All Formats

5+ Appraisal Transfer Letter Templates

An appraisal letter of transfer is used by mortgage brokers to transfer an appraisal from one lender to another to find their clients a better deal. Brokers should be aware of the internal policies of various lenders so that they can have a smooth appraisal transfer not only for the benefit of their business but also for their clients. You can also see more on Internal Transfer Letter Templates.

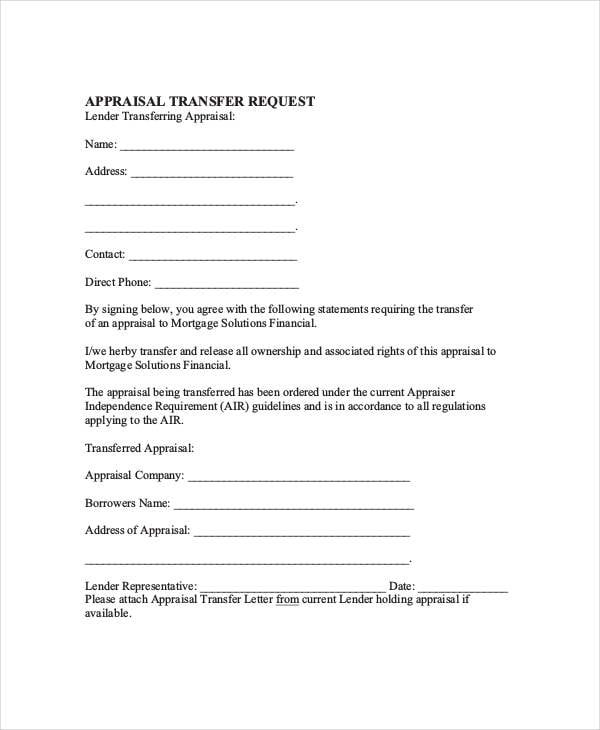

Free Appraisal Transfer Request Letter Template

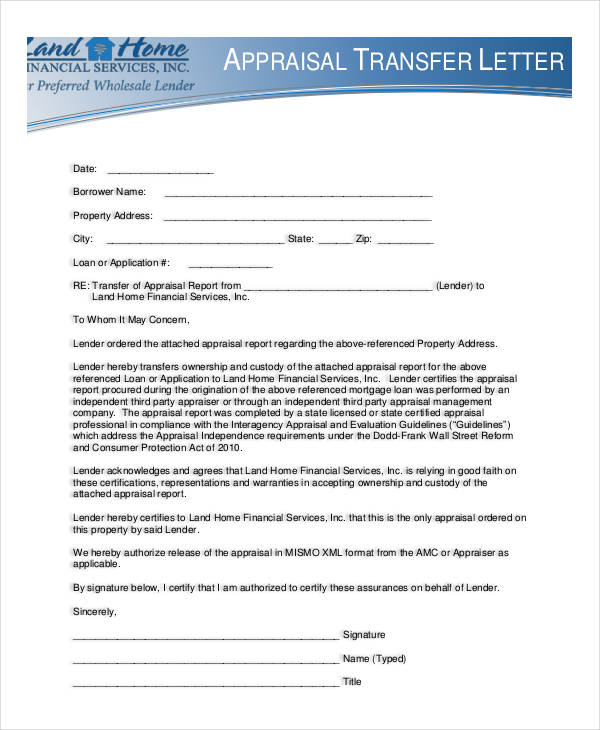

Free Appraisal Report Transfer Letter Template

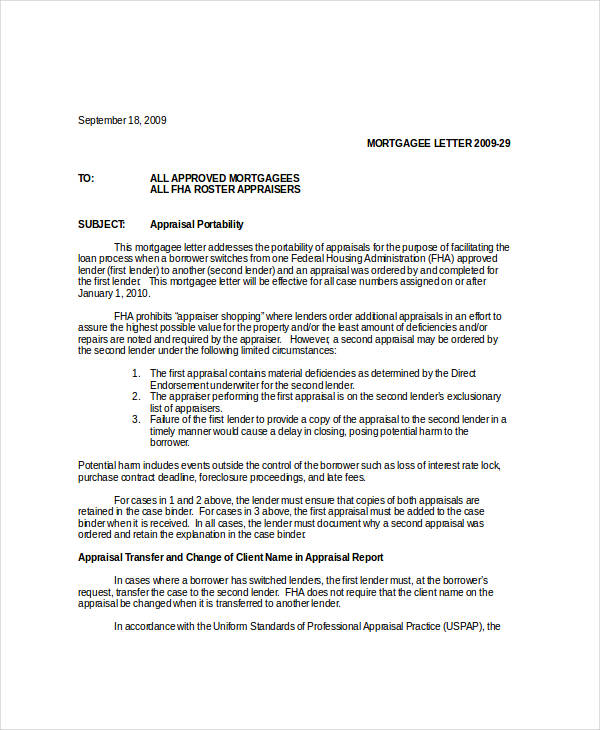

Free Appraisal Portability Transfer Letter Template

Inclusions of an Appraisal Transfer Letter

- The name of the entity requesting for an appraisal transfer

- The address or location of the entity who has written the appraisal transfer basic letter

- The contact details of the broker requesting for an appraisal transfer

- The agreements for the appraisal transfer

- The guidelines followed for the appraisal transfer

- The transferred appraisal

- The client’s name

- The address of the appraisal occurrences

- The name and creative signature of the lender representative

- The date that the appraisal transfer letter has been made

Reasons for Writing an Appraisal Transfer Letter

- The first lender was not able to provide an appraisal copy to the second lender. Be it a delay in providing a copy of the appraisal or totally failing to provide one, this can cause potential transaction harm to the borrower. You can also see more on Department Transfer Letter Templates.

- The materials that are present in the first appraisal contain deficiencies and other inaccurate information as determined by a representative from the second lender.

- The appraiser who is tasked to perform the first appraisal is on the exclusionary list of appraisers of the second lender, which makes the transaction impossible to push through.

Free Appraisal Transfer Letter in PDF Format

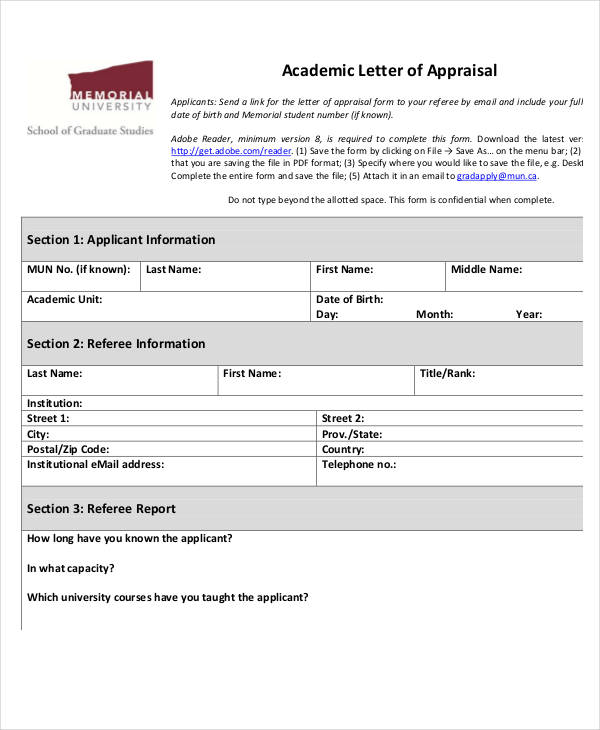

Free Academic Appraisal Requirement Letter Template

Requirements for Appraisal Transfer

- If you will send an appraisal transfer letter electronically, you need to e-mail a suitable electronic format of the letter as requested by the entity to whom you will send it.

- You need to attach the certificate of appraiser independence from the transferring lender.

- Include in the appraisal transfer letter that you have a copy of the proof of appraisal fee.

- If there are any corrections and material changes that are needed to be done to the appraisal, assure that the original appraiser is more than willing to cooperate for the changes to be legally implemented.

- Any modifications of the initial appraisal must be stated and properly outlined.

- The transferring lender should be the source of the transferred appraisal.

- The effective date of the transferred appraisal should not be more than 120 days old by the date of the transaction closing. You can also see more on Company Transfer Letter Templates.

