Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization’s short- and long-term financial goals.

- Planning provides a framework for a business’ financial objectives — typically for the next three to five years.

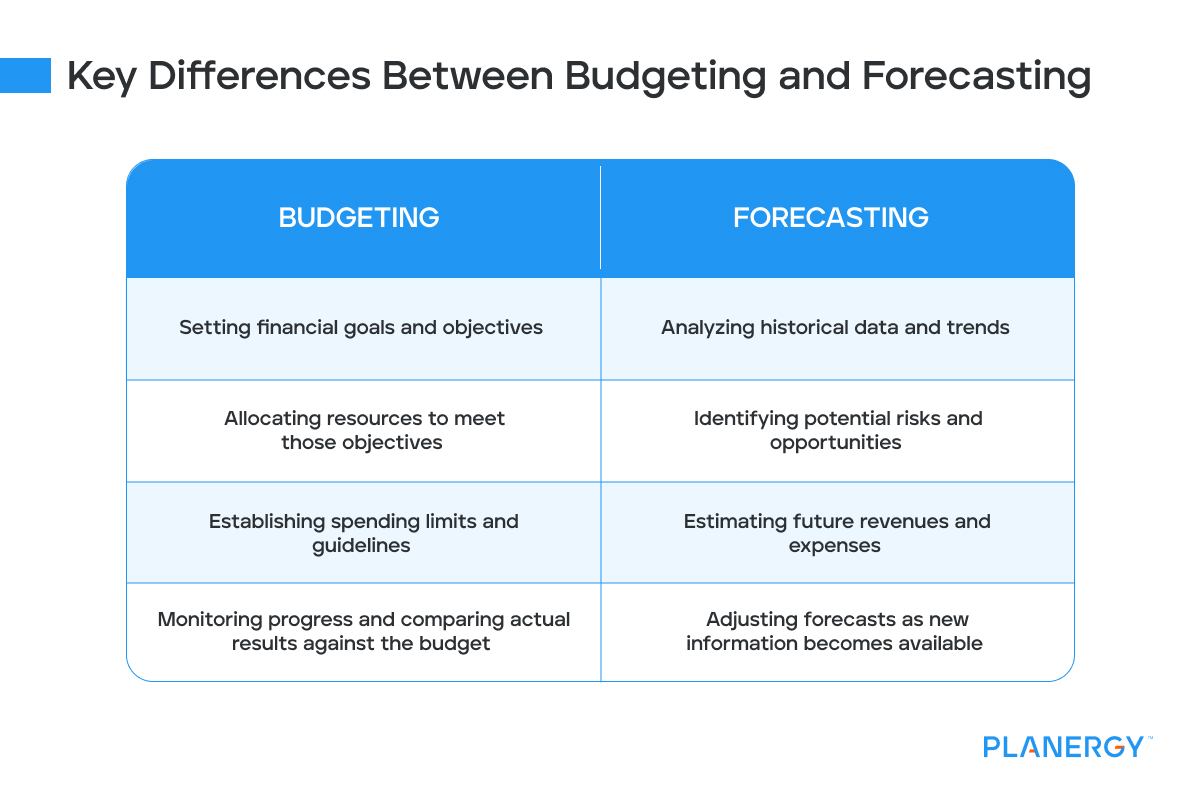

- Budgeting details how the plan will be carried out month to month and covers items such as revenue, expenses, potential cash flow and debt reduction. Traditionally, a company will designate a fiscal year and create a budget for the year. It may adjust the budget depending on actual revenues or compare actual financial statements to determine how close they are to meeting or exceeding the budget.

- Forecasting takes historical data and current market conditions and then makes predictions as to how much revenue an organization can expect to bring in over the next few months or years. Forecasts are usually adjusted as new information becomes available.

The process is usually managed by a chief financial officer (CFO) and the finance department. However, the definition can be expanded to include all areas of organizational planning including: financial planning and analysis , supply chain planning , sales planning , workforce planning and marketing planning .

Discover the power of integrating a data lakehouse strategy into your data architecture, including enhancements to scale AI and cost optimization opportunities.

Register for the ebook on generative AI

Basic business accounting practices date as far back as the 1400s, when Venetian investors kept track of their Asian trade expeditions using double-entry bookkeeping, income statements and balance sheets. The word “budget” is from the old French word “bougette,” meaning “small purse.” The British government began to use the phrase “open the budget” in the mid-1700s, when the chancellor presented the annual financial statements. Businesses began to regularly use the term “budget” for their finances by the late 1800s.

Modern business forecasting began in response to the economic devastation of the Great Depression of the 1930s. New types of statistics and statistical analyses were developed that could help business better predict the future. Consulting firms emerged to help companies use these new prediction tools.

Accounting and forecasting were difficult in the early 20th century because they depended on laborious hand-written equations, ledgers and spreadsheets. The emergence of mainframe computers in the 1960s and personal computers in the 1980s sped up the process. Software applications such as Microsoft Excel became widely popular for financial reporting. However, Excel programs and spreadsheets were prone to input errors and cumbersome when various departments or individuals needed to collaborate on a report.

By the start of the 2000s, companies gained access to ever-growing operational data sources, as well as information outside corporate transaction systems — such as weather, social sentiment and econometric data. The vast amounts of available data for forecasting created a need for more sophisticated software tools to process it.

Numerous planning software packages emerged to handle this data complexity, making planning, budgeting and forecasting faster and easier — both for processing and collaboration. With predictive insights drawn automatically from data, companies could identify evolving trends and guide decision making with foresight, not just hindsight.

Today, cloud-based systems are becoming the standard, providing more flexibility, security and cost savings — helping organizations generate accurate predictions and budgets with fewer errors.

But despite these advancements, businesses are still quite dependent on traditional spreadsheets. 1 Seventy percent of businesses say they rely heavily on spreadsheet reporting, with only 16 percent using on-premise specialist software — and only ten percent using cloud software for planning.

Many businesses still base their strategy on annual plans and budgets, which is a management technique developed over a century ago. But in today’s more competitive environment, organizations are realizing that plans, budgets and forecasts need to reflect current reality — not the reality of two, three or more quarters ago. Continuous planning and rolling forecasts are becoming widely used methodologies to update plans, budgets and forecasts frequently throughout the year, on a quarterly or even monthly basis. These approaches help managers spot trends before their competitors — helping them make better informed, more agile decisions about pricing, product mix, capital allocations and even staffing levels.

Creating and implementing a sound planning, budgeting and forecasting process helps organizations establish more accurate financial report and analytics — potentially leading to more accurate forecasting and ultimately revenue growth. Its importance is even more relevant in today’s business environment where disruptive competitors are entering even the most tradition-bound industries.

When companies embrace data and analytics in conjunction with well-established planning and forecasting best practices, they enhance strategic decision making and can be rewarded with more accurate plans and more timely forecasts. Overall, these tools and practices can save time, reduce errors, promote collaboration and foster a more disciplined management culture that delivers a true competitive advantage.

Specifically, companies are able to:

- Quickly update plans and forecasts in response to new threats and opportunities, identifying risk areas early enough to rectify issues before they are serious.

- Identify and analyze the impact of changes as they occur.

- Strengthen the links between operational and financial plans.

- Better plan and predict cash flows.

- Improve communication and collaboration among plan contributors.

