Business Plan Risk Analysis - What You Need to Know

The business plan risk analysis is a crucial and often overlooked part of a robust business plan. In the ever-changing world of business knowing potential pitfalls and how to mitigate them could be the difference between success and failure. A well-crafted business plan acts as a guiding star for every venture, be it a startup finding its footing or a multinational corporation planning an expansion. However, amidst financial forecasts, marketing strategies, and operational logistics, the element of risk analysis frequently gets relegated to the back burner. In this blog, we will dissect the anatomy of the risk analysis section, show you exactly why it is important and provide you with guidelines and tips. We will also delve into real-life case studies to bring to life your learning your learning.

Table of Contents

- Risk Analysis - What is it?

- Types of Risks

- Components of Risk Analysis

- Real-Life Case Studies

- Tips & Best Practices

- Final Thoughts

Business Plan Risk Analysis - What Exactly Is It?

Risk analysis is like the radar system of a ship, scanning the unseen waters ahead for potential obstacles. It can forecast possible challenges that may occur in the business landscape and plan for their eventuality. Ignoring this can be equivalent to sailing blind into a storm. The business plan risk analysis section is a strategic tool used in business planning to identify and assess potential threats that could negatively impact the organisation's operations or assets. Taking the time to properly think about the risks your business faces or may face in the future will enable you to identify strategies to mitigate these issues.

Types of Business Risks

There are various types of risks that a business may face, which can be categorised into some broader groups:

- Operational Risks: These risks involve loss due to inadequate or failed internal processes, people, or systems. Examples could include equipment failure, theft, or employee misconduct.

- Financial Risks: These risks are associated with the financial structure of the company, transactions the company makes, and the company's ability to meet its financial obligations. For instance, currency fluctuations, increase in costs, or a decline in cash flow.

- Market Risks: These risks are external to the company and involve changes in the market. For example, new competitors entering the market changes in customer preferences, or regulatory changes.

- Strategic Risks: These risks relate to the strategic decisions made by the management team. Examples include the entry into a new market, the launch of a new product, or mergers and acquisitions.

- Compliance Risks: These risks occur when a company must comply with laws and regulations to stay in operation. They could involve changes in laws and regulations or non-compliance with existing ones.

The business risk analysis section is not a crystal ball predicting the future with absolute certainty, but it provides a foresighted approach that enables businesses to navigate a world full of uncertainties with informed confidence. In the next section, we will dissect the integral components of risk analysis in a business plan.

Components of a Risk Analysis Section

Risk analysis, while a critical component of a business plan, is not a one-size-fits-all approach. Each business has unique risks tied to its operations, industry, market, and even geographical location. A thorough risk analysis process, however, typically involves four main steps:

- Identification of Potential Risks: The first step in risk analysis is to identify potential risks that your business may face. This process should be exhaustive, including risks from various categories mentioned in the section above. You might use brainstorming sessions, expert consultations, industry research, or tools like a SWOT analysis to help identify these risks.

- Risk Assessment: Once you've identified potential risks, the next step is to assess them. This involves evaluating the likelihood of each risk occurring and the potential impact it could have on your business. Some risks might be unlikely but would have a significant impact if they did occur, while others might be likely but with a minor impact. Tools like a risk matrix can be helpful here to visualise and prioritise your risks.

- Risk Mitigation Strategies: After assessing the risks, you need to develop strategies to manage them. This could involve preventing the risk, reducing the impact or likelihood of the risk, transferring the risk, or accepting the risk and developing a contingency plan. Your strategies will be highly dependent on the nature of the risk and your business's ability to absorb or mitigate it.

- Monitoring and Review: Risk analysis is not a one-time task, but an ongoing process. The business landscape is dynamic, and new risks can emerge while old ones can change or even disappear. Regular monitoring and review of your risks and the effectiveness of your mitigation strategies is crucial. This should be an integral part of your business planning process.

Through these four steps, you can create a risk analysis section in your business plan that not only identifies and assesses potential threats but also outlines clear strategies to manage and mitigate these risks. This will demonstrate to stakeholders that your business is prepared and resilient, able to handle whatever challenges come its way.

Business Plan Risk Analysis - Real-Life Examples

To fully grasp the importance of risk analysis, it can be beneficial to examine some real-life scenarios. The following are two contrasting case studies - one demonstrating a successful risk analysis and another highlighting the repercussions when risk analysis fails.

Case Study 1: Google's Strategic Risk Mitigation

Consider Google's entry into the mobile operating system market with Android. Google identified a strategic risk : the growth of mobile internet use might outpace traditional desktop use, and if they didn't have a presence in the mobile market, they risked losing out on search traffic. They also recognised the risk of being too dependent on another company's (Apple's) platform for mobile traffic. Google mitigated this risk by developing and distributing its mobile operating system, Android. They offered it as an open-source platform, which encouraged adoption by various smartphone manufacturers and quickly expanded their mobile presence. This risk mitigation strategy helped Google maintain its dominance in the search market as internet usage shifted towards mobile.

Case Study 2: The Fallout of Lehman Brothers

On the flip side, Lehman Brothers, a global financial services firm, failed to adequately analyse and manage its risks, leading to its downfall during the 2008 financial crisis. The company had significant exposure to subprime mortgages and had failed to recognise the potential risk these risky loans posed. When the housing market collapsed, the value of these subprime mortgages plummeted, leading to significant financial losses. The company's failure to conduct a robust risk analysis and develop appropriate risk mitigation strategies eventually led to its bankruptcy. The takeaway from these case studies is clear - effective risk analysis can serve as an essential tool to navigate through uncertainty and secure a competitive advantage, while failure to analyse and mitigate potential risks can have dire consequences. As we move forward, we'll share some valuable tips and best practices to ensure your risk analysis is comprehensive and effective.

Business Plan Risk Analysis Tips and Best Practices

While the concept of risk analysis can seem overwhelming, following these tips and best practices can streamline the process and ensure that your risk management plan is both comprehensive and effective.

- Be Thorough: When identifying potential risks, aim to be as thorough as possible. It’s crucial not to ignore risk because it seems minor or unlikely; even small risks can have significant impacts if not managed properly.

- Involve the Right People: Diverse perspectives can help identify potential risks that might otherwise be overlooked. Include people from different departments or areas of expertise in your risk identification and assessment process. They will bring different perspectives and insights, leading to a more comprehensive risk analysis.

- Keep it Dynamic: The business environment is continually changing, and so are the risks. Hence, risk analysis should be an ongoing process, not a one-time event. Regularly review and update your risk analysis to account for new risks and changes in previously identified risks.

- Be Proactive, Not Reactive: Use your risk analysis to develop mitigation strategies in advance, rather than reacting to crises as they occur. Proactive risk management can help prevent crises, reduce their impact, and ensure that you're prepared when they do occur.

- Quantify When Possible: Wherever possible, use statistical analysis and financial projections to evaluate the potential impact of a risk. While not all risks can be quantified, putting numbers to the potential costs can provide a clearer picture of the risk and help prioritise your mitigation efforts.

