Related Expertise: Retail Industry

The $2.5 Trillion Opportunity for Grocers That Are First to the Future

May 19, 2020 By Chris Biggs , Khaled Tawfik , Ameya Avasare , Henry Fovargue , Dewang Shavdia , and Gavin Parker

One thing is certain in this period of uncertainty: the coronavirus outbreak will permanently transform the grocery retail landscape. Consumer behavior is changing radically. In the wake of the pandemic, first-time users make up 41% of US online grocery shoppers. And about 35% of food expenditures—more than $2.5 trillion globally—is up for grabs as consumers shift to dining at home, experimenting with new buying channels and formats and trying out new products. The competitive balance is fluid as well because weaker retailers are struggling to maintain their positions in this unprecedented economic tsunami.

To come out as winners, grocery retailers need to make bold moves now. But doing so requires understanding how today’s crisis will impact the future—and being first to that future by distinguishing the trends that will persist from those that are transient. If past disruptions are a guide, certain shifts in consumer behavior become permanent or at least endure well after a crisis has passed. For instance, in the wake of the 2003 severe acute respiratory syndrome (SARS) contagion, the rate at which new users signed up for online shopping in China increased fivefold, ultimately resulting in the world’s largest e-commerce ecosystem. And after World War II, the number of companies producing canned goods increased by 230%; consumer demand for food with a longer shelf life grew in the wake of civilian food shortages, which resulted from the massive needs of the military. Many of these products and dozens of offshoots remain popular today.

Shifts that we thought would take as many as five years are occurring in five months.

Copy Shareable Link

To accurately predict what the future holds, grocers and other essential retailers need to discard many of their prior assumptions. Shifts in the business environment that we thought would take as many as five years—such as the rapid rise of grocery e-commerce into more than a relatively small channel—are instead occurring in five months. Other trends that could not have been predicted are presenting unexpected opportunities. And all these changes are happening against the backdrop of potentially the largest recession in several generations.

A Big Shift in Food Spending

An outsized opportunity has arisen from the drop in spending on prepared food, a result of the emergence of COVID-19. Significantly, 35% of food expenditures is in flux, a percentage that is likely to change a few times during the stages of the outbreak. Restaurants have been closed, and takeout has declined. Almost no one has been eating at their jobs because many people have been working remotely. And with money tight and fears about leaving home rampant, consumers have been cooking their own meals to a greater degree. Meal kit sales are up since the outbreak—as much as 40% to 60% over 2019 sales in developed markets.

The new eating habits forged during this period are expected to outlast the pandemic because it will probably be some time before consumers feel safe or economically secure enough to frequent restaurants and takeout providers. In fact, 60% of consumers in recent surveys said that they plan to reduce spending at restaurants and increase at-home eating even as COVID-19 restrictions are lifted. Grocery retailers with the vision to capitalize on consumers’ changed behavior have an opportunity to build a lasting presence in the profitable in-store or at-home dining market.

Future Trends

To survive this uncertain period and succeed long term, grocers must proactively design strategies around the trends and behavior that are expected to outlive COVID-19. (See the sidebar “How the Grocery Market Will Evolve in the Wake of COVID-19.”) Being proactive could make the difference between riding out the next few years and emerging stronger—or failing.

How the Grocery Market Will Evolve in the Wake of COVID-19

Although these past few months have been a boon for essential retailers, with sales growing by as much as 100%, the windfall will almost certainly be short-lived. In fact, most countries are already seeing grocery growth stabilizing at about 5% to 15% because consumers have shifted away from stockpiling. (See the exhibit.)

The identification of coronavirus cases followed by the global lockdown frightened consumers into panic buying, stockpiling food and other essential items. But as the adaptation stage drags on—with the curve of new cases flattening and isolation rules slightly relaxing, yet virus fears remaining and the economic consequences worsening—grocery sales will decline, reflecting sluggish consumer confidence and decreasing disposable income. Lower sales volumes will mostly negate gains in areas such as prepared foods for at-home dining, and overall grocery results will be constrained.

Only when COVID-19 is no longer viewed as a real threat—perhaps at a point in the future when hoped-for virus treatments and vaccines are available—can we expect to return to something resembling normal activities and an economic rebound. At that point, grocers that have already begun to implement growth strategies consistent with new consumer behavior will be in a privileged position.

Forecasting the future is not easy, and consumer behavior, preferences, demographics, and the competitive landscape will differ in each market. But many trends that grocers will have to navigate over the coming years (in addition to the shift in food expenditures) are already emerging. They include:

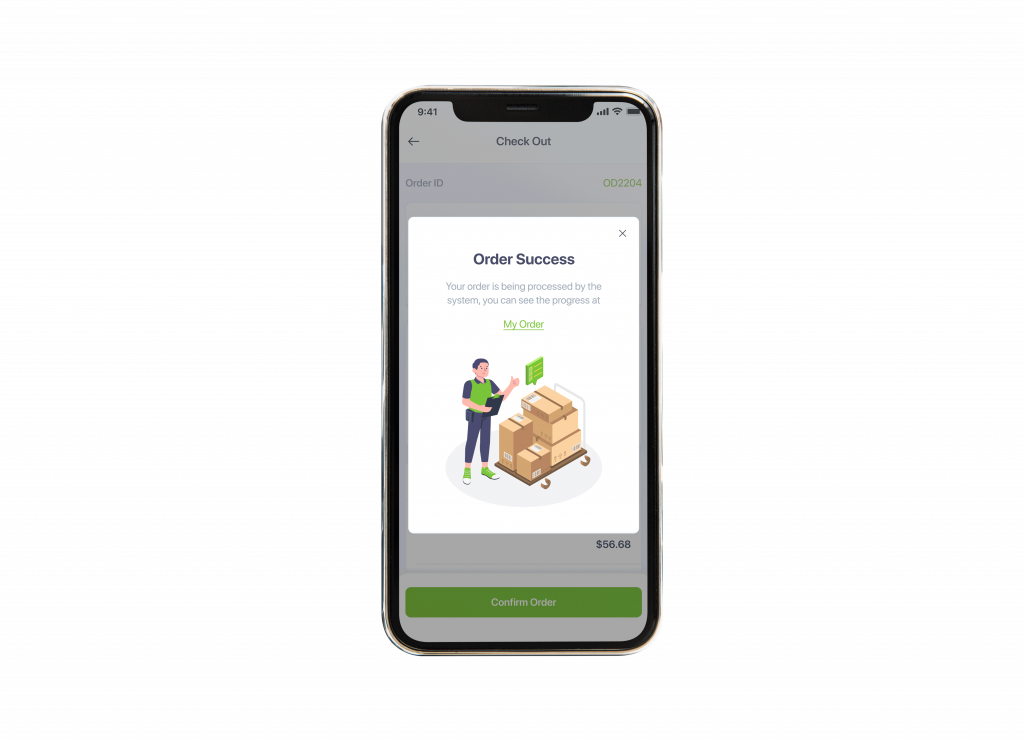

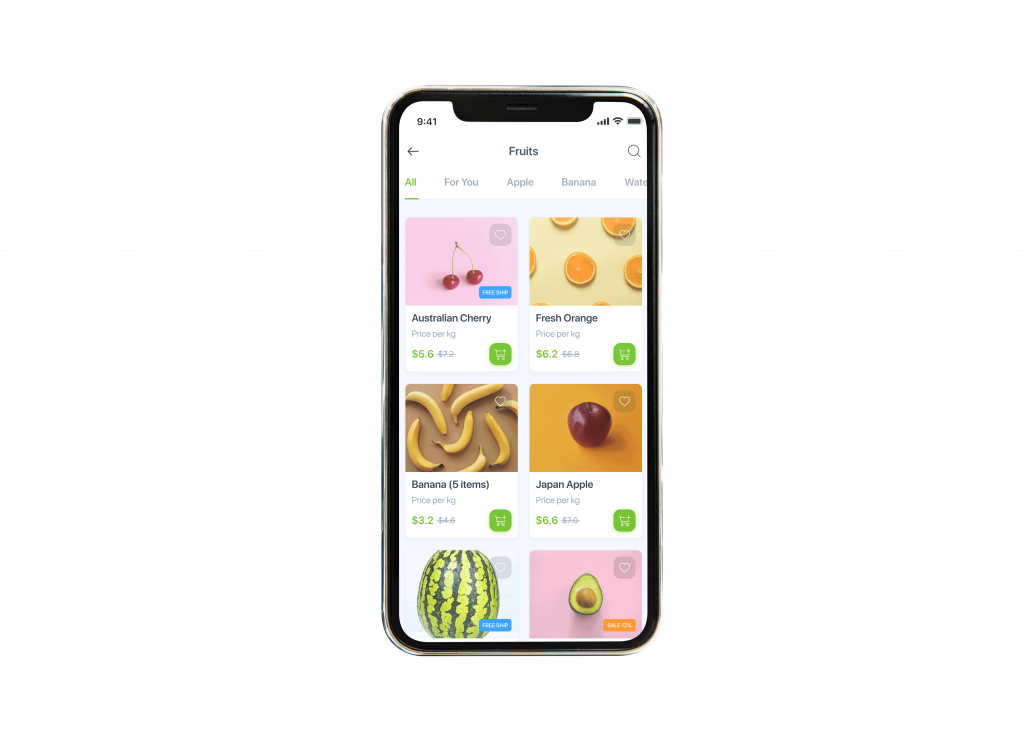

- The Ascendance of Online Channels. Since the COVID-19 crisis began, e-commerce gains for essential retailers across the world are stunning—more than 100% year-over-year growth in many regions. Grocery retailers need a strategic, well-thought-out plan for a compelling online presence and offering that is based on an operating model that will deliver profits as well as growth. The plan must include a high-quality website or app, dependable logistics, fine-tuned inventory management (to ensure availability), and reliable multichannel convenience. Shortcuts for the sake of speed could backfire and result in consumer dissatisfaction.