More in Letters

Restaurant employee appraisal form template, performance appraisal form template, property appraisal waiver form template, construction employee appraisal form template, employee appraisal form template, applicant appraisal form questions template, applicant appraisal form evaluation template, completed appraisal form template, candidate evaluation form template, fundraiser order form template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

How to Build a Strong Real Estate Appraisal Report

In bankruptcy matters, the value of the estate's industrial, commercial or residential real estate frequently is the subject of controversy. Accordingly, parties-in-interest often rely on real estate appraisals. These parties include the debtors, the creditors, their respective legal counsel and the bankruptcy court. This discussion will (1) summarize the basic components of a real estate appraisal report, (2) illustrate the typical sections presented in an appraisal report and (3) summarize the factors to look for in an appraisal report. The inclusion of these components, sections and factors should help the appraisal report withstand a review within a bankruptcy environment.

The Appraisal Report

The Uniform Standards of Professional Appraisal Practice (USPAP) defines the term "report" as "any communication, written or oral, of an appraisal, appraisal review or appraisal consulting service that is transmitted to the client upon completion of an assignment." 1

USPAP also presents the following definitions that are relevant to real estate appraisal reports:

Self-contained Appraisal Report: a written report prepared under Standards Rule 2-2(a).

Summary Appraisal Report: a written report prepared under Standards Rule 2-2(b).

Restricted Use Appraisal Report: a written report prepared under Standards Rule 2-2(c). 2

The selection of the appropriate type of report to prepare in a bankruptcy appraisal assignment is influenced by (1) the specific instructions of the appraiser's client, (2) the relevant statutory authority, judicial precedent or administrative rules, and (3) the experience and judgment of the individual appraiser.

For purposes of this discussion, we assume that the appraisal subject is real estate. We assume that the appraisal subject is a fee-simple ownership interest in the subject property.

This discussion assumes that the appraiser (1) prepares a written appraisal report in preparation for expert witness testimony and (2) presents the written appraisal report as part of the expert witness testimony. During the hearing (whether at an administrative or judicial level), the appraiser will often refer to the written appraisal report during both direct and cross examination. In fact, many experienced appraisers consider the written appraisal report to be "the appraiser's best friend" during expert testimony.

Real Estate Appraisal Report Summary

Exhibit 1 presents an illustrative table of contents (or report outline) for a typical narrative real estate appraisal report. This table of contents is consistent with the USPAP requirements for a self-contained appraisal report, i.e., a report prepared under Standards Rule 2-2(a).

Real Estate Appraisal Report Content

The following discussion summarizes the typical contents of a narrative real estate appraisal report.

1. Title Page. The title page should clearly identify the subject of the appraisal report. The title page will typically identify (1) the property address, (2) the definition of value and (3) the "as of" valuation date.

2. Letter of Transmittal. The letter of transmittal typically includes the following information:

- date of letter and salutation

- street address of the property and a brief description of the property

- identification of the subject property ownership interest

- statement that a property inspection and other necessary investigations and analyses were made by the appraiser

- reference that the transmittal letter is an integral component of an accompanying appraisal report

- identification of the type of appraisal and type of appraisal report

- standard of value (or definition of value) concluded in the appraisal report

- date of the appraisal

- opinion of value

- identification of any extraordinary assumptions and hypothetical conditions

- appraiser's signature.

3. Table of Contents. The table of contents typically lists all of the sections of the appraisal report in the order in which they are presented.

4. Certification. The certification is typically presented as a separate page in the introduction section of the appraisal report. However, the certification may be combined with the final value conclusion. In any event, the appraiser(s) will sign and date the certification. The certification will indicate whether the appraiser has personally conducted the appraisal in accordance with USPAP. According to USPAP Standards Rule 2-3, each written real estate appraisal report should contain a signed certification.

5. Summary of Important Conclusions. The summary of important conclusions page, sometimes called the executive summary page, typically includes the following items:

- brief identification of the subject property

- estimate of the highest and best use of the land as if vacant

- estimate of the highest and best use of the property as improved

- age of the improvements

- abbreviated site description

- land value opinion

- value indication from the cost approach

- value indication from the income-capitalization approach

- value indication from the sales-comparison approach

- final estimate of the defined value

- description of any extraordinary assumptions or hypothetical conditions.

6. Photographs. As a general rule, there cannot be too many photographs in a bankruptcy appraisal report. One of the appraiser's responsibilities is to adequately acquaint the finder of fact with the subject property. Photographs help this process.

7. Location Maps. Location maps continue the process of familiarizing the finder of fact with the subject property. It is not uncommon for the report to present two or three location maps. In this case, each successive map presents a more localized location. Ideally, the finder of fact will be able to look at the most localized location map and know exactly where the subject property is located.

8. Plot Plan. A plot plan is a plan showing the layout of the improvements on the subject property site. A plot plan typically shows improvement locations (on the site), improvement dimensions, landscaping, parking areas and other physical features.

9. Floor Plan. A floor plan is the architectural drawing that shows the floor layout of a building including (1) the exact room sizes and (2) the special relationships of the rooms.

10. Type of Appraisal and Type of Appraisal Report. USPAP defines two alternative types of appraisals: (1) complete appraisal and (2) limited appraisal. These two types of appraisals are defined as follows:

Complete Appraisal: the act or process of developing an opinion of value or an opinion of value developed without invoking the departure rule.

Limited Appraisal: the act or process of developing an opinion of value or an opinion of value developed under and resulting from invoking the departure rule. 3

The bankruptcy appraisal report should clearly identify both (1) the type of appraisal performed and (2) the type of appraisal report presented. The three alternative types of appraisal reports were discussed above.

11. Extraordinary Assumptions and Hypothetical Conditions. The Dictionary of Real Estate Appraisal defines an extraordinary assumption as follows:

An assumption, directly related to a specific assignment, which, if found to be false, could alter the appraiser's opinions or conclusions. Extraordinary assumptions presume as fact otherwise uncertain information about physical, legal or economic characteristics of the subject property; or about conditions external to the property such as market conditions or trends, or about the integrity of data used in an analysis. 4

The Dictionary of Real Estate Appraisal defines a hypothetical condition as follows:

That which is contrary to what exists but is supposed for the purpose of analysis. Hypothetical conditions assume conditions contrary to known facts about physical, legal or economic characteristics of the subject property; or about conditions external to the property, such as market conditions or trends, or about the integrity of data used in an analysis. 5

Extraordinary assumptions and hypothetical conditions should be clearly stated. When a value conclusion is subject to an extraordinary assumption or hypothetical condition (such as a pending lease agreement, atypical financing or a known but not-yet-quantified environmental issue), the appraiser should describe the condition in the appraisal report so that its effect on the value conclusion is clear.

12. General Assumptions and Limiting Conditions. The statement of assumptions and limiting conditions is used both (1) to help protect the appraiser and (2) to inform the client and other appraisal report users. The general assumptions often encompass issues such as (1) legal and title considerations, (2) liens and encumbrances, (3) property management, (4) information furnished by others ( e.g., engineering studies, surveys), (5) concealment of hazardous substances on the subject property, (6) compliance with zoning regulations and (7) compliance with local, state and federal laws.

General assumptions and limiting conditions should not be considered a "boilerplate" section of a bankruptcy appraisal report. Each assumption or limiting condition should be reasonable and supportable in the context of the particular appraisal. In addition, the statement of general assumptions and limiting conditions should not conflict with the appraiser's other professional responsibilities, such as the identification of extraordinary assumptions or hypothetical conditions.

13. Purpose and Intended Use of the Appraisal. To avoid an unintended (and inappropriate) use of the appraisal report, the intended use and the intended user of the property appraisal should be specified in the report. USPAP defines both terms "intended use" and "intended user" as follows:

Intended Use: the use or uses of an appraiser's reported appraisal, appraisal review or appraisal consulting assignment opinions and conclusions, as identified by the appraiser based on communication with the client at the time of the assignment.

