- YES BANK LTD.

- SECTOR : BANKING AND FINANCE

- INDUSTRY : BANKS

YES Bank Ltd.

NSE: YESBANK | BSE: 532648 NSE: YESBANK

23.35 0.35 ( 1.52 %)

28.92% Fall from 52W High

55.3M NSE+BSE Volume

NSE 18 May, 2024 6:01 AM (EDT)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Broker average target upside potential%

Broker 1Year buys

0 active buys

Broker 1Year sells

2 active sells

Broker 1Year neutral

0 active holds

Broker 1M Reco upgrade

0 Broker 1M Reco upgrade

YES Bank Ltd. share price target

Yes bank ltd. has an average target of 17.50. the consensus estimate represents a downside of -25.05% from the last price of 23.35. view 4 reports from 2 analysts offering long-term price targets for yes bank ltd...

- Recent Upgrades

- Recent Downgrades

- Sector Updates

- Most Recent

Stock Research Report for Yes Bank Ltd

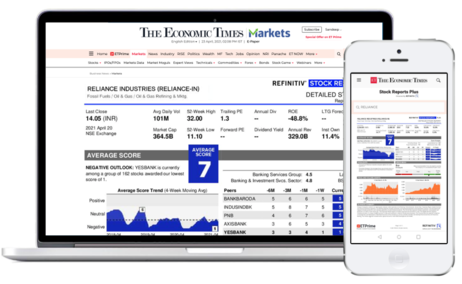

Stock score of Yes Bank Ltd moved down by 1 in 3 months on a 10 point scale (Source: Refinitiv). Get detailed report on Yes Bank Ltd by subscribing to ETPrime .

Get 4000+ Stock Reports worth ₹ 1,499* with ETPrime at no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

YES BANK Limited is an India-based commercial bank, which offers a range of products, services and technology-driven digital offerings to its corporate, retail, and micro, small and medium-sized enterprises (MSME) customers. The Company is engaged in providing banking services, including corporate and institutional banking, financial markets, investment banking, corporate finance, branch banking, business and transaction banking and wealth management. Its segments include Treasury, Corporate Banking, Retail Banking and Other Banking Operations. Treasury segment includes investments, all financial markets activities undertaken on behalf of the Bank's customers and trading. maintenance of reserve requirements and resource mobilization from other banks and financial institutions. Corporate Banking and Retail Banking segment includes lending, deposit-taking and other services offered to corporate and retail customers respectively. Other Banking Operations include para banking activities.

- e-ATM Order

- Share Market News

- FindYourMojo

- Live Webinar

- Relax For Tax

- Budget 2024

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Life Insurance

- Health Insurance

- Group Health Insurance

- Bike Insurance

- SME Insurance

- Car insurance

- Home Insurance

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Equity Trending News

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Company Snapshot

- Report Details

Yes Bank Ltd Research Report Update

- SECTOR : Banks

- BSE : 532648

- NSE : YESBANK

Chg: 0.4 (1.77 %)

Entry Price

Recommend date.

Asset quality troubles & limited growth capital pose headwinds for banks future earnings. Also banks higher requirement for capital would entail huge dilutions leading to subdued return ratios for reasonable period. We thereby assign REDUCE rating.

Copyright© 2022. All rights Reserved. ICICI Securities Ltd. ®trademark registration in respect of the concerned mark has been applied for by ICICI Bank Limited

YES Bank fiasco: a corporate governance failure

- Perspective Article

- Published: 27 April 2021

- Volume 48 , pages 181–190, ( 2021 )

Cite this article

- Rajat Deb ORCID: orcid.org/0000-0002-7009-0051 1

712 Accesses

6 Citations

3 Altmetric

Explore all metrics

Financial market has been jolted on 5 March 2020 when the central government has put YES Bank Ltd., India’s fourth largest private bank, under moratorium, and the RBI has come out with a bailout package. The former CEO had extended loans in quid pro quo non-arrangement to the companies confronting financial turmoil. Theoretically, independent directors supposed to bring independent judgement about strategy and risk management which, for the bank, has been miserably failed and has extended loans without considering the borrowers’ ability of repayment. The audit committee has too failed to show its acumen and approved the management’s proposals.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Corporate Governance and the Financial Crisis

Corporate Governance in the Nigerian Banking Sector: A Bounded Rationality Conundrum

Adams RB, Mehran H (2012) Bank board structure and performance: evidence for large bank holding companies. J Financial Intermed 21(2):243–267

Article Google Scholar

Aebi V, Sabato G, Schmid M (2012) Risk management, corporate governance, and bank performance in the financial crisis. J Bank Finance 36:3213–3226

Afsharipour A (2009) Corporate governance convergence: lessons from the Indian experience. Northwest J Int Law Bus 29(2):375–402

Google Scholar

Battaglia F, Gallo A (2017) Strong boards, ownership concentration and EU banks’ systemic risk-taking: evidence from the financial crisis. J Int Financial Markets, Inst Money 46:128–146

Becht M, Bolton P, Röell A (2011) Why bank governance is different. Oxf Rev Econ Policy 27(3):437–463

Bhattacharyya, A. K. (2011, December 26). AMRI hospital fire: Corporate governance under scanner. The Business Standard , p.7.

