- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

Why Is Budgeting Important in Business? 5 Reasons

- 06 Jul 2022

There are few skills as critical to running a business as budgeting. Yet, over half of the executives surveyed in a 2019 McKinsey study report feeling dissatisfied with the transparency surrounding their organizations’ budgets.

Any employee—especially managers—should understand budgeting and how it can profoundly impact an organization.

Here’s a primer on the importance of budgeting in business.

Access your free e-book today.

What Is Business Budgeting?

Budgeting is the process of preparing and overseeing a financial document that estimates income and expenses for a period. For business owners, executives, and managers, budgeting is a key skill for ensuring organizations and teams have the resources to execute initiatives and reach goals.

A basic budget consists of projected income and expenses for a given period (for instance, the upcoming quarter or year). After expenses are subtracted from projected income, the leftover money can be allocated to projects and initiatives, ensuring you’re not planning to overspend.

Budgets from previous periods can be compared to the company’s actual financial allocation and performance, giving an idea of how close predictions were to actual spend.

For example, imagine you allocated $10 million for your company’s annual corporate social responsibility (CSR) project. Unforeseen circumstances caused it to run $1 million over budget, and that money had to come out of other projects’ budgets.

During the project’s postmortem, you ask questions like, “Why did we run over budget? Was this an issue of inefficiency or misallocation?” When creating the budget for next year, you use those insights to tighten the process and keep the project’s spend at $10 million or more accurately allocate funds to other projects.

Types of Budgeting

There are several budgeting types that each prioritize different factors when approaching a financial plan. These include:

- Zero-based budgeting , which sets each item at zero dollars at the start of periods before reallocating

- Static budgeting or incremental-based budgeting , which uses historical data to add or subtract a percentage from the previous period to create the upcoming period’s budget

- Performance-based budgeting , which emphasizes the cash flow per unit of product or service

- Activity-based budgeting , which starts with the company’s goals and works backward to determine the cost of attaining them

- Value proposition budgeting , which assumes no line item should be included in the budget unless it directly provides value to the organization

The right budgeting type varies by company and situation. If your organization is in financial distress, the zero-based method may be the best fit, as it starts from scratch each period. Trying out several methods is a good way to determine which is ideal; when doing so, ensure your entire organization is aligned.

Related: 6 Budgeting Tips for Managers

Why Is Budgeting Important?

Budgeting involves number-crunching, attention to detail, and making informed decisions about fund allocation—but it’s well worth the effort. Here are five reasons budgeting is important in business.

1. It Ensures Resource Availability

At its core, budgeting’s primary function is to ensure an organization has enough resources to meet its goals. By planning financials in advance, you can determine which teams and initiatives require more resources and areas where you can cut back.

If, for instance, your team needs to hire an additional employee to scale efforts, budgeting for that in advance can allow you to plan other spending.

2. It Can Help Set and Report on Internal Goals

Budgeting for an upcoming period isn’t just about allocating spend; it’s also about determining how much revenue is needed to reach company goals.

You can use budgeting to set company-wide and team financial goals that align with them. This is especially prominent when using activity-based budgeting, but it’s beneficial no matter which type you use.

Financial goals should be attainable enough that you count on them to inform the rest of your budget allocations. Your goals inform the expenses needed to reach them and vice versa.

You can also use budgeting to update employees on progress and revisit the next period’s goals. For instance, if your company aimed to gain 10,000 new users this past year but fell short by 4,000, what could you have done differently? Does the initiative require fund redistribution? What resources could have propelled progress?

Tracking progress, or lack thereof, allows you to align your team and plan for growth in the next period.

3. It Helps Prioritize Projects

A byproduct of the budgeting process is that it requires prioritizing projects and initiatives. When prioritizing, consider the potential return on investment for each project, how each aligns with your company’s values, and the extent they could impact broader financial goals.

The value proposition budgeting method forces you to determine and explain each line item's value to your organization, which can be useful for prioritizing tasks and larger initiatives.

4. It Can Lead to Financing Opportunities

If you work at a startup or are considering seeking outside investors , it’s important to have documented budgetary information. When deciding whether to fund a company, investors highly value its current, past, and predicted financial performance.

Providing documents for previous periods with budgeted and actual spend can show your ability to handle a company’s finances, allocate funds, and pivot when appropriate. Some investors may ask for your current budget to see your predicted performance and priorities based on it.

5. It Provides a Pivotable Plan

A budget is a financial roadmap for the upcoming period; if all goes according to plan, it shows how much should be earned and spent on specific items.

Yet, the business world is anything but predictable. Circumstances outside your control can impact your revenue or cause priorities to change at a moment’s notice.

Consider the onset of the coronavirus (COVID-19) pandemic in 2020. The economic impact of travel bans, lockdowns, and other safety precautions was far-reaching and unexpected. Executives were forced to quickly—yet thoughtfully—rework budgets to account for major losses and newfound safety concerns.

More than two years later, executives are rethinking their budgeting procedures to make it easier to pivot if needed. One shift noted by McKinsey is the turn toward zero-based budgeting to determine the minimum resources necessary to survive as a business—should the circumstances call for it.

A budget gives you a plan; maintaining an agile mindset enables you to pivot that plan and help lead your organization through turbulent times.

Learn to Budget Effectively

Anyone can learn to budget effectively and reap the benefits. To build a foundation of financial literacy , gain a deeper understanding of the levers that impact an organization’s finances, and discover how budgeting can enable you to become a better leader and manager, consider taking an online financial accounting course .

Do you want to take your career to the next level? Explore Financial Accounting —one of three online courses comprising our Credential of Readiness (CORe) program —which teaches the key financial topics needed to understand business performance and potential. Not sure which course is right for you? Download our free flowchart .

About the Author

What a Budget Is and Why Your Business Needs One?

A budget is an essential planning tool for estimating your business’s future revenue, expenses and profits. It helps control spending and identify potential problem areas where revenue might not cover spending and potential growth opportunities when you may have extra cash that could be invested in new opportunities. A detailed, realistic budget can also help the company secure funding from banks and investors.

What Is a Budget?

What is a business budget? It’s an overall view of your business’s finances. It lists information about the current state of your financial situation, as well as estimates for future spending and income. It includes regular revenue, expenses, capital expenditures and commitments such as loans. Your budget helps guide the decision making of your business. Budgets are usually made for a fiscal year and monitored on a regular basis—at least monthly.

What Makes a Good Budget?