Intended User: the client and any other party as identified, by name or type, as users of the appraisal, appraisal review or appraisal consulting report by the appraiser on the basis of communication with the client at the time of the assignment. 6

14. Scope of the Appraisal. A clear and accurate description of the scope of the appraisal is useful to all individuals (and particularly to the finder of fact) who may rely on the appraisal. The scope of the appraisal refers to (1) the amount and type of information researched and (2) the analyses performed in the appraisal assignment. Professional standards impose a responsibility on the appraiser to determine the appropriate scope of work in order to (1) conclude the value opinion and (2) prepare the appraisal report. By describing the scope of the appraisal, the appraiser effectively accepts this responsibility.

15. Definition of Value and Date of Value Opinion. The definition of value (also called the standard of value) is the type of value that is estimated in an appraisal report. The date of the value opinion (also called the effective date of the appraisal) is the "as of" date to which the value opinion applies.

16. Property Rights Appraised. In addition to identifying the subject property, the appraiser should state and define the particular property rights or ownership interests being appraised. Most bankruptcy appraisals involve the valuation of a fee-simple estate. However, a thorough discussion of the property rights appraised is appropriate in an appraisal of partial interests in property, limited ownership rights such as surface rights or mineral rights, fee-simple estates subject to long-term leases and leasehold interests. In addition, such other encumbrances as easements, mortgages and special occupancy or use requirements should be identified and explained in relation to the definition of value concluded.

17. Identification of the Property and Legal Description. An accurate legal description is particularly important in a bankruptcy appraisal. There are three basic types of legal description: (1) the recorded lot, block and tract (also known as the recorded map or subdivision map) description, (2) the metes and bounds description and (3) the government (or rectangular) survey description.

18. Identification of Personal Property, Intangible Property and Other Non-realty. In bankruptcy appraisals, it is particularly important for the appraiser to identify (1) the non-realty items included in the appraisal and (2) the non-realty items excluded in the appraisal. There are three common types of non-realty items that are often identified in a property tax appraisal: (1) personal property, (2) business value and (3) tax incentives.

19. Ownership and History. The bankruptcy appraisal report should discuss both (1) the current ownership of the subject property and (2) the history of recent sales of the subject property.

20. Market Area, City, Neighborhood and Location Data. Arguably, no other aspect of appraisal is as important as the market area, city, neighborhood and location analysis. However, defining the subject neighborhood is sometimes difficult in the appraisal of an industrial or commercial property. Four categories of factors affect the market area analysis: physical factors, economic factors, social factors and political factors. Each of these factors is summarized below.

Physical and Locational Factors. The physical factors that affect market area desirability and quality include the natural features of location, as well as those created by people. Natural features include topography, trees, lakes and other visual amenities. Natural features that affect market areas also include climate and geological conditions such as weather, soil quality and flood, slide and earthquake zones.

Economic Factors. An important economic factor to consider is whether the income level of the area occupants is sufficient to maintain existing structures. This factor strongly relates to employment opportunities available, as well as the stability of existing employment. Other economic factors include: growth rate, trend of property values, supply and demand, marketing time for properties and land-use changes in evidence.

Social Factors. Area or location desirability is influenced by the many social characteristics of the occupants. Neighborhood desirability depends on the effort and money that neighborhood occupants put into the maintenance and modernization of buildings. Community support for the existing legal and political order is also a factor, since neighborhood attitudes can influence political decisions, such as the number of city services provided, tax rates and the quality of the schools.

Political Factors. The level of taxes, assessment fairness, police and fire protection and other city services provided, public education and protective zoning or planning all have an effect on neighborhood desirability. Governmental positions on air, soil and water pollution, job safety, social programs and noise, odor and ecological controls can also be noted. Many political factors are the result of social attitudes, whether regional or local.

Exhibit 2 presents a listing of data that appraisers typically consider in a market area, city, neighborhood and location analysis.

21. Land Description. Land that has been graded and prepared for a specific purpose is typically referred to as a site. A site has features that are classified as physical, locational, legal and economic. Land is immobile, and therefore it is significantly influenced by its surroundings. The value of land is a function of its ability to satisfy a market need. The value of the land is a function of its ability to serve as a site for either existing or proposed improvements. In addition, land value is determined by its highest and best use under current market conditions. The common factors that the appraiser should consider in the land description include size and shape, topography, frontage, drainage and water runoff, soil conditions, environmental conditions, site access and transportation patterns, visibility and neighboring property users.

22. Improvement Description. The next section of the appraisal is a description of the physical improvements. These improvements include any structure on the site as well as any improvements added to the site, such as parking lots, utility lines, storm drainage and landscaping. Each improvement has its own specific characteristics that should be analyzed by the appraiser. Structural improvements consist of a combination of physical components designed to serve a specific purpose. The typical factors included in the improvements description are listed below.

- architectural style

- construction type

- site preparation and foundation

- floor structure

- floor covering

- interior constructions

- sprinkler system

- heating, ventilation, and air conditioning

- electrical system

- exterior walls

- special building features and additions

- site improvements.

23. Zoning. Virtually all communities have zoning ordinances that control land use in their jurisdictions. Zoning ordinances vary widely from one community to another both in land-use classifications and methods of implementation.

24. Analysis of Highest and Best Use as if Vacant. The analysis and conclusion of the subject property highest and best use is a standard procedure in any real estate appraisal. Concluding highest and best use is not only a generally accepted procedure, it is a USPAP requirement. USPAP Standards Rule 1-3 provides the following instruction with regard to highest and best use:

When the value opinion to be developed is market value, and given the scope of work identified in accordance with Standards Rule 1-2(f), an appraiser must: (a) identify and analyze the effect on use and value of existing land use regulations, reasonably probable modifications of such land use regulations, economic supply and demand, the physical adaptability of the real estate and market area trends and (b) develop an opinion of the highest and best use of the real estate. 7

In a highest and best-use analysis, the appraiser determines the property use that fulfills the following four tests:

- physically possible,

- legally permitted,

- economically feasible, and

- maximally productive.

The traditional procedure for determining highest and best use is to analyze the site as if vacant. In the "as if vacant" analysis, the present structures are disregarded in the highest and best-use analysis. However, the feasibility and cost of demolition and removal of existing structures should be noted. In this "as if vacant" analysis, the appraiser is following the "theory of consistent use." In other words, the site and the improvements will be valued based on the same use.

In bankruptcy appraisals, the most common method to estimate land value is the sales comparison method.

25. Analysis of Highest and Best Use as Improved. The appraiser first concludes highest and best use of the site as if vacant and ready for development. Next, the appraiser analyzes the highest and best use of the property as currently improved. The highest and best use of the property as improved is the use that results in the highest present property value. The present value is the present worth of all projected net cash flow discounted at a market-derived rate of return. If the value of the improvements, based on their highest and best use, is less than the value of the land, based on its highest and best use, minus the cost of demolition of the improvements, then the improvements would contribute no value. The highest and best use would be to remove the improvements.

26. Land Value. Land value can be a major component of total property value. Appraisers typically estimate land value separately, even when valuing properties with extensive improvements. The appraiser can use several methods to estimate land value, including:

- sales comparison method

- extraction method

- allocation method

- subdivision development method

- land residual method

- ground rent capitalization method.

In bankruptcy appraisals, the most common method to estimate land value is the sales comparison method. However, when few sales are available or when the value indications of the sales comparison method need additional support, the other land valuation methods may be used.

27. Cost Approach. The principal procedures in a cost-approach analysis are outlined as follows:

- Estimate the highest and best use of the site. This initial procedure provides a basis for selecting comparable site sales. In addition, this procedure provides a basis for setting a benchmark against which accrued depreciation of the improvements is measured.

- Estimate current dollar cost of either reproducing or replacing the subject improvements. In addition to direct costs and indirect costs, current cost estimate typically includes both a developer's profit and an entrepreneurial incentive based on local market evidence.

- Estimate the total dollar amount of accrued depreciation from all causes. This total accrued depreciation typically includes three categories of depreciation: (1) physical deterioration, (2) functional obsolescence and (3) external obsolescence.

- Subtract the dollar amount of total accrued depreciation from the estimate of the current reproduction or replacement cost new. This difference, if computed accurately, approximates the current value of the subject major improvements.

- Estimate the replacement (or reproduction) cost new less depreciation for any minor buildings and other on-site improvements, such as landscaping, fencing and driveways. The key to this procedure is to estimate the value (rather than the cost) that these improvements add to the overall value of the property.

