Original text

This guide walks you step-by-step through writing a business plan for an existing business. The template includes easy-to-follow instructions for completing each section of the business plan, questions to help you think through each aspect, and corresponding fillable worksheet/s for key sections.

The business plan sections covered in this template include:

Confidentiality Agreement

I. Instructions: Executive Summary

Executive Summary

II. Instructions: Company Description

Company Description Worksheet

III. Instructions: Products & Services

Product & Service Description Worksheet

IV. Instructions: Marketing Plan

SWOT Analysis Worksheet

Competitive Analysis Worksheet

Marketing Expenses Strategy Chart

Pricing Strategy Worksheet

Distribution Channel Assessment Worksheet

V. Instructions: Operational Plan

VI. Instructions: Management & Organization

Management Worksheet

Organization Chart

VII. Instructions: Personal Financial Statement

VIII. Instructions: Financial History & Analysis

1X. Instructions: Financial Plan

X. Instructions: Appendices

XI. Instructions: Refining the Plan

Now That You’re (Almost) Finished . . .

Download Template

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway

Writing a business plan is an essential process for any forward-thinking entrepreneur or business owner. A business plan requires a lot of up-front research, planning, and attention to detail, but it’s worthwhile. Creating a comprehensive business plan can help you achieve your business goals and secure the funding you need.

Related content

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

- How to Get a Business License: What You Need to Know

- What Is a Cash Flow Statement?

Best Small Business Loans

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

How SCORE can help you launch your business

Starting a small business isn't easy, but SCORE, a nonprofit connected to the U.S. Small Business Administration, is dedicated to helping. Here's how SCORE's services can better position you for success.

Ready to start your business? Plans start at $0 + filing fees.

by Lorelei Laird

Lorelei Laird is a Los Angeles-based writer specializing in the law. Her stories have been published by the ABA Journ...

Read more...

Updated on: February 21, 2023 · 4 min read

What is SCORE?

Can a score mentor help me reach my business goals, how can a score business plan help, set smart business goals—with some help.

Starting a small business is exciting, but first-timers may feel unprepared for the experience. Entrepreneurs who find themselves suddenly needing to write a business plan or set short-term and long-term business goals may have no one in their lives with the right experience to help.

That's where SCORE comes in. This national nonprofit helps small businesses succeed by connecting experienced business people with entrepreneurs. All of the advice comes from volunteer SCORE-certified mentors who have done it all before.

SCORE is one of several resources offered by the U.S. Small Business Administration (SBA), a government agency that supports and promotes small businesses. It provides free or low-cost business advice to American entrepreneurs through workshops and mentoring. Entrepreneurs can attend local workshops or take online courses and webinars on topics like setting business goals, online marketing, tax compliance, and more.

They can also get connected with a mentor, a volunteer from their area who's successfully launched one or more businesses. SCORE connects entrepreneurs with these business mentors according to where they live and what kind of expertise they need—and SCORE mentor reviews are available in several places online.

Consultations with your mentor are free and confidential. SCORE volunteer mentor Brennon Wilson of Canton, Ohio, says this is important to business people who worry about having their ideas stolen.

"We have signed papers to say that we're not going to break that confidentiality," he notes. "We want clients to be transparent because, if they're not, we can't really get a full understanding of how best to help them."

Wilson, who has launched several businesses and mentored about a dozen entrepreneurs, sees huge value in having a mentor's guidance.

"There's less likelihood of failure because somebody's going to go, 'Hey, I've been there. You don't want to do that,'" he says. "'Go over here and do this.'"

That experience, he says, is a major benefit of having a mentor. Being able to draw on the advice of someone who's walked the same path gives entrepreneurs a better chance of success. It also provides the perspective of someone who's on the entrepreneur's side—Wilson describes mentors as friends—but is likely to be more clear-eyed because they're not emotionally invested in the enterprise. These advantages may be why 92% of small businesses surveyed by financial services company Kabbage said mentors had a direct impact on their profitability and growth in their early years.

To get the most out of a mentoring relationship, Wilson suggests being prepared. That means sitting down before a meeting and thinking about what questions to ask, and what information your mentor will need to answer them.

One important area where a mentor can be helpful is setting business goals and objectives. Colleges don't typically teach people how to write business goals—but such planning is vital to success in any business and is likely to be required by funders, including both conventional banks and venture capitalists . A mentor can provide business plan examples and guide entrepreneurs toward strategic business goals that detail both their vision and the practical steps to realize it.

Wilson says a well-written business plan is vital.

"I mean a current, up-to-date, new, fresh business plan that you're going to really put time and effort into," Wilson says. "That thing is going to be your road map to success."

