December 14, 2020

19 min read

Kidney Dialysis Is a Booming Business—Is It Also a Rigged One?

A new California law aims to curb what sponsors say is profiteering by dialysis centers. But are there any easy answers?

By Carrie Arnold & Larry C. Price

Jo Karabasz knew her dialysis clinic well. Before switching to at-home treatment this summer, the former high school English teacher spent five and a half years visiting some of the dozens of DaVita dialysis clinics that dot the Northern California landscape. Her beige chair in the front corner of one clinic, where she attended appointments three times a week, quickly became her home away from home.

Since she was diagnosed with kidney failure in 2015, Karabasz has had around 820 in-center treatments, where a hemodialysis machine does the job her kidneys no longer could, filtering waste and excess fluid from her bloodstream. (She says she nicknamed her machine “Rocco, My Robot Kidney.”) Each treatment takes about four hours, which translates to around 4.5 months of Karabasz’s life spent in a dialysis clinic chair.

Holidays, wildfires, earthquakes — she says none are as important as her dialysis. Even a single missed dialysis treatment can create major health problems. If Karabasz were to miss two treatments, she could be dead before the third, as fluid would accumulate in her body and make it hard to breathe. In her last days, she could experience vomiting and confusion before her heart eventually stopped beating.

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing . By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

Jo Karabasz

Karabasz says she’s handled a lot in her 58 years of life, but when it comes to her dialysis, she needs things to go smoothly. “Just don’t fuss with me,” she said.

So when one of the DaVita staff told Karabasz in the spring of 2019 that a new California bill could jeopardize the financial assistance she received from the American Kidney Fund (AKF), the nonprofit that helps to pay for her treatments, she felt the floor drop out from under her. “I just sat there in stark terror. Like, you have got to be kidding. Why are they doing that?” Karabasz said. “Why does the California Legislature care if the Kidney Fund helps me?”

This series is a co-production between Undark and Scientific American and was supported by a reporting grant from the National Institute for Health Care Management Foundation .

They cared, proponents of the bill say, because they believed companies like Denver-based DaVita were gaming the system. Gov. Gavin Newsom signed Assembly Bill 290 (AB 290) in October 2019. The bill requires dialysis centers to charge Medicare rates, or a rate determined by a dispute resolution process , for those receiving financial assistance from the American Kidney Fund. It also mandates that the charity furnish the names of all the people it is supporting to insurers. Shortly after the bill passed, Karabasz received a letter from the AKF saying that it would no longer be paying her premium assistance because it viewed AB 290 as being in conflict with its federal operating guidelines.

According to a January 2019 press release from legislator Jim Wood , the Santa Rosa Democrat who introduced AB 290, the bill was designed specifically to prevent companies like DaVita from “increasing their already excessive corporate profits through a scheme to bankroll patients’ health care premiums.” Democratic Sen. Connie Leyva proposed a similar bill in 2018 that was vetoed by then-Gov. Jerry Brown.

The scheme, according to Wood and other critics, works something like this: Nearly everyone in the U.S. with end-stage renal disease is eligible for coverage by Medicare, even if they are under age 65. The federal program pays a fixed cost of about $240 per treatment. Patients receiving Medicare pay an annual deductible, after which they continue to be responsible for a 20 percent co-payment, or about $48, for each visit.

Patients with private insurance, however — including those with health benefits paid for by their employers — are a different story. Those insurance companies must negotiate payments with for-profit dialysis centers, and research has suggested that the centers have an edge in those negotiations — one they use to jack up prices. One research letter , published last year in the Journal of the American Medical Association, Internal Medicine, found that private insurers paid, on average, over $1,000 per treatment — roughly four times Medicare’s fixed costs.

One possible reason: More than 80 percent of dialysis patients receive their treatments from either DaVita or Fresenius Medical Care, which is headquartered in Germany, giving the two companies upwards of 80 percent of the $24.7 billion American dialysis market — and significant influence over the prices charged to private insurers. What's more, both are widely known to donate hundreds of millions of dollars to the American Kidney Fund, covering the vast majority of the nonprofit’s budget. That's a problem, according to Wood. With the help of the American Kidney Fund, after all, more patients are able to stay on private insurance longer, so both companies have an incentive to keep the AKF well-funded. More patients with private insurance means DaVita and Fresenius can bill much higher prices for their dialysis services — and pad their own bottom lines.

Jo Karabasz and her husband Larry, at their home in Sacramento, California.

Credit: Larry C. Price

Karabasz undergoes home hemodialysis in a small spare room containing a lounger, a TV, and a dialysis machine.

Karabasz is a caretaker for her two grandsons, Rewia and Anthony, and is able to continue teaching by helping with remote schooling this year.

According to Wood, for every dollar DaVita or Fresenius donates to the American Kidney Fund, they get roughly $3.50 in return from private insurers. No wonder, then, that the two dialysis giants, which together earned about $2.2 billion in net income in 2019, reportedly donated $247 million to the nonprofit organization in 2018 — roughly 80 percent of the fund’s annual budget that year. (AKF’s own financial documents do not name the companies outright, instead referring to two unnamed corporations. When asked to confirm the identity of these donors, Tamara Ruggiero, a spokesperson for the organization, said the AKF was barred from doing so by rules established by the Inspector General of the Department of Health and Human Services — ironically to “ensure that patients are not unduly influenced in their choice of dialysis providers.”)

Wood has called this an all-out scam, but Fund representatives have pushed back against such characterizations, saying that the new law would make it impossible for them to aid California residents. Only an 11th-hour preliminary injunction — granted in December of 2019 by a U.S. district court in response to motions from the Fund, as well as from DaVita and Fresenius, among other petitioners — saved Karabasz’s monthly assistance.

Representatives of both Fresenius and DaVita declined repeated requests to make company officials available for an on-the-record interview for this story. In a prepared statement supplied by Alicia Patterson, a DaVita communications manager, the company suggested that Wood’s bill would deny thousands of Californians crucial health care assistance. “We will continue to advocate against this harmful law, while at the same time remain focused on providing high-quality care for our patients,” the company said. And in a statement attributed to Fresenius spokesperson Brad Puffer, that company said it aims to provide care to all patients regardless of insurance provider, and that the injunction blocking implementation of AB 290 was instrumental in allowing patients to continue accessing the care they need. “The ongoing focus on this issue does nothing to help improve overall patient care,” Puffer added, “and our goal to help more people gain access to transplant and home dialysis treatment.” No final ruling on the legislation has yet been made, leaving the ultimate fate of the American Kidney Fund’s financial support in California in limbo — something that LaVarne Burton, the president and chief executive of the American Kidney Fund, suggests is part of the problem. Burton said that her organization had repeatedly asked the legislators, “If you don’t want the American Kidney Fund to assist these patients, what are you going to do to make sure that they get access to health care? “There was never a plan,” she said.

For patients like Karabasz, these concerns are far removed from the ongoing, immediate need for dialysis. Karabasz says she doesn’t deny that DaVita might be benefitting from their donations to the Kidney Fund, but then, so is she. And she could not, she insists, afford her insurance premiums without their help, meaning that losing American Kidney Fund assistance would be a matter of life and death.

Health economist Paul Eliason of Brigham Young University argues that remedying the conflicts of interest inherent in the relationship between the Fund and for-profit dialysis clinics would clearly benefit society at large in terms of lower health care costs, at least in the short-term. But he added, it remains to be seen whether these conflicts actually harm patients.

“I do think that by limiting profits to these companies, you'll actually probably see less growth of the big chains — DaVita, Fresenius — in California,” Eliason said. “And that’s going to be good in some ways and bad in some ways. I think that will probably mean there will be less access to care and patients may have to travel farther and be treated in more crowded facilities.”

In 2016 nearly 125,000 Americans started treatment for end-stage renal disease. Whether due to a genetic disorder like polycystic kidney disease or the result of damage from diabetes and high blood pressure, a diagnosis of chronic kidney disease means that the kidneys struggle to filter waste and extra water from the blood. Until the kidneys fail completely, many people have no symptoms that anything is wrong. At this stage, chronic kidney disease can only be diagnosed by a blood or urine test.

For Bernard Zachary, 51, of Modesto, California, who spent his adult life working in construction, heading to the doctor when he was feeling fine seemed like an invitation for trouble. “I was always working and I was always told to get a doctor’s appointment, and I didn’t want to create a doctor bill or anything,” he said.

Bernard Zachary

But in February 2016, after dealing with persistent swelling in his feet, Zachary headed to the hospital. Tests showed he had high blood pressure and that his kidneys had failed. Zachary needed dialysis right away. He opted for a treatment called peritoneal dialysis, which uses the blood vessels in the abdomen and a cleaning fluid called dialysate. This allows Zachary to do his treatments at home every night while he sleeps, rather than going to a clinic several times each week.

DaVita provides the equipment and medical support for his dialysis.

