Home » Blog » Permanent transfer of IPRs would be subject to 18% GST: Notification

Permanent transfer of IPRs would be subject to 18% GST: Notification

- Blog | News | GST & Customs |

- < 1 minute

- Last Updated on 29 October, 2021

Recent Posts

Blog, GST & Customs

GST Compliance Checklist for Year-End | FY 2023-24

Blog, GST & Customs, Income Tax

Checklist for Year-End Financial Planning Before March 31

Latest from taxmann.

Notification no. 13/2021 – Central Tax (Rate) dated 27-10-2021

Based on the recommendation of the 45th GST Council meeting, GST rate on the permanent transfer of the Intellectual Property right (IPR), in respect of goods other than IT software, under the service tariff notification was increased from 12% to 18% by Notification no. 06/2021 – Central Tax (Rate) dated September 30, 2021. However, no such amendment was made in the rate notification of goods (as similar expression was also there). In order to avoid any ambiguities, amendment in the rate notification of goods has also been made to provide the GST rate of 18% on the permanent transfer of all IPRs.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

PREVIOUS POST

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest books.

R.K. Jain's Customs Tariff of India | Set of 2 Volumes

R.K. Jain's Customs Law Manual | 2023-24 | Set of 2 Volumes

R.K. Jain's GST Law Manual | 2023-24

R.K. Jain's GST Tariff of India | 2023-24

Everything on Tax and Corporate Laws of India

Author: Taxmann

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

- Express Delivery | Secured Payment

- Free Shipping in India on order(s) above ₹500

- Missed call number +91 8688939939

- Virtual Books & Journals

- About Company

- Media Coverage

- Budget 2022-23

- Business & Support

- Sell with Taxmann

- Locate Dealers

- Locate Representatives

- CD Key Activation

- Privacy Policy

- Return Policy

- Payment Terms

Rajput Jain & Associates Chartered Accountants An ISO 9001:2008 Certified Firm

Start My Business

- Company Registration

Proprietorship

Partnership

- One Person Company

Limited Liability Partnership (LLP)

Private Limited Company

Public Limited Company

Maintain My Business

Business License / Registration

ESI Registration

EPF Registration

FCRA Registration

MSME Registration

Food Business License

My Regulatory Filing

Business Return Filings

FCRA Return

VAT-TIN Return

Service Tax Return

GST Services

- GST Registration

- GST Consultancy

GST Return Filling

GST Compliances

- Business Setup in India

Entry Strategy

Growth Strategy

Diversification Strategy

Audit & Assurance

Internal Audit

Management Audit

Sox Audit & Clause 49

Due Diligence Audit

Corporate Law Compliance

XBRL Data Conversion Service

LLP Consultancy

Restructuring Services

Company Secretarial Services

Tax & Regulatory Compliance

Value Added Tax (VAT)

Service Tax

Central Excise

Custom Law Services

Business Setup Outside India

Business Outsourcing Service

- Outsourcing Services

Operational Excellence

Performance Optimization

Project Financing

Tax & Regulatory

Income Tax Services

Certification Work

Virtual Office Facility

CFO Services

IBC Services

Business Entities

- Business Licence Registration

Company Law

- Financial Services

Publications

Press Release

Newsletters

Photo Gallery

Being a Consultant

Life at RJA

Professional Development

Work With Us

Your Background

Taxability Position on IRP Under GST

Home Learn Taxability Position on IRP Under GST

Goods and Services Tax Taxability Position on IRP Under GST

Table of Contents

- Gst Rate On Permanent Transfers Of Ipr In Respect Of Goods Has Been Increased By The Cbic

GST rate on permanent transfers of IPR in respect of goods has been increased by the CBIC

the government must issue clear instructions to avoid future controversies, tax avoidance, and subsequent litigation, as well as proper compliance to promote ease of doing business with regard to applicability of GST on Intellectual Property (IP) right

Permanent transfers Vs Temporary transfer : Supply of goods or services?

- Under the Heading 9973(ii) uses the words “Temporary or permanent transfer or permitting the use or enjoyment of IRP under Supply of services . Prima facie, this gives an impression that permanent transfer of Intellectual Property right shall also be treated as supply of services in the goods and services tax regime.

- There was ambiguity as to treatment because of rate of GST to be applied for permanent transfer of IPR is 18 percent if treated as a "supply of services" and 12 % if treated as a "supply of goods." This is now in line with the GST rate on permanent transfers of Intellectual Property Rights ("IPR") in respect of products, which has been increased from 12% to 18% and bringing it in line with the supply of services.

Before amendment via GST Notification By CBEC:

- Permanent transfer of Intellectual Property (IP) right in respect of Information Technology software : 18%:

- In Case of Permanent transfer of Intellectual Property (IP) right in respect of goods other than Information Technology software : 12%:

After amendment via GST Notification By CBEC:

- GST rate on permanent transfers of IPR in respect of goods has been increased by the CBIC.

- Permanent intellectual property law transfer is not regarded as a provision of service. Despite the fact that the applicable tax on both permanent and temporary transfers of intellectual property rights is now the same, the GST law has clarified that only permanent transfers of intellectual property rights are deemed supplies of commodities and are taxed appropriately.

- Permanent transfer of IPR whether of goods or IT software shall be taxable @ 18%: Deletion of entry permanent transfer of Intellectual Property (IP) right in respect of goods other than Information Technology software” and prescribing of entry “Permanent transfer of Intellectual Property (IP) right” which is taxable @ 18%. Now therefore, any permanent transfer of IPR shall be taxable @ 18% Notification : 13/2021-CT (rate) dt. 27.10.2021 (Seeks to amend Notification No. 01/2017 – Central Tax dated 28.06.2017)

- So Conclusion is GST rate on permanent transfer of IPR on goods by increasing GST rate from 12% to 18% & made it at par with supply of services.

Disclaimer: The content of this post isn't considered to be professional or legal advice, We aren't responsible for any damages arising from your access to the location content & must not be relied on or used as a substitute for legal advice from a lawyer professional in your jurisdiction. CARajput is among India's big digital compliance services platform which committed to helping people have started & developed their businesses. We had started with the goal of creating it easier for start-ups to start out their business. Our main aim is to assist the businessman with applicable laws & regulations compliance and providing support at each & every level to make sure the business stays compliant and growing continuously. For any query, help or feedback you may in touch on [email protected] or Call or what’s-up on 9-555-555-480

Share This Post

Rajput Jain & Associates

Rajput Jain & Associates have been in the industry of business service providers for over five decades. We have been able to propel the growth through the modern age of technology incorporating highest ethical and professional values. From registration of companies to solving complex business issues we have improved our expertise over the decades. The guidance of our leaders has helped to guide the upcoming entrepreneurs to resolve their most compelling problems. We provide a full suite of business solutions to increase the efficiency of our client’s be it tax consultancy to new developments in GST. We walk our clients in to the future of possibilities and guaranteed success.

Related Articles

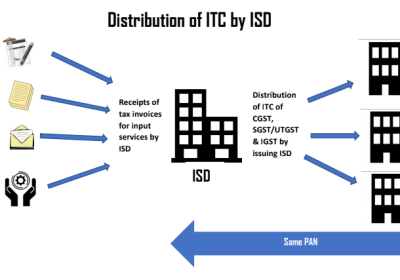

Changes in ISD Concept & Definition: Union budget 2024

05 Feb, 2024

Excess RCM claimed: ITC Claimed Twice against the RCM paid

18 Jan, 2024

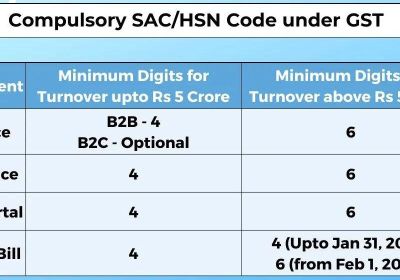

Compulsory e-Invoice Details & New HSN Code Requirements

17 Jan, 2024

GST Taxpayers will be permitted to submit Revised GST Returns w.e.f April 2025

30 Dec, 2023

New Changes in Goods and Services Tax Law which come to be effective from 01.10.2023

17 Oct, 2023

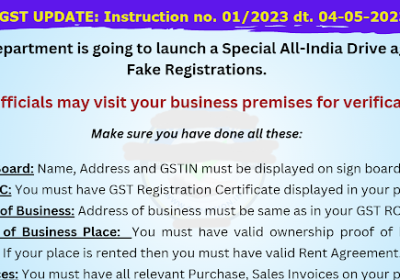

Out- Come of A Special All-India Drive on GST

19 Jul, 2023

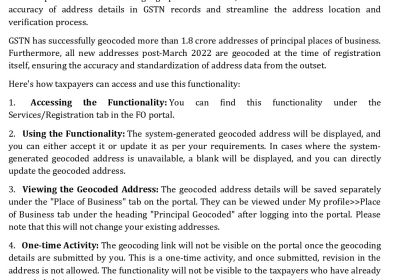

GSTN :Geocoding-Businesses can have to geocode their addresses

10 Jul, 2023

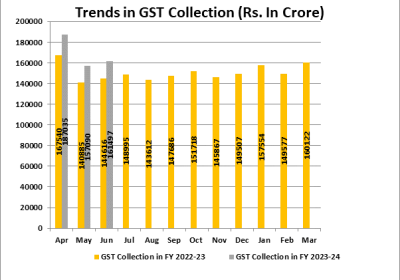

INR 1.61 Cr Gross Goods and Services Tax revenue collected for June 2023;

05 Jul, 2023

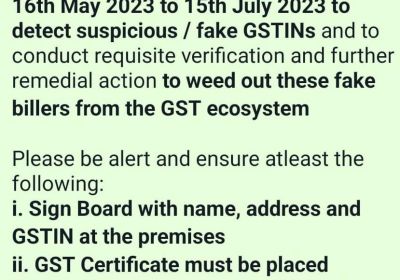

GST Inspector visit at Business Premises of dealers from 16th May to 15th July 2023

15 May, 2023

Related Videos

Types of GST Returns: What is GST Return? | All GST Returns | Types of GST Returns and Due Dates

Published On: Nov 09, 2021 | By: RJA

E-Invoicing Under GST? | E-INVOICING ? | All About GST E-Invoice

E-Invoicing Under GST? | E-INVOICING? | All About GST E-Invoice

Published On: Nov 12, 2021 | By: RJA

Request a call from a RJA Business Advisor.

Popular Categories

- Chartered Accountants

- COMPANY LAW

- Form 15CA & 15CB Certificate

- Goods and Services Tax

- GST Compliance

- GST Filling

- Income tax return

- Limited Liability Partnership

- Nidhi company

- ROC Compliance

- ROC filling

- Transfer Pricing

- Valuation - Merger & acquisition

Browse Blogs

- 15ca and 15cb certification

- Aadhar and PAN Card

- Bitcoin & Cryptocurrency

- Business Registration

- Companies Act / ROC

- Corporate and Professional Updates

- Corporate Law

- FAMA/ FOREX

- Foreign Trade

- GST (Goods and Services Tax)

- GST E-Invoice

- Indirect Tax

- International Taxation

- MCA Compliance

- NBFC (Non-Banking Financial Company)

- Project Finance

- RBI Consultancy

- Statutory Audit

- Tax Planning

Recent Posts

All about the Equity Linked Savings Scheme & its Returns

New Functionality of the interest calculator in GSTR-3B

How to respond notices for AIS (Annual Information Statement) mismatch?

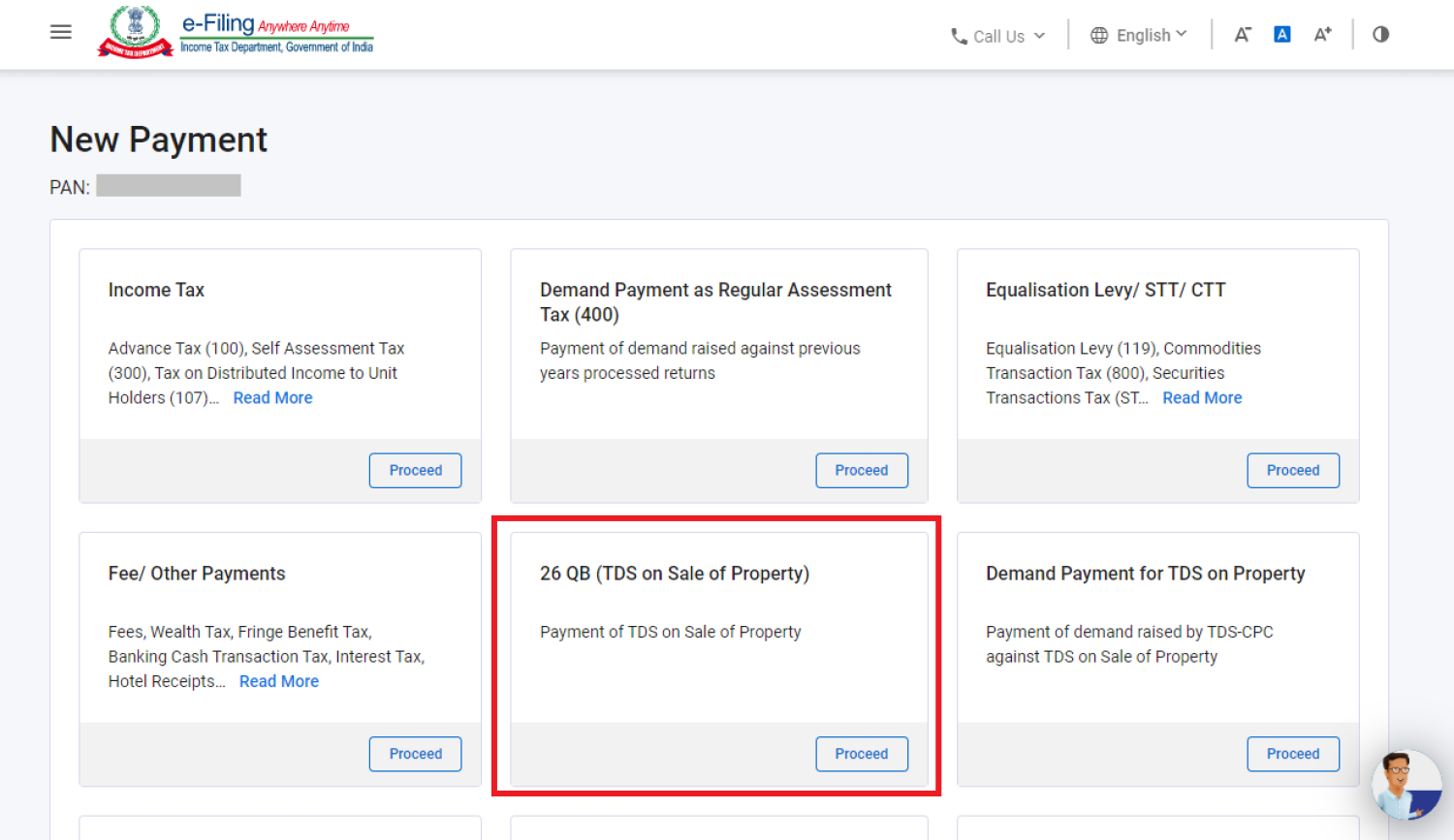

Payment of TDS via using Form 26QB on sale of property

RBI intends to tokenisation assets, bonds as part of the wholesale CBDC pilot.

Connect with a rja advisor.

Fields marked with an * are required

Please send us your query and we feel very happy helping you

Testimonials.

Thank you very much for all your help in setting up my new company and clearing up all outstanding business in my sole trader accounts. For the first time in years I have peace of mind regards my business accounts. Your workforce are a credit to you, the girls at reception are so helpful and Chris has been brilliant. It is very much appreciated.

A US consultancy group

Rajput Jain & Associates. are a tremendous value added to me as an executive and a busy parent. It just makes sense to delegate my tax file to them -- they are proactive, extremely service oriented, and most importantly, I am completely confident they are finding every dollar of tax savings available to me.

A Leading Service Provider

We use Rajput Jain & Associates for all our accounting, Corporation tax, VAT and other compliance needs. The service is professional, courteous and prompt. I would recommend Rajput Jain & Associates to any company requiring a comprehensive accounting and tax service.

A Leading Consultancy Firm in Dubai

Money Back Guarantee

Not happy with the service? You can request a refund at anytime within 30 days!

24/7 Support

Get support through phone, email, mobile app or live chat - 24/7, 365 days.

EMI Payment

Easily pay online with EMI payments, credit or debit card, net banking, PayPal and more.

Keep In Touch

RJA Membership

We are the exclusive member in India of the Association of International Tax Consultants, an association of independent professional firms represented throughout Europe, US, Canada, South Africa, Australia and Asia.

