Financial Management Research Paper Topics

Financial management research paper topics have emerged as an essential part of contemporary education in business and economics. As financial management continues to evolve with global economic changes, the need for research and analysis in this area grows. This article provides a comprehensive guide for students who study management and are assigned to write research papers on various aspects of financial management. From understanding the diverse topics to learning how to write an impactful research paper, this page offers valuable insights. Additionally, it introduces iResearchNet’s writing services, specifically tailored to assist students in achieving academic excellence. The content is structured to guide students through topic selection, writing, and leveraging professional services to meet their academic goals. Whether a novice or an advanced student of financial management, this resource offers a multifaceted perspective on the vast and dynamic field of financial management research.

100 Financial Management Research Paper Topics

The field of financial management offers a vast array of research paper topics. This complex discipline touches every aspect of business operations, influencing strategic planning, decision-making, and organizational growth. Below, you will find a comprehensive list of financial management research paper topics, divided into 10 categories. Each category offers 10 unique topics that cater to various interests within financial management. These topics have been carefully selected to reflect the richness and diversity of the subject.

Academic Writing, Editing, Proofreading, And Problem Solving Services

Get 10% off with 24start discount code, financial planning and control.

- The Role of Budgeting in Financial Planning

- Strategic Financial Management in SMEs

- The Impact of Working Capital Management on Profitability

- Ethical Considerations in Financial Planning

- Risk Management in Financial Planning

- Cost Control Techniques in Manufacturing

- Financial Decision-making Processes in Non-profit Organizations

- The Impact of Inflation on Financial Planning

- International Financial Planning Strategies

- The Relationship between Corporate Governance and Financial Planning

Investment Analysis and Portfolio Management

- The Efficient Market Hypothesis: A Critical Analysis

- The Role of Behavioral Finance in Investment Decisions

- Modern Portfolio Theory and Its Limitations

- Risk and Return Analysis in Emerging Markets

- Socially Responsible Investment Strategies

- The Impact of Political Instability on Investment Decisions

- Real Estate Investment Trusts (REITs): An In-depth Study

- Impact of Technology on Portfolio Management

- Mutual Funds vs. ETFs: A Comparative Study

- The Role of Artificial Intelligence in Investment Management

Corporate Finance

- Capital Structure Decisions in Startups

- The Role of Dividends in Corporate Financial Management

- Mergers and Acquisitions: Strategic Financial Analysis

- Corporate Financing in Developing Economies

- An Analysis of Venture Capital Financing

- The Impact of Corporate Social Responsibility on Financial Performance

- The Role of Financial Management in Business Turnaround Strategies

- Debt Financing vs. Equity Financing: A Comparative Analysis

- Corporate Financial Risk Management Strategies

- Financing Innovation: Challenges and Opportunities

International Financial Management

- Exchange Rate Dynamics and International Financial Decisions

- The Role of International Financial Institutions in Economic Development

- Cross-border Mergers and Acquisitions

- Globalization and Its Impact on Financial Management

- International Tax Planning Strategies

- Challenges in Managing International Financial Risk

- Currency Risk Management in Multinational Corporations

- International Capital Budgeting Decisions

- The Impact of Cultural Differences on International Financial Management

- Foreign Direct Investment Strategies and Financial Management

Financial Markets and Institutions

- The Role of Central Banks in Financial Stability

- The Evolution of Microfinance Institutions

- The Impact of Regulation on Banking Operations

- An Analysis of Stock Market Efficiency

- Financial Derivatives and Risk Management

- The Role of Technology in Financial Services

- A Study of Financial Crises and Regulatory Responses

- Peer-to-Peer Lending Platforms: A New Paradigm

- The Role of Credit Rating Agencies in Financial Markets

- The Future of Cryptocurrency in the Financial Landscape

Personal Finance Management

- Financial Literacy and Personal Investment Decisions

- The Role of Technology in Personal Finance Management

- Retirement Planning Strategies

- Impact of Consumer Behavior on Personal Financial Decisions

- Personal Finance Management in the Gig Economy

- A Study of Personal Bankruptcy Trends

- Credit Card Management Strategies for Individuals

- The Effect of Education on Personal Financial Management

- The Role of Financial Counseling in Personal Finance

- Estate Planning: A Comprehensive Analysis

Risk Management

- Enterprise Risk Management: A Strategic Approach

- The Role of Insurance in Financial Risk Management

- Financial Innovations in Risk Management

- A Study of Credit Risk Management in Banks

- Risk Management Strategies in Supply Chain Finance

- Cyber Risk Management in Financial Institutions

- The Impact of Climate Change on Financial Risks

- A Study of Operational Risk Management in the Healthcare Sector

- Behavioral Aspects of Risk Management

- Crisis Management and Financial Stability

Financial Technology (FinTech)

- The Rise of Blockchain Technology in Finance

- The Impact of FinTech on Traditional Banking

- Regulatory Challenges in the Age of FinTech

- Financial Inclusion through FinTech Innovation

- Artificial Intelligence in Financial Services

- The Future of Cryptocurrencies: Opportunities and Risks

- A Study of Peer-to-Peer Lending Platforms

- FinTech and Consumer Privacy: Ethical Considerations

- Mobile Banking: An Evolutionary Study

- The Role of Big Data Analytics in Financial Decision Making

Ethics and Sustainability in Finance

- Ethical Investing: Trends and Challenges

- Corporate Social Responsibility Reporting in Finance

- Sustainable Finance in Emerging Economies

- Environmental, Social, and Governance (ESG) Criteria in Investment

- The Impact of Business Ethics on Financial Performance

- The Role of Sustainability in Corporate Financial Strategy

- Green Bonds and Financing Sustainable Development

- Social Impact Investing: Opportunities and Challenges

- A Study of Gender Equality in Financial Institutions

- Financial Strategies for Achieving Sustainable Development Goals

Accounting and Finance

- Forensic Accounting: Techniques and Case Studies

- The Role of Management Accounting in Financial Decision-making

- International Financial Reporting Standards (IFRS) Adoption

- The Impact of Taxation on Financial Management

- Accounting Information Systems: An In-depth Analysis

- The Role of Auditing in Corporate Governance

- Accounting Ethics: A Study of Professional Conduct

- Environmental Accounting and Sustainable Development

- The Effect of Automation on Accounting Practices

- A Comparative Study of GAAP and IFRS

The extensive list above offers a broad spectrum of financial management research paper topics. They cater to different academic levels and areas of interest, providing a wealth of opportunities for students to explore the multi-dimensional world of financial management. The selection of these topics can lead to exciting discoveries and insights, pushing the boundaries of existing knowledge in the field. Whether it’s understanding the intricate dynamics of global finance or delving into the ethical considerations in investment decisions, these topics serve as starting points for thought-provoking research that can shape future practices in financial management. By choosing a topic from this comprehensive list, students embark on a journey of intellectual exploration that can contribute to both academic success and the broader understanding of financial management in the modern world.