Studies suggest that somewhere between 23 and 38 percent of people with kidney failure "crash" onto dialysis like Zachary , meaning they start it in an unplanned way, with little or no prior care from a kidney specialist. Many of these individuals are too sick to work full-time at this point. Others, like Zachary, could potentially remain employed but dialysis gets in the way. The physical labor of his construction job would dislodge his dialysis catheter, so he had to quit. Karabasz knew for years that her kidneys were failing and left her job preemptively to pursue tutoring with her husband. As it does for so many Americans, the loss of their jobs meant the loss of employer-sponsored health insurance.

Indeed, because end-stage renal disease was so often accompanied by unemployment, Congress passed a law in 1972 that made patients who also qualified for social security eligible for Medicare three months after diagnosis, even if they were under 65, the age when Medicare typically kicks in. An amendment to a later act required that everyone with end-stage renal disease use Medicare as their primary insurance 30 months after diagnosis. Given that only one-third of those on dialysis survive for five years, those first 30 months are where companies like DaVita and Fresenius earn their profits — and it’s the key window they spend millions fighting for. According to data supplied by AKF, roughly a quarter of its insurance assistance recipients were on employer-provided or otherwise private insurance in 2019.

At first, Karabasz and her husband managed to scrape together nearly $835 per month to continue with her existing Kaiser Permanente insurance from teaching, but the financial strain caused her depression to spiral. Maybe, she says she began thinking, her family would be better off without her. A social worker at her dialysis center noticed her low moods and increasing despondence, and Karabasz eventually confessed everything. The social worker paused, then asked if she’d heard about the American Kidney Fund.

Now 51, Bernard Zachary discovered he had kidney failure after seeing a doctor for persistent swelling in his feet in 2016. Zachary goes to bed each night hooked up to a dialysis machine that he sets up himself.

Zachary spends about an hour each evening before bed prepping the dialysis machine, logging his weight and vitals, and attaching the machine to an abdominal catheter.

Founded in 1971, the AKF began as a small group of people raising money for a friend who needed help paying for dialysis. In the nearly half-century since, it has become one of the country’s largest nonprofit organizations, providing funds to dialysis patients to defray the costs of insurance premiums and other associated expenses. To date, Burton says, the organization has been able to assist everyone who meets its eligibility requirements, which is currently households whose income doesn’t exceed expenses by more than $600 per month, and whose assets total no more than $7,000, not including a patient’s primary vehicle and home, retirement accounts, and basic household items.

Karabasz easily met those requirements and began receiving help almost immediately. To her, it changed everything. “I was very grateful to them and felt confident and secure with them,” she said. “So it seemed that getting help to pay that bill was what was going to work for me. Thank God that that help was available.”

Karabasz is one of more than 80,000 low-income Americans — 3,700 of whom are in California — who receive help from the American Kidney Fund each year. On the surface, the arrangement seems copacetic: a charity helping low-income chronic disease patients receive life-saving treatment. But both lawsuits and the California legislation have challenged this rosy view of the Fund and its work.

In the 1970s, when the AKF was founded, outpatient dialysis was fairly new and the industry was small. Medicare coverage expanded the number of people who could afford dialysis, and increases in the prevalence of diabetes and hypertension, along with an aging population, meant that the number of people who needed dialysis also rose. In 2018, more than 500,000 Americans were receiving some sort of dialysis treatment, according to data from the United States Renal Data System (USRDS). At first, many providers were small and independently owned. Beginning in the late 1990s, two early leaders in dialysis, DaVita and Fresenius, began to buy out smaller clinics.

By gobbling up individual clinics, one by one, the companies could avoid federal oversight of corporate mergers, which generally only kick in when an acquisition is valued over a certain amount. Before 2001, that threshold was $15 million. Today, it sits at $94 million.

University of Chicago economist Thomas Wollmann, photographed in a recent video call. Wollmann says he knows of one area in Texas that has two dialysis clinics right next to each other. “If one buys the other one, that’s devastating to competition,” he said, “because it’s basically a merchant monopoly.”

The problem, points out University of Chicago economist Thomas Wollmann, is that dialysis clinics serve a local clientele. Plenty of competition in New York doesn’t tell you anything about the situation in South Dakota. Wollmann says he knows of one area in Texas, for example, that has two dialysis clinics right next to each other but nothing else for 60 miles in any direction. Each clinic may only be valued at $3 million or $5 million, which is far below the number the Federal Trade Commission is worried about.

But “if one buys the other one, that's devastating to competition because it's basically a merchant monopoly,” Wollmann said. According to a recent National Bureau of Economic Research working paper he authored, of the 4,000 facility acquisitions dialysis providers proposed between 1997 and 2017, about half were exempt from reporting.

As large chains, DaVita and Fresenius have more ability to negotiate prices down for drugs and other needed supplies. This has increased their profit margins and made them able to buy up even more mom-and-pop clinics. Today, the two companies own some 70 percent of U.S. dialysis clinics.

The dramatic drop in competition, research suggests, was amplified by declines in quality of care. An analysis of 1,200 acquisitions over 12 years, conducted by Brigham Young’s Eliason and colleagues, showed that large chains replaced high-skilled and high-cost nurses with cheaper technicians and increased the patient load of each employee by 11.7 percent. That analysis, published in November 2019 in The Quarterly Journal of Economics , showed that the number of patients treated at each dialysis station also rose by 4.5 percent. As a result, patient care quality dropped. They found fewer kidney transplants, higher rates of hospitalization, and lower rates of overall survival among dialysis patients at for-profit clinics.

“What we're seeing in the market, I think, does have an influence on the care patients receive,” said Kevin Erickson , a nephrologist and health policy expert at Baylor College of Medicine in Houston.

Dialysis centers acquired by large chains, Eliason and his colleagues’ research found, also used larger amounts of expensive, injectable drugs used to treat anemia, as most chronic kidney disease patients have a reduced ability to produce new red blood cells. Like all drugs, these injectables can have side effects, including increased risk of heart attack and death, especially when patients receive too high of a dose. According to a 2005 financial document from DaVita , these injectables, along with vitamin supplements, formed 40 percent of the company’s total dialysis revenue. Eliason and colleagues found that the doses of one such drug, Epogen — or epoetin alfa, as it’s called generically — increased by 129 percent after an independent clinic was acquired by a large chain.

“We’re able to look at the same patient in the same facility before and after it's acquired by one of these big companies, and we see that for that patient, their [Epogen] doses just skyrocket,” Eliason said.

But in 2011, when Medicare implemented a system that lumped payment for dialysis in with the drugs used during treatment (thus removing the financial incentive to over-prescribe), dosing of epoetin alfa plummeted.

The need for and use of expensive prescription medication is just one reason that treating end-stage renal disease is so costly. In 2018, according to the USRDS, Medicare paid $31.3 billion in fee-for-service expenditures — where the government pays providers separately for each service provided — to treat the more than 500,000 dialysis patients in the U.S. Although kidney failure patients comprise just around 1 percent Medicare’s fee-for-service population, they represent 7.2 percent of such Medicare expenditures. The high medical costs of people with kidney failure is one of the reasons that Burton suspects the insurance industry supported AB 290, since it would mean they had to pay less to dialysis centers. And of course, offloading expensive kidney disease patients onto government insurance would increase their own profit margins.

When insurers set their premiums, she said, “they’ve already factored in that they will have people with kidney failure, with cancer, with heart disease who are more expensive. If they can factor that into their premium and then get those people off of their insurance, their profits go up even more.”

But it was the use of American Kidney Fund assistance to potentially bolster the profit margins of the dialysis companies that first triggered the fight in the California legislature.

There are currently more outpatient dialysis clinics in the United States than there are Burger King restaurants, and the prevalence of these clinics confirms to critics like Wood that dialysis is a massive and, from his perspective, inordinately profitable business. “Profiteering at the expense of patients and the public is immoral and it should be seen only for what it is — a self-serving scam,” he noted in a press release in January of last year.

In that release, Wood stated that the donations DaVita and Fresenius make to the American Kidney Fund are used to steer patients toward higher-premium commercial insurance plans. Since these insurance plans give dialysis clinics like DaVita and Fresenius more money per treatment than Medicaid and Medicare, getting as many privately insured patients as possible directly benefits their bottom line.

Erickson had a similar perspective. “My guess is there is a large, strong incentive for any dialysis organization, whether it's profit or nonprofit," he said, "to attract patients who are privately insured, where they can potentially receive those higher private insurance reimbursements for up to 30 months.”

It doesn’t take a lot of people to make a big difference. A 2019 analysis in JAMA Internal Medicine by researchers including Gerald Kominski, a health policy professor at UCLA, showed how even a small number of privately insured patients could bolster the industry. In 2017, commercial insurance paid DaVita an average of $1,041 per dialysis treatment, compared to $248 for government insurance. That adds up to $148,722 each year for a privately insured patient versus $35,424 for one on Medicare or Medicaid, the study showed. Although this study didn’t look into financial assistance from the AKF and why dialysis corporations might donate, Kominski suggests that the motivation is apparent. “My guess is that they get a very large return on their investment,” he said, “— many, many dollars back for every dollar they spend in premium support.”

Having to pay providers so much extra money for the same care should leave commercial insurers in the red, but that’s not the case, Kominski explains. Private insurance also wants to maximize profits, but they can use different strategies to increase revenue, such as increasing premiums. Reimbursing at higher rates isn’t a problem for commercial insurers because they don’t face the same pressures as public insurance to keep costs low. Instead, they can just extract more money from their customers in the form of higher premiums.

Noting the rising cost of health care as a persistent problem, Wood’s communication director, Cathy Mudge, wrote in an email that the assembly member has worked on other legislation to curtail it. With AB 290, she wrote, the aim is to rein in the excessive profits that dialysis corporations like DaVita and Fresenius are making at the expense of the general public.

The legislation would force everyone to play by the same rules by requiring recipients of American Kidney Fund grants to have their dialysis reimbursed at Medicare rates, even if they have private insurance. Although AKF says dialysis clinics have no influence over which patients receive its assistance, a whistleblower lawsuit unsealed in Massachusetts in August 2019 supported Wood’s assertions that DaVita, Fresenius, and others were using AKF for their own financial gains. And with so much of the dialysis market controlled by these two large corporations, they don’t need to do very much to benefit from their AKF donations. Simple probability says that anyone on dialysis is likely to be served by a DaVita or Fresenius clinic because they control so many facilities, Eliason says.

Of AB 290’s stalling, Wood wrote in a statement provided to Undark: “This injunction and the year-long delay of the court case are consequential because it emboldens the corporate duopoly of Fresenius and DaVita to continue to gouge the health care system to increase their profits.”

The high financial stakes of California’s efforts to regulate the dialysis marketplace have been apparent in the amounts spent by lobbyists. Records from the California Secretary of State showed that dialysis corporations forked over upwards of $110 million via the California Dialysis Council in 2018. The spending spree began with 2018’s Proposition 8, which sought to cap dialysis profits at 15 percent above the cost of care, and continued into the debate over AB 290. They provided even more by bankrolling an industry-backed group called Dialysis is Life Support, which created videos and ran ads on CNN and other outlets.

Kathy Fairbanks, a spokesperson for the organization, says that the companies were just looking out for their patients. When asked whether corporate lobbying could really be motivated by goodwill alone, Fairbanks suggested the question was “cynical,” adding that “if the end result is that patients will be better off with the defeat of AB 290, that really from our perspective, that’s the end goal.”

Whatever the reality, the relationship between the American Kidney Fund and major for-profit dialysis providers seemed destined for greater oversight in the passage of AB 290 — though the Fund and its supporters saw at least one avenue to fight back: When former President Bill Clinton signed HIPAA into law, it included rules that barred treatment providers from waiving co-insurance and deductible costs for patients on Medicare or Medicaid, or providing “items and services for free or for other than fair market value,” while allowing for various exceptions.

To ensure that grant-making organizations like the AKF didn’t run afoul of these new rules, the Fund asked the Department of Health and Human Services’ Office of Inspector General to review its practices. In a 1997 advisory opinion , the OIG stated that the Fund could continue to accept donations from dialysis providers as long as it didn’t use information about donation amounts, nor which company’s clinics a patient was utilizing, as criteria for distributing assistance. The AKF says it has strictly operated under this guidance since it was issued and does not provide the names of patients who receive assistance to its donors or to insurers.

When AB 290 required the AKF to provide a list of grantees to health insurance companies, Burton said this would directly violate the advisory opinion guidance and so they would have to stop helping California residents. “The legislature by their action gave us no choice,” Burton said. “In order to protect patients in California, and to protect the patients that we serve throughout the country, we had no choice but to go back and to file suit against the state of California.”

The problem with the 1997 guidance, according to Rep. Katie Porter, a congresswoman for California’s 45th District, is that the dialysis market looks vastly different now than it did back then. In a July 2019 letter, she urged Joanne Chiedi, then-acting inspector general for HHS, to suspend its guidance and conduct an investigation into the AKF’s relationship with dialysis providers. Some insurers already do know which of their customers receive premium assistance from the AKF, since the AKF directly pays the bills for some of its grantees. The organization says that this is done with patient knowledge and consent, unlike the list that would be required under AB 290. ( The bill specifies that it would ensure its provisions are not in violation of any federal privacy law.)

In granting the preliminary injunction against AB 290 — two days before it was set to become law — Federal Judge David Carter of the Central District of California was apparently unconvinced. The state had not shown that American Kidney Fund assistance increases health care premiums, Carter held, nor had it shown any evidence of patient steering. The initial trial, scheduled for late spring, has been postponed and no final verdict has yet been reached.

All of this has left patients like 41-year-old Brian Carroll feeling caught between the AKF’s assistance and AB 290. Unable to work because of his kidney disease, a rare condition called focal segmental glomerulosclerosis that causes scar tissue to form in the kidneys, Carroll lost access to his private insurance. After going on Medicare and later seeking out his own secondary insurance, he was forced to move back in with his parents in December 2016 to afford his premium.

Brian Carroll

Carroll has since received a kidney transplant and hopes to soon be healthy enough to go back to work. While the assistance he receives from the American Kidney Fund will run out at the end of the month, he said, “every little bit helps.”

Although Carroll is grateful for the funding he’s received, the idea that DaVita and Fresenius can pad their bottom lines using the American Kidney Fund makes him livid. Unlike Karabasz, who blames AB 290 and those behind it for the uncertainty of her position, Carroll says some responsibility falls on the American Kidney Fund. “If you can still support 49 other states and dialysis patients, and you can’t support California, I don’t understand,” he said.

Even with the preliminary injunction in effect, Carroll says the fund had begun requiring more frequent paperwork to verify his income and dialysis status. Whereas he used to fill out forms once a year, he says he began having to complete the documentation every few months. “You always have that dark cloud of ‘Is this going to be the last time that they do this?’” he said reflecting on the assistance he’s received.

Brian Carroll, a recent kidney transplant patient, at home recovering from surgery. Carroll waited for a kidney for almost five years while on dialysis. Carroll enjoys playing the coronet and goes on limited outings a couple of times a week. He hopes that soon he will be healthy enough to go back to work.

Carroll waited for a kidney for almost five years while on dialysis. To continue receiving financial assistance from the American Kidney Fund through the end of the year, Carroll has had to submit paperwork every few months.

In DaVita's emailed statement, the company said “Should Assembly Bill 290 be implemented, it will affect nearly 4,000 low-income, primarily minority, California dialysis patients who rely on charitable support to pay for their health care costs. We believe the law threatens to harm California citizens who need dialysis to survive and that it is unconstitutional; due to this we joined a legal challenge and are pleased the court issued a preliminary injunction preventing the implementation of AB 290."

Erickson, meanwhile, argues that no decision around AB 290 will result in a perfect system. “As the government comes up with policies to try to regulate private insurance markets to keep prices down, there are trade-offs,” he said. “And, in this case, if a law like this does keep the prices of private insurance down, it might do so at the expense of some of the patients who would benefit from this financial support that they no longer have access to.”

Karabasz says she has no problem with DaVita making a profit. “I don't have time for them to reorganize and rethink how it's done,” she said. “I have two days. And if I don't get my treatment in two days, my life is on the line.”

- News & Research >

- KidneyViews Blog >

It’s (Past) Time to Destroy the Dialysis Business Model

At a late afternoon appointment in June with my wife Jane’s nephrologist, we described our planned trip to Hawaii the following week with our family to celebrate our 50 th wedding anniversary. Jane’s blood pressure was very high, and she had been quite sick, but she had been looking forward to the trip. Her doctor looked at Jane for a long moment and then said, “ I’m sorry, but you can’t go. We are going to have to get you started on dialysis .” Jane and I were stunned and could say nothing. We both had known, of course, this day would come—just like we knew we would someday die —but had suppressed it in our minds for more than 10 years as Jane’s kidneys had slowly deteriorated.

He broke the silence and began to describe the options and preparations, but it was all a haze. Neither of us understood any of it. I finally said, “ If it were you, what would you do? ” He answered, “My partners and I actually discuss that among ourselves. If it were me, I would do hemodialysis overnight at home six nights per week—nocturnal dialysis, it’s called. ” I looked at Jane and could tell she could not answer, so I said, “ Okay, that’s what we’ll do .” I had no idea what I was talking about.

I used to wonder how the breast cancer folks could get every player in the National Football League to wear something pink on a given Sunday in the fall: pink socks, pink gloves, or whatever, to rally millions of fans to support breast cancer research. Why was there nothing even remotely similar on behalf of patients whose kidneys have failed and have an even grimmer survival outlook? I don’t even know what color might be symbolic of kidney disease. I put the answer down to the fact that kidney disease is a huge for-profit industry: dialysis services companies, machine manufactures, for-kidney disease drug manufacturers, and even some nephrologist-owned for-profit dialysis centers.

The whole structure was built on a single business model: in-center kidney dialysis treatment for 3-4 hours three times per week; a model still intact for 90% of all dialysis patients and still accepted as the “standard of care” by most nephrologists . Sometimes referred to as “minimally adequate,” this model undergirds the dialysis services, machine and drug industries, and has created many highly regarded growth companies. Warren Buffett, widely regarded as the most successful investor in America, has a substantial position in one of the major dialysis services firms.

I believed (and still believe) all of this to be true—except that this explanation does not offer an answer for patients with end-stage renal disease. My attempt to draw a breast cancer analogy with kidney failure has two serious flaws. The first is that the answer for ESRD patients does not need to await more research. Yet, have you ever noticed that nine out of ten papers in the nephrology literature end with some variant of the statement, “More research is needed”?

Do you remember the old saying, “ Do as I say, not as I do ?” It must be part of the received wisdom during nephrology training: nephrologists prescribe standard in-center hemodialysis for 90% of their dialysis patients. But when asked what they would do if their own kidneys failed, only 6% of nephrologists would choose that option .

Why the near total disconnect? This is not some just-published revelation. It is the knowledge—known for decades and repeatedly confirmed—that time is the single most important determinant of dialysis efficacy—treatment length and treatment frequency .

One of the best books of 2015 is Simple Rules by Donald Sull (MIT) and Kathleen Eisenhart (Stanford). They demonstrate through rigorous research how the overwhelming complexity of the modern world can be managed through simple rules. One simple rule they describe is how to diagnose children with serious infections. These infections are rare, occurring in less than 1% of children, but account for 20% of childhood deaths. The challenge is to assure that primary care physicians don’t miss one in a 20-minute encounter. A European research team boiled 1,860 studies down to just four highly reliable signals: convulsions, reduced consciousness, rapid breathing, and slow capillary refill.

Thirteen years ago Belding Scribner, among the most respected nephrologists in dialysis history, and his colleague, Dimitrius Oreopoulos, defined dialysis efficacy with a simple rule for comparing dialysis treatments: the Hemodialysis Product or HDP . The HDP is calculated by multiplying a single treatment time by the number of treatments per week squared. The higher the HDP, the better the treatment. HDP is simple, but not simplistic; it effectively summarized their experience and most dialysis research before 2002 and anticipated much that would follow.

For example, dialyzing every other day instead of thrice weekly would eliminate a day when deaths are known to double compared to single “off days”—and HDP goes from 27 to 37 . Increasing treatment time and frequency more can reduce, and (with enough time), even eliminate the rotten, wiped out post-dialysis feeling, diet restrictions, need for phosphate binders, multiple blood pressure pills, risks of cardiac stunning, middle molecule buildup, and more. In short, more is better —and the HDP estimates how much better any dialysis schedule might be. Increase conventional in-center dialysis from 3 to 4 hours and the HDP goes from 27 to 36. Three hours per day for five days per week? 75. If you go to 8 hours each night for six nights each week, you get an HDP of 288! Remember, this is about your life about your life—pick a number…

The Scribner and Oreopoulos HDP is an empirical rule, not a fundamental law of nature, but you get the idea. More is better , and a lot more is a lot better! The path to feeling well and living long as a dialysis patient is clear, and it must make nephrologists uncomfortable to admit they would use longer, more frequent dialysis for themselves—but not prescribe it for their patients.

Why would it make nephrologists uncomfortable to make this admission? It is not just that they are aware that survival of American dialysis patients is the worst in the developed world. It is because once they admit that session length and frequency are the crucial variables, they must admit that the standard in-center dialysis model is broken , because it implicitly assumes dialysis treatment time and frequency are constants —not variables—in the survival and well being equation .

When they say it’s not about money, it is about money . In the United States, about 2% of Medicare patients are on dialysis, but they consume almost 8% of the Medicare budget. Government pressure on dialysis providers is relentless and is already driving many non-profit providers (including hospital-based who have union contracts, and thus higher wages) out of business. There is simply no way for-profit providers or the government can acknowledge clinical arguments that treatment times need to be longer and treatments more frequent without initiating destruction of the present business model. But, business models are destroyed every day and the time has come to destroy this one .

Changing the U.S. dialysis paradigm may seem like an impossible goal, but I believe it can be achieved if each party, nephrologists, dialysis providers, government and ESRD patients, does what they can do best. First, nephrologists must take out their pads and start writing prescriptions for their ESRD patients for optimum dialysis (I didn’t say “ adequate .” We don’t talk about “adequate” breast cancer therapy) based on currently available evidence and technology, including treatment time and frequency . Nephrologists are the one of the four parties who can reasonably be expected to have command of this knowledge and have a professional, ethical and legal responsibility to fully employ it in each of their patients behalf to give them the highest quality and longest life this knowledge can provide; no different than an oncologist’s responsibility to his breast cancer patient… and no less.

But, there is a second crucial difference (and flaw in my analogy) between a breast cancer patient and a kidney failure patient. At diagnosis, a breast cancer patient feels well , despite a potentially grim future. But when kidney disease progresses to the point when discussion about the elephant in the room— dialysis —can no longer be postponed, most patients are already very sick. Both are scared, but the breast cancer patient may be able to enter into a level of rational discussion with her oncologist about the tradeoffs between surgery, radiation, and chemotherapy. To attribute a similar capacity for rational choice to a sick Stage 5 chronic kidney disease patient is simply wrong. Any discussion of standard in-center dialysis, every other day dialysis, peritoneal dialysis, short daily dialysis, nocturnal dialysis, live donor transplant, cadaveric transplant and the various permutations and combinations is just a blur . And, add to this that some of these therapies, including some of the best ones, require a sick patient (and partner) to commit to assuming the burden for care delivery at home! Expecting rational choice in this circumstance is ludicrous…and one result is that nine out of ten patients simply default to standard in-center hemodialysis—arguably, the worst choice. It is up to any responsible nephrologist to take what he knows that would guide his personal choice in the same clinical circumstance, integrate that knowledge with relevant patient-specific factors, lead his patient (and partner) to the most rational decision and write that prescription .

Dialysis providers may initially try to accommodate longer, more frequent prescriptions by schedule juggling, but as the number of prescriptions for longer and more frequent treatments increases, other strategies (beyond trying to dissuade nephrologists) will be required. These big, for-profit providers are managed by very smart people. They are quite aware that to remain profitable, the only available option to provide extended dialysis for more than a few is to successfully switch people to home care. No businessman likes to obsolete his own investment, but it happens sooner or later in most industries. The only real question is whether you do it to yourself or watch somebody else do it to you As a dialysis provider, will you honor the dialysis prescription you receive—or will it be honored by a more far-sighted competitor? (I drove by an abandoned video rental store just yesterday). And remember, increasing treatment times and frequencies will ultimately translate into increasing revenue and net income as patients live much longer.

It is the unique responsibility of the nephrologist to candidly explain to the patient the benefits of the prescription he has written and the effect on survival and well being of not following it. It is a matter of life and death. Then, it will be up to the dialysis providers, in their own self-interest, to train and support every qualified patient (basic criteria: mental and physical capacity similar to that required to safely drive a car, suitable abode, and a helper) for whom a longer or more frequent prescription has been written to go home and stay home. If a patient has to come back in center, the added cost will come off the company’s bottom line. Home dialysis is their only choice as a future business model, because it provides largely free labor, facilities, and utilities that are only partially offset by added supply costs for extended dialysis.

Finally, incident dialysis patients will no longer be taught that dialysis is a lifestyle choice. On the contrary, it is a wellbeing and survival choice. Instead, they will be taught by their nephrologist, and reinforced by their center, that following their nephrologist's prescription will let them return very close to feeling as well as they once felt, and live many years longer than they could otherwise expect . Their job, together with their partner, is to assume the burden of dialysis at home. It is up to the patient to accept this advice. There are not many serious, life-threatening diseases—certainly not breast cancer—where a patient has a chance to personally make herself well again . Taking on that responsibility can be initially scary, sometimes even terrifying. But, after the first few months, there is an indescribably powerful feeling in knowing that you once again have control over your own life.

Is there a loser from this transformation of dialysis? At first glance, the government. Costs will go up as survival improves and the prevalent dialysis population grows. Government must eliminate the perverse limit on the number of weekly treatments that are reimbursed. Can you imagine the outcry if they tried saving money by limiting the number of doses of chemotherapy for a breast cancer patient? Better to limit the amount reimbursed per treatment to incentivize, not discourage, superior dialysis. And training time for home hemodialysis must be made realistic. The present inadequate allowance incentivizes providers to push patients away from home hemodialysis and toward peritoneal dialysis—a poor choice for most patients, with its unfavorable long-term survival outlook.

But at second glance, it is not so clear what the net effect would be. As dialysis patients feel better, complications lessen and they spend less time in doctors’ offices and hospitals, some health care bills will go down and more patients will return to work and pay taxes. The numbers who are invalids living off monthly government checks will fall. It remains to be seen where the tradeoff would wind up, but somehow, it doesn’t feel right to blandly ignore what Scribner and Oreopoulos taught and exploit avoidable disability and death to balance the federal budget.

How can all this ever be made to happen? The answer is actually very simple. All it takes is a caring nephrologist with a prescription pad, reminded of what he would do if he were in his patient’s shoes, to order optimum dialysis for his patient . Just as a medication prescription would be incomplete if it omitted dose or frequency—and seen as a medical error—a dialysis prescription should never omit treatment time and frequency. Let dialysis providers worry about how to make it all happen. I assure you they have seen this coming for years. They are quite qualified and have the knowhow and resources to deal with change, and know they will ultimately benefit from it. In short , the time has come for a new standard of care in dialysis.

Jane died last September—12 years and 3 months after that June appointment—at age 85. She had other major medical problems beyond kidney failure, including one to which her death was attributed. But during Jane’s years on 6x per week nocturnal dialysis at home, she had none of the symptoms of end stage renal disease or characteristic of conventional in-center dialysis, and no diet restrictions, no phosphate binders, no multiple blood pressure meds, and immediate recovery from treatment each morning. The question I had asked her nephrologist turned out to be a turning point in our lives. I am forever grateful for his answer.

So if you arrive at the point where your nephrologist finally acknowledges the elephant and gets out his prescription pad - ask him, “ If it were you, what would you do ? ” His answer may tell you how to save your own life…

Apr 19, 2020 12:15 AM

Reply to a Comment

Gary peterson.

Sep 16, 2015 1:14 PM

Sep 15, 2015 10:18 AM

Sep 21, 2015 4:12 PM

Sep 16, 2015 5:40 AM

Sep 14, 2015 11:47 AM

Sep 21, 2015 4:15 PM

Sep 11, 2015 8:37 AM

Sep 14, 2015 10:00 PM

Sep 11, 2015 10:14 PM

Sep 11, 2015 8:04 PM

Sep 11, 2015 6:40 PM

Sep 10, 2015 10:32 PM

Leave a New Comment

Kidney Dialysis Center Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business Plans » Medical and Healthcare » Hospital & Clinic

Are you about starting a kidney dialysis center? If YES, here’s a complete sample kidney dialysis center business plan template & feasibility report you can use for FREE to get started .

Okay, so we have considered all the requirements for starting a kidney dialysis center. We have analyzed and drafted a sample kidney dialysis center marketing plan backed up by actionable guerrilla marketing ideas for kidney dialysis centers. So let’s proceed to the business planning section.

There are vast business opportunities in the medical practice industry and a kidney dialysis center is one of them. This line of business is thriving in the united states of America and as such, if you are interested in starting a business in the medical practice industry, then you should consider opening your own kidney dialysis center.

When starting a kidney dialysis center, you are required to first look at the existing laws in the country or state you reside. This is because the health industry is usually highly regulated so as to guard against the infiltration of quacks or substandard health facilities.

You can start your kidney dialysis center business from a small town in the United States and if you are consistent and creative, it won’t be too long before your brand becomes nationally recognized especially if you go into franchising. Below is a sample kidney dialysis center business plan template that can help you to successfully write your own with little or no hassles.

A Sample Kidney Dialysis Center Business Plan Template

1. industry overview.

Kidney dialysis center falls under the Dialysis Center industry and players in this industry include medical facilities that provide inpatient and outpatient kidney or renal dialysis services and other related treatment and management.

If you are a close observer of happenings in the dialysis centers industry especially in the United States of America, you will notice that dialysis centers are expected to perform well over the five years to 2018, largely due to inelastic demand for their services.

The only substitute available for dialysis treatment is a kidney transplant, which typically entails many years of waiting and uncertainty. The industry grew significantly during the period because of the Patient Protection and Affordable Care Act (PPACA), which expanded healthcare coverage in the United States.

However, the increase in government payouts is also expected to dampen industry profit, as payments from the government typically take longer to receive. Over the five years to 2023, IBISWorld estimates that industry revenue will expand due to rising federal funding for Medicare and Medicaid and an aging population.

A recent report published by IBISWorld shows that Dialysis Centers in the United States are in the growth stage of their industry life cycle. Over the 10 years to 2023, industry value added is expected to grow at an annualized rate of 3.1 percent.

This exceeds US GDP growth during the same period, which is expected to expand at an annualized rate of 2.2 percent. One of the primary factors influencing this industry’s expanding share of the overall economy is related to regulatory overhaul in the healthcare industry.

As more patients gain access to health insurance, demand for the industry’s services is expected to increase. Furthermore, the US population is aging, and as people age, risk of kidney disease increases; kidney disease is often caused by diabetes and hypertension which are sometimes age related.

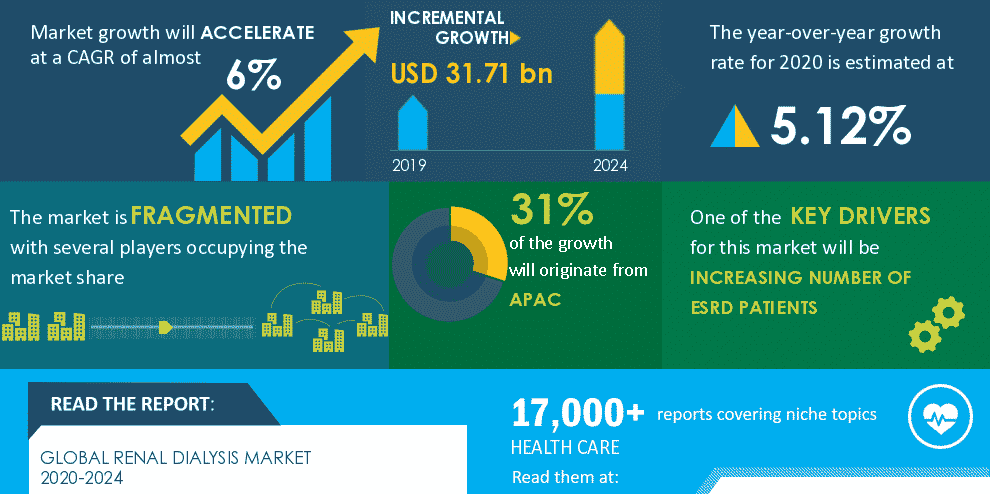

The Dialysis Centers industry is indeed a very massive industry in the U.S. Statistics has it that the industry is worth $24 billion, with an estimated growth rate of 4.8 percent between 2013 and 2018.

There are about 12,637 registered and licensed dialysis centers scattered all across the United States and they are responsible for employing about 135,030 people. DaVita Inc. and Fresenius Medical Care can boast of having the lion share in this industry.

If you are considering starting your own kidney dialysis center in the United States, then you should try and work around the industry barriers. The truth is that the barriers to entry in the Dialysis Centers industry are high due to the significant regulatory requirements and the experience and strength of incumbents.

It is absolutely compulsory for any investor who is looking towards starting a kidney dialysis center to meet extensive federal, state and local laws and regulations. These regulations relate to the adequacy of medical care, equipment, personnel, operating policies and procedures.

Regulations also involve maintaining adequate records, preventing fires, setting rates and complying with building codes and environmental protection laws. These regulations make it difficult and costly for aspiring entrepreneurs to enter the industry.

Apart from the fact that the United States of America is home to loads of people with kidney related diseases, some of the factors that encourage entrepreneurs to start their own kidney dialysis center could be that the business can easily get support from the government at all levels and the business is indeed a profitable venture despite the legislature governing the industry.

Lastly, this line of business is not going into extinction anytime soon and no matter the location you choose to locate your kidney dialysis center, with the right facility and publicity, you are sure not going to lack patients.

2. Executive Summary

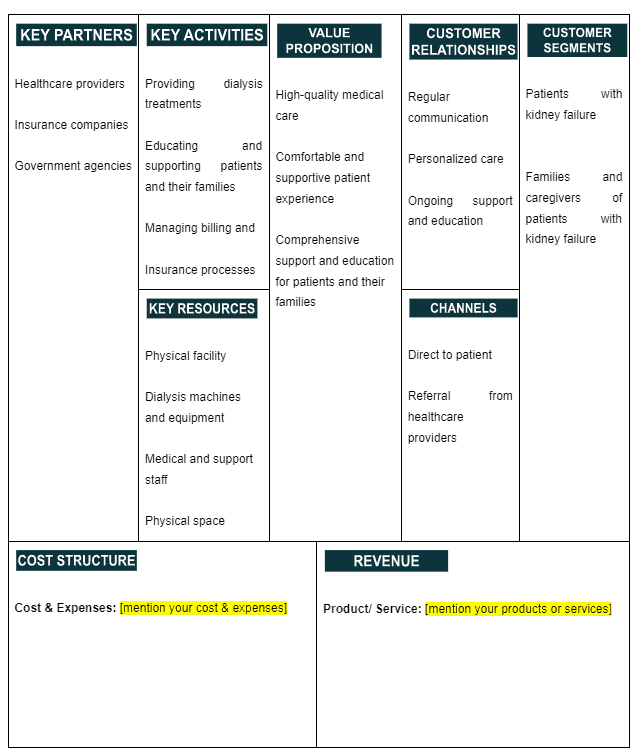

Life Crest® Dialysis Center, LLC is a registered and licensed kidney dialysis center that will be located in Atlantic Avenue, Delray Beach – Florida. We have been able to lockdown a standard facility that is located in the heart of town. Aside from the fact that we will start our dialysis center in Atlantic Avenue, Delray Beach, we intend to have strong presence in the whole of Florida.

