- Stand Up for Free Enterprise

U.S. Chamber Commercial Construction Index - Q4 2021

A majority of contractors report high difficulty finding skilled workers, up from 55% who said the same last quarter. Almost all contractors are experiencing at least one product shortage, up 24 points from a year ago.

Q4 2021 CCI Report

December 15, 2021

The U.S. Chamber of Commerce Commercial Construction Index (CCI) is a quarterly economic index designed to gauge the outlook for, and resulting confidence in, the commercial construction industry.

Recognizing a need to highlight the important contributions of this sector to the nation’s economy, the U.S. Chamber produced this first-of-its-kind index.

Each quarter, contractors across the country are surveyed in order to better understand their levels of confidence in the industry and top-of-mind concerns.

Report Summary

Index Declines as Revenue Projections Fall on Increasing Labor Costs

The U.S. Chamber of Commerce Commercial Construction Index (CCI) fell this quarter to 65, down one point from 2021 Q3. Two of the three key drivers of the Index—revenue and new business confidence—also fell. One key driver, backlog, improved slightly.

The most notable development in the current quarter is a reduction in revenue expectations, which slipped downward from the previous quarter for the first time since the pandemic began. Not surprisingly, contractors also report continuing concerns about inflation: the cost of skilled labor and the fluctuating costs of materials this quarter remained very high.

Key Drivers of Confidence

Contractors’ confidence in the ability of the market to provide sufficient new business in the next 12 months dropped one point to 63 this quarter. The ratio of average current to ideal backlogs rose by one point to 75, with the average months of backlog decreasing from 9.4 months in 2021 Q3 to 8.4 months. The optimal level of backlog on average decreased as well from 12.7 months to 11.2 months. The third key driver, revenue expectations, dipped three points to 58.

Quarterly Spotlight

This quarter’s spotlight examines the ongoing consequences of the COVID-19 pandemic on the commercial construction sector. Most contractors (60%) say that less availability of building products/materials is the top consequence of the pandemic. Following behind in second place, a majority (52%) of contractors say that a major consequence of the pandemic is an increase in the ongoing workforce shortage in construction.

Pandemic-related project delays have also increased. Two-thirds (66%) of contractors expect delays on some projects (up from 60% in Q3). Just under a third (29%) expect no delays, and 71% expect delays to continue three months from now. Six months from now, 33% expect no delays and 67% expect delays on some projects (down from 44% in Q3).

Market Trends

Contractors also see growing and intense difficulties finding skilled workers and are paying more to attract them. A majority (62%) of contractors report high difficulty finding skilled workers, up from 55% who said the same last quarter (and up 20 points year-over-year). Over half (56%) of contractors report a high degree of concern about their workers having adequate skill levels, up six points from last quarter and 20 points year-over-year.

Almost all (95%) contractors are experiencing at least one product shortage, up from 93% last quarter and up 24 points (71%) who said the same a year ago. The product which most contractors are experiencing a shortage in is steel (27%), followed by roofing at 19%. Contractors still see growing profits.

Contractors expecting an increase in profit margin over the next 12 months stayed the same (24%) as last quarter, while those expecting profits to remain the same rose three points to 66%. Ten percent expect their profit margin to decrease over that time (down three points from Q3).

Download the full Q4 report

Recommended

- Economy Understanding America’s Labor Shortage: The Most Impacted States Every state is facing an unprecedented challenge finding workers to fill open jobs. Learn which states have been impacted the most by the nation’s worker shortage crisis. By Lindsay Cates

- Economy How Spring Break Is Brought to You by American Business By Nicholas Molinari

- Economy Five Times the Administration Wrongly Blamed Business for High Prices By Neil Bradley

- Economy The U.S. Chamber Is a Big Champion for Small Business

- Economy How the Baltimore Bridge Collapse Affects Business and the Economy By Sean Hackbarth

View this online

- SIGN UP FOR OUR NEWSLETTERS

Leading Index for Commercial Real Estate Increased 6% in April

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 6.1% in April to 173.9 (2000=100) from the revised March reading of 164.0. Over the month, commercial planning improved 12.6% and institutional planning dropped 6.3%. “The Dodge Momentum Index (DMI) saw positive progress in April, alongside a deluge of data center projects that entered the planning stage ,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Outsized demand to build Cloud and AI infrastructure is supporting above-average activity in the sector. Most other categories, however, faced slower growth over the month. Across these industries, it’s likely that owners and developers are grappling with uncertainty around interest rates and labor shortages, thus delaying their decisions to push projects into the planning queue. If interest rates begin to tick down in the latter half of 2024, more substantive growth in nonresidential planning activity should follow.” A flood of data center projects entered planning in April, causing robust growth in the commercial segment of the DMI, while traditional office and hotel projects continued to face slower momentum . Warehouse planning was basically flat. On the institutional side, education and healthcare planning activity receded again – in part, driven by another month of weak life science and R&D laboratory activity. Year over year, the DMI was 1% lower than in April 2023. The commercial segment was up 6% from year-ago levels, while the institutional segment was down 15% over the same period. … The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year. emphasis added

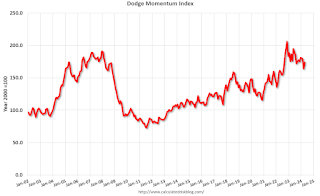

This graph shows the Dodge Momentum Index since 2002. The index was at 173.9 in April, up from 164.0 the previous month.

According to Dodge, this index leads “construction spending for nonresidential buildings by a full year”. This index suggests a slowdown in 2024.

#SocialStocks: TikTok seeks to overturn ban in federal lawsuit

Upstart holdings, inc. (nasdaq:upst) q1 2024 earnings call transcript, related posts, advisors in focus- january 6, 2021, advisors in focus- february 15, 2021, advisors in focus- february 22, 2021, advisors in focus- february 28, 2021, advisors in focus- march 18, 2021, advisors in focus- march 21, 2021.

Don’t miss AIA24 June 5–8! Save hundreds with special rates for AIA members & new AIA members >

January 2024 AIA Consensus Construction Forecast

After an unusually strong performance in 2023, the construction sector will see weaker conditions this year and next.

After an unusually strong performance in 2023, the construction sector will see weaker conditions this year and next

After increasing by more than 20% last year, spending on nonresidential buildings will see a much more modest 4% increase in 2024, at a pace that will slow to just over 1% growth in 2025. Spending on commercial facilities will be flat this year and next, manufacturing construction will increase almost 10% this year before stabilizing in 2025, and institutional construction will see mid-single-digit gains this year and next.

These are key conclusions from the AIA Consensus Construction Forecast panelists, a group comprised of the leading construction forecasters from across the country. This survey provides the most recent update of nonresidential building forecasts for 2024 and provides the first look at 2025.

This past year produced a surprisingly strong performance for the building sector of the economy. The healthy spending rebound of almost 12% in 2022 came on the heels of only modest growth in 2020 and a decline of almost 5% in 2021, before spending accelerated to an estimated 22% in 2023. Manufacturing construction accounted for a large share of these gains as this sector alone produced almost 30% of overall spending on nonresidential buildings last year. However, manufacturing was not the only bright light. On the commercial side, spending on offices was up an estimated 8%, retail and other commercial facilities 7%, and hotels 21%. The institutional sector did equally well, with healthcare and education spending both up an estimated 13%. Religious and public safety facilities each increased at a double-digit pace, and the amusement and recreation category grew to over 8%.

Recently-enacted federal programs provided some of the latest boosts to construction spending on buildings. The CHIPS and Science Act, enacted in August 2022, has boosted manufacturing spending by providing funding to high-tech hubs and semiconductor manufacturing. The Inflation Adjustment Act, also enacted in August 2022, has provided funding for the electrification of homes as well as financial incentives for energy-efficient commercial reconstruction and building. Finally, the Infrastructure Investment and Jobs Act, enacted in November 2021, provides funding for traditional infrastructure, which eventually will encourage more building construction in conjunction with these infrastructure investments.

View interactive data from the Consensus Construction Forecast

Several headwinds facing construction

Even with the additional funding provided by these federal programs, building construction activity is projected to slow. Behind the projected slowdown are several economic headwinds facing this sector, mostly affecting commercial facilities. These include tighter credit conditions, high input costs, falling prices for commercial property values in several sectors, and structural changes in demand for key commercial categories.

- Tighter credit – Rising long-term interest rates, even with their recent easing, has put pressure on many regional banks that account for a significant share of construction lending. As a result, credit standards for construction have tightened significantly. The most recent Federal Reserve Board’s Senior Loan Office Opinion Survey, covering the third quarter of 2023, reports that almost 60% of lenders tightened credit standards for commercial real estate loans over the prior three months. No respondents reported easing them. Tighter credit conditions often are the reason for not moving ahead with a project, or for changing plans during the design phase of a project. ConstructConnect recently reported that its Project Stress Index, which measures the level of delayed, stalled, or abandoned projects, has been moving up sharply in recent months.

- Higher construction input costs – While cost increases for most construction commodities have stabilized recently, inflation remains a problem for the construction industry. Inputs have stabilized at levels 35% to 40% higher than their pre-pandemic rates. While price volatility seems to be under control, there is little likelihood that they will revert to early 2020 levels anytime soon. Additionally, while commodity inputs have stabilized, construction labor costs are still rising at a 4% annual pace.

- Declines in commercial property values – Weak demand has put downward pressure on property values for most commercial sectors. MSCI’s Commercial Property Price Index indicates that multifamily, commercial, and industrial property values have declined 8% on average over the past year. Office values lead the decline, down almost 15% over the past year, but apartments (down 12%) and retail facilities (down almost 7%) have also seen significant declines in property values. Only industrial facilities (up almost 2%) have withstood this downward trend.

- Structural changes in demand – While construction is a notoriously cyclical industry, some of the current trends affecting the office and retail sectors are more structural than cyclical. At present, about 30% of paid workdays nationally are worked remotely. Remote work seems to be stabilizing at around this level. Prior to the pandemic, the share of days working remotely was under 5%, underscoring the need of most companies for less office space. Also, the pandemic gave a boost to e-commerce over traditional brick and mortar retail facilities. E-commerce sales have been increasing at a 15% annual pace and are projected to exceed $1 trillion nationally this year.

The slowdown is already underway

Even though construction spending remains strong in virtually all nonresidential construction categories, other indicators confirm that a construction slowdown is underway. By the latter part of 2023, construction starts had either slowed dramatically or turned negative in virtually all construction sectors. The value of nonresidential building starts increased a mere 2% through the first 11 months of 2023 as compared to the same period in 2022, according to ConstructConnect. Starts in the commercial sector declined 1%, with double-digit declines in retail and warehousing, but were largely offset by growth of 20% in the hotel sector. Manufacturing starts were down 4%, while institutional starts increased by 10%. Within the broader institutional category, education starts increased by 20%, while healthcare starts saw a fairly significant decline.

Architecture firms also saw weaker business conditions last year. Through November of 2023, the AIA’s Architecture Billings Index (ABI) showed declining billings at architecture firms in seven of those months. More significantly, the September through November readings were all in the 44 to 45 range, indicating a more significant decline in billings in those months.

Architecture firm billings are unlikely to rebound anytime soon. New project work coming into firms has also seen a slowdown, with declines each month over the August to November period. These declines in new project work have cut into backlogs at firms. While reaching 7.2 months on average in early 2022, firm backlogs had edged down to the 6.5-month level by the third quarter of last year.

However, the status of billings at architecture firms varies considerably depending on their specialization. Firms specializing in multifamily projects reported strong billings through mid-year 2022. They have been slowing steadily since then, with significant declines by the fourth quarter of 2023. Firms specializing in the commercial/industrial sector likewise were reporting strong growth in billings through mid-year 2022, and modest decline since then. The downturn in billings moderated through most of last year.

Institutional sector offers the most upside

Institutional firms, in contrast, have fared much better in recent quarters, alternating between modest growth and modest declines in billings over the past several quarters. Institutional projects are largely immune from the headwinds confronting commercial and industrial facilities. Funding is generally more heavily dependent on government and nonprofit commitments as well as private philanthropy. Therefore, it is generally more insulated from changing market conditions.

Additionally, institutional projects often are more dependent on broader demographic trends. For example, the number of people in the school and college population will influence the size of educational construction budgets. Also, people aged 65 and older tend to be major consumers of healthcare services and therefore, the number in this age range will influence the need for healthcare facilities. In contrast, demand for commercial and manufacturing facilities is heavily influenced by regular economic cycles and less so by the demographic characteristics of the population.

The AIA Consensus Construction Forecast panelists are expecting relative stability in spending on institutional facilities to follow this pattern. As a result, all the major institutional sectors are projected to see modest growth this year and next. Education and healthcare facilities generally account for about 60% of construction spending in this category. Spending in the education sector is projected to increase 6% this year and 4% in 2025, in part to make up for deferred spending during the pandemic. Healthcare was one of the few major construction sectors that did not see a decline during the pandemic. This pattern of stable growth is projected to continue, producing an increase in spending of around 3.5% annually both this year and next.

Nearly half of firm leaders think that negotiating project design fees is more challenging now than it was 4–5 years ago

Architecture firms spend an average of 6% of their annual budget on marketing and business development.

