- Virtual Experiences

- In-Person Experiences

- Hybrid Experiences

- Social Calendar [New]

- Experience FAQ

- Features & Benefits

- How Pricing Works

- Client Testimonials

- Happiness Guarantee

- Blog Articles

- Video Library

- View 48 Experiences

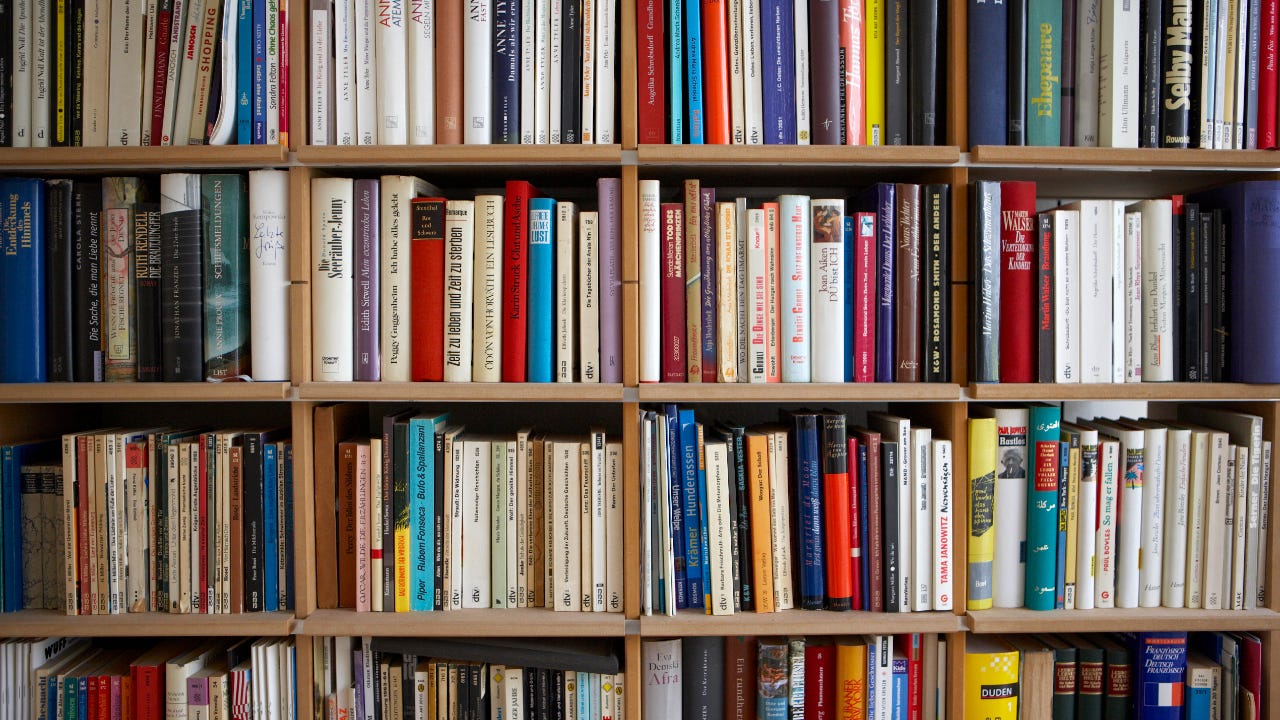

12 Best Business Finance Books to Read in 2024

You found our list of the top business finance books .

Business finance books are guides that give strategies for finding funding and making money. These works cover topics such as valuation, trading, return on investment, profit, debt management, and funding. The purpose of these books is to fund ventures, increase profits, and help organizations be economically successful long term.

These guides are a subset of business books and are similar to entrepreneurship books and books on business strategy .

This list includes:

- small business finance books

- business finance books for beginners

- books for learning business finance

- finance books for entrepreneurs

Here we go!

List of business finance books

From new releases to all-time bestsellers, here is a list of books on business finance to make operations more profitable.

1. Valuation: Measuring and Managing the Value of Companies by McKinsey & Company Inc., Tim Koller, Marc Goedhart, and David Wessels

Valuation: Measuring and Managing the Value of Companies is a masterclass in corporate valuation from consulting firm McKinsey. The textbook covers basic concepts such as creating value, predicting and assessing performance, and strategic investment and management. The book breaks down how to value companies accurately while considering factors such as taxes, inflation, operating and non-operating costs, and retirement. The final chapter also outlines special circumstances and exceptions such as emerging markets and high-growth companies. The appendices expand upon these ideas and offer case studies and formulas to round out the text. Valuation: Measuring and Managing the Value of Companies paints a full picture of how to tell what companies are worth and achieve optimal return on investment.

Notable Quote: “Companies thrive when they create real economic value for their shareholders. Companies create value by investing capital at rates of return that exceed the cost of their capital. These two truths apply across time and geography.”

Read Valuation: Measuring and Managing the Value of Companies .

2. The Alchemy of Finance by George Soros

The Alchemy of Finance is the published wisdom of famed investor George Soros. The book sheds light onto Soros’s trading and investment strategies, and provides a framework for making financial decisions. Earlier chapters view economics through a historical lens, while later chapters make predictions about emerging trends. The economic experiment at the heart of the book takes place during the 1980’s, however the takeaways and observations about markets are still relevant for current times. The writing is dense and this is not a breezy read, however readers who put in the effort can mine valuable economic insights. The Alchemy of Finance is a business finance classic and deserves a spot on any economics must-read list.

Notable Quote: “Economic theory is devoted to the study of equilibrium positions. The concept of equilibrium is very useful. It allows us to focus on the final outcome rather than the process that leads up to it. But the concept is also very deceptive.”

Read The Alchemy of Finance .

Get our free team building toolbox

- icebreaker games

- bingo cards

3. The Personal MBA: Master the Art of Business by Josh Kaufman

The Personal MBA is one of the most useful business finance books for beginners. The book spans a range of topics typically covered in MBA programs and includes an extensive section on finance. Within that chapter, the authors define and explain concepts such as cash flow and income statements, purchasing power, lifetime value, pricing, and funding. This section offers a comprehensive overview of money-making best practices. Surrounding chapters deal with complimentary subjects such as valuation, sales, and improving systems. The book as a whole is a guide to making businesses profitable and efficient and acts as a crash course to holistic business operations.

Notable Quote: “Every time your customers purchase from you, they’re deciding that they value what you have to offer more than they value anything else their money could buy at that moment.”

Read The Personal MBA .

4. Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine by Mike Michalowicz

Profit First is one of the best finance books for entrepreneurs. The book preaches that to make money instead of losing money, one must use profit as a starting point when making decisions. In other words, instead of determining profit based on sales minus operating costs, leaders should first think of the desired profit and work backwards. This reverse engineering approach encourages entrepreneurs to act more intentionally and make choices that support the end goal. The book outlines how to put this theory into practice and overcome challenges that may arise. The final pages include resources such as a beginning assessment and a setup guide that make the advice even more actionable.

Notable Quote: “A financially healthy company is a result of a series of small daily financial wins, not one big moment. Profitability isn’t an event; it’s a habit.”

Read Profit First .

5. How Finance Works: The HBR Guide to Thinking Smart About the Numbers by Mihir Desai

How Finance Works is one of the most helpful books for learning business finance. The book acts as an introductory course into the world of financial systems. The guide outlines how to conduct financial analysis, explains key players and concepts within capital markets, and explores valuation. The guide also touches on capital allocation and dissects the ways good leaders make financial decisions. This guide distills complex concepts down into simple summaries and easily-digestible snippets, yet the book is not so basic that more established professionals cannot find value in it.

Notable Quote: “How safe is it to lend to a company? How financially rewarding is it to be a shareholder of a company? How much value does this company provide? Each of these questions cannot be answered by looking at any one number in isolation. Ratios provide a comparison of relevant numbers in a common way, which makes sense of otherwise meaningless numbers.”

Read How Finance Works: The HBR Guide to Thinking Smart About the Numbers .

6. The Intelligent Investor by Benjamin Graham

The Intelligent Investor is one of the best guides to trading. Written by Benjamin Graham, the legendary investor and mentor to Warren Buffet, the book preaches the gospel of value investing. This philosophy urges readers to invest for the long-term rather than chasing immediate wins. The book lays out formulas for reducing risk and achieving better returns. Graham explores ways to invest defensively in any climate and gives advice on conditions like inflation, volatility, and market fluctuations. The book outlines considerations such as portfolio policy, security analysis, dividend policy, per-share earnings, and stock selection. Graham also provides historical background, case studies, and company comparisons. The Intelligent Investor explores the inner workings of the stock market and lays out sound strategies for avoiding ruin and accumulating wealth.

Notable Quote: “But investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

Read The Intelligent Investor .

7. Accounting for the Numberphobic: A Survival Guide for Small Business Owners by Dawn Fotopulos

Accounting for the Numberphobic is one of the best small business finance books. This book is specifically geared towards owners whose area of expertise is not accounting. This guide teaches entrepreneurs how to overcome the dread of crunching the numbers and how to make sense of available information. The book explores the ins and outs of net income statements, breaks down how to determine a business’s breakeven point, explains why cash flow is important and how to maintain it, and shows owners how to use balance sheets to estimate a company’s worth. The book also contains a financial dashboard that serves as a toolkit to run the numbers. Having a grasp on these concepts helps owners understand how a business is performing, and this book grants entrepreneurs the foundational knowledge and confidence to oversee the books and make financial decisions.

Notable Quote: “The goal is to build a profitable business, not maintain an expensive hobby that will leave you in the poorhouse.”

Read Accounting for the Numberphobic , and check out more small business books .

8. How to Read a Financial Report: Wringing Vital Signs Out of the Numbers by Tage C. Tracy and John A. Tracy

How to Read a Financial Report is one of the more practical books on business finance for beginners. This work teaches readers how to make sense of economic data. The book breaks down standard parts of financial reports such as cash flow statements, net income, tax and liability. The authors show how to understand each factor individually and judge profitability and investment soundness as a whole. The final section explains ways to use financial statements. Scattered throughout the book are exhibits and examples to further readers’ understanding. How to Read a Financial Report touches on the fundamentals of economic analysis and shows beginners how to understand and pinpoint a business’s bottom line.

Notable Quote: “The cash flows summary for the year does not reveal the financial condition of the company. Managers certainly need to know which assets the business owns and the amounts of each asset, which can include cash, receivables, inventory, among others. Also, they need to know which liabilities the company owes and the amount of each.”

Read How to Read a Financial Report .

9. The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns by by John C. Bogle

The Little Book of Common Sense Investing is a helpful guide to index investing. The book makes the point that the most reliable investment strategy is to hold a portfolio of diversified stocks that earn gains over time rather than trying to beat the market and as a result pay high fees or see major losses. This guide explores the nuances of index funds and shows readers how to build a strong and stable portfolio that accumulates wealth. John C Bogle is a founder of Vanguard and one of the creators of the first index funds, so readers receive insights on the topic from one of the world’s foremost experts.

Notable Quote: “The true investor . . . will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies.”

Read The Little Book of Common Sense Investing .

10. Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive Advantage by Mary Buffett and David Clark

Warren Buffett and the Interpretation of Financial Statements offers an in-depth analysis of Warren Buffet’s investment philosophy and strategies. The guide offers a step-by-step breakdown of how to examine investment statements and decide a company’s worth, and is one of the better books for learning business finance. The book relays Buffett’s insights into areas such as how much debt a company can hold and still be healthy, the toll research and development can have on the bottom line, and the types of companies that are better to avoid even if they do seem like a bargain. The guide shows readers how to make sense and make best use of the information on documents like balance sheets and income statements and to make informed decisions that translate into wise investments.

Notable Quote: “Before we start looking for the company that will make us rich, which is a company with a durable competitive advantage, it helps if we know where to look. Warren has figured out that these super companies come in three basic business models: They sell either a unique product or a unique service, or they are the low-cost buyer and seller of a product or service the public consistently needs.”

Read Warren Buffett and the Interpretation of Financial Statements .

11. Blockchain Revolution: How the Technology Behind Bitcoin and Other Cryptocurrencies Is Changing the World by Don Tapscott and Alex Tapscott

Cryptocurrency is a hot topic in the world of finance, and Blockchain Revolution provides a crash course in the concept. The guide gives an introduction to blockchain before projecting the impact this technology will have on various parts of the economy. The book explores cryptocurrency’s potential effects on the financial services sector, government, and culture, and imagines how wide scale adoption might shape future leadership and business models. Later chapters lay out challenges to implementing blockchain technology and brainstorm possible solutions. Blockchain Revolution explains the potential for cryptocurrency to reinvent industry and increase equity and entrepreneurial inclusion, while also providing a guide to the fundamentals of blockchain.

Notable Quote: “Data is becoming a new asset class – one that may trump previous asset classes.”

Read Blockchain Revolution .

12. The Psychology of Money: Timeless lessons on wealth, greed, and happiness by Morgan Housel

The Psychology of Money is a fascinating study of the mindsets behind financial decisions. The book makes the case that accumulating and maintaining wealth is largely about behavior and beliefs, and that business decisions are a matter of emotion as well as math. Morgan Housel sets out to pinpoint the mentalities that lead to money missteps. The pages are full of entertaining anecdotes and valuable lessons about the driving forces behind financial decisions. This book explores how humans think and feel about money, and how those factors impact the way they act. The Psychology of Money subtly shows readers how to gain control of their finances by understanding and regulating their money mindsets and emotions.

Notable Quote: “Growth is driven by compounding, which always takes time. Destruction is driven by single points of failure, which can happen in seconds, and loss of confidence, which can happen in an instant.”

Read The Psychology of Money .

Final thoughts

Common wisdom says that numbers do not lie, however, the numbers can lead to incorrect conclusions if not interpreted correctly. Books on business finance teach professionals how to navigate the often confusing world of accounting, trading, and economics, attain profitability, and make decisions that benefit a business’s bottom line both in the short and long terms. These guides are useful not only for leaders, but anyone involved in making financial decisions. Not to mention, these concepts give readers a deeper understanding of how the best businesses generate returns and can help individually understand how to make fiscally sound decisions and operate more efficiently, in both their personal and professional lives.

For more reading recommendations, check out this list of CEO books , these franchise books , and these office management books .

Book wildly fun team building events with expert hosts

FAQ: Business finance books

Here are answers to common questions about books on business finance.

What are business finance books?

Business finance books are guides to finding funding, operating within budgets, and achieving profitability. These works cover topics such as investment strategy, financial reporting, valuation, and capital structure. The purpose of these books is to help professionals understand the economics behind business operations and to make sound decisions that serve the organization’s books both in the immediate and far-off future.

What are the best business finance books for beginners?

The best business finance books for beginners include How to Read a Financial Report by Tage C. Tracy and John A. Tracy, How Finance Works: The HBR Guide to Thinking Smart About the Numbers by Mihir Desai, and The Personal MBA: Master the Art of Business by Josh Kaufman.

What are the best finance books for entrepreneurs?

The best finance books for entrepreneurs include Valuation by McKinsey & Company Inc. et al, Profit First by Mike Michalowicz, and The Alchemy of Finance by George Soros.

Author: Angela Robinson

Marketing Coordinator at teambuilding.com. Team building content expert. Angela has a Master of Fine Arts in Creative Writing and worked as a community manager with Yelp to plan events for businesses.

We lead wildly fun experiences for teams with 1,000,000+ players to date.

4.96 / 5.0 rating on

50,225 Google Reviews

Get our free team building tool box

$49 value at no cost..

- May as well check it out?

- 100+ tested icebreaker questions

- 24+ themed Bingo generators

- 5+ PDFs (including the 8% Rule)

- 2024 team building calendar and more...

Enter your email for instant access

- Search Search Please fill out this field.

- Financial Literacy Resource Center

- Financial Literacy for Children

- Ultimate Guide to Financial Education

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

- Personal Finance

- Financial Literacy

The 12 Best Finance Books in 2024

Build expertise in personal finance, investing, and decision-making psychology

Michelle Lodge is a contributor to Investopedia, who is also a writer, editor, and podcaster.

:max_bytes(150000):strip_icc():format(webp)/MichelleLodge_headshot_2021-685c46eedead4577803eb3aa169cc1b1.jpg)

There is no shortage of interest in finance books. Sales of business and economics print books reached a 10-year high in 2022, accounting for a quarter of all nonfiction unit volume and realized a 10% raise from 2021, according to market research firm The NPD Group. Business is the second-highest category in print publishing after books about religion. This large, complex print category has more than 100 categories and over 200 subcategories.

To help you sort through these offerings, we’ve put together a list of the best—everything from a biography; how-tos on managing money and investments; a lively reference book about cryptocurrency; policies that impact economics; scandals and personalities laid bare; and the thinking behind decision making in the stock market and other areas, as well as the all-time best book on negotiating. These books, written by authors of diverse backgrounds, offer the most comprehensive picture and the freshest insights to provide a broad perspective on the economy in these complicated and high-risk times and will help you make better financial choices.

Best Overall: No Filter: The Inside Story of Instagram

Sarah Frier’s No Filter: The Inside Story of Instagram ranks as the best overall book on our list of fine finance books. The title doesn’t do the book justice, because it’s so much more than a book about two smart tech guys creating a novel app and then selling it to Facebook.

Through her well-written and -reported prose, Frier, the Bloomberg editor in charge of Big Tech coverage, tackles the significance of social media—how it can alter the outcomes of elections, impact the self-esteem and behavior of followers who don’t have the seemingly perfect lives of celebrities and influencers, and generally hurt society when it professes to do the opposite. She also takes us inside Facebook, especially profiling its co-founder Mark Zuckerberg, who Instagram co-founder Kevin Systrom called the most strategic thinker he has ever met. It’s a gripping read.

“If Facebook was about friendships, and Twitter was about opinions, then Instagram was about experiences— anyone could be interested in anyone’s visual experiences, anywhere in the world,” Frier writes in her tale of app envy among Silicon Valley leaders. In 2010, Instagram co-founders Mike Krieger and Systrom were coming to terms with the scope of their online creation, a social media app for photos and video that led Facebook co-founder Mark Zuckerberg to acquire it for $1 billion two years later.

Systrom stayed on after the sale and tried to preserve the app’s initial intent of a way station for beautiful images, but he clashed with Zuckerberg, who wanted to grow Instagram while keeping it from overshadowing the parent . “Facebook was like the big sister that wants to dress you up for a party, but does not want you to be prettier than she is,” an unnamed former Instagram executive is quoted in the book as saying. Instagram comes out poorly, too, as its images of “perfect-looking” women caused some its followers to seek out cosmetic surgery, and opioids were sold through its site for several years.

Silicon Valley’s workings are thoroughly reported, thanks to Frier’s extensive interviews with venture capitalists and tech executives and Instagram influencers and celebrities. Accolades poured in for No Filter : It was named the best business book in 2020 by the Financial Times and McKinsey Business Book, and it received equally effusive attention from Fortune, The Economist , Inc. , and NPR.

Best on Personal Finance: Rich Dad Poor Dad

As any investor knows, it’s not how much money you make, but how much you keep—a main premise of Rich Dad Poor Dad , now published in a 20th anniversary edition. This conversational book—which considers being financially literate crucial to acquiring wealth—cites the lessons from a “rich dad,” a friend’s father who rises from humble beginnings to create a lucrative business and a capitalist, and a “poor dad,” author Robert T. Kiyosaki’s own father, who was a highly educated government employee his entire working life and a socialist.

Kiyosaki obviously took the “rich dad” lessons to heart in co-writing what’s still considered, after 25 years, a top personal finance book. Chapter 2 questions the “American dream” of homeownership by spelling out Kiyosaki’s controversial argument that owning a house is a financial liability, not an asset, because paying for and maintaining it is a drain on finances, while Chapter 4 delves into the history of taxes and the power of corporations. He says that having financial literacy means a broad understanding of accounting and investing and knowing the markets and the law.

Each chapter ends with a “Study Session,” which reviews the material and poses questions.

Rich Dad spent nearly seven years on the New York Times bestseller list, one of the first self-published books to land there. “It [offers] useful information for a generation on the brink of making important financial decisions,” says Eric Estevez, a member of Investopedia’s Financial Review Board and an independent insurance broker. “Robert has a track record of breaking down complex financial concepts into simple explanations.”

Best Cryptocurrency Reference: The Basics of Bitcoins and Blockchains

You can judge this book by its cover because it delivers on its title, resulting in a comprehensive, lively must-have reference book on cryptocurrencies. Antony Lewis, a former technologist at Credit Suisse in Singapore and London, left banking to join the startup iBit, where clients buy and sell Bitcoins, and has never looked back.

His nine-chapter book starts with defining money—followed by definitions of digital money, cryptography, cryptocurrencies, digital tokens, and blockchains—and illustrates points with pictures, graphs, tables, pie charts, and infographics. He suggests, for example, that Bitcoin be called an “electronic asset” because “the word currency often sidetracks people when they are trying to understand Bitcoin. They get caught up trying to understand aspects of conventional currencies which do not apply to Bitcoin, what backs it (nothing) and who sets the interest rates (there is none).”

Investopedia’s Vinamrata Chaturvedi, senior editor overseeing blockchain and cryptocurrency, says this about the book: “There are many questions we have when thinking about blockchain. This book answers all of them. It explains how blockchain technology works and why cryptocurrencies are the future of money.”

Lewis freely admits that he “loves the industry” of crypto assets, Bitcoins, and blockchains, yet he also cautions about the very real dangers to investors. In a section called “Scams,” he lays out the swindles of Ponzi schemes, exit and fake scams, pump-and-dumps, scam initial coin offerings (ICOs), spoof ICOs, scam mining schemes, and fake (digital) wallets. “People have made and lost fortunes trading cryptocurrencies and investing in ICOs, but there are many risks,” he writes. “If you do decide to get involved, be careful and do a lot of research before committing your money.”

Best for Investing: A Random Walk Down Wall Street

Burton G. Malkiel is an economics professor, a former director at Vanguard, and a former dean of the Yale School of Management, yet his most recognizable contribution to finance is his Random Walk book, originally published in 1973 and, as of 2019, in its 12th edition. If you wait for Jan. 3, 2023, you can get the 50th anniversary edition in a green, not yellow, cover—the one pictured above.

“A random walk is one in which future steps or directions cannot be predicted on the basis of past history,” writes Malkiel. “When the term is applied to the stock market, it means that short-run changes in stock prices are unpredictable.” Sound familiar?

Amy Drury, a member of Investopedia’s Financial Review Board, and CEO and founder of the financial training company OnPoint Learning, who recommended the book, had this to say: “I reread this recently and found that it was a pretty comprehensive overview about finance and investing. It is very dense, so maybe not one to take to the beach, but it is great as a reference book to dip into on specific topics.”

Best Personal Finance Disaster Management: What to Do with Your Money When Crisis Hits: A Survival Guide

There are two ways to read Michelle Singletary’s personal finance book, and both are right: You can tackle it from start to finish or dive into the topics that are the most pressing first and then read the rest. In her Survival Guide —an outgrowth of her nationally syndicated personal finance column, “The Color of Money,” for The Washington Post —Singletary covers how to manage money and deal with crises, using a question-and-answer format, which delivers authoritative, straightforward, and actionable answers.

When money is tight, Singletary advises triaging: assessing what must be paid for, such as having food on the table, and dealing with remaining creditors directly by working out payment plans. What’s especially impressive about her book is that it serves a wide range of readers—those who enjoy hefty incomes and live beyond their means, rank newcomers to financial self-care, and everyone in between.

Its “Resources” chapter lists organizations, companies, and government agencies that offer information and, as needed, possible relief for the consumer. “Very timely, relevant, practical, and helpful” is how Marguerita M. Cheng, CEO of Blue Ocean Global Wealth and an Investopedia Financial Review Board member , describes the book.

Best Global Perspective: The Silk Roads: A New History of the World

To the uninitiated, the words “silk roads” may conjure up the deep beauty of shimmering silk fabric in exotic locales. The reality is quite different. In his 2015 book, Oxford University global history professor Peter Frankopan weaves a complex tale across centuries about fearless merchants, middlemen, soldiers, and leaders—many of whom traveled on life-challenging passages across treacherous terrain throughout the Middle East, China, the Balkans, and South Asia with the added provocations of unpredictable weather and peoples, crime and life-threatening disease, and even the proselytizing by clergy of religions old and brand-new, which led to deadly power grabs and wars.

So valued was silk that it became an international currency when others, such as grain, failed. Through the centuries, new cities sprouted and others faltered. The simple purpose, of course, was commerce.

“ The Silk Roads refocuses our attention on a region that has always and will always play a critical (and defining) role in the global economy,” says David M. Roth, CEO of Wakaya Group, a former director of FIJI Water in Fiji, and an entrepreneur-in-residence at INSEAD. “Frankopan also helps us contextualize and make sense of current events within the long arc of human history. To paraphrase [Democratic political operative] James Carville, it is and always has been about the economy.”

A follow-up from Frankopan is The New Silk Roads: The New Asia and the Remaking of the World Order (Vintage, 2018).

Best on the Dangers of the Gender Data Gap: Invisible Women: Data Bias in a World Designed for Men

In this absorbing book—named 2019’s Financial Times and McKinsey Business Book of the Year and a London Times bestseller, British journalist and activist Caroline Criado Perez spells out how the data gender gap accounts for disadvantages for women worldwide, costing companies and governments plenty in missed opportunities and productivity. It shows how this bias can yield an unhappy workforce and populace and result in unnecessary illnesses—and even deaths—among women.

“The stories we tell ourselves about our past, present, and future. They are all marked—disfigured—by a female-shaped ‘absent presence,’” writes Criado Perez, who draws on numerous research studies. “This is the gender data gap.” Practically speaking, this means that medical studies—which often include miners and construction workers, mostly male, and leave out cleaning staff and nail-salon workers, mostly female—still largely focus on men as the default, leaving doctors to estimate drug dosages and treatments for women. In addition, car safety systems are designed for the larger male body, causing additional injuries for female drivers in the event of an accident. The same is true of personal protective equipment (PPE), which leaves female police officers, for example, unprotected on duty as bulletproof vests often don’t fit them.

Even transportation systems are geared toward the male breadwinner driving a car. Meanwhile, women, who are often responsible for primarily caring for children and aging adults and grocery shopping, are left to rely on usually time-consuming and inefficient public transportation and walking. One success story was a change in the order of snow-clearing practices in the Swedish town of Karlskoga. The governing body decided to clear snow from sidewalks before roadways. That’s because pedestrians, two-thirds of whom were women, sustained injuries, mostly through falls, three times more often in the winter. The estimated cost of all these falls in a single winter season was some $4 million.

Criado Perez maintains that using the male default isn’t intentional, but ingrained. However, the next time you see a female colleague wrapped in a blanket in the office, while male workers simply wear their regular clothes, know that the data gender gap is partly to blame.

Best Biography: The Snowball: Warren Buffett and the Business of Life

Berkshire Hathaway Chairman and CEO Warren Buffett, the so-called “Oracle of Omaha,” has had volumes in many languages written about him. Yet his personal life from the earliest days and beyond remained a mystery until Alice Schroeder penned this eloquent biography at Buffett’s invitation. “Whenever my version is different from somebody else’s, Alice, use the less flattering version,” Buffett advised Schroeder.

This New York Times bestseller traces Buffett’s French Huguenot and German heritage, whose family motto was likely “spend less than you make,” with the addendum of “don’t go into debt.” She goes from his birth 10 months after the 1929 stock market crash to his unconventional marriage and fatherhood, to his many deals and the circus-like atmosphere surrounding Berkshire Hathaway’s popular shareholders meetings.

Buffett credits his success to “intelligent parents” and having “luck.” Yet the numbers-loving Buffett had, by age 10, figured out that having money meant coveted independence, the basics of buying and selling stocks, and how equity’s volatility can impact an investor. His metaphor for compounding is a snowball in wet snow that gathers strength and heft as it rolls down the hill. Still working 82 years later, Buffett is one of the world’s richest men, with an estimated net worth of $99.7 billion as of this writing.

Best Origin Story: Trillions

“Over the past decade, 80 cents of every dollar that has gone into the U.S. investment industry has ended up at Vanguard, State Street, and BlackRock,” writes Robin Wigglesworth, editor of the Financial Times ’ Alphaville, a news and commentary service for financial professionals. Wigglesworth’s compelling book tracks the beginning of index funds to the current day and ponders what their dominance means.

Wigglesworth begins by introducing a cast of 32 characters—among them, only two women: Jeanne Sinquefield, who designed derivatives, and former Barclays Global Investors CEO Pattie Dunn. Other key players:

- “Early-twentieth-century French mathematician Louis Bachelier, whose work on the ‘random walk’ of stocks would make him the intellectual godfather of passive investing”

- Berkshire Hathaway Chairman and CEO Warren Buffett, who won a 10-year-old bet with Ted Seides of Protege Partners in 2017 that the returns of index funds would outstrip those of a basket of hedge funds

- Jack Bogle, the founder of Vanguard, often called “Saint Jack” because his company offered index funds to the public en masse. At the end of his life, Bogle questioned the value of index funds but also defended them. “It’s hard to know how big we can get, and the consequences...,” he said. “But to solve this, we should not destroy the greatest invention in the history of finance.”

Best for Decision-Making Skills: Thinking, Fast and Slow

Daniel Kahneman is a psychologist by training. However, his work on prospect theory earned him a Nobel Prize in Economics in 2002, an award he acknowledges he would have shared with collaborator Amos Tversky, had Tversky lived, and with whom he also explored heuristics in judgment and decision making. Prospect theory means that investors value gains and losses differently, placing more weight on perceived gains than perceived losses.

His research also led him to conclude that women make better investors than men because they hold on to their investments, whereas men panic and sell when the market dips, thereby missing out on upswings. Kahneman estimates that the average person makes 35,000 decisions a day—the fast kind, such as when to get up, what to eat for breakfast, what to wear, and the slow kind that involve deliberative thinking, such as whether and whom to marry, which career to pursue, or where to live.

This data-heavy book, thoughtful and cerebral, is also full of anecdotes about Kahneman’s life of research and experiences. In 2016, Michael Lewis published The Undoing Project: A Friendship That Changed Our Minds , on the close partnership of Kahneman and Tversky.

Best Read on Scoundrels and Saviors: The Predators’ Ball

Today’s younger readers may only know Michael Milken as an advocate for prostate cancer research and the founder of the Milken Institute, a think tank that promotes market-based principles and everything from financial innovations to social issues. When New Yorker writer Connie Bruck’s gripping book was published, life was very different for Milken. He was fighting off federal charges of securities and tax violations. He had been the junk bond king who underwrote some of the biggest corporate raiders, such as Ronald Perelman and Carl Icahn, during the height of junk bonds’ popularity and the leveraged buyout boom.

So concerned was Milken about Bruck’s reporting that he offered to pay her for all the book’s copies sold in exchange for not publishing it. He was right to be scared.

The book chronicles how Milken built the junk bond market and supported the corporate raider culture, while working 18-hour days from his Southern California office, as well as his precipitous fall leading to a plea deal in 1990. In addition to Milken, the characters include Apollo Management’s Leon Black, KKR & Co.’s Henry Kravis, Loews Corp.’s Laurence Tisch, stock trader Ivan Boesky, and Rudy Giuliani, then the crusading U.S. Attorney for the Southern District of New York. Then-President Donald Trump granted Milken a full pardon in 2020.

The Predators’ Ball is a meticulous retelling of the era that spawned the sentiment “greed is good.”

Best for Dealmakers: Getting to Yes

This classic book uses the words of poet Wallace Stevens to lay out its premise: “After the final no there comes a yes and on the yes the future of the world depends.” Getting to Yes , which debuted in 1981 and has been revised since, is the finest book on how to advocate for what you want with skill, integrity, and success.

It offers tips on developing a cordial relationship with the other side—that is, being a person, not the entity you represent—while avoiding the trap of being “nice” and getting walked all over, and deflecting and moving beyond the aggressive tactics of unscrupulous negotiators. Most helpful are examples of simple dealings in which the parameters of what’s at stake are expanded—the pie gets bigger, so to speak, so that both parties end up with more than they first asked for.

Underneath these outcomes are four steps: separating people from the problem; focusing on interests, not positions; inventing multiple options representing multiple gains for both sides; and insisting that the results be based on an objective standard.

Why Trust Investopedia?

Michelle Lodge is steeped in the book and book-reviewing world. She has been published in Publishers Weekly and was an editor and writer for Library Journal , both of which cover books and the industry. While a book review editor at LJ , which recommends books for public library collections, she selected a number of fine business books for review. She was also the editor of the On Wall Street Book Club, in which she reviewed books and interviewed authors on a podcast.

A burgeoning field of business and economics books needs many “heads” to cull out notable selections and pull it all together. Lodge marshaled the resources, in which she considered recommendations from Investopedia Financial Review Board members and Investopedia editors, business executives, bestseller lists from the Financial Times, The New York Times, The Times of London, and others, as well as her own experience as a book review editor. She also pulled three books from her own library: Getting to Yes , The Predators’ Ball , and Thinking, Fast and Slow . Her aim is to cover the bases in subject matter and expertise and tap into a diverse pool of writers, whose coverage reveals the impact on investing, while also ensuring that each selection is a good read.

NPD. " Business and Economic Book Sales in the US Reach 10-year High, NPD Says ."

:max_bytes(150000):strip_icc():format(webp)/roundup_primary_INV_commercebooks1-932d94e4f8c242b38b9e684349dd0609.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

15 Best Finance Books for Financial Professionals

These finance books are must-read picks for financial advisors and other financial professionals.

15 Best Books for Finance Pros

Getty Images

These money-focused reads include informative books by both investors and financial advisors.

Financial advisors and money professionals can choose from a range of books to supercharge their professional development, advice-giving strategies and money-management skills.

Many workers in finance know how deep the rabbit hole of information goes. There seems to be an endless depth to the well of knowledge available to financial professionals. Sometimes, you know what you're after when you dip your bucket into its pools. At other times, it's nice to have a recommendation to guide you.

This list highlights 15 great finance books. It includes behavioral finance books and tomes on understanding how money really works. It lists books by investors and by financial advisors.

This list of the best books for financial advisors won't let you go thirsty for knowledge.

"The Creature from Jekyll Island: A Second Look at the Federal Reserve" by G. Edward Griffin

While the title may sound better suited to a Halloween reading list than a list of the best finance books , make no mistake, this "creature" is one financial professionals should know about. Anyone who deals in finance had better understand money and the Federal Reserve. And no one explains it better – or more engagingly – than Griffin does.

It's written like a detective story, and Griffin pulls back the curtain to reveal "the magician's secrets" that "create the grand illusion called money."

"An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk" by Allison Schrager

It's hard to resist a book with a title like the start of a bad joke, which is good because Schrager's book should not be resisted. It should be devoured. At only 240 pages, it won't take long to do. In fact, you might wish it took a little longer.

An economist and award-winning journalist who has devoted her career to studying how people manage risk in all areas of their lives, Schrager is uniquely suited to help readers do the same.

As financial advisors know, risk cannot be avoided. Instead, the question is how to measure risk to maximize your chance of getting what you're after. In her book, Schrager teaches the five principles of dealing with risk. They may just change how you look at investment risk going forward.

"Nudge: Improving Decisions About Health, Wealth, and Happiness" by Richard H. Thaler

Written by the recipient of a Nobel Prize in economics, "Nudge" is a must-read for financial professionals, says Pete Clemson, senior vice president of digital solutions at Advisor Group.

"While not specifically about finance, it talks about how to change behaviors to be financially successful," he says. "It's even kind of humorous."

"Nudge" looks at how we make choices, which we often do poorly, in life and finance. And it explores how to make better decisions. What's more, if you know how people think, you can help "nudge" them to make better choices, a superpower many financial professionals would be glad to have.

"The Quants" by Scott Patterson

In his New York Times' bestseller, financial journalist Scott Patterson takes readers into the world of the quants, who are "technocrats who make billions not with gut calls or fundamental analysis but with formulas and high-speed computers." Patterson takes readers inside the heads of these math whizzes without forgetting that his readers may not live and breathe formulas.

"This rollicking romp through the history of quantitative finance traces the decadeslong development of quant models along with the colorful characters who developed them," says Steve Sanduski, a certified financial planner and co-founder of ROL Advisor. "(It's) a great primer on how quants dominate the market, written in a highly engaging narrative that is hard to put down."

"The Score Takes Care of Itself" by Bill Walsh

Not all financial books have to be boring – or directly related to personal money management. Take "The Score Takes Care of Itself" by Bill Walsh, for instance. While it's technically a football book, there's plenty in it for financial advisors to learn, Sanduski says.

In the book, Hall of Fame football coach Walsh shares his philosophy of leadership and the 17 values and beliefs that guided how he turned the San Francisco 49ers from one of the all-time worst professional sports teams into three-time Super Bowl champions during his 10 years as head coach, Sanduski says.

"(Walsh's) attention to detail, systems and process is exactly what top advisors need to do when scaling a world-class organization," he says.

"Advice That Sticks: How to Give Financial Advice That People Will Follow" by Moira Somers

Giving advice is easy, but getting your clients to follow your advice is less simple.

Financial psychologist and executive coach Somers knows how frustrating financial nonadherence can be. She also knows, from her clinical and consulting experience and research into positive psychology, behavioral economics and neuroscience, how to increase the chances that it won't happen to you and your clients.

Her book looks at the five main factors that contribute to whether a client will follow through with your advice. It's a thought-provoking, practical and sometimes humorous resource for any advice-giver.

"Thinking in Bets: Making Smarter Decisions When You Don't Have All the Facts" by Annie Duke

Whether it's working for you or against you, luck plays a role in every situation, according to former World Series of Poker champion Annie Duke. The trick is to let go of your need for certainty and instead focus on assessing what you know and what you don't, so you can embrace uncertainty to become a better decision-maker.

"The Alchemy of Finance" by George Soros

Soros is often hailed as one of the most profitable money managers in the world. In his book, he shares the strategies that earned him the title.

A philosopher at heart, Soros has treated the financial markets as his laboratory to astounding success. If you turn the last page of this great finance book holding the same perspective on financial markets you had upon opening the front cover, you probably read it wrong.

"No Longer Awkward: Communicating With Clients Through the Toughest Times of Life" by Amy Florian

At its heart, financial planning isn't about money; it's about people. "No matter how skilled you are at managing money, you might have to help a client when they are dealing with grief," says Misty Lynch, a certified financial planner and director of financial planning at Beck Bode in Boston. "Avoiding feelings is a mistake a lot of advisors make because it makes them feel uncomfortable." But advisors can be a huge help to clients during emotional transitions.

Florian's book will teach you how. "(It) gives practical tips on how to quit saying, 'I'm sorry' or go-to phrases and have a real, meaningful conversation about what your client is going through," Lynch says. "And if you can ever hear (Florian) speak, do yourself a favor and sign up. She is brilliant."

"Creating Money: Attracting Abundance" by Sanaya Roman

Roman's book may lean more toward the spiritual side of money mindsets, but its potential impact can't be overlooked. While unconventional compared to most finance books, it was incredibly helpful when Lynch started to examine her own thoughts about money, she says.

It's broken into four parts, starting with a section that helps you think about how your thoughts and energy attract what you want. "This may sound a little woo for an investment advisor," Lynch says, "but our thoughts drive our actions and our results."

The second part discusses the limiting beliefs you may harbor and how you can move past them. "So much of what we think about money was handed down to us and never questioned," Lynch says. "Even professionals have thoughts about money that can hold us back."

Next, the book takes readers through a section where you define what you love to do and how you can align it with the ways you make money. "There are plenty of people in jobs they don't even like for many reasons, and this chapter is a guide to get everyone thinking bigger," Lynch says.

The final chapter focuses on having money, which may sound easy, but if your "normal" state is being broke, your brain may guide you in a self-fulfilling broke prophecy.

"Overall, this book is fantastic for anyone who is willing to do some mindset work and feel better about money," Lynch says.

"The Most Important Thing: Uncommon Sense for the Thoughtful Investor" by Howard Marks

In the words of Marks, "You can't predict. You can prepare." After decades as a professional investor, Marks compiled excerpts from memos he sent to his clients to create "The Most Important Thing."

In it, Marks "explains his rules-based process, investment philosophy and thoughts on risk in a truly remarkable and effective manner," says B. Brandon Mackie, a certified financial planner and managing associate at Felton & Peel Wealth Management in Georgia and New York. The result is not an investing manual or how-to book. It's one man's philosophy and words of wisdom from a lifetime of experience.

"It reads more like a novel than a finance book, and you're learning from a professional – an expert that manages over $100 billion in assets and has been a professional investor for 50 years," Mackie says. "Passing on the chance to absorb that wisdom is a mistake in any market."

"The Behavioral Investor" by Daniel Crosby

Psychologist and behavioral finance expert Crosby is the man you want guiding you through investors' heads. Trained as a clinical psychologist, Crosby has applied his behavioral insights to his work as an asset manager and bestselling author.

In "The Behavioral Investor," Crosby "delivers what is arguably the most comprehensive guide to the psychology of asset management to date," says Joy Lere, a psychologist and consultant specializing in behavioral finance. "Crosby educates readers about the ways in which an investor's social milieu, psychology and neurobiology combine forces to impact behavior and decision-making."

Advisors who want to create and maintain a competitive edge by integrating behavioral finance in their practices shouldn't be without this book, she says. You'll get that inside edge you need through Crosby's practical, actionable strategies for successful wealth management.

"The modern-day investor's portfolio is incomplete without a copy of this book," Lere says.

"The Psychology of Money" by Morgan Housel

Housel's book takes a narrative approach to revealing human relationships with money. Through 19 short stories, Housel brings to life the complex psychology of money.

The book covers the same personal finance concepts you've probably learned before, but Housel reframes them in a way that makes you rethink your unique relationship with money, says Travis Briggs, CEO of Robo Global U.S.

"The lessons in this book are life-altering," and the "narrative captures the reality that it takes more than numbers to compute the complex calculus that is financial psychology," Lere says. It reveals the "timeless truths about the human experience of money."

"Women of The Street: Why Female Money Managers Generate Higher Returns (and How You Can Too)" by Meredith Jones

"If you want to have a fighting chance of winning the Wall Street World Series, then it will behoove you to throw like a girl," Lere says. "While the finance industry remains a field dominated by male players, Jones hits it out of the park with this valuable playbook."

Drawing from behavioral and biological investment research and interviews from top female money managers , her book shows why women make better investors.

"She helps readers understand the ways in which females in finance have a tendency to show up on the field in unique ways cognitively and behaviorally that ultimately yield a powerful edge and create outsized investment returns."

"Security Analysis" by Benjamin Graham and David Dodd

Most financial advisors know about "The Intelligent Investor," but how many have unearthed the great finance book that is "Security Analysis"?

First published in 1934, it laid the foundation of value investing before value investing was a thing. The latest edition includes 200 pages of commentary by leading Wall Street money managers, so you get to hear not only from "the Father of Value Investing" himself, but from modern practitioners of his philosophies as well.

Tags: money , books , financial advisors , personal finance , financial literacy

The Most Important Ages for Retirement Planning

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

You May Also Like

10 best value stocks to buy now.

Ian Bezek April 12, 2024

Water Stocks and ETFs

Matt Whittaker April 12, 2024

Cheap Dividend Stocks to Buy Under $10

Wayne Duggan April 11, 2024

5 Best Large-Cap Growth Stocks

Glenn Fydenkevez April 11, 2024

5 Socially Responsible Investing Apps

Coryanne Hicks April 10, 2024

7 Diabetes and Weight Loss Drug Stocks

Brian O'Connell April 10, 2024

7 Best Socially Responsible Funds

Jeff Reeves April 10, 2024

Dividend Stocks to Buy and Hold

Wayne Duggan April 9, 2024

What Is a Stock Market Correction?

Marc Guberti April 9, 2024

If You Invested $10,000 in SMCI IPO

7 Best Cybersecurity Stocks to Buy

Glenn Fydenkevez April 8, 2024

10 Best Tech Stocks to Buy for 2024

Wayne Duggan April 8, 2024

9 Best Cheap Stocks to Buy Under $5

Ian Bezek April 5, 2024

5 Best Charles Schwab Money Market Funds

Tony Dong April 5, 2024

How Stocks Perform in Election Years

Wayne Duggan April 4, 2024

10 Best AI Stocks to Buy

Lithium Stocks to Buy Now

Brian O'Connell April 3, 2024

Kiyosaki's Record Predicting Crashes

Wayne Duggan April 3, 2024

9 of the Best REITs to Buy for 2024

Wayne Duggan April 2, 2024

6 Best Cryptocurrencies to Buy

John Divine April 2, 2024

- Business Financial Planning: How to Create Business Financial Plan

- Post author: fincart

- Post published: January 8, 2024

- Post category: Financial Planning

Table of Contents

In this fast and competitive world, the success of a business depends on how prepared they are. Prepared to adapt, to keep up with rivals, to handle the unexpected, and to seize opportunities as they arise. Through Business Financial Planning, businesses can fortify their foundation for success. They can gain insights by making use of their past performance data, their current situation, and trends to make predictions about future performances. They can make efficient use of their resources to maximise profit and wealth to keep all stakeholders happy. Since financial planning is so important for businesses, they hire a business financial consultant to help create a solid financial plan for sustained, long-term growth.

In this blog, let us understand the meaning of business financial planning, how it benefits businesses, how you can create a financial plan for your business, and see how different business financial plans are from individual ones.

What is Business Financial Planning?

With business financial planning, you create the blueprint for your business’s financial future. It details the financial management of your overall business plan. Through it, you decide the allocation of resources, monitor cash flows, decide the budget, manage liabilities, make projections and forecasts, manage risk, and much more, ultimately improving efficiency and achieving your short and long-term business goals. Basically, doing financial planning for business gives you insights to make smart and sustainable decisions. It is a comprehensive approach that ensures that your business not only survives but thrives in the ever-changing market dynamics. It needs to be strong and built on a solid foundation because when you try to grow your business and seek investors or loans, your financial plan will become the bedrock of credibility and confidence.

The importance of financial planning in business

For any business, the Importance of Financial Planning cannot be overstated. It is essential to the success of any business. Here’s why –

- Through financial planning, entrepreneurs gain insights that keep them informed and improve their decision-making.

- A financial plan outlines the business strategies that an entrepreneur will use over the course of the next month, quarter, or financial year.

- Entrepreneurs can use financial plans to assess their past and current situation, the progress of their goals, and their resources. It helps them keep track of their financial performance, identify areas of improvement, and make informed decisions to ensure the optimal allocation of resources for sustained growth and success.

- When the resources are optimally allocated, business owners can increase their profitability and sustainability.

- Financial plans can also help identify risk areas in advance which enables business owners to develop strategies to mitigate them.

- If you are a new business owner or are looking to start a business, it’s important to seek guidance from experts. A business financial planner can make sure you cover every essential component in your plan and ensure it aligns with your business goals.

- Consider the local aspects of your business and ask yourself, “Can a business financial advisor near me help me get started with my financial planning?” With help from a local business financial consultant, you will receive personalised insights tailored to the specific needs and challenges of your new venture while keeping in mind the competition and market trends in your area.

- Explore different business finance consulting services, and leverage the expertise of professionals who can help your business grow and succeed.

Benefits of financial planning for business

A well-crafted business financial plan lays the foundation for stable growth. Let’s list down some ways in which making a financial plan can benefit your business –

1. Cash Flow Management

As the name suggests, cash flow refers to the money coming in and out of your business. Usually, when a business is new, it will spend more money than it will earn, so your expectations about cash flow should be realistic. Through a financial plan, you will be able to forecast and manage cash flows effectively and avoid underflows or overflows.

2. Risk Management

A business faces many different types of financial risks , such as credit risk, liquidity risk, legal risk, operational risk, systematic risk, and market risk. A financial plan helps a business stay prepared for such dangers through forecasts and scenario planning. It will also compel you to create contingencies to tackle unexpected circumstances.

3. Creates Transparency

A financial plan creates transparency among investors, executives, and employees. If you want to hire good employees, they would want to know how stable your business is, and how likely it is to succeed in the future. A good and transparent financial plan attracts investors and high-quality employees.

4. Cost Reduction

A part of your financial plan is your budget. When you assess your expenses, you will likely find areas where you can make cuts to save more money. Cost cutting will help your bottom line and make sure you utilise your resources more efficiently.

Also Read: What is Cost Reduction Strategy? A complete Guide

5. Funding Opportunities

A solid financial plan enhances your credibility and attracts potential investors. Investors will see how their money will be used and study your past performances. Similarly, if your business needs loans, banks will scrutinise your liabilities and how you’ve managed them. A good financial plan can ensure your business gets all the funding it needs.

6. Crisis Management

Through projections, forecasts, and scenario planning, you will see any financial crisis coming from far away. But there are cases when extremely unexpected events happen, such as the 2008 global economic crisis, or the COVID pandemic. A well-prepared financial plan not only enables you to identify potential crises in advance but also equips you with contingency measures to deal with such events. This includes having a comprehensive risk mitigation strategy, maintaining a sufficient cash reserve, and establishing clear communication to keep stakeholders informed.

7. Professional Guidance

These benefits highlight why businesses invest heavily in business finance consulting services. Seeking guidance from a business financial consultant comes with its own advantages, the first being benefiting from the specialised knowledge and experience of financial professionals. A business financial planner can also tailor your financial plan according to the unique needs and goals of your business, and help you by regularly reviewing and adapting your financial plan to changes in the market.

Steps to Develop a Business Financial Plan

Creating effective financial plans for businesses demands a thoughtful approach, honest assessment, and careful implementation. Understand that this plan is going to be your guide for the future, and how closely and effectively you follow it will determine whether or not you achieve your business goals. Here are three simple steps you can take to start creating a successful business financial plan –

A. Setting Financial Goals:

Start by setting attainable short-term and long-term financial goals that are aligned with your business vision. These objectives should be clear, measurable, and defined with a time horizon. Ask yourself some questions – Where do I want my business to be in the next year or five? Do I plan to expand my business? If so, in how many years? Do I want to hit a specific revenue target to attract investors? Be specific with your questions, as the answers will help you set realistic goals. Establishing such goals will provide a strategic framework and help you focus your financial efforts and resources toward specific milestones, which will ultimately steer your business in the direction you wanted and planned for.

B. Budgeting Techniques

A budget can help you dictate the flow of cash. It is a framework that includes your total income, total expenses, and investments and reserves. Assess your situation and note down all your income and its sources, such as sales income, investments, donors, investors, or other revenue streams. Now take a thorough look at your expenses such as daily operational costs, marketing, advertising, employee salaries, research and development of products, equipment, and technology. Of course, if you want to profit, your revenue should exceed all your expenses. A budget helps with exactly this, and more. It will allow you to allocate resources to different departments efficiently. It is essentially a constraint, and everyone must work within it. When you break down your budget, you’ll find it easy to track and manage it.

Also Read: Understanding Budgeting in Financial Management

C. Forecasting and Projections:

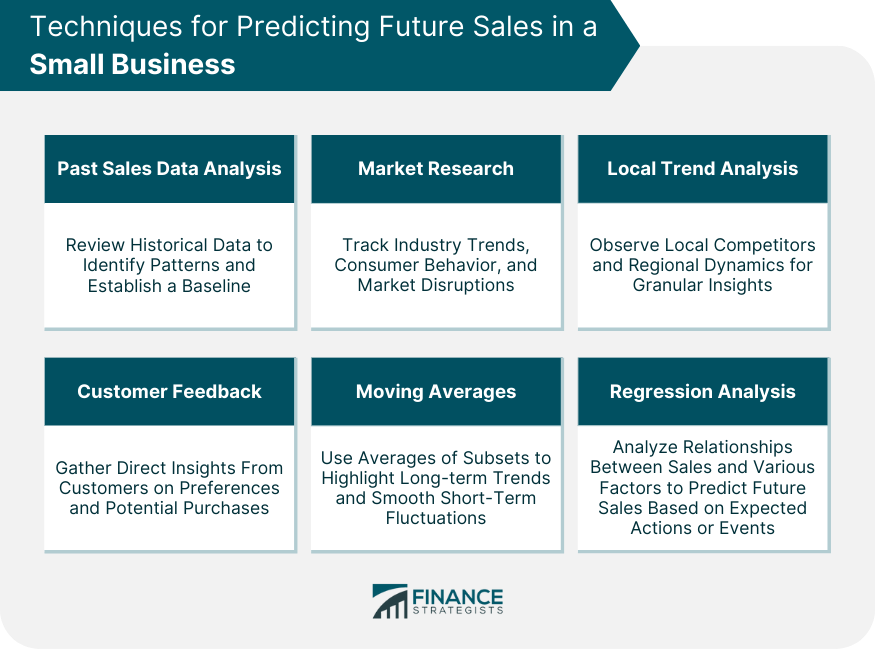

Now you have to create financial projections for different components such as income statements or balance sheets. These take into account the past performance, market trends, expenses you are expecting, and your sales forecast for the next month, quarter, or year. If you own a business that works with a very tight cash flow, you can also consider making a weekly projection.

