Driving transformation at DBS, the ‘world’s best bank’

Few banks globally can match the recent credentials of Singapore’s DBS Bank . Since 2018, the financial institution has been named Best Bank in the World 2022 (Global Finance), World’s Best Bank 2021 (Euromoney), and Global bank of the Year 2018 (The Banker) – seven times in just five years.

DBS was not just the first in Singapore but the first bank in Asia to receive such global recognition.

Founded in 1968, DBS now has more than 36,000 employees, a presence in 19 markets globally, and recently enjoyed its most profitable quarter, with net profits jumping a forecast-beating 48% to a new record high of SG$2.69 billion (US$1.99 billion). This came off the back of a breakout year (2022) for the bank, which delivered a record net profit of SG$8.19 billion.

An early adopter of technology, DBS has also picked up numerous digital banking awards and now considers itself as a tech company offering financial services.

As they say, ‘a different kind of world calls for a different kind of bank’.

Driving that change and digital transformation is Lim Him Chuan , Head of Group Strategy, Transformation, Analytics and Research, where he works closely with the Group CEO Piyush Gupta and the Group Management Committee.

Him Chuan most recently served as CEO of DBS Bank Taiwan, overseeing a successful period where it was named Best International Foreign Bank in Taiwan by Asiamoney .

In his new role, which he took up in April, the 22-year DBS banking veteran is now driving strategy and planning; and on top of this, his team has a mandate around transformation, data science and ecosystem partnerships. This includes end-to-end accountability, championing change and transformation and enabling excellence to achieve sustainable outcomes

Culture transformation at DBS

DBS has been on a transformation journey for more than a decade – transforming not only into a digital bank but changing the culture of the entire organisation.

While many companies swear by the oft-quoted management adage that ‘culture eats strategy’, DBS has stretched that notion in an ethos they call ‘culture by design.’

“What that means is having a very clear vision of the culture we want in the bank, then running programmes of change to shift mindsets and nudge behaviour towards that vision,” Him Chuan tells Business Chief.

Culture does not happen by accident, it needs to be carefully shaped and nurtured, he says.

“When we embarked on our digital transformation in 2014, we wanted to change the way we worked such that we became more nimble, more agile, more innovative – in other words, more like a startup, and less like a traditional bank.

“Our aim is to build a dynamic culture that embraces innovation, while future-proofing employees by equipping our people with digital skill-sets.”

To deliver customer service with a DBS touch and a unique brand of Asian service, the bank came up with its ‘RED’ ethos, which stands for Respectful, Easy to deal with, and Dependable.

“Our aim for RED was to have something that every employee at every level could understand and remember effortlessly, which in turn makes it easier to implement initiatives that bring this customer service ethos to life.

“Under RED, we created cross-functional teams called PIEs (process improvement events) to take the waste out of operating processes and improve customer service. We initially set out to achieve 10 million customer hours saved through PIEs, but eventually achieved about 250 million customer hours saved annually. We have since evolved this into ‘customer journey thinking’, which entails having a deep understanding of the end-to-end experience of various customer interactions with DBS and relentlessly eliminating pain points.”

Sustainability – embedded into the business

With more than two decades of banking experience across Asia, Him Chuan has certainly seen the landscape change – from the rise of Asia-focused banks as they capitalised on regional business growth, to rapid digitalisation driven in part by the rise of fintechs, to sustainability becoming top of mind.

“We are mindful of a world emerging from the throes of Covid-19 that calls for a different kind of bank – one that is more technology and sustainability-focused,” says Him Chuan. “These are areas we know DBS can step up to the plate.”

“In recent years, sustainability has become a key theme for banks, and it has become increasingly important for the industry to work with clients to transition to net zero.”

Already, DBS has taken significant strides in sustainability, embedding environmental and social considerations into the fabric of the business.

In its Responsible Banking pillar, DBS seeks to empower its clients to be more sustainable; and in its latest sustainability report – Our Path to Net Zero: Supporting Asia’s Transition to a Low Carbon Economy – details the selection of science-informed decarbonisation pathways and further sets interim 2030 targets for a large number of sectors.

“As of today, this is one of the most comprehensive and ambitious sets of decarbonisation targets among banks globally,” he declares.

In its Responsible Business Practices pillar, which focuses on how the bank conducts itself as an organisation, DBS delivered on its commitment to be carbon neutral in its own operations by the end of 2022.

“We updated our carbon offset guide to further strengthen the governance and processes around the selection, purchase, and use of offsets as the final lever to our operational decarbonisation strategy,” says Him Chuan.

And last year, the bank opened DBS Newton Green marking Singapore’s first net-zero-energy office building by a bank.

Finally, in its Impact Beyond Banking pillar, which supports social enterprises and community causes as well as employee volunteerism, DBS launched a new Community Impact chapter under the DBS Foundation .

“This aims to equip the underserved with digital and financial literacy skills to face the future with confidence and enable communities to be more food secure and resilient.”

In August this year, DBS announced that it will commit up to SGD 1 billion over the next 10 years to improve lives and livelihoods of the low-income and underprivileged, and foster a more inclusive society. DBS will deploy SGD 100 million each year in Singapore and its other key markets with effect from 2024, augmenting existing community initiatives by the bank and DBS Foundation. The bank also committed its 36,000-strong workforce to contributing more than 1.5 million volunteer hours over the next decade to give back to society.

DBS is passionate too about helping kickstart the transformation journeys of other businesses, recently expanding its flagship Grant Programme to nurture SMEs, launching the Asia Impact First Fund with a US$10 million commitment. The fund focuses on scaling innovative and high-growth enterprises committed to tackling significant social and environmental challenges in Asia,

Looking to the future

Moving forward, Him Chuan says DBS Bank is focused on embedding horizontal management and agile at scale to drive outcomes, taking employee experience and customer experience to the next level, and accelerating new business levers through AI and ecosystems.

In terms of long-term expansion, DBS is aiming to be more deeply embedded in one or more of its four key markets outside of Singapore and Hong Kong – namely, China, India, Indonesia and Taiwan.

“While we are relying on digital expansion in these markets, our experience has shown that a digital-only strategy has been difficult to monetise adequately, and a ‘phygital’ approach results in better customer selection and path to profitability.”

In the past three years, DBS amalgamated Lakshmi Vilas Bank in India, acquired Citigroup’s consumer banking business in Taiwan, and invested in Shenzhen Rural Commercial Bank – and all three transactions will “position DBS well for growth as we look out into the next decade”, says Him Chuen.

“While the macroeconomic outlook is uncertain, we will remain watchful and nimble while staying ahead of the curve in harnessing emerging technologies and building a sustainable future.

“Our journey to redefine the future of banking and to deliver differentiated customer experiences continues, and our work is never done. We will remain focused on delivering strong earnings while being unwavering in our support for customers, employees and the community.”

- Hyundai brand value soars on back of sustainability vision Sustainability

- IndiGo – the high-flying Indian low-cost airline Sustainability

- UOB: making strides in sustainability across Southeast Asia Sustainability

- How a data-driven IT strategy can help meet ESG goals Sustainability

Featured Articles

Nirvik Singh, COO Grey Group on adding colour to campaigns

Nirvik Singh, Global COO and President International of Grey Group, cultivating culture and utilising AI to enhance rather than replace human creativity …

How Longi became the world’s leading solar tech manufacturer

On a mission to accelerate the adoption of sustainable energy solutions, US$30 billion Chinese tech firm Longi is not just selling solar – but using it …

How Samsung’s US$5billion sustainability plan is working out

Armed with an ambitious billion-dollar strategy, Samsung is on track to achieve net zero carbon emissions company-wide by 2050 – but challenges persist …

UOB: making strides in sustainability across Southeast Asia

Huawei smartwatch goes for gold with Ultimate Edition

How IKEA India plans to double business, triple headcount

- Why Manu Jain is the right leader to grow G42 in India

- Exclusive: New chapter for Tech Mahindra CEO CP Gurnani

- How Li Ka-shing became Hong Kong’s richest billionaire

- What high-performing Southeast Asian conglomerates do right

- Meet the female CEOs driving growth for Starbucks China

Performance Management Case Study

In collaboration with mckinsey & company.

Redefining Performance Management at DBS Bank

How lofty ambitions and innovative metrics sharpened customer focus, march 26, 2019, by: david kiron and barbara spindel, introduction.

In 2008, the year David Gledhill went to work for DBS Bank, few would have predicted that within a decade the Singapore-based bank would be racking up an impressive slate of honors. Nonetheless, DBS was the first recipient of Euromoney ’s Best Digital Bank Award in 2016; it received that distinction again in 2018 and, that same year, was also named Global Finance ’s Best Bank in the World.

Just a decade ago, however, DBS, beset by long lines at branches and ATMs, high turnover among relationship managers, and a plodding credit card application process, had the worst customer satisfaction scores of all the banks in Singapore. Chief data and transformation officer Paul Cobban, who came aboard in 2009, recalls that “it was almost embarrassing to tell people at dinner parties” that he worked for the bank “because DBS had such a bad reputation.”

Executives did not simply change their performance management systems to achieve these goals. They redefined the meaning and measurement of performance.

Soon after Cobban joined, a newly arranged management team, with the support of tech-savvy CEO Piyush Gupta, turned things around by thinking of DBS as more of a tech startup than a bank. Gledhill, DBS’s CIO, says, “Our future competition wasn’t going to come from just banks, but from a lot of cool technology companies that were going into finance.” DBS, in Gledhill’s words, committed to becoming “digital to the core,” and he and his team initiated a thoroughgoing culture change to support digital innovation.

Company Background

DBS Bank was established by Singapore’s government in 1968 as the Development Bank of Singapore Limited. (It became known as DBS in 2003.) Still headquartered in the island nation, the multinational financial services group, with a workforce of over 26,000, has expanded throughout China, Southeast Asia, and South Asia, and currently has 280 branches in 18 markets. With its focus in recent years on reimagining banking as a seamless and streamlined digital experience (it has made banking mobile-only, paperless, and branchless in some of its markets), DBS’s mission is embodied in the slogan “Live more, bank less.”

Gledhill finds that operating in Singapore has distinct advantages. He cites the country’s “advanced IT infrastructure and strong intellectual property regulatory frameworks,” which encourage and protect technological innovation, and he points out that 80 of the world’s top 100 tech companies have a presence on the island. He also mentions Singapore’s highly skilled and highly educated pool of talent. “Together with supportive government initiatives to further Singapore’s digital agenda,” Gledhill says, “we believe we are definitely in the right place to fulfill our digital ambitions.”

The Foundational Years: 2009 to 2014

When Gledhill, Cobban, and the rest of their team joined DBS, they immediately set about changing the culture of the company. In the wake of the 2008 financial crisis, DBS was determined to differentiate itself from Western banks by emphasizing that it provided, in Cobban’s words, “a special brand of Asian service.” The qualities of this service were embodied in the acronym RED: respectful, easy to deal with, and dependable. The hope was that living up to these qualities would improve the company’s customer satisfaction scores, which Cobban recalls were “rock-bottom.”

Under the umbrella of RED, they created cross-functional teams called PIEs (process improvement events). The goal was to come up with processes that could be implemented within one week and that would address the bank’s biggest service problems — say, the time it took to replace a lost credit card — often by improving speed and eliminating waste. Cobban recalls, “I said, ‘What can you actually change within a short time frame?’ And that was it from an incentive point of view. It made people realize if they put some effort in now, they can see major results. Even to this day, I’m not quite sure how this happened, but we unlocked the enthusiasm, the energy, of the bottom of the company.”

Removing operational barriers lifted the ambition of employees across the organization without the use of incentives.

