Please upgrade your browser

E*TRADE uses features that may not be supported by your current browser and might not work as intended. For the best user experience, please use an updated browser .

Understanding assignment risk in Level 3 and 4 options strategies

E*TRADE from Morgan Stanley

With all options strategies that contain a short option position, an investor or trader needs to keep in mind the consequences of having that option assigned , either at expiration or early (i.e., prior to expiration). Remember that, in principle, with American-style options a short position can be assigned to you at any time. On this page, we’ll run through the results and possible responses for various scenarios where a trader may be left with a short position following an assignment.

Before we look at specifics, here’s an important note about risk related to out-of-the-money options: Normally, you would not receive an assignment on an option that expires out of the money. However, even if a short position appears to be out of the money, it might still be assigned to you if the stock were to move against you just prior to expiration or in extended aftermarket or weekend trading hours. The only way to eliminate this risk is to buy-to-close the short option.

- Short (naked) calls

Credit call spreads

Credit put spreads, debit call spreads, debit put spreads.

- When all legs are in-the-money or all are out-of-the-money at expiration

Another important note : In any case where you close out an options position, the standard contract fee (commission) will be charged unless the trade qualifies for the E*TRADE Dime Buyback Program . There is no contract fee or commission when an option is assigned to you.

Short (naked) call

If you experience an early assignment.

An early assignment is most likely to happen if the call option is deep in the money and the stock’s ex-dividend date is close to the option expiration date.

If your account does not hold the shares needed to cover the obligation, an early assignment would create a short stock position in your account. This may incur borrowing fees and make you responsible for any dividend payments.

Also note that if you hold a short call on a stock that has a dividend payment coming in the near future, you may be responsible for paying the dividend even if you close the position before it expires.

An early assignment generally happens when the put option is deep in the money and the underlying stock does not have an ex-dividend date between the current time and the expiration of the option.

Short call + long call

(The same principles apply to both two-leg and four-leg strategies)

This would leave your account short the shares you’ve been assigned, but the risk of the position would not change . The long call still functions to cover the short share position. Typically, you would buy shares to cover the short and simultaneously sell the long leg of the spread.

Pay attention to short in-the-money call legs on the day prior to the stock’s ex-dividend date, because an assignment that evening would put you in a short stock position where you are responsible for paying the dividend. If there’s a risk of early assignment, consider closing the spread.

Short put + long put

Early assignment would leave your account long the shares you’ve been assigned. If your account does not have enough buying power to purchase the shares when they are assigned, this may create a Fed call in your account.

However, the long put still functions to cover the position because it gives you the right to sell shares at the long put strike price. Typically, you would sell the shares in the market and close out the long put simultaneously.

Here's a call example

- Let’s say that you’re short a 100 call and long a 110 call on XYZ stock; both legs are in-the-money.

- You receive an assignment notification on your short 100 call, meaning you sell 100 shares of XYZ stock at 100. Now, you have $10,000 in short stock proceeds, your account is short 100 shares of stock, and you still hold the long 110 call.

- Exercise your long 110 call, which would cover the short stock position in your account.

- Or, buy 100 shares of XYZ stock (to cover your short stock position) and sell to close the long 110 call.

Here's a put example:

- Let’s say that you’re short a 105 put and long a 95 put on XYZ stock; the short leg is in-the-money.

- You receive an assignment notification on your short 105 put, meaning you buy 100 shares of XYZ stock at 105. Now, your account has been debited $10,500 for the stock purchase, you hold 100 shares of stock, and you still hold the long 95 put.

- The debit in your account may be subject to margin charges or even a Fed call, but your risk profile has not changed.

- You can sell to close 100 shares of stock and sell to close the long 95 put.

Long call + short call

Debit spreads have the same early assignment risk as credit spreads only if the short leg is in-the-money.

An early assignment would leave your account short the shares you’ve been assigned, but the risk of the position would not change . The long call still functions to cover the short share position. Typically, you would buy shares to cover the short share position and simultaneously sell the remaining long leg of the spread.

Long put + short put

An early assignment would leave your account long the shares you’ve been assigned. If your account does not have enough buying power to purchase the shares when they are assigned, this may create a Fed call in your account.

All spreads that have a short leg

(when all legs are in-the-money or all are out-of-the-money)

Pay attention to short in-the-money call legs on the day prior to the stock’s ex-dividend date because an assignment that evening would put you in a short stock position where you are responsible for paying the dividend. If there’s a risk of early assignment, consider closing the spread.

However, the long put still functions to cover the long stock position because it gives you the right to sell shares at the long put strike price. Typically, you would sell the shares in the market and close out the long put simultaneously.

What to read next...

How to buy call options, how to buy put options, potentially protect a stock position against a market drop, looking to expand your financial knowledge.

- Trading Strategies

- Options Trading Basics

Options Exercise, Assignment, and More: A Beginner’s Guide to Options Expiration

Learn about options exercise and options assignment before taking a position, not afterward. This guide can help you navigate the dynamics of options expiration.

Key Takeaways

- Learn the basics of options exercise and options assignment

- Understand the difference between in-the-money and out-of-the-money options

- The surest way to avoid exercise or assignment is to liquidate or roll a position ahead of expiration, but remember, assignment of a short option can happen at any time

So your trading account has gotten options approval and you recently made that first trade—say, a long call in XYZ with a strike price of $105. Then the option expires, and at the time, XYZ is trading at $105.30.

Wait. The stock’s above the strike. Is that in the money (ITM) or out of the money (OTM)? Do I need to do something? Do I have enough money in my account? Help!

Please, please, please: Don’t be that trader. The time to learn the mechanics of options expiration is before you make your first trade. Opening an account at TD Ameritrade entitles you to a host of free trading education, including an entire course on options trading. (And at the end of this article, you’ll find a short video covering the basics.)

Here’s a guide to help you navigate options exercise and assignment — along with a few other basics.

Memorize This Table (or Cut It Out and Paste It to Your Screen)

The buyer (“owner”) of an option has the right, but not the obligation, to exercise the option on or before expiration. A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security.

Conversely, when you sell an option, you may be assigned the underlying asset—at any time regardless of the ITM amount—if the option owner chooses to exercise. The option seller has no control over assignment and no certainty as to when it could happen.

An option will likely be exercised if it’s in the option owner’s best interest to do so, meaning if it’s advantageous from a price standpoint for the owner to take or to close a position in the underlying security at the strike price rather than at the prevailing price in the open market. After the close on expiration day, ITM options may be automatically exercised, whereas OTM options are not and typically expire worthless (often referred to as being “abandoned”). The table below spells it out.

This assumes a position is held all the way through expiration. Of course, you typically don’t need to do that. And in many cases, the usual strategy is to close out a position ahead of the expiration date. We’ll revisit the close-or-hold decision in the next section and look at ways to do that. But assuming you do carry the options position until the end, there are a few things you need to consider:

- Know your specs .Each standard equity options contract controls 100 shares of the underlying stock. That’s pretty straightforward. Non-standard options may have different deliverables. Non-standard options can represent a different number of shares , shares of stock of more than one company, or underlying shares and cash. Other products—such as equity index options or options on futures—have different contract specs .

- Offsetting positions will match and close .Suppose you’re long 300 shares of XYZ and short one ITM call that’s assigned. That call is deliverable into 100 shares, so you’ll be left with 200 shares of XYZ if the option is assigned.