- Add the site value to the depreciated cost of (1) the building major improvements and (2) the other on-site improvements. The resulting sum is the estimated value of the subject property via the cost approach.

In the estimation of current cost, all cost components should be considered. Total current construction costs (either reproduction or replacement) are often identified as direct and indirect costs. Direct costs are labor and materials (sometimes called "hard costs") and typically include:

- labor hired by the general contractors and subcontractors

- materials used, beginning with site clearance to the final cleanup

- equipment, leased or owned

- temporary electric service

- developer's overhead and profit.

Indirect costs (sometimes called "soft costs") typically include:

- professional service fees, including legal, appraisal, financial feasibility, engineering, architectural and surveying

- construction and possibly permanent loan charges

- property management commissions

- project management fees

- land lease rent, if appropriate

- real estate taxes

- project promotion charges

- any other interim carrying costs.

The common construction cost-estimation methods include:

- quantity survey method

- unit-in-place construction method

- comparative unit method

- historical cost indexing method.

The appraisal report should also describe the analyses related to estimating depreciation. Accrued depreciation is typically defined as a loss in value from any cause. The three types of accrued depreciation follows:

- physical deterioration

- functional obsolescence

- external obsolescence.

The bankruptcy appraisal report should distinguish the concept of cost from the concept of value. Cost is typically a measure of a past expenditure either of labor or materials or both. That is, cost represents a measure of past expenditures. Value, on the other hand, is influenced by the future. This is because value, by definition, constitutes the present worth of future rights and benefits. Therefore, cost is the amount of money necessary to acquire or to create an item, while value represents its worth.

28. Income Capitalization Approach. The income approach converts the property's expected income or cash flow into a present value. There are two categories of income capitalization methods: direct capitalization and yield capitalization. Direct-capitalization methods rely on direct-capitalization rates typically extracted from comparable sales. Yield-capitalization methods rely on yield-capitalization rates that are typically derived as the internal rate of return required by the typical investor.

Value estimates may be calculated by applying an appropriate multiplier or capitalization rate to the subject property's expected income or cash flow. The term "direct capitalization" is sometimes used to refer to the procedure of extracting income multipliers or capitalization rates from comparable sales. However, capitalization rates and income multipliers derived from comparable sales do not explicitly address profitability. Rather, they are simply observed ratios of income to value. However, such market-derived capitalization rates can provide reliable estimates of value if:

- the expected cash flow is a representative income projection.

- the income multiplier or capitalization rate is derived from comparable sales with the same potential for future income.

Common direct-capitalization multipliers or rates include (1) income multipliers such as potential gross income multiplier (PGIM), effective gross income multiplier (EGIM) and net income multiplier (NIM), and (2) several capitalization rates such as overall capitalization rate, land capitalization rate and building capitalization rate.

Property value is commonly estimated by dividing the one-period net operating income (NOI) by an overall capitalization rate. The rate is estimated by (1) extracting overall rates from comparable property sales, (2) comparing the comparable property attributes (physical, locational, financial) to the subject property and (3) selecting an appropriate overall rate. As with the PGIM, EGIM and NIM, an implied assumption is that the future performances of the comparable properties and the subject property will be similar.

Values are often estimated by projecting cash flow over a typical holding period and discounting the cash flow to a present value estimate using a discount rate. This valuation method is called yield capitalization (or a discounted cash-flow analysis). The discount rate directly addresses the expected profitability of the property. The cash flow components typically projected in a property tax appraisal are (1) NOI and (2) the net proceeds from the property resale. The discount rate is sometimes called the "property yield rate" or overall yield rate.

All income approach methods are categorized as either direct capitalization or yield capitalization. Direct capitalization uses a one-period measure of income or cash flow to estimate value. This procedure includes the use of income multipliers such as the potential gross-income multiplier, effective gross-income multiplier and net-income multiplier. This procedure also includes the use of capitalization rates such as the overall capitalization rate, the land capitalization rate and the building capitalization rate.

Yield capitalization requires a projection of the estimated future income of the project property. Value is estimated by discounting this income, including any proceeds from reversion, at an appropriate yield rate. A specific procedure of the yield capitalization method is the discounted cash-flow analysis. When estimating value using yield capitalization, the first-year NOI is explicitly estimated. The property income after the first year is either (1) explicitly estimated for each year of the investment holding period or (2) projected to change according to a particular mathematical process. Several common alternative property income patterns include: level income, compound change and straight-line change.

29. Sales Comparison Approach. The comparability of the selected sale transactions is typically the most controversial aspect of the sales-comparison approach analysis. Therefore, market-sale transactions should not be used unless the sale data have been confirmed by the appraiser or by a reliable delegate. This confirmation process should include inquiries into the circumstances causing the sale or affecting the transaction price. Price represents the amount paid for the real estate in terms of dollars. Before accepting the price as evidence of value, the appraiser should verify the transaction for the following conditions:

- relationship of the parties

- date of sale

- financial terms of sale.

Another controversial issue in bankruptcy appraisals is the appraiser's adjustments to the comparable sales to account for differences between the comparable properties and the subject property. Any adjustments related to differences due to variations in age, size and quality of comparable vs. subject building construction should be identified and quantified in the appraisal report. Appraisers typically use either the detailed property-analysis method or the overall property-rating method to justify these market comparison adjustments:

Detailed Property Analysis Method. After confirming the sale prices and terms of sale with respective buyers, sellers or brokers, the appraiser will typically inspect comparable properties for size and details of construction. This allows the appraiser to make price adjustments to make each sale as comparable as possible to the subject property. However, the detailed property-analysis method is not frequently used in property tax appraisals.

Overall Property Rating Method. Under this method, market comparison is based on an overall judgment as to the percentage-value adjustment called for in order to make each sale comparable with the subject property. The overall percentage applied to each comparable property in turn is justified by the appraiser's explanation that the subject property is better, poorer or the same in relation to its construction as to type, size, features, age and building condition. By adjusting the comparable sale prices upward or downward in accordance with the characteristics of the subject property, a market-value estimate is derived.

For industrial/commercial properties, sale price adjustments are often made by the unit-comparison method based on one or more of the following:

- price per square or cubic foot of building volume

- price per square foot of net rentable area

- price per apartment including land investment

- price per room or price per floor

- gross annual or monthly income multiplier

- for special-purpose properties, for example: hospital, per bed; restaurant and theater, per seat.

For bankruptcy appraisals...it is much more common to conclude a point estimate as the final value opinion.

The sales-comparison approach is well adapted to situations where there are an adequate number of similar properties that have recently sold. In using these sales, appraisers attempt to verify each sale in order to confirm the relationship of the parties, date of sale and any financing terms. In analyzing comparable sales, it may be necessary to adjust a price if prices have changed between (1) the time the comparable property sold and (2) the subject appraisal date. Also, an adjustment is typically required if a comparable sale property's price was influenced by financing terms. The "cash-equivalency" method is often used to adjust for this price influence. The purpose of this adjustment is to reveal the price that a comparable property would have brought without the influence of atypical financing.

There are two methods to analyze comparable sale properties: (1) the detailed property-analysis method and (2) the overall property-rating method. The first method requires the appraiser to make a detailed analysis of all features in a property that influenced the price paid as well as transactional, location and time influences. The second method allows the appraiser to make an overall price adjustment to the comparable sale price. The overall property-rating method is most commonly used in bankruptcy appraisals.

30. Reconciliation and Opinion of Value. The final procedure is the reconciliation of the various value indications into final opinion of value. For appraisal performance for many purposes, it is reasonable to conclude a range of values as the final value opinion. For bankruptcy appraisals, however, it is much more common to conclude a point estimate as the final value opinion. The nature of the reconciliation procedure depends on (1) the purpose and objective of the appraisal, (2) the individual valuation approaches and methods used and (3) the appraiser's estimate of the reliability of each value indications derived.

When all three valuation approaches are used, the appraiser typically considers the relative dependability and applicability of each approach given the subject property type as well as the quantity and quality of data used. In the reconciliation section of the appraisal report, the appraiser may (1) explain variations among the value indications of the different approaches used and (2) account for differences between the value conclusions derived.