Comparing estimated and actual revenue and expenses will help you know if you’ve got enough money to stay afloat, if you need to make cuts and if you’re turning a profit. A good budget provides enough detail and lays out a plan so you don’t spend more money than you take in, but at the same time you spend enough to strategically grow your business and keep it competitive. A business budget should include the following four key components:

- Income: This is usually sales revenue. Some businesses may also have income from other sources, such as grants, investments and fees.

- Operating expenses: Your business’s day-to-day running expenses . These are divided into fixed and variable expenses. Fixed expenses are usually the same from month to month and are paid on a regular basis, like rent or employee salaries and wages. Variable expenses are expected but may change depending on usage, production and sales, and other market influences. They can include the price of raw materials, labor and the cost of distribution for your goods and services.

- One-time expenses: These include capital expenditures and acquisitions.

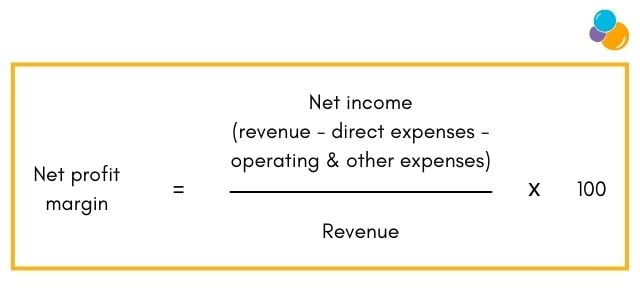

- Profit: The most important profit measure is usually net income, also known as the bottom line.

Key Takeaways

- A budget sets targets for your business’s revenue, expenses and profits.

- Budgets typically forecast performance over a twelve-month period but can also be produced semiannually, quarterly or monthly.

- Monitoring the variance between budget forecasts and actual business performance can provide insights into business conditions and the overall financial health of your company, as well as different departments and areas. Creating budget estimates for different scenarios can help you make strategic decisions for your business.

- Using a budget as a management tool can rein in spending and motivate staff.

- A well-managed budget can help your business obtain loans at affordable interest rates.

Business Budgets Explained

A business budget maps out your financial landscape and lays out the path that you want to follow. To build a budget, start by documenting your business’s current financial situation. List all revenue, expenses and profit. Then use the budget to forecast future scenarios with planned revenue and expenses. Use the budget to set goals and better understand what revenue you’ll need to generate in order to cover expected costs. Monitor your progress regularly and track actual spending and revenue versus projections.

Typically, business budgets cover a 12-month accounting period. It can also be helpful to break down the budget into semiannual, quarter and month segments. Most budgets correspond with the fiscal year, or the time period used for financial and tax reporting purposes.

What are the three types of budgets?

The different kinds end with a surplus, deficit or are balanced. Although those terms are more commonly used to describe government budgets than corporate budgets. In government, the terms generally describe whether there’s enough tax revenue to cover costs.

- Surplus: Revenue exceeds expenses, and the company turns a profit.

- Deficit: Expenses exceed revenue. The business loses money—at least temporarily. Sometimes, it’s reasonable for a budget to be in deficit at the end of the period. For example, suppose you want to invest in new machinery to increase production and boost revenue potential. The cost of that machinery may exceed your revenue for that period, but increased production should result in higher income and profits in the future.

- Balanced: Income equals expenditure. The business breaks even.

Your budget tells you where your finances should be heading. It’s also important to monitor actual income and spending against your budget. Some variance is normal, but if actual income is consistently below budget or actual expenditure is consistently above, it can be a warning that your businesses is facing unexpected financial difficulties.

Variances in actual income and expenditure can also give you information about the business environment. For example, you might find that your income increases more than expected in the run-up to Christmas or declines more than you had expected in August. This information can help you plan supplies and manage cash flow to carry the business through future seasonal fluctuations.

Why Is a Budget Important in Business?

Creating and monitoring a budget can seem like a lot of work, especially if your business is simple and you have no immediate plans to expand or make significant changes. But using a budget to manage your business confers three important benefits:

- It can prevent overspending. Spending can easily run amok, so measure it regularly against your planned expenses in your budget. By comparing planned versus actuals in your budget, you can see when spending creeps up or income is not keeping pace with expenses. You can make adjustments and corrective actions to prevent a deficit.

- It can help motivate employees. Use your budget to share business objectives with your staff. It can also be an insightful tool to set goals for revenue and cost cutting. In some cases, connecting bonuses and commissions to performance can help motivate your employees. If you have staff with spending authority, encouraging them to collectively monitor expenditure against budget can foster teamwork and cooperation to help the company hit its targets.

- It can help you get business funding. When seeking outside funding, investors and banks will review various aspects of your business from different financial statements . A detailed operating budget shows them what it will cost to operate the business in terms of expected future revenue and expenses. A well-managed and thought-out budget can give banks and investors confidence in your strategy and company.

Benefits of a business plan: A business plan sets your strategic goals, establishes priorities, outlines short- and long-term targets, identifies funding needs and sources and lists key stakeholders. Business plans typically encompass a long-term view—usually five years or more. They’re essential for new businesses, as well as established companies.

Budgets and business plans: A detailed budget is a key element in any business plan. The budget sets your short-term financial goals and feeds into your business plan’s longer-term targets. The role of accountants and the way planning and budgeting is incorporated into broader business goals is growing. Accountants aren’t just reporting information, managerial accounting analyzes data to project trends and monitor business performance.

How Business Budgets Work

Business budgets look at how much cash you have and how much you’ll need. A budget is a tool for you to predict if you’ll have more funds coming in than you pay out. You should be realistic with your financial projections . And you may want to underestimate your financial performance, or create separate conservative, middle-of-the-road and ambitious budgets. Budgeting can be especially tough if you’re just getting started and you don’t have historical data to examine. In that case, try to create financial forecasts based off sales figures and information you can glean from peer companies. Financial planning software can help with this step.

Each month you should check your forecasts against actuals . This can help you make decisions and forecasting scenarios with budgets attached can be a useful exercise.

For example, if you are considering taking on additional staff, you can examine the budget impact of adding a permanent employee compared to using temporary contractors or asking current staff to work overtime. If you are thinking about investing in more equipment to increase production, you can experiment with different income estimates to see how much you would have to increase output to justify the capital expenditure .

Budgets help you make wiser business decisions. By removing emotion from purchase decisions, and instead focusing on staying within a budget that reflects strategic priorities, your business can more easily achieve goals and turn a profit.

Your business budget should be detailed enough to give you a clear picture of income and expenses. But too much detail can weigh down your budget. For example, you may include office supplies in your budget. But you don’t need to write out the specific amount for paper clips, highlighters and pens separately. A general category will suffice in most cases.

You can use your budget to set sales and operating profit targets for your business. Your budget can help you identify challenges such as high costs or poor cash flow. A well-thought-out budget can help your business qualify for a bank loan at reasonable interest rates or attract funding from investors.

Types of Corporate Budgets

Different circumstances might warrant different approaches to your budget processes. Depending on things like external market forces, the maturity of your business and the reliability of your historic data, you may choose either a static or flexible budget.

Static vs flexible

Static budget: A static budget is more straightforward and easier to manage than a flexible budget. You create the budget at the start of an accounting period using the best available information at the time. Start by considering historical data and expected revenue and expenses to create a budget for the fiscal year or other accounting period. List out expected revenue and spending by category. Then as the year progresses, monitor actual business performance against the budget. Typically, static budgets are established a year in advance and broken down into quarterly or monthly sections for monitoring purposes.

The advantage of a static budget is that you can see variances between the budget and actual business performance. This tells you how accurate your estimates are, and it provides insight into business conditions. For example, if your start-of-year estimates assumed no adverse weather conditions, but in August your business suffered a sudden interruption because of a hurricane, the effect on every item of income and expenditure would show up as variances against your original estimates. With a sufficiently detailed budget, you’d know not only the impact on your bottom line, but also which aspects of your business were most affected.

However, a static budget also has downsides. When the outlook is uncertain or your business is changing, you may find a large variance between estimated and actual income and spending. Also, with static budgeting, you’re making assumptions based on historical and predicted information. Your estimates may prove to be off.

Flexible budget: If you have a dynamic business or you operate in uncertain business conditions, you might opt for a flexible budget that you can update with new information. Unlike a static budget, a flexible budget is designed to adjust based on the activities of the business. One mechanism for doing this is to express costs as ratios instead of fixed values; for example, a company may budget 40% of revenue for staff salaries.

Fast-growing businesses might opt for a flexible budget. You can examine different scenarios, such as investment opportunities and monitor their effects on the budget more easily. For example, if a manufacturing company has to use more machine hours in March vs February, then its budget should logically increase in March. Conversely, if it uses them for few hours, its budget should reflect that decline. Therefore, most companies that have variable business costs each month or even quarterly have flexible budgets.

Flexible budgets are also useful when the business outlook is uncertain, since income and expenditure can vary significantly under these circumstances. For example, if sales unexpectedly increase significantly, you’ll need to order more supplies than you originally budgeted for. With a flexible budget, you can set up a relationship between sales revenue and cost of supplies so that the money budgeted for supplies automatically adjusts in line with sales revenue.

However, to manage a flexible budget, you’ll need a good grasp on the relationship between your revenue and spending. And don’t forget to set aside time to keep your budget up to date, as it’s more labor-intensive than a static budget.

How to Build a Budget

When building a budget for your business, start by deciding on a static or flexible budget. If you’ve never prepared one before, a static budget might be a good place to start. However, if you are an experienced business manager facing a period of uncertainty, you might consider creating a flexible budget. The decision will affect the way you develop your budget.

Next, set the accounting period for your budget. Common lengths are three months and one year. Set up a regular schedule to review and monitor spending and revenue. This is usually done at least monthly.

Components of a budget: Gather information and set expectations for each of the primary components of the budget—sales revenue, fixed and variable operating expenses and capital expenditures. Use that to calculate expected profits—or the difference between revenue and spending.

Examine financial statements to gather much of the information and to help you understand where your business sits financially. Looking back at historical data—whether you’ve kept a detailed budget or not—can inform your forecasts.

Income: Your principal income is most likely from sales, and sales are usually variable. Take a look at patterns of previous sales and use those to inform your budget. If you’re just getting started, take a look at other similar companies in your industry to set realistic expectations and aspirational but obtainable goals.

Operating costs: Operating costs include fixed and variable costs. Fixed costs include

- Regular salaries for employees

- Interest payments and principal repayments on business loans

This information should be found on your income statement, balance sheet and other financial statements. Business accounting software for small businesses and startups can help you keep tabs on your financial situation.

However, even fixed costs can increase over time, so allow some room in your budget to account for things like:

- Rent increases

- Cost-of-living salary increases and other raises

- Performance incentives

- Additional staff for planned expansion

- Interest and principal repayments on planned new debt

Variable costs depend on your business’s activity. Some examples include:

- Raw materials

- Wages for workers paid by the hour or by piece of work completed

- Commissions

- Credit card interest payments, bank fees and overdraft charges

Estimate costs for raw materials and packaging based on historical data. Be sure to account for any planned expansion or expected growth in sales. Using production estimates and historical trends, you can also calculate estimates for your hourly staff. Don’t forget to include any cost-of-living raises, promotions and commissions.

Some items have both fixed and variable components. For example, you may pay a fixed monthly charge for your water service, plus an additional cost for the amount you use.

One-time expenses: You might also be planning some one-time expenses, such as new office equipment or production machinery. Include estimates for these costs.

Now you have your income and spending estimates, you can start to understand the profitability of your business. It can help you stay on track and make new goals. For example, if your budget is in the red, you may need find new areas to cut spending and new ways to bring in new clients or sell more goods and services.

Four Key Steps to Creating a Business Budget

Here’s an example of setting up a static budget using a standard budget template, which you can download in the next section.

- List your income sources and the estimated revenue of each in the budget column. You’ll list actuals next to it as the financial period progresses.

- Under operating expenses, list your variable expenses and an estimate for each. Use expected income and historical data to make predictions. For example, if you plan to sell 50 units each month, account for the cost of raw materials, the labor to produce the items, and the cost to sell and distribute them.

- Also under operating expenses, list all your fixed expenses and an expected amount in the budget column. Don’t forget to include estimates for raises, new hires and other things like interest payments on debt.

- List one-time expenditures, such as new office equipment, with cost estimates. These will be listed under non-operating expenses in your budget.

These steps can be done manually, but most companies use software for these functions. It helps produce more accurate and complete data to aid in your forecasting, as well as when you compare actual spending. And robust financial planning software include training and certificate programs to help you and your finance team take full advantage of its features.

What is an example of a budget? For a budget example, we’re going to use a hypothetical small company called Michigan Widgets. Here’s how Michigan Widgets’ static budget looked after completing steps 1-4.

MICHIGAN WIDGETS

As you can see, Michigan Widgets had quite a healthy-looking budget for 2019/20. Now let’s feed in some actual figures.

Unfortunately, Michigan Widgets’ business didn’t fare as well as expected in 2019/20 because revenue was less than the budget forecast. Expenses fell too, but not nearly as much. As a result, net income was about 45% lower than expected. The owner isn’t too happy but thinks this was a short-term downturn and that the business will recover in 2021/20. So, the company went ahead with new equipment purchases and didn’t make any staff reductions.

Plan & Forecast More Accurately

Free Budget Template

You can build a static budget for your business with this free downloadable template (opens in new tab) .

Managing Budgets with Software

You can set up and maintain a simple static business budget like the one above using a standard spreadsheet. However, the process of gathering and entering information can be cumbersome and time-consuming. And if you want more advanced capabilities, such as the ability to create a flexible budget, a spreadsheet may not meet your needs.

For a more powerful and faster approach, use financial planning software for your ledgers, invoices and receipts. Software can make the budgeting and planning process less labor-intensive and keep all financial data in one central location. You and your finance teams can easily access up-to-date information to create budgets and forecasts for what-if scenarios. It can be a collaborative process while also providing simple-to-understand reports and dashboards.

A business budget is an essential management tool. Business managers can use it to monitor day-to-day performance, and it can inform decisions about investment and development for the future. Using a budget to set business targets and monitor performance against those targets can motivate staff and encourage teamwork, while helping keep spending under control. Comprehensive accounting software makes creating, tracking and adjusting your budget easier and more accurate.

Financial Management

Financial Forecast vs. Financial Projection: Key Differences

Financial terms are easily confused and often used interchangeably. But phrases like “financial forecast” and “financial projection” that sound similar are quite different.

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

- Wealth Management

- IT Services

- Client Login

- (847) 247-8959

February 27, 2024

How to create a business budget: 8 simple steps.

No matter the size of your business, a business budget is vital to planning and guiding your business’s growth. By understanding the fixed expenses of a company and accounting for the ebb and flow of work, a proper business budget can help your business maintain itself through the year and create protection around unplanned expenses through well allocated funds. In this guide, we'll walk you through the process of creating a business budget, outlining essential steps to help you manage your finances effectively.

What Is a Business Budget?

A business budget is a financial plan outlining projected revenues and expenses for a business during a specific period of time (most typically a year, though there are often monthly or quarterly reexaminations). Although there are variables throughout the year, a complete and accurate budget will serve as a blueprint for businesses in managing income and expenditures, guiding decision-making processes, and ensuring financial stability.

What Should a Business Budget Include?

A comprehensive business budget’s purpose is to provide a business a holistic view of their financial health. When looking through bank statements, take note of those expenses that reoccur throughout the year and note those—as well as those unexpected expenses your company should instead anticipate. Key components to include are:

- Revenue Forecast: Anticipated income from sales, services, or other sources after deducting costs, taxes, and other fees.

- Fixed Operating Expenses: Costs associated with running the business, such as rent, utilities, salaries, and supplies.

- Capital Expenditures: Investments in assets like equipment, machinery, or property.

- Debt Service: Payments towards loans, credit lines, or other forms of debt.

- Taxes: Estimated tax liabilities, including income tax, sales tax, and payroll taxes.

- Contingency Funds: Reserves set aside for unexpected expenses or emergencies.

- Profit Targets: Desired levels of profitability, indicating the financial performance you aim to achieve.

Why Is Budgeting Important to a Business?

Budgeting plays a crucial role in the financial management of a business for several reasons:

- Resource Allocation: Helps allocate resources efficiently to prioritize essential activities and investments.

- Financial Control: Provides a framework for monitoring and controlling expenses to prevent overspending.

- Performance Evaluation: Facilitates performance measurement against predetermined targets, enabling timely corrective actions.

- Decision Making: Guides decision-making processes by providing insights into the financial implications of various options.

- Risk Management: Identifies potential risks and allows for proactive mitigation strategies to safeguard financial stability.

How Does Budgeting Help a Business?

Effective budgeting contributes to the success and sustainability of a business in numerous ways:

- Improved Cash Flow Management: Helps maintain adequate cash reserves to meet financial obligations and fund growth initiatives.

- Enhanced Profitability: Enables businesses to identify opportunities for revenue growth and cost optimization, leading to higher profitability.

- Better Resource Utilization: Ensures optimal utilization of resources by aligning expenditures with strategic priorities and operational needs.

- Increased Financial Transparency: Provides stakeholders with a clear understanding of the company's financial health and performance.

- Long-term Planning: Facilitates long-term planning by forecasting future financial requirements and setting achievable goals.

How to Create a Business Budget

Now that we’ve gone over the importance of a business budget, it’s time to understand the steps you need to take in order to create a comprehensive plan.

Gather Financial Information

Start by compiling relevant financial data, including past income statements, balance sheets, and cash flow statements. Analyze historical trends to identify patterns and make informed projections for the upcoming period.

Determine Your Financial Goals

Define clear, measurable financial goals aligned with your business objectives. Whether it's increasing revenue, reducing costs, or improving profitability, setting specific targets will provide a roadmap for your budgeting process.

Identify Revenue Sources

Identify all potential sources of revenue, including sales, services, investments, and other income streams. Estimate the expected revenue for each source based on market trends, historical data, and sales forecasts.

Estimate Expenses

Next, list all anticipated expenses, categorizing them into fixed and variable costs. Fixed expenses, such as rent and salaries, remain constant regardless of business activity, while variable expenses, like supplies and utilities, fluctuate based on demand.

Factor in Contingencies & Emergency Funds

Allocate a portion of your budget for contingencies and emergency funds to cover unforeseen expenses or revenue shortfalls. Building a financial cushion will provide stability and resilience during challenging times.

Balance Your Budget

Balance your budget by ensuring that projected revenues exceed estimated expenses. If there's a deficit, identify areas where you can reduce costs or increase revenue to achieve equilibrium.

Monitor & Track Your Budget

Regularly monitor and track your budget against actual financial performance to identify variances and deviations. Use accounting software or spreadsheets to update your budget and make adjustments as needed to stay on course.

Review & Adjust Budget Regularly

Review your budget periodically, ideally on a quarterly or annual basis, to assess its effectiveness and relevance. Adjust your budget as necessary based on changing market conditions, business priorities, and performance trends.

Contact Mowery & Schoenfeld for Help with Business Budgeting

Creating and managing a business budget requires expertise and strategic planning. At Mowery & Schoenfeld, we specialize in helping businesses develop robust financial strategies to achieve their financial goals. Contact us today to learn how our team of experienced professionals can assist you with business budgeting and financial management.

Please note that the contents of this site are not being updated since October 1, 2023.

As of October 2, 2023, Acclr Business Information Services (Info entrepreneurs) will be delivered directly by CED’s Business Information Services . To find out more about CCMM’s other Acclr services, please visit this page: Acclr – Business Services | CCMM.