According to the SBA , a business plan should:

- Describe your company

- Explain what role it will play in the marketplace

- Layout the structure and leadership of the business

- Show how you plan to reach customers

- Detail how much funding you need

- Outline your financial goals for your business

Business plan templates are available from the SBA and many other sources.

SCORE mentors won't write a business plan for their mentees, Wilson says—but their experience can help mentees write their own.

"A mentor is going to be able to say 'This is what you want to look at, here are some things to consider, here's what we've seen in the past,'" he says.

SCORE is a valuable resource for someone new to creating a small business. From setting short-term goals and securing funding to marketing and networking, mentors have done it all before—and they're volunteers because they want to share that experience. SCORE provides a way to take advantage of that experience at little or no cost, so it's no wonder that SCORE has had a hand in launching nearly 30,000 businesses nationwide.

"Starting a business is a very lonely road to walk," Wilson says. "So, don't cripple yourself by walking it alone."

You may also like

Why do I need to conduct a trademark search?

By knowing what other trademarks are out there, you will understand if there is room for the mark that you want to protect. It is better to find out early, so you can find a mark that will be easier to protect.

October 4, 2023 · 4min read

What is a power of attorney (POA)? A comprehensive guide

Setting up a power of attorney to make your decisions when you can't is a smart thing to do because you never know when you'll need help from someone you trust.

May 7, 2024 · 15min read

How to Start an LLC in 7 Easy Steps (2024 Guide)

2024 is one of the best years ever to start an LLC, and you can create yours in only a few steps.

May 16, 2024 · 22min read

Financing | Templates

How To Write an SBA Business Plan [+Free Template]

Published June 13, 2023

Published Jun 13, 2023

REVIEWED BY: Tricia Jones

WRITTEN BY: Andrew Wan

This article is part of a larger series on Business Financing .

- 1. Write the Company Description

- 2. Identify Organization & Management

- 3. Specify the Market Analysis

- 4. Write Descriptions of the Products or Services

- 5. Indicate the Marketing & Sales Strategy

- 6. List Financial Data & Projections

- 7. Write the Financing Request

- 8. Fill In the Appendix & Supplemental Information

- 9. Complete the Executive Summary

- Additional Resources

Bottom Line

FILE TO DOWNLOAD OR INTEGRATE

SBA Business Plan Template Download

Thank you for downloading!

If you’re applying for a loan from the Small Business Administration (SBA), there’s a good chance that you’ll need a business plan to get approved. An SBA business plan provides a summary of the various aspects of your business, and we will guide you through the process of creating it, from writing your company description and marketing and sales strategies to completing financial data and projections and your executive summary.

Although there is no standard format, and to help you ensure nothing is overlooked, you can use our SBA business plan template above to ensure you cover the most important areas of your company. A well-prepared business plan can improve your chances of getting an SBA loan.

Step 1: Write the Company Description

This section should contain information about the purpose of your business. It should include a description of the problem or challenge your product or service aims to solve and what types of individuals or organizations will benefit.

A strong company description should also address the following questions:

- Why does your company exist?

- What problems does your business aim to address?

- What prompted you to start your business?

- What organizations or individuals will benefit from your company’s product or service?

- What makes your company different from others?

- What competitive advantages does your business offer?

- What would a successful product launch look like?

- Does your company have strategic partnerships with other vendors?

Step 2: Identify Organization & Management

Details about the legal and tax structure of your business should be included in this section. It can also be helpful to include an organizational chart of your company. You can include information about each team member’s background and experience and how it is relevant to your company:

- Highlight what business structure you have selected and why. Examples commonly include a sole proprietorship, limited liability company (LLC), partnership, S corporation (S-corp), and C corporation (C-corp)

- Include an organizational chart showing which team members are responsible for the various aspects of your company

- You can include resumes for members of your leadership team highlighting their experience and background

Step 3: Specify the Market Analysis

The market analysis section of your SBA business plan should look at who your competitors will be. Look at what they are doing well, what their weaknesses are, and how your company compares.

The SBA’s market analysis page contains information on how you can approach this. Questions you should also consider addressing should include:

- Who are the major competitors in the market?

- What are competitors doing well and are there areas for improvement?

- How does your company compare to the top competitors?

- How has the product or service evolved over time?

- Are there any trends for supply and demand throughout the year?

- What can your company do to stand apart from the top competitors?

Step 4: Write Descriptions of the Products or Services

In this section, you should detail the product or service offered by your business. You should explain what it does, how it helps your customers, and its expected lifecycle. You can also include things like any expected research and development costs, intellectual property concerns such as patents, what the lifecycle of your product looks like, and what is needed to manufacture or assemble it.