Implementing these tips and best practices will strengthen your risk analysis, providing a more accurate picture of the potential risks and more effective strategies to manage them. Remember, the goal of risk analysis isn't to eliminate all risks—that's impossible—but to understand them better so you can manage them effectively and build a more resilient business.

In the ever-changing landscape of business, where uncertainty is a constant companion, the risk analysis section of a business plan serves as a guiding compass, illuminating potential threats and charting a course toward success. Throughout this blog, we have explored the critical role of risk analysis and the key components involved in its implementation. We learned that risk analysis is not just about identifying risks but also about assessing their potential impact and likelihood. It involves developing proactive strategies to manage and mitigate those risks, thereby safeguarding the business against potential pitfalls. In conclusion, a well-crafted business plan risk analysis section is not just a formality but a strategic asset that empowers your business to thrive in an unpredictable world. As you finalise your business plan, keep in mind that risk analysis is not a one-time task but an ongoing practice. Revisit and update your risk analysis regularly to stay ahead of changing business conditions. By embracing risk with a thoughtful and proactive approach, you will position your business for growth, resilience, and success in an increasingly dynamic and competitive landscape. Want more help with your business plan? Check out our Learning Zone for more in-depth guides on each specific section of your plan.

This free Notion document contains the best 100+ resources you need for building a successful startup, divided in 4 categories: Fundraising, People, Product, and Growth.

This free eBook goes over the 10 slides every startup pitch deck has to include, based on what we learned from analyzing 500+ pitch decks, including those from Airbnb, Uber and Spotify.

This free sheet contains 100 accelerators and incubators you can apply to today, along with information about the industries they generally invest in.

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

This free sheet contains all the information about the top 100 unicorns, including their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

12 Types of Business Risks and How to Manage Them

Description

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

90% of startups fail .

Thanks to the explosion of the digital economy, business founders have plenty of opportunities that they can tap into to build a winning business.

Unfortunately, there is a myriad of challenges your new business has to navigate through. These risks are inevitable, and they are a part of life in the business world.

However, without the right plan, strategy, and instruments, your business might be drowned by these challenges.

Therefore, we have created this guide to show you how can your business utilize risk management to succeed in 2022.

There are many types of startup and business risks that entrepreneurs can expect to encounter in 2022. Most of these threats are prevalent in the infancy stages of a business.

To know what you’ll be up against, here is a breakdown of the 12 most common threats.

12 Business Risks to Plan For

1) economic risks.

Failure to acquire adequate funding for your business can damage the chances of your business succeeding.

Before a new business starts making profits, it needs to be kept afloat with money. Bills will pile up, suppliers will need payments, and your employees will be expecting their salaries.

To avoid running into financial problems sooner or later, you need to acquire enough funds to shore up your business until it can support itself.

On the side, world and business country's economic situation can change either positively or negatively, leading to a boom in purchases and opportunities or to a reduction in sales and growth.

If your business is up and running, a great way to limit the effect of negative economic changes is to maintain steady cash flow and operate under the lean business method.

Here's an article from a founder explaining how he set up a lean budget on his $400k/year online business.

2) Market Risks

Misjudging market demand is one of the primary reasons businesses fail .

To avoid falling into this trap, conduct detailed research to understand whether you will find a ready market for what you want to sell at the price you have set.

Ensure your business has a unique selling point, and make sure what you offer brings value to the buyers.

To know whether your product will suit the market, do a survey, or get opinions from friends and potential customers.

Building a Minimum Viable Product of that business idea you've had is the recommendations made by most entrepreneurs.

This site, for example, was built in just 3 weeks and launched into the market to see if there was any interest in the type of content we offered.

The site was ugly, had little content and lacked many features. Yet, +7,700 users visited it within the first week, which made us realize we should keep working on this.

90% of startups fail. Learn how to not to with our weekly guides and stories. Join 40,000+ founders.

3) Competitive Risks

Competition is a major business killer that you should be wary of.

Before you even start planning, ask yourself whether you are venturing into an oversaturated market.

Are there gaps in the market that you can exploit and make good money?

If you have an idea that can give you an edge, register it. This will prevent others from copying your product, re-innovating it, and locking you out of what you started.

Competitive risks are also those actions made by competitors that prevent a business from earning more revenue or having higher margins.

4) Execution Risks

Having an idea, a business plan, and an eager market isn’t enough to make your startup successful.

Most new companies put a lot of effort into the initial preparation and forget that the execution phase is equally important.

First, test whether you can develop your products within budget and on time. Also, check whether your product will function as intended and whether it’s possible to distribute it without taking losses.

5) Strategic Risks

Business strategies can lead to the growth or decline of a company.

Every strategy involves some risk, as time & resources are generally involved to put them into practice.

Strategic risk in the chance that an implemented strategy, therefore, results in losses.

If, for example, the Marketing Department of a company implements a content marketing strategy and a lot of months, time & money later the business doesn't see any ROI, this becomes a strategic risk.

6) Compliance Risks

Compliance risks are those losses and penalties that a business suffers for not complying with countries' and states' regulations & laws.

There are some industries that are highly-regulated so the compliance risks of businesses within them are super high.

For example, in May 2018, the EU Commission implemented the General Data Protection Regulation (GDPR), a law in privacy and data protection in the EU, which affected millions of websites.

Those websites that weren't adapted to comply with this new rule, were fined.

7) Operational Risks

Operational risks arise when the day-to-day running of a company fail to perform.

When processes fail or are insufficient, businesses lose customers and revenue and their reputation gets ruined.

One example can be customer service processes. Customers are becoming every day less willing to wait for support (not to mention, receive bad quality one).

If a business customer service team fails or delays to solve customer's issues, these might find their solution in the business competitors.

8) Reputational Risks

Reputational risks arise when a business acts in an immoral and discourteous way.

This led to customer complaints and distrust towards the business, which means for the company a big loss of sales and revenue.

With the rise of social networks, reputational risks have become one of the main concerns for businesses.

Virality is super easy among Twitter so a simple unhappy customer can lead to a huge bad press movement for the company.

A recent example is the Away issue with their toxic work environment, as a former employee reported in The Verge .

The issue brought lots of critics within social networks which eventually led the CEO, Steph Korey, to step aside from the startup ( she seems to be back, anyway 🤷♂️! ).

9) Country Risks

When a business invests in a new country, there is a high probability it won't work.

A product that is successful in one market won't necessarily be in another one, especially when people within them are so different in cultures, climates, tastes backgrounds, etc.

Country risk is the existing failure probability businesses investing in new countries have to deal with.

Changes in exchange rates, unstable economic situations and moving politics are three factors that make these country risks be even more delicate.

10) Quality Risks

When a business develops a product or service that fails to meet customers' needs and quality expectations, the chance these customers will ever buy again is low.

In this way, the business loses future sales and revenue. Not to mention that some customers will ask for refunds, increasing business costs, as well as publicly criticize the company's products, leading to bad reputation (and a viral cycle that means even less $$ for the business).

11) Human Risk

Hiring has its benefits but also its risks.

Employees themselves involve a huge risk for a business, as they become to represent the company through how they work, mistakes committed, the public says and interactions with customers & suppliers,

A way to deal with human risk is to train employees and keep a motivated workforce. Yet, the risk will continue to exist.