31. Estimate of Exposure Time. USPAP Statement on Appraisal Standards No. 6 (SMT-6) addresses the estimation of exposure time in real estate appraisals. USPAP Statements do not carry the weight of USPAP Standards Rules, so the consideration of exposure time is not a USPAP requirement. However, SMT-6 indicates that the analysis and conclusion of exposure time is a recommended procedure:

Reasonable exposure time is one of a series of conditions in most market value definitions. Exposure time is always presumed to precede the effective date of the appraisal. Exposure time may be defined as follows: the estimated length of time the property interest being appraised would have been offered on the market prior to the hypothetical consummation of a sale at market value on the effective date of the appraisal; a retrospective opinion based on an analysis of past events assuming a competitive and open market. 8

The discussion of reasonable exposure time should appear in an appropriate section of the appraisal report, one that presents the discussion and analysis of market conditions, and also be referenced at the statement of the value definition and at the value conclusion. 9

32. Professional Qualifications of the Appraiser. The statement of the professional qualifications should describe the appraiser's education and training, experience and expertise, and professional credentials and designations. For bankruptcy appraisals, this statement should emphasize the appraiser's experience in conducting bankruptcy appraisals and experience appraising properties like the subject property.

33. Addendum and Secondary Exhibits. This section of the appraisal report should include all maps, charts, graphs, photographs, exhibits, spreadsheets, financial statements, legal documents and other supplemental data not included in the narrative section of the report. It is a good idea to include a table of contents at the beginning of the addendum. This table of contents should list the contents of the appraisal report addendum.

Summary and Conclusion

This discussion, which summarized the typical components of a narrative real estate appraisal report prepared for bankruptcy purposes, may be used as a checklist or guideline by appraisers preparing the appraisal report, by bankruptcy parties-in-interest and their legal counsel in evaluating an appraisal report, and by the bankruptcy finder of fact in determining the degree of reliance to place on the expert witness appraisal report.

1 USPAP, 2004 edition, The Appraisal Foundation, p. 4. Return to article

2 Ibid. Return to article

3 USPAP, 2004 edition, The Appraisal Foundation, p. 1. Return to article

4 The Dictionary of Real Estate Appraisal, pp. 106-107. Return to article

5 Ibid., p. 141. Return to article

6 USPAP, p. 3. Return to article

7 USPAP, p. 19. Return to article

8 Ibid., p. 94. Return to article

9 Ibid., p. 95. Return to article

Appraiser Engagement Agreements

I’ve prepared the following example basic engagement agreements for appraisers to consider in their practices. They are provided in Word to make them easily editable. You’ll find a discussion of engagement agreements in Chapter 8 (Engagement Agreements and Appraisal Terms and Conditions) of my book , published by the Appraisal Institute in 2019.

If you’re a California appraiser, you can also take my 4-hour CE course “ Federal and California Laws and Regulations – with Real World Relevance .” In that course – which fulfills a mandatory BREA CE requirement – we discuss the use of engagement agreements.

These materials are similar to the sample agreements made available by the Appraisal Institute on its website ( link ). On the Appraisal Institute’s website, you’ll find additional examples covering things like multiple appraisal services for a single client. I was a member of the Appraisal Institute’s work group that updated the materials in 2018.

The example basic agreements are offered as starting points for a user’s consideration. Any user of these materials should do their own research about application to their work and/or seek legal counsel.

Non-Litigation General Appraisal Assignments

Examples 1 and 2 are agreements intended for appraisal assignments in which the appraiser is performing a single appraisal for non-litigation purposes. They’re primarily intended for non-lending assignments, because regular lenders generally require their own engagement forms, but the examples are still suitable for lending purposes if your client will accept the wording.

Example 1 is a two-part agreement with a main body identifying key terms and then a separate “terms and conditions” attachment (rev. 2-28-20)

Example 2 is a streamlined “all-in-one” engagement agreement. Of course, you should edit either version to suit your own practice (rev. 7-20-20)

Litigation Consulting/Expert Witness Assignments

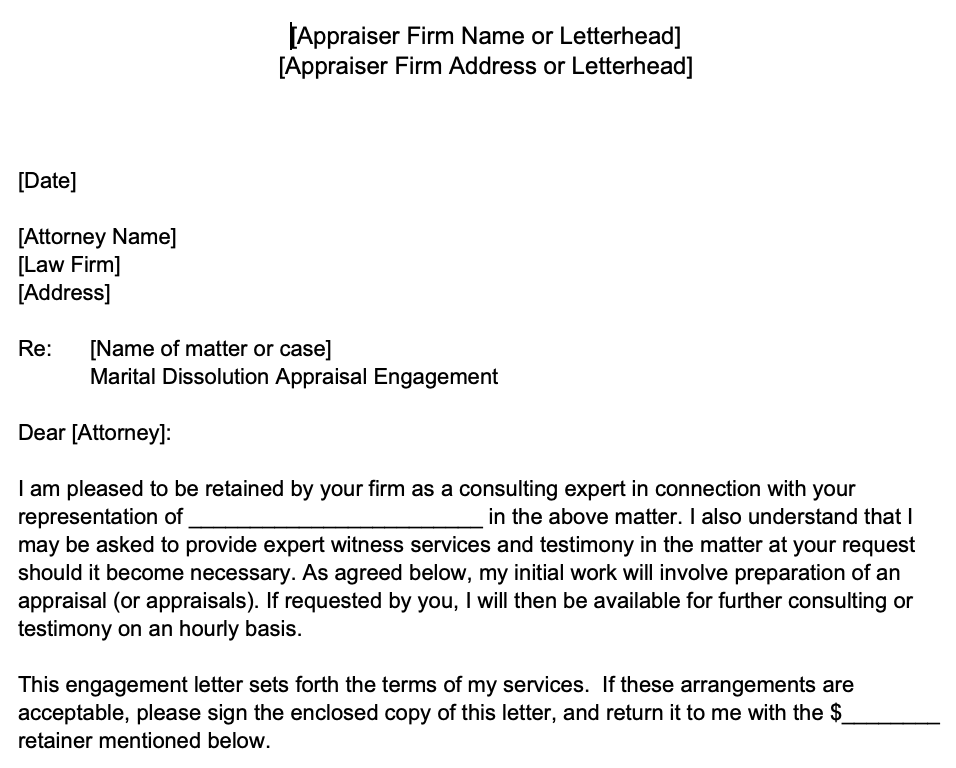

Example 3 is an engagement letter intended for litigation assignments for which the appraiser is being retained as a consulting expert with the possibility that the appraiser may later be designated as a testifying expert witness. (rev. 2-28-20)

Divorce Appraisal Assignments with Potential Testimony

Example 4 is an engagement letter intended for divorce assignments for which the appraiser may initially provide an appraisal for a fixed fee and may then later provide testimony on an hourly basis (a two-stage assignment). (rev. 5-16-23)

Engagement Letters - Doing it Right

Real Estate Appraiser Independence , Real Estate Appraisers

Editor’s Note: Appraiser Phil Spool shows how an effective engagement letter puts you in control of an assignment.

Doing it Right: Engagement Letters

by Phil Spool, ASA

Now that many of you are searching for new non-lender clients in the aftermath of the mortgage crisis and HVCC (Home Valuation Code of Conduct), it is advisable not to lose sight of good business practices; one of the best is ensuring that you have a good engagement letter in place.

Appraisal management companies (AMCs) and most lender clients require their own engagement letters but for non-lender clients, an effective engagement letter allows you to control the assignment rather than the client.

Would you quote an appraisal fee without first finding out what type of property it is: single family residence, duplex, commercial property or vacant land? Or without determining who it is for and why is it needed? Will you be required to testify in court? Where is it located and when is the report due? All of these questions are very important and need to be answered before you can quote a fee and the answers need to be in writing. Quoting a fee is one thing, how you are going to get paid is another. This is why an engagement letter is necessary.

Why do you need an engagement letter? To answer this question, one must generally understand the purpose of an engagement letter. In essence, an engagement letter is a legal document that defines the engagement between you and your client. This letter should state the terms and conditions of the engagement, address the scope of the assignment and the terms of your compensation. In a nutshell, you want your client to be in agreement about what is planned and expected in your appraisal report and how and when you are going to get paid.

