- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

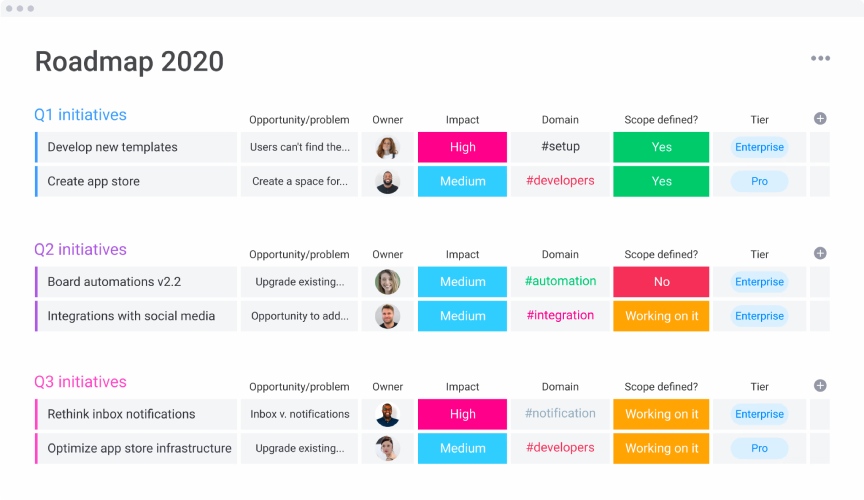

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

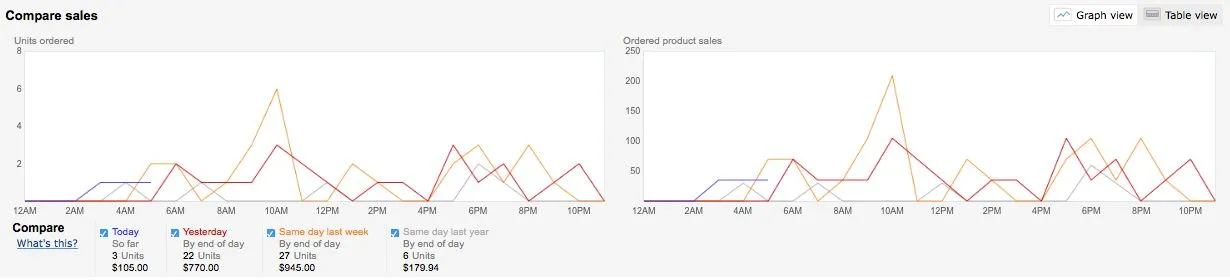

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

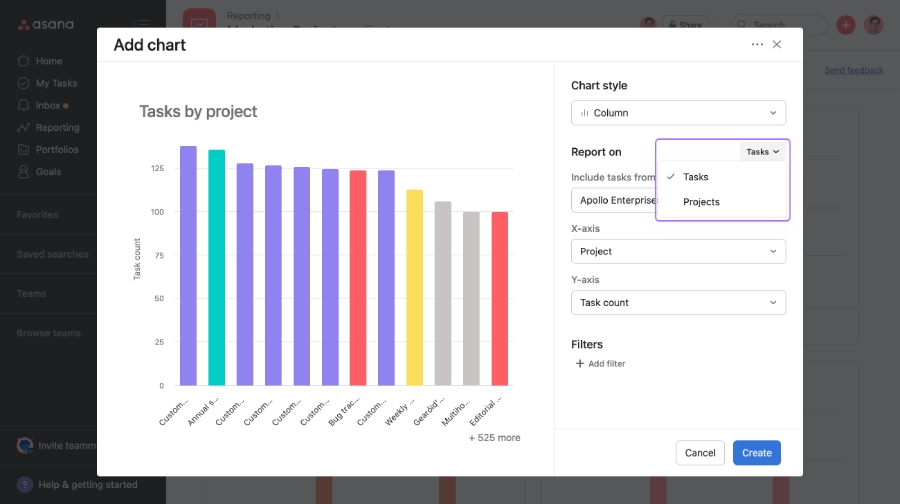

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

- Search Search Please fill out this field.

The Importance of Market Research

Creating a business plan, legal requirements, exploring funding options, crafting a marketing strategy, managing and growing your business, how do i start a small business for beginners, how do i create a business plan, what are six ways to grow and scale a business, the bottom line.

- Small Business

- How to Start a Business

Starting a Small Business: Your Complete How-to Guide

From market research to managing growth

:max_bytes(150000):strip_icc():format(webp)/picture-53823-1434118722-5bfc2a8c46e0fb005119858e.jpg)

The U.S. is home to 33.2 million small businesses, which drive over 43% of GDP. If you are looking to start a business, there are key factors to consider—from market research and creating a business plan to scaling your business. These factors are critical to your journey and can make a big difference no matter what stage of the process you are in.

Entrepreneurs who take concrete action can differentiate themselves from competitors, innovate, and grow. For successful entrepreneurs, the execution of the business is often what means the most.

Key Takeaways

- Starting a small business involves extensive market research of your target audience, competitors, and gaining a deep understanding of the industry.

- It is important to build a comprehensive business plan that includes the product or service description, your target customers, financial projections, and all other key details.

- Understanding the legal requirements of starting your business involves knowledge of business registration, permits, licensing, and other regulatory requirements.

- There are various types of funding channels for starting a business, including financing it yourself, securing external funding from your network, and applying for government and corporate grants and loans.

Being clear about your business goals involves doing your research. Successful entrepreneurs often do extensive research on their field. This includes understanding their prospective customers, the technical aspects of the industry, and the challenges other businesses are facing.

Understanding how other players operate in an industry is important. Attending conferences, joining associations, and building a network of people involved in the field can help you learn how decisions are made. Often, comprehensive market research takes six months to a year.

Understanding Your Target Audience

Knowing your target market is critical for many reasons. These are the customers who are most likely to purchase your product, recommend it to friends, and become repeat buyers. Apart from driving your bottom line, having a strong understanding of your target audience will allow you to tailor your offering more effectively, reach your customers more efficiently, and manage customer expectations.

Compiling demographic data on age, family, wealth, and other factors can give you a clearer understanding of market demand for your product and your potential market size.

It’s important to ask, “Why would someone buy this and part with their discretionary income?” or “Will someone love this enough to tell someone about it?” At the heart of these questions is understanding whether your business solves a key problem, as well as whether it delivers the “more” that connects to your audiences’ human emotions.

Assessing Market Trends and Opportunities

To find an advantage in a given market, look at key market trends in customer behavior and the business landscape. Explore the state of business conditions and consumer spending, along with the economic environment and how interest rates may affect financing and business growth.

Several resources are available to dive into market trends across industries, such as Statistics of U.S. Businesses and the U.S. Census Business Builder . To analyze the competitive landscape, and in turn, identify key opportunities, Porter's 5 Forces is a classic model to help businesses build their competitive strategy.

A business plan is a road map for achieving your business goals. It outlines the capital that you need, the personnel to make it happen, and the description of your product and prospective customers.