12) Technology Risk

Security attacks, power outrage, discontinued hardware, and software, among other technology issues, are the events that form part of the technology risk.

These issues can lead to a loss of money, time and data, which has many connections with the previously mentioned risks.

Back-ups, antivirus, control processes, and data breach plans are some of the ways to deal with this risk.

How Businesses Can Use Risk Management To Grow Business

To mitigate any future threats, you need to prepare a comprehensive risk management plan.

This plan should detail the strategy you will use to deal with the specific challenges your business will encounter. Here’s what to do.

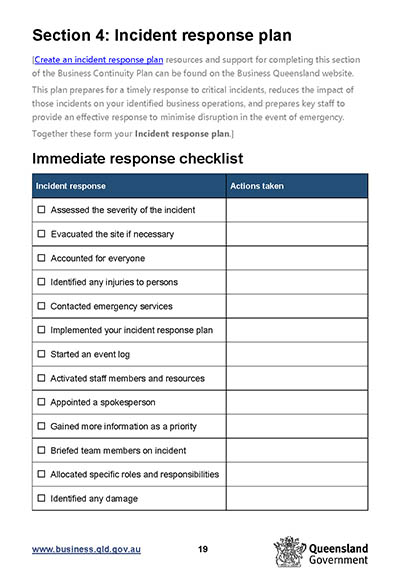

1) Identify Risks

Every business encounters a different set of challenges.

Before mapping the risks, analyze your business and note down its key components such as critical resources, important services or products, and top talent.

2) Record Risks

Once risks have been identified, you need to assess and document the threats that can affect each component.

Identify any warning signs or triggers of that recorded risk, also.

3) Anticipate

The best way to beat a threat is to detect and prepare for it in advance.

Once you know your business can be affected by a certain scenario, develop steps that you will take to stop the risk or to blunt its effects.

4) Prioritize Risks

Not all types of business risk have the same effect. Some can bring your startup to its knees, while others will only cause minimal effects.

To keep your business alive, start by putting in place measures that protect the vital functions from the most severe and most probable risks.

5) Have a Backup Plan

For every risk scenario, have at least two plans for countering the threat before it arrives.

The strategy you put in place should be in line with the current technology and trends.

Ensure your communicate these measures with all your team members.

6) Assign Responsibilities

When communicating measures with the team, assign responsibilities for each member in case any of the recorded risks affect the business.

These members should also be responsible for controlling the risks every certain time and maintaining records about them.

What is a Business Risk?

The term "business risk" refers to the exposure businesses have to factors that can prevent them from achieving their set financial goals.

This exposure can come from a variety of situations, but they can be classified into two:

- Internal factors: The risk comes from sources within the company, and they tend to be related to human, technological, physical or operational factors, among others.

- External factors: The risk comes from regulations/changes affecting the whole country/economy.

Any of these factors led to the business being unable to return investors and stakeholders the adequate amounts.

What Is Risk Management?

Risk management is a practice where an entrepreneur looks for potential risks that their business may face, analyzes them, and takes action to counter them.

The steps you take can eliminate the threat, control it, or limit the effects.

A risk is any scenario that harms your business. Risks can emanate from a wide variety of sources such as financial problems, management errors, lawsuits, data loss, cyber-attacks, natural calamities, and theft.

The risk landscape changes constantly, therefore you need to know the latest threats.

By setting up a risk management plan, your business can save money and time, which in some cases can be the determinant to keep your startup in business.

Not to mention, on the side, that risk management plans tend to make managers feel more confident to carry out business decisions, especially the risky ones, which can put their startups in a huge competitive advantage.

Wrapping Up

Becoming your own boss is one of the most rewarding things you can do.

However, launching a business is not a walk in the park; risks and challenges lurk around every corner.

If you are planning to establish a new business come 2022, make sure you secure its future by creating a broad risk management plan.

90% of startups fail. Learn how not to with our weekly guides and stories. Join +40,000 other startup founders!

An all-in-one newsletter for startup founders, ruled by one philosophy: there's more to learn from failures than from successes.

100+ resources you need for building a successful startup, divided into 4 categories: Fundraising, People, Product, and Growth.

MANAGEMENT • 4 MIN READ

Taking Risks in Business the Right Way: Full Guide

As a successful entrepreneur , business risks are essential to achieving growth and success. While it can be daunting to step outside of your comfort zone, the rewards can be significant.

In this article, we’ll explore the definition and importance of taking risks in business, provide examples of different types of business risks, and offer ideas and strategies for entrepreneurs looking to take calculated risks.

What Do We Mean By Taking Risks in Business?

Business risks refers to the process of identifying and pursuing opportunities that may be uncertain or have the potential for failure. It involves taking calculated risks to achieve business objectives and goals , such as increasing revenue, market share, or expanding into new markets.

However, taking risks in business does not mean taking reckless or blind risks that may result in significant losses or problems to the business .

Should You Be Taking Risks in Business?

Taking risks in business is critical to achieving significant growth and success. According to the Bureau of Labor Statistics (BLS), 50% of small businesses fail within the first five years, while 65% fail within ten years.

However, businesses that take calculated risks are more likely to succeed and achieve long-term growth.

Are There Any Benefits?

- Increased innovation and creativity : Taking risks can encourage entrepreneurs to explore new and innovative ideas that can lead to breakthrough products or services.

- Competitive advantage : Businesses that take risks and innovate can gain a competitive advantage over their competitors, leading to increased market share and revenue.

- Improved decision-making skills : Taking risks requires entrepreneurs to make strategic decisions based on careful analysis and planning, which can improve their decision-making skills over time.

- Increased revenue and profitability : Taking calculated risks can lead to increased revenue and profitability, as businesses can identify new markets and revenue streams.

- Enhanced reputation : Successful risk-taking can enhance a business’s reputation, leading to increased customer loyalty and brand awareness.

9 Ideas for Taking Business Risks Effectively

There are many types of business risks out there. Some are better to take on than others.

Here are 9 examples of business risks and ideas to help take your business to the next level.

1. Launch a New Product or Service

Taking risks in product and service offerings can help businesses differentiate themselves from their competitors and appeal to new customers.

For instance, a restaurant may risk offering a new menu item, such as a vegan option, to attract a new customer base and create a competitive advantage.

2. Expand Into New Markets

Expanding into new markets can help businesses tap into new customer segments and increase revenue . It also helps to diversify their income streams and reduce risks associated with relying on one market.

Furthermore, entering new markets can help businesses gain insights into different cultures and new trends in the industry.

3. Invest in New Technology

Investing in new technology can help businesses increase efficiency, reduce costs, and improve the quality of their products or services. Companies that invest in technology are better equipped to compete in the global marketplace, as the technology helps them stay ahead of their competitors.

In addition, new technology can help businesses become more innovative and agile, allowing them to respond quickly to changing customer needs/

4. Take on Strategic Partnerships

5. diversify revenue streams, 6. hire new talent.

Hiring new talent can help businesses bring in fresh perspectives and ideas, leading to increased innovation and growth . New talent often brings with them fresh insights and skills that can help to grow a business in ways that existing staff may be unable to.

By bringing on new talent, businesses can tap into new markets, create new products and services, and open up new possibilities for growth.

