How To Create An Effective Annual Operating Plan (+Template)

Do you even need one? Perhaps your organization excels at executing business strategies, keeping everything on track while you monitor performance in real-time.

That's the hope, isn't it?

But let's be honest. You wouldn't be here reading this article if you were confident in your existing annual operating planning process.

So let’s dive in and explore the step-by-step process to create your annual operating plan. This guide also includes a free planning template that will help you flesh out the plan’s details.

What Is An Annual Operating Plan?

An annual operating plan (AOP) is a forward-looking blueprint that translates your business strategy into actionable steps. It’s a detailed roadmap that outlines your organization's strategic objectives, annual budget, detailed action plans, and resource allocation for a specific fiscal year.

%20(1).png)

With an AOP (also known as the annual business plan), you get a 10,000-foot view of how to allocate project resources and what risks to manage so you can execute key priorities. The plan serves as a bridge between high-level business goals and day-to-day operations.

💡What is the difference between a business strategy and an annual operating plan (AOP)? Business strategy outlines the choices you need to make for your organization to win. AOP involves budget allocation, timelines, and deliverables, empowering your team to execute your strategy successfully.

Benefits Of An Annual Operating Plan

Organizations can realize the full benefits of an annual operating plan when it's tightly integrated with their strategic plan and financial budget. Here’s how:

Maximized resource efficiency and utilization

An AOP ensures efficient resource allocation to projects and initiatives that align with the business strategy and financial budget. It helps you direct human, financial, and other assets toward achieving strategic objectives , minimizing resource waste by linking daily operations with long-term goals.

Alignment and focus on key business priorities

An annual operating plan provides a clear roadmap toward a shared vision and helps everyone in your team understand their roles in meeting business objectives. It promotes collaboration and communication while eliminating silos, fostering a unified, goal-driven work environment.

Controlled strategy execution

By defining specific Key Performance Indicators (KPIs) and milestones in your AOP, you can easily assess whether the company is on track to achieve its goals. These metrics will help you identify areas that require immediate course correction to stay aligned with the overall strategy.

Confident, data-driven decisions

A well-rounded AOP provides you with data to help you make the right decisions. These insights empower proactive responses to opportunities and challenges, ensuring that all team actions are focused on outcomes.

How To Create An Annual Operating Plan?

Here’s a step-by-step guide for you to follow:

Step 1: Do the initial research and analysis

To kick off the planning process, assess the current state of your organization. Review the previous year's performance, considering various data sources, including financial statements and operational reports .

By doing a thorough business review , you ensure that your annual operating plan for next year is grounded in reality.

This helps you create a holistic plan that considers your business’s needs, strengths, and weaknesses. It also sets the stage for subsequent operational and financial planning —more on this later in the article.

👉How Cascade helps you:

With Cascade’s extensive library of 1,000+ integrations , you can centralize all your business data in one place. This simplifies data analysis and gives you easy access to past performance for an objective and thorough review.

Step 2: Consult with key stakeholders to understand the needs

The effectiveness of your annual operating plan (AOP) hinges on its alignment with your overarching company goals. Without it, you’re just creating a set of plans that, when executed, will have little to no impact on the overall business strategy.

To ensure organizational alignment , discuss with the CEO and CFO about key business priorities. Also, meet with other key stakeholders like department heads to gather insights on departmental needs and priorities.

Their input will help you set realistic and achievable objectives and also get them fully onboard when the time comes to put the plan in motion.

👉How Cascade helps you:

Cascade’s Metrics Library helps you tie metrics with your business objectives so you can have total visibility of what’s happening across the organization and achieve data-driven organizational alignment from top to bottom.

Step 3: Set a budget and allocate resources

First, look at your revenue goals and identify how much will you actually need to sell to hit your targets.

Collaborate with department heads to assess the availability of manpower, equipment, and other resources. Verify whether these are sufficient to meet your set targets.

List out expenses, covering everything from materials and labor to marketing and new equipment. This exercise provides a clear picture of how much of resources you’ll need to allocate across various projects and functions to fulfill the objectives of your annual plan.

👉How Cascade helps you:

Cascade makes budget tracking possible with custom fields that can capture data and link them to objectives. The budget custom field is a numerical field type where you can set the allocated, forecast, and spent values. As you work on your plan, you can update the relevant values and see a progress bar of the allocation vs. actuals.

📹 Check out this short video and learn how to set your custom field for budget tracking:

Step 4: Prepare a plan

In this step, you should define your metrics and go beyond mere measurement. Set concrete targets. Then, link these targets to initiatives , projects, and actions that will drive you toward those numbers.

Whether your organization operates with multiple departmental plans or a single, unified annual operating plan, ensure each department head outlines key projects and action plans aimed at achieving their annual targets.

When setting your KPIs to track progress, don’t forget to focus on both leading and lagging indicators .

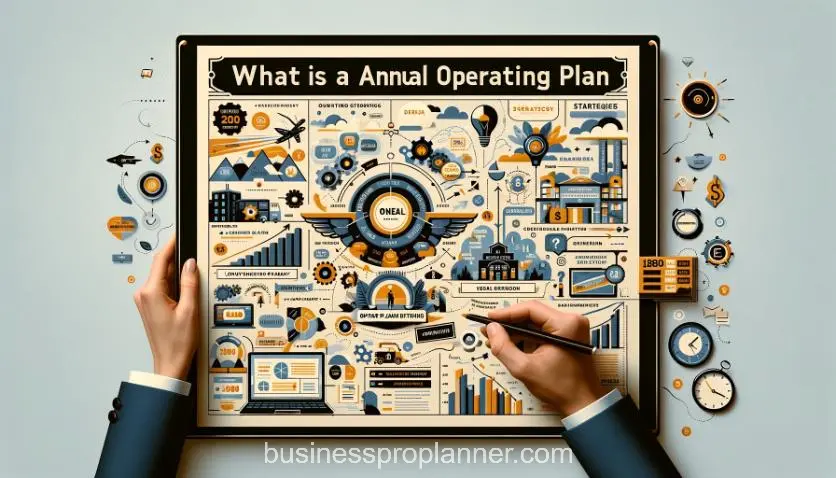

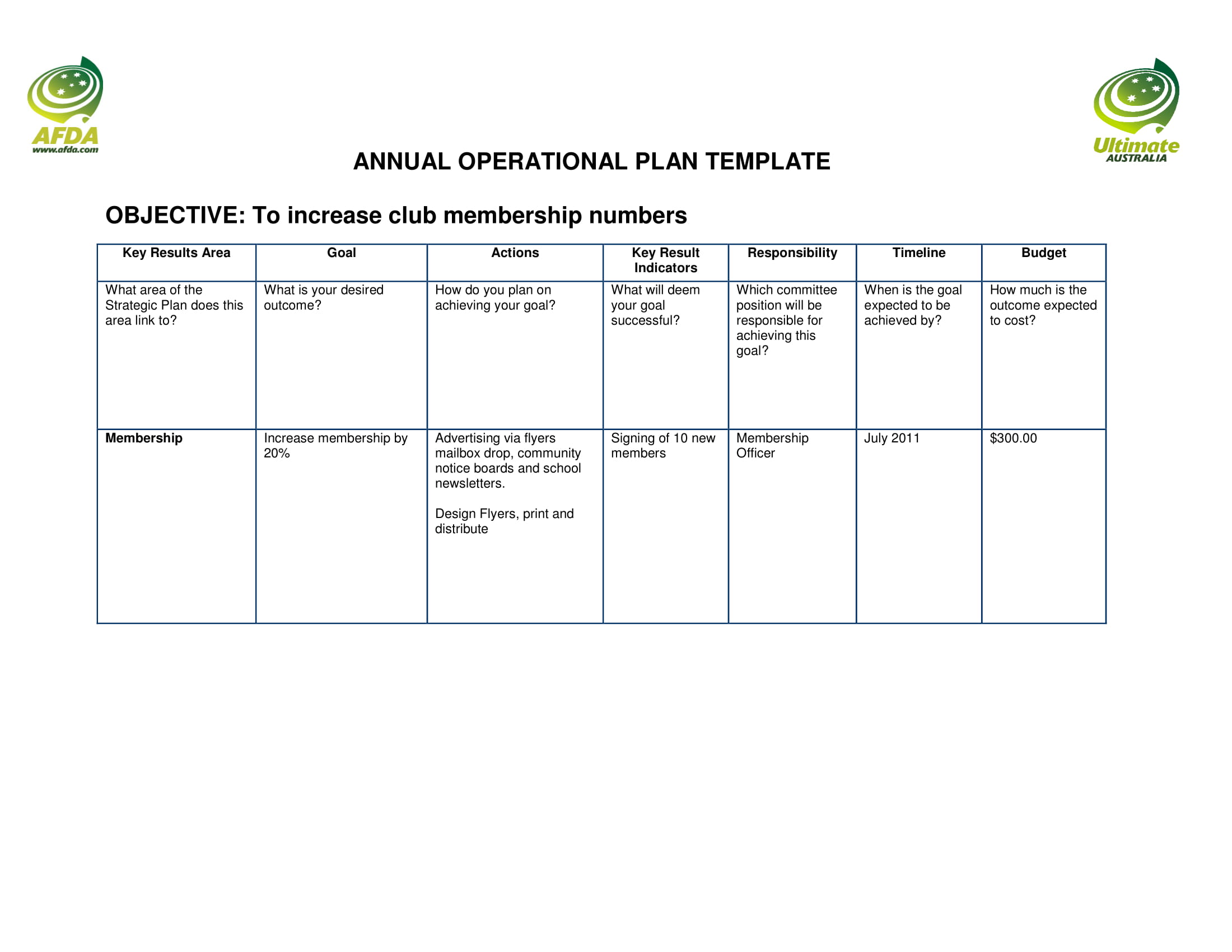

Cascade’s free operational plan template gives you a clear and simple plan structure that you can use to easily collaborate with other department heads or team leaders. It’s pre-filled with examples and fully customizable to fit your needs.

