- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Calculate ROI to Justify a Project

- 12 May 2020

Understanding how to calculate the potential return on investment (ROI) of a project is an essential financial skill for all professionals to develop.

If you’re an employee, knowing how to calculate ROI can help you make the case for a project you’re interested in pursuing and have taken the lead on proposing. If you’re a manager, understanding ROI can give you greater insight into your team's performance . If you’re an executive, working knowledge of ROI can make it easier for you to identify which projects should be greenlit and which should be passed over. Once ROI is proven, it may be possible to replicate success by applying lessons learned from the first project to other segments of the business.

If you’re unfamiliar with accounting and finance , the prospect of determining the ROI of a project may seem beyond your abilities. However, it’s not an overly complicated process. By understanding the basics of financial valuation, which can enable you to put a monetary value on companies, projects, or anything that produces cash flows, anyone can learn to calculate the ROI of a project.

Access your free e-book today.

What Is Return on Investment?

Return on investment (ROI) is a metric used to denote how much profit has been generated from an investment that’s been made. In the case of a business, return on investment comes in two primary forms, depending on when it’s calculated: anticipated ROI and actual ROI.

Anticipated vs. Actual ROI

Anticipated ROI , or expected ROI, is calculated before a project kicks off, and is often used to determine if that project makes sense to pursue. Anticipated ROI uses estimated costs, revenues, and other assumptions to determine how much profit a project is likely to generate.

Often, this figure will be run under a number of different scenarios to determine the range of possible outcomes. These numbers are then used to understand risk and, ultimately, decide whether an initiative should move forward.

Actual ROI is the true return on investment generated from a project. This number is typically calculated after a project has concluded, and uses final costs and revenues to determine how much profit a project produced compared to what was estimated.

Positive vs. Negative ROI

When a project yields a positive return on investment , it can be considered profitable, because it yielded more in revenue than it cost to pursue. If, on the other hand, the project yields a negative return on investment , it means the project cost more to pursue than it generated in revenue. If the project breaks even, then it means the total revenue generated by the project matched the expenses.

Return on Investment Formula

Return on investment is typically calculated by taking the actual or estimated income from a project and subtracting the actual or estimated costs. That number is the total profit that a project has generated, or is expected to generate. That number is then divided by the costs.

The formula for ROI is typically written as:

ROI = (Net Profit / Cost of Investment) x 100

In project management, the formula is written similarly, but with slightly different terms:

ROI = [(Financial Value - Project Cost) / Project Cost] x 100

Check out our video on return on investment below, and subscribe to our YouTube channel for more explainer content!

Calculating the ROI of a Project: An Example

Imagine that you have the opportunity to purchase 1,000 bars of chocolate for $2 apiece. You would then sell the chocolate to a grocery store for $3 per piece. In addition to the cost of purchasing the chocolate, you need to pay $100 in transportation costs.

To decide whether this would be profitable, you would first tally your total expenses and your total expected revenues.

Expected Revenues = 1,000 x $3 = $3,000

Total Expenses = (1,000 x $2) + $100 = $2,100

You would then subtract the expenses from your expected revenue to determine the net profit.

Net Profit = $3,000 - $2,100 = $900

To calculate the expected return on investment, you would divide the net profit by the cost of the investment, and multiply that number by 100.

ROI = ($900 / $2,100) x 100 = 42.9%

By running this calculation, you can see the project will yield a positive return on investment, so long as factors remain as predicted. Therefore, it’s a sound financial decision. If the endeavor yielded a negative ROI, or an ROI that was so low it didn’t justify the amount of work involved, you would know to avoid it moving forward.

It’s important to note that this example calculates an anticipated ROI for your project. If any of the factors affecting expenses or revenue were to change during implementation, your actual ROI could be different.

For example, imagine that you have already purchased your chocolate bars for the agreed-upon $2 apiece and paid $100 to transport them. If the most that the store will pay you is $2.25 per chocolate bar, then your actual revenues drop substantially compared to your projected revenues. The result is a reduced net profit and a reduced actual ROI.

Actual Revenues = 1,000 x $2.25 = $2,250

Net Profit = $2,250 - $2,100 = $150

ROI = ($150 / $2,100) x 100 = 7.14%

Circumstances are rarely as straightforward as this example. There are typically additional costs that should be accounted for, such as overhead and taxes. In addition, there’s always the possibility that an anticipated ROI will not be met due to unforeseen circumstances, but the same general principles hold true.

How to Use Finance to Pitch Your Project

Have you ever pitched a project to senior management, only to have the idea shot down under the guise of “not making financial sense?" It happens more often than you might think. By learning how to calculate ROI for projects you’re interested in pursuing, you can self-evaluate them before they're raised up to decision-makers within your organization and defend them as they’re being considered.

Similarly, by understanding how to calculate ROI after a project you’ve spearhead is done, you can better speak to the contributions that you and your team have made toward shared company goals.

High-performing businesses are successful because they make smart decisions about when and where they allocate available resources. Calculating the ROI of a project before it moves forward can help ensure that you’re making the best possible use of the resources you have available.

To learn more ways that you can use financial concepts to improve your efficacy and advance your career, explore our online finance and accounting courses . Download your free flowchart to determine which is right for you.

About the Author

- Search Search Please fill out this field.

What Is Return on Investment (ROI)?

- How to Calculate ROI

Why Is ROI a Useful Measurement?

- Limitations

What Is a Good ROI?

- Developments

Is ROI Calculated Annually?

The bottom line.

- Corporate Finance

- Financial Ratios

Return on Investment (ROI): How to Calculate It and What It Means

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.

To calculate ROI , the benefit (or return) of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio .

Key Takeaways

- Return on Investment (ROI) is a popular profitability metric used to evaluate how well an investment has performed.

- ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay.

- ROI can be used to make apples-to-apples comparisons and rank investments in different projects or assets.

- ROI does not take into account the holding period or passage of time, and so it can miss opportunity costs of investing elsewhere.

- Whether or not something delivers a good ROI should be compared relative to other available opportunities.

Investopedia / Lara Antal

How to Calculate Return on Investment (ROI)

The return on investment (ROI) formula is as follows :

ROI = Current Value of Investment − Cost of Investment Cost of Investment \begin{aligned} &\text{ROI} = \dfrac{\text{Current Value of Investment}-\text{Cost of Investment}}{\text{Cost of Investment}}\\ \end{aligned} ROI = Cost of Investment Current Value of Investment − Cost of Investment

"Current Value of Investment” refers to the proceeds obtained from the sale of the investment of interest. Because ROI is measured as a percentage, it can be easily compared with returns from other investments, allowing one to measure a variety of types of investments against one another.

ROI is a popular metric because of its versatility and simplicity. Essentially, ROI can be used as a rudimentary gauge of an investment’s profitability. This could be the ROI on a stock investment, the ROI a company expects on expanding a factory, or the ROI generated in a real estate transaction.

The calculation itself is not too complicated, and it is relatively easy to interpret for its wide range of applications. If an investment’s ROI is net positive, it is probably worthwhile. But if other opportunities with higher ROIs are available, these signals can help investors eliminate or select the best options. Likewise, investors should avoid negative ROIs , which imply a net loss.

For example, suppose Jo invested $1,000 in Slice Pizza Corp. in 2017 and sold the shares for a total of $1,200 one year later. To calculate the return on this investment, divide the net profits ($1,200 - $1,000 = $200) by the investment cost ($1,000), for an ROI of $200/$1,000, or 20%.

With this information, one could compare the investment in Slice Pizza with any other projects. Suppose Jo also invested $2,000 in Big-Sale Stores Inc. in 2014 and sold the shares for a total of $2,800 in 2017. The ROI on Jo’s holdings in Big-Sale would be $800/$2,000, or 40%.

What Are the Limitations of ROI?

Examples like Jo's (above) reveal some limitations of using ROI, particularly when comparing investments. While the ROI of Jo's second investment was twice that of the first investment, the time between Jo’s purchase and the sale was one year for the first investment but three years for the second.

Jo could adjust the ROI of the multi-year investment accordingly. Since the total ROI was 40%, to obtain the average annual ROI, Jo could divide 40% by 3 to yield 13.33% annualized. With this adjustment, it appears that although Jo’s second investment earned more profit, the first investment was actually the more efficient choice.

ROI can be used in conjunction with the rate of return (RoR) , which takes into account a project’s time frame. One may also use net present value (NPV) , which accounts for differences in the value of money over time due to inflation. The application of NPV when calculating the RoR is often called the real rate of return .

Determining what constitutes a "good" ROI is crucial for investors seeking to maximize their returns while managing risk. While there's no universal benchmark, several factors influence what's considered satisfactory.

- Risk tolerance: Investors vary in their willingness to tolerate risk. Those who are more risk-averse may accept lower ROIs in exchange for greater stability and predictability in their investments. On the other hand, risk-tolerant investors may seek higher ROIs but are willing to accept greater uncertainty and volatility.

- Investment duration: The time horizon of an investment plays a significant role in determining what qualifies as a good ROI. Longer-term investments typically require higher ROIs to justify tying up capital for an extended period. Shorter-term investments may offer lower ROIs but provide liquidity and flexibility.

- Industry norms: Different industries have varying expectations for ROI based on factors such as market conditions, competitive landscape, and regulatory environment. For example, industries with high barriers to entry or significant capital requirements may require higher ROIs to attract investment.

- Personal goals: Ultimately, what qualifies as a "good" ROI depends on an investor's specific financial objectives. Whether aiming for wealth accumulation, income generation, or capital preservation, investors should align their ROI expectations with their individual goals and circumstances.

What Are the Wider Applications of ROI?

Recently, certain investors and businesses have taken an interest in the development of new forms of ROIs, called social return on investment (SROI) . SROI was initially developed in the late 1990s and takes into account broader impacts of projects using extra-financial value (i.e., social and environmental metrics not currently reflected in conventional financial accounts).

SROI helps understand the value proposition of certain environmental, social, and governance (ESG) criteria used in socially responsible investing (SRI) practices. For instance, a company may decide to recycle water in its factories and replace its lighting with all LED bulbs. These undertakings have an immediate cost that may negatively impact traditional ROI—however, the net benefit to society and the environment could lead to a positive SROI.

There are several other new variations of ROIs that have been developed for particular purposes. Social media statistics ROI pinpoints the effectiveness of social media campaigns—for example how many clicks or likes are generated for a unit of effort. Similarly, marketing statistics ROI tries to identify the return attributable to advertising or marketing campaigns.

So-called learning ROI relates to the amount of information learned and retained as a return on education or skills training. As the world progresses and the economy changes, several other niche forms of ROI are sure to be developed in the future.

What Is ROI in Simple Terms?

Basically, return on investment (ROI) tells you how much money you've made (or lost) on an investment or project after accounting for its cost.

ROI can be calculated over any period of time, but it's most commonly calculated on an annual basis. This allows for easier comparison between different investments and provides a standardized measure of performance. However, in some cases, ROI can also be calculated over shorter or longer periods depending on the specific context and needs of the analysis.

How Do You Calculate Return on Investment (ROI)?

Return on investment (ROI) is calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have an ROI of 1, or 100% when expressed as a percentage. Although ROI is a quick and easy way to estimate the success of an investment, it has some serious limitations. ROI fails to reflect the time value of money , for instance, and it can be difficult to meaningfully compare ROIs because some investments will take longer to generate a profit than others. For this reason, professional investors tend to use other metrics, such as net present value (NPV) or the internal rate of return (IRR) .

What Industries Have the Highest ROI?

Historically, the average ROI for the S&P 500 has been about 10% per year. Within that, though, there can be considerable variation depending on the industry. During 2020, for example, many technology companies generated annual returns well above this 10% threshold. Meanwhile, companies in other industries, such as energy companies and utilities, generated much lower ROIs and in some cases faced losses year-over-year. Over time, it is normal for the average ROI of an industry to shift due to factors such as increased competition, technological changes, and shifts in consumer preferences.

Return on investment is a metric that investors often use to evaluate the profitability of an investment or to compare returns across a number of investments. It is expressed as a percentage. ROI is limited in that it doesn't take into account the time frame, opportunity costs, or the effect of inflation on investment returns, which are all important factors to consider.

REDF. " Measurement & Evaluation ."

World Health Organization. " Investment for Health and Well-Being: A Review of the Social Return on Investment From Public Health Policies ." PDF Download. Pages 2-4.

DQYDJ. " S&P 500 Historical Return Calculator ."

Fortune. " The Best Stocks of 2020 Have Made Pandemic Investors Even Richer ."

- Guide to Financial Ratios 1 of 31

- What Is the Best Measure of a Company's Financial Health? 2 of 31

- What Are Financial Risk Ratios and How Are They Used to Measure Risk? 3 of 31

- Profitability Ratios: What They Are, Common Types, and How Businesses Use Them 4 of 31

- Understanding Liquidity Ratios: Types and Their Importance 5 of 31

- What Is a Solvency Ratio, and How Is It Calculated? 6 of 31

- Solvency Ratios vs. Liquidity Ratios: What's the Difference? 7 of 31

- Key Ratio: Meaning, Example, Pros and Cons 8 of 31

- Multiples Approach: Definition and Example 9 of 31

- Return on Assets (ROA): Formula and "Good" ROA Defined 10 of 31

- How Return on Equity Can Help Uncover Profitable Stocks 11 of 31

- Return on Investment (ROI): How to Calculate It and What It Means 12 of 31

- Return on Invested Capital: What Is It, Formula and Calculation, and Example 13 of 31

- EBITDA Margin: What It Is, Formula, and How to Use It 14 of 31

- What Is Net Profit Margin? Formula for Calculation and Examples 15 of 31

- Operating Margin: What It Is and the Formula for Calculating It, With Examples 16 of 31

- Current Ratio Explained With Formula and Examples 17 of 31

- Quick Ratio Formula With Examples, Pros and Cons 18 of 31

- Cash Ratio: Definition, Formula, and Example 19 of 31

- Operating Cash Flow (OCF): Definition, Types, and Formula 20 of 31

- Receivables Turnover Ratio Defined: Formula, Importance, Examples, Limitations 21 of 31

- Inventory Turnover Ratio: What It Is, How It Works, and Formula 22 of 31

- Working Capital Turnover Ratio: Meaning, Formula, and Example 23 of 31

- Debt-to-Equity (D/E) Ratio Formula and How to Interpret It 24 of 31

- Total Debt-to-Total Assets Ratio: Meaning, Formula, and What's Good 25 of 31

- Interest Coverage Ratio: Formula, How It Works, and Example 26 of 31

- Shareholder Equity Ratio: Definition and Formula for Calculation 27 of 31

- Can Investors Trust the P/E Ratio? 28 of 31

- Using the Price-to-Book (P/B) Ratio to Evaluate Companies 29 of 31

- Price-to-Sales (P/S) Ratio: What It Is, Formula To Calculate It 30 of 31

- Price-to-Cash Flow (P/CF) Ratio? Definition, Formula, and Example 31 of 31

:max_bytes(150000):strip_icc():format(webp)/Investopedia_Returnoninvestmentformula_colorv1-6d281839c5814e109e316ebbbb61a5bd.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to Calculate Return on Investment (ROI)

Arlene Soto

1 min. read

Updated October 25, 2023

Return on investment (ROI) is a financial concept that measures the profitability of an investment. There are several methods to determine ROI, but the most common is to divide net profit by total assets. For instance, if your net profit is $50,000, and your total assets are $200,000, your ROI would be 25 percent. A common definition of ROI is “a profitability measure that evaluates the performance of a business by dividing net profit by net worth.”

In a small business, the uses of ROI could be to measure the performance of pricing policies, an investment in capital equipment, or an inventory investment. When purchasing assets in a business, such as inventory or equipment, you expect to get a financial benefit from the purchase. Return on investment is a tool to help decide between purchase alternatives that will either generate revenue or result in cost savings that benefit the net income of the business. Investors will also look at return on investment when choosing whether to fund a business venture.

Return on investment may also be measured unconventionally, such as in terms of social responsibility or environmental and societal benefits. This is more difficult to measure—in determining the social return on investment, the payback would need to be quantified to calculate the cost versus the benefit. A network of practitioners was formed in 2006 to facilitate the evolution of calculating social return on investment.

While return on investment is a useful tool to look at profitability, calculations are complicated by other factors such as time, maintenance costs, financing costs, other investment considerations, and the overall goals of the company. For instance, with the purchase of capital equipment, it is expected that equipment will provide a benefit to the company for several years. As such, the net income will need to be estimated for future time periods to determine the overall ROI. Additionally, maintenance costs over the life of the equipment will reduce the overall ROI. An accountant can assist with the formulas to determine more complex ROI calculations.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Arlene Soto is the director of the Small Business Development Center at Tillamook Bay Community College. She is the former director the Southwestern Oregon Community College Small Business Development Center Director. She is responsible for outreach to Coos, Curry and Western Douglas Counties in Oregon to provide small business development services through free, confidential business advising and low-cost training programs. Arlene has been working with businesses in the accounting field since 1976 and in management since 1988. She is a Certified Management Accountant and a NASBITE Certified Global Business Professional with a Master’s degree in Management from Marylhurst University and a Bachelor’s degree in accounting from Portland State University.

Table of Contents

Related Articles

5 Min. Read

How to Improve the Accuracy of Financial Forecasts

4 Min. Read

How to Create an Expense Budget

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

6 Min. Read

How to Create a Profit and Loss Forecast

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

What Is ROI (Return on Investment)?

Table of Contents

In business, few concepts are as important as return on investment (ROI). The adage that “you have to spend money to make money” is often true, but only if you’ve anticipated the ROI potential of your investments. Whether you’re implementing new business software or aggressively investing in a marketing campaign, the ultimate goal is to make more money. Understanding how to calculate ROI can help you understand which investments are paying off and which costs should simply be cut.

What is ROI?

Return on investment refers to the amount of profit directly related to an expense or group of expenses. Companies generally use ROI to measure the success of a specific project or purchase. If a business owner were to invest money in an advertising campaign, they’d analyze the sales generated by the ad and use that information to determine the ROI. If the money generated exceeded the amount spent, the profit would be referred to as the ROI of the ad campaign.

Investors also want to know the potential ROI of an investment before committing any funds to a company. Forecasting a company’s potential ROI is a key factor for investors who, after all, ultimately want to profit from their investment.

What is annualized ROI?

Annualized ROI describes the average yearly return on an investment over a period of years. This shows how profitable the venture is overall. Annualized ROI can help you analyze and compare the performance of your investment during specific time periods.

Why is ROI important in business?

Only smart businesses that spend wisely and monitor ROI closely survive in the long run. Some reasons why ROI is so important include:

- Budgeting insight: Calculating ROI can give you a clearer insight into what parts of your business aren’t performing well. This way, you can make more informed decisions on where you should focus your budget .

- Better hiring decisions: Tracking the ROI on your labor spending can help narrow your criteria when hiring new employees. With insight into your team members, you’ll be able to find the ones that work best for your business.

- Long-term business planning: ROI can help you understand where your business shines and where you can improve it. With detailed analytics, you can plan for business growth more effectively and have more confidence in your decision.

- Meeting customer expectations: Keeping track of ROI can also help you meet your customers’ needs. When those needs start to shift, your ROI might decrease. Tracking it means you’ll have enough time to pivot your business strategy .

If you don’t see an optimal ROI on a certain endeavor, stop throwing money at it — you’re better off scrapping it. Continuing to spend on lost causes is a surefire way to run out of money and run your business into the ground.

What is considered a ‘good’ ROI?

What’s considered a good ROI depends on the investment. When a company is spending money on a piece of equipment, for example, the ROI is in productivity. Meanwhile, marketing spending requires an ROI in sales. The ROI you expect from your search engine optimization efforts will be different from the ROI you look for from an investment in a new factory.

A healthy double-digit ROI is great for starters, and if you identify high-percentage ROIs, you should aim to figure out how to amplify and extend those effects. Consider carefully whether you get an ROI at all and be realistic before signing contracts and spending money. Don’t make any big purchases right away — someone promising the moon is likely not going to deliver good returns.

Limitations of ROI

You can gain a lot of financial foresight by calculating your ROI but measuring your business’s success based on an ROI has its limitations.

Here are three limitations to consider.

- Your company’s cash flow is not directly reflected in your ROI, so your business’s financial health may not always be measured accurately using ROI alone: “For example, the ROI may be 5%, but it may be losing cash flow and be a very costly investment,” said Robert Gauvreau, certified public accountant and chief executive officer (CEO) of accounting firm Gauvreau. “Whereas another investment that is generating 4% ROI may be generating a positive cash return to the investors.” Depending solely on ROI to evaluate the financial health of a project only gives you a partial understanding of what’s affecting your finances.

- To calculate an accurate ROI, you need a firm grasp of your future business expenses: If you don’t yet have accurate numbers for future expenses, or if the numbers comprising your calculation are variable, such as interest rates that may change, the ROI may be inaccurate.

- ROI only measures the financial success of a project: For example, investing in new computers and tech for your employees may have a negative ROI, but it may make your employees happier and increase retention. The ROI of a project or venture doesn’t account for the nonfinancial benefits of an investment.

Benefits of calculating ROI

Understanding your profits and the impact of an investment on your business is important and extremely helpful when making decisions for your company.

Here are two more benefits that calculating your return on investment provides:

- Calculating ROI allows business owners to track and analyze short- and long-term projects: “You can set simple targets for both short-term and long-term goals, and ROI can measure if you are achieving those benchmarks quickly and easily,” Gauvreau said.

- Determining ROI helps you evaluate your business’s financial performance: Knowing your ROI keeps your company on track by demonstrating whether your business is profiting above or below its average, said Leonard Ang, real estate agent and CEO of iProperty Management. It’s a good reminder for companies to maintain a standard for their finances.

- ROI is one of the simplest performance metrics to calculate: All ROI does is measure the cost of an investment vs. the revenue that investment yields. It’s a universally accepted financial metric because it’s easy for anyone to understand and translates directly to how much money you’ve made from a given expense.

- Knowing ROI can help you better understand the impact each department is having on your profits: Since ROI is so simple to calculate, it’s one of the easiest ways to compare the performance of departments within your company. Comparing a department’s ROI this year to its past ROI can help you understand how efficiently it’s performing.

ROI formula

To calculate ROI is to take the gains of an investment, subtract the cost of the investment and divide the result by the cost of the investment:

ROI = (gains – costs) / costs

For example, let’s say you make a major purchase, like buying a home.

“You purchase your home for $1 million,” Gauvreau said. “After living in your home for three years, you sell it for $1,120,000. The result, after three years, your home increased in value by $120,000.”

If we follow the ROI = (gains – costs) / costs formula, we find that the return on investment is 12%.

($1,120,000 – $1,000,000) / $1,000,000 = 0.12

Another example of ROI would be investing in the stock market, Gauvreau said. If you invest $100,000 in shares of a company, and 12 months later it grows to $160,000, your ROI would be 60% because:

($160,000 – $100,000) / $100,000) = 0.6

Use return on investment for more effective growth

Understanding the ROI of any project or marketing campaign helps in identifying successful business practices. Many companies use ROI to identify methods of marketing and advertising that yield the highest return based on previous successes. This way, ROI becomes not only a measure of past success but also an estimate for the coming months.

ROI can be applied to most areas of your business and works as a simple but effective method to measure your performance. Using it in combination with non-numerical data, such as employee happiness, can give you some ideas about how to grow your business. With proper ROI use, you can make the most of your resources for long-term success.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

By clicking “Accept” , you agree to the storing of cookies on your device to enhance site navigation, analyse site usage, and assist in our marketing efforts. View our Privacy Policy for more information.

Calculating the return on investment for your business

It's impossible for your business to flourish if you don't invest in its growth. However, it can be hard to determine whether investments will be worth it in the long run. For business owners looking to make smarter financial decisions, this guide outlines everything you need to know about calculating your return on investment (ROI). We cover the difference between a standard and an annualised return rate, run you through the calculations step by step, show you how to interpret the results before addressing the formulas various pros and cons. We conclude by mentioning Kriya's offerings and answering some frequently asked questions.

Whether you're looking to hire new staff or move to bigger premises, if you're a small business on the rise, it's likely you're making a lot of investments. As critical as these expenditures can be, sometimes it's hard to know if you're getting your money's worth. This is where the return on investment, or ROI, comes in.

ROI is one of the best metrics for monitoring your businesses performance. Since its inception in 1914, the formula has helped business owners all around the globe make smarter financial decisions. Specifically, it’s helped individuals and companies take the guesswork out of financing by measuring their return on a potential investment.

Despite its clear benefits, however, many entrepreneurs are yet to familiarise themselves with the formula. Therefore, to clear up any potential confusion, this guide covers everything you need to know about calculating your return on investments. Specifically, we show you how to calculate your basic and annualised ROI and how to interpret the results before outlining the various pros and cons associated with its use.

Before we address its uses, however, what exactly do we mean when we talk about ROI?

WHAT IS A RETURN ON INVESTMENT (ROI)?

In simple terms, ROI is a financial metric that measures the return on an investment relative to its cost. It helps companies and individuals to compare the efficiency of different investments, so they're able to understand if the rewards will outweigh the risks.

Generally speaking, the lower the cost of investment and the higher the net profit, the more positive the ROI. Subsequently, the higher the percentage, the more favourable an investment is likely to be.

The metric is used widely because it’s relatively easy to calculate and can be applied to any type of business or personal investment. It’s specifically popular in the field of marketing because it helps leaders work out if their marketing campaigns are worth investing in.

WHAT’S THE BASIC FORMULA?

The formula for calculating your basic ROI is as follows:

- ROI = 100% * net profit / cost of investment

HOW TO CALCULATE YOUR RETURN ON INVESTMENT (ROI)

Working out your ROI is a relatively straightforward process, especially for small businesses. This means you should be able to analyse your investments in-house without the help of external financial advisors. Depending on the end goal of your calculation, a return on investment can be measured in a number of different ways. However, the formula we've listed above is the most commonly used ratio.

To work out the ROI of a particular expenditure, you can follow the following steps.

1. Determine your net profit from the investment

The net profit represents the total amount of money gained from your investment. In other words, it’s the benefit you and your business will receive if you go through with the -. To work out this figure, you simply deduct the total expenses of the investment from the total revenue.

2. Calculate the cost of investment

Once you’ve established your net profit, it’s time to work out the cost of your investment. To calculate this figure, you simply add the fixed cost of your expenditure to its variable costs. This will provide you with your total cost of investment.

3. Divide the net profit by the cost of investment

In line with the ROI formula, next, you need to divide your net profit figure by the total cost of your investment.

4. Multiply this figure by 100%

Finally, you multiply this decimal number by 100, and you will have your final ROI ratio in the form of a percentage.

WHAT’S AN ANNUALISED RETURN ON INVESTMENT (ROI)?

While the basic ROI formula is the most effective way to measure your immediate returns, it doesn't consider the holding period of the investment. Therefore, if you're looking to analyse your returns over a specific length of time, it may be more appropriate to work out your annualised return.

As the name suggests, an annualised ROI represents the average of an investment's earnings over a year. It's expressed as a time-weighted annual percentage, and types of returns can include capital, interest payments and dividends. The calculation also includes adjustments for compounding interest, so many experts believe it is more accurate than the basic formula.

WHAT IS THE ANNUALISED RATE OF RETURN FORMULA?

The annualised rate of return formula is as follows:

- The annualised rate of return = ( ending value of investment/beginning value of investment) x 100

How to calculate your annualised return

To work out your annualised ROI, you follow the steps below.

1. Determine your beginning value

Your beginning value represents how much your investment portfolio was worth before the capital changed hands. In simpler terms, it’s how much money you put into an investment.

2. Calculate your ending value

Once you’ve established your beginning value, it’s time to work out your ending value. Your ending value is how much you stand to gain from the investment over the period of your annualised return. As stated above, aside from the basic amount of capital, this figure should also include interest payments and dividends.

3. Work out your annualised return

Once you have both of these figures at hand, you can calculate your final annualised return. To do so, you need to divide your ending value by your beginning value before multiplying this number by 100. This will provide you with your final annualised ROI ratio.

HOW TO INTERPRET YOUR ROI

There isn’t much point in calculating your investments basic or annualised ROI if you can’t make sense of the end result. Luckily, interpreting your return is pretty simple: the higher your basic or annualised ROI is, the more fruitful your investment is likely to be.

Since the nature of each investment differs so heavily, there is no benchmark of what a ‘good’ or ‘bad’ ROI ratio is. There are, however, other ways you can interpret your results. By researching other small businesses in your industry and recording the average ROI on their investments, you can gauge what a standard return may look like for a company similar to yours.

You can then compare your results against this figure to establish your business’s performance. You should, however, understand that this comparison will only give you a rough indication of your ROI’s value.

WHY ARE THESE FORMULAS SO IMPORTANT?

By now, you should understand the basics of the standard and annualised ROI formulas. If you are new to the world of profitability ratios, below we explain why they are such a valuable tool for businesses.

They help you to determine profitability

When people invest, they are looking to get more out than they put in. However, due to a whole host of variables, business owners can’t guarantee that this risk will pay off. By calculating the ROI of an investment before they split with their cash, they can calculate its rough profitability. This lowers their chance of encountering negative returns.

They help you to understand risks

Every financial investment involves some degree of risk, and it’s the role of business owners to manage these risks as much as possible. Fortunately, by using the ROI metric, you’re able to avoid risky investments and make the smartest decisions possible for the future of your business.

They are simple to use

Finally, another reason ROI formulas are beneficial is because they're so easy to use. If you're calculating your basic or annual returns, all you need are two key figures. Compared to other financial metrics; these formulas are extremely straightforward. Therefore, it's unsurprising that they're such a staple for business owners trying to manage their finances.

WHAT ARE THEIR LIMITATIONS?

Despite the clear advantages of these formulas, however, they’re far from perfect. To give you a more balanced view of the metrics, here are some limitations to their use.

They aren’t 100% accurate

Return formulas aren’t able to provide accurate financial projections because the formula is based on too many variables. They instead give companies and individuals a rough estimate of their profitability. With this in mind, to avoid getting caught out, business owners shouldn’t base crucial business decisions on these results.

The basic formula doesn’t account for time

As we’ve already addressed, the standard ROI formula only considers the immediate outcome of an investment. This makes it hard to predict how an investment will pay off later down the line. Fortunately, if you’re looking to understand your investments return over a 12 month period, you can use the annualised ROI formula.

Results can be inconsistent

While the standard ROI metric is the most popular way to calculate returns, many other formulas exist. And since every formula generates slightly different results, it’s impossible to obtain an objective measure of your ROI. Because of this, investors should always stick to the basic formula when possible and check which formula was used when comparing the results of other companies.

INVEST IN YOUR BUSINESS WITH FLEXIBLE FINANCING

No matter how long you’ve been in the game, investments are always a bit of a gamble. However, by using these tools above, you can invest in your business’s future in the safest and most secure way possible. If you’re currently lacking the capital needed to make valuable investments, Kriya may have a solution for you.

From recovery loans to embedded financing, Kriya offers a wide range of funding options to business owners up and down the UK. We truly believe that small businesses are the future and that cash flow barriers shouldn’t prevent them from reaching their potential. If you’re serious about investing in your businesses long term growth, you can learn more about what we do here .

FREQUENTLY ASKED QUESTIONS (FAQS)

What is a return on investment (ROI)?

ROI is a financial metric that measures the return on an investment relative to its cost. It helps companies and individuals to compare the efficiency of different investments, so they're able to understand if the rewards will outweigh the risks. Generally speaking, the lower the cost of investment and the higher the net profit, the more positive the ROI.

How do you calculate your return on a business investment?

The basic ROI formula is ‘ROI = 100% * net profit/cost of investment'. In accordance with this formula, to calculate the ROI, you need to determine your investment's net profit and its total cost. Then, you divide the net profit by the total cost and multiply this result by 100. The figure you are left with is your final ROI ratio.

What is an annualised rate of return?

An annualised ROI represents the average of an investment's earnings over a year. It's expressed as a time-weighted annual percentage, and types of returns can include capital, interest payments and dividends. The calculation also includes adjustments for compounding interest, so many experts believe it is more accurate than the basic formula.

How does a business analyse its ROI ratio?

Since the nature of each investment differs so heavily, there is no benchmark of what a ‘good’ or ‘bad’ ROI ratio is. There are, however, other ways you can interpret your results. By researching other small businesses in your industry and recording the average ROI on their investments, you can gauge what a standard return may look like for a company similar to yours. You can then compare your results against this figure to establish your business’s performance.

What are the benefits of the return on investment (ROI) metric?

Return on investment (ROI) formulas are an indispensable tool to businesspeople all around the globe. This is because they are a reliable way to measure the profitability of an investment, they help to keep financial risks to a minimum, and they are simple and easy to use.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Return on Investment (ROI)

By Entrepreneur Staff

Return on Investment (ROI) Definition:

A profitability measure that evaluates the performance of a business by dividing net profit by net worth

Return on investment, or ROI, is the most common profitability ratio. There are several ways to determine ROI, but the most frequently used method is to divide net profit by total assets. So if your net profit is $100,000 and your total assets are $300,000, your ROI would be .33 or 33 percent.

Return on investment isn't necessarily the same as profit. ROI deals with the money you invest in the company and the return you realize on that money based on the net profit of the business. Profit, on the other hand, measures the performance of the business. Don't confuse ROI with the return on the owner's equity. This is an entirely different item as well. Only in sole proprietorships does equity equal the total investment or assets of the business.

You can use ROI in several different ways to gauge the profitability of your business. For instance, you can measure the performance of your pricing policies, inventory investment, capital equipment investment, and so forth. Some other ways to use ROI within your company are by:

- Dividing net income, interest, and taxes by total liabilities to measure rate of earnings of total capital employed.

- Dividing net income and income taxes by proprietary equity and fixed liabilities to produce a rate of earnings on invested capital.

- Dividing net income by total capital plus reserves to calculate the rate of earnings on proprietary equity and stock equity.

More from Operations

Capital equipment.

Equipment that you use to manufacture a product, provide a service or use to sell, store and deliver merchandise. This equipment has an extended life so that it is properly regarded as a fixed asset.

Fulfillment

The process of receiving, packaging and shipping orders for goods

The process of bringing goods from one country for the purpose of reselling them in another country

Depreciation

An expense item set up to express the diminishing life expectancy and value of any equipment (including vehicles). Depreciation is set up over a fixed period of time based on current tax regulation. Items fully depreciated are no longer carried as assets on the company books.

Latest Articles

These coworkers-turned-friends started a side hustle on amazon — now it's a 'full hustle' earning over $20 million a year: 'jump in with both feet'.

Achal Patel and Russell Gong met at a large consulting firm and "bonded over a shared vision to create a mission-led company."

An Iconic Las Vegas Casino Is Shuttering This Summer After 34 Years

The Mirage will close on July 17.

These Are the 10 Most Profitable Cities for Airbnb Hosts, According to a New Report

Here's where Airbnb property owners and hosts are making the most money.

Home > Finance > Investing

How to Calculate Your Return on Investment

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

We recently updated this page to fix a formatting error with superscripts. Our formulas are formatted accurately now; we regret the previous error.

You invested in property a few years ago, and now you want to know: Was that investment worth it? To find out, you need to calculate your return on investment (ROI). We walk you through how to use the ROI formula and also where you can go for easy calculations.

The return on investment formula

To calculate your ROI, divide the net profit from your investment by the investment's initial cost , then multiply the total by 100 to get a percentage:

ROI = (net profit / investment cost) x 100

To calculate your net profit, subtract your stock's current value from the initial investment price.

Let's say you bought $5,000 worth of stock in a company. In three years, you sell it for $7,000. First, find your net profit: $7,000 – $5,000, so $2,000. Then divide your net profit by the initial investment cost of $5,000, multiplying by 100 to calculate the investment ratio:

ROI = ($2,000 / $5,000) x 100

In this case, you've earned a 40% return on investment—not bad.

The higher the percentage, the better your return on investment. A negative percentage, though, means you actively lost money on this investment.

Annualized return on investment

The ROI formula doesn't account for the amount of time you have a stake in an investment, otherwise known as the holding period. That also means the ROI formula doesn't account for compound interest , or the interest you accrue each year that contributes to the next year's interest . (Another way to think of compound interest is the interest you earn on interest .)

If you want to know how much you're earning year over year, accounting for compound interest, use the annualized return on investment formula:

Annualized ROI = [(1 + ROI) 1/n – 1] x 100

In this formula, n means the number of years you're holding the investment, or the holding period.

Let's go back to our example above, where you determined that your ROI after three years is 40%, or, numerically speaking, 0.4. If you're calculating the annualized ROI, your formula should look like this:

Annualized ROI = [(1 + 0.4) 1/3 – 1] x 100

Following this formula, your annualized ROI is about 11.87%.

Additional ROI calculations

A company's cash flow fluctuates from year to year, and so does your stock's value—which means you likely aren't going to earn the exact same ROI every single year. If you want a more detailed understanding of your ROI, then calculating your ROI and annualized ROI aren't enough. Instead, you need to make a few more calculations:

- The compound annual growth rate (CAGR), or annualized total return, measures your investment's potential growth rate year over year, assuming an average rate of growth and a reinvestment of funds at the end of each term.

- The internal rate of return (IRR) is a much more complicated equation that accounts for more detailed cash inflows (and, alas, outflows) over the course of an investment.

By signing up I agree to the Terms of Use and Privacy Policy .

Tools for calculating your ROI

You can calculate your ROI by hand, but why bother? Online ROI calculators can simplify the process—just input the numbers and the calculator will crunch them for you. Alternatively, run the numbers through spreadsheet software like Excel or Google Sheets. Some investing sites offer free Excel templates to make calculating ROI (and more complicated financial metrics like IRR) a little simpler.

The takeaway

The return on investment equation doesn't tell you how much you're guaranteed to make on a given investment—no equation can tell you that for certain, since the lack of certainty is a key part of the game. Still, it's a useful calculation to have under your belt whether you're investing in stock for the first time or trying to determine if your next investment property will be worth what you paid for it.

Want more financial metrics for evaluating an investment? Check out our piece on another key financial ratio: the future value formula .

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

How to Calculate the Return on Investment for Your Startup

How to calculate roi for a startup.

Return on investment is a typical business concept for calculating the financial benefits of an investment. To measure the performance of a business, managers and executives often calculate the return on investment (ROI). This value can be used to define anything from a monetary return to an efficiency ratio and is typically expressed as a percentage or a ratio.

In this article, we will go through the definition of Return on Investment, the importance and benefits of ROI calculations, and teach you how to calculate ROI for your startup.

What is ROI?

Return on investment is a performance measure that can be used to evaluate the effectiveness or profitability of an investment or compare the efficacy of several different investments. The return on investment, or ROI, is an attempt to directly evaluate the amount of return on a specific investment in relation to the cost of the investment.

A company can measure the profitability of any expenditure by calculating the return on investment. Buying pens or fixing an employee's desk are expenses that may not have a direct or monetary return on investment (ROI), but they are still part of a more significant investment. Spending money on a graphic designer to make commercials, a photographer to capture headshots, or a web developer to redesign the company's website are all investments with the potential for a return.

Return on investment (ROI) is a standard metric to assess a project's viability. An angel investor , for instance, might want to calculate the expected return on their investment before putting money into a company. Divide the annual income or profit by the initial or current investment to estimate the return on investment (ROI).

What is ROI used for?

The return on investment (ROI) metric can assess numerous investment choices by contrasting them to their starting prices. Calculations of return on investment (ROI) are frequently used by businesses when considering previous or prospective investments.

Individuals can analyze their investments and compare one investment to another, whether a stock holding or a financial stake in a small firm, by calculating the return on investment (ROI) and comparing the two.

Sometimes, businesses will employ a project's return on investment (ROI) as a metric of its performance. Before committing to an advertising campaign, a business owner will want to know what kind of return they can expect on their investment. A company's return on investment is considered positive if the money earned is greater than the sum spent.

When calculating annualized ROI, the average yearly return on investment realized during the investment term is what you're after. This is useful because the return on investment (ROI) doesn't account for the time spent holding an investment when calculating ROI. The rate of return on an annualized basis is helpful for comparing the results of various investments across different time frames.

What Are Examples of ROI Calculations?

Businesses might encounter difficulties calculating the investment amounts for each part of the ROI equation.

Considerable investment in new computers, for instance, has several deployment expenses that must be calculated and accounted for. The company must calculate the total cost of ownership, which includes the purchase price, any applicable taxes and shipping fees, any consultation or support fees paid, and the cost of initial installation and ongoing upkeep.

After that, the company would need to determine its net profit for a specified time frame. Hard monetary gains from enhanced efficiency and decreased upkeep expenses relative to older computer systems may contribute to these bottom-line gains.

Thus, a company can compare the return on investment (ROI) of two different computer systems by factoring in upfront expenses and long-term benefits. Which of these two computers, then, is the better financial bet?

At the end of the specified period, the company may use actual data for the total net income and the entire investment cost to determine the ROI. The computer implementation can be gauged by comparing the actual and predicted ROI.

What Are the Benefits of ROI?

When making decisions for your business, knowing how investments affect your profits and your business is essential and beneficial.

There are many benefits to calculating ROI for your business . Let's take a look at some.

- It's easy to figure out how to calculate return on investment. It only requires a few numbers that may easily be found in any set of financial statements or balance sheets. You need a few business metrics, like net profit and the amount of investment required, which will give you a quick idea of your initial investment.

- It's easy to figure out what your ROI means. If the number is positive, you made money on this investment. If the number is negative, it means you lost money. ROI is easy to understand, even for people who aren't accountants. Because it is so widely used and so simple to calculate, it enables more accurate comparisons between various companies regarding their investment returns. This makes the calculation results a valuable metric to use when talking to investors.

- ROI can be worked out for several different investments or your business. This lets you see what parts of your business have been helped by a particular investment, like a marketing campaign that brought in more money or a second location that helped you sell more. As we mentioned, it is a metric used to measure the success of an organization's financial decisions for a specific department or division. The improved metric will help determine which businesses or teams are the most profitable.

How Do You Calculate ROI?

For big companies, figuring out ROI can be a difficult task. But the process is easy for people who own small businesses.

For example, to determine the return on your first business investment, you need to know how much you put into the business and, if you have any, how much long-term debt you have now. You will also need to know how much money you made after taxes for the year. All this information is in your accounting software, your spreadsheet, or your accounting journals.

There are several ways to figure out the ROI. Most people use net income divided by the total cost of the investment = Net income / Cost of investment x 100.

Here is an example of how a business might calculate its return on investment.

Let's assume that Joel has an e-commerce business. He runs an e-commerce business that sells dog-related products. He wants to raise awareness and boost sales before the holidays, so he buys some social media ads. He spent a total of $2,000 on ads on social media sites to get people to visit his site during the holidays.

After the end of the holiday shopping season, Joel does the math on his net profit and discovers that the online store he owns has made $10,000 more money than it did during the same time the previous year. After that, he can calculate the advertising's return on investment using the following formula:

ROI = (10,000 / $2,000) x 100 = 500%

This indicates that Joel made five dollars more in net profit for every dollar he invested in advertisements. He can now start to budget for increased expenditure for the upcoming holiday season now that he has seen such a high return on investment (ROI).

Why Is ROI Important for Your Business?

Making smart financial decisions is essential for the success of your business. Your return on investment (ROI) is a crucial metric that can help you compare different investment strategies and determine which will make you the most money.

You can use this metric to make business decisions like investing in a new business or buying a new property to make room for growth.

You can A/B test ways to invest, like on social media platforms. This could be a comparison between Meta and Instagram in terms of your return on investment. For example, you could put the same amount of money into advertisements on each platform, which may give you a better return.

By comparing and evaluating this metric across different investment channels, you can make better financial decisions, get the best return, and grow your business.

How to Increase Your ROI

Depending on what kind of investment you want to make, the best way to increase returns will vary. But there is a way you can try before investing to increase your chances of getting a high return on your money. Eurokick is the solution!

Eurokick is ready to help your startup calculate your return on investment and increase your ROI. Eurokick supports and monitors your startup in every way possible. Contact us and get more information now!

Related Insights

Pre Seed Funding for Startups: What Is It & How Does It Work?

6 Ways To Find Investors And Raise Millions For Small Business

ROI Templates and Calculators For Many Disciplines

By Andy Marker | October 11, 2018

- Share on Facebook

- Share on LinkedIn

Link copied

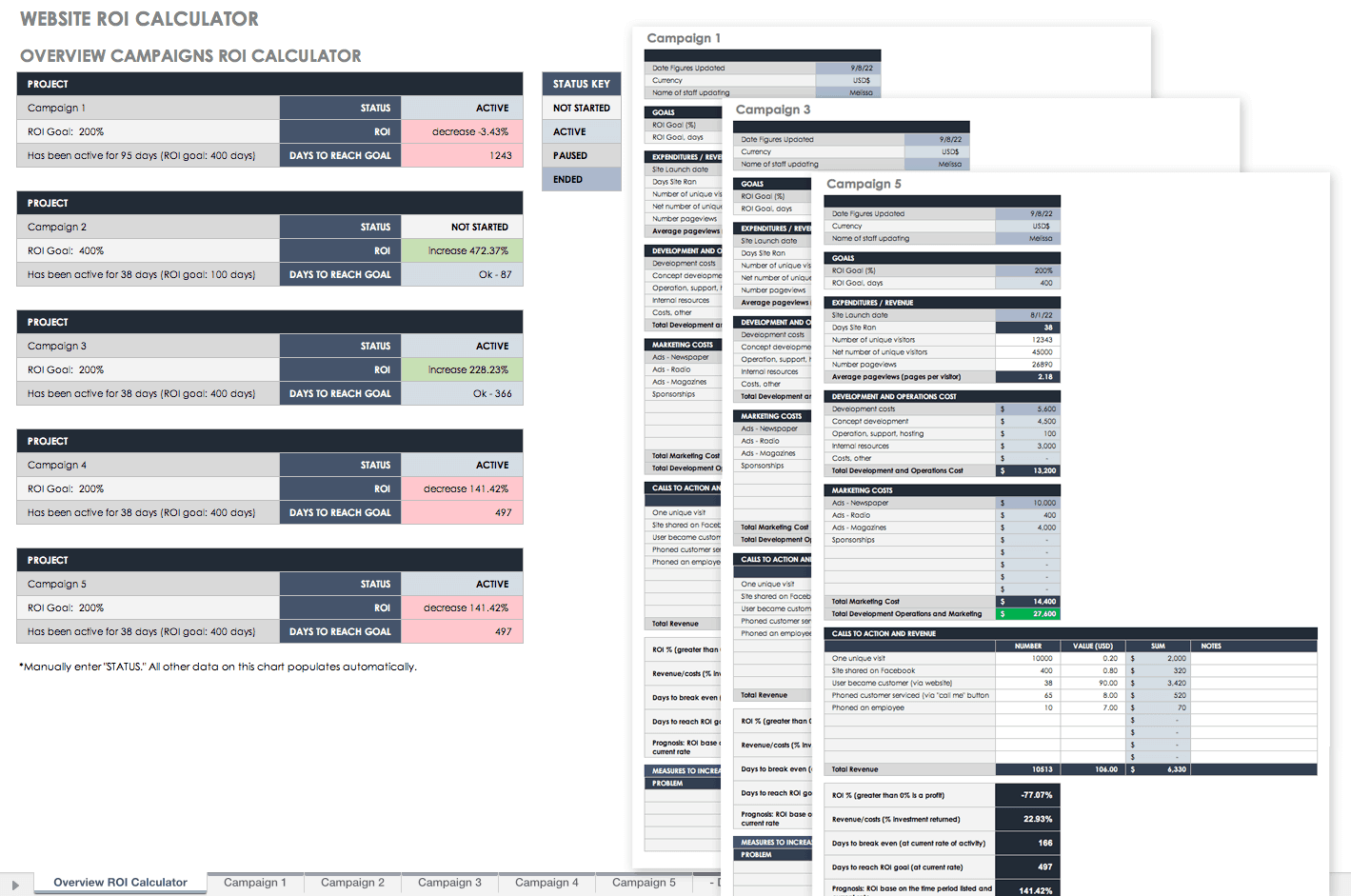

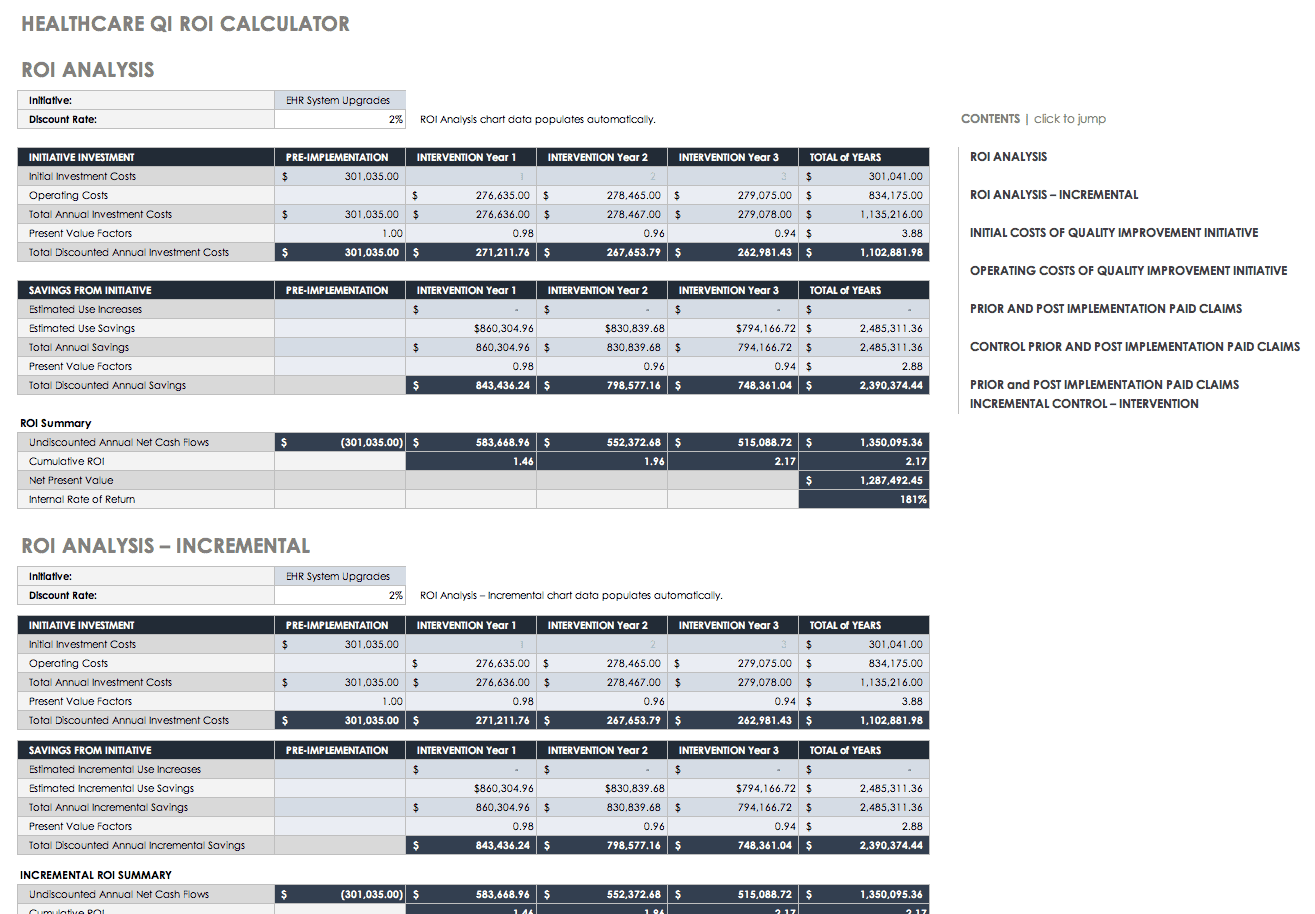

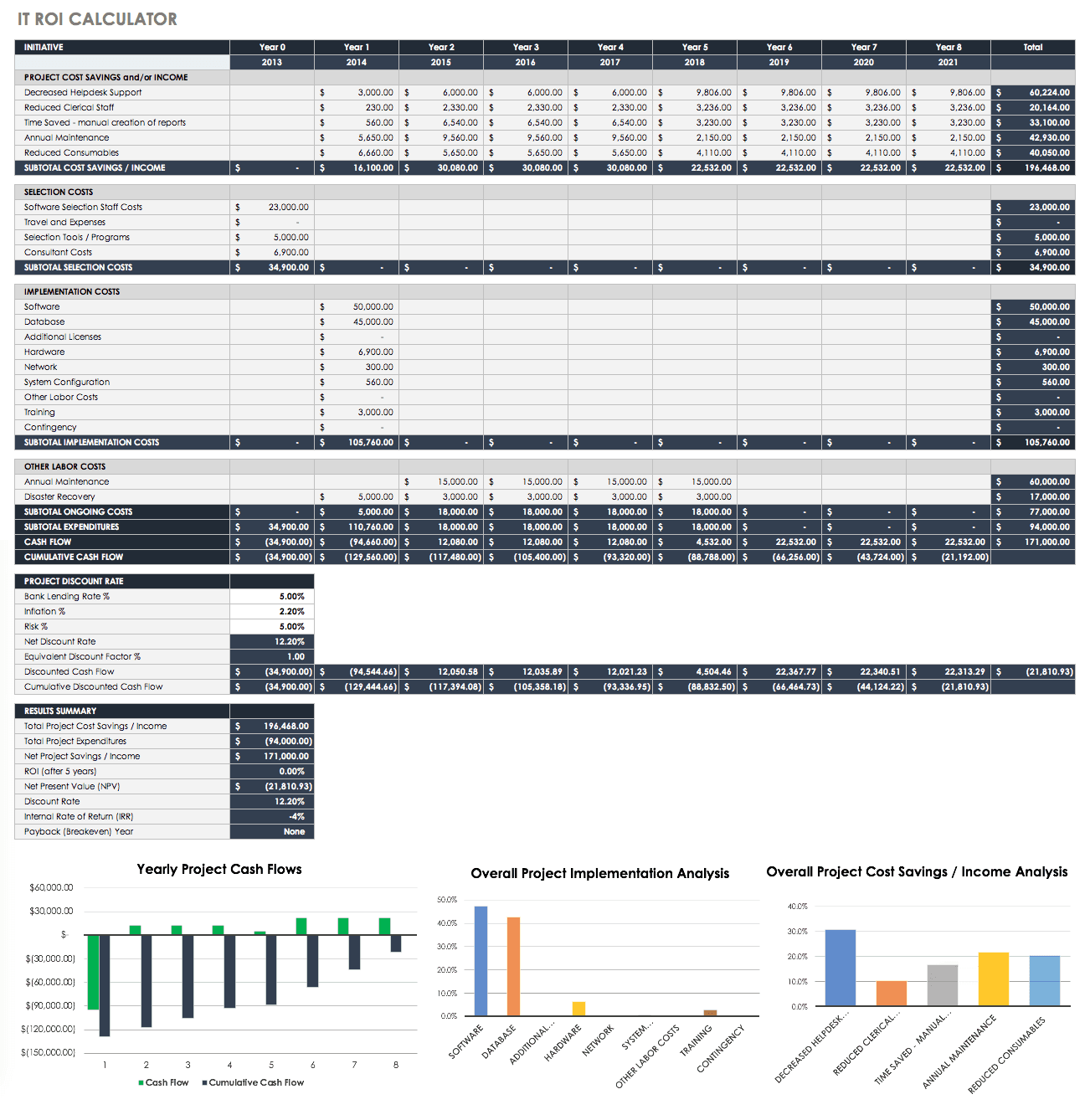

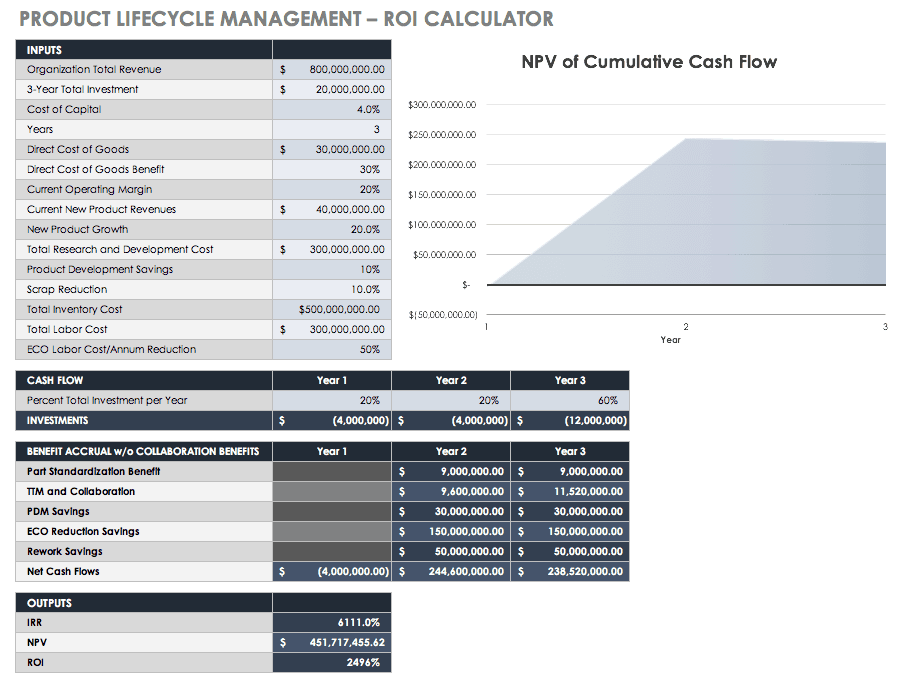

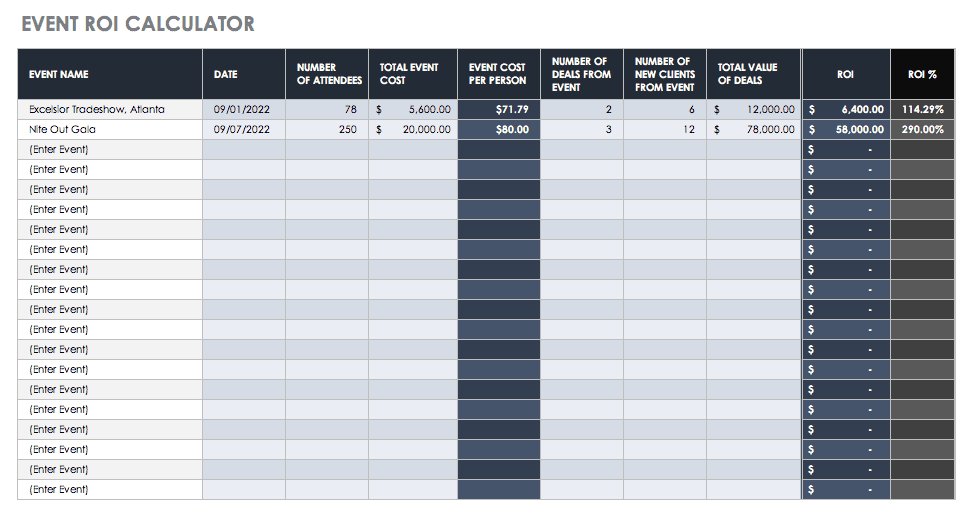

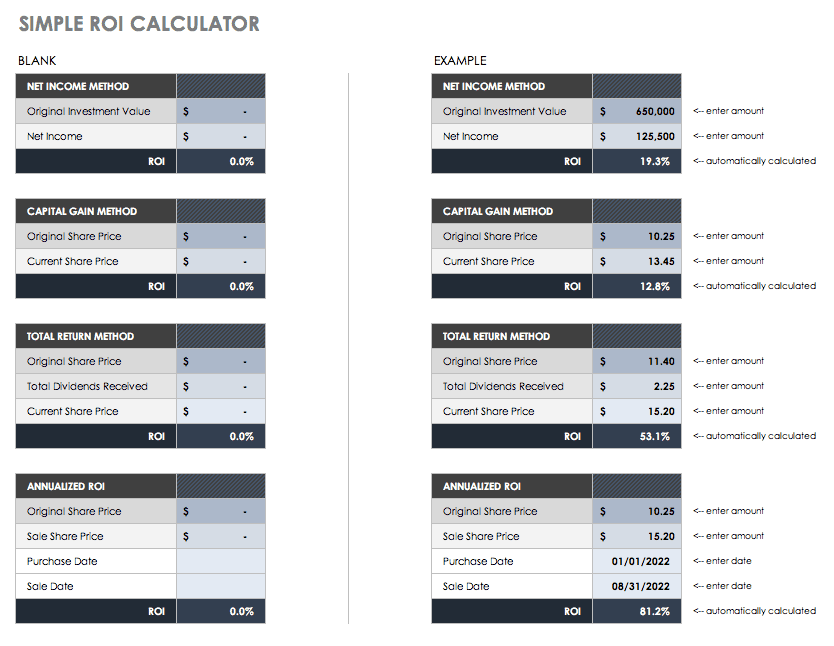

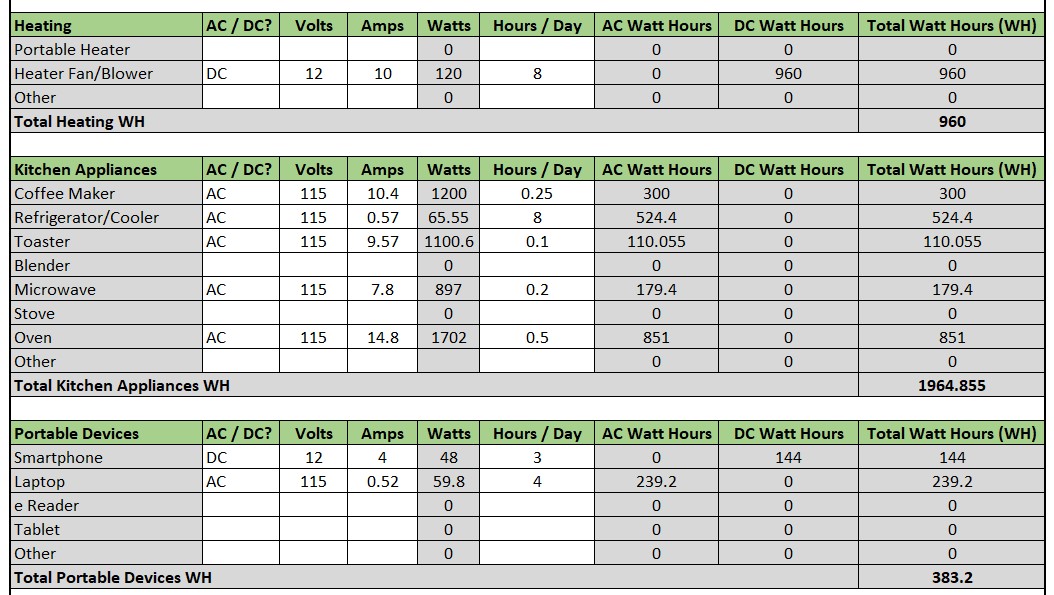

In this guide, you will learn about the role of ROI, its formula, why you would use it, the four methods to easily calculate it, and additional methods to break down work. Download the essential Excel templates to perform a variety of ROI tasks, including content marketing metrics, website ROI analysis, healthcare quality initiative ROI, event ROI calculator, PLM ROI calculator, IT ROI, cost avoidance calculator, and TCO ROI.

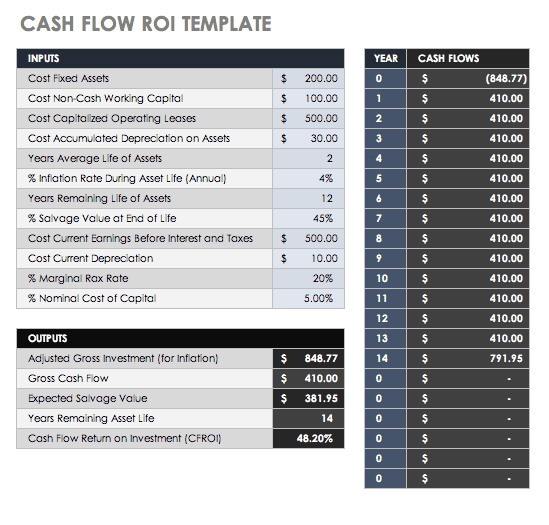

Cash Flow ROI and Template

Cash Flow ROI (CFROI) is a proxy for a company’s economic return. This return is compared to the interest rate charged to commercial banks from the Federal Reserve’s standard (the discount rate), to see if there is value-added potential. CFROI is the average economic return in a year on all of a company’s investments. Enter your variables in this template to determine your company’s CFROI.

Download Cash Flow ROI and Template - Excel

In this template, you will enter the following variables:

Cost Fixed Assets : These are assets not expected to be used up or converted into cash within a year. They can include property, plant, and equipment (PPE), and may be used to generate income.

Cost Non-cash Working Capital : The sum of inventory and receivables

Cost Capitalized Operating Leases : Posted as an asset on the balance sheet, this type of lease expenses the lease payments.

Cost Accumulated Depreciation on Assets : An asset account with a credit balance.

Years Average Life of Assets : The accumulated depreciation divided by the current depreciation expense.

Percent Inflation Rate During Asset Life (Annual) : The change in purchasing power.

Years Remaining Life of Assets : This is calculated based on when the asset went into service and the preferred depreciation method.

Percent Salvage Value at End of Life : The resale value at the end of the asset’s useful life.

Cost Current Earnings Before Interest and Taxes (EBIT) : All incomes and expenses, except interest and income tax expenses.

Cost Current Depreciation : The deduction that helps spread the cost over many years.

Percent Marginal Tax Rate : The tax percent of your income based on your tax bracket.

Percent Nominal Cost of Capital : The rate of return needed to persuade your company to make a given investment.

Below are the outputs from these inputs:

Adjusted gross investment (for inflation)

Gross cash flow

Expected salvage value

Years remaining asset life

Cash flow return on investment (CFROI)

Cash flows per investment year

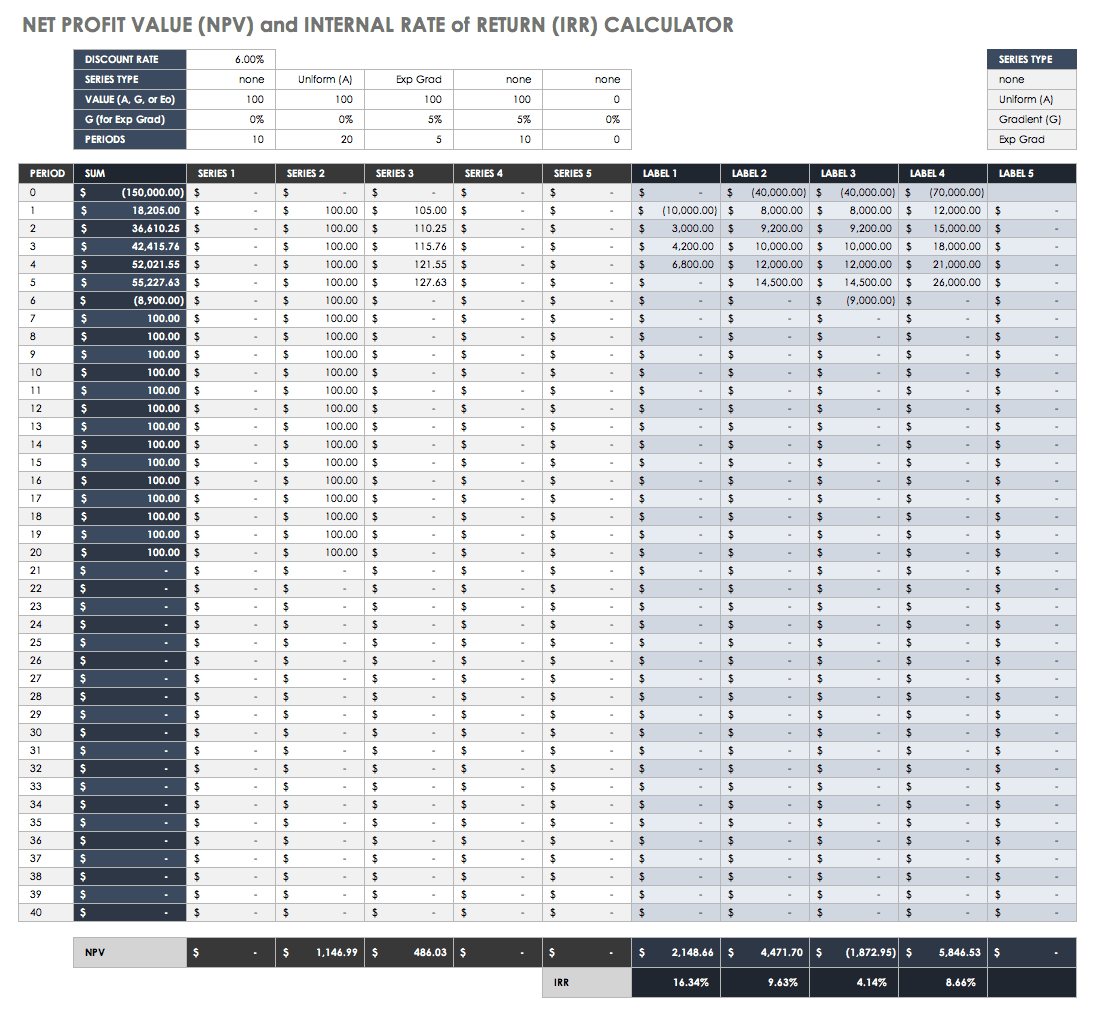

NPV and IRR Calculations and Template

Net present value (NPV) and internal rate of return (IRR) are metrics used to estimate ROI. NPV is the dollar difference between the present value of cash inflows and outflows over time. Companies use NPV as a tool to help them decide if an investment will provide long-term value, to compare different investment options, and to decide whether they should introduce a new product. IRR is the calculation that estimates the percent profitability of possible investments by taking the NPV equal to zero.

NPV looks at each cash flow separately, even when the discount rate is unknown. An NPV greater than zero makes a project financially worthwhile. IRR compares projects using one discount rate, predictable cash flows, equal risk, and a shorter time. IRR does not account for changes in the discount rate, which at times makes it a poor metric. Further, if there are a mix of positive and negative cash flows, IRR calculations are not effective. To calculate your company’s NPV and IRR, use this template.