- Consistently deliver timely, reliable plans and forecasts, plus contingency plans, for a range of possible events.

- Analyze variances and deviations from plans and promptly take corrective action.

- Create a budget specifically for growth and having confidence in how much can be spent.

- More accurately manage sales pipelines while tracking performance against targets.

- Make more confident strategic decisions based on hard data, instead of hopes or guesswork.

- Provide evidence of an organization’s future trajectory to potential investors and lending institutions based on multiple data sources and sophisticated analysis.

Budgeting, planning and forecasting software can be purchased as an off-the-shelf solution or as part of a larger integrated corporate performance management (CPM) solution.

Advanced software solutions enable organizations to:

- Measure and monitor performance through interactive, self-service dashboards and visualizations.

- Examine root-causes with high-fidelity analysis of dimensionally rich data.

- Evaluate trends and make predictions automatically from internal or external data.

- Perform rapid what-if scenario modelling and create timely, reliable plans and forecasts.

Planning is easier and more effective when practitioners follow well-established best practices. Software solutions that support these practices can enhance the timeliness and reliability of information and increase participation by key people throughout the organization; especially those at the front lines.

Leading companies have moved to solutions that address the full planning cycle — data collection, modeling, analytics and reporting — on a common planning platform with lean infrastructure requirements. Such platforms can handle a diverse range of business functions, from budget-focused finance tasks to, for example, supply chain-focused planning for retail environments with thousands of SKUs (stock keeping units).

Companies like IBM offer holistic, integrated software solutions to streamline the planning, budgeting and forecasting process. The logic is that to adapt to today's quickly changing business conditions, an organization needs one solution that creates a single source of truth and visibility into all its data. These solutions can extend well beyond the financial aspects of the business, becoming a powerful forecasting engine across the enterprise. With these agile planning and exploratory analytics software solutions — whether in the cloud or on-premises — companies can perform planning, budgeting and forecasting with greater speed, agility and foresight.

Evaluating and selecting planning, budgeting and forecasting software is a complex task. It requires careful consideration of the software’s functionality, its value to the planning process and its ability to support planning best practices. There are also factors such as vendor reliability and support, user community connections and commitment to customer success once the sale is complete.

IBM Analytics recently published a guide to help organizations evaluate planning, budgeting and forecasting software — identifying key qualities to look for:

- Adaptive . Can you rapidly change models and re-forecast frequently, based on input from business units? Can you update plans as often as necessary?

- Timely . Is your information always current because users contribute directly to a central planning database? Are your consolidations and rollups done automatically to easily meet deadlines?

- Integrated . Do your planning, analysis, workflow and reporting functions reside on one common platform, reducing the need to maintain “shadow” planning systems?

- Collaborative . Is your solution web-based? Does it enable participation anytime, from anywhere with a secure connection?

- Self-service . Are users able to access data and perform complex analysis without the assistance of IT? Are you able to use a familiar spreadsheet interface for faster user adoption and accelerate time to value?

- Enterprise-scale data capacity . Is your solution capable of handling very large data volumes without limiting cube size? Some solutions do not handle “data sparsity” well — forcing data to be split into multiple cubes for analysis, causing version control issues.

- Efficient . Are your managers able to spend less time managing data and more time managing the business?

- Relevant . Do you have the ability to customize views for different user roles, to help increase adoption and process ownership? Do you have formula capabilities that enable modeling of all relevant business drivers?

- Accurate . Do your plans contain errors because of broken links, stale data, improper rollups and missing components?

The key is not just evaluating product features and capabilities, but also evaluating how those features will be implemented by different users within the organization. It’s important to test any planning solution that will be used by a large variety of stakeholders such as finance, operations, HR and sales.

Discover how one of the largest operators of parking facilities in the Middle East used IBM Planning Analytics to deliver better automation and multidimensional analytical power along with cost advantages.

Learn how the real estate developer enhanced its core planning, forecasting and project management capabilities with IBM technology to drive even greater profitability.

Find out how the company used IBM planning analytics to provide monthly and weekly reporting for engineering, marketing, sales and operations.

IBM Planning Analytics provides a single solution to automate planning, budgeting and forecasting for your enterprise.

Gain the autonomy you crave to find, explore and share insights in the governed, trusted environment you need, with IBM Cognos Analytics.

A comprehensive solution that provides power and flexibility for streamlined, best-practice financial consolidation and reporting.

Transform your marketing organization across people, process and platforms to remove complexity, unlock efficiency, and drive growth.

Learn how companies are delivering dependable business forecasts and optimizing the allocation of resources.

Learn the five common drawbacks to spreadsheets as planning tools

Discover the benefits of embracing data and analytics in conjunction with well-established planning and forecasting best practices.

See how you can synthesize information, uncover trends and deliver insights to improve decision making throughout the enterprise.

Request a live, 10-minute demo and get hands-on experience with IBM Planning Analytics by building a revenue plan.

See how headcount planning is done with IBM Planning Analytics in a quick, click-through demo.

Predict outcomes with flexible AI-infused forecasting and analyze what-if scenarios in real-time. IBM Planning Analytics is an integrated business planning solution that turns raw data into actionable insights. Deploy as you need, on-premises or on cloud.

1 The Future of Planning, Budgeting and Forecasting Global Survey, Workday and FSN, 2017 (link resides outside ibm.com)

Please note that the contents of this site are not being updated since October 1, 2023.

As of October 2, 2023, Acclr Business Information Services (Info entrepreneurs) will be delivered directly by CED’s Business Information Services . To find out more about CCMM’s other Acclr services, please visit this page: Acclr – Business Services | CCMM.

- Advice and guidance

- Starting a business

- Personalized Guidance

- Seminars on Business Opportunities

- Certification of Export Documents

- Market Studies

- Export Financing

- International Trade Training

- Connection with the World Bank

- Trade Missions

- SME Passport

- Export Resources

- Import Resources

- Networking Activities

- Networking Training

- CCMM Member Directory

- Market Studies and Research Services

- Business plan

- Registration and legal structures

- Guidance for Drafting a Business Plan

- Help in Seeking Funding

- News, Grants, and Competitions

- Funding Meet-and-Greet

- Resources for Drafting a Business Plan

- Regulations / Permits / Licences

- Personalized Market Information Research

- Personalized Meetings with Guest Experts

- Government Subsidies and Programs

- Training for your employees

- Employee Management

- Interconnection Program

- Wage Subsidies

- French courses

- Merchant-Student Pairing

- Intellectual property

- Marketing and sales

- Operations management

- Hiring and managing human resources

- Growth and innovation

- Importing and exporting

- Calls for tenders

- Support organizations

- Sale / Closure / Bankruptcy

- Business intelligence

- Business lists and profiles

- Market data

- Market trends

- Business advice

- Business plan management consultant

- Legal structures consultant

- Accounting consultant

- Legal consultant

- Export certification

- Resource centre

Budgeting and business planning

Once your business is operational, it's essential to plan and tightly manage its financial performance. Creating a budgeting process is the most effective way to keep your business - and its finances - on track.

This guide outlines the advantages of business planning and budgeting and explains how to go about it. It suggests action points to help you manage your business' financial position more effectively and ensure your plans are practical.

Planning for business success

The benefits, what to include in your annual plan, a typical business planning cycle, budgets and business planning, benefits of a business budget, creating a budget, key steps in drawing up a budget, what your budget should cover, what your budget will need to include, use your budget to measure performance, review your budget regularly.