- Fluid Formats. Successful store formats will need both a superior customer proposition and better economics. Grocers that are dependent on larger stores may find that short-term like-for-like sales gains in bigger outlets are temporarily covering up a longer-term decline in such stores. In addition, the increasing popularity of online channels may further cut into the viability of larger stores. A smart retailer strategy could be to repurpose larger stores as outlets that better fit local customers’ needs and to develop or acquire distinctive smaller formats. Regardless of the format, grocers will have to integrate features that reflect changing consumer preferences, especially around safety. For instance, grocers will have to implement hygienic practices at counters and temporarily remove salad bars.

- Revised Consumer Attitudes Toward Brands and Products. With pocketbooks tight and health worries a lingering shadow, retailers can gain significant market share through differentiated private labels that target a new consumer emphasis on value, nutrition, and health. Retailers should consider developing or acquiring private labels that dovetail with these new consumer preferences.

- A Shift from Mass Promotions to Targeted Ones. In order to cope with spikes in demand and make sure that stock is available, many grocers have simplified their product categories and reduced their promotional intensity. By continuing this strategy, grocers will have an opportunity to reset promotional programs, rather than let complexity creep back in. The outcome would be more-targeted promotions, perhaps geared toward online channels, that consider purchases and shopping behavior.

- Supply Chain Shocks. In this crisis, most grocers’ supply chains struggled to cope with huge fluctuations in demand. Forecasts were inadequate, leading to stockouts of staples and inconsistent product deliveries. But despite the significant demand shifts, retailers have done relatively well in adjusting their supply chains and expanding capacity as the crisis progressed. Over the longer term, grocers must fortify their supply chains even further to better withstand the next pandemic or any other global crisis. Retailers should remap their supplier networks, adding sufficient backups and redundancy to secure smooth product flows no matter the conditions. Forecasts must also become more precise by using artificial intelligence and other data management systems to analyze internal and external demand drivers that could influence changes in customer trends as they happen in real time.

Grocers have adjusted their supply chains, but they must fortify them further to better withstand the next crisis.

- Increased M&A Activities. Grocers are one of the few retailers that will have relatively strong balance sheets in the near term, giving them the opportunity to acquire skills, new store formats, online capabilities, and customer pools by purchasing undervalued assets. This has already begun to occur; global M&A volume has declined 20% to 30% across all industries, but it is flat in the retail segment. For most grocers, the competitive environment in the future will be altered by consolidation and the emergence of new digital rivals.

- A Bigger Role for Societal Impact. Grocers have been pivotal in serving communities during the crisis, leading the way in protecting their employees and shoppers. They have provided desperately needed products and food to consumers through safety-proofed physical outlets, home deliveries, and contributions to food banks. Grocers should build on the momentum toward greater community involvement by permanently embedding total societal impact policies into local and global activities, an approach that has been shown to deliver tangible gains for both communities at large and long-term business. Grocers also have the opportunity to differentiate themselves and gain competitive advantage by embedding sustainability precepts (such as low waste, low plastic) into their operating models.

Make Bold Moves Now

With so much at stake for grocery retailers, and with a high level of uncertainty for the next few years, long-term success stories will come from grocers that make bold moves now to be first to the future. Past crises have taught us that early actors win. The relative return on investment from a major retail transformation when started preemptively in a downturn can be as high as 50%. And companies that expanded business opportunities during a downturn often report purposeful growth that is 8% above those that retrenched.

Retailers need to proactively take actions across three priorities to win the future:

- Reshape channels . Build an attractive e-commerce model that can operate at scale, with the assumption that online sales could grow to as much as 10% to 15% of revenue, compared with their low single-digit precrisis share. Innovate in physical spaces because the unit economics of stores will undoubtedly change. Think through how to reallocate space, downsize large stores, and develop new formats.

- Reimagine offerings. Make changes to the value proposition to better suit customers’ changing needs. This action requires understanding new behavior, such as more at-home dining, and building stronger customer relationships through targeted personalized marketing and differentiated private labels. Stay ahead of shifting trends on an ongoing basis by better monitoring customers’ preferences and needs, rather than view this crisis as a one-off reset.

- Reposition the business. Fuel growth by reallocating resources in ways that reflect future customer behavior and trends; reset costs using a blank-page approach. Build digital capabilities to support business decisions using advanced analytics. Pursue strategic M&A, improve supply chain resilience, and embrace social impact and sustainability policies.

When faced with the need to take such significant action, many retailers pursue what appears to be the easiest, most logical path: they sequence their crisis response. (See the exhibit.)

But for grocery retailers this type of strategy would be unwise. The landscape is changing too rapidly, and customers are realigning their behavior too radically to be reactive. The dynamics of the industry, buffeted so violently by the COVID-19 pandemic, require retailers to be aggressive. In today’s world, and the one to come as the virus ebbs, only parallel decisive actions will produce winning results. In other words, if a retailer is solely focused on stabilization now and plans to prepare for the rebound later, it will likely be too late.

Managing Director & Senior Partner; Global Leader, Retail Sector

Managing Director & Partner

Managing Director & Senior Partner

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2024. All rights reserved.

For information or permission to reprint, please contact BCG at [email protected] . To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com . Follow Boston Consulting Group on Facebook and X (formerly Twitter) .

Subscribe for more insights on the retail industry

Demystifying the Supermarket Business Model: A Comprehensive Explanation

Unravel the complexities of the supermarket business model with our comprehensive guide.

Understanding the Supermarket Business Model

Before we delve into the intricacies of the supermarket business model, it's essential to understand its basics. At its core, a supermarket is a retail store that sells a wide variety of food and household products. It differs from other retail models due to its size, assortment, and self-service format.

In a supermarket, customers have the freedom to browse and select products from the shelves themselves, making it a convenient shopping experience. This self-service approach is one of the key factors that define the supermarket business model.

But let's take a closer look at the supermarket business model and explore its various components and strategies that contribute to its success.

The Basics of the Supermarket Business Model

Supermarkets have several key components that contribute to their success. At the forefront, we have the product selection. Supermarkets offer a vast array of goods, from fresh produce to canned foods, snacks, and household essentials. This diverse product range caters to the varied needs of customers and drives foot traffic.

But it's not just about having a wide range of products. Supermarkets also focus on product quality and freshness . They establish relationships with trusted suppliers and implement stringent quality control measures to ensure that customers get the best products.

Another critical aspect is pricing. Supermarkets operate on a low-margin, high-volume model. They keep prices competitive to attract customers and rely on high sales volumes to generate revenue. This pricing strategy often leads to thinner profit margins but ensures a steady flow of customers.

In addition to products and pricing, supermarkets invest in store layout and customer experience. They strategically arrange shelves to optimize traffic flow and enhance customer convenience. From well-organized aisles to easy-to-navigate sections, every aspect of the store layout is carefully designed to improve the shopping experience.

Moreover, supermarkets prioritize customer service. They train their staff to be knowledgeable and helpful, ensuring that customers have a pleasant and hassle-free shopping experience. From assisting with product inquiries to providing guidance on finding specific items, supermarket staff play a crucial role in customer satisfaction.

Key Components of the Supermarket Business Model

Within the supermarket business model, there are several key components that work together harmoniously. One of the most crucial components is the supply chain. Supermarkets rely on a robust supply chain to ensure a steady and uninterrupted flow of products.

An efficient supply chain management system is vital for supermarkets to maintain optimum inventory levels, minimize wastage, and meet customer demand. From sourcing products from manufacturers and distributors to managing stock levels and replenishment, the supply chain plays a pivotal role in the supermarket business model.

Supermarkets also employ sophisticated inventory management systems that utilize data and analytics to forecast demand and optimize stock levels. By accurately predicting customer preferences and buying patterns, supermarkets can minimize stockouts and reduce excess inventory, leading to improved profitability.

Furthermore, supermarkets place great emphasis on marketing and advertising. They utilize various channels, such as print media, television, radio, and digital platforms, to promote their products and attract customers. Special promotions, discounts, and loyalty programs are often employed to incentivize repeat business and foster customer loyalty.

Lastly, supermarkets actively engage in community outreach and corporate social responsibility initiatives. They support local farmers and suppliers, promote sustainable practices, and contribute to charitable causes. By actively participating in the community, supermarkets build a positive brand image and establish themselves as trusted and responsible retailers.

In conclusion, the supermarket business model is a complex and multifaceted system that revolves around product selection, pricing, store layout, customer service, supply chain management, marketing, and community engagement. By effectively managing these components, supermarkets can thrive in a competitive retail landscape and provide customers with a convenient and satisfying shopping experience.

The Role of Supply Chain in Supermarket Business

Now that we understand the significance of the supply chain, let's explore its role in more detail.

The supply chain plays a crucial role in the success of supermarket businesses. It encompasses all the activities involved in getting products from the manufacturer to the store shelves. An efficient supply chain management system is crucial for supermarkets to minimize costs, meet customer demand, and deliver products in a timely manner.

With a large number of products, managing the supply chain effectively ensures that the right products are available on the shelves when customers need them. This requires streamlining processes, optimizing inventory, and building strong relationships with suppliers.

By streamlining processes, supermarkets can eliminate unnecessary steps and reduce the time it takes for products to reach the store. This not only improves efficiency but also helps in meeting customer demand. When customers find the products they need on the shelves, it enhances their shopping experience and increases customer loyalty.

