Evolution of Airline Business Models: The Case of Pegasus Airlines

- First Online: 25 October 2020

Cite this chapter

- Leyla Adiloğlu-Yalçınkaya 4 &

- Senem Besler 5

Part of the book series: Contributions to Economics ((CE))

408 Accesses

Pegasus Airlines has been an unique airline, as it changed its business model from a charter airline business model to a low-cost airline business model and is currently positioned itself with low-cost network carrier business model. The aim of this study is to examine the change of business model of Pegasus Airlines, which has been operating in airline industry in Turkey since 1990. For this purpose, a single case study approach was designed to allow in-depth analysis of the airline business model. Semi-structured interviews were conducted in 2019, supported by data gathered from multiple sources. The results confirm that the change of regulations and perspectives, geographical advantages of the airports and the state support could serve as catalysts to the ability to change the airline business model. This study makes a contribution to airline business model literature by revealing the factors influencing the evolution of a business model of Pegasus Airlines.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Adiloğlu-Yalçınkaya L (2019) Kurumsal Unsurların ve Kaynak Bağımlılıklarının Havayolu İş Modeli Değişimi Üzerindeki Etkileri: Türk Hava Yolları A.Ş. ve Pegasus Hava Taşımacılığı A. Ş. Örnekleri. Unpublished Ph.D. Thesis, Anadolu University

Google Scholar

AerLingus (2019) About Aer Lingus. Retrieved from https://mediacentre.aerlingus.com/factsheet/about-aer-lingus

Amit R, Zott C (2001) Value creation in e-business. Strateg Manag J 22(6–7):493–520. https://doi.org/10.1002/smj.187

Article Google Scholar

Application of Articles 92 and 93 of the EC Treaty and Article 61 of the EEA Agreement to State Aid in the Aviation Sector (1994).

Baden-Fuller C, Haefliger S (2013) Business models and technological innovation. Long Range Plan 46(6):419–426. https://doi.org/10.1016/j.lrp.2013.08.023

Bieger T, Agosti S (2017) Business models in the airline sector–evolution and perspectives. In: Albers S, Baum H, Auerbach S, Delfmann W (ed) Strategic management in the aviation industry. Routledge, pp 41–64

Bieger T, Wittmer A (2011) Airline strategy: from network management to business models. In: Bieger T, Müller R (eds) Aviation systems. Springer, pp 77–102

CAPA (2018) Sabiha Gökçen: growth to continue. Retrieved from https://centreforaviation.com/analysis/airline-leader/sabiha-gokcen-growth-to-continue-449781

Casadesus-Masanell R, Ricart JE (2010) From strategy to business models and onto tactics. Long Range Plan 43(2–3):195–215. https://doi.org/10.1016/j.lrp.2010.01.004

Chesbrough H, Rosenbloom RS (2002) The role of the business model in capturing value from innovation: evidence from Xerox Corporation’s technology spin-off companies. Indus Corp Change 11(3):529–555. https://doi.org/10.1093/icc/11.3.529

Corbo L (2017) In search of business model configurations that work: Lessons from the hybridization of Air Berlin and JetBlue. J Air Transp Manag 64:139–150. https://doi.org/10.1016/j.jairtraman.2016.09.010

Daft J, Albers SJJoATM (2013) A conceptual framework for measuring airline business model convergence, 28, 47–54. https://doi.org/10.1016/j.jairtraman.2012.12.010

Daft J, Albers SJJoATM (2015) An empirical analysis of airline business model convergence, 46, 3–11. https://doi.org/10.1016/j.jairtraman.2015.03.008

DaSilva CM, Trkman PJLrp (2014) Business model: what it is and what it is not, 47(6):379–389. https://doi.org/10.1016/j.lrp.2013.08.004

Doganis R (2005) Airline business in the 21st century. Routledge

Factsheet (2018) Aer Lingus factsheet. Retrieved from https://mediacentre.aerlingus.com/factsheet/aer-lingus-milestones

Foss NJ, Saebi T (2015) Business models and business model innovation: bringing organization into the discussion. In: Foss NJ, Saebi TA (eds) Business model innovation the organizational dimension. Oxford University Press, UK

Foss NJ, Saebi T (2017) Fifteen years of research on business model innovation: how far have we come, and where should we go? J Manag 43(1):200–227. https://doi.org/10.1177/0149206316675927

Gerede E (2011) Türkiye’deki Havayolu Taşımacılığına İlişkin Ekonomik Düzenlemelerin Havayolu İşletmelerine Etkisinin Değerlendirilmesi. Celal Bayar Üniversitesi Sosyal Bilimler Dergisi 9(2):505–537

Gürses L (1992) Özel Sektör Havada İstikbal Bulamadı. Milliyet Newspaper, p 5

ISG (2019) ISG airport traffic report. Retrieved from https://www.sabihagokcen.aero/kurumsal-bilgiler/havalimani/havalimani-trafik-raporu

Kangis P, O’Reilly MD (2003) Strategies in a dynamic marketplace: a case study in the airline industry. J Bus Res 56(2):105–111. https://doi.org/10.1016/S0148-2963(01)00282-X

Kuyucak Şengür F, Şengür Y (2012) Havayolu İş Modelleri: Kavramsal Bir Analiz. Paper presented at the 20. Ulusal Yönetim ve Organizasyon Kongresi, İzmir

Lambert SC, Davidson RA (2013) Applications of the business model in studies of enterprise success, innovation and classification: an analysis of empirical research from 1996 to 2010. Eur Manag J 31(6):668–681. https://doi.org/10.1016/j.emj.2012.07.007

Lange K, Geppert M, Saka-Helmhout A, Becker-Ritterspach FJBJoM (2015) Changing business models and employee representation in the airline industry: a comparison of British Airways and Deutsche Lufthansa, 26(3):388–407. https://doi.org/10.1111/1467-8551.12096

Lohmann G, Koo TT (2013) The airline business model spectrum. J Air Transp Manag 31:7–9. https://doi.org/10.1016/j.jairtraman.2012.10.005

Magretta J (2002) Why business models matter. In: Harvard Business School, Boston

Massa L, Tucci CL, Afuah AJAoMA (2017) A critical assessment of business model research, 11(1), 73–104. https://doi.org/10.5465/annals.2014.0072

Milliyet (1994) Pegasus Havayolları Satıldı. Milliyet Newspaper, p 9

Milliyet (2003) Yapı Kredi’de Delux Satış. Milliyet Newspaper

Morris M, Schindehutte M, Allen J (2005) The entrepreneur’s business model: toward a unified perspective. J Bus Res 58(6):726–735. https://doi.org/10.1016/j.jbusres.2003.11.001

O’Connell JF, Connolly DJTE (2017) The strategic evolution of Aer Lingus from a full-service airline to a low-cost carrier and finally positioning itself into a value hybrid airline, 23(6):1296–1320. 10.1177/1354816616683492

Osterwalder A, Pigneur Y (2004) An ontology for e-business models. In: Currie W (ed) Value creation from e-business models, vol 1. Butterworth-Heinemann, pp 65–97

Pegasus (2019a) Dünden Bugüne Pegasus. Retrieved from https://www.pegasusyatirimciiliskileri.com/tr/hakkimizda/dunden-bugune-pegasus

Pegasus (2019b) History of Pegasus. Retrieved from https://www.pegasusinvestorrelations.com/en/about-pegasus/about-pegasus

Pegasus (2019c) Pegasus airlines group companies. Retrieved from https://www.pegasusinvestorrelations.com/en/corporate-governance/group-companies

Pegasus (2019d) Pegasus business model. Retrieved from https://www.pegasusyatirimciiliskileri.com/tr/hakkimizda/urun-is-modeli

Pegasus (2019e) Pegasus primary agreement. Retrieved from https://www.pegasusyatirimciiliskileri.com/medium/image/pegasus-hava-tasimaciligi-as-ana-sozlesmesi_537/view.aspx

Sarılgan AE (2011) Türkiye’de bölgesel hava yolu taşımacılığının geliştirilmesi için yapılması gerekenler. Anadolu Üniversitesi Sosyal Bilimler Dergisi 11(1):69–88

“State Aid” (1993) Off J Eur Commun

Taşçı D, Yalçınkaya A (2015) Havayolu Sektöründe Yeni Bir İş Modeli: Bağlı Düşük Maliyetli Havayolu (Airline Within Airline) Modeli Ve Anadolujet Örneği Bağlamında Bir Karşılaştırma. Eskişehir Osmangazi Üniversitesi İİBF Dergisi 10(2):177–201

Teece DJ (2010) Business models, business strategy and innovation. Long Range Plan 43(2–3):172–194

TIM (2018) Retrieved from https://www.tim.org.tr/tr/basin-odasi-gundem-500-buyuk-hizmet-ihracatcisi-odulleri-sahiplerini-buldu.html

Turkish Civil Aviation Law (1983)

Urban M, Klemm M, Ploetner KO, Hornung M (2018) Airline categorisation by applying the business model canvas and clustering algorithms. J Air Transp Manag 71:175–192. https://doi.org/10.1016/j.jairtraman.2018.04.005

Walulik J (2016) At the core of airline foreign investment restrictions: a study of 121 countries. Transp Policy 49:234–251. https://doi.org/10.1016/j.tranpol.2016.05.006

Wensveen JG, Leick RJJoATM (2009) The long-haul low-cost carrier: a unique business model, 15(3), 127–133. https://doi.org/10.1016/j.jairtraman.2008.11.012

Whiteside R (2012) Major financial Institutions of Europe 1994. Graham and Trotman, UK

Yalçınkaya A (2018) Devlet, aktör ve değişim: 1983–2013 yılları arası Türk havayolu taşımacılığı alanında kurumsal değişim. Unpublished Ph.D. Thesis, Anadolu University

Yalçınkaya A (2019) Türk Havayolu Taşımacılığı Sektörünün Tarihsel Gelişimi ve Devlet Müdahaleleri (1933–2006). Cumhuriyet Tarihi Araştırmaları Dergisi 15(29):405–442

Yin R (2016) Qualitative research from start to finish, 2nd ed. The Guılford Press, New York

Zott C, Amit R, Massa L (2011) The business model: recent developments and future research. J Manag 37(4):1019–1042. https://doi.org/10.1177/0149206311406265

Zott C, Amit RJOs (2007) Business model design and the performance of entrepreneurial firms, 18(2):181–199. https://doi.org/10.1287/orsc.1060.0232

Download references

Author information

Authors and affiliations.

Faculty of Aviation and Aeronautical Sciences, Özyeğin University, Istanbul, Turkey

Leyla Adiloğlu-Yalçınkaya

Faculty of Business Administration, Anadolu University, Eskişehir, Turkey

Senem Besler

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Leyla Adiloğlu-Yalçınkaya .

Editor information

Editors and affiliations.

Bucharest University of Economic Studies, Bucharest, Romania

Alexandra Horobet

Department of Economics, International Hellenic University, Serres, Greece

Persefoni Polychronidou

International Hellenic University, Kavala, Greece

Anastasios Karasavvoglou

Rights and permissions

Reprints and permissions

Copyright information

© 2020 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Adiloğlu-Yalçınkaya, L., Besler, S. (2020). Evolution of Airline Business Models: The Case of Pegasus Airlines. In: Horobet, A., Polychronidou, P., Karasavvoglou, A. (eds) Business Performance and Financial Institutions in Europe. Contributions to Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-57517-5_4

Download citation

DOI : https://doi.org/10.1007/978-3-030-57517-5_4

Published : 25 October 2020

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-57516-8

Online ISBN : 978-3-030-57517-5

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Back to the future? Airline sector poised for change post-COVID-19

It’s difficult to overstate just how much the COVID-19 pandemic has devastated airlines. In 2020, industry revenues totaled $328 billion, around 40 percent of the previous year’s. In nominal terms, that’s the same as in 2000. The sector is expected to be smaller for years to come; we project traffic won’t return to 2019 levels before 2024.

Financial woes aside, the pandemic’s longer-term effects on aviation are emerging. Some of these are obvious: hygiene and safety standards will be more stringent, and digitalization will continue to transform the travel experience. Mobile apps will be used to store travelers’ vaccine certificates and COVID-19 test results.

Other effects, though, are more profound. Unlike the 2008 global financial crisis, which was purely economic and weakened spending power, COVID-19 has changed consumer behavior—and the airline sector—irrevocably.

This article will explore five fundamental shifts in the aviation industry that have arisen from the pandemic. For each of these shifts, we also issue a call to action. By responding to these shifts decisively now, carriers should be able to look beyond the pandemic and adapt to the long-term realities of COVID-19.

1. Leisure trips will fuel the recovery

Business travel will take longer to recover, and even then, we estimate it will only likely recover to around 80 percent of prepandemic levels by 2024. Remote work and other flexible working arrangements are likely to remain in some form postpandemic and people will take fewer corporate trips.

In previous crises, leisure trips or visits to friends and relatives tended to rebound first, as was the case in the United Kingdom following 9/11 and the global financial crisis (Exhibit 1). Not only did business trips take four years to return to precrisis levels after the attacks on the World Trade Center but they also had not yet recovered to pre-financial-crisis levels when COVID-19 broke out in 2020. Therefore, we expect that as the pandemic subsides, the rise in leisure trips will outpace the recovery of business travel.

Some carriers are highly dependent on business travelers—both those traveling in business class and those who book economy-class seats right before they need to travel. While leisure passengers fill up most of the seats on flights and help cover a portion of fixed costs, their overall financial contributions in net marginal terms are negligible, if not negative. Most of the profits earned on a long-haul flight are generated by a small group of high-yielding passengers, often traveling for business. But this pool of profit-generating passengers has shrunk because of the pandemic.

A McKinsey Live event on 'Returning to corporate travel: How do we get it right?'

The call: Revisit flight economics

Airlines should reevaluate the economics of their operations, especially long-haul flights. First, a smaller contribution from business traffic could necessitate a different pricing logic. For example, today most carriers price point-to-point nonstop flights at a premium. Travelers who value time over price—mostly business travelers—book these nonstop flights. Leisure travelers, even those traveling in premium classes, are more price sensitive and may choose an indirect routing. This large gap between nonstop pricing and connect pricing may need to narrow.

Second, lower business traffic may require network changes. Airlines added many flights over the past few years between hubs and smaller cities, using small-size widebodies such as the Boeing 787. These flights work because of the high-yielding business demand. With business demand subdued, economics favor larger aircraft flying less frequently. Airlines may find that larger aircraft such as Airbus A350s or Boeing 777s—which have lower unit costs—become the base of the long-haul network.

Third, airlines may also look at reconfiguring the layout of their cabins to address the increased share of leisure traffic. At the simplest level, lower business-class demand may warrant smaller business-class cabins. Taking this further, products may shift to better cater to premium-leisure passengers, such as growth of premium-economy cabins or development of business-class seats more suitable for traveling as couples or groups.

2. Staggering debt levels will lead to ticket price increases and a larger role for government in the sector

Many airlines have had to borrow huge sums of money to stay afloat and cope with high daily cash burn rates. Tapping into state-provided aid, credit lines, and bond issuances, the industry collectively amassed more than $180 billion worth of debt in 2020, 1 “COVID-19 lowers airline credit ratings and raises the cost of debt,” International Air Transport Association, August 21, 2020, iata.org. a figure equivalent to more than half of total annual revenues that year. And debt levels are still rising (Exhibit 2). Repaying these loans is made even harder by worsening credit ratings and higher financing costs.

These costs will need to be recouped. Therefore, we’ll likely see ticket prices rise. By our estimates, this could amount to a rise in ticket prices of about 3 percent, assuming a ten-year repayment window for only the additional debt taken on.

Furthermore, when demand for air travel returns, it will likely outpace supply initially. We see a glut of latent demand of people eager to travel. It will take time for airlines to restore capacity, and bottlenecks such as delays in bringing aircraft back to service and crew retraining could lead to a supply–demand gap, resulting in higher short-term prices.

In many cases, airline rescue efforts come in the form of government bailouts—with strings attached. We’re seeing a reemergence of, or increase in, the level of state ownership and influence. In Europe alone, TAP Air Portugal, Lufthansa Group, and Air Baltic all received state aid combined with an increase or reintroduction of government shareholdings.

The call: Be a constructive collaborator

As the state becomes a more active player—whether as a creditor, a direct shareholder, or as part of the board—airlines will find themselves having to deal more closely with the authorities. Instead of seeing this as a necessary restriction to access much-needed funds, airlines can treat it as an opportunity to shape how the sector evolves with a key stakeholder.

Airlines can work with regulators to set standards across a gamut of issues. These could include committing to reductions in greenhouse-gas emissions in return for more labor flexibility; increasing the cash-on-hand requirements to make airlines more resilient against future shocks; more balanced value sharing between airlines and other sectors such as airports; or changes in the ownership caps to allow greater inflows of foreign capital, reducing the reliance on state capital further down the road.

3. We will see a greater disparity of performance among airlines in the future

Some airlines have responded to the pandemic by restructuring for greater efficiency; others are merely muddling through. Occasionally, this is linked to state-aid programs, which may reduce the incentive for much-needed measures such as cost, organizational, and operational restructuring. Airlines that are not proactively transforming risk failing to set the business up for longer-term structural value creation.

