Business Plan Outline: The Essential Framework

By GGI Insights | April 8, 2024

Table of contents

This article explores the importance of business plan outlines, the choice between modular and linear approaches, the power of visual outlining techniques, the pros and cons of outline templates, and best practices for outlining.

By investing in a well-organized outline, entrepreneurs increase their chances of success in their entrepreneurial endeavors.

A well-structured business plan is the foundation of any successful venture. It provides a clear roadmap for entrepreneurs, helping them navigate the complexities of starting and growing a business. Understanding the right business plan format is one key aspect of a comprehensive business plan. The outline acts as a skeleton that organizes and guides the development of the plan, ensuring that all critical elements are addressed systematically and coherently.

Modular vs. Linear Approaches

When it comes to creating a business plan outline, entrepreneurs have two main options: a modular approach or a linear approach. Each approach has its own benefits and drawbacks, and understanding them can help business owners choose the most suitable method for their specific needs. Looking at various business plan examples can illustrate how some businesses might benefit more from a modular approach, while others find a linear approach more effective.

The modular approach involves dividing the business plan into separate sections or modules, each focusing on a specific aspect of the business. This approach allows for flexibility and customization, making it easier to update and modify individual modules without disrupting the overall structure of the plan. For example, if a company decides to change its marketing strategy, it can simply update the marketing module without having to rewrite the entire business plan. This flexibility is particularly advantageous for businesses operating in dynamic industries where changes are frequent.

Unlock growth potential and align your teams seamlessly with gardenpatch. Their growth strategists break down barriers and optimize your business for success. Click here to unlock business growth!

However, the modular approach may lack a cohesive flow and can make it challenging to maintain consistency across different sections. Without a clear narrative thread connecting the modules, the business plan may appear disjointed and confusing to readers. It requires careful planning and organization to ensure that each module seamlessly integrates with the others, creating a coherent and comprehensive business plan.

The linear approach involves creating a business plan in a step-by-step manner, following a predetermined sequence. This approach ensures a logical flow of information and makes it easier for readers to understand the interconnections between different sections , especially when detailing a comprehensive financial plan . By presenting information in a linear fashion, the business plan tells a story, guiding readers through the company's vision, mission, strategies, and financial projections in a structured and cohesive manner.

If new information or ideas arise during the business planning process, it may be more difficult to incorporate them into the existing linear structure. The need to maintain a strict sequence can limit the ability to accommodate unexpected developments or shifts in the business landscape. This approach is often favored by businesses operating in stable industries where changes are infrequent.

Adaptability Quotient

One key consideration when choosing between the modular and linear approaches is the adaptability quotient of the business. If a business operates in a dynamic and rapidly evolving industry, the modular approach may be more suitable as it allows for easier updates and adjustments. The ability to modify individual modules without disrupting the overall structure of the plan can be invaluable in industries where market conditions, technologies, or consumer preferences change frequently. In this case, a business roadmap that emphasizes flexibility and agility could be essential.

If a business operates in a stable industry with fewer changes, the linear approach may provide a more straightforward and efficient way of organizing the plan. In industries where the business model and strategies remain relatively constant, a linear approach can ensure a clear and logical presentation of information, making it easier for stakeholders to understand the business's direction and goals.

The choice between a modular and linear approach depends on the specific needs and circumstances of the business. It is essential for entrepreneurs to carefully evaluate their industry, market dynamics, and the level of adaptability required before deciding on the most suitable approach for their business plan outline.

The Power of Visual Outlining

Text-based business plan outlines are undoubtedly effective, but incorporating visual outlining techniques can enhance clarity and comprehension. Visual outlining employs graphic elements to represent the relationships and connections between different sections of the plan.

When it comes to presenting complex information in a concise and easily digestible format, visual outlining techniques are invaluable. They not only capture the attention of readers but also facilitate a deeper understanding of the business plan. Let's explore two popular visual outlining techniques that can take your business plan to the next level.

Mind Mapping

Mind mapping is a popular visual outlining technique that uses diagrams to represent ideas and concepts. By linking different elements together and organizing them in a hierarchical structure, entrepreneurs can create a visual representation of their business plan. Mind maps provide a comprehensive overview while allowing for easy navigation and exploration of specific details.

Imagine having a bird's-eye view of your entire business plan, with all its components interconnected in a visually appealing and logical manner. Mind maps help entrepreneurs identify the core elements of their business, such as the mission statement, target market, and competitive analysis, and visually demonstrate how they are interrelated. This technique not only aids in organizing thoughts but also promotes creativity and innovative thinking.

Mind maps allow for flexibility and adaptability. As your business plan evolves, you can easily update and modify the mind map to reflect any changes. This dynamic nature of mind mapping ensures that your business plan remains relevant and up-to-date.

Flowcharts are another powerful tool for visual outlining in business plans. They use graphical symbols to represent the flow of processes or information. Flowcharts can help entrepreneurs visualize the step-by-step progression of their business operations, making it easier to identify bottlenecks or areas for improvement.

With a flowchart, you can visually map out the various stages of your business's workflow, from product development to customer acquisition and beyond. Each step is represented by a specific symbol, such as a rectangle for a process or a diamond for a decision point. By following the arrows that connect these symbols, readers can easily trace the flow of information or activities.