When you're running a business, it's easy to get bogged down in day-to-day problems and forget the bigger picture. However, successful businesses invest time to create and manage budgets, prepare and review business plans and regularly monitor finance and performance.

Structured planning can make all the difference to the growth of your business. It will enable you to concentrate resources on improving profits, reducing costs and increasing returns on investment.

In fact, even without a formal process, many businesses carry out the majority of the activities associated with business planning, such as thinking about growth areas, competitors, cashflow and profit.

Converting this into a cohesive process to manage your business' development doesn't have to be difficult or time-consuming. The most important thing is that plans are made, they are dynamic and are communicated to everyone involved. See the page in this guide on what to include in your annual plan.

The key benefit of business planning is that it allows you to create a focus for the direction of your business and provides targets that will help your business grow. It will also give you the opportunity to stand back and review your performance and the factors affecting your business. Business planning can give you:

- a greater ability to make continuous improvements and anticipate problems

- sound financial information on which to base decisions

- improved clarity and focus

- a greater confidence in your decision-making

The main aim of your annual business plan is to set out the strategy and action plan for your business. This should include a clear financial picture of where you stand - and expect to stand - over the coming year. Your annual business plan should include:

- an outline of changes that you want to make to your business

- potential changes to your market, customers and competition

- your objectives and goals for the year

- your key performance indicators

- any issues or problems

- any operational changes

- information about your management and people

- your financial performance and forecasts

- details of investment in the business

Business planning is most effective when it's an ongoing process. This allows you to act quickly where necessary, rather than simply reacting to events after they've happened.

- Review your current performance against last year/current year targets.

- Work out your opportunities and threats.

- Analyse your successes and failures during the previous year.

- Look at your key objectives for the coming year and change or re-establish your longer-term planning.

- Identify and refine the resource implications of your review and build a budget.

- Define the new financial year's profit-and-loss and balance-sheet targets.

- Conclude the plan.

- Review it regularly - for example, on a monthly basis - by monitoring performance, reviewing progress and achieving objectives.

- Go back to 1.

New small business owners may run their businesses in a relaxed way and may not see the need to budget. However, if you are planning for your business' future, you will need to fund your plans. Budgeting is the most effective way to control your cashflow, allowing you to invest in new opportunities at the appropriate time.

If your business is growing, you may not always be able to be hands-on with every part of it. You may have to split your budget up between different areas such as sales, production, marketing etc. You'll find that money starts to move in many different directions through your organisation - budgets are a vital tool in ensuring that you stay in control of expenditure.

A budget is a plan to:

- control your finances

- ensure you can continue to fund your current commitments

- enable you to make confident financial decisions and meet your objectives

- ensure you have enough money for your future projects

It outlines what you will spend your money on and how that spending will be financed. However, it is not a forecast. A forecast is a prediction of the future whereas a budget is a planned outcome of the future - defined by your plan that your business wants to achieve.

There are a number of benefits of drawing up a business budget, including being better able to:

- manage your money effectively

- allocate appropriate resources to projects

- monitor performance

- meet your objectives

- improve decision-making

- identify problems before they occur - such as the need to raise finance or cash flow difficulties

- plan for the future

- increase staff motivation

Creating, monitoring and managing a budget is key to business success. It should help you allocate resources where they are needed, so that your business remains profitable and successful. It need not be complicated. You simply need to work out what you are likely to earn and spend in the budget period.

Begin by asking these questions:

- What are the projected sales for the budget period? Be realistic - if you overestimate, it will cause you problems in the future.

- What are the direct costs of sales – i.e. costs of materials, components or subcontractors to make the product or supply the service?

- What are the fixed costs or overheads?

You should break down the fixed costs and overheads by type, e.g.:

- cost of premises, including rent, municipal taxes and service charges

- staff costs –e.g. wages, benefits, Québec Parental Insurance Plan (QPIP) premiums, contributions to the Québec Pension Plan (QPP) and to the financing of the Commission des normes du travail (CNT)

- utilities – e.g. heating, lighting, telephone

- printing, postage and stationery

- vehicle expenses

- equipment costs

- advertising and promotion

- travel and subsistence expenses

- legal and professional costs, including insurance

Your business may have different types of expenses, and you may need to divide up the budget by department. Don't forget to add in how much you need to pay yourself, and include an allowance for tax.

Your business plan should help in establishing projected sales, cost of sales, fixed costs and overheads, so it would be worthwhile preparing this first. See the page in this guide on planning for business success.

Once you've got figures for income and expenditure, you can work out how much money you're making. You can look at costs and work out ways to reduce them. You can see if you are likely to have cash flow problems, giving yourself time to do something about them.

When you've made a budget, you should stick to it as far as possible, but review and revise it as needed. Successful businesses often have a rolling budget, so that they are continually budgeting, e.g. for a year in advance.

There are a number of key steps you should follow to make sure your budgets and plans are as realistic and useful as possible.

Make time for budgeting

If you invest some time in creating a comprehensive and realistic budget, it will be easier to manage and ultimately more effective.

Use last year's figures - but only as a guide

Collect historical information on sales and costs if they are available - these could give you a good indication of likely sales and costs. But it's also essential to consider what your sales plans are, how your sales resources will be used and any changes in the competitive environment.

Create realistic budgets

Use historical information, your business plan and any changes in operations or priorities to budget for overheads and other fixed costs.

It's useful to work out the relationship between variable costs and sales and then use your sales forecast to project variable costs. For example, if your unit costs reduce by 10 per cent for each additional 20 per cent of sales, how much will your unit costs decrease if you have a 33 per cent rise in sales?

Make sure your budgets contain enough information for you to easily monitor the key drivers of your business such as sales, costs and working capital. Accounting software can help you manage your accounts.

Involve the right people

It's best to ask staff with financial responsibilities to provide you with estimates of figures for your budget - for example, sales targets, production costs or specific project control. If you balance their estimates against your own, you will achieve a more realistic budget. This involvement will also give them greater commitment to meeting the budget.

Decide how many budgets you really need. Many small businesses have one overall operating budget which sets out how much money is needed to run the business over the coming period - usually a year. As your business grows, your total operating budget is likely to be made up of several individual budgets such as your marketing or sales budgets.

Projected cash flow -your cash budget projects your future cash position on a month-by-month basis. Budgeting in this way is vital for small businesses as it can pinpoint any difficulties you might be having. It should be reviewed at least monthly.

Costs - typically, your business will have three kinds of costs:

- fixed costs - items such as rent, salaries and financing costs

- variable costs - including raw materials and overtime

- one-off capital costs - purchases of computer equipment or premises, for example

To forecast your costs, it can help to look at last year's records and contact your suppliers for quotes.

Revenues - sales or revenue forecasts are typically based on a combination of your sales history and how effective you expect your future efforts to be.

Using your sales and expenditure forecasts, you can prepare projected profits for the next 12 months. This will enable you to analyse your margins and other key ratios such as your return on investment.

If you base your budget on your business plan, you will be creating a financial action plan. This can serve several useful functions, particularly if you review your budgets regularly as part of your annual planning cycle.

Your budget can serve as:

- an indicator of the costs and revenues linked to each of your activities

- a way of providing information and supporting management decisions throughout the year

- a means of monitoring and controlling your business, particularly if you analyse the differences between your actual and budgeted income

Benchmarking performance

Comparing your budget year on year can be an excellent way of benchmarking your business' performance - you can compare your projected figures, for example, with previous years to measure your performance.

You can also compare your figures for projected margins and growth with those of other companies in the same sector, or across different parts of your business.

Key performance indicators

To boost your business' performance you need to understand and monitor the key "drivers" of your business - a driver is something that has a major impact on your business. There are many factors affecting every business' performance, so it is vital to focus on a handful of these and monitor them carefully.

The three key drivers for most businesses are:

- working capital

Any trends towards cash flow problems or falling profitability will show up in these figures when measured against your budgets and forecasts. They can help you spot problems early on if they are calculated on a consistent basis.

To use your budgets effectively, you will need to review and revise them frequently. This is particularly true if your business is growing and you are planning to move into new areas.

Using up to date budgets enables you to be flexible and also lets you manage your cash flow and identify what needs to be achieved in the next budgeting period.

Two main areas to consider

Your actual income - each month compare your actual income with your sales budget, by:

- analysing the reasons for any shortfall - for example lower sales volumes, flat markets, underperforming products

- considering the reasons for a particularly high turnover - for example whether your targets were too low

- comparing the timing of your income with your projections and checking that they fit

Analysing these variations will help you to set future budgets more accurately and also allow you to take action where needed.

Your actual expenditure - regularly review your actual expenditure against your budget. This will help you to predict future costs with better reliability. You should:

- look at how your fixed costs differed from your budget

- check that your variable costs were in line with your budget - normally variable costs adjust in line with your sales volume

- analyse any reasons for changes in the relationship between costs and turnover

- analyse any differences in the timing of your expenditure, for example by checking suppliers' payment terms

Original document, Budgeting and business planning , © Crown copyright 2009 Source: Business Link UK (now GOV.UK/Business ) Adapted for Québec by Info entrepreneurs

Our information is provided free of charge and is intended to be helpful to a large range of UK-based (gov.uk/business) and Québec-based (infoentrepreneurs.org) businesses. Because of its general nature the information cannot be taken as comprehensive and should never be used as a substitute for legal or professional advice. We cannot guarantee that the information applies to the individual circumstances of your business. Despite our best efforts it is possible that some information may be out of date.

- The websites operators cannot take any responsibility for the consequences of errors or omissions.

- You should always follow the links to more detailed information from the relevant government department or agency.

- Any reliance you place on our information or linked to on other websites will be at your own risk. You should consider seeking the advice of independent advisors, and should always check your decisions against your normal business methods and best practice in your field of business.

- The websites operators, their agents and employees, are not liable for any losses or damages arising from your use of our websites, other than in respect of death or personal injury caused by their negligence or in respect of fraud.

Need help? Our qualified agents can help you. Contact us!

- Create my account

The address of this page is: https://www.infoentrepreneurs.org/en/guides/budgeting-and-business-planning/

INFO ENTREPRENEURS

380 St-Antoine West Suite W204 (mezzanine level) Montréal, Québec, Canada H2Y 3X7

www.infoentrepreneurs.org

514-496-4636 | 888-576-4444 [email protected]

Consent to Cookies

This website uses necessary cookies to ensure its proper functioning and security. Other cookies and optional technologies make it possible to facilitate, improve or personalize your navigation on our website. If you click "Refuse", some portions of our website may not function properly. Learn more about our privacy policy.

Click on one of the two buttons to access the content you wish to view.

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

7.3: Introduction to Budgeting and Budgeting Processes

- Last updated

- Save as PDF

- Page ID 26081

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

The budget—For planning and control

Time and money are scarce resources to all individuals and organizations; the efficient and effective use of these resources requires planning. Planning alone, however, is insufficient. Control is also necessary to ensure that plans actually are carried out. A budget is a tool that managers use to plan and control the use of scarce resources. A budget is a plan showing the company’s objectives and how management intends to acquire and use resources to attain those objectives.

A YouTube element has been excluded from this version of the text. You can view it online here: pb.libretexts.org/llmanagerialaccounting/?p=152

Companies, nonprofit organizations, and governmental units use many different types of budgets. Responsibility budgets are designed to judge the performance of an individual segment or manager. Capital budgets evaluate long-term capital projects such as the addition of equipment or the relocation of a plant. This chapter examines the master budget , which consists of a planned operating budget and a financial budget. The planned operating budget helps to plan future earnings and results in a projected income statement. The financial budget helps management plan the financing of assets and results in a projected balance sheet.

The budgeting process involves planning for future profitability because earning a reasonable return on resources used is a primary company objective. A company must devise some method to deal with the uncertainty of the future. A company that does no planning whatsoever chooses to deal with the future by default and can react to events only as they occur. Most businesses, however, devise a blueprint for the actions they will take given the foreseeable events that may occur.

A budget: (1) shows management’s operating plans for the coming periods; (2) formalizes management’s plans in quantitative terms; (3) forces all levels of management to think ahead, anticipate results, and take action to remedy possible poor results; and (4) may motivate individuals to strive to achieve stated goals.

Companies can use budget-to-actual comparisons to evaluate individual performance. For instance, the standard variable cost of producing a personal computer at IBM is a budget figure. This figure can be compared with the actual cost of producing personal computers to help evaluate the performance of the personal computer production managers and employees who produce personal computers. We will do this type of comparison in a later chapter.

Many other benefits result from the preparation and use of budgets. For example: (1) businesses can better coordinate their activities; (2) managers become aware of other managers’ plans; (3) employees become more cost conscious and try to conserve resources; (4) the company reviews its organization plan and changes it when necessary; and (5) managers foster a vision that otherwise might not be developed.

The planning process that results in a formal budget provides an opportunity for various levels of management to think through and commit future plans to writing. In addition, a properly prepared budget allows management to follow the management-by-exception principle by devoting attention to results that deviate significantly from planned levels. For all these reasons, a budget must clearly reflect the expected results.

Failing to budget because of the uncertainty of the future is a poor excuse for not budgeting. In fact, the less stable the conditions, the more necessary and desirable is budgeting, although the process becomes more difficult. Obviously, stable operating conditions permit greater reliance on past experience as a basis for budgeting. Remember, however, that budgets involve more than a company’s past results. Budgets also consider a company’s future plans and express expected activities. As a result, budgeted performance is more useful than past performance as a basis for judging actual results.

A budget should describe management’s assumptions relating to: (1) the state of the economy over the planning horizon; (2) plans for adding, deleting, or changing product lines; (3) the nature of the industry’s competition; and (4) the effects of existing or possible government regulations. If these assumptions change during the budget period, management should analyze the effects of the changes and include this in an evaluation of performance based on actual results.

Budgets are quantitative plans for the future. However, they are based mainly on past experience adjusted for future expectations. Thus, accounting data related to the past play an important part in budget preparation. The accounting system and the budget are closely related. The details of the budget must agree with the company’s ledger accounts. In turn, the accounts must be designed to provide the appropriate information for preparing the budget, financial statements, and interim financial reports to facilitate operational control.

Management should frequently compare accounting data with budgeted projections during the budget period and investigate any differences. Budgeting, however, is not a substitute for good management. Instead, the budget is an important tool of managerial control. Managers make decisions in budget preparation that serve as a plan of action.

