Corporate Planning Kosten

Corporate Planning ist nach eigenen Angaben eine Finanzplanungs-Software für das operative Controlling. Die Controlling-Software bietet Nutzer:innen mit Corporate Planner, Corporate Planner Finance, Corporate Planner Cash sowie einem Web-Client und einem Dashboard alles, was in den Bereichen Planung und Budgetierung, Analyse und Reporting benötigt wird. Zudem enthält Corporate Planning über 300 vorinstallierte betriebswirtschaftliche Funktionen. Die Corporate Planner Cash Lizenz ist kostenlos erhältlich und kann für 2.900 Euro mit dem Kick-Start-Paket geupgraded werden.

Corporate Planning Preise

Der Anbieter kommuniziert keine Preisinformationen. Dies ist eine übliche Praxis für Softwareanbieter und Dienstleister. Alternativ könnt Ihr den Anbieter kontaktieren, um aktuelle Preise zu erfahren.

Reviews für Corporate Planning mit Preis-Informationen (0)

Corporate Planning

Corporate planning is crucial to any professional’s or business’s success as it sets a vision for daily operations. With corporate planning, businesses prepare a detailed road map for all their activities. By understanding corporate planning, you can effectively lead and manage a business. This article delves into the nitty-gritty of corporate strategic planning, its varying types, and the stages involved in creating a comprehensive corporate plan.

Defining Corporate Planning

Corporate planning is a detail-oriented process aimed at helping businesses craft solid strategies to achieve their goals. Companies can thrive by mapping out a clear direction, making informed decisions, identifying obstacles, and efficiently allocating resources to support business activities.

The corporate planning process also helps align teams with a shared mission and overcome challenges to achieve established objectives. It is an ongoing, dynamic, and continuous process that continually adapts to shifting business dynamics throughout the lifespan of a company.

Advantages and Disadvantages

Corporate planning consists of extensive future-oriented preparations that provide businesses with a better approach to handling various situations.

However, like everything, there are advantages and disadvantages to the continuous corporate planning process that need to be considered. Below, let’s explore the advantages and disadvantages of corporate planning in detail:

Advantages:

Reduces Uncertainty: Running a business comes with constant uncertainties and risks . An excellent corporate plan goes beyond merely setting objectives. It helps the company by forecasting the value of risks in the future, thereby minimizing the risk of uncertainty and unplanned contingencies.

Unity: Corporate planning helps the employees understand their roles more explicitly. Employees who know what’s expected of them are less likely to engage in conflicts, leading to higher levels of unity within the organization.

Aids Growth: With employee cooperation and constant development of processes within the company’s scope, corporate strategy, and plan objectives are easier to implement, resulting in a higher success rate.

Disadvantages:

Rigidity: Following a strict set of rules as part of a plan can create an inflexible environment that can lower employees’ morale, which can ultimately interfere with productivity.

Time: Corporate planning can take quite some time before the company begins to see results. The process involves collecting data, devising a plan, implementing, monitoring, and evaluating.

Ambiguity: Although corporate planning provides a reference point for business decisions, it is based on predictions of a mutable future. As a result, the plan may only sometimes be foolproof, and unexpected situations can occur, leaving businesses caught off-guard.

The Different Types of Corporate Planning

Corporate planning is a vital aspect of any business, and it involves a variety of planning types, including:

Strategic Planning:

Strategic planning is a crucial process that requires closely examining a company’s missions, strengths, and weaknesses. Its goal is to define the company’s current status, determine where it wants to go, and how it can get there. Although strategic planning and corporate planning share some overlapping areas, corporate planning has a broader scope.

It is particularly useful in functional planning and guiding complex organizations with various subsidiaries and businesses. The corporate plan also includes the same critical components as the strategic plan, focusing on the broader company and any related services used by the departments, such as marketing and human resources. Corporate planning also considers tools for achieving individual business steps such as countering challenges, employee training, and objectives.

Tactical Planning:

Tactical planning is the subsequent step businesses take after formulating a strategic plan. Tactical planning involves defining goals and determining the necessary steps and actions required to achieve them. With it, you can subdivide the strategic plan into smaller objectives and goals. It is a short-term planning process and strategy that can aid in working towards medium or long-term goals.

Operational Planning:

Operational planning is a specific, detailed plan that outlines the business activities’ day-to-day workings for a specific period, generally lasting more than a year. It specifies employees’ and managers’ daily responsibilities and tasks and the workflow. Operational planning is useful in allocating the available financial, physical, and human resources to reach short-term strategic objectives that support an organization’s growth.

Contingency Planning:

Contingency planning is the process of developing strategies that help businesses respond effectively to unexpected disruptive events. It is intended to ensure that the practices return to standard operating procedures after a disturbance or natural disaster. Contingency planning is an effective tool for handling both adverse and positive events, such as an unexpected financial boost that can impact the organization’s operations.

By incorporating these types of business planning, businesses can ensure success in the short term and achieve long-term growth.

Examples of Corporate Planning :

Audacity Corporation, a renowned studio, and live performance microphones manufacturer, wanted to ensure that their range of microphones for streamers and gamers were market leaders by the end of the financial year.

Their CEO, Brendon, decided to study their competitors’ practices and strategies to achieve this target. They discovered that most of their competitors produced these microphones in-house, and their costs of raw materials were high.

To counter this, Audacity collaborated with companies in China and Taiwan to obtain raw materials at reduced prices and trained their employees to assemble the products more efficiently. As a result, their streaming and gaming microphones became the top-selling product in the market, with 20% more sales than their nearest competitor.

ExxonMobil, one of the largest oil and gas companies operating internationally, announced its corporate plans in 2022. One of their declarations was the plan to increase investments in emission reduction solutions.

They have decided to invest $17 billion by 2027 in this domain to achieve this objective. This investment will enable them to gain a competitive advantage over their contemporaries in the market and help them tackle climate change and carbon emissions in the long run.

The Benefits of Corporate Planning

Providing clear objectives.

Not only does corporate planning provide a sense of direction for professionals within an organization and corporate management, but it also ensures that every action taken has a purpose. Executing tasks with a clear plan can help achieve business objectives efficiently.

Formulating Better Strategies

In the context of business, a strategy is an approach taken to achieve a specific goal or objective. For example, if the objective is to make a product the category leader in sales revenue by the year 2023, a potential strategy could be to persuade buyers that the product is superior to other options on the market by investing in large advertising campaigns. Corporate planning is integral to helping an organization create operational plans and execute strategies in a logical and methodical manner, easing the decision-making process.

Increasing Communication

Corporate planning allows group participation in scenario planning, improving communication between employees and employers. Active involvement ensures that tasks are executed efficiently, and everyone remains on the same page.

Allocating Resources Efficiently

In the context of business, a strategy is an approach taken to achieve a specific goal or objective. For example, if the objective is to make a product the category leader in sales revenue by the year 2023, a potential strategy could be to persuade buyers that the product is superior to other options on the market by investing in large advertising campaigns. Corporate planning is integral to helping an organization create and execute strategies in a logical and methodical manner, easing the decision-making process.

Communicating Brand Messaging

A well-defined corporate plan can help communicate a brand’s message to key stakeholders like shareholders, investors, creditors, customers, and employees. By aligning mission and vision statements, core values are clearly established, helping to convey the brand message cohesively.

By implementing corporate planning, organizations can enjoy these benefits and ultimately operate with enhanced efficiency and productivity.

The Six Stages of Corporate Planning

Start with a vision and mission statement.

A vision statement showcases future expectations for a company, such as a goal to offer innovative mobility solutions on a global scale.

