Plan Projections

ideas to numbers .. simple financial projections

Home > Business Plan > Funding Requirements in a Business Plan

Funding Requirements in a Business Plan

… our funding requirements are …

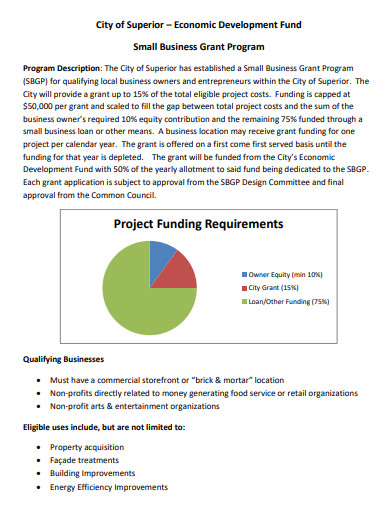

The summary given in the funding requirement section should be consistent with the rest of the business plan. The amount needed, and when it is needed should follow from the detailed financial projections, and the purpose of the funding, sales and marketing, hire of employees, to achieve a milestone etc. should again link in with the rest of the plan,

Funding Requirements Presentation

This is part of the financial projections and Contents of a Business Plan Guide , a series of posts on what each section of a simple business plan should include. The next post in this series is the final section, and deals with the planned exit for investors.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Funding Request for Your Business Plan

What goes into the funding request, parts of the funding request, important points to remember when writing your request, frequently asked questions (faqs).

MoMo Productions / Getty Images

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan. There are a variety of ways to fund your business without debt or investors. Below, we'll cover how to write the funding request section of your business plan.

Key Takeaways

- The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

- You'll want to include information on the business, your current financial situation, how the money will be used, and more.

- Tailor each funding request to the specific funding source, and make sure you ask for enough money to keep your business going.

The funding request section provides information on your future financial plans, such as when and how much money you might need. You will also include the possible sources you could consider for securing your funds, such as loans or crowdfunding. Later, you can update this section when you need outside funding again for business growth.

An Outline of the Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the funding request section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners' and members' information (for partnerships and corporations), and any successes you've had to date in your business.

Current Financial Situation

Again, you've provided some financial information in the financial data section , but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation.

Provide financial details such as income and cash flow statements, and balance sheets in your funding request section.

Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset. If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future as far as five years out.

How Will the Funds Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, and more. If you plan to use the money for several things, highlight each and how much money will go to each.

Most financial sources would rather invest in things that grow a thriving business than things that pay for debt or overhead expenses.

Current and Future Financial Plans

Current and future financial plans include items such as loan repayment schedules or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (and how long before they can do that).

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:

- Tailor your funding request to each financial source : Lenders and investors need different information, such as loan repayment versus ROI, so create different reports for each.

- Keep your funding sources in mind : Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going : Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

How do you request funding for a nonprofit?

Most nonprofits seek funding in the form of grants. Write a grant proposal that includes information on the project or organization, preliminary budget needs, and more. Be sure to format it with a cover letter, proposal summary, the introduction of the organization, problem statement, objectives, methods, evaluation, future funding needs, and the budget.

What are three methods of funding?

Grants and scholarships, equity financing, and debt financing are the main three methods of funding for small businesses . Grants and scholarships do not need to be repaid and are often best for nonprofit organizations. Equity financing is when you receive money in exchange for ownership and profits. Debt financing is when you borrow money that needs to be repaid.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Fund Your Business ."

Congressional Research Service. " How To Develop and Write a Grant Proposal ."

Library of Congress Research Guides. " Types of Financing ."

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated April 10, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

13 Min. Read

How to Write a Nonprofit Business Plan

5 Min. Read

How to Write a Business Plan in Under an Hour

7 Min. Read

How to Write a Brewery Business Plan + Free Sample Plan

11 Min. Read

How to Write a Business Plan for a SaaS Startup

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

Write the Funding Request Section of Your Business Plan

Free Startup Fundraising Checklist

Aayushi Mistry

- December 12, 2023

While writing a business plan to seek funding, you must be clear about what needs to be written under the section where you would request funding. This is an important and essential section of your business plan.

What Is the Funding Request?

A funding request section of your business plan allows you to ask for the required fund. While writing the request, you always have to mention the timeline in which you will utilize the funds. Usually, this timeline is up to the next 5 years from the request.

The funding request may differ on the age of your company. If your company is only a start-up, it will have to provide more details than any older company. Generally, any business up to its 7th year is called a startup company. Although this criterion may differ with respect to location and industry.

Step-by-Step Guide to Writing the Funding Request of Your Business Plan

Before you start writing your requests, be clear about your requirements. And, in the same line, be very clear explaining it. Your readers want you to get to the point. So, they can make accurate decisions just in time. Moreover, it will also save you a lot of time and effort.

Once the facts and figures are drawn (accurately), you need to draft them properly into your business plan. And you have to be very careful and precise while doing it.

So ideally, you need to figure out your requirements. And then put it into the context of the business plan.

So, How to derive your funding requirements?

Deriving funding requirements get a little overwhelming. But if you take it one step at a time, it starts getting easier.

First, determine what you need money for

It could be for hiring new staff, getting new equipment, or starting your business at a new location . Just be very clear with the goals. Then list down the requirements and the required fund for it. In the end, sum it up. If you want funds for recovering your debts, explain all your debts in detail.

Now, It Is Time to Know How Much Amount Can You Get on Your Own.

- Calculate the financial resources: Look out for your saved capital in cash as well as in personal assets. Other than that, see if you can gather the funds from friends and family.

- Grants and subsidies: Check if your company is eligible for any government grants and subsidies. If yes, apply for it and add the amount. Calculate and find the difference between the required amount and the amount you can already put together. And that will be the amount you will be needing from the third party, investors, or from the bank. Once you have the right fund requirement at hand, list out the investors, moneylenders, and loans who can provide you with the sum.

Now, Let’s Start Writing Your Funding Request

1. Provide Business Information

Yes, you still have to give this brief even though you have already explained it in detail. No, it does not get redundant-It does not have to be. In fact, you can take it up as an opportunity to give a little recap to your potential prospects and moneylenders.

Moreover, sometimes, you might have to only send the funding request section and not the entire business plan. In such cases, such information comes handy.

So, here’s what you will have to explain in the funding request section of your business plan-

- Target Market

- Your business structure like LTD, LLC, or more

- Brief about your product/service

- Partners involved

- Business heir, if there exists.

2. Mention the Current Financial Situation

You might have provided some financial information in the financial section. But, you have to add some figures here anyway. Not only will make it contextual, but even easier to have a clear picture in one place.

Here are some financial details that you will have to include in this section:

- Quarterly as well as yearly cash inflow and outflow

- Balance sheets

- P&L statement

- Expected financial condition in the upcoming quarter and year

- Include the list of assets and their ownership details if you are asking loan from the bank

- If your business is in debt, explain the situation in the detail and a brief plan for paying it.

- Mention how much return on investment can they expect.

- In the end, mention how will you pay off the loan or transfer the ownership of the business.

3. Announce How Much Funds Do You Need?

When you explain the situation in brief and have all the facts and figures put aside, narrow it down to your requirements. Mention how much money you need.

4. Discuss Briefly How Will You Use the Money?

Here, you have to narrow down what you need the money for and how you are going to use it. Just list down the details and put the figure for it- so much like how you do your billing. If they are taking the money for multiple things, highlight every detail.

5. Dive Deep into Current and Future Financial Planning

You must have explained a little about the inflow and outflow in the financial section. But over here, you have to get into the details like-

- If you are getting a loan, outline your timelines for payments.

- If you are looking forward to selling, mention how it will affect the investors.

- And then, finally, mention the exit strategy . Your exit strategy includes how you will transfer the business ownership at the end.

- You only have to add the funding request if only you want the funding from outside. If you don’t want to raise your funds from a third party, then you don’t have to include them in your business plan.

- Your investors would like to invest in your business if only it is thriving or promising. They are less likely to lend money if you are in debt.

- You see, you are asking for money. So don’t take this section casually. Know your business inside out and only involve people who know everything about your business.

- Be as specific about your requirements and the funding that you require.

- If you are planning to send it to different investors, tailor your funding request according to the reader.

- All your sources have different mindsets and different funding criteria. Be very specific about it. Do detailed research before starting to write your funding request.

- Don’t hesitate while asking for the funds. Be open and ask just as much as your business really requires. But at the same time, don’t be greedy.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

About the Author

Since childhood, I was in awe of the magic that words bring. But while studying computer science in college, my world turned upside down. I found my calling in being a copywriter and I plunged into a world of words. Since then, there is no looking back. Even today, nothing excites me to find out the wonders the words can bring!

Related Articles

Convince Your Investors that Business is Ready to Scale-Up

7 Small Business Financing Options

How to Prepare a Financial Plan for Startup Business (w/ example)

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Business Plan Funding Request Section: How to Write Guide .

Sep 17, 2023 | Business Consulting , Business Growth , Business Performance , Business Plan , Financial Plan , Funding Needs , Funding Request , Small Business , Startup , Strategy

How to Write the Business Plan Funding Request

“It is more rewarding to watch money change the world than to watch it accumulate.” –Gloria Steinem.

By now, you’ve made significant progress in developing your business plan. With this, the eighth article in our Creating a Detailed Business Plan series will focus on including a funding request.

Business plans are generally the catalyst for requesting banks, lenders, and investors to invest money into a company . Usually, the business plan and funding help support business growth or rapidly scale a startup company.

As you can imagine, this makes the funding request section extremely important . Business plans can be written even with ample existing funding and can be in stages to support different business expansion phases. You can omit a funding request if you aren’t looking for outside investment.

The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

Benefits of including a business plan funding request section

A business plan typically consists of various areas, and if you intend to secure funding for your business, it’s crucial to include the funding request section. Fortunately, this part of your business plan is only necessary if you plan to seek external financial assistance. If you don’t require any funding, you can skip this section.

There are various ways to fund your business without debt or investors. This article will help you create a persuasive funding request for your business plan.

What information is needed for the business plan funding request?

The business plan funding request section of your plan outlines your financial needs for the future, including how much money you require and when you will need it. You should also mention the various sources you could use to secure funding, such as loans or crowdfunding.

Remember that you can constantly update this section in the future if you require additional funding for business expansion.

How much money and how much duration must you include in your funding request?

A funding request is no time to be shy. Your readers will know what funding you’re after when they get to this section, so be forthright. Declare your business funding needs now and in the future. Give exact figures, and spell out any further infusions you’ll require over the next five years.

Explain how long the funds will be needed , when you plan on repayments, and when the investor can expect a return. It’s also helpful to spell out whether you’d prefer a loan, a grant, a direct investment, and any other relevant terms you would like included . For example, are you willing to give up equity in your business to secure the loan, or will you be personally underwriting the loan from your assets?

How do you plan to use the requested funds?

It’s unlikely that anyone will give you money if they don’t understand how you plan on using the funds. So be explicit when explaining the purpose of your request. For example, note whether the funding will go toward working capital, additional equipment, or business expansion to new premises or regions.

Describe your plans if you are growing your team or expanding your operation. If you plan on buying another company, explain what this will do for your bottom line and cash flow.

You might also use the funds to retire debt, create and market a new product line, or combine things. Whatever the use, be rigorous in your explanations.

Business banks and investors aim to secure a reasonable return on their investment. So, they’re far more likely to fund businesses that plan to use the money to grow and become more profitable.

But, on the other hand, if they get the sense that the money is just helping to string along a failing enterprise or the owner is not clear on the funding required, they’ll stay away.

What are your long-term plans for the business?

If you have any solid, situational plans for the business that might positively impact investors, you should spell them out.

Consider your plans for scaling your business. If there’s an expectation of a lucrative buyout or acquisition after meeting specific benchmarks, mention this. Describe your goals if you plan on selling a portion of the company to focus your efforts on more profitable areas.

Mention any primary debt service you plan to make, mainly if it will put your company on a firmer footing for the future.

Why should investors trust you?

This question is critical. It would help convince your readers that you would be a good steward of their money and your business. It’s essential to remember that those who are providing you with money are doing so with the expectation of being paid back and making a profit. If they don’t trust you or doubt your ability to make this happen, they may not be willing to get involved.

Explain the assumptions you’re making in your plans and provide the proper financials to support your contentions. Let the data speak. If you’re correct, the research will bear out our position.

Planning for your finances now and in the future

When it comes to financial planning and funding your growth , it’s essential to consider factors such as loan repayment schedules and potential business sales. If you are seeking a loan, it’s wise to detail your repayment plans, although lenders will likely have their agenda in place. If you plan to sell your business, it’s crucial to inform the lender and explain how this may impact them. Additionally, you should consider possible relocation if you plan to move or a buyout if that’s on the table. Lastly, informing investors of their exit options, such as the ability to cash out and the timeline for doing so, is essential.

Our upcoming article will focus on creating financial projections for a business plan.

You can achieve your goals, and Noirwolf is here to assist you.

Putting together a funding request can be daunting. Asking your accountant for help is always a good idea. You can also use tools like Microsoft Excel and financial planning software like LivePlan . If you need further assistance, we’re ready to help out.

Contact us today to learn more about Noirwolf Consulting services and how we can significantly help you .

Get in Touch

Are you looking to grow your business but unsure where to start? Our small business consulting and leadership coaching services are here to help! We’ll work with you to scale your operations and achieve your goals. Plus, we offer a free 30-minute consultation to ensure we fit your needs correctly. Let’s get started!

Contact Noirwolf Consulting today using the website contact form or by emailing [email protected] or call us at +44 113 328 0868.

Recent posts .

What is Program Management?

Apr 2, 2024

Program management is a vital component of organizational success, as it enables the coordinated execution of interdependent projects that yield benefits beyond the scope of individual project management. It involves the judicious application of knowledge, skills, tools, and techniques to meet specific program requirements. Our experience has demonstrated that organizations with well-developed program management and program management offices (PMOs) consistently outperform those that lack such structures. Therefore, it is imperative that organizations prioritize the establishment of robust program management frameworks to achieve their strategic objectives.

Business Transformation Strategy: A 10-Step Strategy Guide

Mar 4, 2024

Business transformation strategy is a complex and dynamic process that fundamentally restructures an organization’s strategy, processes, and systems. Though each business transformation is unique, several critical steps remain foundational to a successful change management plan. A comprehensive business transformation framework ensures a smooth and practical transformation. This framework should encompass various elements, such as defining the vision and aims of the transformation, assessing the current state of the business, identifying gaps and areas of improvement, developing a roadmap and action plan, implementing the changes, monitoring and measuring progress, and continuously refining the transformation approach as needed.

What is the Change Management Process?

Feb 2, 2024

Change is the only constant in today’s fast-paced world, and organizations must adapt to stay ahead. Fortunately, change management provides a structured and coordinated approach that enables businesses to move from their current state to a future desirable state. To deliver business value, organizations introduce change through projects, programs, and portfolios. However, introducing change is just the beginning! The real challenge is to embed the change and make it a new normal state for the organization. This calls for implementing the main principles of change management, which we will discuss in this article. Get ready to transform your organization and achieve your desired outcomes by mastering the art of change management!

Happy clients .

Trevor mcomber, us.

I recently worked with Zoe@Noirwolf, who provided me with an outstanding 5-year business plan. The expertise in financial planning, market research, SWOT analysis, and consulting was exceptional. Zoe provided me with a comprehensive and well-researched plan tailored to my business. The entire process was professional, timely, and communicative.

Bill Walton, Leeds

Zoe provided first-rate work and is an excellent business consultant. I was trying to figure out my cash flow forecast for my startup. Zoe gave me an interactive consultation session over MS teams, which was valuable and saved me a lot of time. She is super quick in excel and knowledgeable about what to include in your estimates. She was able to offer me ideas & choices that I hadn't considered. Highly recommended.

Jeendanie Lorthe, US

Warren kim, us, oscar sinclair, london, get in touch ..

Looking to grow your business but feeling unsure about where to start? Our small business consulting and leadership coaching services are here to help! We'll work with you to scale your operations and achieve your goals. Plus, we offer a free one-hour consultation to ensure we fit your needs correctly. Let's get started!

Business Plan Section 8: Funding Request

These guidelines will help you prepare a funding request to present to a potential lender alongside your loan application.

We’ve talked before about the benefits of having a business plan for every business, but the truth is, most companies don’t put one together until they want to apply for funding, whether from a bank or investor. Sometimes, even if you don’t need a full business plan when applying for a loan, you will be asked for a funding request. You can also follow the guidelines below to prepare a stand-alone proposal to present to a potential lender with your application.

If the purpose of your business plan is NOT to get funding, feel free to skip this section.

As we’ve said before about writing a business plan, it’s important to keep your audience in mind. You can certainly prepare different versions of your funding request depending on whether you’re applying for a loan or approaching an investor. The terms of each would be different, and you might be looking for different amounts of money or types of funding, especially if you’re approaching several potential partners.

Be clear about whom you’re directing the request to, and think about the questions they might have and what they would want to see. Make sure you’ve done your homework regarding the costs involved with your plans. This is where the financial section of your plan will work hand in hand with this one. Be consistent with your numbers, and ask for enough to cover your needs fully so you don’t fall short and remain unable to complete your goals. At the same time, don’t ask for more than you need.

What to Include in Your Funding Request

1. a summary of the business.

If the request is part of your business plan, you will have already put together all the information found in a business summary. If you’re creating a funding request as a stand-alone document, explain what the company is, where you’re located, what you sell or what services you offer, and who your customers are. Mention whether you’re incorporated, and if so, what type of corporation it is, along with who the owners and key staff members are. Briefly list your business successes and accomplishment thus far.

2. How much money you’re requesting

How much cash are you looking for now, and if you anticipate this being the first part of an ongoing growth plan, how much more money do you plan to request over time? What would the specific timeline look like? The Small Business Administration suggests thinking as far as five years down the road when putting your funding request together. Also spell out what type of funding you’re looking for, whether a loan or investment, and the terms you’re asking for. (As we suggested above, you can put together different versions of the request for different types of funding.)

3. What you will use the money for

Do you need some extra funds for working capital to buy more inventory? Are you paying off a high-interest loan? Buying a building, new equipment, or another company? Expanding your advertising campaign, or hiring more staff? Whatever it is, explain how much each aspect will cost.

4. Financial information

This will be the heart of the financial information section of your business plan , but you need to include it here if you’re putting together a stand-alone funding request.

You’ll need historical data on the company (if it’s an established business), like income statements, balance sheets, and cash flow statements for the last three to five years. If the funding request is for a loan that requires collateral, document what you have to offer. If you’ve invested your own money in the company or there are other investors, state that along with how much.

Offer realistic projections for the future, and explain how this new funding would help you reach those goals. Prepare yearly forecasts for income, balance sheets, cash flow and capital expenditure budgets for the next five years. Be even more specific for the first year, with projections for each month or quarter.

You also need to cover how you plan to pay off the debt, or what kind of return on investment you can offer a potential investor. Potential funders will pay particular attention to this, wanting to maximize their gains and minimize their risk as much as possible. If the plan is targeted to investors, what would their exit plan be? Can they cash out in a specific number of years? Do you plan to go public and offer stock?

Finally, address anything that might affect your ability to repay, whether positively or negatively, such as being acquired, buying out another business, relocating, etc.

Getting money to fund your business may very well be the point of creating your entire business plan, so take the time to carefully prepare your funding request, making sure to include all the information a decision-maker will need.

NEXT ARTICLE > BUSINESS PLAN SECTION 9: APPENDIX

Apply for a loan, get started.

Loans from $5,000 - $100,000 with transparent terms and no prepayment penalty. Tell us a little about yourself, your business and receive your quote in minutes without impacting your credit score.

Thanks for applying!

Loans are originated and funded through our lending arm, Accion Opportunity Fund Community Development. By clicking “Continue to Application,” you consent to, Accion Opportunity Fund Community Development’s Terms of Use and Privacy Policy ; and to receive emails, calls and texts , potentially for marketing purposes, including autodialed or pre-recorded calls. You may opt out of receiving certain communications as provided in our Privacy Policy .

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Training and Development

- Beginner Guides

Blog Business

15+ Business Plan Examples to Win Your Next Round of Funding

By Jennifer Gaskin , Jun 09, 2021

“If you fail to plan, you are planning to fail,” according to words of wisdom dubiously attributed to Benjamin Franklin. While there’s no solid evidence that Franklin actually coined this phrase, the sentiment rings true for any business.

Not having a solid plan makes it unlikely you’ll achieve the goals you seek, whether the goals are getting your to-do list done or launching a successful organization.

In the early stages of a company, that means developing things like pitch decks, business plans, one-sheeters and more. With Venngage’s Business Plan Builder , you can easily organize your business plan into a visually appealing format that can help you win over investors, lenders or partners.

Learn more about how to create a business plan so you can hit the ground running after reading through this list for inspirational examples of business plans.

START CREATING FOR FREE

Click to jump ahead:

Simple business plan example, startup business plan example, small business plan example, nonprofit business plan example, strategic business plan example, market analysis business plan example, sales business plan example, organization and management business plan example, marketing and sales strategy business plan example, apple business plan example, airbnb business plan example, sequoia capital business plan example.

While your business plan should be supported by thorough and exhaustive research into your market and competitors, the resulting document does not have to be overwhelming for the reader. In fact, if you can boil your business plan down to a few key pages, all the better.

CREATE THIS PLAN TEMPLATE

The simple, bold visual aesthetic of this business plan template pairs well with the straightforward approach to the content and various elements of the business plan itself.

Use Venngage’s My Brand Kit to automatically add your brand colors and fonts to your business plan with just a few clicks.

Return to Table of Contents

An essential startup business plan should include a clear and compelling value proposition, market analysis, competitive analysis, target audience identification, financial projections, and a well-defined marketing and operational strategy.

For a typical startup, the need to appear disruptive in the industry is important. After all, if you’re not offering anything truly new, why would an investor turn their attention toward your organization. That means establishing a problem and the ways in which you solve it right away.

CREATE THIS PRESENTATION TEMPLATE

Whether it’s a full-scale business plan or, in this case, a pitch deck, the ideal way for a startup to make a splash with its plans is to be bold. This successful business plan example is memorable and aspirational.

In the Venngage editor, you can upload images of your business. Add these images to your plans and reports to make them uniquely your own.

All businesses start out small at first, but that doesn’t mean their communications have to be small. One of the best ways to get investors, lenders and talent on board is to show that you’ve done your due diligence.

In this small business plan example, the content is spread over many pages, which is useful in making lengthy, in-depth research feel less like a chore than packing everyone on as few pages as possible.

Organizations that set out to solve problems rather than earning profits also benefit from creating compelling business plans that stir an emotional response in potential donors, benefactors, potential staff members or even media.

CREATE THIS REPORT TEMPLATE

Simplicity is the goal for nonprofits when it comes to business plans, particularly in their early days. Explain the crisis at hand and exactly how your organization will make a difference, which will help donors visualize how their money will be used to help.

Business plans are also helpful for companies that have been around for a while. Whether they’re considering new products to launch or looking for new opportunities, companies can approach business plans from the strategy side of the equation as well.

Strategic business plans or strategy infographics should be highly focused on a single area or problem to be solved rather than taking a holistic approach to the entire business. Expanding scope too much can make a strategy seem too difficult to implement.

Easily share your business plan with Venngage’s multiple download options, including PNG, PNG HD, and as an interactive PDF.

One-page business plan example

For organizations with a simple business model, often a one-page business plan is all that’s needed. This is possible in any industry, but the most common are traditional ones like retail, where few complex concepts need to be explained.

This one-page strategic business plan example could be easily replicated for an organization that offers goods or services across multiple channels or one with three core business areas. It’s a good business plan example for companies whose plans can be easily boiled down to a few bullet points per area.

Especially when entering a saturated market, understanding the landscape and players is crucial to understanding how your organization can fit it—and stand out. That’s why centering your business plan around a market analysis is often a good idea.

In this example, the majority of the content and about half the pages are focused on the market analysis, including competitors, trends, pricing, demographics and more. This successful business plan example ensures the artwork and style used perfectly matches the company’s aesthetic, which further reinforces its position in the market.

You can find more memorable business plan templates to customize in the Venngage editor. Browse Venngage’s business plan templates to find plans that work for you and start editing.

Company description business plan example

Depending on the market, focusing on your company story and what makes you different can drive your narrative home with potential investors. By focusing your business plan on a company description, you center yourself and your organization in the minds of your audience.

This abbreviated plan is a good business plan example. It uses most of the content to tell the organization’s story. In addition to background about the company, potential investors or clients can see how this design firm’s process is different from their rivals.

With Venngage Business , you can collaborate with team members in real-time to create a business plan that will be effective when presenting to investors.

Five-year business plan example

For most startups or young companies, showing potential investors or partners exactly how and when the company will become profitable is a key aspect of presenting a business plan. Whether it’s woven into a larger presentation or stands alone, you should be sure to include your five-year business plan so investors know you’re looking far beyond the present.

CREATE THIS PROPOSAL TEMPLATE

With Venngage’s Business Plan Builder , you can customize a schedule like this to quickly illustrate for investors or partners what your revenue targets are for the first three to five years your company is in operation.

The lifeblood of any company is the sales team. These are the energetic folks who bring in new business, develop leads and turn prospects into customers. Focusing your energy on creating a sales business plan would prove to investors that you understand what will make your company money.

In this example sales business plan, several facets of ideal buyers are detailed. These include a perfect customer profile that helps to convey to your audience that customer relationships will be at the heart of your operation.

You can include business infographics in your plan to visualize your goals. And with Venngage’s gallery of images and icons, you can customize the template to better reflect your business ethos.

Company mergers and shakeups are also major reasons for organizations to require strong business planning. Creating new departments, deciding which staff to retain and charting a course forward can be even more complex than starting a business from scratch.

This organization and management business plan focuses on how the company can optimize operations through a few key organizational projects.

Executive summary for business plan example

Executive summaries give your business plan a strong human touch, and they set the tone for what’s to follow. That could mean having your executive leadership team write a personal note or singling out some huge achievements of which you’re particularly proud in a business plan infographic .

In this executive summary for a business plan, a brief note is accompanied by a few notable achievements that signal the organization and leadership team’s authority in the industry.

Marketing and sales are two sides of the same coin, and clever companies know how they play off each other. That’s why centering your business plan around your marketing and sales strategy can pay dividends when it comes time to find investors and potential partners.

This marketing and sales business plan example is the picture of a sleek, modern aesthetic, which is appropriate across many industries and will speak volumes to numbers-obsesses sales and marketing leaders.

Do business plans really help? Well, here’s some math for you; in 1981, Apple had just gone public and was in the midst of marketing an absolute flop , the Apple III computer. The company’s market cap, or total estimated market value, could hit $3 trillion this year.

Did this Apple business plan make the difference? No, it’s not possible to attribute the success of Apple entirely to this business plan from July 1981, but this ancient artifact goes to show that even the most groundbreaking companies need to take an honest stock of their situation.

Apple’s 1981 business plan example pdf covers everything from the market landscape for computing to the products that founder Steve Jobs expects to roll out over the next few years, and the advanced analysis contained in the document shows how strategic Jobs and other Apple executives were in those early days.

Inviting strangers to stay in your house for the weekend seemed like a crazy concept before Airbnb became one of the world’s biggest companies. Like all disruptive startups, Airbnb had to create a robust, active system from nothing.

As this Airbnb business plan pitch deck example shows, for companies that are introducing entirely new concepts, it’s helpful not to get too into the weeds. Explain the problem simply and boil down the essence of your solution into a few words; in this case, “A web platform where users can rent out their space” perfectly sums up this popular company.

Sequoia Capital is one of the most successful venture capital firms in the world, backing startups that now have a combined stock market value of more than $1 trillion, according to a Forbes analysis .

For young companies and startups that want to play in the big leagues, tailoring your pitch to something that would appeal to a company like Sequoia Capital is a good idea. That’s why the company has a standard business plan format it recommends .

Using Sequoia Capital’s business plan example means being simple and clear with your content, like the above deck. Note how no slide contains much copy, and even when all slides appear on the screen at once, the text is legible.

In summary: Use Venngage to design business plans that will impress investors

Not every business plan, pitch deck or one-sheeter will net you billions in investment dollars, but every entrepreneur should be adept at crafting impressive, authoritative and informative business plans.

Whether you use one of the inspirational templates shared here or you want to go old school and mimic Apple’s 1981 business plan, using Venngage’s Business Plan Builder helps you bring your company’s vision to life.

Writing a business plan for funding application

Table of Contents

Business proposition

Unique selling point, market research, competitors, objectives and strategy, target audience, customer profile, channels , qualifications, amount needed, projections, use countingup to manage finance beyond your plan.

Setting up a company comes with many hurdles to face. For example, you might look to buy equipment, stock or pay for marketing.

To help you secure the money you will need, you can apply for finance. That might mean you approach a bank for a small business loan or off an investor a share of your company.

When you decide to look for any form of funding, there’s one crucial document you need for the application — a business plan.

A business plan is not something to take lightly. It can go a long way to help you secure finance. So, before you start writing, it would help to know everything it can cover.

This guide discusses writing a business plan for funding application, including:

Your business plan for a funding application aims to encourage investors or lenders to believe in your business. These groups will only hand out their money for ideas that they can see being successful.

For that reason, your first section outlines what your business proposes. One of the key markers of a successful product or service is its uniqueness.

If your startup has something that only you offer, that is called a unique selling point . That could be the product that you sell or the service you provide.

Even when you sell something unique, you can demonstrate how knowledgeable you are about its market through market research .

You can research who will likely pay for what you sell and other competing businesses.

Research first-hand information through interviews and surveys sent out to the public. Alternatively, look at competitors’ websites and products or services to see how yours compares.

In your business plan, it’s helpful to include a few specific companies you see as competition . Showing that you know who they are can convince lenders or investors that you know the industry and can overcome competitors.

Provide successful businesses with something similar to show there’s a market for what you offer. But remember to clarify how your unique product or service will be more appealing to customers.

Another important section for your business plan for funding application is the objectives and strategy. Here, discuss what you aim to do and how you’ll get there.