Everything you need to know about agency banking

Agency banking was introduced for the first time in 2013 in Bangladesh, with the aim to provide banking services to economically backward and underserved populations, especially those who live in rural locations and very far from banks.

Research by the World bank states that according to a Global Findex report 2021 (released in 2022), the global population of approx. 1.4 billion people are still unbanked. This (1.4 billion) is not at all a small number. And as history says, agency banking’s primary aim is to help the unbanked and underserved populations. That’s the reason why the adoption of agency banking was considered by the banks.

In this blog, we will discuss what agency banking is, why it is needed, who banking agents are, how it works, the major parties, its advantages, the services, and the use cases of its successful implementation.

- What is agency banking?

Victor was a farmer in a village very far from the city, and his son had started his high school study at a boarding school in the city. One day his son got sick and had an urgent need for some extra cash. Victor wanted to send him the money immediately, but there was no bank in the village.

Victor did not have extra cash other than the amount he wanted to transfer to his son. So, he felt disappointed and helpless. But then his friend told him that his bank had introduced an agency banking service in the village, available at the nearby grocery store. Victor visits there and successfully transfers money to his son.

Agency banking acted as a life-saver for Victor. So without further delay, let's understand what exactly is agency banking! In layman's terms, Agency banking is a service introduced by banks that allows them to offer their banking services without having traditional branches in areas that do not have easy access to financial services.

- The need for agency banking

Now that you know what agency banking is, aren't you curious to know what led to agency banking? Why did the need for agency banking rise?

Well, the key reason for this was the challenges faced by the traditional banking system.

High operation and setup cost

Setting up a traditional bank in every place is next to impossible. But anyhow, if the bank tries to do it, the costs to set up and operate are so high that it would be a loss-making initiative for them. Agency banking has taken away this burden from the banks, and now they are providing their services regardless of the physical location.

Limited scaling capabilities

Traditional banks were not able to extend their services to the areas where there were no banks. There was no way to do that until the people from that area could come to the bank. This made banks miss out on many customers leading to limited scalability opportunities.

With the impact of agent banking and its branchless functionalities, it became possible to extend banking services to a larger population leading to the increased ability to scale for banks

Low Profitability

When there were only brick-and-mortar banks (traditional banks), they could only cater to the customers that visited banks. Then when online banking started, they could cater to customers who were already associated with traditional banking and had their bank accounts, but in the online form. So, their profit was limited to these customers only.

Hence with the arrival of agency banking services, banking services are reaching every nook and corner, and with more customers, more profit is an obvious byproduct.

Lack of Agility

Traditional banks are less agile and flexible in terms of adapting to change and catering to customer needs and preferences. But the customers look forward to fast and more convenient services, which is a challenge for the traditional bank to keep up with.

On the contrary, by making several services available for agency banking, traditional banks can extend their services quickly and effectively to their customers, especially those who reside in remote and underserved areas.

Owing to these challenges in traditional banking, the importance of agency banking rose, and today it is accepted and utilized widely by almost all banks to extend their services.

In simple words, a “banking agent is a third party who provides banking services on behalf of a bank to customers.”

The banking agents provide these banking services in remote, unbanked, and underserved areas. Generally, the small shops, grocery stores, gas stations, or postal services in these areas become the banking agents with a bank to provide various banking services like cash deposits, withdrawals, balance inquiries, and many more.

The banking agents operate in different ways, such as some agents provide services by going door-to-door with their mobile phones, tablets, or m-POS machines. Some agents do the same, but from a fixed location in areas that are within easy reach of the customers.

Thus, banking agents are a vital part of the agency banking process. But how exactly does the agency banking process work?

- How does agency banking work?

To provide agency banking services, the banks need to offer an advanced agency banking solution that facilitates a seamless banking experience for the customer and smoother coordination among all the components of agency banking mentioned above. Below are the steps as to how branchless (agency) banking works.

Bank and banking agent come into a contract

In the first stage, the retailer gets authorized as a banking agent by his respective bank or financial institution, and they sign a contract for extending the banking or financial services.

Create an m-wallet for agents

After the authorization and contract process is completed, the banking service provider creates mWallet for the banking agent . This wallet allows the agent to deposit and manage funds electronically. Once the mWallet is created, the banking agent deposits a prepaid balance in the wallet to begin providing services to customers.

The customer opens his bank account

Now, customers can open their bank account and avail of basic services like cash deposits and withdrawals by simply visiting the nearest banking agent with a valid ID.

Initiation of the transaction

If a customer wants to initiate a transaction, he can visit the agent and ask for the type of transaction he wants to make. The agent will then initiate the transaction in cash or card (as per customer preference).

Confirmation of transaction

Once the agent initiates the transaction through his system, the bank processes it and facilitates the transaction for the customer. And on successful processing, the agent confirms it by assigning a transaction receipt to the customer.

- Parties involved in agency banking

Now that we know how agency banking works, let's take a clear understanding of the parties involved in the process of agency banking.

Agency banking service providers

Agency banking service providers are responsible for managing various banking agents. They are also responsible for operating services, marketing, cash handling, branding, and many more.

As discussed earlier, banking agents are the retailers authorized to perform various banking services on behalf of banks and financial institutions. They provide various banking services to customers.

Banks/Financial institutions

Banks and financial institutions are the hosts that comprise both consumer and agent accounts. These are entities through which the actual cash flow takes place.

Read More: What is Fintech and what is its impact on banking?

Super/sub-agents

Banking agents can also form other agents under them and get an additional commission for every transaction they make. This way, these banking agents will be called super/sub-agents.

Consumers are the end-users of agency banking. These are generally those people who don’t have a bank account but have access to mobile phones or those who reside in remote and underserved areas where there are no brick-and-mortar banks.

- Advantages of agency banking for banks

When the need for agency banking arose, the main benefit that was in mind was extending banking services to the population in the areas where the banks could not establish their branches. Some major benefits of agency banking for banks are:

Minimized Costs

Agency banking is a cost-effective way for banks and financial institutions to extend their services in areas having lower penetration of banks. Due to the agency banking model, banks and financial institutions don’t need to set up a physical branch which reduces operational, infrastructure, maintenance, and other high-capital investment costs.

Agency banking allows banks to kill two birds with one stone. First, they can save the cost required to set up a new branch because maintaining a traditional bank is around 25% costlier than managing the network of agents. Second, they can increase profitability by driving business from previously untapped areas.

Increase in customer base

Banking agents allow banks and financial institutions to expand their customer base by offering services to a larger number of unbanked and untapped customers. This increase in the number of customers can lead to a significant increase in profits for banks.

Similarly, with agency banking, the banks can have a large number of agents under them, which in turn, brings more customers to the bank and financial institutions .

Better maintenance of asset quality

Banking agents are often familiar with clients and their financial situations, including repayment capacity and stability. This know-how can help banks to make informed decisions when deciding whether to lend money. Hence the banks can easily maintain the quality of their assets and protect their financial health.

Build trust and awareness among the customers

The presence of banking agents in the formal banking system brings a human touch that users find comforting. They find comfort as they can interact with someone they know. This is precisely the reason why there has been an increased level of trust for agents rather than bank branches.

With such comfort and convenience, clients feel safe performing all the financial operations they need. Such trust in banking agents encourages their whole community (in a particular area) to utilize agency banking in their regions.

Enriched customer experience

Agency banking, also known as branchless banking, allows banks to bring their services directly to users rather than requiring them to visit a physical branch. This convenience has led to an enhanced customer experience, as clients can simply visit agents nearby rather than travel and wait at a bank branch.

Users can perform various banking operations through their agents, such as withdrawing/depositing funds, paying bills, loan payments, and many more, just with a formal ID or biometric.

Agency banking is an easy platform for users as it delivers various banking solutions for the unbanked population using phones, card readers, POS (point-of-sale) terminals, and many other cutting-edge technologies for processing real-time transactions.

High security

In addition to convenience, agency banking offers top-notch security. Customers can obtain a magnetic chip card or stripe, and a bank pin, which they can use at the agent's terminal to carry out transactions. These methods of payment are more secure than using cash.

Read More: DigiPay: A foolproof platform for digital transactions

- Services provided by banks via agency banking

Banks and financial institutions offer a wide range of services through agency banking. The agency banking services include

Cash deposits: The customers pay in cash to the agent, and the agent then transfers the amount to the customer’s account.

Cash withdrawals: The customer requests a particular amount of money to withdraw, and the agents provide customers with cash of the same amount.

Balance inquiries: The customer asks for the balance in his account, and the agent checks in his system and provides the balance details in written or spoken words.

Mini statements: The banking agent can generate a mini statement of a customer’s transaction history in a digital or physical copy through the banking system used by them.

Account transfers: The customers need to provide basic account information or the phone number of the person to whom they want to transfer funds. Agent bank will do it for them.

Customer loan applications: Customers can apply for loans with the help of agency banking. They can get the loan application filled in by the agents.

Utility bills: The customer can pay utility bills like electricity, water supply, gas supply, and many more.

Customer onboarding: The customers can open their bank accounts and onboard themselves to a particular bank of their choice.

Loan repayments: Customers can bring in cash and ask for loan repayments with the help of banking agents without having to pay monthly visits and incur heavy travel costs.

Credit card payments: If the customer has a credit card, he can get the payment done from the convenience of his proximity.

Registration for different services: When banks have various schemes or new beneficial services to offer, the customers can easily avail of these services by registering through an agency banking service.

- Successful implementation of agency banking

One of the biggest hurdles banks faced was providing banking services in rural areas. Because to open a bank branch in a rural area, high OPEX/CAPEX (operational/capital expenditure) is needed.

However, there’s no certainty that the bank would get enough return on investment (ROI). This is one of the prominent reasons why banks fail to reach rural users. Also, rural users have not yet developed a habit of using mobile financial solutions .

But now, with agency banking, the banks have reached rural areas and provided banking services to a large section of the unbanked population throughout the world. Here we’ll discuss the use cases of the impact of agency banking in a few countries.

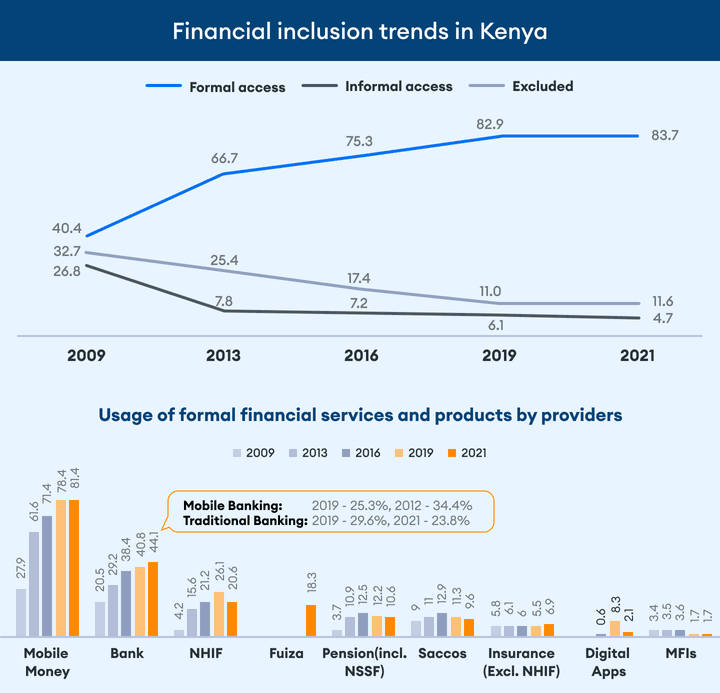

A study by statista says that as of 2020, there were around 72,617 bank agents in Kenya alone. This stat makes it pretty clear, there has been a positive impact of agency banking in the country.

Talking about financial inclusion, the latest report by Deloitte, the usage of financial products (formal access to financial services) in Kenya increased to 83.7% in 2021, up from 66.7% in 2013. The report also states that today millions of previously underserved people of Kenya use formal financial services daily via their mobile phones

According to tracxn , there are nearly 403+ fintech startups in Kenya as of 2022. This figure is also one reason for the big number of agent banks in the country.

According to the latest study by Bangladesh bank (Central Bank of Bangladesh), nearly 7.6 million bank accounts were associated with agent banking in July 2020. This figure represents a year-on-year growth rate of almost 114%, which is humongous.

The above figures are record-breaking and evidence enough to show a successful implementation of agency banking services in Bangladesh.

And as we know, Bangladesh was the pioneer of agency banking for financial inclusion. The latest study by the Gates Foundation on Global Findex Report 2021, it was found that, in Bangladesh, there has been a 50% increase in the use of financial services in the last decade.

Hence it is proved that Bangladesh has witnessed a positive impact of agency banking in this developing economy.

The Democratic Republic of the Congo

According to the UNCDF Report , it was found that nearly 7 million people in congo have access to formal financial services. And with the advent of agency banking, the scope of this access has increased manifold, with 25 million people still deprived of formal financial services becoming potential new customers.

The report also says there has been a significant increase in the penetration of mobile money in the Democratic Republic of Congo (DRC). This statement indicates that the future of Congo holds extensive financial inclusion.

From all the above cases, we see that agency banking has allowed banks to reach more and more populations, which in turn has also grown the economy of these countries.

- Want to adopt agency banking for your bank/ financial institution?

DigiPay.Guru is empowering banks to make banking services accessible to customers irrespective of their location and to expand the customer base quickly with its most reliable and convenient agency banking solution.

We aim to simplify branchless banking and make it available for all customers in unbanked or underserved areas. If you are a bank or financial institution looking to extend your banking or financial services in every location of your country, get in touch with our agency banking experts. Let us understand your needs and help you with our tailor-made solution.

Nikunj Gundaniya

Product manager of DigiPay.Guru, one of the leading digital wallet solution. He is a visionary leader whose flamboyant management style has given profitable results for the company. He believes in the mantra of giving 100% to his work.

Table of contents

Related post.

Omnichannel banking: What it is, why it is needed, and how it can be achieved?

Breaking Barriers to Digital Banking Revolution: The Impact of Agency Banking on unbanked population

The Future of agency banking: Opportunities and trends

Ask us anything or just say hi...

Fill all your details in the form and one of our business consultant will get in touch you within 24 hours.

Get a live demo

Zoe Talent Solutions

Agency banking model, strategy and solutions.

Course Overview

Course outline, book classes now.

Cash transactions are still common worldwide. Agency banking, as a concept, has become an important part of the system. It is a channel wherein third-party agents conduct transactions or other activities on behalf of financial institutions.

An agency network is a cost-efficient strategy to reach remote, underserved markets. However, despite regulatory and legislative conditions becoming easy, financial institutions still refrain from adopting it.