While each engagement letter may vary depending on the complexity or level of service you are providing, the following are some of the more important provisions needed in your engagement letter. The first four discussed are indicated in Standards Rule 1 and Standards Rule 2 in the Uniform Standards of Professional Appraisal Practice (USPAP).

Type of report to be prepared (SR 2-2). Find out what your client needs in terms of the depth of your report. Perhaps the client is only interested in buying or selling the property and is the only intended user of the report. In that situation, perhaps only a Restricted Use appraisal report is needed. If the client wants a residential appraisal report and wants it on one of the forms, then it will be considered a Summary Appraisal Report. Remember, if the intended use is not for a mortgage transaction and a Fannie Mae form is used, you cannot use the current 1004 or 1073 form because the intended use is already stated, which is for a mortgage finance transaction. Some clients need more detail in the report, perhaps for litigation purposes. In this situation, a Self-Contained appraisal report might be in order. Remember, your fee might be based on the time you spend not only on your research but also in preparing your report. So if you are preparing a Self-Contained appraisal report, you should consider a higher fee than if you are preparing a Summary or a Restricted Use appraisal report.

Address of subject property, brief description of the property, intended user(s), intended use and type of value [SR 1-2 (a), (b) and (c)]. The subject should be adequately described so that the client truly understands what you intend to appraise. This might require the inclusion of a brief description of the property and legal description of the property if it contains multiple parcels with one value. For example, if you are requested to appraise an apartment building, you should consider stating the number of buildings with their addresses and total number of units. If you are requested to appraise a single family residence, perhaps just the address might be sufficient. Also note that the engagement letter may not be the forum for a request of an itemized list of documents you need. You can state: “Attached is a list of documents needed for the completion of the appraisal report. Any delay in receiving the requested items might delay the delivery of the report.”

Indicating the name of your client is a must. If there are other intended users, they should also be listed. The same applies to including the intended use in the engagement letter. Remember, the intended use is not the same as the purpose of the appraisal. Typically, the purpose of the appraisal is the type of value. You might want to consider attaching the definition of whatever type of value is to be determined. Most appraisals determine market value. However, your client may request a value in use or an insurable value.

State the property interest to be valued [SR 1-2 (e) (ii)]. If you are appraising a single family residence or an individual condominium unit, then more than likely you will be appraising the “fee simple” interest of the property. If you are appraising a commercial property with a long-term tenant or a multiple tenant building with long term leases, then more than likely you will be appraising the “leased fee interest.” State in your engagement letter that you are appraising the “fee simple” interest or “leased fee” interest so that there is no misunderstanding if you will be utilizing market rent (for fee simple value) or contract rent (for leased fee value). This may be further expanded in your brief description of the Scope of Work.

Identify any extraordinary assumptions and/or hypothetical conditions. An extraordinary assumption is an assumption if found to be false, could alter the appraiser’s opinions or conclusions. A hypothetical condition is something which is contrary to what exists but is supposed for the purpose of analysis. So if you are doing an appraisal that might require an extraordinary assumption or hypothetical condition, state it. For example, if you are appraising a proposed improvement, such as a proposed house, then you will have the hypothetical condition assuming that the improvements will be completed. If you are appraising a property with a retrospective market value, you will probably have the extraordinary assumption that the condition of the property as of the effective date of appraisal was the same as the date of visit.

Briefly describe your scope of work. This is very important. You should determine the scope of work or scope of assignment in relation to your client’s understanding and expectations. State the approaches you will use to arrive at your opinion of value. Be brief but give enough information so that when the appraisal report is completed and sent to the client, the client is not surprised by something you did not do. An example would be to exclude an approach to value that could be considered appropriate but the utilization of another approach or approaches would be sufficient to arrive at a credible assignment result.

State the agreed compensation amount for your appraisal assignment other than depositions and/or court testimony. It is very important that you and your client are in agreement with the terms of your compensation. Be sure to include your fee for the assignment, retainer and when the balance is due. Indicate who is responsible for payment and that they understand they are financially responsible for the payment. Also, indicate that a fee for court testimony is separate from the appraisal fee. You might want to consider including a late fee charge if payment is not received in the agreed amount of time.

State your requirements for a deposition and/or court testimony, including fee structure. Even if your client tells you that your appraisal report will not be used for any litigation purposes, don’t take a chance. Include in your engagement letter something similar or the same statement that the Fannie Mae form 1004 states in No. 4 of the Statement of Assumptions and Limiting Conditions: “The appraiser will not give testimony or appear in court because he or she made an appraisal of the property in question, unless specific arrangements to do so have been made beforehand, or as otherwise required by law.”

If you are taking on this assignment with the full knowledge of a possible testimony in a deposition and/or court, then state your fee terms, including travel time, preparation work time and fee when arriving at the deposition or court. You might request a flat hourly rate, referred to as “portal to portal” or structure your rates in various categories, such as travel time to and from the deposition and/or court, telephone calls, preparation (review of your work product prior to a deposition and/or court testimony) and fee once you arrive at the venue (attorney’s office for a deposition or court for the trial). Regardless of who deposes you or calls you to testify, state in your engagement letter that the engaging party is ultimately responsible for payment.

State the anticipated delivery date of the appraisal report and the method of delivery. Include the delivery date of the appraisal report and how the appraisal report is to be delivered, such as via regular mail or by email.

Your signature and that of the client at the bottom of the engagement letter. Make sure you have space at the bottom of your engagement letter for your signature and date. Print the client’s name and indicate that the client has to sign above the printed name and that they date the engagement letter when they sign it.

An additional clause to be considered is: “This appraiser is bound by current Uniform Standards of Professional Appraisal Practice (USPAP) guidelines.” This would cover many of the items mentioned above as well as any potential misunderstandings with the client, especially regarding the reporting of a predetermined result, a direction in assignment results, the amount of a value opinion and the occurrence of a subsequent event directly related to the appraiser’s opinion and specific to the assignment’s purpose, all of which are stated in the Management portion of the Ethics Rule in USPAP.

Also, the 2010-2011 USPAP added a new item in the Ethics Rule requiring the appraiser to disclose, prior to accepting an assignment, any services regarding the subject property performed by the appraiser within the prior three years, as an appraiser or in any other capacity. Therefore, if you have not performed any services on the property you intend to appraise, include the following statement or something similar: “I have not performed any services regarding the subject property within the prior three years, as an appraiser or in any other capacity.” If you have performed some form of service on the subject property, then disclose it.

In conclusion, I suggest that you confer with an attorney in drafting an engagement letter you feel comfortable with. My article reflects my opinion what you, the appraiser, should consider when contracting with your client.

About the Author Philip G. Spool, ASA, is a State-Certified General Real Estate Appraiser in Florida, appraising since 1973. Formerly the Chief Appraiser of Flagler Federal Savings and Loan Association, he has been self-employed for the past 18 years. In addition to appraising, he is an instructor with Miami Dade College, teaching appraisal courses and continuing education. He is Vice President and Chairman of real estate programs with the Greater Miami Chapter of the American Society of Appraisers. He can be reached at [email protected] .

Tags: Appraiser Independence , Appraisers , Engagement Letter , Reporting , Scope of Work , Standards of Practice , Success , USPAP , volume 24

- Commercial Valuations

- Special Purpose Valuations

- Residential Valuations

- Valuation Process

- Government Tax Appeals

- Additional Services

- Banks and Financial Institutions

- Corporations

- Accounting Firms

- Private Clients

- County Governments

- Letter From Our Founder

- Argianas Team

- You Appraised What?

- Terms and Definitions

- Speak with an Expert

- Career Opportunities

- General Inquiries

- Letter from our Founder

- Privacy Policy

The Engagement Letter: Where an Appraisal Begins

The team at argianas and associates build relationships with each engagement letter.

When we work with our clients, we provide more than just a service. We like to think that with each assignment, we build a relationship. We want our clients to know they can trust us to be the experts they can count on to provide them with a credible, accurate valuation every time. To do that, we begin with a legally binding document called an engagement letter. This letter serves as a precursor to the report and defines the terms and conditions of the appraiser-client relationship. It answers questions like, “what property will be appraised?” and “who will the appraisal report be prepared for?” As a properly-drafted engagement letter lays out the agreement between the appraiser and client (no surprises to either party), you could say it’s a way for us to manage client expectations.

what makes a good letter?