As such, we’re seeing some airlines pull ahead. Before COVID-19, an airline boasted an ROIC well ahead of the overall industry’s rate of 5.8 percent. Not only did its stronger position pre-COVID-19 enable it to navigate the crisis thus far without taking on government loans of the scale relative to other airlines, it also made it possible for it to restructure to emerge with an even more competitive cost base.

Another group of carriers that have an opportunity to transform their business are airlines that have access to a restructuring process, such as Chapter 11 in the United States. These carriers can renegotiate midlife leases, shed excess debt, and emerge leaner. They will be fierce competitors going forward.

The call: Aim higher when it comes to IT and digital investment

Becoming better can necessitate investment. Even though many airlines find themselves in financial straits, we recommend investing more in IT and digitalization, not less. Before the pandemic, airlines spent roughly 5 percent of their revenue on IT. This is relatively low compared with other sectors. By means of comparison, the retail industry spends around 6 percent on average, and financial services 10 percent.

Airlines could consider stepping up IT and automation investment now. For example, airlines can respond to the quicker recovery of domestic and short-haul flights by investing in direct sales and owning the customer relationship. Relationships with IT and distribution providers could be reexplored. Carriers can also invest in the customer experience—such as making check-in and boarding processes more seamless—and support services—from revenue accounting to invoicing—to drive the next level of efficiency. Beyond this, the next horizon is analytics, which involves, among other efforts, using data in smarter ways to enhance decision making, requiring some investment but yielding significant payoffs .

4. Aircraft markets may be oversupplied for some time to come

In the years before COVID-19, aircraft OEMs ramped up production in the anticipation of continued growth. This has led to a glut in aircraft availability. Furthermore, some carriers have returned relatively new aircraft to lessors, such as Norwegian Air Shuttle when it exited the long-haul market. Prices for used-aircraft leases have plummeted and are likely to remain lower. For instance, the monthly lease rate of a 2016 vintage Boeing 777-300ER aircraft was around $1.2 million in 2019. In 2020, the rate fell to less than $800,000. New aircraft are rumored to be available at even deeper discounts.

The call: Act countercyclically now, if you can

If finances permit, carriers can consider acting countercyclically: locking in orders for new aircraft or confirming operating leases now when demand is low. Aircraft are a significant expense for an airline, making up 10 to 15 percent of a carrier’s cost base. As lease rates and OEM pricing fluctuate with supply and demand levels, inking deals during a crisis could allow carriers to enjoy a cost advantage for years to come.

5. Air freight will see undersupply for some time

Over the past ten years, low cargo rates and the unprofitability of the cargo business have led many airlines to relinquish or scale back their dedicated cargo freighter fleets. However, cargo has been a lifeline for the aviation industry during COVID-19. Before the pandemic, cargo typically made up around 12 percent of the sector’s total revenue; that percentage tripled last year. Based on data from the Airline Analyst, only 21 (down from 77 in 2019) of the airlines around the world that disclosed their operating performance achieved positive operating profits for the third quarter of 2020, traditionally the industry’s most profitable quarter. Among these 21 airlines, cargo revenue accounted for 49 percent of total revenues on average.

During the pandemic, e-commerce sales soared while many passenger flights—which are responsible for delivering around half of total air cargo—were grounded. As a result, cargo yields increased by about 30 percent last year. As commercial flights gradually return, belly supply will increase, although not to pre-COVID-19 levels for at least a few years, as the industry is expected stay smaller than before the pandemic for several years.

The call: Bring back freighters, carefully

In response to the high demand and low supply of air freight right now, carriers could investigate short- to medium-term opportunities to boost their cargo services. Airlines can enhance their flexibility through measures such as increasing the deployment of so-called preighters, or passenger airplanes that are used to transport cargo. Airlines may look at freighter conversions, especially as their passenger fleets reduce in number.

Airlines need to be agile. Rushing headlong into developing and maintaining a large freighter fleet again comes with risk. Airlines need to grow cargo in an agile way that allows for quick adjustments; pursuing such a play should be seen as part of a wider theme of establishing a more flexible production setup. High fixed costs combined with unpredictable demand levels outside an airline’s control increase the need for airlines to be able to scale down supply nimbly.

The impact of the COVID-19 pandemic is far from over. There is some relief to be found in various parts of the world now that vaccinations have begun, but the road to recovery for air traffic will take several years. The shape of the post-COVID-19 airline sector is becoming clearer and holds lessons for airlines today. Multiple longer-running trends have been accelerated, such as digitization and the phasing out of less efficient aircraft. Burdened by debt, many carriers have depleted their cash reserves. But the forecast is not without bright spots. Travel will become greener and more efficient, and people are itching to travel again for holidays. Taking steps now will help airlines thrive in this transformed sector.

Jaap Bouwer is a senior expert in McKinsey’s Amsterdam office, Steve Saxon is a partner in the Shenzhen office, and Nina Wittkamp is a partner in the Munich office.

The authors wish to thank Alex Dichter and Vik Krishnan for their contributions to this article.

This article was edited by Jason Li, a senior editor in the Shanghai office.

Explore a career with us

Related articles.

Airline data: What next beyond crisis response?

Will airline hubs recover from COVID-19?

‘Prepare for the marathon and be ready for the course to change’: An interview with the Boston Logan Airport CEO

For the best Oliver Wyman website experience, please upgrade your browser to IE9 or later

- Global (English)

- India (English)

- Middle East (English)

- South Africa (English)

- Brazil (Português)

- China (中文版)

- Japan (日本語)

- Southeast Asia (English)

- Belgium (English)

- France (Français)

- Germany (Deutsch)

- Italy (Italiano)

- Netherlands (English)

- Nordics (English)

- Portugal (Português)

- Spain (Español)

- Switzerland (Deutsch)

- UK And Ireland (English)

Oliver Wyman’s Airline Economic Analysis was initially designed to explore the economic fundamentals that drive airline profitability. In 2021, it has become a study of the forces that are undermining it. Thanks to an almost complete shutdown of both business and international travel, the industry faced substantial losses in 2020, and this trend will continue for much, if not all, of 2021.

In fact, it is fair to say that no crisis in modern times has shattered the aviation business model as much as the coronavirus pandemic. That’s because no previous crisis has disrupted corporate and international travel as much as COVID-19. Along with causing a depressed market for domestic leisure travel, the pandemic has managed to wipe out two decades of demand growth in a few months.

Because of COVID-19, almost three-quarters of companies worldwide canceled or suspended domestic travel, and 93 percent canceled or suspended international travel, according to the Global Business Travel Association. Corporate bookings plummeted 85 percent in 2020 and have remained at that level in 2021, based on Airlines Reporting Corp. data. These decisions by companies to keep executives off the road are particularly painful for airlines because business from corporate fliers is their most profitable market segment.

In a normal year, business travel accounts for more than half of airline earnings and nearly a third of total airline revenue in major economies like the United States. Yet high-yield passengers such as executives account for only nine percent of the total flying public. The average high-yield booking produces 4.3 times more revenue than a typical leisure booking.

Leisure rules

As a result, the industry has become dependent on leisure travelers who, despite the pandemic, began to take trips again in the second half of 2020. With these lower-yielding travelers making up a higher portion of a decimated demand, airlines were doomed to see a drop in revenue and substantial losses.

As we were completing this report, the International Air Transport Association (IATA) was predicting that the global aviation industry would not be cash positive until 2022, despite indications from a few airlines that their core operations could be cash positive sometime this year. In November, the association said it expects carrier losses to be an additional $38.7 billion cumulatively in 2021. That’s after losing $118.5 billion in 2020.

In the US, except for spikes at major holidays, passenger traffic stayed around 40 percent of 2019 levels through most of the second half of 2020, based on traveler checkpoint data from the Transportation Security Administration (TSA). It was still only a little over 40 percent for the first two months of 2021.

This tepid demand for air travel also affected fares, particularly fares to destinations popular with business travelers. Looking at 20 US destinations —10 predominantly business and 10 leisure — we found fares in heavily business-oriented markets dropped 33 percent in the pandemic year of 2020 versus 12 percent during the 2007-2009 US recession and H1N1 flu pandemic. Leisure fares, on the other hand, fell 16 percent by the end of last year versus 13 percent during 2009. This disparity underscores the disproportionate impact the absence of higher-paying business travelers has had.

