- Creating a Small Business Financial Plan

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 02, 2023

Get Any Financial Question Answered

Table of contents, financial plan overview.

A financial plan is a comprehensive document that charts a business's monetary objectives and the strategies to achieve them. It encapsulates everything from budgeting and forecasting to investments and resource allocation.

For small businesses, a solid financial plan provides direction, helping them navigate economic challenges, capitalize on opportunities, and ensure sustainable growth.

The strength of a financial plan lies in its ability to offer a clear roadmap for businesses.

Especially for small businesses that may not have a vast reserve of resources, prioritizing financial goals and understanding where every dollar goes can be the difference between growth and stagnation.

It lends clarity, ensures informed decision-making, and sets the stage for profitability and success.

Understanding the Basics of Financial Planning for Small Businesses

Role of financial planning in business success.

Financial planning is the backbone of any successful business endeavor. It serves as a compass, guiding businesses toward profitability, stability, and growth.

With proper financial planning, businesses can anticipate potential cash shortfalls, make informed investment decisions, and ensure they have the capital needed to seize new opportunities.

For small businesses, in particular, tight financial planning can mean the difference between thriving and shuttering. Given the limited resources, it's vital to maximize every dollar and anticipate financial challenges.

Through diligent planning, small businesses can position themselves competitively, adapt to market changes, and drive consistent growth.

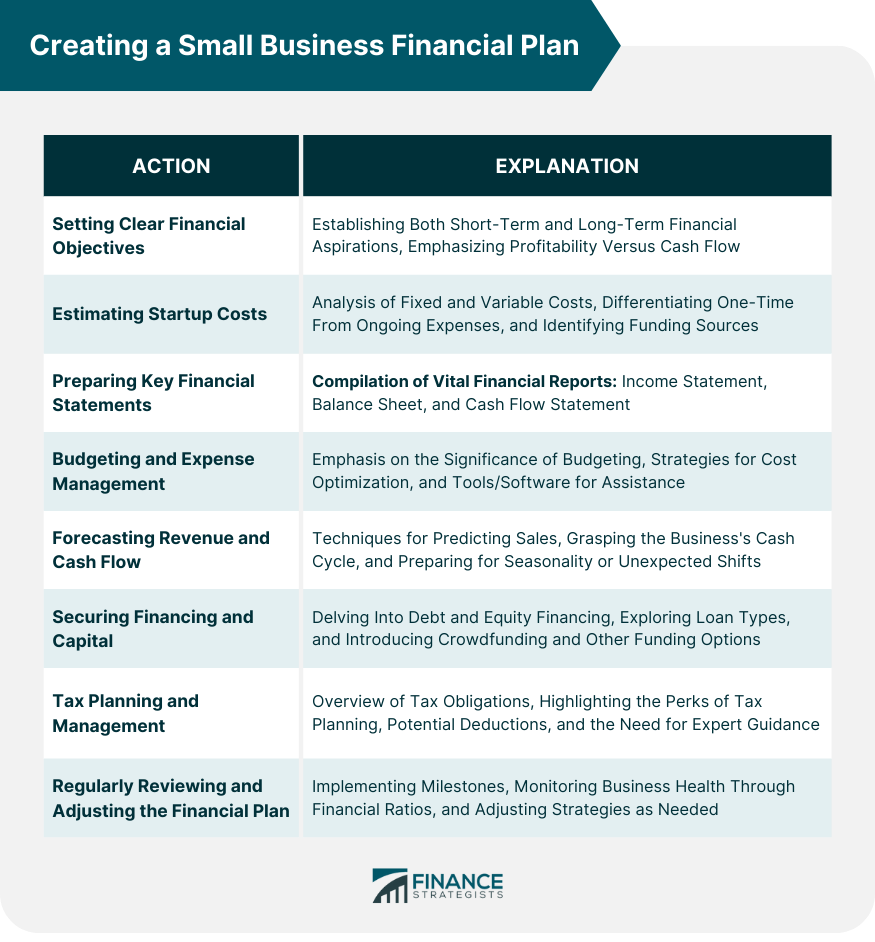

Core Components of a Financial Plan for Small Businesses

Every financial plan comprises several core components that, together, provide a holistic view of a business's financial health and direction. These include setting clear objectives, estimating costs , preparing financial statements , and considering sources of financing.

Each component plays a pivotal role in ensuring a thorough and actionable financial strategy .

For small businesses, these components often need a more granular approach. Given the scale of operations, even minor financial missteps can have significant repercussions.

As such, it's essential to tailor each component, ensuring they address specific challenges and opportunities that small businesses face, from initial startup costs to revenue forecasting and budgetary constraints.

Setting Clear Small Business Financial Objectives

Identifying business's short-term and long-term financial goals.

Every business venture starts with a vision. Translating this vision into actionable financial goals is the essence of effective planning.

Short-term goals could range from securing initial funding and achieving a set monthly revenue to covering startup costs. These targets, usually spanning a year or less, set the immediate direction for the business.

On the other hand, long-term financial goals delve into the broader horizon. They might encompass aspirations like expanding to new locations, diversifying product lines, or achieving a specific market share within a decade.

By segmenting goals into short-term and long-term, businesses can craft a step-by-step strategy, making the larger vision more attainable and manageable.

Understanding the Difference Between Profitability and Cash Flow

Profitability and cash flow, while closely linked, are distinct concepts in the financial realm. Profitability pertains to the ability of a business to generate a surplus after deducting all expenses.

It's a metric of success and indicates the viability of a business model . Simply put, it answers whether a business is making more than it spends.

In contrast, cash flow represents the inflow and outflow of cash within a business. A company might be profitable on paper yet struggle with cash flow if, for instance, clients delay payments or unexpected expenses arise.

For small businesses, maintaining positive cash flow is paramount. It ensures that they can cover operational costs, pay employees, and reinvest in growth, even if they're awaiting payments or navigating financial hiccups.

Estimating Small Business Startup Costs (for New Businesses)

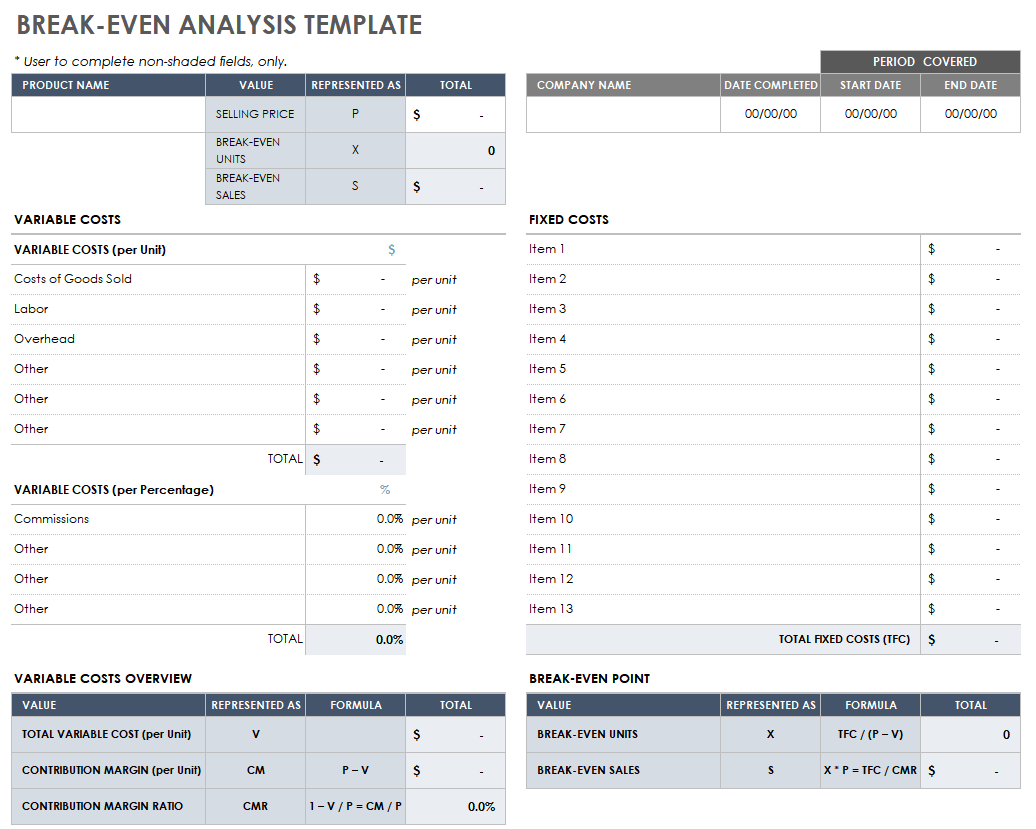

Fixed vs variable costs.

When embarking on a new business venture, understanding costs is paramount. Fixed costs remain consistent regardless of production levels. They include expenses like rent, salaries, and insurance . These are predictable outlays that don't fluctuate with business performance.

Variable costs , conversely, change in direct proportion to production or business activity. Think of costs associated with materials for manufacturing or commission for sales .

For a startup, delineating between fixed and variable costs aids in crafting a more dynamic budget, allowing for adaptability as the business scales and evolves.

One-Time Expenditures vs Ongoing Expenses

Startups often grapple with numerous upfront costs. From purchasing equipment and setting up a workspace to initial marketing campaigns, these one-time expenditures lay the foundation for business operations.

They differ from ongoing expenses like utility bills, raw materials, or employee wages that recur monthly or annually.

For a small business owner, distinguishing between these costs is critical. One-time expenditures often demand a larger chunk of initial capital, while ongoing expenses shape the monthly and annual budget.

By categorizing them separately, businesses can strategize funding needs more effectively, ensuring they're equipped to meet both immediate and recurrent financial obligations.

Funding Sources for Small Businesses

Personal savings.

This is often the most straightforward way to fund a startup. Entrepreneurs tap into their personal savings accounts to jumpstart their business.

While this method has the benefit of not incurring debt or diluting company ownership, it intertwines the individual's personal financial security with the business's fate.

The entrepreneur must be prepared for potential losses, and there's the evident psychological strain of putting one's hard-earned money on the line.

Loans can be sourced from various institutions, from traditional banks to credit unions . They offer a substantial sum of money that can be paid back over time, usually with interest .

The main advantage of taking a loan is that the entrepreneur retains full ownership and control of the business.

However, there's the obligation of monthly repayments, which can strain a business's cash flow, especially in its early days. Additionally, securing a loan often requires collateral and a sound credit history.

Investors, including angel investors and venture capitalists , offer capital in exchange for equity or a stake in the company.

Angel investors are typically high-net-worth individuals who provide funding in the initial stages, while venture capitalists come in when there's proven business potential, often injecting larger sums. The advantage is substantial funding without the immediate pressure of repayments.