Flowcharts not only provide a clear overview of the business processes but also allow for a detailed analysis of each step. By examining the flowchart, entrepreneurs can identify any inefficiencies or potential roadblocks in their operations. This visual representation enables them to devise strategies for streamlining processes and improving overall efficiency.

Incorporating visual outlining techniques, such as mind mapping and flowcharts, into your business plan can greatly enhance its effectiveness. These techniques offer a visually engaging and comprehensive overview of your business, facilitating better understanding and analysis. So, why settle for a plain text outline when you can create a visually captivating business plan that leaves a lasting impression?

Outline Templates: Pros & Cons

Creating a business plan from scratch can be a time-consuming task. To streamline the process, entrepreneurs often use pre-designed outline templates that provide a structured framework for organizing their ideas. For instance, a coffee shop business plan might benefit from an industry-specific template that includes sections on customer demographics, café layout, and menu offerings. While these templates can be advantageous, it is essential to consider their pros and cons before opting for them.

Industry-Specific

Industry-specific outline templates are tailored to the unique requirements and nuances of particular sectors. They provide a starting point for entrepreneurs by including industry-specific sections and relevant key performance indicators. These templates can save time and ensure that critical information is not overlooked. For example, if you are starting a restaurant business, an industry-specific template may include sections on menu planning, kitchen layout, and customer service strategies.

Industry-specific templates can offer valuable insights and best practices specific to your field. They may include examples of successful business plans from similar businesses, giving you a better understanding of what works in your industry. This can be particularly helpful if you are new to the sector or looking for innovative ideas to differentiate your business.

It is important to note that industry-specific templates may lack flexibility. While they provide a solid foundation, they may not fully capture the unique aspects of a specific business. Each business has its own strengths, weaknesses, and competitive advantages that may not be adequately addressed in a template designed for a broader industry.

Universal Templates

Alternatively, entrepreneurs can opt for universal outline templates that are applicable to a wide range of industries. These templates provide a comprehensive framework that covers all essential elements of a business plan. Universal templates offer flexibility and can be easily customized to suit individual business needs. For example, they may include sections on market analysis, financial projections, and marketing strategies that can be adapted to any industry.

Universal templates also allow entrepreneurs to think outside the box and explore different business models. They encourage creativity and innovation by providing a structure that can be molded to fit various industries. This can be particularly beneficial for entrepreneurs who are looking to disrupt traditional business models or enter emerging markets.

It is important to consider that universal templates may require additional effort to adapt to specific industry requirements. While they provide a solid framework, entrepreneurs may need to invest more time and resources in customizing the template to accurately reflect their business. This can include conducting additional research, gathering industry-specific data, and tailoring the content to align with the unique needs of their target market.

Both industry-specific and universal outline templates offer advantages and disadvantages. Industry-specific templates provide a tailored approach and save time by including relevant sections and key performance indicators. On the other hand, universal templates offer flexibility and can be easily customized to suit individual business needs. Ultimately, the choice between the two depends on the entrepreneur's specific requirements, industry, and level of customization desired.

Best Practices for Outlining

Creating a business plan outline is a crucial step in the process of writing a business plan . While there is no one-size-fits-all approach to outlining, following some best practices can greatly enhance the effectiveness and readability of the final document.

When outlining a business plan, one of the most important considerations is prioritizing the information presented. Starting with the most essential and impactful details and progressively guiding readers through supporting information can help ensure that they understand the key aspects of the business and its value proposition. By prioritizing information, you can provide a clear and concise overview of your business, setting the stage for a more in-depth exploration of the details.

Another critical factor to consider when creating a business plan outline is stakeholder alignment. It is essential to identify the key stakeholders and understand their specific interests and objectives. Tailoring the plan to meet their needs and expectations can significantly increase the chances of gaining support and buy-in from stakeholders. When stakeholders feel that their interests are being considered and addressed, they are more likely to actively participate in the implementation process, leading to a higher likelihood of success.

A well-aligned plan can help foster collaboration and cooperation among stakeholders. By clearly articulating the business's goals, strategies, and objectives, you can create a shared understanding and sense of purpose. This alignment can lead to more effective decision-making and a smoother implementation process.

When outlining a business plan, it is essential to consider the overall structure and flow of the document. Organizing the information in a logical and coherent manner can greatly enhance readability and comprehension. Consider using headings, subheadings, and bullet points to break down complex information into manageable sections. This approach can help readers navigate the document more easily and locate specific information quickly.

In addition to prioritizing information and ensuring stakeholder alignment, it is also beneficial to include relevant market research and analysis in the business plan outline. Providing data and insights about the industry, target market, and competitors can demonstrate a thorough understanding of the business's external environment. This information can also help support the business's value proposition and differentiate it from competitors.

When outlining a business plan, it is crucial to review and revise the document regularly. As the business evolves and new information becomes available, the outline should be updated to reflect these changes. Regularly reviewing and refining the outline can help ensure that the business plan remains current and relevant.

Creating a well-structured and comprehensive business plan outline is a critical step in the business planning process. By prioritizing information, aligning with stakeholders, considering the overall structure, including relevant research, and regularly reviewing and revising the outline, you can develop a document that effectively communicates your business's value proposition and increases the likelihood of successful implementation.