Here are some things to consider as you are working on this section:

- Description of what your product or service does

- How your product or service works

- How your customers will benefit from your product or service

- Illustration of the typical lifecycle

- Any patents or intellectual property you or your competitors have

- Pricing structure

- Plans for research and development

- Discuss plans for handling intellectual property, copyright, and patent filings

Step 5: Indicate the Marketing & Sales Strategy

Details of your marketing and sales strategy will be highly dependent on your business. It’s also something that may evolve and change over time in response to things like the overall economic environment, release of competitor’s products or services, and changes in pricing.

With that being said, here is a list of some items that should be addressed:

- Who is your target audience?

- How will you attract customers?

- How and where will sales be made?

- If applicable, what will the sales process look like?

- Where will you market and advertise your product or service?

- How does your marketing strategy compare to other companies in the industry?

- How much should you spend on marketing?

- What is the expected return on investment for marketing?

- Do you have any data showing the effect of marketing?

Step 6: List Financial Data & Projections

If your business has been running, you should include information about its finances. This should include all streams of revenue and expenses. Data for financial projections should also be included, along with a description of the methodology you used to reach those conclusions.

If available, you should be prepared to provide the following financial documents for at least the last three years to five years:

- Personal and business tax returns

- Balance sheets

- Profit and loss (P&L) statements

- Cash flow statements

- Hard and soft collateral owned by your business

- Business bank statements for the last six to 12 months

Financial projections should include enough data to offer some confidence that your business is viable and will succeed. It’s recommended that you provide monthly projections looking forward at least three years, with annual projections for years four and five.

- Projections for revenue and methodology used in arriving at these figures

- Expected shifts in revenue or expenses as a result of seasonality or other factors affecting supply and demand

- Expected expenses from loan payments, rent, lease payments, marketing and advertising fees, employee salaries, benefits, legal fees, warranty expenses, and more

You can use our SBA loan calculator to help you estimate monthly payments for the funding you’re currently looking for and projections for any additional loans you may need. Monthly payments can fluctuate depending on the terms of your loan. If you’re looking for accurate estimates, you can read our article on SBA loan rates .

Step 7: Write the Financing Request

This section is where you should specify how much funding you need, why you need it, what you’ll use it for, and the impact you expect it will have on your business. It’s also a good idea to indicate when you expect to use the funds over the course of the next three to five years.

Here is a checklist of some important items you should cover:

- How much funding you need and why

- When you will use the funds over the next three to five years

- What you will use the funds for

- The expected impact this will have on your business and how it will help reach your business goals

- The anticipation of any recurring needs for additional funding

- Your strategy for how you expect to pay off the loan

- Any future financial plans for your business

Step 8: Fill In the Appendix & Supplemental Information

This last section of your SBA business plan should include any additional information that may be helpful for lenders. This can include more detailed explanations or clarifications of data from other sections of your business plan.

Here are some examples of documents you can include:

- Business licenses

- Certifications or permits

- Letters of reference

- Photos of products

- Resumes of business owners

- Contractual agreements and other legal documents

Step 9: Complete the Executive Summary

The executive summary, which is the first section in a business plan, should be no more than one to two pages and provide a high-level overview of the items listed below. Since each section above is already detailed, a brief description of those sections will be sufficient:

- Your company’s mission statement

- The background and experience of your leadership team

- The product or service and what purpose it serves

- Your target market for the product or service

- Competitive analysis of other products and services

- Your competitive advantage or why your company will succeed

- Marketing and sales strategy

- Financial projections and funding needs

Depending on the type of SBA loan you’re applying for, certain areas of your business plan may be weighed more heavily than others. You can learn about the SBA loan options you can choose from in our guide on the different types of SBA loans .

Additional Resources for Writing an SBA Business Plan

If you’re looking for additional resources to help you write a business plan, you can consider the options below. Since a business plan is just one of many documents you’ll need, you can also read our guide on how to get an SBA loan if you need help with other areas of the loan process:

- SBA: SBA’s business guide contains information on how you can start a small business. It includes steps on creating a business plan, funding your company, and launching a business.

- SCORE: Through SCORE, you can request to be paired with a mentor and get business-related education. Educational courses come in several formats, including webinars, live events, and online courses.

- Small Business Development Center (SBDC): SBDCs provide training and counseling to small business owners. This can help with various aspects of your company such as getting access to working capital, business planning, financial management, and more. You can use the SBA’s tool to find your closest SBDC .

Having a strong SBA business plan can improve your chances of getting approved for an SBA loan. If you’re unsure where to start, you can use our guide and template to cover the most important aspects of your business. You can also see our tips on how to get a small business loan . To get even more ideas on creating a strong business plan, you can also utilize resources through organizations such as SCORE and the SBA itself.