Optimizing inventory is another critical aspect of supply chain management. Supermarkets need to strike a balance between having enough stock to meet customer demand and avoiding excess inventory that can lead to waste and increased costs. By closely monitoring sales data and using forecasting techniques, supermarkets can ensure that they have the right amount of inventory at all times.

Building strong relationships with suppliers is also essential for effective supply chain management. Supermarkets rely on their suppliers to provide them with quality products at competitive prices. By nurturing these relationships, supermarkets can negotiate better deals and secure favorable terms with their suppliers.

The impact of the supply chain on pricing and profit margins in the supermarket business cannot be understated. By optimizing the supply chain, supermarkets can reduce the costs associated with transportation, procurement, and inventory management.

Efficient supply chain management enables supermarkets to negotiate better deals with suppliers, leading to cost savings. These savings can then be passed on to customers in the form of lower prices, attracting more shoppers and increasing sales volumes.

While the low-margin nature of the supermarket business may seem challenging, effective supply chain management allows supermarkets to maintain profitability by achieving economies of scale and cost efficiencies. By streamlining processes, minimizing waste, and optimizing inventory, supermarkets can maximize their profit margins.

In conclusion, the supply chain plays a vital role in the success of supermarket businesses. It ensures that the right products are available to customers when they need them, minimizes costs, and helps supermarkets maintain competitive prices. By optimizing the supply chain, supermarkets can achieve cost efficiencies and maximize their profit margins, ultimately leading to long-term success in the industry.

Revenue Generation in the Supermarket Business

Revenue generation is a critical aspect of any business, and supermarkets are no exception. Let's explore various revenue streams in the supermarket industry.

Supermarkets have evolved over the years to become more than just a place to buy groceries. They have become one-stop destinations for customers, offering a wide range of products and services. One of the primary revenue streams for supermarkets is the sale of groceries. From fresh produce to packaged goods, supermarkets provide customers with a vast selection of items to choose from.

In addition to groceries, supermarkets have expanded their offerings to include a variety of non-food items. From household essentials like cleaning supplies and toiletries to electronics and clothing, supermarkets have become a convenient place for customers to fulfill all their shopping needs. This diversification of products allows supermarkets to generate additional revenue by catering to a wider customer base.

Supermarkets also generate revenue through various services they offer. Many supermarkets have in-store pharmacies, where customers can get their prescriptions filled or purchase over-the-counter medications. This not only provides convenience to customers but also serves as a revenue stream for supermarkets. Additionally, some supermarkets offer services like dry cleaning, photo printing, and even banking facilities, further expanding their revenue streams.

Another revenue stream for supermarkets is the sale of prepared foods. Many supermarkets have delis and bakeries where customers can purchase ready-to-eat meals, sandwiches, and freshly baked goods. These offerings not only attract customers looking for a quick and convenient meal but also contribute to the supermarket's overall revenue.

Supermarkets also generate revenue through various promotional activities. They often partner with brands to run special promotions and discounts, enticing customers to make purchases. Additionally, supermarkets may offer loyalty programs where customers can earn points or receive exclusive discounts, encouraging repeat business and increasing revenue.

Furthermore, supermarkets have embraced technology to enhance their revenue generation. Many supermarkets now offer online shopping and home delivery services, allowing customers to shop from the comfort of their homes. This not only provides convenience to customers but also opens up new revenue streams for supermarkets.

In conclusion, revenue generation in the supermarket business is multifaceted. From the sale of groceries and non-food items to the provision of services and promotional activities, supermarkets have various avenues to generate revenue. By constantly evolving and adapting to changing customer needs, supermarkets can continue to thrive and remain profitable in the competitive retail industry.

Helping designers and strategists turn their boldest ideas into market-leading ventures through Business, Design and Growth.

Whenever you are ready - here is how I can help:

1. Newsletter . Join over 2.000 founders, creators and innovators and get access to the business builder framework.

2. Business Builder OS - Masterclass on finding growth opportunities, building lean offers and acquiring customers - driven by A.I.

3. Builder Toolkit - 30 ideas on how to grow your revenue.

Actionable advice about spotting new opportunities, creating offers & growing revenue.

- Analytics – Customer Acquisition Cost (CAC)

- Business Model Toolkit

Business Model Analytics

- Customer Development Framework – BM Validation

- Customer Development – Cashflow Forecast

- Dominate A Niche

- Rule of 3s – Business Competition

- Privacy Policy

- Terms And Conditions

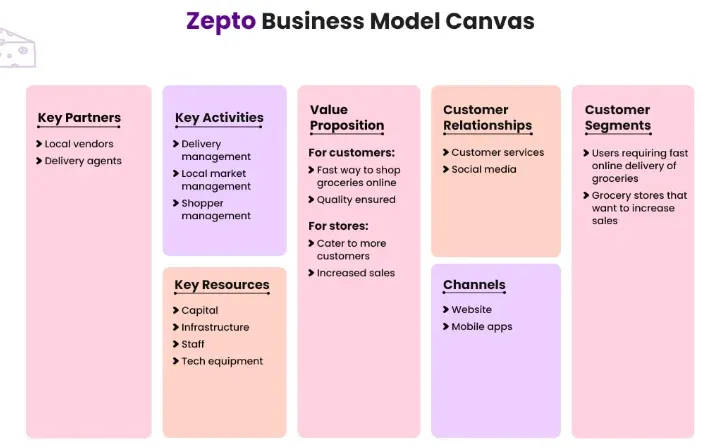

Business Model Innovation – Grocery Delivery

- by Joel Finningley

- Business Model Innovation (BMi) , Grocery-Delivery

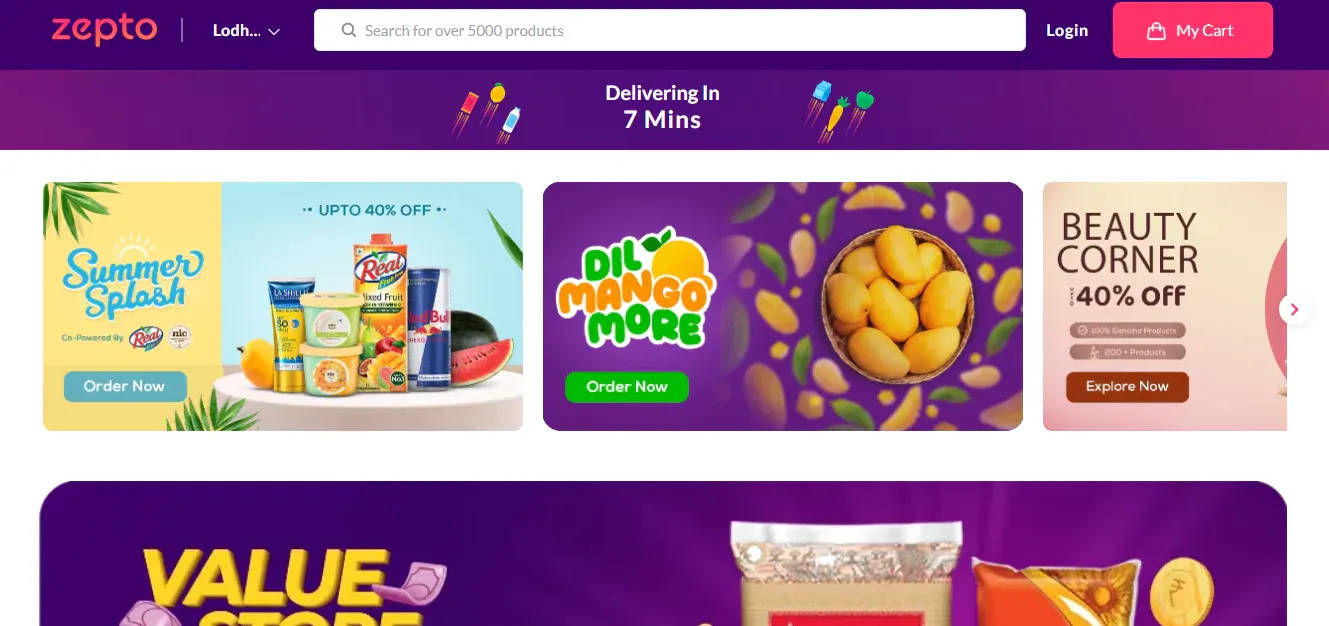

WebVan 2.0 or a new era of grocery?

More than 20 years ago, a startup called Webvan raised more than $800 Million with the promise to revolutionize grocery delivery at the height of the Dot-Com Bubble.

We all know how that story ended (spoiler: it went bust). Now, here we are in 2021 and eGrocery is in the spotlight. Is the business model ready for primetime?

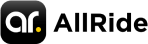

Over the last several years, we have seen many players entering the eGrocery market. The vast majority of those aspiring to lead the charge are either incumbent grocers adapting their model or disruptive eCommerce players using their technological infrastructure to lower costs and modernized apps to acquire new customers.

Grocery Delivery Business Model

How does the grocery delivery business model work.

- What is the Business Model Innovation in Grocery Delivery?

Delivery Fee

Value proposition, revenue streams, cost structure:, what is business model innovation, more egrocery posts.

“ For 2020 , online grocery’s percentage of the $1.04 trillion grocery market is pegged at 10.2%, or about $106 billion … By 2025 , online grocery’s dollar share stands to climb to $250.26 billion of the estimated $1.16 trillion overall grocery market. ” Trending Business Model Analytics Supermarket News

Pureplay ‘ eGrocers ,’ or those who are 100% online with no physical outlets, are having their moment in the sun thanks to the acceleration of the eGrocery shift brought on by the pandemic. Similar to the ‘Challenger Banks’ in the Fintech world, these eGrocers are trying to disrupt the core model of grocery itself by removing the storefront.

