- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Accounting Articles

Cost Allocation

The process of identifying a company’s costs and assigning those costs to cost objects

Chris currently works as an investment associate with Ascension Ventures, a strategic healthcare venture fund that invests on behalf of thirteen of the nation's leading health systems with $88 billion in combined operating revenue. Previously, Chris served as an investment analyst with New Holland Capital, a hedge fund-of-funds asset management firm with $20 billion under management, and as an investment banking analyst in SunTrust Robinson Humphrey 's Financial Sponsor Group.

Chris graduated Magna Cum Laude from the University of Florida with a Bachelor of Arts in Economics and earned a Master of Finance (MSF) from the Olin School of Business at Washington University in St. Louis.

Currently an investment analyst focused on the TMT sector at 1818 Partners (a New York Based Hedge Fund), Sid previously worked in private equity at BV Investment Partners and BBH Capital Partners and prior to that in investment banking at UBS.

Sid holds a BS from The Tepper School of Business at Carnegie Mellon.

- What Is Cost Allocation?

- Types Of Costs

- How To Allocate Costs

- Why Do We Need To Allocate Costs?

- Examples Of Cost Allocation & Calculations

What is Cost Allocation?

Cost allocation is the process of identifying a company’s costs and assigning those costs to cost objects. Cost objects are the products, services, and activities of different departments of a company.

This process of allocating costs helps a business determine which parts of the company are responsible for what costs.

Sometimes it is difficult to draw the connection between allocated costs and their cost objects. When this happens, companies can use spreading costs.

Spreading costs occur when businesses spread the responsibility for production expenses across various areas.

When businesses can accurately allocate their costs, they are able to easily assess what particular cost objects are creating profits and losses for the company. On the other hand, if businesses are unable to allocate their costs correctly, their profit and loss calculations will be off.

Also, businesses must charge a price for their goods and services that covers their expenses and allows them to make a profit.

Intuitively, one can recognize the importance of cost allocation for the optimal performance of a company. Incorrect cost allocation calculations are extremely detrimental to any business and disrupt the ability to operate properly.

Cost allocation is necessary for any business, but as companies get larger and more complex, it becomes even more important to allocate costs accurately.

Key Takeaways

Cost allocation is fundamental and necessary for any business, big or small.

It helps with assessing profits and losses and the management of staffing.

Cost allocation allows companies to explain the pricing of their goods and services to customers.

Allocating costs is necessary for companies to maintain efficiency and financial accountability.

Types of Costs

Companies have various types of costs, and it is important to be able to distinguish between the different types when allocating them.

We can break them down into a few different categories.

- Direct costs: direct costs are those that can be traced to a certain product or service offered by a company. Included in direct costs are materials and labor that go into the production of a good.

- Indirect costs : these expenses are those that go into the production of a good but do not have a connection to a specific cost object. Examples of indirect costs include rent, utilities, and office supplies.

- Fixed costs : these costs remain constant, regardless of a company’s production volume. (e.g., rent)

- Variable costs : these costs increase or decrease as a company’s volume of production changes (e.g., supplies).

- A few examples of fixed overhead costs include rent, insurance, and workers’ salaries. Variable overhead costs include supplies and energy expenses, which both change as the volume of production increases or decreases.

How to Allocate Costs

Now that we understand the different types of costs, we can better understand the processes involved in cost allocation. Regardless of what good or service a company produces, the process remains consistent across industries.

- Identify Cost Objects : anything within a business that creates an expense is considered a cost object. The first step for allocating costs is to note all the cost objects of your company.

Electricity usage

Water usage

Fuel consumption

- Fixed cost allocation: this method assigns particular direct costs with cost objects. Drawing direct connections between costs and cost objects makes this method one of the most simple.

- Proportional allocation: proportional allocation deals with the distribution of indirect costs across associated cost objects. Sometimes proportional allocation divides costs equally across cost objects, while other times, it considers other factors (i.e., size) and divides costs accordingly.

- Activity-based allocation: this method is commonly considered the more accurate method of allocating costs. Activity-based allocation utilizes precise documentation to determine costs within departments and allocates the costs appropriately.

Why Do We Need to Allocate Costs?

A company must allocate its costs in order to optimize its business activities.

Recognizing Profits And Losses

Understanding the distribution of expenses helps companies analyze which areas of their business may be profitable or which areas may be causing a loss. This allows companies to determine whether or not certain expenses can be justified or not.

Companies do not know how much to charge the customer’s goods and services without cost allocation. Once non-profitable cost objects are identified, companies can cut expenses in those departments and focus their efforts on profitable cost objects.

Management Decisions

Cost allocation is also important for a company to manage its staff. In areas where the company is not profitable, it can evaluate the staff performance of that department. Often, the losses incurred by part of a company are due to the underperformance of employees.

Similarly, companies can analyze the allocation of their costs to determine where they are profitable and award the employees of that department.

Using cost allocation to motivate employees offers the administration of a company an objective, quantitative justification for their management decisions.

Transfer Pricing

Transfer pricing is the practice of charging for goods and services at an arm's length. The practice is used by departments the organization to charge for the goods and services exchanged within the same firm.

Cost allocation is vital for deriving transfer pricing, the exchange price of goods or services between two companies.

Examples of Cost Allocation & Calculations

Now we understand cost allocation, the different types, and why we need it. Here are several examples of different ways a company might allocate its costs.

Example 1: Square Footage

Christina’s business has an office and a manufacturing space. The square footage of the office is 1,000 square feet, and the manufacturing space is 1,500 square feet. The rent for the two spaces is $10,000 per month. The company will allocate the rent expense between the two spaces.

$10,000 (rent) / 2,500 square feet = $4 per square foot

- Calculate the rental cost for the office

$4 x 1,000 = $4,000

This means that Christina will allocate $4,000 of the rent to the office.

- Calculate the rental cost for the manufacturing space

$4 x 1,500 = $6,000

This means that Christina will allocate $6,000 of the rent to the manufacturing space.

Example 2: Units Produced

Alex’s manufacturing company makes water bottles. In January, Alex produced 5,000 water bottles with direct material costs of $2.50 per water bottle and $3.00 in direct labor costs per water bottle.

Alex also had $6,500 in overhead costs in January. Using the number of units produced as his allocation method, Alex can calculate his overhead costs using the overhead cost formula.

- Calculate the overhead costs:

$6,500 / 5,000 = $1.30 per water bottle

- Add the overhead costs to the direct costs to find the total costs:

$1.30 + $2.50 + $3.00 = $6.80 per backpack

So, Alex’s total costs in January were $6.80 per backpack. If Alex had not allocated the overhead costs, he would have most likely underpriced the backpacks, which would have resulted in a loss of income.

Everything You Need To Build Your Accounting Skills

To Help you Thrive in the Most Flexible Job in the World.

Researched and authored by Rachel Kim | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Accounting Ratios

- Amortization

- Depreciated Cost

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Module 5: Job Order Costing

Introduction to accumulating and assigning costs, what you will learn to do: assign costs to jobs.

Financial and managerial accountants record costs of production in an account called Work in Process. The total of these direct materials, direct labor, and factory overhead costs equal the cost of producing the item.

In order to understand the accounting process, here is a quick review of how financial accountants record transactions:

Let’s take as simple an example as possible. Jackie Ma has decided to make high-end custom skateboards. She starts her business on July 1 by filing the proper forms with the state and then opening a checking account in the name of her new business, MaBoards. She transfers $150,000 from her retirement account into the business account and records it in a journal as follows:

For purposes of this ongoing example, we’ll ignore pennies and dollar signs, and we’ll also ignore selling, general, and administrative costs.

After Jackie writes the journal entry, she posts it to a ledger that currently has only two accounts: Checking Account, and Owner’s Capital.

Debits are entries on the left side of the account, and credits are entries on the right side.

Here is a quick review of debits and credits:

You can view the transcript for “Colin Dodds – Debit Credit Theory (Accounting Rap Song)” here (opens in new window) .

Also, this system of debits and credits is based on the following accounting equation:

Assets = Liabilities + Equity.

- Assets are resources that the company owns

- Liabilities are debts

- Equity is the amount of assets left over after all debts are paid

Let’s look at one more initial transaction before we dive into recording and accumulating direct costs such as materials and labor.

Jackie finds the perfect building for her new business; an old woodworking shop that has most of the equipment she will need. She writes a check from her new business account in the amount of $2,500 for July rent. Because she took managerial accounting in college, she determines this to be an indirect product expense, so she records it as Factory Overhead following a three-step process:

- Analyze transaction

Because her entire facility is devoted to production, she determines that the rent expense is factory overhead.

2. Journalize transaction using debits and credits

If she is using QuickBooks ® or other accounting software, when she enters the transaction into the system, the software will create the journal entry. In any case, whether she does it by hand or computer, the entry will look much like this:

3. Post to the ledger

Again, her computer software will post the journal entry to the ledger, but we will follow this example using a visual system accountants call T-accounts. The T-account is an abbreviated ledger. Click here to view a more detailed example of a ledger .

Jackie posts her journal entry to the ledger (T-accounts here).

She now has three accounts: Checking Account, Owner’s Capital, and Factory Overhead, and the company ledger looks like this:

In a retail business, rent, salaries, insurance, and other operating costs are categorized into accounts classified as expenses. In a manufacturing business, some costs are classified as product costs while others are classified as period costs (selling, general, and administrative).

We’ll treat factory overhead as an expense for now, which is ultimately a sub-category of Owner’s Equity, so our accounting equation now looks like this:

Assets = Liabilities + Owner’s Equity

147,500 = 150,000 – 2,500

Notice that debits offset credits and vice versa. The balance in the checking account is the original deposit of $150,000, less the check written for $2,500. Once the check clears, if Jackie checks her account online, she’ll see that her ledger balance and the balance the bank reports will be the same.

Here is a summary of the rules of debits and credits:

Assets = increased by a debit, decreased by a credit

Liabilities = increased by a credit, decreased by a debit

Owner’s Equity = increased by a credit, decreased by a debit

Revenues increase owner’s equity, therefore an individual revenue account is increased by a credit, decreased by a debit

Expenses decrease owner’s equity, therefore an individual expense account is increased by a debit, decreased by a credit

Here’s Colin Dodds’s Accounting Rap Song again to help you remember the rules of debits and credits:

Let’s continue to explore job costing now by using this accounting system to assign and accumulate direct and indirect costs for each project.

When you are done with this section, you will be able to:

- Record direct materials and direct labor for a job

- Record allocated manufacturing overhead

- Prepare a job cost record

Learning Activities

The learning activities for this section include the following:

- Reading: Direct Costs

- Self Check: Direct Costs

- Reading: Allocated Overhead

- Self Check: Allocated Overhead

- Reading: Subsidiary Ledgers and Records

- Self Check: Subsidiary Ledgers and Records

- Introduction to Accumulating and Assigning Costs. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Colin Dodds - Debit Credit Theory (Accounting Rap Song). Authored by : Mr. Colin Dodds. Located at : https://youtu.be/j71Kmxv7smk . License : All Rights Reserved . License Terms : Standard YouTube License

- What the General Ledger Can Tell You About Your Business. Authored by : Mary Girsch-Bock. Located at : https://www.fool.com/the-blueprint/general-ledger/ . License : All Rights Reserved . License Terms : Standard YouTube License

Privacy Policy

Cost Allocation: The Key to Understanding Financial Efficiency

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Cost Allocation Definition

Cost allocation is a financial accounting process that involves assigning various costs incurred by a business to the specific activities or elements used or benefitted from incurring these costs. Its purpose is to accurately represent the financial contribution of different parts of a business, providing insights into areas of efficiency or inefficiency, ultimately contributing to pricing and strategic decisions.

Methods of Cost Allocation

There are several methods of cost allocation that organizations can employ, each with their own merits and applications based on the specific circumstances, requirements, and objectives of the business.

Direct Allocation

Direct allocation, sometimes referred to as the direct method, is the most straightforward approach to cost allocation. Simply put, this method entails assigning costs directly to the appropriate cost objects, such as departments, products, or services, without taking into account whether those costs were incurred by multiple cost objects.

This method is predominantly used in situations where it is relatively easy to identify the specific cause-and-effect relationship between incurred costs and cost objects. Thus, it is particularly suitable for settings where resources are worn-out by specific departments, products, or services.

Step-Down Allocation

In contrast to direct allocation, the step-down method, also known as the sequential method or the stair-step method, allows for a more comprehensive spread of costs. This method begins with allocating the costs of the service department that provides the most services to other service departments. The total cost of each service department, including the allocated costs, is allocated step-by-step until all service departments have been allocated.

The step-down method is useful in situations where there are multiple service departments and some serve others more than they are served. It allows for a more distinct tracing of costs, improving the accuracy of indirect cost allocation. However, it can be somewhat arbitrary in terms of deciding which department's costs should be allocated first.

Reciprocal Allocation

The reciprocal allocation method, also known as the simultaneous or algebraic method, is the most accurate and complex of the allocation methods. It accurately accounts for the mutual services provided among service departments.

The use of reciprocal allocation is recommended in situations where an organization has service departments that provide significant amounts of mutual services to each other. Although it requires a certain level of mathematical sophistication, this level of detail and precision can yield more accurate cost assignments and can facilitate better decision-making.

Remember, the key is for an organization to select the method that best fits its unique settings, demands, and operational stipulations. Each method has its own strengths and weaknesses, and hence a well-informed decision is critical to optimally assign costs and enhance economic efficiency.

Criticality of Cost Allocation

Understanding the criticality of cost allocation goes beyond just marking it as a method of sharing costs. It plays a substantial role in the effective operation of a business in various ways:

Accurate Product Cost

One of the main benefits of cost allocation is achieving accurate product cost. With costs properly allocated, the actual costs incurred in producing a given product or service are easily identifiable. This not only facilitates pricing decisions, but also measures the profitability of each product or service. An inaccurate cost allocation can lead to distorted product costs. This could mean over-pricing, which can discourage customers, or under-pricing, which could lead to business losses.

Operational Efficiency

Cost allocation assists in measuring operational efficiency. For example, if a particular department is consistently exceeding its allocated budget, it might be a sign that the operations in that department are not as efficient as they should be. Management can then delve into the department's operations to identify and rectify the inefficiencies. By allocating and reviewing costs, businesses can highlight areas of wastage, inefficiency, and potential improvement.

Meaningful Financial Reports

Lastly, cost allocation supports the generation of meaningful financial reports. Such reports provide deep insights to stakeholders – be it managers, investors, or creditors. They relay important information about business performance, profit generation, asset utilisation and cost management. Without proper cost allocation, these reports could be misleading, making it difficult for stakeholders to make informed decisions.

In conclusion, cost allocation is not merely an accounting formality, but a tool that can significantly impact a company's ability to accurately price products, operate efficiently, and provide meaningful financial information. Its criticality in business operations cannot be overstated.

Cost Pools and Cost Drivers in Cost Allocation

In cost allocation, consistency and accuracy are paramount. And two concepts play a significant role in ensuring this: Cost Pools and Cost Drivers .

Role of Cost Pools in Cost Allocation

Cost pools are essentially aggregations of individual costs that relate to a specific task or factor. They play an essential role in simplifying the cost allocation process. Rather than assigning may individual costs to specific products, services, or departments, firms organize these costs into cost pools that can be allocated based on a common denominator – the cost driver.

Role of Cost Drivers in Cost Allocation

Cost drivers are the actual basis upon which these costs are allocated. They are units of activity or volume that cause a business to incur costs. Typical cost drivers include direct labor hours, machine hours, or units produced. Cost drivers serve as a measure of resource consumption and establish an ongoing basis of measurement for the cost pool.

Connection Between Cost Pools and Cost Drivers

The allocation of cost pools across different departments or products is driven by these cost drivers. In essence, cost drivers provide the linkage between the collected costs (cost pools) and the segments to which those costs are assigned. They provide a consistent basis for distributing costs in the cost pool to the relevant cost objects.

Selecting Appropriate Cost Drivers

Choosing the right cost driver is crucial for accurate cost allocation. Firms should select cost drivers that have a strong correlation with the root cause of costs. This is often derived through a cause-and-effect relationship. For instance, if a factory's costs are primarily driven by machine operations, then 'machine hours' might be an appropriate cost driver.

Likewise, if a service-based organization incurs more costs due to labor, 'labor hours' could serve as the key cost driver. Firms need to ensure that chosen cost drivers reflect a degree of variance. If certain costs have little variability, regardless of changes in the driver, that driver may not be appropriate.

In summary, cost pools and cost drivers are critical elements of the cost allocation process. They enable firms to aggregate related costs and to distribute them in a consistent, fair manner based on a measurable factor. The careful selection of cost drivers ensures that costs are allocated in a way that accurately reflects the realities of an organization's operations.

Cost Allocation in Decision Making

Cost allocation in decision making is integral to multiple areas of a business. A few of these areas, such as pricing, budgeting, and investment decisions, leverage cost allocation heavily.

Role of Cost Allocation in Pricing

In most businesses, pricing decisions directly involve cost allocation. To competitively price a product or a service, firms must divide the total costs into units of a product or service. This process allows them to determine the minimum price to cover the costs and achieve the desired profit margin.

For instance, a manufacturing company using varied types of raw materials, labor, and machinery might initially find it difficult to ascertain the price of one finished unit. Cost allocation, however, provides a mechanism to allot each cost element to each unit. Thus, unit costs drive the ultimate pricing decisions and influence the firm's competitiveness in the market place.

Impact of Cost Allocation on Budgeting

Cost allocation affects budgeting, virtually shaping every financial decision a company makes. Businesses, with clarity on cost division across departments, processes, or products, can plan budgets more effectively. They can identify which areas are cost-intensive and adjust the budget proportionately. Without the right cost allocation, a budget may not accurately reflect the financial resources needed or generated by different business segments.

For example, an IT company might allocate shared costs like server expenses, software license fees, and maintenance costs based on the users or usage in different departments. This allocation helps formulate realistic budgets, ensuring cost efficiency and operational effectiveness.

Cost Allocation and Investment Decisions

Investment decisions constitute another crucial area where cost allocation aids informed decision-making. When evaluating the profitability of an investment opportunity, whether it’s a new project, acquisition, or expansion, companies must understand the associated costs thoroughly.

By correctly allocating costs, companies can more accurately calculate potential returns, leading to more informed investment decisions. Misplacing or underestimating costs might mistakenly make an unprofitable investment appear profitable, resulting in detrimental financial outcomes.

In summary, the process of cost allocation serves to bridge the gap between operational activities and financial management. This linkage is vital in making strategic business decisions, from setting product prices to planning budgets to making investment decisions. Therefore, understanding cost allocation is fundamental to business' financial success.

Challenges and Criticisms of Cost Allocation

Despite their usefulness, implementing cost allocation methods can often be fraught with several challenges. Some of these obstacles are intrinsic to the process of allocation, such as the complexity of accurately tracing costs to specific cost objects and the subjectivity inherent in some allocation bases.

Arbitrary Allocation

One frequent criticism is the arbitrariness of some allocative decisions. For instance, in the allocation of indirect costs, the choice of allocation base (e.g., labor hours, machine hours, etc.) can be somewhat subjective. Some critics argue that this introduces a degree of arbitrariness that may distort the true cost picture.

While there is no perfect solution to this problem, efforts can be made to ensure that the chosen allocation bases are logical and justifiable given the nature of the costs being allocated. Some organizations may also choose to use multiple allocation bases for different types of costs to minimize this arbitrariness.

Overemphasis on Full Costing

Another criticism of cost allocation is its overemphasis on full costing. Full costing attempts to assign all costs, both direct and indirect, to cost objects. However, this approach can lead to the inclusion of irrelevant costs in decision-making processes, which might not add any value. For example, the inclusion of fixed costs, which are incurred regardless of the level of output, may not be helpful in short-term pricing decisions.

In response to this, some firms might opt to use variable costing as a supplement, which includes only those costs that change with production volume. This can provide a more relevant basis for operational and tactical decision-making.

The Use of Assumptions

Different cost allocation methods rely on different assumptions. These assumptions may not always hold true and can lead to inaccurate cost data. For example, the assumption of cost homogeneity in a cost pool may lead to inappropriate allocations if the costs in the pool are driven by different activities.

To mitigate this, it's essential to carefully examine and validate the assumptions underlying a chosen allocation method. Continuous review and refinement of cost pools and allocation bases can also help in keeping allocations realistic and meaningful.

Inaccurate Estimations

Cost allocations also rely heavily on estimations. Inaccurate estimations can lead to over or under-allocation of costs.

To address this challenge, organizations can develop robust estimation methods and validate their cost estimates periodically. This will not only reduce inaccuracies but also enhance the credibility of the cost data generated.

In conclusion, while cost allocation is not without its challenges and criticisms, these can be managed and mitigated through thoughtful and informed management practices. Regular reviews and audits, coupled with the use of technological tools for data collection and analysis, can further enhance the accuracy and relevance of cost allocation in an organization.

Principles of Cost Allocation within a Business Entity

Cost allocation within a business entity should uphold certain principles for the process to be fair, efficient, and effective. The guiding principles of cost allocation are causality, benefits received, fairness, and ability to bear.

Causality refers to the direct correlation between costs incurred and the activities leading to them. When a certain activity or set of activities within an organization results to specific costs, the principle of causality suggests that these costs should be allocated to that activity or activities. This kind of cost allocation allows businesses to link each cost with the function that drives it, making it easier to manage costs and improve profitability.

