Contents of a Business Plan: Everything You Need to Know

The contents of a business plan consist of a detailed description of what, when, why, where, and how the business's operations will be accomplished. 3 min read updated on January 01, 2024

Overview of a Business Plan

A business plan includes the cost of organizing the business, the anticipated sources of revenue, how the products and services are customer oriented, and anticipated profit margins. Business plans serve two main purposes. First, they are a guide business owners use to streamline management and planning/organization of the business. Second, they show potential venture capitalists, bankers, and other lenders a comprehensive plan to encourage them to invest in the business.

Sublevels of a business plan include:

- Marketing plan

- Financial plan

- Human resource plan

- Production plan

Elements of a Business Plan

A well-written business plan will include the following:

- Cover letter

Table of Contents

Executive Summary

- Mission statement

- Company background

- Products and services

- Competitive analysis

Marketing/Realization

- Location/Production/Administrative

- Management and international organization

- Risk analysis

- Financial planning

Summary/Conclusion

Cover Letter

The business plan's cover letter has the same purpose as a cover letter for a resume. The point is to engage prospective investors using the cover letter so they'll look at the entire plan. The cover letter should include the recipient's address, the date, and your address. Begin the cover letter with "Dear" followed by the person's name.

In the body of the cover letter, let the recipient know you're submitting a business plan with a short one-sentence description of the business and what the recipient can expect when reading the plan. In the next paragraph, indicate that you look forward to hearing from them and provide a phone number they can call at their convenience.

Thank them for their time. Sign off. Include your name in typewritten form along with your signature.

Keep this page short and to the point. Include your business logo, business name, if there is a founder, and the name. Add "Business Plan," an image (optional), and the date.

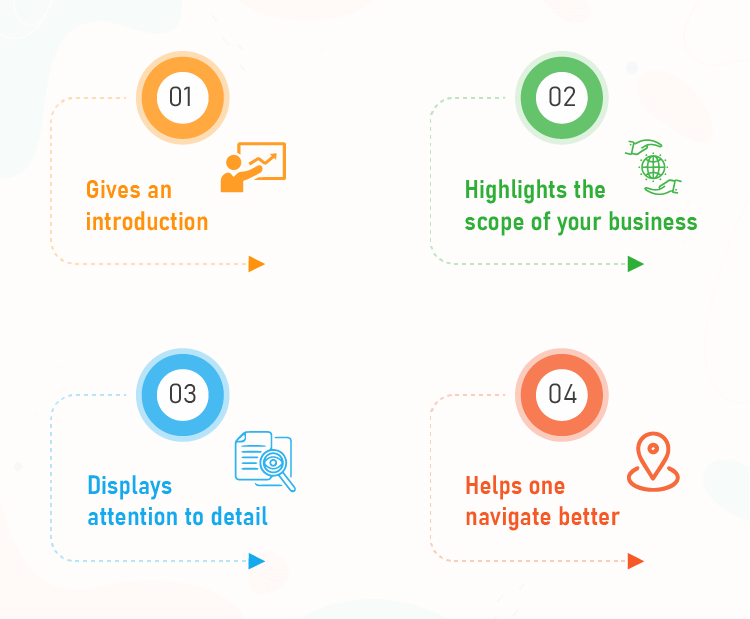

The table of contents is a roadmap to help the recipient peruse the list and easily find each section. Some people may choose to read sections one after the other while others may choose to skip around. Include every section and subsection that may be of interest to a potential investor.

This is an important section. Because you're targeting executives, the overview of your business should be top-quality information to entice them to read the complete plan. The focus should be a summary of the main facets of your business plan.

Mission Statement

This section is a short statement about your business's goal and what you plan to create through the enterprise.

Company Background

This is a short statement including the date the business was developed, its founders, stages of development, the date it was incorporated, and, for existing businesses, the level of success.

Also, include the key figures in the business and the ownership and legal structure.

Products and Services

Under this section, provide a detailed description of your customer needs, benefits to customers, marketing services, and advantages and disadvantages of any competitor services or products.

Marketing Plan

This will include an overview of the market in general with an emphasis on purchase incentives, market analysis, and customer structure. It will also include the position your business holds in the market using information from target customer groups, canvassed market segments, and sale channels.

Competitive Analysis

Provide information about your main competitors' names, locations, market positions, weaknesses, strengths, and target markets.

This section covers details about product range, services, and pricing strategies. Sales targets for the next five years should also be included.

Location/Production/Administration

Include the location of the business and the advantages and disadvantages of its location. The production should discuss in-house and/or outsourced production and material costs. The administration portion will discuss the office infrastructure, such as accounting and technical support.

Management and International Organization

This section could work written as an organizational chart outlining member functions and responsibilities, special skills, and salaries.

Risk Analysis

Provide information on anticipated internal risks such as marketing, production, management, and financing. External risks would include information on ecological, economic, social, and legal areas.

Financial Planning

Lay out your plan for short- and long-term financial planning.

This is a final wrap up of the business plan that binds the everything together.

If you need help with outlining the contents of a business plan, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Creating a Business Plan

- Business Plan Contents Page

- How to Make a Business Plan Format

- Business Description Outline

- Service Business Plan

- LLC Business Plan Template

- Business Plan for Existing Company

- Parts of Business Plan and Definition

- IT Company Business Plan

- Business Plan Format: Everything you Need to Know

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated May 7, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

3 Min. Read

What to Include in Your Business Plan Appendix

5 Min. Read

How To Write a Business Plan for a Life Coaching Business + Free Example

7 Min. Read

How to Write a Bakery Business Plan + Sample

1 Min. Read

How to Calculate Return on Investment (ROI)

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- 212 best farm names

How to Write a Business Plan (Plus Examples & Templates)

May 24, 2021

Have you ever wondered how to write a business plan step by step? Mike Andes, told us:

This guide will help you write a business plan to impress investors.

Throughout this process, we’ll get information from Mike Andes, who started Augusta Lawn Care Services when he was 12 and turned it into a franchise with over 90 locations. He has gone on to help others learn how to write business plans and start businesses. He knows a thing or two about writing business plans!

We’ll start by discussing the definition of a business plan. Then we’ll discuss how to come up with the idea, how to do the market research, and then the important elements in the business plan format. Keep reading to start your journey!

What Is a Business Plan?

A business plan is simply a road map of what you are trying to achieve with your business and how you will go about achieving it. It should cover all elements of your business including:

- Finding customers

- Plans for developing a team

- Competition

- Legal structures

- Key milestones you are pursuing

If you aren’t quite ready to create a business plan, consider starting by reading our business startup guide .

Get a Business Idea

Before you can write a business plan, you have to have a business idea. You may see a problem that needs to be solved and have an idea how to solve it, or you might start by evaluating your interests and skills.

Mike told us, “The three things I suggest asking yourself when thinking about starting a business are:

- What am I good at?

- What would I enjoy doing?

- What can I get paid for?”

If all three of these questions don’t lead to at least one common answer, it will probably be a much harder road to success. Either there is not much market for it, you won’t be good at it, or you won’t enjoy doing it.

As Mike told us, “There’s enough stress starting and running a business that if you don’t like it or aren’t good at it, it’s hard to succeed.”

If you’d like to hear more about Mike’s approach to starting a business, check out our YouTube video

Conduct Market Analysis

Market analysis is focused on establishing if there is a target market for your products and services, how large the target market is, and identifying the demographics of people or businesses that would be interested in the product or service. The goal here is to establish how much money your business concept can make.

Product and Service Demand

A search engine is your best friend when trying to figure out if there is demand for your products and services. Personally, I love using presearch.org because it lets you directly search on a ton of different platforms including Google, Youtube, Twitter, and more. Check out the screenshot for the full list of search options.

With quick web searches, you can find out how many competitors you have, look through their reviews, and see if there are common complaints about the competitors. Bad reviews are a great place to find opportunities to offer better products or services.