Financial Management and the Range of Research Paper Topics

Financial management is a multifaceted discipline that stands at the intersection of economics, business administration, and finance. It governs the planning, organizing, directing, and controlling of financial activities within an organization or individual framework. In an ever-changing global economy, the importance of financial management cannot be overstated. It empowers organizations and individuals to make informed decisions, manage risks, and achieve financial stability and growth. This article delves into the vast domain of financial management and explores the wide array of research paper topics it offers.

A. Definition and Core Concepts of Financial Management

Financial management refers to the efficient and effective management of money to achieve specific objectives. It involves processes and tasks such as budgeting, forecasting, investment analysis, risk management, and financial reporting. The primary goals are to maximize shareholder value, ensure liquidity, and maintain solvency.

- Budgeting and Forecasting : These processes involve planning and estimating future financial needs and outcomes. They guide decision-making and help in aligning resources with organizational goals.

- Investment Analysis : This includes evaluating investment opportunities and determining the most profitable and sustainable investments.

- Risk Management : This aspect focuses on identifying, evaluating, and mitigating financial risks, including market risk, credit risk, and operational risk.

- Financial Reporting : This entails the preparation and presentation of financial statements that accurately reflect the financial position of an organization.

B. Importance of Financial Management

- Ensuring Financial Stability : Effective financial management helps in maintaining the financial health of an organization or individual by ensuring a balance between income and expenditure.

- Optimizing Resources : It enables the optimal utilization of resources by aligning them with short-term and long-term goals.

- Strategic Planning : Financial management plays a key role in strategic planning by providing insights into financial capabilities and constraints.

- Enhancing Profitability : By making informed investment and operational decisions, financial management enhances the profitability of an organization.

C. Modern Trends and Challenges in Financial Management

The evolution of technology, globalization, regulatory changes, and societal expectations have shaped modern financial management. Some noteworthy trends and challenges include:

- Financial Technology (FinTech) : The integration of technology into financial services has revolutionized banking, investing, and risk management.

- Globalization : The interconnectedness of global markets presents both opportunities and challenges in managing international financial operations.

- Sustainability and Ethics : The growing focus on environmental, social, and governance (ESG) criteria has led to ethical investing and sustainable finance.

- Regulatory Compliance : Navigating the complex regulatory landscape is a challenge that requires constant adaptation and vigilance.

D. Range of Research Paper Topics in Financial Management

The vastness of financial management offers a rich source of research paper topics. From exploring the intricacies of investment analysis to understanding the ethical dimensions of finance, the possibilities are endless. The following are some broad categories:

- Corporate Finance : Topics related to capital structure, mergers and acquisitions, dividend policies, and more.

- Investment and Portfolio Management : Including research on investment strategies, portfolio optimization, risk and return analysis, etc.

- International Financial Management : This encompasses studies on exchange rate dynamics, global financial strategies, cross-border investments, etc.

- Risk Management : Topics include various risk management techniques, insurance, financial innovations in risk management, etc.

- Personal Finance Management : This field covers financial planning for individuals, retirement strategies, credit management, etc.

- Financial Technology : Blockchain, cryptocurrencies, mobile banking, and more fall under this innovative domain.

- Ethics and Sustainability in Finance : Research in this area may focus on ethical investing, corporate social responsibility, green financing, etc.

Financial management is an expansive and dynamic field that intertwines various elements of finance, economics, and business administration. Its importance in today’s world is immense, given the complexities of the global financial system. The array of research paper topics that this subject offers is indicative of its diversity and depth.

From traditional concepts like budgeting and investment analysis to modern phenomena like FinTech and sustainability, the world of financial management continues to evolve. It invites scholars, practitioners, and students to explore, question, and contribute to its understanding.

The range of research paper topics in financial management offers avenues for academic inquiry and practical application. Whether it’s investigating the effects of globalization on financial strategies or exploring personal finance management in the gig economy, there’s a topic to spark curiosity and inspire research. These research endeavors not only enrich academic literature but also play a crucial role in shaping the future of financial management. In a rapidly changing world, continuous exploration and learning in this field are essential to remain relevant, innovative, and responsible.

How to Choose Financial Management Research Paper Topics

Choosing the right research paper topic in the field of financial management is a critical step in the research process. The chosen topic can shape the direction, depth, and impact of the research. Given the wide array of subfields within financial management, selecting a suitable topic can be both exciting and challenging. Here’s a comprehensive guide to assist you in choosing the ideal financial management research paper topic.

1. Understand Your Interest and Strengths

- Assess Your Interests : Consider what aspects of financial management intrigue you the most. Your enthusiasm for a subject can greatly enhance the research process.

- Identify Your Strengths : Understanding where your skills and knowledge lie can guide you towards a topic that you can explore competently.

- Connect with Real-world Issues : Relating your interests to current industry challenges or trends can make your research more relevant and engaging.

2. Consider the Scope and Depth

- Define the Scope : A clear understanding of the scope helps in keeping the research focused. Too broad a topic can make the research vague, while too narrow may limit your exploration.

- Determine the Depth : Decide how deep you want to delve into the topic. Some subjects may require extensive quantitative analysis, while others may be more theoretical.

3. Examine Academic and Industry Relevance

- Align with Academic Requirements : Ensure that the topic aligns with your course objectives and academic requirements.

- Analyze Industry Needs : Consider how your research could contribute to the industry or address specific financial management challenges.

4. Evaluate Available Resources and Data

- Assess Data Accessibility : Ensure that you can access the necessary data and information to conduct your research.

- Consider Resource Limitations : Be mindful of the time, financial, and technological resources that you’ll need to complete your research.

5. Review Existing Literature

- Analyze Previous Research : Review related literature to identify gaps, controversies, or emerging trends that you can explore.

- Avoid Duplication : Ensure that your chosen topic is unique and not merely a repetition of existing studies.

6. Consult with Experts and Peers

- Seek Guidance from Faculty : Consulting with faculty or mentors can provide valuable insights and direction.

- Collaborate with Peers : Discussions with classmates or colleagues can help in refining ideas and getting diverse perspectives.