Full-service disadvantage

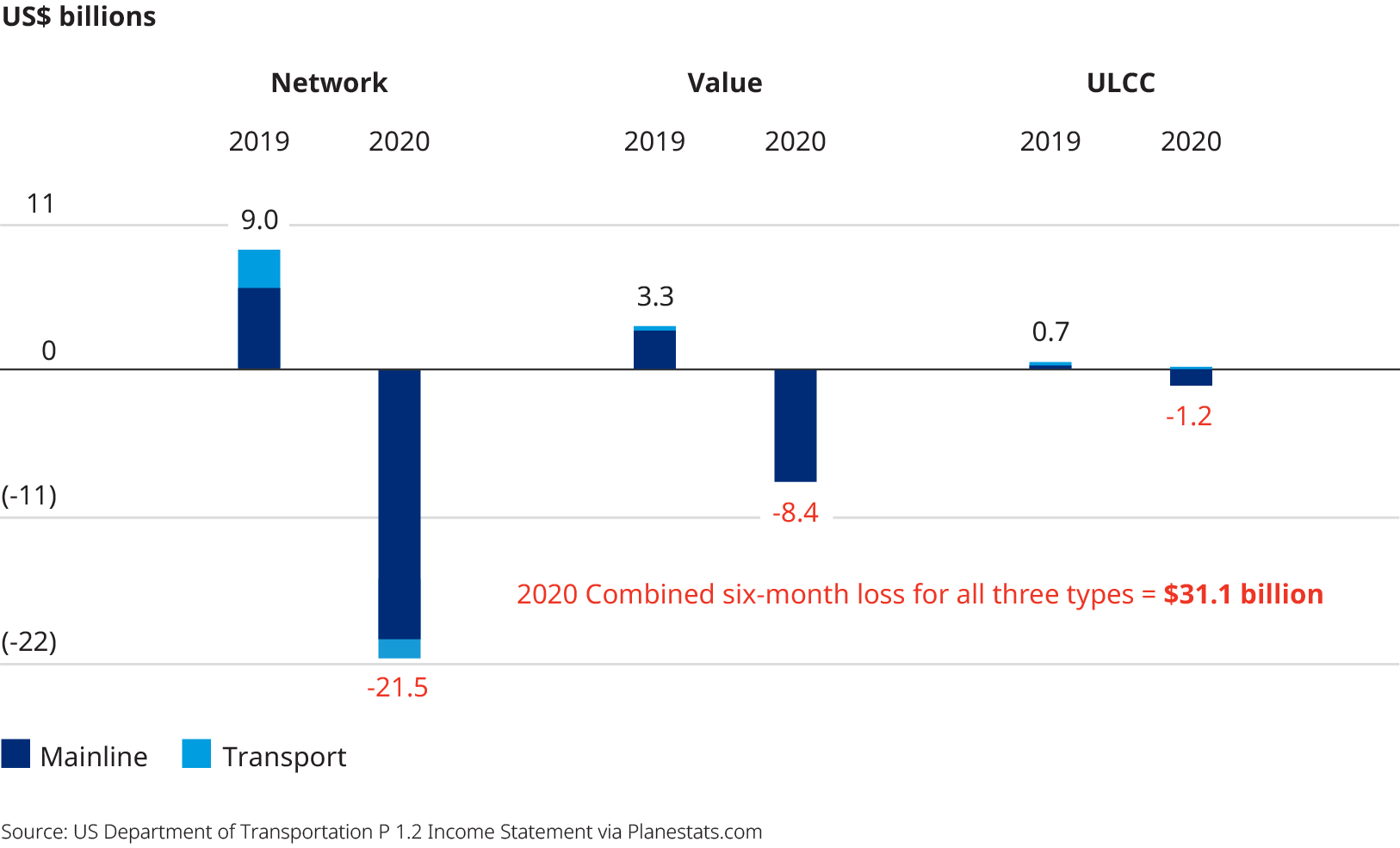

In event-triggered downturns of the past, such as 9/11 and the global financial crisis of 2008-2009, low-cost airlines had an advantage because of their lower operating costs. For those crises, there were similar declines in revenue per available seat mile (RASM) — a benchmark metric used to compare airline revenue performance — across the various classes of carriers.

That wasn’t true for COVID-19. Where in the past low-cost carriers only had an operating cost advantage during crises, they now also have a revenue advantage because their primary market — leisure customers — has recovered faster than the business travel market. Our analysis of US Department of Transportation data reveals RASM for full-service airlines fell 50 percent year-over-year in 2020’s second quarter, probably the darkest period for US carriers. Meanwhile, the RASM for low-cost airlines fell 23 percent in the same three months.

The third quarter’s RASM brought the performance of the two airline groups closer together, with full-service carriers declining 45 percent and low-cost carriers down 38 percent. The cumulative for the six months is 47 percent and 34 percent, respectively.

Staying near home

Another missing component from the travel market has been the international segment. Like business travel, the international market dried up because of the various national restrictions preventing or discouraging cross-border trips and fears consumers harbored of having trips canceled or getting stuck in a foreign country. In two global Traveler Sentiment Surveys conducted by Oliver Wyman in 2020 involving nine countries, respondents said their first trips once pandemic restrictions lifted would still most likely be domestic to see family and friends.

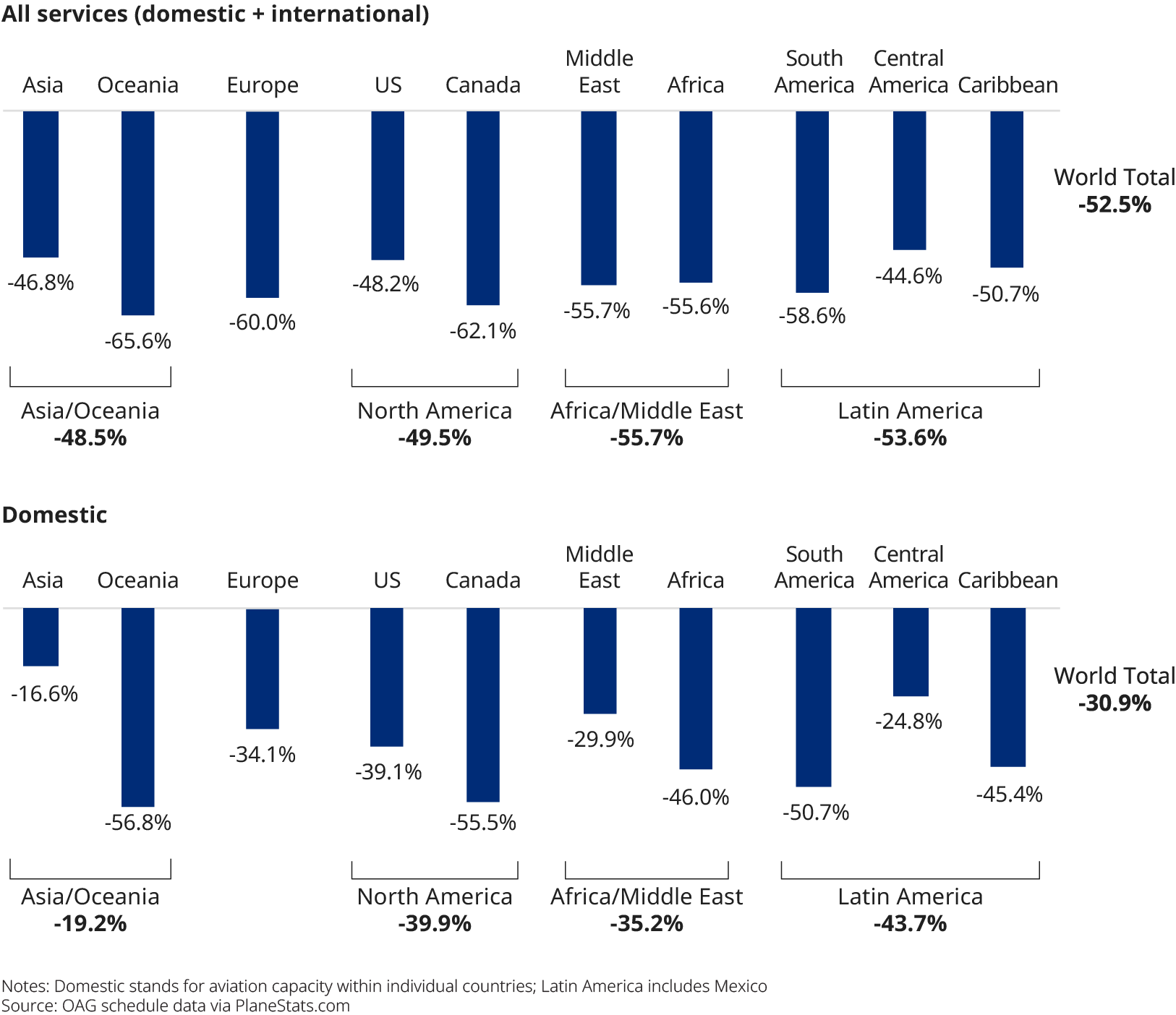

The evaporation of international travel hit the airline industries of some regions very hard, particularly those outside the US, where 60 percent of travel is domestic. In Europe, the Middle East, and Africa, only 10 percent of air travel is domestic.