Financial projections are important as they are shared with stakeholders, and help you navigate uncertainties and make sure that you remain on track toward your business goals. Take a look at your goals and work out how much it will cost you to reach them. Do this for a variety of scenarios – best case, worst case, or likely scenarios. This comprehensive scenario planning will help you stay prepared for any challenges and improve your decision-making.

Other than these steps you should make sure to plan for contingencies. Even though forecasts and projections give you a good idea of where you’re likely headed, they can’t predict the future. The world of finance especially is full of uncertainties, and a business should be prepared for them.

Make sure you have a decently sized cash reserve during slow periods or market downturns. Other things include making sure you have access to quick credit lines and liquid assets. Remember that financial planning doesn’t just stop after you craft the document. It is a continuous process, which means you should monitor and review your plan regularly and accordingly make adjustments.

Individual vs. Business Financial Plans

Here is how a business financial plan differs from that of an individual:

Conclusion:

Every business financial plan should clearly state three things – How the business will make its money, what it needs to do to achieve its goals, and its operational budget. We’ve seen the many benefits of a business financial plan, and how assessment, financial goals, budgeting, and projections can help you craft one. We’ve also seen that financial planning for business is a lot more complex and bigger in scope than individual financial planning. As a business owner, you will be answerable to your investors, employees, banks, and other stakeholders, so your financial plan needs to be transparent and have a solid base.

It would be wise for any business owner to consult with a business financial advisor. This professional guidance can provide valuable insights and expertise while crafting a comprehensive financial plan that is suited to your specific industry, goals, and competition. Their expertise will also help you with other aspects, such as risk management, investment decisions, and your optimising capital structure. By having them by your side, you can make informed decisions, and ensure the financial stability and growth of your business.

You Might Also Like

Gold VS Silver: Which is Better as an Investment?

How to Start Financial Planning in Your 40s?

What Are Some Golden Rules Of Financial Planning/Investment Strategies?

- Creating a Small Business Financial Plan

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 02, 2023

Get Any Financial Question Answered

Table of contents, financial plan overview.

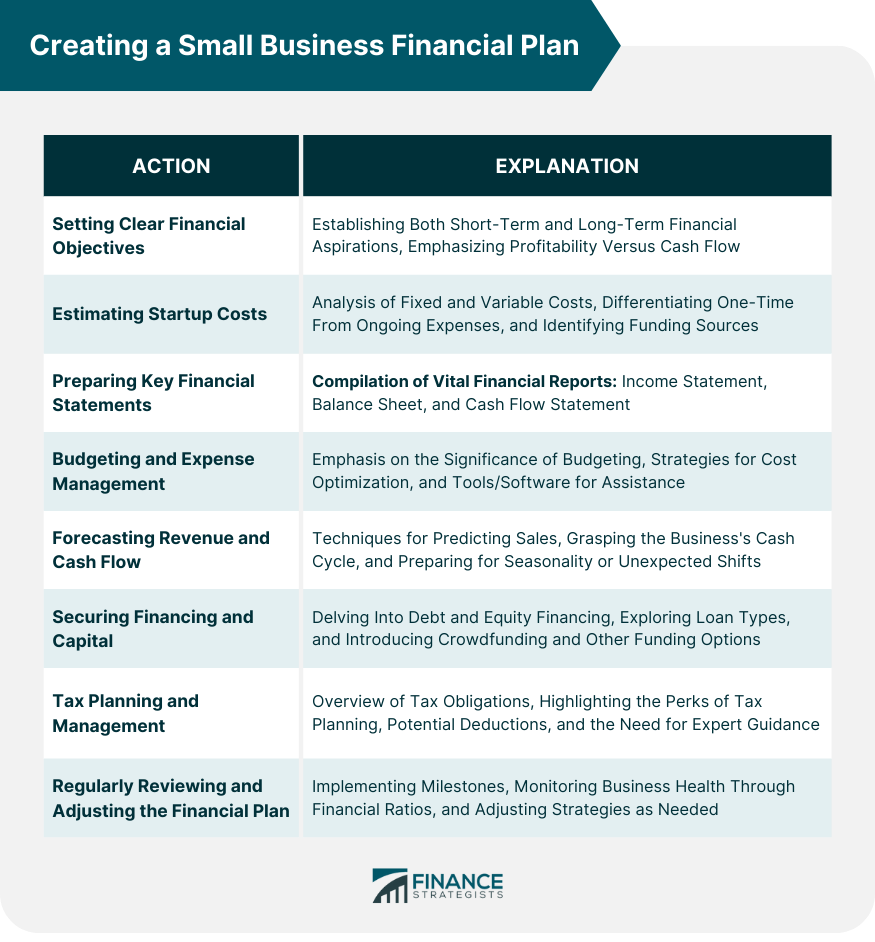

A financial plan is a comprehensive document that charts a business's monetary objectives and the strategies to achieve them. It encapsulates everything from budgeting and forecasting to investments and resource allocation.

For small businesses, a solid financial plan provides direction, helping them navigate economic challenges, capitalize on opportunities, and ensure sustainable growth.

The strength of a financial plan lies in its ability to offer a clear roadmap for businesses.

Especially for small businesses that may not have a vast reserve of resources, prioritizing financial goals and understanding where every dollar goes can be the difference between growth and stagnation.

It lends clarity, ensures informed decision-making, and sets the stage for profitability and success.

Understanding the Basics of Financial Planning for Small Businesses

Role of financial planning in business success.

Financial planning is the backbone of any successful business endeavor. It serves as a compass, guiding businesses toward profitability, stability, and growth.

With proper financial planning, businesses can anticipate potential cash shortfalls, make informed investment decisions, and ensure they have the capital needed to seize new opportunities.

For small businesses, in particular, tight financial planning can mean the difference between thriving and shuttering. Given the limited resources, it's vital to maximize every dollar and anticipate financial challenges.

Through diligent planning, small businesses can position themselves competitively, adapt to market changes, and drive consistent growth.

Core Components of a Financial Plan for Small Businesses

Every financial plan comprises several core components that, together, provide a holistic view of a business's financial health and direction. These include setting clear objectives, estimating costs , preparing financial statements , and considering sources of financing.

Each component plays a pivotal role in ensuring a thorough and actionable financial strategy .

For small businesses, these components often need a more granular approach. Given the scale of operations, even minor financial missteps can have significant repercussions.

As such, it's essential to tailor each component, ensuring they address specific challenges and opportunities that small businesses face, from initial startup costs to revenue forecasting and budgetary constraints.

Setting Clear Small Business Financial Objectives

Identifying business's short-term and long-term financial goals.

Every business venture starts with a vision. Translating this vision into actionable financial goals is the essence of effective planning.

Short-term goals could range from securing initial funding and achieving a set monthly revenue to covering startup costs. These targets, usually spanning a year or less, set the immediate direction for the business.

On the other hand, long-term financial goals delve into the broader horizon. They might encompass aspirations like expanding to new locations, diversifying product lines, or achieving a specific market share within a decade.

By segmenting goals into short-term and long-term, businesses can craft a step-by-step strategy, making the larger vision more attainable and manageable.

Understanding the Difference Between Profitability and Cash Flow

Profitability and cash flow, while closely linked, are distinct concepts in the financial realm. Profitability pertains to the ability of a business to generate a surplus after deducting all expenses.

It's a metric of success and indicates the viability of a business model . Simply put, it answers whether a business is making more than it spends.

In contrast, cash flow represents the inflow and outflow of cash within a business. A company might be profitable on paper yet struggle with cash flow if, for instance, clients delay payments or unexpected expenses arise.

For small businesses, maintaining positive cash flow is paramount. It ensures that they can cover operational costs, pay employees, and reinvest in growth, even if they're awaiting payments or navigating financial hiccups.

Estimating Small Business Startup Costs (for New Businesses)

Fixed vs variable costs.

When embarking on a new business venture, understanding costs is paramount. Fixed costs remain consistent regardless of production levels. They include expenses like rent, salaries, and insurance . These are predictable outlays that don't fluctuate with business performance.

Variable costs , conversely, change in direct proportion to production or business activity. Think of costs associated with materials for manufacturing or commission for sales .

For a startup, delineating between fixed and variable costs aids in crafting a more dynamic budget, allowing for adaptability as the business scales and evolves.

One-Time Expenditures vs Ongoing Expenses

Startups often grapple with numerous upfront costs. From purchasing equipment and setting up a workspace to initial marketing campaigns, these one-time expenditures lay the foundation for business operations.

They differ from ongoing expenses like utility bills, raw materials, or employee wages that recur monthly or annually.

For a small business owner, distinguishing between these costs is critical. One-time expenditures often demand a larger chunk of initial capital, while ongoing expenses shape the monthly and annual budget.

By categorizing them separately, businesses can strategize funding needs more effectively, ensuring they're equipped to meet both immediate and recurrent financial obligations.

Funding Sources for Small Businesses

Personal savings.

This is often the most straightforward way to fund a startup. Entrepreneurs tap into their personal savings accounts to jumpstart their business.

While this method has the benefit of not incurring debt or diluting company ownership, it intertwines the individual's personal financial security with the business's fate.

The entrepreneur must be prepared for potential losses, and there's the evident psychological strain of putting one's hard-earned money on the line.

Loans can be sourced from various institutions, from traditional banks to credit unions . They offer a substantial sum of money that can be paid back over time, usually with interest .

The main advantage of taking a loan is that the entrepreneur retains full ownership and control of the business.

However, there's the obligation of monthly repayments, which can strain a business's cash flow, especially in its early days. Additionally, securing a loan often requires collateral and a sound credit history.

Investors, including angel investors and venture capitalists , offer capital in exchange for equity or a stake in the company.

Angel investors are typically high-net-worth individuals who provide funding in the initial stages, while venture capitalists come in when there's proven business potential, often injecting larger sums. The advantage is substantial funding without the immediate pressure of repayments.

However, in exchange for their investment, they often seek a say in business decisions, which might mean compromising on some aspects of the original business vision.

Grants are essentially 'free money' often provided by government programs, non-profit organizations, or corporations to promote innovation and support businesses in specific sectors.

The primary advantage of grants is that they don't need to be repaid, nor do they dilute company ownership. However, they can be highly competitive and might come with stipulations on how the funds should be used.

Moreover, the application process can be lengthy and requires showcasing the business's potential or alignment with the specific goals or missions of the granting institution.

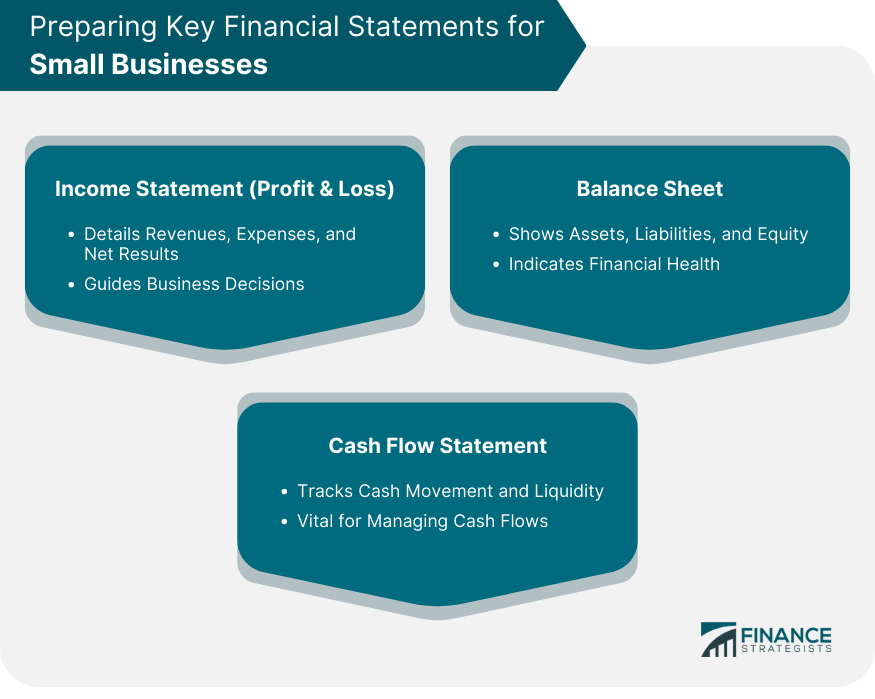

Preparing Key Financial Statements for Small Businesses

Income statement (profit & loss).

An Income Statement , often termed as the Profit & Loss statement , showcases a business's financial performance over a specific time frame. It details revenues , expenses, and ultimately, profits or losses.

By analyzing this statement, business owners can pinpoint revenue drivers, identify exorbitant costs, and understand the net result of their operations.

For small businesses, this document is instrumental in making informed decisions. For instance, if a certain product line is consistently unprofitable, it might be prudent to discontinue it. Conversely, if another segment is thriving, it might warrant further investment.

The Income Statement, thus, serves as a financial mirror, reflecting the outcomes of business strategies and decisions.

Balance Sheet

The Balance Sheet offers a snapshot of a company's assets , liabilities , and equity at a specific point in time.

Assets include everything the business owns, from physical items like equipment to intangible assets like patents .

Liabilities, on the other hand, encompass what the company owes, be it bank loans or unpaid bills.

Equity represents the owner's stake in the business, calculated as assets minus liabilities.

This statement is crucial for small businesses as it offers insights into their financial health. A robust asset base, minimal liabilities, and growing equity signify a thriving enterprise.

In contrast, mounting liabilities or dwindling assets could be red flags, signaling the need for intervention and strategy recalibration.

Cash Flow Statement

While the Income Statement reveals profitability, the Cash Flow Statement tracks the actual movement of money.

It categorizes cash flows into operating (day-to-day business), investing (buying/selling assets), and financing (loans or equity transactions) activities. This statement unveils the liquidity of a business, indicating whether it has sufficient cash to meet immediate obligations.

For small businesses, maintaining positive cash flow is often more vital than showcasing profitability.

After all, a business might be profitable on paper yet struggle if clients delay payments or unforeseen expenses emerge.

By regularly reviewing the Cash Flow Statement, small business owners can anticipate cash crunches and strategize accordingly, ensuring seamless operations irrespective of revenue cycles.

Small Business Budgeting and Expense Management

Importance of budgeting for a small business.

Budgeting is the financial blueprint for any business, detailing anticipated revenues and expenses for a forthcoming period. It's a proactive approach, enabling businesses to allocate resources efficiently, plan for investments, and prepare for potential financial challenges.

For small businesses, a meticulous budget is often the linchpin of stability, ensuring they operate within their means and avoid financial pitfalls.

Having a well-defined budget also fosters discipline. It curtails frivolous spending, emphasizes cost-efficiency, and sets clear financial boundaries.

For small businesses, where every dollar counts, a stringent budget is the gateway to financial prudence, ensuring that funds are utilized judiciously, fostering growth, and minimizing wastage.

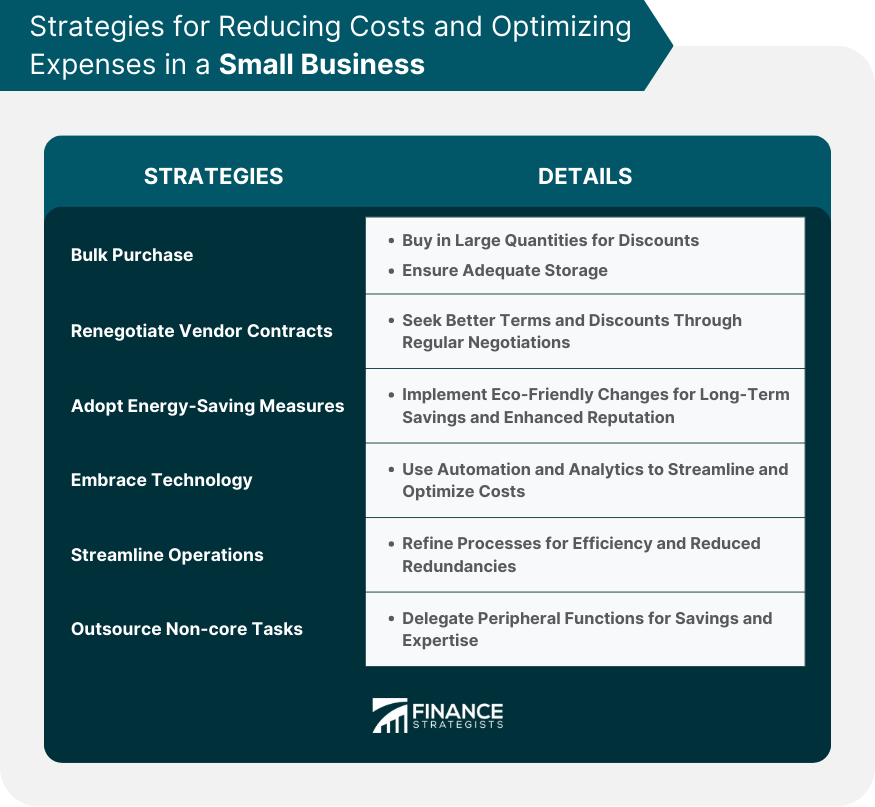

Strategies for Reducing Costs and Optimizing Expenses

Bulk purchasing.

When businesses buy supplies in large quantities, they often benefit from discounts due to economies of scale . This can significantly reduce per-unit costs.