MEMBERSHIP PROGRAMS

- Law.com Pro

- Law.com Pro Mid-Market

- Global Leaders In Law

- Global Leaders In Law Advisers

- Private Client Global Elite

MEDIA BRANDS

- Law.com Radar

- American Lawyer

- Corporate Counsel

- National Law Journal

- Legal Tech News

New York Law Journal

- The Legal Intelligencer

- The Recorder

- Connecticut Law Tribune

- Daily Business Review

- Daily Report

- Delaware Business Court Insider

- Delaware Law Weekly

- New Jersey Law Journal

- Texas Lawyer

- Supreme Court Brief

- Litigation Daily

- Deals & Transactions

- Law Firm Management

- Legal Practice Management

- Legal Technology

- Intellectual Property

- Cybersecurity

- Law Journal Newsletters

- Analyst Reports

- Diversity Scorecard

- Kirkland & Ellis

- Latham & Watkins

- Baker McKenzie

- Verdict Search

- Law.com Compass

- China Law & Practice

- Insurance Coverage Law Center

- Law Journal Press

- Lean Adviser Legal

- Legal Dictionary

- Law Catalog

- Expert Witness Search

- Recruiters Directory

- Editorial Calendar

Legal Newswire

- Lawyer Pages

- Law Schools

- Women in Influence (WIPL)

- GC Profiles

- How I Made It

- Instant Insights

- Special Reports

- Resource Center

- LMA Member Benefits

- Legal Leaders

- Trailblazers

- Expert Perspectives

- Lawjobs.com

- Book Center

- Professional Announcements

- Asset & Logo Licensing

Content Source

Content Type

About Us | Contact Us | Site Map

Advertise | Customer Service | Terms of Service

FAQ | Privacy Policy

Copyright © 2021 ALM Global, LLC.

All Rights Reserved.

- Law Topics Litigation Transactional Law Law Firm Management Law Practice Management Legal Technology Intellectual Property Cybersecurity Browse All ›

- Surveys & Rankings Amlaw 100 Amlaw 200 Global 200 NLJ 500 A-List Diversity Scorecard Browse All ›

- Cases Case Digests Federal Court Decisions State Court Decisions

- People & Community People & Community Q&A Career Annoucements Obituaries

- Judges & Courts Part Rules Judicial Ethics Opinions Court Calendar Court Notes Decision - Download Court Calendar - Download

- Public Notice & Classifieds Public Notices & Classifieds Place a Public Notice Search Public Notices Browse Classifieds Place a Classified

- All Sections Events In Brief Columns Editorials Business of Law NY Top Verdicts Instant Insights Special Sections The Newspaper Special Supplements Expert Witness Search Lawjobs Book Center CLE Center Video Sitemap

Assignments and Security Interests Under UCC Article 9: A Worthy Decision

The March 2020 Commentary and its accompanying amendments to the Official Comments are critical steps in getting the commercial finance industry and, more importantly, courts aligned on how 9-406 and 9-607 work in concert.

December 16, 2022 at 10:30 AM

11 minute read

Share with Email

Thank you for sharing.

The basic definitions of Article 9 align with this approach of applying to both an assignment of payment rights and a security interest in such assets. “[S]ecurity interest” in UCC Article 1, §1-201(b)(35) (General Definitions), includes “any interest of a … buyer of accounts, chattel paper, a payment intangible or a promissory note in a transaction that is subject to Article 9.” The definition of “secured party” in Article 9, §9-102(a)(73) (Definitions and Index of Definitions), includes a “person in whose favor a security interest is created or provided for under a security agreement,” as well as a “person to which accounts, chattel paper, payment intangibles or promissory notes have been sold.” Finally, the definition of “debtor” in Article 9, §9-102(a)(28), includes both a “person having an interest, other than a security interest or other lien, in the collateral” and a “seller of accounts, chattel paper, payment intangibles or promissory notes.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Go to Lexis

Not a Lexis Subscriber? Subscribe Now

Go to Bloomberg Law

Not a Bloomberg Law Subscriber? Subscribe Now

Why am I seeing this?

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

You Might Like

Condominium Board's Authority; Sua Sponte Dismissal: This Week in Scott Mollen’s Realty Law Digest

By Scott Mollen

A Continued Lack of ‘Grace’ in Legal Malpractice

By Andrew Lavoott Bluestone

Personal Liability of a Fiduciary for Claims Against an Estate

By C. Raymond Radigan and Tara E. Mahon

Planning Ahead for Tax Liabilities

By Jeffrey A. Galant

Trending Stories

'Contributed to National Strife': Rudy Giuliani Is Disbarred on Manhattan Court's Order

Few Big Law Firms With Single-Tier Partnerships Are Left. They Aren't Talking About It.

The American Lawyer

Which Law Firms Are On Course to be in the Global Elite?

Simpson Thacher Hires White & Case Finance Partner to Lead European Private Credit Team

International Edition

- 25 Years of the Am Law 200: Is Size as a Strategy a Winning Formula?

- People, Places & Profits, Part III: Are Law Firm Financial Metrics Keeping Pace With Inflationary Growth?

- The State of Diversity in Big Law: Get a Sneak Peek on the 2024 Diversity Scorecard Results

Featured Firms

Law Offices of Gary Martin Hays & Associates P.C. 75 Ponce De Leon Ave NE Ste 101 Atlanta , GA 30308 (470) 294-1674 www.garymartinhays.com

Law Offices of Mark E. Salomone 2 Oliver St #608 Boston , MA 02109 (857) 444-6468 www.marksalomone.com

Smith & Hassler 1225 N Loop W #525 Houston , TX 77008 (713) 739-1250 www.smithandhassler.com

Presented by BigVoodoo

More From ALM

- Events & Webcasts

The New York Law Journal honors attorneys and judges who have made a remarkable difference in the legal profession in New York.

The National Law Journal Elite Trial Lawyers recognizes U.S.-based law firms performing exemplary work on behalf of plaintiffs.

GlobeSt. Women of Influence Conference celebrates the women who drive the commercial real estate industry forward.

Cullen and Dykman is seeking an associate attorney with a minimum of 5+ years in insurance coverage experience as well as risk transfer and ...

McCarter & English, LLP is actively seeking a midlevel insurance coverage associate for its Newark, NJ and/or Philadelphia, PA offices. ...

McCarter & English, LLP, a well established and growing law firm, is actively seeking a talented and driven associate having 2-5 years o...

Professional Announcement

Full Page Announcement

Subscribe to New York Law Journal

Don't miss the crucial news and insights you need to make informed legal decisions. Join New York Law Journal now!

Already have an account? Sign In

N.Y. Uniform Commercial Code Law Section 9-406 Discharge of Account Debtor

- Notification of Assignment

- Identification and Proof of Assignment

- Restrictions on Assignment of Accounts, ...

Source: Section 9-406 — Discharge of Account Debtor; Notification of Assignment; Identification and Proof of Assignment; Restrictions on Assignment of Accounts, ... , https://www.nysenate.gov/legislation/laws/UCC/9-406 (updated Sep. 22, 2014; accessed Jun. 29, 2024).

Accessed: Jun. 29, 2024

Last modified: Sep. 22, 2014

§ 9-406’s source at nysenate.gov

Blank Outline Levels

The legislature occasionally skips outline levels. For example:

In this example, (3) , (4) , and (4)(a) are all outline levels, but (4) was omitted by its authors. It's only implied. This presents an interesting challenge when laying out the text. We've decided to display a blank section with this note, in order to aide readability.

Do you have an opinion about this solution? Drop us a line.