For the second consecutive month, business conditions remained weak at firms in all regions of the country except the Midwest, where modest growth was seen.

Intelligent Investment

Facilities Management Cost Trends 2022

May 6, 2022 30 Minute Read

Download the PDF of the report, which includes the proprietary FM Cost Index

Business and financial leaders are keenly aware of global inflationary pressures and need to understand how these factors will impact facilities management costs in 2022 and beyond.

To shed light on these challenges, CBRE Strategic Investment Consulting partnered with our Procurement and Facilities Management (FM) experts to develop this report, which includes a proprietary FM Cost Index for the industry.

This detailed research is intended to enable meaningful early discussions with budget decision makers, informed by objective data regarding facilities costs.

Facilities management is a complex discipline with four major cost inputs:

Given the multifaceted nature of FM, the data was distilled into a proprietary Cost Index to provide enhanced visibility around how macroeconomic factors will impact annual operating costs for building operations, services and maintenance. This topic is especially important, as 2023 budget planning is already underway. The Index can be found in the PDF version of the report.

Below you will find the data used to build the proprietary Cost Index. We have also included information to provide context for interpreting recent index movement and planning for the future, including an economic outlook section, an assessment of current energy costs and five key recommendations for mitigating rising FM costs . The report also includes additional "deep-dive" sections analyzing labor, supply chain and inflation trends in the broader economy and for the FM industry specifically.

This research is focused on the United States, where detailed third-party and public data are readily available. The trends described herein are similarly impacting other countries across the globe. They are also impacting construction costs (note that CBRE will be issuing a separate construction cost report in H2 2022). We hope this report, the FM Cost Index and our recommendations prove timely and useful to our valued client decision makers, and we invite your suggestions and feedback.

Matt Werner Global President, Enterprise Facilities Management Global Workplace Solutions

Executive Summary

Employers across sectors in the U.S. are combatting a historically tight labor market . Demand for workers has risen dramatically since the early months of the pandemic, but workers have been slow to return. Labor shortages have put significant pressure on employees trying to make up for unfilled positions, and productivity has flattened .

Intense competition for workers is driving up the cost of labor , especially for certain FM jobs with low barriers to entry. Hard services (e.g., electrical, plumbing and HVAC) wages have increased moderately, but the required skills and training present challenges to sustaining this workforce. Soft services (e.g., security, janitorial and landscaping) wages have risen significantly and face added pressure from strong growth in competing sectors like warehousing and retail with similarly low barriers to entry.

External factors are reshaping the cost of facilities management in North America, with similar trends unfolding worldwide.

Materials costs have also risen dramatically since the onset of the pandemic. Demand for certain commodities has outpaced the ability of producers to manufacture and distribute supplies, largely due to labor shortages that have disrupted supply chains . Input costs for FM services are rising faster than the current prices received by FM suppliers, indicating more cost increases should be expected in 2022. Skyrocketing energy prices are compounding the issues facing facilities management.

Wages are the largest driver of FM costs and will not reset , especially given high inflation, meaning costs are unlikely to decrease even after labor and logistics challenges resolve. The pace of inflation is not likely to decelerate until 2023 with manufacturers beginning to catch up to demand in late 2022 and supply chains largely unclogged by late-2023.

Economic Outlook

While the U.S. economy is expected to normalize towards pre-pandemic conditions over the next two years, lingering challenges will sustain many cost pressures.

Economic outlook points to further FM cost escalation in 2022-2023

While the U.S. economy is expected to gradually normalize towards pre-pandemic conditions over the next 18 months, lingering challenges will sustain many cost pressures.

CBRE’s baseline view is that supply bottlenecks will begin to ease in H2 2022, but war in Ukraine and COVID lockdowns in China may stretch recovery into 2023. We expect the pace of inflation to peak this summer but remain roughly on par with 2021 levels by year-end and not return to the low-2% range until Q4 2023.

Overall, the labor market is expected to remain tight in coming years as labor force participation remains historically low, though rising interest rates as the Fed attempts to tamp down inflation are a headwind. For industries like FM that face added hiring challenges (e.g., a limited pool of workers with specialized skillsets, higher likelihood of talent poaching, etc.), wage growth is likely to increase in 2022 and remain above pre-pandemic averages in 2023 unless economic growth surprises on the downside next year.

FM budgets will see the full run-rate impact of rising costs in 2023, since mid-year increases are felt for a full 12 months. In addition, 2023 budgets will see the expected above-average increases.

Figure 5: Year-End Outlook for Key U.S. Economic Indicators

Source: Oxford Economics, CBRE Econometric Advisors, CBRE Strategic Investment Consulting, May 2022.

Energy Costs

Skyrocketing prices are driving up costs across the commodity market, but natural gas, coal and electricity prices have also risen significantly in recent months. Geopolitical factors pose a significant risk, as well.

Energy prices of all types are impacting operators significantly

Commercial natural gas is up 42% over a two-year period, hurting the bottom line of many operators and facilities managers. Commercial electricity, while not as dramatic, is still up 15% in two years and has increased significantly in recent months. The major spike in prices for natural gas used in electricity production may also indicate higher electric bills coming soon.

Managing energy costs will be a critical component of facilities management in the next two years, including utilities for the facilities themselves and the gasoline required to mobilize necessary components, equipment and personnel.

Macro Labor Trends

Competition for labor across sectors has driven up wages and put additional pressure on firms that need to hire, especially for jobs with lower barriers to entry.

Significant imbalance in labor supply and demand continues

The rapid rise in both job openings and quit rates highlight a labor shortage coupled with high turnover. Before the pandemic, job openings outnumbered hires and separations, indicating an already tight labor market.

After falling at the onset of the pandemic, job openings recovered by year-end 2020. Openings then rose sharply in 2021 due to a spike in post-reopening demand for services, as well as a need to replace workers who were laid off during the pandemic or who quit in recent months.

But as voluntary quits, retirements and other job separations have also increased, employers have not been able to hire fast enough to replace these workers, keeping job openings high.

Figure 8: Job Opening, Hiring & Separation Levels, Total Private Sector

Source: Bureau of Labor Statistics, Job Openings and Labor Turnover Survey (JOLTS), through March 2022.

The shortage is pervasive throughout the economy

The labor shortage is impacting most sectors of the economy, including facilities management.

While accommodation, food and retail service sectors were most affected by the initial spike in layoffs, professional, business and other services are feeling a similar impact at this stage of the recovery.

As of March 2022, job openings are far exceeding hires, which are barely above replacement (hires = separations), indicating a significant shortage across many sectors of the economy.

Figure 9: Job Opening, Separation and Hire Rates by Major Sector

Labor crunch is pushing employers to offer workers more compensation

To recruit and retain workers amid the current labor shortage, employers are increasing wages, benefits and incentives.

According to a November 2021 Conference Board survey of compensation executives, budgets for wage hikes are projected to increase 3.9% in 2022, the largest annual jump since 2008.

Beyond baseline wages, employers are increasingly looking at other ways to attract workers:

- Sign-on bonuses

- Increasing shift-differential pay

- Health benefits

- Educational/tuition support

- Increasing pay frequency

- Relocation reimbursements

Growth in wages and other incentives has varied geographically, with greater compensation in markets with more pronounced labor competition and higher living costs.

Figure 10: Wage Increases and Other Incentives Announced in 2021, Anonymous Sample Corporations

Source: Company statements and other press materials, January 2022.

Long-term demographic trends are behind the shrinking workforce

Both structural demographic changes and COVID-related factors are creating an increasingly difficult environment for employers seeking to fill open positions.

Although some COVID-related challenges may reverse once the pandemic is brought under control, other changes, such as the aging population and low birth rates, are likely to persist through the long term.

Figure 11: Key Factors Contributing to a Shrinking Workforce

The pandemic further depressed the labor supply

The pandemic has led to significant illness and death among U.S. workers and contributed to a sharp decline in immigration.

The tens of millions of U.S. COVID-19 cases have decreased work hours and will have a lasting impact on U.S. labor, particularly in positions with more physical requirements.

With labor force participation falling across the U.S. even prior to the pandemic, immigration is increasingly critical in filling the labor gap, especially for low-barrier-to-entry industries like landscaping, janitorial and food service. However, U.S. net migration began falling in 2017 due to federal policy changes, then hit a record low in 2020 amid pandemic conditions.

Immigration is likely to remain well below the levels of the previous 30 years until the latter half of the 2020s.

Figure 12: Net Migration to U.S.

Source: Oxford Economics derived from US Census Bureau data, December 2021.

Figure 13: Key COVID-19 Mortality & Chronic Illness Statistics

Pandemic-related stress on workers and systems continues to keep people from seeking employment.

Exacerbating demographic challenges, workers are exiting the labor force at record rates.

As the pandemic lingers, several factors are prompting people to leave or remain out of the workforce, including concerns about contracting COVID-19, lack of childcare, burnout, reevaluation of career choices and discouragement over hiring prospects. The labor force participation rate (which includes the employed and those currently unemployed but looking for work), remains near historic lows, having rebounded only slightly after a significant decline during the pandemic.

Initially, federal government stimulus and expanded unemployment benefits may have allowed some to temporarily delay job-seeking efforts, but this factor alone does not appear to have significantly impacted decision making for most workers.

Figure 14: Key Pandemic-related Factors Impacting the Labor Force

Both job openings and quits have risen to record highs

People are quitting their jobs at an unprecedented rate, while job opportunities are historically abundant.

The number of unemployed and new weekly unemployment claims are near pre-pandemic levels, underscoring an increasingly limited pool of available workers. Moreover, the fact that the labor force participation rate remains stubbornly low as unemployment improves suggests that part of the problem is a rise in labor force exits among previously employed people.

As of March 2022, total job openings were at 11.5 million, 94% higher than the number of people who were unemployed. Meanwhile, private sector quits reached a record high of 4.3 million in March 2022, and have accounted for more than 70% of total separations since July 2021.

The rise in quits is likely an indication of both optimism and pessimism among workers. Some people are quitting because they have increased confidence about finding a better or higher-paying job amid the flurry of new openings. At the same time, some portion of quits represent people continuing to exit the labor force as pandemic-era challenges persist.

Labor shortage has caused productivity to flatten and compensation to soar

Despite wage inflation, productivity is unlikely to rise (and may decrease) without a substantial increase in hours worked (i.e., hiring).

Hours finally rebounded to pre-pandemic levels, in Q4 2021, but still lags far below the pace of growth in output. This dynamic initially drove up labor productivity, as workers were able to produce more with less labor, but productivity has now plateaued.

This dynamic is not sustainable and is contributing to the rising quits rate. Even with increased compensation, attempting to boost output without an increase in staffing (hours worked) will lead to burnout and corner-cutting, risking both worker safety and output quality. The fact that growth in labor costs (the ratio between the compensation paid to workers and the value of the output they produced) did not catch up to the pace of productivity growth until Q4 2021 suggests that further growth in compensation will be needed to help resolve the current imbalance.

Figure 17: Labor Productivity Metrics, Nonfinancial Corporations Sector

Source: Bureau of Labor Statistics, Productivity and Costs, Q4 2021. Note: Q4 2019 = 100.

Supply Chain and Inflation

There are pent-up supplier cost increases and delivery risks in the FM supply chain globally. Now is the time for a comprehensive review of FM procurement strategies, service levels, and delivery approach.

Producers are paying more for inputs but have kept final prices low for now

Prices for services related to facilities management are likely to increase to keep up with rising costs.

Commodities pricing has increased dramatically through the pandemic, up 20.6% year over year in March 2022.

The overall figure is driven primarily by the rapid rise of metal, fuel, lumber and food prices—in part a result of supply chain disruption.

Prices for core services related to facilities management have increased, but not as much as commodities. However, inputs to maintenance and repair services (i.e., materials, supplies) have increased dramatically, indicating that final services pricing is likely to increase to cover rising costs.

In a survey of CBRE's major FM suppliers conducted in December 2021, firms reliant on metals, chemicals and electrical components (particularly computer chips)—such as waste management and elevator specialists—reported the highest increases (up to 200%) in materials and component costs in 2021.

Figure 18: Producer Price Index % Change - Select Commodities - 2020-2022

Source: Bureau of Labor Statistics, Producer Price Index, CBRE Strategic Investment Consulting, through March 2022.

Inflation is now rising faster than wages

Workers are facing rapidly rising consumer prices, but wage growth has not kept up before or during the pandemic.

The CPI has been rapidly increasing, reaching a 40-year high for year-over-year growth in March 2022 at 8.6%.

While total private wage growth has accelerated since the onset of the pandemic (albeit with some volatility), it has fallen behind growth in consumer prices, putting immense pressure on low-to-middle-wage workers.

An aggregate of wages across key FM industries has grown more quickly than overall wages in recent years and remained somewhat steady since the onset of the pandemic. However, this aggregate also lagged inflation for most of 2021.

Figure 19: Year-over-Year % Change - CPI vs Average Hourly Wage by Sector

Source: Bureau of Labor Statistics, Consumer Price Index, CES, CBRE Strategic Investment Consulting, through March 2022. Note: All measures are seasonally adjusted. FM Aggregate includes the janitorial, landscaping, security, electrical, plumbing & HVAC, and food contractor industries.

Low-wage workers are the most impacted by inflation

Seventy-eight percent of low-income household spending goes to the five items with high increases in CPI in March.

Transportation prices are the primary driver of the non-energy/food increase, which is mostly due to the rapid rise of supply chain disruptions in the automotive industry and the rising cost of metals.

Housing and apparel prices have also risen sharply in recent months. Housing prices are increasing due in part to the cost of materials limiting new supply. Apparel prices are up due to a mix of materials costs and global supply chain disruptions.

Labor and logistics issues are causing major delays across the supply chain.

Shipping delays at the largest seaports in the U.S. combined with a backlog of domestic freight operations caused a shortage of goods and materials that also had an inflation effect on services.

While many ports, like Los Angeles, are increasing their operations to address delays, the labor shortage impacted their ability to scale operations. Issues were mostly resolved by the end of 2021, but impacts have lingered.

Labor shortages for rail yards, manufacturing plants, warehouses and trucking companies are exacerbating the issue. The American Trucking Association reported in October 2021 that the industry is short about 80,000 drivers and they expect that to increase to 160,000 by 2030.

To attract more drivers, the sector has boosted wages, but the recent increase in demand for transportation services has meant the need for even more drivers. Barriers to entry for new drivers (i.e., licensing) are making it more difficult for the industry to respond quickly to demand.

Firms are struggling to fill orders due to supply chain issues

Supply chain and labor issues are causing a backlog of orders and an inventory shortage, indicating a supply-demand imbalance that will result in higher-priced goods and services.

The Institute for Supply Management (ISM) Report On Business® shows that producers and service-providers are increasingly unable to fill orders due to shortages of necessary inputs, resulting in a backlog and delay of service.

As of March 2022, nearly one-third of service-providers noted that their inventory was “too low” for current business activity levels, which is at an all-time high according to the same report.

Reflecting these pressures, 77% of all work order delays across CBRE’s facilities management business over the past 12 months stem from backordered materials and other supply chain challenges, nearly triple the pre-pandemic average share, which has also driven average wait times up 27%.

FM Implications

Financial and business leaders should prepare for 2022 to be another year of significant cost increases, especially around labor, and inflation overall is unlikely to settle back to a pre-pandemic norm until early 2024.

Different views and data sources required to understand FM costs

Within the facilities management industry, both hard services and soft services are facing labor shortages and accompanying wage inflation, but the underlying dynamics differ for the two segments..

Because these are not jobs that can be done remotely, both segments are also dealing with the persistent threat of COVID-19, either due to workers contracting the illness or choosing to leave jobs out of anxiety over their health.

Hard Services e.g., electric, plumbing, HVAC

- High barriers to entry. Specialized skill sets mean it takes a long time to train new workers

- Talent pipeline has plateaued.

- High degree of unionization. Baseline wages for union labor typically higher but less likely to inflate rapidly

- Younger retirement age. Workers tend to leave the labor force earlier (and stay retired) due to greater access to pensions/retirement plans

Soft Services e.g., security, janitorial, landscaping

- Low barriers to entry. Workers have not invested in a unique skill set, so there is less incentive to stay in a position

- High turnover. Jobs tend to be less gratifying and more injury-prone

- Competition. Other industries with low-barrier-to-entry positions can pull from this labor pool

- Lack of immigration. Slowdown in recent years has had an outsized impact on these industries

Hard services FM positions have significantly higher barriers to entry

The skilled trades needed for hard services—like electrical, plumbing and HVAC—all require either certification or apprenticeship, plus 2-4 years of experience, making these roles difficult to fill when vacated.

Security, landscaping and janitorial positions require less work experience and little to no education or on-the-job training, making them much easier to replace.

However, this comes with its own challenges, as employers of these soft services occupations must compete with a wide array of rapidly growing industries, like warehousing and transportation, which have similarly low barriers to entry.

The competition challenges differ for hard services. These workers are less likely to jump to a new occupation, given the time and effort invested in their specialized skills. However, with a limited pool of labor in these specialties, FM employers may find it more difficult to retain these workers during periods of strong construction activity when demand for these hard services is high.

Figure 26: Mean Years of Work Experience Required for Position, Education and Training, 2021

Source: Bureau of Labor Statistics, Occupational Requirements Survey, December 2021.

The talent pipeline for skilled trades has plateaued since 2010

After a surge in trade-degree conferment during the Great Recession, degrees awarded in FM-related hard services were flat over the last decade.

However, there is some evidence that interest in trade schools is rebounding, as enrollment in special-focus, two-year technical programs increased 5.4% year over year in 2020, reaching the highest level in 10 years.

Apprenticeships are another critical component of the talent pipeline, and some companies have been expanding their efforts in this area to help bring in more labor at entry-level wages.

CBRE launched a new apprentice program in 2020 to target building engineers, which ramped up to more than 60 apprentices across 26 states by year-end 2021.

Figure 27: Degrees/Certificates Awarded by Trade Skill

Source: National Center for Education Statistics, Integrated Postsecondary Education Data System, December 2021. Note: Degree categories not limited exclusively to FM trades (e.g. automotive is included in Mechanic & Repair Technicians).

Across all FM occupations, the oldest workers make up significantly larger shares of total workforces than they did 20 years ago.

FM workforces are aging

While age distributions skew younger for hard services than soft, hard services have also experienced more pronounced aging, with shares of workers over 55 roughly doubling since 2000.

The share of young workers in hard services has also risen over the past decade, but so far has only made up for the exodus from construction-adjacent occupations following the Great Recession. The younger-than-25 share must rise more quickly to keep up with retiring workers.

Soft services over-55 shares have increased nearly as much, despite having older work forces to begin with. Twenty-seven percent of soft services employees is currently 55 or older, and there is little relief in sight, as shares of the youngest workers have fallen.

Figure 28: Age Distribution by Occupation & Year

Source: Bureau of Labor Statistics, IPUMS, December 2021. *Non-restaurant food service occupations. Comparable data not available for 2000.

Labor characteristics differ across hard and soft services

Hard services have significantly more unionization and less foreign-born labor than soft services, which impacts earnings and age distributions.

A primary reason hard services occupations skew younger than soft is that workers in these occupations are better able to afford retirement at younger ages due to higher wages and access to pension and retirement programs. These benefits are related partially to a high degree of union affiliation—on average, hard services occupations are unionized at double the national average.

In contrast, low union coverage (except for janitorial) and high shares of immigrant workers (except for security) in the soft services means these occupations have less access to both employer- and government-sponsored retirement plans.

Union wages tend to be higher than non-union wages, but they also typically grow at a slower and steadier pace. Between 2017 and 2020, median weekly earnings for FM-related occupations increased by 7% for union members and 14% for non-union.

Figure 29: Union Representation and Foreign-Born Status by FM Sector

Source: Bureau of Labor Statistics, IPUMS, December 2021. *Non-restaurant food service occupations.

Hard services are more stable, while soft services roles have been harder to fill

The onset of COVID-19 caused swift and significant job losses, particularly in early 2020, though many FM industries were more resilient than overall employment.

The hard services were growing more rapidly than the overall economy leading up to the pandemic and have also been the fastest growing since, despite having high barriers to entry. This highlights the essential nature of these trades, as well as employers’ greater ability to fill positions (relative to soft services) due to both higher wage levels and the switching costs associated with these specialized skill sets.

In contrast, except for landscaping, soft services industries have not yet recovered to pre-pandemic employment, and security and janitorial were also lagging the national average leading up to the pandemic. However, these sectors have also had the highest wage growth since the onset of the pandemic, indicating there is high demand for these occupations (with employers hoping to entice workers with better pay) but an inability to find and retain the labor.

Figure 30: FM-Related Industry Employment Change by Period, 2017-2022

Source: Bureau of Labor Statistics, CBRE Strategic Investment Consulting, March 2022.

Wages are growing fastest in industries still struggling to reach pre-pandemic employment

Wages have grown in most industries related to facilities management at a faster pace than the overall private sector over the course of the pandemic.

Soft services wages have had more significant growth than hard services and the overall economy, likely a result of high pandemic-related demand for these services combined with a limited supply of labor. These jobs also have a low barrier to entry relative to hard services, meaning FM firms are competing with an array of other types of companies (e.g., warehousing, logistics) for the same talent. Hard services wages are also starting at much higher levels than soft services, so significant shifts in percentage terms are less likely.

Most major CBRE FM suppliers have reported that they expect wage growth will stay at or above 2021 increases this year, indicating that these patterns will likely continue through the near term.

Figure 31: Inflation vs. Average Annual Hourly Wage Increase by Period, FM-related Industries

Source: Bureau of Labor Statistics, Current Employment Statistics (CES), through March 2022.

Recommendations

Provide early budget planning input for fy 2023, take steps to better attract and retain facilities workers and vendors, get energy into the equation for cost management and potential cost relief, embrace labor-saving building technologies, proactively manage ongoing supply chain risk, matt werner.

Global President, Client Care, CBRE

- Phone +1 415 772 0376

- Mobile +1 415 203 4242

Taylor Jacoby

Director of Strategic Investment Consulting

- Phone +1 202 585 5547

Bruce Grawert

Vice President

- Phone +1 404 812 5098

Related Services

Integrated facilities management.

Optimize your workplace performance and ensure success with superior facilities management (FM) and maintenance services.

Global Workplace Solutions

Guide transformational outcomes to create tangible value across your portfolio.

Gain comprehensive guidance on insightful, executable real estate strategies for both investors and occupiers.

Related Insights

2022 u.s. construction cost trends.

July 6, 2022 30 Minute Read

A confluence of events—including soaring construction demand, inflation, pandemic-related restrictions, supply chain disruptions, labor shortages and the war in...

Sustainability Starts with Energy Management

August 25, 2021

Companies recognize that a holistic sustainability strategy includes investing in a net-zero future.

Up on the Roof: How Altus Power is Expanding Solar Power for Commercial Real Estate

September 15, 2021 32 Minute Read

As companies adopt more ambitious ESG goals, Altus Power Co-CEO Lars Norell joins Spencer Levy to discuss the role that solar power plays in helping to forge su...

Commercial Building Planning Ticks Up

A total of 22 projects with a value of $100 million or more entered planning in February

HAMILTON, N.J. — The Dodge Momentum Index increased 4% in February to 158.2 (2000=100), from the revised January reading of 151.9. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In February, institutional planning rose 9%, and commercial planning moved 1% higher.

The Dodge Momentum Index rebounded from three consecutive monthly declines that followed a 14-year high in October 2021. Much of February’s gain was due to a sizeable jump in the institutional component, as more education and healthcare projects entered planning. Commerical planning remained solid thanks to office and warehouse projects. When compared to February 2021, the overall Momentum Index was 11% higher in February 2022. The institutional component was up 37%, while the commercial component was down 1% on a year-over-year basis.

A total of 22 projects with a value of $100 million or more entered planning in February. The leading institutional projects were a $500 million first phase of the OC Vibe recreation and mixed-use space in Anaheim, CA, and the $299 million Kaiser Roseville Medical Center in Roseville, CA. The leading commercial projects were the $500 million Potomac Technology Park data center in Manassas, VA, and a $175 million Chick-fil-A refrigerated warehouse in Hutchins, TX.

February’s increase in the Dodge Momentum Index suggests that the construction sector continues to weather the storm of higher material prices and labor scarcity and is looking past the pandemic’s unique issues for projects like schools and offices. As the pipeline of projects awaiting groundbreaking fills, a more even and pronounced recovery in construction starts will take hold.

February 2022 Dodge Momentum Index

About Dodge Construction Network

Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry.

The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem.

Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com

Advertise

Legal stuff.

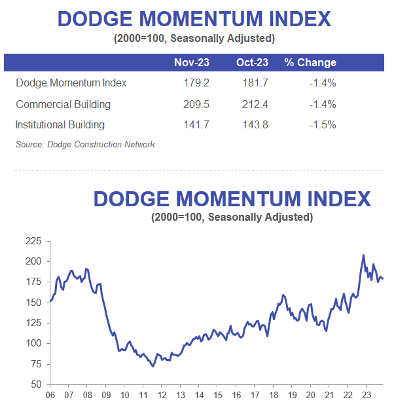

Dodge Momentum Index Decreases 1% in November

Nonresidential planning activity remains historically elevated despite decline

HAMILTON, N.J. – December 7, 2023 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network (DCN) , decreased 1% in November to 179.2 (2000=100) from the revised October reading of 181.7. Over the month, the commercial and institutional components both fell 1%.

“While both portions of the Momentum Index saw slower momentum in planning, overall levels remain steady and will support construction spending in 2024 and 2025,” stated Sarah Martin, associate director of forecasting for DCN. “Nonresidential planning activity will remain constrained from stronger growth amidst ongoing labor and construction cost challenges.”

Excluding data center activity, all commercial segments saw declines in November. On the institutional side, more momentum in healthcare and public projects was offset by continued weakness in education planning. Year over year, the DMI was 14% lower than in November 2022. The commercial segment was down 20% from year-ago levels, while the institutional segment was up 2% over the same time period.

A total of 17 projects valued at $100 million or more entered planning in November. The largest commercial projects include the $480 million Project Cosmo Data Center in Cheyenne, Wyoming, and the $300 million Sherwin Williams Headquarters Building in Cleveland, Ohio. The largest institutional projects include the $315 million phase two of the FSU Health Hospital in Tallahassee, Florida and the $258 million LA Convention Center Exhibition Hall in Los Angeles, California.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

Watch Associate Director of Forecasting Sarah Martin discuss November’s DMI.

About Dodge Construction Network Dodge Construction Network is a solutions technology company providing an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers longstanding and trusted industry solutions to timely connect and enable decision makers across the entire commercial construction ecosystem. For more than a century, Dodge Construction Network has empowered construction professionals with the information they need to build successful, growing businesses. To learn more, visit construction.com

Media Contact : Amy Roepke | [email protected]

Neighborhood Commercial Buildings Survey Results Map

The most up-to-date Neighborhood Commercial Buildings status can be found by entering a property address in the SF Property Information Map. The map below shows all buildings surveyed as part of the Commercial Buildings Historic Resources Survey. Clicking on a property will provide the survey evaluation.

- Properties shaded in green were determined to be contributors to "clusters." Clusters contain several buildings that either relate to each other through architectural style, such as Mediterranean Revival, or property type, such as garages. To learn more about your property, view the attached District Summary Form.

- Properties shaded in pink were determined to be individually significant properties, typically because of the strong architecture of the building or the storefront. To learn more about your property, view the attached District Summary Form.

- Properties shaded in blue did not appear to be a historic resource for the purposes of this survey.

Related Neighborhoods

Related projects.

Have other questions?

Contact the Planning counter – or try these popular topic links:

Property Info

Did you receive a neighborhood or hearing notice? Visit Permits in my Neighborhood. Want to know more about Accessory Dwelling Units? Start here.

Opening a business, renovating or expanding a home, or considering a construction project? Start with Permit Corner.

Looking for a document? Search for an Application ( forms, checklists, fees, etc) or Search for a Publication ( maps, reports, bulletins, etc).

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

Press Herald

Account Subscription: ACTIVE

Questions about your account? Our customer service team can be reached at [email protected] during business hours at (207) 791-6000 .

- Times Record

Brunswick to review apartment building plan for Wilbur’s Woods

The Brunswick Planning Board will meet Tuesday to review the architectural compatibility of the 18-unit apartment building planned for the affordable housing development on McKeen Street.

You are able to gift 5 more articles this month.

Anyone can access the link you share with no account required. Learn more .

With a Press Herald subscription, you can gift 5 articles each month.

It looks like you do not have any active subscriptions. To get one, go to the subscriptions page .

Loading....

The Brunswick Planning Board is gearing up to revisit the Wilbur’s Woods housing development next week after the Zoning Board of Appeals sent a portion of the plan back for review.

Tuesday’s public hearing will focus on the architectural compatibility of the housing project, which plans to build 21 below-market-rate homes as well as an 18-unit apartment building on McKeen Street. Neighbors filed a challenge earlier this year, listing 13 arguments against the project. The Zoning Board rejected all the complaints, save one related to the compatibility of the apartment building.

“I look forward to seeing how you can make a case for the 18-unit apartment building to be architecturally compatible smack-dab in the middle of a neighborhood,” said Chris Teel, a Brunswick resident who filed the appeal on behalf of 52 neighbors near the development site.

Teel, who doesn’t live near the project site, said he believes town officials are “hiding behind affordable housing” without considering a stopping point for development in Brunswick. Teel also said stating that the project will produce affordable housing “drowns out” resident pushback on issues like traffic safety, reduced property value and environmental impact concerns.

For now, Teel said, no additional legal action is planned in response to the Zoning Board decision, though he does plan to speak at the public hearing on Tuesday.

Chris Marshall of GreenMars, the development company behind Wilbur’s Woods, sees the project as part of the solution to the housing crisis in Maine. He said that the company wants Wilbur’s Woods to be part of a vibrant community and well-established neighborhood. In realizing this goal, Marshall said, the company has worked closely with residents by hosting its own community meetings early on in the planning process and by considering local input now. Advertisement

“The residents most recently expressed their concern about the architectural compatibility of the apartment building,” Marshall said. “Although there are several similar buildings in the area, we have dedicated additional resources to demonstrating the design compatibility of the proposed structure. We hope this additional investment demonstrates that we want this to work for both sides: the people who need homes they can afford and the people who already own homes in the neighborhood.”

The architectural compatibility requirement at the center of the public hearing comes from the town’s zoning laws. The rule states that new buildings should match their respective neighborhoods in design, size and mass, and need to also abide by each zoning district’s design standards.

Teel and other residents argued that the apartment building, which would be three stories tall, violates the ordinance because it would “dwarf” neighboring homes, block sunlight and would not fit into the “quiet and quaint” neighborhood.

The public hearing will be held at 6 p.m. Tuesday, May 14, at Brunswick Town Hall. Residents can attend in person or via Zoom. The public can email comments to Land Use Planner Natalie Thomsen at [email protected].

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Forgot Password?

Don't have a commenting profile? Create one.

Hi, to comment on stories you must create a commenting profile . This profile is in addition to your subscription and website login. Already have a commenting profile? Login .

Invalid username/password.

Please check your email to confirm and complete your registration.

Create a commenting profile by providing an email address, password and display name. You will receive an email to complete the registration. Please note the display name will appear on screen when you participate.

Already registered? Log in to join the discussion.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why .

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.

Send questions/comments to the editors.

Daily Headlines

- Enter your email

- Email This field is for validation purposes and should be left unchanged.

- Staff Directory

- Send a Story Tip

- Send a Letter to the Editor

- Contact Advertising

- Place an Obituary

- Daily Headlines Newsletter

- ePaper Delivery Alert

- Mobile Apps

- Sports Twitter

Subscribers

- Manage Your Account

- Log a Delivery Issue

- Subscriber Benefits

Masthead Maine Network

- Centralmaine.com

- Pressherald.com

- Sunjournal.com

- The Forecasters

- Mainely Media Weeklies

- Varsity Maine

- Masthead Maine Events

- Privacy Policy

- Cookie Policy

- Terms of Service

- Commenting Terms

- Public Notices

- Photo Store

- Merch Store

- Archive Search

Member Log In

Please enter your username and password below. Already a subscriber but don't have one? Click here .

Not a subscriber? Click here to see your options

Tuesday, November 07, 2023

Leading index for commercial real estate increased in october, down 8% yoy.

by Calculated Risk on 11/07/2023 04:59:00 PM

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 1% in October to 181.7 (2000=100) from the revised September reading of 180.3. Over the month, the commercial component of the DMI rose 2.0%, while the institutional component retreated 1.4%. “Heightened momentum in warehouse planning activity supported the commercial side of the Index this month, while muted education planning activity slowed the institutional portion,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Overall levels of planning activity remain robust and will support construction spending over the next 12 to 18 months.” Improvements in warehouse planning helped support commercial growth, but despite strong progress in September, education and healthcare activity slowed down this month. Year over year, the DMI was 8% lower than in October 2022 . The commercial segment was down 14%, while the institutional segment was up 7%. ... The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. emphasis added

Last 10 Posts

In memoriam: doris "tanta" dungey.

Econbrowser

Pettis: china financial markets, ny times upshot, the big picture.

Economic Sites

- A Dash of Insight

- Bonddad Blog

- Christophe Barraud Blog

- Mish's Global Economist Analysis

- Oilprice.com

IMAGES

VIDEO

COMMENTS

The Index fell 3% in the last month of the year to 166.4 (2000=100), down from the revised November reading of 170.7 with commercial planning down 4%, and institutional planning slipping 1%.

Warehouse planning projects accelerating, supporting commercial momentum. HAMILTON, N.J. - November 7, 2023 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 1% in October to 181.7 (2000=100) from the revised September reading of 180.3.Over the month, the commercial component of the DMI rose 2.0%, while the institutional component retreated 1.4%.

The U.S. Chamber of Commerce Commercial Construction Index (CCI) fell this quarter to 65, down one point from 2021 Q3. Two of the three key drivers of the Index—revenue and new business confidence—also fell. One key driver, backlog, improved slightly. The most notable development in the current quarter is a reduction in revenue expectations ...

A total of 23 projects valued at $100 million or more entered planning in December, with six valued over $400 million, according to Dodge. The largest commercial projects included: The $500 ...

Commercial and institutional planning rise for third consecutive month. HAMILTON, N.J. - December 7, 2022 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 3.8% (2000=100) in November to 207.2 from the revised October reading of 199.6.During the month, the DMI continued its steady ascent, with the commercial component rising 4.3%, and the institutional ...

An acceleration in commercial planning caused the momentum index to increase 1% in October, to a reading of 181.7. The Dodge Construction Network on Nov. 15 published its Dodge Momentum Index (DMI ...

The Index fell 3% in the last month of the year to 166.4 (2000=100), down from the revised November reading of 170.7 with commercial planning down 4%, and institutional planning slipping 1%. In December, a total of 21 projects with a value of $100 million or more entered planning, according to DCN.

The Dodge Momentum Index, issued by Dodge Data & Analytics, rose for the fifth consecutive month, climbing 8.6% in April to 162.4 (2000=100) from March's revised reading of 149.5.

The Dodge Momentum Index, a benchmark that measures nonresidential building planning, tumbled 2% in May due to slower commercial activity, according to a Dodge Construction Network report. The ...

The Dodge Momentum Index (DMI), issued by Dodge Construction Network (DCN), rose 3% in December to 186.6 (2000=100) from the revised November reading of 181.5. Over the month, commercial planning grew 1.0% and institutional planning improved 6.1%. " The Momentum Index ended the year 11% below the November 2022 peak, ultimately stabilizing as ...

The Dodge Momentum Index, a benchmark that measures nonresidential building planning, fell 8.4% in January due to declines in commercial and institutional project activity. The index typically ...

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year. emphasis added. Click on graph for larger image. This graph shows the Dodge Momentum Index since 2002. The index was at 173.9 in April, up from 164.0 the previous month.

The January 2024 Consensus Construction Forecast has spending on nonresidential buildings with a more modest 4% increase in 2024, at a pace that will slow to just over 1% growth in 2025. ... MSCI's Commercial Property Price Index indicates that multifamily, commercial, and industrial property values have declined 8% on average over the past ...

New CBRE index indicates that cost escalation will increase in 2022, moderate in 2023 and 2024. This index incorporates the three key cost components to provide a comprehensive view of construction costs that can also be statistically modeled to estimate future escalation. The index increased 11.5% in 2021, markedly above the 2%-4% historical ...

Given the multifaceted nature of FM, the data was distilled into a proprietary Cost Index to provide enhanced visibility around how macroeconomic factors will impact annual operating costs for building operations, services and maintenance. This topic is especially important, as 2023 budget planning is already underway.

Commercial Building Planning Ticks Up . A total of 22 projects with a value of $100 million or more entered planning in February . HAMILTON, N.J. — The Dodge Momentum Index increased 4% in February to 158.2 (2000=100), from the revised January reading of 151.9. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of ...

From Dodge Data Analytics: Dodge Momentum Index Increases In April The Dodge Momentum Index posted an 8.6% gain in April, climbing to 162.4 (2000=100) from the revised reading of 149.5 in March.The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction ...

Index (Year 2000=100), Billions Commercial Building Planning: May @ 132.2 (Left Axis) Private Nonres. Commercial Const. Spending: Apr @ $68.5B (Right Axis) Dodge Momentum Index Treks Higher in May . The Dodge Momentum Index rose 2.4 percent in May, from an upwardly revised April reading. Gains came from a jump in commercial building planning ...

Nonresidential planning activity remains historically elevated despite decline. HAMILTON, N.J. - December 7, 2023 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network (DCN), decreased 1% in November to 179.2 (2000=100) from the revised October reading of 181.7.Over the month, the commercial and institutional components both fell 1%.

National Renewable Energy Laboratory 15013 Denver West Parkway Golden, CO 80401 303-275-3000 • www.nrel.gov. NOTICE. This work was authored in part by the National Renewable Energy Laboratory, operated by Alliance for Sustainable Energy, LLC, for the U.S. Department of Energy (DOE) under Contract No. DE-AC36-08GO28308.

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. emphasis added Click on graph for larger image. This graph shows the Dodge Momentum Index since 2002. The index was at 207.2 in November, up from 199.7 in October.

Neighborhood Commercial Buildings Survey Results Map. The most up-to-date Neighborhood Commercial Buildings status can be found by entering a property address in the SF Property Information Map. Property Info. Permits. Documents.

The S&P Global UK Construction Purchasing Managers' Index rose to 53 in April, up from 50.2 in March and the highest reading since February 2023, data released on Tuesday showed.

The Brunswick Planning Board will meet Tuesday to review the architectural compatibility of the 18-unit apartment building planned for the affordable housing development on McKeen Street.

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. emphasis added Click on graph for larger image. This graph shows the Dodge Momentum Index since 2002. The index was at 181.7 in October, up from 180.3 the previous ...