Video Presentation

Data security Practice

Terms & Conditions

Privacy Policy

Refund & Cancellation Policy

Legal Disclaimer

Company Pvt. Policy

Copyright Policy

Business partners

For franchise

Advertise with us

Add to favorites

Appointment

Free Trial Offer

How we work

Accreditations

Get In Touch--

Email: [email protected]

Phone: 9555555480

Legal Disclaimer--

The information contained on this website merely provides details of our firm to persons who have shown interest in knowing more about us and is not intended to solicit work or advertise our capabilities in any manner. The information provided on this website is general in nature and should not be used as a basis of decision-making without further professional advice. The third party site links are only provided for ready reference of the users and CA Rajput Jain & Associates neither controls their content nor undertakes any responsibility regarding them.

© 2016 Rajput Jain & Associates. All Rights Reserved | Sitemap

Send an Enquiry

Temporary vs. Permanent Transfer of IPR: An Analysis of GST rates

In the 45 th GST council meeting, the GST rates of permanent transfer of IPR services is increased from 12 percent to 18 percent. There was no further amendment in the rate of goods notification except the increment of service tariff from 12 to 18 percent. GST rates of 18% on permanent transfer of IPRs has been amended in order to avoid any ambiguities.

The notification no. 13/2021 dated October 27, 2021 was released by central tax to put GST rate on permanent transfer of IPR in respect of goods by increasing GST rate and made it at par with supply of services.

After effect of the new amendment in permanent transfer of IPRs

The Central Board of Indirect Taxes and Customs (CBIC) announced an 18 percent GST on the temporary or permanent transfer of or permission to use or enjoy Intellectual Property Rights (IPR). The Board empowered under sub-sections (1), (3), and (4) of section 9, sub-section (1) of section 11[1], sub-section (5) of section 15[2], sub-section (1) of section 16[3], and section 148[4] of the Central Goods and Services Tax Act, 2017, the Central Government, on being satisfied that it is necessary for the public interest, amended notification No.11/2017- Central Tax (Rate), dated the 28th June 2017.

The GST rate of 18% applies to the temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) rights; services by way of job work in relation to the manufacture of alcoholic liquor for human consumption and other manufacturing services; publishing, printing, and reproduction services; and materials recovery services. Furthermore, 18% GST is required on entrance to theme parks, water parks, and any other location with joy rides, merry-go-rounds, go-carting, or ballet.

The Board has announced that 28 percent GST would be levied on services such as entry to (a) casinos or race clubs or any location with casinos or race clubs, or (b) sports events such as the Indian Premier League.

Pre and Post GST regime under IPR

Pre regime: – The Goods and Services Tax Law does not define what intellectual property rights are, but in MoF (DR) Decree B2/8/2004TRU of 1092004, the definition states that “Intellectual property arises from the application of intelligence, Permanent transfers of intellectual property rights in the pre- GST regime in the form of books, goodwill, etc. did not constitute provision of services. C.B.E. & C. Circular F. No. B2/8/2004TRU, Issue 1092004, “Permanent transfer of intellectual property rights does not constitute the provision of any service. Such transfer leaves the person selling such rights as an “intellectual property owner” no longer subject to taxable services. Therefore, there is no service tax on the perpetual transfer of intellectual property.”

Also, in case of Thermax Ltd. Vs. Commissioner of Central Excise, Pune-I – 2014 (36) S.T.R. 318 (Tri.-Mumbai) the courtroom docket reiterated the view that “it’s also very clean from the stated Circular that a everlasting switch of highbrow assets proper does now no longer quantity to rendering of service. In the existing case, the appellant has emerge as a co-proprietor of the highbrow assets which might imply that the switch is everlasting. Therefore, the transaction does now no longer come beneath Neath the purview of Section 65(55b) of the Finance Act, 1994.”

Post regime : – According to the Goods and Services Tax Act, a permanent transfer of intellectual property rights is classified as a supply of goods. Additionally, section 9(1) of the Central Goods and Services Tax Act of 2017 states that the central government is authorized to impose CGST on all domestic supplies of goods or services. Central Tax (Tax Rate) Heading 9973 “Temporary or permanent assignment or permission to use or enjoy intellectual property (IP) rights in goods other than information technology software” is subject to 12% (6% CGST + 6% SGST) . [2] and in the product category, “perpetual transfer of intellectual property (IP) rights in goods other than information technology software” are taxed at 12% (CGST 6% + SGST 6%).

Announcement dated October 27, 2021 (Notice No. 13/2021 central tax rate (tax rate) revised the tax rate for goods and services from 12% to 18% in case of permanent transfer of intellectual property rights and additionally changed Notice No.01 /2017 2017 The central tax (tax rate) of 28 June, is intended to harmonize the VAT rate for the perpetual transfer of intellectual property rights in goods and services.

GST rates after 18%

The impact of new amendment has mainly affected transactions which are related with publishers dealing with authors, royalty payment of auto OMEs under JVs, M&A deals relating to brand transfers, etc.

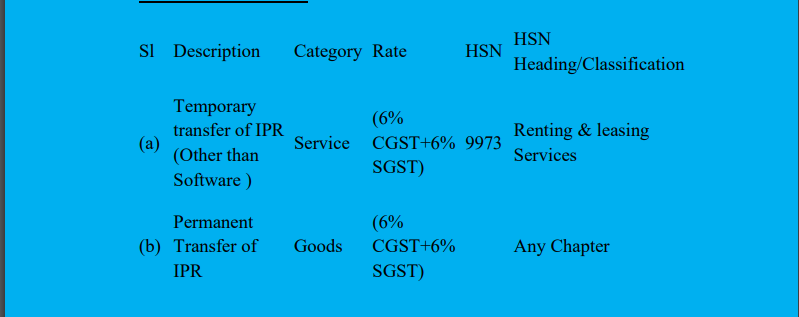

There are various rulings under the old Indirect Tax legislation, where the permanent transfer of IPRs were regarded as commodities. Taking note of the fact that controversy may emerge about the categorization of the permanent transfer of IPRs under GST, the Government, previous to this change, supplied the same description under the tariff notification related to goods as well as services. We may learn the same from a comparison table presented below: –

The adjustment has now only been made to raise the GST rate from 12% to 18% under service tariff notice. There has been no such change to the rate notification for Goods. This would open the door to litigation, since one may claim that permanent transfer of IPRs qualifies as a sale of commodities, and so the appropriate GST would be 12 percent.

The inclusion of a precise rate of 18% in the service tariff notice, effective October 1, 2021, would put an end to any additional confusions about the availability of 5% GST. Prior to the inclusion of a particular provision in the amendment, it was widely assumed that alcohol is equal to food and food products, and hence employment labor services related to the same are taxed at 5%.

An analysis

According to Section 9 (1)[5] of the Central Goods and Services Tax Act of 2017, “a tax known as the central goods and services tax must be imposed on all intra-State sales of goods or services or both,… as may be specified by the Government on the recommendations of the Council…” According to the Central Tax (Rate), “Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right in respect of goods other than Information Technology software” is taxed at 12 percent (6 percent CGST+6 percent SGST), and “Permanent transfer of Intellectual Property (IP) right in respect of goods other than Information Technology software” is taxed at 12 percent (6 percent CGST+6 percent SGST). [Emphasis added.]

Because the phrase ‘permanent transfer’ is included for both categories, products and services, it may seem that all types of services possibly entail permanent transfer. However, a look at the heading of 9973 reveals that this is not the case. 9973’s header is “Leasing / rental services with or without operator.” As a result, the heading 9973 makes it apparent that the heading’s scope is confined to the specific services stated in the heading. As a result, it is this author’s judgment that, with the exception of leasing and rental services, all other services constitute only a temporary transfer, and that even leasing and rental services may, depending on the facts, entail only a temporary transfer. Goods, on the other hand, always imply a continuous transfer. Apart from the particular exception, it seems that temporary transfer or license is seen as a provision of service, while permanent transfer of intellectual property is regarded as a supply of commodities. As a result, in my judgment, the legal situation has remained virtually intact since the implementation of the GST system.

Temporary transfer Vs. Permanent transfers: Supply of goods or services?

Supply of services : Clause (ii) under Heading 9973 uses the words “Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right . Prima facie, this gives an impression that permanent transfer of IPR shall also be treated as supply of services in GST.

Supply of goods :

- For period 01.07.2017 to 14.11.2017 – Permanent transfer of IPR covered only under services rate notification in GST and hence to be treated as supply of services.

- For period 15.11.2017 onwards – Permanent transfer of IPR covered under both goods and services rate notification in GST as services rate notification has not been amended yet to remove the reference of ‘permanent transfer’ of IPRs. Hence, quandary as to taxability of IPRs as goods or services continue to exist in GST regime also.