If there are no similar products or services, you may have stumbled upon something new, or there may just be no demand for it. To find out, go talk to your most honest friend about the idea and see what they think. If they tell you it’s dumb or stare at you vacantly, there’s probably no market for it.

You can also conduct a survey through social media to get public opinion on your idea. Using Facebook Business Manager , you could get a feel for who would be interested in your product or service.

I ran a quick test of how many people between 18-65 you could reach in the U.S. during a week. It returned an estimated 700-2,000 for the total number of leads, which is enough to do a fairly accurate statistical analysis.

Identify Demographics of Target Market

Depending on what type of business you want to run, your target market will be different. The narrower the demographic, the fewer potential customers you’ll have. If you did a survey, you’ll be able to use that data to help define your target audience. Some considerations you’ll want to consider are:

- Other Interests

- Marital Status

- Do they have kids?

Once you have this information, it can help you narrow down your options for location and help define your marketing further. One resource that Mike recommended using is the Census Bureau’s Quick Facts Map . He told us,

“It helps you quickly evaluate what the best areas are for your business to be located.”

How to Write a Business Plan

Now that you’ve developed your idea a little and established there is a market for it, you can begin writing a business plan. Getting started is easier with the business plan template we created for you to download. I strongly recommend using it as it is updated to make it easier to create an action plan.

Each of the following should be a section of your business plan:

- Business Plan Cover Page

- Table of Contents

- Executive Summary

- Company Description

- Description of Products and Services

SWOT Analysis

- Competitor Data

- Competitive Analysis

- Marketing Expenses Strategy

Pricing Strategy

- Distribution Channel Assessment

- Operational Plan

- Management and Organizational Strategy

- Financial Statements and/or Financial Projections

We’ll look into each of these. Don’t forget to download our free business plan template (mentioned just above) so you can follow along as we go.

How to Write a Business Plan Step 1. Create a Cover Page

The first thing investors will see is the cover page for your business plan. Make sure it looks professional. A great cover page shows that you think about first impressions.

A good business plan should have the following elements on a cover page:

- Professionally designed logo

- Company name

- Mission or Vision Statement

- Contact Info

Basically, think of a cover page for your business plan like a giant business card. It is meant to capture people’s attention but be quickly processed.

How to Write a Business Plan Step 2. Create a Table of Contents

Most people are busy enough that they don’t have a lot of time. Providing a table of contents makes it easy for them to find the pages of your plan that are meaningful to them.

A table of contents will be immediately after the cover page, but you can include it after the executive summary. Including the table of contents immediately after the executive summary will help investors know what section of your business plan they want to review more thoroughly.

Check out Canva’s article about creating a table of contents . It has a ton of great information about creating easy access to each section of your business plan. Just remember that you’ll want to use different strategies for digital and hard copy business plans.

How to Write a Business Plan Step 3. Write an Executive Summary

An executive summary is where your business plan should catch the readers interest. It doesn’t need to be long, but should be quick and easy to read.

Mike told us,

How long should an executive summary bein an informal business plan?

For casual use, an executive summary should be similar to an elevator pitch, no more than 150-160 words, just enough to get them interested and wanting more. Indeed has a great article on elevator pitches . This can also be used for the content of emails to get readers’ attention.

It consists of three basic parts:

- An introduction to you and your business.

- What your business is about.

- A call to action

Example of an informal executive summary

One of the best elevator pitches I’ve used is:

So far that pitch has achieved a 100% success rate in getting partnerships for the business.

What should I include in an executive summary for investors?

Investors are going to need a more detailed executive summary if you want to secure financing or sell equity. The executive summary should be a brief overview of your entire business plan and include:

- Introduction of yourself and company.

- An origin story (Recognition of a problem and how you came to solution)

- An introduction to your products or services.

- Your unique value proposition. Make sure to include intellectual property.

- Where you are in the business life cycle

- Request and why you need it.

Successful business plan examples

The owner of Urbanity told us he spent 2 months writing a 75-page business plan and received a $250,000 loan from the bank when he was 23. Make your business plan as detailed as possible when looking for financing. We’ve provided a template to help you prepare the portions of a business plan that banks expect.

Here’s the interview with the owner of Urbanity:

When to write an executive summary?

Even though the summary is near the beginning of a business plan, you should write it after you complete the rest of a business plan. You can’t talk about revenue, profits, and expected expenditures if you haven’t done the market research and created a financial plan.

What mistakes do people make when writing an executive summary?

Business owners commonly go into too much detail about the following items in an executive summary:

- Marketing and sales processes

- Financial statements

- Organizational structure

- Market analysis

These are things that people will want to know later, but they don’t hook the reader. They won’t spark interest in your small business, but they’ll close the deal.

How to Write a Business Plan Step 4. Company Description

Every business plan should include a company description. A great business plan will include the following elements while describing the company:

- Mission statement

- Philosophy and vision

- Company goals

Target market

- Legal structure

Let’s take a look at what each section includes in a good business plan.

Mission Statement

A mission statement is a brief explanation of why you started the company and what the company’s main focus is. It should be no more than one or two sentences. Check out HubSpot’s article 27 Inspiring Mission Statement for a great read on informative and inspiring mission and vision statements.

Company Philosophy and Vision

The company philosophy is what drives your company. You’ll normally hear them called core values. These are the building blocks that make your company different. You want to communicate your values to customers, business owners, and investors as often as possible to build a company culture, but make sure to back them up.

What makes your company different?

Each company is different. Your new business should rise above the standard company lines of honesty, integrity, fun, innovation, and community when communicating your business values. The standard answers are corporate jargon and lack authenticity.

Examples of core values

One of my clients decided to add a core values page to their website. As a tech company they emphasized the values:

- Prioritize communication.

- Never stop learning.

- Be transparent.

- Start small and grow incrementally.

These values communicate how the owner and the rest of the company operate. They also show a value proposition and competitive advantage because they specifically focus on delivering business value from the start. These values also genuinely show what the company is about and customers recognize the sincerity. Indeed has a great blog about how to identify your core values .

What is a vision statement?

A vision statement communicate the long lasting change a business pursues. The vision helps investors and customers understand what your company is trying to accomplish. The vision statement goes beyond a mission statement to provide something meaningful to the community, customer’s lives, or even the world.

Example vision statements

The Alzheimer’s Association is a great example of a vision statement:

A world without Alzheimer’s Disease and other dementia.

It clearly tells how they want to change the world. A world without Alzheimers might be unachievable, but that means they always have room for improvement.

Business Goals

You have to measure success against goals for a business plan to be meaningful. A business plan helps guide a company similar to how your GPS provides a road map to your favorite travel destination. A goal to make as much money as possible is not inspirational and sounds greedy.

Sure, business owners want to increase their profits and improve customer service, but they need to present an overview of what they consider success. The goals should help everyone prioritize their work.

How far in advance should a business plan?

Business planning should be done at least one year in advance, but many banks and investors prefer three to five year business plans. Longer plans show investors that the management team understands the market and knows the business is operating in a constantly shifting market. In addition, a plan helps businesses to adjust to changes because they have already considered how to handle them.

Example of great business goals

My all time-favorite long-term company goals are included in Tesla’s Master Plan, Part Deux . These goals were written in 2016 and drive the company’s decisions through 2026. They are the reason that investors are so forgiving when Elon Musk continually fails to meet his quarterly and annual goals.

If the progress aligns with the business plan investors are likely to continue to believe in the company. Just make sure the goals are reasonable or you’ll be discredited (unless you’re Elon Musk).

You did target market research before creating a business plan. Now it’s time to add it to the plan so others understand what your ideal customer looks like. As a new business owner, you may not be considered an expert in your field yet, so document everything. Make sure the references you use are from respectable sources.

Use information from the specific lender when you are applying for lending. Most lenders provide industry research reports and using their data can strengthen the position of your business plan.

A small business plan should include a section on the external environment. Understanding the industry is crucial because we don’t plan a business in a vacuum. Make sure to research the industry trends, competitors, and forecasts. I personally prefer IBIS World for my business research. Make sure to answer questions like:

- What is the industry outlook long-term and short-term?

- How will your business take advantage of projected industry changes and trends?

- What might happen to your competitors and how will your business successfully compete?

Industry resources

Some helpful resources to help you establish more about your industry are:

- Trade Associations

- Federal Reserve

- Bureau of Labor Statistics

Legal Structure

There are five basic types of legal structures that most people will utilize:

- Sole proprietorships

- Limited Liability Companies (LLC)

Partnerships

Corporations.

- Franchises.

Each business structure has their pros and cons. An LLC is the most common legal structure due to its protection of personal assets and ease of setting up. Make sure to specify how ownership is divided and what roles each owner plays when you have more than one business owner.

You’ll have to decide which structure is best for you, but we’ve gathered information on each to make it easier.

Sole Proprietorship

A sole proprietorship is the easiest legal structure to set up but doesn’t protect the owner’s personal assets from legal issues. That means if something goes wrong, you could lose both your company and your home.

To start a sole proprietorship, fill out a special tax form called a Schedule C . Sole proprietors can also join the American Independent Business Alliance .

Limited Liability Company (LLC)

An LLC is the most common business structure used in the United States because an LLC protects the owner’s personal assets. It’s similar to partnerships and corporations, but can be a single-member LLC in most states. An LLC requires a document called an operating agreement.

Each state has different requirements. Here’s a link to find your state’s requirements . Delaware and Nevada are common states to file an LLC because they are really business-friendly. Here’s a blog on the top 10 states to get an LLC.

Partnerships are typically for legal firms. If you choose to use a partnership choose a Limited Liability Partnership. Alternatively, you can just use an LLC.

Corporations are typically for massive organizations. Corporations have taxes on both corporate and income tax so unless you plan on selling stock, you are better off considering an LLC with S-Corp status . Investopedia has good information corporations here .

There are several opportunities to purchase successful franchises. TopFranchise.com has a list of companies in a variety of industries that offer franchise opportunities. This makes it where an entrepreneur can benefit from the reputation of an established business that has already worked out many of the kinks of starting from scratch.

How to Write a Business Plan Step 5. Products and Services

This section of the business plan should focus on what you sell, how you source it, and how you sell it. You should include:

- Unique features that differentiate your business products from competitors

- Intellectual property

- Your supply chain

- Cost and pricing structure

Questions to answer about your products and services

Mike gave us a list of the most important questions to answer about your product and services:

- How will you be selling the product? (in person, ecommerce, wholesale, direct to consumer)?

- How do you let them know they need a product?

- How do you communicate the message?

- How will you do transactions?

- How much will you be selling it for?

- How many do you think you’ll sell and why?

Make sure to use the worksheet on our business plan template .

How to Write a Business Plan Step 6. Sales and Marketing Plan

The marketing and sales plan is focused on the strategy to bring awareness to your company and guides how you will get the product to the consumer. It should contain the following sections:

SWOT Analysis stands for strengths, weaknesses, opportunities, and threats. Not only do you want to identify them, but you also want to document how the business plans to deal with them.

Business owners need to do a thorough job documenting how their service or product stacks up against the competition.

If proper research isn’t done, investors will be able to tell that the owner hasn’t researched the competition and is less likely to believe that the team can protect its service from threats by the more well-established competition. This is one of the most common parts of a presentation that trips up business owners presenting on Shark Tank .

SWOT Examples

Examples of strengths and weaknesses could be things like the lack of cash flow, intellectual property ownership, high costs of suppliers, and customers’ expectations on shipping times.

Opportunities could be ways to capitalize on your strengths or improve your weaknesses, but may also be gaps in the industry. This includes:

- Adding offerings that fit with your current small business

- Increase sales to current customers

- Reducing costs through bulk ordering

- Finding ways to reduce inventory

- And other areas you can improve

Threats will normally come from outside of the company but could also be things like losing a key member of the team. Threats normally come from competition, regulations, taxes, and unforeseen events.

The management team should use the SWOT analysis to guide other areas of business planning, but it absolutely has to be done before a business owner starts marketing.

Include Competitor Data in Your Business Plan

When you plan a business, taking into consideration the strengths and weaknesses of the competition is key to navigating the field. Providing an overview of your competition and where they are headed shows that you are invested in understanding the industry.

For smaller businesses, you’ll want to search both the company and the owners names to see what they are working on. For publicly held corporations, you can find their quarterly and annual reports on the SEC website .

What another business plans to do can impact your business. Make sure to include things that might make it attractive for bigger companies to outsource to a small business.

- Marketing Strategy

The marketing and sales part of business plans should be focused on how you are going to make potential customers aware of your business and then sell to them.

If you haven’t already included it, Mike recommends:

“They’ll want to know about Demographics, ages, and wealth of your target market.”

Make sure to include the Total addressable market . The term refers to the value if you captured 100% of the market.

Advertising Strategy

You’ll explain what formats of advertising you’ll be using. Some possibilities are:

- Online: Facebook and Google are the big names to work with here.

- Print : Print can be used to reach broad groups or targeted markets. Check out this for tips .

- Radio : iHeartMedia is one of the best ways to advertise on the radio

- Cable television : High priced, hard to measure ROI, but here’s an explanation of the process

- Billboards: Attracting customers with billboards can be beneficial in high traffic areas.

You’ll want to define how you’ll be using each including frequency, duration, and cost. If you have the materials already created, including pictures or links to the marketing to show creative assets.

Mike told us “Most businesses are marketing digitally now due to Covid, but that’s not always the right answer.”

Make sure the marketing strategy will help team members or external marketing agencies stay within the brand guidelines .

This section of a business plan should be focused on pricing. There are a ton of pricing strategies that may work for different business plans. Which one will work for you depends on what kind of a business you run.

Some common pricing strategies are:

- Value-based pricing – Commonly used with home buying and selling or other products that are status symbols.

- Skimming pricing – Commonly seen in video game consoles, price starts off high to recoup expenses quickly, then reduces over time.

- Competition-based pricing – Pricing based on competitors’ pricing is commonly seen at gas stations.

- Freemium services – Commonly used for software, where there is a free plan, then purchase options for more functionality.

HubSpot has a great calculator and blog on pricing strategies.

Beyond explaining what strategy your business plans to use, you should include references for how you came to this pricing strategy and how it will impact your cash flow.

Distribution Plan

This part of a business plan is focused on how the product or service is going to go through the supply chain. These may include multiple divisions or multiple companies. Make sure to include any parts of the workflow that are automated so investors can see where cost savings are expected and when.

Supply Chain Examples

For instance, lawn care companies would need to cover aspects such as:

- Suppliers for lawn care equipment and tools

- Any chemicals or treatments needed

- Repair parts for sprinkler systems

- Vehicles to transport equipment and employees

- Insurance to protect the company vehicles and people.

Examples of Supply Chains

These are fairly flat supply chains compared to something like a clothing designer where the clothes would go through multiple vendors. A clothing company might have the following supply chain:

- Raw materials

- Shipping of raw materials

- Converting of raw materials to thread

- Shipping thread to produce garments

- Garment producer

- Shipping to company

- Company storage

- Shipping to retail stores

There have been advances such as print on demand that eliminate many of these steps. If you are designing completely custom clothing, all of this would need to be planned to keep from having business disruptions.

The main thing to include in the business plan is the list of suppliers, the path the supply chain follows, the time from order to the customer’s home, and the costs associated with each step of the process.

According to BizPlanReview , a business plan without this information is likely to get rejected because they have failed to research the key elements necessary to make sales to the customer.

How to Write a Business Plan Step 7. Company Organization and Operational Plan

This part of the business plan is focused on how the business model will function while serving customers. The business plan should provide an overview of how the team will manage the following aspects:

Quality Control

- Legal environment

Let’s look at each for some insight.