- Advice and guidance

- Starting a business

- Personalized Guidance

- Seminars on Business Opportunities

- Certification of Export Documents

- Market Studies

- Export Financing

- International Trade Training

- Connection with the World Bank

- Trade Missions

- SME Passport

- Export Resources

- Import Resources

- Networking Activities

- Networking Training

- CCMM Member Directory

- Market Studies and Research Services

- Business plan

- Registration and legal structures

- Guidance for Drafting a Business Plan

- Help in Seeking Funding

- News, Grants, and Competitions

- Funding Meet-and-Greet

- Resources for Drafting a Business Plan

- Regulations / Permits / Licences

- Personalized Market Information Research

- Personalized Meetings with Guest Experts

- Government Subsidies and Programs

- Training for your employees

- Employee Management

- Interconnection Program

- Wage Subsidies

- French courses

- Merchant-Student Pairing

- Intellectual property

- Marketing and sales

- Operations management

- Hiring and managing human resources

- Growth and innovation

- Importing and exporting

- Calls for tenders

- Support organizations

- Sale / Closure / Bankruptcy

- Business intelligence

- Business lists and profiles

- Market data

- Market trends

- Business advice

- Business plan management consultant

- Legal structures consultant

- Accounting consultant

- Legal consultant

- Export certification

- Resource centre

Budgeting and business planning

Once your business is operational, it's essential to plan and tightly manage its financial performance. Creating a budgeting process is the most effective way to keep your business - and its finances - on track.

This guide outlines the advantages of business planning and budgeting and explains how to go about it. It suggests action points to help you manage your business' financial position more effectively and ensure your plans are practical.

Planning for business success

The benefits, what to include in your annual plan, a typical business planning cycle, budgets and business planning, benefits of a business budget, creating a budget, key steps in drawing up a budget, what your budget should cover, what your budget will need to include, use your budget to measure performance, review your budget regularly.

When you're running a business, it's easy to get bogged down in day-to-day problems and forget the bigger picture. However, successful businesses invest time to create and manage budgets, prepare and review business plans and regularly monitor finance and performance.

Structured planning can make all the difference to the growth of your business. It will enable you to concentrate resources on improving profits, reducing costs and increasing returns on investment.

In fact, even without a formal process, many businesses carry out the majority of the activities associated with business planning, such as thinking about growth areas, competitors, cashflow and profit.

Converting this into a cohesive process to manage your business' development doesn't have to be difficult or time-consuming. The most important thing is that plans are made, they are dynamic and are communicated to everyone involved. See the page in this guide on what to include in your annual plan.

The key benefit of business planning is that it allows you to create a focus for the direction of your business and provides targets that will help your business grow. It will also give you the opportunity to stand back and review your performance and the factors affecting your business. Business planning can give you:

- a greater ability to make continuous improvements and anticipate problems

- sound financial information on which to base decisions

- improved clarity and focus

- a greater confidence in your decision-making

The main aim of your annual business plan is to set out the strategy and action plan for your business. This should include a clear financial picture of where you stand - and expect to stand - over the coming year. Your annual business plan should include:

- an outline of changes that you want to make to your business

- potential changes to your market, customers and competition

- your objectives and goals for the year

- your key performance indicators

- any issues or problems

- any operational changes

- information about your management and people

- your financial performance and forecasts

- details of investment in the business

Business planning is most effective when it's an ongoing process. This allows you to act quickly where necessary, rather than simply reacting to events after they've happened.

- Review your current performance against last year/current year targets.

- Work out your opportunities and threats.

- Analyse your successes and failures during the previous year.

- Look at your key objectives for the coming year and change or re-establish your longer-term planning.

- Identify and refine the resource implications of your review and build a budget.

- Define the new financial year's profit-and-loss and balance-sheet targets.

- Conclude the plan.

- Review it regularly - for example, on a monthly basis - by monitoring performance, reviewing progress and achieving objectives.

- Go back to 1.

New small business owners may run their businesses in a relaxed way and may not see the need to budget. However, if you are planning for your business' future, you will need to fund your plans. Budgeting is the most effective way to control your cashflow, allowing you to invest in new opportunities at the appropriate time.

If your business is growing, you may not always be able to be hands-on with every part of it. You may have to split your budget up between different areas such as sales, production, marketing etc. You'll find that money starts to move in many different directions through your organisation - budgets are a vital tool in ensuring that you stay in control of expenditure.

A budget is a plan to:

- control your finances

- ensure you can continue to fund your current commitments

- enable you to make confident financial decisions and meet your objectives

- ensure you have enough money for your future projects

It outlines what you will spend your money on and how that spending will be financed. However, it is not a forecast. A forecast is a prediction of the future whereas a budget is a planned outcome of the future - defined by your plan that your business wants to achieve.

There are a number of benefits of drawing up a business budget, including being better able to:

- manage your money effectively

- allocate appropriate resources to projects

- monitor performance

- meet your objectives

- improve decision-making

- identify problems before they occur - such as the need to raise finance or cash flow difficulties

- plan for the future

- increase staff motivation

Creating, monitoring and managing a budget is key to business success. It should help you allocate resources where they are needed, so that your business remains profitable and successful. It need not be complicated. You simply need to work out what you are likely to earn and spend in the budget period.

Begin by asking these questions:

- What are the projected sales for the budget period? Be realistic - if you overestimate, it will cause you problems in the future.

- What are the direct costs of sales – i.e. costs of materials, components or subcontractors to make the product or supply the service?

- What are the fixed costs or overheads?

You should break down the fixed costs and overheads by type, e.g.:

- cost of premises, including rent, municipal taxes and service charges

- staff costs –e.g. wages, benefits, Québec Parental Insurance Plan (QPIP) premiums, contributions to the Québec Pension Plan (QPP) and to the financing of the Commission des normes du travail (CNT)

- utilities – e.g. heating, lighting, telephone

- printing, postage and stationery

- vehicle expenses

- equipment costs

- advertising and promotion

- travel and subsistence expenses

- legal and professional costs, including insurance

Your business may have different types of expenses, and you may need to divide up the budget by department. Don't forget to add in how much you need to pay yourself, and include an allowance for tax.

Your business plan should help in establishing projected sales, cost of sales, fixed costs and overheads, so it would be worthwhile preparing this first. See the page in this guide on planning for business success.

Once you've got figures for income and expenditure, you can work out how much money you're making. You can look at costs and work out ways to reduce them. You can see if you are likely to have cash flow problems, giving yourself time to do something about them.

When you've made a budget, you should stick to it as far as possible, but review and revise it as needed. Successful businesses often have a rolling budget, so that they are continually budgeting, e.g. for a year in advance.

There are a number of key steps you should follow to make sure your budgets and plans are as realistic and useful as possible.

Make time for budgeting

If you invest some time in creating a comprehensive and realistic budget, it will be easier to manage and ultimately more effective.

Use last year's figures - but only as a guide

Collect historical information on sales and costs if they are available - these could give you a good indication of likely sales and costs. But it's also essential to consider what your sales plans are, how your sales resources will be used and any changes in the competitive environment.

Create realistic budgets

Use historical information, your business plan and any changes in operations or priorities to budget for overheads and other fixed costs.

It's useful to work out the relationship between variable costs and sales and then use your sales forecast to project variable costs. For example, if your unit costs reduce by 10 per cent for each additional 20 per cent of sales, how much will your unit costs decrease if you have a 33 per cent rise in sales?

Make sure your budgets contain enough information for you to easily monitor the key drivers of your business such as sales, costs and working capital. Accounting software can help you manage your accounts.

Involve the right people

It's best to ask staff with financial responsibilities to provide you with estimates of figures for your budget - for example, sales targets, production costs or specific project control. If you balance their estimates against your own, you will achieve a more realistic budget. This involvement will also give them greater commitment to meeting the budget.

Decide how many budgets you really need. Many small businesses have one overall operating budget which sets out how much money is needed to run the business over the coming period - usually a year. As your business grows, your total operating budget is likely to be made up of several individual budgets such as your marketing or sales budgets.

Projected cash flow -your cash budget projects your future cash position on a month-by-month basis. Budgeting in this way is vital for small businesses as it can pinpoint any difficulties you might be having. It should be reviewed at least monthly.

Costs - typically, your business will have three kinds of costs:

- fixed costs - items such as rent, salaries and financing costs

- variable costs - including raw materials and overtime

- one-off capital costs - purchases of computer equipment or premises, for example

To forecast your costs, it can help to look at last year's records and contact your suppliers for quotes.

Revenues - sales or revenue forecasts are typically based on a combination of your sales history and how effective you expect your future efforts to be.

Using your sales and expenditure forecasts, you can prepare projected profits for the next 12 months. This will enable you to analyse your margins and other key ratios such as your return on investment.

If you base your budget on your business plan, you will be creating a financial action plan. This can serve several useful functions, particularly if you review your budgets regularly as part of your annual planning cycle.

Your budget can serve as:

- an indicator of the costs and revenues linked to each of your activities

- a way of providing information and supporting management decisions throughout the year

- a means of monitoring and controlling your business, particularly if you analyse the differences between your actual and budgeted income

Benchmarking performance

Comparing your budget year on year can be an excellent way of benchmarking your business' performance - you can compare your projected figures, for example, with previous years to measure your performance.

You can also compare your figures for projected margins and growth with those of other companies in the same sector, or across different parts of your business.

Key performance indicators

To boost your business' performance you need to understand and monitor the key "drivers" of your business - a driver is something that has a major impact on your business. There are many factors affecting every business' performance, so it is vital to focus on a handful of these and monitor them carefully.

The three key drivers for most businesses are:

- working capital

Any trends towards cash flow problems or falling profitability will show up in these figures when measured against your budgets and forecasts. They can help you spot problems early on if they are calculated on a consistent basis.

To use your budgets effectively, you will need to review and revise them frequently. This is particularly true if your business is growing and you are planning to move into new areas.

Using up to date budgets enables you to be flexible and also lets you manage your cash flow and identify what needs to be achieved in the next budgeting period.

Two main areas to consider

Your actual income - each month compare your actual income with your sales budget, by:

- analysing the reasons for any shortfall - for example lower sales volumes, flat markets, underperforming products

- considering the reasons for a particularly high turnover - for example whether your targets were too low

- comparing the timing of your income with your projections and checking that they fit

Analysing these variations will help you to set future budgets more accurately and also allow you to take action where needed.

Your actual expenditure - regularly review your actual expenditure against your budget. This will help you to predict future costs with better reliability. You should:

- look at how your fixed costs differed from your budget

- check that your variable costs were in line with your budget - normally variable costs adjust in line with your sales volume

- analyse any reasons for changes in the relationship between costs and turnover

- analyse any differences in the timing of your expenditure, for example by checking suppliers' payment terms

Original document, Budgeting and business planning , © Crown copyright 2009 Source: Business Link UK (now GOV.UK/Business ) Adapted for Québec by Info entrepreneurs

Our information is provided free of charge and is intended to be helpful to a large range of UK-based (gov.uk/business) and Québec-based (infoentrepreneurs.org) businesses. Because of its general nature the information cannot be taken as comprehensive and should never be used as a substitute for legal or professional advice. We cannot guarantee that the information applies to the individual circumstances of your business. Despite our best efforts it is possible that some information may be out of date.

- The websites operators cannot take any responsibility for the consequences of errors or omissions.

- You should always follow the links to more detailed information from the relevant government department or agency.

- Any reliance you place on our information or linked to on other websites will be at your own risk. You should consider seeking the advice of independent advisors, and should always check your decisions against your normal business methods and best practice in your field of business.

- The websites operators, their agents and employees, are not liable for any losses or damages arising from your use of our websites, other than in respect of death or personal injury caused by their negligence or in respect of fraud.

Need help? Our qualified agents can help you. Contact us!

- Create my account

The address of this page is: https://www.infoentrepreneurs.org/en/guides/budgeting-and-business-planning/

INFO ENTREPRENEURS

380 St-Antoine West Suite W204 (mezzanine level) Montréal, Québec, Canada H2Y 3X7

www.infoentrepreneurs.org

514-496-4636 | 888-576-4444 [email protected]

Consent to Cookies

This website uses necessary cookies to ensure its proper functioning and security. Other cookies and optional technologies make it possible to facilitate, improve or personalize your navigation on our website. If you click "Refuse", some portions of our website may not function properly. Learn more about our privacy policy.

Click on one of the two buttons to access the content you wish to view.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Create a Business Budget for Your Small Business

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A business budget estimates future revenue and expenses in detail, so that you can see whether you’re on track to meet financial expectations for the month, quarter or year. Think of your budget as a point of comparison — you run your actual numbers against it to determine if you’re over or under budget.

From there, you can make informed business decisions and pivot accordingly. For example, maybe you find that your expenses are over budget for the quarter, so you may hold off on a large equipment purchase.

Here’s a step-by-step guide for creating a business budget, along with why budgets are crucial to running a successful business.