Benefits Received

The principle of 'benefits received' posits that costs should be shared among departments or units depending on the extent to which they benefit from the cost pool. If a department derives more value from a resource or service, then it should bear a higher proportion of the cost. Consequently, such a sideways view of cost allocation can incentivize departments to be more efficient in how they use shared resources or services.

Fairness is a crucial principle in cost allocation. The goal is to distribute costs in a manner that all departments or units perceive as just. This rarely means each department pays an equal share of the costs; rather, the distribution takes into account factors like usage, value derived, and department size. Unfair allocation could demoralize departments or units, leading to internal conflicts and reduced productivity.

Ability to Bear

The 'ability to bear' principle suggests that costs should be allocated considering the unit's capacity to absorb the cost. Here, larger or more profitable departments may shoulder a larger share of the costs. However, it is important that the application of this principle does not stifle the growth potential of smaller or less profitable units.

These principles aim to allocate costs in a way that reflects the operational realities of an organization while promoting fairness and operational efficiency. By adherently diligently to these principles, an organization can ensure a seamless and fair cost allocation process.

Cost Allocation and Its Implications on CSR and Sustainability

Correlation between Cost Allocation and CSR Efforts

Cost allocation plays a significant role in a company's Corporate Social Responsibility (CSR) efforts. Resources, both tangible and intangible, are frequently limited within organizations. The allocation of these resources can either inhibit or promote CSR activities. If CSR is not viewed as a business priority, resources may not be allocated sufficiently to develop and implement effective initiatives. Conversely, if an organization is committed to its CSR responsibilities, it will allocate costs accordingly to ensure its efforts are adequately funded and supported.

Inappropriately allocating costs could lead some stakeholders to wrongly believe that an organization is not committed to its CSR responsibilities. Therefore, cost allocation not only influences the actual implementation of CSR measures but also political and public perceptions of an organization’s ethical and social responsibilities.

Impact of Cost Allocation on Sustainability Measures

Sustainability measures are another key area impacted by cost allocation. When it comes to sustainability reporting, cost allocation is essential. The amount of funds set aside for these initiatives can boost a company's green programs or alternatively limit their scope. This can vary from energy-efficient modifications to the infrastructure, reduction in waste production to policy changes that minimize an organization’s environmental footprint.

The strategic decision-making process is a critical area where the effects of cost allocation are evident. If sustainability is significant for an organization, the costs associated with these measures will likely be prioritized in strategic decisions. Leaders must consider both short-term financial implications and long-term societal and environmental impacts. Particularly, these decisions bear a direct influence on the company's reputation and sustainability.

Moreover, cost allocation decisions have a bearing on the company's external communication as well. Specifically, when it comes to issuing sustainability reports, the allocation of costs provides an explicit representation of the company's commitment to sustainable practices.

Making strategic decisions with sustainability implications in mind could increase costs in the short-term but prove beneficial and cost-saving in the long run. Therefore, it is essential that decision-makers view cost allocation as not just a financial concern but a critical aspect of their CSR and sustainability efforts.

Cost Allocation as a Reflection of Organizational Priorities

Through the lens of CSR and sustainability, the implications of cost allocation are evident in the allocation decisions made by an organization. How a company chooses to allocate its costs is a reflection of its values and priorities. If sustainability and ethics are prioritized, cost allocation will support corresponding initiatives. If not, cost allocation can inadvertently communicate non-commitment to external stakeholders, potentially adversely affecting the organization's reputation and market position.

Cost Allocation across Different Industries

Although cost allocation is a universal concept in all kinds of businesses, the way it is implemented can differ significantly between industries.

The Manufacturing Industry

For the manufacturing sector, cost allocation is primarily linked with material costs, labor costs, and overhead expenses, which are apportioned to individual products. By allocating costs following these categories, companies are better positioned to price their products accurately. For instance, in direct material cost allocation, a manufacturing company can include the expenditures related to raw materials required to produce a particular product.

However, this straightforward approach can face complications when dealing with shared or indirect costs. For example, in a factory that builds both toasters and microwaves, how would one allocate the cost of shared raw materials, like steel or energy used in the factory? It becomes even more complex with overhead costs like salaries of administrative staff and, maintenance and depreciation of machinery, where a direct relationship between the cost and product isn’t apparent.

The Service Industry

On the other hand, within the service industry, cost allocation is traditionally more abstract. Labor cost is typically the most significant category, but costs associated with physical resources, like office spaces or computer equipment, also become relevant. Unlike manufacturing, services can't inventory their output in advance of demand. Service industries often allocate costs according to service hours provided or the number of clients served, but this also raises unique challenges.

For instance, a law firm may find it challenging to allocate the cost for a lawyer who handles various cases simultaneously. Similarly, a hospital might struggle with cost allocation for shared resources, such as an MRI machine used by multiple departments. These challenges necessitate creative and fair methods to spread costs and ensure profitability.

The Retail Industry

In the retail industry, purchasing and storing inventory comprise a significant portion of costs. Transportation costs, warehouse expenses and inventory buying costs are examples of costs that are allocated across various products. However, deciding on an allocation basis can be complex. While using sales volume might seem the easiest route, it might distort cost allocation for slow-moving or seasonal products.

As seen above, the cost allocation methods differ across industries due to their operational divergences, and each faces its unique set of challenges. Therefore, it's crucial for a business to understand the approach that works best for its industry and specific situation.

Share this article with a friend:

About the author.

Inspired Economist

Related posts.

Accounting Close Explained: A Comprehensive Guide to the Process

Accounts Payable Essentials: From Invoice Processing to Payment

Operating Profit Margin: Understanding Corporate Earnings Power

Capital Rationing: How Companies Manage Limited Resources

Licensing Revenue Model: An In-Depth Look at Profit Generation

Operating Income: Understanding its Significance in Business Finance

Cash Flow Statement: Breaking Down Its Importance and Analysis in Finance

Human Capital Management: Understanding the Value of Your Workforce

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Start typing and press enter to search

- Cost Classifications

- Relevant Cost of Material

- Manufacturing Overhead Costs

- Conversion Costs

- Quality Costs

- Revenue Expenditure

- Product Cost vs Period Cost

- Direct Costs and Indirect Costs

- Prime Costs and Conversion Costs

- Relevant vs Irrelevant Costs

- Avoidable and Unavoidable Costs

- Cost Allocation

- Joint Products

- Accounting for Joint Costs

- Service Department Cost Allocation

- Repeated Distribution Method

- Simultaneous Equation Method

- Specific Order of Closing Method

- Direct Allocation Method

Cost allocation is the process by which the indirect costs are distributed among different cost objects such as a project, a department, a branch, a customer, etc. It involves identifying the cost object, identifying and accumulating the costs that are incurred and assigning them to the cost object on some reasonable basis.

Cost allocation is important for both pricing and planning and control decisions. If costs are not accurately calculated, a business might never know which products are making money and which ones are losing money. If cost are mis-allocated, a business may be charging wrong price to its customers and/or it might be wasting resources on products that are wrongly categorized as profitable.

Cost allocation is a sub-process of cost assignment , which is the overall process of finding total cost of a cost object. Cost assignment involves both cost tracing and cost allocation. Cost tracing encompasses finding direct costs of a cost object while the cost allocation is concerned with indirect cost charge.

Steps in cost allocation process

Typical cost allocation mechanism involves:

- Identifying the object to which the costs have to be assigned,

- Accumulating the costs in different pools,

- Identifying the most appropriate basis/method for allocating the cost.

Cost object

A cost object is an item for which a business need to separately estimate cost.

Examples of cost object include a branch, a product line, a service line, a customer, a department, a brand, a project, etc.

A cost pool is the account head in which costs are accumulated for further assignment to cost objects.

Examples of cost pools include factory rent, insurance, machine maintenance cost, factory fuel, etc. Selection of cost pool depends on the cost allocation base used. For example if a company uses just one allocation base say direct labor hours, it might use a broad cost pool such as fixed manufacturing overheads. However, if it uses more specific cost allocation bases, for example labor hours, machine hours, etc. it might define narrower cost pools.

Cost driver

A cost driver is any variable that ‘drives’ some cost. If increase or decrease in a variable causes an increase or decrease is a cost that variable is a cost driver for that cost.

Examples of cost driver include:

- Number of payments processed can be a good cost driver for salaries of Accounts Payable section of accounting department,

- Number of purchase orders can be a good cost driver for cost of purchasing department,

- Number of invoices sent can be a good cost driver for cost of billing department,

- Number of units shipped can be a good cost driver for cost of distribution department, etc.

While direct costs are easily traced to cost objects, indirect costs are allocated using some systematic approach.

Cost allocation base

Cost allocation base is the variable that is used for allocating/assigning costs in different cost pools to different cost objects. A good cost allocation base is something which is an appropriate cost driver for a particular cost pool.

T2F is a university café owned an operated by a student. While it has plans for expansion it currently offers two products: (a) tea & coffee and (b) shakes. It employs 2 people: Mr. A, who looks after tea & coffee and Mr. B who prepares and serves shakes & desserts.

Its costs for the first quarter are as follows:

Total tea and coffee sales and shakes sales were $50,000 & $60,000 respectively. Number of customers who ordered tea or coffee were 10,000 while those ordering shakes were 8,000.

The owner is interested in finding out which product performed better.

Salaries of Mr. A & B and direct materials consumed are direct costs which do not need any allocation. They are traced directly to the products. The rest of the costs are indirect costs and need some basis for allocation.

Cost objects in this situation are the products: hot beverages (i.e. tea & coffee) & shakes. Cost pools include rent, electricity, music, internet and wi-fi subscription and magazines.

Appropriate cost drivers for the indirect costs are as follows:

Since number of customers is a good cost driver for almost all the costs, the costs can be accumulated together to form one cost pool called manufacturing overheads. This would simply the cost allocation.

Total manufacturing overheads for the first quarter are $19,700. Total number of customers who ordered either product are 18,000. This gives us a cost allocation base of $1.1 per customer ($19,700/18,000).

A detailed cost assignment is as follows:

Manufacturing overheads allocated to Tea & Cofee = $1.1×10,000

Manufacturing overheads allocated to Shakes = $1.1×8,000

by Irfanullah Jan, ACCA and last modified on Jul 22, 2020

Related Topics

- Cost Behavior

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Receivables

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Accounting Systems

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

What is Cost Assignment?

Share This...

Cost assignment.

Cost assignment is the process of associating costs with cost objects, such as products, services, departments, or projects. It encompasses the identification, measurement, and allocation of both direct and indirect costs to ensure a comprehensive understanding of the resources consumed by various cost objects within an organization. Cost assignment is a crucial aspect of cost accounting and management accounting, as it helps organizations make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

There are two main components of cost assignment:

- Direct cost assignment: Direct costs are those costs that can be specifically traced or identified with a particular cost object. Examples of direct costs include direct materials, such as raw materials used in manufacturing a product, and direct labor, such as the wages paid to workers directly involved in producing a product or providing a service. Direct cost assignment involves linking these costs directly to the relevant cost objects, typically through invoices, timesheets, or other documentation.

- Indirect cost assignment (Cost allocation): Indirect costs, also known as overhead or shared costs, are those costs that cannot be directly traced to a specific cost object or are not economically feasible to trace directly. Examples of indirect costs include rent, utilities, depreciation, insurance, and administrative expenses. Since indirect costs cannot be assigned directly to cost objects, organizations use various cost allocation methods to distribute these costs in a systematic and rational manner. Some common cost allocation methods include direct allocation, step-down allocation, reciprocal allocation, and activity-based costing (ABC).

In summary, cost assignment is the process of associating both direct and indirect costs with cost objects, such as products, services, departments, or projects. It plays a critical role in cost accounting and management accounting by providing organizations with the necessary information to make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

Example of Cost Assignment

Let’s consider an example of cost assignment at a bakery called “BreadHeaven” that produces two types of bread: white bread and whole wheat bread.

BreadHeaven incurs various direct and indirect costs to produce the bread. Here’s how the company would assign these costs to the two types of bread:

- Direct cost assignment:

Direct costs can be specifically traced to each type of bread. In this case, the direct costs include:

- Direct materials: BreadHeaven purchases flour, yeast, salt, and other ingredients required to make the bread. The cost of these ingredients can be directly traced to each type of bread.

- Direct labor: BreadHeaven employs bakers who are directly involved in making the bread. The wages paid to these bakers can be directly traced to each type of bread based on the time spent working on each bread type.

For example, if BreadHeaven spent $2,000 on direct materials and $1,500 on direct labor for white bread, and $3,000 on direct materials and $2,500 on direct labor for whole wheat bread, these costs would be directly assigned to each bread type.

- Indirect cost assignment (Cost allocation):

Indirect costs, such as rent, utilities, equipment maintenance, and administrative expenses, cannot be directly traced to each type of bread. BreadHeaven uses a cost allocation method to assign these costs to the two types of bread.

Suppose the total indirect costs for the month are $6,000. BreadHeaven decides to use the number of loaves produced as the allocation base , as it believes that indirect costs are driven by the production volume. During the month, the bakery produces 3,000 loaves of white bread and 2,000 loaves of whole wheat bread, totaling 5,000 loaves.

The allocation rate per loaf is:

Allocation Rate = Total Indirect Costs / Total Loaves Allocation Rate = $6,000 / 5,000 loaves = $1.20 per loaf

BreadHeaven allocates the indirect costs to each type of bread using the allocation rate and the number of loaves produced:

- White bread: 3,000 loaves × $1.20 per loaf = $3,600

- Whole wheat bread: 2,000 loaves × $1.20 per loaf = $2,400

After completing the cost assignment, BreadHeaven can determine the total costs for each type of bread:

- White bread: $2,000 (direct materials) + $1,500 (direct labor) + $3,600 (indirect costs) = $7,100

- Whole wheat bread: $3,000 (direct materials) + $2,500 (direct labor) + $2,400 (indirect costs) = $7,900

By assigning both direct and indirect costs to each type of bread, BreadHeaven gains a better understanding of the full cost of producing each bread type, which can inform pricing decisions, resource allocation, and performance evaluation.

Other Posts You'll Like...

TCP CPA Practice Questions Explained: Stock Options (ISOs and NSOs)

Free TCP CPA Practice Question Walkthroughs

TCP CPA Practice Questions Explained: Restricted Stock Units (RSUs)

How to Prepare Financial Statements Using the Income Tax Basis of Accounting

How to Prepare Financial Statements Using the Modified Cash Basis

How to Prepare Financial Statements Using the Cash Basis

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

2024 CPA Exams F.A.Q.s Answered

How Jackie Got Re-Motivated by Simplifying Her CPA Study

The Study Tweaks That Turned Kevin’s CPA Journey Around

Helicopter Pilot to CPA: How Chase Passed His CPA Exams

How Josh Passed His CPA Exams Using Shorter Study Sessions

The Changes That Helped Marc Pass His CPA Exams After Failing 6 Times

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

Estimating Cost of a Project: Techniques and Examples

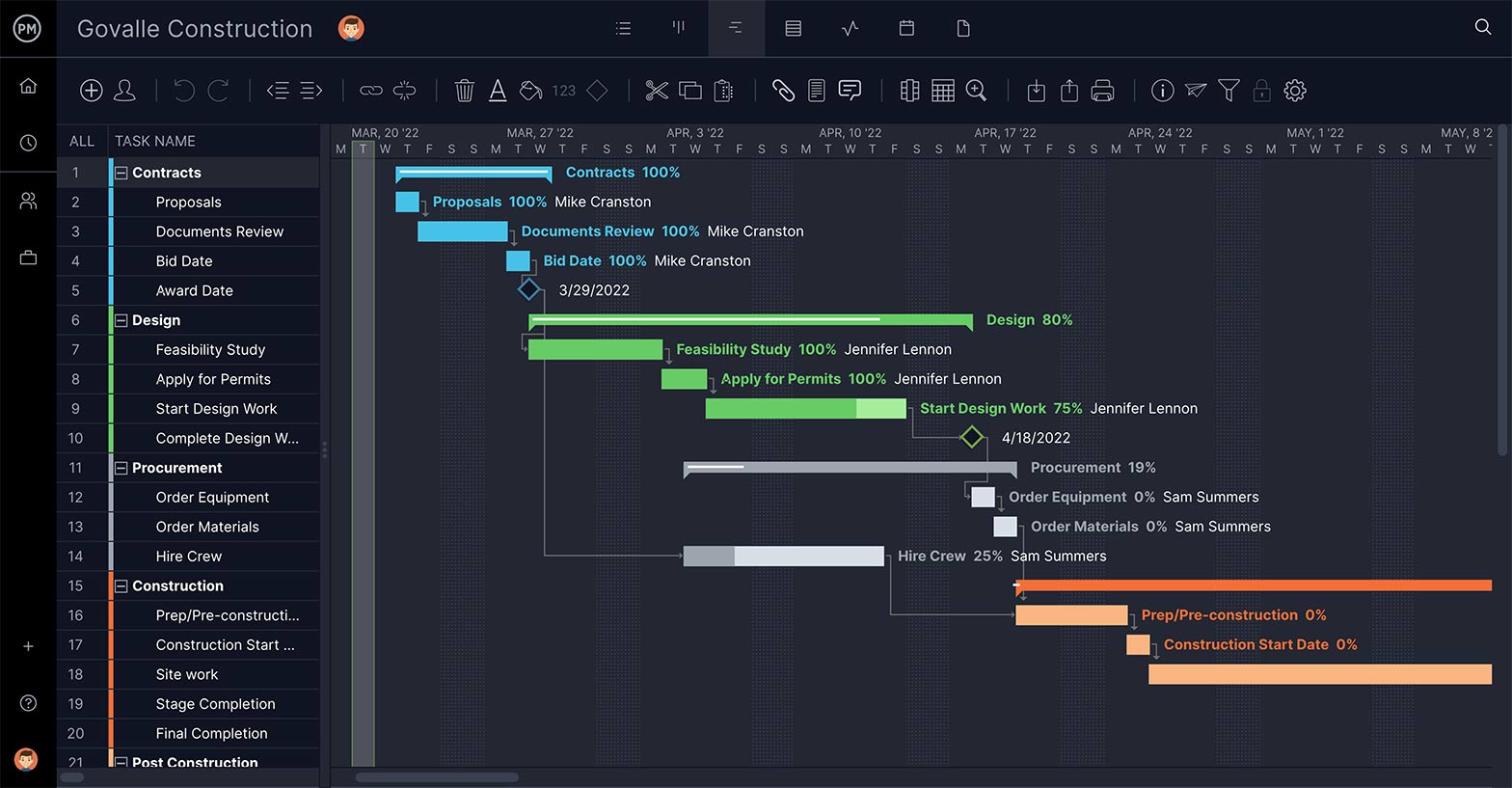

Estimating cost is an important process in project management as it is the basis for determining and controlling the project budget. Costs are estimated for the first time at the beginning of a project or even before a project has started. Subsequently, the (re-)estimation of the project cost is repeated on an ongoing basis to account for more detailed information or changes to the scope or timeline.

For instance, if the earned value management measures that are used for controlling project cost indicate significant variances from the budget, a re-estimation of the cost and schedule and a revisiting of the overall budget can be inevitable.

The methods introduced in this article are tools and techniques of the “Estimate Costs” process that is part of PMI’s Knowledge Area “Project Cost Management” (see PMBOK®, 6 th edition, ch. 7.2).

What Is a Cost Estimate?

Rough order of magnitude vs. definitive estimate, estimate to complete (etc) and estimate at completion (eac), when are cost estimated, why is cost estimation important in project management, comparison of estimation techniques, expert judgment , analogous estimating , parametric estimating, bottom-up estimating, three-point estimating.

A Cost estimate is a quantified expectation of how many resources are required to complete a project or parts of a project.

Such cost estimates are often expressed in currency units. However, other units such as man-days can also be used if the currency amounts are not applicable or irrelevant.

There are different types of cost estimates. The Project Management Body of Knowledge lists the rough order of magnitude (ROM) and the definitive estimate. Both types differ in respect of their accuracy, the project phases in which they are used as well as the available tools and techniques. Some projects use additional, sometimes industry-specific types of estimates.

Cost estimating involves different tools and techniques which typically include

- Expert judgment,

- Analogous estimating,

- Parametric estimating,

- Bottom-up estimating,

- Three-point estimating, and

- Cost of quality.

Read on to learn the details of these techniques, supplemented with examples and practical considerations.

What Are the Types of Cost Estimates?

According to the PMBOK®, there are 2 types of cost estimates:

- Rough order of magnitude (ROM) with an accuracy of -25% to + 75% (other frameworks quote a range of +/-50%) and

- Definitive estimate with an accuracy range of -5% to +10%.

Some sources also list so-called preliminary estimates and budget estimates as further gradations of estimate types. There are also industry-specific types of estimates such as design and bid estimates in construction projects ( source ). However, the current PMI project management framework only refers to the 2 above-mentioned types.

If the budget has to be revisited part way through a project, a so-called estimate to complete (ETC) is determined.

The obvious difference between these 2 types of estimates is the accuracy: the ROM is rather inaccurate with a broad range of possible outcomes. It is therefore typically used in project initiation phases where a ballpark figure is sufficient to get a project started.

The definitive estimate is determined in the course of the project when more information and resources for accurate estimates are available.

Read this article for more details on the ROM and the differences between ROM and definitive estimate .

If partway in a project it turns out that the budget baseline (based on previous estimates) cannot be met, a re-estimation of the project cost is required.

This is done by determining an estimate to complete (ETC) which is used to calculate a new estimate at completion (EAC) that replaces the initial budget at completion and thus becomes the new cost baseline of a project.

Costs are estimated at different points in time throughout the project. The PMBOK states that the process is performed “periodically throughout the project as needed” (source: PMBOK®, 6 th edition, ch. 7.2).

The first point to estimate cost is during the initiation phase, e.g. when the project business case or the project charter is created. For these documents, a project manager has to determine the amount of resources that is required to complete the project.

As the information that is available at that point is usually not very detailed, the project manager will likely end up producing a rough order of magnitude estimate rather than a definitive estimate. Later in the project when more information is available, this order of magnitude estimate will be replaced with a definitive estimate.

After the project initiation phase, the cost will be re-assessed during the planning phase, using the techniques introduced in this article.

In subsequent phases, costs are typically (re-)estimated if relevant new information and details become known or if changes to the project scope or timeline occur. One of the common reasons for re-estimating cost is, for instance, when the indicators of the project controlling suggest that the original budget baseline cannot be met.

Estimating costs is one of the core activities of project management and planning. This is because a project is defined as being subject to at least three fundamental constraints : scope , budget and time. Cost estimates are obviously addressing the budget constraint; hence they are highly relevant for the management of a project. The initial rough cost estimate is usually included in the project charter as well as in the business case of a project.

The estimation of costs is also necessary to compute the project budget which is subject to the approval of the project sponsor(s). In fact, the process “determine budget” uses a technique called “cost aggregation” which directly refers to the outputs of the “estimate cost” process.

Cost estimates are the basis for allocating budget to work packages and deliverables which can be politically sensitive within a project as well as among its stakeholders. Therefore, budget determination and assignment require some stakeholder involvement, communication and, in many cases, their approval.

In addition, cost estimates are input parameters for the earned value and variance analyses as well as forecasting of project costs .

Tools and Techniques for Estimating Project Cost

This section provides an overview of the tools and techniques for estimating project costs. These methods refer to chapter 7.2.2 of PMI’s Project Management Body of Knowledge .

Click on the links to the detailed articles on these techniques to find further explanations and practical examples.

This table compares the approaches to estimating project costs and highlights the differences between these techniques.

This technique is suggested by the PMBOK (ch. 4.1.2.1) as a way to produce a cost estimate.

If you or your team have experience with the kind of work that is in the scope of a project, you can use expert judgment to produce an estimate. This requires a certain level of familiarity with the subject of a project and its environments such as the industry and the organization.

Expert judgment can be applied to both bottom-up and top-down estimating. Its accuracy depends greatly on the number and experience of the experts involved, the clarity of the planned activities and steps as well as the type of the project.

Two examples of expert judgment are:

- Estimating the rough order of magnitude at the beginning of a project. At that time, estimates are often performed top-down due to a lack of team members. more accurate estimation techniques (such as parametric estimating) may also not be available due to a lack of data.

- (Re-)estimating the efforts needed to generate the deliverables of a work breakdown structure (WBS) by asking those responsible for work packages and activities to estimate their resource requirements. This type of expert judgment can lead to comparatively accurate results.

Besides being an estimation technique on its own, expert judgment is also inherent to the other estimation techniques. For instance, if the comparability of previous work and the current project is assessed or adjustments to parametric estimates are determined.

Analogous estimating refers to the use of observed cost figures and related values in previous projects (or portions of a project). In order to be accurate, the type and nature of these reference activities must be comparable with the current project.

“Analogous estimating, also called top-down estimating, is a form of expert judgment.” Source: Heldman, Kim. PMP: Project Management Professional Exam Study

This technique uses historical data in the form of values and parameters to determine the expected resource requirements of a current project. The historic values are adopted for the current work and can be adjusted for differences in scope or complexity. Analogous estimating is categorized as a gross value estimating approach.

In general, analogous estimates are used if a project has access to historical data on similar types of work while the details and resources for more accurate estimates in the current project, such as parametric or bottom-up estimating, are not available.

Parametric estimating is a statistical approach to determine the expected resource requirements. It is based on the assumed or proven relationship of parameters and values. Simple examples are the building cost per square foot in construction projects or the implementation cost per data field in IT projects.

If, for instance, the cost of implementing a new data field in an IT system were $20,000 according to historical data, and a project required 15 new data fields, the total cost of this part of the project would be 15 x $20,000 = $300,000.

The input data can be obtained from previous projects or external data sources such as industry benchmarks or publicly available statistics.

In practice, this technique is employed with a broad variety of sophistication and accuracy. It can be used with a simple ‘rule of three’ calculation but also in conjunction with a complex statistical or algorithmic model that may consider multiple quantitative and qualitative parameters for detailed regression analyses.

In projects that do not use an explicit statistical correlation analysis, some expert judgment is required to assess whether it would be reasonable to apply the historic parameters to the current project. Complexities of projects and activities vary and may therefore require certain adjustments.

For instance, building a highway in a mountainous region likely produces a higher cost per mile than in a flat area. IT development projects in complex IT architectures or systems tend to require more resources than a less complex environment.

Another consideration concerns the expertise and experience of the project team. If a previous project was delivered by highly skilled and experienced resources while the current team is just at the beginning of its learning curve, using unadjusted historic data may understate the estimated cost.

Similar to analogous estimates, adjustments can be made to adapt the parametric estimates to the current project.

Depending on the quality of the input data and its applicability to the current type of work, the parametric estimation technique can produce very accurate figures. However, the higher the accuracy desired the more resources are needed to perform the data gathering and statistical analyses.

Bottom-up estimation refers to a technique that involves estimating the cost at a granular level of work units. The estimates for all components of a project are then aggregated in order to determine the overall project cost estimate.

In practice, these estimates are often performed at the lowest level of the work breakdown structure (WBS), e.g. for work packages or even activities.

While there is no clear rule on who should be performing this estimation, it seems to be a good practice in project management: asking those project team members who are operationally in charge of the respective work packages or activities to estimate there on work.

Thus, this approach to estimating costs often comes with significantly higher accuracy than top-down estimations. However, obtaining and aggregating these granular estimates normally requires some resources and can potentially become a political challenge, especially in large or complex projects.

Three-point estimating is a technique that usually leverages on bottom-up estimates, analogous or expert estimates. The concept requires three different points of estimates: the optimistic (best case), pessimistic (worst case) and the most likely cost estimate.

Based on these 3 points, a weighted average cost estimate is determined that overweighs the “most likely” point. This can be done by assuming a triangular distribution, a PERT or beta distribution.

Read this article for further explanation and examples of this technique.

In this article, we have discussed the techniques of cost estimating as suggested by the PMBOK. Note that the level of detail and granularity of the estimates usually increases throughout the project.

In the initiation phase, the rough order of magnitude (ROM) is often the only type of estimate that can be obtained. Definitive estimates will usually require techniques such as analogous, bottom-up and parametric estimating that may only become available in later stages of a project.

Parametric and bottom-up estimates are usually the techniques that provide the most accurate cost projections. They are commonly used if the budget needs to be revisited and replaced with a new estimate at completion.

When a budget is determined and approved, earned value analysis and variance analysis help project managers control the cost and value generated in a project. You will find more details on the measures and the techniques in this article .

Costing Methods and Techniques

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on March 02, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Costing is the technique and process of ascertaining costs. Keeping this definition in view, various methods have been developed to ascertain costs. A few of the important methods are listed below:

- Job Costing

- Contract Costing

- Cost-plus Costing

- Batch Costing

- Process Costing

- Single (unit or output) Costing

- Operating Costing

- Departmental Costing

- Multiple or Composite Costing

- Operation Costing

Important Costing Methods

1. job costing.

In job costing , the costing of each job undertaken and executed is calculated. This method is adapted in production units that do not involve highly repetitive work.

Production units in which job costing is performed should be able to separate each job or lot based on the number of orders executed.

In commercial foundries, drop forging shops, and specialized industrial equipment manufacturers, job costing is commonly used.

2. Contract Costing

Job costing and contract costing are the same in terms of their underlying principles. A contract is a big job, whereas a job is typically small. Job costing and contract costing are also frequently referred to as terminal costing .

3. Cost-plus Costing

This is an aspect of contract costing. Cost-plus costing occurs when, for a contract, both the contract price and an extra agreed sum are paid to the contractor.

4. Batch Costing

When orders or jobs are arranged into different batches, after taking into account the convenience of producing items, it is known as batch costing. Under batch costing, the cost of a group of products is ascertained.

Batch costing is suitable for companies producing general engineering goods, in which the components can be easily arranged in convenient economic batches. In pharmaceutical companies, batch costing is also used advantageously and effectively.

5. Process Costing

When a product passes through different stages, each of which is distinct, well-defined, and easily separable, process costing can be applied. Process costing helps to calculate the cost of production at each stage.

Extractive industries, including companies dealing in chemicals, paints, foods, or soaps, can effectively and advantageously use the process costing method.

6. Single Costing

Single costing is also known as unit costing or output costing . Under single costing, the cost per unit of output or production is ascertained. Each element constituting such a cost is determined separately.

This costing method is suitable in industries such as brick-making, paper mills, and flour mills.

7. Operating Costing

When expenses are incurred to provide services such as those rendered by bus companies, transport agencies, and electricity companies, the operating costing method is used to good effect.

8. Multiple Costing

In this costing method, the costs of different sections of production are combined after ascertaining the cost of each and every part manufactured.

In the automotive industry, as well as other industries in which products are comprised of many assembled parts, multiple costing is frequently applied.

9. Departmental Costing

In this method, the main objective is to ascertain separately the cost of outputs for each department. Whenever an organization consists of several departments, departmental costing is a reasonable option to adopt.

10. Operation Costing

Operation costing is a refinement of process costing. When mass production or repetitive production are carried out. or where components must be stocked in a semi-finished stage, operation costing is suitable and used with advantage.

Types/Techniques of Costing

In addition to the above-mentioned costing systems, there are different types/techniques of costing. These refer to the various systems that are used to ascertain and analyze costs. They include the following:

1. Historical Costing

Ascertaining and recording costs after they have been incurred is known as historical costing. It provides the management with a record of what has happened and, therefore, is a postmortem of the actual costs.

Since this approach is conventional, it is known as conventional costing or actual costing . Actual costs can be ascertained in two ways: first, post costing; and second, concurrent or continuous costing.

- Post Costing

Under this system, costs are ascertained after production is completed. This is achieved by analyzing financial data in such a way as to disclose the cost of the units that have been produced.

The main advantage of this procedure is that the figures analyzed are the actual figures. For this reason, the cost arrived at is correct.

However, a serious drawback of post costing is that it is historical in nature. This is because the information is obtained after the events have already taken place. As such, this procedure does not enable the manufacturer to take corrective action in time.

- Continuous Costing

Under this system, costs are ascertained by recording expenditures and allocating these to production as and when they are incurred.

The result is that costs are ascertained as soon the job is completed or even when the job is in progress.

Continuous costing necessarily involves estimates, especially in terms of overheads . Therefore, the cost figures may not be exact.

Nevertheless, since continuous costing makes costing data available promptly, it enables the management to take corrective actions.

A core weakness of continuous costing is that it does not provide a standard that can be used to evaluate the efficiency of the current operations.

Additionally, continuous costing does not disclose what the cost of the job ought to have been.

2. Standard Costing

According to the Terminology of Cost Accountancy published by the Institute of Cost and Management Accountants, standard costing is defined as follows:

The preparation and use of standard costs, their comparison with actual costs, and the analysis of variances to their causes and points of incidence.

Under standard costing, costs are calculated in advance based on normal or probable expectations.

These costs are known as standards or standard costs . They are compared to actual costs when incurred to ascertain the variances or differences.

These variances or differences are analyzed in terms of their causes later on. As a result, management can take corrective action when necessary.

3. Marginal Costing

Marginal costing , also known as variable costing, is defined as follows:

The ascertainment of marginal costs and of the effect on profit of changes in volume or type of output by differentiating between fixed costs and variable costs.

Under marginal costing, costs are classified as fixed or variable. Fixed costs tend to remain fixed or constant with changes in the volume of output, whereas variable costs typically vary in a directly proportional way based on changes in the volume of output.

The main objective of marginal costing is to deal with the effects of changes in the volume or range of output on the costs or profit of a business concern.

4. Direct Costing

According to the Terminology of Cost Accountancy published by the Institute of Cost and Management Accountants, direct costing is defined as follows:

The practice of charging of all direct costs to operations, processes, or products, leaving all indirect costs to be written off against profits in the period in which they arise.

This differs from marginal costing in that some fixed costs could be considered to be direct costs in appropriate circumstances.

5. Absorption Costing

The Institute of Cost and Management Accountants defined absorption costing as follows: "The practice of charging all costs, both variable and fixed, to operations, processes or products."

Under absorption costing, no distinction is made between fixed costs and variable costs. Furthermore, all costs, whether fixed or variable, are considered to determine the cost of production. Absorption costing is also known as full costing .

6. Uniform Costing

Uniform costing was defined by the Institute of Cost and Management Accountants as "the use by several undertakings of the same costing principles and/or practices."

Thus, when a number of undertakings, whether under the same management or otherwise, decide to adhere to one set of accepted costing principles (particularly in matters where there can be two opinions), they are said to be following uniform costing.

Uniform costing seeks to establish uniform costing methods. This enables the performance comparison of different undertakings to be undertaken easily and effectively, leading to the common advantage of all participating undertakings.

Costing Methods and Techniques FAQs

What is costing.

Costing is the technique and process of ascertaining costs.

What are the important methods of costing?

A few of the important methods are: 1. Job costing 2. Contract costing 3. Cost-plus costing 4. Batch costing 5. Process Costing 6. Single (unit or output) costing 7. Operating costing 8. Departmental costing 9. Multiple or composite costing operation costing

What is job costing?

In job costing, the costing of each job undertaken and executed is calculated. This method is adapted in production units that do not involve highly repetitive work.

What is single costing?

Single costing is also known as unit costing or output costing. Under single costing, the cost per unit of output or

What are the types/techniques of costing?

In addition to costing systems, there are different types/techniques of costing. These refer to the various systems that are used to ascertain and analyze costs. They include the following: 1. Historical costing 2. Standard Costing 3. Marginal costing 4. Direct costing 5. Absorption costing 6. Uniform costing

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.