Properly drafted engagement letters can and usually do vary depending on the level of service provided. When it comes to what information should be included, think of the 4 w’s – who, what, where and when. The letter will state the subject property, the property type, the interest valued and any other property to be valued. One of the most important pieces of information included in the engagement letter is client information. The preparer should clearly spell out who the client is including the name of the person signing on behalf of the client along with the person’s business title, the full/correct name of the company, and the person or company’s proper mailing address. If the client is also the sole intended user, this should be clearly stated in the letter, and additional intended users should be likewise identified in full. Identifying the intended user as well as the intended use is critical to the appraisal report. And of course, the legal interest to be appraised needs to be clearly stated. To learn more about these considerations including intended use and intended user, read our three-part series here .

The “who” is also another piece of important information. Who will be conducting the appraisal? Clients expect a licensed and certified professional to conduct their appraisal. Inserting information on the person that will conduct the appraisal and their certification level allows the client to make a well-informed decision before proceeding with the appraisal.

The engagement letter is also where the client and appraiser agree on several dates. Both parties should be on the same page about the valuation date (effective value date) and the date on which the report is due (date of appraisal).

The last piece of information to include in the engagement letter is the payment terms. How much will the client be charged for this service? Will a one-time payment be made, or should a payment schedule be outlined? All payment terms should be communicated in the engagement letter, so the expectation is clear.

why do you need it?

While an engagement letter isn’t required by USPAP, the team at Argianas recommends that all assignments begin with one. The letter sets expectations so both the client and appraiser are clear on the scope of work, and a properly drafted engagement letter also limits liability for the appraiser.

If you are needing a commercial appraisal report prepared or have any questions, do not hesitate to give us a call at 630.390.0113 or complete this form . To receive more real estate appraisal resources or to receive our original thought pieces, be sure to join our mailing list to receive our e-newsletter.

Modal Title

Samples, Templates and Documents

We’re here to help you succeed.

From creating engagement contracts and report forms you can customize to your assignments, to highlighting common errors in valuation services, these resources assist and guide you in the day-to-day practice of your profession.

Sample Materials for Services

Use our sample documents as a resource in drafting your own engagement agreements. These materials address non-litigation and litigation appraisal assignments. You’ll need an online account to log in.

Sample Certification Statements

Use these sample certification statements for written reports as a resource in drafting certification statements. You’ll need an online account to log in.

Appraisal Institute Reports

AI Reports® are appraisal report forms designed by appraisers, for appraisers, to help you complete assignments.

Property Use Classification System

The AI Property Use Classification System (PUCS) is a uniform classification system of the potential uses of real estate. Download the current version!

Common Appraisal Errors and Issues

We’ve identified some of the most common errors and issues in valuation services. Use these documents as a resource to help you avoid errors and address issues in your work. You’ll need an online account to log in.

Readdressing, Reassigning, Reappraising

Learn how to handle readdressing, reassigning and reappraising requests in a way that complies with applicable standards and ethics requirements. You’ll need an online account to log in.

Use of Designations and Emblems

Communicate your achievements! Use the AI trademarked designations and designation emblems to show your commitment to the valuation profession. You’ll need an online account to log in.

Appraisal Institute Guide Notes

The Appraisal Institute has adopted a series of guide notes on how to apply the standards requirements in a variety of specific situations.

We’ve been supporting valuation professionals for more than 90 years. Why not join us? We have the education offerings, extensive knowledge base, tools and resources, and designation opportunities you need to excel in your current role and aim higher.

- Sample Letters

FREE 9+ Sample Assignment Letter Templates in PDF | MS Word

An assignment letter is a document that is used mostly in situations such as business bankruptcy and insolvency. It is a legal document which can be presented in courts when handling different cases. Examples of scenarios whereby this paper comes in are when a business owner is assigning a portion of his or her assets to a trustee for selling purposes and also when assigning specific rights to another person such as collecting payment on your behalf.

Assignment Letter

Sample personal business letter - 9+ documents in pdf, word, sample thank you letter to boss - 22+ free documents download ..., sample trademark assignment form - 7+ examples in pdf.

Our assignment templates get designed in the best way possible to usher you properly when creating one. An assignment letter template may also be said to be a Professional Letter of assignment or an assignment letter sample.

Salary Assignment Letter

Size: 130 KB

The top of the page should have the name of the person or the entity issuing the letter together with their personal information such as the telephone number, email address, and the postal address. Below that it should indicate that it is a letter of assignment to give the form an identity. Next should be the full names of the people or entity in the agreement alongside their personal information.

After that, mention the duration of the assignment and the location of where the deal takes place. The body of the document should be concluded by listing all the details of the money that they parties will be handling. Finally, the parties involved should sign the paper to seal the agreement.

Appraisal Assignment Letter

Size: 38 KB

The top of the form should read that the document is an appraisal assignment letter for easier identification. The name plus the postal address of the person or company issuing the appraisals should be listed next. After that, a declaration statement mentioning the names of the parties involved in the agreement should be put down saying who has assigned rights to the other.

The agreement should always comply with the standards set by law. Other acknowledgments that each party is supposed to heed to should also get listed in this document. The model should conclude by stating the period when the agreement will be active.

Voided Assignment Letter

Size: 37 KB

The top of the model should read that it is a voided assignment letter for quick identification of the form. After that, on the left, the name of the person of corporate who is going to receive the document is listed together with other personal information such as a postal address and an email address.

The right should have the date of when the paper gets published. Finally, the reasons as to why there is a voided assignment letter must be on it and signatures of the parties involved should also be given to show that they agree with the stated reasons.

Incentive Assignment Letter

Size: 42 KB

The name of the company issuing the letter should be the first thing on the document and the date below that. Next should be the name and personal details of the person or entity meant to receive it. The incentive assignment should be listed giving all crucial information about it and contacts which the receiver can contact for further negotiations. Finally, it concludes with a short formal message to the receiver.

Professional Assignment Letter

Size: 355 KB

Buddy Assignment Letter

Size: 155 KB

Friendly Assignment Letter

Size: 31 KB

Sample Assignment Letter

Size: 137 KB

Assignment Letter from Trainee

Volunteer Assignment Letter

Size: 52 KB

What are the Advantages of Having our Assignment Letter Templates?

One may lack sufficient knowledge on what to include when forming this document; therefore, the main benefit of having our template is that it gives you the proper guidance on which information to include in your paper and an order of how to put it down.

Another advantage is that our templates are files which you can save on you PC; thus, you can make references from the file again in future when forming assignment letters. Finally, our templates are always designed to help you create one as per the standard legal requirements. You may also see Sample Personal Letters

How Have We Made our Assignment Letter Templates the Best for you?

Our models get worked on by the experts whom we have interviewed thoroughly and proven that they are talented. We also ensure that they have sufficient experience in the field for our templates to be as effective for you as possible. Another way we have made our templates the best for you is by making them editable such that you can do any modifications you prefer on them. Finally, they are printable for you to be able to make as many copies as you want. You may also see Friendly Letters

Which are the Most Crucial Aspects that I Should Entail in my Assignment Letter?

Always list the name of parties in the agreement and also sufficient personal information about them. Never forget to indicate the date you publish the model and the period of how long the contract will be valid. Ensure that both parties agree on what gets stated on the Professional Letters then seal the deal with signatures of each. Finally, since it is a legal document, always ensure that your agreement complies with the provisions of the law to avoid awful penalties.

We ensure that we meet the requirements of all our customers according to their needs. Those that would want a fully customed model can always communicate to us so that we can direct you to our experts to help them understand what kind of make you want. We have customer care agents that are always available to tend to all the inquiries you may have and the consultations you may need. Consider acquiring our accessible and affordable assignment letter template today, to guide you while creating the document you need.

If you have any DMCA issues on this post, please contact us !