- Frost Brown Todd

When Your Vendor’s Lender Demands You Pay It Instead of Your Vendor

Apr 22, 2020

Categories:

Blockchain and Banking Blog Blogs Coronavirus Response Team

Vincent E. Mauer

A commercial lender’s favorite collateral is often a borrower’s accounts receivable. This collateral is the building block of countless revolving lines of credit that provide borrowers with working capital and flexibility. Lenders prefer accounts receivable as collateral because it is similar to cash, unlike collateral that must be fed and liquidated (assets that must be insured, stored, marketed and sold). Additionally, the Uniform Commercial Code (“UCC”) permits lenders to collect accounts receivable directly from the borrower’s customers without using judicial process, thus saving time and money. [1]

After a loan agreement “goes bad” and the lender declares a default, the lender’s options for collection of accounts receivable collateral include giving notice to persons whose accounts owed to a borrower were pledged by that borrower to the lender (the borrower’s customer is a “payor”), [2] that is, accounts receivable in which the lender has a UCC Article 9 Security interest. [3] The primary operative provision is UCC 9-406, which states in part:

- Subject to subsections (b) through (i), an account debtor on an account , chattel paper , or a payment intangible may discharge its obligation by paying the assignor [borrower] until, but not after, the account debtor receives a notification, authenticated by the assignor or the assignee that the amount due or to become due has been assigned and that payment is to be made to the assignee. After receipt of the notification, the account debtor [ payor] may discharge its obligation by paying the assignee [Lender] and may not discharge the obligation by paying the assignor [Borrower] .

- Subject to subsection (h), notification is ineffective under subsection (a): (1) if it does not reasonably identify the rights assigned; (2) . . . [a limitation applicable to payment intangibles that are not accounts receivable, for example insurance settlements]; or (3) at the option of an account debtor, if the notification notifies the account debtor to make less than the full amount of any installment or other periodic payment to the assignee, even if: (A) only a portion of the account , chattel paper , or payment intangible has been assigned to that assignee; (B) a portion has been assigned to another assignee; or (C) the account debtor knows that the assignment to that assignee is limited. [4]

- Subject to subsection (h), if requested by the account debtor [ payor], an assignee [lender] shall seasonably furnish reasonable proof that the assignment has been made . Unless the assignee complies, the account debtor may discharge its obligation by paying the assignor, even if the account debtor has received a notification under subsection (a).

(Emphases added.) Ordinarily, the above-quoted statute means that, after a borrower defaults, the lender can give a “notification” to its borrower’s customers ( payors) [5] and demand that amounts owed to the borrower instead be paid to the lender if the lender has a perfected security interest in its borrower’s receivables.

There are a few common concerns faced by our payor clients who receive notifications from their secured vendor’s secured lenders.

The first thing a payor must understand is that neither (a) the borrower’s granting of a security interest in its accounts receivable, nor (b) a lender’s notification under UCC 9-406, will change the amount owed, the terms of the account debt, or the payor’s rights such as a discount for returned merchandise or prompt payment. A payor who receives a lender’s notification should, therefore, take a deep breath and determine exactly what is owed to the vendor that granted the security interest to the lender.

In my experience, payors who receive a lender’s notification nearly always choose to alert their vendor (the lender’s borrower) of the notification. The statute neither permits nor prohibits such action. Typically, the payor’s communication is, in part, an effort by the payor to (i) alert its vendor that a payment may not be coming, (ii) assess the vendor’s stability so the payor can determine if it needs to find a new source for the goods and services supplied by the vendor, and (iii) to seek information on whether the lender’s notification is real and appropriate.

Contacting the vendor is understandable. It is natural for a payor to seek information from the party with whom it regularly does business rather than a probable stranger, the lender. Vendor-provided information, however, comes with a caveat: If the vendor asserts that the lender’s notice to the payor is in error and should be ignored, the payor accepts that advice at its own risk. The UCC provision quoted above clearly states that a payor who has received an appropriate lender’s notification cannot discharge its debt to the vendor by paying the vendor instead of the lender.

Rather, or in addition to, contacting the vendor, a payor can choose to contact the lender and request evidence that payment to the lender is appropriate. In this event, the UCC requires the lender to provide “reasonable proof that the assignment was made.” This usually means evidence that the vendor granted a security interest to the lender and that the accounts receivable created by the payor’s debt to the vendor is covered by that security interest. A payor should take advantage of this opportunity to communicate with the lender and request “proof,” if either (a) the vendor asserts that the lender’s notice to payor is wrongful, or (b) the lender’s “notification” seems inadequate. This is a proper response to payor’s concerns. [6]

In my experience, lenders often ignore a payor’s request for “proof” following a lender’s “notification.” There are many possible reasons for this inaction by the lender. [7] Whatever the rationale, however, the result is the same. According to UCC 9-406 comment 4:

[e]ven if the proof is not forthcoming, the notification of assignment would remain effective, so that, in the absence of reasonable proof of the assignment, the account debtor could discharge the obligation by paying either the assignee or the assignor. Of course, if the assignee [lender] did not in fact receive an assignment, the account debtor [ payor] cannot discharge its obligation by paying a putative assignee who is a stranger [a fraudster] .

(Emphasis added). Given the last sentence in this comment, the only safe action by payor is payment to the vendor, not the lender, if the lender failed to respond to payor’s request for “proof.”

As noted above, the lender’s notification to payor does not alter the terms of the payor’s obligations to the vendor. For example, if a payor has received a notification from a lender and has requested reasonable proof of the assignment, payor may discharge its obligation by paying the assignor at the time when payment is due, even if the account debtor has not yet received a response to its request for proof. This is a warning for lenders to think about their borrower’s collection cycle when sending notifications to payors.

If a payor deals with a large vendor or one with diverse operations, the vendor may have more than one secured lender. Vendors can have two or more secured creditors each with a security interest in the vendor’s accounts payable. [8] Sophisticated payors will often discover this fact when they do an online search with the appropriate Secretary of State’s office. Unfortunately, the UCC’s official commentary is silent on the payor’s duties in this situation. See, however, comment 7 to UCC 9-406:

For example, an assignor [vendor] might assign the same receivable to multiple assignees [. . . .] Or, the assignor could assign the receivable to assignee-1, which then might re-assign it to assignee-2, and so forth. The rights and duties of an account debtor in the face of multiple assignments and in other circumstances not resolved in the statutory text are left to the common-law rules. See, e.g., Restatement (2d), Contracts Sections 338(3), 339.

When faced with this problem, counsel must determine which state’s common law applies and find the non-UCC answer from applicable law.

Finally, clients often ask whether a particular lender notification is an appropriate and effective “authenticated” notification. The answer depends on the circumstances of the notification. Fortunately, there are plenty of court decisions that can provide guidance on this question. One example is Swift Energy Operating, LLC v. Plemco-South Inc. , 157 So.3d 1154 (La. Ct. App. 2015), where a borrower did business with an account receivable factor, the secured party. The borrower and factor sent an email to the payor which was the alleged lender notification under Louisiana’s version of UCC 9-406. In response to that email, the payor’s employee directed the lender to contact the payor’s appropriate office. The payor’s employee, however, did not sign and return the acknowledgment that payor received the lender’s notification. The lender subsequently failed to contact the payor’s accounts payable office as directed and the payor paid its obligation to the vendor rather than the lender/account receivable factor. Litigation was initiated in an effort to determine if payor was nonetheless liable to the lender for failure to follow the lender’s notification.

The Louisiana Court of Appeals held that the email was not an “authenticated” notification in compliance with the statute. The court reasonably held that the required notice must be directed to the appropriate payor department or employee when the lender has notice of that department. The court ruled:

[W]e find that the notice required by La.R.S. 10:9-406(a) was not effected prior to Swift Energy’s payment to Plemco–South. Given the size of its operation, we find that Swift Energy maintained reasonable routines for communicating significant information through its departmentalization policy, and both Factor King and Plemco–South were timely made aware of the proper department for delivery of the required notice. Had either Ms. Gleberman or Mr. Stigall followed Ms. Keo’s instruction, notice would have been effected to the appropriate department well before the payment to Plemco–South at issue.

Id. at 1164.