Exercise and Assignment: It’s Not Just at Expiration!

Standard U.S. equity options are American-style options, meaning they can be exercised anytime before expiration. If you’re short an option that’s deep ITM, it’s possible you’ll get assigned early. ITM short call positions are particularly vulnerable if a company is about to issue a dividend. ( Learn more about options and dividend risk .)

- It’s automatic, for the most part . If an option is ITM by as little as $0.01 at expiration, it will automatically be exercised for the buyer and assigned to a seller. However, there’s something called a Do Not Exercise request that a long option holder can submit if they want to abandon an option. In such a case, it’s possible that a short ITM position might not be assigned. For more, see the note below on pin risk, or refer to this advanced options expiration article .

- You’d better have enough cash . If an XYZ option is exercised or assigned and you don’t have an offsetting position, you’ll essentially be exchanging an options position for a position in the underlying. A long call or a short put will result in a long position in XYZ; a short call or a long put will result in a short position in XYZ. For long stock positions, you need to have enough cash to cover the purchase or else you’ll be issued a margin call, which you must meet by adding funds to your account. But that timeline may be short, and the broker, at its discretion, has the right to liquidate positions in order to meet a margin call. If exercise or assignment involves taking a short stock position, you need a margin account and sufficient funds in the account to cover the margin requirement.

- Short equity positions are risky business . An uncovered short call or a long put, if assigned or exercised, will result in a short position. If you’re short a stock, you have potentially unlimited risk because there’s no limit to the price increase of a security. There’s also no guarantee the brokerage firm can continue to maintain that short position for an unlimited time period. So if you’re a newbie, it’s generally inadvisable to carry a position into expiration if there’s a chance you might end up with a short stock position.

A note on pin risk : It’s rare, but occasionally a stock settles right on a strike price at expiration. So if you were short the 105 calls and XYZ settled at exactly $105, there would be no automatic assignment, but depending on the actions taken by the option holder, you may or may not be assigned—and you may not be able to trade out of any unwanted positions until the next business day.

But it goes beyond the exact price issue. What if an option is ITM as of the market close, but news comes out after the close (but before the exercise decision deadline) that sends the stock up or down through the strike price? Remember: The holder of the option could submit a Do Not Exercise request.

This uncertainty and potential exposure is called pin risk, and the best way to avoid it is to close your position before expiration.

The Decision Tree: How to Approach Expiration

As expiration approaches, you have three choices. Depending on the circumstances—and your objectives and risk tolerance—any of these might be the best decision for you.

Are options the right choice for you?

While options trading involves unique risks and is definitely not suitable for everyone, if you believe options trading fits with your risk tolerance and overall investing strategy, TD Ameritrade can help you pursue your options trading strategies with powerful trading platforms, idea generation resources, and the support you need.

Learn more about the potential benefits and risks of trading options.

Let the chips fall where they may . Some positions may not require as much maintenance. An options position that’s deeply OTM will likely go away on its own, but occasionally an option that’s been left for dead springs back to life. If it’s a long option, that might feel like a windfall; if it’s a short option that could’ve been closed out for a penny or two, you might be kicking yourself for not doing so.

Conversely, you might have a covered call against long stock, and the strike price was your exit target. For example, if you bought XYZ at $100 and sold the 110-strike call against it, and XYZ rallies to $113, you might be content with the $10 profit (plus the premium you took in when you sold the call, but minus any transaction costs). In that case, you can let assignment happen.

Close it out . If you’ve met your objectives for a trade—for better or worse—it might be time to close it out. Otherwise, you might be exposed to risks that aren’t commensurate with any added return potential (like the short option that could’ve been closed out for next to nothing, then suddenly came back into play).

The close-it-out category also includes ITM options that could result in an unwanted position or the calling away of a stock you didn’t want to part with. And remember to watch the dividend calendar. If you’re short a call option near the ex-dividend date of a stock, the position might be a candidate for early exercise. If so, you may want to consider getting out of the position well in advance—perhaps a week or more. Keep in mind, there is no guarantee that there will be an active market for an options contract, so it is possible to end up stuck and unable to close an options position.

Roll it to something else . This is the third choice. Rolling is essentially two trades executed as a spread. One leg closes out the existing option; the other leg initiates a new position. For example, suppose you’re short a covered XYZ call at the July 105 strike, the stock is at $103, and the call’s about to expire. You could roll it to the August 105 strike. Or, if your strategy is to sell a call that’s $5 OTM, you might roll to the August 108 call. Keep in mind that rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return.

The Bottom Line on Options Expiration

You don’t enter an intersection and then check to see if it’s clear. You don’t jump out of an airplane and then test the rip cord. So do yourself a favor. Get comfortable with the mechanics of options expiration before you make your first trade. Your beating heart will thank you.

Start your email subscription

Recommended for you, related videos, more like this, related topics.

Call Us 800-454-9272

Quick Links

- About Ticker Tape

- About TD Ameritrade

- Tools & Platforms

- For Active Traders

- Retirement Planning

- Rollover IRA

- IRA Selection Tool

- Income Solutions

- Goal Planning

- Find a Branch

- Funding & Transfers

- Form Library

Do Not Sell or Share My Personal Information

Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Margin is not available in all account types. Margin trading privileges subject to TD Ameritrade review and approval. Carefully review the Margin Handbook and Margin Disclosure Document for more details. Please see our website or contact TD Ameritrade at 800-669-3900 for copies.

The risk of loss on an uncovered call options position is potentially unlimited since there is no limit to the price increase of the underlying security. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Naked options strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance.

Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades.

Please note that the examples above do not account for transaction costs or dividends. Options orders placed online at TD Ameritrade carry a $0.65 fee per contract. Orders placed by other means will have additional transaction costs.

Market volatility, volume, and system availability may delay account access and trade executions.

Past performance of a security or strategy does not guarantee future results or success.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD Ameritrade review and approval. Please read Characteristics and Risks of Standardized Options before investing in options.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

FINRA / SIPC , and a subsidiary of TD Ameritrade Holding Corporation. TD Ameritrade Holding Corporation is a wholly owned subsidiary of the Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2024 Charles Schwab & Co., Inc. Member SIPC . --> TD Ameritrade, Inc., member FINRA / SIPC , a subsidiary of The Charles Schwab Corporation. © 2024 Charles Schwab & Co. Inc. All rights reserved.

This link takes you outside the TD Ameritrade Web site.

Trade Options With Me

For Your Financial Freedom

What is Options Assignment & How to Avoid It

If you are learning about options, assignment might seem like a scary topic. In this article, you will learn why it really isn’t. I will break down the entire options assignment process step by step and show you when you might be assigned, how to minimize the risk of being assigned, and what to do if you are assigned.

Video Breakdown of Options Assignment

Check out the following video in which I explain everything you need to know about assignment:

What is Assignment?

To understand assignment, we must first remember what options allow you to do. So let’s start with a brief recap:

- A call option gives its buyer the right to buy 100 shares of the underlying at the strike price

- A put option gives its buyer the right to sell 100 shares of the underlying at the strike price

In other words, call options allow you to call away shares of the underlying from someone else, whereas a put option allows you to put shares in someone else’s account. Hence the name call and put option.

The assignment process is the selection of the other party of this transaction. So the person that has to buy from or sell to the option buyer that exercised their option.

Note that an option buyer has the right to exercise their option. It is not an obligation and therefore, a buyer of an option can never be assigned. Only option sellers can ever be get assigned since they agree to fulfill this obligation when they sell an option.

Let’s go through a specific example to clarify this:

- The underlying security is stock ABC and it is trading at $100.

- Peter decides to buy 1 put option with a strike price of 95 as a hedge for his long stock position in ABC

- Kate sells this exact same option at the same time.

Over the next few weeks, ABC’s price goes down to $90 and Peter decides to exercise his put option. This means that he uses his right to sell 100 shares of ABC for $95 per share. Now Kate is assigned these 100 shares of ABC which means she is obligated to buy them for $95 per share.

Peter now has 100 fewer shares of ABC in his portfolio, whereas Kate has 100 more.

This process is analog for a call option with the only difference being that Kate would be short 100 shares and Peter would have 100 additional shares of ABC in his portfolio.

Hopefully, this example clarifies what assignment is.

Who Can Be Assigned?

To answer this question, we must first ask ourselves who exercises their option? To do this, let’s quickly look at the different ways that you can close a long option position:

- Sell the option: Selling an option is probably the easiest way to close a long option position. Doing this will have no effect on the option seller.

- Let the option expire: If the option is Out of The Money , it would expire worthless and there would be no consequence for the option seller. If, on the other hand, the option is In The Money by more than $0.01, it would typically be automatically exercised . This would start the options assignment process.

- Exercise the option early: The last possibility would be to exercise the option before its expiration date. This, however, can only be done if the option is an American-style option. This would, once again, lead to an option assignment.

So as an option seller, you only have to worry about the last two possibilities in which the buyer’s option is exercised.

But before you worry too much, here is a quick fact about the distribution of these 3 alternatives:

Less than 10% of all options are exercised.

This means 90% of all options are either sold prior to the expiration date or expire worthless. So always remember this statistic before breaking your head over the risk of being assigned.

It is very easy to avoid the first case of being assigned. To avoid it, just close your short option positions before they expire (ITM). For the second case, however, things aren’t as straight forward.

Who Risks being Assigned Early?

Firstly, you have to be trading American-style options. European-style options can only be exercised on their expiration date. But most equity options are American-style anyway. So unless you are trading index options or other kinds of European-style options, this will be the case for you.

Secondly, you need to be an options seller. Option buyers can’t be assigned.

These two are necessary conditions for you to be assigned. Everyone who fulfills both of these conditions risks getting assigned early. The size of this risk, however, varies depending on your position. Here are a few things that can dramatically increase your assignment risk:

- ITM: If your option is ITM, the chance of being assigned is much higher than if it isn’t. From the standpoint of an option buyer, it does not make sense to exercise an option that isn’t ITM because this would lead to a loss. Nevertheless, it is possible. The deeper ITM the option is, the higher the assignment risk becomes.

- Dividends : Besides that, selling options on securities with upcoming dividends also increases your risk of assignment. More specifically, if the extrinsic value of an ITM call option is less than the amount of the dividend, option buyers can achieve a profit by exercising their option before the ex-dividend date.

- Extrinsic Value: Otherwise, keep an eye on the extrinsic value of your option. If the option has extrinsic value left, it doesn’t make sense for the option buyer to exercise their option because they would achieve a higher profit if they just sold the option and then bought or sold shares of the underlying asset. Typically, the less time an option has left, the lower its extrinsic value becomes. Implied volatility is another factor that influences extrinsic value.

- Puts vs Calls: This is more of an interesting side note than actual advice, but put options tend to get exercised more often than call options. This makes sense since put options give their buyer the right to sell the underlying asset and can, therefore, be a very useful hedge for long stock positions.

How can you Minimize Assignment Risk?

Since you now know what assignment is, and who risks being assigned, let’s shift our focus on how to minimize the assignment risk. Even though it isn’t possible to completely remove the risk of being assigned, there are things that you can do to dramatically decrease the chances of being assigned.

The first thing would be to avoid selling options on securities with upcoming dividend payments. Before putting on a position, simply check if the underlying security has any upcoming dividend payments. If so, look for a different trade.

If you ever are in the position that you are short an option and the ex-dividend of the underlying security is right around the corner, compare the size of the dividend to the extrinsic value of your option. If the extrinsic value is less than the dividend amount, you really should consider closing the position. Otherwise, the chances of being assigned are high. This is especially bad since being short during a dividend payment of a security will force you to pay the dividend.

Besides avoiding dividends, you should also close your option positions early. The less time an option has left, the lower its extrinsic value becomes and the more it makes sense for option buyers to exercise their options. Therefore, it is good practice to close your (ITM) short option positions at least one week before the expiration date.

The deeper an option is ITM, the higher the chances of assignment become. So the just-mentioned rule is even more important for deep ITM options.

If you don’t want to indefinitely close your position, it is also possible to roll it out to a later expiration cycle. This will give you more time and add extrinsic value to your position.

FAQs about Assignment

Last but not least, I want to answer some frequently asked questions about options exercise and assignment.

1. What happens if your account does not have enough buying power to cover the assigned position?

This is a common worry for beginning options traders. But don’t worry, if you don’t have enough capital to cover the new position, you will receive a margin call and usually, your broker will just automatically close the assigned shares immediately. This might lead to a minor assignment fee, but otherwise, it won’t significantly affect your account. Tatsyworks, for example, charges an assignment fee of only $5.

Check out my review of tastyworks

2. How does assignment affect your P&L?

When an option is exercised, the option holder gains the difference between the strike price and the price of the underlying asset. If the option is ITM, this is exactly the intrinsic value of the option. This means that the option holder loses the extrinsic value when he exercises his/her option. That’s also why it doesn’t make sense to exercise options with a lot of extrinsic value left.

This means that as soon as the option is exercised, it is only the intrinsic value that is relevant for the payoff. This is the same payoff as the option at its expiration date.

So as an options seller, your P&L isn’t negatively affected by an assignment. Either it stays the same or it becomes slightly better due to the extrinsic value being ignored.

As an example, if your option is ITM by $1, you will lose up to $100 per option or $1 per share that you are assigned. But this does not account for the extrinsic value that falls away with the exercise of the option. So this would be the same P&L as at expiration. Depending on how much premium you collected when selling the option, this might still be a profit or a minor loss.

With that being said, as soon as you are assigned, you will have some carrying risk. If you don’t or can’t close the position immediately, you will be exposed to the ongoing price fluctuations of that security. Sometimes, you might not be able to close the new position immediately because of trading halts, or because the market is closed.

If you weren’t planning on holding that security, it is a good idea to close the new position as soon as possible.

Option spreads such as vertical spreads, add protection to these price fluctuations since you can just exercise the long option to close the assigned share position at the strike price of the long option.

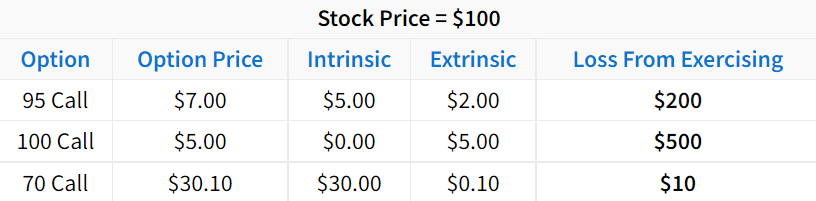

3. When an option holder exercises their option, how is the assignment partner chosen?

This is usually a random process. As soon as an option is exercised, the responsible brokerage firm sends a request to the Options Clearing Corporation (OCC). They send back the requested shares, whereafter they randomly choose another brokerage firm that currently has a client that is short the exercised option. Then the chosen broker has to decide which of their clients is assigned. This choice is, once again, random or a time-based priority system is used.

4. How does assignment work for index options?

As there aren’t any shares of indexes, you can’t directly be assigned any shares of the underlying asset. Therefore, index options are cash-settled. This means that instead of having to buy or sell shares of the underlying, you simply have to pay the difference between the strike price and the underlying trading price. This makes assignment easier and a lot less likely among index options.

Note that ETF options such as SPY options are not cash-settled. SPY is a normal security with openly traded shares, so exercise and assignment work just like they do among equity options.

I hope this article made you realize that assignment isn’t as bad as it might seem at first. It is just important to understand how the options assignment process works and what affects the likelihood of being assigned.

To recap, here’s what you should to do when you are assigned:

if you have enough capital in your account to cover the position, you could either treat the new position as a normal (stock) position and hold on to it or you could close it immediately. If you don’t have a clear trading plan for the new position, I recommend the latter.

If, on the other hand, you don’t have enough buying power, you will receive a margin call from your broker and the position should be closed automatically.

Assignment does not have any significant impact on your P&L, but it comes with some carrying risk. Options spreads can offer more protection against this than naked option positions.

To mitigate assignment risk, you should close option positions early, always keep an eye on the extrinsic value of your option positions, and avoid upcoming dividend securities.

And always remember, less than 10% of options are exercised, so assignment really doesn’t happen that often, especially not if you are actively trying to avoid it.

For the specifics of how assignment is handled, it is a good idea to contact your broker, as the procedures can vary from broker to broker.

Thank you for taking the time and reading this post. If you have any questions, comments, or feedback, please let me know in the comment section below.

22 Replies to “What is Options Assignment & How to Avoid It”

hi there well seems like finally there is one good honest place. seem like you are puting on the table the whole truth about bad positions. however my wuestion is when can one know where to put that line of limit. when do you recognise or understand that you are in a bad position? thanks and once again, a great site.

Well If you are trading a risk defined strategy the point would be at max loss and not too much time left until expiration. For undefined risk strategies however it can be very different. I would just say if you don’t have too much time until expiration and are far from making money you should use some common sense and admit that you are wrong.

What would happen in the event of a crash. Would brokers be assigning, options, cashing out these shares, and making others bankrupt. Well, I guessed I sort of answered my own question. Its not easy to understand, especially not knowing when this would come up. But seems like you hit the important aspects of the agreement.

Actually I wouldn’t imagine that too many people would want to exercise their options in case of a market ctash, because they probably wouldn’t want to hold stocks in this risky and volatile environment.

And to the part of the questions: making others bankrupt. This really depends on the situation. You can’t get assigned more stock than your option covers. This means as long as you trade with reasonable position sizing nothing too bad can happen. Otherwise I would recommend to trade with defined risk strategies so your maximum drawdown is capped.

Thanks for writing about assignment Louis. After reading the section how assignment works, I feel I am somewhat unclear about how assignment works when the exerciser exercises Put or Call option. In both cases, if the underlying is an index, is the settlement done through the margin account money? Would you be able to provide a little more detail of how exercising the option (Put vs Call) would work in case of an underlying stock vs Index.

Thank you very much in advance

Thanks for the question. Indexes can’t be traded in the same way as stocks can. That’s why index options are settled in cash. If your index option is assigned, you won’t have to buy or sell any shares of the underlying index at the strike price because there exist no shares of indexes. Instead, you have to pay the amount that your index option is ITM to the exerciser of your option. Let me give you an example: You are short a call option with the strike price of 1000. The underlying asset is an index and it’s price is 1050. This means your call option is 50 points ITM. If someone exercises your long call option, you will have to pay him/her the difference between the strike price and the underlying’s price which would be 50 (1050-1000). So the main difference between index and stock options is that you don’t have to buy/sell any shares of the underlying asset for index options. I hope this helps. Please let me know if you have any other questions or comments.

Can the same logic be applied for ETFs as it does Indexes? For example, if I trade the SPY ETF, would it be settled in cash?

Thanks! Johnson

Hi Johnson, Exercise and assignment for ETFs such as SPY work just like they do for equities. ETFs have shares that are openly traded, whereas indexes don’t. That’s why indexes are settled in cash, whereas ETFs aren’t. I hope this helps.

There are many articles online that I read that are biased against options tradings and I am a bit surprised to read a really helpful article like this. I find this helpful in understanding options trading, what are the techniques and how to manage the risks. Before, I was hesitant to try this financial game but now, after reading this article, I am considering participating with live accounts and no longer with a demo account. A few months ago, I signed up with a company called IQ Options, but really never involved real money and practiced only with a demo account.

Thanks for your comment. I am glad to see that you liked the post. However, I don’t recommend sing IQ Option to trade since they are a very shady trading firm. You could check out my Review of IQ Option for all the details.

this is a great and amazing article. i sincerely your effort creating time to write on such an informative article which has taught me a lot more on what is options assignment and avoiding it. i just started trading but had no ideas on this as a beginner. i find this article very helpful because it has given me more understanding on options trading and knowing the techniques and how to manage the risks. thanks for sharing this amazing article

You are very welcome

Hello, the first thing that i noticed when i opened this page is the beauty of the website. i am sure you have put much effort into creating this article and the details are really clear here. after watching the video break down, i fully understood the entire process on how to avoid options assignment.

Thank you so much for the positive feedback!

I would love to create a website like yours as the design used is really nice, simple and brings about clarity of the write ups, but then you wrote a brilliant article on how to avoid options assignment. great video here. it was confusing at first. i will suggest another video be added to help some people like me.

Thanks for the feedback. I recommend checking out my options trading beginner course . In it, I cover all the basics that weren’t explained here.

Thanks for your very helpful article. I am contemplating selling a call that would cover half my shares on company X. How can ensure that the assignment process selects the shares that I bought at a higher price, so as to maximize capital losses?

Hi Luis, When you are assigned, you just automatically buy/sell shares of the underlying at the strike price. This means your overall portfolio is adjusted by these 100 shares. The exact shares and your entry price are irrelevant. If you have 50 shares of X and your short call is assigned, you will sell 100 shares of X at the strike price. After this, your position would be -50 shares of X which would be equivalent to being short 50 shares of X. I hope this helps.

Louis, I entered a CALL butterfly spread at $100 below where I intended, just 2 days before expiration date. I intended to speculate on a big earning announcement jump the next day. It was a debit of 1.25. Also, when I realized my mistake, I tried to close it for anything at all. The Mark fluctuated between 40 and 70, but I could not get it to close. So now I am assigned to sell 200 share at 70 dollars below the market price of the stock. I am having a heart attack. I do not have the 200 shares to deliver, so it seems I have to buy them at the market, and sell them for $70 less, for a loss of $14,000.

What other options are open to me? Can my trading firm force a close with a friendly market maker and make it as if it happened on Friday? I am willing to pay a friendly market maker several hundred dollars to make this trade. Is that an option? Other options the trading firm can do for me that would cost me less than $14,000?

Hi Paul, Thanks for your comment. From the limited information provided, it is hard to say what is actually going on. If you bought a call butterfly spread, your max loss should be limited to the premium you paid to open the position. An assignment shouldn’t have a huge impact on your overall P&L. I highly recommend contacting your broker and explaining your situation to them since they have all the information required to evaluate what’s actually going on. But if the loss is real, there is no way for you to make a deal with a market maker to limit or undo potential losses. I hope this helps.

What happens with ITM long call option that typically gets automatically exercised at expiration, if the owner of the call option doesn’t have the cash/margin to cover the stock purchase?

He would receive a margin call

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Receive Emails with Educational Content

Privacy Overview

Want to Become a Better Trader Today?

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

The Risks of Options Assignment

Any trader holding a short option position should understand the risks of early assignment. An early assignment occurs when a trader is forced to buy or sell stock when the short option is exercised by the long option holder. Understanding how assignment works can help a trader take steps to reduce their potential losses.

Understanding the basics of assignment

An option gives the owner the right but not the obligation to buy or sell stock at a set price. An assignment forces the short options seller to take action. Here are the main actions that can result from an assignment notice:

- Short call assignment: The option seller must sell shares of the underlying stock at the strike price.

- Short put assignment: The option seller must buy shares of the underlying stock at the strike price.

For traders with long options positions, it's possible to choose to exercise the option, buying or selling according to the contract before it expires. With a long call exercise, shares of the underlying stock are bought at the strike price while a long put exercise results in selling shares of the underlying stock at the strike price.

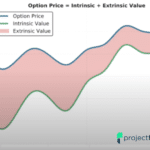

When a trader might get assigned

There are two components to the price of an option: intrinsic 1 and extrinsic 2 value. In the case of exercising an in-the-money 3 (ITM) long call, a trader would buy the stock at the strike price, which is lower than its prevailing price. In the case of a long put that isn't being used as a hedge for a long stock position, the trader shorts the stock for a price higher than its prevailing price. A trader only captures an ITM option's intrinsic value if they sell the stock (after exercising a long call) or buy the stock (after exercising a long put) immediately upon exercise.

Without taking these actions, a trader takes on the risks associated with holding a long or short stock position. The question of whether a short option might be assigned depends on if there's a perceived benefit to a trader exercising a long option that another trader has short. One way to attempt to gauge if an option could be potentially assigned is to consider the associated dividend. An options seller might be more likely to get assigned on a short call for an upcoming ex-dividend if its time value is less than the dividend. It's more likely to get assigned holding a short put if the time value has mostly decayed or if the put is deep ITM and close to expiration with a wide bid/ask spread on the stock.

It's possible to view this information on the Trade page of the thinkorswim ® trading platform. Review past dividends, the price of the short call, and the price of the put at the call's strike price. While past performance cannot be relied upon to continue, this information can help a trader determine whether assignment is more or less likely.

Reducing the risk associated with assignment

If a trader has a covered call that's ITM and it's assigned, the trader will deliver the long stock out of their account to cover the assignment.

A trader with a call vertical spread 4 where both options are ITM and the ex-dividend date is approaching may want to exercise the long option component before the ex-dividend date to have long stock to deliver against the potential assignment of the short call. The trader could also close the ITM call vertical spread before the ex-dividend date. It might be cheaper to pay the fees to close the trade.

Another scenario is a call vertical spread where the ITM option is short and the out-of-the-money (OTM) option is long. In this case, the trader may consider closing the position or rolling it to a further expiration before the ex-dividend date. This move can possibly help the trader avoid having short stock on the ex-dividend date and being liable for the dividend.

Depending on the situation, a trader long an ITM call might decide it's better to close the trade ahead of the ex-dividend date. On the ex-dividend date, the price of the stock drops by the amount of the dividend. The drop in the stock price offsets what a trader would've earned on the dividend and there would still be fees on top of the price of the put.

Assess the risk

When an option is converted to stock through exercise or assignment, the position's risk profile changes. This change could increase the margin requirements, or subject a trader to a margin call, 5 or both. This can happen at or before expiration during early assignment. The exercise of a long option position can be more likely to trigger a margin call since naked short option trades typically carry substantial margin requirements.

Even with early exercise, a trader can still be assigned on a short option any time prior to the option's expiration.

1 The intrinsic value of an options contract is determined based on whether it's in the money if it were to be exercised immediately. It is a measure of the strike price as compared to the underlying security's market price. For a call option, the strike price should be lower than the underlying's market price to have intrinsic value. For a put option the strike price should be higher than underlying's market price to have intrinsic value.

2 The extrinsic value of an options contract is determined by factors other than the price of the underlying security, such as the dividend rate of the underlying, time remaining on the contract, and the volatility of the underlying. Sometimes it's referred to as the time value or premium value.

3 Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

4 The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month.

5 A margin call is issued when the account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when buying power is exceeded. Margin calls may be met by depositing funds, selling stock, or depositing securities. A broker may forcibly liquidate all or part of the account without prior notice, regardless of intent to satisfy a margin call, in the interests of both parties.

Just getting started with options?

More from charles schwab.

Weekly Trader's Outlook

Today's Options Market Update

Options Strategy: The Covered Call

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled Characteristics and Risks of Standardized Options before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested.

Spread trading must be done in a margin account.

Multiple leg options strategies will involve multiple commissions.

Commissions, taxes and transaction costs are not included in this discussion, but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

- Trading Blog

- Remember me Not recommended on shared computers

Forgot your password?

Or sign in with one of these services

- All Content

- This Article

- This Category

- Advanced Search

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Get educated about the nuances and risks of options trading. Have access to resources and be a resource to other traders. Get quick responses from the SteadyOptions team.

Everything You Need to Know About Options Assignment Risk

By Pat Crawley

The fear of being assigned early on a short option position is enough to cripple many would-be options traders into sticking by their tried-and-true habit of simply buying puts or calls. After all, theoretically, the counterparty to your short options trade could exercise the option at any time, potentially triggering a Margin Call on your account if you’re undercapitalized.

But in this article, we're going to show you why early assignment is a vastly overblown fear, why it's not the end of the world, and what to do if it does occur.

What is Assignment in Options Trading?

Do you remember reading beginner options books or articles that said, "an option gives the buyer the right, but not the obligation, to buy/sell a stock at a specified price and date?" Well, it's accurate, but only for the buy side of the contract.

The seller of an option is actually obligated to buy or sell should the buyer choose to exercise their contract. So when options, assignment is when you, the lucky seller of an options contract, get chosen to make good on your obligation to buy or sell the underlying asset.

Let's say you sold a call option on a stock with a strike price of $50, which you held until expiration. At expiration, the stock trades at $55, meaning it's automatically exercised by the buyer. In this case, you are forced to sell the buyer 100 shares at $50 per share.

So when selling options, assignment is when you, the lucky seller of an options contract, get chosen to make good on your obligation to buy or sell the underlying asset.

What is Early Assignment in Options Trading?

Early assignment is when the buyer of an options contract that you're short decides to exercise the option before the expiration and begins the assignment process.

Many beginning traders count early assignments as one of their biggest trading fears. Many traders' fear of early assignment stems from their lack of understanding of the process. Still, it's typically not something to worry about, and we'll show you why in this article. But first, let's look at an example of how the process works.