A well-structured business plan outline is a crucial component of any successful business venture. The choice between a modular or linear approach depends on the adaptability quotient of the business and the desired level of customization. Visual outlining techniques such as mind mapping and flowcharts can enhance clarity and comprehension. When using outline templates, entrepreneurs should consider industry-specific or universal options based on their specific requirements. Finally, following best practices such as prioritizing information and stakeholder alignment can further enhance the effectiveness of the business plan outline. By investing time and effort into creating a comprehensive and well-organized outline, entrepreneurs set themselves up for a greater chance of success in their entrepreneurial endeavors.

Popular Insights:

Shop with purpose at impact mart your purchase empowers positive change. thanks for being the difference.

Customer Onboarding: Proven Techniques for Seamless Client Integration

Customer journey: optimizing interactions for lasting customer loyalty, email open rates: enhancing the readership of your marketing emails, revenue: the fundamental pillar of business viability and growth, marketing strategies: craft dynamic approaches for business expansion, startup school: accelerating your path to entrepreneurial success, ecommerce marketing strategy: data-driven tactics for enhanced loyalty, hubspot crm review: a comprehensive look into what makes hubspot great, hubspot growth suite: catalyzing your company growth with integration, hubspot service hub: taking superb customer service to the next level.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Financial Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Taking Stock of Expenses

The income statement, the cash flow projection, the balance sheet.

The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders' equity. It also should include a brief explanation and analysis of these four statements.

Think of your business expenses as two cost categories: your start-up expenses and your operating expenses. All the costs of getting your business up and running should be considered start-up expenses. These may include:

- Business registration fees

- Business licensing and permits

- Starting inventory

- Rent deposits

- Down payments on a property

- Down payments on equipment

- Utility setup fees

Your own list will expand as soon as you start to itemize them.

Operating expenses are the costs of keeping your business running . Think of these as your monthly expenses. Your list of operating expenses may include:

- Salaries (including your own)

- Rent or mortgage payments

- Telecommunication expenses

- Raw materials

- Distribution

- Loan payments

- Office supplies

- Maintenance

Once you have listed all of your operating expenses, the total will reflect the monthly cost of operating your business. Multiply this number by six, and you have a six-month estimate of your operating expenses. Adding this amount to your total startup expenses list, and you have a ballpark figure for your complete start-up costs.

Now you can begin to put together your financial statements for your business plan starting with the income statement.

The income statement shows your revenues, expenses, and profit for a particular period—a snapshot of your business that shows whether or not your business is profitable. Subtract expenses from your revenue to determine your profit or loss.

While established businesses normally produce an income statement each fiscal quarter or once each fiscal year, for the purposes of the business plan, an income statement should be generated monthly for the first year.

Not all of the categories in this income statement will apply to your business. Eliminate those that do not apply, and add categories where necessary to adapt this template to your business.

If you have a product-based business, the revenue section of the income statement will look different. Revenue will be called sales, and you should account for any inventory.

The cash flow projection shows how cash is expected to flow in and out of your business. It is an important tool for cash flow management because it indicates when your expenditures are too high or if you might need a short-term investment to deal with a cash flow surplus. As part of your business plan, the cash flow projection will show how much capital investment your business idea needs.

For investors, the cash flow projection shows whether your business is a good credit risk and if there is enough cash on hand to make your business a good candidate for a line of credit, a short-term loan , or a longer-term investment. You should include cash flow projections for each month over one year in the financial section of your business plan.

Do not confuse the cash flow projection with the cash flow statement. The cash flow statement shows the flow of cash in and out of your business. In other words, it describes the cash flow that has occurred in the past. The cash flow projection shows the cash that is anticipated to be generated or expended over a chosen period in the future.

There are three parts to the cash flow projection:

- Cash revenues: Enter your estimated sales figures for each month. Only enter the sales that are collectible in cash during each month you are detailing.

- Cash disbursements: Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay for each month.

- Reconciliation of cash revenues to cash disbursements: This section shows an opening balance, which is the carryover from the previous month's operations. The current month's revenues are added to this balance, the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next month.

The balance sheet reports your business's net worth at a particular point in time. It summarizes all the financial data about your business in three categories:

- Assets : Tangible objects of financial value that are owned by the company.

- Liabilities: Debt owed to a creditor of the company.

- Equity: The net difference when the total liabilities are subtracted from the total assets.

The relationship between these elements of financial data is expressed with the equation: Assets = Liabilities + Equity .

For your business plan , you should create a pro forma balance sheet that summarizes the information in the income statement and cash flow projections. A business typically prepares a balance sheet once a year.

Once your balance sheet is complete, write a brief analysis for each of the three financial statements. The analysis should be short with highlights rather than in-depth analysis. The financial statements themselves should be placed in your business plan's appendices.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

5.6 The Business Plan

Learning objective.

- Discuss the importance of planning for your business, and identify the key sections of a business plan.

If you want to start a business, you must prepare a business plan. This essential document should tell the story of your business concept, provide an overview of the industry in which you will operate, describe the goods or services you will provide, identify your customers and proposed marketing activities, explain the qualifications of your management team, and state your projected income and borrowing needs.