On the other hand, a mission statement outlines the organization’s purpose, including target audience, product offerings, and distinguishing factors from competitors. For instance, our company is dedicated to facilitating low-interest healthcare loans to those with poor credit, specifically for low-income households.

Establish Clear-Cut Goals and Objectives

Although people sometimes use the terms interchangeably, goals and objectives have significant distinctions. Fundamentally, a goal defines the aspiration of a company or business over a specific period, while an objective is a measurable and actionable step that propels you toward your goal.

While general goals may suffice for organizations, departments need detailed and specific ones to achieve targets.

For example, a business objective to boost profits would require more specific departmental goals, such as, “We will generate an additional $8,000 in revenue by November 15.” You can create a shared future vision by setting company goals and objectives. This allows everyone to work together towards common goals, making their daily activities more purposeful.

Identify your Organization’s Strengths and Weaknesses

Once you’ve established your business goals and objectives, analyzing the organization’s strengths and weaknesses is a good idea. The most commonly adopted approach for this is the SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis.

To perform a SWOT analysis, list the characteristics corresponding to each category. Based on this evaluation, you can capitalize on the strengths identified and leverage your opportunities to counter or neutralize the weaknesses and potential threats to the organization.

This kind of analysis will enable you to determine any potential challenges impeding the business goals and help you develop strategies to overcome them. In summary, incorporating a SWOT analysis into your business strategy is an effective way to better understand the organization’s internal and external environment, helping you achieve business growth and success.

Consider Short-term and Long-term Goals

Short-term goals are ones you can achieve in the near future, usually between six months and two years. Long-term goals require more time, usually three to five years. By integrating these two types of goals, you can achieve your goals with ease.

Implement the Plan

After clearly understanding your goals, the next step is to proceed with the plan’s implementation. At this stage, an action plan is usually created with specific responsibilities and an expected timeline for achieving each objective. Regular meetings should be set up to monitor this plan effectively to review progress on the action plans and key performance indicators (KPIs). It’s important to note that during implementation, setbacks or challenges may arise, which is why regular check-ins are necessary. These reviews also allow for recognizing successes and making any necessary corrections.

Evaluate Performance

After implementing all plans, the subsequent critical step involves evaluating their performance. Its purpose is to align your overall expectations with the actual contributions of your plans. Evaluating plan performance is necessary because it helps you measure progress and surface possible areas of weakness. Therefore, to ensure continual improvement towards your goals and maximize impact, evaluating implemented plans’ outcomes is a must.

Corporate Planning Tips :

Share your plan broadly.

For a corporate plan to succeed, the entire company’s involvement is crucial. It’s essential to guarantee that every team member is given access to the business plan and encouraged to participate. Additionally, sharing the plan with board members and department leaders can ensure accountability and commitment and help maintain a clear pathway to achieve the plan’s objectives.

Divide Yearly Plans into Quarters

To simplify a plan, break it down into manageable priorities with deadlines. You can assess the plan’s progress more easily by increasing the frequency of check-ins. If you encounter a challenge, you can make necessary changes to the quarterly plans to keep yourself on track.

Utilize Action Plans

Action plans keep you motivated and on target toward achieving your goals. They help you complete short-term goals in a reasonable amount of time, keeping you moving toward your final objective.

Hold Regular Meetings

Regular check-ins to revise your goals and key performance indicators (KPIs) are crucial. Make necessary adjustments to your corporate plan, find solutions, and achieve your KPIs promptly and efficiently.

To learn more about corporate planning, corporate visions, and more, contact Strategy Capstone !

Corporate Planning: What Is It and How Is It Important?

by Go Together DMC | nov 17, 2023 | DMC Brazil | 0 Comments

Business success doesn't happen by chance. It requires a well-thought-out strategy, meticulous execution, and a keen understanding of the corporate landscape. This is where corporate planning comes into play. As an essential element of organizational success, corporate planning shapes the direction, goals, and future of a company. In this blog post, we'll delve into the various aspects of corporate planning, emphasizing its importance in the modern business environment. Furthermore, we'll explore the role of incentive travel, specifically with a focus on DMC Brazil, as a powerful tool in boosting employee morale and achieving organizational goals.

Understanding Corporate Planning:

Corporate planning is a strategic process that involves defining an organization's objectives and developing plans and policies to achieve them. It involves strategy definition, strategy direction, decision-making and resource allocation and is a roadmap that guides decision-making at all levels of the organization, ensuring that every action contributes to the overall success of the company. This process encompasses various facets, including financial planning, market analysis, risk management, and resource allocation. It can also help you identify potential challenges in meeting goals, so you can provide methods to overcome them. Corporate planning is a continuous and dynamic process that lasts throughout the life of the business

Key Aspects of Corporate Planning

Strategic Vision: Lies at the core of corporate planning and involves setting long-term goals and defining the steps needed to reach them. The corporate strategic planning process evaluates the resources available to the company and identifies gaps that you will need to fill to drive business results. These could be gaps within tangible resources (inventory, technology, or headcount) or intangible (institutional knowledge or role-specific skills). A well-defined vision provides clarity to the organization, aligning the efforts of employees towards a common purpose.

Financial Planning: It is the process of assessing the current financial situation of a business to identify future financial goals and how to achieve them. The financial plan itself is a document that serves as a roadmap for a company's financial growth. It reflects the current status of the business, what progress they intend to make, and how they intend to make it.

It also enables a business to determine how it will afford to achieve its objectives and strategic goals. A business typically sets a vision and objectives, and then immediately creates a financial plan to support those goals. The financial plan describes all of the resources and activities that the company will require-and the expected timeframes-for achieving these objectives.

Market Analysis: Understanding the market is essential for staying competitive. Corporate planning includes a comprehensive analysis of market trends, consumer behavior, and competitor activities, allowing companies to adapt and innovate. A market analysis also provides insights into potential customers and your competition, and its core components are:

- Industry analysis: Assesses the general industry environment in which you compete

- Target market analysis: Identifies and quantifies the customers that you will be targeting for sales

- Competitive analysis: Identifies your competitors and analyzes their strengths and weaknesses.

Risk Management: Every planning process and every planning usually ends in a calculated future variant. From the infinite possibilities of future developments, the most probable variant (or most relevant entrepreneurial variant) must be found in the planning process. Often only single risks are considered in the planning process. Often the planners try to plan the "least risky" or "safest" variant. The planning process should encourage creativity and spur the organization on to new top performances. So, identifying and mitigating risks is an integral part of corporate planning.

Benefits of a well-developed corporate plan

We can summarize why planning is key to managers and their businesses with a quite simple reason: it provides direction for daily actions. Understanding corporate planning can help you successfully manage a business or help you work more effectively. Here's just three of its many fundamental reasons:

- It provides clear objectives for the organization

Corporate planning creates a sense of direction for professionals working at an organization. It lets you take every action with certainty since there's a plan guiding every action. You can also easily understand when you're working towards business objectives.

- It helps formulate better strategies using a logical approach

A strategy is an approach you take towards achieving a business goal or objective. For instance, if your objective is to make a product a category leader in sales revenue by the year 2023, the strategy might be to persuade buyers that the product is the best in the market by investing in large advertisement campaigns for the product. Corporate planning helps you ease the process of formulating strategies since it follows a logical and methodical approach. It also eases the decision-making process.

- It increases communication between employees and employers

Corporate planning eases the group participation process for planning decisions. This leads to a better understanding of the plans and the strategies, which ensures that employees perform the tasks better. It also ensures that you get feedback from your team. Understanding the areas where they need help increases efficiency and improves overall workplace culture.