However, in exchange for their investment, they often seek a say in business decisions, which might mean compromising on some aspects of the original business vision.

Grants are essentially 'free money' often provided by government programs, non-profit organizations, or corporations to promote innovation and support businesses in specific sectors.

The primary advantage of grants is that they don't need to be repaid, nor do they dilute company ownership. However, they can be highly competitive and might come with stipulations on how the funds should be used.

Moreover, the application process can be lengthy and requires showcasing the business's potential or alignment with the specific goals or missions of the granting institution.

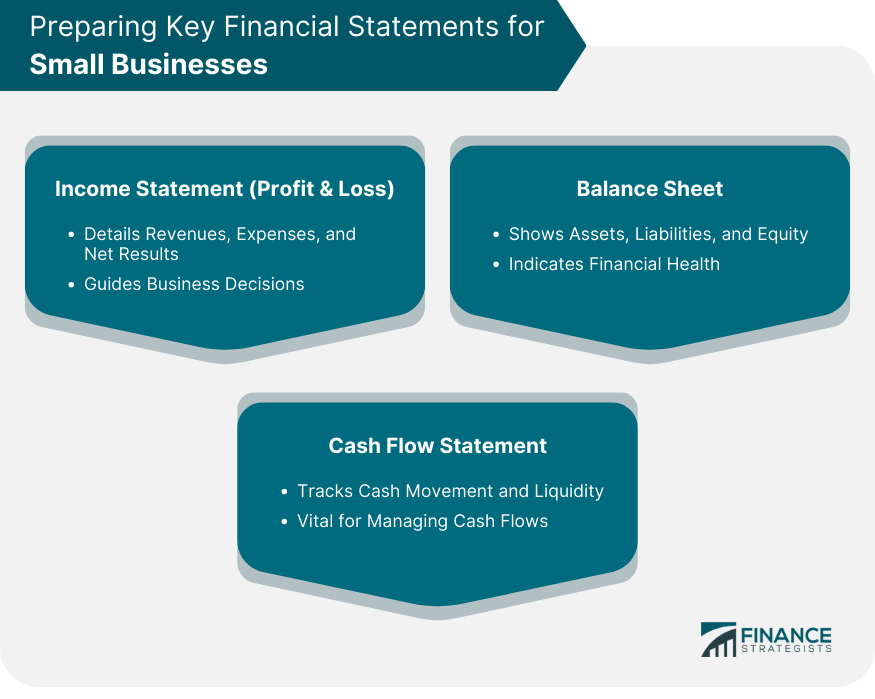

Preparing Key Financial Statements for Small Businesses

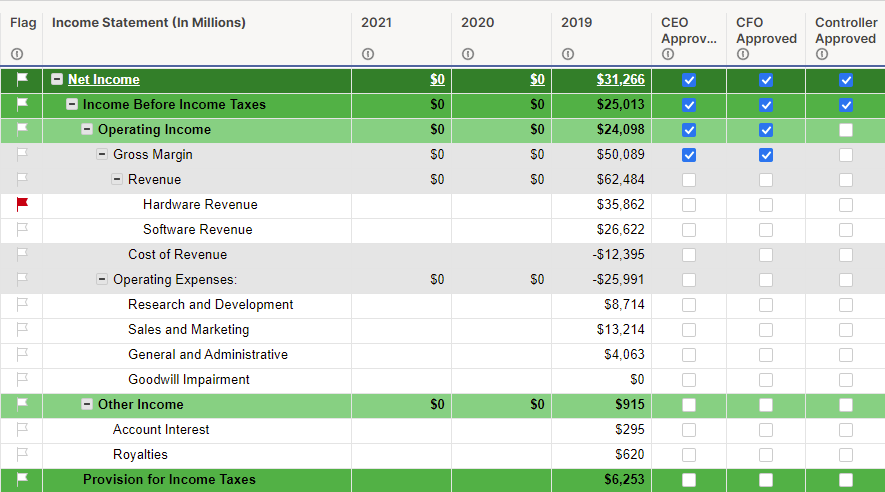

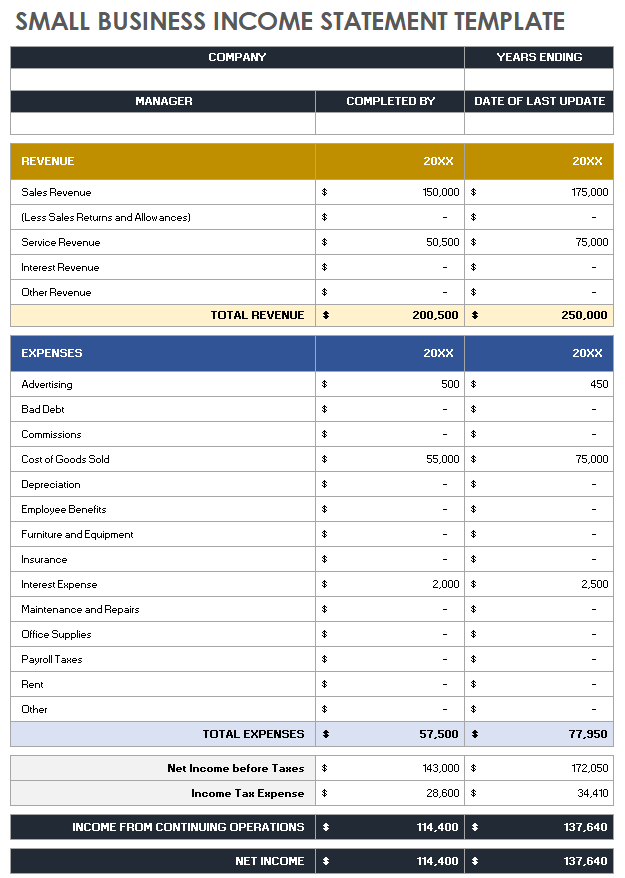

Income statement (profit & loss).

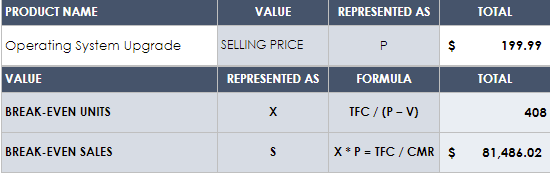

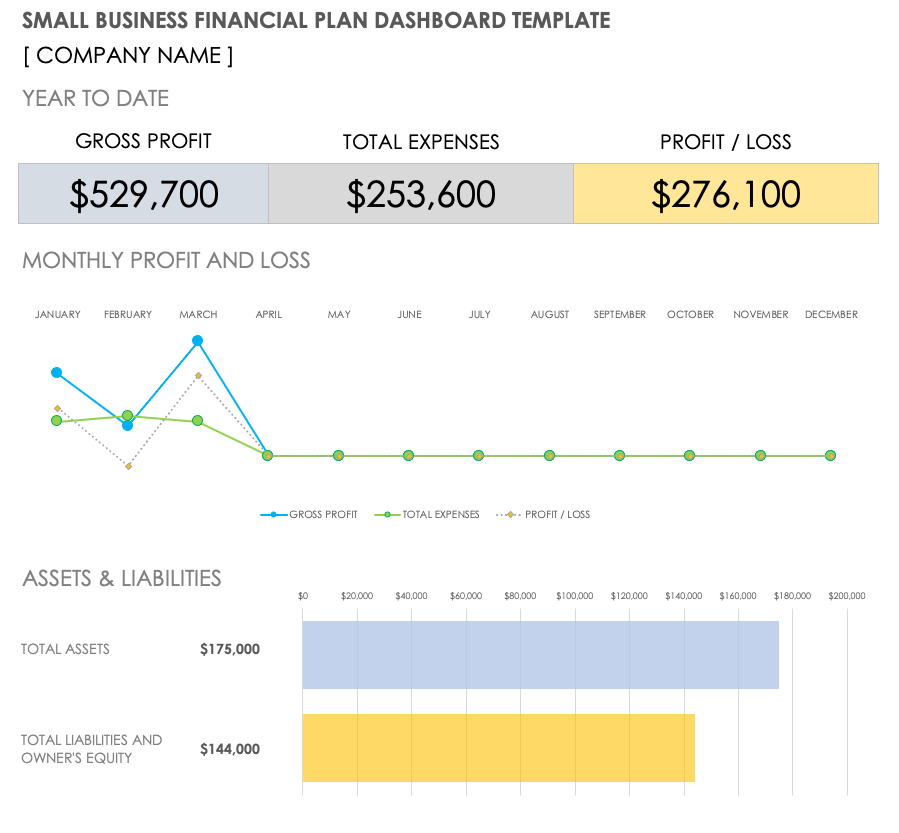

An Income Statement , often termed as the Profit & Loss statement , showcases a business's financial performance over a specific time frame. It details revenues , expenses, and ultimately, profits or losses.

By analyzing this statement, business owners can pinpoint revenue drivers, identify exorbitant costs, and understand the net result of their operations.

For small businesses, this document is instrumental in making informed decisions. For instance, if a certain product line is consistently unprofitable, it might be prudent to discontinue it. Conversely, if another segment is thriving, it might warrant further investment.

The Income Statement, thus, serves as a financial mirror, reflecting the outcomes of business strategies and decisions.