There are a number of models for creating a business plan. The Small Business Administration (SBA) , for instance, provides a format that includes the following nine sections:

- Executive summary: This should be a description of your company and its potential for success. The executive summary can cover your mission statement, employees, location, and growth plan.

- Company description: This is where you detail what your business offers, its competitive advantages, and your strengths as a business.

- Market analysis: Lay out how your company is positioned to perform well in your industry. Describe market trends and themes and your knowledge of successful competitors.

- Organization and management: Who is running your company, and how is your business structured? Include an organizational chart of your management team. Discuss if your business will be incorporated as a business C or S corporation, a limited partnership, a limited liability company, or a sole proprietorship.

- Service or product line: Here is where you describe how your business will solve a problem and why this will benefit customers. Describe how your product lifecycle would unfold.

- Marketing and sales: Detail your marketing strategy and how this will reach your customers and drive return on investment.

- Funding request: If you're looking for financing, lay out the capital you’re requesting under a five-year horizon and where, in detail, it will be allocated, such as salaries, materials, or equipment.

- Financial projections: This section shows the five-year financial outlook for your company and ties these to your request for capital.

Having a coherent business plan is important for businesses looking to raise cash and crystallize their business goals.

Setting Goals and Strategies

Another key aspect of a business plan is setting realistic goals and having a strategy to make these a reality. Having a clear direction will help you stay on track within specified deadlines. In many ways, it allows companies to create a strategic plan that defines measurable actions and is coupled with an honest assessment of the business, taking into account its resources and competitive environment. Strategy is a top-down look at your business to achieve these targets.

Financial Projections and Budgeting

Often, entrepreneurs underestimate the amount of funding needed to start a business. Outlining financial projections shows how money will be generated, where it will come from, and whether it can sustain growth.

This provides the basis for budgeting the costs to run a business and get it off the ground. Budgeting covers the expenses and income generated from the business, which include salaries and marketing expenses and projected revenue from sales.

Another important aspect of starting a business are the legal requirements that enable you to operate under the law. The legal structure of a business will impact your taxes, your liability, and how you operate.

Businesses may consider the following structures in which to operate:

- Corporation

- Limited Liability Company (LLC)

- Partnership

- Sole Proprietorship

Each has different legal consequences, from regulatory burdens to tax advantages to liability being shifted to the business instead of the business owner.

Registering Your Business

Now that you have your business structure outlined, the next step is registering your business . Your location is the second key factor in how you’ll register your business. In many cases, small businesses can register their business name with local and state government authorities.

If your business is being conducted under your legal name, registration is not required. However, such a business structure may not benefit from liability protection, along with certain legal and tax advantages. Often, registering your businesses costs $300 or less.

Before filing, a business structured as a corporation, LLC, or partnership requires a registered agent in its state. These agents handle the legal documents and official papers on your behalf.

Businesses that are looking to trademark their product, brand, or business, can file with the United States Patent and Trademark Office.

Understanding Permits and Licenses

If your business conducts certain activities that are regulated by a federal agency, you’re required to get a permit or license. A list of regulated activities can be found on the SBA website, and includes activities such as agriculture, alcoholic beverages, and transportation.

There are many different ways to fund a business. One of the key mistakes entrepreneurs make is not having enough capital to get their business running . The good news is that there are several channels to help make this happen, given the vital role entrepreneurs play in creating jobs and boosting productivity in the wider economy.

Self-Funding vs. External Funding

Bootstrapping, the term commonly used to describe self-funding your business, is where companies tap into their own cash or network of family and friends for investment. While the advantage of self-funding is having greater control, the downside is that it often involves more personal risk.

External funding involves funding from bank loans, crowdfunding, or venture capital , among other sources. These may provide additional buffers and enable you to capture growth opportunities. The drawback is less freedom and more stringent requirements for paying back these funds.

Grant and Loan Opportunities

Today, there are thousands of grants designed especially for small businesses from the government, corporations, and other organizations. The U.S. Chamber of Commerce provides a weekly update of grants and loans available to small businesses.

For instance, Business Warrior offers loans between $5,000 and $50,000 to small business owners. As another example, Go. Be. Elevate Fund offers $4,000 to grant recipients who are women and/or people of color business owners to help them grow their businesses.

When it comes to marketing, there is a classic quote from Milan Kundera: “Business has only two functions—marketing and innovation." In order to reach customers, a business needs a marketing strategy that attracts and retains customers and expands its customer base.

To gain an edge, small businesses can utilize social media, email marketing, and other digital channels to connect and engage with customers.

Branding Your Business

Building a successful brand goes hand in hand with building a great experience for the customer. This involves meeting the expectations of your customer. What is your brand offering? Is it convenience, luxury, or rapid access to a product? Consider how your brand meets a customer's immediate need or the type of emotional response it elicits. Customer interaction, and in turn loyalty to your brand, is influenced, for example, by how your brand may align with their values, how it shifts their perception, or if it resolves customer frustration.

Digital Marketing and Social Media

We live in a digital-first world, and utilizing social media channels can help your business reach a wider audience and connect and engage in real time. Given that a strong brand is at the heart of successful companies, it often goes without saying that cultivating a digital presence is a necessity in order to reach your customers.

According to HubSpot’s 2023 report, The State of Consumer Trends, 41% of the 600-plus consumers surveyed discovered new products on social media and 17% bought a product there in the past three months.

Managing a business has its challenges. Finding the right personnel to run operations, manage the day-to-day, and reach your business objectives takes time. Sometimes, businesses may look to hire experts in their field who can bring in specialized knowledge to help their business grow, such as data analysts, marketing specialists, or others with niche knowledge relevant to their field.

Hiring and Training Staff

Finding the right employees involves preparing job descriptions, posting on relevant job boards such as LinkedIn, and effectively screening applicants. Careful screening may involve a supplemental test, reviewing a candidate's portfolio, and asking situational and behavioral questions in the interview. These tools will help you evaluate applicants and improve the odds that you'll find the people you are looking for.

Once you have hired a new employee, training is the next essential step. On average, it takes about 62 hours to train new employees. Effectively training employees often leads to higher retention. While on-the-job training is useful, consider having an onboarding plan in place to make the transition clear while outlining expectations for the job.

Scaling Your Business

Growing your business also requires strategy. According to Gino Chirio, executive vice president at the consultancy group Maddock Douglas, there are six ways that companies can grow their business to drive real growth and expansion:

- New processes: Boost margins by cutting costs.

- New experiences: Connect with customers in powerful ways to help increase retention.

- New features: Provide advancements to your existing product or service.

- New customers: Expand into new markets, or find markets where your product addresses a different need.

- New offerings: Offer a new product.

- New models: Utilize new business models, such as subscription-based services, fee-for-service, or advertising-based models.

With these six ways to grow a business, it is important to consider the risk, investment, and time involved. Improving your margins through new processes is often the most straightforward way to grow. Offering new features is also effective since it is tailored to your existing market with products you have already delivered.

By contrast, offering new products may involve higher risk since these have not been tested in the market. However, they may offer higher reward, especially if you have a first-mover advantage and release your product in the market before the competition.