📚 Are you an organization with multiple business units, each requiring its own AOP aligned with a central strategic plan? Explore our case study to see how a customer uses Cascade for strategic alignment between AOPs of different business units and the organization’s overarching 3-year strategy.

Step 5: Review and approve

Ensure your AOP is well-rounded and considers the needs of different stakeholders . Have different departments review the plan to promote alignment and collaboration. This step also ensures everyone is on the same page from the start.

After an internal review, secure approval from decision-makers, such as board members or executives, to gain buy-in at the highest levels. This buy-in makes it easier to implement your annual plan.

Step 6: Execute and monitor

Everyone involved must start working on their assigned initiatives. Ensure every team member knows that their duties are time-bound and remains accountable for completing them.

To make sure you're staying on course, it's vital to keep an eye on the progress through the KPIs established earlier. Monitoring progress against objectives ensures that you stay on track throughout the year.

💡 Tip: Set a regular schedule to review your annual operating plan. Depending on your needs, this could be weekly, monthly, quarterly, or semi-annually.

Cascade can help with monitoring through its user-friendly dashboards and comprehensive reporting capabilities.

Dashboards use chart widgets and graphs populated with real-time data so you can understand what’s happening in different time frames.

.jpg)

Cascade’s reports empower decision-making by providing the context of the data presented.

.png)

Annual Operating Plan Example With A Free Template

Cascade’s Operational Strategy Template is suitable for organizations of all sizes, and you can use it for free.

This template comes with pre-filled fields to guide you on where to enter your data so you can quickly set it up within minutes. You can choose your focus areas and write down the objectives. Then you can set the KPIs that will be measured and tracked as you progress with the plan.

Once set, designate responsible team members and use Cascade's real-time dashboard for monitoring.

It’s a tried and tested template that aligns your employees with the business strategy and provides clear guidelines on how to execute it.

Execute Your Annual Operating Plan With Cascade 🚀

You can’t simply make an AOP without tying it to the larger picture. Executing a plan without clear alignment to the overall business strategy is futile. Yes, your company is busy, but you’re getting nowhere.

With Cascade , you can centralize your strategy. By doing so, you can easily see how the execution aligns with your business strategy.

With its dynamic dashboards, real-time reports, and various other features, you can create seamless plans, execute them, and not worry that they’re being completed in silos. Every action your teams take, and every small goal they achieve, is connected to a bigger strategy that helps achieve your organization’s long-term vision.

Want to give it a try? Sign up today for free or book a 1:1 product tour with one of Cascade’s strategy experts.

Annual Operating Plan FAQ

What should be included in an annual operating plan .

A well-structured annual operating plan should include:

- A clear set of strategic objectives

- Detailed action plans

- Performance metrics

- Resource allocation

- Risk mitigation plans

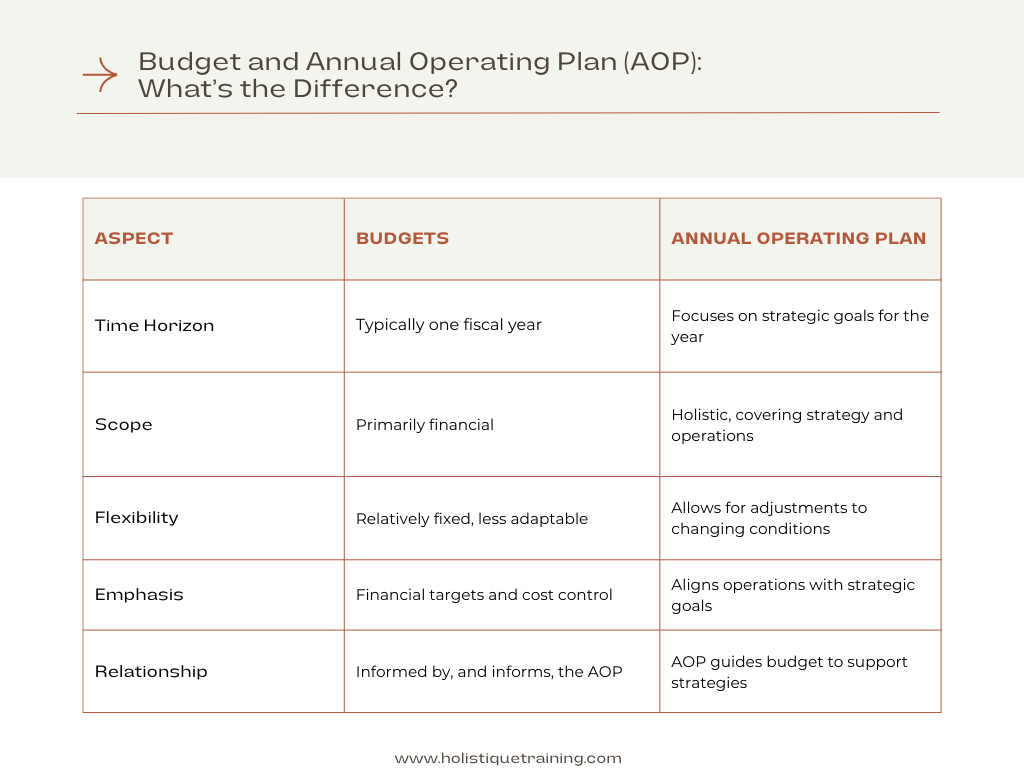

What is the difference between annual operating plans and budgets?

Annual operating plans and budgets are both financial planning tools used to manage performance. An AOP is a comprehensive blueprint that includes your overarching goals and the details to execute them, including the financial and human resources needed.

On the other hand, CFOs use budgets to focus mostly on the financial aspect of the organization’s plan and are highly numbers-driven. They provide detailed projections of revenue, expenses, and cash flows but lack the strategic depth of AOPs. Unlike AOPs, they’re also less flexible once approved and are primarily intended for financial and accounting teams.