» MORE: What is accounting? Definition and basics, explained

QuickBooks Online

How does a business budget work?

Budgeting uses past months’ numbers to help you make financially conservative projections for the future and wiser business decisions for the present. If you’ve had a few bad months and predict another slow one, you can prepare to minimize expenses where possible. If business has been booming and you’re bringing in new customers, maybe you invest in buying more inventory to satisfy increased demand.

Creating a business budget from scratch can feel tedious, but you might already have access to tools that can help simplify the process. Your small-business accounting software is a good place to start, since it houses your business’s financial data and may offer basic budgeting reports.

To create a budget in QuickBooks Online , for example, you break down your estimated income and expenses across each area of your business. Then, the software calculates figures like gross profit, net operating income and net income for you.

You can then compare actual versus projected figures side by side by running a Budget vs. Actuals report. Businesses that need more in-depth features, like cash flow forecasting or the ability to use different projection methods, might subscribe to business budgeting software in addition to accounting software.

If your small business doesn’t have access to these features or has simple financials, you can download free small-business budget templates to manually create and track your budget. Regardless of which option you choose, your business will likely benefit from hiring an accountant to help manage your budget, course-correct when the business gets off track, and make sure taxes are being paid correctly.

Why is a business budget important?

A business budget encourages you to look beyond next week and next month to next year, or even the next five years.

Creating a budget can help your business do the following:

Maximize efficiency.

Establish a financial plan that helps your business reach its goals.

Point out leftover funds that you can reinvest.

Predict slow months and keep you out of debt.

Estimate what it will take to become profitable.

Provide a window into the future so you can prepare accordingly.

Creating a business budget will make operating your business easier and more efficient. A business budget can also help ensure you’re spending money in the right places and at the right time to stay out of debt.

How to create a business budget in 6 steps

The longer you’ve been in business, the more data you’ll have to inform your forward-looking budget. If you run a startup, however, you’ll want to do extensive research into typical costs for businesses in your industry, so that you have working estimates for revenue and expenses.

From there, here’s how to put together your business budget:

1. Examine your revenue

One of the first steps in any budgeting exercise is to look at your existing business and find all of your revenue sources. Add all those income sources together to determine how much money comes into your business monthly. It’s important to do this for multiple months and preferably for at least the previous 12 months, provided you have that much data available.

Notice how your business’s monthly income changes over time and try to look for seasonal patterns. Your business might experience a slump after the holidays, for example, or during the summer months. Understanding these seasonal changes will help you prepare for the leaner months and give you time to build a financial cushion.

Then, you can use those historic numbers and trends to make revenue projections for future months. Make sure to calculate for revenue, not profit. Your revenue is the money generated by sales before expenses are deducted. Profit is what remains after expenses are deducted.

2. Subtract fixed costs

The second step for creating a business budget involves adding up all of your historic fixed costs and using them to reliably predict future ones. Fixed costs are those that stay the same no matter how much income your business is generating. They might occur daily, weekly, monthly or yearly, so make sure to get as much data as you can.

Examples of fixed costs within your business might include:

Debt repayment.

Employee salaries.

Depreciation of assets.

Property taxes.

Insurance .

Once you’ve identified your business’s fixed costs, you’ll subtract those from your income and move to the next step.

3. Subtract variable expenses

As you compile your fixed costs, you might notice other expenses that aren’t as consistent. Unlike fixed costs, variable expenses change alongside your business’s output or production. Look at how they’ve fluctuated over time in your business, and use that information to estimate future variable costs. These expenses get subtracted from your income, too.

Some examples of variable expenses are:

Hourly employee wages.

Owner’s salary (if it fluctuates with profit).

Raw materials.

Utility costs that change depending on business activity.

During lean months, you’ll probably want to lower your business’s variable expenses. During profitable months when there’s extra income, however, you may increase your spending on variable expenses for the long-term benefit of your business.

4. Set aside a contingency fund for unexpected costs

When you’re creating a business budget, make sure you put aside extra cash and plan for contingencies.

Although you might be tempted to spend surplus income on variable expenses, it’s smart to establish an emergency fund instead, if possible. That way, you’ll be ready when equipment breaks down and needs replacing, or if you have to quickly replace inventory that's damaged unexpectedly.

5. Determine your profit

Add up all of your projected revenue and expenses for each month. Then, subtract expenses from revenue. You may also see the resulting number referred to as net income . If you end up with a positive number, you can expect to make a profit. If not, that’s a loss — and that can be OK, too. Small businesses aren’t necessarily profitable every month, let alone every year. This is especially true when your business is just starting out. Compare your projected profits to past profits to confirm whether they’re realistic.

Looking for accounting software?

See our overall favorites, or choose a specific type of software to find the best options for you.

on NerdWallet's secure site

6. Finalize your business budget

Are the resulting profits enough to work with, or is your business overspending? This is your opportunity to set spending and earning goals for each month, quarter and year. These goals should be realistic and achievable. If they don’t line up with your projections, make sure to establish a strategy for making up the difference.

As time goes on, regularly compare your actual numbers to your budget to determine whether your business is meeting those goals, and course correct if necessary.

» MORE: Ways your small business can spend smarter

A business budget projects future revenue and expenses so you can create a smart, realistic spending plan. As the year progresses, comparing your actual numbers against your budget can help you hold your business accountable and make sure it reaches its financial goals.

A business budget includes projected revenue, fixed costs, variable costs and the resulting profits. You can also factor in contingency funds for unforeseen circumstances like equipment failure.

On a similar note...

Business Budget: What is it & Why is it important?

According to a survey conducted by Clutch , 61 percent of small businesses have not created a formal budget. Without a budget, you may not understand how your business is performing.

Creating a budget helps you understand how much money you have, how much you have spent, and how much money you will need in the future. A budget can drive important business decisions like cutting down on unwanted expenses, increasing staff, or purchasing new equipment. If you end up with insufficient money, the budget can guide you in altering your business plan or prioritizing your spending on activities.

With the right budgeting plan, you can keep your business out of debt or find ways to reduce the debt it is currently facing. A comprehensive budget can even be used for obtaining business loans from banks or other financial institutions.

In this guide, you will learn about the importance of a business budget, the components of a good budget, and the different types of budgets.

So, what exactly is a business budget?

A business budget is a spending plan for your business based on your income and expenses. It identifies your available capital, estimates your spending, and helps you predict revenue.

A budget can help you plan your business activities and can act as a yardstick for setting up financial goals. It can help you tackle both short-term obstacles and long-term planning.

