- Member Communities

- Learning Dashboard

- Materials Library

- Best Practices

Capital Project Monitoring and Reporting

The financial management of major capital projects requires a substantial commitment of organizational time and resources. Given their scale and cost, these capital projects can represent a significant undertaking for local governments. Consequently, governmental entities should establish policies and procedures to support effective capital project monitoring and reporting to assist in the management of these significant projects. Such efforts can improve financial accountability, enhance operational effectiveness and promote citizens’ confidence in their government.

In many jurisdictions, finance officials are called upon to oversee or directly perform capital project monitoring and reporting activities. To successfully perform those activities, finance officials should be familiar with project management practices, software systems for project management and project accounting, and capital project reporting procedures.

GFOA recommends that jurisdictions establish policies and processes for capital project monitoring and reporting. GFOA advises officials to:

1. Identify and incorporate legal and fiduciary requirements into capital monitoring and reporting processes. Because finance officials are typically involved with ensuring that capital project activity is consistent with applicable laws and organizational rules and procedures, initial efforts should focus on understanding requirements that relate to:

- Auditing and financial reporting needs consistent with generally accepted accounting principles and jurisdictional accounting requirements.

- Any arbitrage regulations, bond covenants, and/or bond referenda requirements related to long-term debt that may be used to finance capital projects. In addition, ensure that all reporting of bond related projects/programs is consistent and in compliance with SEC regulations.

- State and local laws, including such areas as debt capacity limits, voter authorization, capital budgeting requirements, as well as public bidding and reporting requirements.

- Capital project contract language and the jurisdiction’s contracting practices.

- The relationship between each project and the jurisdiction’s planning processes, including specific initiative plans, local master plans, and any regional or state plans that may impact any planned projects.

- Grant administration and reporting requirements related to the specific grant(s) to be used for capital projects.

2. Identify relevant data for external and internal stakeholder information needs. Finance officials may also be called upon to compile cost and performance data for diverse stakeholders. With this in mind, financial officials responsible for capital monitoring and reporting should:

- Identify key stakeholders involved in capital projects, for example, project oversight staff, project engineers, contractors, finance and budget staff, executive management, bondholders, rating agencies, grantors, elected officials, and constituents.

- Identify the business needs of key participants, including timing status, cost activity, and project scope.

- Establish project milestones, performance measures and reporting criteria based on stakeholder needs and legal and fiduciary requirements.

- Collaborate with participants to determine the content of reports and the preferred reporting tools of various stakeholders, including the depth and frequency of information, established expectations and notable variances. For example, larger entities with a substantial number of similar routine capital projects may consider providing information for routine capital projects at a program level, rather than providing information for each individual project.

3. Plan and design systems to collect, store, and analyze project data and to report results. Often, more than one system or technological solution is required to properly address all informational requirements. To assist in this process, responsible officials should:

- Decide which system will be the primary system(s) for storing capital project financial and/or operational data.

- Assure that appropriate system controls and security have been incorporated, consistent with the jurisdiction’s technology standards.

- The appropriate technological solutions for project accounting, scheduling and reporting. Solutions may include spreadsheets, customized databases, ERP systems, or project management software, and may differ based on the scope, complexity, and cost of each project.

- Positional roles, including access, input and editing privileges for system users who will be charged with compiling, analyzing and reporting financial and management information.

- The process for controlling and managing changes to project scope, schedule, cost, funding, and contract requirements.

- Processes for identifying direct and indirect asset construction component costs.

- Accountability and data integrity within the financial management system.

- Data accuracy. This is particularly important when there are interfaces between separate information systems, such as geographic information systems, project management systems and financial systems. Careful consideration should be given to avoid duplicative data among these different systems.

- Triggers and protocols for identifying and addressing project cost overruns and schedule delays.

- When selecting a system or means to monitor/manage projects, take steps to ensure it will provide the capability to report on projects and programs with minimal manual effort. (See recommendation #4 for information on reporting.)

4. Regularly monitor capital projects’ financial and project activity information. Once legal, fiduciary, and other reporting requirements have been established and information systems are in place, finance officials should monitor capital project activity on a regular basis. At a minimum, such monitoring should include:

- Confirmation that a project plan exists that identifies all required resources and milestone work products and assurance that the project plan is being followed.

- Confirmation that the project’s scope has been clearly identified upon completion of final design and that the project stays within scope or that changes to scope have been made consistent with an established process.

- A review of project-related financial transactions to support budget review, auditing and asset management.

- A review of expenditures, both in relation to the current budget, and over the entire project life.

- A review of any project retainages, warranties, or other conditional performance schedules.

- Review of encumbrances and estimates of planned expenditure activity.

- Confirmation of continued availability and appropriateness of revenue sources identified in the capital budget.

- Confirmation of the adequacy of cash flow in relation to project requirements.

- Review of the timing of investment maturities compared to planned project disbursements.

- Review of sources and project uses of bond proceeds and grants.

- Results compared to established measures of performance, including, at a minimum, cost and schedule performance indices.

5. Reporting on project status and activities. Producing project status reports will help keep officials informed regarding project progress. In establishing report content and frequency it is important to keep in mind that high profile projects often require more extensive reporting of activity compared to a jurisdiction’s more routine capital projects, which may be better addressed at a program level. It is important to be consistent and use plain language when compiling information from various sources and reporting it to multiple stakeholders. Meaningful reports should provide straightforward project information for executive leadership and internal staff as well as citizens and the media, and, at minimum:

- Percent of project completed

- Percent of project budget expended

- Progress on key project milestones

- Contract status information including time remaining and percentage used

- Revenue and expenditure activity

- Cash flow and investment maturities

- Funding commitments

- Available appropriation

- Comparison of results in relation to established performance measures

- Highlight significant changes to project scope, costs, schedule, or funding.

- To aid in the reporting, an annual snapshot of key schedule, cost estimate, and available funding information should be taken to establish baseline data for performance measures and report components.

6. Project close-out. Upon project completion, ensure that actions are taken to finalize project activity, including, at minimum:

- Confirming that the project is closed out appropriately within all systems used to manage, monitor and report on the project.

- Confirm that all remaining contract encumbrances are properly closed out and remaining funds are handled appropriately.

- Confirming that the established procedures for user acceptance of project work and final project completion have been followed.

- Confirming that all closeout and reporting requirements of grantors and bond covenants have been completed.

- Confirming that all project close out data is properly recorded on the fixed assets schedule and capital assets are added to the government’s capital asset tracking system, if any.

- Confirming that procedures are in place to meet any continuing disclosure or ongoing reporting requirements.

7. Evaluate monitoring and reporting activities. In order to ensure that capital project monitoring and reporting practices continue to be effective and relevant to the organization, jurisdictions should conduct a periodic review of these practices, including at minimum:

- An inspection of reporting data for accuracy and completeness.

- The existence and adequacy of measures used for quality assurance and control in each phase of capital projects.

- Solicitation of feedback from stakeholders on the adequacy and relevance of reports and reporting tools, including the extent to which business needs are being addressed.

- A comparison of the organization’s report format and content to other agencies’ practices.

- An assessment of the adequacy of communication between various organizational units.

Updated October, 2017

References:

- Capital Improvement Programming: A Guide for Smaller Governments , GFOA, 1996

- Recommended Budget Practices: A Framework for Improved State and Local Government Budgeting , National Advisory Council on State and Local Budgeting, 1998.

- “Managing the Capital Planning Cycle: Best Practice Examples of Effective Capital Program Management,” Government Finance Review , GFOA, 2004.

- Capital Budgeting and Finance: A Guide for Local Governments , ICMA, 2004.

- Preparing High Quality Budget Documents , GFOA, 2006.

- “Staying on Track: Crafting a Capital Program Reporting System,” Government Finance Review , GFOA, 2006.

- Distinguished Budget Presentation Awards Program, Awards Criteria and Explanations of the Criteria , GFOA.

- Board approval date: Wednesday, October 31, 2007

- Search Search Please fill out this field.

What Is a Capital Project?

Understanding capital projects, examples of capital projects, capital project funding, what are capital projects in government, what is a noncapital project, what makes a capital project successful.

- Corporate Finance

- Corporate Finance Basics

Capital Project: Definition, Examples, and How Funding Works

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Yurle Villegas / Investopedia

A capital project is a long-term, capital-intensive investment to build upon, add to, or improve a capital asset . Capital projects are defined by their large scale and large cost relative to other investments that involve less planning and resources.

Key Takeaways

- A capital project is an often-pricey, long-term project to expand, maintain, or improve upon a significant piece of property.

- A capital project is distinct from other company projects as it is large in scale, high-cost, and requires considerable planning relative to other investments.

- Capital projects often refer to infrastructure, like roads or railways, or, in the case of a corporation, the development of a manufacturing plant or office.

A capital project is a large-scale project with a high cost that is capitalized or depreciated .

Regular capital investments, such as new facilities, structures, or systems, may be necessary to accelerate growth within a company or government—for example, if a company wants to build a new warehouse or purchase new manufacturing equipment to increase efficiency on the factory line.

Capital projects typically consist of the public sector building or maintaining infrastructure, such as roads, railways, and dams, and companies upgrading, expanding, or replacing their facilities and equipment.

Capital projects must be managed appropriately, for they require a significant commitment of company resources and time. The project assumes a calculated risk with the expectation that the capital asset pays off. Management of risk is a key driver of successful project development and delivery of a capital project.

The most common examples of capital projects are infrastructure projects such as railways, roads, and dams. In addition, these projects include assets such as subways, pipelines, refineries, power plants, land, and buildings.

Capital projects are also common in corporations . Corporations allocate large amounts of resources ( financial and human capital ) to build or maintain capital assets, such as equipment or a new manufacturing project. In both cases, capital projects are typically planned and discussed at length to decide the most efficient and resourceful plan of execution.

Capital projects are big investments and, therefore, face a lot of scrutiny, especially when paid for with public funds or the money of a publicly traded company . The goal is for these investments to pay off, but sometimes they are poorly planned and executed and end up losing significant capital .

These projects are big, take time to complete, and can cost a lot of money, meaning it is often necessary to obtain equity or debt financing to make them happen. To receive funding, capital projects are obligated to prove how the investment provides an improvement (additional capacity), new useful feature, or benefit (reduced costs). Analysts might use the return on new invested capital (RONIC) calculation to evaluate if the return on a project is worthy of the capital investment.

Additional funding sources for these projects include bonds , grants , bank loans , existing cash reserves , company operation budgets , and private funding. These projects may require debt financing to secure funding. Debt financing may also be required for infrastructure, such as bridges. However, the bridge cannot be seized if the builder defaults on the loan. Debt financing ensures that the financier can recover funds if the builder defaults on the loan.

Economic conditions and regulatory changes can affect the start or completion of capital projects, as in the case of Brexit , which caused the cancellation or delays of some projects in Britain.

In the United States, Congress is responsible for funding public capital projects, such as roads, power lines, bridges, and dams.

Government capital projects are large-scale, costly projects to maintain or improve public assets, such as parks, roads, and schools.

Most public offices set thresholds for what qualifies as a capital project. For example, in the Commonwealth of Virginia, a capital project is defined as a project that creates at least 5,000 gross square feet of building space or exceeds $3 million in total project cost. Projects that fall under each jurisdiction’s thresholds, which can also include life expectancy, may instead be called noncapital projects.

Careful planning and realistic estimates do. Affordable funding needs to be secured, costs need to be managed well, and the project must have a very good chance of becoming profitable. One or two setbacks could turn a capital project into a financial disaster.

The Bottom Line

Capital assets are key revenue generators and the backbone of many companies. Those wishing to expand and become more profitable will need to invest in capital projects and do so in the most cost-effective way possible. Over time, it is smart, well-executed investments that separate the good stocks from the weak ones.

Marwan Mohamed, Erika Anneli Pärn, and David J. Edwards, via ResearchGate. “ Brexit: Measuring the Impact Upon Skilled Labour in the UK Construction Industry .” International Journal of Building Pathology and Adaptation , Vol. 35, No. 3, Pages 264–279.

Construction Products Association. “ Brexit—Impact on Construction Products .”

Industrial Engineering and Operations Management Society. “ BREXIT: Assessing the Impact on the UK Construction Industry & Mitigating Identified Risks .”

U.S. Capitol Visitor Center, via Internet Archive. “ What Congress Does .”

Virginia Tech, Division of Campus Planning, Infrastructure, and Facilities. “ Understanding Capital vs. Non-Capital Projects .”

:max_bytes(150000):strip_icc():format(webp)/home-69b193bd335d409c9addf5e28854cec3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Business Case Development

- Cost Modeling

- Service Mapping

- Broadband Network

- Address Matching & Georeferencing

- BroadbandFabric Data Suites

- OnLook Analytics App

- NetworkPlan

- CBG Ops. Assessment

- Data Packages

- Key Features

- Company News

- Customer Help Center & Community

- National Fabric Resources

- FCC BDC & USAC HUBB Filings Guide

- Cost Trend Reports

- State Dashboard

- BEAD Funding Program

- State Broadband Center

- RDOF Resource Center

- Capital Projects Center

- Current & Past Work

Capital Projects Fund Reporting and Compliance Requirements

Requirements for capital projects fund recipients.

Understand reporting and compliance requirements recipients of Capital Projects Fund grants must fulfill once awarded funding.

Home » Resources » Capital Projects Fund Center » Capital Projects Fund Reporting and Compliance Requirements

Explore Topics

Capital Projects Fund Overview

Eligible applicants, allocation details, application process, capital projects examples.

Reporting & Other Requirements

Capital Projects Fund – Reporting and compliance requirements

Recipients of allocation grants from the Capital Projects Fund are required to “meet construction, reporting, and compliance requirements.”

Treasury says they will put out more detailed information about fulfilling these requirements in the coming weeks.

Public reporting requirements

Required under Transparency Laws, Treasury must legally disclose to the public:

- Grant Recipients names

- Amount of grants awarded

- Other information provided by Recipients in their Grant applications or Grants Plans

Treasury stated in their guidance they “will post this information on their website and report this information on the usaspending.gov website, which allows the public to see how the federal government has distributed COVID-19 relief funding.”

Other reporting requirements

Each Capital Projects Fund Recipient will be responsible for completing the reporting requirements as listed below:

- Submit Project and Expenditure Reports – Reports submitted quarterly to Treasury that include data in relation to “Projects, expenditures, Project status, sub awards, civil rights compliance, equity indicators, community engagement efforts, programmatic data such as geospatial data for Broadband Infrastructure Projects, and other measures as determined by Treasury.” These reports aim to give the public transparency on whether Capital Projects are practicing and promoting efficient on-time and on-budget delivery. “Treasury will seek information from Recipients on their workforce plans and practices related to Capital Projects Fund Projects, as well as information about subcontracted entities.”

- Submit Performance Reports – Annually and demonstrate the results of the Capital Projects Fund-financed grant programs. “Reports must include data related to Project and Program outputs and outcomes against the stated objectives of the Recipient’s Grant Plan.” Costs associated with collecting and measuring performance data and conducting activities needed to establish and maintain a performance management and evaluation regime, including program evaluations conducted in support of Performance Report requirements, are eligible under the Capital Projects Fund.

The reporting requirements will vary by the use of allocation grants and project type. Treasury says they will put out more detailed information about fulfilling these requirements in the coming weeks 2 .

Compliance requirements for construction

Capital Projects Fund grant Recipients must complete an environmental checklist (available on the Capital Projects Fund website) to ensure projects funded comply with all applicable environmental laws.

Project completion details

Treasury states that all Capital Projects “reach substantial completion prior to December 31, 2026.”

As defined by Treasury substantial completion “is defined as the date for which the Capital Projects can fulfill the primary options that it was designed to perform, delivering services to end-users. At substantial completion, service operations and management systems infrastructure must be operational.”

Recipients are allowed to request an extension beyond December 31st, 2026 if the factors hindering the completion of the project are outside of the Recipient’s control. The extension requests will be accepted on a case-by-case basis by Treasury.

1 – U.S. DEPARTMENT OF THE TREASURY. (2021, September). Guidance for the Coronavirus Capital Projects Fund. Retrieved October 25, 2021, from https://home.treasury.gov/system/files/136/Capital-Projects-Fund-Guidance-States-Territories-and-Freely-Associated-States.pdf

2 – U.S. Department of Treasury. (2021, October 22). Capital Projects Fund. Retrieved November 02, 2021, from https://home.treasury.gov/policy-issues/coronavirus/assistance-for-state-local-and-tribal-governments/capital-projects-fund

Continue reading:

Have any questions?

- Broadband Service Mapping

- US GIS Data

- FCC BDC Filing & USAC HUBB Filing Guide

- RDOF Center

Privacy Overview

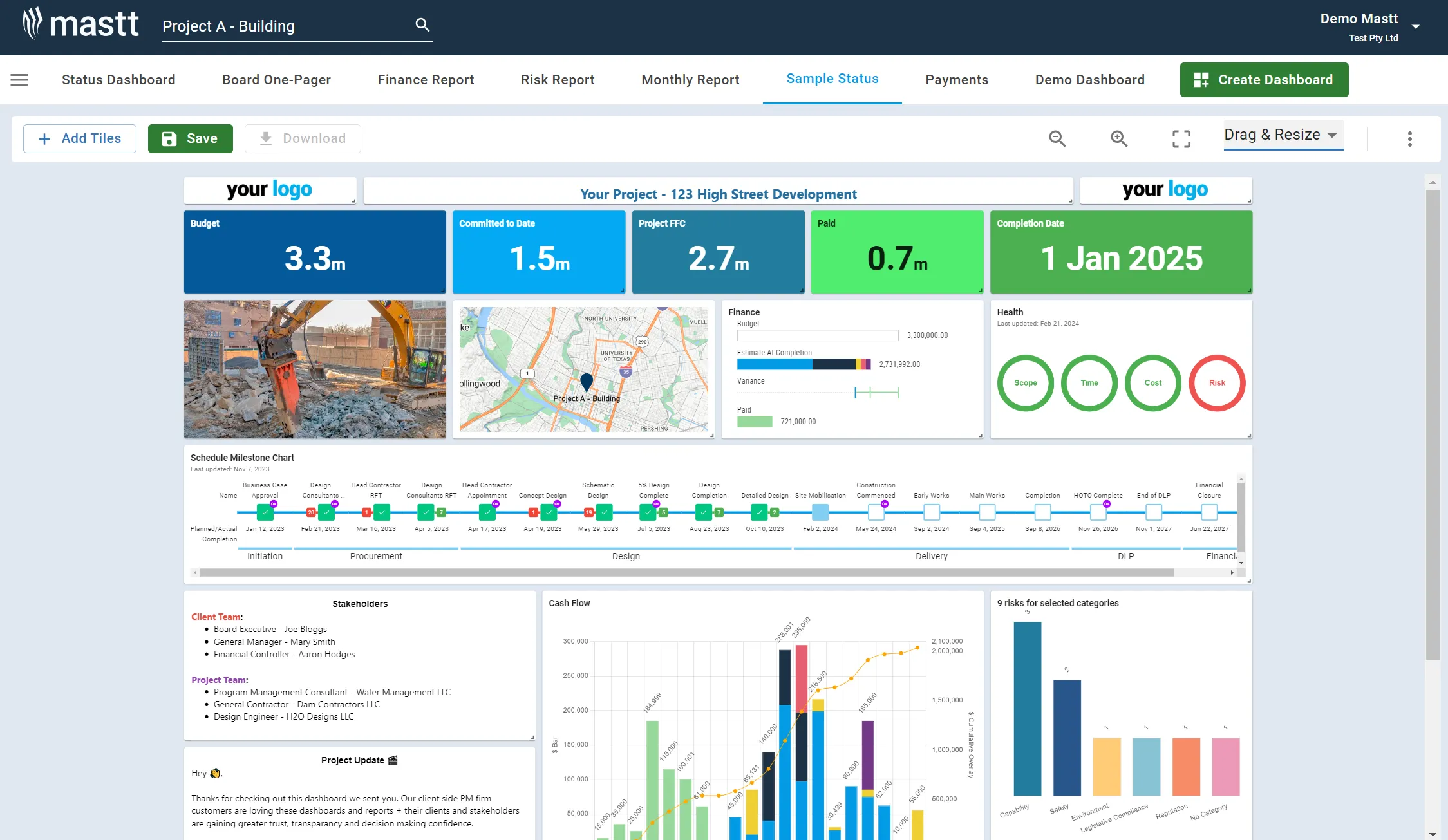

Fast, easy reports & dashboards instantly, anytime

Create high quality visualized reports, dashboards & more instantly from best practice Capital Project report templates

Supercharge your capital projects

Build, store & share interactive dashboards & reports, plus all the cost, time & risk controls you need with it.

- Get confident of timely, on-budget delivery

- Slash reporting time & boost profits

- Ensure complete program visibility 24/7, 365 days a year

See how Mastt delivers $50B+ worth of value

Real time information at your fingertips

Mastt reporting gives you insights on easy to use visual dashboards to analyse information, mitigate risk and make data driven decisions.

Jacob Edwards

Funds Manager

Since moving to Mastt, our reporting regime has become a lot simpler. We are able to report in real time so there's no delay in financial data being updated. The time it takes is a lot quicker, making the fund a lot more efficient for investors.

Simple, easy to use report & dashboards solutions automated

Save time and speed up reporting with the best automated tools to empower your team, eliminating error prone spreadsheets

Automated, Configurable Reports & Dashboards

Create high quality visualized reports, dashboards & more instantly from best practice Capital Project report templates. Trust that all project reporting & compliance data is centralised and standardised.

Create amazing templates, store and share easily

Automate report & dashboard templates for any report and make them available across your project, portfolio or business. Snapshot & store entire projects or reports for sharing, record keeping & compliance

All-In-One Solution for Project Controls

Streamline your reporting and eliminate duplication of effort with Mastt’s suite of automated budget, contract, risk and reporting tools for any Capital Project. Make drill down information a breeze.

Mastt works for every project and stage, from business case through to close-out.

Project dashboards.

Access project reporting anytime on live interactive dashboards with powerful data visualisations

Program and Portfolio Dashboards

Automatically generate real time program and portfolio reports at the touch of a button

Financial Reporting

Real time aggregated finances to see the true state of the program or portfolio

Risk Reporting

See the number 1 risk on your program or portfolio and stop issues before they occur

Maps and Spatial Data Reporting

View and profile information on detailed boundary maps of states, regions, electorates and more

One click PDF Reports

Automatically produce PDF reports with the click of a button

Andrew Benn, WSP Technical Director

"With Mastt, our client can see the status of the project anytime, reducing back and forth queries, and not having to wait until the end of the month to receive a monthly report."

Rebecca White, RPS Program Manager

"Mastt has saved our team significant time and effort in managing the financials elements of 65+projects. The team now has total visibility over their individual projects as well as the overarching program of works."

Erik Maasepp, Capital Insight Senior Project Manager

"Mastt takes away a lot of user error that spreadsheets bring. With Mastt, we are able to combine multiple projects into programs or portfolios for management level analysis and direction."

CAPT. Dan Foley, Army Digital Transformation Manager

"Mastt is increasing the team’s tempo and productivity by enabling real time information across our portfolio of projects. This transparency is assisting us to make informed decisions, to identify opportunities and reduce the risk."

Dan Atkins, Jacobs National Program Manager

"Mastt's ability to record critical financial information as well as program forecasted delivery and milestones put Jacobs in a favourable position to our clients."

.webp)

Mohammed Salameh, Compass' Associate Director

"Moving to Mastt is one of the best decisions my team has ever made. It’s cost-effective, easy to use, and a quick set up."

.webp)

Fergus Bruce, Project Manager at WSP

"A key factor in our decision to adopt Mastt is its user-friendliness. It had to continue to empower us to work smart, allowing us to consistently deliver excellence across multiple sectors and geographic regions."

Delivering Power to Capital Projects

Frequently Asked Questions

What type of customer support is available.

Mastt provides three tiers of support which you can read about here . We love our customers, and most deal with us over phone, email or through help.mastt.com . We also have the industry's largest free template library to support our customers here .

Can I download reports?

Yes, you can build your own dashboards and reports simply and easily with our Dashboard & Reporting module. We alsohave a simple one click report generator that produces reports in standard formats.

Can I access a demo to play with the system?

You can see a recorded demo here or we can arrange a 1:1 demonstration for you here . While we dont have a self serve version of Mastt yet, we will get you access before buying so you can confirm Mastt is right for you.

Can I add my company's branding to Mastt Dashboards?

Yes, personalize your Mastt experience by adding your company's branding to the dashboards and reports.

Am I able to add custom columns in Mastt?

Mastt has many columns predefined for consistency, but you can choose which ones to display. We’re certain we’ve got all the ones you need.

How do I adjust and filter data columns in Mastt?

Tailor the data presentation in Mastt with easy-to-use in-app column adjustments and filters.

Am I able to review historical data in Mastt?

Mastt focuses on current data; however, regular data exports can help you maintain historical records.

Can I download a PDF of my Project/Program Dashboard in Mastt?

Easily download a PDF of your dashboard right from Mastt for convenient sharing and printing.

Can I set up multiple Project/Program Dashboards in Mastt for different purposes?

Yes, create various dashboards or reports in Mastt to cater to different reporting needs and meetings. One project can have unlimited dashboards.

Where does Mastt's Project/Program Dashboard get its data?

The dashboard data comes from Mastt’s Cost, Risk, Schedule & other modules, ensuring centralization and real-time insights. We also have some tiles that are updated right on the dashboard, like our images and text fields. We can also pull data from other systems, right onto your dashboard!

Can I create my own Project/Program Dashboard Templates in Mastt?

Yes, personalize your reporting by creating your own dashboard templates in Mastt.

How easy is it to build a Project/Program Dashboard in Mastt?

Creating a dashboard in Mastt is straightforward, with intuitive tools and pre-built templates.

What are Mastt's pricing options?

Head to mastt.com/pricing to see all our pricing.

How do I input data into Mastt, and am I responsible for keeping it updated?

Yes, after onboarding, you're in charge of inputting and updating project data in Mastt, which occurs directly within the modules.

In which formats can I export my data from Mastt?

You can export your data from Mastt in Excel, CSV, or PDF formats, whichever suits your needs.

How can I easily retrieve data from Mastt?

Simply click to extract your data in your preferred format; it's quick and user-friendly.

How will I know if the data in Mastt is up-to-date?

Mastt displays 'Last Updated' timestamps to keep you informed about the freshness of your data.

Take control of every step in your Capital Project lifecycle

Request A Demo

- Analytics & Reporting

- Billings Management

- Building Information Modeling/Digital Twin

- Change Order Management

- Contract & Procurement Management

- Cost Budgeting & Forecasting

- Design Management

- Document Control & Turnover

- See All Solutions

- Product Finder

- Completions

- Resource Center

- Online Training

- Instructor Led Training

- Knowledge Library

- Whitepapers

- Customer Stories

- Industry Events

- Sustainability

- Contact Us & Locations

- Innovations

- Earned Value Management

- Analytics & Reporting

- Work Planning & Packaging

- Cost Budgeting & Forecasting

- Estimating & Pricing

- Scheduling & Short-Interval Planning

- Document Control & Turnover

InEight Project Controls

Our solutions deliver critical insights and streamline your work, fast.

PRODUCT FINDER

Start here to find the right project solution.

Visit Product Finder

InEight Estimate: T&T Construction Testimonial

Discover how InEight’s products have stayed on the cutting edge of...

- Contact & Locations

InEight Document Software Garners “Document Management Platform Of The Year” Award From LegalTech Breakthrough

Prestigious Annual Awards Program Recognizes Companies and Products Driving Innovation in the Global Legal Industry

- Virtual Instructor-Led Training

- White Papers

Data vs. Intelligence: The Power of Integrated Program Controls

May 30, 2024 | Recent advances in construction program controls have transformative potential, but success requires a thoughtful...

Newly released research shows that despite headwinds, there remains a strong sense of optimism in the construction industry. Our 2023 report highlights the findings from over 300 global construction organizations. Fill out the form below to access the full report.

GLOBAL CAPITAL PROJECTS OUTLOOK

Seeing the bigger picture together: connected data for smarter decisions.

The third edition of the Global Capital Projects Outlook from InEight continues to build upon the themes of optimism and digitization. We have found the industry is made of grit and determination, unshakeable in its confidence and resilience in the face of extreme pressure.

Four key themes are covered in the 2023 Edition:

- The transition to renewable energy is a beacon of hope

- There is a clear divide between the data haves and have nots

- Opportunity lies in technology sophistication

- Shared risk and greater collaboration are coming to the fore

The Report’s Objective

We continued to benchmark how owners and contractors are meeting the challenges of global construction industry trends. After three years, we are confident in providing significant insights that point to a bright future for integrated technologies.

Download Report

Methodology

The survey included 26 questions designed to gauge general confidence and optimism levels across the industry and assess track records, plans and attitudes towards digital transformation. Globally, 67% of respondents are project owners and 33% are contractors.

Chapter 1: Confidence and Growth

Against a backdrop of challenges including materials, equipment and labor sourcing, it is remarkable the construction industry remains highly confident. Its sights are firmly set on the opportunities presented by sustainable building projects, digital technologies and a generous project pipeline.

Chapter 2: Project Certainty

While more projects are staying on schedule, the average overspend is also increasing. However, the industry is growing progressively smarter from experience, with industry benchmarks and historic data used almost half the time. The data suggests this is helping organizations hit cost and schedule targets.

Chapter 3: Seeing and Acting on the Bigger Picture

Few respondents have escaped some level of disruption to their projects in the last year as the effects of supply chain delays and inflation make themselves felt. Companies are using technology to keep tabs on the bigger picture and to maintain control, but approaches to that tech and its reported benefits differ widely.

Chapter 4: Technology and the Evolving Owner-Contractor Relationship

Amidst a global craft skills shortage and ongoing supply chain volatility, businesses are turning to technology to boost productivity and risk management. As a result, construction organizations will increasingly rely on technologies to understand the critical interplay between scope, cost and schedule.

Regional Spotlights

Of the 300 large enterprise capital project and construction professional respondents, 100 each are drawn from our focus regions of North America, Europe and APAC, giving each equal weighting in the report.

Asia-Pacific

The region continues to enjoy strong performance based on a healthy pipeline of capital projects. Retaining its title as the region with the most projects completed on time and on budget, greater focus on sustainability and shared risk highlights a sector that continues to look forward and innovate.

Rampant inflation and the war in Ukraine are having a wide impact in the region, posing risks to both the economic environment and supply chains. Despite this, the construction sector seems to be in good health, thanks in part to a robust pipeline of public infrastructure projects.

North America

The region’s construction industry is the global laggard on project performance due to siloed systems, fragmented communications, and supply chain challenges. Yet this is helping forge a new industry through the adoption of best practices to progressive delivery models.

hear from industry experts on the research

Seeing the Bigger Picture: A special webinar touching on the Global Capital Projects Outlook report.

Aidhean Camson

Vice President Program Controls

Cameron Mills

Director of Project Controls

North East Link Program

Australian Constructors Association

Executive Vice President of APAC & Japan

Paul Griffiths

Senior Vice President, Program Management Practice And Capabilities

Anirban Basu

Chairman & CEO

Sage Policy Group

Chief Product Officer

Jeff Quantrill

Head Of Account Management For EMEA

Watch on Demand

The projects that have progressed in the last 12-15 months are collaborative, early-contractor involvement models where we work with the owners and designers to value engineer the design to mitigate those risks. That ranges from choosing materials that are more readily available to making design changes that reduce on-site labor costs.

Customers are doing more with less, meaning that it isn’t necessarily a spending freeze, they’re looking for ways to improve efficiencies.

We have no shortage of work and no shortage of projects to be built to the point where the limiting factor I think really is labor. We’re short of experienced people on all of those projects that know how to build complex projects of that size and scope.

We need those project management tools to do our day job, which is to do an estimate, transfer that estimate into a budget for a project and then match the cost against the budget and forecast.

Understanding data management, data integrity, that’s so important.

Request a free, no-obligation demonstration of InEight construction project management software and get on the best path of construction.

Start your journey on the best path of construction and get closer than ever to project certainty.

Thanks for contacting us. A member of our team will follow up with you shortly.

The Reporting Guide

This guide gives Indigenous Services Canada (ISC) and Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC) funding recipients:

- information on their financial and program reporting requirements

- a link to the New Fiscal Relationship 10-Year grant

- links to reporting forms, commonly called Data Collection Instruments (DCIs)

On this page

Financial reporting requirements, program reporting requirements, new fiscal relationship, program reporting forms.

Reporting by recipients of ISC and CIRNAC funding is essential to ensure Indigenous People and Canadians get transparent, clear and useful information on what recipients achieved and the resources they used.

All governing bodies are accountable to their stakeholders. ISC and CIRNAC must demonstrate to the Canadian public, through the Minister, Parliament and the Auditor General of Canada that all funds, including those transferred to First Nations, Inuit and Métis recipients are spent on the purposes intended.

Financial reporting is undertaken to gather information on whether funds provided are spent according to the terms and conditions of funding agreements, and that the recipient's financial situation is sufficiently stable to assure continued delivery of funded programs and/or services.

Please note that the 2023-2024 Financial Reporting Requirements are effective April 1st 2024 to report on fiscal year 2023-2024 and following fiscal years until further notice. The 2019-2020 Financial Reporting Requirements apply to fiscal years 2019-2020, 2020-2021, 2021-2022 and 2022-2023.

- 2023-2024 Financial Reporting Requirements

- Consistent Consolidated Financial Statements for First Nations, Tribal Councils and First Nations Political Organizations

- Model Financial Statements for First Nations, Tribal Councils and First Nations Political Organizations

- 2019-2020 Supplementary Information

- 2019-2020 Financial Reporting Requirements

- Archived: 2018-2019 Financial Reporting Requirements

- Archived: 2017-2018 Financial Reporting Requirements

- 2015-2016 Financial Reporting Requirements

Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC) collects program data to support statutory requirements, resource allocation, performance reporting, accountability, program planning, policy analysis and operational requirements.

Below are the program reporting templates, listed by subject matter, that funding recipients may be required to complete under their funding agreements. Funding recipients are not required to complete any templates other than those listed to fulfill the program reporting requirements of their funding agreements.

For ease of reference, the corresponding Data Collection Instrument (DCI) number is listed next to the templates allowing recipients to be sure they are completing the correct program report as listed in their funding agreement with the Department.

As a result of the co-development work between Indigenous Services Canada and the Assembly of First Nations to establish a new fiscal relationship, the Department is offering 10-Year Grants with reduced reporting requirements for eligible First Nations. Please visit the New Fiscal Relationship webpage for a list of the Data Collection Instruments required for First Nation recipients under the 10-Year Grant.

For previous years' form templates, please contact [email protected] or your regional office .

How to open the PDF forms

These forms won't open on a mobile device, you will need a computer.

Don't double-click the PDFs. Right click instead.

To access these PDF forms:

- Install Adobe Reader 10+ Opens in a new browser window or an alternate reader if you don't already have one

- Download and save the PDF file to your computer Download and save the PDF file to your computer

- Right click on the PDF file you have saved on your computer, select "Open with", choose your PDF reader

Program reporting forms – Data Collection Instruments (DCIs) 2024-2025

Program reporting forms – data collection instruments (dcis) 2023-2024, program reporting forms – data collection instruments (dcis) 2022-2023.

For any questions regarding reporting requirements and their submission to the Department, please contact the appropriate regional office .

You may also be interested in:

Proposals, Applications, Workplans

Did you find what you were looking for?

If not, tell us why:

You will not receive a reply. Don't include personal information (telephone, email, SIN, financial, medical, or work details). Maximum 300 characters

Thank you for your feedback

Eni eyes new oil and gas spin-offs in energy transition satellite strategy

- Medium Text

- Company Eni SpA Follow

- Company Bp Plc Follow

- Company Chevron Corp Follow

LISTING AND SELLING

Sign up here.

Reporting by Ron Bousso; Editing by Jan Harvey

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Francesca has covered since 2022 some of Europe's biggest energy groups, focusing on their efforts to decarbonize their business while ensuring growth and technological progress. She also reports about European Union's initiatives against climate change and energy regulation in Italy. She was named Reporter of the Year in 2022 by Reuters. Before energy, Francesca was part of Reuters aerospace and defense reporting team. She is graduated in Economics and loves painting in her free time.

Ron has covered since 2014 the world’s top oil and gas companies, focusing on their efforts to shift into renewables and low carbon energy and the sector's turmoil during the COVID-19 pandemic and following Russia's invasion of Ukraine. He has been named Reporter of the Year in 2014 and 2021 by Reuters. Before Reuters, Ron reported on equity markets in New York in the aftermath of the 2008 financial crisis after covering conflict and diplomacy in the Middle East for AFP out of Israel.

Business Chevron

Dollar sags as slower US inflation boosts rate cut expectations

The dollar skidded to multi-month lows on Thursday after U.S. core inflation hit its slowest in three years and retail sales turned flat, which pulled forward expectations for rate cuts in the world's biggest economy.

- Get Benzinga Pro

- Data & APIs

- Our Services

- News Earnings Guidance Dividends M&A Buybacks Legal Interviews Management Offerings IPOs Insider Trades Biotech/FDA Politics Government Healthcare

- Markets Pre-Market After Hours Movers ETFs Forex Cannabis Commodities Binary Options Bonds Futures CME Group Global Economics Previews Small-Cap Real Estate Cryptocurrency Penny Stocks Digital Securities Volatility

- Ratings Analyst Color Downgrades Upgrades Initiations Price Target

- Ideas Trade Ideas Covey Trade Ideas Long Ideas Short Ideas Technicals From The Press Jim Cramer Rumors Best Stocks & ETFs Best Penny Stocks Best S&P 500 ETFs Best Swing Trade Stocks Best Blue Chip Stocks Best High-Volume Penny Stocks Best Small Cap ETFs Best Stocks to Day Trade Best REITs

- Money Investing Cryptocurrency Mortgage Insurance Yield Personal Finance Forex Startup Investing Real Estate Investing Credit Cards

- Cannabis Cannabis Conference News Earnings Interviews Deals Regulations Psychedelics

Junior Mining Co. Recovers First Gold at B.C. Project

Source: Bill Newman 05/13/2024

The firm encountered this nuggety gold, of 90.9% purity, while advancing toward the central portion of the paleochannel, noted a Research Capital Corp. report.

Omineca Mining and Metals Ltd. OMMSF began recovering gold from the gravels at its Wingdam project in southcentral British Columbia, reported Research Capital Corp. analyst Bill Newman in a May 10 research note.

"Positive news" Newman commented. "The gold is coarse (nuggety), exhibiting characteristics of a very low transport distance from the lode source."

323% Return Implied

Omineca, headquartered in Saskatchewan, Canada, was trading at about CA$0.13 per share, noted Newman at the time of the report.

"We expect additional gold recovery results could be a near-term catalyst for the stock" he added.

Research Capital's target price on the mining firm is CA$0.55 per share, which reflects a potential return for investors of 323%.

Omineca remains a Speculative Buy.

Specific Results, Location

The analyst reported that the junior mining company specifically recovered 10.25 ounces (10.25 oz) of gold, with a 90.9% purity, at Wingdam, through Crosscut 3, about 2.5 meters (2.5m) into the paleochannel.

Crosscut 3 is notable, Newman explained, because it is about 30m downstream of the 2012 Crosscut 1 bulk sample area from which 173 oz of gold were recovered in an enriched zone of gold-bearing gravels, averaging 1.2m in thickness. Crosscut 1 extended 23.5m across the paleochannel.

Crosscut 3 cut directly through a depression in the paleochannel, an excavation measuring 3.5m by 3.5m. Another Crosscut, 4, is 20m downstream of Crosscut 3.

Short-Term Plan

Through Crosscuts 3 and 4, Omineca plans to continue moving deeper into the paleochannel, to reach its central portion and the expected higher gold grades there.

As the work advances, the company will provide regular updates, it said.

Strong Project Economics

Newman pointed out that with the gold price now at about US$2,340 per ounce, Wingdam's economics are "attractive."

The analyst also noted that Omineca pays a fixed price of CA$850 per ounce of gold for its 50% share of the Wingdam. Its partner, the operator, in exchange for the other 50% interest, is responsible for all equipment, labor, and services needed to complete this initial 300-meter bulk sample.

Important Disclosures:

- Omineca Mining and Metals Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Metals Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

Disclosures for Research Capital Corp., Omineca Mining and Metals Ltd., May 10, 2024

Analyst Certification I, Bill Newman, CFA, certify the views expressed in this report were formed by my review of relevant company data and industry investigation, and accurately reflect my opinion about the investment merits of the securities mentioned in the report. I also certify that my compensation is not related to specific recommendations or views expressed in this report. Research Capital Corporation publishes research and investment recommendations for the use of its clients. Information regarding our categories of recommendations, quarterly summaries of the percentage of our recommendations which fall into each category and our policies regarding the release of our research reports is available at www. researchcapital.com or may be requested by contacting the analyst. Each analyst of Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst's personal views and (ii) no part of the research analyst's compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.

Relevant Disclosures Applicable to Companies Under Coverage Relevant disclosures required under IIROC Rule 3400 applicable to companies under coverage discussed in this research report are available on our website at www. researchcapital.ca

General Disclosures The opinions, estimates and projections contained in all Research Reports published by Research Capital Corporation ("RCC") are those of RCC as of the date of publication and are subject to change without notice. RCC makes every effort to ensure that the contents have been compiled or derived from sources believed to be reliable and that contain information and opinions that are accurate and complete; RCC makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions which may be contained therein and accepts no liability whatsoever for any loss arising from any use of or reliance on its Research Reports or its contents. Information may be available to RCC that is not contained therein. Research Reports disseminated by RCC are not a solicitation to buy or sell. All securities not available in all jurisdictions.

Distribution Policy Through www. researchcapital.com, our institutional and corporate clients can access our research as soon as it becomes available, 24-7. New reports are continually uploaded to the site as they become available throughout the day. Clients may also receive our research via Reuters, Bloomberg, FactSet, and Capital IQ. All of our research is made widely available at the same time to all Research Capital client groups entitled to our research. In addition, research reports are sent directly to our clients based on their delivery preference (mail, fax, e-mail).

Fair Dissemination of Research Reports and Ratings To the extent reasonably practicable, Research Reports will be disseminated contemporaneously to all of Research Capital Corporation ("RCC") customers who are entitled to receive the firm's research. Until such time, Research Analysts will not discuss the contents of their reports with Sales and Trading or Investment Banking employees. RCC equity research is posted to our proprietary website to ensure eligible clients receive coverage initiations and changes in rating, targets and opinions in a timely manner. Additional distribution may be done by the sales personnel via email, fax or regular mail. Please contact your investment advisor for more information regarding RCC research.

Percentage Distribution of Research Ratings As required by the Investment Industry Regulatory Organization of Canada, Research Capital provides a summary of the percentage of its recommendations that fall into each category of our ratings. Please click this link Our Research - Research Capital Corporation to see our distribution of ratings.

Potential Conflicts of Interest All Research Capital Corporation ("RCC") Analysts are compensated based in part on the overall revenues of RCC, a portion of which are generated by investment banking activities. RCC may have had, or seek to have, an investment banking relationship with companies mentioned in this report. RCC and/or its officers, directors and employees may from time to time acquire, hold or sell securities mentioned in our Research Reports as principal or agent. RCC makes every effort possible to avoid conflicts of interest, however readers should assume that a conflict might exist, and therefore not rely solely on this report when evaluating whether or not to buy or sell the securities of subject companies.

RC USA INC. Information about Research Capital Corporation's Rating System, the distribution of our research to clients and the percentage of recommendations which are in each of our rating categories is available on our website at www. researchcapital.com. The information contained in this report has been drawn from sources believed to be reliable but its accuracy or completeness is not guaranteed, nor in providing it does Research Capital Corporation assume any responsibility or liability. Research Capital Corporation, its directors, officers and other employees may, from time to time, have positions in the securities mentioned herein. Contents of this report cannot be reproduced in whole or in part without the express permission of Research Capital Corporation. US Institutional Clients – Research Capital USA Inc., a wholly owned subsidiary of Research Capital Corporation, accepts responsibility for the contents of this report subject to the terms and limitations set out above. US firms or institutions receiving this report should effect transactions in securities discussed in the report through Research Capital USA Inc., a Broker – Dealer registered with the Financial Industry Regulatory Authority (FINRA).

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Capital investment is about to surge: Are your operations ready?

In the future , economic prosperity will be driven by sustainability, inclusion, and growth—an agenda that nurtures innovation while reducing environmental impact and improving people’s quality of life worldwide. Fulfilling these ambitions involves major private- and public-sector capital investments in climate transition infrastructure and in supporting economic recovery and growth. But how can we deliver on this extraordinary wave of capital spending quickly and efficiently? Nothing less than the commitment of top government and business leaders can accomplish a mission of this magnitude. This article helps outline how the C-suite can turn commitment into action, starting with exciting new solutions to mitigate risks and capitalize on opportunities. —Bob Sternfels, global managing partner, McKinsey & Company

The world will see a once-in-a-lifetime wave of capital spending on physical assets between now and 2027. This surge of investment—amounting to roughly $130 trillion 1 Capital investment will vary by asset class, but on average, an advanced industries company in North America can expect a spending increase of 65 percent over the previous period. An energy and materials company in Asia will see an increase of 57 percent. Across asset classes in Europe, McKinsey projects a 59 percent increase in capital spending, driven by an increase of 120 percent in European energy and materials spending. Our $130 trillion estimate is based on data from African Development Bank, Asian Development Bank, Capital Excellence practice analysis, Global Insight, Global Water Intelligence, International Transport Forum, MEED, Moody’s Analytics, National Accounts data, World Bank, World Energy Outlook, and McKinsey Global Institute’s net-zero analysis. —will flood into projects to decarbonize and renew critical infrastructure.

But few organizations are prepared to deliver on this capital influx with the speed and efficiency it demands. Many are burdened with inefficient supply chains and outdated project delivery systems. For one thing, constructing and justifying the cost of a physical asset such as a manufacturing plant is much more difficult than it was decades ago, given inflation, rigorous sustainability requirements, and rapid changes in technology and regulations. Adding to the complexity, the next generation of assets needs to be “set and forget”: the high cost of building them must be offset by lower operating costs.

Would you like to learn more about the Battery Accelerator Team ?

Delivering on an investment of this magnitude is no longer just the province of IT or engineering experts. Responsibility for end-to-end capital spending projects may need to move squarely into the domain of the CEO and C-suite leaders, who must engage on the portfolio of capital projects to ensure that the CFO is planning appropriately for increased capital outlays for years to come—which may require potential amendments in capital financing and allocation—and for the associated risks in delivery. Boards and shareholders will be particularly interested in the return on such a massive investment and its likelihood of success in achieving the business’s goals.

For decades, capital project leaders have relied on practices that attempt to optimize individual investments, such as a nuclear power plant, an oil refinery, or a pipeline. Cost overruns approach $1.2 billion on the average project—79 percent of the initial budget—and delays run six months to two years. This approach will not work for new decarbonization and sustainability investments, where groups of similar projects (such as wind farms and solar parks) are delivered repeatedly over a long period of time and require much better performance than in the past. A project-centric approach also will not work for decarbonizing existing assets, which is a capital-intensive effort that requires long-term planning. Low-carbon projects involve different considerations from traditional capital projects: for example, building a renewable-energy facility may also require building energy-storage capacity to supply backup power if needed. The growing threat of climate risks such as storms and floods means that companies may need to be careful about how they design assets and where they locate them. That may rule out siting a chemical plant near a coastline so it has easy access to a shipping terminal.

A more reliable approach is a portfolio-synergistic strategy in which planning is top-down, with the goal being to develop and deliver each project so that the overall results of the capital spending portfolio are optimized. Implementing this new strategy would be a major business challenge, requiring savvy stakeholder management, capital markets expertise, and an understanding of complex approval processes, as well as the ability to source the necessary talent, navigate supply chain obstacles, and communicate a long-term vision and goals.

Would you like to learn more about our Operations Practice ?

That’s a long list of difficult tasks, and organizations are still grappling with it. But some companies are bringing a holistic, CEO-led approach to their capital strategies, leveraging data and analytics to improve the process from design to delivery. In this article, we discuss how these emerging best practices can foster capital excellence and value-creating growth, as well as deliver a competitive advantage for first movers.

A historic investment surge in mobility, power, and buildings

The bulk of capital investment worldwide will go into climate action and sustainability projects, as governments and private-sector organizations move to reduce climate risk and meet the Paris Agreement target of net-zero emissions of greenhouse gases by 2050. 2 “What’s in the Paris agreement on climate change?” Economist , October 29, 2021. Ninety-three percent of CEOs say that sustainability issues are important for the future success 3 A new era of sustainability: UN Global Compact–Accenture CEO study 2010 , United Nations Global Compact, June 2010. of their business, and 54 percent expect sustainability to be embedded within the core business strategies 4 A new era of sustainability: UN Global Compact–Accenture CEO study 2010 , United Nations Global Compact, June 2010. of most companies in the next decade. Governments are imposing carbon taxes and setting decarbonization regulations—for example, in July 2021 the European Commission adopted the Fit for 55 package, a series of legislative proposals to reduce net greenhouse-gas emissions by at least 55 percent by 2030. 5 “European Green Deal: Commission proposes transformation of EU economy and society to meet climate ambitions,” European Commission press release, July 14, 2021.

Sustainability and decarbonization will receive substantial investment. Reaching net-zero emissions by 2050 requires $9.2 trillion in annual average spending on physical assets, $3.5 trillion more than today, according to a new McKinsey report (Exhibit 1).

Three sector groups—mobility, power, and buildings—would account for approximately 75 percent of the total spending on physical assets in this net-zero scenario . Mobility would account for about 40 percent of the spending, including investments in electric vehicles (EVs) and charging infrastructure. Energy would account for 20 percent and would include developing renewable-energy capacities (for example, solar plants and wind farms), upgrading transmission and distribution networks, and investments in carbon capture, utilization, and storage (CCUS) technologies.

Semiconductor supply chains. The COVID-19 pandemic exposed many supply chain vulnerabilities, particularly those in the booming semiconductor industry . 6 “Global semiconductor sales increase 24% year-to-year in October; annual sales projected to increase 26% in 2021, exceed $600 billion in 2022,” Semiconductor Industry Association, December 3, 2021. As a result, organizations around the world are investing heavily in projects that would help them become more self-sufficient in chip production. In the United States, the Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act includes $52 billion for domestic semiconductor production. In January 2022, Intel announced a new $20 billion factory outside Columbus, Ohio; the company also expects to construct a multibillion-dollar chip plant in Germany, with supporting facilities to be built in France and Italy. 7 Mike Wheatley, “Report: Intel to build new chip fab sites in Germany, France and Italy,” SiliconANGLE, December 23, 2021. Taiwan Semiconductor Manufacturing Company plans to build new wafer fab plants outside Taiwan. 8 “TSMC confirms plans for semiconductor fab plant in Japan,” Associated Press, October 15, 2021.

Public infrastructure. Globally, governments are investing in public infrastructure and services to drive economic recovery (Exhibit 2).

For instance, in Europe and the United States, significant funding has been allocated to infrastructure projects across numerous asset classes. In November 2021, the US Congress passed the Bipartisan Infrastructure Law , 9 “President Biden’s Bipartisan Infrastructure Law,” White House, last accessed February 15, 2022. which appropriates $1.2 trillion (including $550 billion in new funding) to rebuild the country’s road and rail infrastructure, deliver high-speed internet access to all Americans, provide greater access to clean water, invest in new clean-power technologies, and improve the nation’s overall resilience to the effects of climate change (Exhibit 3).

In Europe, to deliver on the Green Deal’s goal of climate neutrality by 2050 and emerge stronger from the pandemic, the European Union has launched the largest stimulus package ever: €807 billion labeled as NextGenerationEU. 10 “A European Green Deal: Striving to be the first climate-neutral continent,” European Commission, site accessed February 22, 2022. As of March 2022, the Recovery and Resilience Facility, which funds NextGenerationEU initiatives, has accepted 22 proposals from member states, about 40 percent of which support climate objectives. 11 “NextGenerationEU: First annual report on the Recovery and Resilience Facility finds implementation is well underway,” European Commission press release, March 1, 2022.

The operational challenge

The anticipated capital investment in assets is large, but so are the obstacles to its implementation, including major shortages of labor, equipment, and raw materials. Delivering capital projects is already a challenge. Across industries, projects experience severe cost overruns and delays. As noted earlier, overruns approach $1.2 billion on the average project—79% of the initial budget—and delays can range from six months to two years. The added burden of growth in capital spending will place more stress on a broken system, with project execution failing to keep pace with anticipated growth (Exhibit 4).

Skilled-labor shortages and rising costs have become a major issue in several markets. For example, about 41 percent of the current US construction workforce is expected to retire by 2031, and current construction wage trends far exceed recent rates. In industries such as metals and mining, sustainability challenges will impose additional pressure to produce raw materials to accelerate decarbonization.

Severe capacity constraints are preventing many assets from being built on schedule. For instance, to meet its requirements for an additional 600 gigawatts of onshore windmill power by 2030, Germany would need to build an estimated 200,000 assets. But availability of space, raw materials, equipment, and labor falls far short of the goal, and approvals are slow. Addressing these issues will be a daunting task, requiring foresight and collaboration among governments, company boards, asset owners, contractors, suppliers, and service providers.

The CEO: Architect of the new operations agenda

Strategies for capital excellence.

Despite these constraints, companies in various industries are already taking steps to optimize capital investment for the new breed of assets. While the basics of effective capital management still apply to all projects, the experiences of these firms reveal some new strategies to consider:

- Incorporate sustainability as a strategy.

- Establish a well-orchestrated ROIC scheme.

- Ensure that technical and engineering expertise is represented in the C-suite.

- Create asset-based ecosystems.

- Deploy advanced analytics for better capital planning.

Incorporate sustainability as a strategy. This means making green operations integral to investment in and management of assets, as these organizations have done:

- An agriculture and food company embarked on a top-to-bottom capital excellence transformation journey with a strong focus on sustainability and quality, including locating and building plants with the lightest consumption of resources possible. The company reviewed its supplier selection, operating model, and level of vertical integration and set up performance management tools to track sustainability implementation.

- Construction industry leaders are playing a vital role in decarbonizing materials such as cement and concrete by focusing on three elements: redesign, reduce, and repurpose , which can achieve up to 48 percent net reduction in emissions.

- Oil and gas players are shifting their portfolios toward greener assets. 12 “Commission proposes new EU framework to decarbonize gas markets, promote hydrogen and reduce methane emissions,” European Commission press release, December 15, 2021. For instance, Shell expects to cut the number of its refineries from 13 to six, 13 “Shell accelerates drive for net-zero emissions with customer-first strategy,” Shell press release, February 11, 2021. freeing capital to invest in more sustainable businesses 14 “Shell accelerates drive for net-zero emissions with customer-first strategy,” Shell press release, February 11, 2021. such as electricity, renewables, and services (for example, EV charging). Similarly, BP has embarked on a net-zero journey, 15 “Net zero by 2050,” BP, site accessed March 3, 2022. and TotalEnergies has conducted several acquisitions in electricity retail, renewables, and the future of mobility. 16 TotalEnergies at a glance 2021 , TotalEnergies, July 2021.

- Pure-play start-ups are building eco-friendly businesses, including purpose-built green assets such as battery factories, renewable-energy production facilities, green hydrogen electrolyzers, and even green steel. 17 David Kindy, “Fossil fuel-free ‘green’ steel produced for the first time,” Smithsonian Magazine , August 31, 2021.

Establish a well-orchestrated ROIC scheme. Given the amount of capital available, organizations are at the risk of spending too much for a low return. A robust ROIC plan helps to avoid affecting the company’s performance in the long run, especially given that ROIC most likely will be the ultimate key performance indicator driving enterprise value in the capital markets. Today’s investment choices—where, when, and how to invest in and build physical assets—will have a significant impact on an organization’s performance and ability to survive in the coming years. Here are some examples of long-term ROIC planning:

- A gas company in Europe conducted a thorough assessment of the impact that the European Green Deal would have on its assets and business. New regulation would lead to a 5 percent loss of its business in the next five years, a 30 percent loss in the next 15 years, and a shutdown by 2050. Based on this projection, the company developed a 15-year plan to invest in new businesses based on the capital available, the organization’s capabilities, and the time it would take for the new regulations to have an impact.

- A food company assessed several potential locations to build its new factory, balancing variables such as the price of carbon compared with the distance to its suppliers and distribution centers. In addition, it performed a complete value improvement analysis to determine the scope of what needed to be built and maximize the ratio of value delivered to the capital spent.

Ensure that technical and engineering expertise is represented in the C-suite. Today, the C-suite tends to be dominated by business leaders. Given the technical challenges ahead and the importance of decisions to be made on assets that will affect future growth, companies may want to consider bringing engineering and technical expertise to the board, appointing chief technology officers (CTOs), and strengthening internal capabilities.

- For instance, a company that wanted to enter the telecommunications market as quickly as possible assigned project management for its network deployment to the CTO as a direct responsibility. The project was deemed too strategically important for the deployment to be managed by a contractor.

Create asset-based ecosystems. Shifting away from individual projects, companies by asset class could create successful working communities of contractors, subcontractors, suppliers, and technology providers. These ecosystems could be built on a shared culture of continuous improvement and a drive toward the technical limit of what is feasible. They could also be a key enabler to solve the challenges related to resource shortages and could allow the development of joint road maps to meet long-term cost and delivery targets rather than create bespoke projects starting from scratch each time. Such ecosystems are already evolving:

- Tesla is building its leading-edge “gigafactories” to expand Europe’s battery capacity and unlock the energy storage, grid utilization, and mobility strategies needed to achieve decarbonization. Strong collaboration, partnerships, and commitments among internal and external stakeholders may be necessary to scale battery capacity at the required rate.

- Similarly, in public infrastructure, utility companies have started to shift toward a long-term partnership model. They offer contractors the opportunity to bid for a portfolio of projects instead of a single project, with a commitment to provide work for several years, guaranteeing them revenue for a long period of time. This type of partnership builds trust between owners and contractors, allows the development of joint and repeatable operating models, and offers an incentive for contractors to supply relevant resources and skills to satisfy the contract terms. As a result, after a learning curve, projects are delivered faster, with greater accuracy and less owner involvement.

Deploy advanced analytics for better capital planning. Analytics-driven insights have the potential to transform the way organizations work on capital projects and portfolios, targeting key business decisions across the full project development life cycle. Companies can leverage analytics tools at any stage of a project, from capital portfolio optimization to planning optimization and real-time process tracking. For example:

- At its Kalinganagar plant in India, Tata Steel deployed advanced analytics in a three-phased project to improve the facility’s performance, winning acclaim for becoming one of the leaders in the adoption of Fourth Industrial Revolution technologies.

- An engineering firm wanted to understand drivers of overall profitability to increase profits in three years. Using advanced analytics, the firm assessed data from thousands of projects over the past six years and was able to identify patterns that led to increases in project profitability. Analytics also significantly improved forecasting accuracy over the firm’s existing business tools.

- An oil and gas company leveraged AI-based analytics to forecast project duration and identify high-risk activities for a project that had been delayed more than a year. A machine learning (ML) algorithm was trained to assess historical performance across projects and schedules. The ML tool predicted total project delay with near-total accuracy and identified key risk activities. It had the potential to generate millions of dollars in savings if used during project execution.

The key to capital excellence in the era of physical assets is getting them into action fast. CEOs may need to rally stakeholders around a common goal, as companies and governments did during COVID-19 vaccine development. Leaders could also accelerate existing internal and external processes to complete capital projects with more precision and speed than ever before. The payoff? First movers will gain a substantial competitive edge—and those who do not act fast will have a hard time catching up.

This article is adapted from “ Here comes the 21st century’s first big investment wave. Is your capital strategy ready? ”

The authors wish to thank Raphaelle Chapuis, Becca Kuusinen, and Piotr Pikul for their contributions to this article.

This article was edited by Rama Ramaswami, a senior editor in the New York office.

Explore a career with us

Related articles.

Bridging the labor mismatch in US construction

Florida TaxWatch says 2024-25 state budget larded with $854.6M in 'turkeys,' urges vetoes

The $117.5 billion state budget approved by Florida’s Republican-controlled Legislature is larded with a record $854.6 million of “turkeys,” hometown projects and programs that Gov. Ron DeSantis should consider vetoing, Florida TaxWatch said Wednesday.

The budget turkey bottom-line is the largest identified by TaxWatch in more than four decades of conducting the annual review of the budget in advance of the governor’s signing the spending plan for the year beginning July 1.

Jeff Kottkamp, executive vice-president of TaxWatch and a former state House member and lieutenant governor, said that the Legislature’s willingness to load up the budget with favored projects drawing little scrutiny reflects a complete, systemic change at the state Capitol.

“It’s a slow drip of culture change,” Kottkamp said, reflecting on earlier years when lawmakers knew they were bending the rules when they tucked a hometown project into the budget. Now, Kottkamp said such spending has become normalized.

'Sprinkle lists' a problem, Florida TaxWatch says

So-called 'sprinkle lists' chocked with millions of state taxpayer dollars are added each year as sweeteners to satisfy individual lawmakers during final budget negotiations.

Prep for the polls: See who is running for president and compare where they stand on key issues in our Voter Guide