Even in Asia, where nations, such as China, South Korea, and Vietnam, managed to contain the virus in a matter of a few months, international traffic is down more than 70 percent, primarily because of regulations prohibiting cross-border travel. Despite the fact that airlines in these three countries saw domestic demand recover to 2019 levels in 2020, they felt the loss of international traffic. In China, for instance, international travel makes up 45 percent of its aviation market.

For the second half of 2020, global domestic capacity — measured in available seat miles — was down 34 percent while international was down a stunning 75 percent. Besides sending a lot of widebody aircraft into storage and reducing long-term demand for these larger, long-haul planes over the decade, the loss of international traffic killed the tourism in cities like New York and Paris as well as in some developing economies dependent on spending by visitors. That said, the international leisure segment is likely to recover faster than business, as other countries catch up with the US on vaccinations.

Increased competition

In response to the disruption of two important market segments, the bigger, full-service carriers now find themselves in competition with low-cost carriers for price-sensitive domestic travelers and are slowly taking on some of the characteristics of the upper rung of low-cost carriers. Consequently, passengers will likely see more similarity in the fare structure of the two classes in both economy and premium cabins.

Airlines have been unbundling fares in premium cabins to cater to well-off travelers not flying for business but looking to social distance in roomier business cabins. Led by US carriers, a handful of carriers in the Middle East, Europe, and Asia are also pursuing this strategy.

Besides dwindling revenue, airlines are struggling with cutting costs — often pursuing strategies that do not always produce the intended result. During the 2009 economic recession and H1N1 the same year, cost per available seat mile (CASM) increased 10 to 15 percent with every 10 percent reduction in capacity. Why? Unless airlines are running a very effective cost transformation program, operating costs will rarely decrease proportionally with cuts in capacity.

As an example, look at labor costs. Especially for full-service airlines, furloughing workers will often leave payrolls full of highly paid employees with lots of seniority. Take the case of cost-control programs that match expenses to volatile ups and downs in demand: They may ease cashflow pressures but often raise airline unit costs in the short run.

While all types of carriers will face shrinking margins for the next several years, pressure will be the greatest on full-service carriers and international carriers. With the market unable to quickly make up for lost growth, these network airlines will be increasingly forced to shift their strategies toward those of value carriers by appealing to more price-sensitive customers looking for deals.

Changing schedules

To cut overhead and improve efficiency, airlines will have to adjust schedules, reduce unprofitable routes, and shrink the overall size of networks. Behind the scenes, flight hours also need to be adjusted to better reflect the less congested COVID-19 environment and reduce wasted expense. In a normal year, a full-service or legacy carrier may schedule 14,000 flight, or block, hours per day. These drive a lot of operating costs involving crews, fuel, and maintenance.

Typically, most carriers produce, on average, one percent of excess block time. Following 9/11 and during the financial meltdown, that excess time doubled. The reason: As flights operated faster than planned in a less congested, lower-demand environment, ground time made up of unneeded block hours increased. Anticipating and accounting for these effects is an area where the industry has historically left opportunity on the table, failing to eliminate unnecessary cushion time. One percentage point of excess time for an average full-service carrier can easily represent an additional $250 million in annualized cost in a more normal market.

Even so, the aviation industry has historically struggled to make shrinking operations work to its financial benefit. For example, as US carriers slashed capacity during the 2008-2009 global economic crisis and H1N1, their CASM — another benchmark metric — typically increased 10 to 15 percent for every capacity reduction of 10 percent. That’s because airlines have high fixed costs and overhead that can’t be cut at the same rate as capacity.

Vaccine and stimulus

Of course, with recent news from the Biden administration about increased availability of vaccines and passage of the $1.9 trillion American Rescue Plan Act, the outlooks for aviation and the national economy are gradually brightening. On March 15, our health and life sciences team issued an update , predicting that herd immunity could be reached in most of the US by early summer — the second half of June or the beginning of July. That’s three to six weeks sooner than we were predicting in January.

This projection was based on the rapidly increasing distribution of vaccines. Where today the US is handing out more than two million doses a day, it is likely that number could rise to over three million with the additional funds available through the recently passed stimulus and relief package. The Northeast will be one of the regions that emerges earliest, which is fitting as it was the region to be hit hardest in the early days of the pandemic. If the progression toward herd immunity unfolds as expected, then the US could see a relatively rapid pickup in demand for domestic travel sometime this summer. Of course, our calculations assume no big surprises, such as the emergence of variants resistant to the vaccines or a short-lived immunity from the vaccines which could cause COVID-19 to linger — both of which remain risks.

China and a few other nations in Asia already saw that trend, even without a vaccine, thanks to aggressive COVID-19 containment efforts. For example, China’s domestic air travel recovered to 2019 levels in November. The return of international travel is also a question mark, given the plethora of travel restrictions put into place at the height of the pandemic. The sector will take longer to recover than domestic for that reason and may look different as “vaccine passports” and other protocols are likely to be adopted in some places to facilitate a return to normality. We may also see the development of bilateral agreements to permit travel between nations where there has been mass vaccination or infection rates are minimal.

While still in the thick of the pandemic, it’s hard to assess which impacts will leave permanent scars. The disruption in business travel isn’t expected to fully reverse anytime soon, given the existence of mobility substitutes like videoconferencing that provide an alternative to travel and commuting. This is particularly true for internal company travel. As long as these substitutes persist to any substantial degree, the business travel market will constitute the biggest drag on airline earnings for the foreseeable future — one that will force airlines to keep tweaking their business model to compensate. But even beyond corporate travel, this kind of shock will not be forgotten soon.

About the report

After a hiatus year where a thoughtful analysis of the industry outlook in the face of the then rapidly proliferating COVID-19 pandemic was impossible, the report has returned to begin its second decade.

This year’s in-depth report covers a range of aviation industry-specific economic and performance data as well as global capacity during the pandemic. For our 2021 AEA, we expanded our report to be more global in nature, reflecting the worldwide impact of COVID-19, and included forward looking commentary. The analysis outlines the varied pace at which different regions were affected by the virus and will ultimately recover from it.

The report also includes analyses on:

- Capacity changes and available seat miles

- Employment changes

- Revenue per available seat mile (RASM)

- Cost per available seat mile (CASM)

- Load factors

- Operating profit

- Travel and Leisure

- Tom Stalnaker,

- Khalid Usman,

- Andy Buchanan,

- Grant Alport,

- Aaron Taylor, and

- Rory Heilakka

Global Fleet And MRO Market Forecast 2021-2031

A forecast update on the global commercial airline fleet and aftermarket for 2021

COVID-19 Pandemic Navigator

Our COVID-19 model reveals where containment and suppression efforts are working.

Pilot Shortage As Air Travel Recovers

An important question facing the airline industry is not whether it will face a pilot shortage, but when it will begin.

Podcast: Tackling Gender Imbalance In Aviation

Creating industry-wide change towards gender equity..

Investor Relations

2023 Annual Report

2023 One Report

- Company Overview

- Purpose, Vision, and The Southwest Way

Proven Business Strategy

- News Releases

- Events & Presentations

- Company Reports

- Quarterly Results

- SEC Filings

- Stock Quote & Chart

- Investment Calculator

- Historical Lookup

- Dividend & Stock Split History

- AirTran Acquisition

- Analyst Coverage

- Board of Directors

- Senior Executive Leaders

- Corporate Governance Guidelines

- Corporate Bylaws, Articles of Incorporation & Corporate Policies

- Board Committees

- Direct Stock Purchase Plan & Dividend Reinvestment

- Transfer Agent

- Investor FAQs

- Email Alerts

- Investor relations

- Corporate responsibility

Our Company

- News & Events

- Stock Information

- Corporate Governance

Shareholder Services

- Investor Resources

Upcoming Event

May 15, 2024

Southwest Airlines Annual Meeting of Shareholders (Virtual)

View all events

- Share page Facebook Twitter

Southwest believes in a sustainable future where there will be a balance in our business model between Shareholders, Employees, Customers, and other Stakeholders. In order to protect our world for future generations and uphold our commitments, we will remain focused on sustaining our unmatched financial position in the industry, efficiency that conserves natural resources, fostering a creative and innovative workforce, and giving back to the communities in which we work and live.

Southwest believes in a sustainable future where there will be a balance in our business model between Shareholders, Employees, Customers, and other Stakeholders. In order to protect our world for future generations and uphold out commitments, we will strive to lead our industry in profitability, efficiency that conserves natural resources, fostering a creative and innovative workforce, and giving back to the communities in which we work and live.

