Loan Participation Vs Assignment

- No Comments

Sub-participation

Sub-participation is a form of loan participation in which a lender shares its risk with a second party. This type of loan participation does not change the documentation of the loan. This type of loan participation can also include future amounts for loans that have not yet been fully disbursed, such as a revolving credit facility.

The legality of sub-participation is dependent on the conditions of the loan agreement. In general, a loan participant cannot enforce the loan or proceed against the collateral on their own. Furthermore, the borrower may not even be aware that the loan participant is involved. However, the seller of the participation retains the right to enforce or compromise the loan, as well as to amend it without the consent of the participant.

As for drafting sub-participation agreements, there are many ways to do so. But it is important to include at least the following provisions: The term of the agreement, the rate of interest, and the repurchase provisions. These provisions should be included in the sub-participation or assignment agreement.

Assignment and sub-participation are standard terms in inter-bank transactions. We will examine the purposes of the loan participation and assignment agreements, as well as the terms of the transaction. While they are essentially interchangeable, they are fundamentally different.

Loan participation and assignment are both ways to transfer ownership of a loan. Assigning a loan to a third party or sub-assigning it to yourself is a common way to transfer the loan.

The terms “loan participation” and “assignment” are often used in the banking industry. Both terms refer to the transfer of a loan’s rights and payments between two financial institutions. We’ll look at what each term means and how they differ from each other.

Loan participation has long been a common form of loan transfer. Its advantages over other loan transfer methods include the ability to diversify a portfolio and limit risk. It also eliminates the need for loan servicing. However, this option can be problematic when it differs from underlying loans. For this reason, it’s important to structure loan participation carefully.

Whether a loan is a participation or an assignment depends on a variety of factors. The percentage of loan ownership, relationship with the other financial institution, and confidence in the other party are all important considerations. However, the basic difference between participation and assignment is that the former involves the original lender continuing to manage the loan while the latter takes on the responsibility of doing so.

As a rule, loan participation is a good option if the original lender does not want to keep the title of the loan. It allows the borrower to avoid the costs associated with the loan and is more attractive for borrowers. In addition, loan participation arrangements can be more flexible than outright assignments. However, it’s important to make sure that the arrangement you enter into is formal. This will prevent any confusion or conflict down the road.

Syndication

Understanding the differences between loan participation and syndication is important for lenders. Understanding these two options can help them find the best solutions for their lending needs. Syndication is a common type of lending program where lenders pool their loans together to reduce the risks of defaults. Loan participation programs can be more complex and require due diligence to be effective.

Syndicated lending allows lenders to access the expertise and business relationships of their fellow lenders while maximizing their exposure to deal flow. However, lenders who join a syndicated lending arrangement often give up some of their independence and flexibility to take unilateral action. In addition, these arrangements often involve the involvement of legal counsel, which can also be important.

A loan participation arrangement is a group of lenders coming together to fund a large loan. A lead bank underwrites the loan and sells portions of it to other financial institutions. Loan syndication, on the other hand, is an arrangement whereby multiple financial institutions pool their money together and make one large loan. In this type of arrangement, the original lender transfers the rights and obligations to the purchasing financial institution. The risk is then shared among the participating lenders, allowing them to share in the interest and the risks of the loan’s default.

A syndication contract can be structured in as many tranches as necessary to meet the borrowing needs of a customer. The underlying contract will contain a commitment contract that specifies the ratio of participation among the participants. Each tranche will have a borrower, which will be a common participant or may be different. The contract will require that each participant fulfill their commitments before the scheduled due dates.

Loan participation and assignment are standard transactions between banks. They are similar in some respects but have different purposes.

There are many types of loan participation agreements. Some involve a full assignment, while others are a sub-participation. If you are involved in loan participation or assignment, you need to understand which type of agreement applies to your situation. There are several types of loan participation agreements, including sub-participation agreements, undisclosed agencies, and assignments.

Sub-participation agreements are typically used to assign part of the loan amount to a new lender, and the loan documentation remains unchanged. In addition, these types of agreements include future amounts, which may be provided as part of a revolving credit facility or a portion of a loan that hasn’t been fully disbursed.

Loan participation is a popular option for lenders to limit their exposure to borrowers. Lenders may sell a portion of the loan to an investor or sell a portion of their interest to another party. While the transfer of a loan portion does not always require the consent of the transferor, lenders must consider participating interest guidelines and the applicable rules.

How Do Variables Affect Bank Loan Sales?

Comments are closed.

- Participate

SALES [email protected] 501-246-5148

SUPPORT [email protected] 501-313-3414

Get ahead of the competition.

Demos of our products take only 30 minutes and we offer a free trial.

Schedule Your Demo Today

Schedule a Demo

All Rights Reserved.

- Schedule A Demo

- Search Search Please fill out this field.

- Options and Derivatives

- Strategy & Education

Assignment: Definition in Finance, How It Works, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

What Is an Assignment?

Assignment most often refers to one of two definitions in the financial world:

- The transfer of an individual's rights or property to another person or business. This concept exists in a variety of business transactions and is often spelled out contractually.

- In trading, assignment occurs when an option contract is exercised. The owner of the contract exercises the contract and assigns the option writer to an obligation to complete the requirements of the contract.

Key Takeaways

- Assignment is a transfer of rights or property from one party to another.

- Options assignments occur when option buyers exercise their rights to a position in a security.

- Other examples of assignments can be found in wages, mortgages, and leases.

Uses For Assignments

Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, or other asset of value. to another entity through a written agreement.

Assignment rights happen every day in many different situations. A payee, like a utility or a merchant, assigns the right to collect payment from a written check to a bank. A merchant can assign the funds from a line of credit to a manufacturing third party that makes a product that the merchant will eventually sell. A trademark owner can transfer, sell, or give another person interest in the trademark or logo. A homeowner who sells their house assigns the deed to the new buyer.

To be effective, an assignment must involve parties with legal capacity, consideration, consent, and legality of the object.

A wage assignment is a forced payment of an obligation by automatic withholding from an employee’s pay. Courts issue wage assignments for people late with child or spousal support, taxes, loans, or other obligations. Money is automatically subtracted from a worker's paycheck without consent if they have a history of nonpayment. For example, a person delinquent on $100 monthly loan payments has a wage assignment deducting the money from their paycheck and sent to the lender. Wage assignments are helpful in paying back long-term debts.

Another instance can be found in a mortgage assignment. This is where a mortgage deed gives a lender interest in a mortgaged property in return for payments received. Lenders often sell mortgages to third parties, such as other lenders. A mortgage assignment document clarifies the assignment of contract and instructs the borrower in making future mortgage payments, and potentially modifies the mortgage terms.

A final example involves a lease assignment. This benefits a relocating tenant wanting to end a lease early or a landlord looking for rent payments to pay creditors. Once the new tenant signs the lease, taking over responsibility for rent payments and other obligations, the previous tenant is released from those responsibilities. In a separate lease assignment, a landlord agrees to pay a creditor through an assignment of rent due under rental property leases. The agreement is used to pay a mortgage lender if the landlord defaults on the loan or files for bankruptcy . Any rental income would then be paid directly to the lender.

Options Assignment

Options can be assigned when a buyer decides to exercise their right to buy (or sell) stock at a particular strike price . The corresponding seller of the option is not determined when a buyer opens an option trade, but only at the time that an option holder decides to exercise their right to buy stock. So an option seller with open positions is matched with the exercising buyer via automated lottery. The randomly selected seller is then assigned to fulfill the buyer's rights. This is known as an option assignment.

Once assigned, the writer (seller) of the option will have the obligation to sell (if a call option ) or buy (if a put option ) the designated number of shares of stock at the agreed-upon price (the strike price). For instance, if the writer sold calls they would be obligated to sell the stock, and the process is often referred to as having the stock called away . For puts, the buyer of the option sells stock (puts stock shares) to the writer in the form of a short-sold position.

Suppose a trader owns 100 call options on company ABC's stock with a strike price of $10 per share. The stock is now trading at $30 and ABC is due to pay a dividend shortly. As a result, the trader exercises the options early and receives 10,000 shares of ABC paid at $10. At the same time, the other side of the long call (the short call) is assigned the contract and must deliver the shares to the long.

:max_bytes(150000):strip_icc():format(webp)/novation.asp-final-f5904e1fe68047ba9d8b6feaf53c1736.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

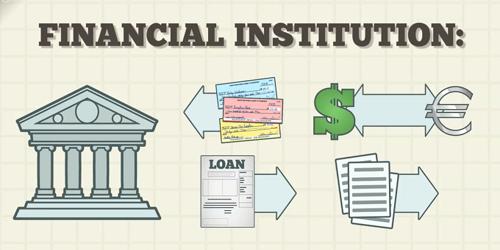

Concept of Financial Institutions

The concept of Financial Institutions –

Financial institutions are organizations that deal with a transaction of financial claims and financial assets. It is an establishment that conducts financial transactions such as investments, loans, and deposits. They issue financial claims against themselves for cash and use the proceeds from this issuance to purchase primarily the financial assets of others. Financial institutions primarily collect saving from people, business and government by offering accounts and by issuing securities. The savings are lent to the user of the funds. They also work as the intermediaries between the issuer of securities and the investing public. Everything from depositing money to taking out loans and exchanging currencies must be done through financial institutions.

The major categories of financial institutions include central banks, retail and commercial banks, internet banks, credit unions, savings and loans associations, investment banks, investment companies, brokerage firms, insurance companies, and mortgage companies.

Thus, financial institutions are specialized firms that facilitate the transfer of funds from savers to borrowers. They offer accounts to the savers and in turn, the money deposited is used to buy the financial assets issued by other forms. encompass a broad range of business operations within the financial services sector, including banks, trust companies, insurance companies, brokerage firms, and investment dealers. Similarly, they also issue the financial claims against themselves and the proceeds are used to buy the securities of other firms. Since financial claims simply represent the liability side of the balance sheet for an organization, the key distinction between financial institution and other types of organizations involves what is on the assets side of the balance sheet.

It encompasses a broad range of business operations within the financial services sector, including banks, trust companies, insurance companies, brokerage firms, and investment dealers. For example, a typical commercial bank issues financial claims against itself in the form of debt (for instance, checking and savings accounts) and equity; and so does a typical manufacturing firm. However, the structure of assets held by a commercial bank reveals that most of the bank’s money is invested in loans to individuals, corporations, and government as well. On the other hand, typical manufacturing firm invests primarily in real assets. Accordingly, banks are classified as financial institutions and manufacturing firms are not. Besides commercial banks, other examples of financial institutions are finance companies, insurance companies, credit unions, pension funds, mutual funds savings and loan associations, and so on.

Information Source:

- accountlearning.blogspot.com

Investing in High Dividend Stock Market Funds

Benefits of Direct Debit

Substitutes of Stock Market Investing

Social Risk Management

False Consciousness – in Marxist Theory

Annual Report 2011-2012 of Larsen and Toubro

Sales Follow up after a Quote Letter

Biography of Grete Waitz

Why Invest in Coal Mining Industry

Most Forms of Exercise are Extremely Safe – but don’t dismiss the Risks

Latest post.

Negative Thermal Expansion (NTE)

Thermal Expansion

Angle Seat Piston Valve

Vitamin D modifies Mouse Gut Flora to enhance Cancer Immunity

Fossil Frogs’ Skincare Secrets

Piston Valve

Rating Action Commentary

Fitch Rates Encore's 2030 Senior Secured Notes 'BB+(EXP)'

Mon 13 May, 2024 - 9:10 AM ET

Fitch Ratings - London - 13 May 2024: Fitch Ratings has assigned Encore Capital Group, Inc.'s (BB+/Stable) proposed issue of USD400 million senior secured fixed rate notes due 2030 an expected rating of 'BB+(EXP)'.

The assignment of a final rating is contingent on the receipt of final documents conforming to information already reviewed.

Key Rating Drivers

Equalised with Long-Term IDR : The senior secured notes will be guaranteed by most Encore group subsidiaries and rank equally with other senior secured obligations, which comprise the majority of Encore's debt. Consequently, the senior secured debt rating is equalised with Encore's Long-Term Issuer Default Rating (IDR), as Fitch expects average recoveries for the notes after accounting for the smaller element of higher-ranking super-senior debt.

Limited Leverage Impact : Fitch expects the proceeds of the notes to principally be used in the near term to reduce drawings under the group's revolving credit facility, ahead of the intended redemption in October of EUR350 million senior secured notes due 2025. Therefore, the refinancing has no material net impact on consolidated leverage, and extends the average tenor of the group's borrowings.

Leading Franchise; Concentrated Activities : Encore's Long-Term IDR reflects its leading franchise in the debt-purchasing sector, its experienced management team and its long-term profitability record. The rating also takes into account the company's concentration of activities within debt-purchasing and the need to accommodate wholesale market funding costs within profitable underwriting. Fitch expects that net leverage will remain at the upper end of management's long-term guidance of 2x-3x in the near term while portfolio purchasing exceeds recent years' levels.

Ongoing High US Deployment : In 1Q24 Encore invested a record USD237 million in the US non-performing loan market, continuing its recent trend of greater deployment in the US than in Europe, in view of more attractive return prospects. The group reported a 22% year-on-year increase in pre-tax profit for the quarter to USD30.5 million.

For further details of the key rating drivers and sensitivities for Encore's IDR, see 'Fitch Affirms Encore at 'BB+'; Outlook Stable', dated 29 June 2023, on www.fitchratings.com )

DEBT AND OTHER INSTRUMENT RATINGS: KEY RATING DRIVERS

Debt and other instrument ratings: rating sensitivities.

The notes' expected rating is primarily sensitive to changes in Encore's Long-Term IDR. Changes to Fitch's assessment of relative recovery prospects for senior secured debt in a default (e.g. as a result of a material shift in the proportion of Encore's debt which is either unsecured or super-senior secured) could also result in the senior secured debt rating being notched up or down from the IDR.

Date of Relevant Committee

27 June 2023

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG Considerations

Encore Capital Group, Inc. has an ESG Relevance Score of '4' for Customer Welfare - Fair Messaging, Privacy & Data Security due to the importance of fair collection practices and consumer interactions and the regulatory focus on them, particularly in the US.

Encore Capital Group, Inc. has an ESG Relevance Score of '4' for Financial Transparency due to the significance of internal modelling to portfolio valuations and associated metrics such as ERC. These factors have negative influences on the rating, but their impact is only moderate, and they are features of the debt purchasing sector as a whole, and not specific to Encore.

The highest level of ESG credit relevance is a score of '3', unless otherwise disclosed in this section. A score of '3' means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch's ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch's ESG Relevance Scores, visit https://www.fitchratings.com/topics/esg/products#esg-relevance-scores .

- senior secured

VIEW ADDITIONAL RATING DETAILS

Additional information is available on www.fitchratings.com

PARTICIPATION STATUS

The rated entity (and/or its agents) or, in the case of structured finance, one or more of the transaction parties participated in the rating process except that the following issuer(s), if any, did not participate in the rating process, or provide additional information, beyond the issuer’s available public disclosure.

APPLICABLE CRITERIA

- Non-Bank Financial Institutions Rating Criteria - Effective from 5 May 2023 to 17 January 2024 (pub. 05 May 2023) (including rating assumption sensitivity)

ADDITIONAL DISCLOSURES

- Solicitation Status

- Endorsement Policy

ENDORSEMENT STATUS

IMAGES

VIDEO

COMMENTS

The major categories of financial institutions are central banks, retail and commercial banks, internet banks, credit unions, savings and loan (S&L) associations, investment banks and companies ...

There are 5 modules in this course. The purpose of this course is to provide you with a basic understanding of the connections between money, the financial system, and the broader macroeconomy. We will examine the economics of modern financial institutions (e.g. banks), including how they are organized, the products and financial services they ...

Assignment 1 - Financial Markets and Institutions. Part 1: From my understanding, the definition of a FinTech organisation can be described as how organisations with new technology have the ability to improve and automate but rather facilitate financial transactions and financial services for individuals and corporations.

Assignment 4 - Financial Markets and Institutions. Synopsis The Financial Accounting Standards Board (FASB) is an American independent and non-profit organisation within the private sector that is responsible for establishing accounting and financial reporting standards for US companies and non-profit organisations.

Upgrade to Premium to enroll in Finance 303: Financial Institutions & Markets Enrolling in a course lets you earn progress by passing quizzes and exams. Track course progress

We will examine a myriad of financial markets, the instruments that trade on them, and the financial and governmental institutions that use or support these markets. In particular, we will cover interest rates, equity markets, the money, capital and mortgage markets, the foreign exchange market, the Federal Reserve, and some derivative markets.

Financial Institutions play an extremely important role in the functioning of the global economy and in the operation of our firms. The financial crisis of 2007-2008 and recent global financial turbulence demonstrated both ... Assignments 10% Class participation-cases 15% Class participation-lecture/speakers 5% 1. Cases: The course has cases to ...

Ch 02- Assignment - Financial Markets and Institutions. Elliot invests $25,000 by purchasing 1,000 shares of an emerging markets mutual fund. This mutual fund invests in companies in Brazil, India, and China. He bought the mutual fund from the mutual fund company. Click the card to flip 👆.

Financial Institutions are business organizations serving as a link between savers and investors and so help in the credit allocation process. In simple, Financial Institutions are the institutions which offer financial services for its clients or members. The most probable service is financial intermediation. The institutions include

financial institutions and markets. group 1 assignment. topics covered. overview of the kenyan financial system. • types of financial institutions. • risks facing financial institutions. • financial markets in kenya. • factors responsible for rapid growth of financial institutions. • functions of financial institutions.

assignment/homework deadline, you must contact me before the test is given or the assignment is due. NOTE: Dr. Goldstein reserves the right to change any aspect at any time, including, but not limited to, assignments, grading methods or relative grading weights, assignment or exam dates, or the course schedule. However, FINAL

Assignment. The terms "loan participation" and "assignment" are often used in the banking industry. Both terms refer to the transfer of a loan's rights and payments between two financial institutions. We'll look at what each term means and how they differ from each other. Loan participation has long been a common form of loan transfer.

c) Decreased competition between financial institutions d) Growth of financial conglomerates A34. (c) Q35. Which of the following is NOT one of the main trends in financial institutions? a) Rapid growth of mutual funds and pension funds b) Decreased consolidation of financial institutions via mergers c) Increased competition between financial ...

Assignment: An assignment is the transfer of an individual's rights or property to another person or business. For example, when an option contract is assigned, an option writer has an obligation ...

Financial Institutions Winter Assignment 3 It is an individual assignment. (33 marks) Bond: 1. T bills. The 91-day T bill has a yield of 0%.

financial institutions, (5) the efficiency of the insurance industry, and (6) the determinants of financial institution efficiency. For each category, we briefly

BSA/AML, fraud, OFAC, and institution-specific factors, such as business lines and subsidiaries and how all of these factors interrelate. This quick reference guide provides a brief, summarized version of the requirements and can help you perform a financial institution risk assessment. When your examiner asks where your FI stands with risk, this

The concept of Financial Institutions -. Financial institutions are organizations that deal with a transaction of financial claims and financial assets. It is an establishment that conducts financial transactions such as investments, loans, and deposits. They issue financial claims against themselves for cash and use the proceeds from this ...

Financial institutions and investment Management Assignment 01 Course Instructor: Teshome Dula (MBA,MSc,PhD) Name :- SEYIFU ABDULMEJID ID:-MBAO/7657/15A Assignment title: Pre-condition for the establishment of Security Exchange; Readiness and Existing gap of Ethiopia 1. Make Survey on how to establish Security exchange and Design a

We will examine a myriad of financial markets, the instruments that trade on them, and the financial and governmental institutions that use or support these markets. In particular, we will cover interest rates, equity markets, the money, capital and mortgage markets, the foreign exchange market, the Federal Reserve, and some derivative markets.

Banking and Financial Institutions Assignment - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Banking and Financial Institutions Assignment

Financial Institutions Assignment 1 solutions. Which sector is the lender of money? Which sector is the borrower of money? The lender of money is households. The borrower of money includes governments, corporates, and non-residents. Brief discuss what caused the financial crisis. (2 marks) The reasons for financial crisis is that

Mon 13 May, 2024 - 9:10 AM ET. Fitch Ratings - London - 13 May 2024: Fitch Ratings has assigned Encore Capital Group, Inc.'s (BB+/Stable) proposed issue of USD400 million senior secured fixed rate notes due 2030 an expected rating of 'BB+ (EXP)'. The assignment of a final rating is contingent on the receipt of final documents conforming to ...

A bank is a financial institution that is licensed to accept checking and savings deposits and make loans. These institutions may also give economic assistance such as: capital management, foreign exchange, utility payment, agency service and Safe deposit boxes are commonly known as locker services.