Purpose of a Business Plan

The business plan is a plan or blueprint for the company, and it’s an indispensable tool in attracting investors, obtaining loans, or both. Remember, too, that the value of your business plan isn’t limited to the planning stages of your business and the process of finding start-up money. Once you’ve acquired start-up capital, don’t just stuff your plan in a drawer. Treat it as an ongoing guide to your business and its operations, as well as a yardstick by which you can measure your performance. Keep it handy, update it periodically, and use it to assess your progress.

In developing and writing your business plan, you must make strategic decisions in the areas of management, operations, marketing, accounting, and finance—in short, in all the functional areas of business that we described in Chapter 1 “The Foundations of Business” . Granted, preparing a business plan takes a lot of time and work, but it’s well worth the effort. A business plan forces you to think critically about your proposed business and reduces your risk of failure. It forces you to analyze your business concept and the industry in which you’ll be operating, and it helps you determine how you can grab a percentage of sales in that industry.

The most common use of a business plan is persuading investors, lenders, or both, to provide financing. These two groups look for different things. Investors are particularly interested in the quality of your business concept and the ability of management to make your venture successful. Bankers and other lenders are primarily concerned with your company’s ability to generate cash to repay loans. To persuade investors and lenders to support your business, you need a professional, well-written business plan that paints a clear picture of your proposed business.

Sections of the Business Plan

Though formats can vary, a business plan generally includes the following sections: executive summary, description of proposed business, industry analysis, mission statement and core values, management plan, goods or services and (if applicable) production processes, marketing, global issues, and financial plan. Let’s explore each of these sections in more detail. ( Note : More detailed documents and an Excel template are available for those classes in which the optional business plan project is assigned.)

Executive Summary

The executive summary is a one- to three-page overview of the business plan. It’s actually the most important part of the business plan: it’s what the reader looks at first, and if it doesn’t capture the reader’s attention, it might be the only thing that he or she looks at. It should therefore emphasize the key points of the plan and get the reader excited about the prospects of the business.

Even though the executive summary is the first thing read, it’s written after the other sections of the plan are completed. An effective approach in writing the executive summary is to paraphrase key sentences from each section of the business plan. This process will ensure that the key information of each section is included in the executive summary.

Description of Proposed Business

Here, you present a brief description of the company and tell the reader why you’re starting your business, what benefits it provides, and why it will be successful. Some of the questions to answer in this section include the following:

- What will your proposed company do? Will it be a manufacturer, a retailer, or a service provider?

- What goods or services will it provide?

- Why are your goods or services unique?

- Who will be your main customers?

- How will your goods or services be sold?

- Where will your business be located?

Because later parts of the plan will provide more detailed discussions of many of these issues, this section should provide only an overview of these topics.

Industry Analysis

This section provides a brief introduction to the industry in which you propose to operate. It describes both the current situation and the future possibilities, and it addresses such questions as the following:

- How large is the industry? What are total sales for the industry, in volume and dollars?

- Is the industry mature or are new companies successfully entering it?

- What opportunities exist in the industry? What threats exist?

- What factors will influence future expansion or contraction of the industry?

- What is the overall outlook for the industry?

- Who are your major competitors in the industry?

- How does your product differ from those of your competitors?

Mission Statement and Core Values

This portion of the business plan states the company’s mission statement and core values . The mission statement describes the purpose or mission of your organization—its reason for existence. It tells the reader what the organization is committed to doing. For example, one mission statement reads, “The mission of Southwest Airlines is dedication to the highest quality of customer service delivered with a sense of warmth, friendliness, individual pride, and company spirit” (Southwest Airline’s, 2011).

Core values are fundamental beliefs about what’s important and what is (and isn’t) appropriate in conducting company activities. Core values are not about profits, but rather about ideals. They should help guide the behavior of individuals in the organization. Coca-Cola, for example, intends that its core values—leadership, passion, integrity, collaboration, diversity, quality, and accountability—will let employees know what behaviors are (and aren’t) acceptable (The Coca-Cola Company, 2011).

Management Plan

Management makes the key decisions for the business, such as its legal form and organizational structure. This section of the business plan should outline these decisions and provide information about the qualifications of the key management personnel.

A. Legal Form of Organization

This section dentifies the chosen legal form of business ownership: sole proprietorship (personal ownership), partnership (ownership shared with one or more partners), or corporation (ownership through shares of stock).

B. Qualifications of Management Team and Compensation Package

It isn’t enough merely to have a good business idea: you need a talented management team that can turn your concept into a profitable venture. This part of the management plan section provides information about the qualifications of each member of the management team. Its purpose is to convince the reader that the company will be run by experienced, well-qualified managers. It describes each individual’s education, experience, and expertise, as well as each person’s responsibilities. It also indicates the estimated annual salary to be paid to each member of the management team.

C. Organizational Structure

This section of the management plan describes the relationships among individuals within the company, listing the major responsibilities of each member of the management team.

Goods, Services, and the Production Process

To succeed in attracting investors and lenders, you must be able to describe your goods or services clearly (and enthusiastically). Here, you describe all the goods and services that you will provide the marketplace. This section explains why your proposed offerings are better than those of competitors and indicates what market needs will be met by your goods or services. In other words, it addresses a key question: What competitive advantage will the company’s goods and services have over similar products on the market?