That’s about as far as the similarities go, however, as delivering mangoes versus moving money are two vastly different business models.

So while traction and growth are one thing, as we have seen with the Food Delivery Apps ( who continue to lose $Billions years after year ), profitability is another. That’s why we are going to dig into the business model of eGrocers and better understand the mechanics behind the business model innovation .

At its core, grocery is a low-margin/high-volume business.

Grocery retailing is fundamentally a low margin business. Depending on the format or how developed the market is, EBITDA margins generally range from 4 to 8% and EBIT runs between 2 and 5% of net sales. Foley Retail Consulting

Pureplay eGrocers don’t necessarily fare much better on a margin basis ( depending on which company you analyze and where ) generally, as the lease/storefront costs get redistributed into other areas of the business (technology, distribution costs).

The main point is that ‘ going digital’ with the business model doesn’t suddenly make grocery a higher-margin business.

Profitability of the model will depend what mix of products an eGrocer decides to sell (based on margins), how they merchandise those goods, what discount models are applied ( ie. via subscription or reward points) and several other factors. What consumers buy will also shift significantly from a bricks ( physical retail) versus clicks ( eCommerce) model.

With a different mix of goods, changing consumers preferences for delivery vs. in-store pickup, and rapid supply-chain innovation , it is a lot of work just to decipher who is doing what in the eGrocery space.

Now that the pandemic has rapidly accelerated consumer demand , we are starting to see the rise of the disruptors emerge in the eGrocery space. More than 20 years on from WebVan debacle, the question is whether or not consumer demand is the missing ingredient combined with a dash of Business Model Innovation?

What is the Business Model Innovation in Grocery Delivery ?

As we have seen above, there are many different players in the space who are pushing the limits of innovation to try and become one of the dominant players in the new grocery industry. Recently, we have seen big deals to illustrate how hot this market is becoming, for example:

“On-demand grocery delivery platform Instacart has raised a $265 million … pushes the company’s valuation to $39 billion. ” TechCrunch

We also have seen smaller examples of innovative new companies localizing the supply-chain and re-inventing the distribution through so called ‘dark store’ model where companies hold goods in ‘ micro-warehouses ’ and ship directly to the consumer.

Examples of smaller deals in the space show how this Business Model Innovation is changing the way the whole grocery model works by cutting out the middleman:

- ”Flink, the Berlin-based grocery delivery startup that operates its own ‘ dark stores ’, raises $52M“

- Mexican online grocer Jüsto raises $65M “It claims to be the first supermarket in Mexico with no physical store .”

The so-called ‘ dark store ‘ is similar to what we are seeing in many different industries ( ghost kitchens , co-living, etc.) where real-estate is being repurposed to suit these new industrial models. In this case, the dark store enables a new model for on-demand grocery delivery of fresh foods by increasing productivity and repurposing space.

“This will provide major gains in your productivity but that’s balanced against the cap-ex associated with bringing that on,” he said. “The nice part is that cap-ex continues to get more and more attractive as we see more come online.” Winsight Grocery

In a hyper-growth market like eGrocery right now. this model makes sense; however, the volume will need to continue accelerating into the future for the dark-store model alone to pay off.

That’s why the “disruptors” – who don’t have the burden of legacy IT system or customer relationships – can also work at the supply-chain level to localize distribution, like we are seeing with Mexican-based Jüsto.

The startup only sells items from local suppliers, with whom it prides itself on developing fair trade agreements (“Jüsto” means fair in Spanish). It also uses artificial intelligence to forecast demand and to try to reduce food waste at its micro-fulfillment centers. The company’s approach results in “competitive prices, lower transaction costs, and improved convenience to consumers by eliminating intermediaries in the supply chain,” according to the company. TechCrunch

The business model innovation here, on the Cost Structure side of the Canvas, can be summarized as follows:

- cut out the middlemen

- use technology to lower logistical costs

- leverage data-science to better match supply & demand

- remove physical infrastructure costs associated with retail

Increased fill rates on orders ( ie. less waste) and arrival of fresher products are among two of the consumer benefits of this model.

As we mentioned in the section above, none of these points change the fact that grocery is a low-margin business. The question is whether or not all of these factors working in unison can shift the business model enough to make it profitable for upstart companies to deliver fresh groceries, on-demand and turn a profit.

When you look at the mechanics of the Food Delivery business model, one can be forgiven for being skeptical that the eGrocer model will work long-term for the disruptors. Nonetheless, the business model innovation is notable and worth considering against the models used by incumbents and their partners/acquisitions to preserve their own market share.

Grocery Delivery – Competition

This dark-store/micro-warehouse model is new in this space. Most of the eGrocery competition (Instacart, Shipt, and other global high-flyers) source their grocery/retail products from 3rd party Grocers and Partners, rather than creating their own inventory and fulfilling orders Direct-to-Consumer from their own spaces.

Enter the concept of a “dark store,” a converted supermarket or former supermarket space converted into an e-commerce warehouse. These stores offer no retail—no cash registers or merchandising—but can meet online demand more efficiently than picked stores. Winsight Grocery

Many of the pureplay business models in the eGrocery space are similar to Food Delivery Apps in terms of structure and pricing. There are:

- delivery/origination Flat Fees for each order that is placed ( tiered Delivery Fees + others like ‘Heavy Fee’ if necessary)

- Service Fees typically based on the % of the order

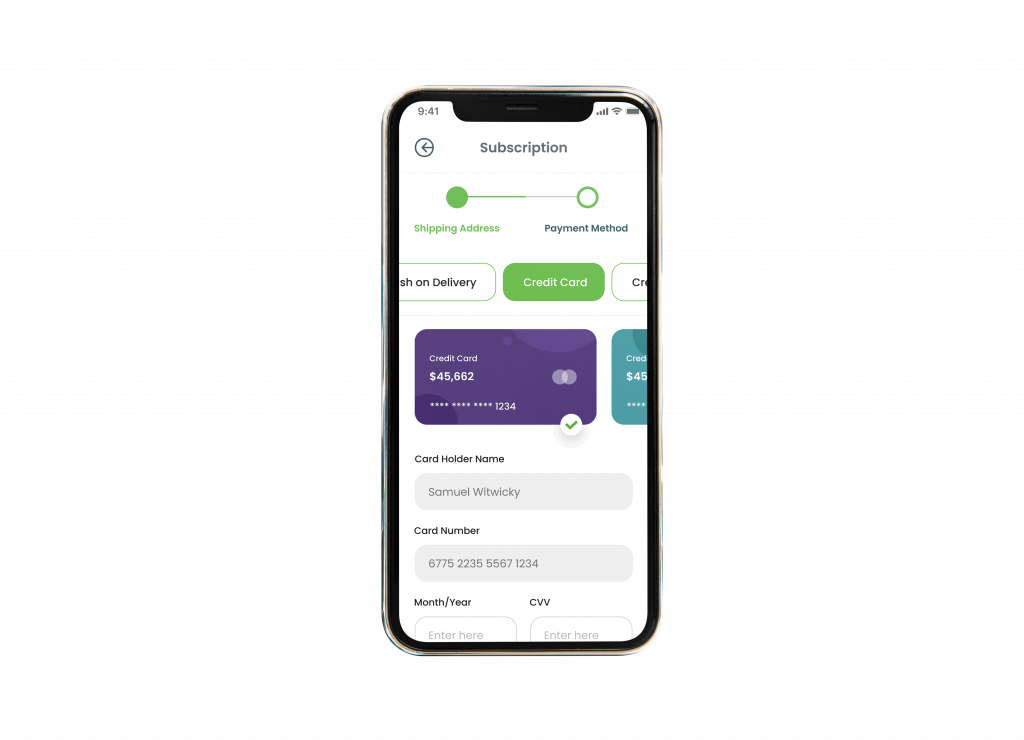

- some type of Membership offering that allows you discounts on the fees based on usage

- Tipping is also becoming a common practice on many of the eGrocery apps, which creates another cost for consumers.

In fact, on the margin, shopping with eGrocers is typically more expensive (on average) for consumers than retail in-store shopping.

In a sense this makes sense, as the service offers convenience and a new experience; however, will consumers sustain their purchasing on these new eGrocers in the middle of a large-scale economic contraction if their bills are consistently higher? We shall see.

Yet shoppers exhibited less price sensitivity as product availability took precedence. Supermarket News

The following is an example from Instacart’s delivery pricing, where Service Fees generally range from 5 – 10% on the order.

Instacart delivery starts at $3.99 for same-day orders over $35. Fees vary for one-hour deliveries, club store deliveries, and deliveries under $35. Instacart

If you sign up for Instacart Express (starting at $99 for the year or $9.99 if you do it by the month) you’ll get free delivery for orders that are more than $35. The Kitchn

We can see from our analysis of Uber (Eats) and other Food Delivery Apps, that the pricing structure is very similar for services like Instacart, Shipt and other similar eGrocer models who send ‘personal shoppers’ in to buy from local and national grocery/retail chains on behalf of consumers.

This is why many Food Delivery businesses are expanding their services rapidly into the grocery market.

On the merchant side of the eGrocery model, services like Instacart charge an average Commission as a % markup on the in-store price (average of 15%, but potentially much higher or lower depending on the situation). The way that fee is calculated and how it is determined for specific partner stores vs. other local stores is the subject of much debate.

What we do know is that the net effect for Grocers is margin erosion.