Life Crest® Dialysis Center, LLC is in business to offer healthcare treatments such as outpatient hemodialysis, hospital inpatient hemodialysis, peritoneal dialysis and home-based hemodialysis amongst other dialysis related care. We are well trained, equipped and positioned to offer dialysis and kidney related treatments.

We are in the industry to deliver excellent dialysis care services to all those who will patronize our services. We will also comply with the laws and health regulations in the United States of America.

Our dialysis center will be open round the clock to attend to clients and we will also offer home services as requested by our clients. Our work force will be trained to operate within the framework of our organization’s corporate culture. We have put structure in place that will enable us accept insurance payments as well as private – party payments from our clients.

Life Crest® Dialysis Center, LLC will ensure that all our clients are given first class treatment whenever they visit our dialysis center. We have a CRM software that will enable us manage a one on one relationship with our customers (patients) no matter how large they are.

Life Crest® Dialysis Center, LLC is a business that is owned and managed by Dr. Julius Cornel. Dr. Julius Cornel is a medical doctor with robust experience and qualifications as it relates to treating kidney related ailments.

3. Our Products and Services

Life Crest® Dialysis Center has the goal of becoming a leader in the industry. We will work hard to help people with kidney ailments carry out dialysis. These are the healthcare services that Life Crest® Dialysis Center, LLC will be offering;

- Outpatient hemodialysis

- Hospital inpatient hemodialysis

- Peritoneal dialysis

- Home-based hemodialysis

4. Our Mission and Vision Statement

- Our vision is to become the number one choice when it comes to providing dialysis and treatment for people with kidney related ailments in the whole of Florida and also to be amongst the top 20 dialysis centers in the United States of America.

- Our mission is to ensure that we do all we can to make people with kidney related ailments live normal lives. Our corporate culture is wrapped around our mission statement and vision.

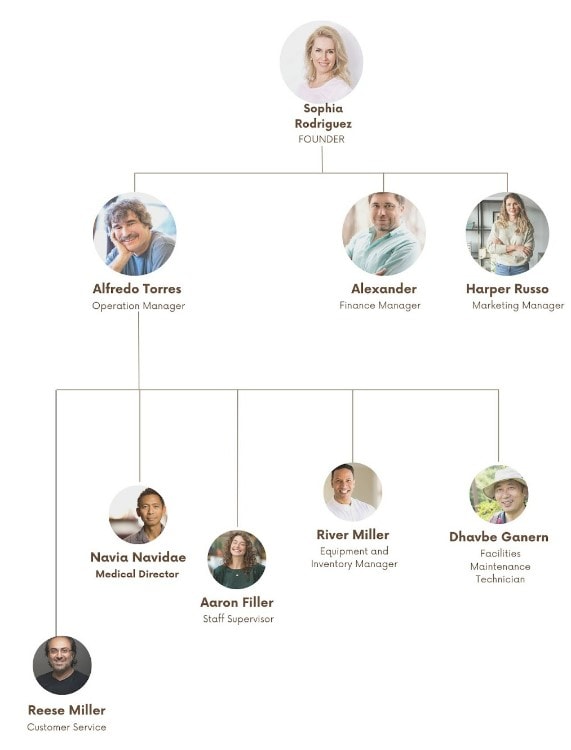

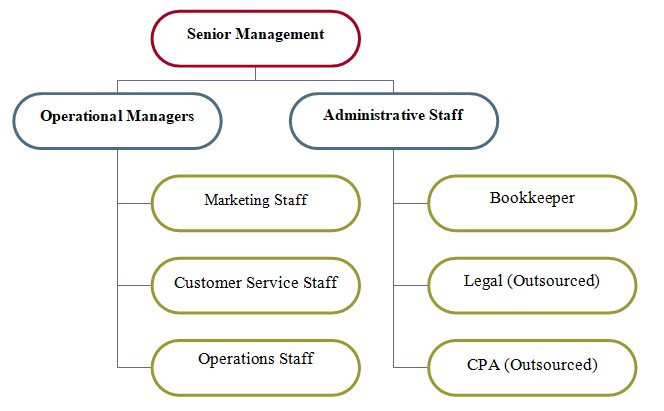

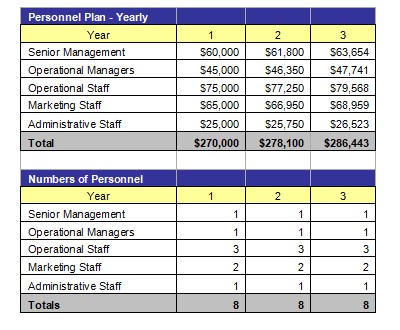

Our Business Structure

From the outset, we have decided to recruit only qualified professionals to man various job positions in our organization.

We are quite aware of the rules and regulations governing the specialist hospitals which is why we decided to recruit only experienced and qualified employees. We hope to leverage on their expertise to build our dialysis center to be well accepted in Delray Beach – Florida and the whole of the United States.

When hiring, we will look out for applicants that are not just qualified and experienced, but honest, customer centric and are ready to work to help us build a prosperous business that will benefit all the stakeholders.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of ten years or more. These are the positions that will be available at Life Crest® Dialysis Center, LLC;

- Chief Medical Director/Chief Executive Officer

Phlebotomist

Nurses/Nurse’s Aides

- Information Technologist (Contract)

- Admin and Human Resources Manager

- Sales and Marketing Executive

- Accountant/Cashier

- Customer Care Executive

5. Job Roles and Responsibilities

Chief Medical Director / Chief Executive Officer:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, and appraising job results and developing incentives

- Accountable for fixing prices and signing business deals

- Responsible for providing direction for the business

- Makes, connects, and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

- Responsible for performing outpatient hemodialysis

- Handles hospital inpatient hemodialysis

- Accountable carrying out peritoneal dialysis

- Responsible for home-based hemodialysis

- Collects and tags specimens exactly as outlined in each medical requisition

- Develops effective collection techniques as they relate to groups such as pediatric and geriatric patients

- Properly package each specimen and ensure that every specimen is delivered to the laboratory on time

- Maintains an organized and clean work area based on state health laws

Pharmacist:

- Accountable for processing prescriptions and dispensing medication

- Responsible for ordering, selling and controlling medicines

- Handles any other duty as assigned by the Medical Director.

- Responsible for managing our patients

- Responsible for offering medication management services

- Assists the doctors and lab technicians in treating patients and carrying out dialysis

Sales and Marketing Manager

- Responsible for handling business research, market surveys and feasibility studies for clients

- Creates new markets cum businesses for the organization

- Empower and motivates the sales team to meet and surpass agreed targets

Accountant/Cashier:

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Provides managements with financial analyses, development budgets, and accounting reports

- Responsible for financial forecasting and risks analysis

- Performs cash management, general ledger accounting, and financial reporting for one or more properties.

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the organization

- Serves as internal auditor for the organization.

Client Service Executive

- Welcomes clients and potential clients by greeting them in person or on the telephone; answering or directing inquiries.

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides them with a personalized customer service experience of the highest level

- Manages administrative duties assigned by the creative director in an effective and timely manner

- Responsible for washing and ironing bedsheets and clothes for patients and staff members

- Responsible for cleaning the wards and hospital facility at all times

- Ensures that toiletries and supplies don’t run out of stock

- Handles any other duty as assigned by the admin and HR manager.

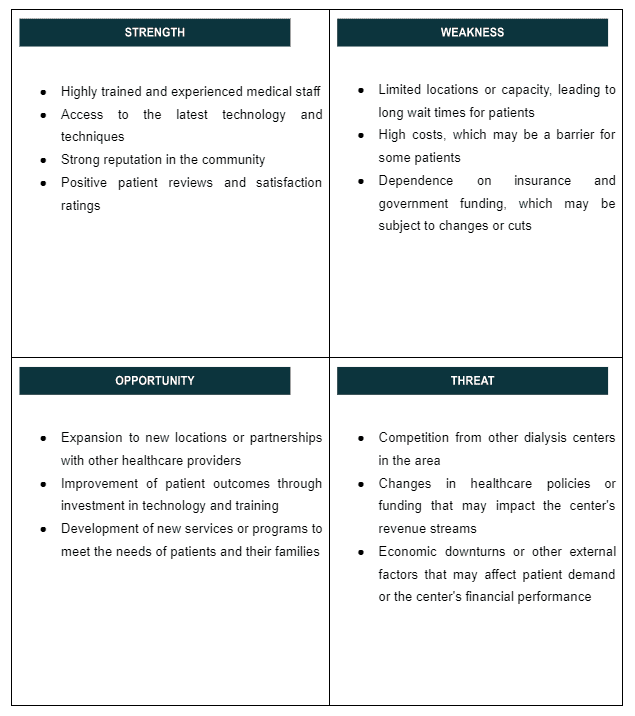

6. SWOT Analysis

Life Crest® Dialysis Center, LLC is set to become one of the leading dialysis centers in the whole of Florida which is why we are willing to take our time to conduct due diligence as it relates to our business. We want our dialysis center to be the number one choice for all residents of Delray Beach.

We know that if we are going to achieve the goals that we have set for our business, then we must ensure that we build our business on a solid foundation.

Notwithstanding that our Chief Medical Director (owner) has a robust experience in the dialysis industry, we still went ahead to hire the services of a business consultant that is specialized in setting up new businesses to help our organization conduct detailed SWOT analysis.

This is the summary of the SWOT analysis that was conducted for Life Crest® Dialysis Center, LLC;

Our strength as a company revolves around our access to highly skilled workforce, having a loyal customer base and of course we have adequate understanding of government policies and their implications. We are not ruling out the fact that we have a team of qualified healthcare professionals manning various job positions in our center.

As a matter of fact, they are some of the best hands in the whole of Delray Beach – Florida. Our location, the Business model we will be operating on, opening 24 hours daily and 7 days in a week, multiple payment options, well equipped medical call center, ambulance services and our excellent customer service culture will definitely be part of what will make us stand tall amongst our competitors.

One obvious weakness that will standout against our organization is the inability to reduce the cost of our dialysis especially within the first 12 months of operation.

- Opportunities:

The opportunities that are available to dialysis centers are unlimited considering the fact that there are fewer privately run dialysis centers in the Delray Beach – Florida and we are going to position our dialysis center to make the best out of the opportunities that will be available to us.

One of the major threats we are likely going to face is the presence of well – established dialysis centers and of course other players in the Hospital and Healthcare industry in our target market location that also manage kidney related ailments.

Some other threats that we are likely going to face when we start our dialysis center are mature markets, stiff competition, volatile costs, and rising medical care prices.

7. MARKET ANALYSIS

- Market Trends

Some notable trends in this industry is that dialysis centers are expected to perform well due to the inelastic demand for their services. The majority of dialysis patients are covered under Medicare, threatening profitability. As patients use Medicare as their primary insurer, repayments to dialysis centers will slow.

So also, with the aid of technology, it is becoming easier to carry out dialysis, treat, and manage kidney related ailments that before now were not easy to handle. No doubt there are many ways of providing kidney dialysis in this changing era since the place of delivery may be in the patient’s home, or in health facilities.

The dialysis industry has recently begun consolidating due to the pressures of healthcare reform. The truth is that the demand for dialysis has steadily grown over the last five years, as healthcare reform legislation broadened insurance coverage and the plummeting unemployment rate increased disposable income.

One thing about this industry is that labor costs are on the high side. However, dialysis centers have also faced nurse and physician shortages and have struggled to recruit qualified personnel.

Industry profitability has generally risen over the past five years due to increases in service prices. No doubt the dialysis centers industry will continue to grow and become more profitable because the aging baby-boomer generation in the United States is expected to drive demand.

8. Our Target Market

Life Crest® Dialysis Center, LLC is in business to service patients in and around Delray Beach – Florida, United States of America. We will ensure that we target both self – pay customers (who do not have health insurance cover), and those who have health insurance cover.

The fact that we are going to open our doors to a wide range of customers does not in any way stop us from abiding by the rules and regulations governing the dialysis industry in the United States. Our customers can be categorized into the following;

- Residents within the area where our dialysis center is located who have kidney related ailments

- Health Management Organizations (HMOs)

Our competitive advantage

We are aware that apart from the competitions that exist amongst various dialysis centers, they also compete against other healthcare services providers such as general hospitals, teaching hospitals, health centers et al, that also provide dialysis.

Our dialysis facility is well positioned and visible, we have enough parking space with good security. Our staff are well groomed in all aspects of healthcare service delivery and all our employees are trained to provide customized customer service to all our patients.

We are going to be one of the few dialysis centers in the whole of Delray Beach – Florida that will run a standard medical call center 24 hours day and 7 days a week. We have enough trained health workers that are ready to run a shift system.

Lastly, all our employees will be well taken care of, and their welfare package will be among the best within our category (startups dialysis centers in the United States) in the industry. It will enable them to be more than willing to build the business with us and help deliver our set goals and objectives.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Below are the sources we intend exploring to generate income for Life Crest® Dialysis Center, LLC;

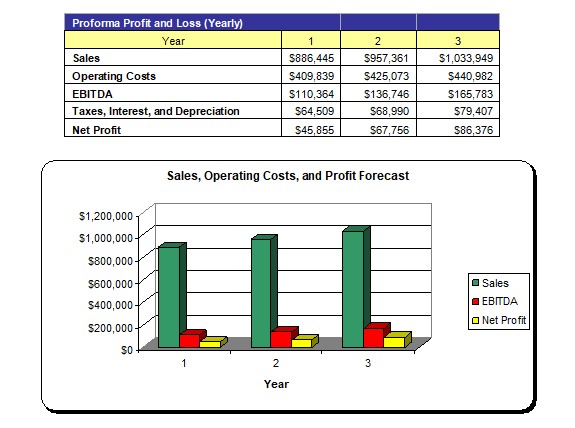

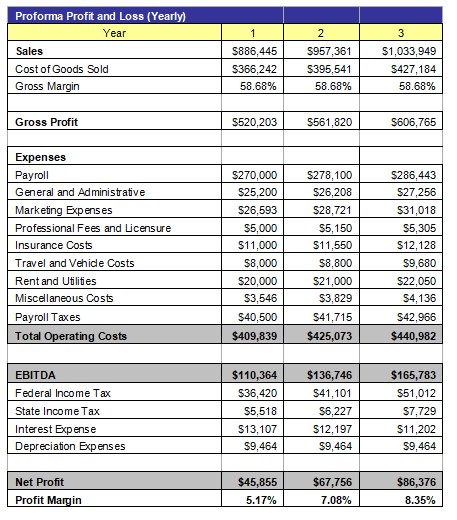

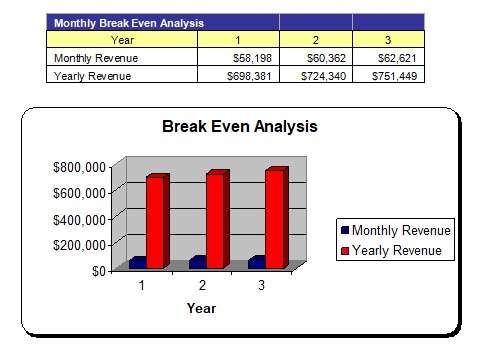

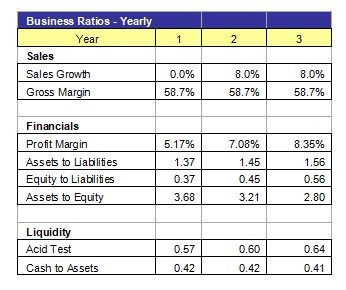

10. Sales Forecast

It is important to state that our sales forecast is based on the data gathered during our feasibility studies, market survey and also some of the assumptions readily available on the field.

Below is the sales projection for Life Crest® Dialysis Center, LLC. It is based on the location of our dialysis center and of course the wide range of our services and target market.

- First Year: $95,000 (From Self – Pay Clients / Patients): $170,000 (From Health Insurance Companies)

- Second Year: $160,000 (From Self – Pay Clients / Patients): $450,000 (From Health Insurance Companies)

- Third Year: $220,000 (From Self – Pay Clients / Patients): $750,000 (From Health Insurance Companies)

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and natural disasters within the period stated above. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

The marketing and sales strategy adopted by Life Crest® Dialysis Center, LLC will be based on generating long-term personalized relationships with patients. In order to achieve that, we will ensure that we offer top notch dialysis and kidney related healthcare at affordable prices compare to what is obtainable in Florida.

All our employees will be trained and equipped to provide excellent diabetic related healthcare services. We know that if we are consistent with offering high quality diabetic related healthcare and excellent customer service, we will increase the number of our customers by more than 20 percent for the first year and then more than 45 percent subsequently.

Before choosing a location for our dialysis center, we conducted a thorough market survey and feasibility studies in order for us to penetrate the available market and become the preferred choice in Delray Beach – Florida.

We hired experts who have good understanding of the dialysis center line of business to help us develop marketing strategies that will help us achieve our business goal of winning a larger percentage of the available market in Delray Beach – Florida.