Now, Enters Incentive Travel as a Motivational Tool

While corporate planning sets the foundation for success, employee motivation plays a crucial role in achieving organizational goals. Incentive travel is a powerful tool that can significantly boost employee morale and contribute to goal achievement. Go Together DMC Brazil recognizes the importance of incentive travel as a means to reward and motivate employees.

- Recognition and Appreciation: Incentive travel serves as a tangible reward for employees who contribute to the success of the organization. It is a way of recognizing their efforts and expressing appreciation for their hard work.

- Team Building: Travel experiences create opportunities for team building and bonding. Shared adventures and experiences contribute to stronger team cohesion, fostering a positive and collaborative work environment.

- Enhanced Productivity: Motivated and engaged employees are more likely to be productive. Incentive travel acts as a catalyst for increased productivity by providing employees with a sense of purpose and accomplishment.

- Goal Alignment: Incentive travel programs can be designed to align with organizational goals. This ensures that the rewards offered are not only motivating but also contribute to the overall success of the company.

Corporate planning is the backbone of organizational success, providing a roadmap for sustainable growth and adaptability in a rapidly changing business environment. But incorporating incentive travel into corporate planning can be a game-changer for employee motivation and goal achievement.

Incorporating incentive travel into corporate planning transforms employee motivation from a mere concept into a tangible, transformative force. By recognizing the individuality of employees, fostering team collaboration, and aligning rewards with personal and organizational goals, business can create a motivated, engaged, and high-performing workforce. This, in turn, becomes a driving force behind the achievement of corporate objectives and long-term success.

Seeking advice from DMCs is a strategic move for companies looking to optimize their events and travel-related activities. Our team at Go Together DMC possess Brazil in-depth knowledge and expertise and a team skilled to offer invaluable solutions when it comes to navigating cultural nuances, understanding local regulations, and recommending unique experiences that may not be apparent to outsiders.

Contact us and let's start crafting an incentive travel perfectly aligned with your corporate plan. Brazil, with its unique blend of natural beauties, hospitality and cultural relevance, can be the game changer you and your company were looking for.

Recent posts

- The ROI of incentive travel: how to creating top-notch results

- Travel to Brazil: Best Destinations in March

- Slow Travel: Why Should You Consider It?

- Who needs a DMC?

- Immersive Travel: How to travel immersively?

Corporate planning

Corporate planning is one of the core tasks of management and controlling in a company. This term encompasses a large number of processes in which future structures or procedures are defined based on existing key figures. These defined measures should be implemented in realistic sub-periods in order to achieve the set goals. A software solution for corporate planning enables the implementation of all methods of planning internal and external influencing factors that affect a company.

4 Outline points of corporate planning

- Budget plan: summary of costs and revenues or profit or loss for the year.

- Balance sheet plan: summary of the build-up of liabilities and then the determination of the company capital

- Investment plan: summary of investments and deinvestments of fixed assets

- Financial plan: Summary of cash flows associated with these plans.

Before the introduction of CoPlanner, we worked with Excel. Here, multidimensionality was not available to the extent that it is currently possible. The different export markets, customers and the multitude of our products pushed the limits of Excel.

Integrated corporate planning with CoPlanner

With CoPlanner business planning is no art:

- more than 250 ready-made tables already in the standard solution

- more than 500 integrated formulas and functions

- more than 50 OLAP cubes

- free hierarchical structure per dimension

- move by drag & drop

Mask design

CoPlanner - layout as you like it:

- predefined standard masks for recording different planning activities

- free mask design for different user groups (e.g. sales, cost center, investment planning) via the mask designer

Freely selectable planning horizon

Rolling, sub- or multi-year planning on a monthly, quarterly and annual basis. CoPlanner knows no limits. Even daily data (e.g. from cash register systems in retail) can be displayed.

Scenario Manager

CoPlanner facilitates planning through simulations and different plan versions.

New budgeting approaches

CoPlanner - the new controlling style:

- Top down and bottom up planning

- Quick planning from actual or forecast data

- Wizard-driven distribution functions

- Trend calculations and key figure control

- Planning of individual elements

- Planning on one or more aggregate levels

Multidimensional planning

New dimensions in corporate planning: Based on OLAP cubes, all planning dimensions such as profit centers, cost centers, products, customers, regions, etc. can be freely defined. Mea-sures such as quantities, prices, absolute values, actual, plan and forecast data round off the planning information.

Customizing

New design dimensions with CoPlanner: With table designer, formula designer, masks and dimension designer, standard defaults can be changed at any time, but also supplemented as desired.

user-based security concept

Only defined authorized persons can access the data. Authorizations can be controlled via menu structures, dimensions, dimension elements and activity profiles (read/write).

Selection of an integrated Planning Software

If corporate planning is to be set up in the company or integrated planning is to be carried out, the question arises first: On which system will the planning be carried out, which software or IT tools will be used? According to the annual reports of the independent consultancy BARC , Excel is currently ranked number 1, but the professional planning tools, including CoPlanner, are becoming increasingly flexible and are relocating 100% of their software to the Web. With the use of professional software solutions for corporate planning, a much higher user satisfaction can be achieved in many areas than with Microsoft Excel .

STEP-Analysis

The internal and external influencing factors generally fall under the well-known STEP analysis, which deals with political, economic, social, legal and environmental factors. In business, it lists the factors of the individual categories, which can have an influence on the respective company. The use of this STEP analysis serves to closely examine a market and the associated market opportunities. Influencing factors that occur regularly are part of operational management. Meanwhile, those that affect events, opportunities, and challenges that are happening for the first time are now assigned to project management.

Corporate Planning is more than just ERP

Unlike enterprise resource planning (ERP), another framework is covered in corporate planning systems. Corporate planning systems address the resources that are barely available or unavailable to a business and the ability to create products or resources or provide services. It also takes account factors that positively or negatively impact the company's ability to perform these operations.

Industry Solutions for corporate Planning

CoPlanner is a specialist in the field of corporate planning and develops individual, innovative and sectoral solutions in partnership with its customers, supplemented by expert advice and training.

Learn more ...

Request a demo

Together we will discuss your professional requirements for business planning, consolidation , personnel cost planning, cost/performance accounting or reporting and we will show you the benefits of a standardized but flexible solution.

This website www.coplanner.com uses cookies. Some of them are technically necessary, while others help us to improve this website or provide additional functionality to visitors.

- Necessary cookies

- Statistics/Analysis

Required web technologies and cookies make our website accessible and usable for you. This concerns essential basic functionalities, such as the navigation on the website, the correct display in your internet browser or the request of your consent. Without these web technologies and cookies, our website will not function.

We want to constantly improve the user-friendliness and performance of our websites. For this reason, we use analysis technologies (also cookies) that pseudonymously measure and evaluate which functions and contents of our websites are used how and how often. On this basis, we can improve our websites for users.

Corporate Planning: An Essential Guide to Strategic Management

Table of Contents

Corporate planning is a vital component of strategic management, as it helps organizations identify their objectives and allocate resources to achieve them. In this blog, we will explore the nature and scope of corporate planning, the steps involved in the planning process, and the benefits of effective corporate planning.

What is Corporate Planning?

Corporate planning is the process of defining an organization’s mission, objectives, strategies, and tactics for achieving its goals. It involves assessing the current state of the organization, identifying opportunities and threats in the external environment, and developing a plan to guide the organization towards its desired future state.

The Steps Involved in Corporate Planning

Effective corporate planning requires a structured approach, which typically involves the following steps:

- Situation analysis: Assessing the internal and external environment of the organization to identify strengths, weaknesses, opportunities, and threats (SWOT analysis).

- Mission and objectives: Defining the organization’s purpose and desired outcomes.

- Strategy development: Identifying and evaluating strategic options, and selecting the most appropriate strategy for achieving the organization’s objectives.

- Action planning: Developing a detailed plan of action, including timelines, resource allocation, and performance metrics.

- Implementation: Executing the plan and monitoring progress towards the desired outcomes.

- Evaluation and control: Assessing the success of the plan and making adjustments as needed to ensure continued progress towards the desired outcomes.

The Benefits of Effective Corporate Planning

Effective corporate planning can provide a range of benefits for organizations, including:

- Clarity of purpose: Clearly defining the organization’s mission and objectives can help align all stakeholders around a common goal.

- Resource optimization: Identifying and prioritizing strategic initiatives can help organizations allocate resources effectively.

- Risk management: Assessing potential risks and developing contingency plans can help organizations prepare for unexpected challenges.

- Continuous improvement: Regular evaluation of progress and making adjustments as needed can help organizations continuously improve their performance and achieve their goals.

Corporate planning is an essential component of strategic management, as it helps organizations clarify their objectives and allocate resources effectively to achieve them. By following a structured approach to corporate planning, organizations can improve their performance, manage risks, and continuously improve their operations.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you! 😔

Let us improve this post!

Tell us how we can improve this post?

Advanced Strategic Management

1 Corporate Management: An Overview

- Nature and Scope of Corporate Management

- Corporate Planning

- Implementation of Corporate Plan

- Review and Evaluation of Corporate Plan

- Approches to Corporate Management

- Strategists and their role in Corporate Management

- Need for Corporate Management

- Corporate Management in Non Business Organisations

2 Corporate Policy

- Concept and Meaning of Corporate Policy

- Features of Corporate Policy

- Determinants of Corporate Policy

- Scope of Corporate Policy

- Policy Formulation Process

- Classification of Corporate Policy

- Importance of Corporate Policy

3 Intensive Growth Strategies

- Nature and Scope of Corporate Strategies

- Nature of Stability Strategy

- Expansion Strategies

- Expansion through Intensification

- Expansion through Integration

- International Expansion

4 Integrated and Diversification Growth Strategies

- Diversification

- Related Diversification (Concentric Diversification)

- Unrelated Diversification (Conglomerate Diversification)

- Rationale for Diversification

- Alternative Routes to Diversification

- Mergers and Acquisitions (M&A)

- Merger and Acquisition Strategy

- Reasons for Failure of Merger and Acquisition

- Steps in Merger and Acquisition Deals

- Mergers and Acquisitions: The Indian Scenario

5 Strategic Alliances

- Strategic Alliance Trends

- Factors Promoting the Rise of Strategic Alliances

- Types of Strategic Alliances

- Benefits of Strategic Alliances

- Costs and Risks of Strategic Alliances

- Factors Contributing to Successful Alliances

- Planning for a Successful Alliance

- Corporate Social Responsibility

6 Internationalization Process

- Reasons for Internationalization

- Stages of Internationalization

- Operating Advantages and Disadvantages of MNCs

- Models of International Trade

7 Evaluation of Markets and Risk Assessment

- Political, Financial and Economic Risks in International Business

- Risk Assessment

- Causes of Risk

- Risk Management Techniques

8 Entry into the International Markets

- Entry Strategies

- Government Involvement in Trade Restrictions and Incentives

9 IT and Strategy

- IT and Strategy

- Use of IT in Strategy Implementation

- IT for Innovation and Performance

- IT in Service Sector

10 Technology and R&D

- Technology and R&D in Organisations

- Features of Technology Package

- Competitive Strategy and Competitiveness

- Competitive Advantage and R&D

- Value Chain and Value Chain Analysis

- Development of R&D Strategy

- Steps Involved in Developing R&D Strategy

- Progress of R&D Organizations in Strategy Development

11 Knowledge Management (KM)

- Knowledge and Knowledge Management

- Sources of Knowledge

- Knowledge Creation

- Knowledge Management Framework

- Benefits of Knowledge Management

- Pioneers in Knowledge Management

- KM Initiatives in Indian Organizations

- Software for Knowledge Management

- Trends and Challenges in Knowledge Management

12 Innovation

- Concepts of Innovation and Creativity

- Factors Influencing Creativity and Innovation

- Characteristics of Innovative Organizations

- The Individual and Innovation Culture

- Fostering Creativity and the Creative Process

- Techniques for Enhancing Creativity

- Building Creative Organizations

- Company Programmes to Enhance Creativity

Essential Elements of a Dynamic Corporate Plan

Table of contents, is a corporate plan the same as a business plan, why does my business need a corporate plan, trends in creating corporate plan sets, strategic trade-offs.

In the dynamic and rapidly changing business landscape, staying on top of everything and continuously generating innovative ideas and strategies to drive your company’s progress can be overwhelming. This is where the significance of a well-crafted corporate plan becomes evident. Considered the guiding roadmap for your organisation, a strategic corporate plan helps support your company’s objectives, goals and the necessary steps to achieve them.

A strategic corporate plan is a comprehensive and forward-looking document that lays out the goals, objectives and actionable steps a company needs to take to develop its vision .

It serves as a blueprint, guiding the firm through the complexities of today’s business environment. By outlining clear goals and providing a strategy for success, the corporate plan organises thoughts and fosters a sense of urgency to propel the company forward.

Two fundamental planning approaches are often used when formulating a fair corporate plan: business and corporate planning. While they share the common objective of setting goals for a business, they serve distinct purposes. The development of a comprehensive corporate plan involves a systematic and in-depth assessment of the company’s current state, market conditions and long-term aim.

Business plan vs. corporate plan

Business plan.

It focuses on determining the “what” of your business. It involves formulating a comprehensive roadmap for your company’s present and future aspirations.

This initial planning phase is crucial for a thriving company, especially when launching a new business idea or introducing significant changes to your existing operations. Before delving into specific corporate strategies, you must establish a generalised business plan.

Key elements of a business plan:

- Company mission : Clearly define your company’s mission and purpose.

- SWOT analysis : Assess your company’s strengths and weaknesses to identify areas for development and improvement.

- Goal-setting : Outline short-term and long-term goals related to growth, finances, and other aspects.

Corporate Plan

Corporate planning is the “how” phase that comes after you set your business corporate plan goals. This step involves devising strategies and tactics to support your company’s mission and achieve the defined goals.

It addresses the practical steps needed to make the vision a reality. Key aspects of a strategic corporate plan:

- Alignment with a business plan : Ensure that the corporate plan aligns with the objectives and goals outlined in the business plan.

- Resource utilisation: Plan how you will leverage your company’s strengths and mitigate weaknesses to meet targets.

- Financial analysis: Use financial data, such as cash-flow statements and credit reports, to make informed decisions.

- Operational efficiency: Implement measures to enhance operational effectiveness and optimise business processes.

Long-term goals

Corporate planning involves setting a strategic vision and charting a course of action to achieve it within a specific timeframe. By establishing long-term goals, businesses can remain focused on their objectives while effectively utilising their resources and fostering a collaborative work environment.

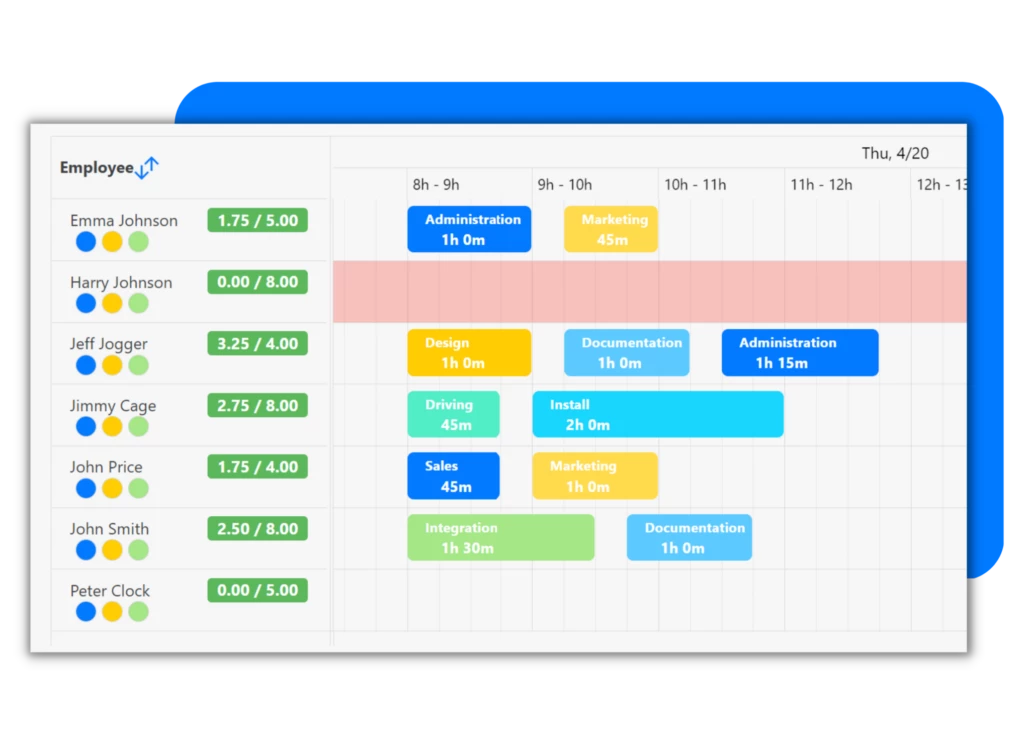

With TimeTrack’s’ Task Planner , businesses can break down their strategic vision into actionable tasks and assign them to relevant workforce or individuals. The tool helps set clear deadlines and track progress, enabling the organisation to stay on track, meet priorities and deliver on milestones in a timely manner.

Statista’s 2021 research reveals that a significant 51% of companies are not expanding their workforce as part of their thriving corporate strategy to cope with the current environment. This statistic underscores the urgency for companies to adopt effective corporate strategies to protect and enhance their adaptability in an ever-changing and volatile market environment.

Better decision-making

Strategic workforce planning enables quality decision-making that aligns with the company’s mission statement, promoting fairness throughout the organisation. It encompasses various aspects, including required employee skills and necessary equipment, helping firms hire the right talent, allocate funds wisely and invest in promising opportunities for success.

TimeTrack’s Time Clock facilitates better decision-making by streamlining administrative processes related to time tracking, payroll and attendance. With automated time tracking , firms can increase transparency and eliminate manual errors to ensure fair and accurate employee compensation, contributing to a positive work environment and fostering employee satisfaction.

A measure of success

Corporate planning is vital for measuring a company’s success in achieving its objectives. Regular evaluations and adjustments are made to overcome obstacles and enhance work processes, ensuring optimal efficiency, fairness, quality and efficacy.

Business process transformation is an integral part of a plan that measures an organisation’s success. As the firm evaluates its progress toward achieving its objectives, it identifies areas that need improvement, development or optimisation.

Cost savings for sustainable development

Corporate planning provides the advantage of creating fair budgets that lead to significant savings and ultimately support sustainable development. Through efficient budgeting, organisations can help deliver financial resources to essential projects, eliminate unnecessary expenses, increase income and ensure transparency in fund allocation.

A well-crafted strategic corporate plan acts as a roadmap, keeping the company on track to deliver and accomplish its ultimate objective without getting distracted. The mission statement, an integral part of corporate planning, conveys the organisation’s roles and goals and aims to ensure that the company maintains its direction and evaluates performance to reach its goals.

Creating a vision

Leaders must define the company’s objectives, mission and corporate values to establish a thriving corporate plan for the future. Involving key staff members in the visioning process ensures diverse perspectives and a well-rounded strategic mix. The central aim should look ahead for three to five years and serve as a blueprint for the organisation’s desired future position.

This process aims to create a clear direction for the company and align its actions with its overarching mission, prioritising fairness and inclusivity amongst all stakeholders. By setting clear aims, priorities and objectives, the company can stay focused on its long-term goals and make informed decisions that propel it toward success.

Resource allocation

Resource allocation is a critical aspect of strategic planning, involving both capital and support people. Efficient allocation requires careful consideration of critical factors for each type:

Capital resources

- Develop risk-adjusted returns by allocating resources across businesses.

- Analyse external opportunities, such as mergers and acquisitions, using capital resources.

- Distribute capital resources between internal projects and external opportunities.

People-based resources

- Position leaders and partners strategically to maximise their contribution and value.

- Ensure a steady supply of talent across all business units.

- Define core competencies and allocate resources accordingly.

Following these functions to support people and capital, resources ensure optimal utilisation across the organisation’s portfolio of services.

Setting functional objectives

The visioning aspects must be transformed into clear and actionable functional objectives. These objectives serve as guiding principles and priorities for employees at all levels and should be regularly reviewed to ensure success.

Incorporating a readiness plan is essential during the process of setting functional objectives. A well-prepared readiness plan ensures that transforming visioning aspects into clear, actionable objectives is smooth and effective. This plan involves identifying the necessary resources, training and support people at all levels of the organisation to align with the new objectives.

Organisational design

An effective organisational design supports multiple priorities within the organisation. This process involves aspects like quality reporting, delegation and structuring:

- Develop centres of excellence.

- Establish structures for governance.

- Define reporting structures, such as top-down or matrix reporting.

- Delegate authority appropriately.

- Allocate responsibilities to balance exposure and return levels.

- Integrate business units and eliminate redundancies through mergers.

- Break down significant commitments and initiatives into smaller projects.

- Determine decision-making processes (bottom-up or top-down).

- Balance business unit autonomy with authority over decisions in partners.

Considering these aspects ensures delivering a well-structured workforce and efficient organisational design.

Portfolio management

Portfolio management evaluates the organisation’s business units, interactions and decisions to enter or exit specific businesses. Key aspects of portfolio management include:

- Strategic planning for future opportunities and investments.

- Market assessment to support competitive advantages and portfolio balance.

- Decision-making on resource allocation among business units.

- Develop diversified companies for risk management.

- Determining the level of vertical integration.

Save time with our Time Clock

Improve your efficiency with TimeTrack

Strategic trade-offs serve three functions: creating incentives, generating cash and managing threats. Incentive structures play a vital role in managing risk and return levels. To deliver long-term success, it’s essential to separate risk management responsibilities from return generation.

High-risk strategies, such as true product differentiation or cost leadership, may lead to high returns. Successful execution and structured plans are essential for delivering these plays. Managing exposure effectively involves priorities like communication, transparency and autonomy for business units to develop and address comprehensive risk management strategies.

Organisations sometimes emulate other companies to mitigate threats and create viable opportunities, particularly in high-risk strategies like true product differentiation, which can lead to market leadership or collapse. These key aims guide decision-making and resource allocation, ensuring that the company optimises its potential for success while navigating potential challenges with informed and strategic approaches.

Corporate plan sets are a fundamental and integral activity that significantly contributes to develop an organisation’s goals through sustainable development.

At every level and department, clear and detailed strategies are implemented with the key aims in mind, and employees are assigned specific tasks and deadlines to follow. These tasks are executed under the guidance of leaders, partners, and mentors, ensuring successful completion for a thriving business, all while adhering to established guidelines. The organisation’s overarching aims serve as the driving force behind each strategic decision, creating a cohesive and purpose-driven work environment that propels the company toward its desired outcomes.