Margin erosion: Instacart charges a five to eight percent platform fee to retailers. Some choose to pass this on as a markup; others absorb it and lose margin. Retail Wire

On the incumbent side, many mainstream grocers are bundling the eGrocery model into their core model in order to ensure they don’t lose market share to upstart eGrocers. That doesn’t necessarily mean they prefer to have customers shop online only , as we have shown in the analysis above.

Their business model is built on volume, but because of their physical presence they run huge costs to maintain high-quality physical spaces and can use those spaces to build strong customer relationships in ways that pureplay eGrocers can’t.

Some examples are a hybrid, like the Whole Foods/Amazon model (Amazon bought Whole Foods in 2017), where they derive elements from each to create new services for their core customers.

BMi – Key Components of the Canvas

These new players ( dark-store model ) in eGrocery cut out the middlemen by sourcing locally, sell groceries direct to the consumer (and thus no markup from in-app vs. in-store pricing), and hold inventory in their own dark stores/micro-warehouses.

What unique value does a Grocery Delivery company’s product or service create for customers?

On-demand, fresh, and local grocery service. Lower waste, potential to create better profits for local-market suppliers (compared to other models).

Customer Segments

What group(s) of customers is a Grocery Delivery company targeting with its product or service?

The space is still very young and consumers are experimenting, but generally we would expect mid/high income consumers in large urban areas ( as many services are not available in rural markets). As the market expands in the next few years, we will see more defined customer segments emerge.

…. project that online grocery will account for 21.5% of total grocery sales by 2025 – an estimated $250 billion- which is a more than 60% increase over pre-pandemic estimates. Mercatus

Customer Relationships

How does an eGrocery company plan to build and maintain relationships with the customers it is serving?

Similar to pureplay eCommerce providers, the relationship with consumers is purely digital. In many ways, this is where traditional/hybrid grocers still maintain an advantage.

Customer Channels

What channels does an eGrocery company use to acquire, retain and continuously develop its customers?

Most of the customer engagement is in-app or via online channels (social media, customer support, etc).

How is a Grocery Delivery company pulling all of the above elements together to create a revenue stream(s) and generate cashflow?

- dark-store eGrocers charge Delivery Fees , like their competitors

- whether they charge Service Fees is still unclear, as this space is still new and they hold their own grocery inventory

- we assume they make the majority of their revenue on Gross Margin from selling groceries much like a traditional grocer; this is the main difference between these new models and services like Instacart

The above 5 Building Blocks represent the right side of the canvas and contribute to the Revenue side of the business model.

Key Resources

What assets and knowledge does a Grocery Delivery company possess that allow it to deliver its value to customers in ways that other companies can’t?

This model uses technology in many different ways: but fundamentally, they own the relationship with the consumer and they own their own inventory, so the knowledge they build around these assets via data science, etc. will be key in the future.

Key Activities

What activities does a Grocery Delivery company engage in that allow it to execute its strategy and either establish a presence in the market or gain market share?

Right now they are the new/innovative upstarts who are expanding their warehouses rapidly in order to try and meet rapid demand. They are raising large amounts of capital (in some cases debt) to expand, and so their goal is to maintain momentum while impressing new customers with the quality of the service.

Key Partnerships:

What strategic and cooperative partnerships does a Grocery Delivery company form to increase the scalability and efficiency of the business?

This will be an interesting space to watch in the future. The model is so new, but if some of these new eGrocers build strong relationships with local suppliers, this would be an opportunity to forge alliances that will help them take on the Grocery Giants.

What are the key costs associated with running a Grocery business and how can key partnerships/resources be leveraged to reduce the cost structure?

Depending on the model, most of the cost base is absorbed either in physical space and the logistics of running that space. New players are investing heavily in technology/innovation in order to try and preserve another 1% in margin. In such a low-margin industry, even a 1 or 2% cost savings in the long-term can make the difference between winning and losing in the massive grocery space.

The remaining 4 Building Blocks come together to form the left side of the canvas, and contribute to the Cost Structure of the business model.

With very little data publicly available, it is necessary to draw some assumptions here. The likely problems they face will probably be similar – although not exactly the same – to the Food Delivery Apps : losing money on a per order basis, lack of loyalty (consumers using multiple apps), and a requirement to constantly compete on margin (race to the bottom) because of how competitive the space is becoming.

One interesting stat is the MAUs (Monthly Active Users) in the US market are ordering 2.8X per month per average on eGrocery services. This helps paint a picture of frequency of use .

In the US market, AOV (Average Order Value) was $95 as of September 2020, up 32% YoY (year over year).

If frequency of ordering and AOV continue to trend up, this bodes well for leaders in the space.

In the Food Delivery space, we have seen ‘promiscuous’ customers using multiple different Food Delivery Apps. A lack of customer loyalty would create big problems long term for eGrocers , so we will need to maintain a close eye on how app usage plays out over time in relation to customer loyalty.

Overall, this is a new and exciting space with lots of competition and a lot of business model innovation, as seen by the new ‘dark-store operators’ and their industry partners. Let’s see consumers respond in key markets to these new offerings, and how traditional retail operators innovate their own models in order to defend their market share.

Innovation using the Business Model as the main mechanism, rather than product or technological innovation. Reinventing a business model – or creating a new one – is a matter of remixing the core components of a business model and developing new value propositions, revenue streams, and cost structures.

Strategy & Grocery – Thrive Market + Memberships

Business Model Innovation – Food Delivery Apps

Business Model Trends – Dark Stores

Instacart Business Model Analysis

- Luxury, CAC & The Next Farfetch

- Is Social Commerce the next eCommerce?

- Live Commerce, Influencers & Conversion

StartBizEasy

The Business Model Utilized by a Grocery Store: Crafting a Profitable Grocery Business

A grocery store is a retail establishment that sells food and household items. To understand how these stores operate and make money, you must first understand their business model.

No matter the business model a grocery store adopts in doing business, they are all known for 2 basic things;

- Purchasing and Storing of Products: The grocery store purchases food and household items from suppliers which are then kept in a warehouse. The objective of doing that is to keep a wide selection of goods on hand to be offered for sale to customers.

- Selling Products: The grocery store then sells these products to customers in a retail setting. Grocery store owners use a variety of strategies to draw customers in order to stay competitive, such as; discount prices, high-quality products, and a convenient shopping experience (online shopping).

This article aims to offer a thorough overview of the grocery store business model and the various elements that contribute to its success.

Table of Contents

What is a business model for a grocery store.

A grocery store’s operational and financial structure is referred to as its business model.

It describes the various actions and procedures that the shop takes to give its clients essential products and services.

You can gain insight into how a grocery store operates and maintains its competitiveness in the market by comprehending its business model.

This information can assist you in making wise decisions whether you’re a consumer or a member of the industry.

Know more about the basic Business Model

Types of Business Models for Grocery Stores

Traditional grocery stores, discount grocery stores, and specialty grocery stores are just a few examples of the various business models that exist for grocery stores.

Traditional Grocery Stores

The most prevalent kind of grocery store is a traditional one which is also known as the Classic Model.

They provide a variety of goods, such as fresh produce, dairy, meat, and baked goods.

Additionally, they sell a wide range of non-perishable goods like snacks, canned goods, and household essentials.

Despite the difficulties presented by alternative models like online grocery stores or home delivery options, the traditional business model for a grocery store in the USA, based on a brick-and-mortar structure, has proven to be a successful option for grocery retailers.

These businesses give customers the benefit of being able to touch and examine products in person before making a purchase and benefit from a personalized shopping experience with knowledgeable and trained staff.

Family-owned stores like Smith’s Family Market and mid-sized stores like Greenway Grocery are two examples of successful traditional grocery stores in the United States.

By providing excellent customer service, a large selection of goods, and cutting-edge services like online ordering, curbside pickup, home delivery, and educational in-store events and workshops, these stores have been able to maintain their customer base and stay competitive.

Having been in operation for more than a century, Smith’s Family Market is a family-run grocery store in a small town in the United States.

It stands out from larger chain stores and attracts customers who value quality and local sustainability.

On the other hand, Greenway Grocery has adopted cutting-edge technologies to enhance the shopping experience.

Discount grocery stores

Compared to regular grocery stores, discount grocery stores offer products at lower prices.

They put a lot of effort into giving customers affordable options without compromising on quality.

They do this by buying in bulk, negotiating better prices with suppliers, and cutting expenses overall. Customers benefit from significant savings on their shopping expenses as a result.

Discount grocery stores are becoming more and more well-liked due to the extensive product selection, convenient shopping environment, and affordable high-quality products.

This type of Grocery model is what is normally referred to as the Wholesale Club model which is a membership-based business where Customers pay an annual fee to use the store’s discounts and bulk purchasing.

The emphasis is on selling goods in large quantities for less money, which can help customers cut costs on their grocery bills.

The bulk products in this model frequently require more storage space, but the membership fee system helps to keep overhead costs low.

Specialty Grocery Stores

Unique and specialized products are the main focus of specialty grocery stores for their patrons.

These shops offer products that are organic or gluten-free to customers who have special dietary requirements. They also sell goods from various nations and cultures.

These stores offer a more personalized and intimate shopping experience, with knowledgeable and passionate staff who can help customers find the perfect product for their needs or recommend a better option.

The reason many customers prefer Specialty Grocery stores to others;

- Wide Selection of Products: Specialty grocery stores offer a diverse range of products not commonly found in traditional grocery stores. From specialty cheeses and cured meats to exotic fruits and international foods, these stores cater to customers with a discerning palate.

- High-Quality Products: Specialty grocery stores take pride in stocking only the best goods, sourced from domestic and foreign vendors. These goods have been carefully chosen for their superiority in taste, quality, and originality.

- Personalized Service: Specialty grocery stores frequently offer a more personal touch than large chains. And staff members are allowed to provide individualized recommendations and advice to customers because they are knowledgeable about the goods they sell -Which is a result of proper training.