For instance, say we collect $1 in premium to short a 30-day put option on XYZ with a strike price of $45 while the underlying is trading at $50. Fast forward, and it's the morning of expiration day. Options will expire at the close of trading in a few hours. The underlying stock is hovering around $44.85. Our plan pretty much worked as planned until, for some reason, the holder of the option exercises the option. We're confused and don't know what's going on.

It works exactly the same way as ordinary options settlement . You fulfill your end of the bargain. As the seller of a put option, you sold the right to sell XYZ at $45. The option buyer exercised that right and sold his shares to you at $45 per share.

And now, let's break down what happened in this transaction:

- You collected $1 in premium when opening the contract

- The buyer of the option exercises his right to sell at $45 per share.

- You’re now long 100 shares of XYZ that you paid $45 for, and you sell them at the market price of $44.80 per share, realizing a $0.20 per share loss.

- Your profit on the transaction is $0.80 because you pocketed $1 from the initial sale of the option but lost $0.20 from selling the 100 shares from assignment at a loss.

Why Early Assignment is Nothing to Fear

Many beginning traders count early assignments as one of their biggest trading fears; on some level, it makes sense. As the seller of an option, you're accepting the burden of a legitimate obligation to your counterparty in exchange for a premium. You're giving up control, and the early assignment shoe can, on paper, drop at any time.

Exercising Options Early Burns Money

People rarely exercise options early because it simply doesn't make financial sense. By exercising an option, you're only capturing the option's intrinsic value and entirely forfeiting the extrinsic value to the option seller. There's seldom a reason to do this.

Let's put ourselves in the buyer's shoes. For instance, we pay $5 for a 30-day call with a strike price of $100 while the underlying is trading at $102. The call has $2 in intrinsic value, meaning our call is in-the-money by $2, which would be our profit if the option expired today.

The other $3 of the option price is extrinsic value. This is the value of time, volatility, and convexity. By exercising early, the buyer of an option is burning that $3 of extrinsic value just to lock in the $2 profit.

A much better alternative would be to sell the option and go and buy 100 shares of the stock in the open market.

Viewed in this light, an option seller can’t be blamed for looking at early assignment as a good thing, as they get to lock in their premium as profit.

Your Risk Doesn’t Change

One of the biggest worries about early assignment is that being assigned will somehow open the trader up to additional risk. For instance, if you’re assigned on a short call position, you’ll end up holding a short position in the underlying stock.

However, let me prove that the maximum risk in your positions stays the same due to early assignment.

How Early Assignment Doesn’t Change Your Position’s Maximum Risk

Perhaps you collect $2.00 in premium for shorting an ABC $50/$55 bear call spread. In other words, we're short the $50 call for a credit of $2.50 and long the $55 call, paying a debit of $0.50.

Before considering early assignment, let's determine our maximum risk on this call spread. The maximum risk for a bear call spread is the difference between the strike minus the net credit you receive. In this case, the difference between the strikes is $5, and we collect a net credit of $2, making our maximum risk on the position $3 or $300.

You wake up one morning with the underlying trading at $58 to find that the counterparty of your short $50 call has exercised its option, giving them the right to buy the underlying stock at $50 per share.

You'd end up short due to being forced to sell the buyer shares at $50. So you're short 100 shares of ABC with a cost basis of $50 per share. On that position, your P&L is -$800, the P&L on a $55 long call is +$250, on account of you paying $0.50, and the call being $3.00 in-the-money. And finally, because the option holder exercised early, you get to keep the entire credit you collected to sell the $50 call, so you've collected +$250.

So your P&L is $300. You've reached your max loss. Let's get extreme here. Suppose the price of the underlying runs to $100. Here are the P&Ls for each leg of the trade:

- Short stock: -$5,000

- Long call: +$4,450

- Net credit received from exercised short option: +$250

- 5,000 - (4,450 + 250) = $300

While dealing with early assignments might be a hassle, it doesn’t open a trader up to additional risk they didn’t sign up for.

Margin Calls Usually Aren’t The End of the World

Getting a margin call due to early assignment isn't the end of the world. Believe it or not, stock brokerages have been around for a long time. They have seen early assignments many times before, and they have protocols for it.

Think about it intuitively, your broker allowed you to open the short option position knowing that the capital in your account could not cover an early assignment. Still, they let you make the trade anyways.

So what happens when you get an early assignment that you can’t cover? Your broker issues you a margin call. Once you’re in violation of their margin rules, they pretty much have carte blanche to handle the situation as they wish, including liquidating the assigned stock position at their will.

However, most brokers will give you some time to react to the situation and either decide to deposit more capital, liquidate the position on your own, or exercise offsetting options to fulfill the margin call in the case of an option spread.

Even though a margin call isn't fun, remember that the overall risk of your position doesn't change due to an early assignment, and it's typically not a momentous event to deal with. You probably just have to liquidate the trade.

When Early Assignment Might Occur?

Dividend Capture

One of the few times it might make sense for a trader to exercise an option early is when he's holding a call that is deep in-the-money, and there's an upcoming ex-dividend date.

Because deep ITM calls have very little extrinsic value (because their deltas are so high), any negligible extrinsic value is often outweighed by the value of an upcoming dividend payment , so it makes sense to exercise and collect the dividend.

Deep In-The-Money Options Near Expiration

While it's important to emphasize that the risk of early assignment is very low in most cases, the likelihood does rise when you're dealing with options with very little extrinsic value, like deep-in-the-money options. Although, even in those cases, the probabilities are pretty low.

However, an options trader that is trading to exploit market anomalies like the volatility risk premium, in which implied volatility tends to be overpriced, shouldn't even be trading deep-in-the-money options anyhow. Profitable option sellers tend to sell options with very little intrinsic value and tons of extrinsic value.

Bottom Line

Don't let the fear of early assignment discourage you from selling options. Far worse things when shorting options! While it's true that early assignment can occur, it's typically not a big deal. Related articles

- Can Options Assignment Cause Margin Call?

- Assignment Risks To Avoid

- The Right To Exercise An Option?

- Options Expiration: 6 Things To Know

- Early Exercise: Call Options

- Expiration Surprises To Avoid

- Assignment And Exercise: The Mental Block

- Should You Close Short Options On Expiration Friday?

- Fear Of Options Assignment

- Day Before Expiration Trading

- Accurate Expiration Counting

What Is SteadyOptions?

12 Years CAGR of 122.7%

Full Trading Plan

Complete Portfolio Approach

Diversified Options Strategies

Exclusive Community Forum

Steady And Consistent Gains

High Quality Education

Risk Management, Portfolio Size

Performance based on real fills

Non-directional Options Strategies

10-15 trade Ideas Per Month

Targets 5-7% Monthly Net Return

Visit our Education Center

Featured Articles

Useful resources, recent articles, spx options vs. spy options: which should i trade.

Trading options on the S&P 500 is a popular way to make money on the index. There are several ways traders use this index, but two of the most popular are to trade options on SPX or SPY. One key difference between the two is that SPX options are based on the index, while SPY options are based on an exchange-traded fund (ETF) that tracks the index.

By Mark Wolfinger, March 15

- Added by Mark Wolfinger

Yes, We Are Playing Not to Lose!

There are many trading quotes from different traders/investors, but this one is one of my favorites: “ In trading/investing it's not about how much you make, but how much you don't lose" - Bernard Baruch. At SteadyOptions, this has been one of our major goals in the last 12 years.

By Kim, March 11

- 1,115 views

- Added by Kim

The Impact of Implied Volatility (IV) on Popular Options Trades

You’ll often read that a given option trade is either vega positive (meaning that IV rising will help it and IV falling will hurt it) or vega negative (meaning IV falling will help and IV rising will hurt). However, in fact many popular options spreads can be either vega positive or vega negative depending where where the stock price is relative to the spread strikes.

By Yowster, March 7

- 1,138 views

- Added by Yowster

Please Follow Me Inside The Insiders

The greatest joy in investing in options is when you are right on direction. It’s really hard to beat any return that is based on a correct options bet on the direction of a stock, which is why we spend much of our time poring over charts, historical analysis, Elliot waves, RSI and what not.

By TrustyJules, March 5

- Added by TrustyJules

Trading Earnings With Ratio Spread

A 1x2 ratio spread with call options is created by selling one lower-strike call and buying two higher-strike calls. This strategy can be established for either a net credit or for a net debit, depending on the time to expiration, the percentage distance between the strike prices and the level of volatility.

By TrustyJules, February 22

- 1,668 views

- February 22

SteadyOptions 2023 - Year In Review

2023 marks our 12th year as a public trading service. We closed 192 winners out of 282 trades (68.1% winning ratio). Our model portfolio produced 112.2% compounded gain on the whole account based on 10% allocation per trade. We had only one losing month and one essentially breakeven in 2023.

By Kim, January 5

- 6,131 views

Call And Put Backspreads Options Strategies

A backspread is very bullish or very bearish strategy used to trade direction; ie a trader is betting that a stock will move quickly in one direction. Call Backspreads are used for trading up moves; put backspreads for down moves.

By Chris Young, October 14, 2023

- 9,703 views

- Added by Chris Young

- October 14, 2023

Long Put Option Strategy

A long put option strategy is the purchase of a put option in the expectation of the underlying stock falling. It is Delta negative, Vega positive and Theta negative strategy. A long put is a single-leg, risk-defined, bearish options strategy. Buying a put option is a levered alternative to selling shares of stock short.

By Chris Young, October 11, 2023

- 11,341 views

- October 11, 2023

Long Call Option Strategy

A long call option strategy is the purchase of a call option in the expectation of the underlying stock rising. It is Delta positive, Vega positive and Theta negative strategy. A long call is a single-leg, risk-defined, bullish options strategy. Buying a call option is a levered alternative to buying shares of stock.

By Chris Young, October 8, 2023

- 11,752 views

- October 8, 2023

What Is Delta Hedging?

Delta hedging is an investing strategy that combines the purchase or sale of an option as well as an offsetting transaction in the underlying asset to reduce the risk of a directional move in the price of the option. When a position is delta-neutral , it will not rise or fall in value when the value of the underlying asset stays within certain bounds.

By Kim, October 6, 2023

- 9,833 views

- October 6, 2023

We want to hear from you!

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Already have an account? Sign in here.

- Existing user? Sign In

- Education Center

- Members Reviews

- SteadyOptions Strategy

- Anchor Trades Strategy

- Simple Spreads Strategy

- Steady Collars Strategy

- SteadyVol Strategy

- SteadyYields Strategy

- Managed Accounts

- Performance

Mike Martin

Option exercise and assignment explained w/ visuals.

- Categories: Options Trading

Last updated on February 11th, 2022 , 06:38 am

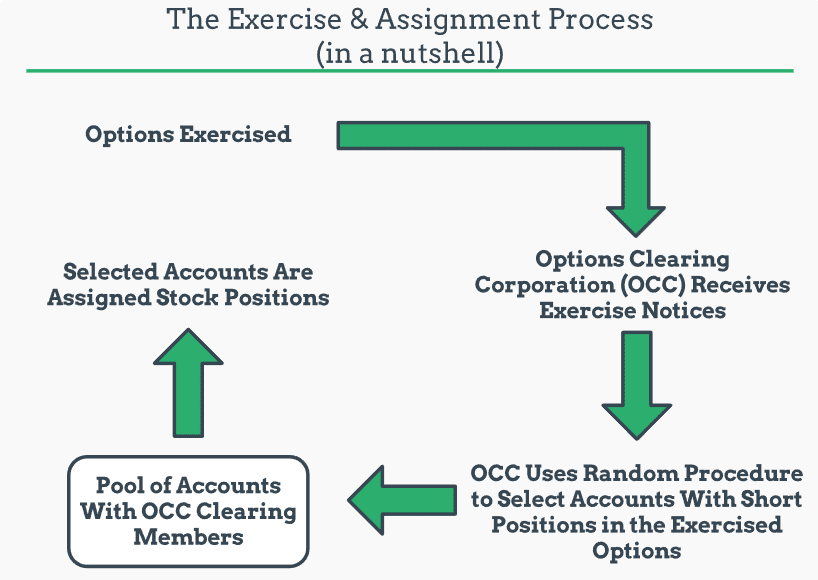

Buyers of options have the right to exercise their option at or before the option’s expiration. When an option is exercised, the option holder will buy (for exercised calls) or sell (for exercised puts) 100 shares of stock per contract at the option’s strike price.

Conversely, when an option is exercised, a trader who is short the option will be assigned 100 long (for short puts) or short (for short calls) shares per contract.

- Long American style options can exercise their contract at any time.

- Long calls transfer to +100 shares of stock

- Long puts transfer to -100 shares of stock

- Short calls are assigned -100 shares of stock.

- Short puts are assigned +100 shares of stock.

- Options are typically only exercised and thus assigned when extrinsic value is very low.

- Approximately only 7% of options are exercised.

The following sequences summarize exercise and assignment for calls and puts (assuming one option contract ):

Call Buyer Exercises Option ➜ Purchases 100 shares at the call’s strike price.

Call Seller Assigned ➜ Sells/shorts 100 shares at the call’s strike price.

Put Buyer Exercises Option ➜ Sells/shorts 100 shares at the put’s strike price.

Put Seller Assigned ➜ Purchases 100 shares at the put’s strike price.

Let’s look at some specific examples to drill down on this concept.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Exercise and Assignment Examples

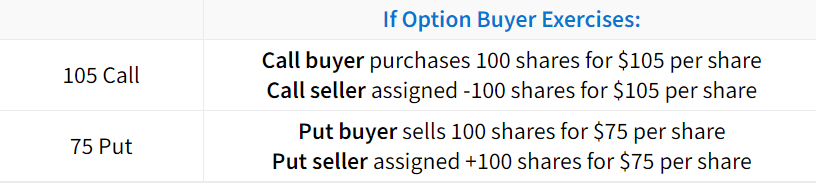

In the following table, we’ll examine how various options convert to stock positions for the option buyer and seller:

As you can see, exercise and assignment is pretty straightforward: when an option buyer exercises their option, they purchase (calls) or sell (puts) 100 shares of stock at the strike price . A trader who is short the assigned option is obligated to fulfill the opposite position as the option exerciser.

Automatic Exercise at Expiration

Another important thing to know about exercise and assignment is that standard in-the-money equity options are automatically exercised at expiration. So, traders may end up with stock positions by letting their options expire in-the-money.

An in-the-money option is defined as any option with at least $0.01 of intrinsic value at expiration . For example, a standard equity call option with a strike price of 100 would be automatically exercised into 100 shares of stock if the stock price is at $100.01 or higher at expiration.

What if You Don't Have Enough Available Capital?

Even if you don’t have enough capital in your account, you can still be assigned or automatically exercised into a stock position. For example, if you only have $10,000 in your account but you let one 500 call expire in-the-money, you’ll be long 100 shares of a $500 stock, which is a $50,000 position. Clearly, the $10,000 in your account isn’t enough to buy $50,000 worth of stock, even on 4:1 margin.

If you find yourself in a situation like this, your brokerage firm will come knocking almost instantaneously. In fact, your brokerage firm will close the position for you if you don’t close the position quickly enough.

Why Options are Rarely Exercised

At this point, you understand the basics of exercise and assignment. Now, let’s dive a little deeper and discuss what an option buyer forfeits when they exercise their option.

When an option is exercised, the option is converted into long or short shares of stock. However, it’s important to note that the option buyer will lose the extrinsic value of the option when they exercise the option. Because of this, options with lots of extrinsic value remaining are unlikely to be exercised. Conversely, options consisting of all intrinsic value and very little extrinsic value are more likely to be exercised.

The following table demonstrates the losses from exercising an option with various amounts of extrinsic value:

As we can see here, exercising options with lots of extrinsic value is not favorable.

Why? Consider the 95 call trading for $7. Exercising the call would result in an effective purchase price of $102 because shares are bought at $95, but $7 was paid for the right to buy shares at $95.

With an effective purchase price of $102 and the stock trading for $100, exercising the option results in a loss of $2 per share, or $200 on 100 shares.

Even if the 95 call was previously purchased for less than $7, exercising an option with $2 of extrinsic value will always result in a P/L that’s $200 lower (per contract) than the current P/L. F

or example, if the trader initially purchased the 95 call for $2, their P/L with the option at $7 would be $500 per contract. However, if the trader decided to exercise the 95 call with $2 of extrinsic value, their P/L would drop to +$300 because they just gave up $200 by exercising.

7% Of Options Are Exercised

Because of the fact that traders give up money by exercising an option with extrinsic value, most options are not exercised. In fact, according to the Options Clearing Corporation, only 7% of options were exercised in 2017 . Of course, this may not factor in all brokerage firms and customer accounts, but it still demonstrates a low exercise rate from a large sample size of trading accounts.

So, in almost all cases, it’s more beneficial to sell the long option and buy or sell shares instead of exercising. We like to call this approach a “synthetic exercise.”

Congrats! You’ve learned the basics of exercise and assignment. If you’d like to know how the exercise and assignment process actually works, continue to the next section!

Who Gets Assigned When an Option is Exercised?

With thousands of traders long and short options in the market, who actually gets assigned when one of the traders exercises their option?

In this section, we’ll run through the exercise and assignment process for options so you know how the assignment decision occurs.

If a trader is short a single option, how do they get assigned if one of a thousand other traders exercises that option?

The short answer is that the process is random. For example, if there are 5,000 traders who are long a call option and 5,000 traders who are short that call option, an account with the short option will be randomly assigned the exercise notice. The random process ensures that the option assignment system is fair

Visualizing Assignment and Exercise

The following visual describes the general process of exercise and assignment:

If you’d like, you can read the OCC’s detailed assignment procedure here (warning: it’s intense!).

Now you know how the assignment procedure works. In the final section, we’ll discuss how to quickly gauge the likelihood of early assignment on short options.

Assessing Early Option Assignment Risk

The final piece of understanding exercise and assignment is gauging the risk of early assignment on a short option.

As mentioned early, only 7% of options were exercised in 2017 (according to the OCC). So, being assigned on short options is rare, but it does happen. While a specific probability of getting assigned early can’t be determined, there are scenarios in which assignment is more or less likely.

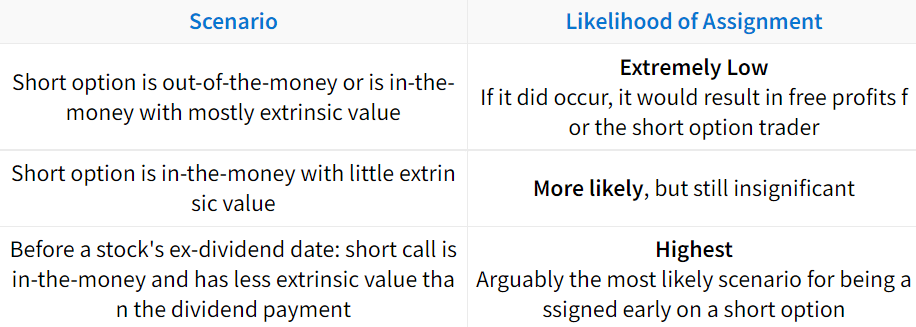

The following scenarios summarize broad generalizations of early assignment probabilities in various scenarios:

In regards to the dividend scenario, early assignment on in-the-money short calls with less extrinsic value than the dividend is more likely because the dividend payment covers the loss from the extrinsic value when exercising the option.

All in all, the risk of being assigned early on a short option is typically very low for the reasons discussed in this guide. However, it’s likely that you will be assigned on a short option at some point while trading options (unless you don’t sell options!), but at least now you’ll be prepared!

Next Lesson

Options Trading for Beginners

Intrinsic and Extrinsic Value in Options Trading Explained

Option Greeks Explained: Delta, Gamma, Theta & Vega

Projectfinance options tutorials.

➥ Bullish Strategies

➥ Bearish Strategies

➥ Neutral Strategies

➥ Vertical Spreads Guide

☆ Options Trading for Beginners ☆

➥ Basics of Calls and Puts

➥ What is a Strike Price?

➥ Option Expiration

➥ Intrinsic and Extrinsic Value

➥ Exercise and Assignment

➥ The Bid-Ask Spread

➥ Volume and Open Interest

➥ Option Chain Explained

➥ Option Greeks 101

➥ Delta Explained

➥ Gamma Explained

➥ Theta Explained

➥ Vega Explained

➥ Implied Volatility Basics

➥ What is the VIX Index?

➥ The Expected Move

➥ Trading VIX Options

➥ Trading VIX Futures

➥ The VIX Term Structure

➥ IV Rank vs. IV Percentile

➥ Option Order Types 101

➥ Stop-Loss Orders On Options Explained

➥ Stop Limit Order in Options: Examples W/ Visuals

➥ Limit Order in Option Trading Explained w/ Visuals

➥ Market Order in Options: Don’t Throw Away Money!

➥ TIF Orders Types Explained: DAY, GTC, GTD, EXT, GTC-EXT, MOC, LOC

Additional Resources

Exercise and Assignment – CME Group

Learn About Exercise and Assignment – CME Group

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.

Our Authors

Share this post

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Quick Links

Other links.

- Terms & Conditions

- Privacy Policy

© 2024 projectfinance, All Rights Reserved.

Disclaimer: Neither projectfinance or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered investment adviser, registered broker-dealer or FINRA|SIPC|NFA-member firm. projectfinance does not provide investment or financial advice or make investment recommendations. projectfinance is not in the business of transacting trades, nor does projectfinance agree to direct your brokerage accounts or give trading advice tailored to your particular situation. Nothing contained in our content constitutes a solicitation, recommendation, promotion, or endorsement of any particular security, other investment product, transaction or investment. Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past Performance is not necessarily indicative of future results.

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Project Finance(Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

Assignment in Options Trading

Introduction articles, what is an options assignment.

In options trading , an assignment occurs when an option is exercised.