- Robust Route Network

- Total domestic market share of 22 percent 1

- Most daily departures in the world 2

- Serve 49 of the top 50 U.S. metro areas 1,3

- Serve all of the top 50 U.S. metro areas 1,3

- Market leader in 22 of the top 50 U.S. metro areas 1,3

- Market leader in 21 of the top 50 U.S. metro areas 1,3

- Significant growth opportunities, including near-international

- Compelling Brand Appeal

- Best People in the airline industry

- Outstanding Customer Service and Hospitality

- Low fares with flexible policies

- Industry-leading frequent flyer program

- Superior Financial Position

- 47 consecutive years of profitability through 2019

- Competitive cost advantage

- Strong balance sheet

- Disciplined capital deployment strategy

- Commitment to return value to Shareholders

[1] 1 – As measured by the Department of Transportation O&D Survey for the twelve months ended September 30, 2023, based on domestic originating passengers boarded. x [2] 2 – Based on operating airline and operating under a single certificate according to the latest available schedule data. x [3] 3 – Metro Areas: A geographic area around a city that includes multiple major airports. In some cases, the airports within a metro area may serve separate competitive markets. x

Investor Alerts

Southwest Airlines offers automated options to receive Investor Alerts.

For details regarding Direct Stock Purchase & Dividend Reinvestment and other Transfer Agent information.

Get Investor Information

- Request Information |

Connect with us

Discussion Forum and Stories

© 2024 Southwest Airlines Co. All Rights Reserved. Use of the Southwest websites and our Company Information constitutes acceptance of our Terms & Conditions , Privacy Policy .

The timing of these postings are made at the discretion of Southwest Airlines. Readers should not assume that the information contained on this site has been updated or otherwise contains current information. Southwest Airlines does not review past postings to determine whether they remain accurate, and information contained in such postings may have been superseded.

This website contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on, and include statements about, the Company’s beliefs, intentions, expectations, and strategies for the future. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as "plans," "believes," "expects," "anticipates," "may," "could," "intends," "goal," "will," "should," and similar expressions and variations thereof. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed in or indicated by the Company’s forward-looking statements. Factors that could cause these differences include, but are not limited to, the factors described under the heading "Risk Factors" in the Company's most recent Annual Report on Form 10-K and in other filings, and as described in the press releases and other materials contained on this website. The Company assumes no obligation to update any forward-looking statements as a result of new information, future events, or developments, except as required by federal securities laws.

- Search Search Please fill out this field.

- Overview of Porter's Five Forces

An Overview of Delta Air Lines

Industry competition, bargaining power of buyers, the threat of new entrants, bargaining power of suppliers, threat of substitutes.

- Fundamental Analysis

Analyzing Porter's 5 Forces Model on Delta Air Lines

Discover which forces pose the biggest threat to Delta

:max_bytes(150000):strip_icc():format(webp)/picture-53887-1440627076-5bfc2a8946e0fb0026013e02.jpg)

As one of the largest airline carriers in the world, Delta Air Lines faces competitive challenges and threats that can impact its performance and profitability. Investors interested in analyzing the company as a potential investment can conduct a fundamental analysis to help them gain a clear picture of Delta's financial position and its position within the airline industry. This information leads to better investing decisions since share price appreciation tends to follow sound fundamentals. The fundamental analysis starts with examining a company's financial documents, such as its financial statements , annual and quarterly reports, and stock performance.

However, the shrewdest investors will go beyond looking at Delta's financial position and will study the potential effects of external forces on the company's health. One of the most effective tools for this is Porter's Five Forces.

Overview of Porter's Five Forces Method

Porter's Five Forces is an analytical framework developed in 1979 by Harvard Business School professor, Michael E. Porter. Porter's goal was to develop a thorough system for evaluating a company's position within its industry and to consider the types of horizontal and vertical threats the company might face in the future.

Horizontal Threats and Vertical Threats

A horizontal threat is a competitive threat, such as customers switching to a substitute product or service, or a new company entering the marketplace and appropriating market share. A vertical threat is a threat along the supply chain , such as buyers or suppliers gaining bargaining power, that can put a company at a competitive disadvantage.

The Five Forces model evaluates three potential horizontal threats and two vertical threats. Industry competition, the threat of new entrants, and the threat of substitutes represent the horizontal threats. The vertical threats come from the increased bargaining power of suppliers and the increased bargaining power of buyers. Using the Five Forces framework, investors can determine the most viable threats to a company. With this information, they can evaluate whether the company has the resources and protocol in place to respond to likely challenges.

Key Takeaways

- Porter's Five Forces is an analytical framework that helps investors evaluate a company based on its position within an industry and the kinds of horizontal and vertical threats it might face in the future.

- A horizontal threat is a competitive threat, such as a new company entering the marketplace and gaining market share.

- A vertical threat puts a company at a competitive disadvantage, such as buyers or suppliers gaining bargaining power.

- In the airline industry, buyers have tremendous bargaining power because they can quickly and easily switch from one carrier to another using third-party trip-booking websites and apps.

Delta Air Lines, Inc. ( DAL ) is the oldest airline still in operation in the United States. The company was founded in 1928 and has its headquarters in Atlanta, Georgia. From May 2020 to April 2021, Delta ranked third in domestic market share for U.S. airlines at 14.3%. Delta's sheer size and status as a longtime leader in the airline industry have helped ensure its continued success. As of July 2021, the company's market capitalization was around $26.6 billion.

The level of competition in the airline industry is high. The big airlines essentially fly to the same places out of the same airports for about the same prices. The amenities, or lack of amenities, they offer are similar, and the seats in coach are just as cramped no matter which airline you choose. Delta's traditional rivals include United and American, but the company also faces major competition from the growing popularity of value carriers, most notably Southwest, but also JetBlue and Spirit.

The number of passengers Delta Air Lines carried in 2020.

Because the air travel experience for customers is remarkably similar no matter which airline they take, airlines are constantly threatened by the prospect of losing passengers to competitors. Delta is no exception. If a customer is planning to book a flight from Houston to Phoenix on Delta but a third-party price aggregator, such as Priceline , reveals a better deal from United, the customer can make the switch with a simple click of the mouse. Delta manages these competitive threats with extensive marketing campaigns that focus on brand awareness and the company's longstanding reputation.

Buyers have immense bargaining power over airlines because the cost and effort required to switch from one carrier to another is minimal. The emergence and raging popularity of third-party trip-booking websites and smartphone apps exacerbate this issue for the airlines. Most travelers do not contact an airline, such as Delta, directly to book a flight. They access sites or apps that compare rates across all carriers, enter their trip itineraries, and then choose the least expensive deal that accommodates their schedules.

Delta can respond to this market force by conducting market research and offering more direct flights at low prices to the destinations fliers search for most frequently on third-party platforms. Additionally, the company should strengthen relationships with credit card companies and strive to offer the best reward programs; customers are loath to switch carriers when they have accumulated what they view as "free" miles with a particular airline.

Potential new entrants to the marketplace represent a minimal threat to Delta. The barriers to entry in the airline industry are remarkably high. The operating costs are massive, and the government regulations a company must navigate are numerous and exceedingly complex. There is not a single airline founded during the 21st century that has even a 2% market share. JetBlue, founded in 1998, represents the newest airline to make a dent in the industry, and the company's market share is still less than one-third of Delta's.

The list of airline suppliers is actually quite long. The list of airlines for suppliers to sell to, however, is short. This asymmetry places the bargaining power directly in the hands of the airlines. Bargaining power is particularly strong for Delta, given its position as the world's largest airline by passenger revenue in 2019. Put simply, Delta's suppliers have a strong incentive to keep the relationship on good terms . Delta can likely find a replacement supplier without a problem if the relationship goes bad. The supplier, by contrast, is unlikely to find another buyer capable of replacing the sales volume represented by Delta.

A substitute , as defined by the Five Forces model, is not a product or service that competes directly with the company's offerings but acts as a substitute for it. Thus, a United flight from New York to Los Angeles is not considered a substitute for a Delta flight with the same start and endpoints. Examples of substitutes are making the trip by train, car, or bus. Unless a trip is very short, such as traveling from Los Angeles to Las Vegas, no methods of travel rate as viable substitutes for air travel. New York to Los Angeles is a 6.5-hour flight. The trip takes 41 hours by car or bus, and a train cannot get you there much faster. Until a new technology comes along that supplants air travel as the fastest and most convenient way to travel long distances, Delta faces little threat from substitute methods of travel.

Institute for Strategy and Competitiveness at Harvard Business School. " The Five Forces ."