Popular articles

Viva Goals Vs. Cascade: Goal Management Vs. Strategy Execution

What Is A Maturity Model? Overview, Examples + Free Assessment

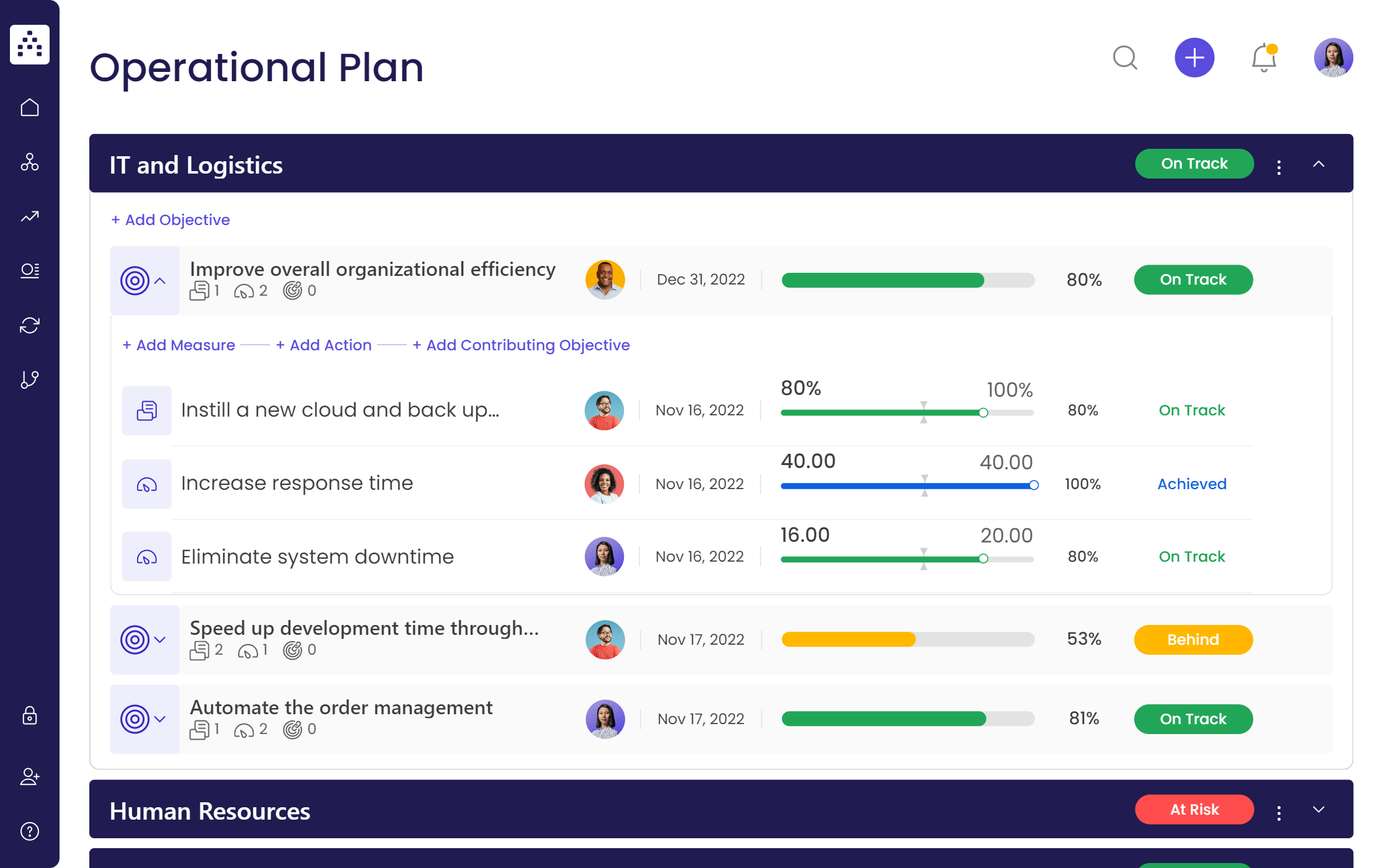

How To Implement The Balanced Scorecard Framework (With Examples)

The Best Management Reporting Software For Strategy Officers (2024 Guide)

Your toolkit for strategy success.

How To Create an Annual Operating Plan for Your SaaS Business

Carly Miller

Content Marketing Writer

Download our Strategic Financial Planning Blueprint

Business planning can be a painful process for all involved. But getting rid of it isn’t an option. A rigorous annual operating plan is what will help you maximize efficiency across the business and allocate resources to hit company goals.

Don’t spend year after year dreading each step of the process of building your business plans. Here, we’ll cover the key concepts and steps you need to know to optimize your processes and create an annual operating plan that drives value for your organization.

Table of Contents

What Is an Annual Operating Plan?

An annual operating plan (AOP) is a strategic document that a company prepares to chart its course for the upcoming year. This AOP encompasses key performance indicators (KPIs), operating budgets, and action plans designed to meet both short-term and long-term objectives. Through the annual operating plan, businesses can pinpoint and allocate their resources efficiently, ensuring they’re on track to achieve their set milestones.

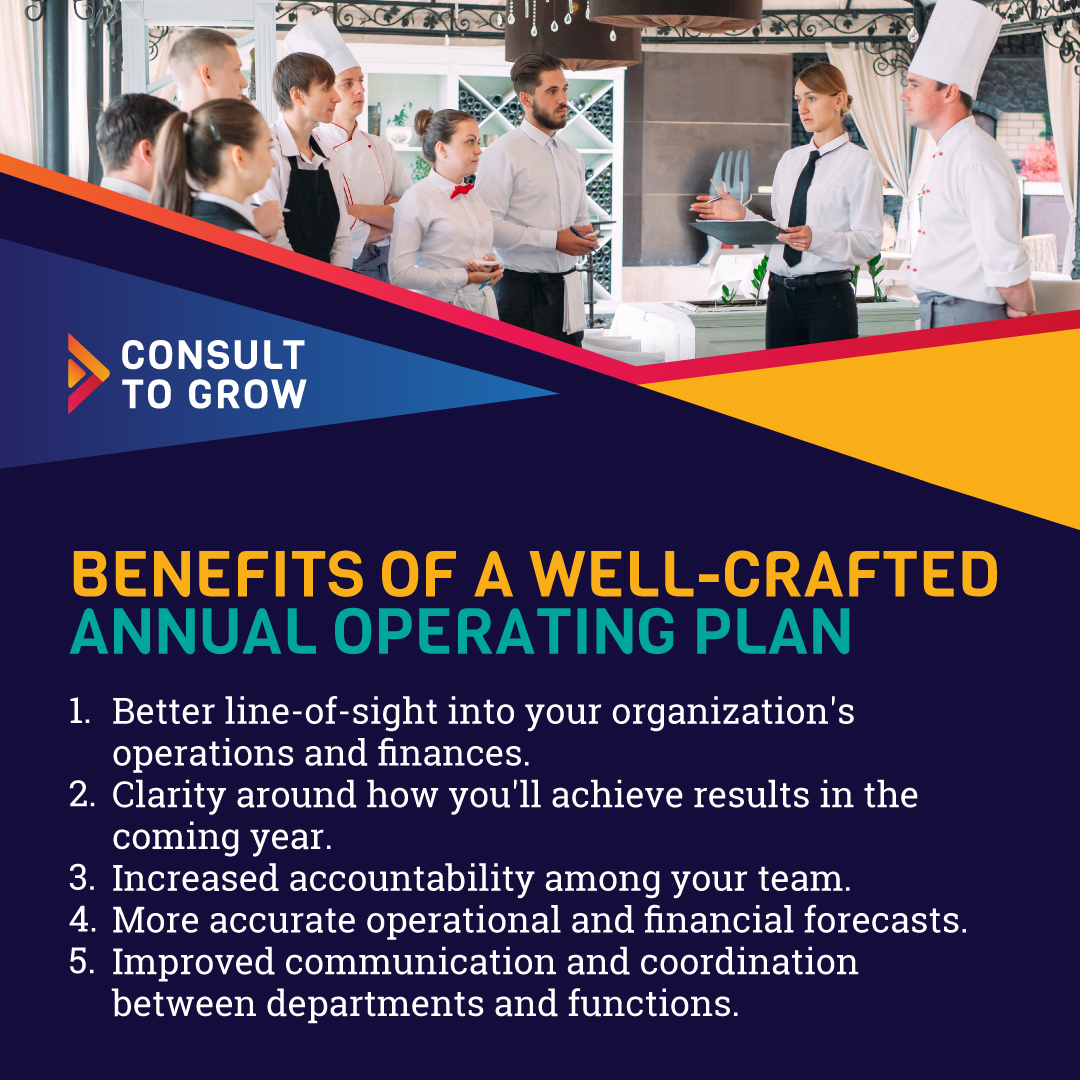

Benefits of Annual Operating Plans

As a part of strategic planning, an annual operating plan ensures that all employees understand their responsibilities and can coordinate their efforts to complete your business objectives.

It enables managers to track progress and determine whether they’ll hit company milestones on time. As a result, managers can request any needed funding from the CFO ahead of time.

Here are more benefits of annual operating plans:

Make Department Plans and Strategies More Data-Driven

A data-driven approach keeps the plans and strategies of various departments more outcome-oriented by drilling down to the impact of costs per head, per month, or per vendor.

Such an approach improves the accuracy and flexibility of your SaaS revenue forecasting by aligning revenue and expense forecasts with the primary levers for your SaaS business.

Align Cross-Functional Departments With Business Goals

Align Cross-Functional Departments With Business Goals Business leaders can curate job roles and department goals based on what’s outlined in the annual operating plan to ensure their team members align with key company objectives.

Help Highlight Potential Need for Fundraising or Spending Re-Evaluation

An annual operating plan can help you have more granular conversations with stakeholders or business owners about how changes in spending could improve performance as market and business conditions shift throughout the year.

Give Departments a Guidepost for Tracking Performance and Goals

An excellent AOP will help various departments track their progress and ensure they take the necessary initiatives to achieve company objectives throughout the fiscal year.

How To Create an Annual Operating Plan

The complexity and maturity of your company will determine the details of your annual planning process. But in general, aim to start the planning process about a third of the way through your Q4 and finish it within six weeks. This ensures decision-making is streamlined and goals are achievable.

Here are the recommended steps:

1. Organize Department-Level Data in the Main Financial Model

Creating an annual operating plan starts with categorizing data from your company to understand the previous year’s performance trends. These insights are the foundation for the rest of your planning process and will help you create a detailed plan.

Your goal in this phase is to clearly understand what teams are spending money on and find consistent and inconsistent spending across general ledger accounts.

For example, if your marketers used LinkedIn ads as a primary channel throughout the previous year, you might anticipate they’ll increase LinkedIn ad spending in the new year.

You can also find significant one-time expenses across departments and look for opportunities to limit these expenses to improve cash flow.

You can then use these insights to develop questions for departmental meetings.

2. Get a Read on Department-Level Plans

This is the most collaborative — and perhaps most important — part of the annual planning process. The ability to connect with department leaders, understand their needs, and contribute to their plans will enhance the effectiveness of your AOP.

The needs of the marketing, human resources, sales, and product departments differ from those of the finance department. So, communicate with their leaders to learn what they care about most rather than handing over dense spreadsheets outlining the financial plan.

Focus your conversations on past performance compared to your plans. Alternatively, you can create high-level strategic budgets and establish goals to achieve them if you don’t have historical data.

3. Translate Department Budgets to the Main Model and Scenarios

In the previous step, you worked with department leaders to understand their needs and strategies. As a result, you should have worked through various department-level scenarios by this point.