Production has already been discussed in previous sections so I won’t go into it much. When writing a business plan for investors, try to avoid repetition as it creates a more simple business plan.

If the organizational plan will be used by the team as an overview of how to perform the best services for the customer, then redundancy makes more sense as it communicates what is important to the business.

Quality control policies help to keep the team focused on how to verify that the company adheres to the business plan and meets or exceeds customer expectations.

Quality control can be anything from a standard that says “all labels on shirts can be no more than 1/16″ off center” to a defined checklist of steps that should be performed and filled out for every customer.

There are a variety of organizations that help define quality control including:

- International Organization for Standardization – Quality standards for energy, technology, food, production environments, and cybersecurity

- AICPA – Standard defined for accounting.

- The Joint Commission – Healthcare

- ASHRAE – HVAC best practices

You can find lists of the organizations that contribute most to the government regulation of industries on Open Secrets . Research what the leaders in your field are doing. Follow their example and implement it in your quality control plan.

For location, you should use information from the market research to establish where the location will be. Make sure to include the following in the location documentation.

- The size of your location

- The type of building (retail, industrial, commercial, etc.)

- Zoning restrictions – Urban Wire has a good map on how zoning works in each state

- Accessibility – Does it meet ADA requirements?

- Costs including rent, maintenance, utilities, insurance and any buildout or remodeling costs

- Utilities – b.e.f. has a good energy calculator .

Legal Environment

The legal requirement section is focused on defining how to meet the legal requirements for your industry. A good business plan should include all of the following:

- Any licenses and/or permits that are needed and whether you’ve obtained them

- Any trademarks, copyrights, or patents that you have or are in the process of applying for

- The insurance coverage your business requires and how much it costs

- Any environmental, health, or workplace regulations affecting your business

- Any special regulations affecting your industry

- Bonding requirements, if applicable

Your local SBA office can help you establish requirements in your area. I strongly recommend using them. They are a great resource.

Your business plan should include a plan for company organization and hiring. While you may be the only person with the company right now, down the road you’ll need more people. Make sure to consider and document the answers to the following questions:

- What is the current leadership structure and what will it look like in the future?

- What types of employees will you have? Are there any licensing or educational requirements?

- How many employees will you need?

- Will you ever hire freelancers or independent contractors?

- What is each position’s job description?

- What is the pay structure (hourly, salaried, base plus commission, etc.)?

- How do you plan to find qualified employees and contractors?

One of the most crucial parts of a business plan is the organizational chart. This simply shows the positions the company will need, who is in charge of them and the relationship of each of them. It will look similar to this:

Our small business plan template has a much more in-depth organizational chart you can edit to include when you include the organizational chart in your business plan.

How to Write a Business Plan Step 8. Financial Statements

No business plan is complete without financial statements or financial projections. The business plan format will be different based on whether you are writing a business plan to expand a business or a startup business plan. Let’s dig deeper into each.

Provide All Financial Income from an Existing Business

An existing business should use their past financial documents including the income statement, balance sheet, and cash flow statement to find trends to estimate the next 3-5 years.

You can create easy trendlines in excel to predict future revenue, profit and loss, cash flow, and other changes in year-over-year performance. This will show your expected performance assuming business continues as normal.

If you are seeking an investment, then the business is probably not going to continue as normal. Depending on the financial plan and the purpose of getting financing, adjustments may be needed to the following:

- Higher Revenue if expanding business

- Lower Cost of Goods Sold if purchasing inventory with bulk discounts

- Adding interest if utilizing financing (not equity deal)

- Changes in expenses

- Addition of financing information to the cash flow statement

- Changes in Earnings per Share on the balance sheet

Financial modeling is a challenging subject, but there are plenty of low-cost courses on the subject. If you need help planning your business financial documentation take some time to watch some of them.

Make it a point to document how you calculated all the changes to the income statement, balance sheet, and cash flow statement in your business plan so that key team members or investors can verify your research.

Financial Projections For A Startup Business Plan