Delta. " Corporate Stats and Facts ."

Bureau of Transportation Statistics. " Airline Domestic Market Share ."

Yahoo Finance. " Delta Air Lines, Inc. (DAL) ."

Delta Airlines. " 2020 Form 10-K ," Page 2.

Bureau of Transportation Statistics. " Airline Ranking 2019 ."

:max_bytes(150000):strip_icc():format(webp)/porter_final-a891ec58af8f4a0aadb7a7a464c51927.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- About Airline Basics

- Advertising and Cooperation

- Terms of Service and Privacy Policy

- Airline Business Models

- Airline Business Plan

- Airline Cost Analysis

- Airline Income Predictions

- Airline Market Research

- Airline Marketing Strategy

- Airworthiness Management

- Airworthiness of Aircraft

- Airworthiness of components

- Aiworthiness Software Systems

- Airworthiness Regulations

- Aircraft Maintenance Management

- Maintenance of Aircraft

- Maintenance of Components

- Aircraft Engineers and Mechanics

- Special Maintenance – NDT, etc.

- Maintenance Software Systems

- Aircraft Maintenance Regulations

- Airline OPS Department

- Flight Planning and Rostering

- Airline Pilot Training

- Cabin Crew Training

- Airline OPS Software

- Airline Operations Regulations

- Ground Ops Management

- Ground Ops Requirements

- Airline Quality Audits

- Findings and Corrective Actions

- Airline Quality Reports

- Airline Quality Software

- SMS as a Management Tool

- SMS Manuals and Procedures

- SMS Calculations

- SMS Software

- SMS Requirements

- Pilot Careers

- Flight Attendant Careers

- Engineering Careers

Common Airline Business Models

As with any business, the main thing to consider when looking at airline business and airline management are the most commonly used airline business models. the business model, in general, determines the way one intends to make money with the airline. there are various possibilities and the ones outlined below only show a generic and most common set of business models available..

There are really 5 main airline business models which are being used by the majority of airlines around the world. Of course, those airlines tend to add their own tweaks to each model in hope to get ahead of competition, but still – the framework remains within one of those 5. I have also added a sixth airline business model, which I called a hybrid model, as some airlines lean towards combining two or more of the available models to their benefit.

I’ll present the list of typical airline business models here, and later on I’ll try to explain a bit on how they work and where they see possibilities of obtaining the revenue they need to make money and continue profitable operations. So those are the five models (+ the hybrid):

- Legacy airlines (also known as Full Service Network Carriers)

- Low cost airlines (Low Cost Carriers)

- Charter Airlines (Holiday Carriers)

Regional Airlines

Cargo airlines.

- Hybrid Airline

Legacy Airlines

A Legacy Airline is, at least in Europe, most often a former national airline which has been privatized to some extent over the years. Those airlines have generally a fairly large fleet, which is quite diversified as they are operating all sorts of routes, starting with long haul through medium range (short haul) and regional flights. Those airline business models have been around probably ever since airlines existed.

Legacy airlines have also the benefit of owning (at least a share) of relevant other aviation services such as handling companies at their hub airports, maintenance facilities, catering companies and the like. This may seem a benefit at first glance, but doesn’t always turned out to be one. I will write a bit more on why that is later.

Here are the main income drivers for legacy airlines:

- Good reputation, which provides for good business with corporate and governmental clients

- A broad set of connecting flights, allowing for long haul journeys from small airports on one ticket, with one airline

- Increased comfort through on board meals, baggage charges which are included in the main fare and airport lounges for business and first class passengers

- Very diversified fares, starting with almost low cost “last minute” or “first minute” tariffs and ending with really expensive business class and first class seats

- Convenient loyalty programs which offer reasonable rewards for travelling with a given airline (or, more frequently, with a given airline alliance)

- Reliable and slowly changing timetable, leaving passengers with a decent level of security with respect to flight connections they require

In general, legacy airlines and similar airline business models can be thought of as reliable, having good customer service, predictable and fairly decent on board service and on board entertainment and leaving some benefits in the form of loyalty programs for frequent flyers.

Low Cost Carriers

The idea of Low Cost Carriers started in the United States, but it’s certainly experiencing a rapid development in Europe at present. I can’t think of a single European who does not remember the advertisements of flights offered per 1 Euro before the legislation on advertising really kicked in on the LLCs. As the name suggests, Low Cost Carriers are huge on reducing costs to the bare minimum and making people believe (rightfully, in most cases) that they are being offered the lowest fare possible on a given route.

The low cost business models assume that price sells itself while, of course, being quite generous on advertising campaigns as the passenger needs to know that the given low fare is actually available on the market.

As all Low Cost Carriers need to comply with the airline regulations which apply to all airlines, regardless of airline business models used, they do not save money on things like maintenance (although they do to a certain extent in a legal way, which I will write about in a different post). Therefore, they need to save on other things. The savings are generally based on passengers not getting expected benefits from their ticket, but having to pay for them instead. This fact changes the way we perceive flight ravel quite dramatically, but again, this will become the subject of a different post.

Here’s what will generally not be included in a standard airfare and charged extra from passengers who actually need the service:

- In-flight meals. There will be none served “for free” (meaning included in the airfare). Rather, many meals and drinks, including alcohol, are available for purchase during flight at prices significantly exceeding typical market value.

- Reserved seating. Low cost airline business models generally assume what is called “free seating”, which means that the first passenger in gets the best seat. This means savings on the reservation and boarding system as well as additional income, because many Low Cost Carriers offer paid “priority boarding” which means that passengers who pay additional fees are allowed to board the aircraft before the other ones.

- No baggage (or very limited baggage) included in the airfare. This means that passenegers generally need to pay additional fees to have their luggage transported with them.

- Additional charges for things such as payment by credit card online. These things often seem obvious to airline passengers, but they are charged additional fees in low cost airline business models.

As you can see, as the result of the actions mentioned above, the overall cost of a transfer may not be too much different to that presented by legacy airlines. However, quite often this is still beneficial to most passengers as people are likely to resign of additional service for the purpose of a lower fare.

Most low cost airline business models also take advantage of other savings possibilities, which are not entirely associated with charging passengers for services, which for quite a long time have been considered as naturally included in the fare. Those savings come from:

- A very unified monotype fleet, which allows for saving coming from maintenance, employer costs associated with type diversification and major discounts from aircraft manufacturers on new aircraft (which can be sold used for a price similar to the price of purchase)

- Very extreme contracts with maintenance providers forcing them to pay penalties for many delayed or cancelled flights, regardless of what actually caused the technical issue

- No connecting flights. The low cost airline business models assume that the only connection that is being offered is point to point. Passengers wanting to take advantage of connecting flights must re-check-in at their transit airport. This saves much on reservation software and check-in fees as well as reduces costs associated with delays and passengers who missed their connecting flight.

- Special arrangements with regional or low cost airports, which gives the Low Cost Carriers a dramatic advantage in landing fees and other associated costs. This is possible due to the volume of passengers they are forwarding to and from those airports.

The low cost airline business models have caused a dramatic shift in the way air transport is being perceived today. They are a very important factor of local economics, assuming that by local we mean an area the size of the European Union.

Charter (Holiday) Airlines

Charter airline business models dwell on holiday excursions offered by several companies offering holiday trips all over the world. In most cases, they do not sell individual tickets. Rather, they sign appropriate contracts with travel agencies for the transport of a given number of passengers to a given location throughout a year. It becomes the travel agency’s responsibility to fill the aircraft with passengers.

In some cases, one aircraft may be chartered by more than one travel agency if the destination is rare enough to cause one tour operator not being able to fill the aircraft. However, also in that case, the charter airline is secured as the entire aircraft is being sold.

There are several advantages to such airline business models, such as:

- No direct sales, which makes making investments into marketing and reservation systems unnecessary.

- Secured cash-flow provided appropriate agreements with tour operators are signed before each fiscal year

- Low cost customer service issues, as the charter operators often use the techniques applied by low cost airline business models such as no included meals on board or payment for additional luggage.

The main problem of charter carriers is to obtain proper contracts with tour operators. Supply quite often exceeds demand in this market, although this varies from country to country and is highly dependent on the travel characteristics of the given nation.

Regional airline business models, as the name suggests, aim at transporting people from smaller, regional airports to larger hubs or between those airports and thereby improving the given countries overall social movability.

The regional airlines tens to find their income streams from:

- Tickets sold on minor routes with frequent travelers, especially in areas where alternative means of transport are difficult, costly, inconvenient or a mix of all of those attributes

- Agreements with large companies which need to provide their employees with a viable means of transport from home to work

- Government subsidies for local areas which need to be connected with the rest of the world despite of it being economically unviable

- Flying in a franchise for other carriers (mainly legacy airlines) and “feeding” passengers to their hubs for further travel, especially on long haul flights.