Different types of budgets

Your final budget is usually a combination of inputs from several other budgets that are prepared at a departmental level. Let’s look at the different types of budget and how they contribute to drafting a business plan.

1. Master budget

A master budget is an aggregation of lower-level budgets created by the different functional areas in an organization. It uses inputs from financial statements, the cash forecast, and the financial plan. Management teams use master budgets to plan the activities they need to achieve their business goals. In larger organizations, the senior management is responsible for creating several iterations of the master budget before it is finalized. Once it has been reviewed for the final time, funds can be allocated for specific business activities.

Smaller businesses often use spreadsheets to create their master budgets, but replacing the spreadsheets with efficient budgeting software typically reduces errors.

2. Operating budget

An operating budget shows a business’s projected revenue and the expenses associated with it for a period of time. It’s very similar to a profit and loss report. It includes fixed cost, variable cost, capital costs, and non-operating expenses. Although this budget is a high-level summary report, each line item is backed up with relevant details. This information is useful for checking whether the business is spending according to its plans.

In most organizations, the management prepares this budget at the beginning of each year. The document is updated throughout the year, either monthly or quarterly, and can be used as a forecast for consecutive years.

3. Cash budget

A cash flow budget gives you an estimate of the money that comes in or goes out of a business for a specific period in time. Organizations create cash budgets using inferences from sales forecasts and production, and by estimating the payables and receivables.

The information in this budget can help you evaluate whether you have enough liquid cash for operating, whether your money is being used productively, and whether there is and whether you are on track to earn a profit .

4. Financial budget

Businesses draft this budget to understand how much capital they’ll need and at what times for fulfilling short-term and long-term needs. It factors in assets, liabilities, and stakeholder’s equity—the important components of a balance sheet , which give you an overall idea of your business health.

5. Labor budget

For any business that is planning on hiring employees to achieve its goals, a labor budget will be important. It helps you determine the workforce you will require to achieve your goals so you can plan the payroll for all of those employees. In addition to planning regular staffing, it also helps you allocate expenses for seasonal workers.

6. Static budget

As the name suggests, this budget is an estimate of revenue and expenses that will remain fixed throughout the year. The line items in this budget can be used as goals to meet regardless of any increases or decreases in sales. Static budgets are usually prepared by nonprofits, educational institutions, or government bodies that have been allocated a fixed amount to use for their activities in each area.

Components of a budget

If you are starting a new business, the first budget you create might be a challenge, but it is a good learning experience and a good way to understand what works best for your business. The best place to start is getting to know your budget components. Initially you may need to make several assumptions to get your budget started.

1. Estimated revenue

This is the money you expect your business to make from the sale of goods and services. There are two main components of estimated revenue: sales forecast and estimated cost of goods sold or services rendered. If your business is more than a year old, then your experience will guide you in estimating these components. If your business is new, you can check the revenue of similar local businesses and use those figures to conservatively create some estimated revenue numbers. But whether your business is new or old, it is important to stay realistic to avoid over-estimating.

2. Fixed cost

When your business pays the same amount regularly for a particular expense, that is classified as a fixed cost . Some examples of fixed costs include building rent, mortgage/utility payments, employee salaries, internet service, accounting services, and insurance premiums. Factoring these expenses into the budget is important so that you can set aside the exact amount of money required to cover these expenses. They can also be a good reference point to check for problems if your business finances aren’t going as planned.

3. Variable costs

This category includes the cost of goods or services that can fluctuate based on your business success. For example, let us assume you have a product in the market that is gaining popularity. The next thing you would like to do is manufacture more of that product. The costs of the raw materials required for production, the distribution channels used for supplying the product, and the production labor will all change when you increase production, so they will all be considered variable expenses.

4. One-time expenses

These are one-off, unexpected costs that your business might incur in any given year. Some examples of these costs include replacing broken furniture or purchasing a laptop.

Since it is difficult to predict these expenses, there is no certain way to estimate for them. But it’s wise to set aside some cash for this category to stay prepared.

5. Cash flow

This is the money that travels in and out of the business. You can get an idea of it from your previous financial records and use that information to forecast your earnings for the year you’re budgeting for. You’ll want to pay attention not only to how much money is coming in, but also when. If your business has a peak season and a dry season, knowing when your cash flow is highest will help you plan when to make large purchases or investments.

The final budget component is profit, which is a number you arrive at by subtracting your estimated cost from revenue. An increase in profit means your business is growing, which is a good sign. Once you have projected how much profit you are likely to make in a year, you’ll be able to decide how much to invest in each functional area of your organization. For example, will you use your profit to invest in advertising or marketing to drive more sales?

A budget is a road map for your business. It helps you predict cash flow, identify functional areas that need improvement, and run your operations smoothly. Successful businesses invest a lot of time and effort into creating realistic budgets, because they’re an efficient way of tracking the extent to which the business has achieved its goals. Creating a budget can get a bit overwhelming for new businesses as there are no previous figures to guide their budget estimates, but with some estimates based on the performance of competitors and an understanding of the components of a budget, you can complete your first budget and have a good road map for future budgets.

Related Posts

- Cash Flow Statement - Definition and Importance

- How to Create a Business Budget for Your Small Business

- Income statement - Definition, Importance and Example

Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

may I have more materials for budgeting?

Hey Patricia,

While we appreciate suggestions from our readers, we just wanted to let you know there’s more coming up on budgeting. However, besides this article, there’s another one on – How to create a business budget for your small business. Hope it’s insightful.

Has helped me learn a few things about types of budgets

I love this article. It is very helpful. I am interested in knowing which budgeting softwares are efficient when you say,” Smaller businesses often use spreadsheets to create their master budgets, but replacing the spreadsheets with efficient budgeting software typically reduces errors.” I am looking for one software for my company!

Thank you. Respectfully,

Hi Nilamba!

Budgeting is one of the important features in Zoho Books.

A few key highlights of Zoho Books include: 1. Management of vendors and customers. 2. Creating Estimates, Sales orders and Invoices. 3. Managing your Expenses, Bills, Purchase Orders. 4. Collaborative Client Portal through which your clients can easily view all their transactions and also make payments. 5. Integrations with other Zoho apps. 6. Integrations with Online payment gateways 7. Automated Bank feeds. 8. Exhaustive Reports and much more… It is available as a mobile app on Android, iOS and Windows as well. Please do write to us at [email protected] and we will be happy to explain how Zoho Books will be a great fit for your business.

Thanks you for the level of understanding on this topic but I need new materials as technology advance.

Thank you for the information, it’s great help.

Excellent and easily elaborated..

You might also like

Switch to smart accounting. try zoho books today.

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated May 7, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy