Caring ‣ Urgent ‣ Aggressive

- Call For A Free Legal Consultation: (201) 261-1700

- Physician Reimbursement

- PIP / No-Fault Arbitration

- Workers’ Compensation Recovery

- Hospital Reimbursement

- ERISA Litigation Claim Attorneys

- Healthcare Arbitration

- Bicycle Accident

- Brain Injury

- Bus Accident

- Car Accident

- Construction Accident

- Hit and Run

- Motorcycle Accident

- Negligent Supervision

- Nursing Home Negligence

- Pedestrian Accident

- Slip and Fall

- Truck Accident

- Train Accident

- Wrongful Death

- Workers Compensation

- Business Disputes

- Business Justice Attorneys

- Employment Counseling and Litigation

- Shareholder/Partner Issues

- Shareholder Derivative Actions

- Business Dissolutions

- Business Transactions

- Buying/Selling a Business

- Corporate Entity Formation

- Director and Officers Duties

- Executive Compensation

- Negotiating Vendor Agreements

- Regulatory and Statutory Compliance

- Age Discrimination

- Disability Discrimination

- Gender Identity Discrimination

- Race Discrimination

- Religious Discrimination

- Sex Discrimination

- Appellate Law

- Child Custody

- Child Custody College Expenses

- Child Support

- Divorce for Business Owners

- Divorce Mediation

- Domestic Violence

- Prenuptial Agreements

- Property Distribution

- Understanding The Divorce Process

- Auto Insurance/Property Damage

- All-risks Property Insurance

- Commercial General Liability (CGL) Insurance

- Disability Insurance

- Health Insurance

- Insurance Agent/Broker Negligence

- Life Insurance

- Long-term Care Insurance

- Marine/Boat Insurance

- Wind & Flood Property Insurance

- Commercial Purchase

- Commercial Sales

- Commercial Lease Agreement

- First-Time Home Buyer

- Lease Agreements

- Real Estate Closing

- Refinancing

- Residential Purchases

- Residential Sales

- Title Review

- Estate Planning

- Estate Planning for Business Owners

- Healthcare Directives

- Powers of Attorney

- Trust Drafting

- Will Contest

- Will Drafting

- Sean Callagy Esq

- The Callagy Law Team

- Testimonials

- Join Our Team

- Message of Empathy

- Business Law

- Commercial Litigation

- News & Events

- Medical Revenue Recovery

- Personal Injury

- Free Legal Guides

- Paramus, NJ Office

- New York, NY Office

- Phoenix, AZ Office

- East Hanover, NJ Office

Call For A Free Legal Consultation

(201) 261 - 1700

Insurance claims , medical revenue recovery, what should an assignment of benefits form include.

An assignment of benefits form (AOB) is a crucial document in the healthcare world. It is an agreement by which a patient transfers the rights or benefits under their insurance policy to a third-party – in this case, the medical professional who provides services. This way, the medical provider can file a claim and collect insurance payments. In the context of personal injury protection coverage, an AOB is a critical step in the reimbursement process.

Personal injury protection coverage , or PIP, is designed to cover medical expenses and lost wages incurred after an auto accident, regardless of who is at fault. In New Jersey, drivers are required to carry PIP. Now, let’s say there’s an accident: the driver sees a medical provider for treatment, and the provider bills the patient’s carrier. There is nothing that requires that the insurance carrier to pay the provider.

This is why an assignment of benefits form is so important. It essentially removes the patient from the equation and puts the medical provider in their place as far as the insurance policy is concerned. This enables the provider to be paid directly. If you see PIP patients and want to be paid directly by the insurer (and avoid claim denials or complex legal situations later) you must get an AOB.

The AOB authorization creates a legal relationship between the provider and the insurance carrier. What should it include?

- Correct Business Entity

Fill out your business name correctly: it seems simple, but this can be a stumbling block to reimbursement. If your business name is Dr. Smith’s Chiropractic Care Center, you cannot substitute Dr. Smith’s, Smith’s Chiropractic, etc. It must be Dr. Smith’s Chiropractic Care Center. If you have a FEIN number, use the name that is listed on your Health Care Financing Administration (HCFA) form.

- “Irrevocable”

It is important that you include this term to indicate that the patient cannot later revoke the assignment of benefits. This tells the court that the AOB is the only document determining standing , or the ability to bring a lawsuit on related matters.

Another key term: the court sees benefits as payments. It does not necessarily give you the right to bring a lawsuit. Include language such as, “assigns the rights and benefits, including the right to bring suit…”

- Benefit of Not Being Billed At This Time for Services

Essentially, this means that a provider gives up the right to collect payments at the time of service in exchange for the right to bring suit against the insurance company if they are not paid in full. Likewise, the patient gives up the right to bring suit, but they do not have to pay now. The wording will look like this: “In exchange for patient assigning the rights and benefits under their PIP insurance, Dr. Smith’s Chiropractic Care Center will allow patients to receive services without collecting payments at this time.”

- Patient Signature

Yes, it’s basic, but make sure the assignment of benefits form is signed and dated by the patient! This renders the AOB , for all intents and purposes, null and void. It is not an executed contract. You would have to start the entire process again, which means waiting longer to be reimbursed for the claim.

- Power of Attorney Clause

Including a power of attorney clause, which supports not only “the right of collecting payment” but also the provider’s ability to take legal action on behalf of the patients, is vital. At Callagy Law, we always argue this is inherent within the no-fault statute; however, there are carriers to argue against the right to arbitration when the language is not in the AOB.

As medical providers, it is critical that you receive proper – and timely – reimbursement for services rendered. The assignment of benefits form is one of the most important pieces in this puzzle. It is essential for an attorney to prepare, or at least review, your AOB and other admission paperwork to ensure that you are able to collect pursuant to your patients’ insurance benefits in whatever ways needed.

Callagy Law can not only review these documents, but also ensure you are pursuing all recoverable bills to which you are eligible. If you have any questions, would like us to review your AOB form, or have issues collecting payment from insurance companies, please contact the Callagy Law team today .

Leave a Reply

Your email address will not be published. Required fields are marked *

- Wind & Flood Property Insurance

- FREE LEGAL GUIDES

You are using an outdated browser. Please upgrade your browser to improve your experience.

Assignment of Benefits, Part 1: New Jersey

I am often asked whether an Assignment of Benefits (“AOB”) is valid in [ insert state here ] under a property insurance policy. The purpose of this blog series will be to provide readers with an answer to the question on a state-by-state basis. As New Jersey is my home-state, it’s up first.

In a standard HO3 Policy, it states under the Conditions Clause, that: “Assignment of this policy will not be valid unless we give our consent.” (“We,” meaning the insurance company.) More often than not, where an AOB is challenged, the carrier will utilize this clause as their basis for the position that the AOB is invalid.

In New Jersey, the courts have addressed this very issue. First, the courts note that the clauses prohibiting assignment of the policy are valid and enforceable. In 1895, the Supreme Court of New Jersey held:

A policy of insurance is a contract of indemnity, personal to the party to whom it is issued, or for whose interest the insurer undertakes to be responsible in case of loss, and cannot be transferred to a third person, so as to be valid in his hands against the insurer, without the insurer’s consent. 1

This, however, is not the end game for AOBs in NJ. In Flint Frozen Foods v. Firemen’s Insurance Company , the Superior Court of New Jersey held that, “once a occurs, an insured’s claim under a policy may be assigned without the insurer’s consent.” 2 The Court further noted that after a covered loss occurs:

[T]he prohibition of assignments without the consent of the insurer [ceases]. Its liability [has] become fixed, and like any other chose in action [is] assignable regardless of the conditions of the policy in question. This is settled by the great weight of authority. In Wood on Fire Insurance , vol. 2, par. 361 the doctrine is stated thus: … ‘[If there has been an assignment following a loss,] the insurer becomes absolutely a debtor to the assured for the amount of the actual loss, to the extent of the sum insured, and it may be transferred or assigned like any other debt.’ 3

More recently, the Appellate Division of the Superior Court reviewed this issue and in addition to following the case law above, detailed the basis of why AOBs are permissible in the Garden State:

The purpose behind a no-assignment clause is to protect the insurer from having to provide coverage for a risk different from what the insurer had intended. [] A no-assignment clause guards an insurer against any unforeseen exposure that may result from the unauthorized assignment of a policy before a loss. Insurers provide policies of insurance to those individuals and entities that insurers have determined are acceptable risks. If an insured assigns the policy to a third party without the insurer’s consent, the insured may cause the insurer to bear a risk the insurer never agreed to accept and never would have accepted. [] But if there has been an assignment of the right to collect or to enforce the right to proceed under a policy after a loss has occurred, the insurer’s risk is the same because the liability of the insurer becomes fixed at the time of the loss. Thereafter, the insurer’s risk is not increased merely because there has been a change in the identity of the party to whom a claim is to be paid. [] Moreover, once the insurer’s liability has become fixed due to a loss, an assignment of rights to collect under an insurance policy is not a transfer of the actual policy but a transfer of the right to a claim of money. [] It is a transfer of a chose in action as opposed to a transfer of an actual policy. [] The insurer becomes absolutely a debtor to the assured for the amount of the actual loss, to the extent of the sum insured, and it may be transferred or assigned like any other debt. 4

As this is a series, and we will be hitting every state one-by-one, it may take some time to get to your state. If you have any specific questions on AOBs or would like to see your state come up sooner, please comment below, or send me an email at [email protected] .

As always, I’ll leave you with a (mildly) related tune, here’s New Jersey’s own Blues Traveler with their debut hit, Run-Around :

1 Kase v. Hartford Fire Ins. Co., 58 N.J.L. 34, 36 (1895) . 2 Flint Frozen Foods v. Firemen’s Ins. Co. , 12 N.J. Super, 396, 399-400 (Law.Div. 1951) rev’d on other grounds, 8 N.J. 606, 86 A.2d 673 (1952) . 3 Id. 4 Givaudan Fragrances Corp. v. Aetna Cas. & Sur. Co. , 442 N.J.Super 28, 37-38 (App.Div. 2015) (internal citations omitted) .

Related Posts

Cosmetic Damage Hail Issues—Biased Engineering Reports and Bad Faith

Catching Up On Summer 2022 Along The Jersey Shore, Ohio Limitations on Punitive Damages In Bad Faith Cases and Colorado Appraisals

Amount of Loss: Appraisal Considerations in New Jersey

We’re ready to serve you.

Our firm represents residential, commercial and government entities in seeking timely, fair and proper compensation. We also support adjusters and contractors and work to protect their fees. In addition, we proudly serve as a reputable firm for referring attorneys to entrust their clients with should they be approached with an insurance claim case. Don’t fight insurance companies on your own. Contact us today!

Expert Insights Delivered to You

- General Forms

- Resources /

Description

- NJPLIGA Conditional Assignment of Benefits Download and complete this form of conditional assignment of personal injury protection benefits and disclosure requirements.

- Received a document?

Assignment of Benefits for Contractors: Pros & Cons of Accepting an AOB

22 articles

Insurance , Restoration , Slow Payment

When a property owner files an insurance claim to cover a restoration or roofing project, the owner typically deals directly with the insurance company. They may not have the funds available to pay the contractor out of pocket, so they’re counting on that insurance check to cover the construction costs.

But insurance companies often drag their feet, and payments can take even longer than normal. Contractors often wish they could simply deal with the insurance company directly through an assignment of benefits. In some circumstances, an AOB can be an effective tool that helps contractors collect payment faster — but is it worth it?

In this article, we’ll explain what an assignment of benefits is, and how the process works. More importantly, we’ll look at the pros and cons for restoration and roofing contractors to help you decide if an AOB is worth it .

What is an assignment of benefits?

An assignment of benefits , or AOB, is an agreement to transfer insurance claim rights to a third party. It gives the assignee authority to file and negotiate a claim directly with the insurance company, without involvement from the property owner.

An AOB also allows the insurer to pay the contractor directly instead of funneling funds through the customer. AOBs take the homeowner out of the claims equation.

Here’s an example: A property owner’s roof is damaged in a hurricane. The owner contacts a restoration company to repair the damage, and signs an AOB to transfer their insurance rights to the contractor. The contractor, now the assignee, negotiates the claim directly with the insurance company. The insurer will pay the claim by issuing a check for the repairs directly to the restoration contractor.

Setting up an AOB

A property owner and contractor can set up an assignment of benefits in two steps:

- The owner and the contractor sign an AOB agreement

- The contractor sends the AOB to the insurance company

Keep in mind that many states have their own laws about what the agreement can or should include .

For example, Florida’s assignment of benefits law contains relatively strict requirements when it comes to an assignment of benefits:

- The AOB agreements need to be in writing. The agreement must contain a bolded disclosure notifying the customer that they are relinquishing certain rights under the homeowners policy. You can’t charge administrative fees or penalties if a homeowner decides to cancel the AOB.

- The AOB must include an itemized, per-unit breakdown of the work you plan to do. The services can only involve how you plan to make repairs or restore the home’s damage or protect the property from any further harm. A copy must be provided to the insurance company.

- A homeowner can rescind an AOB agreement within 14 days of signing, or within 30 days if no work has begun and no start date was listed for the work. If a start date is listed, the 30-day rule still applies if substantial progress has not been made on the job.

Before signing an AOB agreement, make sure you understand the property owner’s insurance policy, and whether the project is likely to be covered.

Learn more: Navigating an insurance claim on a restoration project

Pros & cons for contractors

It’s smart to do a cost-benefit analysis on the practice of accepting AOBs. Listing pros and cons can help you make a logical assessment before deciding either way.

Pro: Hiring a public adjuster

An insurance carrier’s claims adjuster will inspect property damage and arrive at a dollar figure calculated to cover the cost of repairs. Often, you might feel this adjuster may have overlooked some details that should factor into the estimate.

If you encounter pushback from the insurer under these circumstances, a licensed, public adjuster may be warranted. These appraisers work for the homeowner, whose best interests you now represent as a result of the AOB. A public adjuster could help win the battle to complete the repairs properly.

Pro: More control over payment

You may sink a considerable amount of time into preparing an estimate for a customer. You may even get green-lighted to order materials and get started. Once the ball starts rolling, you wouldn’t want a customer to back out on the deal.

Klark Brown , Co-founder of The Alliance of Independent Restorers, concedes this might be one of the very situations in which an AOB construction agreement might help a contractor. “An AOB helps make sure the homeowner doesn’t take the insurance money and run,” says Brown.

Pro: Build a better relationship with the homeowner

A homeowner suffers a substantial loss and it’s easy to understand why push and pull with an insurance company might be the last thing they want to undertake. They may desire to have another party act on their behalf.

As an AOB recipient, the claims ball is now in your court. By taking some of the weight off a customer’s shoulders during a difficult period, it could help build good faith and further the relationship you strive to build with that client.

Learn more : 8 Ways for Contractors to Build Trust With a Homeowner

Con: It confuses payment responsibilities

Even if you accept an AOB, the property owner still generally bears responsibility for making payment. If the insurance company is dragging their feet, a restoration contractor can still likely file a mechanics lien on the property .

A homeowner may think that by signing away their right to an insurance claim, they are also signing away their responsibility to pay for the restoration work. This typically isn’t true, and this expectation could set you up for a more contentious dispute down the line if there is a problem with the insurance claim.

Con: Tighter margins

Insurance companies will want repairs made at the lowest cost possible. Just like you, carriers run a business and need to cut costs while boosting revenue.

While some restoration contractors work directly with insurers and could get a steady stream of work from them, Brown emphasizes that you may be sacrificing your own margins. “Expect to accept work for less money than you’d charge independently,” he adds.

The takeaway here suggests that any contractor accepting an AOB could subject themselves to the same bare-boned profit margins.

Con: More administrative work

Among others, creating additional administrative busywork is another reason Brown recommends that you steer clear of accepting AOBs. You’re committing additional resources while agreeing to work for less money.

“Administrative costs are a burden,” Brown states. Insurers may reduce and/or delay payments to help their own bottom lines. “Insurers will play the float with reserves and claims funds,” he added. So, AOBs can be detrimental to your business if you’re spending more while chasing payments.

Con: Increase in average collection period

Every contractor should use some financial metrics to help gauge the health of the business . The average collection period for receivables measures the average time it takes you to get paid on your open accounts.

Insurance companies aren’t known for paying claims quickly. If you do restoration work without accepting an AOB, you can often take action with the homeowner to get paid faster. When you’re depending on an insurance company to make your payment, rather than the owner, collection times will likely increase.

The literal and figurative bottom line is: If accepting assignment of benefits agreements increases the time it takes to get paid and costs you more in operational expense, these are both situations you want to avoid.

Learn more: How to calculate your collection effectiveness

AOBs and mechanics liens

A mechanics lien is hands down a contractor’s most effective tool to ensure they get paid for their work. Many types of restoration services are protected under lien laws in most states. But what happens to lien rights when a contractor accepts an assignment of benefits?

An AOB generally won’t affect a contractor’s ability to file a mechanics lien on the property if they don’t receive payment. The homeowner is typically still responsible to pay for the improvements. This is especially true if the contract involves work that wasn’t covered by the insurance policy.

However, make sure you know the laws in the state where your project is located. For example, Florida’s assignment of benefits law, perhaps the most restrictive in the country, appears to prohibit an AOB assignee from filing a lien.

Florida AOB agreements are required to include language that waives the contractor’s rights to collect payment from the owner. The required statement takes it even further, stating that neither the contractor or any of their subs can file a mechanics lien on the owner’s property.

On his website , Florida’s CFO says: “The third-party assignee and its subcontractors may not collect, or attempt to collect money from you, maintain any action of law against you, file a lien against your property or report you to a credit reporting agency.”