About the Author

Find Andrew On LinkedIn

Andrew Wan is a staff writer at Fit Small Business, specializing in Small Business Finance. He has over a decade of experience in mortgage lending, having held roles as a loan officer, processor, and underwriter. He is experienced with various types of mortgage loans, including Federal Housing Administration government mortgages as a Direct Endorsement (DE) underwriter. Andrew received an M.B.A. from the University of California at Irvine, a Master of Studies in Law from the University of Southern California, and holds a California real estate broker license.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

8 Business Plan Templates You Can Get for Free

8 min. read

Updated April 10, 2024

A business plan template can be an excellent tool to simplify the creation of your business plan.

The pre-set structure helps you organize ideas, covers all critical business information, and saves you time and effort on formatting.

The only issue? There are SO many free business plan templates out there.

So, which ones are actually worth using?

To help remove the guesswork, I’ve rounded up some of the best business plan templates you can access right now.

These are listed in no particular order, and each has its benefits and drawbacks.

What to look for in a business plan template

Not all business plan templates are created equal. As you weigh your options and decide which template(s) you’ll use, be sure to review them with the following criteria in mind:

- Easy to edit: A template should save you time. That won’t be the case if you have to fuss around figuring out how to edit the document, or even worse, it doesn’t allow you to edit at all.

- Contains the right sections: A good template should cover all essential sections of a business plan , including the executive summary, product/service description, market/competitive analysis, marketing and sales plan, operations, milestones, and financial projections.

- Provides guidance: You should be able to trust that the information in a template is accurate. That means the organization or person who created the template is highly credible, known for producing useful resources, and ideally has some entrepreneurial experience.

- Software compatibility: Lastly, you want any template to be compatible with the software platforms you use. More than likely, this means it’s available in Microsoft Word, Google Docs, or PDF format at a minimum.

1. Bplans — A plan with expert guidance

Since you’re already on Bplans, I have to first mention the templates that we have available.

Our traditional and one-page templates were created by entrepreneurs and business owners with over 80 years of collective planning experience. We revisit and update them annually to ensure they are approachable, thorough, and aligned with our team’s evolving best practices.

The templates, available in Word, PDF, or Google Doc formats, include in-depth guidance on what to include in each section, expert tips, and links to additional resources.

Plus, we have over 550 real-world sample business plans you can use for guidance when filling out your template.

Download: Traditional lender-ready business plan template or a simple one-page plan template .

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

2. SBA — Introduction to business plans

The U.S. Small Business Administration (SBA) offers two different business plan templates along with a short planning guide.

While not incredibly in-depth, it’s enough to help you understand how traditional and lean plans are structured and what information needs to be covered. The templates themselves are more like examples, providing you with a finished product to reference as you write your plan.

The key benefit of using these templates is that they were created by the SBA. While they may provide less guidance, you can be assured that the information and structure meet their expectations.

Explore: The SBA’s planning guide and free templates

3. SCORE — Planning workbook

SCORE’s template is more like a workbook. It includes exercises after each section to help you get your ideas down and turn them into a structured plan.

The market research worksheets are especially useful. They provide a clear framework for identifying your target market and analyzing competitors from multiple angles. Plus, they give you an easy way to document all the information you’re collecting.

You will likely have to remove the exercises in this template to make it investor-ready. But it can be worth it if you’re struggling to get past a blank page and want a more interactive planning method.

Download: SCORE’s business plan template

4. PandaDoc — A template with fillable forms

PandaDoc’s library offers a variety of industry-specific business plan templates that feature a modern design flair and concise instructions.

These templates are designed for sharing. They include fillable fields and sections for non-disclosure agreements, which may be necessary when sending a plan to investors.

But the real benefit is their compatibility with PandaDoc’s platform. Yes, they are free, but if you’re a PandaDoc subscriber, you’ll have far more customization options.

Out of all their templates, the standard business plan template is the most in-depth. The rest, while still useful, go a bit lighter on guidance in favor of tailoring the plan to a specific industry.

Explore: PandaDoc’s business plan template library

5. Canva — Pitch with your plan

Canva is a great option for building a visually stunning business plan that can be used as a pitch tool. It offers a diverse array of templates built by their in-house team and the larger creative community, meaning the number of options constantly grows.

You will need to verify that the information in the template you choose matches the standard structure of a traditional business plan.

You should do this with any template, but it’s especially important with any tool that accepts community submissions. While they are likely reviewed and approved, there may still be errors.

Remember, you can only edit these templates within Canva. Luckily, you only need a free subscription, and you may just miss out on some of the visual assets being used.

To get the most value, it may be best to create a more traditional planning document and transfer that information into Canva.

Explore: Canva’s business plan gallery

6. ClickUp — The collaborative template

Out of all the project management tools that offer free business plan templates, ClickUp’s is the most approachable.