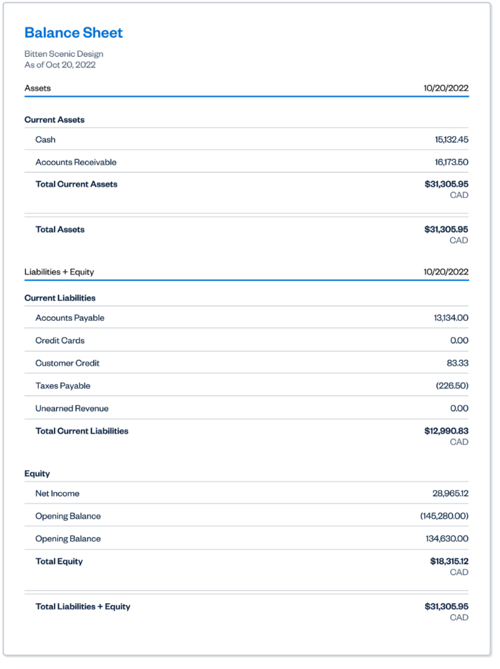

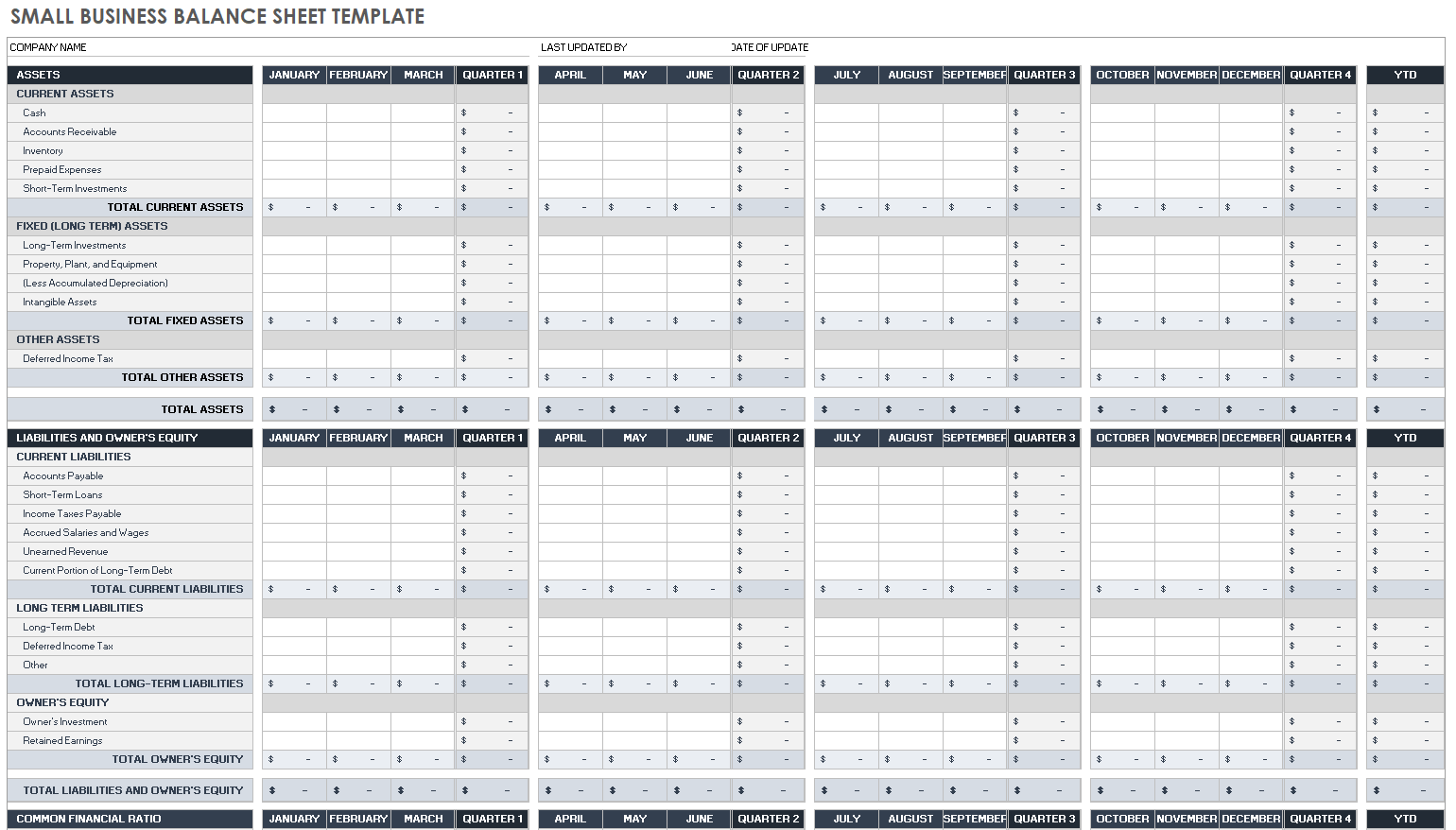

Balance Sheet

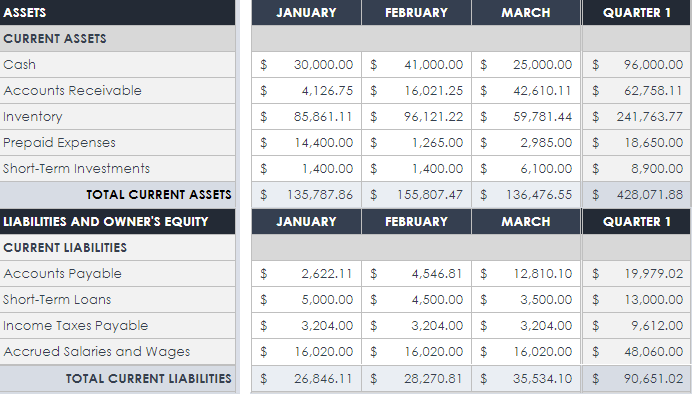

The Balance Sheet offers a snapshot of a company's assets , liabilities , and equity at a specific point in time.

Assets include everything the business owns, from physical items like equipment to intangible assets like patents .

Liabilities, on the other hand, encompass what the company owes, be it bank loans or unpaid bills.

Equity represents the owner's stake in the business, calculated as assets minus liabilities.

This statement is crucial for small businesses as it offers insights into their financial health. A robust asset base, minimal liabilities, and growing equity signify a thriving enterprise.

In contrast, mounting liabilities or dwindling assets could be red flags, signaling the need for intervention and strategy recalibration.

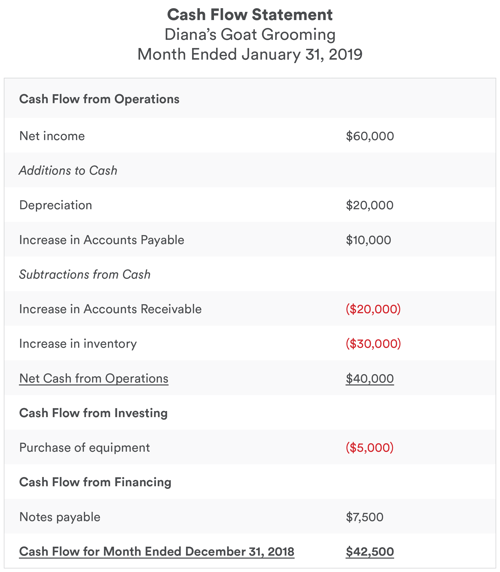

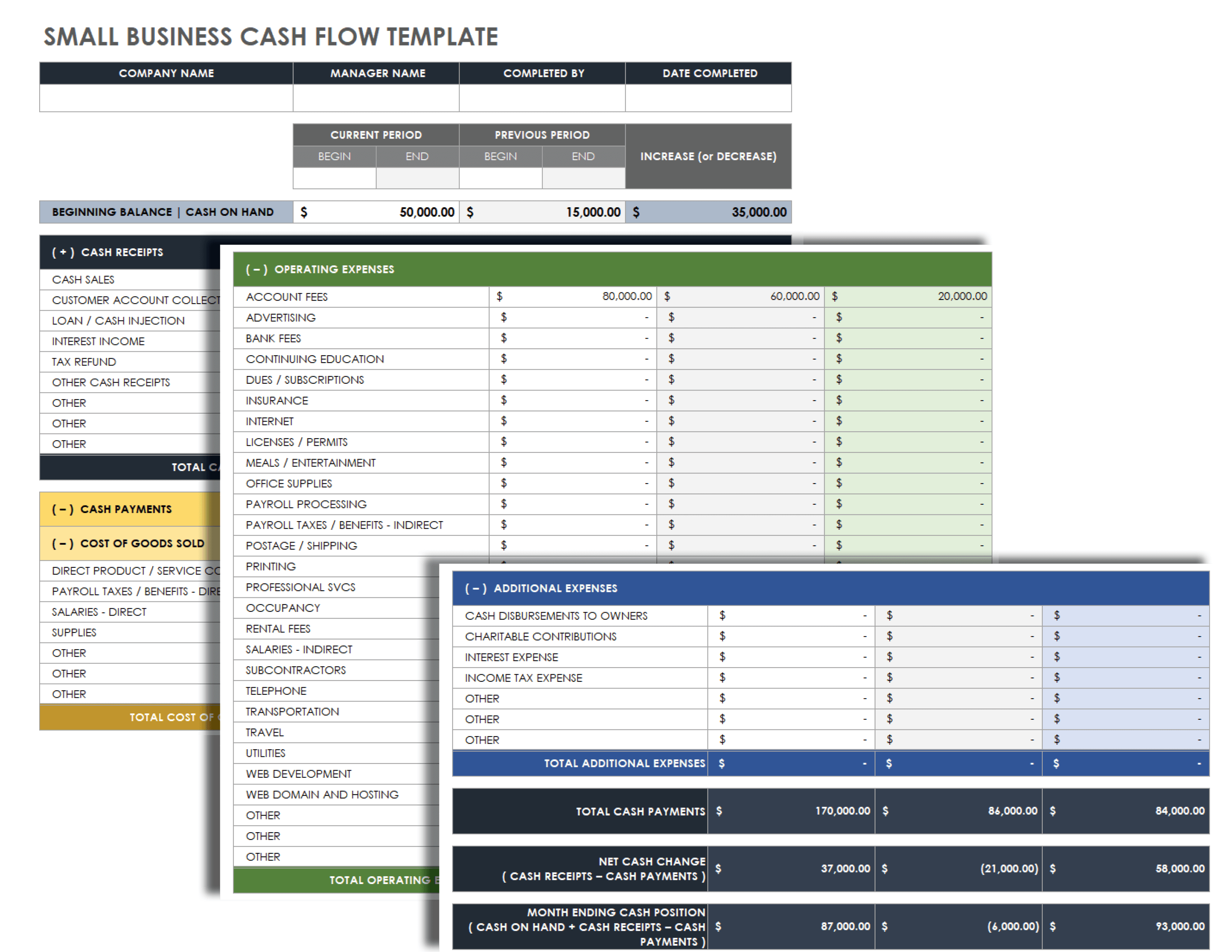

Cash Flow Statement

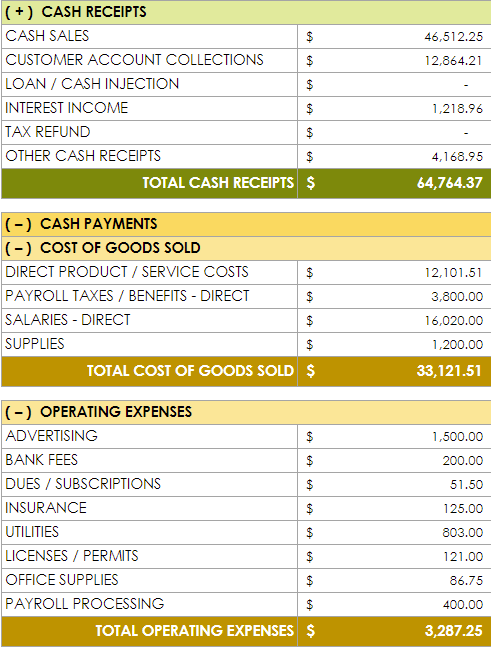

While the Income Statement reveals profitability, the Cash Flow Statement tracks the actual movement of money.