Since rate of GST to be applied is also different for permanent transfer of IPR being 18%, if treated as ‘supply of services’ and 12%, if treated as ‘supply of goods’, there was an ambiguity as to treatment of same. This is now aligned for GST rate on permanent transfer of Intellectual Property Right ( “IPR” ) in respect of goods by increasing GST rate from 12% to 18% and made it at par with supply of services.

The doctrinal stance of law has remained constant throughout the years, despite changing statutes and increasing case law. Permanent transfer of intellectual property law is not regarded as service providing. Despite the fact that the relevant tax on both permanent and temporary transfer of intellectual property rights is currently the same rate, the GST legislation has mandated that only permanent transfer of intellectual property rights is deemed a supply of goods and is taxed appropriately.

The blog has been written by Mr. Piyush Khatri (Assisted by Mr. Ayush Garg – Intern).

[1] Central Goods and Services Tax Act 2017, s. 11.

[2] Central Goods and Services Tax Act 2017, s. 15, cl. 5.

[3] Central Goods and Services Tax Act 2017, s. 16, cl. 1.

[4] Central Goods and Services Tax Act 2017, s. 148.

[5] Central Goods and Services Tax Act 2017, s. 9, cl. 1.

Piyush Khatri

Head office.

- 2nd Floor, City Square Complex, University Rd, opp. Kashiram Hall, University Area, AHMEDABAD - 380015, Gujarat

- +91 79-2630 3777 2630 5040

- +91 79-2630 2223

- [email protected]

Delhi Office

- 26-Basement, National Park, Lajpat Nagar-IV, NEW DELHI - 110024 (India)

- +91-11-40719580 +91-78757 00089

- [email protected]

Rajasthan Office

- 5/56, Church road, BEAWAR – 305901, Rajasthan (India)

- +91 1462 251362

- [email protected]

Quick Links

- 3000 Atrium Way, Suite 200-#253, Mt. Laurel, NJ 08054

- Meet The Team

ALG India Law Offices LLP

Intellectual property lawyers.

Article: Whether Transfer of IPR is Considered Supply of Service or Supply of Goods Under the GST Regime?

Author: Shreya Das

Introduction

Intellectual Property Rights are becoming more and more integral part of businesses. Right owners are expanding the usage of their intellectual properties by way of giving license or assignment. To expand market share, businesses are acquiring/using each-others’ intellectual properties. Transfer of intellectual property can be done in two ways. Right holders can either give their rights over by way of licensing agreement or by way of an assignment.

Whereas licensing agreement does not actually transfer proprietary rights, assignment agreement transfers rights permanently, including proprietary rights. The applicable tax for these two different types of transactions is different as well. In this article, I shall be discussing the applicable tax on permanent transfer of intellectual property rights based on its nature.

Pre-GST Regime

Prior to 2017, permanent transfer of intellectual property was not considered as supply of service. As per the C.B.E. & C. Circular F. No. B2/8/2004-TRU, dated 10-9-2004, “A permanent transfer of intellectual property right does not amount to rendering of service. On such transfer, the person selling these rights no longer remains a “holder of intellectual property right” so as to come under the purview of taxable service. Thus, there would not be any service tax on permanent transfer of IPRs” [1].

A permanent transfer of intellectual property right therefore did not amount to rendering of service as the person selling these rights no longer remains a “holder of intellectual property right” . In the case of AGS Entertainment Pvt. Ltd. vs. Union of India , [2013 (32) S.T.R. 129] [4], the High Court of Madras took a similar view.

Another case wherein the court held that service tax is not applicable on permanent transfer is iIn the matter of SKOL Breweries Ltd. (Now known as Anheuser Busch InBev India Ltd.) Vs C.C.E & C.S.T. [Service Tax Appeal No. 2017 of 2012] [5], the Customs, Excise & Service Tax Appellate Tribunal, [Hon’ble Mr. S.S Garg &, Judicial Member, Hon’ble Mr. P. Anjani Kumar, Technical Member] vide its order dated November 10, 2020, took a similar view, and confirmed that there is no service tax applicable on permanent transfer of the intellectual property rights. With reference to the Finance Act, 1994, noting Section 65(55b) – “Intellectual Property Service”“(a) transferring, [ temporarily ]; or (b) Permitting the use or enjoyment of, any intellectual property right” read with Section 65(105)(zzr) – “Taxable Service” “to any person, by the holder of intellectual property right, in relation to intellectual property service.” , the Tribunal pointed out that one of the key ingredients for determining if any service related to intellectual property right is taxable under service tax or not, is to see if there has been “…temporary transfer of any intellectual property right OR there has to be the permission to use or enjoy any intellectual property right” [Emphasis supplied]. It is clear when there is a transfer of intellectual property rights, it has to be temporary in nature to apply service tax on the same.

Introduction of GST

As per Section 9 (1) of the Central Goods and Services Tax Act, 2017, “there shall be levied a tax called the central goods and services tax on all intra-State supplies of goods or services or both, … as may be notified by the Government on the recommendations of the Council…” . As per the Central Tax (Rate), under the category of service, under heading 9973, “Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right in respect of goods other than Information Technology software” is taxed at 12% (6% CGST+6% SGST) [2], and under the category of goods, “Permanent transfer of Intellectual Property (IP) right in respect of goods other than Information Technology software” is taxed at 12 % (6% CGST+6% SGST) [3] [Emphasis supplied].

Since the term ‘permanent transfer’ is mentioned for both categories viz. goods and service, it may seem like all kinds of services are capable, potentially, of involving a permanent transfer. A reference, however, to the heading of 9973 makes it clear that it is not so. The heading of 9973 reads as “Leasing / rental services with or without operator” . The heading of 9973 therefore makes clear that the scope of the heading is limited only to the particular services mentioned in the heading. Notwithstanding the broad language of the contents of heading 9973, its scope does not cover services other than those mentioned in the heading. It is this author’s opinion accordingly that except only for leasing and rental services, all other services entail only a temporary transfer and that even leasing and rental services may on its factual circumstances entail only a temporary transfer. Goods, on the other hand, always entail a permanent transfer. It would appear therefore that apart from the specific exception, temporary transfer or licensing is considered as supply of service and permanent transfer of intellectual property as supply of goods. In my opinion therefore, the position of law remains largely unchanged by the introduction of the GST regime.

Over the years, with changing laws, and developing case law, the doctrinal position of law remains the same. A more specific contextual inquiry is called for, though, in relation to leasing and rental services. Permanent transfer of intellectual property law is not considered as supply of service. Even though the applicable tax on both permanent and temporary transfer of intellectual property rights happen presently to be at the same rate, by the introduction of the GST law, it has been endorsed that it is only permanent transfer of intellectual property rights that is considered as supply of goods and taxed accordingly.

[1] C.B.E. & C. Circular F. No. B2/8/2004-TRU. http://centralexcisetrichy.gov.in/newcentral/tradenotice/st/yr0405/tn12.pdf

[2] https://cbic-gst.gov.in/gst-goods-services-rates.html

[3] https://cbic-gst.gov.in/gst-goods-services-rates.html

[4] AGS Entertainment Pvt. Ltd. vs. Union of India. https://indiankanoon.org/doc/123738864/

[5] SKOL Breweries Ltd. Vs C.C.E & C.S.T. (CESTAT Bangalore). https://taxguru.in/wp-content/uploads/2020/12/SKOL-Breweries-Ltd.-Vs-C.C.E-C.S.T.-CESTAT-Bangalore.pdf

Disclaimer: Views, opinions, interpretations are solely those of the author, not of the firm (ALG India Law Offices LLP) nor reflective thereof. Author submissions are not checked for plagiarism or any other aspect before being posted.

Copyright: ALG India Law Offices LLP

Read More on Articles & Reviews

June 10, 2022

- Article: When Can Parody Be Cited As Fair Dealing In A Copyright Dispute? Read more....

March 16, 2022

- Review: ‘Guidelines For Advertising Of Virtual Digital Assets And Linked Services’ (The Advertising Standards Council Of India) Read more....

December 14, 2021

- Article: Whether Street Art & Graffiti Can Be Protected As Artistic Works Under Indian Copyright Law? Read more....

December 1, 2021

- Review: ‘Comments On The Draft Geographical Indications Guidelines: Implications And Discrepancies’ By Sulok S.K. Read more....

November 2, 2021

- Article: Can A Composite Trademark Be Dissected Into Its Constituent Elements To Determine Infringement? Read more....

Modal Header

The contents of this website are meant solely for the purposes of information and updates, and not for the purposes of advertising or soliciting. ALG India Law Offices LLP is not responsible for decision(s) taken by anyone on the basis of information/updates provided in the website.

By clicking "ENTER" below, you acknowledge that the information/ updates provided on the website does not amount to advertising or solicitation.

- Non Solicitation

This website is not a solicitation or invitation to create an attorney-client relationship. No such relationship is created or deemed to be created by visiting this website or by contacting us. This is a passive website intended principally to disseminate published materials already available in the public domain. We, as well our attorneys, do not take out or subscribe to paid rankings, paid listings, paid endorsements or paid advertisements.

- Data Privacy & Protection

No information is collected nor, if available, from visitors to the site or recipients of the communication, used or permitted to be used for marketing, solicitation or recruiting purposes, nor such information is provided or sold to third parties. No information is collected from you or your browser for any purpose including tracking the popularity of this site and the usefulness of particular links or features. No such information is collected or used to target individuals or to contact them. No “cookies” – files written to your computer and designed to help track website visitors’ surfing activities – are used.

- Conflict of Interest Policy

We observe all applicable Bar Council rules and norms in conflict of interest matters. Between practice areas, we do not perceive automatic or deemed conflict of interest. We do not perceive automatic or deemed conflict of interest with closed files unless there is a subject matter overlap. We check for the conflict of interest specifically on a file as against our other existing and live files, and not on a client as against existing client basis, viz. the conflict of interest is strictly on the subject matter against subject matter basis. In case of potential or possibility of being conflicted in the future, however, we seek and take consent from the existing client if we want to take up a file. Our conflict of interest norms are stricter than the minimum standards of the Bar.

We disclose names/identities of our existing clients (but not of their files, nor of the contents of their files nor of any information about them that is or can be expected to be confidential for business/legal purposes) when other clients or potential clients seek us to disclose representative client names/lists etc. If any potential or existing client informs us to except them from this practice, we oblige and refrain from doing so in their regard.

- Data & Document Retention Practice

We retain hard copies of materials of a file for a period of 3 months after a file is closed and after that it is destroyed. File intimation is always specifically communicated to the client. We retain any soft copies of materials in a file for a period of 6 months after a file is closed and after that it is deleted. If hard copies are sought to be returned on closure of file, it should be specifically asked for.

- Firm Management Policy

The private/personal activities of individual lawyers of the firm (such as, but not limited to, writing and publishing in journals and publications, blogs, and expressing views in the public domain, in print and online media, taking membership of organizations and groups in a private capacity, political activities, membership of political parties, contesting elections and other electoral activities, etc.) are not reflective of the firm, nor does the firm support, endorse or identify with any of them.

ALG attorneys practice only in teams viz. accept appointment as advocates-cum-agents on any file/mandate only jointly in practice-groups of at least two ALG attorneys. At ALG, Advocates and IP Agents also participate and share in and contribute towards discharging certain ancillary and support functions in addition to their primary professional responsibilities as lawyers and IP Agents, and this also they do as part of teams and not as individuals. Management functions such as client-relations generally, as well as on any specific file, previous client relations, potential client relations, billing, expenditure, accounts, infrastructure and office management etc. are all thus discharged by such teams. ALG attorneys are not permitted to engage in any sole or individual practice, not even in an outside-ALG or private capacity.

There is functional specialization in ALG in addition to specializations in Areas of Focus and Areas of Practice. In her/his professional work as an Advocates and/or an IP Agent, each individual at ALG specializes, as part of a team, in certain allocated core functions on any client file and discharges only that core function on any client file, instead of handling a client file in all respects or/and from file opening to file closing.

We assume no liability for any reliance on our communications unless signed in ink and issued as a final written legal opinion. Interim opinions, discussion drafts, email communications, telephone conversations, electronic documents, unsigned communications and memos are not intended to be relied upon either by the addressee or by any third party. No communication nor even an ink signed final written legal opinion is intended unless expressly stated to be so to be cited, filed or tendered before any government or statutory agency or authority. We do not hold out as to the accuracy or validity of any communication or legal opinion to any third parties or at any future time.

Contents of this website and communications are posted for discussion purposes only. It is not intended to be and should not the relied upon as a legal opinion. It may not be relied upon by any person as advice or information, nor is it to be quoted, extracted, excerpted, collated, annexed or referred to in any private, public or official or formal document, nor shown to or filed with any government authority, official, forum or agency or any public body. All references and elucidations of the law or of the statutory or regulatory framework are subjective and interpretative and not intended to be either a full statement or elaboration thereof or as having been verified for authenticity. The material is such as may change with time and the authors do not make any representation as to the validity of the contents of this document. The information on these pages/ communication or on this site do not convey legal advice of any kind. Any use of this communication or site does not create a lawyer-client relationship nor will any information submitted via this site or by email be considered a lawyer-client communication or otherwise be mandated as confidential in the absence of a pre-existing express written agreement to the contrary.

The information contained on this website, in any e-mail and any attachments is legally privileged and confidential. If you are not an intended recipient/visitor, you are hereby notified that any dissemination, distribution or copying is strictly prohibited. If you are visiting by mistake or have received this e-mail in error, please leave/ notify the sender and permanently delete the e-mail and any attachments immediately and you should not retain, copy or use any contents or this e-mail or any attachment or any material at this site for any purpose, nor disclose all or any part of the contents to any other person. This is a privileged client only website and a passive communication for restricted distribution at the sole discretion of its authors who hereby predicate its confidentiality, copyright and circulation to be in the mode and manner described below. This page and other pages/communication, including the contents in attachments or at the site, is intended only for clients or persons who have expressed an interest in receiving it or been expressly referred for this purpose. It is not intended for general or public access or circulation.

Unless otherwise noted, all content and materials, including, but not limited to, articles, reports, images, illustrations, designs, icons, photographs, video clips and audio clips that are part of this communication, including attachments, or at the site (collectively, the “Content”) are protected by copyright vesting in the provider of the Content. You shall abide by all additional copyright notices, information or restrictions contained in any Content accessed through any other means. No Content may be copied, reproduced, framed, hyperlinked, republished, downloaded, uploaded, posted, transmitted, or distributed in any way; provided, however, you may download and/or print, one copy of the Content on any single computer/printer for your personal, non-commercial use only, provided you keep intact all copyright and other proprietary notices. Copying, storing or printing of any Content for other than personal use is expressly prohibited without prior permission. Please contact us in case of any doubt. Use of any robot, spider, other automatic device, or manual process to monitor or copy all or any part of Content is strictly forbidden. Modification of the Content or use of the Content for any other purpose is a violation of copyright and other proprietary rights. For purposes of these terms, the use of any Content in any other communication or site or networked computer environment is prohibited. All trademarks, service marks and trade names are proprietary.

- Billing Policy

ALG does not adopt, have or implement any differential billing rate, treatment or fee schedule for and amongst its clients, whether domestic or foreign, or between any such or other categories, either on a on a case by case basis or on any such categorization basis. ALG does, however, provide differently customized client-tailored suite of its IP legal representational services for each of its clients resulting in naturally different costs to different clients for what might otherwise superficially appear similar engagements but would be only apparently similar engagements. ALG works closely with each of its clients to understand that client’s needs and requirements to adapt its billing structure, format and arrangement itself for a more conducive mutual fit. ALG does provide special discounts to its clients but this is on the basis of long-standing relationships reflecting sustained and deep engagement and commitment. It provides these automatically and only in accordance with its internal policies, not on request, demand, discretion or ad-hocism. ALG also provides but only in accordance with its internal policy in force at any given time, what are in the nature of bulk discounts for several simultaneous similar or related instructions or engagements. Actually, these reflect value based reductions given the nature of the instructions and engagements as a package. ALG’s billing arrangements for any engagement are predicted on an attorney-client relationship. ALG is a lawfirm and it provides only legal IP representational services; it does not provide non-legal IP business services or non-legal IP liaison services. ALG’s billing is for this reason incapable of being disaggregated in any part into either of these two types of services that ALG does not provide. ALG does not have any generally applicable fee schedules for any generic or pre-defined activities, services, tasks or engagements because ALG does not provide such modular or otherwise template based services.

We at ALG take seriously our commitment to serving and uplifting our communities. To these ends, we strive to fulfil our professional and ethical responsibilities by providing free legal services appropriately to indigent or otherwise needy individuals and organisations; briefs and cases.

The firm expects each ALG lawyer, regardless of designation, to devote a portion of her/his time and energies to providing pro bono legal services (for free or at reduced charge). The firm strongly encourages all ALG lawyers to seek and maintain active empanelment with local and regional Legal Aid Committees, to seek and take up legal cases and matters both in court and outside court, at appropriately discounted if not altogether waived professional fees. All ALG lawyers are strongly encouraged to discharge their duty to the bar, profession and society by doing so and they are not restricted to only intellectual property law cases and matters in this regard.

Each ALG lawyer’s record of pro bono legal work is considered an important factor in that lawyer’s evaluation and taken into consideration for advancement decisions at the firm.

ALG provides the same quality of professional representation and legal service, regardless of an accepted client’s ability to pay. Pro bono matters of ALG lawyers are treated as that of the firm and no differently than regular billable matters, being accorded the same attention, dedication and resources.

404 Not found

- Submit Post

- Union Budget 2023

- Goods and Services Tax

GST Liability on Intellectual Property Right (IPR) Related Services

In this article, An attempt has been made to simplify GST liability on services related to Intellectual Property rights.

What is Intellectual Property Right :- The term ‘Intellectual Property Right’ (IPR) has not been defined in GST Law. MF(DR) circular No. B2/8/2004-TRU dated 10-9-2004 states as follows – Intellectual property emerges from application of intellect, which may be in the form of an invention, design, product, process, technology, book, goodwill, etc.

Intellectual property rights are like any other property right. They allow creators, or owners, of patents, trademarks or copyrighted works to benefit from their work or investment in a creation.

The intangible nature of intellectual property presents difficulties when compared with traditional property like land or goods. Unlike traditional property, intellectual property is “indivisible”, since an unlimited number of people can “consume” an intellectual good without it being depleted.

IPR – Goods or Services IPR itself is a ‘Good’ but license to use IPR is a service’.

Permanent transfer of IPR is Goods: Intellectual Property Right is a property of a creator and if the creator permanent transfers the right on property, it is considered as a supply of Goods.

Temporary transfer of right to use IPR is Services:- The creator of IPR temporary transfers the right to use of any Intellectual Property Right ( IPR) is a supply of services. He may permit the use or enjoyment of IPR to others for consideration.

As per Para c of schedule II of CGST Act: Temporary transfer or permitting the use or enjoyment of any Intellectual Property Right (IPR) is ‘supply of service’

Transfer of IPR is Taxable under GST: – Both the permanent transfer of IPR and temporary transfer are subject to GST. Temporary transfer includes permitting use or enjoyment of IPR.

GST Rates of IPR :

Services related to IPR can be broadly classified under the following headings:-

(a) Software Development services

(b) Franchise Service

(c) Copy right Service

GST liability on Software:- Software is a set of instructions that allows physical hardware to function and perform computations in a particular manner, be in word processor, web browser or the computer’s operating system.

Development of Software is service under GST : Development, design, programming, adaptation, up-gradation, enhancement, implementation of information technology software is a supply of service . ( Para 5(d) of Schedule II of CGST Act ).

Information Technology Software: Information technology software means any representation instructions, data, sound or image, including source code and object code recorded in machine-readable form, where a user is capable to manipulate and get interactivity of all these instructions using a computer or an automatic data machine or any other device or equipment.

The software in physical form is goods under GST : Though the CGST Act defines the development of software as ‘service’, software in physical form (branded as well as tailor-made), ‘Information Technology Software’ is ‘goods’ in Customs Tariff Act under heading 8523 80 20.

In Tata Consultancy Services v. State of Andhra Pradesh (2004) it has been held that canned software (i.e. computer software packages sold off the shelf) like Oracle, Lotus, Master-Hey, etc. are ‘goods’. The copyright in the program may remain with originator of the program, but the moment copies are made and marketed, they become ‘goods’.

In -State Bank of India v. Municipal Corporation 1997 it was held that ‘computer software’ is ‘appliance’ of the computer. It was held that it is ‘goods’ and octroi can be levied on full value and not on the only value of empty floppy.

Customized and non-customized software both are goods –( Infosys Technologies Ltd . v. Special Commissioner(2008))

GST Rates of Software

The GST rate (as goods) is the same as GST rate of development of software or licensing of software service.

GST Rates & HSN for Software as services :-Temporary transfer of IPR of software is service. The GST rate is 18% (9% CGST and 9% SGST/UTGST) or 18% IGST. Temporary or permanent transfer or permitting use or enjoyment of Intellectual Property Right (IPR) in respect of software falls under service group 99733.

GST Rates & HSN for Software as goods :- Permanent transfer of IPR of software is ‘goods’ and GST rate is 18% [9% CGST plus 9% SGST] or 18% IGST. The HSN classification is ‘Any Chapter’- Sr. No. 452P of Schedule III of Notification No.1/2017-CT (Rate) and 1/2017-IT (Rate) both dated 28-6-2017 inserted w.e.f. 15-11-2017.

Place of Supply :

Place of Supply of Service of development of software and services on software is the location of recipient.

Software is intangible. It does not have a unique existence and can exist on different servers at any point in time. Hence, in case of service of development of software (development, design, and programming of information technology software) and services on software (testing, debugging, modification, etc. i.e. customization, adaptation, up-gradation, enhancement, implementation of information technology software), the place of supply is the location of recipient of service – CBIC circular No. 209/1/2018-ST dated 4-5-2018.

To be continued ………………..

Part II of the Article will cover GST liability on IPR of Franchise services & Copyright Services.

Author can be reached to [email protected]

- Goods And Services Tax

- « Previous Article

- Next Article »

Name: CA Anita Bhadra

Qualification: ca in job / business, company: bharat electronics limited, location: mumbai, maharashtra, in, member since: 17 aug 2017 | total posts: 195, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Group

- Join Our Telegram Group

Gst rate for sawmill licence 12% or 18%

Hello Madam, In the GST rate Table, you have wrongly mentioned GST rate of permanent transfer of IPR (goods) as 6% instead of 9%

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Notice: It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: e9f404120ab698c1054e12048e227ee5

Subscribe to Our Daily Newsletter

Latest posts.

Tax Department detects HRA Fraud with illegal usage of PANs!

End Detention Under MCOCA if Prosecution Sanction Denied: Bombay HC

Guidelines for CGST Investigation: Ensuring Compliance & Ease of Business

Register for Live Webinar: Faceless Appeals before CIT (A)

11 Latest Amendments in Income Tax: Analysis & Implications

181 FAQs on Replacement of Indian Penal Code, Criminal Procedure Code & Evidence Act

Taxpayer Fails to Prove CA’s Advice: ITAT Denies Appeal Delay Condonation

Kerala HC Dismisses Delayed Writ: Jeweller’s GST Refund Petition Rejected

Imposing 15% Tax Demand Remittance for Stay is Arbitrary: Kerala HC

Unutilized CENVAT Credit to be Included in Closing Stock Value: ITAT Mumbai

Featured posts.

Section 139(8A)- Updated Return (ITR-U): FAQs

Bombay HC Dismisses Rs. 3731 Crore CGST Act Penalty Notice issued to Salaried Employee

April, 2024 Tax Compliance Tracker: Income Tax & GST Deadlines

Live Webinar: How can MSME recover payment without going to court

Pre-End of Accounting Year Checklist

TDS Rate Chart (FY 2024-25; AY 2025-26)

10 Important Actions to be taken before filing of GST returns for March 2024

Maharashtra GST: List of non-genuine tax payers as on 29-02-2024

TOP 7 Tax Saving Options Other Than 80C- For FY 2023-24

- Top Stories

Permanent Transfer of IPRs attracts 18% GST: CBIC [Read Notification]

The Central Board of Indirect Taxes and Customs ( CBIC ) has notified that permanent transfer of IPRs attracts 18% GST.

In exercise of the powers conferred by sub-section (1) of section 9 and subsection (5) of section 15 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby makes the further amend the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.1/2017-Central Tax (Rate), dated the 28th June, 2017.

In the said notification, in Schedule II – 6%, S. No. 243 and the entries relating thereto shall be omitted.

Further, in Schedule III 9%, against S. No. 452P, in column (3), the words “in respect of Information Technology software” shall be omitted.

The above mentioned changes are applicable on Integrated Goods and Service Tax (IGST), Central Goods and Service Tax (CGST) and Union Territory Goods and Service Tax (UTGST).

Support our journalism by subscribing to Taxscan AdFree . Follow us on Telegram for quick updates.

The Conundrum Of Taxing IPR: The Achilles Heel Of Taxation Regime In India

[ By Brahm Sareen ]

The author is a student at the University school of law and legal studies, GGSIPU.

Introduction:

Recently, the multinational corporations (hereinafter referred to as “MNCs”) operating under the franchise agreement in India started facing scrutiny by the taxman over the royalty income which is a part of their intangible assets. These MNCs operate in India by allowing the Indian companies to operate their subsidiaries in their global brand name. With the growth in the transfer of these intangible assets, the states naturally started taxing these transactions making them a part of the broader economy [1] . However, in the past, these transactions had sparked controversy over the taxability of intellectual property rights (hereinafter referred to as “IPR”) in India. The conundrum of whether to categorize intangible assets as sale of goods or services along with defining the nature of the agreement remains unresolved.

A recently similar question of law was dealt with by the Hon’ble High Court of Punjab and Haryana in a writ petition filed by Subway systems in India against the tax authoritie. In this case, Subway alleged that the Indian Taxman, without issuing an advance ruling notification, issued various summonses over the non-payment of taxes on their intangible assets and royalty. The question remains the same, as to whether MNCs be taxed on their intangible assets under the right to use, or the transaction be treated as a transfer of right to use or “deemed sales”? Therefore, delving into the aspects of the current IP taxation regime in India is important as the Indian taxation regime deals with these transactions differently.

IPR tax regime in India:

Before the advent of GST reforms in the taxation regime of India, there lies a long-drawn debate on the assignment and licensing of intangible property. However, a well-defined jurisprudential aspect in the IPR taxation regime still lacks as irregularities and discrepancies were all left on the judiciary to decide. In this sense, it is important to define an intangible property to further categorize it and identify the nature of the agreement and the transaction involved.

According to section 2(11)(b) of the Income-tax Act, 1961 , intangible assets include “know-how, patents, copyrights, trade-marks, licenses, franchises or any other business or commercial rights of similar nature” excluding goodwill of a business. Delving into the question of whether these assets are goods or services, the CGST Act, 2017 shall be referred. According to section 2(52) of the CGST Act, 2017 , goods include all types of moveable property other than money and securities. Going by this definition it is safe to assume that the supply of any moveable property is a supply of goods.

In Tata Consultancy services vs. the State of Andhra Pradesh , the Hon’ble Supreme Court held that intangible assets can be called goods if they are capable of being abstracted, consumed, used, transferred, delivered, stored, or possessed. While on the other hand according to C.B.E &C Circular No.80/10/2004-S.T dated 17.09.2004 , temporary transfer of IPRs will be termed as intellectual property services while the permanent transfer of such rights cannot be termed as service. This is because the holder of the intellectual property will no longer hold it in his/her possession and therefore, it will be dealt as sales of the intellectual property. This position of law is also defined by Section 66E(c) of the Finance Act, 1994 which states that temporary transfer or enjoyment or permission to use an IP is a part of services excluding permanent transfers of such property. Accordingly, if the intellectual property is dealt as goods then the transfer of such goods will be deemed sales according to article 366(29A) of the Indian constitution. The position of law, therefore, before the application of GST in India was based on the interpretation of the nature of the transaction, however current regime too has failed to give a conclusive end to the problem of taxability.

Licensing v. Assignment

Much of the debate on the rates of tax to be imposed on MNCs boil down to the nature of the transaction involved. Particularly, the argument lies in the categorization of such transactions. It is not the first time that this question of law is argued. For one reason, it can be sufficiently derived that the jurisprudence before GST had enough debate on the same. One such example is Commissioner of Sales Tax v. Duke and Sons Pvt. Ltd. While this case enumerates the difference between licensing and assignment, the same is ridiculed the moment it distinguishes the transfer of a trademark from the assignment of the same further stating that “permission in writing as required by law may be enough” to suffice transfer of a trademark. The whole jurisprudence behind the concept of “deemed sales” was reduced to permission in writing in this one single sentence. Further, the proposition in its judgment which distinguished assignment and transfer of right to use were against the settled position of law. Something to which an attempt was made by the court to reverse the same in BSNL vs. Union of India which had set out a clear test of exclusivity to identify the nature of the transaction. The BSNL judgment though has been rendered irrelevant with the advent of GST as tax is concurrent now, still laid down the exclusivity test that can be still applied.

The Duke judgment as a whole gave a clear description of what the difference between assignment and licensing. It was held that the assignment of a trademark would mean the proprietor would be divested from his right to use the trademark whereas the same would not be the case in-licensing of a trademark. A license per se is an assurance to the licensee that the owner or the proprietor of the asset won’t initiate any legal proceedings against him if he uses the same. On the other hand, the assignment of an asset would simply mean the right over the asset being transferred to the assignee either wholly or partially. Where section 19 of the Copyright Act, 1957 treats the assignee as the owner of the asset, and a plain reading of section 45 of Trademark Act, 1999 clears the air that the assignee becomes the proprietor of the assigned trademark, the court simply failed to interpret the legislative intent.

Current position

Recently, the 45 th GST Council made the recommendation to increase the applicable tax rate for the permanent transfer of intellectual property rights in respect to goods from 12% to 18% vide Notification No. 13/2021-Central Tax (Rate) . Earlier the rates applicable to the permanent or temporary transfer of IPR in respect to the supply of goods were 12% other than IT software which was taxed at 18%. However post the notification, the separate tax rate for IT software has been omitted and the supply of goods is now taxed at 18% GST. This means that the permanent transfer of goods and services is now taxed at 18% GST. This is a clear case of nomenclature and disputed territory as a consequence. The phrase “permanent transfer” was not deleted from the service notification, however, was inserted in the notification of the goods creating a quandary as to the applicability of rates. This problem has not been resolved with the amended notification rather only the applicable rate has been increased.

Are franchise services the same as licensing services?

The question of whether the franchise model would be dealt with the same applicable taxes like that of licensing services under Serial No. 17, Heading 9973 mentioned in Notification No.11/2017-Central Tax (Rate) dated 28.06.2017 is of utmost importance in the present writ petition filed by Subway. This question has been answered in an Advance ruling by Gujarat AAR GST in In re Tea Post Private Ltd . In this ruling, the AAR of Gujarat had faced a question of whether the franchising services and royalty fees would come under the ambit of Heading 9973 attracting the applicable rate of GST at 12% or would be dealt with differently under other headings. The applicant was a tea house chain under a franchise agreement with a third party under the brand name “TEA POST” who thereby submitted that the franchise fees and royalty is covered under heading 9973 and service code 997336 as per the scheme of classification of services. The AAR ruled that licensing and franchising shall be dealt differently. It stated that licensing implies that the ownership would remain with the licensor however the same cannot be stated in the case of franchising. In franchising, the ownership is enjoyed by the franchisee in “lieu of fee where the processes are controlled by franchisor”. Therefore, the AAR held that the nature of the agreement is of franchising than licensing. As a consequence, the applicable heading shall be Serial No. 21 Heading 9983- other professional, technical and business services and service code (Tariff) No. 998396 as “Trademarks and franchises”. The tax rate was decided to be 18%.

The ruling by Gujarat AAR has a lot of significance in the subway’s case. Subway like any other multi-national food outlet operates on a franchisee model. Therefore, the agreement cannot be dealt with in the same manner as that of licensing. This would directly impact the attracted GST rate in the present writ petition. Even though this does not justify the taxman’s conduct of heavy scrutiny towards businesses operating on franchisee models, this does make a case for the taxman to justify the rate of 18% under Heading 9983.

This was not the first time Subway faced a conflict of this nature. In the case of Subway Systems India Pvt. Ltd. vs. the State of Maharashtra , the conflict of whether the franchise fees and royalty would be taxed under VAT demanded by the tax authorities had arisen. However, the judgment was held in favour of Subway wherein the Bombay High Court held that mere inclusion of franchises under the MVAT act would not attract VAT and the nature of the agreement has to be analyzed. Even though the indirect taxation system in the pre-GST regime was not a settled position, various courts time and again held that franchise agreement gives mere permission to the franchisee to use the trade name or brand name and is a “representational right”. [2] Therefore, the taxman’s argument stating that franchise fees and royalty shall be categorized under transfer of right to use is both unsupported by law and reason.

What does an increased GST for MNCs mean?

The conundrum of taxability of intangible assets has created apprehension for MNCs operating in India. For one reason, MNCs believe that the franchisee business operated by them is full of risks and uncertainty owing to India’s transitory and unsettled tax laws. Therefore, MNCs try to avoid taxes through practices such as IP structuring, debt-shifting, and Transfer pricing. This puts the Indian tax authorities in apprehension of potential losses. While IP structuring is one of the common practices where MNCs register their intangible assets in low-tax countries, the same is one of the main causes of scrutiny towards MNCs by the authorities in India

However, this could mean that the Indian economy, which is still recovering from the pandemic, would be facing more problems with taxman’s hard scrutiny towards multinationals. This conduct will further invite procedural complications and ambiguities. As of now, it seems that the multinationals are in murky waters of uncertainty and the Indian taxman is on a hunt. This worsens the already worse situation the Indian economy has been in ever since the pandemic. To ensure secured investments, the agreement on setting up a global minimum corporate tax rate on MNCs would help India survive.

[1] Balaji Subramanian et al., Bottling Fame, Brewing Glory and Taxing the Transfer of Intangibles , 11 NSLR, 223, 224 (2017).

[2] MC Donalds India Pvt. Ltd. v. Commissioner of Trade and Taxes, New Delhi, 2017 SCC OnLine Del 8414.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Kerwa Dam Road., National Law Institute University, Bhopal Madhya Pradesh, India. 462044.

write to us at – [email protected]

India: Navigating The Tax Implications Of Intellectual Property Rights Transactions

Taxation plays a crucial role in financing public expenditure and supporting a country's economic growth. In recent years, Intellectual Property (IP) rights have been recognized as a valuable asset that can contribute significantly to a country's economy. As a result, taxation laws have expanded their scope to include IP rights. The transfer of IP takes place through the means of either assignment or licensing and each with its own set of tax implications. A robust tax regime in relation to IP rights would reflect how the IP regime as a system would thrive in a nation.

Taxability of IP Rights

But before proceeding to the section on deductions and exemptions, let us understand how IP rights, being intangible property, can be taxed. To be taxable, the nature of IP must be defined. Then it becomes easy to decide the deductions, exemptions, depreciation, and other allied provisions. As such, the GST law recognizes IPR as a "good," but a license to use the same is considered a "service." At the same time, the permanent transfer of IPR is "good", and the temporary transfer of the right to use IPR is recognized as a "service". Various judicial pronouncements, such as Commissioner of Sales Tax v. Duke & Sons (P) Ltd. ((1999) 112 STC 370 (Bom)), A.V. Meiyyappan v. Commissioner (AIR 1969 Mad 284), etc., also recognize patents, copyright, trademarks, and technical know-how as "goods". It should be noted that GST is only applicable on the transfer of IP rights for temporary use in exchange for a consideration, not on the sale of IP because the owner no longer owns the sold IP rights.

Provisions of IP taxation under the Income Tax Act, 1961

Several Sections deal with the taxation of IP rights under the Income Tax Act, of 1961, such as Sections 32(1) (ii), 35A, 35AB, 80 GGA, 80-O, 80OQA, 80QQB, 80RRB, etc. The Act treats IP as a depreciable asset for the computation of income.

Section 9(1)(vi) of the Act defines royalty and says that income by way of royalty is taxable. About the transfer of IP, if it is made for a lump sum consideration once and for all, then it falls under the category of capital gains and is taxable.

However, the following are certain exemptions to the above provision wherein royalties are not taxable:

Firstly , the royalty payable in respect of any right, property, or information used or services utilized by a person outside India to carry on business or profession or for any purpose of making or earning income from any source outside India.

Secondly , royalty is a lump sum consideration for any transfer outside India or imparting of information outside India in respect of any data, documentation, drawing, or specification relating to any patent, invention, model, design, secret formula or process, trademark or similar property if it is payable under an agreement made before 1st April 1976 and the same is approved by the Central Government.

Thirdly , a lump sum payment of income through royalty by a resident for the transfer of all rights, including granting of a license in respect of computer software supplied by a non-resident manufacturer, is approved under the policy on Computer Software Export, Software Development, and Training, 1986 of the Government of India.

Fourthly , in respect of patents and copyrights, section 35A of the Income Tax Act, 1961, deals with expenditure on the acquisition of both patents and copyrights. The purchaser is entitled to claim depreciation if they are bought for a lump sum consideration with an enduring benefit. Additionally, deductions are permitted for each of the previous years in an amount equal to the relevant fraction of the total amount divided over 14 years for expenses incurred on the acquisition of patents and copyrights for businesses after 1966 and after 1998. Also, in the case of amalgamation, if the amalgamating company sells or transfers the rights to the amalgamated company being an Indian company, then, in that case, deductions do not apply to the amalgamating company.

Further, by section 35AB, if the assessee acquired know-how for his business in a previous year for which a lump sum consideration was given, one-sixth of the amount so paid shall be deducted in determining the profits and gains of the business for that previous year. The remainder of the amount will be deducted in equal installments over the next five years. In other words, the expense will be deducted in six equal installments over six years.

Income from Copyrights

Deductions on Income from Copyrights is dealt with under Section 80QQA of the Income Tax Act, 1961. It provides that in cases where an author is an individual resident in India, a deduction of 25% is allowed on the income derived by the author in the exercise of his profession in the previous year relevant to the assessment year beginning on April 1, 1980, or to any one of the nine assessment years following the assessment year, or any one of the four assessment years following the assessment year.

However, it is to be noted that no deductions are available in textbooks namely- dictionaries, thesaurus, or encyclopedias. It is also not allowed in books that are prescribed or recommended as a textbook, or included in the curriculum of degree or post-graduate courses.

Royalty on Patents

According to Section 80RRB, on royalties in respect of patents registered on or after the 1st day of April 2003, where the assessee is an individual resident in India, deductions are allowed of an amount equal to the whole of such income or three lakh rupees. In the case of compulsory licensing, the income by way of royalty for deduction shall not exceed the amount of royalty specified under the terms and conditions of the license settled by the Controller under the Patents Act, 1970. Furthermore, section 115BBF provides for a concessional rate of taxation of 10% on royalty income from the exploitation of patents granted under the Patents Act, 1970. To be eligible for this, the eligible taxpayer must be an Indian resident and at least 75% of the expenditure must be incurred in India, provided no other concessional tax rate would be allowed if the same is sought under section 115BBF. Whereas section 80O says that no deductions are to be allowed to income from patents in respect of the assessment year beginning on the 1st day of April 2005, and for the subsequent years.

Intellectual property (IP) holders may benefit from tax-related advantages and deductions that can help reduce their tax liability. These tax provisions may include tax credits, deductions, and other incentives that can be used to offset the costs associated with developing, acquiring, and maintaining IP. To make the most cost-effective use of IP, IP holders need to analyze and understand the various tax provisions that are available to them. This can involve a thorough review of the tax code, consultation with tax experts, and careful planning to ensure that the IP is being utilized in a manner that maximizes tax benefits.

By taking advantage of these tax provisions and carefully managing their IP assets, IP holders can reduce their tax burden and improve their overall financial performance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

© Mondaq® Ltd 1994 - 2024. All Rights Reserved .

Login to Mondaq.com

Password Passwords are Case Sensitive

Forgot your password?

Why Register with Mondaq

Free, unlimited access to more than half a million articles (one-article limit removed) from the diverse perspectives of 5,000 leading law, accountancy and advisory firms

Articles tailored to your interests and optional alerts about important changes

Receive priority invitations to relevant webinars and events

You’ll only need to do it once, and readership information is just for authors and is never sold to third parties.

Your Organisation

We need this to enable us to match you with other users from the same organisation. It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use.

- Consultants

- Be a Member

- SIGN IN Become a Member

Intellectual Property Rights Taxability Under GST Laws

Table of Contents

In this article, an attempt has been made to explain the taxability of Intellectual Property Rights (hereinafter called IPR) on the touchstone of Goods & Service Tax Act, 2017 (hereinafter called the Act), with the help of cases of Hon’ble High Courts and Hon’ble Tribunal both pertaining to pre-GST and post GST regime. The Articles are in parts – Part I deals with taxability of IPR – Part –II deals Forward Charge or RCM and Part III deal with rates of Tax.

Factual Matrix:

2: This could be illustrated by way of an example. An Indian Company is availing the Intellectual Property Rights (hereinafter called IPR) related services provided by a Foreign Entity based outside India, who is holding License for Patents for the manufacture of Automobile Parts and who does not have any place of establishment in India.

3. Under Agreement, Indian Company has been granted License by the Foreign Company to make, produce, procure and sell the products outside India, without bringing the same into India and would directly sell the products outside India on High Sea Sales basis. Towards consideration, Indian Company shall have to pay a Royalty to Foreign Company based on the value sale of licensed products outside India.

4: During the pre-GST regime, the Finance Act, 1994 had defined “intellectual property right” to mean “any right to intangible property, namely, trademarks, designs, patents or any other similar intangible property, under any law for the time being in force, but does not include copyright”.