How Do I Transfer My Apartment Lease?

- Depending on your lease and its clauses, your apartment lease transfer could be seamless or a real nightmare

- Your landlord may charge you a fee to transfer your lease to screen the new candidate on top of your next month’s rent

- If you’re thinking of moving, here’s what to watch out for when requesting an apartment lease transfer

Muriel Vega

June 16, 2020

You've been at your dream apartment for years. But all of a sudden, your job situation has changed, and you have to move closer to work.

The problem is, you just re-signed your lease, and you don't want to absorb the crazy high fee that comes with breaking it. Depending on your lease, you may have to pay for each month you're not there .

One solution: An apartment lease transfer.

What is an apartment lease transfer?

An apartment lease transfer is a situation where another person takes over your lease after getting approval from your landlord.

You'll be in charge of finding a responsible tenant to take over your lease and pay the remaining rent directly to your landlord . But the best part of this arrangement is that you won't be responsible for the new tenant's behavior.

So, how can you get started with your lease transfer?

1. Consult your lease agreement

First, you need to read your lease and see what your restrictions are. You need to know where you stand and what your options are before reaching out to your landlord.

For example, are you allowed to do an apartment lease transfer, and if you are, what are the fees and costs? You may be required to pay an upfront transfer fee, plus, in some instances, lose your security deposit or last month's rent payment.

Read carefully if your apartment lease has one of the following clauses about breaking your lease .

Tenant-responsible clause

When you decide to break your lease, the responsible tenant clause says that you're accountable for the rent since you're on the lease, but only until you line up the next resident. This clause is the best-case scenario for a full-lease transfer, as once the new tenant signs the lease, your responsibility ends as the ink dries on the dotted line.

Lease buy-out clause

While this scenario still allows you to break your lease, it's not very lease transfer-friendly. This clause requires the tenant to pay a buy-out fee to get out of their lease, plus sometimes, up to an extra month of rent. This payment essentially breaks the lease and allows the landlord to start over. There's no lease transfer or subletting available.

No clause restrictions

Your landlord could've used a generic lease, and there's no clause in case you need to break your lease or do a lease transfer. This can be either a good or bad thing. Your landlord may be OK with a 30-day heads up and let you out of the lease with no fees or headaches. Of course, always terminate the lease in writing to protect yourself.

Or your landlord could charge you the full amount left on the lease. State laws can come in handy if there are protections available in your area.

2. Talk to your landlord

Your relationship with your landlord will come in handy here — all those on-time payments and quick replies. Even if your lease has a strict clause on no apartment lease transfers, it's worth bringing it up with your landlord.

Come into the conversation with a reliable, financially-stable tenant with good references to take your place, an open mind to negotiate on fees and the paperwork needed to transfer the lease once approved. Bring a few possible tenant ideas, with references and work histories, and, if financially feasible, offer to pay the background check on the chosen one.

3. Get it in writing

Once approved, get it in writing — type up a quick agreement, and you both can sign it.

Also, bring an assignment of residential lease agreement with you for your landlord to review. It will show them that you're serious about this transfer and doing your due diligence.

This agreement , if approved by the landlord, will be signed by you, the landlord and the new tenant. You'll need both written agreements to protect yourself as a former tenant. It's highly recommended to get them both notarized to avoid disputes at a later time.

Regardless of your landlord's approval, don't count on getting your security deposit right away. Unless the landlord agrees to give it to you early, usually, you have to wait until the end of the lease (yes, the lease you transferred). So, be sure to deep clean the unit and take photos to make sure you get that deposit back.

4. When all else fails, sublet

You had a constructive conversation with your landlord, but no dice on the lease takeover. Pitch him subletting instead to avoid the high costs of breaking a lease if allowed by the lease. Subletting is not the same as a lease takeover, however.

Subletting is where you find someone to pay your apartment's rent, but your name is still on the lease. This is a last-ditch effort, as it comes with the stress of keeping up if the new tenant paid the rent or not. And if they didn't, you're on the hook for an unexpected rent payment. Some people open up their apartments to home-sharing apps like Airbnb, but it also requires prior landlord approval.

Proceed carefully with subletting as it could affect your credit score, and your security deposit may disappear if they trash the unit and leave you with the bill.

After you complete your apartment lease transfer

Once everything is set in stone (and in writing) with your landlord, set a moving date with the new tenant. It's nice to share the quirks of the apartment, the utilities they're responsible for and any advice with dealing with the landlord.

Now that the responsibility of the apartment lands on the tenant's shoulders, thanks to the apartment lease transfer, you can rest easy as you pack up and get going to your new dream apartment.

The information contained in this article is for educational purposes only and does not, and is not intended to, constitute legal, medical or financial advice. Readers are encouraged to seek professional financial, medical or legal advice as they may deem it necessary.

About the author.

Muriel Vega is an Atlanta-based journalist who writes about technology and its intersection with arts and culture. She's worked on content for startups like Mailchimp, Patreon, Punchlist, Skillshare, Rent. and others. Muriel has also contributed to The Washington Post, Eater, DWELL, Outside Magazine, Atlanta Magazine, AIGA Eye on Design, Bitter Southerner and more.

How to transfer your lease: A simple guide

By Anika Legal | Thu 7th Jan. '21

On a fixed-term lease and need to move? Don’t fret – breaking your lease is not your only option! Breaking your lease can be incredibly stressful for both the landlord and tenant – but you can avoid this mess by getting your lease transferred. Here’s a simple guide on what you need to know.

If you don't know what "breaking a lease" means or you are thinking of breaking your lease, have a read of this post too - " What are lease breaks, and why can't I just leave my property? ".

Before beginning the lease transfer process, it helps to understand your rights and responsibilities to avoid any nasty surprises and unnecessary stress. If you are renting a property, you would have signed a lease agreement at the beginning of your tenancy. A lease is a binding contract containing what your rights and obligations are throughout your time in the rental. If you don’t have a copy, your agent is legally required to provide you one.

A lease transfer is effectively changing that lease from your name and transferring all those rights and obligations to another person who will be taking over the lease.

But be mindful of when the lease transfer begins. Generally, tenants are required to pay their rent a month in advance. Make sure the person transferring onto the lease understands when they need to make their first rent payment to avoid any late payments.

Find someone to take over your lease

- In order to transfer your lease, there needs to be someone to transfer it to. Although your landlord cannot unreasonably refuse consent, maximise your chances by finding someone who has a good rental history and the financial capacity to pay the rent on time.

- Most agents will request the prospective tenant receiving the lease transfer to put in an application (same as if you were to apply to any other rental property). Make sure the prospective tenant provides supporting documents such as payslips and rental receipts to support your request and remove any doubt of your ability to be a reliable tenant.

Get written consent from your landlord

- You must get written consent from your landlord if you want to transfer your lease. Verbal consent through a phone call or a face to face meeting will not be sufficient. If you try to transfer your lease without your landlords’ written consent, it will be invalid and void.

By law, a landlord must not unreasonably withhold consent for a lease transfer. If a tenant believes their landlord has unreasonably withheld their consent, they may apply to VCAT. VCAT will hear from both parties and will either:

- Decide that consent is not required and let the lease transfer go ahead without the landlord’s consent; or

- Decide that it was not unreasonable to withhold consent and uphold the denial of the lease transfer, disallowing you from transferring your lease.