7. Try New Marketing and Advertising Strategies

Trying new marketing and advertising strategies can help businesses reach new audiences and increase brand awareness. It can also help to boost sales and build customer loyalty. Companies should be open to experimenting with different strategies to achieve their desired results.

8. Pursue a New Business Model

Pursuing a new business model can help businesses adapt to changing market conditions and stay relevant. For instance, when the global pandemic hit, many businesses had to pivot to e-commerce or digital services in order to stay afloat.

9. Launch a New Business Venture

Challenges of taking risks in business and solutions, financial risks.

Taking financial risks can lead to significant losses if the business does not generate enough revenue to cover the investment.

To overcome this challenge, entrepreneurs should conduct a thorough financial analysis and consider alternative funding sources, such as loans or investors.

Market Risks

Entering new markets or launching new products can be risky if there is no demand or if the competition is too strong.

To overcome this challenge, entrepreneurs should conduct market research to identify customer needs and preferences and evaluate the competition.

Operational Risks

Making significant changes to business operations can be risky if they are not well-planned and executed.

To overcome this challenge, entrepreneurs should create a detailed vision and strategy and test the changes on a small scale before implementing them on a larger scale.

Reputational Risks

Taking risks that result in negative publicity can damage a business’s reputation and lead to a loss of customers.

To overcome this challenge, entrepreneurs should prioritize transparency and honesty in their operations and communication with customers.

Legal Risks

Taking risks that violate laws or regulations can lead to legal penalties and damage to the business’s reputation.

To overcome this challenge, entrepreneurs should consult with legal experts and ensure compliance with all relevant laws and regulations.

Take on Bigger Risks and Get 2X Success

Business coaching and mentoring can be an effective way for entrepreneurs to overcome the challenges of taking risks in business and achieve significant growth and success.

2X is a business coaching and mentoring company that helps entrepreneurs grow their business from 6 to 7 figures through customized coaching and mentorship programs.

Their book, From 6 to 7 Figures , provides practical advice and strategies for entrepreneurs looking to take their business to the next level .

Taking risks in business is critical to achieving significant growth and success. However, it requires careful analysis and strategic planning to minimize the potential for negative outcomes. Businesses that take calculated risks are more likely to succeed and achieve long-term growth.

By implementing the ideas and strategies outlined in this article and seeking guidance from a company like 2X, entrepreneurs can take risks that lead to accelerated growth and success in their business.

The Playbook To 7+ Figures

This has been called “the business Bible for 6-figure entrepreneurs”… now you can get it with exclusive bonuses for a crazy low price!

Related Articles

The 2X Backstory – Helping 6/7 Figure Businesses Scale

Breaking Down The Real-Life Principles That Matter To Help You Join The 4% Of Businesses That Make The Leap To 7-Figures

How to Use Business Systems To Scale to 7 & 8 Figures

So you're ready to scale, huh? You want to get out of the day-to-day operations and get the freedom, wealth, and predictable growth that you...

How To Build A Sales Department Into A High-Converting Machine

“What are the single best levers to scale?” I’ve asked myself this question more times than I can count. And now after working with hundreds...

How To Build a World-Class Team That Don’t Drain Your Time

To grow a business extremely fast, you need ONE key thing: Leverage. And there are three core forms of leverage a business owner can use...

How To Create Raving Fans With World-Class Fulfillment

If you ask almost any six-figure entrepreneur how to double their business as fast as possible, they’ll probably start telling you about marketing tactics and...

How To Use Numbers To Make Easier, Faster, Better Decisions

Create A Business Vision And Get Unstoppable Momentum

You don't get in the car until you know where you want to go… Yet most people try to drive their business without having a...

How To Join The Inc. 5000 List Of Fastest Growing Companies In 2023

2X has secured a spot on Inc. 5000’s list of fastest growing private companies in the U.S. for 2022.

2X Ranks In Inc. 5000 List Of Fastest Growing Private Companies

Brad Lea’s Secret Masterplan To Grow From 8 To 9 Figures

Listen below to the interview that 2X CEO Austin Netzley did with influencer Brad Lea. You’ll get powerful insights into systems, growth strategies, mindset, how...

Living His Dream: From 65 Hour Work Weeks To 7-Figures | 2X

You grind your fingers to the bone and work long, unsustainable hours in the pursuit of success.

Three Ways To Triple Your Revenue In 12 Months | 2X

If you’ve never scaled a business to 7-figures before, it can feel like an uphill battle. You soon discover that the tools that got you...

How Erin Built A Thriving Business Without The Stress

Sometimes the growth of your business can lead you into a false sense of security. Because, on the face of it, things are going well....

Working From Home: Work-Life Balance Strategies for Entrepreneurs | 2X

Are you an entrepreneur who is struggling to balance work and life? Are you finding it hard to stay focused when working from home? If...

10 Key Takeaways From The October 2022 2X Mastermind Event

WOW! The dust is just starting to settle after an amazing two days at our Mastermind Event in Austin, Texas last week.

The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

PwC Pulse Survey: Managing business risks

Read time: 10 minutes

of executives are focusing business strategy on growth

Cyber #1 business risk, with 40% citing it as a serious risk

are changing processes to address labor shortages

In our second Pulse Survey of 2022, business leaders point to a wide range of challenges in the current environment, even as they take proactive steps to respond.

Key findings include:

- Business leaders are cautiously optimistic about their future prospects. More than four-fifths (83%) are focusing the business strategy on growth — more than any other objective. And only 30% see recession as a serious risk.

- Executives cite acquiring and retaining talent as a serious risk. Yet even as companies fret about human capital, in particular the need for people with the skills to help them grow, they’re taking steps to streamline the workforce.

- Cyber is the No. 1 business risk, with 40% of all respondents listing more frequent and/or broader cyber attacks as a serious risk (and another 38% calling it a moderate risk). Cyber threats are no longer solely the domain of the CISO.

- While companies continue to invest in many areas of the business, they’re scaling back the most in real estate and capex. After two years of remote work, many companies simply need less space, and they’re allocating capital accordingly.

- As the yardstick for company performance expands beyond financial metrics, companies have an imperative to build trust and transparency among their stakeholders. Almost two thirds (65%) of executives tell us they’re focused on developing or refining their trust strategy.

- Tested by the pandemic, business executives are now more prepared for the future, and 69% of respondents say that they’re referring to a lessons-learned playbook developed out of COVID-19.

Cautious optimism

Despite a wide range of business risks and mixed economic signals, companies remain focused on growth.

of companies are focusing their business strategy on growth, more than any other objective.

Business executives are cautiously optimistic despite a challenging business environment

Executives cite a long list of business issues as serious risks to their companies. Cyber tops the list, with 40% citing more frequent and/or broader cyber risks as a serious risk. Talent acquisition and retention (38%) and rising production costs (34%) are close behind.

Among the less-frequently-cited risks were geopolitical factors like US-China relations (27% of respondents consider this a serious risk), a prolonged conflict in Ukraine (22%) and US societal unrest (17%). Recession was also well down on the list of business risks (only 30% consider it a serious risk, despite 60% of executives saying a recession is likely in the next year).