The period covered by a budget varies according to the nature of the specific activity involved. Cash budgets may cover a week or a month; sales and production budgets may cover a month, a quarter, or a year; and the general operating budget may cover a quarter or a year.

Budgeting involves the coordination of financial and nonfinancial planning to satisfy organizational goals and objectives. No foolproof method exists for preparing an effective budget. However, budget makers should carefully consider the conditions that follow:

- Top management support All management levels must be aware of the budget’s importance to the company and must know that the budget has top management’s support. Top management, then, must clearly state long-range goals and broad objectives. These goals and objectives must be communicated throughout the organization. Long-range goals include the expected quality of products or services, growth rates in sales and earnings, and percentage-of-market targets. Overemphasis on the mechanics of the budgeting process should be avoided.

- Participation in goal setting Management uses budgets to show how it intends to acquire and use resources to achieve the company’s long-range goals. Employees are more likely to strive toward organizational goals if they participate in setting them and in preparing budgets. Often, employees have significant information that could help in preparing a meaningful budget. Also, employees may be motivated to perform their own functions within budget constraints if they are committed to achieving organizational goals.

- Communicating results People should be promptly and clearly informed of their progress. Effective communication implies (1) timeliness, (2) reasonable accuracy, and (3) improved understanding. Managers should effectively communicate results so employees can make any necessary adjustments in their performance.

- Flexibility If significant basic assumptions underlying the budget change during the year, the planned operating budget should be restated. For control purposes, after the actual level of operations is known, the actual revenues and expenses can be compared to expected performance at that level of operations.

- Follow-up Budget follow-up and data feedback are part of the control aspect of budgetary control. Since the budgets are dealing with projections and estimates for future operating results and financial positions, managers must continuously check their budgets and correct them if necessary. Often management uses performance reports as a follow-up tool to compare actual results with budgeted results.

The term budget has negative connotations for many employees. Often in the past, management has imposed a budget from the top without considering the opinions and feelings of the personnel affected. Such a dictatorial process may result in resistance to the budget. A number of reasons may underlie such resistance, including lack of understanding of the process, concern for status, and an expectation of increased pressure to perform. Employees may believe that the performance evaluation method is unfair or that the goals are unrealistic and unattainable. They may lack confidence in the way accounting figures are generated or may prefer a less formal communication and evaluation system. Often these fears are completely unfounded, but if employees believe these problems exist, it is difficult to accomplish the objectives of budgeting.

Problems encountered with such imposed budgets have led accountants and management to adopt participatory budgeting. Participatory budgeting means that all levels of management responsible for actual performance actively participate in setting operating goals for the coming period. Managers and other employees are more likely to understand, accept, and pursue goals when they are involved in formulating them.

Within a participatory budgeting process, accountants should be compilers or coordinators of the budget, not preparers. They should be on hand during the preparation process to present and explain significant financial data. Accountants must identify the relevant cost data that enables management’s objectives to be quantified in dollars. Accountants are responsible for designing meaningful budget reports. Also, accountants must continually strive to make the accounting system more responsive to managerial needs. That responsiveness, in turn, increases confidence in the accounting system.

Although many companies have used participatory budgeting successfully, it does not always work. Studies have shown that in many organizations, participation in the budget formulation failed to make employees more motivated to achieve budgeted goals. Whether or not participation works depends on management’s leadership style, the attitudes of employees, and the organization’s size and structure. Participation is not the answer to all the problems of budget preparation. However, it is one way to achieve better results in organizations that are receptive to the philosophy of participation.

- Accounting Principles: A Business Perspective. Authored by : James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University. Provided by : Endeavour International Corporation. Project : The Global Text Project. License : CC BY: Attribution

- Introduction to Budgeting (Managerial Accounting) . Authored by : Education Unlocked. Located at : youtu.be/pCwLhz0ltlE. License : All Rights Reserved . License Terms : Standard YouTube License

How to Master the Fine Art of Business Planning and Budgeting

Updated on: 5 January 2023

Starting a business is a challenging thing: you have to work hard and do your best to ensure its success. However, the work doesn’t end even when your business actually becomes operational. You still have to do so much more to ensure that it will keep on track.

Of course, it could be hard, especially for the beginners. It seems that you have to keep an eye on so many things and focus on so many urgent tasks every day that there isn’t any time left for business planning and budgeting. However, it is very important to find that time, because business planning and budgeting are actually one of the most important things for business success.

Why so? Because a plan allows you to get a better understanding of how you see your business, how you want to develop it, and so on. When you create a plan, you set targets that you want to achieve as well as define the ways of evaluating the success of your business.

Basically, planning gives you all the necessary tools that you can use to improve your business in the nearest future. However, this happens only when planning is done correctly.

What to Include in Your Annual Plan?

If you want to create a perfect business plan, you have to know what has to be included in it and how big it will be. Of course, there are no strict limitations to a size of a business plan as each business is different. However, if you are doing it for the first time, I recommend starting with a yearly plan: it is not too big and not too short.

A good annual plan has to include the following things:

- an executive summary

- a list of products and services you offer (or plan to offer this year)

- a detailed description of your target market

- a financial plan

- a marketing plan as well as a sales plan

- milestones and metrics

- a description of your management team

In order to write it in the best way possible, you need to spend some time thinking about the current status of your company as well as how it should look like by the end of the year. Describe your target market, think about the goals that have to be achieved this year, about the products and services that have to be launched.

Visualize the information to make it easier for you to see the whole picture (this is especially important for those, who don’t have much experience in planning). You can use charts, and different diagram types such as mind maps to visualize and organize your ideas and plans.

Try choosing a few main goals for your company and add them to the annual plan being as specific as possible: for example, if you want to increase your earnings, you should specify by how much (10%, 15%, etc.). It’s also good to think about the obstacles you might face and come up with some ways to minimize the potential risks that could occur.

Remember that while a business plan has to be specific and detailed when you write it, it shouldn’t remain static by the end of the year. No business is predictable enough for this to happen: you should understand it and prepare to act quickly, adding changes to a business plan if something unexpected happens.

Business Planning Cycle

As I said, typical business planning isn’t a static thing – actually, it’s a cycle that usually looks like this:

- You take some time to evaluate the effectiveness of your business. In order to do so, you should compare its current performance with the last year’s one – or with targets set earlier this year.

- Then you have to think about opportunities that might appear as well as the threats you might face.

- Remember about both successes and failures your business experienced throughout last year. Analyze them and think what can be done to repeat/avoid them.

- Think of the main business goals you would like to achieve and be sure to add them to the new annual plan (or edit the old one according to them).

- Create a budget.

- Come up with budget targets.

- Complete the plan.

- Be sure to review it regularly (every month, every three months, etc.), making changes if necessary.

Repeat the whole cycle.

Business Planning and Budgeting

When a business is still small and growing, it might seem unnecessary to plan its budget. However, it’s crucial if you want to avoid financial risks and be able to invest in opportunities when they appear.

Moreover, with the rapid growth of your business, you might find yourself in a situation where you aren’t able to control all the money anymore. Expansion of the business usually includes the creation of different departments responsible for different things – and each of these departments needs to have its own budget.

As you see, the bigger your business becomes, the more complicated it gets. While it’s okay to not control every cent by yourself, it is still up to you to make sure that your business keeps growing instead of becoming unprofitable. That’s why it’s so important to create a budget plan that allows you to understand the exact income your business brings by the end of the month and the amount of it, you are able to save or spend on different things.

It is important to remember that a business plan is not a forecast in any way. It doesn’t predict how much money you’ll make by the end of the year. Instead, it’s a tool for ensuring that your business will remain profitable even after covering all the necessary expenses.

Moreover, a business plan also ensures that you’ll have the opportunity to invest money into future projects, fund everything that has to be funded this year, and meet all of the business objectives.

Benefits of a Business Budget

The whole budget planning has a lot of benefits:

It allows you to evaluate the success of your business: when you know exactly how much profit your business gave you at the beginning of the year, you are able to compare it with the profit by the end of the year, understanding whether your financial goals have been met or not.

It allows managing money effectively: for example, if you save money for predicted one-time spends, you won’t be caught by surprise by them.

It helps identify the problems before they actually happen: for example, if you evaluate your budget and see that the income left after covering all the expenses is quite small, you’ll understand that you need to make more profit this year.

It helps make smarter decisions, by only investing money that you can afford to invest.

It allows you to manage your business more effectively, allocating more resources to the projects that need them the most.

It helps in increasing staff motivation.

Basically, when you have a budget plan ready, you have your back covered.

How to Create a Budget?

There are so many articles written on how to create a perfect business budget, but most of them narrow down to these 5 simple things:

- Evaluate your sources of income. You have to find out how much money your business brings on a daily basis in order to understand how much money you can afford to invest and spend.

- Make a list of your fixed expenses. These ones repeat every month and their amount doesn’t change. Some people forget to exclude the sum needed to cover these expenses from the monthly income, but it’s important to do so in order to get a clear understanding of your budget.

- Don’t forget about variable expenses. These ones don’t have a fixed price but still have to be paid every month. Come up with an approximate sum you’ll have to pay and include it in your budget.

- Predict your one-time expenses. Every business needs them from time to time, but if you plan your budget forgetting about these expenses, spending money on them could affect it greatly and not in a positive way.

- When you list all the income and expense sources, it’s time to pull them all together. Evaluate how much money you’ll have each month after you cover all these expenses. Then think of what part of that sum you could afford to invest into something.

While a whole process of budget creation might seem too complicated, you still should find time to do it. It’s totally worth the effort – moreover, such a plan could help you not only throughout the next month but also throughout the next year (if your expense and income sources won’t change much).

Of course, it’s still important to review it from time to time, making changes when necessary. However, the review process won’t be as complicated as the creation of a budget plan from scratch.

Key Steps in Drawing up a Budget

If you’ve never created a budget plan before, you could make some budgeting mistakes . However, when it comes to financial planning, the smallest mistake could have a negative impact. The following tips can help you easily avoid most mistakes, making your budget plan more realistic.

- Try to take it slow

The more time you spend on budgeting, the better it is for you. It’s hard to create a flawless budget plan quickly: there’s a big chance you might miss something. That’s why it’s vital to make sure that you’ve listed all the sources of your income and expenses, and are prepared well.

- You can use last year’s data

Last year’s data could help you see the whole picture better: you can compare it with this year’s data, finding out whether your income has increased or decreased. However, you should use it only for comparing and as a guide. You have new goals and resources this year, and the environment you’re working in has changed too, so your current planning and strategies should differ from the ones you used last year.

- Make sure that a budget is realistic

The most important thing about a budget plan is that it has to cover not only predictable expenses but also less predictable ones. Of course, making predictions is hard but using previous data along with some other business plans as examples could make the whole process easier.

A budget also has to be detailed: the information it contains has to allow you to monitor all the key details of your business, be it sales, costs, and so on. You could also use some accounting software for more effective management.

- It’s okay to involve people

If your business is big enough, you probably have some employees responsible for a part of the financial operations. It’s good to involve them in a budget creation process too, using their knowledge and experience to predict some expenses, for example. If the people you involve are experienced enough, the combination of their professionalism and your knowledge will make a budget more realistic and effective.

- Visualizing helps

Various charts and diagrams are so popular in business for a reason: they allow tracking your incomes and expenses easily. For example, you can create one chart based on your plan and another chart based on an actual budget and compare them during planned revisions to see whether your budget plan works just as expected or not.

As I mentioned above, it’s easier to control finances when you are running a small business. Such business needs only one budget that is created for a certain period – in most cases, for a year. Larger businesses, however, require something else. They have various departments, so it is better to create several budgets at once, tailoring each of them to a certain department’s needs.

Don’t Forget to Review!

I’ve already mentioned that a review is an important process of every business planning and budgeting. No matter how good your plan is, it is impossible to predict everything with 100 percent accuracy. Your business will grow and the environment around it will change, so the quicker you’ll react to such changes, the better it is for you.

That’s why you should schedule budget reviews from time to time. I recommend starting with reviewing it every month and then switching to a more comfortable schedule. Every month review can help you notice the flaws of your plan (which is especially important if you don’t have much experience in this kind of thing) as well as understand how stable your business is.

If you see that you don’t have to make changes often, you could start reviewing your plan every three or six months (however, I recommend doing it more often).

You can use various common diagrams to help you . The best thing about diagrams is that they help visualize data well, which is very important when you need to see the whole picture more clearly – and this happens often during budget planning. For example, a diagram or a chart of your company’s income can show you how much your finances have grown during a certain period. Moreover, if you notice certain downfalls in a chart (that aren’t predicted), you’ll be able to react to it quickly, fixing things that went wrong.

What do you need to consider during the whole review process? First, your actual income. Probably it will be different each month: every business has its own peak sales periods and drop sales ones, and you have to find them and remember them for more effective planning next year. It is important to check whether the income matches the one you predicted or not: if not, you have to find out why it happened.

Second, you have to evaluate your actual expenses. See if they differ from your budget, how much do they affect it, why they exceed your expectations (if they do), and so on.

Probably the best thing about reviewing is that it allows you to react to all the unexpected situations quickly, saving your business from the potential troubles and downfalls. So be sure not to skip it.

As you see, writing a business plan is a complex process. You have to be very attentive, to plan everything, starting with your goals and ending with your expenses, to consider so many things and to involve other people in planning if possible. Moreover, you also have to learn all the time, reviewing your plans, making changes, finding the ways to react to unexpected situations.

But while this might look like a tough thing to do, it is very convenient for everyone who wants to manage their business successfully. The planning takes a lot off your shoulders and makes the whole business running process easier. You are able to evaluate the effectiveness of your business by looking at the monthly income increase, at the goals you wanted to achieve, and so on. You are also able to predict the potential downfalls of your business and to use the tools you have to minimize all the risks.

You are able to evaluate the effectiveness of your business by looking at the monthly income increase, at the goals you wanted to achieve, and so on. You are also able to predict the potential downfalls of your business and to use the tools you have to minimize all the risks.

I hope that this guide will help you create strong and realistic budget and business plans, and successfully implement them in running your business. If you have some tips on business and budget planning that you want to share, please do so in the comment section below!

Author’s Bio:

Kevin Nelson started his career as a research analyst and has changed his sphere of activity to writing services and content marketing. Apart from writing, he spends a lot of time reading psychology and management literature searching for the keystones of motivation ideas. Feel free to connect with him on Facebook , Twitter , Google+ , Linkedin .

Join over thousands of organizations that use Creately to brainstorm, plan, analyze, and execute their projects successfully.

More Related Articles

Leave a comment Cancel reply

Please enter an answer in digits: 5 + fifteen =

Download our all-new eBook for tips on 50 powerful Business Diagrams for Strategic Planning.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Create a Business Budget for Your Small Business

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A business budget estimates future revenue and expenses in detail, so that you can see whether you’re on track to meet financial expectations for the month, quarter or year. Think of your budget as a point of comparison — you run your actual numbers against it to determine if you’re over or under budget.

From there, you can make informed business decisions and pivot accordingly. For example, maybe you find that your expenses are over budget for the quarter, so you may hold off on a large equipment purchase.

Here’s a step-by-step guide for creating a business budget, along with why budgets are crucial to running a successful business.

» MORE: What is accounting? Definition and basics, explained

QuickBooks Online

How does a business budget work?

Budgeting uses past months’ numbers to help you make financially conservative projections for the future and wiser business decisions for the present. If you’ve had a few bad months and predict another slow one, you can prepare to minimize expenses where possible. If business has been booming and you’re bringing in new customers, maybe you invest in buying more inventory to satisfy increased demand.

Creating a business budget from scratch can feel tedious, but you might already have access to tools that can help simplify the process. Your small-business accounting software is a good place to start, since it houses your business’s financial data and may offer basic budgeting reports.

To create a budget in QuickBooks Online , for example, you break down your estimated income and expenses across each area of your business. Then, the software calculates figures like gross profit, net operating income and net income for you.

You can then compare actual versus projected figures side by side by running a Budget vs. Actuals report. Businesses that need more in-depth features, like cash flow forecasting or the ability to use different projection methods, might subscribe to business budgeting software in addition to accounting software.

If your small business doesn’t have access to these features or has simple financials, you can download free small-business budget templates to manually create and track your budget. Regardless of which option you choose, your business will likely benefit from hiring an accountant to help manage your budget, course-correct when the business gets off track, and make sure taxes are being paid correctly.

Why is a business budget important?

A business budget encourages you to look beyond next week and next month to next year, or even the next five years.

Creating a budget can help your business do the following:

Maximize efficiency.

Establish a financial plan that helps your business reach its goals.

Point out leftover funds that you can reinvest.

Predict slow months and keep you out of debt.

Estimate what it will take to become profitable.

Provide a window into the future so you can prepare accordingly.

Creating a business budget will make operating your business easier and more efficient. A business budget can also help ensure you’re spending money in the right places and at the right time to stay out of debt.

How to create a business budget in 6 steps

The longer you’ve been in business, the more data you’ll have to inform your forward-looking budget. If you run a startup, however, you’ll want to do extensive research into typical costs for businesses in your industry, so that you have working estimates for revenue and expenses.

From there, here’s how to put together your business budget:

1. Examine your revenue

One of the first steps in any budgeting exercise is to look at your existing business and find all of your revenue sources. Add all those income sources together to determine how much money comes into your business monthly. It’s important to do this for multiple months and preferably for at least the previous 12 months, provided you have that much data available.

Notice how your business’s monthly income changes over time and try to look for seasonal patterns. Your business might experience a slump after the holidays, for example, or during the summer months. Understanding these seasonal changes will help you prepare for the leaner months and give you time to build a financial cushion.

Then, you can use those historic numbers and trends to make revenue projections for future months. Make sure to calculate for revenue, not profit. Your revenue is the money generated by sales before expenses are deducted. Profit is what remains after expenses are deducted.

2. Subtract fixed costs

The second step for creating a business budget involves adding up all of your historic fixed costs and using them to reliably predict future ones. Fixed costs are those that stay the same no matter how much income your business is generating. They might occur daily, weekly, monthly or yearly, so make sure to get as much data as you can.

Examples of fixed costs within your business might include:

Debt repayment.

Employee salaries.

Depreciation of assets.

Property taxes.

Insurance .

Once you’ve identified your business’s fixed costs, you’ll subtract those from your income and move to the next step.

3. Subtract variable expenses

As you compile your fixed costs, you might notice other expenses that aren’t as consistent. Unlike fixed costs, variable expenses change alongside your business’s output or production. Look at how they’ve fluctuated over time in your business, and use that information to estimate future variable costs. These expenses get subtracted from your income, too.

Some examples of variable expenses are:

Hourly employee wages.

Owner’s salary (if it fluctuates with profit).

Raw materials.

Utility costs that change depending on business activity.

During lean months, you’ll probably want to lower your business’s variable expenses. During profitable months when there’s extra income, however, you may increase your spending on variable expenses for the long-term benefit of your business.

4. Set aside a contingency fund for unexpected costs

When you’re creating a business budget, make sure you put aside extra cash and plan for contingencies.

Although you might be tempted to spend surplus income on variable expenses, it’s smart to establish an emergency fund instead, if possible. That way, you’ll be ready when equipment breaks down and needs replacing, or if you have to quickly replace inventory that's damaged unexpectedly.

5. Determine your profit

Add up all of your projected revenue and expenses for each month. Then, subtract expenses from revenue. You may also see the resulting number referred to as net income . If you end up with a positive number, you can expect to make a profit. If not, that’s a loss — and that can be OK, too. Small businesses aren’t necessarily profitable every month, let alone every year. This is especially true when your business is just starting out. Compare your projected profits to past profits to confirm whether they’re realistic.

Looking for accounting software?

See our overall favorites, or choose a specific type of software to find the best options for you.

on NerdWallet's secure site

6. Finalize your business budget

Are the resulting profits enough to work with, or is your business overspending? This is your opportunity to set spending and earning goals for each month, quarter and year. These goals should be realistic and achievable. If they don’t line up with your projections, make sure to establish a strategy for making up the difference.

As time goes on, regularly compare your actual numbers to your budget to determine whether your business is meeting those goals, and course correct if necessary.

» MORE: Ways your small business can spend smarter

A business budget projects future revenue and expenses so you can create a smart, realistic spending plan. As the year progresses, comparing your actual numbers against your budget can help you hold your business accountable and make sure it reaches its financial goals.

A business budget includes projected revenue, fixed costs, variable costs and the resulting profits. You can also factor in contingency funds for unforeseen circumstances like equipment failure.

On a similar note...

- Search Search Please fill out this field.

- Corporate Finance

How Budgeting Works for Companies

:max_bytes(150000):strip_icc():format(webp)/DavidRubinbiophoto-720c26a0862f4b3e86e1d2036ffcf10f.jpg)

What Is a Budget?

A budget is a forecast of revenue and expenses over a specified future period. Budgets are utilized by corporations, governments, and households and are an integral part of running a business (or household) efficiently. Budgeting for companies serves as a plan of action for managers as well as a point of comparison at a period's end.

The budgeting process for companies can be challenging, particularly if customers don't pay on time or revenue and sales are intermittent. There are several types of budgets that companies use, including operating budgets and master budgets as well as static and flexible budgets. In this article, we explore how companies approach budgeting as well as how companies deal with missing their budgets.

Key Takeaways

- A budget is a forecast of revenue and expenses over a specified period and is an integral part of running a business efficiently.

- A static budget is a budget with numbers based on planned outputs and inputs for each of the firm's divisions.

- A cash-flow budget helps managers determine the amount of cash being generated by a company during a period.

- Flexible budgets contain the actual results and are compared to the company's static budget to identify any variances.