Notably, the PIEs helped effect a culture shift in the organization by enabling rapid, visible improvements to a wide range of operational processes. Removing operational barriers lifted the ambition of employees across the organization without the use of incentives. “We create a mechanism that anybody can participate in,” Cobban says. “We make it a very low bar to participate, and we did not expect everyone to be successful.”

In addition to improving organizational processes, the new team ensured that the company’s focus was squarely on the customer. In 2009, in what Cobban calls “in hindsight a moment of genius,” the management team invented the measure of the customer hour, a unit of wait time for a customer (a customer waiting for a credit card for an hour equals one customer hour), and used the PIE concept to eliminate as many customer hours as possible. Cobban hoped to be able to take 10 million customer hours out of the bank and ended up taking out 250 million. The process, Cobban says, “was really focused on making the customer’s life better,” a goal that unlike, say, increasing the bank’s profits, gave DBS employees a shared sense of purpose. (Google, Cobban notes, has since adapted DBS’s customer hours concept.) The shift in focus entailed an accompanying shift in the meaning of performance, as the previous measures of success were no longer relevant.

The final innovation was to upgrade DBS’s technological capabilities. “We had to build resilience into our platforms and data centers,” Gledhill says. “Our securities and monitoring operations needed revamping. But more important was the need around insourcing. We built our own technology DNA around the company so that we could really start to look and act more like a technology company. We fixed our application stack and got rid of our legacy systems to build an environment on which we would really start to scale.” The company, which was 85% outsourced in 2009, was 90% self-managed by 2018.

Looking back on the new management team’s early successes, Cobban jokes that “we were so bad, it was easy to improve within that first year.” The team wasn’t yet aspiring to compete with tech companies, but it was laying the groundwork for doing so. Gledhill was still, at that point, “thinking about ‘world class’ as being world-class among banks.” He sees the team’s initial actions, which included experimenting with agile practices, as integral to DBS’s later successes, noting that “our foundational years from 2009 to 2014 were critical building blocks where we fixed the basics to be able to move fast.” The changes to DBS’s approach to performance during this period both responded to and helped drive the company’s digital transformation. Soon, however, the company articulated a new and ambitious goal that led to a major shift in its performance management.

Project GANDALF: 2014 to the Present

Around 2014, Gupta and Gledhill began to see DBS’s competition as tech companies — like Google, Amazon, Netflix, Alibaba, LinkedIn, and Facebook — rather than other banks. They set their sights on joining that pantheon as a world-class tech company. The initials of the tech giants together spell GANALF. The company goal was to add a D to the acronym, for DBS, to spell GANDALF, the wizard of J.R.R. Tolkien’s The Hobbit and The Lord of the Rings novels. “That aspiration, more than any single piece of technology or anything else,” Gledhill declares, “really galvanized people to a completely new level of performance and thinking.” The CIO adds that the company “made it fun as well.”