Download NPV and IRR Calculations and Template - Excel

In this template, you will input the following:

Discount rate

Series payment type (None, Uniform, Gradient, or Exp Grad)

Value (A, G, or Eo)

G % for Exp Grad

The number of periods

For each period, the values

Below are the outputs for this template:

The sum for each period

The different series for each period

NPV for each series

NPV for each label

IRR for each label

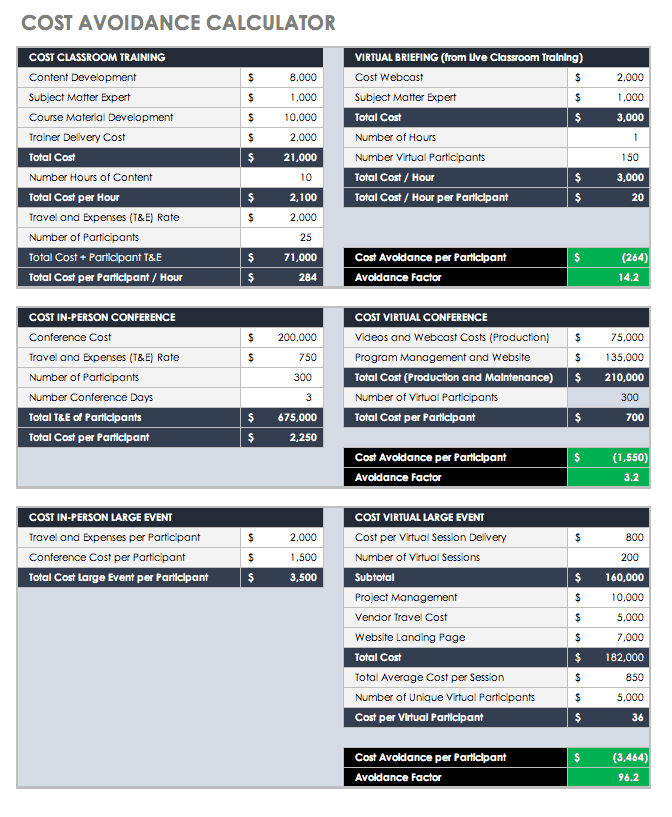

Cost Avoidance Calculator Template

Preparing for a conference or large event is a big commitment for a business. There are direct costs, such as airfare, registration, and accommodations, and indirect costs such as the hours of preparation. Cost avoidance includes actions or event-substitutions that reduce future costs, such as planning virtual conferences, trainings, or parts replacement before failure (and subsequent damage to other parts). Cost avoidance activities may incur higher immediate costs but save money — sometimes totaling extreme savings — over time. This is a different concept from cost savings , in which you actually save the money you plan on spending. Lower spending, investment, or debt levels is what saves money.

Use this template to calculate cost avoidance as ROI. This calculator has a variety of event scenarios, including training, conference, and an in-person event. These costs are compared to a virtual briefing, a virtual conference, and a virtual large event, respectively. With your input, you can calculate the costs per participant for each, the cost avoidance factor per participant, and the avoidance factor.

Download Cost Avoidance Calculator - Excel

Marketing ROI and Content Marketing Templates

Marketing is a huge expense for any business. Whether your company invests in a comprehensive program that rolls out print and television ads as well as a social media presence, or just has a Facebook page, you should know the worth of your content over time. Sirius Decisions stated in 2013 that 60 to 70 percent of content goes unused. The cost of creation itself involves the per hour cost of each person by the number of creation hours involved, plus any actual content expenses. Having the ROI for marketing content can help motivate your staff to use it.

The marketing ROI (MROI) is simply the revenue generated from your content minus the cost to produce your content. This is a simple calculation, but some professionals caution that marketing professionals should define how and what they have measured in order to signal to stakeholders whether they are defining short-term channel-specific ROI or informing for long-term budget or strategic decisions. In this marketing ROI template, you will find space for multiple marketing initiatives in order to compare their relative value.

Download Marketing ROI Template - Excel

To use this template, input the following:

Total initiative cost

Total circulation/audience

Response rate (percent of generated leads by the audience)

Conversion rate (percent of leads which will purchase)

Average revenue per sale

Average profit per sale

From these inputs, you will get these outputs:

Total costs of all initiatives

Total cost/audience for all initiatives

Average profit per sale for all initiatives

Number of leads generated

Number of sales

Total revenue uplift

Total profit uplift

ROI percent

Cost per lead

Cost per sale

Break even response rate

Break even conversion rate

Break even profit per sale

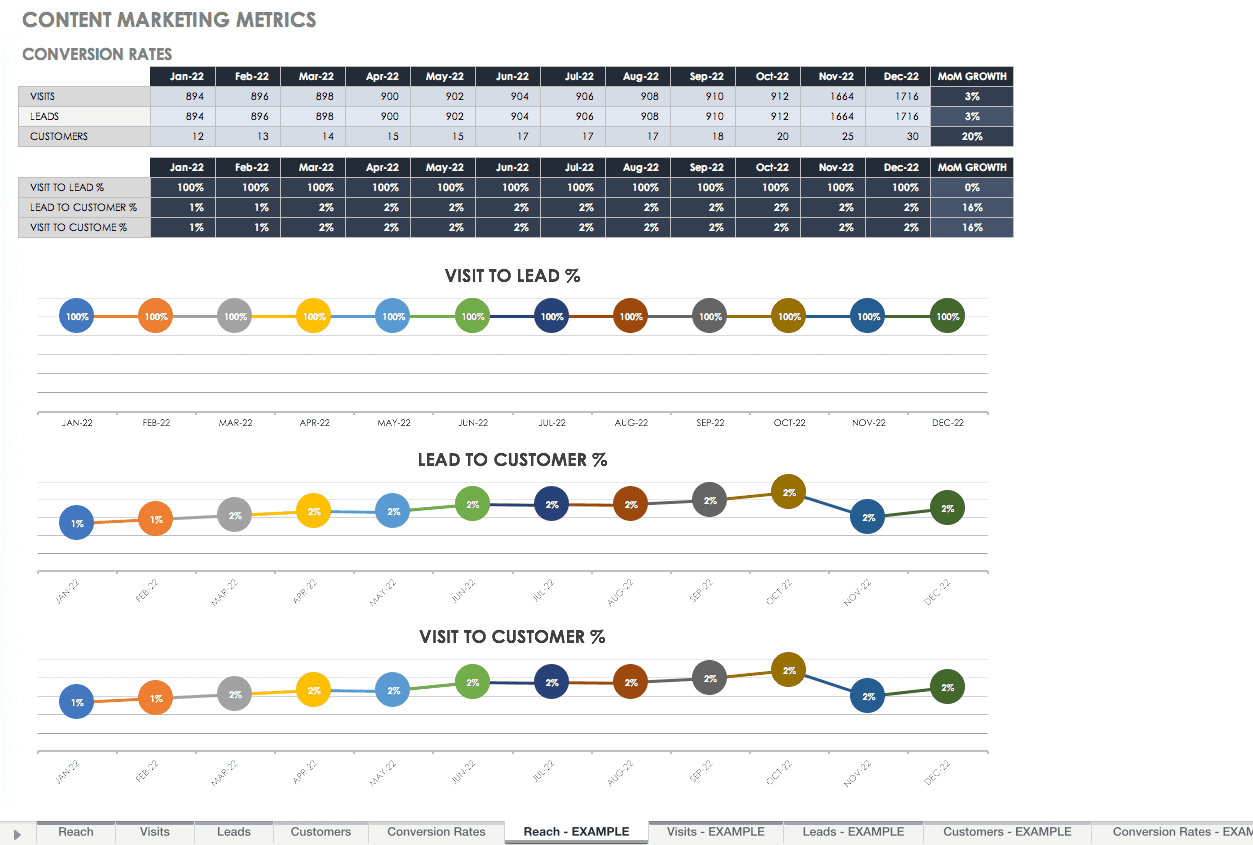

The demand for marketing measurement and reporting is rising with marketing costs. There are many metrics that should be reported to show the success of your marketing program. Many professionals are not comfortable communicating their impact on the bottom line metrics to get the support they need. The key metrics that every marketing person should be comfortable reporting include the following:

Total Reach : The number of people your company can reach across your different networks and platforms. Each is a potential client.

Reach by Channel : The number of people following or subscribed per channel.

Total Website Visits : The number of people who visited your website in a period of time. This metric shows how well your inbound marketing is directing people to your website, which is also tracked month over month (MoM).

Website Visits by Source : This metric reports where people are coming to your website from to determine how well specific campaigns are working.

Total Leads Generated : This metric shows the interest your campaign generates for the products or services. It is one of the strongest ROI indicators.

Leads Generated by Source : This metric shows the channels that produce the most leads, which allows you to focus on the most valuable sources.

Total Customers Driven by Marketing : This metric tracks which marketing campaigns are yielding the most customers.

Marketing Generated Customers by Source : Track the source of the customers acquired by each campaign.

Conversion Rates

Visit to Lead Conversion Rat e: This measures the percent of people whose website visit becomes a new lead for sales.

Lead to Customer Conversion Rate : This measures the percent of people moving from leads to customers. This metric helps determine if your campaigns are generating sales-ready leads.

Visit to Customer Conversion Rat e: This is the overall funnel: whether your traffic generated turns into customers.

Content Marketing Metrics Template

Use each of the above five categories to record metrics for reporting with this template. It provides a space for each metric and ready-made graphs to add to your marketing deck so you can present your success. Fill out the reach, visits, leads, and customers templates, and your conversion rates template will automatically fill from your data.

Download Content Marketing Metrics Template

Excel | Smartsheet

Website ROI Analyses and Template

Google Analytics 4 (GA4) can help you determine the financial value of your content so you can calculate ROI. Use GA4 to track the URLs from all your web materials, such as your website, Facebook, newsletters, and any other sources. You can track who comes to your site and the path they took to get there. For example, you can get a count of how many times someone accessed your site from a Facebook post, or how many times your content was downloaded from your site.

To set up Google Analytics 4, start by either signing in or creating an Analytics account. Set up your GA4 property, add a data stream and install your Google Analytics with Google Tag Manager. Here’s how to set up Google Analytics 4:

Create an Analytics account, unless you already have one.

Create a Google Analytics 4 Property:

Go to the Admin section of your Google Analytics 4 interface and then click Create Property .

Enter the name of your property, choose your company’s country, reporting time zone, and the main currency your business operates.

Press Next , and answer several questions.

Then select your business objectives.

Click Create .

Configure your first Data Stream:

In Admin , in the desired Property column, click Data Streams > Add stream .

Click iOS app , Android app , or Web . In this article we focus on the Web stream.

For the Web , enter the URL of your website (the protocol https is already selected) and enter the name of your website.