That sounds like a contractor assignee can’t file a lien if they aren’t paid . But, according to construction lawyer Alex Benarroche , it’s not so cut-and-dry.

“Florida’s AOB law has yet to be tested in court, and it’s possible that the no-lien provision would be invalid,” says Benarroche. “This is because Florida also prohibits no-lien clauses in a contract. It is not legal for a contractor to waive their right to file a lien via an agreement prior to performance.”

Learn more about no-lien clauses and their enforceability state-by-state

Remember that every state treats AOBs differently, and conflicting laws can create additional risk. It’s important to consult with a construction lawyer in the project’s state before accepting an assignment of benefits.

Best practices for contractors

At the end of the day, there are advantages and disadvantages to accepting an assignment of benefits. While it’s possible in some circumstances that an AOB could help a contractor get paid faster, there are lots of other payment tools that are more effective and require less administrative costs. An AOB should never be the first option on the table .

If you do decide to become an assignee to the property owner’s claim benefits, make sure you do your homework beforehand and adopt some best practices to effectively manage the assignment of benefits process. You’ll need to keep on top of the administrative details involved in drafting AOBs and schedule work in a timely manner to stay in compliance with the conditions of the agreement.

Make sure you understand all the nuances of how insurance works when there’s a claim . You need to understand the owner’s policy and what it covers. Home insurance policy forms are basically standardized for easy comparisons in each state, so what you see with one company is what you get with all carriers.

Since you’re now the point of contact for the insurance company, expect more phone calls and emails from both clients and the insurer . You’ll need to have a strategy to efficiently handle ramped-up communications since the frequency will increase. Keep homeowners and claims reps in the loop so you can build customer relationships and hopefully get paid faster by the insurer for your work.

Ask an expert for free

I am doing some part-time administrative work for a friend who has an owner/operator pressure washing business located in NC in its first year of business. Recently, my friend has expressed interest in expanding his operations to FL so that he can eventually live and work between both...

I am a homeowner, 4 days prior to Ida, we had solar panels installed. Half were damaged and blown off of course, so after we allowed the solar panel co to do our roof and redo our panel system. After a year, they finally replaced our roof and...

I believe a person was impersonating as a licensed general contractor. When I verified the license in GA, the license belonged to a completely different individual. When I called the provided insurance carrier of the general contractor, the insurance company said the company did not have an active...

Thomas Tracy

View Profile

About the author

Recommended for you

How to protect your payments when dealing with a construction bankruptcy.

Bankruptcies in the construction industry are unfortunately very common. Learn how a mechanics lien can help make sure your company...

Construction Contracts: What Does “Workmanlike Manner” Mean?

Just about every construction contract will require that work be done in a "workmanlike manner." But what exactly does that...

What Is a Work in Progress Schedule? | Construction Accounting

The Work In Progress (WIP) schedule is an accounting schedule that's a component of a company's balance sheet. It's calculated...

Guide to Alternative Dispute Resolution (ADR) in Construction

With a proper dispute resolution clause in place, contractors, subs, and suppliers can avoid taking their disputes into litigation.

What Is a Notice of Completion?

What is a Notice of Completion? As anyone reading this surely knows, the construction industry loves its documents! There's a...

Do I Have to Sign a Lien Waiver to Get Paid?

Lien waivers are an important part of optimizing construction payment. Property owners and GCs rely on waivers to manage the...

What Does ‘Pay-When-Paid’ Mean?

In the construction business, everything comes down to the contract. And that's unfortunate because most of the people who make...

What Is A Joint Check Agreement?

While joint checks and joint check agreements are common in the construction business, these agreements can actually be entered into...

Jurisdiction E - Medicare Part B

California, Hawaii, Nevada, American Samoa, Guam, Northern Mariana Islands

- Noridian Medicare Portal (NMP) Login

Assignment of Benefits - JE Part B

Browse by Topic

- Advance Beneficiary Notice of Noncoverage (ABN)

- Clinical Trials

- Compliance Program

- Documentation Requirements

- Drugs, Biologicals and Injections

- Durable Medical Equipment, Prosthetics, Orthotics and Supplies (DMEPOS)

- Electronic Data Interchange (EDI)

- Emergencies and Disasters

- Fraud and Abuse

- Home Health

- Incentive Programs

- Incident To

- Medicare Secondary Payer (MSP)

- Non-Covered Services

- Noridian Medicare Portal (NMP)

- Overpayment and Recoupment

- Preventive Services

- Promoting Equity

- Remittance Advice (RA)

Assignment of Benefits

Assignment of benefits is not authorization to submit claims.

It is important to note that the beneficiary signature requirements for submission of claims are separate and distinct from assignment of benefits requirements except where the beneficiary died before signing the request for payment for a service furnished by a supplier and the supplier accepts assignment for that service. Specifically, the beneficiary signature requirements for submission of claims must be met for all Part A and Part B claims and apply to both provider and supplier claims, whereas the assignment of benefits requirements apply to providers and must be met to authorize Medicare to pay the provider rather than the beneficiary. In addition, the beneficiary does not need to assign benefits in any circumstance where assignment is mandatory. Thus, in most cases, a signed assignment of benefits is not needed.

CMS Internet Only Manual, Publication 100-04, Medicare Claims Processing Manual, Chapter 1, Section 50.1.6

© 2024 Noridian Healthcare Solutions, LLC Terms & Privacy

End User Agreements for Providers

Some of the Provider information contained on the Noridian Medicare web site is copyrighted by the American Medical Association, the American Dental Association, and/or the American Hospital Association. This includes items such as CPT codes, CDT codes, ICD-10 and other UB-04 codes.

Before you can enter the Noridian Medicare site, please read and accept an agreement to abide by the copyright rules regarding the information you find within this site. If you choose not to accept the agreement, you will return to the Noridian Medicare home page.

THE LICENSES GRANTED HEREIN ARE EXPRESSLY CONDITIONED UPON YOUR ACCEPTANCE OF ALL TERMS AND CONDITIONS CONTAINED IN THESE AGREEMENTS. BY CLICKING ABOVE ON THE LINK LABELED "I Accept", YOU HEREBY ACKNOWLEDGE THAT YOU HAVE READ, UNDERSTOOD AND AGREED TO ALL TERMS AND CONDITIONS SET FORTH IN THESE AGREEMENTS.

IF YOU DO NOT AGREE WITH ALL TERMS AND CONDITIONS SET FORTH HEREIN, CLICK ABOVE ON THE LINK LABELED "I Do Not Accept" AND EXIT FROM THIS COMPUTER SCREEN.

IF YOU ARE ACTING ON BEHALF OF AN ORGANIZATION, YOU REPRESENT THAT YOU ARE AUTHORIZED TO ACT ON BEHALF OF SUCH ORGANIZATION AND THAT YOUR ACCEPTANCE OF THE TERMS OF THESE AGREEMENTS CREATES A LEGALLY ENFORCEABLE OBLIGATION OF THE ORGANIZATION. AS USED HEREIN, "YOU" AND "YOUR" REFER TO YOU AND ANY ORGANIZATION ON BEHALF OF WHICH YOU ARE ACTING.

LICENSE FOR USE OF "PHYSICIANS' CURRENT PROCEDURAL TERMINOLOGY", (CPT) FOURTH EDITION

End User/Point and Click Agreement:

CPT codes, descriptions and other data only are copyright 2002-2020 American Medical Association (AMA). All Rights Reserved. CPT is a trademark of the AMA.

You, your employees and agents are authorized to use CPT only as contained in the following authorized materials: Local Coverage Determinations (LCDs), training material, publications, and Medicare guidelines, internally within your organization within the United States for the sole use by yourself, employees and agents. Use is limited to use in Medicare, Medicaid, or other programs administered by the Centers for Medicare and Medicaid Services (CMS). You agree to take all necessary steps to ensure that your employees and agents abide by the terms of this agreement. You acknowledge that the AMA holds all copyright, trademark, and other rights in CPT.

Any use not authorized herein is prohibited, including by way of illustration and not by way of limitation, making copies of CPT for resale and/or license, transferring copies of CPT to any party not bound by this agreement, creating any modified or derivative work of CPT, or making any commercial use of CPT. License to use CPT for any use not authorized here in must be obtained through the AMA, CPT Intellectual Property Services, 515 N. State Street, Chicago, IL 60610. Applications are available at the AMA Web site, https://www.ama-assn.org .

This product includes CPT which is commercial technical data and/or computer data bases and/or commercial computer software and/or commercial computer software documentation, as applicable which were developed exclusively at private expense by the American Medical Association, 515 North State Street, Chicago, Illinois, 60610. U.S. Government rights to use, modify, reproduce, release, perform, display, or disclose these technical data and/or computer data bases and/or computer software and/or computer software documentation are subject to the limited rights restrictions of DFARS 252.227-7015(b)(2)(June 1995) and/or subject to the restrictions of DFARS 227.7202-1(a)(June 1995) and DFARS 227.7202-3(a)June 1995), as applicable for U.S. Department of Defense procurements and the limited rights restrictions of FAR 52.227-14 (June 1987) and/or subject to the restricted rights provisions of FAR 52.227-14 (June 1987) and FAR 52.227-19 (June 1987), as applicable, and any applicable agency FAR Supplements, for non-Department Federal procurements.

AMA Disclaimer of Warranties and Liabilities CPT is provided "as is" without warranty of any kind, either expressed or implied, including but not limited to, the implied warranties of merchantability and fitness for a particular purpose. The AMA warrants that due to the nature of CPT, it does not manipulate or process dates, therefore there is no Year 2000 issue with CPT. The AMA disclaims responsibility for any errors in CPT that may arise as a result of CPT being used in conjunction with any software and/or hardware system that is not Year 2000 compliant. No fee schedules, basic unit, relative values or related listings are included in CPT. The AMA does not directly or indirectly practice medicine or dispense medical services. The responsibility for the content of this file/product is with Noridian Healthcare Solutions or the CMS and no endorsement by the AMA is intended or implied. The AMA disclaims responsibility for any consequences or liability attributable to or related to any use, non-use, or interpretation of information contained or not contained in this file/product.

CMS Disclaimer The scope of this license is determined by the AMA, the copyright holder. Any questions pertaining to the license or use of the CPT must be addressed to the AMA. End Users do not act for or on behalf of the CMS. The CMS DISCLAIMS RESPONSIBILITY FOR ANY LIABILITY ATTRIBUTABLE TO END USER USE OF THE CPT. The CMS WILL NOT BE LIABLE FOR ANY CLAIMS ATTRIBUTABLE TO ANY ERRORS, OMISSIONS, OR OTHER INACCURACIES IN THE INFORMATION OR MATERIAL CONTAINED ON THIS PAGE. In no event shall CMS be liable for direct, indirect, special, incidental, or consequential damages arising out of the use of such information or material.

This license will terminate upon notice to you if you violate the terms of this license. The AMA is a third-party beneficiary to this license.

LICENSE FOR USE OF "CURRENT DENTAL TERMINOLOGY", ("CDT")

End User/Point and Click Agreement

These materials contain Current Dental Terminology, (CDT), copyright © 2020 American Dental Association (ADA). All rights reserved. CDT is a trademark of the ADA.

1. Subject to the terms and conditions contained in this Agreement, you, your employees, and agents are authorized to use CDT only as contained in the following authorized materials and solely for internal use by yourself, employees and agents within your organization within the United States and its territories. Use of CDT is limited to use in programs administered by Centers for Medicare & Medicaid Services (CMS). You agree to take all necessary steps to ensure that your employees and agents abide by the terms of this agreement. You acknowledge that the ADA holds all copyright, trademark and other rights in CDT. You shall not remove, alter, or obscure any ADA copyright notices or other proprietary rights notices included in the materials.

2. Any use not authorized herein is prohibited, including by way of illustration and not by way of limitation, making copies of CDT for resale and/or license, transferring copies of CDT to any party not bound by this agreement, creating any modified or derivative work of CDT, or making any commercial use of CDT. License to use CDT for any use not authorized herein must be obtained through the American Dental Association, 211 East Chicago Avenue, Chicago, IL 60611. Applications are available at the American Dental Association web site, http://www.ADA.org .

3. Applicable Federal Acquisition Regulation Clauses (FARS)\Department of Defense Federal Acquisition Regulation Supplement (DFARS) Restrictions Apply to Government use. Please click here to see all U.S. Government Rights Provisions .

4. ADA DISCLAIMER OF WARRANTIES AND LIABILITIES. CDT is provided "as is" without warranty of any kind, either expressed or implied, including but not limited to, the implied warranties of merchantability and fitness for a particular purpose. No fee schedules, basic unit, relative values or related listings are included in CDT. The ADA does not directly or indirectly practice medicine or dispense dental services. The sole responsibility for the software, including any CDT and other content contained therein, is with (insert name of applicable entity) or the CMS; and no endorsement by the ADA is intended or implied. The ADA expressly disclaims responsibility for any consequences or liability attributable to or related to any use, non-use, or interpretation of information contained or not contained in this file/product. This Agreement will terminate upon notice to you if you violate the terms of this Agreement. The ADA is a third-party beneficiary to this Agreement.

5. CMS DISCLAIMER. The scope of this license is determined by the ADA, the copyright holder. Any questions pertaining to the license or use of the CDT should be addressed to the ADA. End users do not act for or on behalf of the CMS. CMS DISCLAIMS RESPONSIBILITY FOR ANY LIABILITY ATTRIBUTABLE TO END USER USE OF THE CDT. CMS WILL NOT BE LIABLE FOR ANY CLAIMS ATTRIBUTABLE TO ANY ERRORS, OMISSIONS, OR OTHER INACCURACIES IN THE INFORMATION OR MATERIAL COVERED BY THIS LICENSE. In no event shall CMS be liable for direct, indirect, special, incidental, or consequential damages arising out of the use of such information or material.

LICENSE FOR NATIONAL UNIFORM BILLING COMMITTEE ("NUBC")

Point and Click American Hospital Association Copyright Notice

Copyright © 2021, the American Hospital Association, Chicago, Illinois. Reproduced with permission. No portion of the AHA copyrighted materials contained within this publication may be copied without the express written consent of the AHA. AHA copyrighted materials including the UB-04 codes and descriptions may not be removed, copied, or utilized within any software, product, service, solution or derivative work without the written consent of the AHA. If an entity wishes to utilize any AHA materials, please contact the AHA at 312-893-6816

Making copies or utilizing the content of the UB-04 Manual or UB-04 Data File, including the codes and/or descriptions, for internal purposes, resale and/or to be used in any product or publication; creating any modified or derivative work of the UB-04 Manual and/or codes and descriptions; and/or making any commercial use of UB-04 Manual / Data File or any portion thereof, including the codes and/or descriptions, is only authorized with an express license from the American Hospital Association.

To obtain comprehensive knowledge about the UB-04 codes, the Official UB-04 Data Specification Manual is available for purchase on the American Hospital Association Online Store . To license the electronic data file of UB-04 Data Specifications, contact AHA at (312) 893-6816. You may also contact AHA at [email protected] .

Consent to Monitoring

Warning: you are accessing an information system that may be a U.S. Government information system. If this is a U.S. Government information system, CMS maintains ownership and responsibility for its computer systems. Users must adhere to CMS Information Security Policies, Standards, and Procedures. For U.S. Government and other information systems, information accessed through the computer system is confidential and for authorized users only. By continuing beyond this notice, users consent to being monitored, recorded, and audited by company personnel. Unauthorized or illegal use of the computer system is prohibited and subject to criminal and civil penalties. The use of the information system establishes user's consent to any and all monitoring and recording of their activities.

Note: The information obtained from this Noridian website application is as current as possible. There are times in which the various content contributor primary resources are not synchronized or updated on the same time interval.

This warning banner provides privacy and security notices consistent with applicable federal laws, directives, and other federal guidance for accessing this Government system, which includes all devices/storage media attached to this system. This system is provided for Government authorized use only. Unauthorized or improper use of this system is prohibited and may result in disciplinary action and/or civil and criminal penalties. At any time, and for any lawful Government purpose, the government may monitor, record, and audit your system usage and/or intercept, search and seize any communication or data transiting or stored on this system. Therefore, you have no reasonable expectation of privacy. Any communication or data transiting or stored on this system may be disclosed or used for any lawful Government purpose.

New Jersey no-fault coverage claims

A special notice to our nj liberty mutual policyholders.

Under the provisions of your policy and applicable New Jersey regulations, Decision Point Reviews and/or "Pre-certification" of specified medical treatment and testing is required for medically necessary expenses to be fully reimbursable under the terms of your policy. The New Jersey Personal Injury Protection (PIP) Coverage brochure below explains how your medical claim will be handled, including the Decision Point Review/"Precertification" and Voluntary Network requirements that you and your Medical Provider must follow to receive maximum benefits provided by your policy.

NJ Personal Injury Protection Coverage Brochure Dear Provider Letter NJ Assignment of Benefits Form NJ PIP Attending Provider Treatment Plan Form (APTP) NJ No-Fault Pre-Service Appeal Form NJ No-Fault Post-Service Appeal Form

XL LG MD SM XS

Official Site of The State of New Jersey

- FAQs Frequently Asked Questions

The State of NJ site may contain optional links, information, services and/or content from other websites operated by third parties that are provided as a convenience, such as Google™ Translate. Google™ Translate is an online service for which the user pays nothing to obtain a purported language translation. The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. - Read Full Disclaimer

- Search close

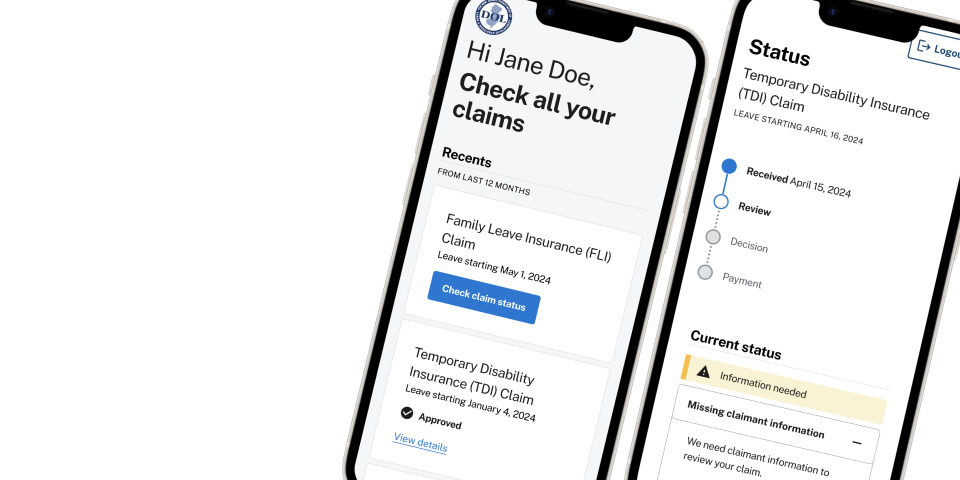

Division of Temporary Disability and Family Leave Insurance

A New Look for Your Claim Status

When you log in, you'll see an improved layout and clearer language.

NEW - Video Tutorials

Watch our step-by-step guides for completing an online application.

.jpg)

Disability During Unemployment (DDU) Benefits

Applying for Temporary Disability benefits but haven't worked recently and/or are collecting Unemployment benefits?

Do You Get State Health Insurance Benefits?

See this important message from our partners regarding NJFamilyCare.

Check Out Our Podcast Series

We are providing information in a helpful new way.

Family Leave During Unemployment (FLDU)

Need to bond with a new addition to your family or care for a loved one, but you haven't worked recently?

Adoptive Parents Can Get Benefits, Too

You can claim Family Leave benefits while bonding with a newly adopted child.

- Check your claim status

- Learn about claim decisions

- Sick, Injured, or Post-Surgery

- Pregnant or Just Had a Baby

- Father/Partner Bonding with Baby

- Adoptive/Foster Parent

- Family Caregiver

- Healthcare Provider

You may be eligible for Temporary Disability Insurance benefits if your physical or mental illness or injury prevents you from working and was not caused by your work.

LEARN MORE >

You may apply for Family Leave Insurance benefits if you are bonding with a newborn, newly adopted, or newly placed foster child. You may also apply if you are caring for a loved one with a serious physical or mental health condition, or to handle certain matters related to domestic or sexual violence.

Expectant mothers may qualify for both Temporary Disability and Family Leave Insurance benefits. Find out how the two programs work together for Maternity Leave Coverage .

Debit Card Information

We issue benefits on a prepaid Money Network/My Banking Direct debit card . Find out how and when you’ll receive your card.

Print an Application

Although the quickest way to apply is online, you can print out an application to submit by mail or fax if you prefer .

- Frequently Asked Questions

Workers, employers, and healthcare providers can get answers to common questions about our programs.

Listen to Our Podcast

Check out our podcast series - a resource packed with common questions and answers in a conversational format.

LISTEN NOW >

Information for Workers

- When You're Sick, Injured, or Post-Surgery

- When You're Pregnant or Just Had a Baby

- Fathers/Partners Bonding with Newborns

- Parents Bonding with Newly Adopted Children

- Caring for a Family Member

- Coping with Domestic/Sexual Violence

- Is Your Job Protected?

- Applying for Benefits When You're Unemployed

- Helpful Resources

Information for Employers

- Temporary Disability Insurance

- Family Leave Insurance

- Private Plan Information

- Employer Toolkit

Information for Healthcare Providers

- Submit a Medical Certification

About Our Programs

- Maternity Coverage

- Job Protection Information

- Listen to Our Podcasts

- Program Statistics

- Laws and Regulations

- Get Help with Our Online System

- Glossary of Terms

- Additional Support & Assistance

- Governor Phil Murphy

- Lt. Governor Tahesha Way

- Services A to Z

- Departments/Agencies

- Privacy Notice

- Legal Statement & Disclaimers

- Accessibility Statement

- Log In Personal Business Agent

- Insurance Products

- Join the NJM Family

- Auto and Recreation

- Classic and Collector Car

- Motorcycle and ATV

- Boat and Personal Watercraft

- Personal Umbrella

- Commercial Business

- Workers' Compensation

- Commercial Auto

- ProPack Commercial Package Policy

- ProEdge Businessowners Policy

- Commercial Excess and Umbrella

- Find an Agent

- Make a Payment

- Personal Claims

- Business Claims

- Life Events

- Safety Center

- Small Business Solutions

- Roadside Assistance

- 1-800-232-6600

- No Jingles or Mascots

- Media Coverage

- News Releases

- Sustainability

- Teen Driver Safety

- Career Tips

- Internships

Get a Business Insurance quote from NJM! Contact us to see how we can serve your business's insurance needs.

Have workers' compensation claim questions? Use this email form to get answers about your claim.

Download now.

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

IMAGES

VIDEO

COMMENTS

An assignment of benefits form (AOB) is a crucial document in the healthcare world. It is an agreement by which a patient transfers the rights or benefits under their insurance policy to a third-party - in this case, the medical professional who provides services. This way, the medical provider can file a claim and collect insurance payments.

balance. A photocopy of this assignment shall be considered as affective and valid as the original. I authorize the provider to initiate a complaint or file appeal to the insurance commissioner or any payer authority for any reason on my behalf and personally will be active in the resolution of claims delay or unjustified reductions or denials.

ASSIGNMENT OF BENEFITS 1 of 2. 720 Monroe Street I Suite C208 I Hoboken, NJ 07030 121 Newark Avenue I Suite 300 I Jersey City, NJ 07302 764 Broadway I Bayonne, NJ 07002. (201) 533-9200 • www.spinesportshc.com. ASSIGNMENT OF BENEFITS FORM. THIS IS A DIRECT ASSIGNMENT OF MY RIGHTS AND BENEFITS UNDER THIS POLICY.

the New Jersey Insurance Fraud Prevention Act and/or any similar cause of action which is in any way related to your claim, you or anyone using an assignment of benefits on your behalf,; and d. Ensuring that your billing does not include professional or technical services of any non-employees (i.e., independent contractors, temporary workers) is

denial appeals process" set forth in the NJ Administrative Code. I request that the insurance carrier consent to my assignment of benefits within 10 days of receipt otherwise it is deemed consented to. As medical provider I agree to attempt to reasonably comply with the PIP carrier's decision point

An assignment of benefits is an arrangement where you, the beneficiary, request that your insurance company pay the health benefit payment(s) directly to your health care providers. When you sign the assignment of benefits form, you are essentially entering into a contract with your health care provider to transfer your right of reimbursement ...

Firemen's Insurance Company, the Superior Court of New Jersey held that, "once a occurs, an insured's claim under a policy may be assigned without the insurer's consent." 2 The Court further noted that after a covered loss occurs: [T]he prohibition of assignments without the consent of the insurer [ceases]. Its liability [has] become ...

General Forms; Form Description. NJPLIGA Conditional Assignment of Benefits Download and complete this form of conditional assignment of personal injury protection benefits and disclosure requirements. New Jersey Property-Liability Insurance Guaranty Association.

An assignment of benefits, or AOB, is an agreement to transfer insurance claim rights to a third party. It gives the assignee authority to file and negotiate a claim directly with the insurance company, without involvement from the property owner. An AOB also allows the insurer to pay the contractor directly instead of funneling funds through ...

• Find the form and follow the step-by-step instructions. Important information Use this form to assign benefits to a service provider in order to receive reimbursement for services received. Our usual practice is to reimburse . our insureds by check for the covered long-term care services they receive.

New Jersey Surplus Lines Insurance Guaranty Fund Unsatisfied Claim and Judgment Fund Workers' Compensation Security Fund 233 Mount Airy Road Basking Ridge, New Jersey 07920 Tel: (908) 382-7100 www.njguaranty.org CONDITIONAL ASSIGNMENT OF PERSONAL INJURY PROTECTION BENEFITS & DISCLOSURE REQUIREMENTS (hereinafter "Conditional Assignment")

Dear Patient Assignment of Benefits Acknowledgement Please read this letter carefully because it provides specific information concerning how a medical claim under Personal Injury Protection coverage will be handled, including specific requirements which you must follow in order

Assignment of benefits is not authorization to submit claims. It is important to note that the beneficiary signature requirements for submission of claims are separate and distinct from assignment of benefits requirements except where the beneficiary died before signing the request for payment for a service furnished by a supplier and the supplier accepts assignment for that service.

PERSONAL INJURY PROTECTION BENEFITS CONDITIONAL ASSIGNMENT OF BENEFITS (For losses occurring on or after 10/1/12) Policy Number: Claim Number: Patient's Name: Provider's Name: I authorize and request Government Employees Insurance Company, GEICO General Insurance Company, GEICO

required under the laws of New Jersey or Pre-certification as outlined in State Farm's Decision Point Review Plan (Plan) ... Also included in the enclosed information is a "Conditional Assignment of Benefits" (CAOB) form for you and your patient to sign. Acceptance of assignment of benefits will be conditioned on State Farm's receipt of a ...

NJ Personal Injury Protection Coverage Brochure Dear Provider Letter NJ Assignment of Benefits Form NJ PIP Attending Provider Treatment Plan Form (APTP) NJ No-Fault Pre-Service Appeal Form NJ No-Fault Post-Service Appeal Form. Call for a quote 800-295-2820 24/7 Roadside Assistance 800-426-9898 ...

Horizon Casualty Services, Inc. PO Box 10175. Newark, NJ 07101-3175. REGULATIONS ON NEW JERSEY INSURED GROUP POLICY. Special rules apply for Coordination of Benefits (COB) where the Horizon BCBSNJ policy is an insured group policy issued by Horizon BCBSNJ.

Family Leave Insurance. You may apply for Family Leave Insurance benefits if you are bonding with a newborn, newly adopted, or newly placed foster child. You may also apply if you are caring for a loved one with a serious physical or mental health condition, or to handle certain matters related to domestic or sexual violence. LEARN MORE >.

Benefits; Career Tips; Internships; Contact Us; Offices; Contact Us ; About NJM; Forms. Business Insurance Sales Inquiry. ... Auto Insurance New Jersey New Jersey Post-Service Appeal Form. Download now. of 3 Next. Contact Us. Call 1-800-232-6600. Email, mail or fax. FOLLOW NJM ON: CALL NJM: 1-800-232-6600. Home; About NJM; Careers ...

Assignment of Benefits . Contact us for a copy in MS Word. (ON YOUR LETTERHEAD) ASSIGNMENT OF BENEFITS & LTD. POWER OF ATTORNEY . I, _____, irrevocably assign to you, PRACTICE NAME my medical provider, all of my rights and benefits under my insurance contract for payment for services rendered to me. I authorize you to file insurance claims on my behalf for services rendered to me and this ...

Each assignment or transfer is a contract between private parties but, by law, must be approved by the Secretary. ... Form Number: 3000-003; 3000-003a. Type of Review: Extension ... Respondent's Obligation: Required to obtain or retain a benefit. Frequency of Collection: On occasion ...

required under the laws of New Jersey or Pre-certification as outlined in State Farm's Decision Point Review Plan (Plan) ... Also included in the enclosed information is a Conditional Assignment of Benefits (CAOB) form for you and your patient to sign. Acceptance of assignment of benefits will be conditioned on State Farm's receipt of a ...