Rather than throwing you into all the features and expecting you to figure it out—ClickUp provides a thorough startup guide with resource links, images, and videos explaining how to write a plan using the tool.

There’s also a completed sample plan (structured like an expanded one-page plan) for you to reference and see how the more traditional document can connect to the product management features. You can set goals, target dates, leave comments, and even assign tasks to someone else on your team.

These features are limited to the ClickUp platform and will not be useful for everyone. They will likely get in the way of writing a plan you can easily share with lenders or investors.

But this is a great option if you’re looking for a template that makes internal collaboration more fluid and keeps all your information in one place.

Sign Up: Get a free trial of ClickUp and explore their template library

7. Smartsheet — A wide variety of templates

I’m including Smartsheet’s library of templates on this list because of the sheer number of options they provide.

They have a simple business plan template, a one-page plan, a fill-in-the-blank template, a plan outline, a plan grading rubric, and even an Excel-built project plan. All are perfectly usable and vary in visual style, depth of instructions, and the available format.

Honestly, the only drawback (which is also the core benefit) is that the amount of templates can be overwhelming. If you’re already uncertain which plan option is right for you, the lengthy list they provide may not provide much clarity.

At the same time, it can be a great resource if you want a one-stop shop to view multiple plan types.

Explore: Smartsheet’s business plan template library

8. ReferralRock affiliate marketing business plan

I’m adding ReferralRock’s template to this list due to its specificity.

It’s not your standard business plan template. The plan is tailored with specific sections and guidance around launching an affiliate marketing business.

Most of the template is dedicated to defining how to choose affiliates, set commissions, create legal agreements, and track performance.

So, if you plan on starting an affiliate marketing business or program, this template will provide more specific guidance. Just know that you will likely need to reference additional resources when writing the non-industry sections of your plan.

Download: ReferralRock affiliate marketing business plan template

Does it matter what business plan template you use?

The short answer is no. As long as the structure is correct, it saves you time, and it helps you write your business plan , then any template will work.

What it ultimately comes down to, is what sort of value you hope to get from the template.

- Do you need more guidance?

- A simple way to structure your plan?

- An option that works with a specific tool?

- A way to make your plan more visually interesting?

Hopefully, this list has helped you hone in on an option that meets one (or several) of these needs. Still, it may be worth downloading a few of these templates to determine the right fit.

And really, what matters most is that you spend time writing a business plan . It will help you avoid early mistakes, determine if you have a viable business, and fully consider what it will take to get up and running.

If you need additional guidance, check out our library of planning resources . We cover everything from plan formats , to how to write a business plan, and even how to use it as a management tool .

If you don’t want to waste time researching other templates, you can download our one-page or traditional business plan template and jump right into the planning process.

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

Table of Contents

- Qualities of a good template

- ReferralRock

- Does the template matter?

Related Articles

7 Min. Read

5 Consequences of Skipping a Business Plan

12 Min. Read

Do You Need a Business Plan? Scientific Research Says Yes

10 Min. Read

When Should You Write a Business Plan?

3 Min. Read

11 Key Components of a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Business Plans: Examples & Templates

- Examples & Templates

- Business Model Canvas

- Target Market

- Competitors

Sample Business Plans

- Business Plans Handbook 2024 Actual business plans compiled by, and aimed at, entrepreneurs seeking funding for small businesses. Presents sample plans taken from businesses in the manufacturing, retail and service industries

- Free Sample Business Plans Over 500 example business plans. Choose the category that is closest to your own business or industry.

Business Plan Templates

- Business Plan Development Guide Provides practical and easy-to-follow guides for developing a business plan

- SCORE: Business Planning & Financial Statements Template Gallery Nonprofit association dedicated to entrepreneur education and growth and success of small businesses. Includes templates for business planning, finance, marketing and sales, and management.

- SBA Guide to Writing a Business Plan This guide provides information on the most common parts of a business plan with details on what is included in each part.

Ask A Business Librarian

Make an appointment

Chat with a Librarian

Call (303) 492-8367

Email [email protected]

Image Credits

What I Do at Work . By The Scott . Used under CC BY-NC 2.0.

- << Previous: Home

- Next: Business Model Canvas >>

- University of Colorado Boulder Libraries

- Research Guides

- Location: Business

- Business Plans

- Last Updated: Apr 10, 2024 3:58 PM

- URL: https://libguides.colorado.edu/businessplans

Netflix inks a 3-year deal with the NFL to show football games

Peter Kafka , Chief Correspondent covering media and technology

- Netflix announced a three-season deal with the NFL.

- The streamer will show two NFL games on Christmas this year.

- There's a simple reason Netflix now wants to get into live sports programming.

No more wondering whether Netflix is going to show real live sports : The streamer now has a three-season deal with the most popular sports league in America — the NFL.