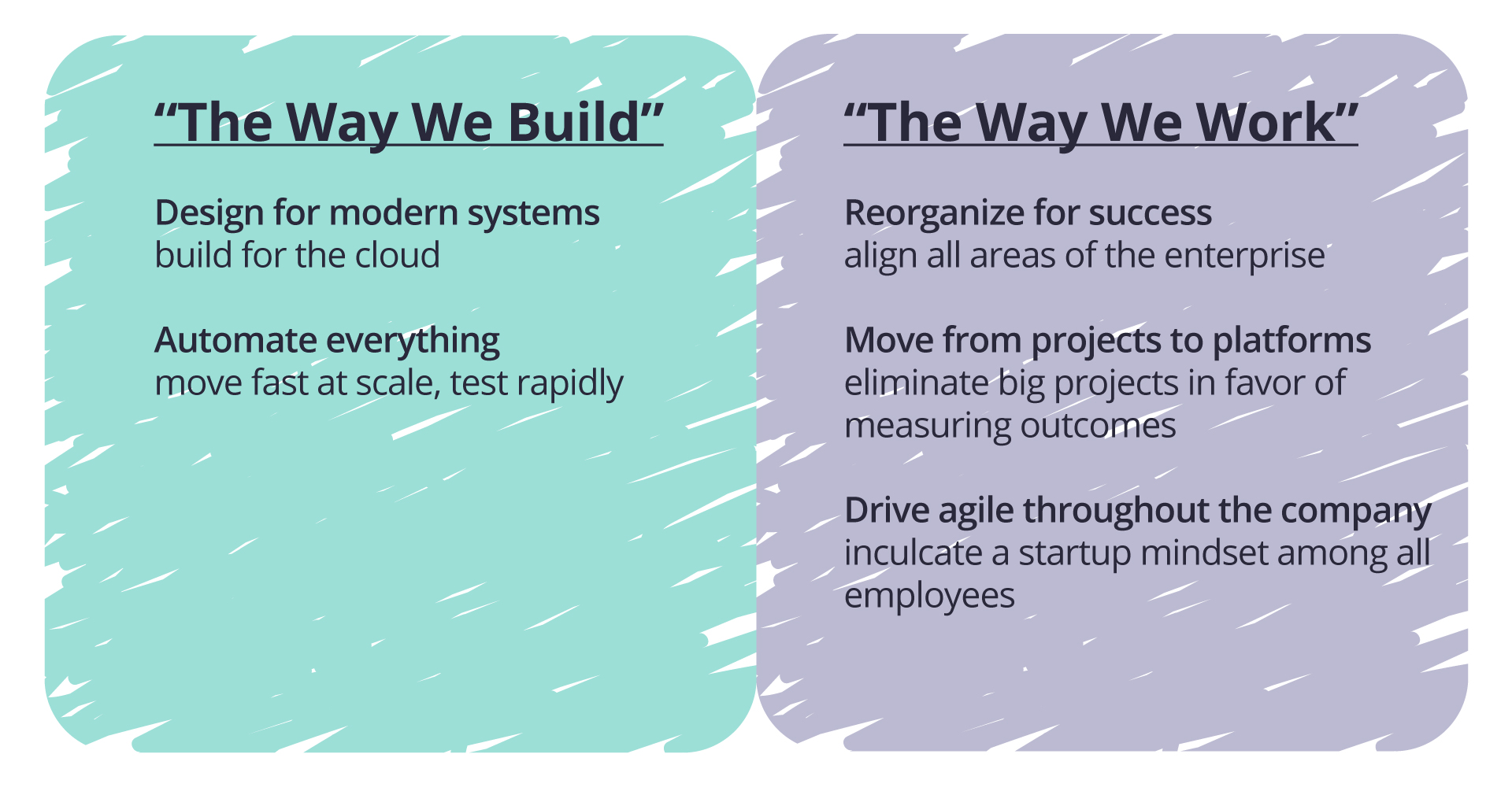

5 Focus Areas for DBS Bank’s Digital Transformation

The GANDALF goal led to a shift in the company’s approach to performance management, which DBS explicitly used to drive its transformation toward becoming a digital leader. The company quantified what it wanted to achieve and measured itself continually against its goals through its management scorecard and key performance indicators. The effort was enterprise-wide and aligned the business and technology sides. “It’s a partnership with HR in terms of reimagining the training and tools and the programs that we want to run,” Gledhill says. “It’s working with our marketing folks to figure out how we shape and sell our message. It’s working with the other business leaders to get them on board. So, it becomes a culture shift more than anything else, which has to affect all parts of the organization. Everybody has to shift the way they operate.”

To disrupt itself and join the digital elite, DBS took the following steps:

1. Gave new meaning to “performance.” Once the PIEs had resolved the customer satisfaction problems related to basic issues like length of wait time for customer center calls, they evolved into a set of programs focused more holistically on the customer. Cobban recalls, “We realized we now need to take friction out of the customer journey — it’s a lot faster than it used to be, but still there’s quite a lot of friction. This deep understanding of what customers really need is pivotal to what we built in.” DBS turned to human-centered design thinking to solve customer problems, running more than 500 “customer journey projects.” Employees are invited to create solutions and pitch them to senior staff. That might mean designing apps that don’t consume too much battery power because in a digital age, being “respectful,” part of the RED mandate, means being conscious of the importance of a customer’s battery life.

In 2017, in another move that greatly altered the company’s conception of performance, DBS developed a method for measuring the financial impact of digitization. Called the digital value capture (DVC), the data quickly and quantitatively demonstrated the importance of migrating customers to digital banking. “Through DVC, we noted that, compared to a traditional customer, a digital customer brings in twice the income, with 1.5, 2, and 3.6 times higher deposit, loan, and investment balances, respectively. A digital customer, on average, also costs 57% less to acquire and is more engaged, with 16 times more self-initiated transactions,” Gledhill notes. DVC data served multiple purposes: It created a new mandate for DBS employees, it was shared with investors, and it helped develop the enterprise’s business plan.

2. Used performance management to drive digital transformation. The company uses a balanced scorecard approach to measure performance, and digital transformation now comprises a significant part of the scorecard. As Gledhill explains, “Because we are really pushing this digital agenda, our scorecard has changed. We want to drive people to push digital adoption of the customers. And so 20% of our scorecard — so 20% of the bank’s performance, which ultimately defines how much we get paid — is focused on digital transformation.” The scorecard’s metrics are very precise. Gledhill continues, “We have very specific measures in there about the percent of customers we acquired digitally, about the shift from manual channel to electronic channel, execution for transactions, and how much we engage. So, acquire, transact, engage. Every business and every product within every business has targets about how it has to shift its customer base to those electronic channels. So, the scorecard is very tightly aligned to digital.”

“With most people, it was very liberating because it set an aspiration of something they’d completely, to that point, failed to imagine, and it was fun.” — David Gledhill

3. Changed the culture that supports performance management. In addition to providing a unifying sense of purpose to the organization, the GANDALF goal has focused DBS on its company culture. Through a process called Culture by Design, DBS has been extremely precise about codifying the culture it wants to establish: one that gives its 26,000-person workforce the feel of a startup. The acronym ABCDE details the characteristics of the culture: Agile (adapting more quickly), Be a learning organization (adopt new ways of approaching the business), Customer-obsessed (understanding customers’ pain points), Data-driven (using data holistically to transform internal processes), and Experiment and take risks (encouraging the 4D process: discover, define, develop, and deliver).

“Once we defined these key characteristics, we started reinforcing them by making aspects of these traits and behaviors a requirement for everyone,” Cobban explains. “We continue to reinforce these characteristics throughout the bank through multiple learning and collaboration programs. We focus on identifying ‘blockers’ to our cultural innovation and set about targeted countermeasures to address them.”

For instance, the company’s meetings, according to Cobban, were frequently ineffective. Problems included “people being late, unprepared, poor agenda, too many people in the meeting, too many meetings generally.” A program called Meeting MOJO was conceived to overcome this particular blocker. Under MOJO, every meeting now has a meeting owner (MO) who in turn appoints a joyful observer (JO). The MO, according to Cobban, ensures that the meeting has a clear agenda, that it starts and ends on time, and that there is “equal share of voice” throughout the discussion. At the end of the meeting, the JO provides feedback to the MO about whether the meeting was a success according to those criteria. “The results have been dramatic,” Cobban says. “More of our meetings start and finish on time, and they now have more structure and engage more attendees.”

“If you give people a sense of purpose and get out of the way, it’s far more powerful than trying to incentivize somebody with money.” — Paul Cobban

In addition, in 2017, DBS launched DigiFY, a mobile learning platform and online course intended to transform the company’s bankers into digital bankers. The program imparts skills in seven categories: agile; data-driven; digital business models; digital communications; digital technologies; journey thinking; and risk and controls. By the time employees achieve mastery in the three-part course, they are qualified to teach its precepts to their coworkers. Once the company decided it required digital bankers, it methodically set about defining, creating, supporting, measuring, and developing them.

As Cobban explains, all these changes took place within a traditional performance management system; what’s more, they were divorced from financial incentives. “We have not set out to change the culture of performance management directly through compensation. My experience is that it’s not effective in shaping a company,” he says. “Our performance approach is very conventional. We have an annual appraisal process. We have KPIs that we need to meet. If you give people a sense of purpose and get out of the way, it’s far more powerful than trying to incentivize somebody with money.”

Creating Buy-In at the Customer Center

Improvements to the customer center at DBS exemplify the shifts taking place within the organization at large. Beginning in 2014-2015, at the customer center as well as throughout the enterprise as a whole, performance management was used to drive the digital agenda. DBS’s head of customer center Geeta Sreeraman states that while the center, like most contact centers is “a highly KPI-driven environment;” the KPIs were very aligned to the bank strategy. “And our focus was, and continues to be,” she adds, “how do we participate in this whole digital transformation?” The answer was to use technology to engage the staff, improve efficiency, and enhance the customer experience.

A top priority was changing the mindset of the 500-plus customer care representatives. This was accomplished in part by enlisting the employees to collaborate in the creation of the unit’s KPIs. “We don’t want a top-down KPI that doesn’t account for their challenges,” Sreeraman says. The “culture of cocreation,” she observes, resulted in “a lot more buy-in.” Moreover, management regularly reviews and refines the unit’s metrics as the nature of engaging with customers changes. For instance, DBS customers increasingly use chat to handle simple banking issues. As customers turn to phone calls as a last resort to address more complex technical problems, KPIs related to the average time of a phone call are of lesser relevance. Metrics relating to first-contact resolution and customer satisfaction become more critical.

By the time customers do make phone calls, then, there is a strong possibility that they’re experiencing a problem that they were unable to solve using self-service online tools. DBS began using speech analytics not to punish poor performance but to understand both the challenges faced by call center staff and customer pain points. “A lot of our high-emotion calls were because of confusion,” Sreeraman says. If, for instance, the analytic tools revealed that callers were frustrated because they couldn’t access their bank statements, the company specifically trained employees to assist customers in accessing their statements online. (This solution had the added benefit of supporting DBS’s agenda to get its customers to go digital.) Similarly, if an urgent problem arises, the company can figure it out more quickly by registering an increase in negative emotions associated with calls.

Access to data enabled innovations at the customer care center. “We enhanced our internal data capabilities to make sure that we capture real-time data through dashboards,” Sreeraman says, adding that the data also facilitates any “real-time management that we need to do.” As part of having a transparent and open culture, an in-house mobile engagement app called Alive makes performance data available 24 hours a day. Managers can see which employees need additional support and which are in a position to stretch themselves. The app is also used to encourage employees to manage their own performance. They can “benchmark their performance with the rest of the cohort to assess if they are on track to meet their objectives,” Sreeraman says. Employees are encouraged to take responsibility: to self-assess, seek feedback from managers, and set SMART (specific, measurable, achievable, realistic, and time-bound) goals. This “self-driven” performance management, she says, is “where we are headed right now.”

As DBS’s recent accolades suggest, the bank has been successful in aligning its performance management system, its KPIs, and its culture with an ambitious digital transformation agenda. Of course, work remains to be done. Gledhill is interested in applying principles of performance management to the company’s teams; he also wants to deploy machine learning and advanced analytics tools to further optimize customer interactions. But as he measures DBS against the tech giants, reflecting on the audacious goal of putting the D in GANDALF, he is confident that the company will continue to make progress. “I would say we’re a long way away from some of the advanced tools and techniques these guys use, but here’s the point,” he reasons. “If this is always your North Star, you will always progressively move closer and closer to it. That’s how we look at it.”

David Gledhill

group chief information officer and head of group technology and operations

David Gledhill is group chief information officer as well as head of group technology and operations at DBS Bank. In 2017, he was the recipient of the MIT Sloan CIO Leadership Award, becoming the first CIO from an Asian company to have won. Prior to joining DBS in 2008, he worked for 20 years at JP Morgan.

Paul Cobban

chief data and transformation officer, technology and operations group

Paul Cobban is chief data and transformation officer, technology and operations, at DBS. He joined DBS in 2009 as managing director for business transformation, and was chief operating officer of technology and operations from 2013 to 2017.

Prior to joining DBS, Cobban held a variety of roles at Standard Chartered Bank, and he also worked at JP Morgan UK as an IT project manager and at IBM as a programmer and project manager.

Geeta Sreeraman

head of customer center, Singapore, technology and operations

Geeta Sreeraman is head of the customer center at DBS Bank, where she leads a team of 600 employees. Since joining DBS in 2011, she has held various senior positions, from managing relations with regulatory bodies to leading the development of the department. Under her leadership, her group has won many accolades, include Best Contact Centre at the Annual Contact Centre Association of Singapore Awards. She started her career as a relationship manager for Citibank India.

Banking On Technology-Enabled Performance Management

By Peter Cappelli

The DBS Bank example is a good illustration of how to pull off organizational change, especially a big one. The key is to use many different levers to get employees to behave differently. In this case, performance management is one of those.

It is useful to think of organizational change as similar to trying to get an individual employee to behave differently, but you have to do it at scale. There are all kinds of reasons we keep doing things the same way, but the most important is arguably that change is both unsettling and, in many cases, risky, especially if what we have been doing has been working pretty well for us.

It helps to have a powerful need for change. Some people refer to this as a burning platform — a pressure that is big enough that we cannot simply ignore it. DBS wasn’t failing; it just wasn’t very good. The pressure had to come from someplace else.

The success of DBS seems to have come from two initiatives. The first was empowerment. We’ve long known that employees can be engaged to work hard and creatively on projects for which they are responsible and that they own. The Singapore work culture is generally quite top-down, so the decision to empower teams to take on projects is more radical than it sounds. I suspect the employees responded to it with even more energy than they might elsewhere.

The second initiative relates to performance management, specifically the creation of measures of success. It is hard to engage people in anything if they do not know how they are doing, and it is especially difficult to improve if you cannot measure whether you are doing better: Imagine trying to improve your golf game if you went to the driving range and could never see where the ball went. The truly innovative initiative at DBS was to create a measure of performance — hours of customer time — that had face validity (we can see why it is good for business and for customers to bank faster), will stay in place over time, and is comparable across parts of the bank.

Paul Cobban says that the bank’s performance appraisal system is very conventional, but the management team did make changes in it that drove behavior in a different direction. That began with new organizational measures, a balanced scorecard, and new measures of individual behaviors that the team wanted employees to execute. We should not underestimate the importance of training on those behaviors because a big cause of resistance to change is employees who aren’t sure whether they will be able to hit the new goals, so they often do not try. Good training goes a long way toward taking that fear away.

Even with all these efforts, organizational changes typically fail. They are working at DBS in part because the leaders smartly let the new practices drive culture changes and aligned efforts to move employees in a new direction. DBS leaders provided a compelling vision of becoming a digital company, empowered employees to act on that vision, measured how they are doing, and gave them the skills to succeed. As with any successful change, it is a lot more work to make it happen than it sounds from a story. The key element here is leadership commitment: Put time and sustained resources into the effort and see it through to a conclusion.

Peter Cappelli is the George W. Taylor Professor of Management at The Wharton School and director of Wharton’s Center for Human Resources. He is also a research associate at the National Bureau of Economic Research in Cambridge, Massachusetts, served as senior advisor to the Kingdom of Bahrain for employment policy from 2003-2005, and since 2007 is a distinguished scholar of the Ministry of Manpower for Singapore.

About the Authors

David Kiron is the executive editor of MIT Sloan Management Review ’s Big Ideas Initiative, which brings ideas from the world of thinkers to the executives and managers who use them.

Barbara Spindel is a writer and editor specializing in culture, history, and politics. She holds a Ph.D. in American studies.

Contributors

Michael Fitzgerald, Carolyn Ann Geason, Allison Ryder, and Karina van Berkum

Acknowledgments

David Gledhill, CIO, DBS Bank

Paul Cobban, chief data and transformation officer, DBS Bank

Geeta Sreeraman, head of customer center, DBS Bank

More Like This

Add a comment cancel reply.

You must sign in to post a comment. First time here? Sign up for a free account : Comment on articles and get access to many more articles.

DBS Bank India plans to double small business book in 3 years

MUMBAI : Having achieved its target of a billion-dollar book in the small business segment, DBS Bank India now plans to double its exposure in three years, a senior banker said, underscoring the lender’s optimism around a sector that contributes nearly 30% to the gross domestic product (GDP) and is a significant job creator.

“We are growing our SME (small and medium enterprise) book and we have added new products. Like startups, it is not only a lending business and there is a liability side of the business too," Rajat Verma, managing director and head of institutional banking at DBS Bank India said in an interview.

Its SME business revenue has increased to 20% of its institutional banking revenue in Q1 2024, from 19% in Q1 2023. These percentages, however, exclude the offshore institutional book.

Verma believes the current growth trajectory of its small business segment, which he says is “in the 30s", should continue at the current level.

“I am a great fan of a consistent growth rate over a period of time. It is not good to do 40% one year and then 10% the other year but 20-25% consistently; the book could double in the next three years."

Read This: Startups, SMEs increasingly covet so-called fractional CXOs

Launched in 2019, DBS Bank India is a wholly-owned subsidiary of DBS Bank Ltd, Singapore. India allows foreign banks to operate either as a branch or a wholly-owned subsidiary of the parent. The other bank to set up a local subsidiary was SBM Bank India, while the rest operate as branches.

“We have touched the $1 billion (fund and non fund based SME exposures) mark in the SME business and we think it is one of the businesses which will drive our growth. This also includes loans given to startups," said Verma who joined the bank in 2023 from HSBC India.

Verma noted that the asset quality of its small business book is “very good, the default level is low despite growing quite rapidly."

The bank’s overall gross NPA ratio stood at 5.61% as on 31 March 2023, down from 9.5% in the previous financial year, according to its FY23 annual report.

According to him, while a conglomerate might have 30-40 or even 50 banks in a consortium, depending on the type of conglomerate and how much debt they need, an SME would have two or three at most.

“So, the choice of banking partner is a critical one, and likewise for the bank too. We are focused on the SME space and it is a business that is growing fast while the quality of assets remains healthy," he said.

Data shows that the quality of small business loans has improved for the entire banking sector.

The gross non-performing asset (NPA) ratio in micro, small and medium enterprises (MSME) loans for banks declined to 4.7% of outstanding loans as of 30 September, from 6.8% in March 2023 and 7.7% in September 2022, according to the latest Financial Stability Report released by the Reserve Bank of India (RBI) in December.

Aggregate bank loans to MSMEs grew 29% to ₹ 10 trillion in 2023-24, according to a separate data set from RBI.

More Here: SME IPOs are shining, but experts advise caution

Verma said that one reason for the sector's strong asset quality metrics is the reduction in information asymmetry. “These include the data available from credit bureaus, data on the founders, GST (Goods and Services Tax) returns, besides others."

According to Verma, DBS Bank India’s strategy is to partner with these companies for the long term. “I am also interested in making sure that we onboard clients who will stay with us five or 10 years down the road," he said, adding that the bank is interested in SMEs, midcaps, and large caps.

“So SME is a feeder to the mid cap. The mid cap is the feed to the large cap."

Meanwhile, the bank’s environmental, social, and governance (ESG) financing book had crossed SGD 1 billion (about $740 million) in 2023. While it had planned to grow from that base by 60% by the end of calendar year 2024, it now expects to exceed this substantially.

Also Read: India's private capex not secular across industries, says HSBC's Malhotra

Mint specials, wait for it….

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

Congratulations!

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

Subscribe to continue

This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp

Open Demat Account and Get Best Offers

Start Investing in Stocks, Mutual Funds, IPOs, and more

- Please enter valid name

- Please enter valid mobile number

- Please enter valid email

- Select Location

I'm interested in opening a Trading and Demat Account and am comfortable with the online account opening process. I'm open to receiving promotional messages through various channels, including calls, emails & SMS.

The team will get in touch with you shortly

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

MAS to ensure DBS identifies root cause of recent disruptions and addresses it effectively

SINGAPORE - The Monetary Authority of Singapore (MAS) is following up with DBS Bank to ensure that it identifies the root cause of recent disruptions to its internet banking and payment services, and addresses it effectively.

Following several outages in 2023, DBS and POSB online banking services were down again on May 2.

The latest outages took place even as a remediation plan to identify and rectify the cause of disruptions that took place in 2023 is still ongoing.

“While DBS Bank had made substantive progress to address the shortcomings identified from service disruptions experienced by its customers in 2023, the remediation plan by DBS Bank has not been completed and implementation is still ongoing,” an MAS spokesperson told The Straits Times on May 7.

The disruptions also came just two days after the MAS on April 30 announced that it would not seek to extend a six-month pause on the bank’s non-essential activities.

The MAS spokesperson said: “The six-month pause allowed DBS Bank to focus its resources and management attention on the remediation work and the bank has committed to continue its focus to complete the remediation plan.

“MAS is closely monitoring DBS Bank’s progress on the remaining deliverables and the effectiveness of the measures implemented.”

However, additional capital requirements imposed on the bank on May 5, 2023, as a result of the disruptions will remain.

The capital requirements, which translate to approximately $1.6 billion in total additional regulatory capital, will be lifted when the MAS “is satisfied that DBS Bank has demonstrated the ability to maintain service availability and reliability, and handle any disruptions effectively”, the spokesperson said.

Compared to 2023’s service disruptions, which lasted eight to 12 hours, the latest incident saw a much faster recovery, market observers said.

Banners on DBS’ mobile app were put up around 6pm, alerting customers that access to digital services was unavailable and the bank was resolving the issue.

DBS and POSB digibank online and mobile services returned to normal at 7.37pm and 7.41pm respectively. Services on DBS PayLah! returned to normal at 8.03pm.

But without knowing the details of DBS’ latest outage, IT experts said it will be difficult to isolate the root cause of the disruptions.

Outages could be due to numerous causes from servers, storage, networking, applications on its microservice architecture, software that different applications use to communicate with each other, and databases, among others, they said.

For instance, the outage can be caused by a software misconfiguration in the automatic failover protocols for business continuity and disaster recovery.

This happens when the backup or failover system does not automatically switch to a secondary server or system when the primary one encounters a failure or downtime, said Mr Raju Chellam, cyber-security expert and honorary chair of cloud and data standards at IT Standards Committee.

Malfunctions can also occur if modifications were made during system changes like software updates and upgrades without adequate checks being conducted before it was rolled out to the production servers, he said.

Outages can also be the result of human errors and third party issues such as cables being accidentally cut or burnt in data centres.

On Oct 14, 2023, a fault in the cooling system in Equinix data centre caused hours-long outages at DBS and Citibank.

On April 30, DBS said it had identified several work-in-progress areas including strengthening the bank’s systems architecture and creating more monitoring tools to detect potential problems more quickly.

Chief executive officer Piyush Gupta said while progress had been made, DBS would continue to strengthen its technology resiliency to meet expectations for reliable, seamless and effortless banking.

Mr Sam Liew, president of the Singapore Computer Society, said improvement in digital infrastructure is essential to support a widespread adoption of cashless transactions.

There is also a need for a supportive payment framework to enable a cashless society.

Ultimately, there must be digital trust to encourage widespread adoption, he said.

Join ST's WhatsApp Channel and get the latest news and must-reads.

- MAS/Monetary Authority of Singapore

- Banks and financial institutions

- Service outage

Read 3 articles and stand to win rewards

Spin the wheel now

- The Star ePaper

- Subscriptions

- Manage Profile

- Change Password

- Manage Logins

- Manage Subscription

- Transaction History

- Manage Billing Info

- Manage For You

- Manage Bookmarks

- Package & Pricing

Singapore's MAS asks DBS to identify reasons for disruptions, The Strait Times reports

Wednesday, 08 May 2024

Related News

Bank Negara, Bank of Korea renew bilateral swap arrangement

Central bank has ai in its intervention corner, al rajhi bank malaysia appoints mohd syahrul ishak as new ceo.

FILE PHOTO: A view of the Monetary Authority of Singapore's headquarters in Singapore June 28, 2017. Picture taken June 28, 2017. REUTERS/Darren Whiteside/File Photo

SINGAPORE's central bank is following up with DBS Bank, the banking arm of DBS Group, to identify the root cause of recent disruptions to its internet banking and payment services and address it effectively, The Strait Times reported.

Last week, DBS Group said its online and mobile banking services had returned to normal after suffering issues for more than an hour on May 2.

The disruptions came just two days after the Monetary Authority of Singapore (MAS) ended DBS's six-month ban from acquiring new businesses or making non-essential IT changes after the company addressed problems that had disrupted its digital banking services in 2023.

"While DBS Bank had made substantive progress to address the shortcomings identified from service disruptions experienced by its customers in 2023, the remediation plan by DBS Bank has not been completed and implementation is still ongoing," a MAS spokesperson told The Straits Times on Tuesday.

"MAS is closely monitoring DBS Bank's progress on the remaining deliverables and the effectiveness of the measures implemented," the report added. - Reuters

Tags / Keywords: MAS , DBS , internet , finance , disruption

Found a mistake in this article?

Report it to us.

Thank you for your report!