One scenario could be: What if we hire another 30 people in the production department? Is the ROI of new product releases worth the cash impact?

Another scenario you could consider: What if we doubled our marketing acquisition budget? What effect would this have on pipeline generation ?

When you translate the department-level discussions to the primary model, you must also run what-if scenarios for the whole organization.

Having a CEO and a CFO with a good relationship can make all the difference when creating an AOP, and running these scenarios will let CFOs have a more strategic conversation with the CEO about how to handle different aspects of the current economic environment.

The models will show how different fundraising scenarios, revenue forecasting , and headcount plans affect your cash flow, runway, and burn rate.

4. Align With the CEO for Company and Board Approval

At this stage, you’ll present fully fleshed-out scenarios and plans from the third step to finalize things for the CEO and board.

However, due to market uncertainty, you may spend more time with your CEO working out scenarios and model assumptions to determine the best path forward.

As a result, you may want to give yourself plenty of time to adjust your plans based on your CEO’s recommendations and comments.

Then, the CEO can sign off on the plans and approve the various scenarios you’ll present to the board.

5. Reforecast Throughout the Year To Keep the Plan Fresh

The value of an annual operating plan is in the process itself. You must keep it fresh monthly and quarterly. So, update your models to reflect new context about the business and macroeconomic environment.

Also, compare rolling forecasts to the original annual plan. This comparison lets you revisit the plan with the most recent actuals and adjust based on business performance and macroeconomic conditions.

Download this blueprint and complete guide to nailing your annual planning process.

Why saas startups need to go beyond annual operating plans.

As you create your AOP for 2023, market uncertainty is forcing you to be more adaptable and agile. So, prioritize automation and data integration to address evolving business needs. You’ll need an overarching framework for centralizing, processing, and analyzing financial statements and other financial data.

You need a framework to pull all financial data from your organization and map it into a common ontology, saving 80% of the time you typically spend cleaning data from individual record systems.

Financial tools like Mosaic provide this framework, eliminating the need to rely on engineers to develop a data architecture to support your agile planning.

How Mosaic Enables Business Growth

Mosaic provides a Strategic Finance Platform that serves as the connective tissue for your small business. It automates financial data integration and empowers you to add more strategic value to the planning process.

Plus, the 125+ SaaS metrics make monitoring your business’s growth simple.

Want to learn more about how Mosaic makes the typical high-stress top-line planning process easier for SaaS startups? Reach out for a personalized demo and find out how you can easily create your annual operations plan.

Annual Operating Plan FAQs

What should be included in an annual operating plan.

An annual operating plan should be a concise overview of the entire company’s strategic and tactical plans for the year ahead. This should include:

- A narrative of strategic context to go along with the proposed annual budget

- An explanation of the current and planning organizational structure to support strategic initiatives

- A clear outline of quantitative company goals and OKRs

- The breakdown of departmental metrics that you’ll use to track progress

What is the difference between annual operating plans and budgets?

An AOP and a budget both address your financial structure, but they have some differences.

The differentiator is that the annual operating plan is like a document or deck that outlines overarching goals and departmental focuses. In contrast, the budget is much more numbers-driven and includes revenue goals, financial assumptions , and expense forecasts.

What is the objective of an annual operating plan?

When creating an annual operating plan the objective is to tie together forecasts, budgets and plans (including their accompanying goals and KPIs) from different departments into a single cohesive overarching plan for the company. Annual operating plans help departments align around company objectives and give each department achievable goals to work towards.

Related Content

- A Guide to the Strategic Budgeting Process in SaaS

- Guide to Rolling Budgets: How To, Pros & Cons, Examples

- Top-Line vs. Bottom-Line Growth: How to Analyze and Improve Each

Never miss new content

Subscribe to keep up with the latest strategic finance content.

The latest Mosaic Insights, straight to your inbox

Own the of your business.

Annual Operating Plan: How to Build One in 8 Easy Steps

Creating an effective annual operating plan (AOP) is important for any business, whether it’s a bustling startup or a well-established small business. This strategic planning tool serves as a roadmap, guiding your company toward its business objectives and fiscal year goals. Learn more about annual operating plans and how to make one to get your year started on the right foot.

1. Conduct a Business Review

Kick off your planning process by reviewing the previous year. Examine your financial statements, business goals and key performance indicators (KPIs) to understand where your business stands. Reflect on both the successes and the shortcomings, considering metrics and actuals to gain a comprehensive view. This step is crucial to informed decision-making by both CFOs and business owners.

2. Check In With Stakeholders

Your stakeholders, including department heads, team members and investors, play a vital role in the planning process. Their feedback can provide valuable insights into the operational and strategic needs of your business. This collaborative approach ensures that your AOP is aligned with the company’s goals and addresses the needs and expectations of all parties involved.

3. Set Your Goals and Key Performance Indicators

Define clear, achievable business goals and establish key performance indicators (KPIs) for the upcoming year. These goals should be SMART (Specific, Measurable, Achievable, Relevant, Time-bound) and directly tied to your strategic vision. KPIs will serve as quantifiable metrics to track progress and gauge the success of your initiatives.

4. Identify Obstacles

Anticipate challenges that might hinder your progress. Whether it’s cash flow issues or the challenges of launching a new product, preparing for obstacles ensures a more resilient plan. Consider internal and external factors such as market trends, competition and resource limitations.

5. Plan a Strategy

Craft a strategy that includes the initiatives necessary to achieve your business goals. This should include a blend of financial planning, marketing strategies, human resources allocation and operational tactics. Ensure that your strategy is flexible yet focused, with clear milestones for monitoring progress.

6. Create a Realistic Budget

Your operating budget is a key component of your AOP. It should realistically reflect your anticipated revenue, expenses and cash flow. Utilize financial planning tools, such as Excel or specialized SaaS platforms, to create a detailed and accurate budget. This budget should align with your strategic goals and provide a clear financial roadmap for the year.

7. Assign Roles and Responsibilities

Clarify roles and responsibilities within your team. Ensure everyone understands their part in achieving milestones and business objectives. This clarity helps to keep your team focused and aligned with the AOP’s goals.

8. Check In and Adjust as Needed

An effective AOP is not set in stone. Regular check-ins allow you to compare actual performance against your plan and make necessary adjustments. This flexibility allows your business to adapt to changes and unexpected challenges, ensuring that your AOP remains relevant and effective throughout the year.

What Is an Annual Operating Plan?

An annual operating plan is a detailed outline of a company’s projected activities over the upcoming year. It includes budgets, projected revenue, goals and strategies.

Why Do You Need an Annual Operating Plan?

An AOP provides clarity and direction. It helps in aligning the efforts of different departments towards common business goals, thereby improving the bottom line.

Where Can I Find Tools to Help Create an Annual Operating Plan?

There are numerous tools available, from Excel templates to sophisticated SaaS platforms. Microsoft offers resources for step-by-step planning, while various online platforms provide AOP and SOP (standard operating procedure) templates. These tools can help streamline the planning process and ensure accuracy and consistency.

What Are Some Common Mistakes People Make When Creating an Annual Operating Plan?

Common mistakes include setting unrealistic goals, neglecting stakeholder input, inadequate risk assessment and failing to adjust the plan as needed. It’s important to be aware of these pitfalls so you can avoid them when creating your AOP.

What Experts Say

“There were several critical steps I needed to consider when I created my annual operating plan. I started by looking at what I felt I needed to achieve to run a successful travel blog/website. This included increasing website traffic, generating revenue and growing my email subscriber list. I needed a way to understand my target audience, their behaviors, interests and preferences. Then I outlined my services.

“I did comprehensive market research on my possible competitors and the current state of the travel industry, and planned how I would make money, whether it be through advertisements, sponsor content, or affiliate marketing. I then created a content schedule, a thought-out plan on when I would release what type of content, what topics I would cover and when it would be published.

“This is a simplified overview of how I created my annual operating plan for my new business venture. The actual process did involve more steps, for instance, marketing and promotion, my financial plan and what my KPIs will be to determine my progress. Remember to stay flexible when creating your operating plan since any industry has the possibility to change rapidly.”

Saya Nagori, CEO & Travel Expert WanderDC

The Bottom Line

An annual operating plan is not just a financial document; it’s a strategic tool that guides your business through the fiscal year. Building an effective annual operating plan is a process that requires careful thought, collaboration and strategic planning. By following these steps and leveraging the right tools, you can create an effective AOP that aligns with your business needs and helps achieve your goals.

This content is for educational and informational purposes only, and is not intended as financial, investment or legal advice.

Article Contributors

Saya Nagori, CEO & Travel Expert

WanderDC is a travel hub curated by Saya, a resident of Washington DC since 2018. Since her adventures to DC as a teen, she’s loved the city and the surrounding areas. Now, she aims to give the best recommendations and insights to travelers looking to wander DC. She also shares her recommendations for the surrounding areas including Maryland and Virginia.

Related Articles

Fixed Capital vs Working Capital: What’s the Difference?

Understanding Personal Guarantees in Small Business Financing

Financial Terms: A Cheat Sheet of 77 Essential Words for Business Owners

Is your business based in .

If so, please visit our website.