It also needs to be said that those airlines generally encounter slightly smaller operating costs due to the usage of smaller aircraft, cheaper regional airports and a significantly smaller number of passengers which translates into much lower booking and ticketing costs.

Cargo airline business models are pretty self-explanatory. Those are airlines which make their living out of transporting good for forwarders or big shipping companies. Those airlines generally operate at night and do not have any costs associated with the transport of people. However, they are highly dependent on proper contracts with forwarding and shipping companies, which generally require a very high level of service. This in turn means for the cargo airlines additional costs associated with ensuring absolutely perfect reliability.

Hybrid Airlines

There are about as many hybrid airline business models as one could possibly imagine. Those include legacy airlines transporting cargo to their destinations, offering their own low cost carriers or franchising out their regional routes to other airlines in order to achieve proper feeder traffic.

There are still many options for new and unexplored airline business models. Let me know of any ideas you might have or other models which you have experienced and which do not fit to any of the ones described above.

13 comments on “ Common Airline Business Models ”

Thank you, well-written and useful article. Would be appreciated to have examples for each category.

Thank you, I’m glad that you enjoyed the article 🙂 Regarding examples, those could be:

Legacy airline: Lufthansa, Low cost carrier: Ryanair, Charter airline: Thomas Cook, Regional Airline: Etihad Regional, Cargo Airline: BlueBird Cargo, Hybrid Airline: Monarch

Many of the large players tend to invest in all other areas of aviation For example for Lufthansa we have also Lufthansa Regional, Lufthansa Cargo and Germanwings.

Hello Mike. I really enjoined reading this article. hope to see more from you. wondered if you can write a bit about Business model of air cargo players. kind regards

I’m not really an expert in cargo operations. I know that in many cases the operator is working for a large shipping company, like FedEx or TNT. This means that in some cases an aircraft with the shipping company’s livery is not actually operated by the shipping company, but by a third party who, basically, charters their aircraft on a regular basis. Such contracts can be quite strict, as of course delays and cancellations are out of the question 🙂

HI mike, crystal air cruises are lunching a new luxury world tour service in August, what category will that fall under?

Good way to promote an interesting product 🙂 Although probably not for my pocket at the moment 🙂 I would say that’s a charter holiday flight, although with a very specific customer range.

Great idea, by the way! Would love to try it!

Hello Mike, I am really interested and I have a question for you. Is it possible to get in touch by email?

Of course, just drop me a line at contact(at)airlinebasics.com

Looking forward to hear from you!

Hello Mike ,

Interesting arrival .

What about an airline servicing the nation as a domestic and performing for tourists for domestic travel targeted for leisure, while also serving International flight ( regional flights). And as well proving both cargo services .

Would it, still be hybrid or whah ??

Sorry “interesting article “ Typo error

Hi Mike, interesting. And if i may ask you, where would you put Etihad,Qatar and Emirates on those business models and would u be able to briefly explain why?

Thank you Ozman

Hey, I want to know more about the alternative models: (1) high fare full service network carriers. (2) low fare high service network carriers. (3) High fare high service carriers. (4) low fare low service carriers ( point-to-point)

Can I get the citation for your text? pls urgent

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- See my first video! New Airline Basics YouTube channel!

- What is Back to Birth Traceability?

- Aircraft Maintenance Certification – Certifying Staff, License Categories and Internal Authorizations

- Line Maintenance – Management and Main Challenges

- How to Create an Approved Aircraft Maintenance Program

- Irfan on Aircraft Component Maintenance – Main Issues

- godfrey LEBOHO on Airline business plan – the basics

- Paul on Aircraft Maintenance – Line, Base and Defects

- calculated RL on See my first video! New Airline Basics YouTube channel!

- Sachin Amrutkar on Aircraft Maintenance – Line, Base and Defects

- January 2017

- September 2016

- January 2014

- February 2013

Presentations made painless

- Get Premium

American Airlines Group: Business Model, SWOT Analysis, and Competitors 2023

Inside This Article

In this blog article, we will delve into an in-depth analysis of American Airlines Group, focusing on their business model, SWOT analysis, and key competitors for the year 2023. As one of the leading airlines in the United States, American Airlines Group has a vast network and a strong presence in the industry. By examining their business model, we will explore how they generate revenue and maintain their competitive advantage. Additionally, a SWOT analysis will provide insights into their strengths, weaknesses, opportunities, and threats. Lastly, we will identify their key competitors and analyze their strategies to understand the future landscape of the airline industry.

What You Will Learn:

- Who owns American Airlines Group and the significance of its ownership structure

- The mission statement of American Airlines Group and its core values

- How American Airlines Group generates revenue and the key factors contributing to its financial success

- An in-depth understanding of the American Airlines Group's business model canvas and its different components

- An overview of the major competitors of American Airlines Group and their impact on the airline industry

- A comprehensive SWOT analysis of American Airlines Group, highlighting its strengths, weaknesses, opportunities, and threats.

Who owns American Airlines Group?

Major shareholders.

American Airlines Group is a publicly traded company, so its ownership is distributed among various shareholders. The largest shareholders of American Airlines Group are primarily institutional investors, including mutual funds, pension funds, and other investment firms. These major shareholders hold significant stakes in the company and often have a significant influence on its strategic decisions.

One of the largest institutional shareholders of American Airlines Group is Vanguard Group, a renowned investment management company. Vanguard holds a substantial number of shares in the airline company, making it one of the most influential stakeholders. BlackRock, another prominent investment management firm, is also among the major shareholders of American Airlines Group.

Insider Ownership

Aside from institutional investors, American Airlines Group also has insiders who own shares in the company. Insiders typically include company executives, directors, and other individuals closely associated with the management. These insiders often hold shares as part of their compensation packages or as a reflection of their confidence in the company's future prospects.

Doug Parker, the CEO of American Airlines Group, is one of the notable insiders who owns a significant number of shares. As the leader of the company, Parker's share ownership reflects his commitment to its success and aligns his interests with those of other shareholders. Other top executives and board members of American Airlines Group also hold substantial stakes in the company.

Public Shareholders

American Airlines Group also has a broad base of public shareholders who own shares of the company. These shareholders can include individual investors, retail investors, and even small investment firms. As a publicly traded company, American Airlines Group offers its shares on stock exchanges, allowing anyone to buy and sell its stock.

Public shareholders play a crucial role in the ownership structure of American Airlines Group, as they provide the company with liquidity and contribute to its market valuation. Their interests are represented by the votes they cast during shareholder meetings and the influence they exert through their collective ownership.

American Airlines Group's ownership is a combination of major institutional shareholders, insiders, and public shareholders. The largest stakeholders are institutional investors such as Vanguard and BlackRock, while insiders like CEO Doug Parker also hold significant ownership stakes. Public shareholders, including individual investors, contribute to the ownership structure and influence the company's decisions through their collective ownership. This diverse ownership structure reflects the broad interest and participation in American Airlines Group.

What is the mission statement of American Airlines Group?

The mission statement of american airlines group: connecting people, cultures, and nations.

American Airlines Group, one of the largest airline companies in the world, operates with a clear and compelling mission statement. At its core, American Airlines Group aims to connect people, cultures, and nations through a seamless and exceptional travel experience. With a commitment to providing safe, reliable, and customer-focused air transportation, the company strives to bring people closer together, bridging geographical boundaries and fostering global connections.

Emphasizing Connectivity and Customer Satisfaction

American Airlines Group's mission statement underscores their dedication to connectivity. By offering an extensive network of flights to numerous destinations worldwide, the company seeks to enable individuals, families, and businesses to easily access and explore various parts of the globe. Whether it's a domestic flight within the United States or an international journey spanning continents, American Airlines Group aims to be the preferred choice for travelers seeking convenient and efficient transportation options.

Furthermore, customer satisfaction is a key element of American Airlines Group's mission. As they connect people from different walks of life, the company is committed to providing a positive travel experience that exceeds expectations. This entails ensuring the safety and well-being of passengers, offering exceptional customer service, and delivering on-time and reliable flights. By prioritizing customer satisfaction, American Airlines Group aims to build lasting relationships with its passengers and be recognized as a trusted and preferred airline.

Promoting Cultural Exchange and Understanding

American Airlines Group recognizes the importance of fostering cultural exchange and understanding between nations. Through their extensive flight network, the company plays a vital role in facilitating travel for individuals from diverse backgrounds, enabling them to experience new cultures, traditions, and perspectives. By connecting people across borders, American Airlines Group contributes to breaking down barriers and promoting a more interconnected and inclusive world.