2024 university enrolment guide for school leavers

Next in business news.

Trending in Business

Air pollutant index, highest api readings, select state and location to view the latest api reading.

- Select Location

Source: Department of Environment, Malaysia

Others Also Read

Best viewed on Chrome browsers.

We would love to keep you posted on the latest promotion. Kindly fill the form below

Thank you for downloading.

We hope you enjoy this feature!

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Crime, justice and law

- Criminal record disclosure

DBS business plan: 2019-2020

Outlines the objectives of the Disclosure and Barring Service (DBS) from 2019 to 2020.

PDF , 2.75 MB , 13 pages

This file may not be suitable for users of assistive technology.

This report sets out the objectives and priorities of the Disclosure and Barring Service between 2019 and 2020.

Is this page useful?

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey .

IMAGES

COMMENTS

We seek to intermediate trade and capital ȵ ows as well as support wealth creation in Asia. Our established and growing presence in Greater China, South Asia and Southeast Asia makes us a compelling Asian bank of choice. We are a full-service commercial bank in Singapore and Hong Kong and are scaling up these capabilities in India and Taiwan.

About us. DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

DBS business plan 2023 -2024. 1. Chairman and Chief Executive's foreword. In 2020, the Disclosure and Barring Service (DBS) board launched its five-year strategy for the period 2020-25. We are ...

The DBS business plan 2021-22 focuses on the actions we need to take over the next 12 months to deliver strong operational performance and the ambitions set out in our five-year strategy. Quality ...

Guided by our vision to be the "Best Bank for a Better World", DBS seeks to create long-term value for stakeholders in a sustainable way. As part of our sustainability strategy, we are weaving environmental and social considerations into our business across three key pillars: 01 Responsible Banking We are supporting our clients to be

2. Introduction. The DBS 2022-23 business plan focuses on the actions we need to take over the next 12 months to deliver the ambitions set out in our five-year strategy. Quality is at the heart of ...

The DBS story illustrates what a genuinely future-ready business looks like. By this point, DBS isn't merely a technology-friendly bank; it would be more apt to identify it as a technology ...

DBS will deploy SGD 100 million each year in Singapore and its other key markets with effect from 2024, augmenting existing community initiatives by the bank and DBS Foundation. The bank also committed its 36,000-strong workforce to contributing more than 1.5 million volunteer hours over the next decade to give back to society.

The process, Cobban says, "was really focused on making the customer's life better," a goal that unlike, say, increasing the bank's profits, gave DBS employees a shared sense of purpose. (Google, Cobban notes, has since adapted DBS's customer hours concept.) The shift in focus entailed an accompanying shift in the meaning of ...

Here's a snapshot of what the new normal might look like. As the economic damage from the Covid-19 outbreak continues to rise, businesses across a wide range of industries are struggling to cope with the disruption caused by measures aimed at containing the virus. Certain trends are being accelerated - from online shopping and digital ...

We are focused on three sustainability pillars: (i) Responsible banking (ii) Responsible business practices and (iii) Creating social impact. We use the Sustainable Development Goals (SDGs) as a framework for guiding our areas of focus, including. SDG 5 - Gender Equality. SDG 7 - Affordable and Clean Energy.

DBS business plan: 2021-22. The DBS business plan 2021-22 focuses on our objectives for the next 12 months, in line with our five-year strategy. From: Disclosure and Barring Service. Published. 19 ...

1 Maintain>= HK$600,000 average total deposit balance within first 6 calendar months upon Business Account opening (HKD equivalent) with a maximum of HK$5,300. 2 Completed at least 6 outward payment transactions in the first 6 calendar months upon Business Account opening via IDEAL Online Banking Platform with a maximum cash rebate of HK$500.

We will not ask for your account details, User ID, PIN or OTP over the phone, email or SMS. DBS Business banking services comprises new account opening, online business loan, equipment loan, trade collections and a wide range of banking products for SME.

According to Verma, DBS Bank India's strategy is to partner these companies for the long term. MUMBAI: Having achieved its target of a billion-dollar book in the small business segment, DBS Bank ...

Exclusive reward of 1.5 miles per S$1. Start earning DBS Points in 2 simple steps: Simply pay your income tax using your DBS/POSB Credit Card 2 via the bill payment option on iBanking. Apply for MP3 for Income Tax Payment via the 'Apply now' button below. Apply now. 2 Only DBS/POSB Credit Cards that reward you with DBS Points are applicable.

14 DBS Annual Report 2015 Business model - how we create value In Institutional Banking, we serve large corporates, SMEs and institutional investors, from helping them finance their business activities to managing their financial risks. We offer a full range of credit facilities from short-term working capital financing to specialised lending.

Banners on DBS' mobile app were put up around 6pm, alerting customers that access to digital services was unavailable and the bank was resolving the issue. DBS and POSB digibank online and ...

SINGAPORE's central bank is following up with DBS Bank, the banking arm of DBS Group, to identify the root cause of recent disruptions to its internet banking and payment services and address it ...

Business Function Group Technology and Operations (T&O) enables and empowers the bank with an efficient, nimble and resilient infrastructure through a strategic focus on productivity, quality & control, technology, people capability and innovation.

DBS business plan: 2022-23. The DBS business plan 2022-23 focuses on our objectives for the next 12 months, in line with our five-year strategy. From: Disclosure and Barring Service.

The Disclosure and Barring Service business plan 2023-24 focuses on our objectives for the next 12 months, in line with our five-year strategy. From: Disclosure and Barring Service. Published. 6 ...

How to Apply. Simply call DBS SME Loan Hotline at 2290 8123 or visit our SME Banking Centres and our Relationship Manager will be glad to assist you. You will need to submit the following documents: You will need to submit the following documents: Company registration documents and business profile. Latest financial reports.

DBS business plan: 2019-2020. Outlines the objectives of the Disclosure and Barring Service (DBS) from 2019 to 2020. From: