| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

What Is An IPO?

Updated: Jan 26, 2024, 5:53pm

An IPO is an initial public offering. In an IPO, a privately owned company lists its shares on a stock exchange, making them available for purchase by the general public.

Many people think of IPOs as big money-making opportunities—high-profile companies grab headlines with huge share price gains when they go public. But while they’re undeniably trendy, you need to understand that IPOs are very risky investments, delivering inconsistent returns over the longer term.

How Does an IPO Work?

Going public is a challenging, time-consuming process that’s difficult for most companies to navigate alone. A private company planning an IPO needs not only to prepare itself for an exponential increase in public scrutiny, but it also has to file a ton of paperwork and financial disclosures to meet the requirements of the Securities and Exchange Commission (SEC), which oversees public companies.

That’s why a private company that plans to go public hires an underwriter, usually an investment bank, to consult on the IPO and help it set an initial price for the offering. Underwriters help management prepare for an IPO, creating key documents for investors and scheduling meetings with potential investors, called roadshows.

“The underwriter puts together a syndicate of investment banking firms to ensure widespread distribution of the new IPO shares,” says Robert R. Johnson, Ph.D., chartered financial analyst ( CFA ) and professor of finance at the Heider College of Business at Creighton University. “Each investment banking firm in the syndicate will be responsible for distributing a portion of the shares.”

Once the company and its advisors have set an initial price for the IPO, the underwriter issues shares to investors and the company’s stock begins trading on a public stock exchange, like the New York Stock Exchange (NYSE) or the Nasdaq.

Why Do an IPO?

An IPO may be the first time the general public can buy shares in a company, but it’s important to understand that one of the purposes of an initial public offering is to let early investors in the company cash out their investments.

Think of an IPO as the end of one stage in a company’s life-cycle and the beginning of another—many of the original investors want to sell their stakes in a new venture or a start-up. Alternatively, investors in more established private companies that are going public also may want the opportunity to sell some or all of their shares

“The reality is that there’s a friends and family round, and there are some angel investors who came in first,” says Matt Chancey, a certified financial planner ( CFP ) in Tampa, Fla. “There’s a lot of private money—like Shark Tank-type money—that goes into a company before ultimately those companies go public.”

There are other reasons for a company to pursue an IPO, such as raising capital or boosting a company’s public profile:

- Companies can raise additional capital by selling shares to the public. The proceeds may be used to expand the business, fund research and development or pay off debt.

- Other avenues for raising capital, via venture capitalists, private investors or bank loans, may be too expensive.

- Going public in an IPO can provide companies with a huge amount of publicity.

- Companies may want the standing and gravitas that often come with being a public company, which may also help them secure better terms from lenders.

While going public might make it easier or cheaper for a company to raise capital, it complicates plenty of other matters. There are disclosure requirements, such as filing quarterly and annual financial reports. They must answer to shareholders, and there are reporting requirements for things like stock trading by senior executives or other moves, like selling assets or considering acquisitions.

Featured Partner Offers

Wealthfront

On WealthFront's Website

On Acorn's Secure Website

Key IPO Terms

Like everything in the world of investing, initial public offerings have their own special jargon. You’ll want to understand these key IPO terms:

- Common stock. Units of ownership in a public company that typically entitle holders to vote on company matters and receive company dividends . When going public, a company offers shares of common stock for sale.

- Issue price. The price at which shares of common stock will be sold to investors before an IPO company begins trading on public exchanges. Commonly referred to as the offering price.

- Lot size. The smallest number of shares you can bid for in an IPO. If you want to bid for more shares, you must bid in multiples of the lot size.

- Preliminary prospectus. A document created by the IPO company that discloses information about its business, strategy, historical financial statements, recent financial results and management. It has red lettering down the left side of the front cover and is sometimes called the “red herring.”

- Price band. The price range in which investors can bid for IPO shares, set by the company and the underwriter. It’s generally different for each category of investor. For example, qualified institutional buyers might have a different price band than retail investors like you.

- Underwriter. The investment bank that manages the offering for the issuing company. The underwriter generally determines the issue price, publicizes the IPO and assigns shares to investors.

SPACs and IPOs

Recent years have seen the rise of the special purpose acquisition company ( SPAC ), otherwise known as a “blank check company.” A SPAC raises money in an initial public offering with the sole aim of acquiring other companies.

Many well-known Wall Street investors leverage their established reputations to form SPACs, raise money and buy companies. But people who invest in a SPAC aren’t always informed which firms the blank check company intends to buy. Some disclose their intention to go after particular kinds of companies, while others leave their investors entirely in the dark.

“It’s giving your money to an entity that doesn’t own anything but tells you, ‘Trust me, I’ll only make good acquisitions with it,’” says George Gagliardi, a CFP in Lexington, Mass. “Like a baseball batter wearing a blindfold, you don’t know what’s coming at you.”

Many private companies choose to be acquired by SPACs to expedite the process of going public. As newly formed companies, SPACs don’t have long financial histories to disclose to the SEC. And many SPAC investors can recoup their money in full if a SPAC does not acquire a company within 24 months.

Upcoming IPOs

IPO activity hit record highs in 2021, thanks to the very strong stock market. But since early 2022, the market for initial offerings has been frozen solid. As of mid-2023, there are some faint stirrings of activity in the IPO markets, but analysts believe it will be next year before we see very many boldface debuts. Here are some of the more prominent upcoming IPOs :

| Company | Industry | Most Recent Valuation |

|---|---|---|

How to Buy IPOs

Buying stock in an IPO isn’t as simple as just putting in your order for a certain number of shares. You’ll have to work with a brokerage that handles IPO orders—not all of them do.

“Typically you’d have to buy IPO stock through your stock broker, and on rare occasions, directly from the underwriter—i.e., knowing someone at the company or investment bank,” says Gregory Sichenzia, founding partner of Sichenzia Ross Ference, a New York City-based securities law firm.

Brokers like TD Ameritrade , Fidelity, Charles Schwab and E*TRADE may offer access to IPOs. At many firms, though, you’ll also need to meet certain eligibility requirements, such as a minimum account value or a certain number of trades transacted within a certain time frame.

Perhaps most importantly, even if your broker offers access and you’re eligible, you still might not be able to purchase the shares at the initial offering price. Everyday retail investors generally aren’t able to scoop up shares the instant an IPO stock starts trading, and by the time you can buy the price may be astronomically higher than the listed price. That means you may end up purchasing a stock for $50 a share that opened at $25, missing out on substantial early market gains.

To help combat this, platforms like Robinhood and SoFi now enable retail investors to access certain IPO company shares at the initial offering price. You’ll still want to do you research before investing in a company at its IPO.

Get Forbes Advisor’s expert insights on investing in a variety of financial instruments, from stocks and bonds to cryptocurrencies and more.

Should You Invest in IPOs?

As with any type of investing, putting your money into an IPO carries risks—and there are arguably more risks with IPOs than buying the shares of established public companies. That’s because there’s less data available for private companies, so investors are making decisions with more unknown variables.

Despite all the stories you’ve read about people making bundles of money on IPOs, there are many more that go the other way. In fact, more than 60% of IPOs between 1975 and 2011 saw negative absolute returns after five years.

Take Lyft, the ride-share competitor to Uber. Lyft went public in March 2019 at $78.29 per share. The stock price dropped immediately, and within a year, it reached a low around $21. The stock price has recovered somewhat, and as of writing the price was above $57. But even if you had bought in when Lyft went public, you still wouldn’t have recouped your investment.

Other companies do well over time, but stumble out of the gate. Peloton was supposed to go public at $29 per share but opened in September 2019 at $25.24 and struggled for the first six months, hitting $19.72 in March 2020. It’s considered the third worst mega-IPO debut in history. (A mega-IPO, or Unicorn IPO, is an IPO of a company valued at more than $1 billion.) If you stuck with Peloton, you’d have seen its stock rise to $154.67 by February 12, 2021. The question is—would you have been able to hold on through Peloton’s lows to reach its Covid-19-induced highs?

“Just because a company goes public, it doesn’t necessarily mean it’s a good long-term investment,” says Chancey. Take Y2K’s most infamous victim, Pets.com, which went public, netting about $11 per share, only to have its price crater to $0.19 in less than 10 months due to massive overvaluation, high operating costs and the Dot Com market crash.

Conversely, a company might be a good investment but not at an inflated IPO price. “At the end of the day, you could buy the very best business in the world, but if you overpay for it by 10 times, it’s going to be really hard to get your capital back out of it,” Chancey says.

“Buying IPOs, for the majority of buyers, isn’t investing—it’s speculating, as many of the shares allocated in the IPO are flipped the first day,” says Gagliardi. “If you really like the stock and plan to hold it as a long-term investment, wait a few weeks or months when the frenzy has disappeared and the price has come down, and then buy it.”

A Diversified Approach to IPO Investing

If you’re interested in the exciting potential IPOs but would prefer a more diversified, lower risk approach, consider funds that offer exposure to IPOs and diversify their holdings by investing in hundreds of IPO companies. The Renaissance IPO ETF (IPO) and the First Trust US Equity Opportunities ETF (FPX), for example, have returned 18.35% and 13.92% since inception, respectively. The S&P 500, a major benchmark for the U.S. stock market, on the other hand, has seen average returns of about 10% for the past 100 years.

Yes, you may see slightly higher highs with IPO ETFs than with index funds, but you also may be in for a wild ride, even from one year to the next. According to Fidelity, between 2009 and 2018, one-year U.S. IPO returns hit a low of -9% in 2015 only to skyrocket to 44% in 2016. That’s why most financial advisors recommend you invest the bulk of your savings in low-cost index funds and allocate only a small portion, generally up to 10%, to more speculative investments, like chasing IPOs.

- Best Investment Apps

- Best Robo-Advisors

- Best Crypto Exchanges

- Best Crypto Staking Platforms

- Best Online Brokers

- Best Money Market Mutual Funds

- Best Investment Portfolio Management Apps

- Best Low-Risk Investments

- Best Fixed Income Investments

- What Is Investing?

- What Is A Brokerage Account?

- What Is A Bond?

- What Is the P/E Ratio?

- What Is Leverage?

- What Is Cryptocurrency?

- What Is Inflation & How Does It Work?

- What Is a Recession?

- What Is Forex Trading?

- How To Buy Stocks

- How To Invest In Stocks

- How To Buy Apple (AAPL) Stock

- How To Buy Tesla (TSLA) Stock

- How to Buy Bonds

- How To Invest In Real Estate

- How To Invest In Mutual Funds

- How To Calculate Dividend Yield

- How To Find a Financial Advisor Near You

- How To Choose A Financial Advisor

- How To Buy Gold

- Gold Price Today

- Silver Price Today

- Investment Calculator

- ROI Calculator

- Retirement Calculator

- Business Loan Calculator

- Cryptocurrency Tax Calculator

- Empower Review

- Acorns Review

- Betterment Review

- SoFi Automated Investing Review

- Wealthfront Review

- Masterworks Review

- Webull Review

- TD Ameritrade Review

- Robinhood Review

- Fidelity Review

How To Invest In A Startup

SpeedTrader Review 2024

How The Consumer Price Index (CPI) Measures Inflation

7 Best Small-Cap ETFs of June 2024

10 Best Short-Term Bond ETFs Of June 2024

9 Best Long-Term Bond ETFs Of June 2024

I'm a freelance journalist, content creator and regular contributor to Forbes and Monster. I've written for AARP, the BBC, Family Circle, LearnVest, Money, Parents and Prevention, among others. Find me at kateashford.com or follow me at @kateashford.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, understanding the ipo process and how it works.

Transitioning from a private to a public company can raise substantial capital. Learn how an initial public offering works.

An initial public offering (IPO) refers to the first time a business sells new or existing securities on the stock market, known as “going public.” Selling shares to the public can boost your company’s image while lowering your equity and debt costs. It enables your startup investors to maximize their returns and can help your corporation expand and attract skilled employees.

However, the IPO process is lengthy, and companies must meet U.S. Securities and Exchange Commission (SEC) requirements. Explore the IPO timeline and the steps involved to understand your responsibilities before and after taking your business public.

Starting the IPO process

As a company grows and increases in value, it may make sense to take it public. Conducting a registered public offering has many advantages, but it also comes with new obligations. Investopedia wrote, “Typically, this stage of growth will occur when a company has reached a private valuation of approximately $1 billion, also known as unicorn status.” But this figure isn’t set in stone.

Corporations must meet initial listing standards for national securities exchanges. According to Investor.gov , “Initial listing standards generally include a company’s total market value and stock price, and the number of publicly traded shares and shareholders of the company.” The criteria vary by the exchange.

The SEC recommended that companies consider the following factors before beginning the IPO process:

- It costs money and takes time to achieve an IPO. Check out PwC's IPO cost calculator for more information.

- Public companies have additional responsibilities after going public. These duties include providing SEC and shareholder reports.

- Failure to meet your legal obligations can create liability issues for you and your company. Additionally, you must continue to meet exchange listing requirements.

- You will no longer manage your business alone, as shareholders will have a say. A board of directors will guide your company through most decisions.

- Your financial information will be available to the public. You must file annual and quarterly reports detailing your financial status and submit Form 8-K before making major announcements.

[ Read more: Employee Stock Options: How Can Your Small Business Offer Them? ]

Conducting a registered public offering has many advantages, but it also comes with new obligations.

Select one or more underwriters

Investment banks (underwriters) employ financial experts who specialize inIPOs. They assign a lead underwriter, called a book runner, to oversee the process and may assign co-managers to assist with other duties. Underwriters ensure due diligence by investigating every legal element and potential risk. In addition, they oversee every aspect of the IPO process, from document preparation to issuing stock.

Orrick suggested that businesses assess underwriters by:

- Determining if the underwriter understands your company.

- Considering their ability to tell your organization's story.

- Evaluating their reputation and experience.

- Examining the quality of the underwriting team.

- Reviewing the underwriter's proposed IPO scheduled.

- Looking for any conflicts of interest.

- Asking about post-IPO support.

Develop IPO documentation and marketing materials

Your team of experts will gather data to complete the next IPO steps. A team typically involves lawyers, SEC experts, company management, underwriters, and certified public accountants. They will complete a letter of intent and file the registration statement (Form S-1) with the SEC.

After the SEC review and any follow-up activities, the group develops a preliminary prospectus known as a red herring. According to PwC’s "Roadmap for an IPO" , this step occurs after about three months and must conform with SEC rules. Company executives will use the prospectus and supporting documents to woo potential investors.

[ Read more: How to Give a Killer Business Presentation (Even If You're Nervous!) ]

Generate interest via an IPO roadshow

Your underwriter will organize meetings at various locations, which will be attended by your management team, an investor relations representative, and potential investors. During a roadshow, you will give your sales pitch , deliver a multimedia presentation, and answer questions. PwC wrote, “This can be a very grueling process since the roadshow can last up to two weeks with several presentations a day.”

Set the initial offer price, and finalize your IPO date

Underwriters consider information gathered while on the road to set an initial price. They develop a final prospectus, file it with the SEC, and send it to potential investors. Your team will meet for a closing meeting and determine when you'll officially take your company public.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Applications are open for the CO—100! Now is your chance to join an exclusive group of outstanding small businesses. Share your story with us — apply today .

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Apply for the CO—100!

The CO—100 is an exclusive list of the 100 best and brightest small and mid-sized businesses in America. Enter today to share your story and get recognized.

Get recognized. Get rewarded. Get $25K.

Is your small business one of the best in America? Apply for our premier awards program for small businesses, the CO—100, today to get recognized and rewarded. One hundred businesses will be honored and one business will be awarded $25,000.

For more strategic tips

How to build a b2b relationship with a large company, 6 tips for becoming a supplier to a big businesses, how to develop a qa process for your business.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- All Self-Study Programs

- Premium Package

- Basic Package

- Private Equity Masterclass

- VC Term Sheets & Cap Tables

- Sell-Side Equity Research (ERC © )

- Buy-Side Financial Modeling

- Real Estate Financial Modeling

- REIT Modeling

- FP&A Modeling (CFPAM ™ )

- Project Finance Modeling

- Bank & FIG Modeling

- Oil & Gas Modeling

- Biotech Sum of the Parts Valuation

- The Impact of Tax Reform on Financial Modeling

- Corporate Restructuring

- The 13-Week Cash Flow Model

- Accounting Crash Course

- Advanced Accounting

- Crash Course in Bonds

- Analyzing Financial Reports

- Interpreting Non-GAAP Reports

- Fixed Income Markets (FIMC © )

- Equities Markets Certification (EMC © )

- ESG Investing

- Excel Crash Course

- PowerPoint Crash Course

- Ultimate Excel VBA Course

- Investment Banking "Soft Skills"

- Networking & Behavioral Interview

- 1000 Investment Banking Interview Questions

- Virtual Boot Camps

- 1:1 Coaching

- Corporate Training

- University Training

- Free Content

- Support/Contact Us

- About Wall Street Prep

- Investment Banking

Initial Public Offering (IPO)

Step-by-Step Guide to Understanding an Initial Public Offering (IPO)

Learn Online Now

What is an IPO?

An Initial Public Offering (IPO) is the process wherein a privately held company issues equity in the form of stock to the public markets for the first time.

- An IPO is the process by which a formerly private company decides to raise capital by issuing its equity to outside investors for the first time.

- An IPO is a method for companies to raise equity capital from outside investors in the markets, for which investment banking underwriters are hired to facilitate.

- Once the private company undergoes an IPO, it becomes formally recognized as a publicly-traded company post-IPO (“gone public”).

- An IPO is an opportunity for a corporation to raise significant capital by offering its shares to the public, while existing investors can realize a return on their investment, assuming the lock-up period has passed.

Table of Contents

How Does an Initial Public Offering (IPO) Work?

What is the ipo process timeline, what is the underwriting process in an ipo, what is the sec s-1 filing requirement for ipos, what are the benefits of an ipo (“going public”), what are the risk of an ipo, ipo vs. direct listing: what is the difference, criticism of traditional ipo process (bill gurley).

The term IPO stands for “Initial Public Offering” and describes the process in which a private company issues shares of itself to the public.

The securities issued, most often common shares , represent partial ownership stakes in the underlying equity of the issuer.

An initial public offering (IPO) is a major milestone for many private companies, as most venture or growth-capital-backed companies strive to someday become publicly traded.

Once the formerly private-held company has undergone an initial public offering (IPO), it is now recognized as a public company, i.e. it has “gone public”.

An IPO is an opportunity for a private company to raise significant capital by offering its shares to the public, while existing investors can exit their holdings and realize a return on their investment once the lock-up period has passed.

The newly issued shares of the company are then listed on a stock market exchange, such as the New York Stock Exchange (NYSE) or the Nasdaq .

Stock exchanges like the NYSE and Nasdaq function as a centralized market connecting buyers with sellers, with the market participants ranging from retail investors to institutional investors such as hedge funds .

Investing in an IPO (Source: SEC Investor Bulletin )

- Step 1. Hire Underwriters → Traditionally, the IPO process is initiated by a private company hiring several investment banks—often referred to as “underwriters”—to advise on the transaction and ensure the maximum amount of capital is raised, with the minimal amount of issues encountered (e.g. conflicts with regulatory requirements).

- Step 2. Red Herring Prospectus + Roadshows → Once the company prepares to “go public”, the investment banking advisors will market the company to institutional investors via “roadshows” to first secure demand from those investors with substantial sums of capital. The roadshow comprises a series of presentations given by senior management alongside their team of advisors to potential institutional investors to gauge their initial interest and figure out how to convince them to participate, i.e. “book building”. Before the roadshow, the advisors also prepare a preliminary prospectus, also known as the “ red herring prospectus ”, which contains information on the company (e.g. financial data, management team background, plans on proceed usage, and other pertinent information).

- Step 3. Submit S-1 Filing → The pricing of the offering is arguably the most important decision because the offering price is perhaps the most influential determinant of investor demand. The terms surrounding the IPO, such as the offering price and listing date are largely predicated on the interest level of institutional investors, as their participation is crucial to the underwriting process. Therefore, a lack of interest from institutional investors can result in adjustments before the final S-1 filing is submitted to the SEC (or the IPO could even be scrapped if the demand is too bleak and market conditions are too unfavorable).

- Step 4. Obtain Formal SEC Approval → The formal approval and sign-off on the S-1 filing from the SEC is mandatory before the company’s shares can be distributed into the open markets. Once approval is obtained from the SEC, the underwriting process can proceed with the distribution of shares.

- Step 5. IPO Share Issuance → Once shares are officially issued, the company’s IPO is technically complete, and it is now recognized as a publicly traded company. But the underwriters must continue with their efforts to ensure all the stock issuances are sold and to stabilize the price, if necessary, i.e. minimize the price volatility.

The underwriter of most IPOs, aside from those at the very bottom range in size, are offered to the public through a syndicate of underwriters.

The group of underwriters works with the issuer to structure the issuance, with the risk spread across various firms, instead of concentrated on one investment bank.

But while there are likely numerous investment banks advising on the deal, there is typically a “lead underwriter” with more responsibilities and influence than the other advisory firms.

Together, the underwriters of the IPO must structure the offering and settle on the terms. In particular, the offering price must be set appropriately, where the maximum amount of capital is raised (i.e. no money is left on the table) and there is sufficient demand in the market.

Learn More → Investment Banking Guide

For a private company to successfully undergo an initial public offering (IPO), the specific requirements established by the Securities and Exchange Commission (SEC) must be met.

The core documentation filed with the SEC is the S-1 registration statement , which is composed of two parts:

- Prospectus → The first part of the S-1 contains the legally required information detailing the sale of the securities. The prospectus must describe the company’s business segments, an overview of its operations, audited financial statements, risk factors, the background of the management team, and any material information of relevance to potential investors.

- Information Not Required in Prospectus → The second part of the S-1 contains discretionary information that the company is not required to report to investors, yet must file with the SEC.

The table below describes the key sections of the S-1 :

| Section | Description |

|---|---|

Undergoing an IPO (i.e. “going public”) provides numerous advantages to the company and to its existing investors.

- Access to Capital → First and foremost, an initial public offering (IPO) represents an opportunity to raise a significant amount of capital, which in turn, is utilized to continue funding a company’s operations and its strategies to reach its next growth stage (and obtain more market share).

- Liquidity Event → From the perspective of management and existing pre-IPO investors, the IPO can be a liquidity event. While the IPO is an opportunity for management to “take some chips off the table”, venture firms and growth equity investors often must liquidate all of their positions, irrespective of their long-term thesis on the company’s prospects. The pre-IPO company, in all likelihood, is backed by venture investors and growth equity investors, so the IPO is an liquidity event, albeit there are restrictions on the timing of when those shares can be sold (i.e. the lock-up period). Venture capital firms and growth equity firms, at the end of the day, are investing on behalf of their limited partners (LPs), so the positions must be exited after the lock-up period and the sale proceeds are then distributed back to the LPs. An exit via an IPO is not necessarily an immediate exit, per se, since there is a lock-up period in which existing shareholders are prohibited from selling their shares for a period spanning between 90 to 180 days.

- Improved Branding → As a side benefit, the company’s branding tends to benefit substantially post-IPO, especially from investors interested in potentially owning shares, which indirectly expands the company’s name recognition and makes it easier to attract (and retain) more qualified employees. For example, widespread coverage of the company’s stock in the media can potentially increase its sales from the positive impact on its brand perception.

- Lower Cost of Capital → By becoming a publicly-traded company, a company can potentially benefit from having access to cheaper forms of capital, e.g. corporate lenders will typically then be able to offer debt financing at a lower interest rate with more favorable terms.

The benefits of becoming publicly traded, especially from a monetary perspective, are relatively straightforward. However, there are several downsides that management must weigh when contemplating the decision to either go public or remain private.

- Less Control → The primary risk to management is the company—by virtue of becoming a public company—is no longer under their complete ownership and control. The new shareholders are partial owners in the company and if a sizable percentage of the shareholder base is displeased with the management team and the company’s financial performance, management is at risk of being voted out and replaced.

- Disclosure Requirements → The disclosure requirements as part of going public is meant to provide full transparency of the internal workings of the company, which opens management up to public scrutiny by investors. In addition, the company’s closest competitors can access their filings such as their financials and plans to achieve future growth. The scrutiny from the markets, equity analysts, and the media can serve as a distraction to the management team and employees.

- Near-Term Oriented : The quarterly filings (10-Q) place more pressure on the management team to meet short-term earnings targets (i.e. earnings per share) and other performance metrics tied to revenue or EBITDA, for instance. Hence, management’s decisions can become short-term oriented due to the external pressure from shareholders and the market to meet their quarterly or annual earnings guidance and targets set by external parties (e.g. equity research analysts).

- Costly Process → The process of going public can be a lengthy process, where the company incurs significant costs, such as advisory fees paid to the investment banks, legal fees paid to lawyers, and other fees paid to third parties like auditors and consultants. The regulatory hurdles, stringent compliance requirements, and disclosure requirements all contribute to the need to hire such advisors and third parties to help arrange the proper paperwork, which of course, all come at significant costs considering the high stakes.

- Operational Disruption → The disruption to the company’s day-to-day operations is yet another factor that must be taken into account. The IPO process can meet unexpected, time-consuming hurdles that can extend the time from announcement to becoming a public company. In that stretch of time, employees can easily become distracted by the media coverage, while management is likely occupied with the entire ordeal of the IPO requirements. The reason all of that matters is that the quality of the company’s products and services can suffer, resulting in less revenue and lower margins from operating inefficiencies.

- Reporting Requirements → The reporting requirements associated with becoming a public company mean more time, effort, and capital must be spent on ensuring compliance with the strict rules established by the SEC. Further, the consequences of not complying with the SEC can result in significant fines and penalties.

In recent years, more companies have opted to go public through a direct listing , as opposed to via an IPO. The direct listing process bypasses the time-consuming, costly underwriting process, as a team of underwriters is not necessary.

The traditional advisory services from an investment bank, such as pricing guidance and stabilization efforts, are not needed because the company in such a case decides to rely on the market to determine the price.

There are significant risks attached to the decision to go public via a direct listing, where the upside and downside are both magnified. Significant price volatility tends to be a characteristic inherent to direct listings , irrespective of the outcome.

Generally, a direct offering tends to only be feasible for companies with a well-known brand, where investor interest is already practically guaranteed.

For instance, Spotify (NYSE: SPOT) decided to proceed with the direct listing route at a time when the company was already the market leader in the music streaming vertical. Thus, the anticipation from investors for the IPO was high, while the overall market sentiment was very optimistic.

The notable benefits of going public via a direct listing are as follows.

- No (or Less) Dilution

- No Lock-Up Period

- Cost Savings (i.e. No or Minimal Advisory Fees)

- Supple / Demand Auction-Based Process

- Increased Liquidity

To reiterate, however, a direct listing remains the riskier option, as the process is relatively new, and because there is no assurance that the shares will be priced “correctly” by the market or that a sufficient number of shares will be sold.

The shares of newly public companies often surge on the first day of trading, with the market capitalization (i.e. equity value ) rising in excess of $50 to $80 million on the first day.

The delta in the IPO offering price and the market share price is the source of much criticism, where investment banks are accused of intentionally underpricing IPOs (and “leaving money on the table”).

However, one must consider that the underwriter must make sure all shares are sold, rather than solely maximizing the valuation. Striking the right balance between the two is easier said than done, and the same applies to predicting demand from the retail market.

With that in mind, the underpricing of an IPO can be attributed to the investment bank’s primary goal of selling all the shares offered in the issuance, i.e. the trade-off between offer price maximization and selling the entire issuance.

The more concerning claim is that investment banks intentionally underprice IPOs for their own self-interest, about building trust among institutional investors.

The fact that those institutions are also clients brings attention to a potential conflict of interest.

The post-IPO spike in the share price of a newly listed company represents profits to the investors (i.e. the institutional network of the investment bank) who participated in the IPO sale.

Given that one of the core functions of investment banking is managing relationships with institutional clients, there is valid reason for such criticism.

Suppose the IPO price was hypothetically priced perfectly, and the share price movement was non-existent (or even declined), then clients would not benefit from the share price appreciation.

On the other hand, an instantaneous rise in the share price post-IPO (and high returns) is likely to establish a long-term relationship with the institutional investor, with an increased probability of participation in future IPOs underwritten by the investment bank.

Therefore, many critics support direct listing instead of the traditional IPO. Venture capitalist Bill Gurley has held long-standing views that the discounted feature of the IPO is not a mistake, but rather a part of the business model.

“Putting Hot IPOs in Perspective” – Bill Gurley (Source: Above the Crowd )

Everything You Need To Master Financial Modeling

Enroll in The Premium Package : Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

- Google+

- 100+ Excel Financial Modeling Shortcuts You Need to Know

- The Ultimate Guide to Financial Modeling Best Practices and Conventions

- What is Investment Banking?

- Essential Reading for your Investment Banking Interview

We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO.

The Wall Street Prep Quicklesson Series

7 Free Financial Modeling Lessons

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

Roadmap for an IPO: A guide to going public

Starting early is key to a successful ipo.

The landscape for IPOs is, to put it mildly, dynamic. The outlook continues to evolve with more recent triggers, such as changes in the global political climate and interest rate environment, leading to windows of opportunity opening and closing quickly. For organizations looking to open paths to capital, particularly an IPO, it is critical to leverage the right insights to make the right moves at the right times.

There are multiple paths to going public – IPO, SPAC, direct listing, etc. How do you know which is the right path for you? Is now the right time? What can you expect after going public? You need a plan that sets you apart long after the bell rings.

Let’s get started

Jump ahead to the section of interest

The decision to go public

Simply requiring additional capital does not always mean that going public is the right answer. There are a handful of important questions you should consider, and it is important to keep specific goals in mind throughout the going-public process.

Determining filer status

Filer status drives its reporting requirements during both the going-public process and throughout life as a public company. Filer status should be assessed continuously during the going-public process and each fiscal year thereafter for public companies.

Preparing to become a public company

Preparation is the secret to success. The better prepared your company is, the more efficient and less costly the process can be. We recommend that an orderly plan be executed over a one- to two-year period.

Structuring your IPO

Choosing the appropriate structure for an IPO can provide substantial benefits. Regardless of the structure or process chosen, getting the right company or group structure in place is critical to driving value and efficiency.

Maximizing the value of your IPO

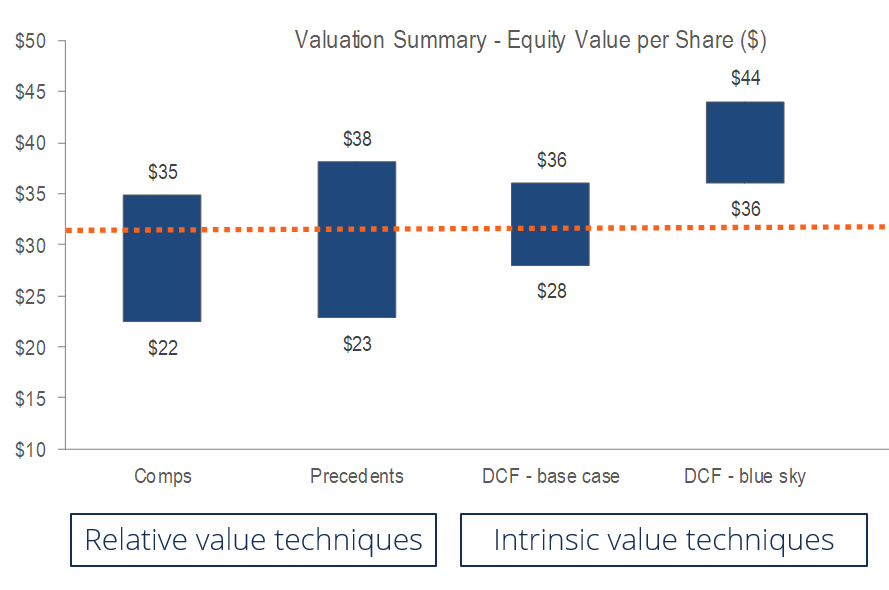

The equity story is the foundation of any successful IPO, as it creates a clear vision for your organization while serving as a compelling rationale for why investors should be interested. Investment bankers will rely on an equity story to determine both the marketability of the company and the valuation.

Common accounting and financial reporting issues

From financial statements to taxation and compensation to complex technical accounting, get in front of these issues well in advance of the registration process so that they won't be an impediment to becoming a public company.

Building a going public team

You need advisors who have “been there and done that.” Be on the lookout for key players, from the specialists to the staff members who will help prepare the registration statement and other sales documents.

Preparing the registration statement

Management knows the business best, so it should take an active role providing direction in the drafting process. Allowing others to draft significant amounts could result in a registration statement that deviates from management’s view.

Navigating the IPO process

Most successful IPOs are launched by those businesses that operate as public companies well in advance. An experienced project management team can help position you for success.

We are public! Now what?

Once listed, a company will be under far greater public scrutiny and will have a range of continuing obligations. Public perception has a direct effect on the value of its stock. Do not underestimate it.

Register now!

Don't miss our new webcast series "Path to Public"

With you when the bell rings

To create a clear path forward, you need the confidence that comes from working with a team of straight-talking advisors and actionable insights from a team of dedicated professionals. Find out how we can guide you through each step of the readiness assessment process and beyond.

{{filterContent.facetedTitle}}

{{item.publishDate}}

{{item.title}}

{{item.text}}

Mike Bellin

Partner, Consulting Solutions, IPO Services Leader, PwC US

Thank you for your interest in PwC

We have received your information. Should you need to refer back to this submission in the future, please use reference number "refID" .

Required fields are marked with an asterisk( * )

Please correct the errors and send your information again.

By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). If you change your mind at any time about wishing to receive the information from us, you can send us an email message using the Contact Us page.

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is an IPO? Definition and How IPOs Work

Dayana is a former NerdWallet authority on investing and retirement. She has written for The Associated Press, The Motley Fool, Woman’s Day, Real Simple, Newsweek, USA Today and more. She has written and contributed to several personal finance books and has been interviewed on the "Today" Show, "Good Morning America," NPR, CNN and other outlets.

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for over 15 years, and was a senior writer and spokesperson at NerdWallet before becoming an assigning editor. Previously, she was a researcher and reporter for leading personal finance journalist and author Jean Chatzky, a role that included developing financial education programs, interviewing subject matter experts and helping to produce television and radio segments. Arielle has appeared on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. She is based in Charlottesville, Virginia.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

An IPO marks the first time a privately held company becomes a publicly traded one.

IPOs can potentially be lucrative opportunities to buy a small stake in a company you believe will increase in value.

IPOs can be risky too, but thorough research, small investments and smart asset allocation can mitigate those risks.

Thousands of companies sell shares of stock in their businesses on U.S. stock exchanges. How did they snag a spot in investor brokerage accounts? Via a process called “going public,” more formally known as filing for an initial public offering, or IPO.

| Charles Schwab | Robinhood | Interactive Brokers IBKR Lite |

|---|---|---|

| 4.9 | 4.3 | 5.0 |

| $0 per online equity trade | $0 per trade | $0 per trade |

| $0 | $0 | $0 |

| None no promotion available at this time | 1 Free Stock after linking your bank account (stock value range $5.00-$200) | None no promotion available at this time |

IPO meaning

An IPO, or initial public offering, is when a company goes from being privately-owned to publicly-owned. That means that investors can purchase its stock on the stock market.

Those company shares may then be purchased on a particular exchange, like the New York Stock Exchange or the Nasdaq. Investors can then purchase those shares, which makes them a shareholder in the business.

Once a company is listed on a stock exchange, shares of its stock can be traded — bought and sold — between investors. (Learn more about the stock market and how it works .)

» View the best brokers for investing in IPOs

How does an IPO work?

An IPO is often a complex process in which a group of "underwriters" (typically large investment banks) buy all of the shares of the new company and then re-sell them to ordinary investors.

However, some companies bypass the conventional IPO process by going public through a direct listing or a special-purpose acquisition company (SPAC) .

A company that is going public through an IPO will announce a price range and IPO date in advance. At that time, interested investors will be able to purchase shares through a brokerage account.

Keep in mind that the published offering price is unlikely to be the share price that's available to retail investors — once the stock begins trading, its share price swings with the rest of the market just like every other public company. Often, IPOs spike in price in the early hours or days, then quickly fall.

Where can I find out about upcoming IPOs?

NerdWallet has a list of upcoming IPOs , as do the major stock exchange websites like Nasdaq and NYSE. And there are often rumors published in the media about companies that may go public in the near future, but it’s pure speculation until a company makes a formal announcement of its intentions.

It can be several months, or even years, until an IPO is finalized. To prepare, investment bankers estimate the company’s valuation to decide the price per share of stock and how many shares will be offered to investors.

All of that information and more becomes available to the public when the company files a registration statement — typically a Form S-1 — with the Securities and Exchange Commission. This preliminary prospectus provides a lot of background information about the company and its business, management team, sources of revenue and financial health.

A company’s initial filing is typically a draft and may be missing key information, such as the final offering price and date the upcoming IPO is expected to launch. Keep checking back for amendments to the Form S-1 on the SEC’s EDGAR database so you’re making investment decisions with the most up-to-date IPO information.

Why do companies file IPOs?

An IPO enables a growing company to raise a lot of cash quickly. The money investors pay to buy shares can be used to fund projects, pay down debt and help the business expand operations or hire more workers.

A stock market launch also triggers a broader swath of changes a company must make, not least of which is issuing reports on its financials to the public quarterly and annually and allowing shareholders to vote on some business decisions, such as who sits on the company’s board of directors.

For investors, IPOs can be an attractive and lucrative opportunity to purchase a small stake in a company they believe will increase in value. But buyer beware: Some stocks that are now considered runaway successes struggled for months or even years after their IPOs. Consider that after going public in 2012, Meta (then known as Facebook) took more than a year to trade above its IPO price. [0] Meta Investor Relations . https://investor.fb.com/stock-info/default.aspx . Accessed Mar 17, 2022. View all sources

What are the risks of investing in an IPO?

You may celebrate getting in early on the latest IPO if it proves to be a long-term success, but you’ll be cursing that same stock if it blows up your portfolio. No investment is a sure thing, and IPOs are no exception.

While IPOs may appear to offer a tantalizing get-rich-quick opportunity, there have been some famous flops over the years. Take Pets.com, which liquidated less than a year after its IPO. According to an analysis from Nasdaq of IPOs between 2010 and 2020, two-thirds were underperforming the overall market three years after their initial offering day. [0] Nasdaq . What Happens to IPOs Over the Long Run? . Accessed Mar 17, 2022. View all sources

To mitigate some of the risks, take the same approach to investing in IPOs as you would to buying any other stock:

Know what you’re getting into. When researching a company, start by reading its annual report — if it has been publicly traded for a while — or Form S-1. Many of the risks to a company’s short- and long-term success are outlined by company insiders in those reports. But don’t just take their word for it: Do your own research into the industry, the company’s competitors and general stock market conditions before you invest in any company. That's a smart thing to do whether the company is established or new to the public markets. (Here’s how to research a stock .)

Ease your way into ownership. Buying a lot of shares of a volatile stock at the beginning can set you up for a wild ride. When a company’s share price is somewhat unpredictable, dollar-cost averaging (spreading out your trades and purchasing the stock at regular intervals over time) protects you from the risk of, say, buying shares at the peak. And keep in mind that you don’t have to be the first in line: Stocks like Apple , Amazon and Google have provided rich gains for investors who bought shares years after those companies' initial public offerings.

Keep your portfolio in balance. Never let a single investment — IPO or otherwise — skew your portfolio’s allocation in a way that could be detrimental to your long-term goals. To reduce your overall risk, it's often suggested that the portion of your holdings devoted to individual stocks make up no more than 5% to 10% of your overall portfolio, with the remainder of your long-term savings spread out across a variety of index mutual funds .

If an IPO is what gets you excited about investing in the stock market for long-term growth, that’s great. Just remember that individual stocks on their own aren’t the only way to get in on the action — there are other diversified investments like the aforementioned index funds that allow you to buy a large selection of stocks at once. To explore these and other options, see our step-by-step guide for beginners on how to invest in stocks .

On a similar note...

Find a better broker

View NerdWallet's picks for the best brokers.

on Robinhood's website

Need help with your finances? Work with a Certified Financial Planner™ for one of the lowest prices on the market.

Discuss your finances on a one-time call for $99 or subscribe to a full financial planning membership for just $30/month with a six-month commitment.

NerdWallet Advisory LLC

- Get 7 Days Free

What Is an Initial Public Offering?

We look at what it means for a company to “go public.”

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

Editor's note: This article originally published on Sep. 23, 2020.

An initial public offering, or IPO, is a process a private company undertakes to become public. Almost all companies start as privately funded, receiving money from founders, friends, and family. Once the company has a strategic business plan, it can apply for small-business loans and venture capital funding.

However, these private funding sources will eventually run out for a growing company. The company then looks for alternative capital to reinvest in its business. A common next step is to look for public funding by making shares available to public investors through an IPO.

What Are Advantages of an IPO? The most important reason for going public is access to funding. Institutional and individual investors can buy public shares of the company's stock to help finance business reinvestment. In return, investors are potentially rewarded with a share of the company's earnings and dividends.

Another IPO benefit is alternative funding sources. Part of going public is disclosing a company’s financial information, making revenue sources and costs more transparent. This helps a company apply for loans more easily.

IPOs are also helpful when one company wants to acquire another. In exchange for purchasing the other business, the company can offer shares of its own stock.

In addition, they allow the company to enhance its employee compensation plan. Public companies can offer stock options to employees in addition to a salary, benefiting those who started early in the company’s history.

Going public also helps the company’s brand awareness. It’s a very public event, and the company can boost its prestige by listing on a popular exchange, like the New York Stock Exchange or Nasdaq.

How Does an IPO Work? The first step in going public is selecting an investment bank to manage the IPO process. These banks include companies like JPMorgan Chase JPM and Goldman Sachs GS. Their main objective is to round up buyers interested in purchasing the company's stock. They gauge interest in the IPO and market the stock to institutional investors. They will also assemble a team, including accountants, lawyers, and SEC experts, to handle different parts of the IPO.

Due diligence is the second step in going public. This involves collecting financial documents, completing SEC regulation forms, and publicizing the business model, risks, and competition. This is also when the company assembles the board of directors, the team responsible for protecting shareholder interests and holding the company leadership accountable.

The third step involves the SEC approving the IPO. This includes the investment bank and company agreeing to an IPO date, how many shares will be available to the public, and the price for each share. Once the details are settled, the investment bank will distribute financial information to potential investors.

Going public is the final step. The company is listed on the exchange and begins trading on the open market. The share price agreed upon by the company and investment bank can now fluctuate based on supply and demand forces.

What Are Disadvantages of IPOs? Fees are the largest concern companies have when going public. Investment bank services aren't cheap, and the costs to maintain financial, legal, and SEC teams are steep. These are just the costs to do an IPO--there are others to maintain a public presence. Financial reporting, auditing, and regulation costs will be constant once the company's stock is available to public investors.

SEC regulation is a big concern--and for good reason. The SEC’s goal is to protect investors, so it wants companies to present accurate and complete information. Intense scrutiny from this regulatory agency won’t go away, so these companies must be prepared to meet their guidelines.

Another issue for company leadership is pressure from shareholders and the board of directors. Because these groups now influence the company’s direction, they might force leaders to move the business in a way the leaders didn’t intend.

Going public can be distracting for company leadership. Driven to increase stock performance, executives might drift away from their company’s mission and engage in unrelated initiatives or questionable corporate behavior.

What Do IPOs Mean for Investors? Once a company becomes public, it makes sense to wonder if that stock is right for investors. We recommend waiting a few months until the stock's price stabilizes, but each IPO is different, says Morningstar's director of investor education Karen Wallace. If the stock's price is less than Morningstar's fair value estimate, it could be worth considering.

More in Stocks

/d10o6nnig0wrdw.cloudfront.net/06-28-2024/t_1377507e2da0485faab7721e212e9baf_name_file_960x540_1600_v4_.jpg)

10 Top Dividend Stocks for 2024

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RXEHKWMHQNDBLD3ZFOOZOB5VIU.png)

Finding Small-Cap Stock Opportunities In a Big-Cap World

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HU3X6PAILNCOVAUSKMJBJCVK6U.jpg)

The 10 Best Companies to Invest in Now

About the author, sachin nagarajan.

Sachin Nagarajan is an associate manager research analyst, equity strategies, for Morningstar Research Services LLC, a wholly owned subsidiary of Morningstar, Inc.

Before joining Morningstar's manager research team in 2022, Nagarajan worked on Morningstar's editorial team, where he showcased the firm's equity research and sustainable investing content. He was also a customer support representative on the Morningstar Office support team.

Nagarajan holds a bachelor's degree in English from University of Dayton.

4 Tech-Heavy Funds to Watch

3 funds that feasted on nvidia, 4 equity funds with high portfolio turnover, why we upgraded t. rowe price dividend growth to gold, 4 stock funds where talent tops mediocre processes, 4 stock funds whose processes don’t need genius management, which funds have recently bought or sold netflix, risk-management concerns ding these two equity strategies, how to find tax-efficient morningstar medalist funds, how to find recently upgraded gold-rated funds, sponsor center.

- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

How to Prepare a Company for an Initial Public Offering

An initial public offering of stock can be viewed as the definitive sign of a company's success. here is a look at the steps a company can take to prepare for an ipo..

For many growing companies , "going public" is more than just selling stock. It's a signal to the world that the business has made it. That's why undertaking an initial public offering (commonly known as an IPO) -- the first sale of stock to the public by a private company -- has long been the ultimate goal for many an entrepreneurial business. An IPO can not only provide a company with access to capital to fuel growth and liquidity for founders and investors, but it provides the public market's unofficial stamp of approval. Yet recent regulatory changes, such as the 2002 Sarbanes-Oxley Act (SOX), have given new meaning to the term IPO. It's not just a public offering of stock, but it can also be an intensely arduous and increasingly expensive ordeal. In order to gain the benefits of raising capital and achieving greater liquidity that an IPO offers, companies must be more solidly established and better able to pass tougher regulatory requirements than in the past. Doing so comes with a bigger price-tag than ever before. These days, companies going public should expect to pay more than $2 million in out of pocket expenses to cover a host of fees – among them legal, accounting, printing, listing, filing -- in addition to the underwriter discount and commission of 7 percent of the offering proceeds and to shore up internal processes to meet the tougher reporting and governance standards for public companies. The following pages will detail the pros and cons of going public, the qualifications a business needs to go public, and the steps involved in the IPO process.

Dig Deeper: What the Sarbanes-Oxley Act Means for Companies that Want to Go Public

Taking a Company Public: Why You Should Consider It An IPO is one of the most sign ificant events in the life of a business. The capital raised through a successful public offering boosts a business' ability to expand into new market s or grow through acquisitions. It can help a company attract new talent with stock options and other equity awards and reward initial investors with liquidity. "There is also the prestige factor," says James S. Rowe, a securities partner with Kirkland & Ellis LLP, a 1,500-lawyer firm that has counseled countless companies through the IPO process. "The fact that you're a public company gets you in the door with vendors and suppliers and prospective business partners. Being a publicly traded company has additional cache and is something that can be helpful to a company in its commercial relationships." Such benefits, however, don't come without costs. One important intangible cost to consider is the loss of control over the business when a formerly private company goes public. The following is a list of pros and cons to consider in determining whether to take a company public.

Dig Deeper: Is Consolidation a Threat or a Boon to Small Companies?

Taking a Company Public: The Benefits of Going Public

• Given the higher valuation of a public company and the greater liquidity in the public markets, there is greater access to capital, Rowe says. In fact, while the first public offering may be costly and time consuming, if there is market demand for the stock a company can always issue more stock -- which can be conducted more quickly and efficiently as a seasoned issuer. • The increased liquidity can help a company attract top talent by enabling it to grant stock options or restricted stock awards. • A public offering provides a business with the currency with which to acquire other businesses and a valuation if your business becomes an acquisition target, Evans says. • An IPO serves "as a way for founders or em ployees or other share or option holders to get liquid on their investment, to see a financial reward for the hard work that has gone into building the business," Evans says. • The act of going public can also serve as a marketing event for a company, to drum up interest in the business and its products or services.

Dig Deeper: What's Your Business Worth Now? Taking a Company Public: The Downside of Going Public

• The biggest downside to going public is often the loss of control over the company for management and founders/investors. Once a company is public, managers will be under often intense pressure to meet quarterly earnings estimates of research analysts, which can make it much more difficult to manage the business for long-term growth and predictability. • The SEC requires public companies to reveal sometimes sensitive information when they go public and on an ongoing basis in required filings. Such information may include data about products, customers, customer contracts, or management that a private company would not have to reveal. • Public companies have additional reporting and procedural obligations since the passage of the Sarbanes-Oxley Act, many of which may be costly for a company to implement, such as the Section 404 requirements relating to internal controls over financial reporting, says Bruce Evans, managing director at Summit Partners, a Boston-based private equity and venture capital firm. • In a worst-case scenario, a group of dissident investors could potentially obtain majority control and wrangle control of the company away from the board. • If a stock performs poorly after a company goes public, an IPO can generate negative publicity or "an anti-marketing event" for the company, Evans says.

Dig Deeper: Examples of Confidential Info You Should Prepare to Disclose

Taking a Company Public: Which Companies Should Consider an IPO Not every company can -- or should -- go public. There is an array of factors to consider before summoning the bankers. These factors include meeting certain financial qualifications set by the various exchanges, the appropriateness of an IPO strategy for your business and business goals, and the market receptivity to IPOs generally and within your particular sector. Exchange Qualifications Before you can even consider taking your company public, you must meet certain basic financial requirements, which are set by the exchange where you expect to list. For instance, if you want to list your company's stock on the New York Stock Exchange (NYSE), you will generally need a total of $10 million in pre-tax earnings over the last three years, and a minimum of at least $2 million in each of the two most recent years. The NASDAQ Global Select Market requires pre-tax earnings of more than $11 million in the aggregate in the prior three fiscal years and more than $2.2 million in each of the two most recent fiscal years. Fortunately, both exchanges have alternative markets that have less rigorous financial requirements for listing companies. The NASDAQ Global Market requires companies have income from continuing operations before income taxes in the latest fiscal year or in two of the last three fiscal years of $1 million or more. The NASDAQ Capital Market has a lower barrier to entry, requiring net income from continuing operations in the latest fiscal year or in two of the last three fiscal years of at least $750,000. Meanwhile, the NYSE's American Stock Exchange (AMEX) requires pre-tax income of $750,000 in the latest fiscal year or in two of the three most recent fiscal years. The exchanges also offer alternative listing standards based on cash flow, market cap, and revenue for larger companies not meeting the pre-tax earnings' tests. Under SEC rules, a company must also have three years of audited financial statements before it can register to go public. If a company lacks three years of audits, it can often create them 'after the fact,' Rowe says, assuming it has the records and systems in place to allow an auditor 'look-back.' Since that can be a costly and time-consuming undertaking, pre-planning is essential.

Dig Deeper: Stock Exchanges and Securities Laws

Taking a Company Public: Picking the Right IPO Strategy

Even if a company meets the minimum requirements for listing on one of the exchanges, it may not be in the company's best interest to go public. "I think businesses should go public that have achieved a size that would allow them to have a predictable revenue and earnings stream," Evans says. "Smaller businesses tend to be more volatile and there is a premium paid for predictability in the public markets." Another factor to consider is whether your business will have a market capitalization large enough to support enough trading in your stock that buyers consider that stock to be "liquid," Evans added. "To go public with too small a market cap means that buyers don't get a really liquid public security. The reality is that unless you have enough of a market cap, I think public offerings are probably best for growth companies." Market Considerations Another factor that is increasingly determining whether companies go public is the economy and, in particular, the public's appetite for IPOs. The IPO market hit a 30-year low in 2008, when only 31 companies went public on the major U.S. exchanges, according to Hoovers. Nine years earlier, in 1999, there were 477 IPOs, more than half of which were venture-backed, according to the National Venture Capital Association (NVCA). Market interest in IPOs definitely waxes and wanes – especially recently. The good news is that the IPO market picked up slightly in 2009, when 63 companies went public on the major U.S. exchanges, with virtually all of that activity occurring in the second half of the year. "There is a pipeline, things are turning around," says Evans. But he says the market for IPOs would get better if some of the regulations in the Sarbanes-Oxley Act were pared back. The law, which sought to provide the public with more corporate accountability, requires compliance with so many costly rules that the overhead associated with compliance "adds millions to a company's operating expenses," Evans says. "Companies tend to have to wait longer now to overcome that expense before they can go public. It's a direct impediment to their ability to go public." Another component of the law requires CEOs and CFOs to personally certify financial and other information in their securities filings. "Quite frankly, it makes it less attractive in some instances to want to take that on," Evans says.

Dig Deeper: The Declining IPO Market During a Recession

Taking a Company Public: The Steps You'll Need to Take If your company meets these financial requirements, you determine an IPO will help you meet business goals, and the market conditions appear right, then it's time to begin the IPO process. Typically, it takes four to eight months to complete this process, from the time you actively engage underwriters to the time you close the offering. Here are the key steps in the IPO process: Put the right management team in place. Fast growing companies generally have strong management teams already in place, but the demands of becoming a public company often require additional strengths and capabilities. The senior management team must have considerable financial and accounting experience in complying with increasingly complex financial and accounting requirements. In light of this, many pre-IPO companies seek to recruit CFOs or other executives from outside who have had experience going public with other companies. "I don't agree with that at all," Evans says. "An experienced CFO that knows his or her business well, and who has been successful in that role, doesn't need to have gone through a public offering before." But it is important that key managers possess strong communication skills to present the company's vision and its performance to the market, and to meet the often-intensive informational demands of research analysts and investors. The composition of your board of directors may also need adjustment. The exchanges require that a majority of the company's board of directors be 'independent,' and that the audit, compensation, and nominating corporate governance committees -- to the extent they exist -- be composed of independent directors. In addition to creating even more stringent independence requirements for audit committee members, Sarbanes-Oxley requires an issuer to disclose whether it has an 'audit committee financial expert.' To meet these requirements, independent board members (who are not insiders or affiliates) may need to be recruited, particularly for the audit committee, Evans says.

Dig Deeper: What to Pay Your Top Team

Upgrade financial reporting systems. Before proceeding, you need to ensure that you have the proper systems in place to ensure a flow of accurate, timely information. Identifying the right metrics and closely monitoring them can significantly enhance your business results, since it forces everyone in the company to focus on the factors that drive your business. Sarbanes-Oxley imposes a number of additional requirements in this area, including 'disclosure controls and procedures,' which are necessary to ensure that information is properly captured and reported in the company's public filings. Another requirement relates to 'internal controls over financial reporting,' which are designed to help ensure that the company's financial statements are accurate and free of misstatements. Developing and assessing these controls can take time and be quite costly. This is especially true in the case of internal controls over financial reporting, which are governed by Section 404. Although IPO issuers are not required to comply with 404 until well after they go public, it is important to anticipate any potential material weaknesses in these controls and to address them as early as possible.

Dig Deeper: How to Revamp Your Company's Financial Reporting System