Netflix will show two NFL games on Christmas Day this year, plus "at least one" game on Christmas in 2025 and 2026, the company and the NFL announced Wednesday.

The deal will cost Netflix about $75 million per game, Bloomberg reported.

As we've discussed before, the logic for Netflix is simple here : While Netflix spent years insisting it didn't want to be in live sports, that was before it had an ad business, and live sports — particularly for the NFL — are considered the best way to aggregate an audience of ad watchers. Not coincidentally, Netflix is making its pitch to advertisers Wednesday in New York as part of the annual "upfront" pitch cycle.

And if you don't care about Netflix's ad sales and care only about watching NFL games, this simply means you need to have yet another network to watch games this fall. The league, which has become an expert at getting multiple media companies to pay it for games, already had deals with CBS, Fox, NBC, Disney/ESPN, and Amazon. Add another to the list.

Update: May 16, 2024 — Netflix will pay the NFL about $150 million to broadcast two NFL games this year, according to a Bloomberg report, not $150 million for each game.

Disclosure: Mathias Döpfner, CEO of Business Insider's parent company, Axel Springer, is a Netflix board member.

Watch: Why MassMutual is all in on the Boston Red Sox, according to CMO Jennifer Halloran

- Main content

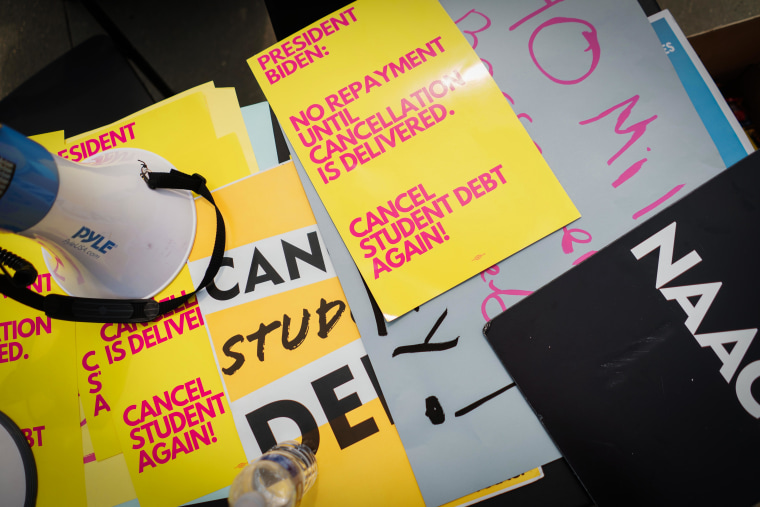

Stress, confusion and uncertainty as borrowers navigate Biden debt relief plans

When student loan repayments began last October, Rachel Grace was faced with a painful financial choice: start making payments or drop her health insurance coverage. She chose her loans and has since been crossing her fingers that she stays healthy.

“We’re already all pinching pennies. It was that big health insurance cost every month that I thought was the one place where, at least for now, fingers crossed, I can do without so that I can tackle this loan payment,” said Grace, who is 39 and works in marketing communications in Nebraska. “Of course, that could change in an instant, and that’s scary.”

But this week, Grace got the news she'd been in financial limbo over for months — her federal loans were being forgiven, wiping out a roughly $300 a month payment, under a Biden administration plan to clear the loan balances for those who have been making payments for at least 20 years.

After the Supreme Court rejected President Joe Biden’s sweeping debt forgiveness proposal and a Covid-era pause on student loan payments expired , millions of borrowers have been faced with tough financial choices and a web of new debt relief plans and administrative delays that have left many in limbo over if and when their debt will be forgiven, said student debt counselors and borrowers.

“The road to hell is paved with good intentions,” said Betsy Mayotte, the head of the Institute of Student Loan Advisors, a nonprofit that provides free student loan advice. “I have seen a significant number of borrowers who have had relief, but on the flip side, because everything has had to happen really fast, it’s also caused some confusion for borrowers and it’s caused some bumps in the road.”

But the effects of that relief are starting to be felt by more borrowers like Grace, something the Biden campaign is working to capitalize on in the months leading up to the election.

Biden’s efforts to provide relief to student loan borrowers has been a top policy priority during his time in office. The Biden administration says it has provided student debt relief to 4.6 million Americans through more than two dozen different programs, including fixes to a pre-existing loan forgiveness program for public service workers, erasing debt for borrowers defrauded or misled by their school and expanding debt forgiveness for people with disabilities.

Last month, Biden proposed additional plans he said would reduce or erase the student loan debts for millions more as early as this fall, an Education Department official said.

But many borrowers have struggled to make sense of what all those initiatives mean for them or see the full benefits as some programs continue to be implemented, said Robert Farrington, who counsels student loan borrowers and is editor-in-chief of the website The College Investor.