How to Develop an Annual Operating Plan + Template

You may have heard the famous quote, “give me six hours to chop down a tree and I will spend the first four sharpening the axe,” supposedly by Abraham Lincoln .

It highlights the importance of planning and preparation in order to do the job effectively. And that is the case with an annual operating plan in business. It is a document that, when prepared correctly, will create the framework your business needs to achieve its goals.

This article helps you create the document, providing an annual operating plan template on which to base yours.

What is an Annual Operating Plan (AOP)?

An annual operating plan, also known as an annual operations plan, is a report that lays out the elements the company needs to reach its targets, including key performance indicators (KPIs), budgets and other human, physical, educational and financial resources. It provides a roadmap to help you navigate day-to-day activities that will lead the organisation to meet its objectives.

The document lays out the resources required by different company activities and who holds responsibility for carrying them out. It also takes into account pertinent risks for the company and how it might mitigate them to remain on course to achieve its aims.

The AOP differs from your budget and your strategic plan in the following way:

How to create your annual operating plan

1. assess your current situation.

Look back at your performance over the last year and consider what you achieved in relation to your aims and objectives. Review how closely aligned your performance was with company values and your mission. This will help you to reset your planning for the next year.

In which areas could you improve in the future? Consider actions that did not achieve the necessary results. For example, did a new product launch fail to spark the expected revenue boost ? Consider what you can learn in order to refine your processes going forward or whether you should cancel some activities and seek out other opportunities instead.

Analyse all areas of the business to ascertain where you can make improvements. One of these areas could include the effectiveness of your board . You can use iBabs to track board member engagement, which will allow you to identify directors who might need more encouragement or training. A more engaged board is a more effective board and that can help you move the business forward over the next year.

2. Analyse the market climate

The risks in your sector will have a bearing on your planning for the forthcoming year. There is no point in pursuing a plan that is destined not to work because the market climate is incompatible with its success.

This means keeping a keen eye on the industry press to spot market trends that will help you set KPIs that chime with the business environment in which you will be working.

Discuss the plan with the CEO to find realistic routes forwards for the next business year, as well as planning contingencies that can address the shifting landscape.

Make use of competitive landscape analysis to see what your peers are doing and how they work. This will identify opportunities to diversify and gain an advantage over your competitors. Use a SWOT analysis to better understand their strengths, weaknesses, opportunities and threats. This will help you adjust your planning framework to the market conditions.

3. Build your business strategy

Consider what you want to achieve overall for the business during the next year based on what is achievable as the market stands. Develop a strategy that will allow you to meet your objectives, given the risks and challenges that lie in store.

Use your board portal to facilitate collaboration between board members on this topic between meetings. This allows them to thrash out the minor details outside of the boardroom, creating more time in board meetings to discuss the more substantial aspects of the strategy.

You should also meet with department heads to discuss what they want to achieve during the year and what they need from you to meet those objectives. Attempt to work out how you can allocate the necessary resources for them to meet their aims. Also, use historical data to give you a realistic read on their ability to deliver what is required.

4. Create the operational plan

Using the information you have gathered, you can begin to create a framework for the day-to-day activities that will comprise your operational plan. Set KPIs to help you monitor progress during the year and adjust your plan accordingly. Allocate the necessary resources and assign responsibilities.

Once you have selected the areas on which you want to concentrate for the twelve months ahead, set SMART goals to achieve the growth that you require. These are goals that are S pecific, M easurable, A chievable, R elevant and T ime-bound.

Ensure your goals are relevant by aligning them with your company mission and that they are time-bound by setting them for the full term of your annual operating plan.

Include your budget and financial planning within the operational plan, which allocates how that budget works in a practical manner within the organisation. Include sales targets to help you achieve the results you need to carry out your plan.

5. Explore new technology

Consider how technology could help you meet your operational goals with the resources that you have available.

This could include using artificial intelligence to automate some repetitive tasks and free up employees to work in other areas. When it comes to allocating human resources, you can make your plan more efficient by finding solutions that make the most of your employees’ talents.

Another use of technology to improve your operational efficiency is to use board meeting software like iBabs to run your meetings. This allows you to implement a digital meeting management process that uses your resources more effectively.

6. Implement your plan

Put the plan into action and communicate that plan clearly to all stakeholders. Everyone must understand which goals you are aiming for, the steps required to reach them and their role in reaching those steps.

Use internal communications methods such as company town halls to discuss the operating plan with employees and field any questions that they might have. In order to make sure your board members understand their responsibilities, create and track action items in your board software to increase accountability.

Once the plan is in place, make sure to review it periodically, as changes in the market may have a bearing on its current state.

Annual Operating Plan Template

This template provides you with a basis for operational plans for businesses and non-profits, as well as for longer-term planning. It allows you to visualise your goals, the stakeholders with ultimate responsibility, the measures of success and the potential risks you could encounter.

Why is creating an AOP important?

Creating an AOP organises the route towards your goals. Without it, you could veer off-course without being able to recognise that immediately. The steps in your plan help you to track progress more effectively and adjust accordingly if necessary.

What is the difference between an annual operating plan and a business plan?

Your business plan is your overall aims and goals and the methods to achieve them. The annual operating plan breaks that down into a one-year timeframe and plots how you will achieve the aims of your business plan that year.

How often should we update the annual operating plan?

You should check in on your plan regularly during the year, quarterly or even monthly. This is to ensure that you are on target and that the AOP is still on track to lead you to your goals, considering the market conditions.

How can we ensure everyone stays engaged with the annual operating plan?

Setting SMART goals and KPIs allows all stakeholders to know where they stand and what they need to do to meet their targets. With strong internal communications, you can keep everyone informed and motivated, offering incentives and praise for meeting goals.

How do we determine the right key performance indicators (KPIs) for our annual operating plan?

This involves selecting leading KPIs that help you predict future performance. Discuss them with relevant stakeholders to ensure that they are realistic and helpful in achieving your aims.

How can we effectively communicate the annual operating plan to other stakeholders?

Use your internal communications channels to keep stakeholders informed about developments and progress. This could include, for example, internal webinars or emails. For boards, use your board portal software to provide documentation and action points for directors.

Using an annual operating plan template to create a road map towards achieving your goals helps you stay on course and gain an important overview of how you need to distribute your resources during the coming year. It provides all stakeholders with targets to meet and responsibilities to carry out so everyone understands the part they will play.

For board members, you can use iBabs’ meeting management software to digitalise your processes, keep your board on track towards completing their action items and monitor directors’ engagement with board matters. Request a demo of iBabs today to find out how to improve your workflows, accountability and effectiveness using one platform.

References and further reading

- New iBabs features

- Board orientation checklist

- How to improve board effectiveness

- Good governance checklist

- How to create an executive director work plan

- Take the Meeting Excellence Assessment

Popular posts

- Robert's Rules of Order: The Meeting Agenda Simplified

- Here Is A Sample Letter To Remove A Board Member With Respect

- Complete Guide to Robert's Rules of Order Minutes + Template

- Chairing a Board Meeting + Script and Pro Tips

- [Step-By-Step] The Best Board Report Format + Template

- Robert’s Rules of Order: Simplified Beginner’s Guide

- Here’s How You Should Write A Chairperson Report

- How To Take Executive Session Minutes (With An Example)

- Board Meeting Protocol: Rules, Procedure, Etiquette and More

- How to Close a Board Meeting as a Chairman

Posts by topic

- Board Composition (5)

- Board Management (8)

- Board Meetings (19)

- Clinical Governance (2)

- Functionalities (4)

- General (61)

- Governance (5)

- Healthcare Organisations (2)

- Local Authorities and Governments (6)

- Meeting techniques (25)

- Meeting trends (18)

- Paperless meetings (21)

- Robert’s Rules Of Order (8)

- Roles and Responsibilities (1)

- Security (5)

- Sustainability (3)

- Tools & templates (10)

iBabs Meeting Insights

Join over 24,000 professionals on the Meeting Insights email list to get updated to the latest on meeting management. All our tips and tricks delivered to your inbox.

- Gain insight into the vital role of board committees in corporate decision-making and oversight.

- Find out about board document annotations, how they benefit decision making and the different types of annotation.

- Get a deep dive into what byelaws are, what they cover, and how they ensure effective governance.

- D and O stands for directors and officers, but what does that mean and what do they do on a board? Find out here.

- Find out what meeting action items are, why they are important, what elements they should contain and best practices for effective governance.

- Meeting minutes are detailed written notes created during official company meetings. These notes describe everything that takes place during meetings.

- Learn what meeting motions are, the different types and how to vote on a motion at a meeting.

- Discover the crucial role of board administrators and their impact on effective governance. Learn about their responsibilities and qualifications.

- Learn what a board book is, what it should include and how to use it to maximise the efficiency and transparency of your board meetings.

- A board committee charter plays an important role in guiding the work of committees, but what does it contain and how does it aid governance?

- Every board needs a board manual, and this article explains what should be included and why you need to keep it up-to-date.

- Learn what a board meeting agenda is, what to include in it and how to use it to keep your meeting on track.

- A board member agreement is an important document for ensuring the board runs as it should. Find out how here.

- How does a board of trustees differ from a board of directors and what function does it hold within an organisation?

- A board officer is one of the key elements of the board, but which positions do officers hold, what do they do and how are they elected?

- Find out what a board portal is and how it can help you streamline your board meetings and make informed decisions.

- Learn what a board president is and explore the qualifications and traits necessary to successfully fill this role.

- Find out what a board resolution is, discover the different types of board resolutions and how they are used to make important decisions.

- The board secretary is one of the key roles in corporate governance and this page explains how the secretary serves the board to help it achieve its goals.

- In most meetings, there are many topics on the agenda to be covered in a limited window of time. Therefore, it’s important to be formal and keep the board members focused on the matters at hand.

- The casting vote might be used in a meeting as a way of breaking a deadlock. This page explains who has the vote, how they use it and when they cannot.

- The CEO report is a regular analytic tool for assessing the progress of the organisation. This article shows you what it should include.

- The chairman of the board, or chairperson, is the highest authority figure on the board of directors. Their function is specified in their organisation's bylaws.

- Having a code of conduct for your board is essential for compliance and risk management. This page explains more about what is involved.

- A committee management system is a useful resource for a government agency. Found out how it helps governance within councils and other bodies here.

- A committee report is a key tool in distributing the findings and recommendations on topics to the board as a whole. Find out how it works here.

- During the board’s work there may be a conflict of interest arise for a board member. Find out how to identify and mitigate conflicts.

- Find out what a consent agenda is for a board meeting, what it usually includes and how it benefits the work of the board.

- A company might have a de facto director on the board, but what does that mean and what role do they play in governance

- What is a determination letter for the board of a non-profit organisation? Find out what it is and what that means in this article.

- A director serves on the board of a company, but what are their roles and responsibilities, and what attributes make a successful director?

- The disclosure committee plays a pivotal role in compliance, and this article explains its obligations and composition.

- A managing director is a senior executive with a role to play in running a company. Find out what the position involves on this page.

- Get a clear understanding of what a board meeting approval is, when it is needed and which factors should be considered.

- What does motion seconded mean and how does it affect the procedure of a board meeting? This article explains more.

- A non-executive director can play a key role in the board’s work, but what does that involve and how is it different from an independent director?

- Learn what a notice of meeting is in board meetings, when to send it and what to include in it.

- What is a plenary session for a board of directors, why is it important and how does it differ from other types of meeting?

- Members can use a point of information, or request for information, in a meeting, but when is it appropriate and what should you avoid?

- In the midst of a discussion, a board member might request to make a point of personal privilege, but what does that mean?

- A private board is one that serves in a company that does not sell shares to the public. Find out how that affects how the board works.

- A public board is the board of directors of a publicly listed company. This page explains how it is structured and who holds it accountable.

- A public meeting is one in which citizens can witness the workings of local government. This article describes the types of public meetings and why bodies hold them.

- Get a clear, concise overview of what quorum is and its significance in modern organisations.

- Learn what a roll call vote is in board meetings and how it can help increase transparency and accountability.

- A shadow director can sit on a board even though they are not an official director. Understand more about this role on this page.

- A tie vote in a board meeting requires a resolution. This article explains what it is and how to resolve it.

- This page features a timekeeper definition to help you understand the role that this person plays in a board meeting.

- A two-tiered board structure is a popular governance device in some parts of the world. Find out what it is and how it works on this page.

- On occasion, there might be a need to call a vote of no confidence, but under what circumstances and what is the correct procedure?

- Discover what abstention means in board meetings, learn about different types of abstention and the consequences of abstention.

- Learn about the different types of ad hoc committee and how they can help address specific challenges.

- Discover the definition of adjournment in organisational proceedings. Learn the differences between adjournment and recess.

- An advisory board is different from a board of directors. Find out how and what its role is within a business.

- Boards sometimes require an alternate director to take the place of a sitting board member. This page explains why that might happen and what the rules are.

- An annual general meeting is a regular event that brings together board members and shareholders. This page explains how it works.

- A company’s annual operating plan is an important document for helping achieve its goals, but how does it work and what does it contain?

- An ex-officio board member joins a board to impart their expertise, but can they vote and what are their responsibilities? Find out here.

- An executive session is a meeting within a meeting, but how do you conduct it and record the outcomes?

- An extraordinary general meeting is a meeting of the board and shareholders held between AGMs. Find out what it is and why companies hold them.

- An independent director provides a point of difference on a board, but what do they bring to the table and what are their responsibilities?

- Board diversity is a hot topic in the world of governance, and this article explains what it is and the different types of diversity.

- Find out what board meeting etiquette is and why failing to enforce it in your directors can be detrimental to your meetings.

- Board recruitment is essential to fill gaps and improve governance for the business. This article explains the process of recruiting directors.

- Citizen engagement is an important part of local government, but how does it work, what forms does it take and what are the benefits?

- Sometimes board meetings reach decisions by consensus, but what is consensus in a board meeting and how do you record decisions?

- Good corporate governance is essential for companies to operate to thief full potential. But what is it and how do boards achieve it?

- Digital accessibility is essential for government organisations in order to allow all citizens to participate in the process. This page explains more.

- Directors have a fiduciary duty to the company and its stakeholders. This page explains more and puts the term in context.

- Good governance is at the heart of effective organisations, but what are the principles of good governance and how to apply them?

- Groupthink on a board should be avoided as much as possible as it can lead to a number of negative outcomes. This page shows you what to look for.

- Companies can track board meeting attendance. Find out why accountability is important and what the consequences are of poor attendance.

- Overboarding is a trending topic for boards and investors across the world, but what does it mean and what are the risks involved?

- Succession planning is key to an organisation’s long term future and success. This page explains what it is and the process to achieve it.

- The Anglo-American governance model is a popular board framework in English speaking countries, but what is it and how does it work?

- The audit committee is pivotal to the running of the board. This article explains what the committee does and who sits on it.

- Discover the purpose and key features of the Chatham House Rule – the guideline that promotes confidentially and open discussions.

- The executive committee is separate from the main board but answers to it. Find out who sits on the executive committee and what its role is.

- Find out what the nomination committee is, who sits on it and what its responsibilities are, as well as learning about its relationship with the board.

- The order of business in a board meeting helps you maintain focus and efficiency. Find out what it involves and how it helps.

- The remuneration committee is one of the committees of a board of directors and this page explains what it does and how it contributes to the board’s work

- Occasionally in board meetings, a member will call the question. But what does that mean and what effect does it have?

- Find out how to appoint the chairperson of a committee and what their responsibilities are in relation to both the committee and the main board.

What Is AOP and Why Does It Matter for Your Business?

An Annual Operating Plan (AOP) is a pivotal strategic planning document, that outlines a company’s objectives, plans, budget strategies, and actions for the next fiscal year. Developing a clear, thoughtful annual operating plan is crucial for aligning teams, allocating resources effectively, and guiding data-driven business growth.

Our detailed guide will cover what an AOP entails, its crucial role, and steps to craft a successful AOP for your organization’s planning process .

Table of Contents

Key Takeaways

- An AOP outlines goals, budgets, and tactics for the fiscal year ahead.

- It aligns teams and guides data-driven decision-making.

- Its process involves forecasting, resource planning, and finalizing budgets.

- It differs from a long-term strategic plan.

- Effective AOPs require collaboration, leadership buy-in, and communication.

- An effective AOP requires collaboration, leadership approval, and clear communication.

What is an Annual Operating Plan?

An annual operating plan is a document that comprehensively outlines a business’s objectives, budgets, strategies, and tactical plans for the upcoming fiscal year, usually the next 12 months.

It provides a detailed roadmap for how a company will operate over the year ahead to achieve its goals and strategic priorities. The annual operating plan expands on the broader 3-5 years strategic plan, translating high-level strategy into specific operating plans.

For numerous companies, the yearly planning cycle typically produces two essential documents.

- Annual Operating Plan (AOP) : Includes business objectives, initiatives, budgets, and tactics.

- Annual Budget : Detailed financial projections – P&L, cash flow, balance sheet.

The AOP and financial plan are closely intertwined, with the actions specified in the annual operating plan guiding the necessary budgeting. While “AOP,” “ operations plan ,” “ operating budget ,” and “ annual business plan ” are terms often used synonymously.

An annual operating plan is a comprehensive framework that integrates both organizational goals and financial strategies, essential for stakeholder engagement.

AOP vs. Annual Budget

The annual operating plan and annual budget are interconnected:

The annual operating plan outlines operating plans while the budget quantifies the revenues, costs, and resources needed to execute those plans. The two core documents develop iteratively during the annual planning process.

Why Is an AOP Important for Business?

An effective annual operating plan provides tremendous value:

- Gets all teams working towards shared goals.

- Ensures alignment with corporate strategy.

Decision-Making:

- Drives data-driven resource allocation.

- Provides rationale for initiatives.

Accountability:

- Sets KPIs and metrics for tracking.

- Improves organization-wide accountability.

- Focuses teams on driving revenue growth.

- Reveals market opportunities to pursue.

Without a well-defined AOP, departments can lose alignment and cohesion. An AOP brings everything together into an integrated plan.

Implementing an AOP helps businesses scale operations and accelerate growth in a strategic, coordinated way. An AOP is vital for any organization that wants to achieve its full potential.

AOP vs. Strategic Plan

The AOP differs from a strategic plan:

The AOP executes on the current fiscal year portion of the long-term corporate strategy. The two plans align and complement each other.

Creating an Effective AOP: The Process

Here is an overview of the key steps in the AOP process:

- Gather Inputs from All Departments: Finance leads the annual operating plan process but all business units provide critical inputs on goals, initiatives, and resource needs.

- Analyze Business Environment: Review growth objectives, market trends, competitive landscape, risks, and opportunities.

- Define Corporate Objectives and KPIs: Set company-wide objectives and KPIs aligned with strategic goals.

- Make Data-Driven Forecasts: Develop projections for sales , revenue, and customers based on historical data and market analysis.

- Determine Tactical Initiatives: Define specific initiatives across all departments required to hit targets.

- Create Budgets: Build operating expense, capital expenditure, and headcount budgets factoring in initiative costs.

- Consolidate into AOP Document: Bring together objectives, plans, budgets, and KPIs into an integrated annual operating plan.

- Gain Leadership Approval: Review the annual operating plan with executives and the board to get sign-off. Adjust as needed.

- Communicate for Alignment: Share AOP across the organization for transparency and alignment.

This stage-gate process enables thoughtful, collaborative annual operating plan creation aligned with the company’s strategy and market realities.

Elements of an Effective AOP

While AOP formats vary across organizations, some typical sections include:

- Executive Summary: Highlights key goals, initiatives, budgets, and metrics.

- Company Objectives: Quantified targets – revenue, profitability, customer metrics.

- Department Plans: Tactical plans and budgets for Sales, Marketing, Technology, etc.

- Financial Projections: P&L forecast, balance sheet, cash flow forecasts.

- KPIs: Key performance indicators include key metrics across Sales, Marketing, Operations, HR and other departments.

- Initiatives: Major projects and programs needed to hit objectives.

- Risks and Mitigation Plans: Assessment of potential risks and mitigation strategies.

- Operating Expenses: Planned spending by department.

- Headcount Plan: Number of planned new hires aligned with growth.

- Capital Expenditures: Investments in property, equipment, and technology.

Tips for Developing an Effective AOP

Here are some best practices to create a high-quality, actionable annual operating plan:

- Collaborate extensively – involve all departments in the process.

- Ensure alignment with strategic priorities.

- Make data-driven forecasts and budgets.

- Assign owners to initiatives to ensure accountability.

- Build flexibility to adapt to changing conditions.

- Communicate the plan widely across the organization.

- Define success metrics for key goals and initiatives.

- Review quarterly to track progress and adjust as needed.

Significance of the AOP for Business Success

A well-constructed annual operating plan is invaluable for executing strategy and driving business growth, such as:

- Gives a detailed roadmap for the year ahead.

- Enables teams to develop tactics to achieve strategic objectives.

- Drives data-based decision-making on investments.

- Promotes transparency around resource allocation.

- Creates focus and urgency to drive revenue growth.

- Allows performance tracking versus plan.

For companies that create and execute a thoughtful annual operating plan, it can propel growth and success.

An annual operating plan is a critically important document that guides a company’s priorities and actions. Developing an effective AOP through collaborative planning, number-crunching, and clear communication sets up the organization for success.

With a well-constructed annual operating plan, companies can align cross-functional teams, optimize decision-making on investments and initiatives, and ultimately drive growth and performance.

Taking the time to create a thoughtful, comprehensive provides the blueprint for executing business strategy and accelerating progress in the dynamic marketplace.

Muhammad Asif Saeed has extensive experience in commerce and finance. Specifically, He holds a Bachelor of Commerce degree specializing in Accounts and Finance and an MBA focusing on Marketing. These qualifications underpin his understanding of business dynamics and financial strategies.

With an impressive 20-year career in Pakistan’s textile sector, including roles at Masood Textile (MTM) and Sadaqat Limited, excelling in business & financial management. His expertise in financial and business management is further evidenced by his authoritative articles on complex finance and business operation topics for various renowned websites including businessproplanner.com,businesprotips.com,distinctionbetween.com, trueqube.com, and bruitly.com, demonstrating his comprehensive knowledge and professional expertise in the field.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

A Guide to Creating an Annual Operating Plan for 2024

Why do you make resolutions at the end of every year.

The answer is quite obvious. Most of you do it to start the new year on a positive note and to make positive changes in your lifestyle in the year ahead.

Resolutions help you resolve to change the things that need changing and enter the new year on the right foot. So does an Annual Operating Plan for businesses.

Don’t forget to add Group Health Insurance for your employees while creating an AOP for 2023. You can check out other policies such as Group Personal Accident Insurance & Group Term Life Insurance .

What is an annual operating plan?

An Annual Operating Plan is an annual layout or a roadmap?️for your business’s growth. It charts the course you should take to grow your business to desired targets. It is a blueprint of activities that you and your team choose to undertake to reach the annual milestone of the business.

{{founder="/web-library/components"}}

Why is AOP in Finance Important

In the financial world, the Annual Operating Plan (AOP) is crucial. It's the roadmap for a company's financial journey. AOP sets clear goals. It aligns resources with these goals. This alignment is key. It ensures focused efforts and efficient resource use.

AOP also aids in performance tracking. It offers benchmarks. These benchmarks are vital. They help in measuring progress and identifying areas needing improvement. Therefore, AOP is not just a plan. It's a tool for continuous growth.

Moreover, AOP fosters team unity. It brings everyone on the same page. This unity is essential for success. It ensures that all departments work towards common objectives. In essence, AOP is the backbone of strategic financial planning.

What Does an Annual Operating Plan Include?

An annual operating plan must include the following.

- Objectives

- Business activities

- Resource requirements

- Performance Monitoring Plans

Each annual operating plan you make will look a bit different. Use the points above as your basic outline, and add or remove other things as you see fit.

Why is an AOP needed?

Benjamin Franklin once said, ‘If you fail to plan, you are planning to fail’ . This quote sums up the fundamental importance of an operating plan. The plan is like a to-do list?that helps the teamwork collectively to achieve business goals. Imagine having no plan. You and your employees would not know in which direction your organisation is headed.

An AOP is, thus, needed to chart a course that your business should take in the coming years. It gives shape to the objectives of your organisation, thereby removing any ambiguity.

Annual Operating Plan Best Practices

Creating an effective Annual Operating Plan (AOP) is an art. Here are some best practices:

- Start with Clear Objectives : Define clear, achievable goals. These goals should align with your company's vision.

- Involve Key Stakeholders : Collaboration is key. Involve different departments. This ensures a well-rounded and realistic plan.

- Focus on Data : Base your plan on solid data. This approach ensures accuracy and relevance.

- Be Flexible : The business world is dynamic. Your AOP should be adaptable to changes.

- Regular Reviews : Don't set and forget. Regularly review and adjust your AOP as needed.

These practices ensure that your AOP is not just a document. It's a dynamic guide that drives your business forward.

Benefits of Annual Operating Plans

Aligns cross-functional department activities with business objectives.

Corporate leaders can tailor job descriptions and departmental targets according to the provisions in the annual operational plan. This guarantees that their team members are aligned with critical business goals.

Promotes Data-Informed Departmental Strategies and Plans

Implementing a data-informed strategy ensures that the objectives and tactics of various departments are result-driven. This strategy meticulously breaks down the effect of expenditures per employee, per month, or per supplier.

Highlights Potential Need for Fundraising

A yearly operational plan facilitates more detailed discussions with stakeholders or business owners about how alterations in spending could boost performance in response to shifts in market and business conditions throughout the year.

Provides Departments with a Benchmark for Monitoring Performance and Objectives

An effective yearly operational plan aids various departments in tracking their progress, ensuring they imp

How to create the best operating plan?

Taking a pen ?️ and paper (or powering up your computer) to make a list is easy. Anyone can do that. But to make an effective plan which would work is where the trick lies.

So, here are some quick and easy tips ? to create an effective plan.

Create a vision board

This is the first step. After all, you can’t go on a journey without having a destination in mind!

So, create a vision board-i.e. where you see your business 1 year from now. Set the annual objectives of your business to get a clear view of the goals.

Pro-tip: When making a vision board, don’t do it alone. Involve all the departments in the planning process. Each department will know its strengths and weaknesses. Moreover, every department, working in tandem, will make it possible to achieve the identified goals. So, brainstorm ?. Take the opinions of your employees about ways you can grow the business. Use a practical mind map tool to map out all the correlations between the collaborative ideas. You never know what useful idea can be born from an effective brainstorming session!

Moreover, start early ⏰. There is no point in creating an Annual Plan in the middle of the year. The planning should be undertaken 3-4 months before the next year starts. If you did not make a plan and the year has started, do it ASAP. Do not procrastinate.

Assess the feasibility

It is said that the goals should be S. M. A. R. T., meaning:

1️. Specific

2️. Measurable

3️. Achievable

4️. Relevant

5️. Time-bound

If your business goals fulfill this criterion, you will be able to fulfill them. So, just creating the vision board is not enough. You need to determine whether the objectives listed on the board are feasible or just some far-fetched ideas. This is an important step that differentiates an effective plan from an ineffective one. Check out whether the goals that you have envisaged are achievable or not. This is a feasibility check which should not be missed.

Pro-tip: Here again, involve all the departments to assess the feasibility of the goals. This is because the departments know whether the goals are realistic or not. Moreover, achieving the specified goals is not a one-person job. It involves all departments' collective efforts, so their involvement in the decision-making and feasibility checking phases is essential.

Go on a trip down memory lane

The past gives you a glimpse into what went wrong. That is why it is essential to check how the business performed last year- the areas that need improvement and the areas that delivered a good performance. Looking into last year’s performance would help you weed out the problem areas so that you can take steps to address and resolve them. This would ensure that the business plan that you are making is effective as the possible leaks would be plugged in.

Pro-tip: Analyse business performance over the last couple of years to better understand which areas require your attention. Use Key Performance Indicators (KPIs) to measure the business performance and measure these metrics against the industry average. If the metrics need improving, you would know where additional efforts are needed.

Create a budget

Once the planning is done, reviewed, and assessed, it's time for budgeting. Budgeting involves laying down the expected expenses needed to achieve the envisioned goals. Budgeting also gives you an idea of the expected business expenses over the year. You can allocate specific resources when you know how much you can spend. Moreover, budgeting also helps curb unnecessary spending and boost profitability.

Pro-tip: Don’t be too taxing when creating a budget. If you’ve envisioned grand goals for the year ahead, you would require a bigger budget. If your budget is small, the goals should also be realistic. Do not force your team to work on a shoestring budget and achieve great results.

Run it with your team

Once the outline for the year and the budget have been set, run it with the people who would make the Annual Operating Plan a possibility - your team. Tell them about the vision that you have created for the business and ask for their opinions.

Understand whether, in your team’s view, understand whether the plan is feasible or not. What you might consider achievable, your time might not. Since they are the ones that would be putting in their efforts to make your plan a reality, they should be in the know.

Pro-tip: Conduct a strategy meeting after the plan has been outlined and the budget set. Run the plan with your team and take their approval before putting it into the process.

After your team has approved the plan and believes it is achievable, it is time to delegate. Divide the objectives into smaller tasks and allocate them to the relevant departments. Make them accountable for the tasks delegated.

Pro-tip: Delegate the tasks to each department and agree upon a mutual timeline within which the task would be completed.

Keep a contingency plan

The best-laid plans can go awry, and you need to be prepared for that. Even when you have taken the pains to revisit every detail with a magnifying glass, the plan that you have envisioned might not deliver the expected results. Be prepared for the same. Be prepared for your objectives or plans to fall through, for the budget to overshoot, and for any other contingency that might come your way.

Pro-tip: Invest in insurance plans to battle the financial repercussions of an emergency. Employee insurance plans provide financial benefits to employees in an emergency, while corporate insurance plans can help your business deal with unexpected losses.

Review and revisit

Lastly, a review is necessary because of changing business dynamics. Your organisation runs in a dynamic environment that might produce deviations from the set plan. A review is, thus, necessary to keep the plan in place and make amendments to the same, if needed.

Pro-tip: Be flexible with your operations. Leave room for adjustments and changes. Remember, change is the only constant. If your plan needs an amendment, do not fear it. Make the necessary changes and see how the deviation has affected the plan on an overall basis. Review the plan quarterly for checking the direction in which it is headed.

{{finding-right-ghi="/web-library/components"}}

Why Startups Need To Go Beyond Annual Operating Plans

Startups are unique. They operate in fast-paced, often unpredictable environments. Therefore, relying solely on Annual Operating Plans (AOP) isn't enough. Startups need agility. They need plans that can adapt quickly.

Beyond AOP, startups should embrace continuous planning. This approach allows for frequent adjustments. It's responsive to market changes. This responsiveness is crucial for startups.

Also, startups should focus on innovation. A rigid AOP might limit this. Flexibility in planning fosters creativity. It allows startups to seize unexpected opportunities.

In summary, while AOPs are important, startups thrive on adaptability and innovation. These qualities ensure they stay ahead in a competitive landscape.

How is AOP Different from a Budget?

AOP and a budget are often confused, but they're different. The Annual Operating Plan (AOP) is about strategy. It's a comprehensive plan. It outlines the company's goals and how to achieve them. AOP is broad. It covers various aspects of operations.

A budget, on the other hand, is about numbers. It's a financial document. It details income and expenditure. The budget is a part of AOP. It supports the AOP by providing financial limits.

In essence, AOP is the game plan. The budget is the financial boundary within that plan. Both are crucial, but they serve different purposes in a company's financial strategy.

The Bottom Line

Be a pro when it comes to creating an effective AOP. There is no universal formula for creating a winning AOP. However, these tips help. Remember that an annual operating plan is not a one-person job. While you might envision great things for your business or organisation, you need to run your dreams with your team. They would be able to give you a third-person view of whether your envisioned goals are achievable or not.

So, when you envision the plan, go by the top-down approach. List your goals and see how they can be achieved. On the other hand, when you involve your team, give them a bottoms-up approach. Allow them to check how the envisioned goals might be achieved.

Also, do not delay creating a plan. Start the process before the year ends so that when the new year starts, you have an outline for your business that has been fool-proofed. This would give your organisation a head start in achieving the set targets.

Ping us on Twitter .

Q: What is an Annual Operating Plan?

A: An Annual Operating Plan (AOP) is a roadmap outlining a company's goals, actions, resources needed, and timelines for a year.

Q: Why do I need an Annual Operating Plan?

A: An AOP aligns your team's goals with the company's objectives, helps manage resources efficiently, and tracks performance throughout the year.

Q: How do I start creating my Annual Operating Plan?

A: Start by setting your goals, then detail the actions needed, identify required resources, set timelines, and determine how you'll monitor progress.

Q: Can I change my Annual Operating Plan during the year?

A: Yes, an AOP is a flexible tool and should be updated as market conditions, opportunities, or challenges change.

Q: What should I include in my Annual Operating Plan?

A: An AOP should include your goals, the actions you'll take, the resources needed, timelines for these actions, and how you'll track progress.

Q. How does a startup or SME without previous AOP experience begin the process effectively?

A. Startups should focus on clear, achievable goals. They can seek mentorship or use online resources for guidance. Therefore, even without prior experience, a structured approach can help in creating a practical AOP.

Q. What are the common challenges businesses face when implementing their AOP, and how can they overcome them?

A. Businesses often struggle with resource allocation and adhering to timelines. Regular team meetings and flexible planning can mitigate these issues. Therefore, keeping communication open and plans adaptable is crucial.

Q. How can businesses measure the success of their AOP accurately and make adjustments for future planning?

A. By setting quantifiable benchmarks and regularly reviewing progress, businesses can measure AOP success. Adjustments should be data-driven, taking into account performance metrics and feedback. Therefore, continuous evaluation and adaptation are essential for future planning.

- We’re Hiring! Join Our Team

- Free Consultation

- (858) 230-8956

Your Guide to Crafting an Effective Annual Operating Plan

An annual operating plan is the backbone of your brand’s financial success—it guides your operations, goal-setting, and financial decision-making.

But, if you have yet to build your own annual operating plan, the process can seem intimidating. The six-step checklist below will help you build an operating plan that works for your business, accommodating your current financial status and facilitating future growth.

With simple financial analysis, budgeting, planning, and auditing, your brand will be ready to conquer the next fiscal year.

What is an Annual Operating Plan?

An annual operating plan is a strategic planning document that shapes your business’ financial activities for the coming year. But, you may have heard it called another name , like:

- An annual budget

- A master budget

- An operating budget

- A customized, brand-specific name

An annual operating plan serves as an overview of your financial functions. Some of its primary purposes include:

- Defining strategic, year-long goals

- Establishing financial targets and budgets

- Monitoring and dictating incentive-based pay structures

- Identifying and maintaining your cash position

- Outlining funding requirements

While your annual operating plan will likely be built primarily by your finance team, you will also need to seek input from other departments, including:

- Advertising

- Purchasing and Procurement

- Customer service

If you operate a small business, you may oversee all of these departments yourself or carry out their duties—and you will need to draw on all of your professional expertise when building an effective annual operating plan.

How to Build an Annual Operating Plan from Scratch

So, how do you build a robust, useful annual operating plan? These six steps will guide you through developing an airtight plan for your business’ short-term financial future.

#1 Generate Key Financial Reports

The first step to building an annual operating plan is generating three key financial reports :

- The income statement – A description of money made and spent

- The balance sheet – A list of assets and liabilities—funds available and funds owed

- The cash flow statement – A ledger of cash receipts and purchases over a specific period

Each of the reports above will help you determine how much money your business currently has, how much it needs to spend to continue operating, the amount owed to other businesses or individuals, and the ratio of revenue to expenses. This collectively comprises the critical data you need to start building your annual operating plan.

#2 Establish a Sales Budget

With a clear picture of the money available to you and your recent financial history in hand, you can begin budgeting.

There are two crucial arms of your business, and you will need to create spending, earning, and saving guidelines for each one:

- Sales functions

- Production functions