This section also indicates how you plan to obtain or make your products. Naturally, the write-up will vary, depending on whether you’re proposing a service company, a retailer, or a manufacturer. If it’s a service company, describe the process by which you’ll deliver your services. If it’s a retail company, tell the reader where you’ll purchase products for resale.

If you’re going to be a manufacturer, you must furnish information on product design, development, and production processes. You must address questions such as the following:

- How will products be designed?

- What technology will be needed to design and manufacture products?

- Will the company run its own production facilities, or will its products be manufactured by someone else?

- Where will production facilities be located?

- What type of equipment will be used?

- What are the design and layout of the facilities?

- How many workers will be employed in the production process?

- How many units will be produced?

- How will the company ensure that products are of high quality?

This critical section focuses on four marketing-related areas—target market, pricing, distribution, and promotion:

- Target market . Describe future customers and profile them according to age, gender, income, interests, and so forth. If your company will sell to other companies, describe your typical business customer.

- Pricing . State the proposed price for each product. Compare your pricing strategy to that of competitors.

- Distribution . Explain how your goods or services will be distributed to customers. Indicate whether they’ll be sold directly to customers or through retail outlets.

- Promotion . Explain your promotion strategy, indicating what types of advertising you’ll be using.

In addition, if you intend to use the Internet to promote or sell your products, also provide answers to these questions:

- Will your company have a Web site? Who will visit the site?

- What will the site look like? What information will it supply?

- Will you sell products over the Internet?

- How will you attract customers to your site and entice them to buy from your company?

Global Issues

In this section, indicate whether you’ll be involved in international markets, by either buying or selling in other countries. If you’re going to operate across borders, identify the challenges that you’ll face in your global environment, and explain how you’ll meet them. If you don’t plan initially to be involved in international markets, state what strategies, if any, you’ll use to move into international markets when the time comes.

Financial Plan

In preparing the financial section of your business plan, specify the company’s cash needs and explain how you’ll be able to repay debt. This information is vital in obtaining financing. It reports the amount of cash needed by the company for start-up and initial operations and provides an overview of proposed funding sources. It presents financial projections, including expected sales, costs, and profits (or losses). It refers to a set of financial statements included in an appendix to the business plan.

Here, you furnish supplemental information that may be of interest to the reader. In addition to a set of financial statements, for example, you might attach the résumés of your management team.

Key Takeaways

- A business plan tells the story of your business concept, provides an overview of the industry in which you will operate, describes the goods or services you will provide, identifies your customers and proposed marketing activities, explains the qualifications of your management team, and states your projected income and borrowing needs.

- In your business plan, you make strategic decisions in the areas of management, operations, marketing, accounting, and finance. Developing your business plan forces you to analyze your business concept and the industry in which you’ll be operating. Its most common use is persuading investors and lenders to provide financing.

A business plan generally includes the following sections:

- Executive summary . One- to three-page overview.

- Description of proposed business . Brief description of the company that answers such questions as what your proposed company will do, what goods or services it will provide, and who its main customers will be.

- Industry analysis . Short introduction to the industry in which you propose to operate.

- Mission statement and core values . Declaration of your mission statement , which are fundamental beliefs about what’s important and what is (and isn’t) appropriate in conducting company activities.

- Management plan . Information about management team qualifications and responsibilities, and designation of your proposed legal form of organization.

- Goods, services, and the production process . Description of the goods and services that you’ll provide in the marketplace; explanation of how you plan to obtain or make your products or of the process by which you’ll deliver your services.

- Marketing . Description of your plans in four marketing-related areas: target market, pricing, distribution, and promotion.

- Global issues . Description of your involvement, if any, in international markets.

- Financial plan . Report on the cash you’ll need for start-up and initial operations, proposed funding sources, and means of repaying your debt.

- Appendices . Supplemental information that may be of interest to the reader.

(AACSB) Analysis

Let’s start with three givens: (1) college students love chocolate chip cookies, (2) you have a special talent for baking cookies, and (3) you’re always broke. Given these three conditions, you’ve come up with the idea of starting an on-campus business—selling chocolate chip cookies to fellow students. As a business major, you want to do things right by preparing a business plan. First, you identified a number of specifics about your proposed business. Now, you need to put these various pieces of information into the relevant section of your business plan. Using the business plan format described in this chapter, indicate the section of the business plan into which you’d put each of the following:

- You’ll bake the cookies in the kitchen of a friend’s apartment.

- You’ll charge $1 each or $10 a dozen.

- Your purpose is to make the best cookies on campus and deliver them fresh. You value integrity, consideration of others, and quality.

- Each cookie will have ten chocolate chips and will be superior to those sold in nearby bakeries and other stores.

- You expect sales of $6,000 for the first year.

- Chocolate chip cookies are irresistible to college students. There’s a lot of competition from local bakeries, but your cookies will be superior and popular with college students. You’ll make them close to campus using only fresh ingredients and sell them for $1 each. Your management team is excellent. You expect first-year sales of $6,000 and net income of $1,500. You estimate start-up costs at $600.

- You’ll place ads for your product in the college newspaper.

- You’ll hire a vice president at a salary of $100 a week.

- You can ship cookies anywhere in the United States and in Canada.

- You need $600 in cash to start the business.

- There are six bakeries within walking distance of the college.

- You’ll bake nothing but cookies and sell them to college students. You’ll make them in an apartment near campus and deliver them fresh.

The Coca-Cola Company, “Workplace Culture,” The Coca-Cola Company, http://www.thecoca-colacompany.com/citizenship/workplace_culture.html (accessed August 31, 2011).

Southwest Airline’s company Web site, about SWA section, http://www.southwest.com/about_swa/mission.html (accessed August 31, 2011).

Exploring Business Copyright © 2016 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Share This Book

Search Product category Any value Sample Label 1 Sample Label 2 Sample Label 3

Business Plan vs. Financial Plan: What’s The Difference?

- December 16, 2022

- Fundraising

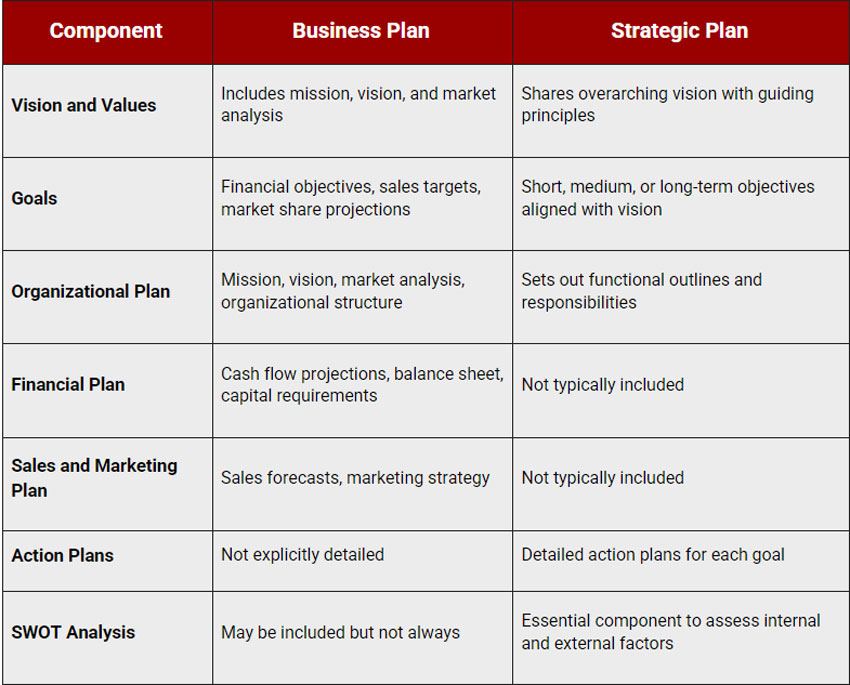

When preparing their business plan, entrepreneurs sometimes get confused between different terms, especially the difference between a business plan and a financial plan.

Whilst a business plan must include a financial plan, these 2 documents are very different and have separate objectives.

In this article we explain you what are a business plan and a financial plan, their objectives and what are the key differences between them.

What is a Business plan?

A business plan is a long document that contains a detailed description of your business and your strategy. Unlike a pitch deck, a business plan is a Word document and often includes 30 up to 100 pages.

We use business plans to communicate information about a business to third-parties. We often use it when a business needs funding. Debt investors (e.g. banks or venture debt investors ) almost always require a business plan as part of a loan application. Instead, equity investors usually ask for a pitch deck .

What should you include in a business plan?

Chances are you will find different definitions online for what you need to include in your business plan. Yet, most interested parties (investors or banks) agree on the different elements that a business plan must include, they are:

- Executive summary : usually a one-pager, this section outlines key information about the company such as a short business overview , operations, location and leadership

- Products and services : a detailed overview of the different products and/or services the company offers including features, benefits to customers and pricing. This section can also include, if relevant, information about the production and manufacturing elements (costs, materials and processes). Also, include here any proprietary technology (e.g. patents) your business might have

- Market analysis : a description of the market including its size and its growth. Here you should also include any information about your competitive environment, especially you position yourself vs. competitors

- Marketing strategy : this section explains how a business acquires and retains its customers. Your acquisition strategy ( inbound or outbound for example) as well as your conversion funnel must be clearly explained. If any, you should include here the different marketing campaigns you are running (e.g. paid ads, offline marketing), their goals and historical performance.

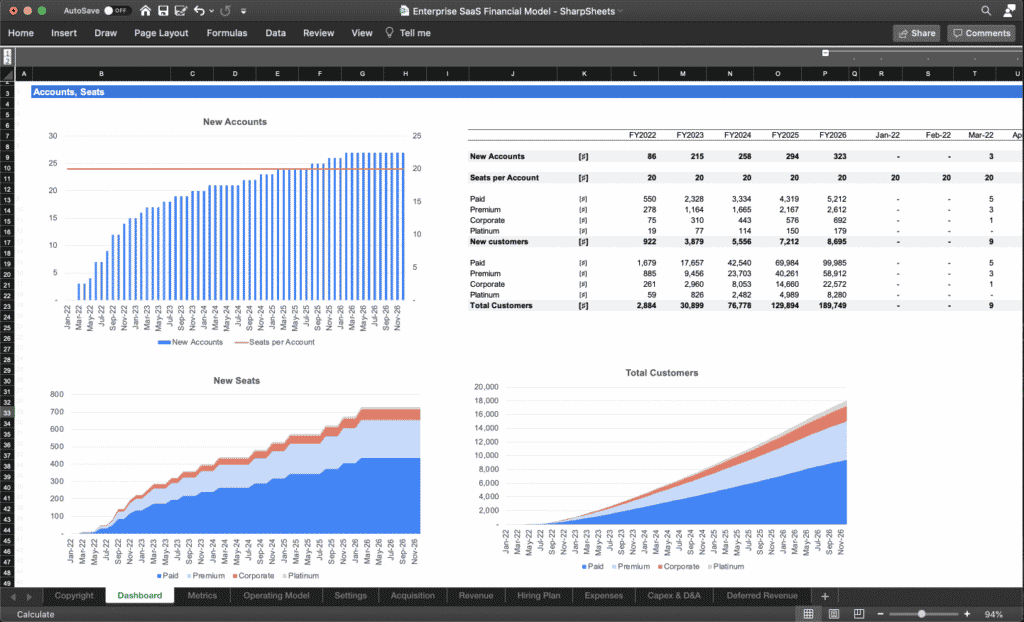

- Financial plan : every business plan must include a financial plan. As explained below, a financial plan is the projection in the future of the 3 financial statements . Usually, a financial plan is a 3- to 5-year forecast , depending on the objective of the business plan and the stage the business is in today.

What is a Financial plan?

As explained above, a financial plan is an element of every business plan.

A financial plan can take different forms (charts, tables) yet should always at least show the projection over a certain period ( 3- to 5-year usually) of the 3 financial statements.

A financial plan should also include some historical data (if any). If you have 3 years of historical financial data, include them in there as well. Indeed, investors will want to see how realistic are your projections .

Also, make it clear what are the key assumptions behind your financial forecasts: projecting the future isn’t easy and we often need to make some assumptions. Yet, the more available sources and data points you have to substantiate your projections, the better. Investors appreciate entrepreneurs who are realistic about their projections and understand the opportunities as well as the potentials risks involved. Whenever possible, use historical data and/or industry benchmarks .

Privacy Overview

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Transition to growth mode

with LivePlan Get 40% off now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

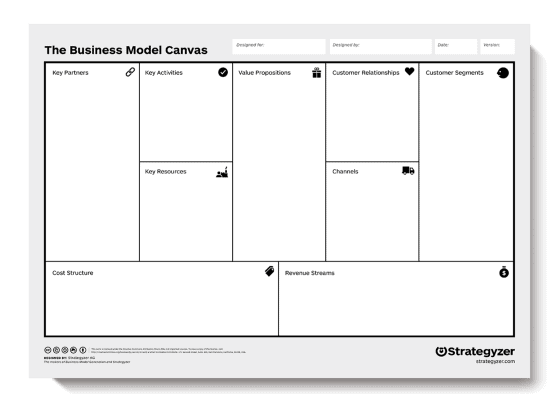

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

Does your business plan need a push?

Writting a business plan can be a springboard exercise for your business, and it's not as difficult as people think. All it takes is a bit of method, and some efficient tools. The good news our free articles and paid course have you covered!

Resources on Business Plan Writing :

An article of the Accelerated MBA written by:

Antoine Martin (Ph.D) | Business coach

Is this article relevant? Share it & help someone!

In this article:

Financial projections: how to write the financial plan in business plan.

So, you’ve decided to write a business plan? Good for you! It’s an important document that will help you outline your business goals, strategies, and tactics.

But it’s not just a document for you, as the business owner in charge of everything – it’s also important for potential investors and lenders.

In particular, one of the most important sections of your business plan should be your financial plan or, in other words, your overall financial projections for the next few years – understand, three to five years – distilled in a specific and highly codified format.

Why? Because the financial projections in a business plan are the numbers’ version of your pitch – if something doesn’t add-up, that’s where you see it.

Now, we know that numbers can be impressive (not to say daunting), so in this post, we’ll explain to you how to write a financial plan in your business plan.

We’ll also explain the logic you are supposed to follow to do things right (because financiers expect you to follow a very specific logic).

And we’ll explain what your business plan absolutely needs to include from a financial standpoint.

If that makes sense to you, then let’s get going!

By the way…

Before we dig into the financial projections’ discussion, let us give you a tiny bit of background!

We are professional business coaches, and our job is to push entrepreneurs and business owners to their next steps.

Business planning and business plans are part of that, obviously, therefore we have written a series of free articles on how to write a business plan – of which this page is a part.

We are on a mission to make entrepreneurship fun and accessible, so we provide about 80 percent of our content for free – including a free business plan template to be downloaded down this page.

Still, in case that’s not sufficient, we’ve also created our Business Plan Builder Module , which has been designed to make your life super easy.

Shameless plug: it gives you access to:

- a complete and solid business plan writing work-frame tool

- automated financial tables that take the hassle away (yayyy!)

- two designer-made templates (comprehensive + pitch deck)

- and two hours of tutorial videos recorded with a business coach to explain all the logic you’ll need to master if you plan on writing a business plan that converts.

There’s simply no way to make things easier!

Now, having said that, let’s get going.

As a reminder, what is a business plan about?

To start the discussion, remember that a business plan is about much more than just numbers. As we’ve explained in our article What are Business Plans For? , the role of such a document is to show that beyond a nice business plan pdf nobody really cares about, you have a real business and a plan to get it somewhere.

First, a business plan’s purpose is to help you explain what your project is about. In that sense, the document you need to write should be written as a storytelling instrument, designed, and formulated to tell people a story they will want to read AND remember.

Second, it should give you a way to showcase your main business objectives for the next few years, as well as the strategy you will put into place to get there and deliver on your promises.

Third, your business plan should also provide a market analysis, and a description of your main target segment. That gives the reader a better understanding of your ecosystem’s potential, but more importantly the exercise forces you to look around, open your eyes and do some meaningful research.

You wouldn’t want to drive blindfolded, would you?

Of course, your document should also have a financial component – which is the topic of this article – and there the challenge is to ensure that your financial projections make sense, that they are clear, accurate and easy to follow.

Long things short, investors and bankers expect you to match a very specific business plan outline and format (there’s a code!) and you don’t have much wiggle room there – so be careful in your approach!

What is a Financial Plan & what should it include?

Now, let’s get into the core of this article: financial plans and financial projections. What are they, why are they important – there is a lot to explore.

First things first, what is a financial plan? How important is it in a business plan? And what type of elements is it made of? What are the projected financial statements you need to provide? Oh, and what do we mean by ‘financial projections’ in the first place, by the way?

What is the role of a financial plan in business plan?

A financial plan is the financial part of your business plan. Its purpose is simple: explain to the reader what should be the ins and outs of your project from a financial perspective, and help them see if their own business projections are aligned with yours.

On the one hand, the idea is to put numbers on your project, to make it tangible and show that your vision includes the end and the means.

On the other, it is also to show that you are capable of defending your big idea as well as the projected financials that need to come with it – something that many wannabe entrepreneurs are actually unable to do…

As a side note, and as silly as that might sound, this means that your business plan should include a lot more than just a financial plan and a smart cash flow projection!

That point brings us back to the one we made earlier when we said that a business plan should follow a specific structure (go read that article!), but we mention it again because we want things to be very clear: your business plan should be a matter of storytelling, not just a matter of financial projections!

Typically, we often see accountants work on business plans, and what they produce is rarely enough because they only deliver financial estimates that make no real sense to non-accountants (even less to the entrepreneurs at stake) and leave aside the rest of the topics – particularly the storytelling!

Said differently? The numbers are one aspect of the story, but you still have to come up with the pitch – which is where the rest of the business plan comes in handy.

Make sure to deliver an easy-to-read mix!

Your financial plan must provide your financial projections

To get into the technical part of the discussion, the financial plan in your business plan should include your financial projections, organized in a very formal format.

That makes two distinct points to consider!

On the one hand, you should be able to show with clear numbers what money should come in and when (that’s the income forecasts), for this year but also for the next, the ones after that for three to five years.

On the other, you should also be able to show what money needs to go out to make the business roll. What are the production costs, the fixed and variable expenses, the salaries, and of course the various marketing expenses needed to generate the development you are planning on getting to.

On that point, remember that your cost of client acquisition should also be part of the formalized projections – otherwise your numbers will be flawed (and doomed).

Ultimately, you need to be very clear as to when your new business (or existing business) should break even, as to when should profits be expected, as to when lenders and investors will get their money back, so forth and so on.

It must include specific financial documents people will expect to see

From a very formal perspective, you shouldn’t be trying to make one single projection sheet. Nope! Your readers will expect to see three important financial documents in the financial section of the business plan you will introduce to them.

- A profit and loss statement – also known as your P&L statement, or as an income statement

- A cash flow statement

- And a balance sheet.

First, the P&L table or income statement should show what money is expected to come in or go out, but it should also show if and when the business will make a profit or a loss, year by year, for the next five years.

The sales forecast and the operating expenses should be easy to understand at that stage, and you should also be able to provide your estimated gross profit, your gross margin, as well as your net profit and net margin.

In case you are wondering, your gross profit corresponds to your sales minus your cost of production. Your net profit corresponds to the gross profit minus all the remaining costs.

It’s okay to read that twice…

Not being profitable is also okay, by the way. That’s the game. However, you must be able to explain why you won’t be profitable in a given year, and how you plan on filling the gap in the bank – otherwise your business dies, right?

Second, the cashflow statement should explain your cash flow management strategy and indicate when you will need to fill the bank account in, and why.

For instance, important account receivables could justify a temporary cashflow need, but the gaps left from the previous years should also be visible. Obviously, the funding needs should also be there and aligned with the financial situation of the business.

Third, the balance sheet is a summary of the previous two tables, except that it shows the various elements in terms of assets or liabilities. For instance, the account receivables we mentioned just before would be an asset (because some money is owed to the business) while account payables would be a liability (since the business owes money to someone else).

Does all this sound a little complex?

That’s because it is.

No need to worry, though. We have you covered and will provide all the templates and tools you need further below. For now, just keep reading.

So, what’s the financial plan in a business plan for?

To conclude, the financial plan in business plan should act as a financial cartography of what you have in mind for that business of yours.

- The financial plan should illustrate the plan you have for the business in terms of numbers