This comes as some economic data indicates signs of improvement. The unemployment rate , for instance, edged down to 3.5%. Inflation , while still high, showed some signs of stabilizing in July. This slight shift is also reflected in our survey, with 62% of executives now saying it's likely that inflation will remain elevated for the next 12 months, down from 69% in January. As a result, executives may be shifting from an active concern about the business environment to focusing on growth. Climate change was also low (23% consider it a serious risk), even with the growing emphasis on environmental sustainability at most companies.

Despite these risks, business leaders see bright spots. When asked how they are responding to the current business environment, 83% say they’re focusing their business strategy on growth. This is somewhat surprising given the mixed signals in the economy right now, including rising interest rates and slowing economic growth. After more than two years dealing with uncertainty related to the pandemic, business leaders recognize the urgent need to focus on growth in order to compete, and they’re zeroing in on what they can control.

With growth in mind, executives are exploring both acquisitions and increases in internal investment. Seventy percent tell us they’re considering an acquisition as a result of the current business environment. Internally, they’re increasing investments in digital transformation (53%), IT (52%), cybersecurity and privacy (49%) and customer experience (48%). Many of these investment areas can help improve efficiency and scalability and introduce new technology to boost productivity as companies continue to deal with talent shortages.

What your company can do

- Lean into growth even amid uncertainty. Focusing on your growth agenda will be key to competing. Pay close attention to the changes and trends that may impact your business and assess which ones you can plan for. Success is more than solely managing costs and risks. For example, you may need to change products, services or pricing — all of which drive growth.

- Take a hard look at all parts of your portfolio and where you can optimize. Position it to drive both operational excellence and growth.

- Consider whether an acquisition would help you get the talent you need. The recent rise in interest rates has slowed deal activity, but dealmaking should always be an option — and some prices have come down.

- Don’t try to do too many things. Focus on the areas that free up the most dollars with the least amount of pain. Then look for value creation opportunities for your investments. Rather than expanding your investments in digital technologies broadly, for example, focus on those that drive productivity.

Despite concerns about their ability to hire and retain the right talent, some companies are starting to streamline their workforce.

of respondents are reducing their overall headcount, even as business leaders remain concerned about hiring and retaining talent.

Walking a tightrope on talent

Nearly two-thirds of businesses (63%) have changed or are planning to change processes to address labor shortages, up from 56% in January 2022 . Ironically, as businesses pivot even more toward automation, it’s critical to find employees with the right combination of deep functional knowledge and technology know-how. Without the right talent, automations can fail to deliver on promised efficiencies and increase operational risk.

Finding the right talent continues to be a challenge for business leaders. Talent acquisition came in second as a risk behind cyber, with 38% of respondents citing it as a serious risk. Companies continue to look for and attract new talent in creative ways, including:

Expanding remote work options for roles that allow: A large majority (70%) of respondents say they have either implemented this or have a plan in place.

Pursuing acquisitions to gain access to talent: About half (52%) of executives say they’re considering an acquisition to gain access to needed talent.

Customizing their HR strategy by employee type: 59% either have a plan to do this or have implemented one.

At the same time, respondents are also taking proactive steps to streamline the workforce and establish the appropriate mix of worker skills for the future. This comes as no surprise. After a frenzy of hiring and a tight labor market over the past few years, executives see the distinction between having people and having people with the right skills. For example, 50% of all respondents are reducing their overall headcount, 46% are dropping or reducing signing bonuses and 44% are rescinding offers.

We see these precautionary actions more in certain industries. Consumer markets and technology, media and telecommunications companies, for example, are more likely to invest in automation to address labor shortages. At the same time, healthcare is seeing bigger talent challenges than other industries and is more focused on rehiring employees who have recently left.

Analyze your strategic workforce needs to understand both the skills and capabilities required today as well as those that will be needed to execute your company’s future strategic initiatives. Customize your HR strategy based on the employee type you need to grow.

For each component of your people experience (e.g., recruiting and performance management), consider what changes you might need to make to drive the right culture, experience and outcomes.

Use performance management tools that use data to assess how employees and managers are doing — especially given the shift to hybrid work where in-person oversight is less common.

Conduct periodic culture assessments to help assess and create an inclusive environment even as the talent profile of the organization changes. In particular, avoid a “two-tiered” organization in which in-person and remote workers are treated differently. Balance your automation efforts with both your talent needs and what you want your company culture to be.

Cybersecurity and threats

Growing cyber threats and a greater reliance on data in business models mean that cybersecurity is now a central responsibility for the entire C-suite and board.

of executives cite cyber attacks as a serious risk — the top business risk companies are facing

Cybersecurity is now on the agenda of the entire C-suite

Cybersecurity is becoming an enterprisewide issue, beyond the CISO’s office. Cyber attacks top the list of business risks, with 40% of all respondents listing it as a serious risk (and another 38% citing it as a moderate risk). Virtually all roles ranked cyber attacks high on their list of risks, including tax leaders (with 47% citing it as a serious risk), CFOs (44%) and CMOs (41%).

An even bigger signal of the growing concern around cyber is that 51% of board members cited it as a serious risk (and another 35% as a moderate risk) — more than any other category of business leader. In March 2022, the SEC proposed to enhance and standardize cybersecurity disclosures , requiring that the registrant’s board of directors oversee cybersecurity risk. The proposal would also require annual reporting or certain proxy disclosure about the board of directors’ cybersecurity expertise. As a result, board members are becoming increasingly attuned to cyber threats and their role in overseeing cybersecurity risk management.

Cybersecurity — including the related realms of privacy and data protection — is also becoming a growing policy concern of business leaders. Not surprisingly, 84% say they’re either monitoring closely or taking action on potential regulatory changes.

The importance of cyber reflects two things. First, virtually all companies are now digital companies, with a heavy reliance on data and analytics and a growing reliance on mobile and cloud. Second, cyber threats continue to grow and become more sophisticated.

View cybersecurity as a broad business concern and not just an IT issue. Build cybersecurity and data privacy into agendas across the C-suite and board. Increase investment to improve security .

Educate your employees on effective cybersecurity practices.

For each new business initiative or transformation, make sure there’s a cyber plan in place.

Use data and intelligence to regularly measure your cyber risks. Proactively look for blind spots in your third-party relationships and supply chains.

Investment changes reflect new ways of working

Investments in real estate are declining more than any other area of the business — likely a response to hybrid and remote work.

of companies are scaling back their investment in real estate, more than any other business area.

Companies rethink their investments

As the trend for hybrid and remote work continues, companies are reassessing their physical office footprint with some deciding that less is more. Most (70%) have either expanded or have plans to expand permanent remote work options for job roles that allow. In fact, 42% have already implemented such measures — up from 30% in our January Pulse survey .

Only 31% of respondents plan to increase their investment in real estate, and 22% plan to decrease their investment (a higher decrease than any other investment area). Financial services and health industries are leading the way, with 30% and 29%, respectively, decreasing investments in real estate. Similarly, 15% of overall respondents say they will decrease their investment in facilities and general capex over the next 12 months. When a large swath of workers is no longer in the office on a regular basis, companies can significantly downscale their physical footprint.

On the other hand, executives are making investments in areas that will help drive growth. About half are increasing investments in digital transformation (53%), IT (52%) and cybersecurity and privacy (49%). Forty-eight percent are increasing investment in customer experience and 40% are putting more dollars toward research and development.

Align your investment plan with your company’s strategic direction. Make multi-year investments to drive both short- and long-term outcomes.

Embed clear return on investment expectations in the budget for every investment you make. Disciplined leaders are taking a very honest look at every part of their business.

Determine where your company wants to go with ways of working and how to most effectively optimize your talent, real estate and technology strategies to enable that plan.

As businesses grapple with risk and uncertainty, building and maintaining trust is key.

of respondents say they are focused on developing and/or refining their trust strategy.

The trust imperative

Trust is increasingly becoming a source of competitive advantage for companies that treat it as such — and a point of failure for companies that don’t. In our current survey, 42% of executives say businesses will be the most trusted entity in the next 12 months — up from 39% in January 2022. Executives are doubling down, with 65% saying they’re focused on developing and/or refining their trust strategy.

As the yardstick for company performance expands beyond financial metrics, companies have an imperative to build trust and transparency among different stakeholder groups — employees, customers, suppliers, regulators and the communities in which they operate. This includes both doing the right things and communicating clearly on topics such as reporting and tax transparency.

One third (32%) of business executives tell us they’re very agile when changing business strategy to address stakeholder demands for transparency. That may not seem high in absolute terms, but it was second-highest among all responses regarding agility.

As companies respond to an ever-shifting landscape of risks , challenges and even crises, trust creates a multiplier effect — both positive and negative. Organizations that have cultivated trust as an asset and built up a reservoir of goodwill have more latitude in their response. Conversely, companies with a deficiency of trust make challenges that much tougher on themselves.

Identify the areas of your business that most significantly determine your ability to build (or lose) trust, including cybersecurity, supply chain and communications. Work with your teams to embed trust in those processes.

Trust can’t be limited to certain functions or business units. It needs to be an integral part of your organization’s DNA.

Educate your leadership teams on their role in building trust and identifying areas where trust can be impaired. Senior executives should be consistent in aligning words to actions. Be visible and transparent with all stakeholders about your company’s plans for the future. If you’re considering actions such as rescinding offers, for instance, make sure you’re paying close attention to the potential impact on your reputation as an employer.

Create or refine your stakeholder plan, including your communication cadence for bringing each stakeholder along on your strategic journey. It’s critical to help your stakeholders understand the why. Set up listening channels to understand how stakeholders feel about your organization.

Pandemic lessons learned

Executives should take the time to reflect on their experiences of the past few years.

of respondents say they’re referring to a lessons-learned playbook developed out of COVID-19.

Tested by the pandemic, business executives feel more prepared for the future

If there’s a bright spot to the upheavals we’ve been experiencing over the past several years, it’s that companies and their leaders have become far more agile in how they respond. By the time executives could implement the changes they had scrambled to develop, something else would shift, causing the need for more changes. This time compression is forcing faster response times and, as a result, three- to five-year strategies can no longer be the go-to.

For manufacturers and other types of companies with long supply chains, many pivoted away from global just-in-time manufacturing after experiencing critical shortages due to production issues. Problem is, the processes were developed and used over decades because they were incredibly cost efficient. Smart executives are now reflecting on which investments made in response to the pandemic should be kept and which should be wound down.

Risks are also now more interconnected as well. The following examples highlight how business changes can result in new risks:

While heroic shifts to remote work happened overnight in early 2020, cybersecurity risks soared as employees were logging in from home.

We’re now seeing companies settle on hybrid work models, with some employees working remotely all the time, some splitting their time between home and office and others working exclusively on-site. While this leads to added flexibility and allows companies to hire from a larger pool of employees, it also creates the potential for inequitable treatment of remote workers compared to in-office workers. In fact, 29% of CHROs say that finding a balance between in-office, remote and hybrid work will present a top-3 workforce-related concern for the next 12 months.

As companies continue to automate processes due to labor shortages, many are finding that they don’t have the talent they need. Without the right talent, automations can fail to deliver on promised efficiencies and increase operational risk.

- Conduct a lessons-learned exercise to explore how your company fared over the past few years. Do a gut check on any of the countermeasures you took as a result of the pandemic. Consider all aspects of your business, from supply chain to management to people to tax to systems. Make sure you involve the right people.

- Collaborate closely across the leadership team as you develop go-forward plans. Aligned leadership teams that connect dots are critical to driving effective execution.

- Consider business partners and the idea of an ecosystem mentality. Business partners can help free up resources.

- Revisit the models that your company uses to drive decisions. Many models do not include consideration of new risks that can materially impact your business. For example, how will increasing political polarization impact your revenue goals? Bring all voices to the table to help develop new ideas and ways to drive growth and build trust.

This won’t be the last unusual business experience you face. Avoid the temptation to rush to consider how to emerge stronger.

Sector implications

- Health industries

- Financial services

- Industrial products

- Consumer markets

- Tech, media, telecom

- Energy and utilities

- Private companies

Health executives see cyber attacks, supply chain, tax policy as top business risks

Cyber attacks top the list of risks for health industries. Forty-three percent of health industries executives cite cyber attacks as a serious risk to their organization, compared to 40% of respondents overall. Amid the rising threat of data breaches, ransomware attacks and leaking of sensitive patient data, companies increasingly are using technology in real-time detection and defense. Almost one quarter of health industry executives tell us they’re already seeing benefits from using artificial intelligence in cyber defense.

These executives also rank supply chain disruptions and tax policy as more serious business risks than other sector leaders, with 41% citing these risks compared to 34% and 28% of other respondents, respectively. Pharmaceutical and life sciences companies in particular should develop strategies to prepare for the tax implications of the Inflation Reduction Act, which contains provisions aimed at lowering the cost of prescription drugs and health insurance .

Rising production costs (37%) and talent acquisition and retention (31%) rounded out the top five most serious business risks for health industries. Our January 2022 PwC Pulse Survey found health industry executives already grappling with staffing shortages and the risks COVID-19 variants pose to growth. We expect payer, provider and pharmaceutical and life sciences executives to continue preparing for those risks, along with the potential for recession as we move further into the inflation cycle.

Looking ahead to the next 12 months, health industries leaders are increasing their investments in IT (59%), digital transformation (57%) and cybersecurity and privacy (57%). Those are smart investments as digitally connected health ecosystems emerge for health services organizations and pharmaceutical and life sciences companies use digital technologies to become more consumer-centric. Health industries respondents are also more likely to say that they’re increasing investments in R&D and innovation in the next 12 months (51% versus 40% overall).

Awaiting a recession, FS leaders still seek talent

Financial services (FS) respondents are more bearish on the economy than their counterparts in other industries. Seventy percent tell us they think a recession is likely in the next 12 months, compared to 60% overall. Moreover, a full third (33%) of FS respondents — tied with respondents in industrial products — consider recession a serious risk, the highest among all industries. Despite these concerns, FS executives say they’ll continue investing in certain key areas over the next year. Sixty percent plan to increase spending on digital transformation (compared to 53% overall) and 56% say they’ll raise expenditures on customer experience (versus 48% overall).

FS respondents also see talent acquisition and retention as a potentially bigger pitfall than anyone else. Forty-four percent say it’s a serious risk (versus 38% overall). In response, the sector is among the most likely to offer flexible work options, with 68% saying they’ve expanded remote work choice where possible or plan to do so, and only 27% say they’ve implemented a plan for having employees on-site more often (compared to 32% overall). In addition, FS is least likely to reduce headcount, with 36% of respondents saying they have no plans to do so. Perhaps as a result of these workforce policies, 30% of FS executives say they plan to cut investments in real estate over the next year, the most in any industry.

Interestingly, and in contrast to the above, only 38% of FS respondents indicate their companies will increase investments in the workforce, the lowest figure among all industries. Also of note, 31% of FS respondents, eight percentage points more than the average, report that their companies have no plans to make acquisitions to acquire talent. This indicates that most of them will make do with existing investments and develop needed skills on their own.

For US manufacturers, inflation, supply chain woes beg greater agility

While industrial products (IP) sector leaders still grapple with supply chain disruptions and labor shortages, they’re also being hit by the double-whammy of inflation and the specter of a recession, making agility ever more important. Due to these and other pressures on the sector, US manufacturing output contracted in both May and June. However, looking ahead, the Inflation Reduction Act and the CHIPS and Science Act may have important, positive implications.

Nearly three in four sector leaders (73%) cite rising production costs (e.g., wages, materials, energy, inventory) as posing a “moderate or serious” risk to their business. As a result, even more leaders (77%) say they’re increasing prices for products and services. Meanwhile, most IP executives (57%) report that their businesses are streamlining their product portfolios in the face of the challenging current environment presumably in order to protect shrinking margins.

The sector continues to be beleaguered by supply chain woes, with 71% saying they pose either a moderate or serious risk to their business. Still, yet, nearly as many, (75%) report that they’re improving supply chain resiliency . Looking ahead, 45% of sector leaders believe that supply chain disruptions will ease in the next year.

Workforce issues, too, are still a pain point, with 77% of respondents agreeing that problems surrounding talent acquisition and retention pose risks to their business. IP executives are expanding permanent remote work options for roles that allow for it (64%) and increased compensation for existing employees (retention bonuses, off-cycle raises). Despite the challenging workforce environment, most IP leaders (69%) describe their businesses as “very or moderately” agile in responding to the shifts in the workforce and in attracting talent. Efforts underway may be paying dividends, as payrolls in US manufacturing rose unexpectedly by 30,000 jobs in July 2022.

Given the recent spike in cyber attacks on the industry , 75% of IP executives say that more frequent and/or broader attacks are either a moderate or serious risk to their companies. A vast majority (82%) say they’re taking action or closely monitoring policy around cybersecurity, privacy and data protection, and 76% are revising or enhancing their cyber risk management. Most IP sector leaders (73%) describe their companies as “very or moderately” agile in the changing cyber environment.

Investing for the future in uncertain times

Consumer-facing companies are more likely than their peers to expect a dip in earnings in 2022 due to a confluence of business risks ranging from supply chain issues and inflation to geopolitical concerns and residual COVID-19 considerations.

In response, nearly two-thirds (65%) of consumer markets (CM) leaders have cut earnings forecasts (versus 58% for all sectors), 62% are reducing prices (versus 50% overall) and 58% (versus 52%) have either instituted hiring freezes or plan to do so.

Close to half of CM leaders (44%) tell us supply chain disruptions pose a serious risk to their business (versus 34% for all sectors). Most (77%) plan to digitize their supply chains for resilience and flexibility. Rising production costs are also top of mind as is the role of inflation in depressing consumer demand.

As consumers focus on necessities such as food and gas, CM executives are contending with unsold inventory and increasingly scarce warehouse space. Meanwhile, longer lead times stemming from supply chain disruption have further complicated the balance of supply and demand, exacerbating already shifting consumer preferences .

Despite these headwinds, CM companies are charting future moves. Almost 60% report increasing investments in both tech and digital transformation. CM leaders also expect to invest more in operations (51% versus 41% overall), R&D (48% versus 40%) and ESG initiatives (52% versus 45%).

Their focus on tech-enabled innovation acknowledges that consumers reward companies for a seamless, one-of-kind customer experience with a business they can trust and whose values they identify with. To that end, CM leaders are closely monitoring policy developments in cybersecurity, data protection and privacy.

Most CM companies (71%) are expanding permanent remote work opportunities, as roles allow, and 70% (versus 63% overall) are introducing automation to address labor shortages. Meanwhile, 68% (versus 59% overall) are customizing their HR strategy to meet employee needs in various roles. CM leaders’ commitment to growth signals their vision of an agenda for the future that they can navigate, regardless of current uncertainty and unforeseen disruptions.

Talent in flux: Preparing for growth as recession risk rises

The talent paradox is real. Forty percent of the technology, media and telecommunications (TMT) leaders who responded to our Pulse Survey ranked talent acquisition and retention as a serious risk to their companies. Yet TMT leaders were more likely than their peers to reduce employee headcount (58%), implement hiring freezes (58%), lower or eliminate signing bonuses (57%) or rescind job offers (49%).

The Pulse Survey comes as TMT companies recalibrate following a pendulum swing from pandemic boom to economic slowdown. But even as inflation and recession fears roil the markets, 88% of TMT leaders reported that they’re focusing their business strategies on growth. These findings dovetail with PwC’s recent Global Entertainment & Media Outlook , which describes how priorities have shifted as the sector emerged transformed by a period of social upheaval.

Identifying and capitalizing on growth alternatives may be essential to remaining competitive in today’s economic environment. Companies nimble enough to pivot to new growth opportunities may require a plan to cultivate talent well-suited to this moment. That may mean a smaller workforce, but one that’s more focused on new areas of development. Incentivizing current and recent employees may be key in this effort.

TMT companies were more likely to have increased compensation for existing employees (70% versus 64% overall). For roles that allow it, 81% of TMT leaders report that they have expanded or plan to expand remote work options (versus 70% for all sectors). They’re also more likely than their peers to encourage employees who recently left to return (58% versus 49% overall), potentially reducing the time necessary for onboarding and training.

Bold ambitions for energy and utilities in a world of amplified risks

Energy and utilities executives have bold ambitions for the future along with very real, present-day obligations. It’s a balancing act playing out amid a backdrop of emerging threats, economic uncertainty and rising costs as well as societal, political and regulatory pressures. Sector leaders feel the weight of this, citing cyber attacks, high US interest rates, supply chain disruptions, climate change, the US regulatory environment and tax policy changes as serious risks facing their companies. Notably, industry respondents rank these risks higher than executives overall.

The risks may feel amplified, and for good reason. Leaders are balancing the growing demand for net-zero sources of energy with the realities of today’s energy supply. Many cleaner energy initiatives hinge on the ability to procure solar panels and other materials including critical minerals. Meanwhile, new and evolving threats to grids, pipelines and energy infrastructure emerge daily.

With the important task of protecting the nation’s energy supply, it’s increasingly important to make cybersecurity everyone’s priority . Energy and utilities executives are aligned on the need to revise and enhance cyber risk management, naming it as the top action (84%) the industry is taking in response to today’s business environment. Executives are also looking to invest in cybersecurity, with 59% planning to increase investments in the next 12 months, the top area for investment. IT, digital transformation, customer experience and ESG round out the top five areas for investment.

Trust is top of mind for energy and utilities executives. At a level much higher than other industries, 63% of energy and utilities expect business to be the most trusted entity in the next 12 months. More than half (53%) plan to proactively become more transparent with all stakeholders. This includes taking action to address or monitor proposed SEC climate disclosure rules , one of the top policy areas on their radars. The adoption of investor-grade climate and emissions reporting is one step in a bigger effort that’s underway. It also includes operationalizing ESG commitments, embedding ESG in business strategy and pursuing opportunities to lead the march toward a cleaner energy future.

Threats and talent top risks for private companies

Private companies are playing catch-up to public companies, as many delayed investments and deferred maintenance over the past few years. They’re also squarely focused on growth and the aspects of business that directly tie to the bottom line.

The vast majority of private company respondents tell us they’re both transforming business processes and revising/enhancing their cyber management (89% for both). Private companies are also increasing investments in several areas more so than other executives: IT (59% versus 52% overall), cyber (59% versus 49% overall) and digital transformation (57% versus 53% overall). Private company executives know that making investments in the right technologies and business processes will be essential to growth.

Private companies are more concerned about talent acquisition and retention than public companies, with 61% of private company executives listing it as a serious risk (versus 38% overall). Private companies have traditionally found it harder to recruit top talent because they often don’t have the same access to capital, career development opportunities and brand recognition.

Interestingly, private companies trail when it comes to raises for existing employees, with only 34% planning to increase compensation (versus 64% overall). On the other hand, only 20% of private company executives say they plan to — or have already — reduced headcount (versus 52% of public companies). Many private companies are outsourcing and using managed services more for non-core activities, which can help them focus on attracting key personnel for core activities.

Cyber tops the list of risks for both private and public companies. Fifty-seven percent of private companies mention more frequent and/or broader cyber threats as a serious risk (versus 39% of public companies). While cyber attacks are a risk for all businesses, public companies have spent years investing in security technologies and protocols. Private companies may not have the same resources, potentially leaving them more vulnerable to cyber attacks.

Private companies have a more pessimistic view of the economy, with 80% citing it likely that inflation will remain elevated (versus 62% overall) and 84% saying a recession is likely (versus 60% overall). The private sector typically feels the impact of both recession and recovery before the public sector. Still, nimble private companies that adjust their strategies quickly can take advantage of the opportunities that changes in the economic environment present.

Managing business risks: What’s top of mind in the C-suite?

About the survey.

Between August 1 and August 5, 2022, PwC surveyed 722 US executives including CFOs and finance leaders (13%), CHROs and human capital leaders (14%), tax leaders (13%), risk management leaders, including CROs, CAEs and CISOs (12%), COOs and operations leaders (12%), CIOs, CTOs and technology leaders (13%), CMOs and marketing leaders (13%) and corporate board directors (10%). Respondents were from public and private companies in six sectors: industrial products (24%), consumer markets (25%), financial services (22%), technology, media and telecom (14%), health industries (7%) and energy and utilities (4%). The Pulse Survey is conducted on a periodic basis to track the changing sentiment and priorities of business executives.

Download the chart pack Get access to the complete survey responses and data

Related content, pwc pulse survey: executive views on business in 2022.

Businesses are stymied by inflation, the pandemic and a talent shortage. The C-suite is uniting to prioritize investments that accelerate growth.

Upcoming and recent PwC tax webcasts

Register today to hear the latest insights from the world of tax.

2024 Tax Policy Outlook: Defining the choices ahead

The stakes rarely have been higher as business leaders seek to manage operations and plan investments in an environment of uncertain tax policy and tax changes....

2022 US Metaverse Survey

Learn what 6,000 business executives and consumers think about the metaverse in PwC’s inaugural survey. And find out what four areas to focus on to drive growth...

J.C. Lapierre

Chief Strategy and Communications Officer, PwC US

Thank you for your interest in PwC

We have received your information. Should you need to refer back to this submission in the future, please use reference number "refID" .

Required fields are marked with an asterisk( * )

Please correct the errors and send your information again.

By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). If you change your mind at any time about wishing to receive the information from us, you can send us an email message using the Contact Us page.

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is Risk Management & Why Is It Important?

- 24 Oct 2023

Businesses can’t operate without risk. Economic, technological, environmental, and competitive factors introduce obstacles that companies must not only manage but overcome.

According to PwC’s Global Risk Survey , organizations that embrace strategic risk management are five times more likely to deliver stakeholder confidence and better business outcomes and two times more likely to expect faster revenue growth.

If you want to enhance your job performance and identify and mitigate risk more effectively, here’s a breakdown of what risk management is and why it’s important.

Access your free e-book today.

What Is Risk Management?

Risk management is the systematic process of identifying, assessing, and mitigating threats or uncertainties that can affect your organization. It involves analyzing risks’ likelihood and impact, developing strategies to minimize harm, and monitoring measures’ effectiveness.

“Competing successfully in any industry involves some level of risk,” says Harvard Business School Professor Robert Simons, who teaches the online course Strategy Execution . “But high-performing businesses with high-pressure cultures are especially vulnerable. As a manager, you need to know how and why these risks arise and how to avoid them.”

According to Strategy Execution , strategic risk has three main causes:

- Pressures due to growth: This is often caused by an accelerated rate of expansion that makes staffing or industry knowledge gaps more harmful to your business.

- Pressures due to culture: While entrepreneurial risk-taking can come with rewards, executive resistance and internal competition can cause problems.

- Pressures due to information management: Since information is key to effective leadership , gaps in performance measures can result in decentralized decision-making.

These pressures can lead to several types of risk that you must manage or mitigate to avoid reputational, financial, or strategic failures. However, risks aren’t always obvious.

“I think one of the challenges firms face is the ability to properly identify their risks,” says HBS Professor Eugene Soltes in Strategy Execution .

Therefore, it’s crucial to pinpoint unexpected events or conditions that could significantly impede your organization’s business strategy .

Related: Business Strategy vs. Strategy Execution: Which Course Is Right for Me?

According to Strategy Execution , strategic risk comprises:

- Operations risk: This occurs when internal operational errors interrupt your products or services’ flow. For example, shipping tainted products can negatively affect food distribution companies.

- Asset impairment risk: When your company’s assets lose a significant portion of their current value because of a decreased likelihood of receiving future cash flows . For instance, losing property assets, like a manufacturing plant, due to a natural disaster.

- Competitive risk: Changes in the competitive environment can interrupt your organization’s ability to create value and differentiate its offerings—eventually leading to a significant loss in revenue.

- Franchise risk: When your organization’s value erodes because stakeholders lose confidence in its objectives. This primarily results from failing to control any of the strategic risk sources listed above.

Understanding these risks is essential to ensuring your organization’s long-term success. Here’s a deeper dive into why risk management is important.

4 Reasons Why Risk Management Is Important