You are using an outdated browser. Please upgrade your browser to improve your experience.

- How We Do It

- Current Thinking

- Institutional

- Let’s Talk

- MY CIDEL LOGIN

Thoughts on Compounding: Too Risky for Red Bull

Ever wondered what even Red Bull considered too risky? Dive into ‘Too Risky for Red Bull’ where our lead portfolio managers, Michael Brown, CPA, CA, CFA and Robert Spafford, CFA examine the parallels between how founder and former CEO, Dietrich Mateschitz, managed Red Bull and why the same principle applies to identifying high quality companies.

Click here to read more.

The Importance of Liquidity in Estate Planning

This month’s blog post was written by jonah mayles and zak goldman , partners at sterling park..

We often think that creating an estate plan is like a road map. Our clients determine what they want the destination to look like (the size, beneficiaries, and goals of the estate); and our role, as one of several advisors to the client, is to help them navigate the journey by considering potential obstacles that can arise preventing our clients from arriving at their desired destination.

A thoughtful and well-executed estate plan is the most important tool to smoothing this path. And, part of that estate plan should provide sufficient liquidity to meet the various needs of the estate. Many families underestimate the need and cost of creating liquidity for their estate. We often remind clients that their estates will require liquidity regardless of a significant net worth; particularly if that net worth is comprised of illiquid assets (such as real estate or an operating business).

The need for liquidity can arise for several reasons, including estate tax liabilities, charitable bequests, and estate equalization. These estate needs are some of the roadblocks and impediments that can prevent a client from achieving their desired estate destination.

Assessing a client’s net worth is usually a straightforward calculation of assets versus liabilities. However, determining one’s net worth is a different calculation to determining one’s estate liquidity. It is important to consider the cost of turning assets into cash for the purpose of funding estate needs. These costs generally include taxes and professional fees when disposing of assets, taxes on corporate distributions, and the risk of selling assets at an inopportune time.

The costs associated with liquidating assets are often not the primary concern of the client and their family; rather, it is being forced to sell legacy assets that the family intended on preserving for future generations. Once these assets are sold, most families are aware that they will never be replaced. It is important to understand the various options for creating liquidity and the costs associated with each option to avoid the selling of legacy assets.

For example, a client with real estate assets held in various corporations has several options to create liquidity:

- Disposing of real estate assets – This option will include taxes on the disposition of such assets (often significant when these assets have been held for a long time with significant appreciation in value) and dividend taxes on the distribution of capital from the company to the estate (if the capital dividend account balance is insufficient). Moreover, the family has now disposed of generational assets, and preserving such assets is often a primary objective of an estate and succession plan. Such assets can provide for multiple generations. However, this is a good option if the family planned to liquidate the real estate assets in the first place.

- Leveraging real estate assets – If the family has unleveraged real estate, they can acquire a loan to fund estate needs, using the real estate as security for the loan. This is a popular initial choice for many families we have met. Primary considerations for this option are the cost of borrowing and, more importantly, how the debt will eventually be repaid. The tax debt has been paid but the family will now have to repay the bank debt over a significant period or eventually use option 1 and liquidate real estate. Borrowing costs would be $4,725,000 if a $10M loan is repaid over a 20-year period ($500K per year) at an interest rate of 4.5%. That would result in an average cash outflow of $736,250 per year (interest and principal repayment). This option is kicking the “debt can” down the road to be dealt with on another day, and such a deferral can be appealing.

- Cash on hand – This is, of course, the simplest option. Unfortunately, it is also the least ‘available’ option to most families. Many estates lack sufficient cash to cover tax liabilities and other requirements. Even if a family has significant cash reserves, those reserves are often held within corporate structures due to preferable tax treatment. Accordingly, a family may need $16M – $17M in cash within the corporate structure to net $10M of cash to the estate (assuming a 40% cost of distributing cash from the company). That being said, families with cash reserves and marketable securities with large inherent capital gains can sometimes combine the cash and donate marketable securities to offset and fund the tax liability of the estate.

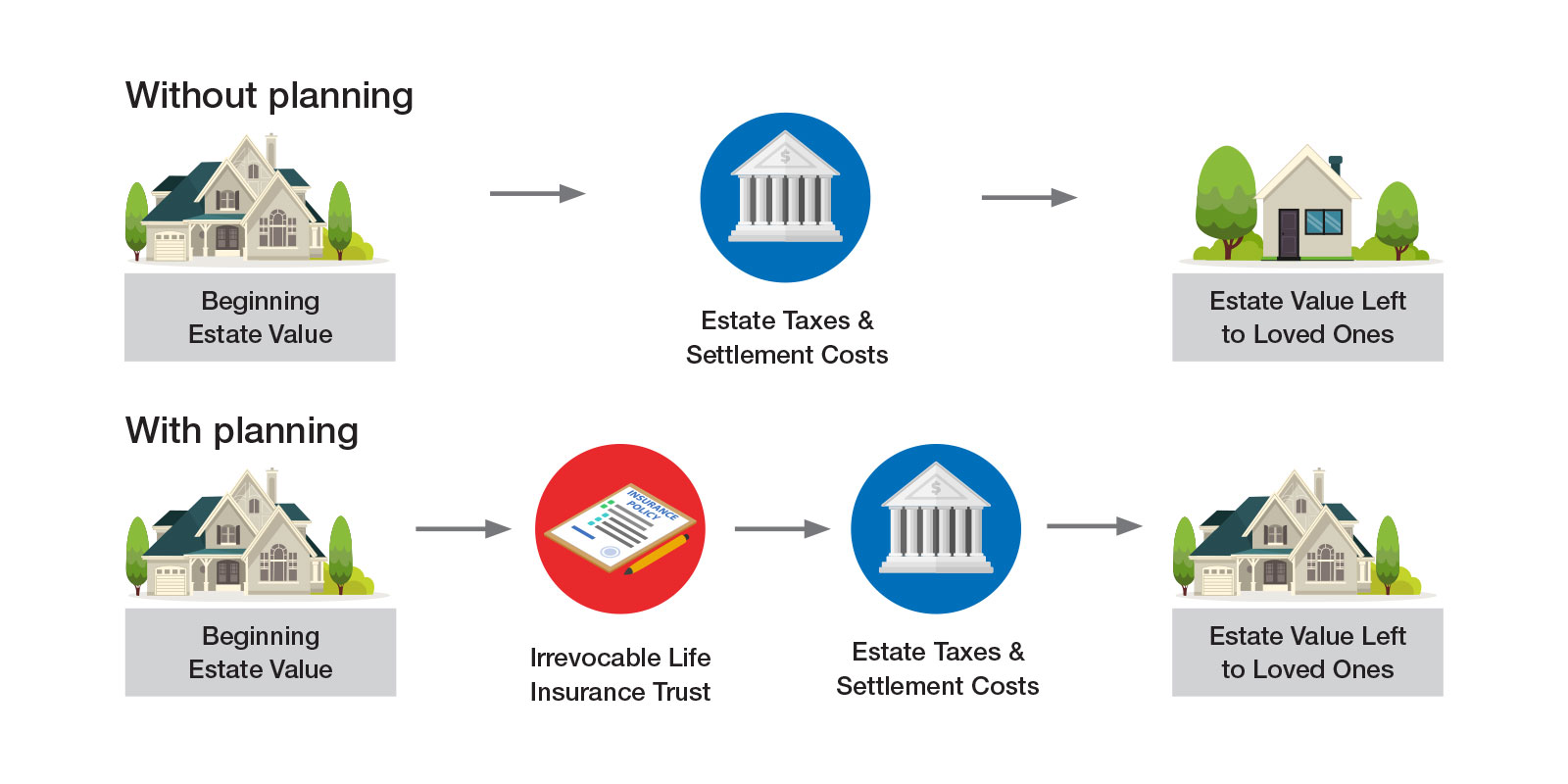

- Life Insurance – This option can provide sufficient liquidity at the exact moment it is needed. Of course, health and cash flows need to be considered when considering this option. In addition, the proper structuring of the insurance product and leverage (if used) is essential to ensure that the estate will be receiving adequate proceeds to fund the estate’s needs. Clients choosing this option rarely need insurance for traditional purposes; instead, it is a question of tax-efficiencies and preserving the family’s assets. The cost of the insurance will vary depending on the age and health of the insured and whether leverage has been used, but is generally less than the previous options. However, clients must be comfortable using current capital for a future need. Used correctly, a permanent life insurance policy can be an estate-planning solution to provide the estate with the required liquidity needed to deal with end-of-life costs and smooth estate disbursements. Using life insurance within an estate plan can help bridge these liquidity needs by providing a substantial cash payment within 2-4 weeks that can be used by the estate for its various needs, such as estate taxes and other costs and disbursements.

We believe that when choosing how to fund an estate’s particular needs, all options need to be reviewed and considered. This is a process that should start with determining one’s goal and intentions for their estate. Once this has been articulated, a roadmap can be devised to guide the estate to that intended goal. This roadmap will clarify what can hinder the plan and what is needed to mitigate against potential roadblocks. The importance of liquidity, its cost and timing are foundational considerations to ensuring a successful estate plan.

Terms of Use

By accessing the wealth matters – our insights page, you agree that you have read, understood and agree to be bound by the website terms of use, in addition to the terms stated below. if you do not agree with this website’s terms of use, please exit from this page, and do not access any other pages on this website., cidel bank & trust inc. (including its subsidiaries and affiliates, “cidel”) reserves the right, at its discretion, to change, modify, add, or remove portions of this page, and the information contained herein, without prior notice. , information is not legal or other advice, wealth matters – ours insights publications are intended to convey general information about legal issues and developments as of the indicated date. it does not constitute legal, tax, accounting, or any other advice and must not be treated or relied upon as such., statements made in wealth matters – our insights publications, including the interpretation of case law, are of a general nature only and in no way represent a warranty of the position or accuracy of the law at the time, nor do they pre-determine any position cidel may take with respect to a specific fact situation or particular client matter. furthermore, cidel does not endorse, guarantee the accuracy of, or accept any responsibility for any content written or contributed by third parties who are featured as guest bloggers on wealth matters – our insights, nor does cidel endorse, guarantee the accuracy of, or accept any responsibility for the content of third-party websites or materials that may be linked, quoted or otherwise referenced in these publications. for greater certainty, cidel does not warrant or guarantee that the information contained on this page is accurate, complete, updated regularly and obtained from reliable sources., in making the wealth matters – our insights page available, no client, advisory, fiduciary or professional relationship, including a client-solicitor relationship is created, intended or established. the contents are not a substitute for the user seeking advice from a professional that is familiar with the reader’s factual situation or circumstances., top 7 lessons and insights from a trust and estate tax lawyer, this month’s blog post was written by héléna gagné , partner at osler, hoskin & harcourt llp..

When the acclaimed TV show Succession aired on HBO, many would ask us trust and estate practitioners, “does the show accurately portray real life?” The answer is: it is great fiction, but it is also not that fictitious! At the same time, we might say that if you have seen the Roy Family, you’ve seen one family. While each family has its own realities, dynamics, values, goals, and cast of characters (pun intended!), there remain ubiquitous topics and universal considerations observed in practice, and we thought we would share with you our Top 7 Lessons and Insights!

- Understanding what you own – or the entirety of what you own and under what terms!

First, one should regularly update their personal balance sheet, not only as this could one day serve as a helpful guide to an executor, but also in order to map out and list the entirety of one’s assets. It is too common that we have to assist executors in locating and gathering all of the Estate assets – what about that inactive bank account, or that loan made to your old friend? Or worse, what about these cryptocurrencies that your children convinced you to purchase? Without properly taking digital assets into account in your estate planning, you could be throwing away real “monetary” value. Make sure to identify all of your assets, and in the case of digital assets, to leave a password-protected list of digital assets and digital accounts along with the passwords to access this “digital monetary value”.

Second, one may be under the impression that they own shares of Waystar Royco, but it may not always be as simple as it seems. Is the property owned personally, co-owned or owned as tenant in common, or is it owned in joint tenancy? In the case of joint tenancy, when one joint tenant dies, he or she ceases to be an owner, and the remaining joint tenant continues as the owner. Not knowing how title is held could result in an unexpected result in one’s estate planning.

- Don’t forget about taxes!

A fairly recent Quebec Superior Court decision serves as a good reminder of the risks of forgetting about taxes. The facts of the case are regrettable: Ms. Caron was diagnosed with an aggressive cancer and was instantly hospitalized. She immediately called an estate practitioner to give instructions for her Last Will and Testament pursuant to which she would leave her income-generating real estate properties to her siblings and the rest of her estate to her husband. Unfortunately, Ms. Caron died shortly after having signed her will in the hospital. Nothing in the will provided that these income properties were bequeathed net of tax to the estate. Therefore, the significant tax liabilities triggered upon her death in respect of the large unrealized capital gains on the income-generating properties fell upon the estate and not to her siblings to whom the income-generating properties were bequeathed. As a result, the estate was not solvent, and the remainder of the estate was devoted to payment of the tax liabilities. The intent of the testatrix was put at question in this case in order to interpret the will: but the text was given primacy and the residuary beneficiary of the estate, Ms. Caron’s husband, ultimately did not receive anything from the estate given the extent of the tax liabilities.

Once you have listed what you own, it is important to estimate the tax liability on death or disposition and consider how it may impact your estate planning.

- Do not let “perfect” be the enemy of “good”

Too often I have seen clients asking to postpone the signature of their will for things that can be easily modified by codicil or by redoing their will if need be. A draft will is not a will, nor is an email containing instructions to prepare your will. Do not withhold signing your will once it is prepared. It may not be perfect yet, and you may want more time to rethink certain aspects of it, but you will have a will in place that is at least more reflective of your wishes than your old will or worse, no will at all!

- Who should I appoint as my trustee and executor?

I once heard a practitioner tell his client to choose a person that she would trust with her life even after death. I often wondered whether this was an appropriate standard to set. There are many people I would trust with my life. I know that they would rise to the challenge if we were stranded on a deserted island, but I am not sure whether the same people would be the right choice to administer my estate diligently or if they would even be comfortable doing so. Other professionals may say to choose a person who knows you well enough that when faced with decisions, he or she would know what you would have wanted. There too, I often question whether this is an appropriate ask. If I appoint my brother as trustee of a trust for the benefit of my teenage child, he might know me well enough to know what I would have decided when asked to encroach on the capital of the trust, whatever the reason may be. However, this does not take into account that my brother may have a certain relationship he wishes to preserve with my child, which may prove to be difficult and complicated when he steps in as trustee. I suggest to clients that they consider appointing third parties and professionals, such as corporate trustees, as executors and trustees, and more and more they decide that such appointments may be the key to preserving family relationships.

- Estate planning is also planning for incapacity

It is important to also plan for circumstances in which you are unable to make decisions for yourself with respect to your assets and personal care. As Hayley Peglar, a trust and estates lawyer, recently stated , “Turning your mind to potential future incapacity can give you agency in decisions made on your behalf and soften the impact of a further temporary or permanent incapacity for your loved ones.”

- When have you done your last “Will check up”?

You go to the dentist twice a year and you run on a treadmill at your doctor’s office during your annual medical check up. But, what about your “Will check up”? Many will say that an estate plan should be reviewed every 3 to 5 years. In fact, it should be reviewed at least that often but, more importantly, any time there is a significant life event such as a marriage or divorce, the death of a family member, the birth of a child or a grandchild, or a change in your assets. These events mean it’s time to dust it off and review whether your will is still appropriate for your wishes and estate planning goals in the circumstances.

- Seek professional advice

Despite the countless YouTube videos I could watch on “how to cut my own hair at home”, I still prefer entrusting my hairdresser when it comes to haircare. I would argue that, even though there are simple forms and questionnaires you may find online that may be helpful in getting your reflections started, entrusting an expert is even more important when it comes to something as important as your will and estate planning (not to say that your hair is not important!). Estate planning should involve all the different professionals necessary to advise you, including your financial advisor, accountant and lawyer who will collectively take an integrated approach to ensure that the tax, legal and financial aspects of your estate planning are all well taken care of.

Philip Young on BNN Bloomberg

Our Philip Young, Portfolio Manager, shared his views on the highly anticipated IPO of Reddit and also answers a question “Do you own Salesforce and or Tokyo Electron?.

We invite you to watch the full segment that BNN Bloomberg have made available on their site by clicking here .

February 2024

Estate tax tips for an american spouse, this month’s blog post was written by stephanie gabor , partner at torys llp..

For a Canadian, marrying an American citizen may have its advantages, but from a tax perspective, an American spouse is complicated and expensive. Assets owned by the American spouse will be subject to the U.S. estate tax at death – the estate tax is imposed at marginal rates of 18% up to 40% on the fair market value of all assets (wherever situated) owned at death. Fortunately, with advance planning, it’s possible to manage estate tax exposure while still ensuring that a surviving American spouse has access to – and a significant degree of control over – inherited assets.

For a married couple that includes a Canadian spouse (who is not a U.S. person) and a U.S. spouse (e.g. a U.S. citizen), the following considerations may be helpful in navigating their estate plan:

- U.S. Gift and Estate Tax Exemption . The current (and anticipated) gift and estate tax exemption will provide the backdrop for estate planning for the couple. This exemption refers to the amount that a U.S. person can transfer during life or at death to any person free of U.S. gift or estate tax. [1] Under current law, the estate tax exemption is $13.61 million (USD), but absent new tax legislation, it will fall by one-half at the end of 2025. Ideally, the value of assets owned by the U.S. spouse should remain below the current (or anticipated) estate tax exemption, however, the volatility of the exemption makes this a moving target and, as a result, a more prudent approach may be to limit the U.S. spouse’s ownership of assets as much as possible (after taking into account other financial, tax and legal considerations).

- if the Canadian spouse dies first, then the U.S. spouse becomes the sole owner and the full value of the property will be subject to estate tax if the U.S. spouse still owns the property at death; or

- if the U.S. spouse dies first, the full value of the property will be subject to estate tax unless the U.S. spouse can show that the Canadian spouse paid for all or part of the asset or the property was received as a gift (in either case the value subject to estate tax will be reduced accordingly).

A more prudent approach may be for the Canadian spouse to own the asset him/herself. Under the Canadian spouse’s will, if the U.S. spouse survives, the asset could pass to a trust qualifying as a “spousal trust” for Canadian income tax purposes which (if properly structured) would not be subject to U.S. estate tax at the U.S. spouse’s subsequent death (as described in more detail under #3 below).

- Spousal Trust . The will of the Canadian spouse may direct that assets intended to benefit the U.S. spouse pass to a “spousal trust” (which qualifies for the spousal rollover for Canadian income tax purposes) rather than outright. Provided the U.S. spouse’s interest in and control over the trust are properly circumscribed (as described below), assets held in the trust should not be subject to U.S. estate tax at the U.S. spouse’s death. [2]

The U.S. spouse can be given a significant degree of control over the spousal trust without rendering the trust taxable for U.S. estate tax purposes. For example:

- The U.S. spouse may act as sole trustee with complete control over the investment of the trust assets;

- The U.S. spouse may be able to determine who inherits the trust fund at his/her death (subject to certain limitations); and/or

- The U.S. spouse may be given the power to make distributions from the trust to him/herself, provided those distributions are for his/her health, education, maintenance and support. The U.S. spouse may be appointed to act with (or may have the power to appoint) an “independent trustee” who would have broad discretion to make distributions to the U.S. spouse for any purpose.

Keeping these strategies in mind when executing an estate plan may help a “cross-border” couple achieve their dispositive goals while minimizing exposure to the U.S. estate tax.

[1] There is additional estate tax relief under the Convention between Canada and the United States of America with Respect to Taxes on Income and on Capital (e.g. for certain gifts to charities).

[2] Assuming it is a Canadian trust, the trust would be subject to the U.S. trust anti-deferral regime, also known as the “throwback tax” and would need to be managed accordingly.

By accessing the Wealth Matters – Our Insights page, you agree that you have read, understood and agree to be bound by the website terms of use, in addition to the terms stated below. If you do not agree with this website’s terms of use, please exit from this page, and do not access any other pages on this website.

Thoughts on compounding: no heroes.

Michael Brown, CPA, CA, CFA , Lead Portfolio Manager explains how avoiding drama in investments led to a 20.9% return in 2023.

Click Here to read more.

January 2024

Family and estate law considerations when helping a loved one purchase a home, this month’s blog post was co-authored by daniel stober , partner, and nikita mathew , associate, at torkin manes llp..

Over the past decade, it has become increasingly common for Canadians to provide financial assistance to family members to help with the purchase of a first home. A recent survey revealed that 35% of first-time homebuyers in Canada received financial assistance from a relative with the purchase of their home [1] .

Before providing financial assistance to a loved one to help with the purchase of a home, however, it is critical to consider the family and estate law implications of such assistance.

In Ontario, the Family Law Act (“FLA”) sets out the process by which property is divided between married spouses upon separation, which is known as the “equalization” regime. In essence, on separation, the spouses will each calculate their respective “net family property”, which is the increase in the value of the spouses’ assets and debts from the date of marriage to the date of separation. Absent an agreement between the spouses to the contrary, on separation, the spouse with the higher net family property figure will owe the other spouse a payment that is equal to half the difference between the two net family property figures (known as an “equalization payment”).

In the event of a spouse’s death during marriage, the surviving spouse may choose to either take the “equalization payment” in the same manner as on separation, or take what is provided for the surviving spouse under the deceased spouse’s Will.

The FLA does provide some special protection to gifts given to a child during their marriage. The equalization regime typically allows traceable gifts to be excluded from the calculation of net family property. However, as soon as a gift is used to purchase, maintain, or improve a matrimonial home, it loses its special status and the value of the gift will be shared equally between the child and their spouse upon a separation, or, potentially, upon the death of one spouse.

Even in the case of unmarried spouses, if a child is living with their partner in the home a parent helped them purchase, there is a risk that their partner could make a trust claim to share in the value of the home upon separation.

Accordingly, without proper planning, the funds you provide to a loved one to help with the purchase of a home could be shared with the loved one’s spouse on separation or death.

One way to protect the funds provided to a child for the purchase of a matrimonial home during a marriage is for the funds to be loaned rather than gifted. This changes the way the sum of money is treated under the FLA, making it a debt to be repaid to the parent. If funds are to be loaned for the purchase of a home, it is imperative that the loan be properly documented. This can be done, for example, through a promissory note that outlines a repayment plan, security for the loan, expectations for repayment and other similar details.

However, the best protection to ensure that a child retains the entirety of a parent’s gift towards a home is for the child and their partner to enter into a cohabitation agreement or a marriage contract (colloquially known as a “pre-nup”). This type of agreement can set out the child and their partner’s explicit intentions as to how to deal with their home upon a separation, including how a parent’s gift should be treated. A properly drafted cohabitation agreement or marriage contract can exclude a gift used for a matrimonial home from equalization on separation or death.

From an estates perspective, it is important to consider the effect of a gift or loan to one child on the overall estate plan. For example, if the parents have two children and their overall plan is to treat the children equally, a gift or loan to one child, or gifts or loans in unequal amounts between the children, must be accounted for in the parents’ Wills in order to achieve equality between the children.

Despite the recent uncertainty in Ontario’s real estate market, it seems likely that assistance from family members will continue to be a key support to young people purchasing homes. It is important that legal advice be sought before any financial assistance is provided to ensure that your legacy is protected.

[1] https://financialpost.com/real-estate/first-time-homebuyers-worried-afford-down-payments

December 2023, the art of giving: navigating donations through private foundations and donor advised funds, this month’s blog post was written by megan duncan, assistant vice president, associate investment counsellor at cidel..

Many Canadians are increasing their charitable giving initiatives as a way to give back to causes that are close to their heart and to create a legacy of philanthropic giving for generations to come. A great amount of wealth will be passed down from one generation to the next in the coming decades, and many families are looking to use this as an opportunity to pass down their philanthropic values, impart virtues and perpetuate the tradition of generosity. Charitable giving can be facilitated through three primary means – direct donations, private foundations and donor advised funds 1 .

Donating directly to charities is a simple and easy way for individuals and families to be philanthropic to qualified donees of their choosing. Giving this way is largely appropriate when donations are made as desired and are not part of a larger wealth planning initiative. Similar to private foundations and donor advised funds, individuals can donate either cash or securities and receive a tax receipt at the time of the donation.

Private foundations are registered directly with the Canada Revenue Agency (CRA) where the donor is responsible for all activities of the foundation (i.e. issuing tax receipts, screening charities to ensure they are a qualified donor as per CRA, remitting grants), including the fiduciary duty regarding management of the funds. One must be aware of the legal, administrative, and ongoing costs and duties of administering a foundation, such as tax filings and reporting requirements. Foundations are public entities and are subject to public disclosure of financial information, board members, trustees, and grants made. As such, private foundations lack anonymity.

Conversely, a primary advantage of a private foundation is that it allows donors to have control over when and where grants are made, subject to the applicable CRA rules and regulations (i.e. each year there is a stipulated minimum donation amount that must be made). Further, the foundation itself may be able to operate charitable programs itself, whereas donor advised funds cannot.

As one can imagine, the administrative responsibilities and regulatory requirements for operating a private foundation are vast and, for those without the necessary time and expertise, can be quite a burden to manage.

A Donor Advised Fund (DAF), on the other hand, is a flexible charitable vehicle registered with the CRA that allows you to grow your charitable assets tax-free and support charities of your choosing without the administrative responsibilities and costs of establishing your own private foundation. This means more of your effort can go directly toward the causes you care deeply about. The donor receives an immediate donation receipt in the year assets are transferred to the DAF, and can recommend grants from the fund to their preferred organizations and causes over time.

DAFs can be set up quickly and easily, with the Foundation handling the administrative tasks, reporting obligations, and remittance of grants on behalf of the donor. For many individuals and families, not having to undertake such responsibilities is a key advantage to using a DAF. DAFs can be named by the donor and therefore can be as transparent or anonymous as one would like. For families looking to make an impact anonymously, DAFs are the ideal tool.

In the case of private foundations and donor advised funds, the donation of assets into the charitable vehicle results in a tax deduction and the assets can be invested and grow over time in a tax-free manner, furthering the eventual asset base available for donations. In addition to providing much needed resources to support a great cause, this tax relief may be further enhanced if you donate public securities with accrued capital gains. By doing so, you are issued a charitable tax receipt for the fair market value of the securities but are not taxed on the gain realized at the time of making the donation. Donating securities in-kind is more efficient to both you and the charity as you receive a larger tax credit and are able to give more to the charity you care about.

Considering the donor’s circumstances and philanthropic objectives, each charitable giving option can provide distinct advantages. Initiating a dialogue between the financial advisor and the client to assess the merits and drawbacks of each giving option marks an important initial stride toward building a lasting legacy of charitable contributions.

1 Cidel is pleased to offer both Private Foundations and Donor Advised Funds. Please contact Cidel if you would like to learn more about how we can help you achieve your charitable objectives.

November 2023

Holding company and estate planning: planning ahead to avoid triple taxation, this month’s blog post was co-authored by héléna gagné , partner, and marc roy , associate, at osler, hoskin & harcourt llp..

There are a number of reasons why one may use a personal holding corporation as a part of her or his estate planning. In particular, it may have received tax-free intercorporate dividends from an operating company which were used to acquire investments in the holding company and benefitting from a deferral of the tax that would have otherwise been payable on those dividends had they been paid to an individual instead of the holding company. It may also be that an individual has transferred assets or investments to a holding company and introduced a family trust as part of a plan to pass property to one’s children while minimizing tax on death by deferring the realization of capital gains to the next generation.

In addition to these deferral advantages, using a holding company may be useful when it comes to making charitable donations in light of the recent changes to the alternative minimum tax (AMT). Under the new AMT rules, only 50% of the donation tax credit for charitable gifts made by individuals is allowed when determining whether the AMT applies and, depending on all the circumstances, can result in significant tax owing despite making a large charitable gift. The AMT does not apply to corporations and making charitable gifts from a holding corporation remains an effective strategy to support important causes in a tax-efficient manner.

There are, however, certain downsides that are important to be aware of. In our Canadian tax system, we have a general principle referred to as “integration” pursuant to which the total amount of tax paid at the corporate level and at the personal level on corporate income distributed to an individual shareholder should come out to the same amount as if the income was earned directly by the individual. However, this principle does not always work out perfectly; when it comes to capital gains earned by a holding corporation, in particular, the total amount of tax that has to be paid is slightly greater than if the capital gain is realized directly by an individual.

A much more important potential downside, but one that can be avoided with proper planning, is the potential for double or even triple tax upon death.

Generally, on a person’s death, there is a deemed disposition of their capital property and realization of any latent capital gains, giving rise to tax on those gains. But there can also be tax at the corporate level (e.g., upon a sale of assets by the corporation), and on the windup of the corporation or on distribution of its assets to an individual who inherits the shares.

Consider a parent who owns the shares of a holding company with investments that have appreciated in value, and who leaves those holding company shares to his or her child in his or her will.

If the parent simply held the investments personally, on death the parent would realize a capital gain on the appreciated value of the investments, which would be subject to tax in the estate in respect of the parent’s final taxation year. The child would inherit the investments with full basis and would only be taxed in the future on any further gains.

With the investments held in a holding company, on the other hand:

- The parent’s estate pays tax on the capital gain in respect of the holding company shares;

- When the holding company sells the investments to distribute their value, it realizes another capital gain and pays tax at the corporate level, effectively taxing the same gain twice;

- If the holding company also makes distributions to the child, the child pays tax on the taxable portion of the dividend received.

- The child will have capital losses in respect of the holding company shares, but the use of those losses is limited and insufficient to offset the additional tax.

This negative outcome can be prevented with good post-mortem planning, but the post-mortem planning can only be executed with good planning during life in anticipation. In particular, it is important to give the flexibility in your will to your executors to proceed with reorganizations of your holdings. The legal structure of your holdings might also be arranged prior to death in accordance with your estate planning goals with an eye to avoiding any tax pitfalls.

Another common situation that is important to plan for is the possibility of cross-border heirs to your estate. Making distributions to a beneficiary in the U.S. or other countries can add numerous layers of complexity. Where a U.S. beneficiary stands to inherit shares of a Canadian holding company, different strategies may be applied before death to prepare and to minimize the risk of double taxation between Canada and the U.S.

Cidel’s team of professionals can assist you in assessing all of your planning needs and can refer you to appropriate tax specialists to address and mitigate these and other potential pitfalls. It is important to involve and coordinate between your lawyer, accountant, tax specialist and wealth management team, who may play the role of chef d’orchestre , and always ensuring a holistic approach to your entire situation and your potential tax concerns.

DISCLAIMER Terms of Use

By accessing the wealth matters – our insights page, you agree that you have read, understood and agree to be bound by the website terms of use, in addition to the terms stated below. if you do not agree with this website’s terms of use , please exit from this page, and do not access any other pages on this website. , cidel bank & trust inc. (including its subsidiaries and affiliates, “cidel”) reserves the right, at its discretion, to change, modify, add, or remove portions of this page, and the information contained herein, without prior notice. , information is not legal or other advice, wealth matters – ours insights publications are intended to convey general information about legal issues and developments as of the indicated date. it does not constitute legal, tax, accounting, or any other advice and must not be treated or relied upon as such. , statements made in wealth matters – our insights publications, including the interpretation of case law, are of a general nature only and in no way represent a warranty of the position or accuracy of the law at the time, nor do they pre-determine any position cidel may take with respect to a specific fact situation or particular client matter. furthermore, cidel does not endorse, guarantee the accuracy of, or accept any responsibility for any content written or contributed by third parties who are featured as guest bloggers on wealth matters – our insights, nor does cidel endorse, guarantee the accuracy of, or accept any responsibility for the content of third-party websites or materials that may be linked, quoted or otherwise referenced in these publications. for greater certainty, cidel does not warrant or guarantee that the information contained on this page is accurate, complete, updated regularly and obtained from reliable sources., in making the wealth matters – our insights page available, no client, advisory, fiduciary or professional relationship, including a client-solicitor relationship is created, intended or established. the contents are not a substitute for the user seeking advice from a professional that is familiar with the reader’s factual situation or circumstances., october 2023, increasing the surface area of luck.

Can high quality businesses create their own luck? Click here to discover with Michael Brown the role of luck in business and how investors can better position themselves for success.

Navigating the proposed changes to Alternative Minimum Tax (“AMT”)

This month’s blog post was authored by chantal copithorn , partner at pwc canada..

AMT was first introduced in the 1980’s as a way to ensure a minimum amount of tax was paid on income that benefited from certain preferential deductions or incentives. Since then, there have been minimal changes to the AMT rules. That is, until now. The 2023 federal budget and recent draft legislation proposed a number of changes to the AMT calculation that could apply in 2024 with the intention of increasing the AMT tax rate, broadening the AMT base and better targeting the AMT to higher income earners.

For background, the AMT applies to individuals (including certain trusts) and is currently calculated as (a) the adjusted taxable income (“ATI”) less an exemption of $40,000, times (b) the lowest federal marginal tax rate (currently 15%) and reduced by (c) certain tax credits. A taxpayer will pay the higher of their regular tax liability or the AMT tax liability. To the extent the AMT exceeds the regular tax liability, the excess can be carried forward for seven years and can be credited against the regular taxes payable in those years, provided the regular taxes exceed the AMT in the subsequent year. Each of the provinces also have an AMT.

Proposed Changes

The draft legislation that was issued in August of 2023 proposed a number of changes to the ATI calculation including the following:

- Including 100% of a capital gain

- Including 30% of capital gains arising on the donation of publicly traded securities

- Limiting the deduction for certain interest and financing charges to 50%

- Limiting the deduction for capital loss carryforwards and capital loss carry backs to 50%

- Limiting the deduction for allowable business investment losses to 50%

- Limiting non-capital loss carryovers to 50%

- Eliminate the employee stock option deduction

The proposed changes also include disallowing 50% of non-refundable tax credits including the donation tax credit.

Additionally, the legislation increased the exemption to the second highest tax bracket (approximately $173,000 for 2024, indexed annually for inflation) and the AMT rate to 20.5%.

Certain trusts will now be excluded from the AMT, including graduated rate estates, and the basic exemption will be denied for other inter-vivos trusts (other than qualified disability trusts).

Let’s look at an example to show the impact of the proposed changes to a taxpayer who earns $100,000 of investment income and has a large one-time capital gain of $1,500,000.

Under the current rules, the taxpayer would pay the regular tax and not be subject to the AMT since the regular tax is higher. Under the proposed rules, the individual would be required to pay the higher amount of AMT being $292,535, of which $12,035 represents excess AMT that will carryforward and can be applied against federal taxes payable in the next seven years. This situation could arise where, for example, someone sells a vacation property, and does not claim their principal residence exemption. Depending on whether the individual has significant income in a future year, they may not be able to recover this punitive tax.

Looking at another example, an individual has a capital gain of $5,000,000 in a year and makes a donation of $4,000,000 to a qualified charity. The result is:

Under the current rules, the taxpayer will pay the regular tax and will not be subject to the AMT. The proposed rules will subject the taxpayer to the AMT at a much higher amount. The taxpayer may consider not making such a substantial donation as a result of the additional cost.

Taxpayers considering transformational donations will also be impacted (e.g., a taxpayer making a significant donation in the year of a sale of a business). The impact of the proposed AMT and whether they can use the AMT carryforward could be compelling and certainly will influence how much they give. This could cause a negative impact to the charitable sector resulting in less donations.

Since the rules are proposed to apply in 2024, taxpayers could consider triggering capital gains before the end of the year; and/or making certain donations before the end of the year so that the resulting tax impact can be determined under the current AMT rules.

The Department of Finance requested submissions on various tax proposals including the AMT with a deadline of September 8, 2023. A number of submissions were made but only time will tell whether any adjustments or relief to the draft proposals will be implemented.

Cidel Bank & Trust Inc. (including its subsidiaries and affiliates, “Cidel”) reserves the right, at its discretion, to change, modify, add, or remove portions of this page, and the information contained herein, without prior notice.

Wealth matters – ours insights publications are intended to convey general information about legal issues and developments as of the indicated date. it does not constitute legal, tax, accounting, or any other advice and must not be treated or relied upon as such., statements made in wealth matters – our insights publications, including the interpretation of case law, are of a general nature only and in no way represent a warranty of the position or accuracy of the law at the time, nor do they pre-determine any position cidel may take with respect to a specific fact situation or particular client matter. furthermore, cidel does not endorse, guarantee the accuracy of, or accept any responsibility for any content written or contributed by third parties who are featured as guest bloggers on wealth matters – our insights, nor does cidel endorse, guarantee the accuracy of, or accept any responsibility for the content of third-party websites or materials that may be linked, quoted or otherwise referenced in these publications. for greater certainty, cidel does not warrant or guarantee that the information contained on this page is accurate, complete, updated regularly and obtained from reliable sources., september 2023, today’s executor is a digital executor, this month’s blog post was authored by demetre vasilounis , associate at fasken martineau dumoulin llp..

The estates and trusts world has taken notice of the importance of digital assets—there is no question about that. Depending on an individual’s circumstances, their email messages, files, cryptocurrency or similar assets may have great significance to their estate plan. Therefore, if an individual’s digital assets are something that advisors and clients alike need to consider for every estate planning matter, the estates and trusts industry as a whole needs to start to thinking about how to best plan for those digital assets from a legal, financial and technical perspective.

To learn more about this topic, I read the late Sharon Hartung’s novel Digital Executor: Unraveling the New Path for Estate Planning . Sharon was an engineer who spent many years working for IBM. She began writing about digital assets and estate planning after experiencing challenges administering her mother’s estate. I was drawn to Sharon’s work through her first novel Your Digital Undertaker: Exploring Death in the Digital Age in Canada , which is all about taking an information technology-based project management approach to estate planning. While Your Digital Undertaker is a great book for anyone who is completely unfamiliar with estate planning , Digital Executor is more geared towards advisors who have only just begun to interact with the issues necessitated by digital assets.

The crux of the book is its exploration of the meaning of the term “ digital executor ” relative to the digital assets of the testator’s estate. By way of background, a will can delegate different executors for different types of assets: for example, a literary executor may be appointed to deal with copyrights if the deceased was an author, or an art executor may be appointed to manage the testator’s artwork (i.e. if the estate contains a large quantity of artwork). The idea is that these distinct executors have specific skills or knowledge that will assist them in their specialized roles, and are appointed in addition to the “primary” executor who deals with the other estate assets.

Naturally, one might think that a “digital executor” should thus have exclusive domain over the testator’s digital assets. As the novel points out, there are numerous problems with this idea. For instance, consider that many people’s digital and non-digital lives are very much intertwined. This not only means, for example, that people tend to “do everything” from their phones (such as sending messages, listening to music and even tracking their health), but also that their physical assets are very much connected to their digital assets (for instance, through banking or investing apps). This is also amplified by the fact that with each passing year, and each successive generation of people, the average person’s digital footprint is getting larger and larger ; naturally, this magnifies the role that digital assets play in one’s overall estate planning.

By way of example, in the 20th century, when a testator died, the executor would have been charged with the task of “going through their papers” in a home or work office and discovering information about the testator’s assets , liabilities and other affairs . While such a discovery process may still be relevant for some individuals today, in the 21st century most people’s email accounts would be the primary means of discovering such information. Indeed, email accounts contain all sorts of critical information: relationships with financial services (i.e. banks, insurance companies), outstanding billings (if, for example, the testator ran their own business or practice), or even information about other digital assets (e.g. if the testator held crypto with any third-party service provider ) , among many other things. In an increasingly environmentally-conscious world, it’s becoming far less likely that an individual will preserve this information o n a piece of paper when an email account is simply more accessible . All of this is to say that if the executor is not able to access the testator’s email account due to a lack of planning on the testator’s part, then this could be a colossal issue for the estate.

As Digital Executor points out, the ability to access a testator’s email accounts isn’t just convenient; it’s essential. Therefore, email accounts of the testator are something that an executor would need to be able to access and manage, and accordingly are not something that should be limited to a digital executor. That’s exactly the argument that Digital Executor makes : the term “digital executor” is an invented one, as today’s executor is a digital executor and as such will need to be equipped to handle managing the testator’s digital footprint and its implications for the testator’s overall estate planning.

Of course, as the trusts and estates industry has begun to learn, a lack of proper planning can lead to being locked out of digital assets that could affect the overall ascertainable value of the estate (like email , as described above ) or may themselves have an inherent value (like cryptocurrency). Such planning is important in many ways; even something like neglecting to cancel a testator’s monthly or yearly subscriptions to certain digital services can unnecessarily cost the estate hundreds (or even thousands) of dollars per year.

Digital Executor: Unraveling the New Path for Estate Planning is a great resource for helping advisors learn both the digital assets and overall estate planning questions they should be asking their clients. It’s no secret in any estate planning matter communication is key, and the increasing relevance of this topic will only continue to beget an increasing need for such communication.

August 2023

Alter ego and joint partner trusts, this month’s blog post was authored by michael rosen , partner at fogler, rubinoff llp.

Alter ego and joint spousal or common-law partner trusts (referred to here more simply as a “joint partner trust”) are unique types of trusts that can provide tax savings and estate planning benefits. In the right circumstances, they can be a useful tool for estate planning purposes. In this blog, I provide a brief overview of their features and some considerations about their use.

Key Characteristics

Alter ego trusts and joint partner trusts have the following key characteristics (note that for simplicity, when I write “spouse” I am including “partner” as well).

- The trust is created during the lifetime of the settlor.

In other words, the trust cannot be created by a will.

- The settlor was 65 years or older at the time the trust was created.

The “settlor” is the person who creates a trust. These trusts are only available to those over the age of 65.

- the settlor (or the spouse of the settlor, for a joint partner trust) alone must be entitled to receive all of the income of the trust, and

- no person other than the settlor (or the spouse of the settlor, for a joint partner trust) can receive any income or capital from the trust.

For an alter ego trust, the settlor is the only person entitled to receive anything from the trust, while the settlor is still alive. For joint partner trusts, the settlor and the settlor’s spouse are the only individuals entitled to receive anything from the trust while either of them is alive.

- The settlor and the trust must be resident in Canada.

A person who is not resident in Canada cannot create an alter ego trust. Furthermore, the trust must remain resident in Canada.

Generally speaking, the residency of a trust is determined based on where the “central management and control” of the trust actually takes place. Therefore, a non-resident trustee should generally not be appointed. This can be an issue if the settlor wants to appoint a child who is not resident in Canada. A trust company may be able to act instead to ensure the residency of the trust remains in Canada.

- For joint partner trusts, both the settlor and the spouse of the settlor can contribute property to the trust.

The CRA has confirmed that two spouses can create a joint partner trust by jointly contributed property to the trust (and no one else contributes). Subsequently, either spouse can continue to contribute property to the trust.

Tax Treatment

Alter ego trust and the joint partner trust get special tax treatment, which is why they are used at all. These features are as follows:

- There are no taxes paid when property is transferred into the alter ego trust.

Normally when a person transfers assets into a trust, there is a deemed disposition and capital gains taxes must be paid on those assets. By default, property transferred into an alter ego trust or joint partner trust does not result in a deemed disposition (although in some circumstances, the person transferring the funds can elect to opt out of this special tax treatment and pay taxes immediately).

- The 21-year deemed disposition rule does not apply.

Normally, a trust is deemed to have disposed of all of its assets on the 21 st anniversary of the trust and therefore would have to pay taxes on any accrued gains in the trust. Alter ego trusts and joint partner trusts are an exception to this rule. Instead, the deemed disposition will occur for alter ego trusts on the death of the settlor, and for joint partner trusts on the death of the survivor of the settlor and the settlor’s spouse.

- The highest marginal rate applies to any taxable income generated in the trust.

This is not a helpful feature, and is in fact similar to most other trusts. These trusts must pay taxes at the highest marginal rate. However, normally trust income is paid to the settlor or the settlor’s spouse, and is then taxed at their respective marginal rate.

Benefits and Drawbacks

Alter ego trusts and joint partner trusts are often used for estate planning and probate planning purposes. In Ontario, probate taxes are called “estate administration tax.” Because trust assets are no longer directly the settlor or contributor’s property, if a will must be submitted for probate, the assets of the trust are not part of the deceased person’s estate and probate tax does not need to be paid on those assets. Furthermore, because the trust continues to exist after the death of the settlor (or the settlor’s spouse), a probated will of the deceased person should not be required and the assets can be accessed more quickly. Finally, it can be helpful when capacity is at issue to have an alternate trustee act instead of someone under a power of attorney.

Other benefits can include privacy (the value of an estate must be listed on a probate application in Ontario, which is technically a public document) and creditor-proofing (a discussion of this is well beyond the scope of this blog).

However, alter ego trusts and joint partner trusts can have drawbacks and therefore are not recommended for everyone. These drawbacks include increased complexity – conceptually, a trust is not a straightforward concept and can be difficult to understand. There also are additional expenses associated with the trust, including the initial setup and annual tax returns that will be required. There are also some negative tax implications, such as a potential mismatch on losses being applied against gains from the settlor’s personal assets and no access to the graduated rate estate rates.

If you are considering using an alter ego trust or joint partner trust or think you might benefit from one, you should talk to your lawyer or professional advisor.

Uncertainty (An Investing Parable)

Michael Brown, Lead Portfolio Manager CPA, CA, CFA, share a captivating tale that follows investors quest for certainty in an uncertain world.

Executor Horror Stories and Benefits of a Professional Trustee

This month’s blog post was co-authored by justin irwin, trust officer at cidel trust company, and brodie kirsh , associate at aird & berlis llp..

When preparing an estate plan, there are many factors to consider such as tax efficiency, cross-border issues, beneficiary designations and family dynamics. However, it is also essential to think long and hard about your choice of executor (referred to as an “estate trustee” in Ontario). While advance arrangements are incredibly important, you should be cognizant of the fact that unexpected things may happen. Seeking advice from legal and other professionals can help you anticipate issues that may arise from your choice of executor. The following scenarios aim to illustrate what can go wrong with a choice of executor and why professional assistance can be beneficial.

Scenario 1: The Unreliable Executor

The deceased prepared a Will naming her son as executor. After she died, her son was convicted of a crime and sentenced to prison and so was unable to act. The alternate executor named in the Will was also unfit to act. The Will was misplaced and, with neither named executor able to act, the Estate went unadministered for two years. The Estate’s debts and expenses went unpaid, and the bank that had provided the deceased with a secured line of credit took possession of her house and sold it for below market value. To resolve this situation, the family’s lawyer applied to the Court to prove a photocopy of the Will and be appointed as executor. As a result of the delays in administration, the value of the Estate was significantly reduced by taxes, legal fees, and bank fees.

As showcased with this example, it is important to consider all an individual’s qualities and behaviors to determine whether there are any ‘red flags’ that might arise in the course of an estate’s administration. If you are unsure of whether your choice of executor would be a good fit, choosing a professional trustee may be the better option to ensure proper and consistent estate administration. Additionally, a professional trustee will be able to hold the original Will in a safe and secure location to avoid the challenges of proving a lost will.

Scenario 2: The Family Dispute

The deceased in this scenario left a Will naming one of her three children as executor. When the chosen executor was unable to act, poor communication between the three children caused delays before another one of the children was appointed as executor. Once appointed, the executor paid off the mortgage owing on the deceased’s real estate and completed significant repairs and renovations to sell the property. Unfortunately, sour relationships between the siblings provoked a series of disputes over the Estate. These included the amount the executor paid for professional services and other estate expenses, and a variety of issues involving loans and gifts to the siblings during the deceased’s lifetime. The disputes needed to be resolved via lengthy and costly litigation.

As evidenced in this example, appointing a family member to administer an estate, particularly when one sibling is appointed over another, may cause aggravation and exacerbate any existing disagreements within the family. Professional trustees, however, are not personally invested in the estate or the family’s affairs and are unlikely to have a potential conflict of interest. If you anticipate that family issues may cause future discord, it may be prudent to appoint a professional trustee to act as executor over a family member.

Scenario 3: The Complex Estate

The deceased died in Ontario without a Will. None of his immediate family lived in Canada, and no other family member would be an obvious choice to act as executor. Beyond the logistical difficulties, the deceased had a complicated Estate for a variety of reasons: (1) he was the majority shareholder of a business and the executor needed to determine the value of the shares to be bought out by his business partners, (2) he owned property outside of Canada, meaning that it would be necessary to deal with foreign jurisdictions, and (3) the deceased was involved in litigation before his death, which the executor would need to resolve. Given this state of affairs, none of the deceased’s family were eager to act as estate trustee.

When someone has a complex estate, it may be challenging for friends and family to administer. Rather than burdening those closest to you with a complex estate administration, a professional trustee may be in the best position to effectively administer your estate due to their specialized knowledge and expertise.

Every person’s needs are different when it comes to estate planning and administration. As seen in the above examples, thinking ahead when it comes to your choice of executor can help you avoid many problems and save significant costs. If there is no suitable choice in your family or group of friends to act as executor, or if the estate will be complex or high conflict, then a professional trustee can provide the necessary experience, diligence, and impartiality. It is important to discuss these scenarios with a range of professional advisors such as lawyers, accountants, and wealth managers to ensure that there will always be a suitable executor who can continue the administration of the estate and any trusts that are included in your Will.

Probate Tax and Probate Planning in Ontario

This month’s blog post was written by jennifer a.n. corak , partner at minden gross llp..

In Ontario, [1] estates lawyers are routinely faced with questions regarding probate tax and probate planning. This article discusses some often-asked questions.

What is Probate Tax?

“Probate tax” (formally, Estate Administration Tax) is paid when an application is made for a Certificate of Appointment of Estate Trustee to prove the authority of an executor to administer a deceased’s estate and, if the deceased died with a Will, to prove the validity of that Will (a process often referred to as probating the Will). [2] Whether such a Certificate is needed generally depends on the type of assets owned by the deceased at death, and whether they died with a Will. For example, when an individual dies with a Will, the Will gives the named executor the authority to act; however, third parties sometimes require proof of that authority before allowing such executor to administer the deceased’s assets. The named executor obtains this proof by applying for a Certificate of Appointment from the Ontario Superior Court of Justice. [3]

How is Probate Tax Calculated?

Probate tax is currently calculated as 1.5% of the value of the assets administered under the Will being probated above $50,000. [4] Therefore, if the assets flowing through a Will had a value of $2,050,000 at the deceased’s death, $30,000 of probate tax would be owing as part of the application (calculated as ($2,050,000 – $50,000) x 1.5%). Certain asset values are not included in the calculation (e.g., the value of assets that flow outside of the Will and of real estate outside Ontario). Where Ontario real estate is concerned, the value to be included in the calculation is the value less encumbrances.

What is “Probate Planning”? Can Probate Tax Exposure be Minimized?

“Probate planning” is used to describe taking steps to reduce exposure to probate tax. A number of strategies can be employed to do so, but it is important to remember that no two situations are the same. Each individual must consider their own personal circumstances, including their wishes regarding asset distribution, and should get legal advice from a qualified estates lawyer before engaging in probate planning. Some examples of probate planning opportunities, as well as high-level comments on each, follow:

- Multiple Wills

In Ontario, a common probate planning strategy is the execution of multiple Wills. As mentioned above, probate tax is calculated based on the value of the assets being governed by the Will being probated. Certain assets would not need a probated Will to be dealt with (e.g., probate is often not needed to deal with shares in closely-held private corporations and personal effects).

This strategy generally separates assets into two categories. One Will (often called the “Secondary Will” or “Non-probated Will”) governs the distribution of assets that do not need a Certificate of Appointment to be administered, and the other Will (often called the “Primary Will” or “Probated Will”) governs the distribution of the remaining assets. Only the value of those assets that fall under the Primary Will being probated would be exposed to probate tax. The cost and added complexity of this planning is often weighed against the possible probate tax savings on death.

For example, consider the business owner that holds shares in a private corporation worth $1,000,000, where the other shareholders do not require proof of the executor’s authority to act. By having a Secondary Will govern the distribution of such shares, probate tax exposure is reduced by $15,000.

- Bare Trust Planning

In Ontario, legal and beneficial ownership can be split, opening the door to bare trust planning using a nominee corporation (the “Nominee”). This strategy involves transferring legal title in an asset to a Nominee while keeping beneficial ownership. Despite being on title, the Nominee is only an agent of the beneficial owner(s) and the relationship between the Nominee and beneficial owner(s) is generally documented by a written agreement or declaration of trust. On the beneficial owner’s death, legal ownership remains with the Nominee and beneficial ownership is transferred in accordance with the deceased’s Secondary Will (meaning the need for properly drafted multiple Wills). Set up and on-going maintenance costs should be considered before engaging in this planning.

- Designating Beneficiaries

When beneficiaries (other than a deceased’s estate) are designated on life insurance policies and registered investment accounts, they pass directly to the designated beneficiaries (not forming part of the deceased’s estate) and are not subject to probate tax.

Before designating a beneficiary, consideration should be given to how the designation fits within the overall estate plan (e.g., perhaps liquidity from the registered account is needed to satisfy cash gifts in the Will). Form and content of the designation should also be considered, as well as tax consequences that flow from it (if any).

- Joint Assets

If assets are held jointly so that they pass automatically to a surviving owner on the death of the first to die, then such assets pass outside of the deceased’s estate and are not subject to probate tax. This strategy, if effective, would only avoid probate tax on the first death. It is often seen with spouses (e.g., when they own their home as joint tenants, with right of survivorship [5] ).

There are legal considerations before engaging in this planning, particularly when a parent is contemplating adding a child as joint owner. A qualified estates lawyer should be consulted before taking steps to change ownership, and legal advice should be obtained regarding risks associated with joint ownership (e.g., exposure to creditors), and steps needed for this strategy to be effective (sometimes multiple Wills are needed).

With careful planning it is possible to reduce exposure to probate tax, but what may be an appropriate probate planning strategy for one might not be for another. Probate planning should be considered in the context of an individual’s estate plan as a whole, with the benefit of legal advice, and the individual should remember that changes in law, circumstances or the administrative practices of third parties can impact a plan’s effectiveness.

[1] This article focuses on the laws in the Province of Ontario.

[2] an executor may want or need to probate a will for other reasons; this is beyond the scope of this article., [3] if an individual dies without a will, someone would apply to have authority to administer the deceased’s assets., [4] the value of the estate is rounded up to the nearest thousand (e.g., if the value was $2,049,250, probate tax would be calculated on $2,050,000)., [5] as opposed to owning their home as tenants in common., how cidel’s canadian equity team compounds intellectual capital.

Michael Brown, Lead Portfolio Manager CPA, CA, CFA, examines the flywheel effect of compounding intellectual capital with the Canadian Equity Team at Cidel.

Click here to read more.

A recap of recent amendments to the succession law reform act: what you need to know*, this month’s blog post was written by andrea tratnik , partner, trusts and estates group, and damian di biase, student-at-law, at beard winter llp..

Last year, significant changes were made to the Succession Law Reform Act , RSO 1990, c S.26 (“ SLRA ”), which is the primary legislation in Ontario that governs estate law. In particular, effective January 1, 2022, key amendments were made to the SLRA regarding the remote witnessing of Wills, testamentary effects of marriage and marriage dissolution, and validating testamentary documents. These changes, which have had a considerable impact on estate planning, are outlined below.

Parties can continue to use audio-visual communication technology for Will signings

Prior to the Covid-19 pandemic, Wills and Powers of Attorney had to be signed in the physical presence of two witnesses. Emergency measures were introduced during the pandemic to allow for virtual signings of these documents; changes to the SLRA made these measures permanent for Wills and corresponding changes to Ontario’s Substitute Decisions Act, 1992 , SO 1992, c 30 made these measures permanent for Powers of Attorney.

More particularly, testators and witnesses may continue to use audio-visual communication technology to satisfy the requirement that they be in the presence of each other for the signing of a Will or Power of Attorney. This option may assist testators who have poor health or mobility issues by enabling them to participate in estate planning fully via platforms such as Zoom or Microsoft Teams. In order to proceed with a virtual signing, at least one witness must be a lawyer or a paralegal.

Electronic signatures on Wills and Powers of Attorney are still not permitted. Virtual signings require wet ink signatures and involve the use of counterpart documents.

Marriage no longer revokes Wills, but spousal gifts and executor appointments are revoked upon separation

Formerly, a Will was automatically revoked by marriage. As a result of the SLRA changes, marriage no longer revokes a Will. The result of this amendment is that testators who have Wills preceding a marriage will not have to re-make or re-sign their Wills in order for such Wills to remain in effect after marriage; they will, however, need to consider whether they wish to make changes to the terms of their Wills to provide for their new spouse.

While marriage no longer revokes a Will, any testamentary gift made to a spouse, and any appointment of a spouse as executor or trustee, will be revoked upon separation. This revocation formerly applied only upon divorce.

A spouse will be considered to be separated from a testator if, before the testator’s death, they were living separate and apart as a result of the breakdown of their marriage for a period of three years, they entered into a valid separation agreement, or either a court order or a family arbitration award was made in the settlement of their affairs arising from the breakdown of their marriage.

Spouses who are separating but still intend to give testamentary gifts to each other will need to update their testamentary documents to ensure these gifts are not revoked.

Spousal entitlements no longer apply to the separated spouse if the deceased dies intestate

If a person dies without a Will, their estate will be distributed in accordance with the intestacy laws set out under the SLRA. Generally, a person’s spouse and children are the primary beneficiaries under an intestacy and, formerly, the SLRA made no distinction between spouses and separated spouses.

Separated spouses are now excluded from being able to receive spousal entitlements on an intestacy. A spouse will be considered separated from the deceased for this purpose in accordance with the same criteria set out above.

While this change may prevent some unwelcome consequences, it remains advisable to have a Will in place to adequately address all testamentary intentions.

Improperly executed Wills can now be validated through an application to court

Previously, a Will was not valid if it did not comply with the formal signing and witnessing criteria set out under the SLRA.

However, parties may now apply to the Superior Court of Justice for an order that an improperly executed Will is valid and fully effective. The Court may grant the order if it is satisfied that the document sets out the testamentary intentions of the deceased.

This amendment may assist in situations where – due to timing issues or otherwise – a document was not executed properly but testamentary intentions are clear. Despite this relieving provision, it remains advisable to meet all formal requirements when signing a Will.

For more information on these changes and for further assistance in your estate planning, please reach out to your wealth consultant and/or a lawyer.

* A modified version of this article first appeared on Beard Winter LLP’s website on March 31, 2023.

Incapacity planning: who decides when you cannot, this month’s blog post was written by hayley peglar , partner at weirfoulds llp..

Incapacity planning refers to addressing circumstances in which you are unable to make decisions on your own behalf while you are alive. Turning your mind to potential future incapacity can give you agency in decisions made on your behalf and soften the impact of a further temporary or permanent incapacity for your loved ones.

This post focuses on Ontario’s framework for two key realms of decision making: property and personal care. In general, when you are unable to make these decisions, they are made by either your attorney [1] under the terms of a power of attorney document or they are made by a statutory or court-appointed guardian of property. [2] The Substitute Decisions Act, 1992 (the “ SDA “) [3] sets out the framework for powers of attorney and guardianships of property and of personal care/the person.

Decisions about Property

Decisions about property include those concerning a person’s assets and liabilities of all forms, including, e.g., cash and investments, real estate, corporate interests, digital property, and taxes.

The SDA permits a person (referred to as the “grantor”) to grant a continuing power of attorney for property. A continuing power of attorney is a document which gives authority to the attorney to manage the grantor’s property even once the grantor has lost capacity to make decisions about their property. The attorney will be able to do on the person’s behalf anything in respect of property that the person could do if capable, except make a will, subject to the conditions and restrictions set out in the power of attorney.

What happens if a person does not have a power of attorney for property in place? If a certificate is issued under the Mental Health Act , [4] the Public Guardian and Trustee will be the person’s statutory guardian of property unless and until they are replaced. [5] If no certificate has been issued under the Mental Health Act , it will be necessary to start a guardianship application.

Any person [6] may apply to the Ontario Superior Court of Justice to seek to be appointed by court order as an incapable person’s guardian of property. Guardianship applications take time (often months, and sometimes even years) and can cost in the tens of thousands of dollars (and much more if the guardianship is contested). A guardianship application must be served not only on the allegedly incapable person and the Public Guardian and Trustee, but also on their spouse or partner, children who are at least eighteen, parents, and brothers and sisters (if these people are known). Depending on your family dynamics, this may not be consistent with your wishes about who is given notice of your incapacity. While guardianships play a crucial role in the protection of incapable adults, they require a public court process, when you may wish for your personal circumstances (such as your medical circumstances and financial circumstances) to be kept private. The court might appoint someone as your guardian you would not choose yourself.

Decisions About Personal Care

Decisions about personal care include those concerning health care, nutrition, shelter, clothing, hygiene and safety.

What happens if a person loses capacity to make personal care decisions without a power of attorney for personal care in place? While the Health Care Consent Act identifies substitute decision makers for medical treatment where there is no attorney for personal care or guardian of the person, decisions relating to other personal care matters are not clearly provided for by legislation. It may be necessary for a family member or friend to apply to the court to have a guardian of the person appointed. As with a guardianship for property, such an application may be expensive, time consuming, invasive, and at odds with your personal preferences. [7]