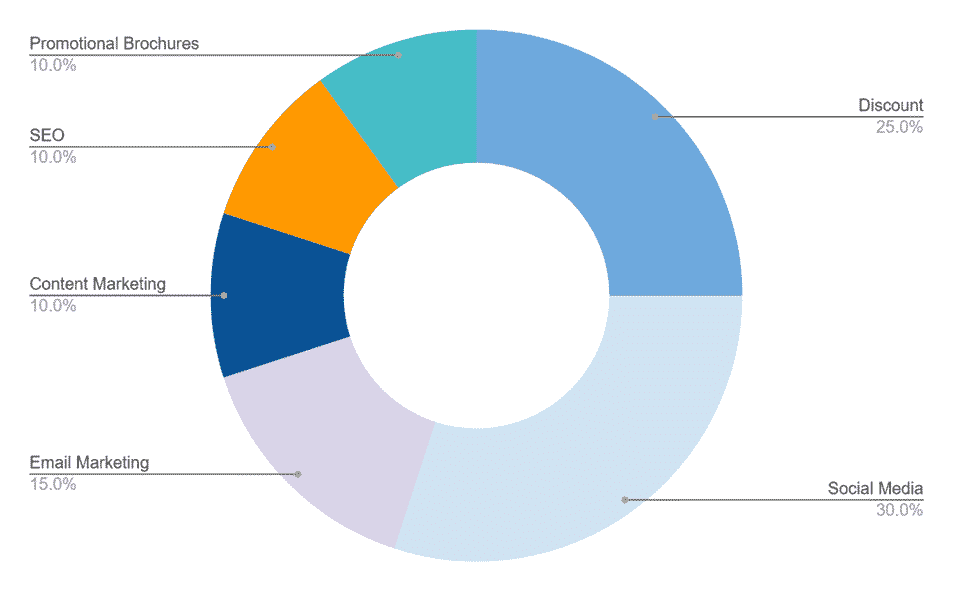

In summary, Life Crest® Dialysis Center, LLC Services will adopt the following sales and marketing approach to win customers over;

- Introduce our dialysis center and the services we offer by sending introductory letters to residents, health management organizations, medical insurance companies, sports clubs, business owners and corporate organizations

- Advertise our dialysis center in community based newspapers, local TV and radio stations

- List our dialysis center in yellow pages’ ads (local directories)

- Leverage on the internet to promote our dialysis center

- Engage in direct marketing

- Leverage on word of mouth marketing (referrals)

- Enter into business partnership with health management organizations, sports clubs, government agencies and health insurance companies.

11. Publicity and Advertising Strategy

Life Crest® Dialysis Center, LLC is in the dialysis center line of business to become one of the market leaders and also to maximize profits hence we are going to explore all available means to promote our dialysis center.

Life Crest® Dialysis Center, LLC has a long – term plan of opening dialysis centers in key cities in and around Florida which is why we will deliberately build our brand to be well accepted in Delray Beach – Florida before venturing out. Here are the platforms we intend leveraging on to promote and advertise Life Crest® Dialysis Center, LLC;

- Place adverts on both print (community based newspapers and health magazines) and electronic media platforms

- Sponsor relevant community health programs

- Leverage on the internet and social media platforms like; Instagram, Facebook, twitter, YouTube, Google + et al to promote our brand

- Install our billboards in strategic locations all around Delray Beach – Florida.

- Engage in roadshow from time to time

- Distribute our fliers and handbills in target areas

- Ensure that all our workers wear our branded shirts and all our vehicles and ambulances are well branded with our company’s logo et al.

12. Our Pricing Strategy

We will ensure that all our services are offered at highly competitive prices compared to what is obtainable in the United States of America.

On the average, dialysis centers and healthcare service providers usually leverage on the fact that a good number of their clients do not pay the service charge from their pockets; private insurance companies, Medicare and Medicaid are responsible for the payment. In view of that, it is easier for dialysis centers to bill their clients based in their discretion.

However, in some cases dialysis and healthcare service providers also adopt the hourly billing cum per visit billing method. For example, it is easier and preferable for dialysis centers to bill personal kidney dialysis services by the hour of treatment required as against a fixed price.

- Payment Options

The payment policy adopted by Life Crest® Dialysis Center, LLC is all inclusive because we are quite aware that different customers prefer different payment options as it suits them but at the same time, we will ensure that we abide by the financial rules and regulation of the United States of America.

Here are the payment options that Life Crest® Dialysis Center, LLC will make available to her clients;

- Payment with cash

- Payment via credit cards

- Payment via online bank transfer

- Payment via check

- Payment via mobile money transfer

In view of the above, we have chosen banking platforms that will enable our client make payment for our dialysis/services without any stress on their part.

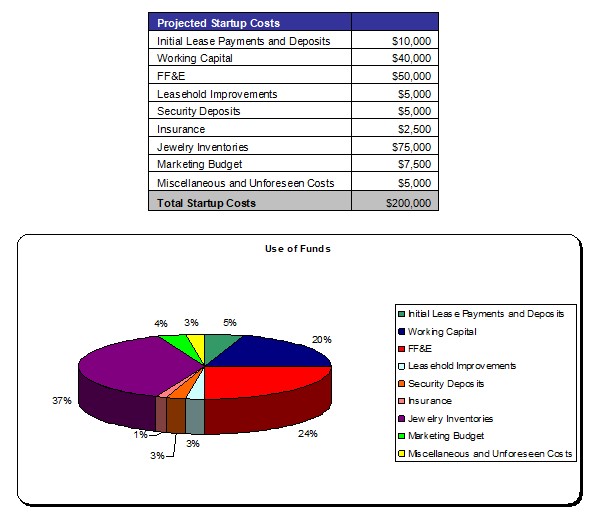

13. Startup Expenditure (Budget)

If you are looking to start a dialysis center, then you should be ready to raise enough capital to cover some of the basic expenditures that you are going to incur. The truth is that starting this type of business does not come cheap.

You would need money to secure a standard dialysis center facility, you will need money to acquire dialysis related medical equipment and you would need money to pay your workforce and pay bills for a while until the revenue you generate from the business becomes enough to pay them.

The items listed below are the basics that we would need when starting our dialysis center in the United States, although costs might vary slightly;

- The total fee for registering the Business in the United States – $750.

- Legal expenses for obtaining licenses and permits – $1,500.

- Marketing promotion expenses for the grand opening of Life Crest® Dialysis Center, LLC in the amount of $3,500 and as well as flyer printing (2,000 flyers at $0.04 per copy) for the total amount of – $3,580.

- The cost for hiring Business Consultant – $2,500.

- The total cost for computer software (Accounting Software, Payroll Software, CRM Software, Microsoft Office, QuickBooks Pro, drug interaction software, Physician Desk Reference software) – $7,000

- Insurance (general liability, workers’ compensation and property casualty) coverage at a total premium – $3,400.

- The total cost for payment of rent for 12 months at $1.76 per square feet in the total amount of – $85,800.

- The total cost for dialysis center remodeling (construction of racks and shelves) – $50,000.

- Other start-up expenses including stationery ( $500 ) and phone and utility deposits – ( $2,500 ).

- Operational cost for the first 3 months (salaries of employees, payments of bills et al) – $500,000

- The cost for Start-up inventory (stocking with a wide range of products) – $150,000

- Storage hardware (bins, rack, shelves,) – $10,720

- The total cost for Nurse and Drugs Supplies (Injections, Bandages, Scissors, et al) – $3,000

- The total cost for medical equipment – $300,000

- The cost for the purchase of furniture and gadgets (Computers, Printers, Telephone, TVs, tables and chairs et al) – $4,000.

- The cost of launching a website – $700

- Miscellaneous – $10,000

We would need an estimate of $1.5 million to successfully set up our dialysis center in Delray Beach – Florida.

Generating Startup Capital for Life Crest® Dialysis Center, LLC

Life Crest® Dialysis Center, LLC is a private business that will be owned and managed by Dr. Denis Copperfield Jnr. He decided to restrict the sourcing of the startup capital for the business to just three major sources. These are the areas we intend generating our startup capital;

- Generate part of the startup capital from personal savings

- Source for soft loans from family members and friends

- Apply for loan from the bank

N.B: We have been able to generate about $500,000 ( Personal savings $300,000 and soft loan from family members $200,000 ) and we are at the final stages of obtaining a loan facility of $700,000 from our bank. All the papers and documents have been duly signed and submitted, the loan has been approved and any moment from now our account will be credited.

14. Sustainability and Expansion Strategy

The future of a business lies in the number of loyal customers that they have, the capacity and competence of their employees, their investment strategy and business structure. If all of these factors are missing from a business (dialysis center), then it won’t be too long before the business closes shop.

One of our major goals of starting Life Crest® Dialysis Center, LLC is to build a business that will survive off its own cash flow without the need for injecting finance from external sources once the business is officially running. We know that one of the ways of gaining approval and winning customers over is to offer our dialysis a little bit cheaper than what is obtainable in the market and we are prepared to survive on lower profit margin for a while.

Life Crest® Dialysis Center, LLC will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are taken of. Our organizations’ corporate culture is designed to drive our business to greater heights and training and retraining of our workforce is at the top burner.

We know that if this is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List/Milestone

- Business Name Availability Check: Completed

- Business Registration: Completed

- Opening of Corporate Bank Accounts: Completed

- Securing Point of Sales (POS) Machines: Completed

- Opening Mobile Money Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of Insurance for the Business: Completed

- Leasing of facility and remodeling the dialysis center – facility: In Progress

- Conducting Feasibility Studies: Completed

- Generating capital from family members: Completed

- Applications for loan from the bank: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents and other relevant Legal Documents: In Progress

- Design of The Company’s Logo: Completed

- Printing of Promotional Materials: In Progress