Being a digital marketer, I have been working with different clients and following strict deadlines. For me, learning the skill of time management and tracking was crucial for juggling between tasks and completing them. So, writing about time management and monitoring helps me add my flavor to the knowledge pool. I also learned a few things, which I am excited to share with all of you.

Time Tracking

- Absence Management Software

- Clock In System

- Time Attendance System

- Auto Scheduling

- Duty Roster

- Shift Planning

- Appointment Planning

- Task Planning

- Info Center

- Timesheet Templates

- Rota Templates

- Promotional Program

- Affiliate Program

- Success Stories

Corporate Planning

Corporate Planning may be defined as the process of deciding long term goals and objectives within the ambit of organisation’s strength and weaknesses in the existing and prospective environmental setting to ensure their achievement either by integrating the short term and long term plans or by adopting such measures which may bring even structural changes in the composition of the organisation, after taking recourse to financial resources.

Learn about:- 1. Introduction to Corporate Planning 2. Definitions of Corporate Planning 3. Characteristics 4. Scope 5. Need 6. Basic Premises 7. Factors for the Success of Corporate Planning

8. Major Practices 9. Process 10. Steps 11. Difference between Strategic Planning and Corporate Planning 12. Reasons which Lead to the Failure of Corporate Planning 13. Limitations.

Corporate Planning: Introduction, Definitions, Characteristics, Scope, Need, Process, Steps and Limitations

Corporate planning – introduction.

Corporate planning in a sense may be stated as Strategic Planning as described by a number of writers including Stenier. In spite of the difference in the concepts of long range planning and Corporate Planning. Stenier, Miner and Gray have used Corporate Planning and long range planning synonymously. Such conceptual similarity may not necessarily obliterate the conceptual difference between the two terms; we will maintain the difference for our analysis.

ADVERTISEMENTS:

D.E. Hussey while defining Corporate Planning stated that “Corporate long range planning, is not a technique, it is a complete way of running a business. Under it, the future implication of every decision is evaluated in advance of implementation. Standards of performance are set up beyond the time horizon of the annual budget. The company clearly defines what it is trying to achieve. A continued study is made of the environment in which the company operates so that the changing patterns are seen in advance and incorporated into the company’s decision process.”

According to Dr. Scott “Strategic Long range Planning is a systematic approach by a given company to making decisions about issues which are of fundamental and crucial importance to its continuing long term health and vitality. The fundamental and crucial importance of issues is derived from the fact that they provide an underlying and unifying basis for all other plans to be developed within the company, over a determinate period of time. Thus a long range strategy is designed to provide information about a company’s basic direction and purpose which will serve as a guide for all the operational activities of that company.”

Likewise, Professor Stoner states that “Strategic Planning is the process of selecting an organisation’s goals, determining the policies and strategic programmes necessary to achieve specific objectives enroute to the goals, and establishing the methods necessary to assume that the policies and strategic programmes are implemented.”

Stoner elaborates further the concept of strategic planning by making distinction with the operational planning. The distinction between the two may be summarised in a few words – “Whereas operational planning focusses on operating planning, problems such as present profit, present resources, environment, efficiency and even low risk, strategic planning focusses on long term survival and development. For this purpose, the emphasis shifts from present to future and from present operation to future growth and development. With the drift from present to future, there ought to be a change from the low risk to high risk.”

Peter Drucker defines corporate planning as a “continuous process of making entrepreneurial decisions systematically and with the least possible knowledge of their fraternity; organising systematically, the effort needed to carry out these decisions; and measuring the results against expectations through organised systematic feedback.”

If we analyse this definition it will contain the following elements to constitute Corporate Planning or Strategic Planning:

1. Laying down long range corporate goals and objectives.

2. Macro and Micro Environments.

3. Strengths and weaknesses of the organisation.

4. Integration between short term and long term plans.

5. Structural changes in the organisation.

6. Implementation of the plan.

7. Optimal use of scarce financial resources.

8 Evaluation of performance.

9. Feedback to make corporate planning more effective and purposeful.

Long term goals and objectives pertain to the areas of production, marketing, quality and even cost of production. In the area of production, the company may specifically spell out its goals regarding the volume of production, addition of new products or product lines. This decision may change the structure of the organisation. Similarly the marketing objectives may relate to market spread from domestic to international market.

To achieve the above goals and objectives, the organisation shall have to assess its strengths and weaknesses in relation to competitors and the market forces and other components of macro and micro environments.

After assessing the strengths and weaknesses in the prevailing and prospecting macro and micro environments, the corporation shall have two options before it – One – it may resort to an expansion programme to cope with the growing commitments to the objectives laid down; for this purpose it will be required to push forward the existing plan of action which amounts to integrating short term plans with long term plans.

Two-the other option may be diversification or technological upgradation. In both the cases some structural changes may be needed in the composition of the organisation.

The objectives of strategic planning is to achieve the desired long term objective/ goals by making the optimal use of the scarce resources in men and material.

Evaluation of the plan implementation is necessary to know from the feedback if the execution has been confronted with any blockade in implementing of the plan. If the bottlenecks are experienced they may be removed by taking suitable measures to achieve the desired objective with efficiency, in the light of the feedback received.

Corporate Planning – Definitions

Corporate planning is a sophisticated planning tool. It has been introduced into the corporate world recently, first in USA and later in all advanced industrial countries. A humble beginning has been made in India also. For example, BHEL practices corporate planning vigorously. In simple words, corporate planning is the determination of the long-term goals of a company as a whole and then developing plans to achieve these goals giving due weightage to environmental changes. It is planning for overall organisational performance.

Hussey defines corporate planning as, “the formal process of developing objectives for the corporation and its component parts, evolving alternative strategies to achieve these and doing this against a background of systematic appraisal of internal strengths and weaknesses and external environmental changes, the process of translating strategy into detailed operational plans and seeing that these plans are carried out.”

This is a comprehensive definition of corporate planning which includes deterministic, motivational and directional elements of corporate planning.

In the words of Steiner, “Corporate planning is the process of determining the major objectives of an organisation and the policies and strategies that will govern the acquisition, use and disposition of resources to achieve these objectives.”

According to Drucker, “Corporate planning is the continuous process of making present entrepreneurial (risk-taking) decisions systematically and with the best possible knowledge of their futurity, organising systematically the efforts needed to carry out these decisions; and measuring the results of these decisions against the expectations through organised systematic feedback.”

As per Drucker’s view, “Corporate planning is not confined to taking strategic decisions in the light of future conditions but is also concerned with the implementation of these decisions in the best possible way and undertaking periodic review of these decisions in the light of new development.”

Corporate planning is quite comprehensive as it includes – (i) strategic planning, (ii) operational planning and (iii) project planning.

Corporate Planning – Top 6 Characteristics

1. Corporate planning is a formal and systematic process.

2. It is a rational process. It requires imagination, foresight, reflective thinking, judgement and other mental facilities.

3. Corporate planning is a continuous process. It is a dynamic exercise that goes on throughout the company’s life.

4. Corporate planning has a long-term perspective.

5. Corporate planning provides an integrated framework within which each of the functional and departmental plans are tied together.

6. Corporate planning is basically concerned with the future impact of present decisions.

Corporate Planning – Scope

A corporation can be effective only if it can grapple successfully with the external environment (that is the society) in which it functions. Similarly, the corporation can function smoothly and efficiently only if it can deploy its material, manpower and methods in a way that they function with optimal efficiency.

