900) = Total Net Income ($6,600)

Above all, once you have a clear sense of your profitability for the month, you can use it to make the right financial decisions for your small business moving forward.

For example, if you realize you’re in the red and spending more than you earn, you might cut your spending and focus on finding new clients . Alternatively, if your income is significantly higher than your expenses, you might consider investing your profits back into your business (like investing in new software or equipment).

Use Your Business Budget to Stay on Track

Putting in the work to create a budget for your small business may seem like a hassle. But while it takes a bit of time and energy, it’s worth the extra effort. Thorough business budgeting gives you the financial insights you need to make the right decisions for your business to grow, scale, and prosper in the future.

This post was updated in October 2023

Written by Deanna deBara , Freelance Contributor

Posted on June 20, 2017

Freshly picked for you

Thanks for subscribing to the FreshBooks Blog Newsletter.

Expect the first one to arrive in your inbox in the next two weeks. Happy reading!

How to create a business budget

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Small business loans

- • Bad credit loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.

Key takeaways

- A business budget is a financial plan that helps estimate a company's revenue and expenses, making it an essential tool for small businesses

- The steps to creating a business budget include choosing budget and accounting software, listing expenses and forecasting revenue

- If a business finds itself in a budget deficit, strategies such as cutting costs, negotiating with suppliers and diversifying revenue streams can help

As a small business owner, keeping your finances organized through a business budget is crucial to running a successful company.

Business budgeting involves creating a financial plan that estimates future revenue and expenses to make informed financial decisions, which can ultimately move the needle on your business’s financial goals and help it grow in profitability.

What is a business budget?

A business budget is a financial plan that outlines the company’s current revenue and expenses. The budget also forecasts expected revenue that can be used for future business activities, such as purchasing equipment. It sets targets for your business’s revenue, expenses and profit and helps you determine if you’ll have more money coming in than you pay out.

A business budget is an essential tool that helps you make wise business decisions. Without it, it’s difficult to gauge your business’s financial health.

What is the difference between a cash flow statement and a business budget?

A cash flow statement (CFS) is a financial document that summarizes the movement of cash coming in and going out of a company. The CFS gauges how effectively a company manages its finances, including how it manages debt responsibilities and funds day-to-day operations.

It’s similar to a business budget in that you can see expenses and revenue. But while a budget gives a moment-in-time snapshot of your business’s financial performance compared to forecasts, the cash flow statement focuses on the actual inflows and outflows of money through your business.

Follow these steps to ensure a well-developed budget, from understanding your expenses to generating revenue and adjusting expenses to balance the budget.

1. Choose a budget and accounting software

First, you’ll want to store your expense and revenue information with accounting software to help you track your numbers and generate reports. Some software may also help you assign categories to the transactions, identify tax deductions and file taxes. Quickbooks is an example of accounting software.

Some business bank accounts also have accounting software built in, helping you stay organized by keeping your accounting and banking in one place.

2. List your business expenses

The next step in creating a small business budget is to list all your business expenses. Here are the types of expenses you want to include in your budget:

- Fixed expenses: Fixed expenses cost a fixed amount monthly or within the assessed period. Those costs include rent, insurance, salaries and loan payments.

- Variable expenses: Variable expenses can change monthly or over time, making them trickier to budget. This might include materials, direct labor, utility bills or marketing expenses.

- Annual or one-time costs: Some costs only occur a few times per year, while others you’ll only pay for as needed, such as buying new equipment. You still want to budget for these expenses by allocating a portion of your weekly or monthly budget toward one-time expenses.

- Contingency funds: Unexpected business costs can throw a wrench in your budget if not planned for. Such costs could include emergency repairs, necessary equipment purchases, sudden tax increases or unforeseen legal fees. To plan for these costs, you can create a contingency or emergency fund that’s separate from your operational budget.

- Maintenance costs: To allocate funds for maintenance costs, begin by including regular inspections and maintenance in your budget. Then, make sure to leave room for changes and unexpected maintenance costs.

3. Forecast your revenue

To estimate your future revenue, start by deciding on a timeline for your forecast. A good place to start is the previous 12 months. Your accounting software may also include revenue forecasting as one of its features, which can automate this step for you.

The timeline and your recent past growth can help you understand how much revenue you’ll generate in the future. Consider external factors that could drive revenue growth, such as planned business activities like expansion, marketing campaigns or new product launches.

You’ll also want to think about anything that might slow your growth. Many businesses experience seasonal fluctuations, which can impact your budget if you don’t plan for it. To account for these changes, list the minimum expenses required to keep your business running. Use your financial statements to understand these costs, and consider averaging out irregular expenses over the year to avoid surprises.

Ideally, your business should build a cash reserve during profitable periods to cover expenses during slower seasons. If necessary, consider various financing options, such as a business credit card or line of credit, that you can draw from to manage cash flow during peak or off times.

4. Calculate your profits

The next step in creating a business budget is to calculate your business profits. You can look at your total profits by calculating revenue minus expenses. That way, you see how much money you have to work with, called your working capital .

You should also understand your profit margins for each of your products and services, which can help you set prices or decide whether to offer a new product or service.

How to calculate your profit margins

To find out your gross profit margin, you’ll first need to calculate the gross profit. To calculate your business’s gross profit, subtract the cost of goods sold (COGS) from your total revenue. COGS includes all the expenses related to producing your products and services.

Once you have the gross profit, use the gross profit margin formula: (Revenue – COGS) / Revenue x 100. This will give you a percentage that shows how much profit you gain from that particular product after accounting for the product’s costs.

5. Make a strategy for your working capital

Knowing what to do with extra revenue, which is your working capital, is crucial for managing your business finances and growth. Here’s how to get started with a financial strategy that propels your business goals forward:

- Set spending limits for different categories in your budget. When listing your expenses, you should have set a dollar amount for each category. You can estimate this by a monthly average or a general forecasted amount.

- Set realistic short- and long-term goals. These goals will motivate you to stick to your budget and guide your spending decisions.

- Compare your actual spending with your net income and priorities. Look at the areas you’re spending and consider whether you need to reallocate money to different categories. Consider separating expenses into business needs and extras.

- Adjust your budget and actual spending. Adjust your spending to ensure you do not overspend and can allocate money towards your goals. If you need to cut spending, consider the categories that are extras, such as types of marketing that you don’t know will generate a return on investment.

6. Review your budget and forecasts regularly

Finally, review your budget regularly. By frequently checking in on your budget, you can identify any discrepancies between your planned and actual expenses and adjust accordingly. This allows you to proactively handle any financial issues that may arise rather than reacting to them after they’ve become a problem.

Regular reviews also allow you to refine your budgeting process and improve its accuracy over time. Keep in mind that your budget is not set in stone but rather a tool to guide your financial decisions and help you achieve your business goals.

What to do if you have a deficit in your business budget

Finding a deficit in your small business budget can be alarming, but there are several strategies you can employ to handle this situation.

- Do a cash flow analysis. Begin by doing a cash flow analysis to review what your business is earning and spending money on. Identify potential problems and adjust the budget as needed to prevent overspending.

- Cut nonessential business costs. Cutting spending may involve eliminating nonessential costs and transferring funds from other categories to overspent categories. Your goal is a balanced or profitable budget.

- Negotiate with suppliers. Be transparent in your communications with suppliers and explain your quality standards and why you’re seeking cost reduction. Explore options for cost reduction that do not compromise quality, such as process improvements or ordering in larger quantities.

- Create a lean business model. By removing anything that doesn’t benefit your customer, your business can potentially save time and resources. Lean business models focus on continually improving processes and customer experience without adding additional resources, time or funds.

- Add revenue and diversify revenue streams. Raising revenue requires a realistic plan with measurable goals to increase sales and overall business income. You can also consider other products and services you could offer that would make your business profitable.

- Use financing to cover temporary gaps. Applying for a small business loan can help pay bills during an unplanned shortfall. Since this will add an expense to your budget, make sure you can handle the loan repayments and your regular expenses.

- Plan for a deficit. In some cases, a planned budget deficit might be a strategic decision, such as investing in new opportunities that promise long-term benefits.

Bottom line

Having a well-developed business budget is crucial for making informed decisions. You can effectively manage your small business’s finances by tracking and analyzing your business’s inflows and outflows, forecasting your expected revenue and adjusting your budget to stay balanced.

Even in the face of a budget deficit, there are various strategies you can use to keep your business profitable, including negotiating costs with your suppliers, assessing your business operations and offering new products and services.

With a solid business budget in place, you can confidently navigate financial challenges and drive long-term success for your small business.

Frequently asked questions

What are the benefits of a business budget, what are the components of a business budget, how do you calculate fixed and variable costs in a business budget.

Related Articles

How to get a small business loan without collateral

How to get a small business loan when self employed

How to finance a small business for the holidays

How to start a small business

- Search Search Please fill out this field.

- Small Business

6 Steps to a Better Business Budget

A top-notch budget can help propel your business success

:max_bytes(150000):strip_icc():format(webp)/100378251brianbeersheadshot__brian_beers-5bfc26274cedfd0026c00ebd.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

You've just purchased or opened a small business and you know your trade. But when it comes to bookkeeping—and more specifically, budgeting —your skill set is lacking. The good news is that it is possible to come up with a budget (or at least a good estimation of what will be needed in terms of dollars and cents) fairly easily.

Estimating and matching expenses to revenue (real or anticipated) is important because it helps small business owners to determine whether they have enough money to fund operations, expand the business, and generate income for themselves. Without a budget or a plan, a business runs the risk of spending more money than it is taking in, or conversely, not spending enough money to grow the business and compete.

Key Takeaways

- A business budget helps owners determine if they have enough money to fund operations, expand, and generate income.

- Without a budget, a company runs the risk of spending money it doesn't have, not spending enough to compete, or failing to build a solid emergency fund.

- To create a budget, check industry standards to determine the average costs of doing business and create a spreadsheet estimating the amount of money you'll need to allocate toward your costs.

- Factor in some slack in your budget to cover unexpected costs and review areas where you could cut costs if times get tough.

- Review your budget every few months and shop around for new suppliers to save money on products or services for your business.

Getting Started With a Business Budget

Every small business owner tends to have a slightly different process, situation, or way of budgeting. However, there are some parameters found in nearly every budget that you can employ.

For example, many business owners must make rent or mortgage payments. They also have utility bills, payroll expenses, cost of goods sold (COGS) expenses (raw materials), interest, and tax payments. The point is every business owner should consider these items and any other costs specifically associated with the business when setting up shop or taking over an existing business.

With a business that is already up and running, you can make assumptions about future revenue based on recent trends in the business. If the business is a startup , you'll have to make assumptions based on your geographic area, hours of operation, and by researching other local businesses. Small business owners can often get a sense of what to expect by visiting other businesses that are for sale and asking questions about weekly revenue and traffic patterns.

After you've researched this information, you should then match the business's revenue with expenses. The goal is to figure out what an average weekly expense for overhead, utilities, labor, raw materials, etc. would look like. Based on this information, you may then be able to estimate or forecast whether you'll have enough extra money to expand the business or to tuck away some money into savings. On the flip side, owners may realize that in order to have three employees instead of two, the business will have to generate more in revenue each week.

These six simple tips will help you put together a top-notch small business budget:

1. Check Industry Standards

Not all businesses are alike, but there are similarities. Therefore, do some homework and peruse the internet for information about the industry , speak with local business owners, stop into the local library, and check the Internal Revenue Service (IRS) website to get an idea of what percentage of the revenue coming in will likely be allocated toward cost groupings.

Small businesses can be extremely volatile as they are more susceptible to industry downturns than larger, more diversified competitors. So, you only need to look for an average here, not specifics.

2. Make a Spreadsheet

Prior to buying or opening a business, construct a spreadsheet to estimate what total dollar amount and percentage of your revenue will need to be allocated toward raw materials and other costs. It's a good idea to contact any suppliers you'd have to work with before you continue on. Do the same thing for rent, taxes, insurance(s), etc. It's also important you understand the different types of budgets you'll need to set up for your small business and how to implement them.

3. Factor in Some Slack

Remember that although you may estimate that the business will generate a certain rate of revenue growth going forward or that certain expenses will be fixed or can be controlled, these are estimates and not set in stone. Because of this, it's wise to factor in some slack and make sure that you have more than enough money socked away (or coming in) before expanding the business or taking on new employees.

4. Look to Cut Costs

If times are tight and money must be found somewhere in order to pay a crucial bill, advertise, or otherwise capitalize on an opportunity, consider cost-cutting . Specifically, take a look at items that can be controlled to a large degree. Another tip is to wait to make purchases until the start of a new billing cycle or to take full advantage of payment terms offered by suppliers and any creditors. Some thoughtful maneuvering here could provide the business owner with much-needed breathing and expansion room.

5. Review the Business Periodically

While many firms draft a budget yearly, small business owners should do so more often. In fact, many small business owners find themselves planning just a month or two ahead because business can be quite volatile, and unexpected expenses can throw off revenue assumptions. Establishing a budget planning calendar can be an effective tool for business owners to ensure they have enough capital to meet their business needs.

6. Shop Around for Services/Suppliers

Don't be afraid to shop around for new suppliers or to save money on other services being performed for your business. This can and should be done at various stages, including when purchasing or starting up a business, when setting annual or monthly budgets, and during periodic business reviews.

The Bottom Line

Budgeting is an easy, but essential process that business owners use to forecast (and then match) current and future revenue to expenses. The goal is to make sure that enough money is available to keep the business up and running, to grow the business, to compete, and to ensure a solid emergency fund.

University of California, Irvine, Accounting & Fiscal Services. " Understanding Fiscal Years and Fiscal Periods ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-485221701-581f4df15f9b581c0b6e2256.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to Create a Business Budget for Your Small Business

According to a study done by CBinsights, a few of the top reasons why small businesses fail include include pricing and cost issues, losing focus and running out of cash. These issues can be prevented by having a realistic budget in place.

Before you can focus on the budget, however, you need to identify what aspects of your business you’d like to improve. This will allow you to decide what can be done with your funds. Based on that list, you can set up short-term and long-term goals.

These goals will be directly affected by your incoming and outgoing cash. A short-term goal can be paying off a debt or purchasing new equipment. Long-term goals, like keeping aside marketing expenses, are crucial because they are connected to the overall growth of your business.

You should be practical about the goals you set. They should be purely based on your business’ capacity to spend and save. Once you have your goals in place, you can create an effective, foolproof budget by following these steps.

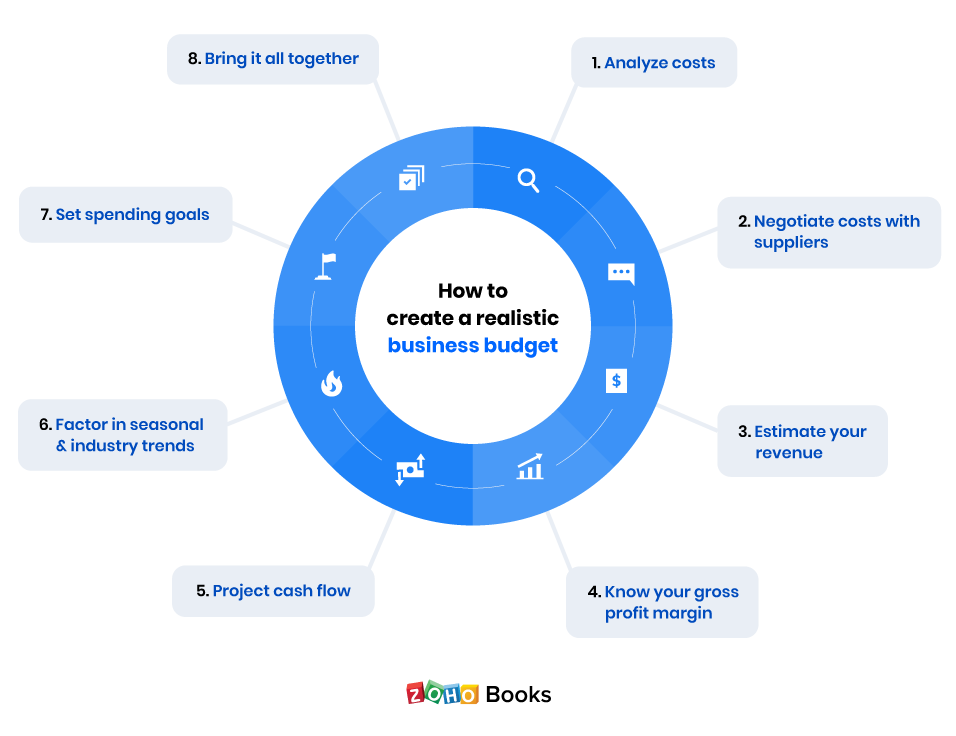

1. Analyze costs

Before you start drafting a budget, you must research the operating costs involved in your business. Knowing your costs inside and out gives you the baseline knowledge needed to craft an effective spending plan.

If you create a rough budget and later discover that you need more money for your business activities, this will jeopardize your goals. Your budget should be such that you can increase your revenue and profit enough as your business expands to handle your growing expenses. Your budget should factor in fixed, variable, one-time, and unexpected costs. Some examples of a fixed expense are rent, mortgages, salaries, internet, accounting services, and insurance. Examples of variable costs include cost of goods sold and commissions for labor.

There is not much harm in overestimating the costs involved since you will need enough cash to handle your future expenditures. If your business is new, then you must include start-up costs as well. Planning the budget this way will help you make informed decisions and tackle any unwanted financial surprises.

2. Negotiate costs with suppliers