It categorizes cash flows into operating (day-to-day business), investing (buying/selling assets), and financing (loans or equity transactions) activities. This statement unveils the liquidity of a business, indicating whether it has sufficient cash to meet immediate obligations.

For small businesses, maintaining positive cash flow is often more vital than showcasing profitability.

After all, a business might be profitable on paper yet struggle if clients delay payments or unforeseen expenses emerge.

By regularly reviewing the Cash Flow Statement, small business owners can anticipate cash crunches and strategize accordingly, ensuring seamless operations irrespective of revenue cycles.

Small Business Budgeting and Expense Management

Importance of budgeting for a small business.

Budgeting is the financial blueprint for any business, detailing anticipated revenues and expenses for a forthcoming period. It's a proactive approach, enabling businesses to allocate resources efficiently, plan for investments, and prepare for potential financial challenges.

For small businesses, a meticulous budget is often the linchpin of stability, ensuring they operate within their means and avoid financial pitfalls.

Having a well-defined budget also fosters discipline. It curtails frivolous spending, emphasizes cost-efficiency, and sets clear financial boundaries.

For small businesses, where every dollar counts, a stringent budget is the gateway to financial prudence, ensuring that funds are utilized judiciously, fostering growth, and minimizing wastage.

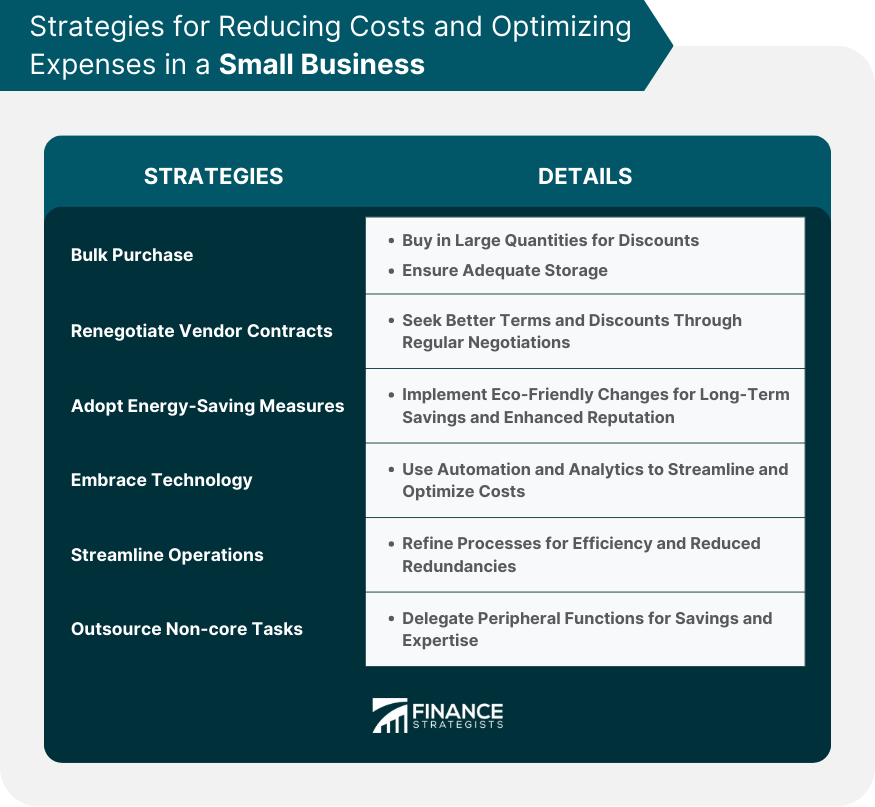

Strategies for Reducing Costs and Optimizing Expenses

Bulk purchasing.

When businesses buy supplies in large quantities, they often benefit from discounts due to economies of scale . This can significantly reduce per-unit costs.

However, while bulk purchasing leads to immediate savings, businesses must ensure they have adequate storage and that the products won't expire or become obsolete before they're used.

Renegotiating Vendor Contracts

Regularly reviewing and renegotiating contracts with suppliers or service providers can lead to better terms and lower costs. This might involve exploring volume discounts, longer payment terms, or even bartering services.

Building strong relationships with vendors often paves the way for such negotiations.

Adopting Energy-Saving Measures

Simple changes, like switching to LED lighting or investing in energy-efficient appliances, can lead to long-term savings in utility bills. Moreover, energy conservation not only reduces costs but also minimizes the environmental footprint, which can enhance the business's reputation.

Embracing Technology

Modern software and technology can streamline business processes. Automation tools can handle repetitive tasks, reducing labor costs.

Meanwhile, data analytics tools can provide insights into customer preferences and behavior, ensuring that marketing budgets are used effectively and target the right audience.

Streamlining Operations

Regularly reviewing and refining business processes can eliminate redundancies and improve efficiency. This might mean merging roles, cutting down on unnecessary meetings, or simplifying supply chains. A leaner operation often translates to reduced expenses.

Outsourcing Non-core Tasks

Instead of maintaining an in-house team for every function, businesses can outsource tasks that aren't central to their operations.

For instance, functions like accounting , IT support, or digital marketing can be outsourced to specialized agencies, often leading to cost savings and access to expert skills.

Cultivating a Culture of Frugality

Encouraging employees to adopt a cost-conscious mindset can lead to collective savings. This can be fostered through incentives, regular training, or even simple practices like recycling and reusing office supplies.

When everyone in the organization is attuned to the importance of cost savings, the cumulative effect can be substantial.

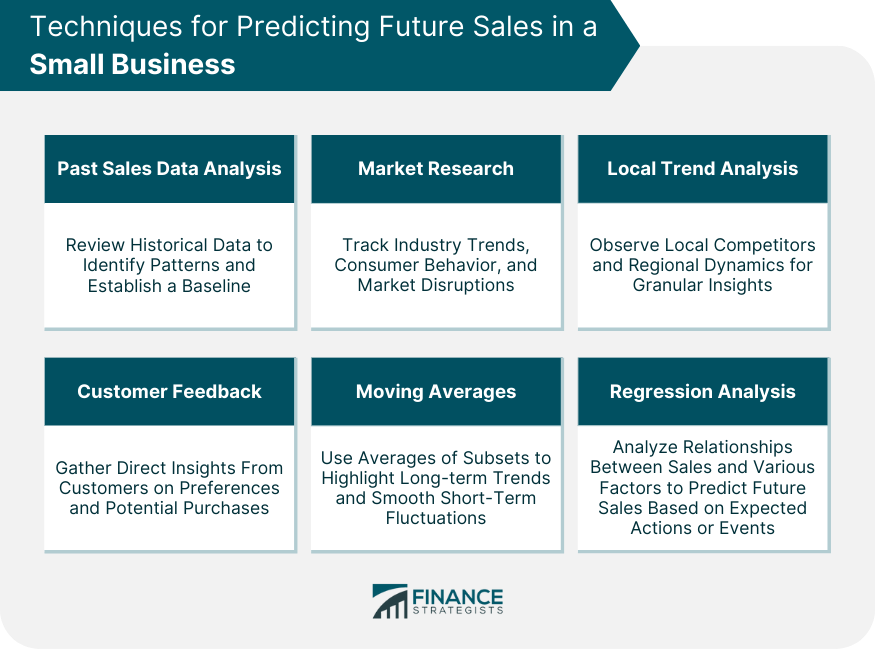

Forecasting Small Business Revenue and Cash Flow

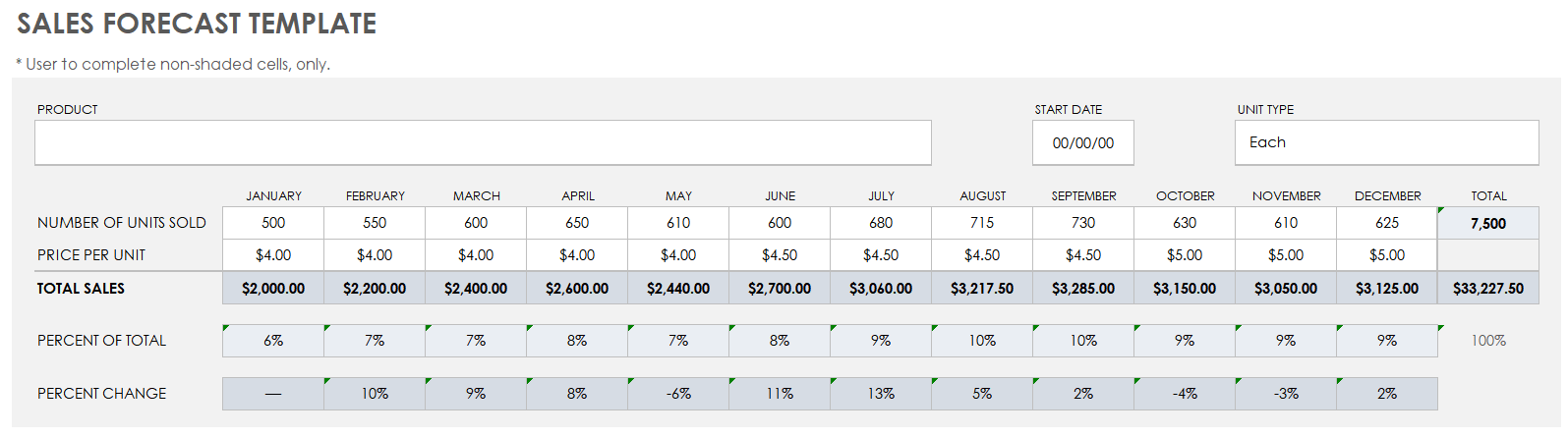

Techniques for predicting future sales in a small business, past sales data analysis.

Historical sales data is a foundational element in any forecasting effort. By reviewing previous sales figures, businesses can identify patterns, understand seasonal fluctuations, and recognize the effects of past initiatives.

This information offers a baseline upon which to build future projections, accounting for known recurring variables in the business cycle .

Market Research

Understanding the larger market dynamics is crucial for accurate forecasting. This involves tracking industry trends, monitoring shifts in consumer behavior, and being aware of potential market disruptions.

For instance, a sudden technological advancement can change consumer preferences or regulatory changes might impact an industry.

Local Trend Analysis

For small businesses, localized insights can be especially impactful. Observing local competitors, understanding regional consumer preferences, or noting shifts in the local economy can offer precise data points.

These granular details, when integrated into a larger forecasting model, can enhance prediction accuracy.

Customer Feedback

Direct feedback from customers is an invaluable source of insights. Surveys, focus groups, or even informal chats can reveal customer sentiments, preferences, and potential future purchasing behavior.

For instance, if a majority of loyal customers express interest in a new product or service, it can be indicative of future sales potential.

Moving Averages

This technique involves analyzing a series of data points (like monthly sales) by creating averages from different subsets of the full data set.

For yearly forecasting, a 12-month moving average can be used to smooth out short-term fluctuations and highlight longer-term trends or cycles.

Regression Analysis

Regression analysis is a statistical tool used to identify relationships between variables. In sales forecasting, it can help understand how different factors (like marketing spend, seasonal variations, or competitor actions) relate to sales figures.

Once these relationships are understood, businesses can predict future sales based on planned actions or expected external events.

Understanding the Cash Cycle of Business

The cash cycle encompasses the time it takes for a business to convert resource investments, often in the form of inventory, back into cash.

This involves the processes of purchasing inventory, selling it, and subsequently collecting payment. A shorter cycle implies quicker cash turnarounds, which are vital for liquidity.

For small businesses, a firm grasp of the cash cycle can aid in managing cash flow more effectively.

By identifying bottlenecks or delays, businesses can strategize to expedite processes. This might involve renegotiating payment terms with suppliers, offering discounts for prompt customer payments, or optimizing inventory levels to prevent overstocking.

Ultimately, understanding and optimizing the cash cycle ensures that a business remains liquid and agile.

Preparing for Seasonality and Unexpected Changes

Seasonality affects many businesses, from the ice cream vendor witnessing summer surges to the retailer bracing for holiday shopping frenzies.

By analyzing historical data and market trends, businesses can prepare for these cyclical shifts, ensuring they stock up, staff appropriately, and market effectively.

Small businesses, often operating on tighter margins , need to be especially vigilant. Beyond seasonality, they must also brace for unexpected changes – a local construction project obstructing store access, a sudden competitor emergence, or unforeseen regulatory changes.

Building a financial buffer, diversifying product or service lines, and maintaining flexible operational strategies can equip small businesses to weather these unforeseen challenges with resilience.

Securing Small Business Financing and Capital

Role of debt and equity financing.

When businesses seek external funding, they often grapple with the debt vs. equity conundrum. Debt financing involves borrowing money, typically via loans. While it doesn't dilute ownership, it necessitates regular interest payments, potentially impacting cash flow.

Equity financing, on the other hand, entails selling a stake in the business to investors. It might not demand regular repayments, but it dilutes ownership and might influence business decisions.

Small businesses must weigh these options carefully. While loans offer a structured repayment plan and retained control, they might strain finances if the business hits a rough patch.

Equity financing, although relinquishing some control, might bring aboard strategic partners, offering expertise and networks in addition to funds.

The optimal choice hinges on the business's financial health, growth aspirations, and the founder's comfort with sharing control.

Choosing Between Different Types of Loans

A staple in the lending arena, term loans offer businesses a fixed amount of capital that is paid back over a specified period with interest. They're often used for significant one-time expenses, such as purchasing machinery, real estate , or even business expansion.

With predictable monthly payments, businesses can plan their budgets accordingly. However, they might require collateral and a robust credit history for approval.

Lines of Credit

Unlike term loans that provide funds in a lump sum, a line of credit grants businesses access to a pool of funds up to a certain limit.

Businesses can draw from this line as needed, only paying interest on the amount they use. This makes it a versatile tool, especially for managing cash flow fluctuations or unexpected expenses. It serves as a financial safety net, ready for use whenever required.

As the name suggests, microloans are smaller loans designed to cater to businesses that might not need substantial amounts of capital. They're particularly beneficial for startups, businesses with limited credit histories, or those in need of a quick, small financial boost.

Since they are of a smaller denomination, the approval process might be more lenient than traditional loans.

Peer-To-Peer Lending

A contemporary twist to the traditional lending model, peer-to-peer (P2P) platforms connect borrowers directly with individual lenders or investor groups.

This direct model often translates to quicker approvals and competitive interest rates as the overheads of traditional banking structures are removed. With technology at its core, P2P lending can offer a more user-friendly, streamlined process.

However, creditworthiness still plays a pivotal role in determining interest rates and loan amounts.

Crowdfunding and Alternative Financing Options

In an increasingly digital age, crowdfunding platforms like Kickstarter or Indiegogo have emerged as viable financing avenues.

These platforms enable businesses to raise small amounts from a large number of people, often in exchange for product discounts, early access, or other perks. This not only secures funds but also validates the business idea and fosters a community of supporters.

Other alternatives include invoice financing, where businesses get an advance on pending invoices, or merchant cash advances tailored for businesses with significant credit card sales.

Each financing mode offers unique advantages and constraints. Small businesses must meticulously evaluate their financial landscape, growth trajectories, and risk appetite to harness the most suitable option.

Small Business Tax Planning and Management

Basic tax obligations for small businesses.

Navigating the maze of taxation can be daunting, especially for small businesses. Yet, understanding and fulfilling tax obligations is crucial.

Depending on the business structure—whether sole proprietorship , partnership , LLC , or corporation—different tax rules apply. For instance, while corporations are taxed on their earnings, sole proprietors report business income and expenses on their personal tax returns.

In addition to income taxes, small businesses may also be responsible for employment taxes if they have employees. This covers Social Security , Medicare , federal unemployment, and sometimes state-specific taxes.

There might also be sales taxes, property taxes, or special state-specific levies to consider.

Consistently maintaining accurate financial records, being aware of filing deadlines, and setting aside funds for tax obligations are essential practices to avoid penalties and ensure compliance.

Advantages of Tax Planning and Potential Deductions

Tax planning is the strategic approach to minimizing tax liability through the best use of available allowances, deductions, exclusions, and breaks.

For small businesses, effective tax planning can lead to significant savings.

This might involve strategies like deferring income to a later tax year, choosing the optimal time to purchase equipment, or taking advantage of specific credits available to businesses in certain sectors or regions.

Several potential deductions can reduce taxable income for small businesses. These include expenses like rent, utilities, business travel, employee wages, and even certain meals.

By keeping abreast of tax law changes and actively seeking out eligible deductions, small businesses can optimize their financial landscape, ensuring they're not paying more in taxes than necessary.

Importance of Hiring a Tax Professional or Accountant

While it's feasible for small business owners to manage their taxes, the intricate nuances of tax laws make it beneficial to consult professionals.

An experienced accountant or tax consultant can not only ensure compliance but can proactively recommend strategies to reduce tax liability.

They can guide businesses on issues like whether to classify someone as an employee or a contractor, how to structure the business for optimal taxation, or when to make certain capital investments.

Beyond just annual tax filing, these professionals offer year-round counsel, helping businesses maintain clean financial records, stay updated on tax law changes, and plan for future financial moves.

The investment in professional advice often pays dividends , saving businesses from costly mistakes, penalties, or missed financial opportunities.

Regularly Reviewing and Adjusting the Small Business Financial Plan

Setting checkpoints and milestones.

Like any strategic blueprint, a financial plan isn't static. It serves as a guiding framework but should be flexible enough to adapt to evolving business realities.

Setting regular checkpoints— quarterly , half-yearly, or annually—can help businesses assess whether they're on track to meet their financial objectives.

Milestones, such as reaching a specific sales target, launching a new product, or expanding into a new market, offer tangible markers of progress. Celebrating these victories can bolster morale, while any shortfalls can serve as lessons, prompting strategy tweaks. F

or small businesses, where agility is an asset, regularly revisiting the financial plan ensures that the business remains aligned with its overarching financial goals while being responsive to the dynamic marketplace.

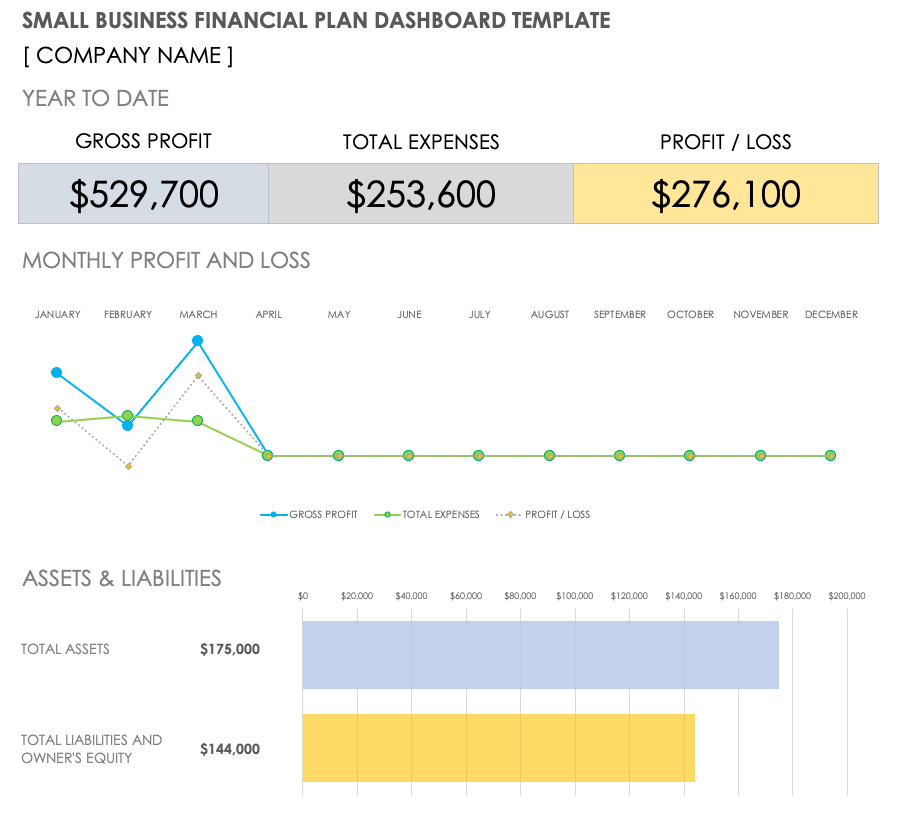

Using Financial Ratios to Monitor Business Health

Financial ratios offer a distilled snapshot of a business's health. Ratios like the current ratio ( current assets divided by current liabilities ) can shed light on liquidity, indicating whether a business can meet short-term obligations.

The debt-to-equity ratio , contrasting borrowed funds with owner's equity, offers insights into the business's leverage and potential financial risk.

Profit margin , depicting profitability relative to sales, can highlight operational efficiency. By consistently monitoring these and other pertinent ratios, small businesses can glean actionable insights, understanding their financial strengths and areas needing attention.

In a realm where early intervention can stave off major financial setbacks, these ratios serve as vital diagnostic tools, guiding informed decision-making.

Pivoting Strategies Based on Financial Performance

In the ever-evolving world of business, flexibility is paramount. If financial reviews indicate that certain strategies aren't yielding anticipated results, it might be time to pivot.

This could involve tweaking product offerings, revising pricing strategies, targeting a different customer segment, or even overhauling the business model.