- Supporting Local Businesses: By making purchases at a specialty grocery store in the USA, you are promoting local commerce and preserving the diversity and vibrancy of your neighborhood.

Examples of Specialty Grocery Stores in America

- Gourmet Food Stores: These establishments focus on high-end and gourmet foods, frequently offering a wide range of fine wines, charcuterie, and cheeses.

- Natural Food Stores: In the United States, natural food stores sell a variety of organic and non-GMO goods, such as fresh produce, meat, and dairy.

- Ethnic food markets: These stores offer customers a taste of various cultures and cuisines by specializing in international foods and ingredients. According to PRNewswire Ethnic food market is projected to grow by USD 22.02 billion by 2026,

- Health Food Stores: In the USA, health food stores sell a range of products that are designed to be healthy, such as gluten-free, vegan, and paleo-friendly options.

Online Grocery Shopping Model

Online grocery shopping has grown in popularity as a result of advancements in technology and an increase in internet users.

Customers can place grocery orders using this model while relaxing in their own homes.

It functions by combining online and mobile ordering platforms, as well as collaborations with nearby retailers or warehouses for product fulfillment and delivery.

While it is convenient to shop online, doing so also necessitates a significant investment in logistics and technology.

Over the years we’ve seen popular online grocery stores that were once operating in the traditional model move to the online grocery shopping model like; Amazon Fresh, Walmart, and Kroger. They provide a wide range of goods, such as dairy, bakery, and fresh produce, and frequently at affordable prices.

Even though online shopping is a generalized term, there are diverse kinds of online grocery shopping, the major two are;

- Subscription-based online Grocery models: Grocery delivery services like Blue Apron and HelloFresh allow customers to sign up for regular deliveries, making it more affordable and offering discounts for ordering a certain amount of groceries each month.

- Meal kit delivery services: Businesses like Plated and Sun Basket give customers all the ingredients they need to prepare a meal at home, providing a practical solution for active families who still want to eat at home.

The Hybrid Grocery Store Model

Some supermarkets employ a hybrid business model that combines aspects of the traditional, wholesale club, and online business strategies.

As a result, the store is able to serve a wider variety of customers and their needs.

For those customers who prefer traditional shopping, a grocery store might provide online ordering with in-store pickup or delivery options in addition to a physical location.

This model combines the best of both worlds for the store, but it also necessitates significant investments in technology, logistics, and physical operations.

Know more on the Types of Business Models

Factors Contributing to the Success of a Grocery Store Business Model

A grocery store business model’s success depends on a number of variables. These consist of:

A grocery store’s success depends on where it is located. The target market should be able to easily access it, and it should be highly visible.

Product Selection

A grocery store’s product selection ought to take its target market’s needs and preferences into account.

In order to keep its product selection current and relevant, the store should review it frequently.

Consumer Assistance (Customer Service)

A successful grocery store business model requires excellent customer service.

Grocery stores should train their staff to offer customers prompt, cordial, and informed service.

Promotional and Marketing

For boosting brand recognition and drawing customers into the store, marketing, and promotion are essential.

This can be accomplished using a variety of techniques, including social media marketing, advertising, and in-store displays.

Supply Chain Management

Successful supply chain management is essential to the operation of grocery stores.

To make sure that products are delivered on time and in the right quantities, the store should have a dependable system in place.

- Exploring the Basics of a Solid Business Model: Business 101

- The 5 Key Elements of a Business Model?

- A Comprehensive Guide to the Business Model Canvas

- The 4 Types of Business Models?

A grocery store’s success depends greatly on the business model it utilizes.

Grocery stores should concentrate on offering a large selection of products, superior customer service, and efficient marketing and promotion to their customers.

In order to guarantee that products are delivered on schedule and in the appropriate quantities, they should also have an effective supply chain management system.

What is a grocery store?

An establishment that sells food and household goods is a grocery store. Customers can buy these items in a retail environment, where there is a wide variety of merchandise available and different tactics are used to attract customers, such as low prices and a convenient shopping experience.

What is the business model of a grocery store?

A grocery store’s operational and financial structure is referred to as its business model. It describes the steps the store takes to deliver necessary goods and services to customers and aids in understanding how the store runs and keeps its competitiveness in the marketplace.

What are the various types of grocery store business models?

Traditional grocery stores, discount grocery stores, specialty grocery stores, online grocery stores, and hybrid grocery stores are just a few examples of the various business models available for grocery stores. Each type of model has its own distinctive traits and tactics, such as providing a range of goods, offering discounted goods, or providing specialized goods.

What is the main objective of a grocery store?

The main objective of a grocery store is to provide customers with a wide range of food and household products for purchase, at convenient locations and competitive prices.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Threads (Opens in new window)

- Click to share on Bluesky (Opens in new window)

Discover more from StartBizEasy

Subscribe to get the latest posts to your email.

Type your email…

I am Eghosa Kester Igbinigie, the owner of StartBizEasy.com and Richnuggets.com. As a business enthusiast, writer, and speaker, I hold a degree in Business Administration (BSc) and own several successful businesses

Similar Posts

How to Start a Mini Importation Business in Nigeria: A Step-by-Step Guide

Today, we find ourselves in an era where opportunities are within reach, even from the comfort of our own homes. One…

Print on Demand Business in Nigeria: The Ways to Profitability

In this article i will be revealing to you how to start a profitable print on demand business in Nigeria with…

I want to start a Business but have no Ideas

Starting a business can be an exciting and challenging experience. However, if you want to start a business but have no…

How to Start a Lucrative Boutique Business in Nigeria

In Nigeria, a boutique business refers to a retail establishment that specializes in selling fashionable and often unique clothing, accessories, and…

How to Start a Catering Services Business: Tips and Templates

In this article “How to Start a Catering Services Business”, we will reveal to you the tips to start a successful…

How to Start a Small Jewelry Business From Home (All 6 Steps)

A small jewelry business from home refers to a venture where you as an individual or a small group of people…

This is my first time go to see at here and i am really happy to read everthing at alone place.

Wonderful items from you, man. I’ve have in mind your stuff previous to and you’re simply too excellent. I really like what you have bought here, really like what you’re stating and the way wherein you say it. You are making it enjoyable and you still take care of to stay it wise. I cant wait to read far more from you. This is really a terrific web site.

It’s a pity you don’t have a donate button! I’d certainly donate to this fantastic blog! I guess for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to fresh updates and will talk about this blog with my Facebook group. Talk soon!

I am actually grateful to the owner of this site who has shared this impressive post at here.

Very good information. Lucky me I came across your site by chance (stumbleupon). I have saved it for later!

Thanks for finally talking about > The Business Model Utilized by a Grocery Store: Crafting a Profitable Grocery Business

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Subscribe now to keep reading and get access to the full archive.

Continue reading

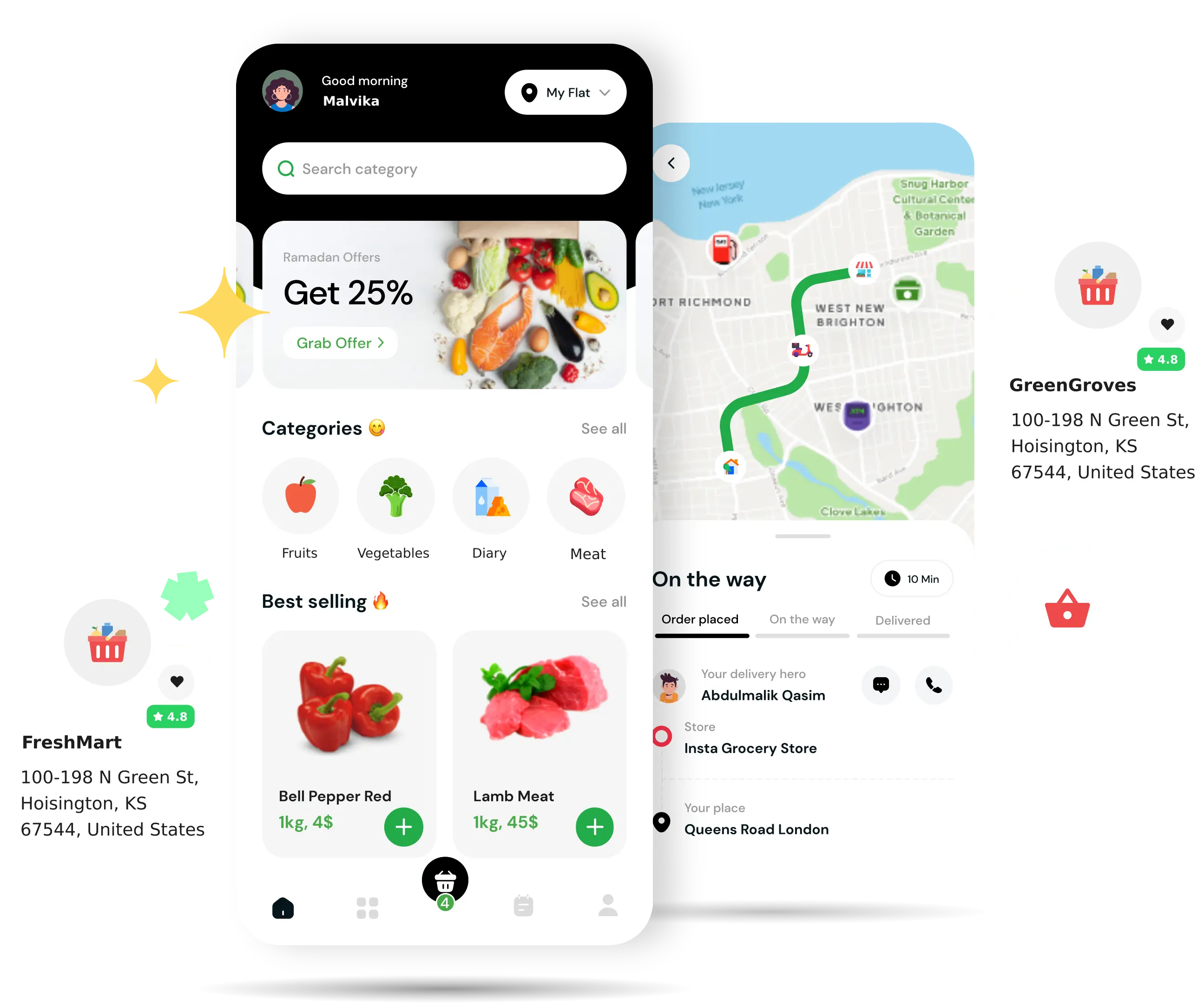

Instacart Business Model: Decoding How It Works

Instacart’s business model revolves around simplifying grocery shopping for busy individuals, allowing them to conveniently select their groceries from anywhere. As a result, Instacart has emerged as the leading grocery delivery service in the U.S., valued at an impressive $17 billion.