Hence to be effective and efficient the corporation has to cope with external as well as internal environment. Hence corporate planning has two aspects, macro and micro; the former is concerned with the interaction with the external environment and the latter with the interaction with the internal environment. The scope of corporate planning in its macro (aggregative) and micro (functional) aspects has been discussed below-

Scope of Corporate Planning:

1. Aggregative (Macro) Aspects:

i. Economic- National Economic Projections — Technological Progress.

ii. Political- Policy towards private investment.

iii. Social- Social mores and attitudes towards pricing and income distribution.

iv. Regulatory- Government controls on imports and investment, repatriations and size of firms.

v. Competition- Relative growth rate of firms, future tax trends, government policy towards large-scale enterprise.

The need for and extent of corporate planning within any economy is governed basically by the factors.

Scope of Macro-Aspect of Corporate Planning:

1. Economic:

i. National Planning:

a. G.N.P. growth forecasts.

b. Inter sectoral plans.

c. Role of public and private sectors.

d. Monetary and fiscal policy.

e. Export prospects and balance of payments trends.

f. Credit policy.

g. Changes in price level.

ii. Demand:

a. Price policy.

b. Population growth rate.

c. Income-saving pattern.

d. Rate of urbanisation.

iii. Technological Planning:

a. State of indigenous technology.

b. Foreign collaboration and import of technology,

c. Facilities for research and development work.

iv. Availability of Resources:

a. Materials.

b. Manpower

c. Methods.

v. Infrastructure Facilities:

a. Transport.

c. Equivalent.

e. Finance.

2. Political:

i. Manifestoes of party in power and in opposition.

ii. Attitudes towards nationalization and the growth of public sector.

iii. Attitudes towards investors.

iv. Attitudes towards workers.

v. Interests of different pressure groups and lobbying.

vi. Donations to political parties.

i. Policies towards income distribution.

ii. Policies towards “Social pricing”.

iii. Attitudes towards consumption and savings.

iv. Attitude towards social responsibility of business.

v. Attitude towards environmental pollution.

4. Regulatory:

Government Regulations-

i. Industrial licensing.

ii. Foreign exchange.

iii. Capital and bonus issues.

iv. Competition policy.

v. Repatriation of capital/dividends.

vi. Tariff Commission.

5. Competitive:

i. Relative, growth rate of firms.

ii. Government policy towards large business houses.

iii. Tax policies.

iv. Competition for market and market structure.

v. Competition for control of scarce resources like materials, managerial manpower and finance.

vi. Competition from public and cooperative sectors

From the above discussion it is obvious that data on wide variety of topics and aspects has to be collected for coping with the external environment. This process of scanning the external environment is usually denoted by the term “monitoring of the environment”.

There is of course substantial inter-dependency among these various aspects, namely, economic, political, social regulatory and competitive. However, for a moment we may ignore this interdependency and consider the need for and scale of planning which are positive functions of all these factors.

The intensity of impact of each one of these factors varies from country-to-country, from industry-to-industry, from sector-to-sector, from unit-to-unit and, from time-to-time for the same unit. Hence, there is a real need to monitor the environment regularly and continuously.

In particular, one may note the distinctive differences in the developed and developing economics in this respect. In the developed economics, there is stiff competition for a share of the market and relatively less competition for resources. Whereas in developing countries there is not much likelihood of customer based competition.

Instead there is a stiff competition for claims on resources, especially materials, managerial manpower and finance. Further, in developed countries the corporations are giant-sized while government regulation is minimal. On the contrary, in developing countries the corporations are relatively smaller in size but government control and regulations are relatively large and oppressive.

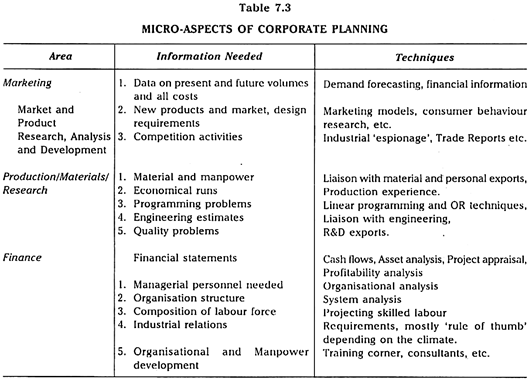

2. Functional (Micro) Aspects:

i. Marketing- New products, new markets, etc.

ii. Production- Technical problems, research.

iii. Materials- Quality, availability.

iv. Finance- Capital structure, sources, viability.

v. Manpower- Managerial, labour force projections, and development.

In addition it is necessary to note that the size of the corporation, the business in which it is engaged and the goals that it has set for itself are crucial factors which affect its planning whether macro or micro.

The second aspect of corporate planning is the “micro” to functional aspect. In broad terms the functional aspects of corporate planning embrace marketing, production and materials procurement, finance and personnel and manpower planning?

Corporate Planning – Major Practices

1. Definition of Corporate Goals:

Planning is a goal-oriented process. Hence, unless the goals are defined planning becomes impossible. Thus, the definition of corporate goals becomes the necessary and essential first step in corporate planning.

Since survival and growth are universally recognised as the basic goals of an organisation, they constitute the basic goals of a corporation as well, as corporation is essentially a social organisation. However, a corporation has multiple goals as objectives need to be identified in every single area in which the quality and effectiveness of performance of a corporation, directly and vitally affects its chances of survival and growth.

Peter F. Drucker has identified eight such key areas as follows:

i. Market standing

ii. Innovation

iii. Productivity

iv. Resources physical, financial and technological

v. Profitability

vi. Managerial performance and development

vii. Workers’ performance and attitude

viii. Public responsibility

2. Forecasting Change in Environment:

The effectiveness and efficiency of a corporation depends to a large extent on its ability to cope with the changing environment both macro and micro. Since the corporation has to survive and grow in a dynamic and ever changing society it is essential to look ahead and forecast the probable changes.

If the changes foreseen represent opportunities for the corporation, then the corporation can, through advance planning, seize the opportunity and exploit it to the maximum advantage of the company. On the contrary if unfavourable changes in environment are foreseen defensive action may be planned to minimise losses or disadvantages. Thus, whatever the nature of change if it is foreseen, the corporation can plan to benefit by this fore-knowledge.

3. Overall View:

It is necessary to recognise that the goals and perspective of individual divisions and departments as also the view of any grouping of divisions or departments is not the same thing as the perspective or viewpoint of the corporation as an integrated whole. The corporate perspective and the corporate goal is distinctly different from the individual perspectives and goals of departments and divisions or from any aggregation of such goals and perspectives.

4. Influence of Environment:

Since a corporation has to grapple both with the external environment as well as internal environment, corporate planning has to take into account the whole environment both internal as well as external. Thus, corporate planning takes into account both micro and macro-environment. This is essential because the efficiency and effectiveness of a corporation depends wholly on its ability to adjust to the environment in which it has to function.

Corporate Planning – Process

Corporate planning is a continuous phenomenon. To be specific planning may be stated as a “thinking process, an organised foresight and the vision based on fact and experience.” Planning is more important than the plan.

Corporate planning is a process, that is to say, it is an activity carried out in a sequence of steps taken in a certain order. Like any other complex process it consists of hundreds of steps, some of which may be so small as to advance the process only imperceptibly, while others may be so important that to omit them in describing the process would make the description unintelligible.

Plan is the culmination of a particular thought process. It is also important for the survival and growth of an organisation; but in the modern times, the corporation has to keep itself fully prepared in the competitive environment to meet every eventuality or threat.

Hence, planning becomes an unending process which goes on even after the execution of a particular plan. In other words, the plan ends but planning continues. Those organisations which are not involved in the constant planning process will lag behind in the race in a competitive market.

Constant thinking process leads to clarity about what is to be done or how it is to be done. It will lead to developing knowledge about the futurity which gives rise to the development of vision. The vision so developed will help Mangers to adopt such alternative course of action through which the corporate goal could be achieved with efficiency.

To make corporate planning successful, it becomes necessary to involve people operating at different levels. Their involvement will benefit the organisation in two ways – (i) their commitment and support for plan formulation and execution and (ii) their suggestions for making corporate planning more relevant and result oriented.

Dilating further on the efficacy of employee’s participation in decision-making, it may be stated that most difficult decisions could be taken without any problem. Some of the difficult issues may be resolved through turnaround strategy or switch over from labour intensive to capital intensive technology causing of retrenchment of such employees. Such decisions have been take in the past by DCM, ITC and SAIL.

Dismissal is the last rest in every act of gross indiscipline. To save the organisation, not one but many may be dismissed after taking consensus into account.

If the action is based on objective consideration with conviction, hardest decisions could be taken. Hence it may either be the dismissal of an employee or rustication of students from the University, such hard decisions are taken in the interest of organisations.

In certain cases even the employee is the party to his retrenchment.

Corporate planning, as already pointed out, starts with the formulation of mission, long term objectives and goals. Their long term goals and objectives may be laid down in the context of environmental setting. Within the limits of macro and micro environments strengths and weaknesses of the organisation are fully analysed in the paradigm of long term objectives and goals.

B.W. Denning has also laid emphasis on Environmental Appraisal. Instruments identified by him are markets competition, technology, economy, government, taxation etc.

These environments create opportunities and threats for different organisations existing in the country. In the light of the opportunities and threats an analysis of organisation’s strengths and weaknesses are ascertained which are necessary to achieve corporate goals. Estimation of corporate resources especially financial is an important condition for strategic planning.

Availability of material, machine and equipment are not sufficient; more important is the human resource. Hence, there is a need for the analysis of skill, capability and the competence profile of the employees of the organisation. Simultaneously key skills required for structural change in the organisation and functional processes ought to be identified and defined.

Study of long term objectives and goals will be incomplete without establishing a linkage between the long term objectives and goals and the operating/short term plans.

While discussing corporate planning, it becomes essential to state the status of tactical planning. Tactical planning is not a strategic or corporate plan. Corporate planning has two important elements – (i) Long term objectives and goals and (ii) structural changes in the organisational structure. Tactical planning does not fulfil any of these two conditions. It may be stated as the short term tactics to help realise the long term objectives and goals of the corporation.

The corporation is importing the machine and selling it in the market. Its long term objective is to manufacture every component and assemble them into a machine to sell in the market. One of the weaknesses of the corporation is that it does not have the needed skill and competence.

The corporation prepares a tactical plan. Under this plan, it makes the supplier agree to train its people for the sake of assembling the components and parts in the importing country. The know-how so obtained by the corporation’s people will be instrumental in realising the long term objective of producing the machine itself. This is tactical planning.

Next step in the process of strategic planning is development of strategic alternatives. These alternatives have been identified as (i) Expansion (ii) Diversification (iii) Integration (iv) Acquisition and Merger (v) Divestment and (vi) Liquidation.

Each of these alternatives has to be evaluated to find out its efficiency to achieve the desired organisational objectives and goals. The alternatives so selected will be implemented. The performance of the alternative course of action will be evaluated periodically which will provide the desired feedback to consider if some changes are necessary in the objectives and goals put forth by the organisation. As the long term objectives/goals are not generally changed casually, the feedback may be helpful in bringing about changes in the operational plans or even tactical plans.

Corporate Planning – 5 Major Steps

There are five major steps in corporate planning:

Step # 1. Environmental Scanning :

(a) External Environment:

Business environment is scanned to secure up-to-date information on opportunities and threats revealed by the changing environmental forces, such as customers, customer needs, competition, economic, social and political climate, ecology, and technology. The situation analysis indicates where we are, how we got here and where we are now going.

(b) Internal Environment:

Marketers must also have adequate knowledge of internal situation through self-analysis, i.e., on corporate strength and weakness. The corporate resources are the limitations on exploitation of marketing opportunities knocking at our door. The environmental opportunities may not become specific corporate opportunities.

Company opportunities constitute a set of marketing undertakings in which a particular company has competence and capability to enjoy the competitive benefit because of its particular and unique market approach. There should be a happy marriage between the company resources and company opportunities so that the marketer can accomplish the set corporate goals.

The internal and external environmental scanning offer us SWOT, i.e., Strengths and Weaknesses as well as Opportunities and Threats. Threats are considered as challenges to be met or overcome by strategic planning. Marketing information and research enables us to scan external environment. Sales audit and cost analysis enable us to study internal environment.

Step # 2. Defining Corporate Mission :

The statement of basic purpose or mission offers customer-oriented answers to a few questions, e.g., what is our business? Who is our customer? What is our goal? The mission focuses the attention on the fundamental customer needs.

Examples of Mission- What is our business?

i. Communication Co. We offer varied forms of reliable, efficient, cost-effective services in telecommunications.

ii. Xerox- We automate offices.

iii. Levi Strauss- In wearing garments we offer fashion, comfort and durability.

iv. Cosmetic Co. In the shops we sell hope.

Step # 3. Setting Objectives :

The mission answers the question, “What is our business?” The objectives answer the question, “What do we want to achieve?” Objectives must be clear, ambitious but realistic, measurable and time-bound. The mission points out the needs to be served. The objectives indicate performance standards, e.g., market share, profit, services, customer satisfaction, etc. Please note that objectives or goals are the desired or planned outcome.

Step # 4. Identifying Strategic Business Unit (SBU) :

Within a multi-product or multi-business corporation, we may have one or more business areas or SBU. In the corporation there may be more than six divisions but in reality we may have only three distinct businesses. Hence, for strategic planning, all divisions will be grouped into only three strategic business units.

The concept of SBU has unique importance in corporate strategic planning. The products that form a planning unit (SBU) should have, in common, major strategic features such as target markets, distribution channels/advertising, and sales force strategies. Thus, SBU is a separate division for a major product or a product line or a market in a multi-product or a multi-business organisation.

It is in charge of conducting situation analysis, determining marketing objectives, selecting target market, measuring the market and designing a strategic marketing-mix.

In order to identify SBU, a business is defined on the basis of consumer-orientation (not product-orientation) in terms of three dimensions- (1) Customer needs to be met, (2) Group of customers to be served, and (3) Product or service to fulfil those needs.

The SBU has three features- (1) It is a collection of related products meeting similar needs, (2) The unit has its own rivals and it wants to surpass them through best marketing strategies, (3) The manager of SBU organisation is directly responsible for strategic marketing planning, control and profits.

Each SBU manager is given a set of strategic planning goals and the requisite finance. The manager will present SBU marketing strategic plan to the corporation which will give its sanction with a few modifications, if essential. The manager of SBU will formulate a distinctive plan of marketing objectives and strategies, distinctive marketing-mix for the target market, i.e., chosen market segment. Each SBU will have its own distinct mission, competition and strategy.

The concept of SBU provides precise and practical direction to the process of corporate strategic planning. In India, SBU concept is adopted by big businesses in corporate strategic planning.

Step # 5. Selecting Appropriate Strategies :

Once the corporation has planned where it wants to go, the next step is to answer the question “How are we going to get there”? Corporate strategies supply the best answer to this vital question, viz., the best means to achieve the desirable goals and fulfill the mission.

There are four alternative strategies before the corporation or an SBU: