Consulting Firm Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Consulting Firm Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Start Your Consulting Firm Plan Here

Consulting Business Plan

If you need a business plan for your consulting business, you’ve come to the right place. Our consulting business plan template below has been used by countless entrepreneurs and business owners to create business plans to start or grow their consulting businesses.

Important note: If you are looking for a business plan consultant , specifically, a consultant to help you write your business plan, we recommend Growthink who offers a business plan consultation service here.

Sample Consultant Business Plan & Template

Below are links to each section of your consulting business plan template:

- Executive Summary

- Company Overview

- Industry Analysis

- Customer Analysis

- Competitive Analysis

- Marketing Plan

- Operations Plan

- Management Team

- Financial Plan

Next Section: Executive Summary >

Consulting Business Plan FAQs

What is a consulting business plan.

A consulting business plan is a plan to start and/or grow your consulting firm. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan, and details your financial projections.

You can easily complete your consulting firm business plan using our Consulting Firm Business Plan Template here .

What Are the Main Types of Consulting Firms?

There are many types of consulting firms. Most consultant companies are in business concentrations such as Management, Strategy, Operations, IT, Human Resources, Financial Advisory, and Marketing/Sales. There are also firms that are singularly focused such as those that offer business plan consulting.

What Are the Main Sources of Revenue and Expenses for a Consulting Business?

The primary source of revenue for consulting firms are fees paid by the client. The client will either sign a contract or agreement of the services it will choose and the pricing for those services beforehand.

The key expenses for a consulting business are the cost of leasing the office, employee cost, marketing/advertising costs, and any office technology or software.

How Do You Get Funding for Your Consulting Business?

Consulting businesses are most likely to receive funding from banks. Typically you will find a local bank and present your consulting business plan to them. Angel investors and other types of capital-raising such as crowdfunding are other common funding sources.

What are the Steps To Start a Consulting Business?

Starting a consulting business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Consulting Business Plan - The first step in starting a business is to create a detailed consulting business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your consulting business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your consulting business is in compliance with local laws.

3. Register Your Consulting Business - Once you have chosen a legal structure, the next step is to register your consulting business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your consulting business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Consulting Equipment & Supplies - In order to start your consulting business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your consulting business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful consulting business:

- How to Start a Consulting Business

Where Can I Get a Consulting Business Plan PDF?

You can download our free consulting business plan template PDF here . This is a sample consulting business plan template you can use in PDF format.

BUSINESS STRATEGIES

How to create a consultant business plan

- Nirit Braun

- Oct 30, 2023

- 12 min read

When launching your consulting business, one of the essential first steps is crafting a well-structured and detailed business plan. Your consulting business plan is like a strategic playbook that lays out your goals, tactics and financial projections. It not only steers you toward success but also equips you to adapt and thrive in the dynamic world of consulting.

Keep reading for tips on how to build a strong business plan for your business. Use the template provided at the end to get started on your own plan.

Looking to kick off your consultancy business? Create a business website today with Wix.

Why create a consultant business plan? Top benefits to consider

A business plan forces entrepreneurs to thoroughly evaluate their business idea, target audience and competitive landscape. This process clarifies their vision and mission, ensuring that they have a clear understanding of how their consultancy will provide value to clients. A business plan helps you in the following ways:

Create a business blueprint : With a business plan in place, entrepreneurs looking to start a business can make informed decisions based on a solid foundation of research and analysis. They can choose the most effective strategies for marketing, pricing and service delivery, enhancing their chances of success. Your business plan can also be used to explain what type of business you'll start - whether that's an LLC, Corporation or something else. Learn more about how to start an LLC .

Secure funding : The cost to start a consultancy business can range from around $60 to several thousand dollars . For those seeking external funding, a well-developed business plan demonstrates credibility and professionalism. Investors and lenders are more likely to support a venture with a thought-out plan that showcases its potential for growth and profitability.

Set measurable goals : A business plan sets measurable goals and performance metrics, which is vital with this type of business . This allows entrepreneurs to track their progress, adapt strategies as needed and celebrate milestones along the way.

Want to remind yourself of the basics? Learn more about how to start a service business .

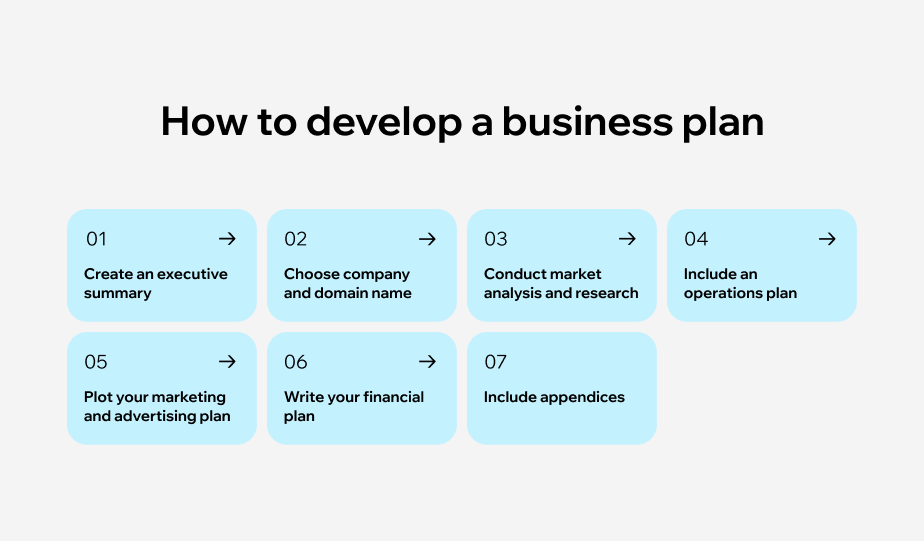

How to create a successful consultant business plan in 6 steps

In this section, we'll break down the key components involved in crafting a successful consultant business plan in six steps.

Executive summary

Business and domain names

Market analysis and research

Operations plan

Marketing and advertising plan

Financial plan

01. Executive summary

An executive summary serves as a concise overview of the consultant's business plan, providing a snapshot of the key components and the business' essence. It's usually the first section investors, lenders and stakeholders read, so it must encapsulate the business' value proposition, objectives, strategies and projected growth. To write a clear executive summary for a consultant business make sure to keep it succinct yet informative. Clearly state the purpose of the business, the services offered, the target market and the unique value proposition. Avoid technical jargon that may confuse readers.

Then you can mention the business' strengths, such as the expertise of the consultants, unique methodologies or specialized services. Emphasize factors that set your consultancy apart from competitors.

Briefly discuss the market need for your services and how your consultancy plans to fulfill it. It’s worth noting that strategy and management consulting, as well as technology consulting, financial consulting and HR consulting are in high demand . Highlight any trends or changes in the industry that your business can capitalize on.

Remember to include a snapshot of your financial projections, indicating expected revenue, costs and profitability. This provides a glimpse into the business' potential financial success.

Example of an executive summary for a consultant business

"XYZ Consulting is a boutique consultancy firm specializing in digital transformation for small and medium-sized enterprises (SMEs). With a team of seasoned professionals, we offer tailored solutions to help businesses harness the power of technology for growth. Our unique approach blends strategic consulting with hands-on implementation, ensuring tangible results. In a rapidly evolving tech landscape, XYZ Consulting is poised to be the partner SMEs need to thrive. Our financial projections forecast a steady growth trajectory, with a focus on achieving profitability within the first two years. With a proven track record and a finger on the pulse of industry trends, XYZ Consulting is well-equipped to guide businesses toward digital success."

02. Business and domain names

Knowing how to name a business is crucial for a consultancy venture and a key step before you register your business . It's the foundation of your brand and influences how clients perceive your services. With Wix , you can use a free business name generator or consulting company name generator as helpful tools for brainstorming unique and memorable names. Ensure the name reflects your expertise and the services you offer.

Similarly, the domain name for your business website is vital. It should be easy to remember, relevant to your services and ideally, match your company name. Check the domain's availability using domain registration platforms. Ensure the domain name aligns with your consultancy's focus and services. Generally, this means keeping it short and easy to spell and pronounce.

Learn more: How to make a consulting website

03. Market analysis and research

Incorporating a thorough market analysis within your consultant business plan is essential. Understand the competitive landscape, target audience and market trends. Research your competitors' strengths and weaknesses, pricing strategies and client base. This information will shape your business strategies and help you identify gaps in the market that your consultancy can fill.

04. Operations plan

The operations plan outlines the logistical aspects of your consultancy. It covers location, premises, equipment and staffing requirements. Determine whether your consultancy will be home-based, have a physical office or operate virtually. Define the equipment and software needed to deliver services effectively. Outline your staffing needs, including the roles and expertise required.

05. Marketing and advertising plan

Your marketing and advertising plan outlines how you will promote your consultant business. Identify the most effective strategies to reach your target audience. Consider content marketing, social media campaigns, networking events and speaking engagements to showcase your expertise. Emphasize how your marketing efforts will build brand awareness and attract clients.

You’ll need to develop a suite of brand assets to use in your marketing as well, starting with a company logo. You can use a free logo maker to get a professional logo in minutes.

06. Financial plan

The financial plan is a critical component of any business plan. It outlines how you will raise money for your business initially and provides a timeline for reaching profitability. Detail your startup costs, including equipment, marketing expenses and personnel. Present your revenue projections, taking into account different pricing models and growth scenarios. Highlight your break-even point and the strategies you'll employ to achieve profitability.

By addressing each part of their plan, entrepreneurs can create a robust business plan that guides them toward achieving their business goals and building a reputable consulting brand.

Consultant business plan examples

These templates illustrate two hypothetical consultant business plans, each tailored to a specific niche. These are just templates and should be adapted to your specific business goals and industry dynamics.

Consultant business plan template #1 : XYZ Digital Consultants

XYZ Digital Consultants is a pioneering consultancy firm focused on digital transformation for businesses seeking to thrive in the digital age. Our team of experienced professionals offers strategic guidance and hands-on implementation to drive growth through technology adoption. With projected profitability within two years and a commitment to excellence, XYZ Digital Consultants is poised to lead businesses into a successful digital future.

Company and domain name

Company name: XYZ Digital Consultants

Domain name: xyzdigitalconsultants.com

Market opportunity: The rapid shift toward digital operations has created a substantial demand for expert guidance. Our analysis reveals a gap in the market for holistic digital transformation solutions tailored to the needs of SMEs.

Competitor research: We've identified key competitors and their strengths, which informs our strategy to emphasize personalized service and comprehensive implementation.

Location: Primarily virtual, with occasional in-person consultations as needed.

Premises: Home-based setup with access to modern communication tools.

Equipment: High-speed internet, latest software tools and virtual meeting platforms.

Staffing: Founder and lead consultant, supported by contract specialists as projects demand.

Content marketing: Regular blog posts on digital transformation trends, case studies and client success stories.

Social media campaigns: Active presence on LinkedIn and X to engage with potential clients and share valuable insights.

Networking events: Participation in industry webinars, seminars and local business events to showcase expertise.

Speaking engagements: Leveraging speaking opportunities at conferences and workshops to establish authority in the field.

Startup costs (equipment, website development, marketing materials): $15,000

Revenue projections (year one): $150,000

Revenue projections (year two) : $300,000

Break-even point: Achieved by the end of year one

Funding: Initial investment and savings from the founder

Consultant business plan template #2 : LeadersEdge Consultants

LeadersEdge Consultants is a dynamic consultancy dedicated to leadership development and organizational excellence. Our experienced team offers customized programs that empower leaders to drive positive change. With a projected growth trajectory and a commitment to fostering impactful leadership, LeadersEdge Consultants is poised to transform organizations and elevate their success.

Company name: LeadersEdge Consultants

Domain name: leadersedgeconsultants.com

Market opportunity: Our analysis reveals a growing need for leadership development programs in diverse industries.

Competitor research: We've identified competitors' offerings and recognized an opportunity to provide a unique blend of coaching, training and strategy implementation.

Location: Virtual consultations, with the option for on-site workshops

Premises: Virtual office setup with video conferencing capabilities

Equipment: High-quality audiovisual tools, assessment software and learning platforms

Staffing : Founder will serve as the lead consultant, supported by certified leadership coaches

Customized workshops: Designing tailored leadership development programs for individual organizations.

Webinars: Hosting webinars on leadership best practices to showcase expertise and engage potential clients.

Thought leadership content: Publishing whitepapers, eBooks and video content on leadership topics.

Collaborations: Partnering with HR and talent development professionals to expand reach.

Startup costs ( making a website , training materials) : $10,000

Revenue projections (year one): $120,000

Revenue projections (year two): $250,000

Break-even point: Achieved within the first six months

Funding: Initial investment from the founder.

How much should you be charging as a consultant?

The amount you charge as a consultant will depend on a number of factors, including:

Your experience and expertise

The type of consulting services you offer

The value you provide to your clients

The market rate for consulting services in your field

In general, consultants charge between $100 and $500 per hour. However, some experienced and highly specialized consultants can charge upwards of $1,000 per hour.

To determine your consulting rate, you can use the following formula:

Consulting rate = Hourly rate * Value multiplier

Your hourly rate should reflect your experience and expertise, as well as the type of consulting services you offer. For example, if you have 10 years of experience and you offer specialized consulting services, you can charge a higher hourly rate than a consultant with less experience and who offers more general consulting services.

Your value multiplier should reflect the value you provide to your clients. For example, if you can help your clients to achieve significant results, you can charge a higher value multiplier.

Here is an example of how to use the formula:

Consultant: Experienced consultant with 10 years of experience offering specialized consulting services

Hourly rate: $200 per hour

Value multiplier: 2

Consulting rate: $200 per hour * 2 = $400 per hour

Can a consulting business be profitable?

Yes, a consulting business can be profitable. In fact, consulting is one of the most profitable industries in the world. According to a report by IBISWorld, the average profit margin for consulting businesses is 20%. This means that for every $100 in revenue, consulting businesses generate $20 in profit.

There are a number of factors that contribute to the profitability of consulting businesses. First, consultants are able to charge high fees for their services. Second, consulting businesses have relatively low overhead costs. Third, the demand for consulting services is high, and it's only expected to grow in the coming years.

Of course, not all consulting businesses are successful. Some consultants struggle to find clients or to charge high enough fees. Others may not be able to deliver the results that their clients expect. However, for consultants who are able to overcome these challenges, the potential rewards are great.

Here are some tips for increasing your chances of success as a consultant:

Specialize in a high-demand area of consulting. This will allow you to charge higher fees and attract more clients.

Build a strong reputation and network of clients. This will help you to generate word-of-mouth referrals and land new clients.

Market your services effectively. Make sure that potential clients know about your services and how you can help them.

Deliver high-quality results. This is the most important thing you can do to ensure that your clients are satisfied and that they continue to use your services in the future.

How much does it cost to start a consulting business?

The cost to start a consulting business can vary depending on a number of factors, such as the type of consulting services you offer, the size of your business and your location. However, in general, you can expect to spend between $10,000 and $50,000 to start a consulting business.

Here is a breakdown of some of the typical start-up costs for a consulting business:

Business formation: $100 to $1,000

Website and domain name: $100 to $2,500

Marketing and advertising: $500 to $5,000

Office equipment and supplies: $500 to $5,000

Professional liability insurance: $500 to $1,000

Other miscellaneous expenses: $500 to $5,000

Total start-up costs: $10,000 to $50,000

You can reduce your start-up costs by working from home, using free or low-cost marketing tools and purchasing used equipment. You can also start your consulting business part-time while you continue to work your full-time job. This will give you a chance to generate revenue and build a client base before you leave your full-time job.

If you need financial assistance to start your consulting business, you may be able to qualify for a loan from a bank or credit union. You may also be able to find investors who are willing to invest in your business.

Which clients to avoid and which to take on?

Here are some tips on which clients to avoid and which to take on in a consulting business:

Clients to avoid

Clients who aren't willing to pay your rates. If a client isn't willing to pay your rates, it's a sign that they don't value your services.

Clients who are unrealistic about their expectations. If a client has unrealistic expectations about what you can achieve, you're likely to set yourself up for failure.

Clients who are difficult to work with. If a client is demanding, rude or disrespectful, it's best to avoid them.

Clients who aren't a good fit for your business. If a client isn't in your target market or if their business isn't aligned with your values, it's best to decline working with them.

Clients to take on

Clients who are willing to pay your rates. This shows that they value your services and are committed to working with you.

Clients who have realistic expectations. This makes it more likely that you will be able to meet their needs and exceed their expectations.

Clients who are easy to work with. This will make the consulting process more enjoyable and productive for both of you.

Clients who are a good fit for your business. This means that they're in your target market and that their business is aligned with your values.

In addition to the above, here are some other factors to consider when deciding which clients to take on:

Your own skills and experience. Make sure that you have the skills and experience to help the client achieve their goals.

The client's budget. Make sure that the client has a budget that's sufficient to cover your fees.

The client's timeline. Make sure that you have the time and resources to meet the client's timeline.

Your gut feeling. If you have a bad feeling about a client, it's best to trust your gut and decline working with them.

It's important to be selective about the clients you take on. By avoiding difficult clients and focusing on good-fit clients, you can set yourself up for success in your consulting business.

Consultant business plan FAQ

What qualifies you as a consultant.

To qualify as a consultant, you need to have the expertise and experience in the area that you're consulting in. You also need to be able to communicate your ideas effectively and build relationships with clients.

How do you start off as a consultant?

How to make 6 figures as a consultant, how do you pay yourself as a consultant, do consultants pay their own taxes, want to create another business plan.

How to create a virtual assistant business plan

How to create a cleaning business plan

How to create a plumbing business plan

How to create a trucking business plan

How to create a daycare business plan

How to create a food truck business plan

How to create a restaurant business plan

How to create a clothing line business plan

How to create a real estate business plan

How to create a contractor business plan

How to create a bar business plan

How to create a coffee shop business plan

How to create a bakery business plan

Looking for other service business ideas ?

How to start an online business

How to start a consulting business

How to start a fitness business

How to start a fitness clothing line

How to start a makeup line

How to start a candle business

How to start a clothing business

How to start an online boutique

How to start a T-shirt business

How to start a jewelry business

How to start a subscription box business

How to start a beauty business

How to start a car wash business

How to start a baking business

How to start a food prep business

How to start a trucking business

How to start a construction business

How to start a landscaping business

How to start a food business

How to start a vending machine business

How to start a contractor business

How to start a coaching business

How to start an eCommerce business

How to start a dropshipping business

How to start a farming business

How to start a plumbing business

How to start a rental property business

How to start a cleaning business

Check out more service business examples .

Looking to start a business in a specific state?

How to start a business in Arizona

How to start a business in South Carolina

How to start a business in Virginia

How to start a business in Michigan

How to start a business in California

How to start a business in Florida

How to start a business in Texas

How to start a business in Wisconsin

Related Posts

How to create a website from scratch in 11 steps (for beginners)

How to start a business in 14 steps: a guide for 2024

Consulting business names for your firm

Was this article helpful?

Consulting Business Plan: 5-Step Plan For A Successful Firm

If you want to start a consulting business , then you need to write your consulting business plan.

I’ve watched countless starry-eyed entrepreneurs “start” their business with a 50-100 page business plan.

They spend weeks — or even months — toiling away at their desk after their 9-5 detailing everything about their future business.

After they’ve written it, they beam with pride.

“This plan is the key to my success in consulting! With this plan, I can’t fail.”

Then, they take their plan out to the real world.

The real world isn’t as perfect and pretty when starting your business.

And that golden business plan? Well, it almost always doesn’t work the way they’d hoped.

All of the projections they made? Naw, not even close.

So they scurry back to their desk to revise the plan — and the cycle continues.

Here’s the truth about consulting business plans…

You don’t need a long, complex business plan.

If your business plan is more than 5 pages, every extra page you write is almost certainly wasting your time.

All you need is a 1-3 page document to cover the foundations of your business.

By the end of this post, you’ll write your 5-part entrepreneurial consulting business plan — and have everything you need to start a successful consulting business.

Let’s begin with the first part: your consulting business model.

1. Consulting Business Model

- “What kind of consulting business do you want to build?”

That’s the first question you want to answer for your consulting business plan.

Understand what type of business you want to build first before you start building it.

Six-Figure Blueprint

That way, you’re building a business to support your lifestyle and not the other way around.

At Consulting Success®, we believe that your business shouldn’t consume your life .

Your consulting business should enrich your life and create a fulfilling lifestyle for you and your family.

For your consulting business model, you have 4 options:

1. Solo Model : The classic independent consultant . Your business is just you (and maybe a few contractors). From delivering projects to marketing and sales, you are responsible for every part of the business.

(To see the pros and cons of each model, see our post on The 3 PROVEN Consulting Business Models .)

2. Firm Model : The typical large consulting firm. Your firm consists of consultants, associations, junior and senior people. Your role starts off as doing a bit of everything — but eventually, your role becomes hiring, training, and managing your team.

3. Productized Model : This model comes out of one of the above models. You identify a particular problem your clients have, and you build your business around solving that problem with a focus on efficiency. This model is all about systems, efficiency, and scale.

4. Hybrid Model : The hybrid model is a mix of the models above. For example, you might offer a productized consulting offer — but also do some solo custom consulting. Once you’ve mastered one of these models, the hybrid model helps you add new products and services to create more revenue.

Pick one of the models above. If you’re unsure about which one to use, start with the solo model. You can always change it in the future. Chances are, your business will evolve in the future anyways.

With your consulting business model selected, let’s move to the next part of your consulting business plan — clarity around your ideal client.

For every hour you spend on planning, you should spend 4 hours on putting your plan into action.

2. Ideal Client Clarity

- “Who is the ideal client my consulting business will serve?”

That’s the second question you’ll answer with your consulting business plan.

This is all about how you’re going to specialize .

As an entrepreneurial consultant, specialization is crucial.

You can’t offer everything to anybody.

You’ll have to begin by choosing a specific type of client to serve — your niche.

A niche is a certain subset of people whom you might potentially serve — SaaS companies, manufacturing, pharmaceuticals, etc.

To find your ideal client, you’ll have to test out different niches.

This is why we teach the Niche Scoring Method in our Clarity Coaching Program .

Using this scorecard, you score each potential niche from 1 to 5 based on the following factors:

- EXPERIENCE . How would you rate your experience with this niche?

- EXPERTISE . How would you rate your status as an expert within this niche?

- RESULTS . How would you rate your confidence that you can deliver results for this niche?

- POTENTIAL . How would you rate this niche’s growth and how willing they are to hire consultants?

- INTEREST . How would you rate your interest in this niche?

- ACCESS . How would you rate your ability to speak with ideal clients in this niche?

In the Clarity Coaching Program for Consultants , we also teach you about the different layers of specialization, how to find and validate your ideal client’s potential, how to do outreach to potential clients, and more.

By going through these exercises, you’ll figure out which niche is best for you to start with.

Picking a niche and defining your ideal client is the foundation on which you’ll build your business — and get clients.

You shouldn’t move on with your consulting business plan until you’ve defined your ideal client.

Once you’ve done that, you can move on to the next part: Magnetic Messaging.

3. Magnetic Messaging

- “What message will get my ideal client’s attention?”

That’s the third question you’ll answer on your consulting business plan.

You’ve picked your business model.

You’ve defined your ideal client.

Now, you’ll write a message designed to get your ideal client’s attention.

We’ve created a formula to make writing this message as simple as possible: Magnetic Messaging.

Here’s the formula:

I help [WHO] to [solve WHAT problem] so they can [see WHAT results]. My [WHY choose me]…

Let’s break each part of the formula down.

- WHO : Who you serve.

- WHAT (Problem): What problem you solve for them.

- WHAT (Result): What result you create for them.

- WHY : Why they should choose you.

Why does this message grab your ideal client’s attention?

- It speaks to who they are.

- It mentions what problem they have.

- It showcases what result they can get.

- It differentiates you from others who might provide a similar service.

When your message contains these 4 elements, it will draw interest from your ideal clients. They’ll want to learn more.

They’ll browse your marketing materials, read your articles, sign up for your email list, and reach out to you for conversations.

Effective messaging is the foundation of your marketing: what you communicate to the marketplace to get your ideal client’s attention.

You won’t write the perfect message on your first try.

But you do need to write a first draft — and actually put it to work in the marketplace.

Once you’ve written down your first magnetic message, it’s time to start planning your strategic offer.

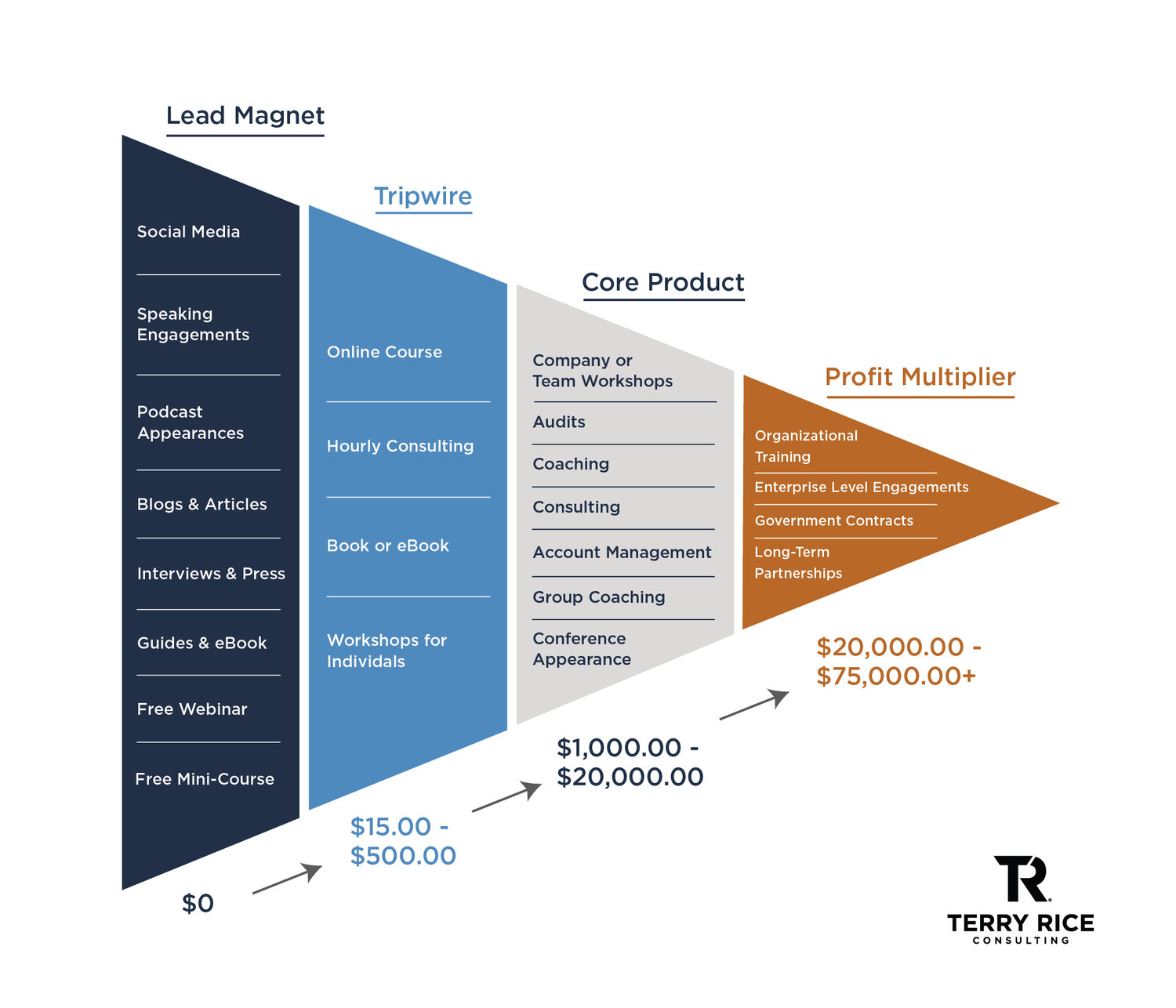

4. Strategic Offers

- “What can I offer my ideal client — and at what price point?”

That’s the 4th question you’ll answer on your consulting business plan.

With clarity around your ideal client and a message that grabs their attention…

…you must create an offer — a service — that solves their problems and gets them the result that they want.

The classic custom consulting service is the “full engagement.”

After you engage in a meaningful sales conversation with your prospective client, you’ll send them a consulting proposal .

In your proposal, instead of including one option, you’ll include three:

Option 1 – $

- Basic offer

- Minimum effort required

- Provides value

- Lowest investment

Option 2 – $$

- Help them reach results quicker than option 1

- Provides more value than option 1 (ideally, without having to spend more time)

- Higher investment

Option 3 – $$$

- If money isn’t an issue

- Best results

- Shortest time to result

- Highest investment

Map out the different options you’ll offer your prospects.

Take a look at the marketing consulting example below for an idea of how the 3 different options might look:

However, we recommend you start with a discovery offer .

A discovery offer is a smaller service (priced at $1.5K to $15K). You design it to get your client a quick, low-risk win.

Your discovery offer helps get your “foot in the door” with the client. Once you get them that quick, low-risk win, they’ll trust your expertise. This will open the door for larger projects with the same client.

Discovery offers are easier to sell, create, and deliver.

Here’s our discovery offer checklist:

- Align with what the buyer wants

- Is a logical first step

- Leads to the next steps

- Ranges between $1.5K to $15K

- Provides tangible benefits (growth, clarity, etc)

Of course, you’ll also have to set your consulting fees .

You can use the hourly method, the fixed-rate method, the value-based method , or the retainer method.

Pricing is an incredibly complex and deep topic. But you’ll have to pick a price to start with and adjust it based on the feedback you get.

Never sell yourself short. Remember: pricing is marketing. If you can deliver your clients results, then charge what you’d feel good about.

Once you’ve mapped out your 3 engagement options and a discovery offer, you’re ready to take your offers to the marketplace — and start winning consulting business.

5. Marketing Engine/Sales Pipeline

- “How am I going to create conversations with my ideal client?”

This is the final question you’ll answer on your consulting business plan.

And it’s where you start to see real results: winning clients, delivering projects, and earning revenue.

However, according to our How To Become A Consultant Study , marketing and sales are where consultants struggle the most.

Your Marketing Engine is what you’re doing every day to get in front of your ideal clients.

Your Sales Pipeline organizes all of the leads who come into contact with you.

Let’s start with your pipeline.

Your pipeline is organized into 6 columns:

- LEAD . You’ve identified the prospective client and have begun reaching out to them to set-up a conversation.

- CONVERSATION . You’ve had a sales conversation with the prospective client.

- PROPOSAL . You’ve sent a proposal to the prospective client.

- WIN . The prospective client has accepted your proposal and you won the business.

- LOSS . The prospective client has declined your proposal and you lost the business.

- NURTURE . Most people you reach out to won’t be ready to buy or make a decision right away. In fact, even people who say ‘No’ to a proposal now, may buy from you later as long as you stay top of mind through your nurture process.

All of your prospective clients fit into one of these 6 categories.

Using a CRM to create and organize this pipeline will help you organize your marketing and sales efforts.

Marketing is what fills up your “lead” column.

Without marketing, you won’t have any leads. And without leads, you won’t have the chance to win new business.

We organize marketing for consultants in 3 different categories:

- Outreach: Reaching out to your ideal clients to initiate conversations.

- Follow-Ups: Following up with your ideal clients to initiative conversations.

- Authority Building : Creating content for your ideal clients that demonstrates your expertise and adds value — and helps create conversations.

A basic Marketing Engine will have you doing a mix of these different methods every day.

Every day, you want to be reaching out to new clients, following up with your leads, and creating content that demonstrates your expertise and adds value.

The type of marketing you focus on also depends on the stage of your business .

If you’re a newer consultant, you’ll rely more on outreach. You don’t have as much of an audience for authority content to work yet.

But if you’re a later-stage consultant, you’ll rely more on content. Your content and consulting website has a farther reach, and can generate leads at scale.

For your business plan, focus on setting up a pipeline that is easy to track, and creating the right marketing habits to fill up your leads column.

At this stage, your plan is done.

It’s time to start taking action.

Imperfect Action: Write Your Entrepreneurial Consultant Business Plan

By answering these 5 questions…

…you’ll write a consulting business plan that enables you to take action.

We’ve included dozens of articles, case studies , and guides on how to answer these 5 questions.

However, in consulting, execution is more important than your plan.

So, use our resources to help answer these 5 questions — and go build your consulting business.

Ready to Take Your Consulting Business to the Next Level?

Apply to join our Clarity Coaching Program , the place where dedicated consultants go to get a personalized plan, strategy, coaching and support to grow a successful consulting business.

If you’re committed and serious about growing your consulting business, then this customized coaching program is for you.

We’ll work hands on with you to develop a strategic plan and then dive deep and work through your ideal client clarity, strategic messaging, consulting offers, fees, and pricing, business model optimization, and help you to set up your marketing engine and lead generation system to consistently attract ideal clients.

Schedule a FREE growth session today to apply for our limited-capacity Clarity Coaching Program by clicking here .

Leave a Comment, Join the Conversation! Cancel reply

Your Email will be kept private and will not be shown publicly.

Privacy Overview

How to write a consulting business plan

If you want to work as a consultant, you'll need a plan. Here's how to create one just for you.

Consultants do things differently

If you’re a self-employed consultant your work isn't like other forms of business. Unlike retailers or manufacturers, you're not making and/or selling tangible products. And unlike service companies, you're not employing a team of people to provide solutions.

Remember you’re not not just selling your time. As a consultant, you will be paid for the skills, knowledge and abilities you've developed over your career.

We have some useful background reading about the benefits of becoming a consultant or contractor , which will help explain how such businesses work. But having decided to become a consultant, what's the next step?

Like all new small businesses, you'll need a plan. That plan will have to cover funding, growth, pay rates, expenses, marketing, equipment costs, training and qualifications. It will also have to cover your goals, and the strategy you'll use to reach them.

Consulting business plans are a little different to other business plans. Here's what you need to know to get your consulting career off the ground.

Who are you writing the plan for?

This is an important question to ask yourself before you start. For most conventional businesses the answer will be "For the bank and investors." That's because small businesses usually need startup funding to get off the ground.

But consultants setting up their own business might not need much funding – if any. It's still important to have a business plan though – not only to clarify the details in your own mind, but also to help you understand the potential risks and rewards.

A good business plan will combine elements of both finance and strategy, but the contents will vary depending on the target audience. We'll take a look at the options next.

A business plan for banks and investors

You may not need funding for capital equipment expenses or office rent. But you might need a loan to tide you over for the first few months, until you have a regular cash flow. The initial period for any new business can be a tough time – money worries will just make it tougher.

You may also decide that you want to make more of an impression by hiring office space, perhaps in a shared office environment. Or you might want funds to spend on marketing and advertising, particularly if you're offering consulting services in a competitive market.

For all of this, you'll need money. You could apply for a bank loan, look for grants, or try other forms of capital-raising such as crowdfunding. Whichever method you choose, any potential investors will want to see the important numbers. That means you'll need to cover the following points in your business plan:

- target market and sector analysis

- business objectives and USP (unique selling proposition)

- startup expenses and assets, including equipment

- overheads and fixed costs

- marketing strategy and budget

- funding requirements, loan collateral and cost of interest

- pay rates, revenue and cash flow projections

- sales forecasts in monthly intervals

- ongoing expenses

- growth projections and strategy

Some of this information will be difficult for you to estimate. It might be even harder for you to present clearly. Use your accounting software to help with figures and to produce professional tables and charts. Then, an accountant can help you include the right information in your plan.

A business plan for you

Of course, you might not need any funding. Perhaps you have enough savings to keep you going for a few months and clients already lined up. Or you may be starting your consulting career after an inheritance or unexpected windfall.

If money isn't an immediate concern, you can afford to be less formal when drafting your plan. That means making sensible predictions and setting goals for yourself, not just financial targets – though you should include those too.

This isn't an exercise in creative writing. The purpose of creating a plan is to help you concentrate on what you want to achieve. Some points to consider include:

Reasons for being a consultant

Why are you doing this? It's important to answer honestly. If the answer is “to make more money” or “because I'm good at what I do” then write that down. Write down all the reasons you can think of, then read them back. Do they sound convincing? Make sure you know your true motivation, as it will help you focus on your goals.

Consulting can mean you have an irregular income. Sometimes you might be busy, other times less so. It makes sense to keep some money in savings accounts, especially if you'll be paying tax at the end of the year instead of while you're earning.

Relationship risks

Think about the impact of consulting on your family or friends. Consultants often work irregular hours, sometimes from home, and they might be working at weekends. That can put a strain on relationships. Be realistic about this and set boundaries around when and where you will work.

Which clients to avoid and which to take on

You will already have an idea of the types of client you don't want to work for, because you know the industry you work in. For example, known late-payers can damage your cash flow so it's sensible to avoid them where possible. Look for clients who are reliable, as they’ll help make your business a success. Know that you can let go of clients who are more trouble than they're worth.

Training and certification

In many industries, especially IT, it's important to keep your skills up to date. But your clients are unlikely to pay for you to go on training courses – that's an expense you'll have to cover yourself. How will you stay up to date? Think about industry magazines, websites, forums, news feeds, conferences, courses, distance learning, peer groups and self-teaching strategies.

Personal goals

Perhaps you're planning to be a consultant for the rest of your working life. Maybe you want to do it for a couple of years and then move back in-house as an employee. Or you might want to start employing other consultants at some stage and build up an agency – maybe even sell it. It doesn't matter what your personal goals are, as long as you have some. Write them down and bear them in mind when making big decisions.

What to do with your profits

This is a good opportunity to think about how much money you want to make . Consider how much you will charge and what you will do with your commission. For example you may decide to use 50% to cover costs, pay yourself with 30% and put 20% back into your business.

Some of this information would be inappropriate to include in a financial business plan for banks or investors. But it can be very helpful in guiding you through the early part of your consulting career.

Five top tips for writing a good consulting business plan

Business plans can be difficult documents to write. If you've never done it before, thinking clearly and logically about your business strategy may not be easy. Here are some tips to help you succeed:

1. Write the first draft

Don't worry about grammar, structure or neatness. Just get the thoughts out of your head and onto the paper or screen. Some people find this easier to do in an informal setting, such as a library or café.

2. Do your research

Understand the market you're going to be working in. Get to know all the details, as it'll help you write a more effective consulting business plan.

3. Identify your USP

That's your unique selling proposition. Why should companies hire you and not one of your competitors? Think carefully about what you're particularly good at, then use that as a basis for marketing yourself.

4. Get feedback

Talk to your peers, friends, previous business associates and potential customers. Show them your plan and listen to their feedback.

5. Keep it simple

Don't write dozens of pages. You'll bore the investors and your plan will end up on a pile where nobody will ever look at it again – including you. Stick to the important points.

Update your business plan regularly

A business plan isn't a static document. It should change and evolve over time as your business grows. You will learn a great deal in your first few months working as a consultant, and that knowledge should be applied to your business plan. It's a good idea to review your plan every month.

You may find that some of what you initially wrote turns out to have been misguided, inaccurate or just plain wrong. That's normal. Nobody can predict every step a business will take. The important thing is to learn as you go along – and make use of that knowledge to improve your plan.

Plan for consulting success

A consulting business plan is written as much for you, the consultant, as for anyone else. The point of writing it is to concentrate on what's important. That clarity is what will help you succeed.

So don't look at a business plan as just another box to be ticked. It's a fundamental process when starting any business, particularly a consulting business where you will need initiative and drive to succeed.

Take the time to write a proper business plan, and keep it regularly updated as your business grows. You can use our free business plan template . You'll find it an invaluable guide to becoming a successful consultant.

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Download the business plan template

Fill in the form to get a free business plan template as an editable PDF. We’ll send a one-pager and a multi-pager to choose from.

Privacy notice .

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Included Safe and secure

- Included Cancel any time

- Included 24/7 online support

Or compare all plans

Consulting Firm Business Plan Guide

Starting your own business, or scaling up is intimidating. we’re here to break it down piece by piece so you can create your very own plan., in this free , you will learn:.

- Why Create a Consulting Firm Business Plan?

- The Key Components of a Business Plan

- How to Use a Business Model Canvas

- How to Bake Productization Into Your Business Plan

You’re in the right place if…

○ You have an idea for a consulting firm, and you’re ready to take the next step ○ You’ve started a business, and you need focus and direction

○ Your consulting company needs to bring in partners or funding

Starting a consulting business is no small task, so setting a clear action plan is essential. This comprehensive guide will give you a step-by-step breakdown of how to create a consulting business plan, why you need one, and how a business model canvas can help you along the way.

Try Thinkific for yourself!

Accomplish your course creation and student success goals faster with thinkific..

Download this guide and start building your online program!

It is on its way to your inbox

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

How to Write a Consulting Business Plan + Free Template

2. Company Overview

This section of a business plan helps the reader get a thorough understanding of your consulting firm.

The company overview offers a detailed description highlighting what type of consultancy you would run, its physical location, legal structure, mission objectives, history, and all such related information.

Begin by clearly stating the concept and niche of your consulting firm. Further, highlight whether you would be running a sole proprietorship or partnership, and if it’s the latter discuss the profit-sharing ratio.

Don’t forget to mention your business structure and whether or not will you run a Limited Liability Company (LLC).

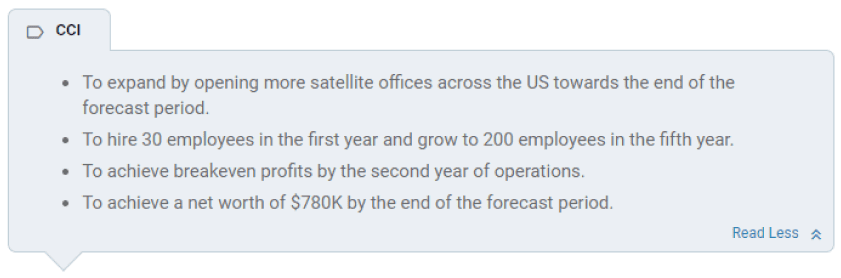

This section is your chance to introduce your business objectives, core value proposition, and mission objectives. Highlight any milestones you plan to achieve or have already achieved and make this section insightful.

Refer to this example describing the short-term objectives of a consulting firm from an Upmetrics plan.

3. Competitor and Market Analysis

An in-depth analysis of the consulting industry, market, and competitors is essential to build a successful consulting business. This is the most crucial part of your consultancy business plan helping you identify your target market, emerging trends, competitors, and your advantage over them.

Market analysis

The market analysis section of your consultant business plan will help you evaluate the market condition, target market, and business growth opportunities for your consultancy business.

Begin by researching and analyzing the consultancy market size and the serviceable obtainable market of your specific consultancy.

Further, determine your target audience by creating a buyer’s persona of your ideal customer. In this customer analysis section, determine their demographic and psychographic details to get a clear understanding of who your customer would be.

Refer to this buyer’s persona written using Upmetrics AI assistant:

Lastly, identify the emerging market trends within your industry, potential risks, and the shifts in consumer behavior likely to influence your business.

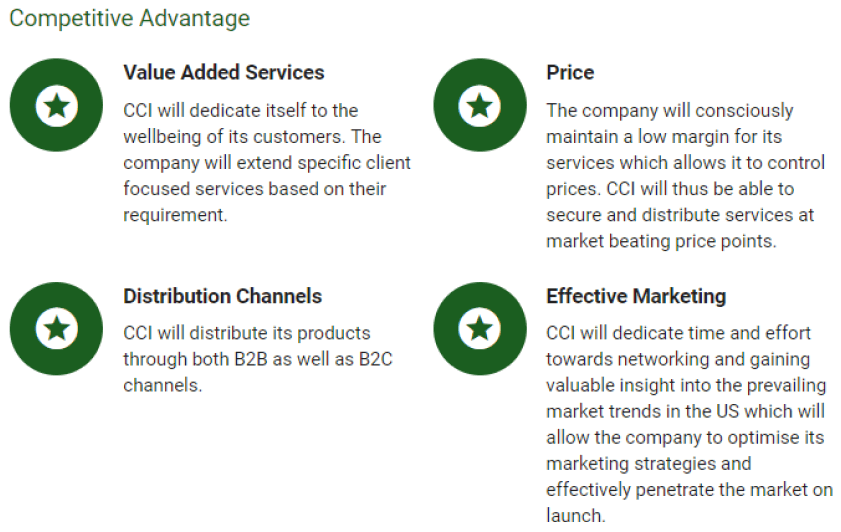

Competitors analysis

In the competitive analysis section of your plan, identify the consulting firms and other businesses that offer direct or indirect competition to your business.

Your direct competitors are other consultants in your local market, while your indirect competitors are in-house experts, software solutions, and an industry-specific business community extending resourceful help.

Conduct a SWOT analysis of your key competitors and analyze them based on their service offerings, target demographics, pricing, and other relevant factors.

Highlight your competitive advantage over these firms, suggesting that there are ample opportunities for you to succeed despite the competition.

Here’s an example of a competitive advantage for a consultancy business using Upmetrics.

4. Service Offerings

Consulting businesses offer a variety of consulting services. In this section of your consulting business plan, you will create a clear list of all the services you will be offering.

The list can include various business consulting services such as:

- Strategy consulting

- Operation consulting

- Human resources consulting

- IT Consulting

- Risk and compliance consulting

Now, elaborate on these services to help your readers understand what it truly entails. Refer to this example of legal and compliance services brief description:

As part of our risk and compliance service, the company will offer:

- Draft, negotiate, and conclude ‘Joint Venture Agreements’, and ‘Memoranda of cases for one of our key clients.

- Legal Advice & Consultation

- Case Litigation & Pleading

- Legal Translation

- Business Start-up Advice

- Management Consultancy

- Representation and Attorney Services

- Legal Compliance

Determine the pricing of these services and place it alongside your service list. Ideally, you should create differential and tiered pricing plans for your services to cater to different target audiences.

All in all, make this section an informative read for your readers helping them understand your unique business offerings.

5. Marketing Plan

A well-defined marketing plan is among the most important components of your consulting firm’s business plan. Well, It’s time to design your marketing strategies using your market research about the target customers and the potential clients.

Multifarious marketing efforts are essential to make your new business visibly famous in the market. Well, here are a few strategies that a successful consultant follows religiously:

Social media marketing

Choose different social media platforms to build your consultancy brand online. LinkedIn can be a good choice for a consultancy business followed by FaceBook and Instagram. Create your marketing plans for different platforms and be consistent with your posting there.

Informative website

Build an informative website for your consulting business and enhance its ranking on search engines by creating a dedicated content marketing program.

Email marketing

A well-defined email marketing program to attract new clients, newsletters for subscribed customers, and promotional services offer to convert a potential customer base.

Targeted advertising

Running a paid ads program to reach targeted small businesses and potential clients.

Refer to this example of marketing and promotion programs for your consultancy from Upmetrics.

In this section of your consulting business plan, also highlight your marketing budget and its allocation to different marketing activities.

6. Management Consulting Team

Introduce your managerial team in this section of your consultant business plan by showing how you have the right people to run a successful consultancy.

Begin by introducing the people at top managerial positions and offer a brief description depicting their skills, expertise, and experience in offering specific consulting services.

Refer to this example introducing the managing director of a consulting agency.

Mr. Ashton will serve as the Managing Director of CCI. A highly motivated and dynamic individual, Thomas boasts vast experience in the field of aesthetics having spent a career spanning 14 years essaying various white-collar roles for aesthetic companies across America. His ability to multi-task and expertly weave through operational pitfalls equips him with exceptional management and administrative skills. The US operations include sourcing, interacting, and building client relations across the industry value chain involving professional salons and end-user clientele. Mr. Ashton’s expert management and industry-specific skills will play an instrumental role in achieving the parent company’s goal of establishing a sustainable and reliable aesthetic brand in the US.

Don’t limit this section to the introduction of owners and managers. Instead, introduce every person who’s an asset to your business and can contribute significantly to your business goals.

In this section, you will also highlight the organizational design to offer a clear understanding of the hierarchy in your consulting firm. And lastly, don’t forget to add the salaries and wages of these people alongside their roles while creating your management plan.

7. Operational Plan

The operations plan shows that you don’t only have the means but also the knack to operate the consulting business efficiently.

This section of your business plan highlights the processes and procedures essential to run the everyday operations of your consulting business and the milestones you wish to achieve.

Confused what should you include in your operations plan? Let’s check this out:

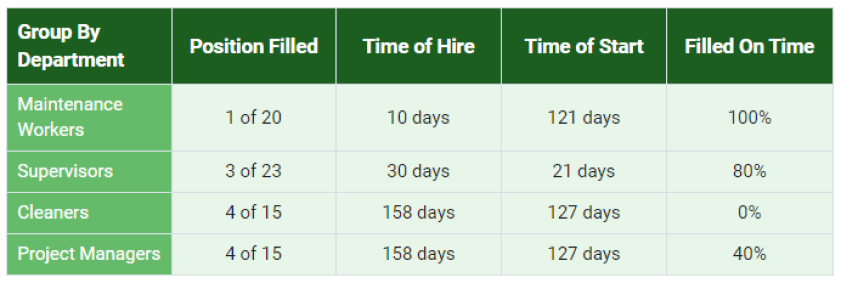

Hiring plan

Mention the number of project managers, analysts, BD, administrative, and support workers needed for your business. Briefly describe the qualifications, skill sets, and experience for these roles and lay your hiring plan to hire employees.

Refer to this example of a hiring plan for a consultancy by Upmetrics.

Operational processes

Briefly explain the different processes and procedures of your business in the consulting industry. This includes processes for client acquisition, service delivery, project management process, quality assessment, and client retention.

Tools and equipment

Mention all the equipment you will require to deliver quality consulting services to the clients. Also, include the pricing of these equipment and how you plan to source them from the market.

Overall, think of smaller nuances and make this section as brief and detailed as possible. Consider it as a guidebook that will answer all the operational queries that arise while running the business.

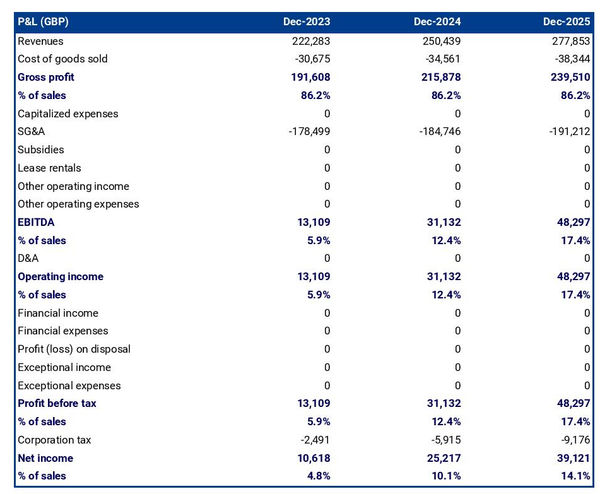

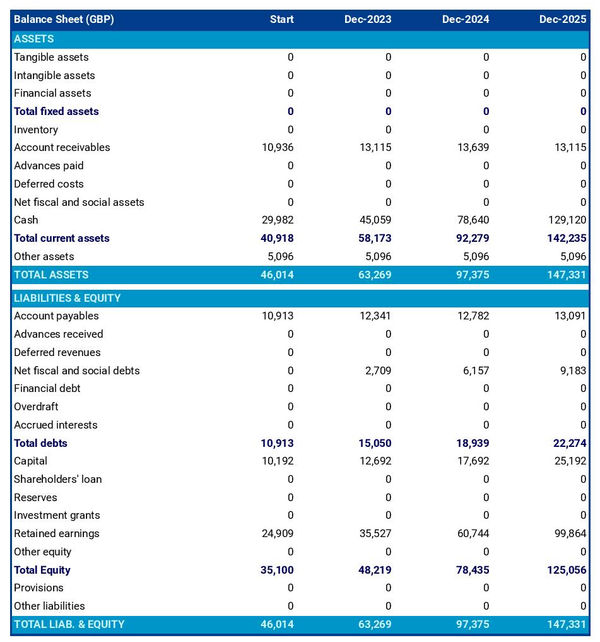

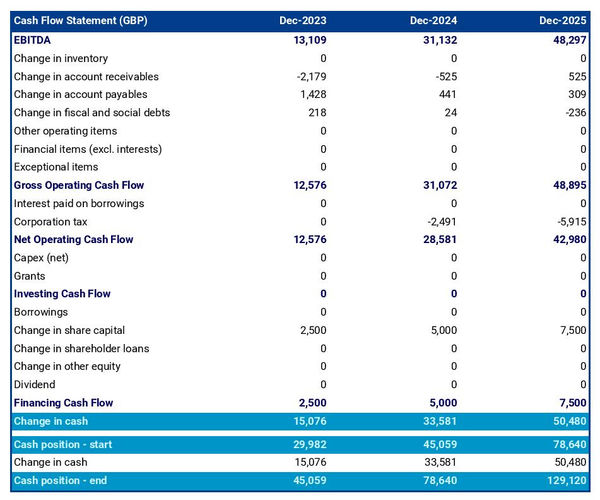

8. Financial Outlook

A comprehensive financial plan is the most crucial component of your business plan and sometimes it is the only section investors or readers might be interested in.

So work on putting together a well-detailed financial plan with realistic financial forecasts to increase the weight of your consulting plan.

The projections in a financial plan are important because they help the readers gauge the financial viability of your business idea. They offer a clear picture of the profitability, growth potential, and cash-generating capacity of your consulting business.

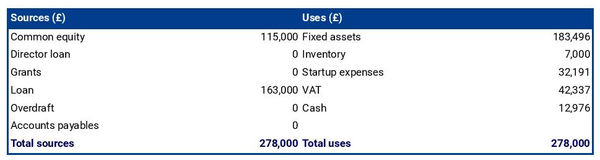

To create a befitting plan, begin by offering a detailed insight into your startup costs, revenue streams, profit margins, operational costs, and cash flow projections. Gather these projections to work on your key reports.

Refer to different business plans to see what more could you add to your financial section apart from these key essentials:

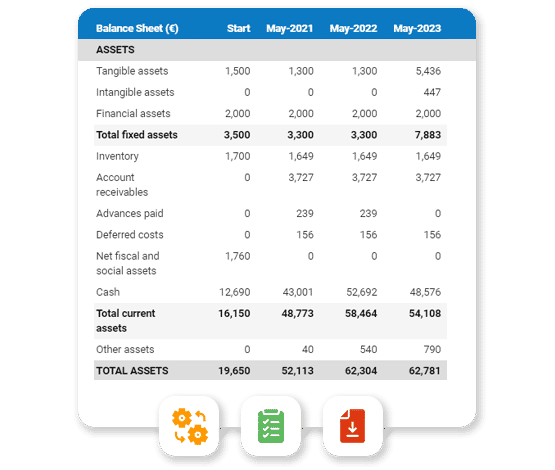

- Balance sheet

- Profit and loss statement/ Income statement

- Cash flow statement

- Break-even analysis

- Investment plan

While making a financial plan, ensure that you figure out the calculations for the next 3-5 years. And yes, we agree that calculating all these financial projections from scratch can get overwhelming. However, with this financial forecasting tool from Upmetrics , the entire task of creating a detailed plan will get much easier and more effective.

Simply enter the details in the tab and let the tool undertake all the manual calculations and create engaging visual reports to add to your plan.

Get Your Free Management Consulting Business Plan

Need help writing the contents of your management consulting business plan? Well, here you go. Download our management consulting business plan pdf and start writing.

Our intuitive and modern consulting business plan template offers a step-by-step guide with relevant examples to speed up your process of writing an effective business plan. It will get your actionable plan ready while ensuring that you add all the crucial details to it.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Start preparing your business plan with Upmetrics AI

And here we are. Now that you are aware of how to write an effective business plan using our consulting business plan template, you are one step closer to starting your business with a bang.

But that’s not it. What if we tell you that your business planning process can be made easier and more efficient with a few cutting-edge tools? Well, the Upmetrics business planning app is here at your service.

With an AI assistant to speed up your writing process, financial forecasting tools to help you with projections, and thousands of free educational guides to help you set up the business- we think you get it all with Upmetrics.

Get started now.

Related Posts

Bookkeeping Business Plan

Virtual Assistant Business Plan

How to Write Customer Analysis for Business Plan

Step-by-Step Guide to Writing a Business Plan

Frequently asked questions, what are the key components of a management consulting business plan.

While there are no fixed rules regarding what to include in your consulting business plan, you can ensure that you don’t miss adding these key components to your plan:

- Executive summary

- Company overview

- Market and competitor analysis

- Service offerings

- Management team

- Operations plan

- Financial plan

What financial projections should be included in the business plan?

While making your consulting business plan, ensure that you add the financial forecasts for startup costs, expenses, revenue, cash flow, sales, and expected profitability to your plan.

How often should I update my Management Consulting Business Plan?

Ideally, you should update your business plan at least once a year since you operate in a highly dynamic industry. However, if you feel that the yearly updates are insufficient, you can also review and update your plan every quarter.

How should I approach the funding section of my business plan?

Begin by calculating your startup costs and the actual monetary situation to evaluate the funding needs for your business. Thereafter check the potential funding sources and their application procedure to avail required funding.

As a consulting business, you can choose one of these funding sources:

- Private loan

- SBA approved loans

- Angel Investors

- Venture Capitalist firms

- Crowdfunding

Can the business plan help in securing funding or investments?

Absolutely it does. Investors, credit lenders, and banks will look after your business plan before accepting the funding request for your business. This is because a business plan offers a clear understanding of your business idea while simultaneously vouching for the financial feasibility of your plan.

What legal considerations should I include in my business plan?

Here are a few of the legal considerations you should make while writing your business plan:

- Business licenses and permits

- Health safety compliance

- Insurance coverage

- Legal business structure

- Employment laws

About the Author

Vinay Kevadiya

Vinay Kevadiya is the founder and CEO of Upmetrics, the #1 business planning software. His ultimate goal with Upmetrics is to revolutionize how entrepreneurs create, manage, and execute their business plans. He enjoys sharing his insights on business planning and other relevant topics through his articles and blog posts. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

How To Write A Consulting Business Plan

Creating a business plan is essential for any business, but it can be especially helpful for consultants who want to establish their credibility and get ahead in the industry.

A well-crafted business plan not only outlines your vision for the company but also provides a step-by-step process of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article will provide an overview of the key elements that every consultant should include in their business plan.

Download the Ultimate Consulting Business Plan Template

What is a Consulting Business Plan?

A consulting business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons why you will be profitable, how you can succeed in your market, what will set your product or service apart from others, and includes information about your team members, if applicable, to convince investors and lenders (if needed) that you have what it takes to make your venture successful.

Why Write a Consulting Business Plan?

A consulting business plan is required for banks and loan companies, and it is often requested by investors. This document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Consulting Business Plan

The following are the key components of a successful consulting business plan:

Executive Summary

The executive summary of a consulting business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your consulting firm

- Provide a short summary of the key points of each section of your business plan.

- Organize your thoughts in a logical sequence that is easy for the reader to follow.

- Include information about your company’s management team, industry analysis, competitive analysis, and financial forecast.

Company Description

This section should include a brief history of your company. Include a short description of how it all started, and provide a timeline of milestones the company has achieved.

If you are just starting your consulting business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your consulting firm, mention this.

Industry Analysis

The industry or market analysis is an important component of a consulting business plan. Conduct thorough market research to determine industry trends, identify your potential customers, and the potential size of this market.

Questions to answer include:

- What part of the consulting industry are you targeting?

- Who are your competitors?

- How big is the market?

- What trends are happening in the industry right now?

You should also include information about your research methodology and sources of information, including company reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or consulting services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what you are using as your unique selling proposition (USP) that will set you apart in this industry.

Complete a SWOT Analysis. Your SWOT analysis should include:

- Strengths : what are your strengths?

- Weaknesses : what are your weaknesses?

- Opportunities : how can you take advantage of competitive weaknesses and strike back at them with your strengths and possible new product or service offerings?

- Threats : what are the potential threats to your company? How can you prepare for them? What can you do to mitigate potential risks?

You will then use this information to develop your own competitive strategy. Determine your competitive advantage and how you will differentiate your business from these competitors.

Marketing Plan

Your consulting marketing plan is where you determine how you are going to reach your target customer(s). Your marketing strategy should be clearly laid out, including the following 4 Ps.

- Product/Service : Make sure your service offering is clearly defined and differentiated from your competitors, including the benefits of using your service.

- Price : How do you determine the price for your service? You should also include a price strategy that takes into account what customers will be willing to pay and how much the competition within your market charges.

- Place : Where will your customers find you? What channels of distribution will you use to reach them?

- Promotion : How will you reach your target market? You can use social media or write a blog, create an email marketing campaign, post flyers, pay for advertising, launch a direct mail campaign, etc.

You should also include information about your paid advertising budget, including an estimate of expenses and sales projections.

Operations Plan

The operations plan should include the following information:

- How will you deliver your service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Management Team

Include a list of team members including names and titles, as well as their expertise and experience relevant to your specific consulting industry. Include brief biography sketches for each team member.

Financial Plan

Now include a complete and detailed financial plan. This is where you will need to break down your expenses and revenue projections for the first 5 years of operation. This includes the following financial statements:

Income Statement

Your income statement should include:

- Revenue : how will you generate revenue?

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the service offering.

- Net Income (or loss) : once expenses and revenue are totaled and deducted from each other, what is the net income or loss?

Sample Income Statement for a Startup Consulting Firm

Balance sheet.

Include a balance sheet that shows what you have in terms of assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Consulting Firm

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Income : all of the revenue coming in from clients.

- Expenses : all of your monthly bills and expenses. Include operating, marketing and capital expenditures.

- Net Cash Flow : the difference between income and expenses for each month after they are totaled and deducted from each other. This number is the net cash flow for each month.

Using your total income and expenses, you can project an annual cash flow statement. Below is a sample of a projected cash flow statement for a startup consulting business.

Sample Cash Flow Statement for a Startup Consulting Firm

You will also want to include an appendix section which may include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- A list of your hard assets and equipment with purchase dates, prices paid and any other relevant information

- A list of your soft assets with purchase dates, prices paid and any other relevant information

- Biographies of the key employees listed in the executive summary section above.

- References to people you have done business with who are willing to confirm their positive business holdings with your company.