7. Consider Ethical Implications

- Evaluate Ethical Considerations : Ensure that your research complies with ethical guidelines, especially if it involves human subjects or sensitive data.

- Reflect on Social Impact : Consider how your research might influence society, policy, or industry standards.

8. Test the Feasibility

- Conduct a Preliminary Study : A small-scale preliminary study or analysis can help in gauging the feasibility of the research.

- Set Realistic Goals : Ensure that your research objectives are achievable within the constraints of time, resources, and expertise.

9. Align with Career Goals

- Consider Future Applications : Think about how this research might align with your career goals or professional development.

- Build on Past Experience : Leveraging your past experiences or projects can lend depth and continuity to your research.

10. Stay Flexible and Adaptable

- Be Open to Change : Research is often an iterative process; being flexible allows for adaptation as new insights or challenges emerge.

- Maintain a Balanced Perspective : While focusing on your chosen topic, keep an open mind to interrelated areas that might enrich your research.

Choosing the right financial management research paper topic is a nuanced process that requires careful consideration of various factors. From understanding personal interests and academic needs to evaluating resources, ethics, and feasibility, each aspect plays a significant role in shaping the research journey.

By following this comprehensive guide, students can navigate the complexities of selecting a suitable research paper topic in financial management. The ultimate goal is to find a topic that resonates with one’s interests, aligns with academic and professional objectives, and contributes meaningfully to the field of financial management. Whether delving into the dynamics of risk management or exploring the impact of FinTech innovations, the chosen topic should be a catalyst for inquiry, creativity, and growth.

How to Write a Financial Management Research Paper

Writing a research paper on financial management is a rigorous process that demands a thorough understanding of financial concepts, analytical skills, and adherence to academic standards. From selecting the right topic to presenting the final piece, each step must be methodically planned and executed. This section provides a comprehensive guide to help students craft an impactful financial management research paper.

1. Understand the Assignment

- Read the Guidelines : Begin by understanding the specific requirements of the assignment, including formatting, length, deadlines, and the expected structure.

- Clarify Doubts : If any aspect of the assignment is unclear, seek clarification from your instructor or mentor to avoid mistakes.

2. Choose a Strong Topic

- Identify Your Interest : Select a topic that interests you, aligns with your strengths, and meets academic and industry relevance. Refer to the previous section for detailed guidelines on choosing a topic.

3. Conduct Extensive Research

- Explore Varied Sources : Use academic journals, textbooks, online databases, and industry reports to gather diverse perspectives and evidence.

- Evaluate the Credibility : Ensure that the sources are credible, relevant, and up-to-date.

- Organize Your Findings : Maintain well-organized notes, including source citations, to facilitate smooth writing later.

4. Develop a Thesis Statement

- Define Your Focus : Craft a clear and concise thesis statement that outlines the central argument or purpose of your research.

- Align with the Evidence : Ensure that your thesis is well-supported by the evidence you have gathered.

5. Create an Outline

- Structure Your Paper : Plan the structure of your paper, including the introduction, body, and conclusion.

- Organize Ideas : Arrange your ideas, arguments, and evidence logically within the outline.

6. Write a Compelling Introduction

- Introduce the Topic : Provide background information and context to the reader.

- Present the Thesis : Clearly state your thesis to guide the reader through your research.

- Engage the Reader : Use compelling language to create interest in your study.

7. Develop the Body of the Paper

- Present Your Arguments : Use clear and concise paragraphs to present each main idea or argument.

- Support with Evidence : Include relevant data, charts, graphs, or quotations to support your claims.

- Use Subheadings : Subheadings can help in organizing the content and making it more reader-friendly.

8. Include Financial Analysis

- Apply Financial Models : Use relevant financial models, theories, or frameworks that pertain to your topic.

- Perform Quantitative Analysis : Utilize statistical tools, if necessary, to analyze financial data.

- Interpret the Results : Ensure that you not only present the numbers but also interpret what they mean in the context of your research.

9. Write a Thoughtful Conclusion

- Summarize Key Points : Recap the main arguments and findings of your paper.

- Restate the Thesis : Reiterate your thesis in light of the evidence presented.

- Provide Insights : Offer insights, implications, or recommendations based on your research.

10. Revise and Edit

- Review for Clarity : Read through the paper to ensure that the ideas flow logically and the arguments are well-articulated.

- Check for Errors : Look for grammatical, spelling, and formatting errors.

- Seek Feedback : Consider getting feedback from peers, tutors, or mentors to enhance the quality of your paper.

11. Follow Formatting Guidelines

- Adhere to Citation Style : Follow the required citation style (APA, MLA, etc.) consistently throughout the paper.

- Include a Bibliography : List all the references used in the research in a properly formatted bibliography.

- Add Appendices if Needed : Include any supplementary material like data sets or additional calculations in the appendices.

Writing a financial management research paper is a complex task that demands meticulous planning, diligent research, critical analysis, and clear communication. By adhering to these detailed guidelines, students can craft a research paper that not only meets academic standards but also contributes to the understanding of intricate financial management concepts.

Whether exploring investment strategies, corporate finance, or financial risk management, a well-crafted research paper showcases one’s analytical capabilities, comprehension of financial principles, and the ability to apply theoretical knowledge to real-world scenarios. It is an invaluable exercise in intellectual exploration and professional development within the realm of financial management.

iResearchNet Writing Services

For custom financial management research paper.

For students who are striving to excel in their academic journey, but are grappling with the challenges of creating a robust financial management research paper, iResearchNet comes to the rescue. With an array of quality writing services tailored to suit your unique needs, we are here to help you achieve your academic goals. Here’s an overview of our unique offerings, aimed at providing you the best in custom financial management research paper writing.

- Expert Degree-Holding Writers : Our team comprises handpicked writers, each holding degrees in finance or related fields. They come with a wealth of experience in academic writing, industry exposure, and a deep understanding of financial management concepts. They have the expertise to delve into complex topics and transform them into comprehensive, high-quality research papers.

- Custom Written Works : At iResearchNet, we believe every assignment is unique. We offer bespoke services, writing each paper from scratch, ensuring it matches your specific requirements and academic level. Our writers create well-structured, argumentative, and analytically sound papers that reflect original thinking.

- In-Depth Research : We recognize the importance of thorough research in crafting a superior financial management paper. Our writers dive deep into a variety of resources, extracting relevant information, data, and insights to ensure that your paper is rich in content, evidential support, and critical analysis.

- Custom Formatting : We adhere to the formatting style of your choice – APA, MLA, Chicago/Turabian, or Harvard. Our writers are adept at applying these styles to your paper, ensuring that every citation, reference, and the general layout complies with the required academic standards.

- Top Quality : Our commitment to quality is uncompromising. Each paper goes through a rigorous quality check, ensuring clarity of thought, precision of language, validity of arguments, and the overall coherence of the paper.

- Customized Solutions : We recognize that each student has unique needs. Our writers engage in a collaborative process with you to understand your academic objectives, style preferences, and specific requirements to provide a custom solution that best fits your needs.

- Flexible Pricing : We offer our premium services at competitive prices. We believe that every student deserves access to quality writing services, and our flexible pricing system ensures our services are affordable.

- Short Deadlines : Faced with a tight deadline? No worries. We can handle urgent orders, with turnaround times as short as three hours for certain assignments, without compromising on quality.

- Timely Delivery : We respect your timelines and are committed to delivering your paper well within your specified deadline, giving you ample time for review and revisions, if needed.

- 24/7 Support : Our dedicated customer service team is available around the clock to answer your queries, resolve any issues, and provide updates on your order status.

- Absolute Privacy : We have stringent privacy policies in place to ensure the confidentiality of your personal information and order details. We guarantee that your data will never be shared with third parties.

- Easy Order Tracking : Our user-friendly online platform enables you to easily track your order’s progress, communicate with the writer, and manage all aspects of your order conveniently.

- Money Back Guarantee : Your satisfaction is our ultimate goal. If, for any reason, you are not satisfied with our services, we offer a money-back guarantee, assuring you that your investment is safe with us.

With iResearchNet, you can rest assured that your financial management research paper is in capable hands. We understand the challenges that come with academic writing and strive to offer a comprehensive, stress-free solution that caters to your specific needs. Our core values of quality, integrity, and customer satisfaction drive us to deliver top-tier services that elevate your academic journey.

Leave the daunting task of research and writing to us, and focus on what truly matters – learning, understanding, and applying financial management concepts. So, reach out today, and let us help you turn your academic challenges into opportunities for growth and success!

Unlock Your Potential with iResearchNet – Your Partner in Academic Success!

Are you ready to take your financial management research paper to the next level? The journey to academic excellence is filled with challenges, but you don’t have to face them alone. With iResearchNet’s team of highly qualified writers and industry experts, we’ve got your back!

1. Embrace Quality and Excellence: We are not just offering a service; we are offering a partnership in your academic success. Our carefully crafted research papers are more than mere assignments; they are learning tools, meticulously designed to help you understand and excel in financial management.

2. Save Time, Learn More: By trusting us with your research paper, you free yourself to focus on understanding core financial management concepts, preparing for exams, or engaging in other valuable educational pursuits. Let us handle the intricate details of research and writing.

3. Invest in Your Future: This is more than just another paper; it’s a step towards your future career in finance. Our expertly crafted custom papers can be your gateway to deeper insights and better grades.

Why Wait? Let’s Get Started!

The clock is ticking, and your deadline is fast approaching. Our expert writers are standing by, ready to transform your requirements into a masterpiece of academic writing. With iResearchNet, you are not just buying a paper; you are investing in knowledge, quality, and your future success.

Take action today. Click the link below, fill in the details, and start your journey towards academic excellence with iResearchNet. Experience the difference that professionalism, quality, and personalized service can make in your academic life.

Order Now – Let iResearchNet Guide You to Success!

Order high quality custom paper.

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Financial Research Paper Topics: Interesting Finance Questions to Uncover

Are you having trouble thinking of a good topic for your finance research paper? Believe it or not, you are not alone. It might be difficult to find the perfect financial research topic time and time again. After all, picking the right subject is crucial to your financial field. Whether you’re putting together a presentation, penning an essay, or doing research papers, your choice of subject is of critical significance.

To aid you in overcoming this obstacle, we have compiled a detailed list of organized finance topics for research papers. If you want to be sure you choose the right subject for your financial management efforts, we’ve provided a concise guide with crucial advice.

How to Choose Topics for a Finance Research Paper?

If you need assistance deciding on a subject for your finance research paper, here are some pointers. But before we get into those pointers, it’s important to keep in mind that custom writing services may be a great resource for choosing finance topics for your research paper. You may save yourself time and effort by relying on their staff of seasoned writers to help you choose a subject that is both interesting and applicable to your assignment. The following are three guidelines for deciding on a subject for a finance research paper:

- Find Unanswered Questions : Try to pinpoint issues that haven’t received enough attention so far in financial research. You may add to the corpus of knowledge already available by identifying information gaps. Investigate financial management, traditional finance, corporate finance, personal finance and similar topics in order to develop a workable solution or to provide novel ideas.

- Review Existing Literature : Gaining familiarity with the state of the art in finance research requires reading theses and academic articles. Doing so will aid you in pinpointing certain niches in which you may excel. Search the literature for broad perspectives or recurring themes that might help you zero in on a particular issue.

- Stay Updated and Seek Input : Conduct internet research to keep up with the latest financial concerns. Investigate pressing concerns in the industry, such as the effects of the global financial crisis or new developments in the financial markets. You should also talk about your topic with others who have written research papers, such as your friends, classmates, or professors. Getting their thoughts might help you hone your subject and provide vital information.

Where to Get Data for Finance Papers?

It is crucial to get accurate and up-to-date information while conducting studies in the financial sector. One efficient method is to pay for papers or to hire a finance researcher and analysts to do the work for you, especially when it comes to personal finance.

- ProQuest is a significant tool since it provides access to scholarly literature from every field of study in the form of periodicals, newspapers, industry reports, dissertations, and profiles of prominent businesses.

- Scopus and Web of Science provide a plethora of resources, including journals, books, and conference proceedings, that provide comprehensive coverage across academic subjects.

- Global Financial Data (GFD) is one such database that caters only to finance research, and its extensive research has a wealth of data on various asset classes, prices, indexes, and currency exchange rates.

- Bloomberg, Thomson Reuters Datastream, and WRDS provide faculty and researchers with institutional access to a plethora of financial data and tools. This includes real-time market data, financial statements, economic indicators, and personal finance topics to write about.

List of Finance Research Topics

This exhaustive list covers everything you need, whether you’re an MBA student, a finance management professional, or a college student. Explore the exciting field of finance research, delving into areas like healthcare financing, the latest developments in the field, corporate finance, and the aftereffects of the global financial crisis. The finance research papers” in this volume will keep you interested and well-informed.

Finance Research Topics for MBA

Investment analysis, financial management, and personal finance are just a few of the many disciplines that fall under the umbrella of finance research subjects for MBA students. Such topics in finance are essential because they provide MBA students with a solid grounding in financial theory and practice. Here are a few suggestions for MBA students looking for research topics in finance:

- Risk Management Strategies in Financial Institutions.

- Behavioral Finance in Investment Decision-Making.

- Financial Inclusion and Economic Development.

- Comparative Analysis of IFRS Adoption and Financial Reporting Quality.

- Impact of Financial Technology (Fintech) on Traditional Banking.

Finance Management Research Topics

Finance management topics include a broad spectrum of areas that dive into the complexities of managing financial resources in different contexts. Investment analysis, risk management, financial markets, and corporate finance all fall under finance management. Writing a finance research paper helps you understand financial decision-making, develop effective strategies, and advance the field. Before commencing your research paper, consider the following finance research paper ideas:

- Corporate Risk Management Strategies On Firm Performance.

- Benefit Investment Management Practices In Pension Funds.

- Assessing Financial Risks And Mitigation Techniques In Developing Market Multinationals.

- Electronic Banking And Financial Inclusion In Developed And Developing Nations.

- An Empirical Study Of Investor Behavior And Global Finance Data.

Healthcare Finance Research Topics

Explore the application of financial theory to the healthcare sector while writing about finance research paper topics. This financial research is essential for expanding our knowledge of healthcare economics, investment strategies, cost control, and healthcare policy. Finance researchers may also investigate intricate monetary systems to enhance healthcare services and the health of patients. Some healthcare finance topics might include the following:

- Impact Of Healthcare Policy On Financial Sustainability.

- Cost-Effectiveness Analysis Of Healthcare Interventions.

- Healthcare Reimbursement Models And Their Impact On Healthcare Providers.

- Economic Evaluation Of Preventive Healthcare Programs.

- Healthcare Financing And Access To Care For Underserved Populations.

Interesting Finance Dissertation Topics

For the purposes of writing finance research papers and finishing a dissertation, investigating interesting finance topics is essential. You can gain a more thorough comprehension of economic principles and their real-world applications. In order to have a high-quality research paper done quickly and with no effort, it’s a good idea to look into help with dissertation writing services. For your next research paper, you can consider the following interesting financial topics:

- The banking sector and digital transformation: customer experience and operational effectiveness.

- Corporate risk management strategies in the banking industry: Traditional vs. developing risk management procedures.

- A case study of emerging nations and how well-functioning financial systems foster economic progress.

- Financial aid programs in promoting access to higher education

- A post-pandemic examination of banking institutions’ resilience and regulatory measures’ systemic risk mitigation.

Current Research Topics in Finance

Examining current finance research paper topics is essential due to the dynamic nature of the financial industry. By digging into current financial topics to write about, you learn more about the market, investing methods, risk management, and more. This financial research supports decision-making, policy-making, and the development of new financial solutions. Here are a few lists of subjects to consider if you are looking for current financial topics to write about.

- Financial Statement Analysis And Investment Decisions In Different Industries.

- Exploring The Effectiveness Of Machine Learning Algorithms In Predicting Financial Asset Prices.

- The Role Of Financial Derivatives In Managing Risk And Enhancing Returns In The Business Sector.

- Corporate Governance Practices On Financial Performance And Asset Valuation.

- Sustainable Finance Projects In Promoting Environmental, Social, And Governance (ESG) Goals.

Best Finance Research Topics

A finance research paper topic requires the identification of intriguing subjects for extensive research. The best financial research opens the door to explorations of many facets of finance, including investing tactics and the stock market. As you start to write research papers on finance topics, you’ll open up opportunities for self-discovery, theory-building, and prudent decision-making. You’ll also help them become better researchers and writers, leading to better articles.

- Artificial Intelligence and Financial Decision-Making.

- Financial Risk Management in the Age of Cryptocurrencies.

- Behavioral Finance and Investment Decision-Making.

- The Effectiveness of Financial Regulations in Preventing Market Manipulation.

- The Role of Fintech in Financial Inclusion: Case Studies from the United States.

Interesting Finance Topics for College Students

Among the many subsets that make up the umbrella term finance topics for college students are financial research and finance topics for paper. Financial research topics are important because they help students learn the fundamentals of finance, get them ready for the issues they’ll face in the real world, and develop the analytical thinking they’ll need to make sound judgments in the future. Here are a few examples of finance topics to talk about among college students:

- A Comparative Study of E-commerce on Traditional Retail Banking.

- Comparing Interest Rate Changes with Stock Market Volatility in Developed and Emerging Markets.

- The Effectiveness of Microfinance Institutions in Alleviating Poverty.

- Financial Education Programs and College Students’ Financial Decision-Making.

- Initial Public Offering (IPO) Underpricing: Comparative Study of Developed and Developing Markets.

Finance Research Paper Topics for University Students

Investing, banking, corporate finance, and other areas fall under the umbrella of finance-related topics for the purposes of a university research paper. Because it deepens their knowledge, sparks new ideas, and helps the financial sector expand, topics in finance are more important for college students to study. Students who buy custom assignments benefit from individualized attention, time savings, and the insight of subject matter experts. Check out our extensive finance research topic list to uncover interesting topics for your next paper.

- Interest Rate Changes On Corporate Borrowing And Investment Decisions.

- Financial Literacy And Investment Behavior Among University Students.

- Impact Of International Trade And Globalization On Financial Markets.

- Factors Influencing Mergers And Acquisitions In The Financial Industry.

- Financial Derivatives In Managing Risk In The Stock Market.

Public Finance Research Topics

Research Topics in Public Finance include a broad spectrum of questions concerning fiscal and monetary policy at the national, state, and local levels of government. Understanding the effects of government spending and fiscal policies on GDP growth, income distribution, and social welfare is essential, which is why studies in this field are so important. Policymakers can do better for the world when they have access to information on financial research paper topics to read about.

- The potential of digital currencies as financial assets in public finance management.

- Impact of Tax Policy on Economic Growth: A Comparative Study.

- Government Debt and its Implications on Fiscal Sustainability.

- Public-Private Partnerships in Infrastructure Development.

- Effectiveness of Fiscal Stimulus Packages in Times of Economic Crisis.

Corporate Finance Research Topics

Corporate Finance Research explores various financial management topics within businesses. Conducting research in this area is crucial for understanding financial decision-making, risk management, capital structure, and valuation. It helps companies optimize their financial strategies, make informed investment decisions, and enhance overall financial performance.

- Corporate Governance and Financial Performance: An Industry Comparison.

- Debt Financing in Manufacturing Sector Corporate Investment Decisions.

- Corporate Taxation and Capital Structure Decisions: A Comparative Study of Countries.

- Corporate Venture Capital and Startup Financing: A Comparative Analysis.

- Corporate Governance Mechanisms and Capital Allocation Efficiency: Emerging Markets.

Business Finance Research Topics

Subjects that fall under the umbrella of business finance topics include any and all discussions of how businesses handle their money, from budgeting to investing to making important business decisions. Researching business finance is essential since it reveals new tendencies, aids in the creation of cutting-edge tactics, and boosts monetary output. It helps companies maintain competitiveness in a fast-paced industry and make well-informed choices. These samples can assist you whether you are looking for financial research paper topics or investment research paper ideas.

- Corporate Social Responsibility and Financial Performance.

- Exchange Rate Fluctuations on International Business Transactions.

- Financial Innovation and SME Financing.

- Financial Markets in Economic Development.

- Financial Leverage and Firm Value in Different Industries.

Related posts:

- Proposal Essay Topics Ideas

200 Best Ideas for Research Paper Topics in 2023

- Good Essay Topics & Ideas for College by Edusson

- Medical Research Paper Topics: Ideas on Healthcare and Medical Science

Improve your writing with our guides

Psychology Essay Topic: Theories Explaining Human growth and Development

Reflection Paper Topics: Art

Get 15% off your first order with edusson.

Connect with a professional writer within minutes by placing your first order. No matter the subject, difficulty, academic level or document type, our writers have the skills to complete it.

100% privacy. No spam ever.

Financial Research Paper Topics – The Complete List to Choose From

Table of contents

- 1 How to Choose Financial Research Topics?

- 2 List of Finance Topics to Write About

- 3 Interesting Finance Topics

- 4 Research Topics for Finance Students

- 5 Finance Research Topics for MBA

- 6 Public Finance Topics

- 7 International Research Topics in Finance

- 8 Healthcare Finance Research Topics

- 9 Corporate Finance Topics

- 10 Business Finance Topics

- 11 Personal Finance Topics

- 12 Conclusion

A search for the right financial research paper topic is constant. Indeed, we can understand this because knowing the reasonable topics in finance puts us ahead of the game. Students majoring in business are obliged to make presentations and submit essays, projects, and research papers on banking and accounting at one point in their career.

The challenges of picking the best finance topics are, however, always within. For this reason, we’ve done extensive research and have composed a great list of financial research paper topics and divided them into groups for you to choose from.

If you’re in doubt about how to choose your topic, we’ve got that covered too. Read our easy guide on which steps to take to ensure your paper topic is appropriate, along with our vital tips on what to pay attention to when choosing them.

How to Choose Financial Research Topics?

To choose the proper topic and get prepared for the process of research paper writing , you should first explore something that nobody has explored so far. Other than that step of selecting a unique topic, here are some other helpful tips we recommend in selecting the best and most appropriate financial research topic:

- Find a question that has no answers yet in the field of your study and give it additional research to find a suitable solution;

- Read several finance theses and papers to get a good idea for choosing your topic;

- Always find a general viewpoint for your financial research topic and use your study to narrow it down to something specific;

- Do online research and find what topics may be a burning issue to work on them. This type of research will make the research paper topic valid, compelling, suitable for your particular research, and unique;

- Talk about your topic with your friends or other people who have experience in writing papers. You can consult your professors too.

List of Finance Topics to Write About

We offer you a list of exciting finance topics you can write about divided into groups. This way, you can choose the best topic from your target group and make sure you can cover it to a T. Have fun researching.

Interesting Finance Topics

Perhaps you want to write an interesting business paper. You’ll need to choose among some of the most recurring finance paper topics and write a persuasive paper. Here’s our list of the ten options we find most engaging.

- A comparative study on the set-backs and benefits of acquisition and merger

- Possible solutions to the Capital Asset Pricing Model

- Future commerce and the impact of manipulating commodity

- A comparative analysis of the Continuous-time model application

- Building stability for retail investors using the Systematic Investment Strategy

- US’ economy and income tax

- How does the American economy function with the current banking operations

- Financial statement analysis and the ratio analysis – is it a practical component?

- Senior citizen investment – a case study of this portfolio

- Multi-level marketing and its applications in different economies of the world

Research Topics for Finance Students

Finance students have to write research papers throughout their years of study. Sometimes, it may be hard to find the most engaging financial topics to write about, which is why our list should help.

- The differences and similarities between traditional finance and behavioral one

- Consumer satisfaction in e-banking

- The best risk management methods for the manufacturing industry – a detailed analysis

- A derivative marketplace and its financial risks – identification and measuring

- Potential risks for the banking sector and how to avoid them?

- The new technologies behind banking in commercial banks

Finance Research Topics for MBA

The following list of research topics in finance would help you intrigue your professors and look at the discipline from a new perspective.

- Investment analysis of your chosen company

- Capital management – a detailed report

- Saving taxes – considerations and financial plans

- Life insurance investments and the involvement of investors in them

- A comparative analysis between traditional products and UIL

Public Finance Topics

Public finance topics are a type of finance research paper topics that covers taxation, government borrowing, and other aspects.

- Accounting and government budgeting

- The austerity related to finance and government education

- The theory and practice of government taxation

- How does the government raise money through borrowing

- The government’s revenue collection plan

- Budgeting and accounting of the government

International Research Topics in Finance

Since business transactions are happening worldwide, and local trade is no longer the only option, we must study international business.

- What can we do to prevent global economic crises?

- Can the banking industry lower the impact of the recurring financial crisis?

- Can a country achieve funding healthcare for homeless people?

- Which sectors of healthcare need more funding?

- The problems of high prices of medication in the US

Healthcare Finance Research Topics

Here are some of the most relevant topics for healthcare finance:

- What’s better – paid or free healthcare?

- Healthcare finance – the origins

- Is financing healthcare a privilege or a right?

- Healthcare policies in the U.S. through history

- How can first-world countries improve healthcare?

- How much impact does the government have on its healthcare?

- Can we achieve worldwide free healthcare?

Corporate Finance Topics

Corporate finance deals with structuring capital, financing, and making decisions for each investment. The following list of research topics in finance covers ways to make minimal mistakes in this field.

- Possible solutions to ethical concerns in corporate finance

- Small and medium-capitalization businesses – understanding their investment patterns

- Investment for mutual funds – a detailed analysis of its different streams

- How do equity investors manage their potential risks

- What are the potential pros and cons of SWIFT, and how does it work?