For small businesses, the ability to pivot can be a lifeline. It allows them to respond swiftly to market changes, customer feedback, or internal challenges.

A robust financial plan, while offering direction, should also be pliable, accommodating shifts in strategy based on real-world performance. After all, in the business arena, adaptability often spells the difference between stagnation and growth.

Bottom Line

Financial foresight is integral for the stability and growth of small businesses. Effective revenue and cash flow forecasting, anchored by historical sales data and enhanced by market research, local trends, and customer feedback, ensures businesses are prepared for future demands.

With the unpredictability of the business environment, understanding the cash cycle and preparing for unforeseen challenges is essential.

As businesses contemplate external financing, the decision between debt and equity and the myriad of loan types, should be made judiciously, keeping in mind the business's health, growth aspirations, and risk appetite.

Furthermore, diligent tax planning, with professional guidance, can lead to significant financial benefits. Regular reviews using financial ratios allow businesses to gauge their performance, adapt strategies, and pivot when necessary.

Ultimately, the agility to adapt, guided by a well-structured financial plan, is pivotal for businesses to thrive in a dynamic marketplace.

Creating a Small Business Financial Plan FAQs

What is the importance of a financial plan for small businesses.

A financial plan offers a structured roadmap, guiding businesses in making informed decisions, ensuring growth, and navigating financial challenges.

How do forecasting revenue and understanding cash cycles aid in financial planning?

Forecasting provides insights into expected income, aiding in budget allocation, while understanding cash cycles ensures effective liquidity management.

What are the core components of a financial plan for small businesses?

Core components include setting objectives, estimating startup costs, preparing financial statements, budgeting, forecasting, securing financing, and tax management.

Why is tax planning vital for small businesses?

Tax planning ensures compliance, optimizes tax liabilities through available deductions, and helps businesses save money and avoid penalties.

How often should a small business review its financial plan?

Regular reviews, ideally quarterly or half-yearly, ensure alignment with business goals and allow for strategy adjustments based on real-world performance.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Average Cost of a Certified Financial Planner

- Benefits of Having a Financial Planner

- Cash Flow Management

- Cash Flow-Based Financial Planning

- Components of a Good Financial Plan

- Debt Reduction Strategies

- Divorce Financial Planning

- Education Planning

- Fee-Only Financial Planning

- Financial Contingency Planning

- Financial Planner for Retirement

- Financial Planning Career Pathway

- Financial Planning Pyramid

- Financial Planning Tips

- Financial Planning Trends

- Financial Planning and Analysis

- Financial Planning for Allied Health Professionals

- Financial Planning for Married Couples

- Financial Planning for Military Families

- Financial Planning for Retirement

- Financial Planning for Startups

- Financial Planning vs Budgeting

- Financial Tips for Young Adults

- How to Become a Chartered Financial Planner

- How to Build a 5-Year Financial Plan

- Limitations of Financial Planning

- Military Spouse Financial Planning

- The Function of a Financial Planner

- When Do You Need a Financial Planner?

Ask a Financial Professional Any Question

Meet top certified financial advisors near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

How to Conduct Small Business Financial Planning Effectively

September 14, 2023

by Joanne Camarce

In this post

- Why is financial planning important for a small business?

How to craft a strong financial plan for your small business

- Financial planning considerations small businesses make

- Financial planning tips for small businesses

As a small business owner, financial planning can feel overwhelming.

But financial planning is crucial for small businesses. Not only does it provide you with an entire overview of your financial health, but it helps you figure out how to grow and develop your business as efficiently as possible.

There are many budgeting and forecasting software for small businesses that can estimate future revenue and expenses by planning the financial resources you need.

What is small business financial planning?

Small business financial planning is the process of reviewing revenue, turnover, assets, capital, inventory, and anything else concerning a business's financial affairs. It summarizes the financial health of a business and outlines its financial goals for the future.

Whether it's a long-term investment plan or a short-term plan for revenue growth, your financial plan will be clear as to what your goals are and how you can plan to achieve them.

In this article, we’ll discuss everything you need to know about financial planning as a small business . We’ll cover what financial planning is, whether you need a financial advisor, and how to create a solid financial plan for your business.

We’ve also got some valuable tips for financial planning as a small business and an overview of a few essential things to bear in mind when creating a financial plan.

Why is financial planning important for a small business?

You just finished registering your business through a qualified registered agent . Now, you’ve got a lot on your plate running the actual business, and finance is a complex subject. Here are a few reasons to plan your finances:

- Understanding your financial situation: As a small-to-mid-size business, it’s important to have clear oversight of your financial health. With oversight of your finances, you’ll know what resources you have available, what areas of your business are doing well, and what areas need improvement.

- Identifying areas of growth: Financial planning is a great way to identify areas of growth. It shows you where you can improve your business and how to spend your money. And as a small business owner, you need to make sure you’re spending your money as efficiently as possible.

- Thinking about the long term: Financial planning is the perfect opportunity to think about the long-term growth of your small business. You can create a step-by-step plan to get from where you are now to where you want to be.

Do you need a financial advisor as a small business owner?

A financial advisor helps you make informed decisions about what to do with your money and other assets.

But the question is: do you need one? In short, no. You don’t need a financial advisor. But there are benefits to using one if you’re running a small business.

These include:

- Saving time: With a financial advisor taking care of your money, you can spend less time managing your finances and more time running your business.

- Evaluating market trends: Financial advisors know the industry inside and out. They’re on top of all the latest economic trends that influence the way you run your business.

- Saving money: Using a financial advisor isn’t cheap, but it can help you save money in the long run. With such a wide range of industry knowledge, they’ll find ways you can cut costs that you might not have considered.

Even though a financial advisor isn’t a necessity, there are certainly reasons you should think about using one as a small business owner. It might seem like a lot of money to spend, but it’ll save you both time and money.

Unfortunately, there isn't a one-track system to create a successful financial plan. Every company is different, which means financial plans change from business to business. But there are some best practices you can follow to make sure your financial plan is as strong and stable as possible.

Identify any capital required

First things first, you must identify the capital you need to help your business grow. Knowing what capital you need helps you plan your finances more efficiently and maximize your resources.

Not to mention, it allows small business owners to figure out how much they have (in terms of money, resources, and assets) in comparison with what they need.

So how can you identify the capital you need? First, you need to figure out what capital you already have. This will give you a solid starting point to find the capital you need to get to where you want to be.

Spend some time reviewing what your business already has, and go from there. Once you know what resources you have available, you can think about what capital you need.

Create a balance sheet

A balance sheet reveals your company’s assets, liabilities, and equity. It adds your liabilities (any debt or losses) to your equity (what your business is worth) to determine the value of your assets.

Here’s an example of a balance sheet in action:

When combined with other documents, such as an income statement or cash flow statement , small business owners get a pretty clear picture of their financial health.

How can you create a balance sheet? Follow these steps to create your own:

- List all your assets along with their current market value

- Outline all your debts and liabilities

- Subtract the value of your liabilities from the total value of all your assets

What you’re left with is the equity ( net worth ) of the business.

To keep things simple, the free balance sheet template is also available.

Produce a cash flow statement

As a small business owner, it’s important to keep on top of your operating cash flow .

Having a healthy cash flow is an important part of running a successful business. It gives you a buffer for emergencies, allows you to pay your employees on time, and provides you with the funds you need to run your business.

To keep track of your cash flow, you need to create a cash flow statement. A cash flow statement is a financial document that summarizes all the cash going in and out of your company. It shows how the company's operations are running, where money is coming from, and how it’s being spent.

Here’s an example:

With a cash flow statement in place, you can easily measure how well your company manages its cash position.

Project your future earnings

Part of the financial planning process involves projecting your future earnings. The most efficient way to do this is to create an earnings forecast. Based on how your company has performed in the past, you make predictions about future earnings over a specific period.

In other words, you use past data to predict your future earnings.

But how is this useful for a small business? There are a few ways:

- Find your future goals: Forecasting helps you figure out where you want your company to be further down the road and map out the journey to get there.

- Align your team: When you conduct an earnings forecast, you create a goal for everyone to work toward. By doing this, you align your company to hit certain targets.

- Show investors your roadmap: As a small business, you might be thinking about getting investors involved . An earnings forecast outlines the course of your business development, which investors will certainly want to see.

Financial planning considerations small businesses make

For your outline, you only need bullet point descriptions of content you plan to write. When it comes to financial planning, there are certain considerations small businesses need to keep in mind that large companies won’t.

Or if a large corporation needs to take the same consideration, they’ll probably review it from an entirely different perspective. Let’s take a look at some of the financial planning considerations you need to be aware of as a small business owner.

1. Retirement planning

We know what you’re thinking. Isn’t retirement planning important for every business, not just small businesses? You’re right. Every business owner should think about retirement planning. But small business owners need to do it sooner rather than later.

Large corporations have retirement planning and processes in place for employees. But as a small business owner, this job is up to you.

Here are a couple of things to think about when it comes to retirement planning:

- Distribute your finances: Preparing for retirement involves saving, distributing, and investing your money. The most common investments are usually retirement accounts, which allow you to grow your money with tax benefits and interest. If you’re giving away any assets to friends or family, be sure to check whether they are tax deductible .

- Create a will or trust: Retirement planning takes life expectancy into account. Having a living will or trust in place will protect your assets in the event of an accident or incapacitation.

Get your ducks in a row as soon as possible to make sure you can enjoy a long and happy retirement. The sooner you factor it into your financial plan, the more chance you will reach your goal.

2. Risk management

Every business faces risk. Whether that’s losing market share to a new competitor or taking a hit in product sales, there’s always a possibility things won’t go to plan.

But the potential loss for a small business can be detrimental if you don’t have a risk management plan. A risk management plan outlines the possible financial issues your business might face and how to mitigate them. This will ensure that you’re prepared for the worst-case scenario.

And if you’re thinking about getting an investor on board, they’ll be pleased to know you have a plan to tackle any challenges that come your way.

So when it comes to your financial planning, make sure you think about integrating a risk management plan, too. It might seem like a lot of effort, but if things don’t go your way, you’ll be glad to have a plan of action in place.

3. Tax planning

No one wants unexpected fines and charges, especially if you’re a small business. A large fine from the authorities could be the difference between a successful year or cutting costs across the company.

Fortunately, this is where tax planning can help.

Tax planning involves organizing your finances in the most tax-efficient way. It identifies areas where you can save money and claim money back. It also reduces your likelihood of getting unwanted fines. As a result, you can put more money back into your business. And as a small business, the more money you can invest in your growth, the better.

If you’re not sure where to start with tax planning, don’t worry. There’s a lot of tax software out there that can help you out.

Financial planning tips for small businesses

We’ve covered a lot of ground so far, so let’s wrap things up by looking at four of our most useful financial planning tips for small businesses.

1. Review your operating expenses

Operating expenses are costs incurred from your core business operations. For example, the rent you pay for your workspace or your inventory costs.

Taking stock of your operating expenses allows you to identify the cost of running your business, which is vital for financial planning. With this information, you can work out your net profit. This means you can figure out how much money you have leftover after all your expenses are settled.

And as a small business, keeping on top of your net profit is the key to success. Without an SMB accounting system, you won’t know what money you have available, which could result in overspending.

If you’re not sure where to start, there are plenty of expense management platforms out there to make the job easier.

2. Outline your business goals

Clearly outlining your business goals gives your financial planning direction. When you have company goals in place, you can tailor your financial plan to achieve those goals.

Imagine your business goal is to increase your annual turnover by 10% within the next year. As a result, your financial plan outlines how you can cut costs on production to offer a lower price to consumers.

Take a look at the pricing page from ActiveCampaign . This software is entirely online, meaning it can offer services for a very reasonable price.

Offering a lower price has a higher chance of increasing your conversions and getting a higher annual turnover.

Make sure you’re clear on what your company goals are before you create a financial plan. By aligning business goals with the financial planning process, you have a higher chance of achieving them.

3. Consider your funding options

If you haven’t already, make sure you explore the loans and grants that are available to small businesses.

Securing funding can help you reinvest your capital, grow your company, and improve your financial health. The good news is that there’s a variety of funding options out there for small businesses.

Organizations such as the U.S. Small Business Association and the U.S. Government (among others) offer funding options for small businesses. You’ve got nothing to lose by applying, so take a look at what’s out there.

4. Build your credit score

If you consider funding or investment, you don’t want poor business credit to be a problem. Investors and shareholders aren’t going to invest in a business with a bad credit score. It could also cause problems with acquisitions and other business transactions further down the road.

So what can you do to improve your credit score and keep it strong? Pay your bills on time. Don't miss credit card payments. Don't accept any loans with interest rates you can't afford. This will make sure your credit rating stays above the line.

When cents make sense

You’ve now got a pretty solid understanding of small business financial planning and some best practices to follow when creating a financial plan.

Now it’s time to put all this knowledge into practice.

If you’re worried about taking on this arduous task, don’t be. There are ways to make the process easier to manage. With the right platform, you can streamline the planning process and keep everything stored in one location.

Take a look at the best financial analysis software for small businesses to monitor your financial performance efficiently.

Money talks. What's yours saying?

Use the right budgeting and forecasting software for your small business to plan your finances accurately.

Joanne Camarce grows and strategizes B2B marketing and PR efforts. She loves slaying outreach campaigns and connecting with brands like G2, Wordstream, Process Street, and others. When she's not wearing her marketing hat, you'll find Joanne admiring Japanese music and art or just being a dog mom.

Recommended Articles

What Is Bookkeeping? (+ How to Do It)

One of the most important aspects of running a business is keeping track of company finances.

by Michael Gigante

Accounting & Finance

Financial Forecasting: The Crystal Ball of Your Business

With the power of math and hindsight, you no longer need to sell your soul to demonic forces...

by Piper Thomson

What Is the Accounting Cycle? (+8 Easy Steps)

Small business is all about bookkeeping.

by Jazmine Betz

Never miss a post.

Subscribe to keep your fingers on the tech pulse.

By submitting this form, you are agreeing to receive marketing communications from G2.

- Investment Management

- Fee-Based Investing

- Tactical Investment Management

- Investment Management for Trusts

- RSU Planning

- Stock Option Planning

- IPO & Pre-IPO Financial Planning

- Tax Planning

- Tax Efficient Investing

- Tax Reduction Strategies

- IRA Planning

- Social Security Planning

- Wealth Management

- Asset Protection Planning

- Financial Windfall Planning

- Liquidity Event Planning

- Legacy Financial Planning

- Retirement Planning

- Fiduciary Planning

- Holistic Financial Planning

- Multi-Generational Planning

- Business Owner Planning

- Transition Planning

- Selling a Business Consulting

- Estate Planning

- Charitable Planning

- Why Choose Us?

- Client Portal

10 Effective Financial Planning Tips for Small Business Owners

Christopher K. Winn

In the United States, small businesses aren’t merely numbers on a chart; they’re the heartbeat of our economy. With an astounding 30 million of them, they command a dominant 99.9% of all firms. Yet, amidst this vast landscape, many entrepreneurs dive in without a deep grasp of business finance. Financial planning, however, isn’t just another task—it’s the bedrock of enduring success in a bustling market.

Being a small business owner often means wearing multiple hats, from CEO to Sales Manager. Perfecting every role is a tall order, but with financial planning as your compass, you’re equipped to make sound decisions. It’s not about mastering everything but mastering what matters.

This article will simplify the core principles, providing a user-friendly guide. Our mission? To arm you with the necessary insights and tools, ensure your business flourishes and stands tall in the face of challenges. Let’s begin.

What is Financial Planning for Small Businesses?

Financial planning for a small business is a strategic process of outlining a company’s financial future, integral to planning a business strategy. By setting clear financial goals and devising plans to achieve them, businesses ensure they navigate economic challenges with agility. A comprehensive financial plan evaluates risks and offers measures to counter potential financial pitfalls in the ever-changing economic landscape.

The importance of financial planning is especially paramount for small businesses. With limited resources, unlike large corporations with vast reserves, they must be judicious in resource allocation. Take IKEA as an example: evolving from a modest mail-order venture in 1947 to a global furniture leader, their journey highlights the role of astute financial planning and its emphasis on efficiency.

Small businesses risk financial missteps without a robust financial plan, potentially leading to challenges or poor investment decisions, undermining their long-term stability.

Why Financial Planning is Crucial for Businesses?

The U.S. Chamber of Commerce recently revealed that 51% of small business owners grapple with securing funding. This statistic underscores small businesses’ difficulty obtaining the capital they need to flourish.

Financial planning emerges as the cornerstone solution to this issue. A meticulously crafted financial plan acts as both a guide for a business’s growth trajectory and a persuasive instrument when pursuing funding. It delineates financial objectives, revenue forecasts, expense tracking, and risk mitigation strategies.

To potential investors or lenders, a solid financial plan signals more than just a capital request. It conveys a business’s dedication to prudent financial management, showcasing a clear growth vision and a method for fund allocation to achieve that growth.

Read Also: Key Components of Successful Financial Planning as a Small Business Owner

But the importance of financial planning for businesses isn’t limited to funding pursuits. It’s a strategic instrument for firms to maximize their existing resources for sustained expansion. A staggering 82% of companies collapse due to cash flow issues. Through precise financial goal-setting, cash flow monitoring, and expense evaluation, businesses can pinpoint opportunities for cost reduction or resource redistribution.

Financial planning empowers small businesses to navigate away from debilitating debt and its myriad challenges, from debt-induced risks and inflation to unpredictable market dynamics. A robust financial plan mitigates avoidable hazards and optimizes resource use, setting the stage for success.

The Comprehensive Financial Plan

A financial plan is an all-encompassing document detailing your business’s financial objectives and strategies. It offers an insightful overview of your company’s financial health, encompassing current cash flows and outstanding debts, and outlines a roadmap to optimize growth while curtailing liabilities.

A pivotal aspect of this plan is the alignment of short-term and long-term business aspirations. Immediate objectives, like managing current cash flows and addressing operational requisites, must align with the overarching vision of sustained company growth and fiscal stability.

Such alignment ensures that short-term achievements pave the way for long-term milestones. For example, astute cash flow management today can fuel investments that catalyze future expansion. This synergy in financial planning fosters purpose-driven decision-making and offers the flexibility to adapt to market shifts without deviating from the core business mission.

Risk tolerance evaluation is also an integral component in creating a strategic plan. It aids in balancing the pursuit of growth avenues with the preservation of financial soundness. Regularly revisiting and understanding risk tolerance ensures that financial strategies resonate with your comfort thresholds, making them adaptable, attuned to evolving scenarios, and harmonized with immediate and distant business objectives.

While financial planning demands rigor, enlisting a financial planner can be invaluable. Crafting a financial plan independently is feasible, but a specialist’s insights can fortify your preparedness for unforeseen challenges, be it a slump in product demand or unpredictable cost surges, safeguarding your business’s financial horizon.

Key Principles of Effective Financial Planning

Effective financial planning is the cornerstone of sound financial management for businesses of all sizes. And to navigate the complexities of financial decision-making, it’s essential to understand the general principles that underpin successful financial planning. Here they are:

Create a Comprehensive Budget

A budget is a great way to stay on track with your business and financial goals. It can help you save more, pay down your debt, and even become better at saving for the future. You don’t need complicated, expensive software to set it up. Simplified accounting and budgeting solutions such as Mint and QuickBooks can help you determine where every last cent goes.

A well-structured budget is a financial roadmap that enables businesses and individuals to allocate resources strategically and make informed decisions. In a business context, budgeting helps plan for various expenses, including operational, marketing, and growth initiatives. On a personal level, budgeting allows individuals to track and control their spending, save for future goals, and avoid financial stress.

What’s more, a budget also helps in controlling costs. It reveals which expenses you can reduce and how much money you need to pump into your insurance to shield your business from risk. Eventually, unforeseen risks fall on the business owner’s shoulders. So, strive to create separate budgets for business and personal needs.

Track Expenses Regularly

The essence of effective financial planning often boils down to diligent expense tracking. Monitoring your spending through a method that aligns with your preferences and habits is vital. While some might prefer a traditional manual log, others might opt for modern software solutions or mobile apps. It’s worth exploring various tracking methods to discover the one that resonates with you.

Regardless of the method chosen, consistent expense monitoring is an indispensable financial practice. It offers a transparent view of monetary outflows, helping you discern spending trends and behaviors. Such insights are invaluable for businesses and individuals, facilitating well-informed financial choices.

For individuals, tracking personal expenses can be simpler than anticipated. Those receipts you often discard after shopping? Consider retaining them for a month. By documenting these purchases, either digitally or on paper, you are gaining a clearer picture of your spending habits. Analyze this data to identify patterns. You might discover, for instance, that you’re frequently splurging on items that don’t contribute meaningfully to your financial well-being.

To plan business strategy, identify spending patterns, and uncover areas where cost-cutting or optimization is possible. It reveals unnecessary expenditures, facilitating better resource allocation and budgeting. Additionally, by tracking expenses over time, you can evaluate the effectiveness of financial strategies, adapt to changing circumstances, and work towards achieving long-term financial goals.

The point is that keeping track of every cent enables you to cut down on waste and optimize your resources. Cutting unnecessary items and saving as much as possible, even if you have unexpected wealth streaming, can help pave the way for a brighter financial future.

A sudden wealth planner in Portland can help you manage and spend your sudden wealth wisely.

Develop a Strategic Financial Plan

After establishing a budget and a system for expense tracking, the next logical step is to formulate a financial plan. Wondering about the core elements of such a plan? Let’s delve into:

- Short-term and Long-term Goals: Businesses delineate short-term objectives, like elevating monthly sales, and long-term aspirations, such as penetrating new markets. These goals steer decision-making and resource distribution, propelling consistent growth.

- Income: This denotes a business’s revenue from sales, investments, or other avenues. Grasping and enhancing income sources is pivotal for enduring financial health, enabling businesses to meet expenses, channel funds into growth, and realize profits.

- Expenses: These are the costs a business incurs in its daily operations, spanning overheads, salaries, and material costs. Prudent expense management is key to retaining profitability and judiciously using resources.

- Investments: This pertains to channeling capital into assets or endeavors promising returns. Sound investment choices bolster business expansion and market edge.

- Current Assets and Liabilities: Current assets, like cash and inventory, are easily converted into liquid funds. Liabilities, on the other hand, include immediate financial obligations such as loans. Balancing these ensures liquidity and short-term fiscal health.

Your financial blueprint should detail monthly savings targets, annual revenue goals, and the timeline to achieve your objectives. Remember, financial plans aren’t universal. Each business and its proprietor have distinct requirements and hurdles. Tailor your financial strategy to cater to your specific business demands, addressing particular fiscal challenges, capitalizing on prospects, and steering towards overarching ambitions. Your personal risk appetite is also a crucial consideration.

For instance, while some might find a diversified investment portfolio appealing, others might gravitate towards safer avenues like fixed-income products.

Prioritize Business Investment

While it’s essential to allocate funds for personal necessities like retirement savings, insurance, life event savings, investments, and debt repayments, it’s equally crucial to channel resources back into your business. This reinvestment is the backbone of long-term growth and sustainability.

You’re fueling your operations’ expansion by earmarking a segment of your profits for business reinvestment. This can manifest in developing new products or services, adapting to market shifts, enhancing infrastructure, penetrating new markets, or gaining a competitive edge.

Read Also: Scaling to Profitability – How To Run A Successful Company

Any seasoned financial advisor, whether in Portland or elsewhere, will vouch for reinvesting a portion of your revenue for a brighter financial horizon. For instance, consider the benefits of procuring new equipment, which can streamline operations and boost efficiency. A general guideline suggests reinvesting 20-30% of your revenue into the business.

This range strikes a balance between propelling growth and ensuring fiscal solidity. If you’re in an aggressive growth phase or venturing into new markets, you might tilt toward the higher end of this spectrum. Conversely, a more conservative approach might be apt during economic volatility or when bolstering cash reserves is paramount.

Establish an Emergency Fund

While the future remains unpredictable, one thing is sure: change is inevitable. Factors like fluctuating market dynamics, climatic changes, and political shifts can all impact businesses. Hence, it’s prudent to set aside funds for unforeseen challenges.

Such reserves act as a financial safety net during unexpected setbacks, be it economic slumps, disruptions in the supply chain, or abrupt equipment malfunctions. Without a substantial emergency fund, businesses might be exposed, potentially resorting to high-interest loans or facing insolvency risks when hit with unforeseen costs or revenue declines.

An expert financial advisor for small business owners will recommend saving 20% of your income. Whatever works for you could be as little as $5 a day or $200 monthly.

This percentage ensures that you have a significant financial buffer to handle essential costs like rent, payroll, utilities, and inventory if there is a crisis. However, the specific percentage may need to be adjusted based on the industry, business size, and the level of financial risk. For example, smaller businesses or those in more volatile sectors might consider saving closer to the higher end of this range to ensure a robust safety net.

You can put that money into a savings account that pays interest or a money market account. While at it, cut expenses where you can. It might not seem like much, but every little coin adds more to your savings.

Saving money can be easy if you make it a habit. The sooner you start saving, the more time your money has to grow.

Manage Debt Wisely

If you recall the Asian financial crisis in 1997, hundreds of businesses almost collapsed due to overwhelming debt. If that doesn’t ring a bell, you might remember the Great Recession 2008, where hundreds of businesses went under. At that time, many borrowers were unable to pay their loans.

A decade later, debt remains an inevitable part of the business. Small companies borrow for several reasons, with the average loan size for small businesses reaching $663,000 across the country. Debt is almost always inevitable in business. It’s an essential source of funding. What you need to worry more about is overwhelming personal debt.

If you’re like many entrepreneurs, you’re probably carrying around student loans, credit card debt, mortgages, medical debt, and money borrowed from family and friends. Debt can be backbreaking to pay off and eat away at your profits.

However, it can also be a valuable financial tool when used strategically, but it requires vigilant oversight and adherence to a well-considered repayment plan. Prudent debt management helps avoid financial distress and contributes to overall financial health. So, when you control interest expenses and maintain a favorable credit profile, your business can secure better lending terms, access additional capital when needed, and be better positioned for sustainable growth.

Fortunately, there are several ways to manage your debt. Debt consolidation is one way to get started.

Debt consolidation is taking multiple debts and rolling them into one loan to ease the strain of paying off numerous creditors. Ensure you’re not slipping back into the debt trap by taking on new loans without a strategy to pay them back. If you’re unsure how much debt you can take on, talk to a financial advisor for small businesses.

Plan for Retirement and Succession

This is a big one — a small enterprise planning for retirement can seem like a far-off dream, especially if you’re in your 20s or early 30s. The good news is that it’s never too early to start saving for retirement, and you can do a few things to put yourself in the best position to have a healthy retirement.

A retirement plan may include a SEP IRA, one-participant 401(k), or traditional and Roth IRA. While SEP IRAs are advantageous for small businesses, allowing employers to make contributions on behalf of eligible employees, 401(k)s provide a broader range of investment options and often include employer-matching contributions. Choosing a retirement plan, setting goals, and working with a financial advisor are essential to retirement security.

Read Also: Retirement Planning for Business Owners – Selling Your Business for Your Retirement

Planning for retirement also involves planning for succession. Whether passing the business to family members, selling to a key employee, or seeking an external buyer, succession planning involves identifying and developing future leaders, creating a clear transition strategy, and addressing legal and financial considerations. Combining retirement and succession planning allows you to seamlessly transition out of your roles while preserving the business’s legacy.

You could also choose to sell your business and retire or continue to run the business and retire at a particular time. As a small business owner, you can decide when and where to retire. You may want to relocate or buy a vacation home in a different location.

Cultivate Good Spending Habits

Spending wisely is the basis of every essential part of every successful financial plan. It’s not just about saving money – it’s also about making smart moves about how you spend it. The best way to do this is by developing sustainable spending habits.

Sustainable spending habits involve prudent allocation of resources, careful budgeting, and prioritizing expenditures that contribute to growth and profitability. This includes distinguishing between essential and non-essential expenses, optimizing purchasing strategies, and consistently reviewing and adjusting the budget to align with evolving business needs.

As you may know, good spending habits don’t happen overnight. They take time and effort, but you must work to improve your financial situation. Involve employees in the process, educate them on the importance of cost-consciousness, and seek their input on cost-saving measures. Businesses should also leverage financial tools and software like Mint and QuickBooks to track expenses, identify trends, and make data-driven decisions.

Stay Tax Compliant

Taxes are never fun, but they are even more important to remember when running your business to stay compliant with the IRS and keep your company on the right track.

Complying with tax laws and regulations also ensures that your business operates within the legal framework, avoiding costly penalties and legal complications. Similarly, using tax deductions and credits available to companies is just as important. These incentives can significantly reduce tax liabilities, freeing up capital for reinvestment, growth, and other strategic initiatives.

Tax financial planning doesn’t have to be a nightmare. Rather than scrambling to organize financial records at tax season’s end, businesses should implement an organized and continuous expense tracking system throughout the year. This simplifies tax preparation and gives real-time insights into financial performance and tax liabilities. Stay on top of your taxes by tracking your expenses thoroughly throughout the year, and ensure you’re taking advantage of all available deductions.

Consider Professional Advice

If you’re struggling with business financial planning, seek professional financial advice from financial planners, accountants, and business coaches for small businesses.

If you’re a small business owner, doing your personal and corporate books can be doubly taxing.

With Interactive Wealth Advisors’ help, you can simplify the process by integrating your business and personal planning— in an attempt to find synergies that may help to provide tax and retirement planning opportunities.

Financial planners specialize in creating comprehensive financial strategies, including retirement planning, investment advice, and risk management. Accountants are essential for managing records, ensuring tax compliance, and providing insights into financial health. On the other hand, business coaches offer guidance on overall business strategies, leadership development, and growth planning. These professionals bring expertise and a fresh perspective, offering valuable insights and strategies to enhance a business’s financial success.

Ensure they fit you before hiring an investment advisor , accountant, or business coach. Verify their credentials, like CPA or CFP, and check their experience in your industry. Ask them questions about their work and how they work with clients. Seek referrals from trusted sources and assess their reputation. Understand their fee structure, ensure it suits your budget, and investigate their track record by requesting case studies or references. A little research should help you reach your ideal professional.

Financial planning is integral to the success of small business owners in achieving financial stability and growth. By implementing these fundamental principles diligently, business owners can meet immediate goals while securing their long-term well-being.

So take action now, tailor your financial plans, and adopt prudent spending habits. And seek professional services from dedicated financial advisors at Interactive Wealth Advisors for invaluable personalized insights and strategies to propel financial success. With our experts’ proper knowledge and support, your small business can navigate the complexities of financial management and steer you toward prosperity.

Book a call with us and let us know how we can help!

Cancel reply

No comments.

Get started by creating a new comment.

Recent publications

5 Tax Planning Actions To Take Before Year-End

Photo by Scott Graham on Unsplash As the year-end approaches, individuals and businesses must engage in thoughtful tax planning. This time is great for adopting tax strategies to save money and build a good financial start for the next year. Effective tax planning goes beyond just reducing tax liabilities; it involves making informed decisions that align with and...

Claiming Business Losses on Your Tax Return

Photo by bruce mars on Unsplash Achieving consistent profits is the goal for any business, but it’s common for companies, especially newer ones, to face periods of no profit. If your business is experiencing such a phase, there’s a tax-related upside to consider. Just as profitable times bring tax benefits, the tax system also has measures to support...

7 Reasons Why a Financial Advisor Can Help Your Business

Photo by Campaign Creators on Unsplash Financial challenges are a common hurdle among many small businesses. Over 66% report financial difficulties, with 43% specifically struggling with covering operating expenses. This underscores the critical need for sound financial advice for businesses. However, despite the obvious advantages of engaging financial advisors, only about a third of business owners consider this...

Can You Contribute to Both IRA and 401k?