Related Posts

Sample visa invitation letter templates, how to write an application letter for employment [ with samples ], sample community service letter templates, sample commitment letter templates, sample application letter templates, letterhead samples, sample visa sponsorship letter templates, application letter templates, sample job application cover letter templates, formal excuse letter templates, leave letter templates, sick leave letter templates, free 10+ sample inform letter templates in pdf, free 13+ sample closing business letter templates in pdf | ms word | google docs | pages, 10 free notice to quit letter samples & templates, sample assignment of contract - 6+ free documents download in ..., sample assignment of mortgage template - 9+ free documents ..., sample assignment agreement template - 9+ free documents ..., sample appointment letter - 28+ download free documents in pdf ....

Appraisal Letter Format (+Free Samples & Templates)

An appraisal letter is given to employees after completing their performance review . If done right, it can be a great motivator for employees, ultimately leading to the success of an organisation. Usually, a company’s HR department issues appraisal letters to employees.

This blog post will discuss everything about appraisal letters and provide free Word (editable) and PDF templates.

Digital-first solutions like RazorpayX Payroll allow businesses to automatically generate various HR letters, along with all the benefits of fully-automated payroll processes.

Demo RazorpayX Payroll for Free

Table of Contents

What is an appraisal letter?

An appraisal letter is a written document stating that the employer has noticed the employee’s contribution to the organisation. In short, it reflects their hard work, and the outcome enhances their morale.

An appraisal letter mentions the strengths and weaknesses of an employee and provides valuable insights. It also helps identify the areas where an employee performed well and what skills they must acquire to perform better during the next appraisal cycle.

How to write an appraisal letter?

An appraisal letter provides clarity and motivation to an employee. However, you need to ensure that you follow the below-mentioned tips:

- Since the letter is an official document, it should be issued on the company’s letterhead.

- Start the letter by honestly praising the employees, their work, and accomplishments during the appraisal cycle. While praising, keep the tone professional & polite.

- If possible, write down the employees’ noteworthy achievements in the appraisal letter. Keep it crisp.

- Mention the details of employees’ new salary, revised CTC, increment, and the effective date of the appraisal.

- Also, include if an employee has received any promotion or bonus.

- At the end of the letter, you can spend a little bit of time providing some constructive criticism based on the employee’s performance during the cycle. This feedback needs to be specific and understandable so that the employee can work on it.

- Finally, close the appraisal letter by outlining what the employee is expected to do in the future. This part should be short and straight. It is better to communicate the expectations in person.

- Mention that the company looks forward to working with the employee in future.

Appraisal letter format and template

[Company_Name]

[Company_Address]

Appraisal Letter – CONFIDENTIAL

Dear [Employee_Name],

Employee ID: [Employee_ID]

[Company_Name] has and continues to move forward because of your hard work and contributions. [Company_Name], as always, stays committed to its people first approach and puts you and your contributions at the forefront.

In continuation to that thought and philosophy, we are taking this opportunity to congratulate and recognise you for your contributions and thank you for all your efforts.

In recognition of your performance and contributions to [Company_Name], we are delighted to promote you to [Employee_Designation] and revise your Cost to Company to INR 330000, effective from [Appraisal_Date] The break- down of your CTC is mentioned in Annexure A.

We wish you tremendous success in the coming years and look forward to your long-term association and contributions to [Company_Name].

Best, [HR_Name]

[HR_Designation]

This is your expected monthly salary structure. Salary Component Amount Basic Salary 13,750 HRA 6,875 Special Allowance 4,125 Leave & Travel Allowance 2,750 ESI Employer Contribution 0 PF Employer Contribution 0 Total 27,500

Note: You will receive salary, and all other benefits forming part of your remuneration package subject to, and after, deduction of TDS, PF, ESI and professional taxes in accordance with applicable law.

Download Appraisal Letter in Word for Free

Download Appraisal Letter in PDF for Free

Generate multiple HR letters with RazorpayX Payroll

RazorpayX Payroll is an HR and payroll software that provides customisable HR letters such as offer letter , appointment letter , relieving letter , and more.

Not just that, it also comes with in-built tools that quickly calculate the take-home salary and CTC for employees.

It helps manage employees across their lifecycle from onboarding to exit along with their full and final settlement. Sign up for RazorpayX Payroll for free. You can choose from 3 different plans that fit your specific business needs.

Payroll Software

What is Payroll

Payroll Process

Payroll Management

Leave Attendance Management

Attendance Management System

HR Software

1. Why are appraisals essential?

Appraisals are essential because they allow organisations to recognise and reward employees who contribute to their success. Such recognition motivates the employee to perform better, resulting in the organisation's overall growth.

2. How often should appraisals happen?

The frequency of appraisal depends on company policies and standards. It can happen at different periods, such as annually, half-yearly, or quarterly.

Liked this article? Subscribe to our weekly newsletter for more.

Alish is a writer at RazorpayX. Zoophilist. Coffee Addict. And now a FinTech enthusiast. When not writing you'll find her learning French, taking a long walk (or run) with her dog, or Netflixing.

Related Posts

Leave Encashment – Meaning, Calculation, Tax Exemption

Promotion Letter Format – Download Free Word Templates

Appreciation Letter to Your Employees – Free Downloadable Template

Welcome Letter for Your New Hire – Download Free Word Samples

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Type above and press Enter to search. Press Esc to cancel.

Performance Appraisal Letter

[Performance appraisal is an assessment of an employee’s performance and an understanding of a person’s potential for future growth and development. In a professional setting, these letters are commonly referred to as performance letters. The goal of drafting a performance appraisal letter is to communicate with someone about their performance in writing or in person. An appraisal letter is a rung on the ladder of success for an employee, and it also decides his pay raise. Supervisors share performance appraisal information after studying the elements influencing workers’ work performances. This can also boost his motivation to produce better work till the next appraisal period.]

Receiver/Employee name…

Job Designation and Department Name…

Date: DD/MM/YY (Date on which letter is written)

Sender/Your Name…

Sub: Performance Appraisal

Dear Mr. (Name of the person),

After reviewing you performance of last year sales target, management has decided to offer you an increment of (amount) which will be effective from (date). (Describe in your words). This letter serves as your final appraisal and a copy of the same is being sent to the payroll department for further proceedings. (Describe all about the situation).

It is a pride for us to have an employee like you who has taken the organization’s success to greater heights. (Express performance appraisal information). We hope that you will continue to work with the same dedication in the future also. (Cordially describe your greetings). If you have any doubts regarding your increment, please feel free to contact me or visit me personally.

Yours sincerely,

Contact Info. and Signature…

Another Format, [Email Format]

From: sender mail address, [email protected]

To: receiver mail address, [email protected]

It is a privilege for me to write this letter to you. (Describe in your words). Employees like you who work with sheer dedication are an asset to the organization. (Describe all about the situation). I am feeling very proud to mention that the company has decided to give you a raise in your salary by 35%. (Money amount). I have gone through your performance chard and was surprised to see that you have always achieved your target well on time and sometimes even exceeded the same also.

Your increment will be valid from the 7th of next month, and I am forwarding this copy of the appraisal letter to the payroll department also. (Express performance appraisal information). If you have any doubts regarding your increment, please feel free to meet me in person. (Cordially describe your greetings).

Yours truly,

Contact Info…

Letter format for Employer’s Verification on Loan Applicant

Sample Leave Application for One Month from Office

Sample Reference Letter for Internship

Sample Job Experience Letter for Marketing Executive

Report on Pharmaceutical Marketing of Orion Laboratories Ltd.

Copper sulfate – an inorganic compound

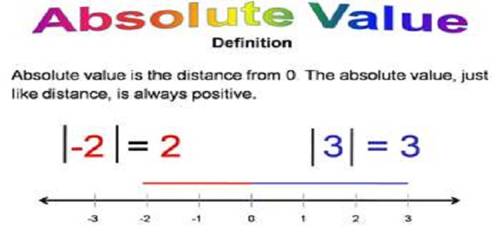

Absolute Value of a Number

Capital market in Bangladesh

Airbus 340 Plane Lands in Antarctica for First Time In History

Define on Employers of Choice

Latest post.

Overvoltage – in Electrical Engineering

Dynamic Frequency Scaling

Dynamic Voltage Restoration (DVR)

Behavior of Marine Plankton may Forecast Future Extinctions

200,000 Years Ago, Two Species Interbred to Generate a New Butterfly Species

Concentrator Photovoltaics – a photovoltaic technology

COMMENTS