“There is a firehose of announcements and new programs and so many various nuances to all of these things. There’s different repayment plans, there’s different forgiveness programs, different lawsuits,” said Farrington. “It’s hard for borrowers to even know what applies to them. It’s so confusing.”

Education Department officials say borrowers who believe they are eligible for debt relief but haven’t received it yet should contact their loan servicer or the department ombudsman ’ s office .

Amid the confusion, the Biden campaign has been seeking to show the real-world impact on borrowers who have received debt forgiveness in its pitch to voters for a second term, a campaign official said. Biden and other top administration officials have fanned out across the country to tout their efforts.

In one instance, Biden visited the home of a former school principal in North Carolina who had $90,000 in debt erased under the public service loan forgiveness program, a decades-old program the Biden administration has made changes to in order for more borrowers to qualify. A TikTok video of the visit made by the man’s son got millions of views.

Still, the majority of voters have said they disapproved of Biden’s handling of the student loan issue — with 44% approving, making it Biden’s strongest area among registered voters, according to an NBC News poll last month. In a separate poll by the Harvard Institute of Politics, just 39% of voters under age 30 said they approved of the job Biden has done on student loans. But like in the NBC poll, it was a higher approval rating than on other key issues.

The campaign official said it will take more time and aggressive messaging to get the attention of voters, whom the campaign believes are not yet paying close attention to the election. The campaign is also seeking to contrast Biden’s policies with those of former President Donald Trump, who has opposed student debt relief programs and actively sought to eliminate funding for them while president.

Rep. James Clyburn, D-S.C., a close Biden ally, said he expects tens of thousands of additional borrowers to see debt relief ahead of the election as Biden’s programs continue to be implemented, giving the campaign more opportunities to highlight the contrast with Trump’s opposition to such programs, he said.

“Who do you want to put in charge of that program?” Clyburn said in an interview with NBC News. “The guy who refused to implement it?”

Biden “has implemented the program that [Trump] tried to get rid of,” Clyburn continued.

But for the millions of borrowers not eligible to have their debt cleared, they have been required to make payments since October, creating an additional financial strain for many. Around 40% of borrowers who have resumed payments said they are cutting back on spending while 29% said they were reducing the amount they were saving, according to a University of Michigan survey released in January.

The survey found that borrowers who had lower incomes, less education and weaker income prospects were more likely to increase their use of credit to maintain their spending amid the resumption of loan payments.

Others have opted not to make their payments. Around 64% of borrowers who had payments due were current on their student loan payments as of the end of December, according to the Department of Education.

The Biden administration has said it will hold off until this fall on enforcing the harshest penalties for nonpayment, like reporting delinquent borrowers to credit rating agencies and using forced collections.

Mayotte said a number of borrowers she works with have been holding off on making their payments because they can’t afford them or have opted to use the money to pay down higher-interest debt or to invest in high-yield savings or investing accounts until the administration’s nonpayment penalties kick in.

Once that happens, the wider implications of the restart in payments could be felt, but so far it hasn’t appeared to have had a significant impact on the wider economy, according to an analysis by Wells Fargo.

For Grace, who took out around $40,000 in private and federal loans to attend a four-year public university in 2003, she said her monthly loan payments have been a heavy burden on her finances since she first started making them more than a decade ago.

At the start of her career, her loan payments amounted to more than 15% of her take-home pay, preventing her from being able to build up an emergency fund for unexpected costs, like a car repair, and causing her to rack up credit card debt. For years, she said, she had to work a second job on the weekends to cover her expenses.

But her financial picture drastically changed during the pandemic when the Covid payment pause began. Without that monthly loan payment, she said she was able to start building up her savings and pay off credit card debt. Eventually, she was able to buy her first home.

“Prior to that pause, things were pretty dire,” Grace said. “And so this gave me the opportunity to really finally start to catch up. It’s amazing what happens when you don’t have hundreds of dollars month after month going to this.”

Grace said she knew the payment would eventually restart and didn’t take on any additional monthly expenses. But with inflation driving up the cost of everything from groceries to utilities, the resumption of the payment was an even bigger strain on her budget than before.

When it came time for the payments to restart in October on the $10,000 she still owes, Grace was also making a decision about signing up for her employer’s health insurance plan for 2024. She opted to take the risk of going without health insurance to continue making progress on paying down her debt.

With her federal loan payment now forgiven, she knows what she will do with the extra next month.

“I won’t be going to Target with that money, I won’t be going on vacation,” she said. “I will be enrolling in health insurance.”

Shannon Pettypiece is senior policy reporter for NBC News digital.