The UCC’s provision for nonjudicial collection of accounts receivable collateral is important and valuable to lenders. Unfortunately, it regularly raises questions and concerns for recipients of lender notifications. Experienced counsel can help their payor clients resolve concerns, determine who to pay, and possibly smooth any tensions between the payor and its vendor by demonstrating that the payor exercised every opportunity to protect the vendor before paying the lender.

For more information, please contact Vince Mauer or any attorney in Frost Brown Todd’s Financial Services industry team.

[1] This post does not address a lender’s efforts to control accounts receivable collateral while the lending relationship is intact, such as use of a lockbox to receive payments and control over the borrower’s bank accounts into which the accounts receivable payments are deposited by the borrower (whether by check or wire transfer).

[2] For purposes of this blog post, I will use the term “Payor” for the borrower’s customer who owes money to the borrower and whose debt to borrower is subject to a security interest in favor of the lender. This blog post is written from a Payor’s perspective.

[3] A warning for lenders: According to the Ohio Supreme Court, this remedy is not fully available against the collateral of a borrower whose customer, the Payor, is a government entity. See MP Star Financial Inc. v. Cleveland State Univ. , 837 N.E.2d 758 (Ohio 2005) ( “provision of UCC making an account debtor liable to an assignee of accounts receivable, for payments made to assignor after receiving notice of assignment, does not apply to payments made by an account debtor that is a governmental unit.”).

[4] Under subsection (b)(3), an account debtor that is notified to pay an assignee less than the full amount of any installment or other periodic payment has the option to treat the notification as ineffective, ignore the notice, and discharge the assigned obligation by paying the assignor [vendor]. This is a convenience for Payors and a warning to lenders.

[5] For the typical recipient of this notice (a Payor), the borrower whose account was assigned is a vendor, a business that sells goods or services to you and grants its lender a security interest in the account receivable generated by that sale.

[6] Comment 3 to UCC 9-406 states: “[i]f an account debtor [Payor] has doubt as to the adequacy of a notification, it may not be safe [for the Payor] in disregarding the notification unless it [Payor] notifies the assignee [lender] with reasonable promptness as to the respects in which the account debtor considers the notification defective.” So, a Payor with concerns may be better off to seek information from the lender rather than making its own decision concerning the adequacy of the notification.

[7] I have occasionally counseled lender clients to ignore a Payor’s request for “proof.” The reasons for this advice are beyond the scope of this blog post.

[8] Hopefully, there is an Intercreditor Agreement addressing lien priorities and which lender(s) can send a lender notification.

Before you send us any information, know that contacting us does not create an attorney-client relationship. We cannot represent you until we know that doing so will not create a conflict of interest with any existing clients. Therefore, please do not send us any information about any legal matter that involves you unless and until you receive a letter from us in which we agree to represent you (an "engagement letter"). Only after you receive an engagement letter will you be our client and be properly able to exchange information with us. If you understand and agree with the foregoing and you are not our client and will not divulge confidential information to us, you may contact us for general information.

Uniform Commercial Code § 9-406. Discharge of Account Debtor; Notification of Assignment; Identification and Proof of Assignment; Restrictions on Assignment of Accounts, Chattel Paper, Payment Intangibles, and Promissory Notes Ineffective, NY CLS UCC § 9-406

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

2022 New York Laws UCC - Uniform Commercial Code Article 9 - Secured Transactions Part 4 - Rights of Third Parties 9-406 - Discharge of Account Debtor; Notification of Assignment; Identification and Proof of Assignment; Restrictions on Assignment of Accounts, Chattel Paper

(a) Discharge of account debtor; effect of notification. Subject to subsections (b) through (h), an account debtor on an account, chattel paper, or a payment intangible may discharge its obligation by paying the assignor until, but not after, the account debtor receives a notification, authenticated by the assignor or the assignee, that the amount due or to become due has been assigned and that payment is to be made to the assignee. After receipt of the notification, the account debtor may discharge its obligation by paying the assignee and may not discharge the obligation by paying the assignor.

(b) When notification ineffective. Subject to subsection (g), notification is ineffective under subsection (a):

(1) if it does not reasonably identify the rights assigned;

(2) to the extent that an agreement between an account debtor and a seller of a payment intangible limits the account debtor's duty to pay a person other than the seller and the limitation is effective under law other than this article; or

(3) at the option of an account debtor, if the notification notifies the account debtor to make less than the full amount of any installment or other periodic payment to the assignee, even if:

(A) only a portion of the account, chattel paper, or payment intangible has been assigned to that assignee;

(B) a portion has been assigned to another assignee; or

(C) the account debtor knows that the assignment to that assignee is limited.

(c) Proof of assignment. Subject to subsection (g), if requested by the account debtor, an assignee shall seasonably furnish reasonable proof that the assignment has been made. Unless the assignee complies, the account debtor may discharge its obligation by paying the assignor, even if the account debtor has received a notification under subsection (a).

(d) Term restricting assignment generally ineffective. Except as otherwise provided in subsection (e) and Sections 2-A-303 and 9--407, and subject to subsection (g), a term in an agreement between an account debtor and an assignor or in a promissory note is ineffective to the extent that it:

(1) prohibits, restricts, or requires the consent of the account debtor or person obligated on the promissory note to the assignment or transfer of, or the creation, attachment, perfection, or enforcement of a security interest in, the account, chattel paper, payment intangible, or promissory note; or

(2) provides that the assignment or transfer or the creation, attachment, perfection, or enforcement of the security interest may give rise to a default, breach, right of recoupment, claim, defense, termination, right of termination, or remedy under the account, chattel paper, payment intangible, or promissory note.

(e) Inapplicability of subsection (d) to certain sales. Subsection (d) does not apply to the sale of a payment intangible or promissory note.

(f) Subsection (b)(3) not waivable. Subject to subsection (g), an account debtor may not waive or vary its option under subsection (b)(3).

(g) Rule for individual under other law. This section is subject to a rule of law, statute, rule or regulation other than this article which establishes a different rule for an account debtor who is an individual and who incurred the obligation primarily for personal, family, or household purposes.

(h) Inapplicability. This section does not apply to:

(1) an assignment of a health care insurance receivable to the extent such assignment conflicts with other law or the parties have otherwise agreed in writing that such receivable is non-assignable,

(2) a claim or right to receive compensation for injuries or sickness as described in 26 U.S.C. § 104(a)(1) and (2), as amended from time to time, or

(3) a claim or right to receive benefits under a special needs trust as described in 42 U.S.C. § 1396p (d)(4), as amended from time to time.

Get free summaries of new opinions delivered to your inbox!

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Secured Party Has Same Rights as Assignee Under UCC § 9-406

On November 22, 2022, the Court of Appeals issued a decision in Worthy Lending LLC v. New Style Contrs., Inc. , 2022 NY Slip Op. 06631 , holding that a secured party has the same rights as an assignee under UCC § 9-406, explaining:

Section 9-607 (a) (3), entitled “Collection and Enforcement by Secured Party,” provides as follows: If so agreed, and in any event after default, a secured party may enforce the obligations of an account debtor or other person obligated on collateral and exercise the rights of the debtor with respect to the obligation of the account debtor or other person obligated on collateral to make payment or otherwise render performance to the debtor, and with respect to any property that secures the obligations of the account debtor or other person obligated on the collateral. An account debtor who receives a secured creditor’s notice asserting its right to receive payment directly can pay the secured creditor and receive a complete discharge (UCC 9-406 [a]) or, if in doubt, can seek proof from the secured creditor that it possesses a valid assignment and withhold payment in the interim (UCC 9-406 [c]). Here, Worthy is the “secured party,” with the authority to enforce the rights of its debtor (Checkmate) to collect on the obligations of the account debtor (New Style). The lower courts held that subsection 9-607 (e) bars Worthy from using the mechanism provided for in section 9-607, by providing that this section does not determine whether an account debtor, bank, or other person obligated on collateral owes a duty to a secured party. However, the plain language of subsection (e) merely states that UCC 9-607 does not itself determine whether an account debtor owes a duty to a secured party. The agreement between Worthy and Checkmate grants Worthy the right to direct Checkmate’s debtors to pay Worthy directly, and bars Checkmate from interfering with any such direction if given. Subsection (e) of 9-607 does not even imply, much less state, that parties cannot contractually assume duties concerning the right of a secured party to enforce the rights of a debtor as against account debtors. Indeed, section 9-607 (a) (3) expressly provides that “in any event after default,” a secured party may obtain collateral directly from an account debtor, and the secured party and debtor may agree that the secured party may do so by agreement, without regard to default—which they did here. Consistent with the statute’s text, the official comments of the UCC Permanent Editorial Board (PEB)[FN1] issued in 2020 explain that UCC 9-607 “establishes only the baseline rights of the secured party vis-a-vis the debtor” and permits “the secured party to enforce and collect [from an account debtor] after default or earlier if so agreed” (UCC 9-607, Comment 6; see also PEB Commentary No. 21 at 4 n 21). New Style contends that UCC 9-406 allows only assignors—not holders of security interests—to rely on the payment-redirection provisions contained in that section. UCC Section 9-406 (a) states: An account debtor on an account, chattel paper, or a payment intangible may discharge its obligation by paying the assignor until, but not after, the account debtor receives a notification, authenticated by the assignor or the assignee, that the amount due or to become due has been assigned and that payment is to be made to the assignee. After receipt of the notification, the account debtor may discharge its obligation by paying the assignee and may not discharge the obligation by paying the assignor. The definition of “security interest” in the UCC itself does not distinguish between a security interest and an assignment and the definition section contains no separate definition of “assignment,” “assignor” or “assignee.” The commentary makes clear that a security interest is treated as an assignment. As the commentary explains, treating assignments and security interests identically promotes efficient dealings between the parties—they do not have to try to determine whether the interest is an assignment or a security interest by parsing contractual language. New York case law, state and federal, is consistent. The PEB recently amended the official UCC comments to clarify what has long been the case: the term assignment, as used in UCC article 9, refers to both an outright transfer of ownership and a transfer of an interest to secure an obligation. (Internal quotations and citations omitted).

Stay informed! Sign up for email alerts and notifications here . Read more about our Complex Commercial Litigation practice.

§ 28:9–406. Discharge of account debtor; notification of assignment; identification and proof of assignment; restrictions on assignment of accounts, chattel paper, payment intangibles, and promissory notes ineffective.

(a) Subject to subsections (b) through (k) of this section, an account debtor on an account, chattel paper, or a payment intangible may discharge its obligation by paying the assignor until, but not after, the account debtor receives a notification, signed by the assignor or the assignee, that the amount due or to become due has been assigned and that payment is to be made to the assignee. After receipt of the notification, the account debtor may discharge its obligation by paying the assignee and may not discharge the obligation by paying the assignor.

(b) Subject to subsections (h) and (k), notification is ineffective under subsection (a):

(1) If it does not reasonably identify the rights assigned;

(2) To the extent that an agreement between an account debtor and a seller of a payment intangible limits the account debtor’s duty to pay a person other than the seller and the limitation is effective under law other than this article; or

(3) At the option of an account debtor, if the notification notifies the account debtor to make less than the full amount of any installment or other periodic payment to the assignee, even if:

(A) Only a portion of the account, chattel paper, or payment intangible has been assigned to that assignee;

(B) A portion has been assigned to another assignee; or

(C) The account debtor knows that the assignment to that assignee is limited.

(c) Subject to subsections (h) and (k), if requested by the account debtor, an assignee shall seasonably furnish reasonable proof that the assignment has been made. Unless the assignee complies, the account debtor may discharge its obligation by paying the assignor, even if the account debtor has received a notification under subsection (a).

(d) In this subsection, "promissory note" includes a negotiable instrument that evidences chattel paper. Except as otherwise provided in subsections [(e) and (j)] of this section and §§ 28:2A-303 and 28:9-407 , and subject to subsection (h), a term in an agreement between an account debtor and an assignor or in a promissory note is ineffective to the extent that it:

(1) Prohibits, restricts, or requires the consent of the account debtor or person obligated on the promissory note to the assignment or transfer of, or the creation, attachment, perfection, or enforcement of a security interest in, the account, chattel paper, payment intangible, or promissory note; or

(2) Provides that the assignment or transfer or the creation, attachment, perfection, or enforcement of the security interest may give rise to a default, breach, right of recoupment, claim, defense, termination, right of termination, or remedy under the account, chattel paper, payment intangible, or promissory note.

(e) Subsection (d) does not apply to the sale of a payment intangible or promissory note, other than a sale pursuant to a disposition under § 28:9-610 or an acceptance of collateral under § 28:9-620 .

(f) Except as otherwise provided in §§ subsection (j) of this section and §§ 28:2A-303 and 28:9-407 and subject to subsections (h) and (i), a rule of law, statute, or regulation that prohibits, restricts, or requires the consent of a government, governmental body or official, or account debtor to the assignment or transfer of, or creation of a security interest in, an account or chattel paper is ineffective to the extent that the rule of law, statute, or regulation:

(1) Prohibits, restricts, or requires the consent of the government, governmental body or official, or account debtor to the assignment or transfer of, or the creation, attachment, perfection, or enforcement of a security interest in, the account or chattel paper; or

(2) Provides that the assignment or transfer or the creation, attachment, perfection, or enforcement of the security interest may give rise to a default, breach, right of recoupment, claim, defense, termination, right of termination, or remedy under the account or chattel paper.

(g) Subject to subsections (h) and (k) of this section, an account debtor may not waive or vary its option under subsection (b)(3).

(h) This section is subject to law other than this article which establishes a different rule for an account debtor who is an individual and who incurred the obligation primarily for personal, family, or household purposes.

(i) This section does not apply to an assignment of a health-care-insurance receivable.

(j) Subsections (d) and (e) of this section do not apply to a security interest in an ownership interest in a general partnership, limited partnership, or limited liability company.

(k) Subsections (a), (b), (c) and (g) of this section do not apply to a controllable account or controllable payment intangible.

JOIN MAILING LIST

Corporate Disputes

Risk & Compliance

How New York UCC, Article 9, applies to the sale and purchase of accounts receivable

August 2019 | EXPERT BRIEFING | BANKING & FINANCE

financierworldwide.com

The sale of accounts receivable is a viable option for sellers to increase cash flow. Likewise, purchasing accounts receivable at a discount can be a good business opportunity. When buying accounts receivable, purchasers must comply with Article 9 of the New York Uniform Commercial Code (UCC) in order to record the change in ownership.

This article explores the methods by which a party can sell (assignor) its accounts receivable (debt) to a purchaser (assignee) and mitigate future risks associated with non-payment by the party obligated to pay into the account (debtor).

Introduction: application of the UCC to assignments

Determining who owns an account receivable can be difficult because accounts are intangible in nature. Article 9 of the UCC protects purchasers of accounts receivable by providing a method to record ownership. Recording the sale of the receivable is accomplished by filing a UCC financing statement. The filing serves multiple purposes. It can be used to show ownership and require payment from the debtor, provides notice of sale to other creditors and can be used to defeat or rank competing claims to the same account in bankruptcy.

Article 9 states that a purchaser or assignee receives a “security interest” through assignment. This may raise concerns for a buyer that wants to obtain full rights in the accounts receivable and not just a security interest, which is commonly given to secure a loan but does not include enforcement rights until a default. In addition, the sale of an account is recorded in the same manner as a security interest serving as collateral, namely, by filing a UCC-1 financing statement. However, according to the official comments to the UCC, despite the somewhat confusing language, the assignee in fact obtains full ownership over the account receivable it purchases. Use of terminology such as “security interest” is merely a drafting convention, and “has no relevance in distinguishing sales from other transactions”.

Assignability of a debt (i.e., accounts receivable)

General conditions of the UCC Article 9. There are three general conditions, outlined below, that must be satisfied to effect the sale of an account receivable under Article 9.

First, assignment must fall within the scope of “account”: An “[a]ccount… means a right to payment of a monetary obligation whether or not earned by performance: … for services rendered or to be rendered”. A debt which relates to the provision of goods, and not just services, also satisfies the conditions necessary to effect assignment of a debt. While the definition of “account” under the UCC does not explicitly include goods, the official comment provides that the definition of “account” is not limited to just “goods or services”, rather, the definition has “expanded”.

Second, when purchasing accounts receivable or debts for goods sold, the filing of a UCC financing statement (UCC-1) by the purchaser is mandatory.

Third, notice to the debtor may be given. If the assignee decides that it wants the debtor to pay it directly, then notice to the debtor is required under the UCC. Without notice, the debtor “may discharge its obligation by paying the assignor until, but not after, the account debtor receives a notification”. Notice is often not provided until there is a default by the assignor because companies often sell their accounts receivable and continue to collect the amounts due from customers on behalf of the assignee. This is often done because the assignor does not want its customers to know it is using accounts receivable to finance its business. Furthermore, the assignor may have a better ability to collect due to close business ties.

Effect of contractual anti-assignment provisions. A party to a contract may want to prohibit assignment for a variety of reasons. However, New York generally favours assignments. In fact, under New York law, while violation of contractual language prohibiting assignment or requiring the approval of one party may trigger a breach of contract by the assignor, this does not invalidate the transfer. In order to make an assignment ineffective, contractual language must be very explicit, such as a provision stating that any attempted assignment is “void”.

The UCC provides additional protection to accounts receivable, in that anti-assignment provisions are ineffective if they attempt to restrict the sale or grant of a security interest in an account. Thus, accounts receivable may be sold despite contractual restrictions prohibiting such transfers.

Validity of an assignment

Legal requirements for valid assignment. In general, “a security agreement is effective according to its terms between the parties, against purchasers of the collateral, and against creditors”. A security interest (i.e., assignment) is enforceable if value was given, the assignor had the authority to transfer its rights in the collateral to the secured party and the assignor authenticated a security agreement that provides a description of the collateral (defining “authenticate” as “to sign, or with present intent to adopt or accept a record, to attach to or logically associate with the record an electronic sound, symbol, or process” such as an electronic signature).

The term security agreement is defined in the UCC as “an agreement that creates or provides for a security interest”. As discussed, the term “security interest” is a UCC drafting convention and is not distinguished from a sale.

Validity of assignment of part of a debt. Partial assignments are valid and enforceable. H Co., Ltd. v. Michael Kors Stores, LLC (2009) found that “an assignment may be for ‘a part only of the designated payment’”. In addition, Terino v. LeClair (1966) found that “debt which was partially assigned was to be created and payment was to become due in the future did not render equitable assignment invalid”.

Rights and title that passes from the assignor to the assignee. When assignment is performed correctly, the assignee receives all rights, title and interest possessed by the assignor with respect to the debt (i.e., accounts receivable). The assignor will have no remaining power over, or interest in, the debt.

As per the UCC, the assignee receives unencumbered rights as existing under the original contract and those arising from the original transaction. The rights of an assignee are subject to: (i) all terms of the agreement between the account debtor and assignor and any defence or claim in recoupment arising from the transaction that gave rise to the contract; and (ii) any other defence or claim of the account debtor against the assignor which accrues before the account debtor receives a notification of the assignment authenticated by the assignor or the assignee.

In addition, the purchaser of the debt takes the debt subject to previously recorded sales or filed financing statements conveying or covering the same debt. For example, financing banks often take a security interest in all of a debtor’s property, including accounts. If the description in the prior-filed financing statement covers “accounts” of the assignor “generally”, the assignee will need to obtain an intercreditor agreement subordinating the financing bank’s interest in the account or the assignee’s interest will remain subject to the prior-filed security interest of the financing bank.

The assignee may assign the debt to another party. The new assignee will have the same rights, privileges, and interest in the debt. Further, “[i]f a secured party assigned a perfected security interest, a filing [of a UCC financing statement] is not required to continue the perfected status of the security interest against creditors of and transferees from the original debtor”. However, it is good practice to file an amendment identifying the new secured party or owner of the receivable.

Automatic assignment of future debts. The UCC provides that, subject to certain exceptions, a security agreement may create a security interest in after-acquired collateral, and may provide that accounts are sold in connection with future advances. Accordingly, so long as the description in the financing statement continues to accurately describe the collateral (i.e., the debt), no new filing is required. Therefore, the assignee may specify in its assignment agreement with the assignor that future debts are assigned to the assignee “as they arise” or similar language.

Perfection, priority and notice of assignment

What to file . New York requires the filing of form UCC-1, financing statement. A financing statement must have the assignor’s proper corporate name (not the trade name), the assignee’s name, and an indication of the collateral (i.e., the debt and the specific account receivable). The UCC indicates that financing statements should contain: the assignor’s address, whether the assignor is an individual or organisation, registration numbers and the assignee’s address. A financing statement is effective for five years and may be renewed for an additional five years.

Where to file . Under the UCC, the general rule is that the place for filing is a debtor’s location. However, in the context of assignment, location of the debtor does not affect the validity of the financing statement. Rather, it is the location of the assignor that is important. If the assignor is a corporation or similar corporate entity, filing must be done in the state of incorporation. If the assignor is an individual, then in the state of the assignor’s residence. If the assignor is an unincorporated business, then in the state of the assignor’s principal place of business or chief executive office. Generally, financing statements are filed with the Secretary of State’s office in the appropriate jurisdiction. In addition, any person can file a financing statement if the assignee authorises the filing in an authenticated (signed) record or agreement.

How long to file. Generally, there is no time period within which a security interest must be perfected by filing the financing statement. However, New York follows the “first in time, first in right” rule. Thus, the assignee’s security interest should be perfected as soon as possible to prevent another purchaser or creditor from priming the assignee’s security interest.

Preservation of assignment rights in bankruptcy

Importance of perfection for bankruptcy. In the event of bankruptcy by either the debtor or assignor, whether or not a debt has been perfected will play a critical role in determining the value of a claim against the debtor’s estate. The assignee, in effect, stands in the shoes of the assignor. Therefore, if neither the assignee nor the assignor have perfected their security interest against the debtor, then the assignee will be an unsecured creditor in the debtor’s bankruptcy.

In the event that the assignor declares bankruptcy and the assignee has not filed appropriate financing statements, the accounts sold to the assignee may become an asset of the debtor’s estate. In this scenario, the assignee is an unsecured creditor. If, however, the assignee has filed the appropriate financing statement conveying the accounts were sold to the assignee, the accounts are not considered property of the debtor or its bankruptcy estate.

The sale of receivables is a common way for businesses to finance ongoing operations including the purchase of inventory. If the proper formalities are followed, a purchaser can be reasonably assured that they have priority to, and ownership of, the account receivable.

John Kissane is a partner and Sabih Siddiqi and Celinda Metro are associates at Watson Farley & Williams LLP. Mr Kissane can be contacted on +1 (212) 922 2200 or by email: [email protected]. Mr Siddiqi can be contacted on +1 (212) 922 2200 or by email: [email protected]. Ms Metro can be contacted on +1 (212) 922 2200 or by email: [email protected].

© Financier Worldwide

John Kissane, Sabih Siddiqi and Celinda Metro

Watson Farley & Williams LLP

The Vendor's Lender: Secured Creditor's Rights in Receivables Are Paramount

- Share via LinkedIn

The Banking Law Journal

This article originally appeared in the The Banking Law Journal, Volume 140 No.9 and is reprinted with permission. All rights reserved.

In this article, the author explains that once an account debtor is notified to pay the secured creditor, not remitting payment on a receivable directly to the lender can mean that the account debtor pays twice.

Accounts receivable serve as an important source of collateral – indeed, receivables and other rights to payment represent the lifeblood of asset-based lending, securitizations and factoring arrangements. Article 9 of the Uniform Commercial Code (the UCC) applies to any transaction, regardless of its form, that creates a security interest in personal property as well as to a sale of accounts and other instruments evidencing a monetary obligation. 1 The scheme embodied in Article 9 contains a comprehensive set of important rules that address these forms of intangible property.

A number of courts have misinterpreted Article 9 to preclude a secured party from commencing suit against its debtor’s customers to collect amounts owed to the debtor. 2 The premise behind this rationale is rooted in the language of the statute and the nature of the various relationships: “to hold that an account debtor is obligated to pay the secured creditor and not the debtor would be tantamount to creating a duty owed by the account debtor to the secured creditor that was separate and distinct from the duty it owed to the debtor.” 3 These decisions threaten the foundation of receivables financing and undermine the certainty envisioned by the drafters of Article 9.

A recent decision by the highest court in New York ruled in favor of the secured creditor and correctly found that a holder of a presently exercisable security interest in a debtor’s receivables is entitled to receive and collect payment directly from the account debtor after furnishing the customer notice of its interest. The court in Worthy Lending LLC v. New Style Contractors, Inc. , reversed the dismissal of a complaint filed by the secured creditor against a customer of the debtor and the finding that Article 9 of the UCC did not authorize a direct cause of action. 4

RULES FOR COLLECTION AND ENFORCEMENT

Other than cash and securities, collateral consisting of rights to payment represent the most liquid asset of a debtor’s business. This form of asset may, unlike inventory and equipment for example, be collected without interruption of the debtor’s operations. Further, rights to payment do not present valuation and other complexities that are often attendant realization on tangible personal property. Section 9-607 of the UCC permits a secured creditor at any time, if so agreed, and, in any event after a default, to notify account debtors 5 and others that are obligated to the debtor to make payment directly to the secured party. 6 Additionally, that statute grants the secured creditor the right to enforce the obligations of the account debtor, exercise the rights of the debtor and enforce claims of the debtor against account debtors and other parties. 7 Section 9-607’s primary aim is to address the rights of the secured creditor in relation to its debtor to collect a specified payment right. The statute does not, however, itself determine whether an account debtor owes a duty to a secured party. 8

Section 9-406 of the UCC addresses accounts and a different relationship. That statute addresses the rights of the secured party in relation to the account debtor to collect a specified payment right. Section 9-406, unlike other provisions of Article 9, uses terminology that references “assignor,” “assignee” and “assignment” and not “debtor,” “secured party” and “security interest.” 9

The statute makes no mention of secured parties. It provides that an account debtor may discharge the obligation it owes by paying the assignor (i.e., the borrower) until, but not after, the account debtor receives required notification that the amount due has been “assigned” and that payment is to be made to the “assignee.” “After receipt of the notification, the account debtor may discharge its obligation by paying the assignee and may not discharge the obligation by paying the assignor.” 10

Section 9-406 addresses the requirements of notice and permits the account debtor to request reasonable proof that an “assignment” has been made (i.e., that an interest in the right to payment has been conveyed). 11 The statute also makes legal restrictions contained in contracts between the debtor and its customer/account debtor that prohibit or restrict assignment to be ineffective. 12

The courts in Worthy Lending LLC v. New Style Contractors, Inc. were called upon to determine whether the terms used in the statute – assignor, assignee, assignment – allow the holder of a presently exercisable security interest to commence suit against an account debtor to collect payment constituting collateral. The decision required resolution by the highest court in the State of New York, which reversed the lower courts and answered the question in the affirmative.

The facts in Worthy Lending are relatively unremarkable in commercial finance. The borrower needed capital and entered into an arrangement with its lender to borrower up to $3 million. The borrower granted the lender a security interest in its assets to secure all obligations, including accounts receivable. The security agreement granted the lender the right to notify and instruct account debtors (i.e., the debtor’s customers) to remit payment directly to the lender.

The secured creditor perfected its security interest by filing a UCC-1 financing statement with the applicable office of the Secretary of State. The lender later sent New Style Contractors, Inc. (New Style) a notice of its security interest and directed the account debtor to remit all amounts owed by New Style to the debtor only to the lender. 13 New Style, despite receiving notice directing it to pay the lender instead of its vendor, the debtor, failed to make payment as instructed. Instead, it paid the debtor the amounts it owed.

The debtor, after defaulting on its obligations, filed for bankruptcy. The secured creditor commenced a lawsuit against New Style seeking to recover over $1.4 million, the amount of the accounts receivable owed to the debtor at the time the lender provided notice. The cause of action was based on UCC § 9-607 and was an action to collect proceeds owed to the debtor and to enforce the rights of the debtor with respect to New Style.

New Style moved to dismiss the suit, since the lender only had a security interest in accounts receivable and did not obtain an actual, valid assignment as required by the express terms of Section 9-406 of the UCC. As such, the account debtor argued that lender’s rights were not the same as those of an assignee under the UCC. Absent an actual assignment, the secured creditor should be limited to its standing as such and those rights are governed by UCC § 9-607. That section of the UCC does not, by itself, create any direct obligation by an account debtor to a secured party.

New Style also argued that it had already paid the account pursuant to instructions it received from its vendor, the debtor, and discharged all amounts owed. New Style had no direct contractual privity with the lender who, from New Style’s perspective, was a stranger to the business relationship between New Style and its vendor.

LOWER COURT PROHIBITS DIRECT ACTION

The lower court granted New Style’s motion to dismiss the secured creditor’s complaint. The court found that a security interest was not equivalent to an assignment and such an outright conveyance of property is necessary to trigger the application of Section 9-406. Absent an actual assignment, the secured creditor was not an assignee of accounts as required by the statue and has no independent basis for a cause of action.

The court also noted that the existence of an underlying dispute between the secured creditor and the debtor, such as the collection action involved in this case, bars the lender from bringing a cause of action against the account debtor under Section 9-607. The court found that the secured creditor cannot be said to be exercising the rights of the debtor with respect to the payment obligation of the account debtor in the face of an ongoing dispute between the lender and its debtor. A contrary result would, according to the lower court, be tantamount to creating a duty owed by an account debtor to the secured creditor that is separate and distinct from that owed to the debtor.

HIGH COURT FINDS SECURITY INTERESTS ARE ASSIGNMENTS

Section 9-406(a) provides that “an account debtor . . . may discharge its obligation by paying the assignor until, but not after, the account debtor receives a notification . . . that the amount due or to become due has been assigned and that payment is to be made to the assignee . . . .” 14 The statute contains a clear payment direction provision designed to facilitate sales and other transfers of an interest in receivables. New York State’s highest court split from the U.S. Courts of Appeals for the Fourth and Eleventh Circuits and reversed the lower courts by holding that a security interest is also an assignment of accounts receivable.

In a unanimous opinion, the court found that the language of UCC §§ 9-607 and 9-406, together with the “clear commentary” by the drafters with respect to those sections, make no distinction between a security interest and an assignment and the definition section of the UCC contains no separate definition of “assignment,” “assignor” or “assignee.” In fact, the commentary states that an assignment “‘refers to both an outright transfer of ownership and a transfer of interest to secure an obligation.’” 15 Treating assignments and security interests identically promotes efficient business dealings and commerce. 16 No parsing of contractual language by parties and the courts is necessary to determine whether an interest is an assignment or a security interest. The duty of the account debtor to pay upon receipt of notice to do so is required by law.

The court responded to the concerns of the lower courts with respect to the fact that the account debtor, typically a stranger the borrower-lender relationship, may end up paying twice. The customer in this case already paid the debtor. The court found “[t]hat is the statutory consequence of failing to pay a secured party who has notified the account debtor to pay the secured party directly.” 17 The burden of double payment therefore falls on the account debtor under the circumstances. 18

The UCC has been appropriately referred to as “the backbone of American commerce.” The statutes provide a comprehensive set of uniform laws designed to promote commercial certainty in business transactions in the United States. The high court’s decision in Worthy Lending LLC v. New Style Contractors, Inc. furthers that end. It is now clear, at least in New York, that secured creditors who are granted the right by their debtors (or upon default possess the right) to demand payment directly from account debtors and may enforce that right under the UCC notwithstanding any claimed dispute between the secured creditor and the debtor.

The lower court decisions make clear that a number of courts is confused by the use of the undefined terms “assignment,” “assignee” and “assignor” in Article 9. The language of the statutes, particularly when read in the context of policy and applicable PEB commentary, makes clear that terminology used and defined, such as “security interest” and “debtor,” is drafting intended to encompass sale transactions as well as security interests in accounts.19 And for purposes of Section 9-406, the rights of an “assignee” of accounts against an account debtor inures to the benefit of both an absolute owner and a lender holding a security interest in accounts receivable.

1 UCC § 9-109(a)(1) & (3).

2 See, e.g., Durham Commer. Capital Corp. v. Ocwen Loan Servicing, LLC, 77 Fed. Appx. 952 (11th Cir. 2019) (concluding that Article 9 did not give the lender, as a secured creditor that was not an assignee within the meaning of the statute, a private right of action against an account debtor); Forest Capital v. Blackrock, Inc., 658 Fed 576 (4th Cir. 2016).

3 Worthy Lending LLC v. New Style Contrs., 196 A.D.3d 422 (N.Y. App. Div. 2021), rev’d, 2022 LEXIS 2384 (Ct. App. N.Y. Nov. 22, 2022).

4 2022 LEXIS 2384 (Ct. App. N.Y. Nov. 22, 2022).

5 An “account debtor” is a person obligated on a right to payment of a monetary obligation (i.e., a customer of the lender’s borrower). UCC § 9-102(a)(3).

6 UCC § 9-607(a). This section permits the secured creditor to collect and enforce obligations that are part of its collateral in its capacity as a secured party. It is not necessary that the secured creditor become the absolute owner of the collateral first, whether by foreclosure or otherwise, in order to have enforcement rights. Id. cmt. 6.

7 Id. § 9-607(a)(3). Section 9-607 is broader than former law and applies to all persons obligated on the collateral and “explicitly provides for the secured party’s enforcement of the debtor’s rights in respect of the account debtor’s (and other third parties’) obligations . . . which include the right to enforce claims that the debtor may enjoy against others.” Id. cmt. 3. The statute permits the secured party to obtain property constituting its collateral directly from an account debtor.

8 Id. § 9-607(e).

9 See id. § 1-201(b)(35) (defining “security interest” to include “any interest of a . . . buyer of accounts, chattel paper, a payment intangible or a promissory note in a transaction that is subject to Article 9”); id. § 9-102(a)(73) (defining “secured party” to include a “person in whosefavor a security interest is created or provided for under a security agreement” as well as a “person to which accounts, chattel paper, payment intangibles or promissory notes have been sold”). Accord id. § 9-102(a)(28) (defining “debtor”).

10 Id. § 9-406(a).

11 Id. § 9-406(c).

12 Id. § 9-406(d). Accord id. § 9-406(f).

13 The lender’s notice also provided as follows: “Pursuant to Section 9-406 of the Uniform Commercial Code, payments of accounts made by New Stile to [the debtor] or to any other than [the lender] will not discharge any of New Styles obligations . . . and notwithstanding any such payments, New Style shall remain liable to [the lender] for the full amount of [the receivable owed].”

14 UCC § 9-406(a) (emphasis added).

15 Worthy Lending LLC v. New Style Constrs., Inc., 2022 N.Y. LEXIS 2384 *3 (Ct. App. N.Y. Nov. 22, 2022) (quoting PEB Commentary No. 21 at 4).

16 Id. at *7.

17 Id. at *10.

18 It is significant to point out that neither the existence of a lender’s security interest or the receipt of notification from a secured party under the UCC will change the amount owed, the terms of the payment obligation or any defenses the account debtor may have to payment. See UCC § 9-404.

19 See generally, UCC § 9-109 cmt. 5.

This publication is designed to provide general information on pertinent legal topics. The statements made are provided for educational purposes only. They do not constitute legal or financial advice nor do they necessarily reflect the views of Holland & Hart LLP or any of its attorneys other than the author(s). This publication is not intended to create an attorney-client relationship between you and Holland & Hart LLP. Substantive changes in the law subsequent to the date of this publication might affect the analysis or commentary. Similarly, the analysis may differ depending on the jurisdiction or circumstances. If you have specific questions as to the application of the law to your activities, you should seek the advice of your legal counsel.

Unless you are a current client of Holland & Hart LLP, please do not send any confidential information by email. If you are not a current client and send an email to an individual at Holland & Hart LLP, you acknowledge that we have no obligation to maintain the confidentiality of any information you submit to us, unless we have already agreed to represent you or we later agree to do so. Thus, we may represent a party adverse to you, even if the information you submit to us could be used against you in a matter, and even if you submitted it in a good faith effort to retain us.

This Site uses cookies as outlined in our Online Privacy Statement . By navigating this Site and not disabling cookies via your browser or other means, you are consenting to the use of cookies.

It’s Not Nice to Pay an Invoice Twice: Payment Demands During COVID-19 by Assignees of Accounts Under UCC Section 9-406

- Share via Email

- More Sharing Options

- Share via LinkedIn

- Share via Twitter

For a printable PDF version of this article, please click here.

The mail room just received a piece of unregistered first-class mail from a company you don’t recognize. The letter floats around the office for a couple of days before landing on the desk of your accounts payable clerk, who is taking the week off. The clerk returns and determines that the letter seems to be some sort of collection scam–the letter says to pay some collection company for an account receivable you owe to one of your vendors. But that vendor is set up for ACH debits, and a payment just went out the day before your A/P clerk returned. Because there’s nothing to pay, your A/P clerk round-files the notice. Three more payments go out before you receive notice and complaint from the collection company: it’s suing you for not paying those same four invoices. First, the bad news: You still owe the collection company for the invoices. Next, the worse news: You call your critical vendor to say that you have to pay all future amounts over to the collection company, and your vendor threatens to withhold critical deliveries. Your vendor says that the collection company is gouging them on late fees and attorneys and isn’t owed another penny. How did this become your problem?

The Legal Framework

Article 9 of the Uniform Commercial Code (the “UCC”) provides a powerful collection tool for lenders and purchasers of accounts receivable. An “account debtor” (the party obligated to pay an account receivable) may be obligated to pay the same invoice twice if it receives a proper notice from an assignee but nonetheless pays the original owner of the account receivable. Assignments and Pledges of Accounts Payees on accounts, payment intangibles, and promissory notes (“payment obligations”) may freely assign the obligations, notwithstanding any restrictions in the agreement between the account debtor and the payee/assignor. Section 9-406(d) of the UCC renders the anti-assignment term and any default resulting from violation of that term ineffective. This allows payees/assignors to monetize payment obligations through pledge or sale. The term “assignee” in the context of Section 9-406 means either a purchaser of a payment obligation or a secured party with a security interest in the payment obligation. Effective Notification An assignee may provide notice to the account debtor of the assignment or pledge under Section 9-406(b). A proper notice must be authenticated (signed, which includes electronic signatures). A notice that is authenticated may nonetheless be ineffective under either of the following circumstances:

- If it does not reasonably identify the rights assigned.

- At the option of an account debtor, if the notification tells the account debtor to pay the assignee less than the full amount of any installment or other periodic payment.

Proof of Assignment An account debtor may request proof from the assignee that the assignment was made under Section 9-406(c). Proof could consist of the signed agreement in which the assignor pledges or assigns the payment obligation. A filed financing statement, in and of itself, is not sufficient proof. If the assignee fails to “seasonably” comply with the request for proof, then the account debtor may discharge the payment obligation by paying the assignor without risking the double-payment consequence described below. “Seasonably” means “timely,” but is not defined as a specific time frame. But official comment 4 to Section 9-406 explains that an account debtor that has received notification of an assignment and has requested reasonable proof of the assignment may discharge its obligation by paying the assignor when payment is due (or even earlier if reasonably necessary to avoid risk of default), but that paying the assignor substantially before the payment is due will not discharge the obligation unless the assignee has failed to seasonably provide requested proof of the assignment. Consequences for Failing to Pay Assignee Except as noted above, paying the assignor rather than the assignee after receiving a valid notification from the assignee does not discharge the underlying payment obligation, and the assignor can seek to enforce the payment obligation directly against the account debtor. This means that the account debtor may have to pay twice unless it can recover the double payment from the assignor. Defenses to Payment The assignee does not obtain greater rights to payment than the assignor. As provided in Section 9-404, “the rights of an assignee to an assigned or pledged payment obligation are subject to (1) all terms of the agreement between the account debtor and assignor and any defense or claim in recoupment arising from the transaction that gave rise to the contract, and (2) any other defense or claim of the account debtor against the assignor which accrues before the account debtor receives a notification of the assignment authenticated by the assignor or the assignee.”

Suggested Procedures Upon Notification

Because businesses are increasingly under stress, especially small businesses that may have entered into factoring agreements by which they’ve sold or pledged their accounts to hard money-lenders for quick cash at a discount, businesses should expect to see more diversion notices from banks, factors, and other finance companies. The UCC is pretty unforgiving if a company is late to respond. A business is wise to do the following:

- Determine whether the notice meets requirements for effective notice and complete a checklist. To download a Sample Account Assignment Checklist, click here .

- Immediately notify the accounts payable department (or whomever is responsible for cutting checks and sending wires) of the assignment, and freeze any payments to the debtor.

- If contacted by an attorney for the assignee or the assignor, refer the attorney to the company’s legal counsel. Once an attorney knows that the business is represented by counsel, the attorney cannot ethically have further contact with the company without consent of its attorney (internal or external).

- Contact the legal department and provide a completed checklist. To download a Sample Account Assignment Checklist, click here .

- Determine whether the amount claimed by the assignee is correct. The company may have paid a prior invoice before receiving the notice, or there may be an outstanding billing dispute between the company and the assignor.

- Contact the assignee for any missing items of proof, or to assert contras, set-offs, or counterclaims.

- Notify the assignor of the notice and the company’s obligation to pay the assignee. If a payment is due or will become due shortly, notify the assignor that payment may be slightly delayed while the company awaits a response on the request for proof.

- If the assignee is entitled to payment, update payment information in the business’s system. Follow procedures for verifying payment information.

- If a request for proof has not been satisfied, and a payment obligation risks default, make the payment to the assignor after a final notice to the assignee. Consult legal counsel before doing this.

- If the assignor disputes the assignee’s right to be paid, consult with the company’s lawyer about whether to interplead the amounts owed (pay the funds to the court and let the assignor and assignee fight over them).

Practical Considerations

If you’re receiving one of these notices, it’s not necessarily a sign that your vendor is in trouble with its lender or factor but it can be. If you have an ongoing business relationship with a cash-strapped vendor, you could find yourself with the problem in the example above. A desperate vendor that can’t pay workers or keep the lights on may be better off pulling its workers or withholding goods and services, even though by doing so it would breach its agreement with you. The breach creates a counterclaim that can be offset against the receivable, which is bad for the lender or factor. Each of the parties has something to lose and something to gain, so quick action to negotiate a settlement in which each party gets less than it wants can head off a more disastrous result.

Key Contributor

Related Articles

We look forward to hearing from you. Please note that sending an email to one of our lawyers or to our client services department does not create an attorney-client relationship. Such a relationship will only be established once it is confirmed in writing between Miller Nash LLP and you or your company. Please do not email confidential information, as any unsolicited information received will not be regarded by us as confidential.

Get notified in your email when a new post is published to this blog

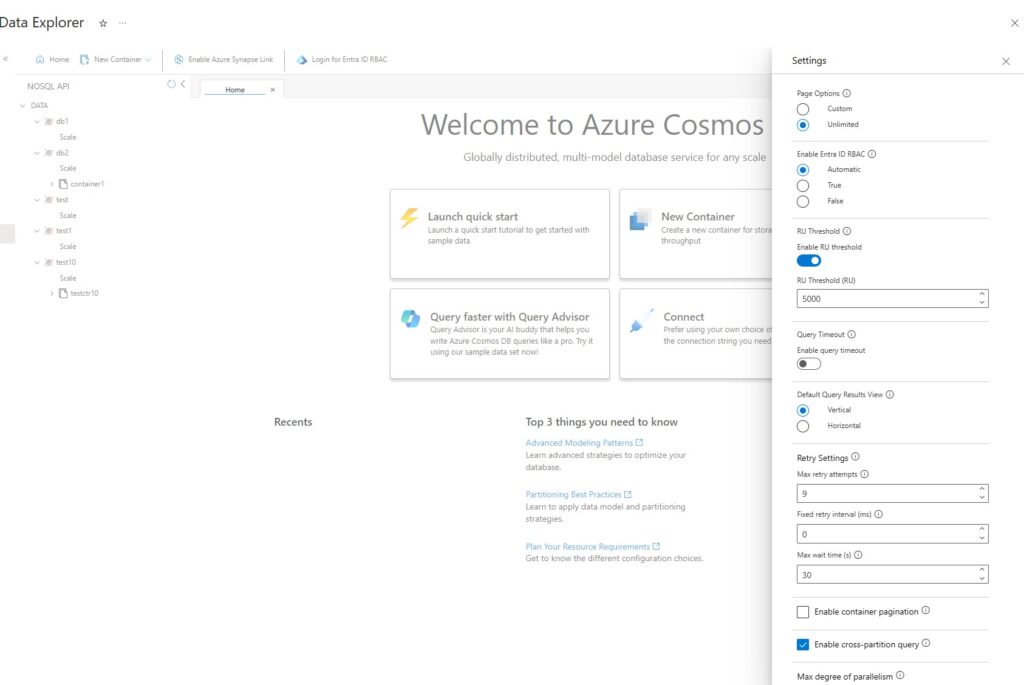

Now use role-based access control in Azure Cosmos DB Data Explorer

Meredith Moore

July 2nd, 2024 0 0

Azure Cosmos DB Data Explorer is a web-based tool that allows you to interact with your data, run queries, and visualize results in Azure Cosmos DB. It is available in the Azure Portal and as a standalone web app .

RBAC allows you to use Microsoft Entra ID identities to control data access in Data Explorer, instead of using account keys. This way, you can grant granular permissions to different users and groups and audit their activities. RBAC also enables you to use features such as Entra ID Conditional Access and Entra ID Privileged Identity Management to further protect your data. It allows for finer-grained access control based on roles, reducing the risk associated with key management and distribution.

Previously, RBAC could only be used with the standalone app, and not directly within the Data Explorer in the Azure portal. Today you have enhanced capabilities, and you can use it within the Data Explorer in the portal and the standalone Data Explorer web app for your Azure Cosmos DB NoSQL accounts.

How to enable RBAC in Data Explorer for NoSQL accounts

The use of RBAC in Data Explorer is controlled by the Enable Entra ID RBAC setting. You can access this setting via the “wheel” icon at the upper right-hand side of Data Explorer.

The setting has three values tailored to your needs:

- Automatic (default): In this mode, RBAC will be automatically used if the account has disabled the use of keys. Otherwise, Data Explorer will use account keys for requests.

- True: In this mode, RBAC will always be used for Data Explorer requests. If the account has not been enabled for RBAC, then the requests will fail.

- False: In this mode, account keys will always be used for Data Explorer requests. If the account has disabled the use of keys, then the requests will fail.

Previously, RBAC was only supported in the Data Explorer standalone web app using a feature enabled link . This is still supported and will override the value of the Enable Entra ID RBAC setting. Using this query parameter is equivalent to using the ‘Automatic’ mode mentioned above.

How to use RBAC in Data Explorer