What exactly does it mean to ‘unreasonably withhold consent’? Unfortunately, there is no solid definition. Factors VCAT may consider include the prospective tenant’s ability to pay rent and their previous rental history.

Your landlord may require you to pay an administration fee for the reasonable costs of preparing a new lease. Your landlord cannot charge you a fee for them to consent and they cannot refuse giving their consent to the transfer of your lease because you have refused to pay the fee. But what happens if you have already paid a fee to your landlord for their consent? If this is the case, then you can apply to VCAT to get an order for the landlord to refund the fee.

Like the lease, the bond needs to also be transferred. This does not happen automatically. To transfer your bond, your landlord or agent will need to submit a tenant transfer with the Residential Tenancies Bond Authority (RTBA). Once the transfer has been submitted, all tenants will receive an email from the RTBA where they will need to accept the transfer. Once all parties have accepted the transfer, the bond has officially been transferred.

But beware , transferring your bond through the RTBA only transfers the name, NOT the actual money. The transfer or exchange of the actual bond money is the responsibility of the transferor and transferee to do themselves. This means that the person transferring into the lease must provide the bond money to the person transferring out of the lease. It is critical to ensure that both parties of the lease transfer are aware of this. If you are leaving the property, do not agree to the transfer of the names on the RTBA records before you've received the money from the person taking over!

It is not uncommon for one of the tenants on a lease to transfer their tenancy to someone else. This is referred to as transferring co-tenancy. The process for transferring co-tenancy is the same as a full lease transfer (as explained above).

Essentially, instead of the whole lease being transferred from one person to another, a co-tenancy transfer only transfers the rights of the person transferring out with the person transferring in. The tenants on the lease who were not involved in the transfer will not be affected.

If you are undergoing a co-tenant transfer, be mindful of how the bond is divided. The RTBA will only transfer the names on the bond. However, like a full lease transfer, the exchange of bond money is a private matter that needs to be worked out between tenants.

The bond is generally divided between tenants in co-tenancies. As a tenant transferring in, ensure you know how much bond you are responsible for. A bond is not always divided equally between tenants. As a tenant transferring out, make sure you have clearly communicated with the person replacing you how much bond they are responsible for to prevent any issues arising and to ensure you get the amount of bond you initially contributed back.

We hope this has cleared up some of the ins and outs of lease transfers – stay tuned for more helpful tenancy tips and blog articles !

We last updated this page in March 2022. Please remember that this is only legal information. If you're thinking about taking action, you should chat to a lawyer for advice about your situation first.

How useful was this content?

Ready to solve your rental problems.

Complete our 10-minute questionnaire to get free legal support.

Understanding Property Lease Transfer: Key Steps & Options

Understanding property lease transfer involves comprehending the critical steps and options available when transferring a lease from one tenant to another. This process requires knowledge of lease assignment, early lease termination, and the effects of termination clauses on the lease transfer. Leasey.AI, a company proven in navigating these processes, stands as a crucial resource for property managers seeking guidance.

Exploring Real Estate Lease Assignment

What defines a successful lease assignment process, how to navigate lease termination early, can termination clauses affect a lease transfer, steps for seamless rental agreement handover, what are key documents in rental agreement succession, what is subleasing and how does it work, what distinguishes subleasing from direct lease transfers, differences in commercial vs. residential lease transfers, what legal differences impact commercial lease handovers, lease transfer taxes and fees explained, how are transfer taxes calculated for different lease types, the role of a property manager in lease transitions, what responsibilities does a manager have in lease changes, understanding the legal framework of lease transfers, how do local laws influence lease transfer regulations.

As a property manager with years of experience in the field, I’ve come to understand that a smooth lease transfer can significantly impact your rental business’s success. A straightforward real estate lease assignment or lease transfer ensures continuity, minimizes vacancy periods, and maintains revenue streams. It’s not just about finding a new tenant; it’s about carefully transferring obligations to ensure a seamless transition for all parties involved.

In my journey, exploring real estate lease assignment has been a pillar of maintaining stability in rental properties. It’s a nuanced process, but with the right steps and understanding, it can be handled efficiently. I’ve seen firsthand how understanding the key aspects of lease assignments can prevent potential legal issues and foster positive relations between tenants and landlords.

Exploring real estate lease assignment means transferring a tenant’s rights and obligations under a lease to another party. This process keeps the original lease terms intact but shifts the responsibility to a new tenant. Such assignments often involve a registration process with the property manager or landlord to ensure the new tenant’s qualifications meet the lease requirements. Implementing a thorough assignment review helps in maintaining lease integrity.

A successful lease assignment process is characterized by thorough vetting and seamless transfer of obligations. It involves detailed tenant screening, understanding the rental agreement’s nuances, and registering the new tenant in compliance with existing lease terms. This methodological approach ensures the lease assignment preserves property management standards and tenant satisfaction. Properties that execute a detailed lease assignment process tend to experience smoother transitions and fewer vacancies.

Navigating early lease termination requires a clear understanding of the lease conditions and effective communication between the landlord and tenant. When either party acts to terminate a lease prematurely, it’s important to review termination clauses that might allow for such actions without significant penalties. Companies like Leasey.AI suggest planning for early termination scenarios in the initial lease agreement can handle unexpected changes more gracefully. This preparation includes establishing clear termination conditions that protect both landlord and tenant interests.

Termination clauses significantly affect a lease transfer as they outline the conditions under which a lease may be ended or transferred before its expiry date. Including detailed termination clauses in lease agreements offers a clear path for both termination and lease transfer processes. These clauses can dictate the feasibility of a lease transfer, including any costs or requirements that the current tenant must meet. Properly constructed termination clauses thus provide a safeguard and a structured framework for managing lease transfers effectively.

- 70% of lessees consider transferring their lease before the term ends.

- 3 major steps are needed: research, agreement, and official transfer.

- 5% average cost saving on fees when comparing lease transfer options.

- A 90-day period is often given to complete a transfer process.

- Over 60% of transfers include vehicles and apartments.

- 2024 models show a 15% increase in lease transfer popularity.

- 8 out of 10 transfers are finalized within a 45-day timeframe.

A seamless rental agreement handover requires meticulous planning and execution. My experience in property management has shown that understanding the lease transfer process ensures a smooth transition. First, notify all parties involved, including tenants and property owners, of the pending lease transfer. Next, conduct a thorough property inspection to assess its condition before the handover. Finally, updating the security deposit details ensures financial clarity for all parties. These key steps help in avoiding future disputes, making Lincoln Property Company a preferred manager for many.

In a rental agreement succession, the key documents include the original lease agreement, a lease assignment form, and a property inspection report. The original lease agreement provides the legal basis for the succession. The lease assignment form officially transfers lease obligations to the new tenant. Lastly, the property inspection report records the property’s condition at the time of the transfer. These documents are crucial in ensuring a transparent and legally sound process, as demonstrated by management firms like BC Property Management.

Subleasing allows a tenant to rent out their leased property to another individual, with or without property management’s permission. This option can be beneficial when the original tenant needs to vacate the property temporarily but does not want to break their lease. The sublease agreement outlines the terms under which the subtenant will occupy the property. It includes details on rent, duration, and the rights transferred from the original tenant. Companies like New License Property Management excel in facilitating such arrangements, ensuring legal and financial protections are in place.

You must understand that subleasing and direct lease transfers differ significantly in terms of legal and financial responsibilities. In subleasing, the original tenant remains responsible for the lease terms and conditions, acting as a middleman. Conversely, a direct lease transfer completely removes the original tenant from the equation, transferring all obligations directly to the new tenant. This distinction is crucial for property managers to grasp to advise tenants correctly. Firms such as Determination Realty provide expertise in distinguishing these types, ensuring tenants make informed decisions.

Detailed Overview: Key Steps and Options in Property Lease Transfer Process

- A 10% rise in online lease transfers since last year.

- Every transfer has to pass a credit check as a standard step, providing security.

- 20% of lease transfers occur due to relocating for jobs.

- Testing the market for your lease can take up to 2 weeks.

- 80% of successful transfers use a professional service to help.

- Online tools have proven to make the process 30% faster.

- Transfer fees range from $100 to over $500, depending on the state.

Lease transfers for commercial properties differ significantly from residential ones in complexity and flexibility. Commercial lease transfers often involve larger financial stakes and more complex negotiations. These agreements may include specific terms related to business operations that are not present in residential leases. Conversely, residential lease transfers tend to be more straightforward, focusing on living arrangements and personal use of the property. Understanding these differences ensures property managers can handle transfer requests effectively and efficiently.

Commercial lease handovers face stricter legal scrutiny compared to their residential counterparts. This is because commercial leases typically involve more detailed terms regarding the use of the property, alterations, and business-related liabilities. For example, commercial leases may include clauses on assignment and subletting that require explicit consent from the landlord. Additionally, commercial tenants might need to provide financial records or business plans to prove their capability to uphold the lease terms. These requirements highlight the necessity for property managers to conduct thorough due diligence during the transfer process.

Transferring a lease often incurs taxes and fees that can vary depending on the property type and location. These expenses are an important aspect for property managers to consider when facilitating a lease transfer. For commercial properties, transfer taxes might reflect the property’s valuation and the complexity of the business lease agreement. Residential leases may feature lower transfer fees but are still subject to local regulations and taxes. Awareness of these costs helps property managers set accurate expectations for all parties involved.

Transfer taxes for leases are calculated based on several factors, including the property’s location, type, and the lease’s remaining duration. For commercial properties, the calculation may also consider the business’s valuation, potentially resulting in higher transfer fees. Residential properties generally enjoy simpler tax structures, with fees often based on the property value or a flat rate set by local authorities. This distinction underlines the importance of property managers researching local tax codes and regulations to accurately inform tenants about potential costs. For further information on real estate transactions and transfer taxes, the National Association of Realtors website offers a wealth of knowledge.

In my experience, the role of a property manager involves ensuring smooth lease transitions. This role includes communicating changes to tenants and landlords. Property managers also oversee the transfer process, ensuring all paperwork complies with legal standards. Their involvement helps prevent potential disputes during the lease transfer process.

A property manager has several key responsibilities during lease changes. First, they must review the lease agreement to understand its transfer clauses. They then manage communications between the outgoing and incoming tenants. Lastly, property managers ensure the lease transfer adheres to local laws. This role is crucial in executing a seamless transition.

Understanding the legal framework is essential for property lease transfers. This knowledge enables property managers to navigate the complex legalities involved. They must ensure that the lease transfer process complies with state and local regulations. Familiarity with the legal framework provides a foundation for managing lease transfers effectively.

Local laws significantly influence lease transfer regulations. These regulations can vary widely between jurisdictions. Property managers must research local statutes to ensure compliance. Understanding local laws is key to facilitating legal and successful lease transfers. This research prevents legal issues and ensures a smooth transition process.

- main , property lease transfer

Realize Value Overnight

Leasey.AI provides a seamless implementation experience — your personal Leasing Assistant will onboard your properties and get your account up and running, so you can start enjoying the benefits of automation instantly.

You may also like

What’s the Best Property Management Software in 2024? 4 Popular Options

Optimal property management software solutions for the smaller scale landlords.

6 Benefits of Automated Property Management: Unlock Efficiency by Streamlining Your Leasing Process

How to Transfer an Apartment Lease to Someone Else?

So, you’ve recently signed a lease to your new apartment, but an unforeseen circumstance has suddenly forced you to uproot your life.

Whether caused by financial matters, family issues, or a job relocation, you need to find someone to take over your lease, but you don’t want to worry about someone not paying rent on time.

In that case, a lease transfer is ideal. Here are four steps to transfer your apartment to someone else.

Table of Contents

Step 1: Check Out Your Lease Agreement

Your lease agreement outlines the relationship between you and your landlord or property manager .

The lease document also contains important information like your monthly rent, rental term length, and the number of occupants allowed in your unit.

It’s not uncommon for tenants to misplace a lease agreement or read through it quickly before signing.

If you can’t find your rental agreement, ask your landlord or property manager for a copy.

Once you have your rental agreement, read through it carefully.

Specifically, look through your lease agreement to see how your landlord or property manager deals with a lease transfer.

For example, some apartment managers require a processing fee with your lease transfer application.

Here are some of the specifications you may expect to see in your lease agreement:

Written Consent

For most lease transfers, written consent from your landlord is required.

Your landlord or property manager’s written consent is a document signed by them and, eventually, you and the new tenant.

Processing Fee

Sometimes your landlord or property manager will require you to pay a processing fee to transfer your lease to someone else.

Your landlord or property manager determines (if there is a fee) the amount, so it is possible to negotiate the price.

For example, if you are nearing the end of your lease, you can avoid a fee.

However, for the most part, if you want to avoid a transfer fee , it typically depends on your landlord’s reasoning for the payment or your reason for moving.

Landlord’s Power to Decline

If your new tenant cannot meet the eligibility requirements to take over your lease, your landlord or property manager can refuse a lease transfer.

For instance, if it appears your new tenant cannot pay rent on time (or have a bad credit history), then your landlord or property manager has a reasonable excuse to deny your wish for a lease transfer.

In many lease transfers, it is your responsibility to find a new tenant, so you should consider verifying their financial stability.

Step 2: Find Someone to Take Your Lease

Finding someone to take over your lease is taxing, especially if you want someone trustworthy and stable – which you do.

And, not to mention that finding a replacement becomes even more challenging when you’re urgently looking, but not impossible.

We suggest that you find a couple of potential candidates to take over your lease because it is always a good idea to have more than one interested renter.

Facebook Marketplace, Craigslist, or any other websites where you can list your apartment , is an efficient way to advertise your place.

When listing your apartment, be sure to include photos, rental cost, utility costs, location, etc., when trying to find a new tenant.

Sometimes, people around you are looking for a place to rent for a short time, so word of mouth is another way to find a new tenant.

In other words, ask friends, family, and co-workers if they or anyone they know are looking for a place to rent.

Just remember that finding someone who can prove their ability to pay their rent on time will help put you and your landlord or property manager at ease.

In turn, you are making the lease transfer process smoother.

If you are having trouble finding someone, think about offering to cover their first month’s rent or, if possible, paying the first couple of months’ utilities. Essentially, try to provide incentives to entice people to take over your lease.

Lastly, another way is to ask your landlord or property manager if they have anyone who has shown interest in renting a place in your complex.

Step 3: Meet with your Landlord or Property Manager

You will need your landlord or property manager’s written consent to transfer your lease to someone else.

Them saying, “Go for it,” isn’t enough – it needs to be on paper.

The best way to get this is to schedule an informal meeting with your landlord or property manager.

We recommend not doing this until you have a new tenant in mind, as it will show your urgency and seriousness in transferring your lease.

Before speaking with your landlord or property manager, research your state’s laws regarding a lease transfer to someone else.

Different states have different rules, so make sure you know the limitations of your landlord or property manager’s authority.

For example, in California, a landlord needs a reasonable cause for denying a tenant’s motion for a lease transfer. But, if the landlord’s refusal seems unreasonable, it is the tenant’s responsibility to prove it.

Whether or not you have developed a positive relationship with your landlord or property manager, there are some things that you can do to ensure your conversation goes smoothly.

But, first, note that a mutually respectful conversation is the essential determinate for an easygoing lease transfer.

So, try to treat your landlord or property manager with respect and kindness – no matter your history together.

Things To Discuss and Bring To Your Meeting

- Have a new tenant (or a couple) eager to take over your lease.

- Have undisputed evidence that your new tenant is financially secure, like pay stubs and a good credit score .

- Explain your reason for moving – especially if it is something out of your control.

- Offer to pay the remainder of your rent for the month or next month’s rent.

- Discuss the documents you’ll need to finalize your lease transfer.

Once your lease transfer is approved, don’t be afraid to clarify the terms you and your landlord or property manager settle on.

Specifically, your replacement should have the sole responsibility for paying the remaining rent. Hence if the new tenant fails to pay on time, your landlord or property manager cannot look to you.

Moreover, this is why it is essential to show that late payments are nothing more than a hypothetical possibility because you’ve proven your replacement’s excellent rental rapport.

What To Do if Your Landlord Declines Your Lease Transfer

So, you’ve talked to your landlord or property manager, and they’ve declined your lease transfer.

Now, even more than before, your urgency to get out your lease has become your top priority.

First off, it’s okay to acknowledge how maddening a stubborn landlord or property manager can be, especially when your reason for moving out is out of your control.

Now, if you believe your landlord or property manager doesn’t have a legitimate reason to refuse your lease transfer, then here’s what you should do: contact a real estate lawyer .

A specialized landlord-tenant lawyer could help you dispute your landlord or property manager’s decision if you feel they unreasonably rejected your lease transfer.

A landlord’s legal rights vary depending on the state you reside in. Therefore, a real estate lawyer should be well-informed of your state’s landlord-tenant laws.

Step 4: Make It Official

Once your landlord or property manager has approved your lease transfer, it’s time to write out the official documentation.

An official record of a lease transfer should include your landlord or property manager’s signature, your signature, and the new tenant’s signature.

Additionally, it should have the address of the place from which you are transferring your lease.

While this could be as simple as scratch paper with all the information mentioned above, there are lease assignment templates you can fill out and print.

However, the above might not be necessary, as your landlord or property manager may have a document of their own that you and the new tenant must sign.

Packing Up Your Apartment

Hopefully, with our guide, you have successfully transferred your apartment lease to someone else.

Now that you are free from your contractual obligations, it’s time to focus on getting the apartment ready for the new tenant.

Lastly, although not a formality, it doesn’t hurt to communicate with the new tenant to guarantee a trouble-free move-out process .

Other articles you may also find useful:

- How Long Can A Tenant Stay After Lease Expires?

- What Happens To An Apartment Lease When Someone Dies?

- How to Break a Lease on an Apartment

- How Apartment Leases Work (All You Need to Know)

- Can You Break Your Apartment Lease Due to Bad Neighbors?

- What Can Apartments Charge For When Moving Out?

- Can I Break My Apartment Lease If I Feel Unsafe?

- Signed a Lease but Changed My Mind – What Are My Options?

- What Happens if I Break My Lease and Don’t Pay?

- Who Is Responsible for Cleaning Out the Apartment After Death?

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

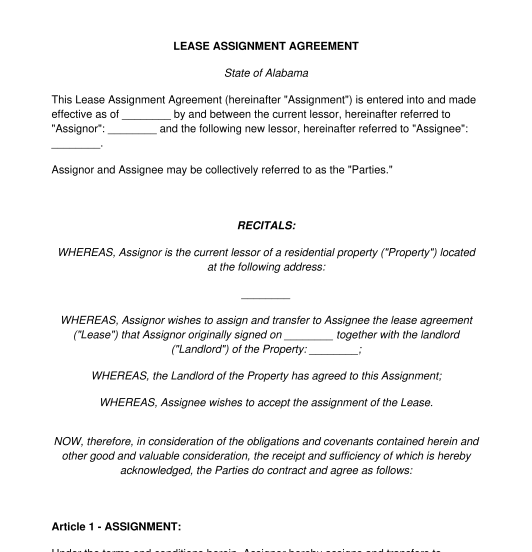

Lease Assignment Agreement

Rating: 4.9 - 137 votes

A Lease Assignment Agreement is a short document that allows for the transfer of interest in a residential or commercial lease from one tenant to another. In other words, a Lease Assignment Agreement is used when the original tenant wants to get out of a lease and has someone lined up to take their place.

Within a Lease Assignment Agreement, there is not that much information included, except the basics: names and identifying information of the parties, assignment start date, name of landlord, etc. The reason these documents are not more robust is because the original lease is incorporated by reference , all the time. What this means is that all of the terms in the original lease are deemed to be included in the Lease Assignment Agreement.

A Lease Assignment Agreement is different than a Sublease Agreement because the entirety of the lease interest is being transferred in an assignment. With a sublease, the original tenant is still liable for everything, and the sublease may be made for less than the entire property interest. A Lease Assignment transfers the whole interest and puts the new tenant in place of the old one.

The one major thing to be aware of with a Lease Assignment Agreement is that in most situations, the lease will require a landlord's explicit consent for an assignment. The parties should, therefore, be sure the landlord agrees to an assignment before filling out this document.

How to use this document

This Lease Assignment Agreement will help set forth all the required facts and obligations for a valid lease assignment . This essentially means one party (called the Assignor ) will be transferring their rights and obligations as a tenant (including paying rent and living in the space) to another party (called the Assignee ).

In this document, basic information is listed , such as old and new tenant names, the landlord's name, the address of the property, the dates of the lease, and the date of the assignment.

Information about whether or not the Assignor will still be liable in case the Assignee doesn't fulfill the required obligations is also included.

Applicable law

Lease Agreements in the United States are generally subject to the laws of the individual state and therefore, so are Lease Assignment Agreements.

The Environmental Protection Agency governs the disclosure of lead-based paint warnings in all rentals in the States. If a lead-based paint disclosure has not been included in the lease, it must be included in the assignment. Distinct from that, however, required disclosures and lease terms will be based on the laws of the state, and sometimes county, where the property is located.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: Tenants and Subtenants Obligations under a Sublease Agreement

Other names for the document:

Assignment Agreement for Commercial Lease, Assignment of Commercial Lease, Assignment of Lease, Assignment of Residential Lease, Assignment Agreement for Lease

Country: United States

Housing and Real Estate - Other downloadable templates of legal documents

- Security Deposit Return Letter

- Rent Payment Plan Letter

- Residential Lease Agreement

- Sublease Agreement

- Tenant Maintenance Request Letter

- Rent Receipt

- Late Rent Notice

- Notice of Intent to Vacate

- Roommate Agreement

- Quitclaim Deed

- Parking Space Lease Agreement

- Short-Term Lease Agreement

- Tenant Security Deposit Return Request

- Termination of Tenancy Letter

- Change of Rent Notice

- Complaint Letter to Landlord

- Lease Amendment Agreement

- Notice of Lease Violation

- Consent to Sublease

- Eviction Notice

- Other downloadable templates of legal documents

- See our FAQs

- Send an email

- Chat online

- Call (877) 881-0947

Legal Ways To Transfer Property

Last reviewed or updated 11/09/2023

Start Your Bill of Sale

Answer a few questions. We'll take care of the rest.

How do I perform a basic property transfer?

For small items such as everyday groceries or even larger retail purchases in shops, you usually don't have to sign any kind of separate agreement like a Bill of Sale. An informal contract is finalized when money exchanges hands and you obtain the item, with its receipt acting as confirmation. However, as the value increases, or if it is something like a car or boat where the sale gets recorded with a government agency, paperwork becomes necessary. Some states even require you to complete a Bill of Sale for these transactions.

Real estate is by far the most complicated subject matter for property transfers. Transferring real estate can often involve more steps that people expect. Commonly, transferring ownership of a home or property is done using a deed as well as a Real Estate Purchase Agreement or a Property Sale Agreement . The agreements are legal documents that represent the contract between the buyer and the seller, while the deed is what gets recorded with the state or county government. The deed to a home or piece of real estate works like the title to a car to show who owns the property.

How can I transfer property as a gift?

Another way to transfer property is as a gift. Defined as a transfer of ownership where the donor does not receive the full consideration (or payment) in return, it is governed as a distinct type of transfer from a sale. Transferring personal property can be accomplished simply through the act of giving the item to the recipient. For high value items, it can be helpful to document the gift in some way. For vehicles, completing the state title transfer document is generally required, even if there is no money being exchanged.

Usually accomplished between family members, gifts of real estate also have to be notarized or witnessed in order to be completed. Note that gifts are considered taxable under Chapter 12, Subtitle B of the Internal Revenue Code. The tax is usually paid by the donor, though in some cases that responsibility may transfer to the recipient.

Can I transfer property through relinquishment?

Though not explicitly defined, relinquishment of rights to a given piece of real estate or property can also be considered a valid form of property transfer. For example, if you and a sibling inherit property as co-owners, you may be able to relinquish your share of the property. As usual, a document in which you or another party relinquishes their rights to a given piece of real estate has to be notarized or witnessed in order to be effective.

Note that different states can and do regulate the matter differently. Always ask a lawyer to see if relinquishment is possible, and if so, what requirements you must follow.

Can I transfer property through my Will?

A Last Will and Testament can be used to transfer property after the owner's death. The full assignment of rights may depend on the beneficiary or heir accepting the Will's terms. A Will, however, cannot transfer ownership until the owner’s death. Before any property is transferred via a Will, there is a court process called probate that ensures a person’s assets and property are distributed according to their wishes. Wills and estate plans are complex, yet can prove to be important tools for helping your family and heirs understand your final wishes for your property, assets, and belongings.

Are all types of transfers subject to tax?

It is important to note that all types of property transfers are subject to taxation. To make sure you comply with tax laws and avoid unpleasant surprises, talk to a tax professional before selling or transferring property. Completing a contract or Bill of Sale for the sale or transfer can often help provide you with a record of the transaction for tax purposes.

Researching your state laws and ensuring the transfer complies with them, can also help you avoid legal problems down the road. If you have more questions about transferring property, whether it’s your old car, your home, or a prized possession, reach out to a Rocket lawyer network attorney for affordable legal advice.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer .

Related Guides

Does an eviction affect your credit, legal essentials for a worry-free labor day weekend, how to stop a business from collecting personal data, ask a lawyer, try rocket lawyer free for 7 days, start your membership now to get legal services you can trust at prices you can afford. you'll get:.

All the legal documents you need—customize, share, print & more

Unlimited electronic signatures with RocketSign ®

Ask a lawyer questions or have them review your document

Dispute protection on all your contracts with Document Defense ®

30-minute phone call with a lawyer about any new issue

Discounts on business and attorney services

- Search Search Please fill out this field.

What Is a Conveyance?

Understanding conveyance, legality of conveyances, familial conveyances, types of real estate deeds, types of conveyances, examples of conveyances, frequently asked questions.

- Conveyance FAQs

The Bottom Line

- Home Insurance

- Home Ownership

Conveyance: Property Transfer Examples and FAQs

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

The term conveyance refers to the act of transferring property from one party to another. The term is commonly used in real estate transactions when buyers and sellers transfer ownership of land, building, or home.

This is done using an instrument of conveyance—a legal document such as a contract, lease, title , or deed. The document stipulates the agreed-upon purchase price and date of actual transfer, as well as the obligations and responsibilities of both parties.

Key Takeaways

- Conveyance is the act of transferring property from one party to another.

- The term is commonly used in real estate transactions when buyers and sellers transfer ownership of land, building, or home.

- A conveyance is done using an instrument of conveyance—a legal document such as a contract, lease, title, or deed.

- Such transfers may be subject to a conveyance tax.

- Fraudulent conveyance is an unfair or illegal transfer of assets done in order to avoid creditors during bankruptcy or to avoid taxes.

In finance, the term conveyance represents the act of legally transferring property from one entity to another. So when two parties engage in the sale of a piece of property, they transfer ownership through a conveyance. For instance, when a car owner legally signs the title over to a buyer, they are engaged in a conveyance.

The term conveyance is commonly associated with real estate transactions . Conveyance of ownership of real estate is also referred to as conveyancing, and the legal representative overseeing the process can be referred to as a conveyancer . Real estate transactions often incur a tax called a conveyance tax or a real estate transfer tax. This levy is imposed on the transfer of property at the county, state, or municipal level.

A conveyance is normally executed using a conveyance instrument. This is a written instrument or contract that outlines the obligations and responsibilities of both the buyer and the seller including the purchase price , date of transfer, and any other terms and conditions associated with the sale. The instrument may be a deed or a lease —a document that transfers the legal title of a property from the seller to the buyer.

There are cases where one party doesn't live up to its obligations as outlined in the conveyance instrument or contract. When this happens, the other party can take the defaulting party to court to enforce the contract or to claim damages.

Conveyancing ensures that the buyer is informed in advance of any restrictions on the property, such as mortgages and liens , and assures the buyer of a clean title to the property. Many buyers purchase title insurance to protect against the possibility of fraud in the title transfer process.

There are also legal distinctions of conveyances, mainly stemming from British law, that hold certain rights of conveyance within family estates or bloodlines:

- Fee tail conveyances stipulate that property must remain within a family, and in particular be passed down to one's children. A fee tail only can remain in place as long as children remain alive.

- Fee simple absolute conveyances provide a claim to one's heirs, who can then assume full rights of ownership and sell to whomever they wish, even outside of the family.

- Fee simple defeasible conveyances are similar to the above but come with certain restrictions or conditions. If a condition is violated, the ownership claim reverts back to the grantor.

- Life estate conveyances exist only as long as the owner remains alive, without respect to any heirs.

If the other party doesn't fulfill their obligations, you can take them to court to enforce the contract or to claim damages.

Different forms of real estate deeds are used to make sure each party fulfills the conditions outlined in the conveyance. Some agreements may be more simple; others may hold one party contingent on several outcomes.

- Bargain and sale deeds, sometimes called special warranty in other states, occur when the grantor makes assertions about the title, but the covenants in the agreement only relate to any time period in which the grantor owned the property. Commonly used by banks on foreclosed properties, these type of conveyances hold little to no claims regarding prior ownership of the property.

- Quitclaim deeds are used to convey title without any covenants. The grantor of a quitclaim deed makes no assertion over the ownership or condition of the property. Quitclaim deeds are often used for gifting title as it is a basic type of deed that simply convey that the grantor does not hold any interest in the property being transferred.

- Reconveyance deeds are used when prevailing conditions have changed and the deed needs to be "re-conveyed". This type of conveyance is used by mortgage lenders when a borrower has paid off their mortgage; with the debt having been satisfied, the lender no longer has conditional claims to the property.

Real Estate Conveyances

Conveyance is a general term that applies in a legal sense beyond residential real estate . The conveyance in most real estate transactions is also known as the sale deed. Conveyance is the category, and sales deed is a type of conveyance within that category. There are several primary types of deeds used to transfer real estate:

The process behind a typical conveyance includes a review of liens and other encumbrances . it ensures all conditions have been met, settling all taxes and charges with the appropriate party prior to transfer, confirming financing , and preparing all the documents for final settlement. The documents provided for conveyancing typically include the deed, mortgage documents, certificate of liens, the title insurance binder , and any side agreements related to the sale.

In most states, it is illegal to transfer property to a third party in order to avoid creditors ’ claims on that property. This is known as a fraudulent conveyance , and creditors can pursue their claim on the property via civil legal action.

Mineral Rights Conveyances

Conveyance also applies to the oil and gas industry . As land is a form of real estate with attached rights, exploration companies use the term conveyance to refer to contracts that transfer rights to or ownership of certain parcels of land to the company.

Among the most common conveyances is a contract granting mineral rights without turning over the title of the land, but conveyances are also used to establish the right of way for a company’s operations on a landowner’s property. The landowner is, of course, compensated for transferring these rights to the exploration company.

Other Real Property

Many forms of conveyance occur when real, tangible assets are transferred not just by physical possession but by signing over the title to the new owner. For example, consider buying a new car; whether through a dealership or private seller, the car is legally conveyed when the previous car owner signs the title over to the new car owner.

Another form of conveyance is the transfer of inventory. Consider a company that buys a large number of raw materials that must be transferred to its warehouse. Based on the agreed-upon shipping terms, conveyance of ownership may happen at acquisition, sometime during delivery, or when the goods are physically possessed by the buyer. This entire act of transferring ownership of property from one entity to another embodies conveyance.

Let's look at the transfer of a piece of land owned by an individual's grandfather. In the first example, the grandfather decides to sell the property to their grandson via an arms-length transaction and at fair market value. In this case, the deed is transferred at closing to the grandson, who becomes the new legal owner.

In a second case, the grandfather decides to gift the property to the grandson. Here, no money is exchanged for the value of the property, but a gift tax must be paid on any value greater than the prevailing gift tax exclusion amount. For 2022, the IRS set the gift tax exclusion amount as $16,000, and the gift tax exemption will increase to $17,000 for 2023.

In a third case, the grandfather dies and wills the property to the grandson. Again, the deed is conveyed but no money changes hands, and there is no gift tax. Instead, there may be an estate tax on any value exceeding $12.06 million for estates of decedents who died in 2022. The basic exclusion amount is increasing to $12.92 million for decedents who pass away in 2023.

What Is a Conveyance Tax?

A conveyance tax is levied by a government authority (such as a municipality or state) on the transfer of real property. This tax is usually paid by the seller , although this may be negotiated prior to closing.

What Is a Voluntary Conveyance?

In a voluntary conveyance , the owner agrees to transfer property to a new owner, but does not receive full compensation (known as "consideration" in legal terms). For instance, when willed to an heir, voluntarily forfeited to a lienholder, or donated to charity.

What Is a Deed of Reconveyance?

A deed of reconveyance is a legal document issued by a lender or lienholder when a mortgage or other debt secured by real property is paid off. This deed releases the property owner from any further claims by the lender.

What Is a Fraudulent Conveyance?

Fraudulent conveyance occurs when a property is transferred for reasons meant to avoid taxes, creditors, or which otherwise constitutes illegal activity such as money laundering.

Conveyance is the process of transferring property from one party to another. Often relating to the transfer of investments such as real estate or securities, conveyance is heavily tied to legal processes to ensure proper documentation is maintained and applicable gift taxes (or exclusions) are followed. Conveyance not only transfers ownership of assets but delegates ongoing responsibilities and obligations of both sides of the transaction.

Legal Information Institute. " Fraudulent Transfer Act ."

Internal Revenue Service. " IRS Provides Tax Inflation Adjustments for Tax Year 2023 ."

:max_bytes(150000):strip_icc():format(webp)/real-estate-agent-greeting-couple-at-house-111661701-af259000453e4b1cbc8e23e81ba31d54.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Real Estate Crunch

What Happens If I Have A Lease And The Property Is Sold?

Written By:

Post Publish Date -Updated::

Navigating the sale of a leased property can be challenging, especially when you’re the tenant. Building rapport with a property owner and then discovering they’re selling can stir feelings of uncertainty. You might wonder where your lease stands and if relocation is looming.

Generally, most lease agreements contain provisions that, in the event of a property sale, the lease remains intact and is transferred to the new owner. But this isn’t the end-all. Whether you’re a tenant, a seller, or a buyer, there are essential steps and considerations to ensure everyone’s interests are protected. Read on as we’ll delve into the primary concerns and recommended actions for tenants, sellers, and buyers when a leased property changes hands.

Table of Contents

Lease continuation for the subsequent owner:, lease termination upon transfer:, for tenants:, for landlords:, revisit your lease:, speak to the previous owner:, establish communication with the new owner:, confirm lease terms:, document everything:, stay updated:, know your rights:, security deposit:, seek legal counsel if necessary:, always be prepared:.

- You Can Listen To Our Podcast About Lease in Limbo – Navigating Property Sales and Tenant Rights Below or By clicking here.

Can You Sell A Property Without The Original Sales Deed?

What is a proof of the ownership of a house, definition of single family residence explained.

Entering into a lease agreement is a commitment from both the tenant (lessee) and the landlord (lessor) to abide by specific terms for a set period. But what happens when the property gets sold during this lease?

Understanding Lease Transfer

One of the most important things you can do is understand the lease transfer. The terms of the lease govern the situation typically by looking at the following:

Many leases include a provision stating that if the property is sold, the new owner inherits the lease. The tenant can continue living in the property, paying rent as usual, but now to the new owner.

Some leases have a clause that terminates the lease upon the sale of the property. In such cases, the original landlord may be required to compensate the tenant, as specified in the agreement.

Protecting Interests: Both Tenant And Landlord

There are things that both the tenants and landlord should do to protect their interests in the cast when the property is sold.

The most crucial thing a tenant should do is check all this out before signing a lease agreement.

- Read Before Signing: Before signing a lease, read it meticulously. Understand every clause, especially those relating to the sale of the property.

- Seek a Sale Clause: If the lease doesn’t mention what happens upon sale, request a provision ensuring the lease continues with any new owner.

- Documentation: Always maintain a copy of the signed lease, rent receipts, and any correspondence with the landlord.

- Regular Communication: If you learn the property is on the market, communicate with your landlord. Understand their intentions and your position.

- Get to Know the New Owners: Establish a line of communication with the new property owner once sold. Confirm the terms of your lease with them.

- Seek Legal Counsel: If discrepancies arise or the new owner doesn’t honor the lease, consult an attorney familiar with tenant laws in your jurisdiction.

A landlord must also clearly understand what is written on the lease agreement, especially if they plan to sell the property. Here are things that landlords should look at and do if they sell their property under lease.

- Transparent Lease Agreements: Always be clear in your lease about what happens if you decide to sell. This reduces future complications.

- Inform Your Tenant: Notify your tenant if you’re considering selling. Keeping them in the loop can ensure a smoother transition.

- Introduce the New Owner: Once sold, introduce the new owner to your tenant, ensuring the transition is as seamless as possible.

10 Steps For Tenants When Leasing A Sold Property:

If a property has been sold that you are leasing, there are things that you, as the lease, should address. Below, we have listed ten of the most critical steps.

Immediately review your lease to understand your rights and the implications of the sale.

Clarify any concerns or questions about the sale and your lease agreement.

Please introduce yourself and ensure they have a copy of your current lease.

Discuss the lease terms with the new owner, ensuring both parties are on the same page.

Keep records of all interactions with the new owner, from payments to maintenance requests.

Ask the new owner if they have any immediate plans for the property that might affect you.

Familiarize yourself with tenant rights in your area, especially concerning a change in property ownership.

Ensure your security deposit is transferred to the new owner or ascertain its status.

If issues arise or the new owner doesn’t respect the lease agreement, consult with an attorney.

While it’s not ideal, always be prepared for the possibility that you might need to move. Whether due to conflicts with the new owner or changes they wish to make, it’s good to be ready.

Our Personal Experience

From personal experience, I can attest to the significance of understanding your rights when renting a property gets sold. This scenario played out for us when our leasing property was sold.

Regrettably, the new owner proved somewhat challenging. Fortunately, our lease contained a specific clause that permitted us to exit the agreement if the property changed hands.

This provision allowed us to transition to a new property without further complications gracefully.

It underscores the importance of scrutinizing your lease before committing, ensuring you’re well-versed in your rights, particularly when the property you’re leasing gets sold.

The sale of a leased property can be a seamless process or a challenging transition, depending on the lease terms and the intentions of all parties involved. Tenants and landlords can ensure a smooth transition by being transparent, maintaining open communication, understanding their rights, and preparing for potential outcomes.

With the proper precautions, both parties can navigate the complexities of such a situation with confidence and clarity.

You Can Listen To Our Podcast About Lease in Limbo – Navigating Property Sales and Tenant Rights Below or By clicking here .

Real Estate Crunch gives you real property and real estate information and advice. We offer a free monthly newsletter; you can sign up for our newsletter by clicking here.

We also have a weekly podcast called “ Real Estate Crunch ,” found on all major podcast platforms. Listen to our podcast by clicking here.

Follow us on our social media platforms – Facebook and Instagram.

Related Question

Selling a property without the Sales Deed is possible, but it is essential to take all necessary steps to protect both the buyer and seller from potential risks or legal issues. You must do your due diligence; obtaining proper legal advice is always recommended when buying or selling a property.

By clicking here , you can read more about Can You Sell A Property Without The Original Sales Deed?

The deed is the proof of ownership of the house or land. The deed is a legal instrument that shows who owns the home and land. There are many kinds of deeds, from the warranty deed, special warrant, bargain and sale deed, and quitclaim deed. Even though they have some similarities, these deeds also have many differences.

By clicking here , you can read more about What Is A Proof Of The Ownership Of A House?

One term that you may come across frequently in real estate transactions is “single-family residence.” It is essential to understand what this means so that you know exactly what type of property you are buying or selling.

By clicking here , you can read more about Definition Of Single Family Residence Explained .

- Latest Posts

- The Evolution Of Modular Homes: How Sweden Perfected An American Innovation – May 8, 2024

- Investing In Duplexes: Are They Worth It? Pros And Cons Explained – May 1, 2024

- Top 10 Benefits Of Modular Housing In Solving The Housing Shortage – April 30, 2024

Share Our Blogs On Social Media

- Power of Attorney

- Last Will and Testament

- Living Will

- Health Care Directive

- Revocable Living Trust

- Estate Vault™

- > - Estate', 'ProductMenu')">More >>

- Residential Lease Agreement

- Commercial Lease Agreement

- Eviction Notice

Quitclaim Deed

Contract for Deed/Land Contract

- > - Real Estate', 'ProductMenu')">More >>

- Promissory Note

- Bill of Sale

- Loan Agreement

- Sales Agreement

- Purchase of Business Agreement

- > - Financial', 'ProductMenu')">More >>

- LLC Operating Agreement

- Confidentiality Agreement

- Partnership Agreement

- Business Plan

- > - Business', 'ProductMenu')">More >>

- Prenuptial Agreement

- Separation Agreement

- Child Travel Consent

- Child Medical Consent

- > - Family', 'ProductMenu')">More >>

- Online Notary

- Chat Online

- Help Center

- 1-855-231-8424 Mon-Fri 8am - 7pm ET

- United Kingdom

- 0 ? {effect:'slide', direction:'left', duration:500} : undefined));">More

What are you looking for?

Guide to selling and transferring real estate by owner, essential documents for buying and selling property.

These documents help you sell real estate and manage the buyer's payments.

A Quitclaim Deed is used to transfer a title or whatever interest the owner (grantor) may have in property to another person (grantee) without any war...

Real Estate Purchase Agreement

A Contract for Sale of Real Estate is used to document the purchase and sale of real property.

A Land Contract (or Contract for Deed) is a contract between a seller and buyer of real estate, where the seller provides the financing for the purcha...

Last updated January 10, 2024

Kyle Adam is a seasoned content creator, editor, and SEO specialist with over four years of experience. Presently, he serves as Senior Marketing Writer and Editor at LawDepot. Holding a...

Reviewed by

Sarah Ure is a Legal Writer at LawDepot. Sarah has undergraduate degrees in English and Psychology from the University of Calgary, as well as a Law degree from the University of Victori...

Fact checked by

Rebecca Koehn has been working in content creation and editing for over ten years and search engine optimization for over five years. Koehn is the Content Marketing Manager for LawDepot...

Table of Contents

- Selling versus transferring real estate

- Selling a house or piece of real estate

- Transfer of property

- Selling a house by owner

- How much does it cost to sell a house?

- How to sell a house by owner

- Transfer of real estate

- What is a property deed transfer?

- How do I transfer ownership of a property?

- Should I transfer ownership if I'm financing the sale?

- What is real estate transfer tax?

- Understanding your obligations

When it comes to real estate, tracking ownership is essential. In the United States, every piece of land and real estate ownership should be documented and filed with county recording offices .

Therefore, when you sell or gift property to someone, you need to create and execute certain documents to reflect ownership changes.

In this guide, we'll discuss the difference between selling and transferring real estate, the process of selling your house without a realtor, and the different ways you can transfer or gift property.

Selling and transferring real estate are separate actions that come with their own rules and requirements. Each activity requires unique documentation.

Although closely related, selling real estate and transferring real estate are not fundamentally linked. You can transfer real estate to someone without selling it, but you can't sell it without transferring the property title to the new buyer.

Selling your house means you're accepting a buyer's money in return for your home. Depending on the housing market and your property, selling your home can be a quick or drawn-out process. You can sell your real estate property with or without the help of a real estate agent.

Sometimes, you have to sell your home due to factors out of your control. Other times, you may just be ready for a change. Selling your real estate requires you to transfer the property title to the buyer as well . However, if you simply want to give a property to someone else as a gift, selling your home is not required.

There are many instances where people transfer a title without selling the property. For example, you may transfer your family home to your adult children when you move into senior-specific living or downsize into a smaller home.

Whether you are selling a piece of real estate or giving it away as a gift, you always have to transfer the title to the new owner when giving up ownership of a property.

Transferring real estate involves changing the property title from one person to another by filing the necessary paperwork with your county recording office . Usually, creating a deed and filing it completes the ownership change.

A deed is a legal document that transfers a property's title to someone new, proving that they have ownership. You can also file a deed to add an additional owner or remove a joint owner.

Homeowners selling their own homes without the assistance of real estate agents is growing in popularity. When homes are being sold privately, you may hear people refer to them as “for sale by owner” or FSBO for short.

Although it can be more work, selling real estate privately can financially benefit you and save you thousands of dollars.

Selling without a realtor is not for everyone. However, you may decide to sell your home without a realtor if:

- You plan on financing the purchase for the buyer

- You're selling your home to a family member

- You have the time and interest

- You want to save money

- You want complete control over the transaction

The cost of selling a house can vary depending on a variety of factors. The process may involve repair costs, legal fees, staging costs, moving costs, and more. However, the cost of selling a house can be most affected by whether or not you hire a real estate agent.

Cost of selling through a real estate agent

When you have a real estate agent help you sell your home, they take a commission. According to Bankrate , a real estate agent's commission is typically 5 to 6% of the sale price .

So, if you list your home through a real estate agent and sell it for $300,000, your agent could walk away with a commission of $15,000 to $18,000, leaving you with less of your equity.

For some sellers, paying a realtor is worth it, but others would rather fully profit off of the sale and not pay a realtor at all.

In addition to an agent's commission, you may have to pay for repairs, home improvements, closing costs, legal fees, and moving fees when you sell your house. With these additional expenses, the cost to sell a house can be around 15% of its sale price . According to Zillow , in the United States, the average seller can spend anywhere from $17,000 to $22,000 in closing costs.

Cost of selling privately

When you sell real estate privately, you still may have to pay for closing costs, such as repairs, home improvements, and legal fees. However, when selling privately, you'll save on realtor commission fees and keep more of your profits after closing. Therefore, selling privately could save you up to 6% of your home's sales price .

Keep in mind, if you are inexperienced with selling real estate, privately selling your property could lead to a lower sale price. Therefore, it's important to conduct thorough research and ensure you are getting the best deal.

When you sell your house without a realtor, you have to do all the leg-work on your own. If you're up to the challenge, check out the five steps of selling your house by yourself.

1. Determine the fair market value

You must determine your home's fair market value (FMV) when selling your house so you can set an optimal asking price. There are multiple ways to assess your home's fair market value, including the following:

- Base the fair market value off of your purchase price if you bought the home recently and the market hasn't drastically changed

- Research the selling prices of comparable dwellings in the same area or in the same building

- Hire a professional to appraise your home

If you hire a third-party appraiser, ensure they are state-licensed, state-certified, and follow ethical and performance standards .

Once you know your home's fair market value, you can decide on the asking price. If you set the price too low, you'll miss the opportunity to capitalize on the sale fully. If you set the price too high, you'll risk having low interest in your listing.

When you set an unrealistic price, buyers who could otherwise afford your home's fair market value may not show interest because you've set the asking price too high. With potential buyers showing minimal interest, it could take a long time to sell your home.

When you hire a real estate agent, they use their experience to help you decide on an ideal asking price. However, if you are willing to conduct your own research or hire an appraiser, you can determine an appealing asking price that will still financially benefit you.

2. List your property and find a buyer

To reach potential buyers, you must list your property. Generally, listing your property online is the most efficient way to reach the largest audience. Thankfully, there are many free or low-cost websites where you can list your property, such as Zillow and ForSaleByOwner.com . Additionally, you can list your property in a local newspaper's classified section.

You'll have to show them your property or hold an open house when you have interested buyers. Depending on your area's housing market, you could have your home listed for a very short or extended time. Once you find someone interested in purchasing your property, the two of you can begin negotiating a price.

3. Negotiate and secure an offer

During negotiations or before making an offer, a potential buyer may want to hire professionals to inspect certain aspects of the house, such as the foundation, exterior walls, roof, or grading of the land. These inspections can hold up the negotiation process.

As a seller who wants to complete the sale quickly, it can be nerve-wracking during negotiations. A buyer could seem interested but suddenly change their mind. To better gauge a potential buyer's interest level, you can ask them to use a Letter of Intent to show their intention of purchasing your property.

Once negotiations are further along, you and your buyer can use an Offer to Purchase Real Estate to outline the potential transaction . This document is helpful when a buyer is ready to make an offer on the house, but wants certain conditions met before the sale is finalized.

For example, a buyer may require the completion of the following actions in their offer:

- Property appraisal : an assessment of the value of the home, which confirms the buyer isn't paying significantly more than what the property is worth.

- Title search : a search of the current property title which verifies that the property has no liens against it or any other ownership issues that could impact the sale.

- Home inspection : a review of the property performed by a licensed inspector that details any damage or defects in the home and any attached buildings.

- Disclosure form : a document that outlines information regarding the property, such as if recent renovations were done, if there were any past problems with pests, etc.

- Maintenance and repairs : specific things done to the property before the buyer takes possession, such as painting, cleaning carpets, or fixing the roof.

A buyer will often not offer you your asking price. Generally, regardless of whether real estate agents are involved in a negotiation, a buyer may make an offer lower than the asking price. Sometimes a buyer may rationalize a lower offer due to additional repairs or renovations that they foresee.

However, if there are lots of buyers and not enough homes on the market, a buyer may offer you your asking price or more.

4. Create a Real Estate Purchase Agreement and secure finances

A Real Estate Purchase Agreement is a contract used to outline the terms of a residential property deal between a buyer and a seller. It may only be used for residential properties where construction has been completed.

After you've negotiated a sale price, the purchase agreement can help you solidify the terms of the transaction. When creating the contract, you provide the following information:

- Your information

- The buyer's information

- Property details

- Pricing and financing details

- Closing and possession dates

- Conflict resolution

- Termination options

The financing terms of the agreement are very important. Within our template , you can choose between the following three financing options:

- Third-party financing : A bank or other lending institution provides a loan to the buyer, which must be paid back over time.

- Seller financing : You, the seller, provide financing to a buyer who cannot obtain a loan from a financial institution. The buyer pays you a predetermined amount in intervals until they have paid the agreed-upon price in full.

- Assumption : A buyer takes over your mortgage, which means the home loan transfers to their name. The buyer takes financial responsibility for the remainder of the mortgage. Assumption often requires that the buyer is qualified to take over the loan under the lender's guidelines.

You do not have to file purchase agreements with your county or state . Once you and your buyer have both signed the Real Estate Purchase Agreement and you've secured the agreed-upon finances, you must transfer the property title to the buyer.

5. Transfer the property title

A Real Estate Purchase Agreement does not have the power to transfer a property's title , so you must use a deed or Contract for Deed in conjunction with the purchase agreement. For more information on transferring property titles, continue reading below.