Bhattacharyya AK (2015) Audit committee apathetic towards internal audit. The Business Standard , p 6

Bhattacharyya AK (2020) Biz judgement rule and directors’ liability. The Business Standard , p 5

Bhattacharyya AK, Rao SV (2004) Economic impact of regulation on corporate governance: evidence from India . Working Paper No. 486/2004. Indian Institute of Management Calcutta

Bhusnurmath M (2020) Make Money safe again. The Economic Times , p 10.

Bliss MA, Gul FA (2012) Political connection and cost of debt: Some Malaysian evidence. J Bank Finance 36(5):1520–1527

Bryane M (2003) Codes of corporate conduct: moving from order to progress. Corp Gov—Int J Enhancing Board Perform 3(2):29–31

Caprio G, Laeven L, Levine R (2007) Governance and bank valuation. J Fin Intermed 16(4):584–617

Carter DA, Simkins BJ, Simpson WG (2003) Corporate governance, board diversity, and firm value. Fin Rev 38:33–53

Choi H, Sul W, Kee Min S (2012) Foreign board membership and firm value in Korea. ManagDecis 50(2):207–233

Doldor E, Vinnicombe S, Gaughan M, Sealy R (2012) Gender diversity on boards: the appointment process and the role of executive search firms. Equal Human Right Committee Report 85:1–98

Ellus A, Yerramilli V (2013) Stronger risk controls, lower risk: evidence from U.S. Bank holding companies. J Finance 48:1757–1803

Faleye O, Krishnan K (2017) Risky lending: does bank corporate governance matter? J Bank Finance 83:57–69

Farhi E, Tirole J (2012) Collective moral hazard, maturity mismatch, and systemic bailouts. Am Econ Rev 102(1):60–93

Farooq MO, Elseoud MSA, Turen S, Abdulla M (2019) Causes of non-performing loans: the experience of gulf cooperation council countries. Entrep Sustain Issues 6(4):1955–1974

Flannery MJ (1998) Using market information in prudential bank supervision: a review of the US empirical evidence. J Money, Credit Bank 30(3):273–305

Gaur D, Mahapatra DR (2021) The nexus of economic growth, priority sector lending and non-performing assets: case of Indian banking sector. South Asian J Bus Studies. https://doi.org/10.1108/SAJBS-01-2020-0010

Ge W, Drury DH, Fortin S, Liu F, Tsang D (2010) Value relevance of disclosed related party transactions. Adv Account 26(1):134–141

Gordon EA, Henry E, Palia D (2004) Related party transactions and corporate governance. Adv Financial Econ 9:1–27

Grove H, Patelli L, Victoravich LM, Xu P (2011) Corporate governance and performance in the wake of the financial crisis: evidence from US commercial banks. CorGov: Int Rev 19(5):418–436

Hagendorff J, Keasey K (2012) The value of board diversity in banking: evidence from the market for corporate control. Eur J Financ 18(1):41–58

Iqbal J, Strobl S, Vähämaa S (2015) Corporate governance and the systemic risk of financial institutions. J Econ Bus 82(1):42–61

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3(4):305–360

Jian M, Wong TJ (2010) Propping through related party transactions. Rev Acc Stud 15:70–105

Kanagaretnam K, Lim CY, Lobo GJ (2014) Effects of international institutional factors on earnings quality of banks. J Bank Finance 39:87–106

Kang E, Ding DK, Charoenwong C (2010) Investor reaction to women directors. J Bus Res 63(8):888–894

Kaushik, K., & Kamboj, R. P. (2012). Study on the State of Corporate Governance in India. Gatekeepers of Corporate Governance—Securities and Exchange Board of India (SEBI) . Indian Institute of Corporate Affairs, Thought Arbitrage Research Institute, Indian Institute of Management Calcutta, Kolkata.

Khanna V, Black B (2007) Can corporate governance reforms increase firm’s market values? Evidence from India. J Empir Leg Stud 4(4):749–796

Kohlbeck MJ, Mayhew BW (2010) Valuation of firms that disclose related party transactions. J AccPubl Policy 29(2):115–137

Laeven L, Valencia F (2013) Systemic banking crises database: an update. IMF Econ Rev 61(2):225–270

Liang Q, Xu P, Jiraporn P (2013) Board characteristics and Chinese bank performance. J Bank Finance 37(8):2953–2968

Liao L, Luo L, Tang Q (2014) Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br Acc Rev 47(4):409–424

Millon M, John J, Tehranian H (2009) Corporate governance and earnings management at large U.S. bank holding companies. J Corp Finance 15(4):412–430

Mollah S, Zaman M (2015) Shari’ah supervision. corporate governance and performance: Conventional vs Islamic banks. J Bank Finance 58:418–435

Nguyen DD, Hagendorff J, Eshraghi A (2015) Which executive characteristics create value in banking?. Evidence from appointment announcements. Corp Gov 23(2):112–128

Osemeke L, Adegbite E (2016) Regulatory multiplicity and conflict: towards a combined code on corporate governance in Nigeria. J Bus Ethics 133(3):431–451

Palvia A, Vähämaa E, Vähämaa S (2015) Are female CEOs and chairwomen more conservative and risk averse? Evidence from the banking industry during the financial crisis. J Bus Ethics 131(3):577–594

Peni E, Vähämaa S (2012) Did good corporate governance improve bank performance during the financial crisis? J Financial Serv Res 41(1–2):19–35

Proimos A (2005) Strengthening corporate governance regulations. J Invest Compliance 6(4):75–84

Rakshit D, Ghosh SK (2009) Uniformity in corporate governance: miles to go. Corporate Governance: Millennium Challenges , IPE, Hyderabad, pp. 90–106.

Ramly Z, Chen SG, Mustapha MZ, Sapiei NS (2017) Women on boards and bank efficiency in ASEAN-5: the moderating role of the independent directors. Rev ManagSci 11:225–250

Rowe W, Shi W, Wang C (2011) Board governance and performance of Chinese banks. Banks Bank Syst 1:1–40

Sarkar J, Sarkar S (2009) Multiple board appointments and firm performance in emerging economies: evidence from India. Pac Basin Financ J 17(2):271–293

Shah, A. (2020) It’s the incentives, stupid. The Business Standard , p 9

Shkodra J, Ismajli H (2017) Determinants of the credit risk in developing countries: a case of Kosovo banking sector. Banks Bank Syst 12(4):90–97

State Bank of India Annual Report, 2018–19, p. 145 https://www.sbi.co.in/corporate/AR1819/pdf/english/Financial.pdf . Accessed on 19 Jan 2021

Swartz M, Watkins S (2003) Power failure, the insider story of the collapse of Enron. Doubleday, New York

Tang X, Du J, Hou Q (2013) The effectiveness of the mandatory disclosure of independent directors’ opinions: Empirical evidence from China. J Account Public Policy 32(3):89–125

Tanna S, Pasiouras F, Nnadi M (2011) The effect of board size and composition on the efficiency of UK banks. Int J Econ Bus 18(3):441–462

Umar M, Sun G (2018) Determinants of non-performing loans in Chinese banks. J Asia Bus Studies 12(3):273–289

Upadhyay A, Sriram R (2011) Board size, corporate information environment and cost of capital. J Bus Finance Acc 38(9–10):1238–1261

Vallascas F, Mollah S, Keasey K (2017) Does the impact of board independence on large bank risks change after the global financial crisis? J Corp Finan 44:149–166

Walker, D. (2009). A review of corporate governance in UK banks and other financial industry entities . Consultative Document, November

Wang T, Hsu C (2013) Board composition and operational risk events of financial institutions. J Bank Finance 37(6):2042–2051

YES Bank Annual Report, 2018–19, p. 5. https://www.yesbank.in/pdf/annualreport_2018_19_pdf . Accessed on 19 Jan 2021

Zagorchev A, Gao L (2015) Corporate governance and performance of financial institutions. J Econ Bus 82:17–41

Zinkin J (2011) Challenges in implementing corporate governance: Whose business is it anyway? Wiley, Singapore

Download references

Author information

Authors and affiliations.

Department of Commerce, Tripura University, West Tripura, Tripura, 799022, India

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Rajat Deb .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Deb, R. YES Bank fiasco: a corporate governance failure. Decision 48 , 181–190 (2021). https://doi.org/10.1007/s40622-021-00277-7

Download citation

Accepted : 30 March 2021

Published : 27 April 2021

Issue Date : June 2021

DOI : https://doi.org/10.1007/s40622-021-00277-7

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Corporate governance

- Independent director

- Audit committee

- Find a journal

- Publish with us

- Track your research

To read this content please select one of the options below:

Please note you do not have access to teaching notes, yes bank: a case of quick turnaround.

Publication date: 5 April 2022

Teaching notes

Learning outcomes.

The learning outcomes of this paper is as follows: to understand and analyze the turnaround model of Pearce and Robbins (1993); to familiarize with parameters and actions in the Prompt Corrective Action (PCA) framework of Reserve Bank of India (RBI); to comprehend the probable situation warranting turnaround; to identify the key ratios which signal the financial health of a bank; and to understand the applicability of the turnaround model in bank’s revival.