What is Instacart?

Founders, funding, and key milestones, revenue-sharing model in instacart, flexible delivery pricing and additional fees in instacart, instacart express, targeted advertising opportunities in the instacart app, revenue generation strategies of instacart, instacart’s business model, instacart’s customer acquisition methods, the shopper recruitment process, key problems and solutions, instacart’s competitors, instacart’s strengths, instacart’s weaknesses, instacart’s opportunities, instacart’s threats, instacart’s ambitious expansion plans for future growth.

Instacart, the technology-driven platform, brings groceries and home essentials straight to your doorstep. With their innovative business model, they offer speedy deliveries in major US cities, often within just 1 hour. Embracing the sharing economy concept, Instacart has garnered significant attention as a leading force in the on-demand sector.

Aspiring entrepreneurs are drawn to understanding their business model and how they generate revenue. In this post, we delve into the inner workings of Instacart, unveiling its remarkable success and providing intriguing facts and figures about this $2 billion valuation company.

Founded in 2012, Instacart swiftly emerged as a disruptive force in the technology landscape, revolutionizing the on-demand economy. With substantial funding, this leading grocery delivery platform expanded its operations nationwide, making waves across the United States. Here are essential facts about Instacart:

The remarkable amount of funding received by Instacart reflects the confidence investors have in its potential and future prospects. To comprehend why Instacart stands out as a promising company, let’s explore its unique features, value propositions, and delve into its core operations and customer segments.

How Instacart Works: A Seamless Grocery Shopping Experience

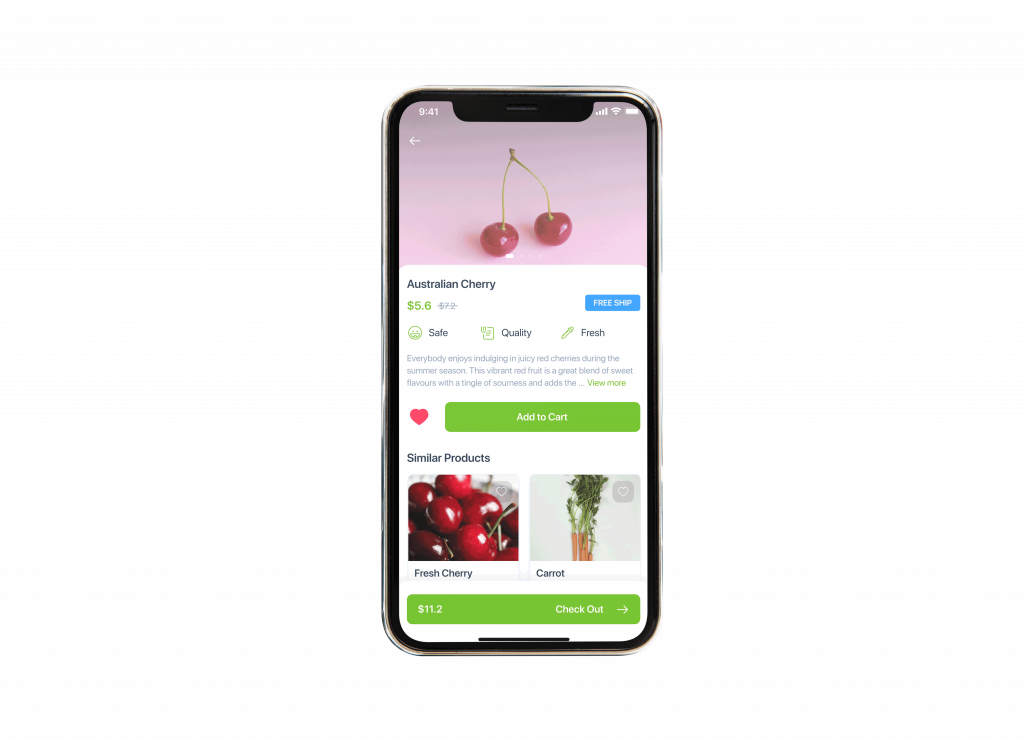

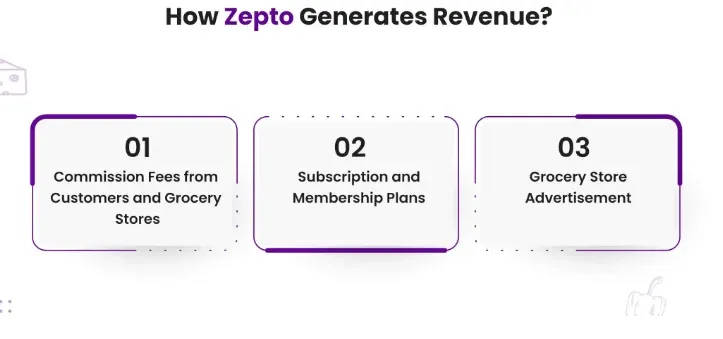

Instacart generates income by means of revenue sharing, delivery charges, price mark-ups, premium subscription fees, and in-app advertising.

Instacart operates on a revenue-sharing model where they collect a commission for each order processed on behalf of their clients. It is important to note that this commission is borne by the retailer rather than the app user.

In order to foster mutual growth and success, Instacart has established revenue-sharing agreements with its retail partners. The specific rates of these agreements are flexible and negotiated based on the transaction volumes of each retailer.

This approach allows Instacart and its retail partners to collaboratively benefit from the platform’s operations and ensure a fair distribution of profits.

When utilizing Instacart’s delivery service, consumers are subject to delivery fees based on various factors such as city, location, and timeframe. These fees ensure the smooth transportation of orders to customers.

As per the information provided on their website, standard delivery fees for orders exceeding $35 are $3.99 for scheduled or 2-hour delivery and $5.99 for 1-hour delivery. For orders below $35, the fees are $7.99 for scheduled or 2-hour delivery, and $9.99 for 1-hour delivery.

In addition to delivery fees, a service charge is applied to orders, typically ranging from 5% to 10% of the total order value. Instacart may also impose supplementary charges including a ‘heavy’ fee when items exceed a specified weight limit, a bag fee, a bottle deposit fee, and an alcohol service fee.

Similar to popular ride-sharing platforms like Lyft and Uber, Instacart operates on a surge demand model. This means that during peak demand hours, such as busy times of the day, week, or month, prices may be higher and delivery times may be longer.

It’s important to consider these factors while planning your grocery delivery. Additionally, customers have the option to provide tips to the shoppers, which are directly received by the individuals handling the orders.

Instacart offers consumers the convenient Instacart Express model, which provides a subscription service tailored for regular users. By opting for Instacart Express, customers can enjoy unlimited free delivery for their orders in exchange for a monthly or annual upfront fee.

The monthly membership fee is $9.99, while the yearly membership fee amounts to $99.

The Instacart Express subscription brings several benefits to consumers, including:

- No delivery fee on any orders totaling $35 or more;

- Reduced service charges;

- Freedom from demand surge pricing.

With Instacart Express, users can experience a seamless and cost-effective grocery shopping experience, eliminating the hassle of delivery fees, benefiting from reduced service charges, and enjoying consistent pricing without worrying about surge pricing during high-demand periods.

With a vast user base of nearly ten million Instacart shoppers across North America, the platform presents a lucrative avenue for generating revenue through in-app advertising. Sellers and brands have the opportunity to purchase advertising space directly on the platform, gaining direct access to their desired consumer base.

Instacart’s in-app advertising is designed to be highly targeted, following a similar advertising model employed by industry leaders such as Amazon and Etsy. Renowned brands like Mars and Coca-Cola have already capitalized on this advertising platform.

The rates charged by Instacart to advertisers are undisclosed and vary based on factors like the brand’s size, the desired advertising space, and the duration of the ad campaign. In certain cases, Instacart adopts a ‘cost-per-click’ payment model, where the company advertising is charged a fee only when a consumer clicks on their ad.

Furthermore, advertisers have the opportunity to bid on search terms entered by users while creating their shopping lists within the Instacart platform. This ensures a dynamic and competitive advertising environment within the app.