A good place to start building a business is to understand the following core steps that are involved in an entrepreneur's journey : market research, creating a business plan, knowing the legal requirements, researching funding options, developing a marketing strategy, and business management.

A business plan is made up of a number of primary components that help outline your business goals and company operations in a clear, coherent way. It includes an executive summary, company description, market analysis, organization and management description, service or product line description, marketing and sales plan, funding requests (optional), and financial projections.

Business growth can fall into the following six categories, with each having varying degrees of risk and investment: new processes, new experiences, new features, new customers, new offerings, and new models.

Knowing how to start a small business involves the key steps of market research, setting up a business plan, understanding the legal requirements, exploring funding options, crafting a marketing strategy, and managing your business.

For aspiring small business owners, these steps can help you successfully deliver your product or service to the market, and ultimately grow. While it can take a considerable amount of work, the payoffs are manifold: independence of work, personal fulfillment, financial reward, and following your passion.

U.S. Chamber of Commerce. " The State of Small Business Now ."

U.S. Small Business Administration. " Market Research and Competitive Analysis ."

U.S. Small Business Administration." Write Your Business Plan ."

U.S. Small Business Administration. " Choose a Business Structure ."

U.S. Small Business Administration. " Register Your Business ."

U.S. Small Business Administration. " Apply for Licenses and Permits ."

U.S. Small Business Administration. " Fund Your Business ."

U.S. Chamber of Commerce. " 52 Grants, Loans and Programs to Benefit Your Small Business ."

Ogilvy. " Behind Every Brand Is a Great Experience, and Vice Versa—Why Today's Customer Expects Synergy ."

HubSpot. " The State of Consumer Trends in 2023 ."

Training Magazine. " 2022 Training Industry Report ."

Harvard Business Review. " The Six Ways to Grow a Company ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1327127856-ce97892716b346b99dcf1d14af294a97.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

.css-s5s6ko{margin-right:42px;color:#F5F4F3;}@media (max-width: 1120px){.css-s5s6ko{margin-right:12px;}} Join us: Learn how to build a trusted AI strategy to support your company's intelligent transformation, featuring Forrester .css-1ixh9fn{display:inline-block;}@media (max-width: 480px){.css-1ixh9fn{display:block;margin-top:12px;}} .css-1uaoevr-heading-6{font-size:14px;line-height:24px;font-weight:500;-webkit-text-decoration:underline;text-decoration:underline;color:#F5F4F3;}.css-1uaoevr-heading-6:hover{color:#F5F4F3;} .css-ora5nu-heading-6{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:start;-ms-flex-pack:start;-webkit-justify-content:flex-start;justify-content:flex-start;color:#0D0E10;-webkit-transition:all 0.3s;transition:all 0.3s;position:relative;font-size:16px;line-height:28px;padding:0;font-size:14px;line-height:24px;font-weight:500;-webkit-text-decoration:underline;text-decoration:underline;color:#F5F4F3;}.css-ora5nu-heading-6:hover{border-bottom:0;color:#CD4848;}.css-ora5nu-heading-6:hover path{fill:#CD4848;}.css-ora5nu-heading-6:hover div{border-color:#CD4848;}.css-ora5nu-heading-6:hover div:before{border-left-color:#CD4848;}.css-ora5nu-heading-6:active{border-bottom:0;background-color:#EBE8E8;color:#0D0E10;}.css-ora5nu-heading-6:active path{fill:#0D0E10;}.css-ora5nu-heading-6:active div{border-color:#0D0E10;}.css-ora5nu-heading-6:active div:before{border-left-color:#0D0E10;}.css-ora5nu-heading-6:hover{color:#F5F4F3;} Register now .css-1k6cidy{width:11px;height:11px;margin-left:8px;}.css-1k6cidy path{fill:currentColor;}

- Business strategy |

- What is strategic planning? A 5-step gu ...

What is strategic planning? A 5-step guide

Strategic planning is a process through which business leaders map out their vision for their organization’s growth and how they’re going to get there. In this article, we'll guide you through the strategic planning process, including why it's important, the benefits and best practices, and five steps to get you from beginning to end.

Strategic planning is a process through which business leaders map out their vision for their organization’s growth and how they’re going to get there. The strategic planning process informs your organization’s decisions, growth, and goals.

Strategic planning helps you clearly define your company’s long-term objectives—and maps how your short-term goals and work will help you achieve them. This, in turn, gives you a clear sense of where your organization is going and allows you to ensure your teams are working on projects that make the most impact. Think of it this way—if your goals and objectives are your destination on a map, your strategic plan is your navigation system.

In this article, we walk you through the 5-step strategic planning process and show you how to get started developing your own strategic plan.

How to build an organizational strategy

Get our free ebook and learn how to bridge the gap between mission, strategic goals, and work at your organization.

What is strategic planning?

Strategic planning is a business process that helps you define and share the direction your company will take in the next three to five years. During the strategic planning process, stakeholders review and define the organization’s mission and goals, conduct competitive assessments, and identify company goals and objectives. The product of the planning cycle is a strategic plan, which is shared throughout the company.

What is a strategic plan?

![planning of small business [inline illustration] Strategic plan elements (infographic)](https://assets.asana.biz/transform/7d1f14e4-b008-4ea6-9579-5af6236ce367/inline-business-strategy-strategic-planning-1-2x?io=transform:fill,width:2560&format=webp)

A strategic plan is the end result of the strategic planning process. At its most basic, it’s a tool used to define your organization’s goals and what actions you’ll take to achieve them.

Typically, your strategic plan should include:

Your company’s mission statement

Your organizational goals, including your long-term goals and short-term, yearly objectives

Any plan of action, tactics, or approaches you plan to take to meet those goals

What are the benefits of strategic planning?

Strategic planning can help with goal setting and decision-making by allowing you to map out how your company will move toward your organization’s vision and mission statements in the next three to five years. Let’s circle back to our map metaphor. If you think of your company trajectory as a line on a map, a strategic plan can help you better quantify how you’ll get from point A (where you are now) to point B (where you want to be in a few years).

When you create and share a clear strategic plan with your team, you can:

Build a strong organizational culture by clearly defining and aligning on your organization’s mission, vision, and goals.

Align everyone around a shared purpose and ensure all departments and teams are working toward a common objective.

Proactively set objectives to help you get where you want to go and achieve desired outcomes.

Promote a long-term vision for your company rather than focusing primarily on short-term gains.

Ensure resources are allocated around the most high-impact priorities.

Define long-term goals and set shorter-term goals to support them.

Assess your current situation and identify any opportunities—or threats—allowing your organization to mitigate potential risks.

Create a proactive business culture that enables your organization to respond more swiftly to emerging market changes and opportunities.

What are the 5 steps in strategic planning?

The strategic planning process involves a structured methodology that guides the organization from vision to implementation. The strategic planning process starts with assembling a small, dedicated team of key strategic planners—typically five to 10 members—who will form the strategic planning, or management, committee. This team is responsible for gathering crucial information, guiding the development of the plan, and overseeing strategy execution.

Once you’ve established your management committee, you can get to work on the planning process.

Step 1: Assess your current business strategy and business environment

Before you can define where you’re going, you first need to define where you are. Understanding the external environment, including market trends and competitive landscape, is crucial in the initial assessment phase of strategic planning.

To do this, your management committee should collect a variety of information from additional stakeholders, like employees and customers. In particular, plan to gather:

Relevant industry and market data to inform any market opportunities, as well as any potential upcoming threats in the near future.

Customer insights to understand what your customers want from your company—like product improvements or additional services.

Employee feedback that needs to be addressed—whether about the product, business practices, or the day-to-day company culture.

Consider different types of strategic planning tools and analytical techniques to gather this information, such as:

A balanced scorecard to help you evaluate four major elements of a business: learning and growth, business processes, customer satisfaction, and financial performance.

A SWOT analysis to help you assess both current and future potential for the business (you’ll return to this analysis periodically during the strategic planning process).

To fill out each letter in the SWOT acronym, your management committee will answer a series of questions:

What does your organization currently do well?

What separates you from your competitors?

What are your most valuable internal resources?

What tangible assets do you have?

What is your biggest strength?

Weaknesses:

What does your organization do poorly?

What do you currently lack (whether that’s a product, resource, or process)?

What do your competitors do better than you?

What, if any, limitations are holding your organization back?

What processes or products need improvement?

Opportunities:

What opportunities does your organization have?

How can you leverage your unique company strengths?

Are there any trends that you can take advantage of?

How can you capitalize on marketing or press opportunities?

Is there an emerging need for your product or service?

What emerging competitors should you keep an eye on?

Are there any weaknesses that expose your organization to risk?

Have you or could you experience negative press that could reduce market share?

Is there a chance of changing customer attitudes towards your company?

Step 2: Identify your company’s goals and objectives

To begin strategy development, take into account your current position, which is where you are now. Then, draw inspiration from your vision, mission, and current position to identify and define your goals—these are your final destination.

To develop your strategy, you’re essentially pulling out your compass and asking, “Where are we going next?” “What’s the ideal future state of this company?” This can help you figure out which path you need to take to get there.

During this phase of the planning process, take inspiration from important company documents, such as:

Your mission statement, to understand how you can continue moving towards your organization’s core purpose.

Your vision statement, to clarify how your strategic plan fits into your long-term vision.

Your company values, to guide you towards what matters most towards your company.

Your competitive advantages, to understand what unique benefit you offer to the market.

Your long-term goals, to track where you want to be in five or 10 years.

Your financial forecast and projection, to understand where you expect your financials to be in the next three years, what your expected cash flow is, and what new opportunities you will likely be able to invest in.

Step 3: Develop your strategic plan and determine performance metrics

Now that you understand where you are and where you want to go, it’s time to put pen to paper. Take your current business position and strategy into account, as well as your organization’s goals and objectives, and build out a strategic plan for the next three to five years. Keep in mind that even though you’re creating a long-term plan, parts of your plan should be created or revisited as the quarters and years go on.

As you build your strategic plan, you should define:

Company priorities for the next three to five years, based on your SWOT analysis and strategy.

Yearly objectives for the first year. You don’t need to define your objectives for every year of the strategic plan. As the years go on, create new yearly objectives that connect back to your overall strategic goals .

Related key results and KPIs. Some of these should be set by the management committee, and some should be set by specific teams that are closer to the work. Make sure your key results and KPIs are measurable and actionable. These KPIs will help you track progress and ensure you’re moving in the right direction.

Budget for the next year or few years. This should be based on your financial forecast as well as your direction. Do you need to spend aggressively to develop your product? Build your team? Make a dent with marketing? Clarify your most important initiatives and how you’ll budget for those.

A high-level project roadmap . A project roadmap is a tool in project management that helps you visualize the timeline of a complex initiative, but you can also create a very high-level project roadmap for your strategic plan. Outline what you expect to be working on in certain quarters or years to make the plan more actionable and understandable.

Step 4: Implement and share your plan

Now it’s time to put your plan into action. Strategy implementation involves clear communication across your entire organization to make sure everyone knows their responsibilities and how to measure the plan’s success.

Make sure your team (especially senior leadership) has access to the strategic plan, so they can understand how their work contributes to company priorities and the overall strategy map. We recommend sharing your plan in the same tool you use to manage and track work, so you can more easily connect high-level objectives to daily work. If you don’t already, consider using a work management platform .

A few tips to make sure your plan will be executed without a hitch:

Communicate clearly to your entire organization throughout the implementation process, to ensure all team members understand the strategic plan and how to implement it effectively.

Define what “success” looks like by mapping your strategic plan to key performance indicators.

Ensure that the actions outlined in the strategic plan are integrated into the daily operations of the organization, so that every team member's daily activities are aligned with the broader strategic objectives.

Utilize tools and software—like a work management platform—that can aid in implementing and tracking the progress of your plan.

Regularly monitor and share the progress of the strategic plan with the entire organization, to keep everyone informed and reinforce the importance of the plan.

Establish regular check-ins to monitor the progress of your strategic plan and make adjustments as needed.

Step 5: Revise and restructure as needed

Once you’ve created and implemented your new strategic framework, the final step of the planning process is to monitor and manage your plan.

Remember, your strategic plan isn’t set in stone. You’ll need to revisit and update the plan if your company changes directions or makes new investments. As new market opportunities and threats come up, you’ll likely want to tweak your strategic plan. Make sure to review your plan regularly—meaning quarterly and annually—to ensure it’s still aligned with your organization’s vision and goals.

Keep in mind that your plan won’t last forever, even if you do update it frequently. A successful strategic plan evolves with your company’s long-term goals. When you’ve achieved most of your strategic goals, or if your strategy has evolved significantly since you first made your plan, it might be time to create a new one.

Build a smarter strategic plan with a work management platform

To turn your company strategy into a plan—and ultimately, impact—make sure you’re proactively connecting company objectives to daily work. When you can clarify this connection, you’re giving your team members the context they need to get their best work done.

A work management platform plays a pivotal role in this process. It acts as a central hub for your strategic plan, ensuring that every task and project is directly tied to your broader company goals. This alignment is crucial for visibility and coordination, allowing team members to see how their individual efforts contribute to the company’s success.

By leveraging such a platform, you not only streamline workflow and enhance team productivity but also align every action with your strategic objectives—allowing teams to drive greater impact and helping your company move toward goals more effectively.

Strategic planning FAQs

Still have questions about strategic planning? We have answers.

Why do I need a strategic plan?

A strategic plan is one of many tools you can use to plan and hit your goals. It helps map out strategic objectives and growth metrics that will help your company be successful.

When should I create a strategic plan?

You should aim to create a strategic plan every three to five years, depending on your organization’s growth speed.

Since the point of a strategic plan is to map out your long-term goals and how you’ll get there, you should create a strategic plan when you’ve met most or all of them. You should also create a strategic plan any time you’re going to make a large pivot in your organization’s mission or enter new markets.

What is a strategic planning template?

A strategic planning template is a tool organizations can use to map out their strategic plan and track progress. Typically, a strategic planning template houses all the components needed to build out a strategic plan, including your company’s vision and mission statements, information from any competitive analyses or SWOT assessments, and relevant KPIs.

What’s the difference between a strategic plan vs. business plan?

A business plan can help you document your strategy as you’re getting started so every team member is on the same page about your core business priorities and goals. This tool can help you document and share your strategy with key investors or stakeholders as you get your business up and running.

You should create a business plan when you’re:

Just starting your business

Significantly restructuring your business

If your business is already established, you should create a strategic plan instead of a business plan. Even if you’re working at a relatively young company, your strategic plan can build on your business plan to help you move in the right direction. During the strategic planning process, you’ll draw from a lot of the fundamental business elements you built early on to establish your strategy for the next three to five years.

What’s the difference between a strategic plan vs. mission and vision statements?

Your strategic plan, mission statement, and vision statements are all closely connected. In fact, during the strategic planning process, you will take inspiration from your mission and vision statements in order to build out your strategic plan.

Simply put:

A mission statement summarizes your company’s purpose.

A vision statement broadly explains how you’ll reach your company’s purpose.

A strategic plan pulls in inspiration from your mission and vision statements and outlines what actions you’re going to take to move in the right direction.

For example, if your company produces pet safety equipment, here’s how your mission statement, vision statement, and strategic plan might shake out:

Mission statement: “To ensure the safety of the world’s animals.”

Vision statement: “To create pet safety and tracking products that are effortless to use.”

Your strategic plan would outline the steps you’re going to take in the next few years to bring your company closer to your mission and vision. For example, you develop a new pet tracking smart collar or improve the microchipping experience for pet owners.

What’s the difference between a strategic plan vs. company objectives?

Company objectives are broad goals. You should set these on a yearly or quarterly basis (if your organization moves quickly). These objectives give your team a clear sense of what you intend to accomplish for a set period of time.

Your strategic plan is more forward-thinking than your company goals, and it should cover more than one year of work. Think of it this way: your company objectives will move the needle towards your overall strategy—but your strategic plan should be bigger than company objectives because it spans multiple years.

What’s the difference between a strategic plan vs. a business case?

A business case is a document to help you pitch a significant investment or initiative for your company. When you create a business case, you’re outlining why this investment is a good idea, and how this large-scale project will positively impact the business.

You might end up building business cases for things on your strategic plan’s roadmap—but your strategic plan should be bigger than that. This tool should encompass multiple years of your roadmap, across your entire company—not just one initiative.

What’s the difference between a strategic plan vs. a project plan?

A strategic plan is a company-wide, multi-year plan of what you want to accomplish in the next three to five years and how you plan to accomplish that. A project plan, on the other hand, outlines how you’re going to accomplish a specific project. This project could be one of many initiatives that contribute to a specific company objective which, in turn, is one of many objectives that contribute to your strategic plan.

What’s the difference between strategic management vs. strategic planning?

A strategic plan is a tool to define where your organization wants to go and what actions you need to take to achieve those goals. Strategic planning is the process of creating a plan in order to hit your strategic objectives.

Strategic management includes the strategic planning process, but also goes beyond it. In addition to planning how you will achieve your big-picture goals, strategic management also helps you organize your resources and figure out the best action plans for success.

Related resources

Solve your tech overload with an intelligent transformation

9 steps to craft a successful go-to-market (GTM) strategy

Unmanaged business goals don’t work. Here’s what does.

How Asana uses work management to effectively manage goals

Chief of Staff

Align strategy & operations across teams

Small business owner

Be released from the day-to-day

Startup founder

Find fit & grow your team

Board meetings

Run board meetings with ease.

Plans & roadmaps

Build organization or team plans.

Strategic alignment

Align leaders and teams.

Performance intelligence

AI powered performance intelligence.

Operating efficiency

Simplify, focus, and automate.

Business transformation

Run business improvement programs.

People development

Data driven people development.

Write plans, procedures, notes, or policies.

Use AI to build smart goals & OKRs.

Your vision masterplan.

Run projects, oragnize tasks across teams.

Align the operating rhythm, run effective meetings.

Diagnostics

Find growth gaps across the business.

Build scorecards, visualize performance.

Why partner?

Easier advisory with a demonstrable ROI

Become a partner

Become a fractal Chief of Staff.

ROI Calculator

See the ROI in our program.

GET CERTIFIED

Advisor Certifications

Be recognized as a strategic leader.

Platform specialist

Implement agile leadership practices.

CX Consultant

Lead sales, marketing, & service strategy.

EX Consultant

Lead people & culture strategy.

Business consultant

Lead business planning & strategy.

Leadership coach

Lead executive coaching.

Certified advisor

Fractal Chief of Staff, COO, or Strategic Advisor.

Help centre

Help and knowledge articles.

Waymaker Academy

Grow your skills.

Leadership articles.

Events & webinars

Join a masterclass.

Download resources.

Listen, learn, connect.

Product overview

3 Ways to build a better business.

Diagnose gaps, roadmap, goals & more

Watch a demo

Watch a detailed overview of Waymaker.io

For start ups & small business

Every essential step to grow

For scaling & enterprise business

Release your team to scale your business

For coaches & consultants

Become a high value advisor as a Waymaker partner

Playbooks for growth

On demand playbooks in Waymaker Academy

License types, prices and start a free trial

START MY FREE TRIAL

Lead and deliver

Get certified + free courses & playbooks

Waymaker's Leadership Curve

The framework overview

News & articles

Listen to leaders

eBooks & Webinars

Learn with our eBooks & Webinars

Get started, learn & find help

WATCH A DEMO

Build a better business with Waymaker partnership

How to partner

3 steps to a better coaching & consulting business

Get Certified

Become a Waymaker Certified Advisor

High Growth Advisor Program

Scale your advisory

Grow your partner business

Access free & paid services to grow your business

Model your partner ROI

Use our ROI calculator

SPEAK WITH OUR TEAM

About Waymaker

Join our team?

APPLY FOR A ROLE

Build a scaleable business & leadership advisory business.

Discover Waymaker partnership.

Become a Waymaker Partner

Scale your coaching & consulting.

Free courses and playbooks for Waymaker partners.

Be recognized for leadership.

Platform Specialist

For agile & business coaches.

For sales and marketing consultants.

For HR consultants and coaches.

Business Consultant

For strategic business coaches & consultants.

Leadership Coach

For executive and leadership coaches.

Certified Advisor

For recognized experts in leadership and strategy.

Bite sized brilliance to grow your business.

Leadership Blog

Podcast | leadership torque.

Helping you make business improvement, business as usual.

Learn with our downloadable eBooks.

Merch & Resources to help you achieve more by doing less.

Free courses and playbooks.

Leadership software

What is leadership software?

Waymaker Leadership Curve

A framework overview.

Get started, learn & find the help you need.

Platform features

Waymaker's intelligent platform includes goals (OKRs), roadmaps, meetings, tasks, and dashboards.

Diagnose growth gaps.

Create goals and OKRs.

Create roadmaps of goals.

Tasks, task automation, and task templates.

Automate meetings and minutes.

Build scorecards, view goal and task dashboards.

Professional services

Increase profits, reduce chaos.

Property & Development

Streamline & reduce risk.

Software & Technology

Align everyone, outperform growth

Small business

Work on your business, not in it.

WAYMAKER LEADERSHIP BLOG

- Strategic planning for small business: A guide to success

by Waymaker | Jun 6, 2023

Understanding the Importance of Strategic Planning

Defining strategic planning, benefits of strategic planning for small businesses, common challenges in small business strategic planning, assessing your small business’s current situation, conducting a swot analysis, evaluating your business’s financial health, identifying your target market and competitors, setting clear goals and objectives, creating smart goals, aligning goals with your business’s mission and vision, prioritizing goals for maximum impact, developing a comprehensive strategy, choosing the right business model, crafting a unique value proposition, establishing key performance indicators (kpis).

- You may also like...

Get started

Small business owners often find themselves with their hands full – managing operations, employees, finances, and customer relationships, just to name a few. With so much on their plates, it can be easy to overlook the importance of strategic planning. However, failing to think ahead can leave a business with no clear direction, making it difficult to achieve growth and success. This article will explore the benefits of strategic planning and guide small business owners through the process of developing a solid strategy.

At its core, strategic planning is about charting a course for the future of your business. It involves setting goals, analyzing your current situation, and identifying opportunities and threats that lie ahead. By taking the time to develop a st rategic plan , you can ensure that your efforts are aligned with your long-term objectives and that you are making the most efficient use of your resources.

Strategic planning is a process that involves the following steps:

- Assessing your current situation

- Setting clear goals and objectives

- Developing a comprehensive strategy

Assessing your current situation involves taking a hard look at your business and the larger market. You’ll want to analyze your strengths and weaknesses, as well as any opportunities or threats that may be on the horizon. This will help you to identify areas where you can improve and opportunities that you can take advantage of.

Setting clear goals and objectives is essential for any strategic plan. You’ll want to define what you want to achieve and when you want to achieve it. This will help you to stay focused and motivated as you work towards your long-term goals.

Developing a comprehensive strategy involves outlining the specific actions that you’ll take to achieve your goals. This may involve developing new products or services, expanding into new markets, or improving your existing operations.

Why is strategic planning so important for small businesses? There are several key benefits:

- Improved decision-making: A strategic plan provides a framework for making decisions that align with your long-term goals. This can help you to avoid short-term thinking and make decisions that will benefit your business in the long run.

- Increased efficiency: By identifying your priorities and allocating your resources accordingly, you can make the most efficient use of your time and money. This can help you to achieve your goals more quickly and with less waste.

- Better communication: A well-crafted strategic plan can help you to communicate your vision and goals to employees, investors, and other stakeholders. This can help to build buy-in and support for your business.

- Greater adaptability: As your business environment changes, a strategic plan can help you to pivot and adjust your approach accordingly. This can help you to stay ahead of the curve and remain competitive.

While the benefits of strategic planning are clear, many small business owners struggle to develop and implement a solid strategy. Some of the most common challenges include:

- Time constraints: Small business owners have a lot on their plates, and finding the time to plan for the future can be difficult. However, investing time in strategic planning can ultimately save you time in the long run by helping you to avoid costly mistakes and inefficiencies.

- Lack of expertise: Developing a strategic plan requires a deep understanding of your business and the larger market, which many small business owners may lack. Consider seeking out outside expertise or partnering with a consultant to help you develop a solid plan.

- Resistance to change: Sometimes, it can be difficult to convince employees or partners to embrace a new strategy or way of doing things. Communication and transparency are key here – be sure to explain the reasoning behind your strategy and involve others in the planning process as much as possible.

Despite these challenges, it’s important for small business owners to remember that strategic planning is a critical component of long-term success. With the right tools and mindset, any business can develop a clear and effective strategy.

Before you can start developing your strategic plan, it’s important to take a step back and assess your current situation. This involves conducting a comprehensive analysis of your business’s strengths, weaknesses, opportunities, and threats (SWOT analysis), as well as evaluating your financial health and understanding your target market and competitors.

Assessing your small business’s current situation is crucial to ensure that you have a clear understanding of where your business stands in the market. By conducting a SWOT analysis, you can identify your business’s internal strengths and weaknesses, such as your unique selling proposition and areas where you may be falling behind your competitors. Additionally, you can identify external opportunities and threats, such as potential areas for growth or new competition.

A SWOT analysis is a useful tool for identifying your business’s internal strengths and weaknesses as well as external opportunities and threats. To conduct a SWOT analysis, consider the following questions:

- Strengths: What are your business’s unique strengths? What do you do better than your competitors?

- Weaknesses: What are your business’s current weaknesses? Are there areas where you are falling behind your competitors?

- Opportunities: What are some potential opportunities for growth or expansion in your industry?

- Threats: What are some external threats that could impact your business, such as changes in the regulatory environment or new competition?

By answering these questions, you can gain a better understanding of your business’s current situation and develop strategies to improve your strengths and address your weaknesses.

Fiscal responsibility is critical to the success of any small business. Before developing a strategic plan, it’s important to evaluate your business’s financial health. This includes analyzing your cash flow, profitability, and overall financial stability.

By evaluating your business’s financial health, you can identify areas where you may need to cut costs or increase revenue. This can help you make informed decisions about your business’s future and ensure that you have the resources you need to achieve your goals.

Understanding your target market and competitors is critical to developing a successful strategy. To do this, consider the following questions:

- Who are your target customers? What are their needs and preferences?

- What sets you apart from your competitors? What do they do well, and where are there opportunities for you to differentiate yourself?

- What are some potential barriers to entry or competition?

By identifying your target market and competitors, you can tailor your marketing and sales efforts to reach the right customers and stand out from your competitors. This can help you build a loyal customer base and increase your revenue over time.

Setting clear goals and objectives is an essential step in achieving success for any business. It is important to have a solid understanding of your current situation and then create specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with your business’s mission and vision.

When you set SMART goals, you are creating a roadmap for your business that will help you stay focused and on track. These goals will provide you with a clear direction and a way to measure your progress towards success.

Creating SMART goals requires careful planning and consideration. To make sure your goals are effective, you should follow these guidelines:

- Specific: Your goals should be clearly defined and specific. This means that you should avoid setting vague or general goals that are difficult to measure or achieve.

- Measurable: Establish quantifiable targets or metrics to track progress toward your goals. This will help you to measure your progress and determine whether you are on track to achieving your goals.

- Achievable: Your goals should be challenging but attainable. Setting goals that are too easy will not provide you with the motivation to achieve them, while setting goals that are too difficult will only lead to frustration and disappointment.

- Relevant: Your goals should be aligned with your business’s mission and vision. This means that you should consider your business’s values and purpose when setting your goals.

- Time-bound: Set a deadline or timeline for achieving each goal. This will help you to stay focused and motivated, and will also provide you with a sense of urgency to achieve your goals.

Aligning your goals with your business’s mission and vision is essential to ensure that you are working towards the right objectives. This involves understanding your business’s values and purpose and identifying key areas of focus.

By aligning your goals with your business’s mission and vision, you can ensure that you are working towards the right objectives and that you are making progress towards achieving your overall business goals.

Once you have identified your goals and objectives, it’s important to prioritize them based on their potential impact on your business. This involves considering the resources required to achieve each goal and the potential return on investment.

By prioritizing your goals, you can ensure that you are focusing your resources on the most important objectives and that you are making the most of your time and effort.

In conclusion, setting clear goals and objectives is an essential step in achieving success for any business. By creating SMART goals, aligning them with your business’s mission and vision, and prioritizing them for maximum impact, you can ensure that you are working towards the right objectives and making progress towards achieving your overall business goals.

With your goals and objectives established, it’s time to develop a comprehensive strategy for achieving them. This involves choosing the right business model, crafting a unique value proposition, and establishing key performance indicators (KPIs).

Your business model defines how your business creates, delivers, and captures value. To choose the right business model, think about your target market, your products or services, and your revenue streams.

Your value proposition is what sets you apart from your competitors and defines your business’s unique identity. To craft a strong value proposition, focus on your customers’ needs and preferences and identify what sets you apart from your competitors.

KPIs are a way to measure progress toward your goals and objectives. The specific KPIs you choose will depend on your business’s unique situation and goals. Some examples of KPIs include revenue, customer acquisition, customer retention, and employee satisfaction.

Strategic planning is a critical component of long-term success for small businesses. By taking the time to assess your current situation, set clear goals and objectives, and develop a comprehensive strategy, you can ensure that your business is headed in the right direction. While the process of strategic planning may seem daunting, the benefits are clear – improved decision-making, increased efficiency, better communication, and greater adaptability. With the right mindset and tools, any small business can chart a course for growth and success.

You may also like…

Streamline Your Workflow with New Folder Functionality in Waymaker.io

We're excited to introduce folders, a new feature that will transform the way you organize your content across...

Introducing the People module: AI powered role descriptions, automated org charts, and powerful performance alignment.

The Waymaker People module makes it easy to plan roles, align performance metrics and build world class role...

Understanding the role of a company director as a small business leader

As a small business owner who also serves as a company director and an employee of your company, you hold a unique...

Performance intelligence software for holding plans, people, and performance accountable. Achieve up to 77% better goal performance with Waymaker.io

Business growth

Business tips

Do sweat the small stuff: Why planning the little things matters for your business

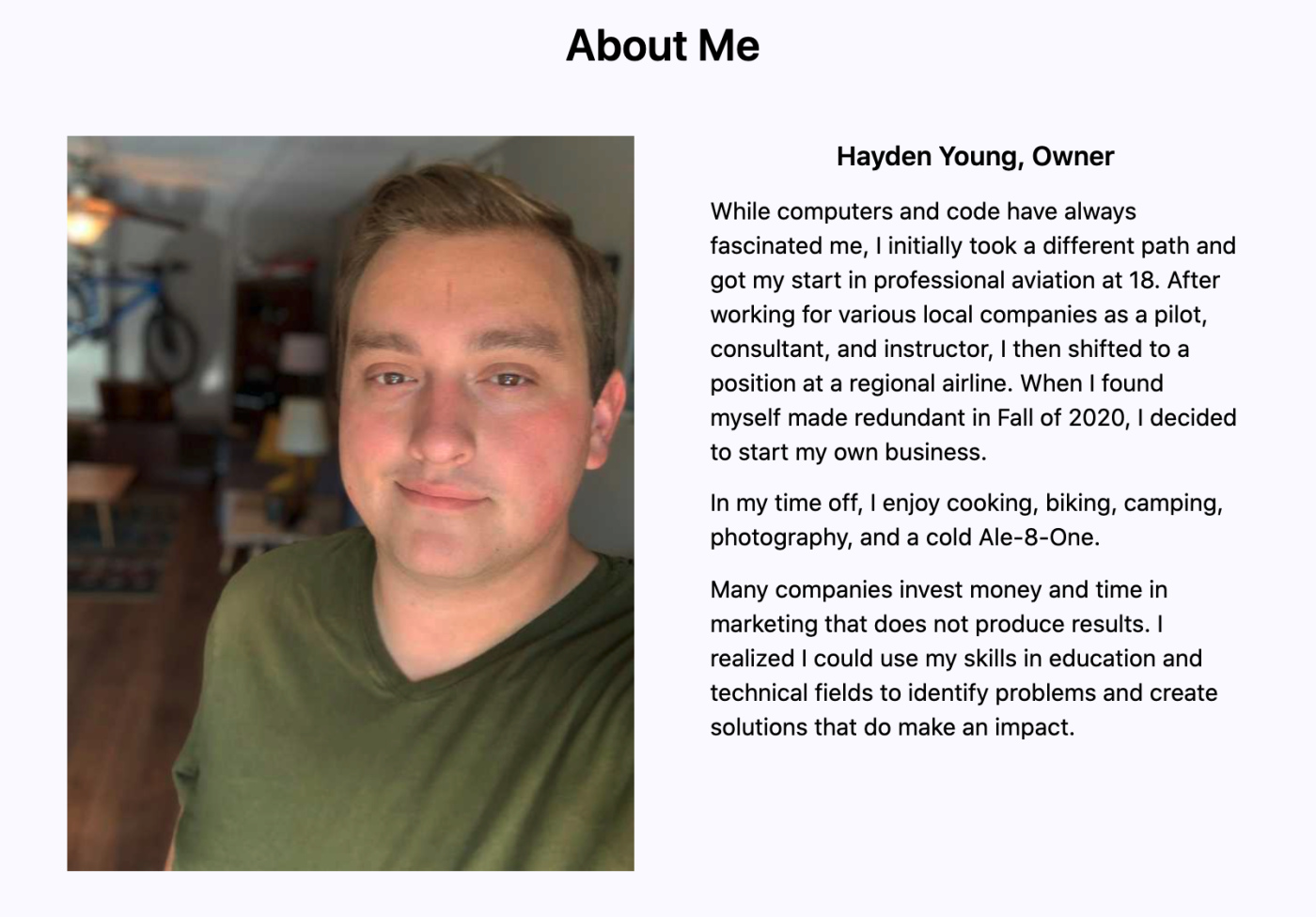

A pilot-turned-business-owner's view on small business planning.

When people talk about planning, it's often broken down into four types: strategic, operational, tactical, and contingency. I'm a business owner and a pilot, and all four types of planning are crucial for both of those roles. I'll get into that a little more, but first, I want to tell you a story.

The opposite of planning is complacency

One time, a fellow pilot and I planned a flight down to a local airport known for its food. The plan was for me to fly solo out of my home airport and pick them up on my way, at an airport closer to their house.

After my shift at the flight school that day, I completed my basic flight planning. This consists of weight and balance calculations and checking the weather and operational notices. I made the flight over to pick up my friend, and we headed to the destination. My buddy was a newer pilot, so I was mentoring a little during the flight. For example, I made a point of checking the weather before every departure. Don't get me wrong, you are absolutely supposed to do that regardless of your experience level, but...well, I'll tell the rest of the story.

We made the trip down and back (the food was as good as promised), and after a short delay dropping them off, I spun up the engine for the last time. The sun had just set on the Bluegrass, it was a lovely night, and I was looking forward to the quiet jump home.

In a combination of fatigue and complacency, I didn't consider checking the weather this time.

I should have. For starters, it's required. But beyond that, the sunset would have undoubtedly produced some change in the weather. And sure enough, that evening, the wind at altitude had picked up.

The departure took me out over a cliff at the end of the runway, where the wind was now very turbulent. I'd been confident I had a good picture of the situation, so it caught me off completely off guard. Less than a minute after departing, the airplane was violently shaking and hard to control.

My mind fell back to my training: aviate, navigate, communicate. I maintained control and track while communicating with the approach controller.

Was it a mechanical failure? What else could explain the rapid degradation in control authority?

As I was trying to work out what I could do to troubleshoot, it was over. Almost as fast as it started, I had flown out of the turbulence. I made some extra maneuvers performing flight control tests before making a normal approach. The response from the tower when I requested clearance to land: "November 123, cleared to land runway 22, be advised a CRJ-700 reported a 20-knot gain and loss on a 3-mile final."

I checked my airspeed and ground speed, finding a 35-knot discrepancy.

It all became clear: I didn't have any mechanical issues. My issue was, as the mechanics say, "located between the pilot's seat and the flight controls."

I got lucky. If I had checked the weather, I likely wouldn't even remember that flight now, years later. Some simple planning— very simple planning—would have put me in a much better position.

Small planning for small businesses

Any business owner can relate to this story. Not directly, of course, but think about all the times you've sat down with your accountant, a client, a vendor, or even a coworker. At least once, I bet, you missed something that was crystal clear in hindsight, right? We all do. That's why some amount of planning is vital, regardless of how minor a task is.

I now own my own web development and marketing consulting company. Not long ago, I sent a quote to a client that was an order of magnitude higher than I'd led the client to expect. I failed to do my planning on multiple levels before a client meeting and tried to just feel my way through it.

I'm sure everyone knows how that story ends.

Business plans, financial plans, or the planning and consideration around buying large-ticket items might feel obvious. But something as simple as jumping into a quick meeting with a vendor should be afforded some planning as well.

How big planning can help small planning

Let's take a look at the four kinds of planning I mentioned earlier, and how they can make your smaller-scale planning a lot simpler.

Strategic planning. Everything starts with strategic planning—looking years down the road. What's the big picture? You can think of this as planning for your planning, but you need to always revisit this level of planning as time passes and the environment changes. In the story of my flight, a strategic planning failure happened when I decided to make the trip after a long day at work and to conduct the last leg on my own. Had I made better strategic decisions, I probably would have ended up checking the weather.

Operational planning. In aviation, we have a standard operating procedure (SOP) for almost everything. It, like your operational planning, explains how to do something, not why . Businesses should also have SOPs. What are the actionable steps we need to take to get from here to there?

Tactical planning. The rubber is on the road now. How are the operational plans going to be executed? Tactical planning always uses the most up-to-date information and is the most specific type of planning. In business, this is usually project-based planning based on the unique needs of a project. You might even make a tactical plan before heading into a meeting to ensure the meeting serves to advance your other, higher-level plans. (You've probably already identified my failure to check the weather, or perform any tactical planning at all, as the ultimate failure on the last leg of my day.)

Contingency planning. All these plans we've come up with are great, but does anything really go down the way we expected it to? No. And that's where contingency planning comes in. One of the most common contingency plans I make with every client is what we'll do if we miss deadlines or budget . They really appreciate this kind of forethought, and in the cases when it does come up, they can relax a bit. Happy customers! In the airline industry, we have whole books of contingency plans pre-engineered for any situation. We often carefully discussed, step-by-step, what each member of the team would do if and when the play went left. And that's exactly why I made it through the turbulence.

The most important part: OODA

It's one thing to plan. It's another thing to act in a way that makes those plans worth something. If we don't remain attentive and flexible, the plan we worked hard to make is useless.

Colonel John Boyd of the U.S. Air Force pioneered a decision-making loop called OODA : observe, orient, decide, act. We aren't working in a vacuum, and if we don't constantly re-evaluate, our planning goes to waste. Observe the environment, orient yourself to what you see, decide how to respond, and then act. Then observe the result of your actions—and keep going through the loop.

Without planning, OODA won't do much good, but plans never go exactly the way you imagine, and OODA can help you adapt.

I hope you're as excited about planning as I am.

If so, don't keep those plans in your head. Write them down. Talk about them with coaches and employees, clients and vendors. You never know when someone is going to have a better idea than you— it might even be the new guy . Planning for the big stuff makes the small stuff easier. And planning for the small stuff makes the tiny stuff run like clockwork. Don't get complacent, or you'll end up with those face-palmy mistakes.

And, please, always check the weather.

Get productivity tips delivered straight to your inbox

We’ll email you 1-3 times per week—and never share your information.

Hayden Young

After working as a pilot, consultant, and instructor, I found myself made redundant in 2020 at 23 years old. I decided to take the money in my 401k and start my own business. In my time off, I enjoy cooking, biking, photography, and a cold Ale-8-One.

- Small business

Related articles

How to create a sales plan (and 3 templates that do it for you)

How to create a sales plan (and 3 templates...

How to build a B2B prospecting list for cold email campaigns

How to build a B2B prospecting list for cold...

The only Gantt chart template you'll ever need for Excel (and how to automate it)

The only Gantt chart template you'll ever...

6 ways to break down organizational silos

Improve your productivity automatically. Use Zapier to get your apps working together.

- Our Approach

- Our Programs

- Group Locations

- Member Success Stories

- Become a Member

- Vistage Events

- Vistage CEO Climb Events

- Vistage Webinars

- Research & Insights Articles

- Leadership Resource & PDF Center

- A Life of Climb: The CEO’s Journey Podcast

- Perspectives Magazine

- Vistage CEO Confidence Index

- What is Vistage?

- 7 Laws of Leadership

- The CEO’s Climb

- Coaching Qualifications

- Chair Academy

- Apply to be a Vistage Chair

Research & Insights

- Talent Management

- Customer Engagement

- Business Operations

- Personal Development

Strategic Planning

Small business strategic planning: 10 tips to transform your company

Share this:

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

Within our strategic planning practice we have worked with every conceivable type of business, large and small. Larger companies are more likely to engage in strategic planning, not because it is more relevant for them but because they tend to hire professional managers who understand the dramatic impact that a strategic plan can have on profitability and morale.

About half of Vistage members (I have worked with more than 50) engage in some type of strategic planning process, with varying degrees of formality. You may be wondering, why wouldn’t everybody want a plan?

One has to start by understanding the underlying psychology. We get caught in a trap, where the urgent nature of today’s work always takes precedence over strategy. We feel greater accomplishment from finishing routine tasks than attacking larger projects that deliver enterprise value but may require months to complete.