Technology plays a critical role in enabling small vendors and other businesses to adopt the agency model. Although not widespread, third-party agents have become a critical part of the financial services ecosystem. Thus, understanding the agency model will be beneficial to all financial institutions.

Also Explore Other Courses

- International Central Banking Models and Legal Framework

- Bank Teller Training Program

Mastering Basel III Training Course

Anti money laundering regulations, compliance, process and policy.

- Islamic Banking and Finance Training Course

This Zoe training course will empower you with a detailed understanding and superior knowledge of the agency banking model. Since this is an unexplored-yet-critical domain, gaining experience will give you an advantage for rising banking sector opportunities.

Furthermore, this will help in becoming an expert for advice and guidance on strategies for setting up this model, thus offering you added exposure and experience.

Course Objectives

The key objective of this Agency Banking Model, Strategy and Solutions training course is to empower professionals to—

- thoroughly understand the agency banking model, together with advanced strategies and solutions critical for its success

- apply advanced concepts to define competitive, efficient systems for one’s organisation to ace the agency banking concept

- understand and confidently work with advanced technological setups to achieve operational excellence

- mentor other professionals on best practices related to agency banking

- review existing processes within one’s organisation to check organisational readiness for adopting the agency banking model or enhancing the existing one

- contribute to organisational credibility and development through various steps, thus demonstrating one’s ability to assume core responsibilities, in turn supporting one’s career progression

- gaining the required skills, knowledge and experience to compete with other professionals and stand out in one’s expertise, thus becoming a professional of choice for many organisations, adding dynamism to one’s professional portfolio

Training Methodology

Zoe Talent Solutions conducts various training programs across many disciplines. These courses are customisable and are thus thoroughly checked before commencement of the program. Lectures are delivered by experienced professionals, using audio-visual presentations as good reference.

Trainee participation is assured through group activities and assignments. Further, whenever possible, the training participants are exposed to role-plays and other practical lessons to enhance their experience and understanding on the topic.

This unique format of training was devised by Zoe Talent Solutions as an effective method with maximum learning and is used for all its courses. It is called the Do–Review–Learn–Apply Model.

Organisational Benefits

Organisations whose professionals undertake this Agency Banking Model, Strategy and Solutions course will benefit in ways mentioned below:

- A more structured, successful approach to setting up an agency banking model for the organisation, managed by trained professionals

- Robust, well-defined strategies and unique approaches to implement and successfully sustain the agency banking model

- Efficient solutions to resolve customer needs in time, thereby leading to customer satisfaction and loyalty and increased organisational credibility

- Regular audits to check the organisation’s readiness to enhance an existing agency banking model or establish a new one

- Organisational growth and development because of increased credibility and a well-planned approach to any aspect related to agency banking

- Frequent training programs for existing employees to stay updated with market changes

- Careful review and treatment of all possible risks for the organisation when implementing agency banking

- Use of advanced technological systems to offer a wide range of relevant services in efficient time, maintaining brand image

- Continuous update of processes and systems as per existing market demands and forecasted changes to stay competitive in the industry

Personal Benefits

Professionals opting for this training course will benefit in the several ways mentioned below:

- Detailed information and superior understanding and knowledge of agency banking, including appropriate strategies and solutions

- Enhanced strategic and analytical skills to work with data to devise attractive and relevant strategies for one’s organisation, contributing to organisational development

- Improved attention to detail and foresight to carefully check for early warning signals of possible risks to help set up processes and systems with little or no difficulty

- Increased confidence and knowledge to train other professionals on various aspects of agency banking, including a detailed overview of the model and its relations, existing strategies and theories and appropriate solutions

- Greater understanding and decision-making skills to take timely decisions at the time of set- up or during operation of the model in order to save money for one’s organisation

- Greater experience, exposure, knowledge and confidence to work on various facets or multiple responsibilities related to agency banking, thereby aiding multiple future offers for growth across one’s organisation or across multiple organisations

- Increased knowledge and understanding to work with advanced technologies and apply advanced concepts and theories to establish and successfully operate the agency banking model

- Better understanding and confidence to review existing processes and systems to check for organisational readiness before launching the model

- Enhanced awareness and knowledge to make organisational changes as per changing needs of the market, thus help one and one’s organisation stay competitive in the market space

Who Should Attend?

- Senior management of organisations who need to thoroughly understand the agency banking model to make appropriate strategic decisions

- Bankers and other staff responsible to ensure smooth operation with agents or third-party vendors

- Managers and leaders overseeing end-to-end management of the agency banking model

- Shareholders and other future participants/members who would like to know the health of a company before making investment decisions

- Internal and external auditors responsible for regular audits for adherence to required standards and legislative direction

- Legal advisors responsible for helping the organisation in the event of a dispute

- Agents and other third-party vendors interested in being part of the agency banking model

- Any other professional who would like to know more about the agency banking model

The course covers the following topics critical to help you understand the agency banking model better, including relevant strategies and solutions:

Module 1 – Components of the Agency Ecosystem

- Service providers

Module 2 – Types of Agent Banks

- Foreign agent banks

- Investment banks

- Third-party agent banks

Module 3 – Types of Banking Agents

- Supermarkets

- Convenience stores

- Lottery outlets

- Post offices

Module 4 – Agency Banking Strategy

- Channel distribution

- Channel innovation

- Cost leadership/effectiveness

- Future position

Module 5 – Agency Banking Solutions

- Cash withdrawal

- Bill payment

- Cash deposits

- Funds transfer

- Balance enquiry

- Documentation collection for debit/credit cards, loan applications and account opening forms

- Collection of bank correspondence and mail

- Mobile banking services

Module 6 – Agency Banking Service Limitations

- Final approval of bank account opening

- Final approval of bank card/cheque issuance

- Loan- and financial appraisal-related activities

- Cheque encashments

- Foreign currency-related activities

Module 7 – Benefits of the Agency Banking Model

- Enhanced customer experience

- Investing in brand evangelism

- Appetite for data

- Achieve sustainable development goals by financial inclusion

- Cost-efficient distribution channel

- Deposit mobilisation

Module 8 – Disadvantages of Agency Partnerships

- Bank reputation at risk

- Dependence on branch support

- Lack of real control

- Risk of low-quality sales methods

- Inadequate understanding of product

Share This Content

Click here to auto generate invoice for this course

Get a free proposal to conduct this course in your organisation as an in-house basis

If you've any questions, Let us know by clicking the button below.

Customized Schedule is available for all courses irrespective of dates on the Calendar. Please get in touch with us for details.

Related Courses

Advanced Investment Management: Property, Stock, Financial & Funds

Cash Transfer Programming (CTP) – Cash and Voucher Based

Investment Analyst Training Course

LBO Model, Loan Structuring, Pricing and Leveraged Acquisition Finance

Investment Portfolio Management Training Course

Pension Plan and Fund Administrator Training Course

Pension Fund Law and Regulation Act Training

Zoe Talent Solution uses cookies to ensure you get the best experience on our website | Terms & Conditions Got it!

Download our new Travel Payments report to

What is agency banking?

Here we explain what agency banking is, what the benefits of agency banking are and how it’s set to transform the financial arena.

The Thredd team

February 28, 2023

Want to revolutionise your fintech business? Agency banking could accelerate your growth journey. But what is agency banking and how can it help you?

Agency banking is where a card programme manager delivers banking-like functionality, without being a bank. The programme manager functions as the ‘banking agent’ and utilises a financial services provider (you might hear them referred to as an agency service provider) to serve customers.

The end customer receives a physical or virtual card, with an account number and sort code or IBAN and can make and receive payments via their account.

It’s also key to note that it’s branchless banking - all the interactions are usually completed through a smartphone, whether that’s via an app or website.

What is a banking agent?

A banking agent is an entity who cannot offer banking services themselves, because they don’t have the correct license and regulatory compliance. However, by working with a third-party financial services provider who is able to package up banking services, the agent can start offering these services to end customers. They can offer customers services like paying money in, taking it out, and transferring funds.

Thredd can assist a business in having their own banking-like capabilities. Find out more about how we can help.

Thredd and banking agents

Thredd provides banking agent the ability for Thredd’s customers to take and make banking payments using Thredd’s banking rails, without needing to be set up as a bank.

There are a whole host of payment services available via a banking agent which include: Faster Payments in, Faster Payments out, BACS, CHAPS, SEPA payments and Direct Debits.

Understanding a banking agent

How a banking agent works with Thredd:

- The programme manager signs up with Thredd for agency banking.

- The programme manager is set up for agency banking by Thredd and by Thredd’s agency banking service provider. The agency banking service provider sets up all account details and provides the bank accounts into which end customers can pay.

- The programme manager must have a separate deposit account with their issuer. This where any funds received from end customers can be transferred into.

- The programme manager signs up their end customers for agency banking services, using the Thredd API.

- At this stage, end customer’s banking accounts are set up by the agency banking service provider and returned to Thredd, who passes on the details back to the programme manager.

- End customers can now pay into their account or transfer money out, using the banking account details provided by their programme manager.

Why do customers choose to use a banking agent?

Banking agents were born out of the need for people who can’t access traditional banking, have banking-like facilities. This could be because they’re financially excluded from incumbent banks, and traditional banking streams, but have access to a mobile phone, which means they can access services through a banking agent.

What are the benefits of banking agents?

Benefits for banking agents:

- It delivers a new revenue stream and the opportunity to grow customer volume.

- Gives banking agents the ability to offer banking and payment services.

- Regulatory compliance is maintained.

Benefits of banking agents to the end customer:

- Help reach people who may be financially excluded otherwise - customers just need a smartphone and ID to have banking-like services.

- It’s branchless banking, which some find more convenient, they just need to go to their nearest banking agent.

More industry insights

May 09, 2024

May 08, 2024

April 03, 2024

March 26, 2024

News, events and insights.

Sign up to receive Industry news, events and insights delivered straight to your inbox.

Merchant White label Solution

Everything you need to know about Agency Banking

In recent years, agency banking has emerged as a game-changer in the financial services sector. It is revolutionizing financial services for people, particularly in underserved communities. However, this model has paved the way for increased financial inclusion, providing individuals and businesses with convenient access to a wide range of financial services. Hence, we will explore the concept of agency banking, its impact on financial inclusion, and how technology is driving its growth. Join us on this journey as we delve into the world of agency banking and its transformative potential.

Agency Banking: Revolutionizing Financial Services for Financial Inclusion

Agency banking refers to a banking model where financial services are offered through third-party agents, typically retail outlets or businesses, instead of traditional brick-and-mortar bank branches. These agents act as intermediaries, providing a range of services such as deposits, withdrawals, fund transfers, bill payments, and even loan applications on behalf of banks or financial institutions. This model enables banks to extend their reach beyond physical branches and reach individuals and businesses in underserved areas.

Advantages of Agency Banking

Agency banking offers several advantages that contribute to financial inclusion and improved accessibility to banking services. Firstly, it brings banking services closer to the people, eliminating the need for individuals to travel long distances to reach a bank branch. This convenience plays a vital role in ensuring that even those in remote areas can easily access financial services. Additionally, agency banking is cost-effective for both banks and customers. That is because it reduces infrastructure costs associated with building and maintaining physical branches.

Technology Driving Agency Banking

One of the key drivers of agency banking’s success is technology. The advent of digital banking solutions and mobile technology has significantly accelerated the growth of agency banking networks. With the rise of smartphones and affordable data plans, customers can now access banking services. They achieve ths through mobile apps or USSD codes, making transactions quick, convenient, and secure. Fintech companies have played a crucial role in enabling agency banking by developing innovative solutions. They also develop platforms that connect banks, agents, and customers seamlessly.

Impact on Financial Inclusion

Agency banking has had a transformative impact on financial inclusion, especially in underserved communities. By bringing banking services to these areas, individuals and businesses gain access to formal financial services. This access to savings accounts, credit facilities, and other financial products not only promotes economic empowerment. It also creates opportunities for entrepreneurship and small business growth. Financially included individuals are better equipped to manage their finances, plan for the future, and improve their quality of life.

In conclusion, agency banking is revolutionizing financial services for financial inclusion and promoting the banking industry. Through its innovative model and the power of technology, agency banking is bridging the gap between traditional banking services and underserved communities. By leveraging the convenience and accessibility of agency banking, individuals and businesses can now enjoy the benefits of formal financial services, empowering them to thrive economically. As the agency banking sector continues to grow and evolve, it holds immense potential to drive sustainable development and create a more inclusive financial ecosystem.

Click one of our contacts below to chat on WhatsApp

Social Chat is free, download and try it now here!

4 Overlooked Key Benefits of Agency Banking

- by Josephine Njoroge

- Sep 13, 2019

Cash is still king in many markets. It is the payment mode that fulfills both the need for a quick transaction and the cost requirement of the merchant.

Agency banking , the channel where 3rd-party agents perform transactions on behalf of institutions, enables customers to translate e-money to physical cash for use.

When the cost of setting up and running brick-and-mortar branches is prohibitive, an agency network is a cost-efficient strategy to reach remote, underserved markets.

Financial institutions, though, still lag behind in adopting the agency model, despite the regulatory ease-up.

Here are some unconventional ways to look at the benefits of agent banking and why financial institutions should consider to adopt the agency channel:

1. Keeping It Personal

Customers are increasingly becoming overindulged. If banks want to show that they care, they should make sure that customers are offered services at a convenient spot nearby.

A customer of Software Group conducted a survey where customers expressed preference for a local vendor as opposed to a bank branch for financial services.

Adopting the agency model allows a regular businessman at a local shop to offer personalized banking services while the customer is making other purchases. This is done while exchanging pleasantries and discussing matters of mutual concern between the store owner and the customer.

2. Investing in Brand Evangelism

3. Appetite for Data

The increased footprint at agent shops gives banks the opportunity to gather unconventional data based on customer transactions and purchase habits. Data can then be used to create unique financial products for both end customers and merchants.

This is why it is key for an agency banking software to collect data and offer data reporting and analytics capabilities. Software Group’s Agency Banking Solution provides embedded analytics, supercharged with AI to help our clients unleash their agent network's full potential.

Our client Baobab is one of the leaders in the microfinance sector in Africa, and a good example of the power of data in agency banking. Baobab use behavioral data from their platform to run proprietary algorithms and establish the eligibility of clients for pre-approved loan products. The customer is then able to take a pre-approved loan from their local agent. The use of data has enabled Baobab to make their services much more relevant and accessible for clients and to increase their revenue from the agency channel.

Another example from the industry is Safaricom , the largest virtual bank in Africa. Safaricom has introduced a new product called ‘Fuliza’ which is a Swahili word meaning 'continuously flowing'. Fuliza is an overdraft facility that enables M-Pesa customers complete a transaction when they have insufficient funds in their wallet accounts. Published results show that $810 million was disbursed within 6 months of rolling out Fuliza. This product was developed out of data on the number of transactions that are incomplete due to insufficient funds.

While offering convenience to the customer, such products can be new revenue streams for financial institutions.

4. Achieve Sustainable Development Goals through Financial Inclusion

1.6 billion people and 200+ million MSMEs around the world did not have access to basic financial services in 2017, according the World Bank’s Global Findex Database.

Financial inclusion is tied up to each one of the sustainable goals for development. And financial institutions have a critical role to play in ensuring that the majority of people have easy access to financial services.

Software Group’s customer Fidelity Bank Ghana has laid the foundation of inclusive finance in Ghana with a long experience in the inclusive finance field. Today, Fidelity has 75 branches and an agent network of 1800 agents spread all around Ghana. The bank served a total of 1 million customers in 2018 and would like to increase this number to 5 million by 2020.

To achieve this goal, Fidelity relies on innovative technology, including an Agency Banking Solution by Software Group and the right marketing strategy to get their products out on the market and reach more customers. Growing the agency network is one of the key acquiring tools in their plan to reach the 5 million-customer target.

Embrace Success in Agency Banking with Software Group

Software Group’s Agency Banking Solution helps banks and microfinance institutions scale their points of service with a low upfront investment. It is based on our best practices and lessons learned from deploying agency in the last 10 years in more than 15 countries.

The power of the agency channel can be strategically combined with other digital channel solutions, such as Mobile Wallet and Digital Field Application for a more holistic approach to digital service distribution. Just like our client Botswana Post did – combining agency service points with a wallet app for end customers. The digitally-enabled channels allowed Botswana Post to serve the widely dispersed in the country government pensioners, saving them time and increasing convenience tremendously.

Interested in adopting branchless banking? Contact Software Group today. Sources: The Kenyan Wall Street, 'Fuliza hit Ksh 81 billion lending mark at the end of June 2019', August 24, 2019. World Bank’s Global Findex Database 2017.

Related Articles

Why Software Group Adopted the Platform Approach to Digital Banking

- by Valentin Stoychev

How to Choose the Best Digital Banking Platform?

- by Zornitsa Meshkova

6 Ideas How to Transform Agency Banking into a Low-Touch Channel

Microservice Architecture’s Essential Role in the Business of Digital Banking

Josephine Njoroge

More by the author.

We use technology such as cookies on our site to personalise content, provide social media features, and analyse our traffic. By continuing to use our website and/or clicking ' Accept ', you're agreeing to the use of cookies in accordance with our Cookies Policy and Privacy Policy .

Agency Banking for Financial Inclusion

A tech-driven agency channel reduce costs on reaching new customer segments with secure digital processes.

Financial Institutions can build a sustainable and data-driven alternative channel while activating new bank accounts in real-time

What is Agency Banking?

Cost-efficient and Secure

This branchless banking model became very popular specially in Africa and the Midle-east. Agency Banking allows banks to cut on operational and brick-and-mortar costs and at the same time to reach new customers in distant and rural areas. The agents represent an alternative delivery channel (ADC) and they assist the customer onboarding process, ensuring the compliance norms of KYC with biometrics.

Automated processes for faster sales

Mobile technology enables the success of the agency banking model. Without digital solutions agency channels struggle with bank processes in the field due to a large number of paper forms, manual compliance checks, lack of network access, and limited functionality.

With a platform like Papersoft’s, banks can provide a paperless customer journey, digitize the document capture process, automate KYC checks and compliance and quickly onboard new customers.

How to set up a new Agency Banking channel?

A real-time overview of the Agency Channel operations improves the decision-making of managers

Manage a secure Agent Network

Analyze Data and control the operations

Papersoft’s solution upgrades the agency channel’s processes and quality, with greater data insights about the entire operation. Access to dashboards where you can monitor key metrics on overall network performance. Ensure that your tech-driven and trained agent network is ready to onboard new customers and provide them with a simple experience.

Why use an Agency Banking Strategy?

IDENTIFY YOUR CUSTOMER

Capture and validate your customers’ documents without having to fill in any paper forms. Our solution includes OCR, anti-fraud document or record checks, e-signature and biometric capabilities that ensure the registration matches the real customer identity.

IMPROVED CUSTOMER EXPERIENCE

Transform the information-intensive journey of opening an account in agent’s outlets into an effortless process ensuring a great customer experience, with a fast and secure solution to onboard and manage clients.

TECHNOLOGY BUILT FOR EMERGING MARKETS

Our app works on basic smartphones and allows agents to work anywhere even in areas without connectivity. Validate all information offline with business context alerting issues.

SEAMLESS AGENT MANAGEMENT

Papersoft’s platform allows managing a sustainable agent network, upgrading the agent onboarding processes and quality of new agents with greater data insights about the entire operation.

LIQUIDITY MANAGEMENT

Receive real-time liquidity overviews, including cash under management and paid commissions through better control at field level. This way, your agents will be better equipped to deal with cash shortage by planning their rebalancing times. Increase collected deposit reducing the risk of dormant accounts.

OPTIMIZE ACCOUNT OPENING

Digitize and automate your document workflow, leaving behind the paper-anchored process, eliminating all the constraints and errors of manual validation. Reduce registration times and activate accounts only after validating all KYC requirements.

Reach out to know more

Last-mile Banking Toolkit

Waynbo – Shared Agent Network

Content Management Suite

IT Solutions Reseller

Let’s Talk

Click here to contact us

Project supported by

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

How to Write a Business Plan to Start a Bank

Published Feb.29, 2024

Updated Apr.23, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Table of Content

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have computers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; inventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

How to Start a Plumbing Business in 2024: A Detailed Guide

Vegetable Farming Business Plan

Trading Business Plan

How To Write A Textile Manufacturing Business Plan

Start a Vending Machine Business in 2024: A Detailed Guide

Oil and Gas Business Plan

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Insurance Agency Business Plan Template

Written by Dave Lavinsky

Over the past 20+ years, we have helped over 3,000 entrepreneurs and business owners create business plans to start and grow their insurance agencies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an insurance agency business plan template step-by-step so you can create your plan today.

Download our Ultimate Insurance Business Plan Template here >

What is an Insurance Agency Business Plan?

A business plan provides a snapshot of your insurance agency as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an Insurance Agency

If you’re looking to start an insurance agency or grow your existing insurance agency you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your insurance agency in order to improve your chances of success. Your insurance agency business plan is a living document that should be updated annually as your agency grows and changes.

Source of Funding for Insurance Agencies

With regards to funding, the main sources of funding for an insurance agency are personal savings, credit cards, bank loans, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate the business.

The second most common form of funding for an insurance agency is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan. Venture capitalists will not fund an insurance agency unless it is based on a unique, scalable technology.

Finish Your Business Plan Today!

Your insurance agency business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of insurance agency business you are operating and the status; for example, are you a startup, do you have an insurance agency that you would like to grow, or are you operating multiple insurance agency locations already.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the insurance agency industry. Discuss the type of insurance agency you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of insurance agency you are operating.

For example, you might operate one of the following types:

- Direct Writer / Captive : this type of insurance agency only sells one insurance company’s products – like Allstate or State Farm

- Independent Insurance Agent : this type of insurance agency is privately-owned, and sells policies with may different insurance companies

In addition to explaining the type of insurance agency you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new location openings, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the insurance business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the insurance industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, if there was a trend towards weather-related policy purchases, it would be helpful to ensure your plans call for flood insurance options.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your insurance company business plan:

- How big is the insurance agency business (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key insurance carriers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your insurance agency. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your insurance agency business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, households, businesses, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of insurance agency you operate. Clearly baby boomers would want different pricing and product options, and would respond to different marketing promotions than recent college graduates.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most insurance agencies primarily serve customers living in their same geographic region, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Insurance Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Insurance Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other insurance agencies.

Indirect competitors are other options that customers have to purchase from you that aren’t direct competitors. This includes self pay and public (Medicare, Medicaid in the case of health insurance) insurance or directly working with an insurance carrier. You need to mention such competition to show you understand that not everyone who purchases insurance does so through an insurance agency.

With regards to direct competition, you want to detail the other insurance agencies with which you compete. Most likely, your direct competitors will be insurance agencies located in your geographic region.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What products do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior insurance agency products/services?

- Will you provide insurance agency products that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your products?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For an insurance agency business plan, your marketing plan should include the following:

Product : in the product section you should reiterate the type of insurance agency that you documented in your Company Analysis. Then, detail the specific products/services you will be offering. For example, in addition to P&C insurance, will you also offer life insurance?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the menu items you offer and their prices.

Place : Place refers to the location of your insurance agency. Document your location and mention how the location will impact your success. For example, is your insurance agency located next to the Department of Motor Vehicles, or a heavily populated office building, etc. Discuss how your location might provide a steady stream of customers.

Promotions : the final part of your insurance agency marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Making your insurance agency’s front store extra appealing to attract passing customers

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Partnerships with local organizations (e.g., auto dealerships or car rental stores)

- Local radio advertising

- Banner ads at local venues

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your insurance agency such as serving customers, procuring relationships with insurance carriers, negotiating with repair shops, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your 500th customer, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch a new location.

Management Team

To demonstrate your insurance agency’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in the insurance agency business. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in insurance agencies and/or successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you acquire 20 new customers per month or 50? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your insurance agency location and/or website, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing an insurance agency:

- Location build-out including design fees, construction, etc.

- Marketing expenses

- Website development

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your store design blueprint or location lease.

Insurance Business Plan Summary

Putting together a business plan for your insurance agency is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the insurance agency business, your competition and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful insurance agency.

Download Our Insurance Business Plan PDF

You can download our insurance business plan PDF here . This is a business plan template you can use in PDF format.

Insurance Business Plan FAQs

What is the easiest way to complete my insurance business plan.