Instacart employs various strategies to generate revenue and sustain its operations. Here are the primary sources of revenue for the platform:

- Delivery Fees: For orders exceeding $35, Instacart charges a standard delivery fee. Customers can expect to pay $3.99 for scheduled or 2-hour delivery and $5.99 for 1-hour delivery. Orders below $35 incur higher fees of $7.99 for scheduled or 2-hour delivery and $9.99 for 1-hour delivery;

- Membership Fee (Instacart Express): Instacart offers an annual membership called “Instacart Express” priced at $99. Members enjoy the benefit of free delivery for their grocery orders throughout the year, subject to certain terms and conditions;

- Mark-up Prices: While some stores on Instacart maintain the same prices as their in-store counterparts, others may have mark-ups of 15% or more. The revenue generated from these mark-up prices is retained by Instacart, enabling them to compensate shoppers and sustain their operations.

Customer Segments of Instacart:

- Users: Individuals who dislike shopping, elderly individuals, and those with busy schedules;

- Shoppers: People possessing a smartphone and a vehicle (car or bicycle), individuals who enjoy shopping, and those seeking additional income;

- Stores: Businesses aiming to boost sales and expand their customer base.

Value Propositions of Instacart:

- Users: Convenient grocery shopping, speedy delivery, and a wide inventory selection;

- Shoppers: Flexible work schedule, supplemental income, and part-time employment opportunities;

- Stores: Increased sales and a larger customer base.

Channels of Instacart:

- Android and iOS App;

- Internet marketing.

Customer Relationships of Instacart:

- Customer service;

- Social media;

- Local stores;

- Community engagement.

Revenue Streams of Instacart:

- Commissions;

- Markup on prices;

- Delivery fees;

- Service fees;

- Membership fees;

- Advertising.

Key Resources of Instacart:

- Partnerships with stores;

- Human resources.

Key Activities of Instacart:

- Software development;

- Platform maintenance;

- Payment processing;

- Delivery services;

- Shoppers management;

- Local market management.

Key Partners of Instacart:

- Local grocery stores and supermarkets;

- IT platform providers.

Cost Structure of Instacart:

- Technological maintenance;

- Shopper payments;

- Payment processing fees;

- Administration and operations;

- Word of Mouth Advertising;

- Internet Marketing;

- Free first delivery;

- Various promotional offers.

- Inviting applications from individuals interested in earning money through part-time shopping;

- Processing the applications through the recruitment team and scheduling face-to-face, one-on-one interviews;

- Providing comprehensive training to the selected individuals to prepare them for shopping and delivering groceries.

- Shopper Retention: Retaining part-time shoppers for an extended period is challenging. To address this, Instacart introduced a tipping option during the checkout process, enhancing shopper earnings and incentivizing them to stay longer;

- Delivery Time Reduction: Ensuring timely grocery delivery within 2 hours posed a challenge. Instacart strategically positions shoppers outside partner stores, enabling them to be ready for orders and saving 50% of the delivery time;

- Shopper Shortage: Managing a fleet of freelance shoppers and assigning immediate tasks is difficult. Instacart implemented a “busy pricing” policy, adding a small delivery charge based on shopper availability. The additional fee partly goes to shoppers, encouraging them to work efficiently;

- Customer Trust: Some customers lost trust upon discovering Instacart’s marked-up pricing compared to in-store prices. Instacart acknowledged this issue and clarified its pricing structure. Despite a few users discontinuing their use, the majority were willing to pay the markup for the convenience of doorstep grocery delivery;

- Wrong Item Delivery Possibilities: Occasionally, shoppers may deliver the wrong item. Instacart addresses this concern by providing dedicated customer support accessible via phone or email. Refunds are processed for missed items by the personal shopper;

- Out-of-Stock Items: Items on the shopping list sometimes become unavailable. To tackle this, shoppers offer substitute items, which may not always meet customer preferences. Instacart introduced features such as customer notes and an “often out of stock” button, allowing customers to provide specific instructions and be aware of frequently unavailable items.

- Shipt: Owned by Target, Shipt operates in 300 cities across the USA and partners with renowned grocery stores such as Costco, CVS, Jewel, Kroger, Office Depot, and Publix;

- Amazon Fresh: Offered by the world’s largest retailer, Amazon Fresh is available in only 15 cities and exclusively for Amazon Prime members;

- Walmart+: Walmart’s membership program provides exclusive perks and discounts to its members, leveraging the strength of one of the largest retailers globally;

- Fresh Direct: Established in 1999, Fresh Direct specializes in direct delivery from farmers, artisans, and fishermen. They offer a wide range of products, including beverages, flowers, health and beauty items, and baby products. However, their service is limited to six cities;

- Blue Apron: A grocery delivery company focused on providing customers with meal kits that include ingredients and recipes for preparing meals at home.

Analysis of Instacart’s SWOT

- Reliable Suppliers: Instacart partners with established and trustworthy stores, including major retailers in the country;

- Quick Delivery: Customers can receive their groceries as quickly as within one hour;

- Customer Service: Instacart provides 24/7 customer support through social media managers on their site and social networks;

- Strong Financial Position: The company’s balance sheet allows for investments in new and diverse projects;

- Brand Recognition: Instacart has a strong brand that consistently attracts new customers;

- Diverse Portfolio: The brand portfolio enables Instacart to target different customer segments effectively.

- Project Management: Internal focus on delivery may result in neglecting the interests of external stakeholders, leading to potential public relations issues;

- Pricing Strategy: Instacart’s premium pricing may sometimes be perceived as unjustified by customers.

- International Markets: Instacart can expand its market share through globalization and leveraging the internet;

- Artificial Intelligence (AI): Advancements in AI can assist in predicting consumer demand and improving recommendation engines;

- Environmental Policies: New policies focused on sustainability can provide additional benefits for Instacart’s technology-driven operations;

- Changing Consumer Behavior: Shifts in consumer trends and habits, such as those observed during the COVID-19 pandemic, can promote increased app usage.

- Competition: The growing number of competitors, including major retailers like Amazon and Walmart, poses a significant challenge;

- Sticky Prices: Instacart operates in an industry where pricing is often resistant to change, potentially undermining the value of its premium service;

- Economic Conditions: Economic downturns can impact customer spending patterns and purchasing power, affecting Instacart’s business.

Instacart is gearing up for significant growth in the coming years, aiming to expand both its user base and partner merchant network. Recognizing the need for diversification and a broader reach, the company is actively working on attracting more consumers to its platform, focusing not only on groceries but also on a wider range of consumer goods.

The COVID-19 pandemic highlighted the strong demand for diverse products among Instacart users, leading the company to seize the opportunity by expanding its offerings through its partner network.

To further enhance its services, Instacart recently launched the Priority Delivery service in 15 major cities across the United States. This new offering guarantees grocery deliveries within a speedy timeframe of just 30 minutes, providing an even more convenient experience for customers.

In addition to its domestic plans, Instacart has also indicated its intention to expand internationally. This commitment was demonstrated by the appointment of two new product leaders in May 2021, tasked specifically with developing the company’s presence beyond North America.

Instacart is firmly dedicated to becoming a global leader in the e-commerce market, leaving no doubt about its aspirations for global expansion and success.

The Instacart business model revolves around delivering convenience, a timeless aspect that remains essential in this industry. Despite the increasing competition, Instacart continues to dominate the online grocery shopping market, establishing itself as the frontrunner.

It appears that competitors will struggle to catch up if the current trajectory remains unchanged.

Presentations made painless

- Get Premium

Kroger: Business Model, SWOT Analysis, and Competitors 2023

Inside This Article

In this blog article, we will delve into the intricacies of Kroger's business model, conduct a SWOT analysis to identify its strengths, weaknesses, opportunities, and threats, and explore its primary competitors in the market. As one of the largest supermarket chains in the United States, Kroger's business model encompasses a vast network of grocery stores, fuel centers, and online platforms. By analyzing its internal and external factors, we aim to gain insights into Kroger's position in the industry and its potential growth opportunities in the upcoming year, 2023.

What You Will Learn:

- Who owns Kroger and the significance of understanding the ownership structure of a company.

- The mission statement of Kroger and how it guides the company's strategic decisions and actions.

- The various revenue streams and business strategies employed by Kroger to generate profits.

- An explanation of the Business Model Canvas and how it applies to Kroger's operations and success.

- The major competitors of Kroger in the retail industry and the challenges they pose to its market share.

- A comprehensive SWOT analysis of Kroger, highlighting its strengths, weaknesses, opportunities, and threats in the market.

Who owns Kroger?

Overview of kroger's ownership structure.

Kroger, one of the largest supermarket chains in the United States, is a publicly traded company. This means that its ownership is distributed among numerous shareholders who hold shares of the company's stock. As of the latest available information, Kroger has a diverse ownership structure, with both institutional and individual investors owning its shares.

Institutional Ownership

Institutional investors, such as mutual funds, pension funds, and investment firms, play a significant role in owning Kroger. These entities often purchase large quantities of shares, giving them a substantial ownership stake in the company. Institutional ownership provides stability to the stock and can influence the company's decisions through voting rights and active involvement in its governance.

Some well-known institutional investors that own shares of Kroger include Vanguard Group, BlackRock, and State Street Corporation. These institutional investors manage funds on behalf of their clients, which may include individual investors, retirement funds, and other organizations.

Individual Ownership

Individual investors also have the opportunity to own shares of Kroger. This can be done through purchasing the company's stock directly on a stock exchange, such as the New York Stock Exchange (NYSE), where Kroger is listed under the ticker symbol "KR."

Individual ownership allows investors to benefit from the company's performance and potentially earn dividends on their shares. It also gives them the ability to vote on certain matters affecting the company's operations during annual general meetings.

Employee Ownership

Kroger also offers its employees the opportunity to own shares of the company through various employee stock ownership plans (ESOPs) and stock purchase programs. These initiatives aim to align the interests of employees with those of shareholders, fostering a sense of ownership and commitment within the workforce.