IMAGES

VIDEO

COMMENTS

Writing a business plan for a startup can sometimes seem overwhelming. To make the process easier and more manageable, this template will guide you step-by-step. The template includes easy-to-follow instructions for completing each business plan section, questions to help you think through each aspect, and corresponding fillable worksheet/s for ...

The template includes easy-to-follow instructions for completing each section of the business plan, questions to help you think through each aspect, and corresponding fillable worksheet/s for key sections. The business plan sections covered in this template include: Confidentiality Agreement. I. Instructions: Executive Summary. Executive Summary.

Describe Your Services or Products. The business plan should have a section that explains the services or products that you're offering. This is the part where you can also describe how they fit ...

Fund your business. It costs money to start a business. Funding your business is one of the first — and most important — financial choices most business owners make. How you choose to fund your business could affect how you structure and run your business. Choose a funding source.

Step 2: Do your market research homework. The next step in writing a business plan is to conduct market research. This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to ...

Learn about the best business plan software. 1. Write an executive summary. This is your elevator pitch. It should include a mission statement, a brief description of the products or services your ...

Business Glossary. Definitions for common terminology and acronyms that every small business owner should know. Bplans offers free business plan samples and templates, business planning resources, how-to articles, financial calculators, industry reports and entrepreneurship webinars.

Score's Business Plan Template for a Startup Business helps the user lay the groundwork for their new business venture. Score's template includes 11 worksheets, so when completed, you'll have a detailed business model outlined. This can help you discover potential weaknesses in your plan, identify new opportunities, and convince potential ...

SCORE is one of several resources offered by the U.S. Small Business Administration (SBA), a government agency that supports and promotes small businesses. It provides free or low-cost business advice to American entrepreneurs through workshops and mentoring. Entrepreneurs can attend local workshops or take online courses and webinars on topics ...

Having a strong business plan can improve your chances of getting an SBA loan. You can use our guide as an SBA business plan template. ... It includes steps on creating a business plan, funding your company, and launching a business. SCORE: Through SCORE, you can request to be paired with a mentor and get business-related education. Educational ...

This template includes instructions for each section of the business plan, followed by corresponding fillable worksheet/s. The last section in the instructions, "Refining Your Plan," explains ways you may need to modify your plan for specific purposes, such as getting a bank loan, or for specific industries, such as retail.

How to Write a Business Plan Step 1. Create a Cover Page. The first thing investors will see is the cover page for your business plan. Make sure it looks professional. A great cover page shows that you think about first impressions. A good business plan should have the following elements on a cover page:

SCORE, the nation's largest network of volunteer, expert business mentors, is dedicated to helping small businesses plan, launch, manage and grow. SCORE is a nonprofit organization that is driven to foster vibrant small business communities through mentoring and educational workshops.

Traditional business plans use some combination of these nine sections. Executive summary. Briefly tell your reader what your company is and why it will be successful. Include your mission statement, your product or service, and basic information about your company's leadership team, employees, and location.

Download: SCORE's business plan template. 4. PandaDoc — A template with fillable forms. PandaDoc's library offers a variety of industry-specific business plan templates that feature a modern design flair and concise instructions. These templates are designed for sharing. They include fillable fields and sections for non-disclosure ...

Sample Business Plans. Actual business plans compiled by, and aimed at, entrepreneurs seeking funding for small businesses. Presents sample plans taken from businesses in the manufacturing, retail and service industries. Over 500 example business plans. Choose the category that is closest to your own business or industry.

Learn how to build a business plan with Score Middle Georgia hosted by the Greater Macon Chamber.More about Score:SCORE, the nation's largest network of 11,0...

KODAK, Tenn., May 16, 2024 /PRNewswire/ -- Family-owned and operated sausage company Swaggerty's Farm announces plans for a new building to expand their headquarters and plant in Kodak, Tennessee ...

The hosts of the WM Phoenix Open, The Thunderbirds, said that the 2024 tournament raised a record $17.5 million, about $3 million more than the previous record of $14.5 million set in 2023. Like ...

Peter Kafka, Chief Correspondent covering media and technology. May 16, 2024, 8:23 AM PDT. Netflix has inked a three-year deal to show certain NFL games. Two will stream this Christmas. Ethan ...

Dozens of cabin crew at Air India Express called in sick earlier this week, forcing the budget carrier to cancel 85 flights since Tuesday evening and disrupting the travel plans of thousands of ...

When it came time for the payments to restart in October on the $10,000 she still owes, Grace was also making a decision about signing up for her employer's health insurance plan for 2024.

Designed for anyone who has done their business research, most of their marketing plan, and understands some basic accounting and finance. It explains the purposes and value of a plan and uses a content template to help determine what goes into each section of this plan. FREE! A $35 value! Our Presenters Doug Ware and Richard Kingdon With a 40-year career in the power generation business at ...