Business Finance Topics

Each decision we make in business has some financial implications. Therefore, we must understand the fundamentals to write finance topics that require management, analysis, valuation, etc.

- Establishing business enterprises and the application of business finance

- Business modernization and the role of business finance

- Selling our life insurance – Is tax an effective incentive here?

- Who do mutual funds change within the public and private sectors?

- Different investment options for different financial classes – Is there a preference?

- The choices and preferences of investors – A detailed analysis

- The investors’ perspective on investing in private insurance companies

- Corporate entities and increasing their accountability

- Business finance and its ethical concerns

- Small to medium business tax payments

Personal Finance Topics

Personal finance is a susceptible area, as we all like to tend to our finances appropriately. Here are some of the most exciting burning issues in this field:

- Possible saving strategies while you’re on a budget – An evaluation

- The effect of inflation and the increase in the interest rate on personal finance

- Employees and employers working from home – what are the benefits?

- Is free healthcare or affordable healthcare a common right every citizen should have?

- What are the best ways to save money when you’re on a budget?

- Credit scored – a detailed analysis

- The importance of vehicle and credit loans

- How does tax impact making our financial decisions?

- What are the best ways to properly manage credit?

- Mobile banking and its difficulties

Yes, choosing among numerous financial research paper topics can sometimes be overwhelming. Still, we’ve laid out all the inspirational ideas for them in categories so that you can find your best pick fast and easily. If you feel like you can’t write that paper yourself, that’s okay too.

Contact our services at PapersOwl for some first-class research writing. On the other hand, if you feel like you are a professional in this field, we have you covered for that too. You can write research papers for money through our service and make extra cash from your writing skills.

If you have any additional questions about finance research topics, please contact our college paper help . Our team of experts will tend to all of your questions promptly.

Readers also enjoyed

WHY WAIT? PLACE AN ORDER RIGHT NOW!

Just fill out the form, press the button, and have no worries!

We use cookies to give you the best experience possible. By continuing we’ll assume you board with our cookie policy.

Some key developments in international financial management

- Open access

- Published: 29 June 2021

- Volume 91 , pages 595–615, ( 2021 )

Cite this article

You have full access to this open access article

- Wolfgang Breuer ORCID: orcid.org/0000-0001-5470-4263 1 &

- Santiago Ruiz de Vargas ORCID: orcid.org/0000-0002-3349-4874 2

11k Accesses

3 Citations

2 Altmetric

Explore all metrics

Avoid common mistakes on your manuscript.

1 International financial management and valuation: an important field of financial research

International financial management is about investment and financing decisions confronting the management of multinational companies due to the international context of their activities. Investment and financing decisions involve the valuation of uncertain future cash flows (Ross 2004 , p. 1). A key element of the international context is that these decisions are affected by exchange rate risk. Therefore, the methodology used to support rational decision making in an international context must capture the additional complexity that exchange rate risk and exchange rate forecasting pose.

Forty years ago, in a special issue of this journal, the areas of research pertinent to international financial management were addressed (Stehle 1981 , pp. 75–76) and a status report on the theory of international capital markets was given (Franke 1981 , pp. 51–66). After four decades, this special issue presents articles of current interest that address important aspects of the research field of international financial management and valuation. But before presenting these, we would like to offer a brief update on where we stand today in the field of international financial management.

In these 40 years, the number of countries and currencies has increased substantially, to more than 220 countries with more than 150 currencies as of the beginning of this decade. Footnote 1 The world has experienced rapid internationalization and widespread integration of capital markets (e.g. Obstfeld and Taylor 2004 ; Das 2004 , 2006 ; Frieden 2020 ). This has caused business and investor cross-border activities to experience enormous expansion. Trading volumes on international capital markets have been boosted considerably, and the array of available financing instruments has substantially increased. The triennial central survey of the Bank of International Settlements reports a daily total OTC foreign exchange turnover of US$ 6.6 trillion for April 2019 (“net-net” basis, Bank for International Settlements 2019 , Table 1, p. 1) in comparison to US$ 0.6 trillion in April 1989, i.e. three decades earlier (grand total, Bank for International Settlements 1996 , p. 3).

The framework for investment and financing decisions in an international context is given by the international monetary system and the integration, depth and breadth of international financial markets. Of course, the growing integration of real goods and services markets and the intensity of international trade also play an important role in international financing and investment decisions. Since the breakdown of the Bretton Woods system of fixed exchange rates 50 years ago, most developed countries have adopted a free float, and a comprehensive liberalization of capital and current-account transactions has taken place. This still reflects the current overall trend (see International Monetary Fund (IMF) 2020 , p. 3). However, some developed countries in Europe introduced a common currency in 1999, the euro, thus establishing a fixed-rate regime for their common market, while accepting a free float of their currency in relation to countries outside this monetary union (Baldwin and Wyplosz 2020 ; Brasche 2013 ; Wagener and Eger 2014 ). Consequently, managing exchange rate risk and forecasting future exchange rates have become essential aspects of international financial management decision making since the breakdown of the Bretton Woods system.

These developments have been accompanied by wide-ranging theoretical and empirical research on international financial management, most of which applies and extends the concepts and methodology that have been developed in financial economics. In particular, a theory of international capital markets establishing equilibrium conditions based on the absence of arbitrage (see e.g. Ross 2004 ; Kruschwitz and Löffler 2020 ; Franke and Hax 2009 ) has been developed (Solnik 1974 ; Grauer et al. 1976 ; Mehra 1978 ; Sercu 1980 ; Stulz 1981a ; Adler and Dumas 1983 ; Ross and Walsh 1983 , among others).

In the next section, we will give a brief overview of the relevance of internationally related topics at the annual meetings of the European Finance Association (EFA). It shows that aspects of foreign exchange management and valuation issues play a crucial role in papers on finance with an international focus. Against this background, we will take a closer look at the contents of a selection of important textbooks on international financial management in Sect. 3 . Section 4 presents this special issue’s four papers, and Sect. 5 concludes.

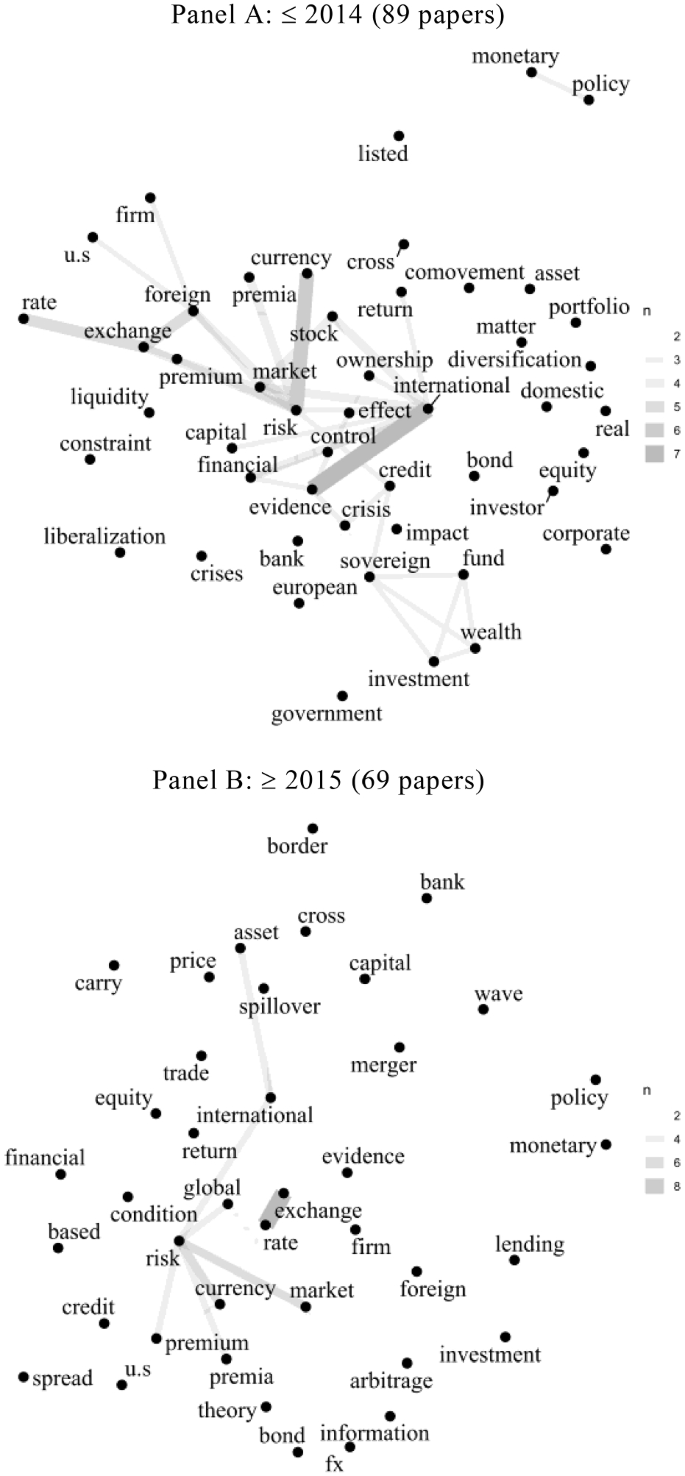

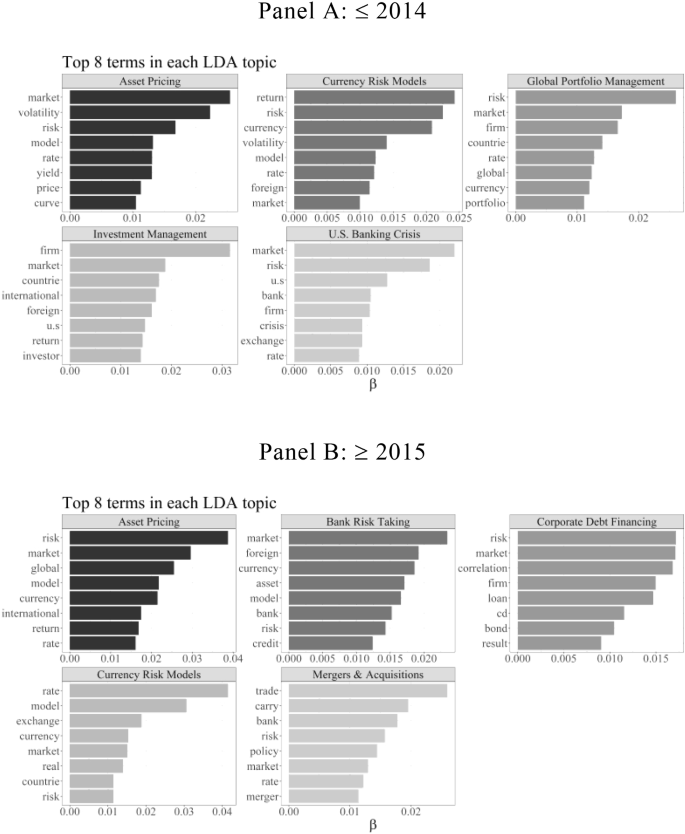

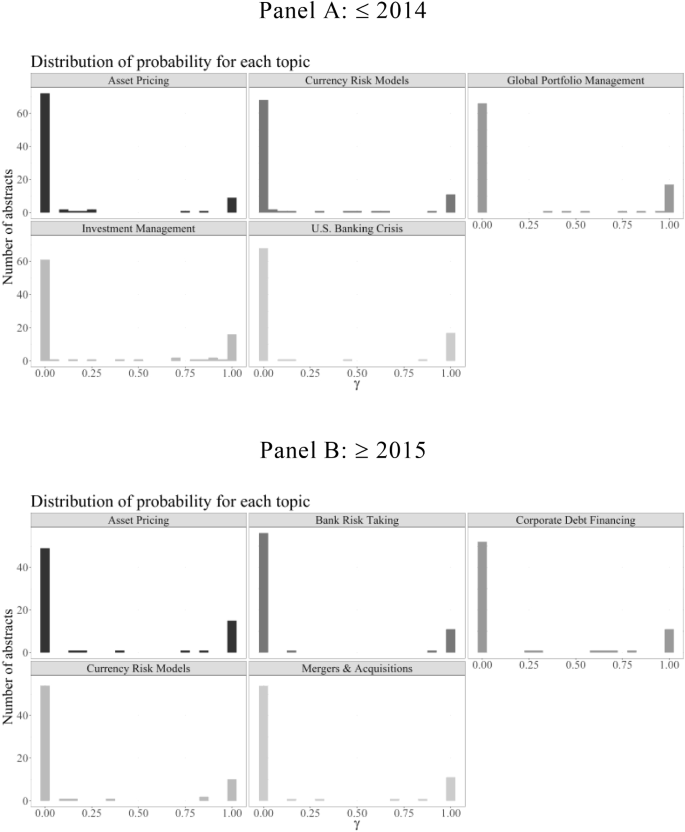

2 International finance at the annual meetings of the European Finance Association