Case overview/synopsis

The case explores various challenges faced by Mr Prashant Kumar during the turnaround process of Yes bank. The youngest bank started its operation in 2004, and in the first six years of operations, Yes bank registered a compound annual growth rate of 100% on the balance sheet, becoming the fourth-largest private sector bank in the country. However, the irony is that this shine and glitter was a short-lived phenomenon and after the regulatory inspection of 2016, Yes bank collapsed like a house of cards. This case has incorporated the three major phases of Yes bank i.e. the rise, the fall and the revival. The turnaround process led by Mr Kumar was explained using the turnaround model given by Pearce and Robbins (1993) and the PCA framework of the RBI. The conditions which warranted the need for the turnaround in Yes bank and the factors responsible for the same are discussed. The multiple challenges faced by Mr Kumar and the strategic responses adopted by him were incorporated in great detail. What were the outcomes of those strategic choices? Should he continue with similar approaches? Was he successful in stabilizing the bank which was broken from the core? What next if stability is achieved? How Mr Kumar should lift Yes bank to the recovery zone? And most importantly, will Mr Kumar be able to change the poor public image of Yes bank? The reflections of all the above questions are narrated with the actions of Mr Kumar.

Complexity academic level

The case is intended to be taught in the class of strategic management for postgraduate-, master- or executive-level participants of business administration. As the case is focused on a banking organization, it also can be taught in banking class.

Supplementary materials

Teaching Notes are available for educators only.

Subject code

CSS 1: Accounting and Finance.

- Turnarounds

- Corporate strategy

- Banks/banking

- Financial institutions

- Regulatory policy

Acknowledgements

Disclaimer. This case is written solely for educational purposes and is not intended to represent successful or unsuccessful managerial decision-making. The authors may have disguised names; financial and other recognizable information to protect confidentiality.

Jethwani, K. and Ramchandani, K. (2022), "Yes bank: a case of quick turnaround", , Vol. 12 No. 2. https://doi.org/10.1108/EEMCS-01-2021-0028

Emerald Publishing Limited

Copyright © 2022, Emerald Publishing Limited

You do not currently have access to these teaching notes. Teaching notes are available for teaching faculty at subscribing institutions. Teaching notes accompany case studies with suggested learning objectives, classroom methods and potential assignment questions. They support dynamic classroom discussion to help develop student's analytical skills.

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

- YES BANK LTD.

- SECTOR : BANKING AND FINANCE

- INDUSTRY : BANKS

YES Bank Ltd.

NSE: YESBANK | BSE: 532648

Mid-range Performer

23.35 0.35 ( 1.52 %)

28.92% Fall from 52W High

55.3M NSE+BSE Volume

NSE 18 May, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Broker average target upside potential%

Broker 1Year buys

0 active buys

Broker 1Year sells

2 active sells

Broker 1Year neutral

0 active holds

Broker 1M Reco upgrade

0 Broker 1M Reco upgrade

YES Bank Ltd. share price target

Yes bank ltd. has an average target of 17.50. the consensus estimate represents a downside of -25.05% from the last price of 23.35. view 4 reports from 2 analysts offering long-term price targets for yes bank ltd...

- Recent Upgrades

- Recent Downgrades

- Sector Updates

- Most Recent

- Super Investors

- Account

- Consolidated Standalone

- Share Holding

- Balance Sheet

- Corp. Action

Yes Bank share price

NSE: YESBANK BSE: 532648 SECTOR: Bank - Private 1525k 7k 2k

Price Summary

₹ 23.14

₹ 22.59

₹ 32.81

₹ 14.1

Ownership Below Par

Valuation expensive, efficiency poor, financials weak, company essentials.

₹ 72089.51 Cr.

3132.96 Cr.

₹ 14.36

₹ 7917.57 Cr.

₹ 0.4

Add Your Ratio

Your Added Ratios

Index presence.

The company is present in 25 Indices.

NIFTYMIDCAP

NIFTYMIDCAP150

NIFTYMIDSMALL400

NIFTYLGEMID250

NY500MUL50:25:25

NIFTYTOTALMCAP

NIFTYHOUSING

S&P LARGEMIDCAP

S&P MIDSMLCAP

- Price Chart

- Volume Chart

Price Chart 1d 1w 1m 3m 6m 1Yr 3Yr 5Yr

Volume chart 1d 1w 1m 3m 6m 1yr 3yr 5yr, pe chart 1w 1m 3m 6m 1yr 3yr 5yr, pb chart 1w 1m 3m 6m 1yr 3yr 5yr, peer comparison, group companies.

Track the companies of Group.

Cost of Liabilities %

Peg ratio earnings growth, it implies that the company is overvalued and vice versa.'>, advances growth %.

Share Holding Pattern

Promoter pledging %, strengths.

- Good Capital Adequacy Ratio of 17.9 %.

- The company has delivered good Profit growth of 26.9030692556978 % over the past 3 years.

Limitations

- The bank has a very low ROA track record. Average ROA of 3 years is -0.24319547922422 %

- CASA Growth of -0.3570704465074 % YoY, which is very low.

- Company has a low ROE of -2.48980826999671 % over the last 3 years.

- The Bank has a high NPA ; Average NPA of the last 3 years stands at 3.74666666666667 %.

- High Cost to income ratio of 73.1281283451175 %.

- The company has delivered poor Income growth of -4.50859561822854 % over the past 3 years.

- Increase in Provision and contingencies of 49.9813895257724 % on YoY.

Quarterly Result (All Figures in Cr.)

Profit & loss (all figures in cr. adjusted eps in rs.), balance sheet (all figures are in crores.), corporate actions dividend bonus rights split, investors details promoter investors, annual reports.

- Annual Report 2023 23 Mar 2024

- Annual Report 2022 23 Mar 2024

- Annual Report 2021 30 Jul 2021

- Annual Report 2020 20 Aug 2020

- Annual Report 2019 9 Jan 2020

- Annual Report 2018 9 Jan 2020

- Annual Report 2017 2 Apr 2021

Ratings & Research Reports

- Credit Report By: ICRA 9 Jan 2020

- Credit Report By: CARE 9 Jan 2020

- Credit Report By:CRISIL 8 Nov 2022

- Credit Report By:CARE 8 Nov 2022

- Credit Report By:CRISIL 4 Sep 2021

- Credit Report by:CRISIL 4 Jul 2020

- Credit Report By:FITCH 30 Aug 2021

- Credit Report by:CRISIL 26 May 2020

- Credit Report by:ICRA 26 May 2020

- Credit Report by:CRISIL 24 Jun 2020

- Credit Report by:CARE 24 Jun 2020

- Credit Report by:ICRA 24 Jun 2020

- Credit Report By:CARE 16 Oct 2021

- Credit Report By:ICEA 13 Sep 2021

- Credit Report By:CRISIL 11 Oct 2023

- Credit Report By:FITCH 11 Oct 2023

- Credit Report By:CARE 11 Oct 2023

Company Presentations

- Concall Q4FY24 9 May 2024

- Concall Q4FY22 11 May 2022

- Concall Q3FY24 5 Feb 2024

- Concall Q2FY24 30 Oct 2023

- Presentation Q4FY24 29 Apr 2024

- Presentation Q4FY23 13 Jun 2023

- Presentation Q3FY24 29 Jan 2024

- Presentation Q3FY20 21 Mar 2020

- Presentation Q2FY24 25 Oct 2023

- Presentation Q2FY21 10 Nov 2020

- Presentation Q1FY24 24 Jul 2023

- Presentation Q1FY21 10 Nov 2020

Company News

Yes bank stock price analysis and quick research report. is yes bank an attractive stock to invest in.

The Indian Banking sector is rising rapidly due to infrastructure spending, favorable government policy, rising disposable income and increasing consumerism and easier access to credit.

The banking industry is in boom with growing demand across India. But is it the right time to invest in banking stocks is the question to be asked? We can look into more details and dig a little deeper into the analysis of the stock.

Let’s look at how Yes Bank is performing and if it is the right time to buy the stock of Yes Bank with detailed analysis.

For Banking companies, The primary source of Income is interest earned on various loans given to individuals and corporates. Yes Bank has earned Rs 22697.4304 Cr. revenue in the latest financial year. Yes Bank has posted Poor revenue growth of - 4.50859561822854 % in last 3 Years.

In terms of advances, Yes Bank reported 12.2713108413152 % YOY, rise . If you see 3 years advance growth, it stands at 5.8401707347199 %.

Currently, Yes Bank has a CASA ratio of 30.7596438981468 %. It’s overall cost of liability stands at 5.01090543641817 %. Also, the total deposits of Yes Bank from these accounts stood at Rs 217501.8616 Cr.

Yes Bank has a Poor ROA track record. The ROA of Yes Bank is at 0.213195222843689 %.

The Lender is efficiently managing it’s overall asset portfolio. The Gross NPA and Net NPA stood at 2.17 % and 0.83 % respectively as on the latest financial year.

One other important measure of banks’ financial health is provisioning coverage ratio. The YoY change in provision and contingencies is positive at 49.9813895257724 % which means it has increased from the previous year.

Non-Interest income or other incomes are very important for banks as it gives a regular source of income for bank with no additional risk. Other income of Yes Bank surged and is currently at Rs 3926.6498 Cr.

Yes Bank has a Good Capital Adequacy Ratio of 17.9 .

The best metric which provides insights about bank’s valuation is P/B ratio. Currently Yes Bank is trading at a P/B of 1.6267 . The historical average PB of Yes Bank was 1.36842055480763 .

Share Price : - The current share price of Yes Bank is Rs 23 . One can use valuation calculators of ticker to know if Yes Bank share price is undervalued or overvalued.

Brief about Yes Bank

Yes bank ltd. financials: check share price, balance sheet, annual report and quarterly results for company analysis.

Welcome to our comprehensive analysis of Yes Bank Ltd.'s stock, designed specifically for long-term stock investors seeking in-depth stock analysis. In this article, we will delve into various aspects of Yes Bank Ltd.'s stock, providing valuable insights to aid investors in making informed investment decisions.

Yes Bank Ltd. Share Price:

Yes Bank Ltd.'s share price is a key indicator for long-term stock investors, reflecting the market's confidence in the company's performance and future prospects. By utilizing our user-friendly pre-built screening tools , investors can analyze and monitor Yes Bank Ltd.'s share price trends and patterns. These tools help investors gain a deeper understanding of the market potential and sentiments surrounding Yes Bank Ltd.'s stock. Whether the share price is on an upward trajectory or experiencing fluctuations, our tools provide valuable insights to inform your investment decisions.

Yes Bank Ltd. Balance Sheet:

Yes Bank Ltd.'s balance sheet serves as a crucial source of information for evaluating the company's financial health and performance. It presents an overview of the company's assets, liabilities, and shareholder equity. Long-term stock investors can utilize our pre-built screening tools to analyze Yes Bank Ltd.'s balance sheet meticulously. By doing so, investors can gain insights into the company's asset base, its ability to manage liabilities, and its overall financial stability.

Yes Bank Ltd. Annual Report:

Yes Bank Ltd.'s annual report is a valuable resource for long-term stock investors seeking a detailed understanding of the company's operations, financial performance, and future plans. Our website provides downloadable copies of Yes Bank Ltd.'s annual reports, enabling investors to gain comprehensive insights into the company's strategies and growth prospects. These reports include a CEO letter, financial statements, and management discussions. By carefully reviewing the annual reports, investors can assess Yes Bank Ltd.'s performance and make informed investment decisions.

Yes Bank Ltd. Dividend:

Yes Bank Ltd. has a history of paying dividends to its shareholders. For long-term stock investors, the dividend track record is an important consideration when evaluating an investment. Regular dividend payments indicate a company's commitment to shareholders and can offer a steady income stream. By closely monitoring Yes Bank Ltd.'s dividend history and its future dividend plans, investors can evaluate the company's profitability, financial stability, and long-term growth prospects. Our tools provide insights into Yes Bank Ltd.'s dividend policies and assist in making informed investment decisions.

Yes Bank Ltd. Quarterly Results:

Yes Bank Ltd. regularly releases quarterly reports, providing investors with insights into the company's financial performance on a periodic basis. By analyzing Yes Bank Ltd.'s quarterly results, long-term stock investors can gain a deeper understanding of the company's revenue, earnings, and expenses. Our pre-built screening tools enable investors to analyze and observe any significant trends or patterns in Yes Bank Ltd.'s quarterly results. By leveraging this analysis, investors can enhance their decision-making process and gain insights into the company's performance.

Yes Bank Ltd. Stock Price:

Yes Bank Ltd.'s stock price is influenced by various factors, including the company's financial performance, market sentiment, and prevailing economic conditions. Our website provides tools for monitoring Yes Bank Ltd.'s stock price and staying informed about trends in the stock market. By analyzing Yes Bank Ltd.'s stock price using our pre-built screening tools, long-term investors can identify potential buying opportunities and assess the company's market potential. Our tools provide valuable insights into Yes Bank Ltd.'s stock price movements, empowering investors to make informed investment decisions.

Yes Bank Ltd. Price Chart:

A visual representation of Yes Bank Ltd.'s stock price over time, the price chart captures historical stock price movements. By analyzing Yes Bank Ltd.'s price chart, long-term stock investors can identify trends and patterns that may influence their investment decisions. Our pre-built screening tools enable investors to scrutinize the price chart, assisting in the identification of key trends. The price chart of Yes Bank Ltd.'s stock reveals important information, reflecting the company's growth potential and investors' sentiment.

Yes Bank Ltd. News:

To make informed investment decisions, long-term stock investors need to stay updated with the latest news about Yes Bank Ltd.. Our website offers a comprehensive collection of news articles from various sources, including financial news websites and social media platforms. By staying up-to-date with the latest news, investors can gain valuable insights into Yes Bank Ltd.'s operations, strategic initiatives, and potential market trends. Our tools provide access to the latest news on Yes Bank Ltd., enabling informed investment decisions.

Yes Bank Ltd. Concall:

Yes Bank Ltd. regularly holds conference calls with analysts and investors, known as concalls. These calls provide a platform for discussing the company's financial performance and future plans. Investors can access information about upcoming concalls on our website and utilize insights gained from previous calls. Listening to Yes Bank Ltd.'s concalls offers a unique opportunity for long-term stock investors to gain a deeper understanding of the company's operations and assess its financial performance. Our tools enable investors to stay informed about concall events.

Yes Bank Ltd. Transcripts:

Our website offers downloadable transcripts of Yes Bank Ltd.'s concalls, providing detailed records of the discussions held during these calls. Transcripts offer valuable insights into Yes Bank Ltd.'s operations, financial performance, and market outlook. By reviewing these transcripts, long-term stock investors can perform a comprehensive analysis of the company's financial health, growth prospects, and management strategies. Our tools provide access to Yes Bank Ltd.'s concall transcripts, enhancing investors' understanding of the company.

Yes Bank Ltd. Investor Presentations:

Yes Bank Ltd. provides investor presentations on its website, offering detailed information about the company's financial performance, strategic initiatives, and future plans. Investors can access these presentations through our website, gaining deeper insights into Yes Bank Ltd.'s operations, growth potential, and market outlook. Investor presentations serve as a valuable resource for long-term stock investors looking to evaluate the company's long-term viability and investment potential.

Yes Bank Ltd. Promoters:

Analyzing Yes Bank Ltd.'s promoters' holdings is crucial for long-term stock investors. Our pre-built screening tools enable investors to analyze the company's promoter holdings, providing insights into potential conflicts of interest and the company's ownership structure. Understanding the significance of promoters' holdings helps investors assess the strength, growth prospects, and long-term viability of Yes Bank Ltd.

Yes Bank Ltd. Shareholders:

The composition of Yes Bank Ltd.'s shareholder base, consisting of both institutional and individual investors, is an important consideration for long-term stock investors. By analyzing the shareholder base using our pre-built screening tools, investors can gain insights into potential risks or opportunities. Understanding the composition of the shareholder base provides valuable information about the company's strength, growth prospects, and recognition in the market.

Yes Bank Ltd. Premium Features:

To provide an enhanced analysis, our website offers premium features such as the DCF Analysis, BVPS Analysis, Earnings multiple approach, and DuPont analysis. These tools offer detailed insights into Yes Bank Ltd.'s financial performance, valuation, and profitability. By utilizing these premium features, long-term stock investors can make more informed investment decisions and gain a deeper understanding of the company's fundamentals.

Yes Bank Limited ROCE

ROCE, short for Return on Capital Employed, is an important profitability ratio used in stock analysis. It measures how much pre-tax profit a company is generating for each unit of capital employed in the business. The higher the ROCE, the more efficiently the company is utilizing its capital. On the Yes Bank Limited stock analysis page, you can easily access the ROCE of the company in the financials table or ratio section.

Yes Bank Limited EBITDA

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric that indicates a company's operational performance. It gives an idea of how much cash a company generates from its normal business operations without accounting for financing and tax decisions. By examining Yes Bank Limited's EBITDA on our stock analysis page, you can get an overview of how efficiently the company manages its operations.

Yes Bank Limited DPS

DPS, or Dividends Per Share, is a financial metric that reflects the amount of money a company pays out to its shareholders in the form of dividends per each unit of its stock. A consistent and stable DPS can indicate a reliable and financially healthy company. On our Yes Bank Limited stock analysis page, you can access all the relevant information about the DPS of the company and make informed investment decisions.

Yes Bank Limited EPS

EPS, or Earnings Per Share, is a profitability ratio that indicates how much profit a company generates per each outstanding share of its stock. It can give a clear picture of the potential earnings of each investor if the company performs well. With Yes Bank Limited's EPS data available on our stock analysis page, you can get a better understanding of the company's earning potential and take advantage of investment opportunities.

Ratio Delete Confirmation

IMAGES

VIDEO

COMMENTS

YES Bank Ltd. share price target. YES Bank Ltd. has an average target of 17.50. The consensus estimate represents a downside of -21.35% from the last price of 22.25. View 4 reports from 2 analysts offering long-term price targets for YES Bank Ltd.. Reco - This broker has downgraded this stock from it's previous report.

See 4 recent research reports for YESBANK, BSE:532648 YES Bank Ltd. from 2 source(s) with an average share price target of 18. ... Yes Bank reported its Q3FY20 numbers wherein the performance was impacted by a surge in slippages leading to a substantial erosion in networth (CET 1 at 0.6% as on December 2019). ...

UBS report stated that Yes Bank had loaned over its net worth to companies that were International Journal of Multi disciplinary Research Configu ration, ISSN: 2582-8649, Vol . 2, No.3, July 2022

Yes Bank is a private sector bank in India with a balance sheet size of ₹ 3.4 lakh crore as on December 2022. As a part of RBI's Reconstruction Scheme 2020, State Bank of India initially infused capital of ₹6050 crore for a ~48% stake in Yes Bank. Under this scheme, the minimum price was ₹10 per share and it also contained a lock-in ...

The present case study is based on the nation's biggest-ever banking failure of India's fastest-growing private bank, YES Bank. The YES Bank fiasco showcases the prevalent flaws of uprising NPAs and mounting bad debts in the financial sector. Post Asset Quality Review (AQR) conducted by RBI elucidate that the NPA of YES Bank is seven times ...

Stock Research Report for Yes Bank Ltd. Stock score of Yes Bank Ltd moved down by 1 in 3 months on a 10 point scale (Source: Refinitiv). ... YES BANK Limited is an India-based commercial bank, which offers a range of products, services and technology-driven digital offerings to its corporate, retail, and micro, small and medium-sized ...

Get Yes Bank Ltd, latest stock/share price quote, and fundamental stock ananlysis and reseaech report by industry expert. Visit ICICIdirect to know more! ... Yes Bank Ltd Research Report Update. SECTOR : Banks ; BSE : 532648 ; NSE : YESBANK ; 23.90. Chg: 0.5 (2.14 %) Our View reduce. Entry Price 83.00. Target 75.00. Recommend Date 05-08-2019 ...

Financial market has been jolted on 5 March 2020 when the central government has put YES Bank Ltd., India's fourth largest private bank, under moratorium, and the RBI has come out with a bailout package. The former CEO had extended loans in quid pro quo non-arrangement to the companies confronting financial turmoil. Theoretically, independent directors supposed to bring independent judgement ...

This case has incorporated the three major phases of Yes bank i.e. the rise, the fall and the revival. The turnaround process led by Mr Kumar was explained using the turnaround model given by Pearce and Robbins (1993) and the PCA framework of the RBI. The conditions which warranted the need for the turnaround in Yes bank and the factors ...

This Research paper covers multiple dimensions of Yes bank's journey. ----- Date of Submission: 05-07-2020 Date of Acceptance: 21-07-2020 ----- I. Introduction Yes bank is an Indian private bank started its journey in 2004. It is one of the new generation private

See 4 recent research reports for YESBANK, BSE:532648 YES Bank Ltd. from 2 source(s) with an average share price target of 15. ... Yes Bank reported its Q3FY20 numbers wherein the performance was impacted by a surge in slippages leading to a substantial erosion in networth (CET 1 at 0.6% as on December 2019). ...

According to news report The YES BANK's credit book on wa lk 31, 2014 was ₹55633 Crore and its stores report were ₹74192 Crore which was a lot quicker than rivals develop over 80% a nd that

The present case study is based on the nation's biggest-ever banking failure of India's fastest-growing private bank, YES Bank. The YES Bank fiasco showcases the prevalent flaws of uprising NPAs and mounting bad debts in the financial sector. Post Asset Quality Review (AQR) conducted by RBI elucidate that the NPA of YES Bank is seven times ...

Introducing WhatsApp Banking. All your banking needs just a message away. Say Hi on +91 829-120-1200 to start. Know More

Yes Bank was the UPI companion for almost 20 apps, according to the National Payments Corporation of India (NPCI). However, as a result of its failure, Yes Bank has suspended most of its UPI accounts.

The UBS report said YES Bank had the h ighest share of loans backe d by unlisted shares and current assets (2 3 per cent) and added the bank is most vulnerable to a large corpor ate default.

This Research paper is showing Financial analysis of Yes bank for the year 2014-15 to 2018-19. For the purpose of analysis camels model is consider appropriate and conclusion on each criterion used on from the above analysis. It is found that yes bank has improved is performance on criterion such as used on from the above

Research Paper Open Access CSR in Banking Sector- An Empirical Study on Yes Bank Limited Dr. Benson Kunjukunju Professor & Head, Post Graduate Department of Commerce, Mar Thoma College of Science and Technology, Chadayamangalam (P.O)-691534, Kerala Mob: 9496152627, 8075268936 ...

Yes Bank, an Indian private bank started its journey in 2003 under the leadership of three founders, Rana Kapoor, Ashok Kapur and Harkirat Singh. Due to decisions taken by two founders and other ...

Yes Bank has a Good Capital Adequacy Ratio of 17.90 . The best metric which provides insights about bank's valuation is P/B ratio. Currently Yes Bank is trading at a P/B of 1.57 . The historical average PB of Yes Bank was 1.37. Share Price: - The current share price of Yes Bank is Rs 22.55.