How Budgets Work

Although the budgeting process for companies can become complex, at its most basic, a budget compares a company's revenue with its expenses in a given period. When they spend more than what was budgeted they can create a revenue deficit .

Of course, determining how much to spend on various expenses and projecting sales is only one part of the process. Company executives also have to contend with a myriad of other factors, including projecting capital expenditures , which are large purchases of fixed assets such as machinery or a new factory. They must also plan for their ongoing cash needs, revenue shortfalls, and the economic backdrop. Regardless of the type of business, the ability to gauge performance using budgets is critical to a company's overall financial health.

Types of Budgets

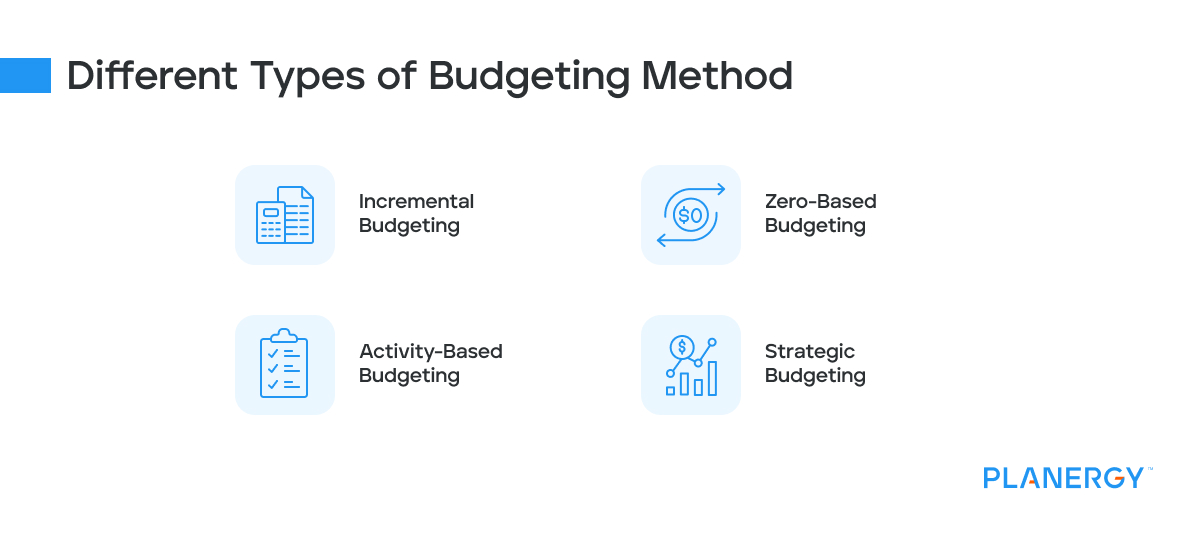

Below are a few of the most common types of budgets that corporations use to accurately forecast their numbers.

Master Budget

Most companies will start with a master budget, which is a projection for the overall company. Master budgets typically forecast the entire fiscal year. The master budget will include projections for items on the income statement , the balance sheet, and the cash flow statement . These projections can include revenue, expenses, operating costs, sales, and capital expenditures.

Static Budget

A static budget is a budget with numbers based on planned outputs and inputs for each of the firm's divisions. A static budget is usually the first step of budgeting, which determines how much a company has and how much it will spend. The static budget looks at fixed expenses, which are not variable or dependent on production volumes and sales. For example, rent would be a fixed cost regardless of the sales volume for a company.

Some industries such as nonprofits receive donations and grants resulting in a static budget from which they can't exceed. Other industries use static budgets as a starting point or a baseline number, similar to the master budget, and make adjustments at the end of the fiscal year if more or less is needed in the budget. When creating a static budget, managers use economic forecasting methods to determine realistic numbers.

Operating Budget

The operating budget includes the expenses and revenue generated from the day-to-day business operations of the company. The operating budget focuses on the operating expenses, including cost of goods sold (COGS) and the revenue or income. COGS is the cost of direct labor and direct materials that are tied to production.

The operating budget also represents the overhead and administrative costs directly tied to producing the goods and services. However, the operating budget doesn't include items such as capital expenditures and long-term debt.

Cash-Flow Budget

A cash-flow budget helps managers determine the amount of cash being generated by a company during a specific period. The inflows and outflows of cash for a company are important because expenses need to be paid on time from the cash generated. For example, monitoring the collection of accounts receivables , which is money owed by customers, can help companies forecast the cash due in a particular period.

This process can be challenging if too many customers are past-due. To compensate for this, many businesses create something called an " allowance for doubtful accounts ," which estimates the amount of accounts receivable that are expected to not be collectible.

Cash flow budgets help to examine past practices to examine what's working and what's not and make adjustments. For example, a company could apply for a short-term working capital line of credit from a bank to ensure they have cash in the event a client pays late. Also, companies can ask for more flexible options for their accounts payables , which is money owed to suppliers, to help with any short-term cash-flow needs.

Using a Budget To Evaluate Performance

Once a period has ended, management must compare the forecasts from the static or master budget to the company's performance. It's at this stage that companies calculate whether the budget came in line with planned expenditures and income.

Flexible Budget

A flexible budget is a budget containing figures based on actual output. The flexible budget is compared to the company's static budget to identify any variances (or differences) between the forecasted spending and the actual spending.

With a flexible budget, budgeted dollar values (i.e., costs or selling prices) are multiplied by actual units to determine what particular number will be given to a level of output or sales. The calculation yields the total variable costs involved in production. The second component of the flexible budget is the fixed costs. Typically, fixed costs do not differ between static and flexible budgets.

Since flexible budgets use the current period's numbers—sales, revenue, and expenses—they can help create forecasts based on multiple scenarios. Companies can calculate various outcomes based on different outputs, such as sales or units produced. Flexible or variable budgets help managers plan for both low output and high output to help ready themselves regardless of the outcome.

Budget Variances

As stated earlier, variances can arise between the static budget and the actual results. The two common variances are called the flexible budget variance and sales-volume variance.

The flexible budget variance compares the flexible budget to actual results to determine the effects that prices or costs have had on operations. By comparison, the sales-volume variance compares the flexible budget to the static budget to determine the effect that a company's level of sales activity had on its operations.

From these two budgets, a company can develop individual flexible and static budgets for any element of its operations. The variances are classified as either favorable or unfavorable.

If the sales-volume variance is unfavorable (flexible budget is less than static budget), the company's sales (or production with a production volume variance) will turn out to be less than anticipated.

If, however, the flexible budget variance was unfavorable, it would be the result of prices or costs. By knowing where the company is falling short or exceeding the mark, managers can evaluate the company's performance more efficiently and use the findings to make any necessary changes.

A flexible budget can help companies account for both variable and fixed expenses, creating a more dynamic process and leading to more accurate forecasts.

Implementing Budgets

For most companies, expenses pop up from time to time. Static budgets typically act as a guideline, meaning they can be changed or adjusted once the variances have been identified via a flexible budget. Understanding the different types of budgeting , managers can gain a wealth of information through the analysis of budget variances leading to better-informed business decisions.

Mitchell Franklin, Patty Graybeal, Dixon Cooper. “ Principles of Accounting, Volume 2: Managerial Accounting. 7.4 Prepare Flexible Budgets .” OpenStax, 2019.