What is Desk Research? A Guide + Examples

Desk research can help you make data-driven decisions, define or adapt strategies, and uncover untapped market potential to drive growth – when it’s done right!

Nowadays, we have all the information we need at our fingertips; but knowing where to find the right data quickly is key.

So, what is desk research? What does it involve, and how can Similarweb Research Intelligence help?

Let’s find out.

What is desk research?

Desk research is a type of market research that uses existing data to support or validate outcomes and conclusions. Also known as secondary research , it’s a cost-effective way to obtain relevant data from a broad range of channels.

How is desk research used?

From small start-ups to established businesses, doing desk research provides you with crucial insights into trends, competitors, and market size . Whatever you do, desk research can help with product positioning and guide data-driven business decisions that help you become the ultimate competitor and find new ways to grow.

According to the latest data on the Internet of Things , around 130 new devices connect to the web every second. Stats on the state of data show we create and consume data at an exponential rate–data interactions will only continue to rise.

Primary vs. secondary research – what’s the difference?

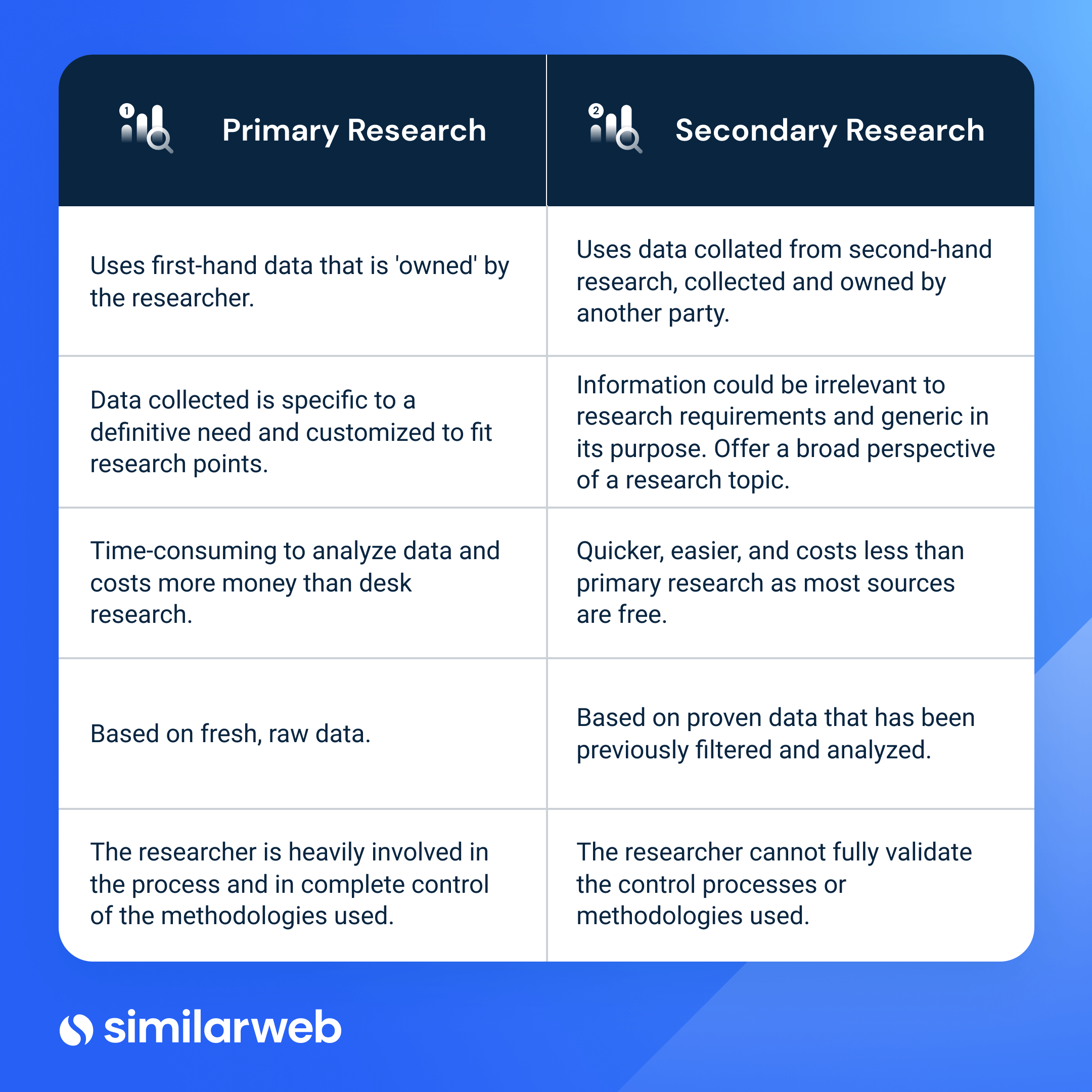

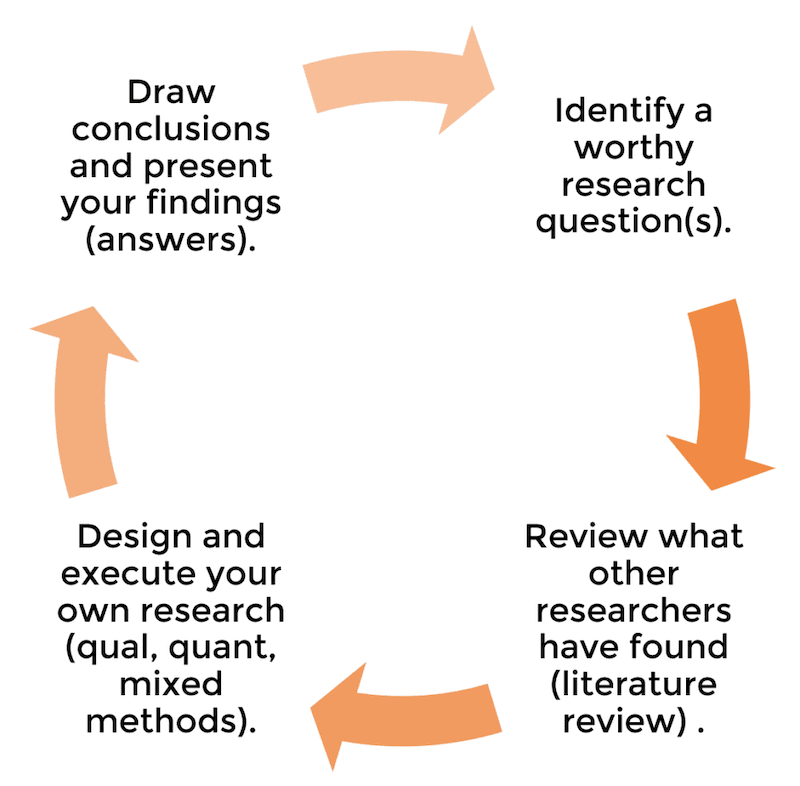

Most market research methods fall into either primary or secondary research. When we talk about desk research, we tend to focus only on secondary methods. However, most primary research can also be done remotely, from a desk.

Primary research is self-conducted research that gathers data to answer questions. It usually involves going directly to a source, such as a customer or a prospect. Compared to secondary research, it takes longer, costs more, and demands more resources. Primary research methods include interviews, market research surveys , questionnaires, competitor reviews, market mapping , focus groups, etc.

Secondary research is the synthesis or summary of existing research using previously gained information from various sources. Most market research starts with secondary research: It aims to provide a researcher or analyst with a basis of knowledge formed from existing data. Secondary research methods include collecting data from the internet, government databases, reports, and academic journals, to name just a few.

Pros and cons of desk research

As with any type of market research, you need to choose the right method to deliver the best outcome for your research goal. Desk research is advantageous for several reasons, but it won’t always suit every market research project. Market research best practice tells us that we should use desk-based research before primary research – as this helps to reduce or refine the scope of the work before the second, more costly phase.

Here’s a summary of the pros and cons of desk research.

Advantages of desk-based research

Doing secondary market research is highly beneficial; here’s why.

- Low cost – most secondary research sources are low-to-no cost.

- Speed – as the data already exists, data collection is quick.

- Clarity – desk research drives & add-value to primary research actions.

- Scalability – due to the large datasets used in secondary research.

- Availability – pre-collected data is readily available to analyze.

- Insightful – get valuable insights and help resolve some initial research questions.

Disadvantages of desk-based research

As any good researcher will attest, it’s always good to look at a topic from every angle. Here are a few things to consider before starting any secondary research process.

- Out of-date data – consider if the coverage dates of the research are relevant. In a fast-moving market, having access to up-to-date information could be critical.

- Lack of perceived control over the data – secondary research is undertaken by a third party; as such, methodology controls need to be reviewed with caution.

- No exclusivity – desk research data is widely available and can be used by other researchers.

- Verification & interpretation – particularly when working with large data sets, it can take time to analyze and review to ensure the information is suitable for your research.

Types of desk-based research

Nowadays, you can do most market research from a desk. Here, I’ll focus solely on secondary research methods: Where finding and using the right resources is key. The data you use needs to be up-to-date and should always come from a trusted source.

Desk research methods – internal data resources

Before stepping into external research, look for any relevant internal sources. This data can often prove invaluable, and it’s a great place to start gathering insights that only you can see. The information is already yours, so aside from the fact it won’t cost a dime, it’s data your rivals won’t have access to.

Sources of internal information that can help you do desk research include:

- Historical campaign and sales analysis: Everything from website traffic and conversions through to sales. Accessible through your own analytics platform(s).

- Website and mobile application data: Your own platforms can also tell you where users are – such as the device split between mobile and desktop.

- Existing customer information: audience demographics , product use, and efficiency of service.

- Previous research conducted by other analysts: Even if the research seems unrelated, there could be indicative information within.

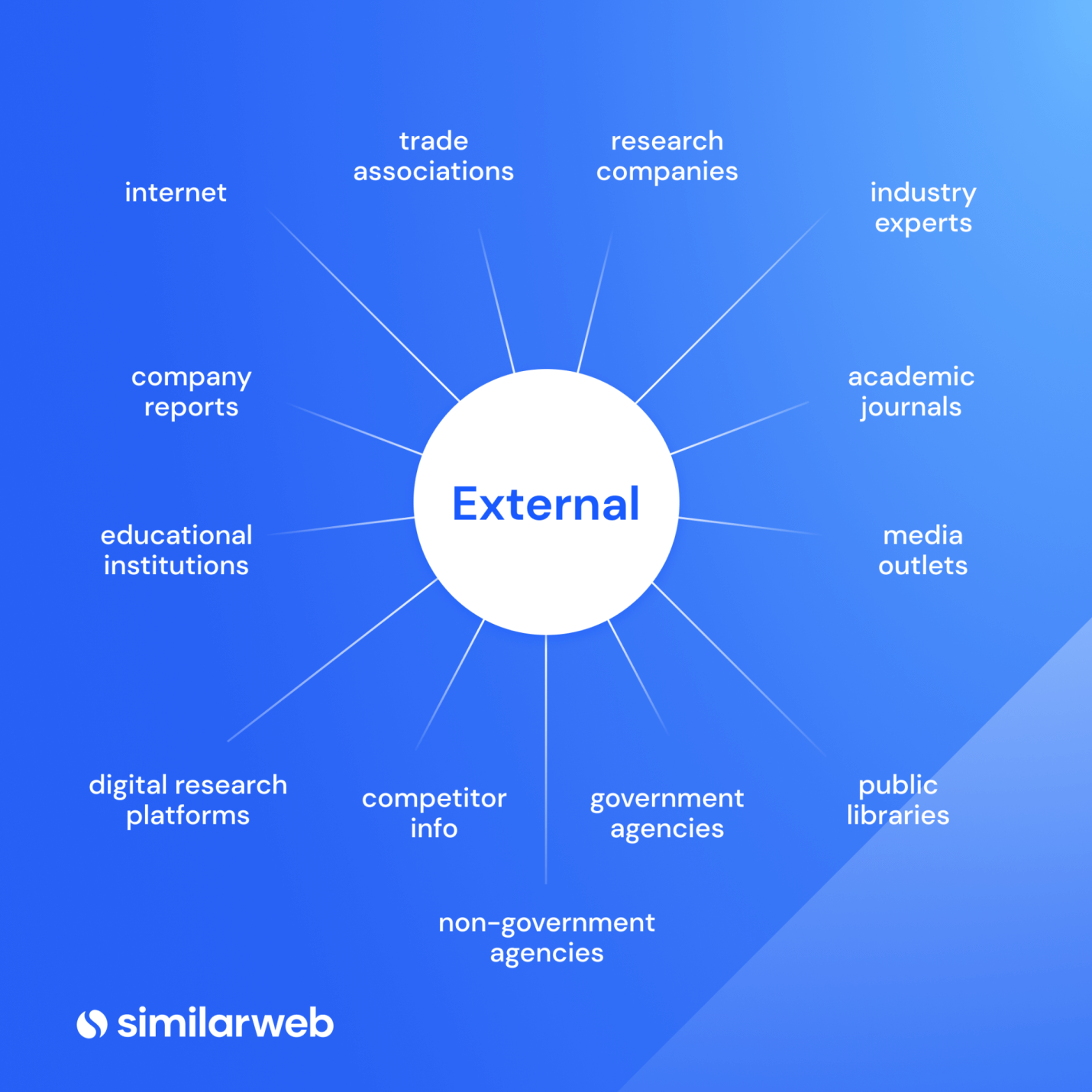

Desk research methods – external data resources

Using external data sources for desk research is an ideal way to get information about market trends, and explore a new topic.

- The internet: A virtual aggregator of all secondary research sources – always validate findings with credible sources.

- Commercial resources: Research associations and company reports usually cost money but give you data that’s specific to your industry/aim.

- Trade association reports: To see if there’s a trade association of interest, do a quick search online or use the Encyclopedia of Associations , the Directory of Associations , or the National Trade and Professional Associations Directory

- Industry Experts: Expert consultancy is an efficient way of getting information from someone who has ‘been there, done that.’ Also, consider ‘influencers.’

- Research associations & journals: Most research associations are independent and offer bespoke, specialized reports.

- Media coverage: TV, radio, newspapers, and magazines can often help uncover facts and relevant media stories related to your topic.

- Market research intelligence software: Platforms like Similarweb give you actionable insights into industry and competitors’ trends. With access to mobile app intelligence, you get a complete picture of the digital landscape.

- Government & non-government agencies: In the US, the biggest generator of data is the federal government. US Census Bureau , Congressional Research Service , US Government Publishing Office , US Small Business Administration , and the Department of Education . Most information from these sources is free.

- Local government sites: A reliable source to find data on population density or employment trends.

- Public library records: Access data via the Digital Public Library of America in the US or the National Archives in the UK.

- Competitor information: Sign-up for mailing lists, view comparison reports, and read online reviews.

- Educational institutions: Academic research papers and journals are well-researched. If you can find a relevant one, you’ll likely get solid data from credible sources.

How to choose the best type of desk research

With so many freely-available sources online for desk-based research; it’s easy to feel overwhelmed. The best guidance I can offer is to keep a list of key questions you are trying to answer with this research, and consider:

- What are you hoping to learn from your research?

- Why is this data relevant?

- Is there an action you can take from this information?

- How up-to-date is the data you are using?

Always keep the questions you’re trying to answer front of mind. It’ll help you stay focused and keep your desk research on the right track. Time and money will usually determine the right type of desk research to use, but, even then, it’s important to stay focussed on where you spend your time vs. the return on that investment.

Inspiration: This article outlines some of the best market research questions to ask.

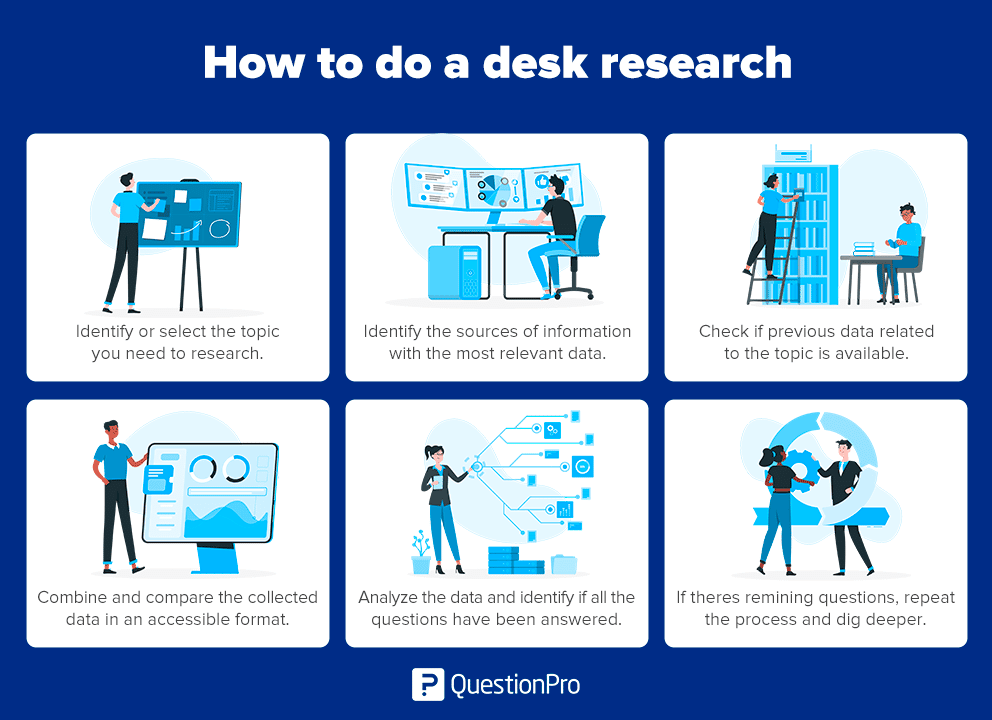

How to do desk research in five steps

Follow these steps to guide you through doing desktop research:

1. Clearly define your research topic Identify your topic and its purpose, then list any relevant research attributes.

2. Select appropriate resources Make a list of sources that’ll provide relevant information for your research topic.

3. Look for existing data Once you’ve collated your research sources, look for internal and external data relevant to your research topic. Remember to only use data from authentic sources.

4. Collate, compare & assemble Next, you’ll need to collate all the data you’ve obtained, remove any duplication, and bring it together into a usable format.

5. Data analysis The final step of doing desk research is to analyze the data. At this point, you should be able to see if your research questions have been answered. If any questions remain unanswered, go back to step 2, and look for alternative resources that will help you get clearer insights.

Desk-based research tools

Online resources are by far your most valuable asset for doing secondary research. However, software like Similarweb Digital Intelligence , Google Analytics (GA), and Google Search Console (GSC) can save you time and give you a more visually-appealing view of relevant data.

My list of go-to tools for desk research includes:

- Google Analytics & Search Console – your own site’s performance and visitor stats.

- Similarweb Digital Research Intelligence – uncover market, industry & competitor trends across web, mobile, and apps.

- Tableau – data visualization for presenting your findings.

- Competitor data – on rival’s websites, newsletters, and social media accounts.

Read: The best market research tools of 2023

Note that GA and GSC are free to use but limited in terms of what you can see outside your own site. With Similarweb, you can access virtually limitless industry-wide data.

Stop Guessing, Start Analyzing

Get actionable insights for desk research here

How Similarweb helps with desk research

Here are just a few examples of how Similarweb Digital Research Intelligence can help you with secondary research.

- Benchmarking yourself against your industry – Benchmarking suite

- Understand how competitor websites and apps perform – Company research module

- Get a full picture of your industry – Market research & industry analysis tools

- Understand how apps are impacting your market – App Intelligence

- Analyze consumer behavior – Audience analysis tool

- Understand the complete customer journey – Consumer journey tracker

Using research intelligence tools will save you time and money while removing bias from the data – ultimately giving you clarity and a complete view of the digital world relevant to your research topic.

Success Story: See how Airbnb uses Similarweb to reveal growth opportunities in new markets .

Desk research examples with Similarweb

A good example of desk research in action is looking into an industry to uncover market leaders, trends, relevant search trends, and an overview of a complete industry. Using the market analysis module in Similarweb, you can find out exactly what’s happening in your market, and make data-driven decisions that’ll help you increase market share , and drive faster, more sustainable business growth.

For this particular desk research example, I chose the airline industry.

Let’s dive in.

Industry Overview

See a snapshot of industry traffic and engagement metrics . This data is typically based on Similarweb’s index of the top 100 websites in a chosen vertical. You can easily create a custom industry , allowing you to do competitive benchmarking against specific companies in your market.

Industry Leaders

Quickly see who is winning in an industry using the Market quadrant analysis graph and industry leaders table. Analyze top-performing websites in your vertical, and dive into their traffic and engagement performance to view bounce rates, visit duration, monthly visits, month-on-month changes, unique visitors, pages/visits, and traffic share .

Industry Trends

Analyze trends in near real-time so you can take action when it matters most–not a quarter later. Create a personalized view of your industry for in-depth analysis and make informed decisions that will help you grow your market share.

Marketing Channels

Access valuable traffic metrics and insights for each marketing channel. See data for direct, social, display ads, paid search, referrals, emails, and organic traffic channels and evaluate performance for each. Uncover opportunities to grow your own traffic share, evaluate engagement and quality of traffic, and identify trends over time.

Search Trends (within an industry)

Discover trending topics and emerging search terms in any industry. View what’s trending, search volume, % change, volume trend, and traffic leaders for both branded and non-branded search in your sector. Use these insights to get an understanding of market demand, search intent, and audience interests within a specific category, brand, or product.

Demographics

Gain crucial insights into the audiences visiting your website, your competitors’ websites, and your industry as a whole. See gender and age distribution across web, mobile, or combined traffic channels, and compare your demographics with that of your rivals.

The market analysis element of Similarweb will help you answer some of your most important research questions, such as:

- How a specific industry grew over time

- Who the top and emerging players are in your industry

- Which products or services are trending and/or what are consumers searching for

- What demographics are relevant to you, and your competitors

The app intelligence module completes the picture and gives you a broad view of the digital landscape across your market. You can quickly see how apps are impacting your industry, and look at download, engagement, installs, ranking, and more.

Here, I’m sticking with the airline industry to establish whether or not android or iOS is the best fit for a new app. Immediately, I can see there are between 1-1.5M monthly active users on iOS vs. an equivalent of around 350,000k on Android.

Like what you see? Take a tour of Similarweb for yourself.

Discover industry insights for desk research here

Wrapping up

Good desk research helps you quickly uncover key information that can shape and steer successful market research projects. When done right, you’ll be able to answer questions and discover crucial data about your industry, competitors, and key trends to consider while building a strategy for growth.

Asking the right research questions from the onset and keeping these at the forefront of your mind throughout will save time and help direct your market analysis in the right direction.

Is desk-based research free?

Depending on the method used, desktop research can be done for free. If you require industry or government agency reports, these often carry a charge but are more likely to be free from bias when compared to commercially produced reports that (sometimes) receive sponsorship.

Which businesses can utilize secondary desk research?

Desk-based research can uncover crucial insights into market trends, market sizing, and competitors. The information can be used by any size business to help guide strategic decision-making and help refine a product’s positioning.

Should you do secondary research before primary research?

Absolutely, yes. Secondary research should always come before primary or field research. The formative research phase helps pinpoint where more in-depth primary research is required. Desk research can also verify and support findings from field research but should not replace primary research–as they are each utilized under different circumstances.

Who does desk-based research?

Desk research can ‘technically’ be done by anyone, but it’s typically performed by a researcher, an analyst, or a marketing professional. Good market research has solid foundational data to drive critical business decisions. Experienced researchers and analysts are best-placed to spot opportunities, trends, and patterns when the stakes are this high.

So, while anybody can access secondary data free of charge, investing the necessary resources to do things right to get the most out of the process is essential.

Related Posts

US Financial Outlook: Top Trends to Watch in 2024

Top Economic Trends in Australia to Watch in 2024

What Is Data Management and Why Is It Important?

What is a Niche Market? And How to Find the Right One

The Future of UK Finance: Top Trends to Watch in 2024

From AI to Buy: The Role of Artificial Intelligence in Retail

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

What Is Desk Research? Meaning, Methodology, Examples

Apr 4, 2024

10 min. read

Research in the digital age takes many shapes and forms. There are traditional methods that collect first-hand data via testing, focus groups, interviews, and proprietary data. And then there are ways to tap into the time and effort others have put into research, playing “armchair detective” by conducting desk research .

Desk research gives you a shortcut to insights by pulling data from other resources, which is crucial for understanding the customer journey . It takes less time and is more cost-effective compared to conducting primary market research . Most importantly, it can give you the consumer insights you need to make important business decisions.

Let’s explore the official desk research definition along with types of desk research, methodologies, examples, and how to do desk research effectively.

Desk Research Meaning: What is Desk Research?

Advantages and limitations of desk research, desk research methodology and methods, how to conduct desk research effectively, best practices for desk research, applications of desk research, how to conduct desk research with meltwater.

Desk Research definition: Desk research, also known as secondary research or complementary research , involves gathering information and data from existing sources, such as books, journals, articles, websites, reports, and other published materials. Users analyze and synthesize information from already available information.

Companies use desk research at the onset of a project to gain a better understanding of a topic, identify knowledge gaps, and inform the next stages of research. It can also supplement original findings and provide context and background information.

Desk research gives marketers attractive advantages over traditional primary research, but it’s not without its shortcomings. Let’s explore these in more detail.

Desk research advantages

- Quick insights. Conducting interviews, focus groups, panels, and tests can take weeks or even months, along with additional time to analyze your findings. With desk research, you can pull from existing information to gain similar results in less time.

- Cost-effectiveness. Desk market research is usually less expensive than primary research because it requires less time and fewer resources. You don’t have to recruit participants or administer surveys, for example.

- Accessibility. There’s a world of data out there ready for you to leverage, including online databases, research studies, libraries, and archives.

- Diverse sources. Desk market research doesn’t limit you to one information source. You can use a combination of sources to gain a comprehensive overview of a topic.

Want to see how Meltwater can supercharge your market research efforts? Simply fill out the form at the bottom of this post and we'll be in touch.

Desk research limitations

- Data quality. Marketers don’t know how reliable or valid the data is, which is why it’s important to choose your sources carefully. Only use data from credible sources, ideally ones that do not have a financial interest in the data’s findings.

- Less control. Users are at the mercy of the data that’s available and cannot tailor it to their needs. There’s no opportunity to ask follow-up questions or address specific research needs.

- Potential bias. Some sources may include biased findings and/or outdated information, which can lead to inaccurate conclusions. Users can mitigate the risk of bias by relying only on credible sources or corroborating evidence with multiple sources.

Desk research typically involves multiple sources and processes to gain a comprehensive understanding of an idea. There are two main desk methodologies: qualitative research and quantitative research .

- Qualitative research refers to analyzing existing data (e.g., interviews, surveys, observations) to gain insights into people's behaviors, motivations, and opinions. This method delves deeper into the context and meaning behind the data.

- Quantitative research refers to analyzing and interpreting numerical data to draw conclusions and make predictions. This involves quantifying patterns and trends to find relationships between variables.

Both desk research methodologies use a variety of methods to find and analyze data and make decisions.

Examples of desk research methods include but are not limited to:

- Literature review. Analyze findings from various types of literature, including medical journals, studies, academic papers, books, articles, online publications, and government agencies.

- Competitor analysis . Learn more about the products, services, and strategies of your competitors, including identifying their strengths and weaknesses, market gaps, and overall sentiment.

- Social listening . Discover trending topics and sentiments on social media channels to learn more about your target audience and brand health.

- Consumer intelligence . Understand your audience based on digital behaviors, triggers, web usage patterns, and interests.

- Market research . Analyze market reports, industry trends, demographics, and consumer buying patterns to identify market opportunities and strengthen your positioning.

Now let’s look at how to use these methods to their full potential.

While desk research techniques can vary, they all follow a similar formula. Here’s how you can conduct desk research effectively, even if it’s your first time.

1. Define your objective

Desk research starts with a specific question you want to answer.

In marketing , your objective might be to:

- Learn about Gen Z buying behaviors for home goods

- Gauge the effectiveness of influencer marketing for food brands

- Understand the pain points of your competitor’s customers

These questions can help you find credible sources that can provide answers.

2. Choose reliable data sources

Based on your objectives, start collecting secondary data sources that have done the heavy lifting for you. Examples include:

- Market reports (often available as gated assets from research companies)

- Trade publications

- Academic journals

- Company websites

- Government publications and data

- Online databases and resources, such as Google Scholar

- Secondary research companies or market research tools like Meltwater and Linkfluence

- Online blogs, articles, case studies, and white papers from credible sources

In many cases, you’ll use a combination of these source types to gain a thorough answer to your question.

3. Start gathering evidence

Go through your source materials to start answering your question. This is usually the most time-intensive part of desk research; you’ll need to extract insights and do some fact-checking to trust those insights.

One of your top priorities in this step is to use reliable sources. Here are some ways you can evaluate sources to use in your desk research:

- Consider the authority and reputation of the source (e.g., do they have expertise in your subject)

- Check whether the content is sponsored, which could indicate bias

- Assess whether the data is current

- Evaluate the publisher’s peer review processes , if applicable

- Review the content’s citations and references

- Seek consensus among multiple sources

- Use sources with built-in credibility, such as .gov or .edu sites or well-known medical and academic journals

If your source materials have supporting elements, such as infographics, charts, or graphs, include those with your desk research.

4. Cross-reference your findings with other sources

For desk research to be effective, you need to be able to trust the data you find. One way to build trust is to cross-reference your findings with other sources.

For instance, you might see who else is citing the same sources you are in their research. If there are reputable companies using those same sources, you might feel they’re more credible compared to a random internet fact that lacks supporting evidence.

5. Draw your conclusions & document the results

Organize and synthesize your findings in a way that makes sense for your objectives. Consider your stakeholders and why the information is important.

For example, the way you share your research with an internal team might have a different structure and tone compared to a client-facing document.

Bonus tip: Include a list of sources with your documentation to build credibility in your findings.

When conducting desk research, follow these best practices to ensure a reliable and helpful outcome.

Organize and manage your research data

It’s helpful to have a system to organize your research data. This way, you can easily go back to review sources or share information with others. Spreadsheets, databases, and platforms like Meltwater for market research are great options to keep your desk research in one place.

Create actionable recommendations

It’s not enough to state your findings; make sure others know why the data matters. Share the data along with your conclusions and recommendations for what to do next.

Remember, desk research is about decision-making, not the data itself.

Document your sources

Whether you choose to share your sources or not, it’s best practice to document your sources for your own records. This makes it easier to provide evidence if someone asks for it or to look back at your research if you have additional questions.

Now for the big question: How can marketers apply desk research to their day-to-day tasks?

Try these desk research examples to power your marketing efforts.

Use desk research for market intelligence

Markets, preferences, and buying habits change over time, and marketers need to stay up to date on their industries. Desk research can provide market intelligence insights, including new competitors, trends, and audience segments that may impact your business.

Apply desk research in competitive analysis

Desk research can help you identify your true competitors and provide more context about their strengths and weaknesses. Marketers can use this intel to improve their positioning and messaging. For instance, a competitor’s weak spot might be something your company does well, and you can emphasize this area in your messaging.

Include desk research in content strategy and audience analysis

Desk research can support consumer intelligence by helping you define various audience segments and how to market to them. These insights can help you develop content and creative assets on the right topics and in the right formats, as well as share them in the best channels to reach your audience.

Emerging technologies like Meltwater's integrated suite of solutions have a strong impact on desk research, helping you streamline how you find and vet data to support your desired topics.

Using a combination of data science, AI, and market research expertise, Meltwater offers the largest media database of its kind to help marketers learn more about their audience and how to connect with them. Millions of real-time data points cover all niches, topics, and industries, giving you the on-demand insights you need.

Our clients use Meltwater for desk research to measure audience sentiment and identify audience segments as well as to conduct competitor analysis , social listening , and brand monitoring , all of which benefit from real-time data.

Learn more about how you can leverage Meltwater as a research solution when you request a demo by filling out the form below:

Continue Reading

How To Do Market Research: Definition, Types, Methods

How to Gain a Sustainable Competitive Advantage with Porter's 3 Strategies

What Are Consumer Insights? Meaning, Examples, Strategy

Consumer Intelligence: Definition & Examples

The 13 Best Market Research Tools

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Desk Research: What it is, Tips & Examples

What is desk research?

Desk research is a type of research that is based on the material published in reports and similar documents that are available in public libraries, websites, data obtained from surveys already carried out, etc. Some organizations also store data that can be used for research purposes.

It is a research method that involves the use of existing data. These are collected and summarized to increase the overall effectiveness of the investigation.

Secondary research is much more cost-effective than primary research , as it uses existing data, unlike primary research, in which data is collected first-hand by organizations, companies, or may employ a third party to obtain the data in your name.

LEARN ABOUT: Data Management Framework

Desk research examples

Being a cost-effective method, desk research is a popular choice for businesses and organizations as not everyone can pay large sums of money to conduct research and collect data. That is why it’s also called “ documentary research “.

Here are some more common secondary research methods and examples:

1. Data available on the Internet: One of the most popular ways to collect data for desk research is through the Internet. The information is available and can be downloaded with just one click.

This data is practically free or you may have to pay a negligible amount for it. Websites have a lot of information that companies or organizations can use to meet their research needs. However, you need to consider a reliable website to collect information.

2. Government and non-government agencies: Data for secondary research can also be collected from some government and non-government agencies. There will always be valuable and relevant data that companies or organizations can use.

3. Public libraries: Public libraries are another good source to search for data by doing desk research. They have copies of important research that has been done before. They are a store of documents from which relevant information can be extracted.

The services offered at these public libraries vary. Most often, they have a huge collection of government publications with market statistics, a large collection of business directories, and newsletters.

4. Educational Institutions: The importance of collecting data from educational institutions for secondary research is often overlooked. However, more research is done in colleges and universities than in any other business sector.

The data collected by universities is mainly used for primary research. However, companies or organizations can go to educational institutions and request data.

5. Sources of business information: Newspapers, magazines, radio and television stations are a great source of data for desk research. These sources have first-hand information on economic developments, the political agenda, the market, demographic segmentation and similar topics.

Companies or organizations can request to obtain the most relevant data for their study. Not only do they have the opportunity to identify your potential customers, but they can also learn the ways to promote their products or services through these sources, as they have a broader scope.

Differences between primary research and Desk Research

How to do a desk research.

These are the steps to follow to conduct a desk investigation:

- Identify the research topic: Before you begin, identify the topic you need to research. Once done, make a list of the attributes of the research and its purpose.

- Identify research sources: Subsequently, explain the sources of information that will provide you with the most relevant data applicable to your research.

- Collect existing data: Once the sources of information collection have been narrowed, check to see if previous data is available that is closely related to the topic. They can be obtained from various sources, such as newspapers, public libraries, government and non-government agencies, etc.

- Combine and compare: Once the data is collected, combine and compare it so that the information is not duplicated and put it together in an accessible format. Make sure to collect data from authentic sources so you don’t get in the way of your investigation.

- Analyze data: Analyze the data that is collected and identify if all the questions have been answered. If not, repeat the process to dig deeper into practical ideas.

- Most of the information is secondary research and readily available. There are many sources from which the data you need can be collected and used, as opposed to primary research, where data must be collected from scratch.

- It is a less expensive and time-consuming process, as the required data is readily available and does not cost much if it is extracted from authentic sources.

- The data that is collected through secondary or desktop research gives organizations or companies an idea about the effectiveness of primary research. Thus, a hypothesis can be formed and the cost of conducting the primary research can be evaluated.

- Doing desk research is faster due to the availability of data. It can be completed in a few weeks, depending on the objective of the companies or the scale of the data required.

Disadvantages

- Although the data is readily available, the credibility and authenticity of the available information must be assessed.

- Not all secondary data resources offer the latest reports and statistics. Even when they are accurate, they may not be up to date.

Desk research is a very popular research method, because it uses existing and reliable data that can be easily obtained. This is a great benefit for businesses and organizations as it increases the effectiveness of the investigation.

QuestionPro provides the best market research platform to uncover complex insights that can propel your business to the forefront of your industry.

START A FREE TRIAL

MORE LIKE THIS

Data Information vs Insight: Essential differences

May 14, 2024

Pricing Analytics Software: Optimize Your Pricing Strategy

May 13, 2024

Relationship Marketing: What It Is, Examples & Top 7 Benefits

May 8, 2024

The Best Email Survey Tool to Boost Your Feedback Game

May 7, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Just one more step to your free trial.

.surveysparrow.com

Already using SurveySparrow? Login

By clicking on "Get Started", I agree to the Privacy Policy and Terms of Service .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Enterprise Survey Software

Enterprise Survey Software to thrive in your business ecosystem

NPS® Software

Turn customers into promoters

Offline Survey

Real-time data collection, on the move. Go internet-independent.

360 Assessment

Conduct omnidirectional employee assessments. Increase productivity, grow together.

Reputation Management

Turn your existing customers into raving promoters by monitoring online reviews.

Ticket Management

Build loyalty and advocacy by delivering personalized support experiences that matter.

Chatbot for Website

Collect feedback smartly from your website visitors with the engaging Chatbot for website.

Swift, easy, secure. Scalable for your organization.

Executive Dashboard

Customer journey map, craft beautiful surveys, share surveys, gain rich insights, recurring surveys, white label surveys, embedded surveys, conversational forms, mobile-first surveys, audience management, smart surveys, video surveys, secure surveys, api, webhooks, integrations, survey themes, accept payments, custom workflows, all features, customer experience, employee experience, product experience, marketing experience, sales experience, hospitality & travel, market research, saas startup programs, wall of love, success stories, sparrowcast, nps® benchmarks, learning centre, apps & integrations, testimonials.

Our surveys come with superpowers ⚡

Blog General

Desk Research 101: Definition, Methods, and Examples

Parvathi vijayamohan.

2 March 2023

Table Of Contents

If you ever had to do a research study or a survey at some point, you would have started with desk research .

There’s another, more technical name for it – secondary research. To rewind a bit, there are two types of research: primary , where you go out and study things first-hand, and secondary , where you explore what others have done.

But what is desk research? How do you do it, and use it? This article will help you:

- Understand what is desk-based research

- Explore 3 examples of desk research

- Make note of 6 common desk research methods

- Uncover the advantages of desk research

What is desk research?

Desk research can be defined as a type of market/product research, where you collect data at your desk (metaphorically speaking) from existing sources to get initial ideas about your research topic.

Desk research or secondary research is an essential process from a business’s point of view. After all, secondary data sources are such an easy way to get information about their industry, trends, competitors, and customers.

Types of secondary data sources

#1. Internal secondary data: This consists of data from within the researcher’s company. Examples include:

- Company reports and presentations

- Case studies

- Podcasts, vlogs and blogs

- Press releases

- Websites and social media

- Company databases and data sets

#2. External secondary data: Researchers collect this from outside their respective firms. Examples include:

- Digital and print publications

- Domain-specific publications and periodicals

- Online research communities, like ResearchGate

- Industry speeches and conference presentations

- Research papers

What are examples of desk research in action?

#1. testing product-audience match.

Let’s say you’re developing a fintech product. You want to do a concept testing study. To make sure you get it right, you’re interested in finding out your target audience’s attitudes about a topic in your domain. For e.g., Gen Z’s perceptions about money in the US.

With a quick Google search, you get news articles, reports, and research studies about Gen Z’s financial habits and attitudes. Also, infographics and videos provide plenty of quantitative data to draw on.

These steps are a solid starting point for framing your concept testing study. You can further reduce the time spent on survey design with a Concept Testing Survey Template . Sign up to get free access to this and hundreds more templates.

Please enter a valid Email ID.

14-Day Free Trial • No Credit Card Required • No Strings Attached

#2. Tracking the evolution of the Web

As we wade into the brave new world of Web 5.0 , there are quite a few of us who still remember static websites, flash animations, and images sliced up into tables.

If you want to refresh your memory, you can hop on the Wayback Machine . iI gives you access to over 20 years of web history, with over 635 billion web pages saved over time!

Curiosity aside, there are practical use cases for this web archive. SEO specialist Artur Bowsza explores this in his fantastic article Internet Archeology with the Wayback Machine .

Imagine you’re investigating a recent drop in a website’s visibility. You know there were some recent changes in the website’s code, but couldn’t get any details. Or maybe you’re preparing a case study of your recent successful project, but the website has changed so much, and you never bothered to take a screenshot. Wouldn’t it be great to travel back in time and uncover the long-forgotten versions of the website – like an archaeologist, discovering secrets from the past but working in the digital world?

#3. Repairing a business reputation

As a brand, you hope that a crisis never happens. But if hell does break loose, having a crisis management strategy is essential.

If you want examples, just do a Google search. From Gamestop getting caught in a Reddit stock trading frenzy to Facebook being voted The Worst Company of 2021 , we have seen plenty of brands come under fire in recent years.

Some in-depth desk research can help you nail your crisis communication. Reputation management expert Lida Citroen outlines this in her article 7 Ways to Recover After a Reputation Crisis .

Conduct a thoughtful and thorough perception sweep of the reputation hit’s after-effects. This includes assessing digital impact such as social media, online relationships and Google search results. The evaluation gives you a baseline. How serious is the situation? Sometimes the way we believe the situation to be is not reflected in the business impact of the damage.

6 popular methods of desk research

#1. the internet.

No surprise there. When was the last time you checked a book to answer the burning question of “is pineapple on pizza illegal?” (it should be).

However, choosing authentic and credible sources from an information overload can be tricky. To help you out, the Lydia M. Olson Library has a 6-point checklist to filter out low-quality sources. You can read them in detail here .

#2. Libraries

You have earned some serious street cred if your preferred source is a library. But, jokes apart, finding the correct information for your research topic in a library can be time-consuming.

However, depending on which library you visit, you will find a wealth of verifiable, quotable information in the form of newspapers, magazines, research journals, books, documents, and more.

#3. Governmental and non-governmental organizations

NGOs, and governmental agencies like the US Census Bureau, have valuable demographic data that businesses can use during desk research. This data is collected using survey tools like SurveySparrow .

You may have to pay a certain fee to download or access the information from these agencies. However, the data obtained will be reliable and trustworthy.

#4. Educational institutions

Colleges and universities conduct plenty of primary research studies every year. This makes them a treasure trove for desk researchers.

However, getting access to this data requires legwork. The procedures vary according to the institution; among other things, you will need to submit an application to the relevant authority and abide by a data use agreement.

#5. Company databases

For businesses, customer and employee data are focus areas all on their own. But after the pandemic, companies are using even more applications and tools for the operations and service sides.

This gives businesses access to vast amounts of information useful for desk research and beyond. For example, one interesting use case is making employee onboarding more effective with just basic employee data, like their hobbies or skills.

#6. Commercial information media

These include radio, newspapers, podcasts, YouTube, and TV stations. They are decent sources of first-hand info on political and economic developments, market research, public opinion and other trending subjects.

However, this is also a source that blurs the lines between advertising, information and entertainment. So as far as credibility is concerned, you are better off supporting this data with additional sources.

Why is desk research helpful?

Desk research helps with the following:

- Better domain understanding. Before doing market research, running a usability test, or starting any user-centric project, you want to see what companies have done in the past (in related areas if not the same domain). Then, instead of learning everything from scratch, you can review their research, success, and mistakes and learn from that.

- Quicker opportunity spotting. How do you know if you’ve found something new? By reviewing what has gone before. By doing this, you can spot gaps in the data that match up with the problem you’re trying to solve.

- More money saved . Thanks to the internet, most of the data you need is at your fingertips, and they are cheaper to compile than field data. With a few (search and mental) filters, you can quickly find credible sources with factual information.

- More time saved . You have less than 15 minutes with your research participant. Two minutes if you’re doing an online survey. Do you really want to waste that time asking questions that have already been answered elsewhere? Lack of preparation can also hurt your credibility.

- Better context. Desk research helps to provide focus and a framework for primary research. By using desk research, companies can also get the insight to make better decisions about their customers and employees.

- More meaningful data. Desk research is the yin to the yang of field research – they are both required for a meaningful study. That’s why desk research serves as a starting point for every kind of study.

This brings us to the last question.

How do you do desk research?

Good question! In her blog post , Lorène Fauvelle covers the desk research process in detail.

Y ou can also follow our 4-step guide below:

- First, start with a general topic l ike “handmade organic soaps”. Read through existing literature about handmade soaps to see if there is a gap in the literature that your study can fill.

- Once you find that gap, it’s time to specify your research topic . So in the example above, you can specify it like this: “What is the global market size for handmade organic soaps”?

- Identify the relevant secondary data for desk research. This only applies if there is past data that could be useful for your research.

- Review the secondary data according to:

- The aim of the previous study

- The author/sponsors of the study

- The methodology of the study

- The time of the research

Note: One more thing about desk research…

Beware of dismissing research just because it was done a few years ago. People new to research often make the mistake of viewing research reports like so many yogurts in a fridge where the sell-by dates have expired. Just because it was done a couple of years ago, don’t think it’s no longer relevant. The best research tends to focus on human behaviour, and that tends to change very slowly.

- Dr David Travis, Desk Research: The What, Why and How

Wrapping up

That’s all folks! We hope this blog was helpful for you.

How have you used desk research for your work? Let us know in the comments below.

Growth Marketer at SurveySparrow

Fledgling growth marketer. Cloud watcher. Aunty to a naughty beagle.

You Might Also Like

Effective surveys for student engagement: strategies for keeping students interested, what is market research and how to do it, 8 performance evaluation methods that boost employee morale: a detailed guide.

Leave us your email, we wont spam. Promise!

Start your free trial today

No Credit Card Required. 14-Day Free Trial

Power your desktop research with stunning surveys

Don't rely on the past alone. get insights into the future with powerful feedback software. try surveysparrow for free..

14-Day Free Trial • No Credit card required • 40% more completion rate

Hi there, we use cookies to offer you a better browsing experience and to analyze site traffic. By continuing to use our website, you consent to the use of these cookies. Learn More

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Secondary Research

Try Qualtrics for free

Secondary research: definition, methods, & examples.

19 min read This ultimate guide to secondary research helps you understand changes in market trends, customers buying patterns and your competition using existing data sources.

In situations where you’re not involved in the data gathering process ( primary research ), you have to rely on existing information and data to arrive at specific research conclusions or outcomes. This approach is known as secondary research.

In this article, we’re going to explain what secondary research is, how it works, and share some examples of it in practice.

Free eBook: The ultimate guide to conducting market research

What is secondary research?

Secondary research, also known as desk research, is a research method that involves compiling existing data sourced from a variety of channels . This includes internal sources (e.g.in-house research) or, more commonly, external sources (such as government statistics, organizational bodies, and the internet).

Secondary research comes in several formats, such as published datasets, reports, and survey responses , and can also be sourced from websites, libraries, and museums.

The information is usually free — or available at a limited access cost — and gathered using surveys , telephone interviews, observation, face-to-face interviews, and more.

When using secondary research, researchers collect, verify, analyze and incorporate it to help them confirm research goals for the research period.

As well as the above, it can be used to review previous research into an area of interest. Researchers can look for patterns across data spanning several years and identify trends — or use it to verify early hypothesis statements and establish whether it’s worth continuing research into a prospective area.

How to conduct secondary research

There are five key steps to conducting secondary research effectively and efficiently:

1. Identify and define the research topic

First, understand what you will be researching and define the topic by thinking about the research questions you want to be answered.

Ask yourself: What is the point of conducting this research? Then, ask: What do we want to achieve?

This may indicate an exploratory reason (why something happened) or confirm a hypothesis. The answers may indicate ideas that need primary or secondary research (or a combination) to investigate them.

2. Find research and existing data sources

If secondary research is needed, think about where you might find the information. This helps you narrow down your secondary sources to those that help you answer your questions. What keywords do you need to use?

Which organizations are closely working on this topic already? Are there any competitors that you need to be aware of?

Create a list of the data sources, information, and people that could help you with your work.

3. Begin searching and collecting the existing data

Now that you have the list of data sources, start accessing the data and collect the information into an organized system. This may mean you start setting up research journal accounts or making telephone calls to book meetings with third-party research teams to verify the details around data results.

As you search and access information, remember to check the data’s date, the credibility of the source, the relevance of the material to your research topic, and the methodology used by the third-party researchers. Start small and as you gain results, investigate further in the areas that help your research’s aims.

4. Combine the data and compare the results

When you have your data in one place, you need to understand, filter, order, and combine it intelligently. Data may come in different formats where some data could be unusable, while other information may need to be deleted.

After this, you can start to look at different data sets to see what they tell you. You may find that you need to compare the same datasets over different periods for changes over time or compare different datasets to notice overlaps or trends. Ask yourself: What does this data mean to my research? Does it help or hinder my research?

5. Analyze your data and explore further

In this last stage of the process, look at the information you have and ask yourself if this answers your original questions for your research. Are there any gaps? Do you understand the information you’ve found? If you feel there is more to cover, repeat the steps and delve deeper into the topic so that you can get all the information you need.

If secondary research can’t provide these answers, consider supplementing your results with data gained from primary research. As you explore further, add to your knowledge and update your findings. This will help you present clear, credible information.

Primary vs secondary research

Unlike secondary research, primary research involves creating data first-hand by directly working with interviewees, target users, or a target market. Primary research focuses on the method for carrying out research, asking questions, and collecting data using approaches such as:

- Interviews (panel, face-to-face or over the phone)

- Questionnaires or surveys

- Focus groups

Using these methods, researchers can get in-depth, targeted responses to questions, making results more accurate and specific to their research goals. However, it does take time to do and administer.

Unlike primary research, secondary research uses existing data, which also includes published results from primary research. Researchers summarize the existing research and use the results to support their research goals.

Both primary and secondary research have their places. Primary research can support the findings found through secondary research (and fill knowledge gaps), while secondary research can be a starting point for further primary research. Because of this, these research methods are often combined for optimal research results that are accurate at both the micro and macro level.

Sources of Secondary Research

There are two types of secondary research sources: internal and external. Internal data refers to in-house data that can be gathered from the researcher’s organization. External data refers to data published outside of and not owned by the researcher’s organization.

Internal data

Internal data is a good first port of call for insights and knowledge, as you may already have relevant information stored in your systems. Because you own this information — and it won’t be available to other researchers — it can give you a competitive edge . Examples of internal data include:

- Database information on sales history and business goal conversions

- Information from website applications and mobile site data

- Customer-generated data on product and service efficiency and use

- Previous research results or supplemental research areas

- Previous campaign results

External data

External data is useful when you: 1) need information on a new topic, 2) want to fill in gaps in your knowledge, or 3) want data that breaks down a population or market for trend and pattern analysis. Examples of external data include:

- Government, non-government agencies, and trade body statistics

- Company reports and research

- Competitor research

- Public library collections

- Textbooks and research journals

- Media stories in newspapers

- Online journals and research sites

Three examples of secondary research methods in action

How and why might you conduct secondary research? Let’s look at a few examples:

1. Collecting factual information from the internet on a specific topic or market

There are plenty of sites that hold data for people to view and use in their research. For example, Google Scholar, ResearchGate, or Wiley Online Library all provide previous research on a particular topic. Researchers can create free accounts and use the search facilities to look into a topic by keyword, before following the instructions to download or export results for further analysis.

This can be useful for exploring a new market that your organization wants to consider entering. For instance, by viewing the U.S Census Bureau demographic data for that area, you can see what the demographics of your target audience are , and create compelling marketing campaigns accordingly.

2. Finding out the views of your target audience on a particular topic

If you’re interested in seeing the historical views on a particular topic, for example, attitudes to women’s rights in the US, you can turn to secondary sources.

Textbooks, news articles, reviews, and journal entries can all provide qualitative reports and interviews covering how people discussed women’s rights. There may be multimedia elements like video or documented posters of propaganda showing biased language usage.

By gathering this information, synthesizing it, and evaluating the language, who created it and when it was shared, you can create a timeline of how a topic was discussed over time.

3. When you want to know the latest thinking on a topic

Educational institutions, such as schools and colleges, create a lot of research-based reports on younger audiences or their academic specialisms. Dissertations from students also can be submitted to research journals, making these places useful places to see the latest insights from a new generation of academics.

Information can be requested — and sometimes academic institutions may want to collaborate and conduct research on your behalf. This can provide key primary data in areas that you want to research, as well as secondary data sources for your research.

Advantages of secondary research

There are several benefits of using secondary research, which we’ve outlined below:

- Easily and readily available data – There is an abundance of readily accessible data sources that have been pre-collected for use, in person at local libraries and online using the internet. This data is usually sorted by filters or can be exported into spreadsheet format, meaning that little technical expertise is needed to access and use the data.

- Faster research speeds – Since the data is already published and in the public arena, you don’t need to collect this information through primary research. This can make the research easier to do and faster, as you can get started with the data quickly.

- Low financial and time costs – Most secondary data sources can be accessed for free or at a small cost to the researcher, so the overall research costs are kept low. In addition, by saving on preliminary research, the time costs for the researcher are kept down as well.

- Secondary data can drive additional research actions – The insights gained can support future research activities (like conducting a follow-up survey or specifying future detailed research topics) or help add value to these activities.

- Secondary data can be useful pre-research insights – Secondary source data can provide pre-research insights and information on effects that can help resolve whether research should be conducted. It can also help highlight knowledge gaps, so subsequent research can consider this.

- Ability to scale up results – Secondary sources can include large datasets (like Census data results across several states) so research results can be scaled up quickly using large secondary data sources.

Disadvantages of secondary research

The disadvantages of secondary research are worth considering in advance of conducting research :

- Secondary research data can be out of date – Secondary sources can be updated regularly, but if you’re exploring the data between two updates, the data can be out of date. Researchers will need to consider whether the data available provides the right research coverage dates, so that insights are accurate and timely, or if the data needs to be updated. Also, fast-moving markets may find secondary data expires very quickly.

- Secondary research needs to be verified and interpreted – Where there’s a lot of data from one source, a researcher needs to review and analyze it. The data may need to be verified against other data sets or your hypotheses for accuracy and to ensure you’re using the right data for your research.

- The researcher has had no control over the secondary research – As the researcher has not been involved in the secondary research, invalid data can affect the results. It’s therefore vital that the methodology and controls are closely reviewed so that the data is collected in a systematic and error-free way.

- Secondary research data is not exclusive – As data sets are commonly available, there is no exclusivity and many researchers can use the same data. This can be problematic where researchers want to have exclusive rights over the research results and risk duplication of research in the future.

When do we conduct secondary research?

Now that you know the basics of secondary research, when do researchers normally conduct secondary research?

It’s often used at the beginning of research, when the researcher is trying to understand the current landscape . In addition, if the research area is new to the researcher, it can form crucial background context to help them understand what information exists already. This can plug knowledge gaps, supplement the researcher’s own learning or add to the research.

Secondary research can also be used in conjunction with primary research. Secondary research can become the formative research that helps pinpoint where further primary research is needed to find out specific information. It can also support or verify the findings from primary research.

You can use secondary research where high levels of control aren’t needed by the researcher, but a lot of knowledge on a topic is required from different angles.

Secondary research should not be used in place of primary research as both are very different and are used for various circumstances.

Questions to ask before conducting secondary research

Before you start your secondary research, ask yourself these questions:

- Is there similar internal data that we have created for a similar area in the past?

If your organization has past research, it’s best to review this work before starting a new project. The older work may provide you with the answers, and give you a starting dataset and context of how your organization approached the research before. However, be mindful that the work is probably out of date and view it with that note in mind. Read through and look for where this helps your research goals or where more work is needed.

- What am I trying to achieve with this research?

When you have clear goals, and understand what you need to achieve, you can look for the perfect type of secondary or primary research to support the aims. Different secondary research data will provide you with different information – for example, looking at news stories to tell you a breakdown of your market’s buying patterns won’t be as useful as internal or external data e-commerce and sales data sources.

- How credible will my research be?

If you are looking for credibility, you want to consider how accurate the research results will need to be, and if you can sacrifice credibility for speed by using secondary sources to get you started. Bear in mind which sources you choose — low-credibility data sites, like political party websites that are highly biased to favor their own party, would skew your results.

- What is the date of the secondary research?

When you’re looking to conduct research, you want the results to be as useful as possible , so using data that is 10 years old won’t be as accurate as using data that was created a year ago. Since a lot can change in a few years, note the date of your research and look for earlier data sets that can tell you a more recent picture of results. One caveat to this is using data collected over a long-term period for comparisons with earlier periods, which can tell you about the rate and direction of change.

- Can the data sources be verified? Does the information you have check out?

If you can’t verify the data by looking at the research methodology, speaking to the original team or cross-checking the facts with other research, it could be hard to be sure that the data is accurate. Think about whether you can use another source, or if it’s worth doing some supplementary primary research to replicate and verify results to help with this issue.

We created a front-to-back guide on conducting market research, The ultimate guide to conducting market research , so you can understand the research journey with confidence.

In it, you’ll learn more about:

- What effective market research looks like

- The use cases for market research

- The most important steps to conducting market research

- And how to take action on your research findings

Download the free guide for a clearer view on secondary research and other key research types for your business.

Related resources

Market intelligence 10 min read, marketing insights 11 min read, ethnographic research 11 min read, qualitative vs quantitative research 13 min read, qualitative research questions 11 min read, qualitative research design 12 min read, primary vs secondary research 14 min read, request demo.

Ready to learn more about Qualtrics?

Get a free consultation

🎙 Product leaders speak. Don't miss the Cieden Podcast — listen now!

- UX/UI design

- UX/UI consulting

- 2-week Design sprint

- Dedicated design team

- Business analysis

- Development

- Video production

- Artificial Intelligence

- Enterprise-level

- Real estate

- Case studies

- Testimonials

- AI UX concepts

- UX/UI skills matrix template

- Price calculator

How to Do Desk Research in 5 Simple Steps

Before you launch a product, you should get answers to several questions. The first and, we believe, most important one is to define the overall market situation and take a closer look at the potential customer. Mastering how to do desk research is a suitable, cost-effective way to get information for making data-driven decisions.

In this article, we’re going to highlight some essential tools for conducting desk research and defining user groups.

What is desk research?

Desk research (also called secondary research) is a research method that involves using existing data. This technique will allow you to get the first idea of your market and users “from your desk.”

Secondary research includes already published materials in reports, articles, or similar documents. We also recommend using software tools that can help you become more familiar with your users (you can find some of them below).

This method is much more cost-efficient than primary research and requests less time for conducting it. Still, a lot of analysis work should be done, and the result is really helpful. The best way is to mix qualitative user research and desk research. It’ll help you fit into your timelines and budgets.

Primary vs. secondary research

Since we’ve just mentioned primary research, let’s see what it is and how it differs from secondary desk research.

Primary research refers to the process of gathering firsthand data directly from the source, be it customers or prospects. This approach takes more time and effort than desk research, but you get the latest and most detailed information.

The most common primary research methods include the following:

- interviews;

- questionnaires;

- competitor reviews;

- focus groups;

- market mapping.

Secondary research , or desk research, involves analyzing existing data and information collected by someone else or for another project or research purpose. It’s often the starting point for market research, providing foundational knowledge from pre-existing data. This method is quicker and easier than primary research, but the information you get might be older or less specific.

The desk research methods include gathering data from the following sources:

- government databases;

- academic journals;

- social media.

While both research methodologies are helpful, you may be wondering when to use each.

Go for primary research when you:

- need up-to-date information not readily available;

- study specific questions or problems not addressed in existing research;

- require in-depth info directly from your target audience;

- aim to test new ideas.

Desk research often paves the way for primary research. Chose this approach when you:

- need a basic overview of a topic or industry;

- want to get a background knowledge and context;

- aim to study existing trends and statistics;

- want to compare different perspectives on the same topic;

- seek to save time and resources.

Need help with desk research ?

Pros and cons of desk research

Desk research is a valuable tool for any researcher. But, like any tool, it has its strengths and weaknesses.

Pros of desk research

Using desk research methods is highly beneficial. Here are just several reasons for that:

- Budget-friendly. Compared to primary research, desk research is more cost-efficient. You’re using existing information at low to no cost instead of generating it yourself.

- Fast. Desk research lets you access data and reports instantly, offering quick insights without lengthy data collection.

- Scalable. Desk research allows you to cover vast amounts of data.

- Readily available data. Data for desk research is readily available online, and you can access it anytime.

- Insightful. With careful searching, you can find helpful reports, studies, and expert opinions that provide valuable perspectives on your topic.

Cons of desk research

Despite the advantages, desk research comes with its cons. Here’s what to prepare for:

- Outdated data. Data for desk research can quickly become outdated, so verifying its relevance is a must.

- Limited control. You’re relying on someone else’s data, meaning you can’t control its methodology or accuracy.

- Minimal exclusivity. Desk research findings are readily available to others, therefore they’re not exclusive to your unique project.

- Verification complexities. Verifying data sources and interpreting information can be time-consuming.

Types of internal and external data sources

Desk research is a way to gather insights literally without leaving your desk. But where do you find the necessary info? Let’s look at the secondary data sources available to you:

Internal data sources

Your company is already a goldmine of information. So before jumping into other types of desk research, consider digging into internal resources:

- Historical campaigns and sales. Review past campaigns, website traffic insights, sales conversions, and other relevant data.

- Product analytics. Dive into product analytics to learn more about different customer segments , user behavior, engagement patterns, performance metrics, and user flows.

- Internal research. Use existing internal research reports and studies (if any) and get insights from them.

External data sources

Besides studying your company information, there are plenty of external resources to explore. Look into the following examples of secondary data:

- Internet. Access any type of resources through the web.

- Commercial resources. Industry reports or market research studies by third-party firms can offer data specific to your topic.

- Trade associations. Use reports and resources from trade associations, for example, the Directory of Associations , the National Trade and Professional Associations Directory , or the Encyclopedia of Associations .

- Industry experts. Connect with industry thought leaders and analysts.

- Research associations. Access independent research papers and industry publications.

- Media. Monitor news, press releases, magazine articles, and TV and radio content to get information on your topic.

- Market research software. Leverage specialized software platforms that offer advanced analytics, reports, or access to industry data.

- Government data. Use statistics and reports from government agencies like the US Census Bureau , US Government Publishing Office , US Small Business Administration , and so on.

- Local government data. Get market data, demographic info, and employment trends through local gov websites.

- Public libraries. Access library databases through the Digital Public Library of America or the National Archives in the UK.

- Competitors. Study competitor websites, press releases, mailing lists, online reviews, and social media activity.

- Educational resources. Analyze academic research papers and journals relevant to your topic.

Examples of desk research

Let’s now explore some examples of design projects leveraging desk research:

Analyzing dreams with Sleepify

The creator of the Sleepify project sought a user-centric design for an app tracking dreams and well-being. They leveraged external desk research and competitor analysis to:

- study sleep’s impact on a person’s well-being through UCE Research and ePsychologi.pl platforms;

- discover the strengths and weaknesses of competitor apps.