The Ultimate Guide to Pricing Strategies & Models

Discover how to properly price your products, services, or events so you can drive both revenue and profit.

FREE SALES PRICING CALCULATOR

Determine the best pricing strategy for your business with this free calculator and template.

Updated: 08/16/23

Published: 08/16/23

Pricing your products and services can be tough. Set prices too high, and you miss out on valuable sales. Set them too low, and you miss out on valuable revenue.

Thankfully, pricing doesn’t have to be a sacrifice or a shot in the dark. There are dozens of pricing models and strategies that can help you better understand how to set the right prices for your audience and revenue goals.

That’s why we’ve created this guide.

Whether you’re a business beginner or a pricing pro, the tactics and strategies in this guide will get you comfortable with pricing your products. Bookmark this guide for later and use the chapter links to jump around to sections of interest.

Pricing Strategy

Types of pricing strategies, how to create a pricing strategy, pricing models based on industry or business.

Conducting a Pricing Analysis

Pricing Strategy Examples

A pricing strategy is a model or method used to establish the best price for a product or service. It helps you choose prices to maximize profits and shareholder value while considering consumer and market demand.

If only pricing was as simple as its definition — there’s a lot that goes into the process.

Pricing strategies account for many of your business factors, like revenue goals, marketing objectives, target audience, brand positioning, and product attributes. They’re also influenced by external factors like consumer demand, competitor pricing, and overall market and economic trends.

It’s not uncommon for entrepreneurs and business owners to skim over pricing. They often look at the cost of their products (COGS) , consider their competitor’s rates, and tweak their own selling price by a few dollars. While your COGS and competitors are important, they shouldn’t be at the center of your pricing strategy.

The best pricing strategy maximizes your profit and revenue.

Before we talk about pricing strategies, let’s review an important pricing concept that will apply regardless of what strategies you use.

.png)

Free Sales Pricing Strategy Calculator

- Cost-Plus Pricing

- Skimming Strategy

- Value-Based Pricing

You're all set!

Click this link to access this resource at any time.

Determine the Best Pricing Strategy For Your Business

Fill out this form to access the free template., price elasticity of demand.

Price elasticity of demand is used to determine how a change in price affects consumer demand.

If consumers still purchase a product despite a price increase (such as cigarettes and fuel) that product is considered inelastic .

On the other hand, elastic products suffer from pricing fluctuations (such as cable TV and movie tickets).

You can calculate price elasticity using the formula:

% Change in Quantity ÷ % Change in Price = Price Elasticity of Demand

The concept of price elasticity helps you understand whether your product or service is sensitive to price fluctuations. Ideally, you want your product to be inelastic — so that demand remains stable if prices do fluctuate.

Cost, Margin, & Markup in Pricing

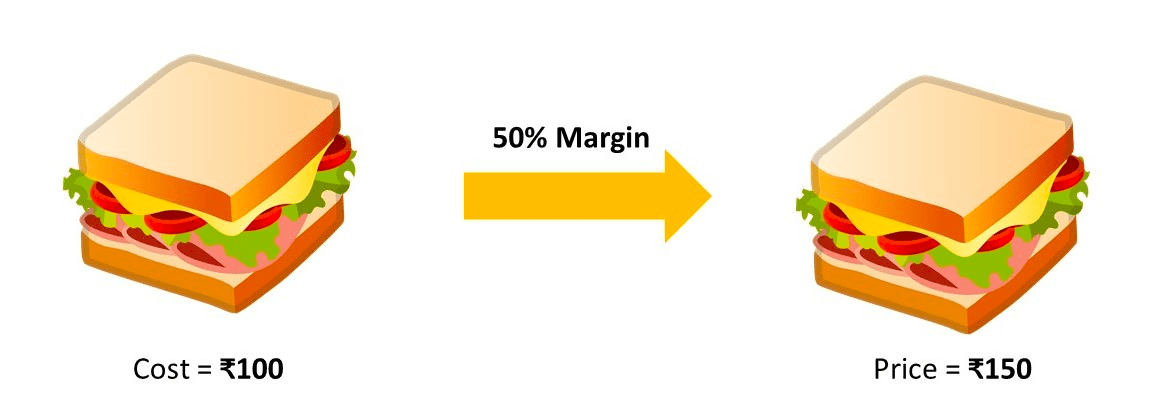

To choose a pricing strategy, it’s also essential to understand the role of cost, margin, and markup — especially if you’d like your pricing to be cost-based . Let’s dive into the definition for each.

Cost refers to the fees you incur from manufacturing, sourcing, or creating the product you sell. That includes the materials themselves, the cost of labor, the fees paid to suppliers, and even the losses. Cost doesn’t include overhead and operational expenses such as marketing, advertising, maintenance, or bills.

Margin (in this case, gross margin) refers to the amount your business earns after you subtract manufacturing costs.

Markup refers to the additional amount you charge for your product over the production and manufacturing fees.

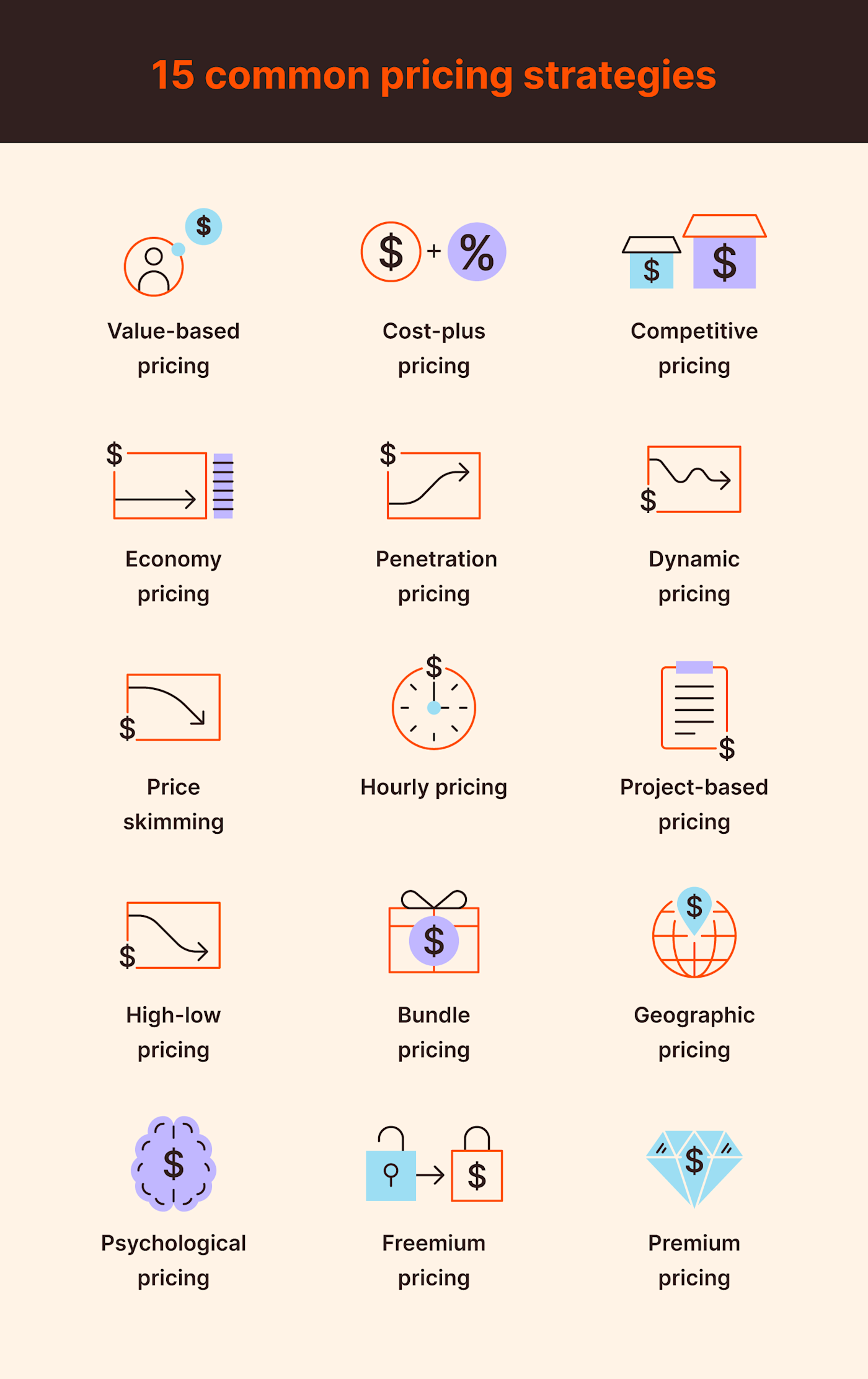

Now, let’s cover some common pricing strategies. As we do so, it’s important to note that these aren’t necessarily standalone strategies — many can be combined when setting prices for your products and services.

- Competition-Based Pricing

- Dynamic Pricing

- High-Low Pricing

- Penetration Pricing

- Skimming Pricing

- Psychological Pricing

- Geographic Pricing

Now, let's dive into the descriptions of each pricing strategy — many of which are included in the template below — so you can learn about what makes each of them unique.

Discover how much your business can earn using different pricing strategies with HubSpot's free sales pricing calculator so you can choose the best pricing model for your business.

Download Template

1. competition-based pricing strategy.

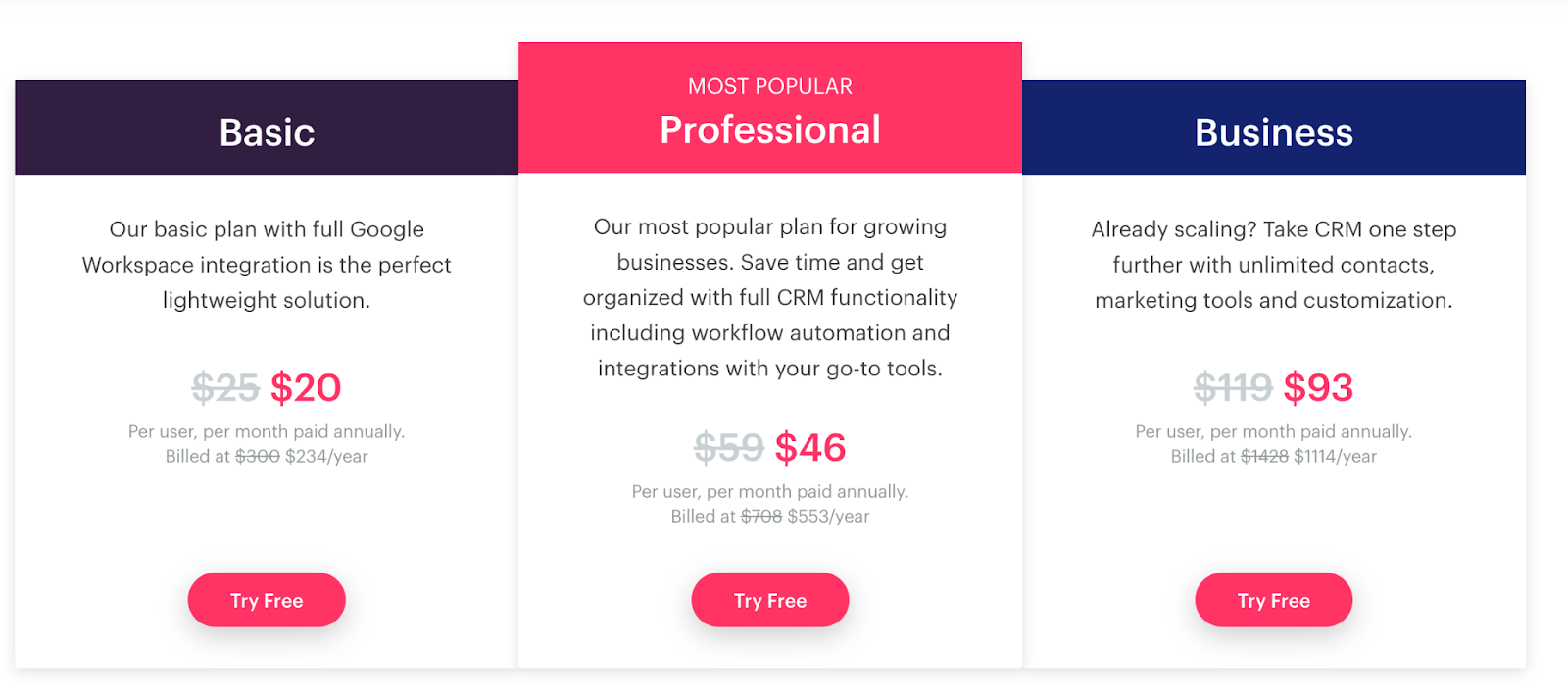

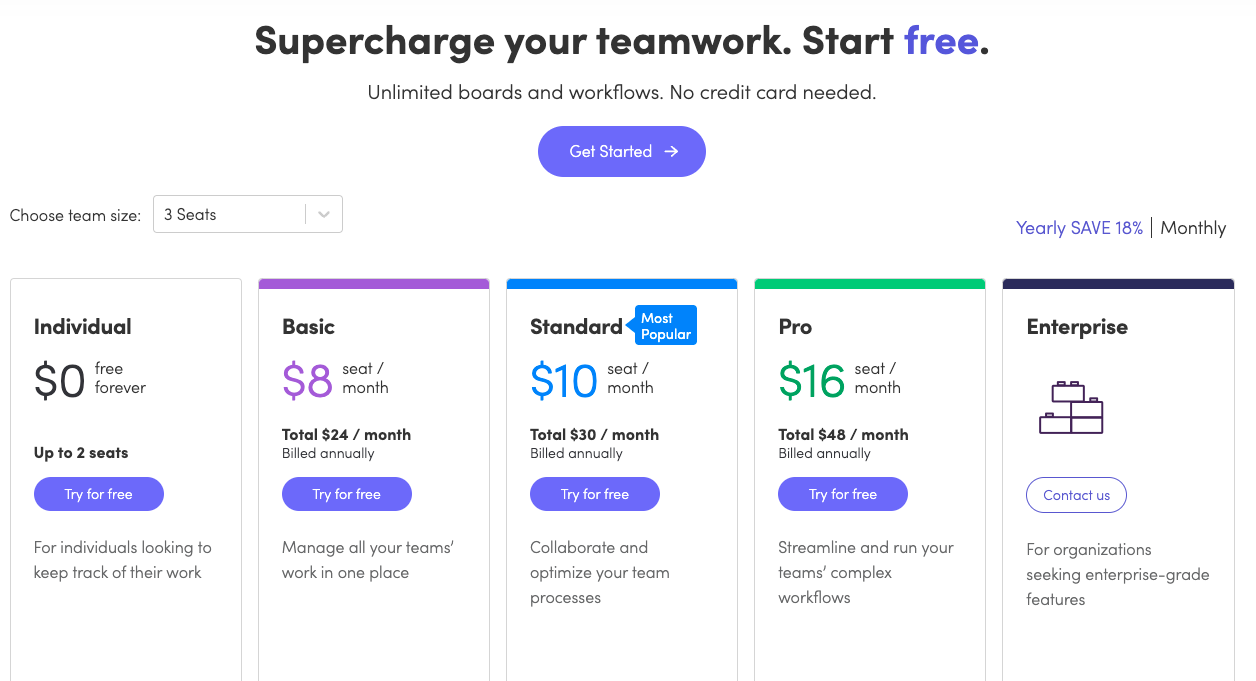

Competition-based pricing is also known as competitive pricing or competitor-based pricing. This pricing strategy focuses on the existing market rate (or going rate ) for a company’s product or service; it doesn’t take into account the cost of their product or consumer demand.

Instead, a competition-based pricing strategy uses the competitors’ prices as a benchmark. Businesses who compete in a highly saturated space may choose this strategy since a slight price difference may be the deciding factor for customers.

With competition-based pricing , you can price your products slightly below your competition, the same as your competition, or slightly above your competition. For example, if you sold marketing automation software , and your competitors’ prices ranged from $19.99 per month to $39.99 per month, you’d choose a price between those two numbers.

Whichever price you choose, competitive pricing is one way to stay on top of the competition and keep your pricing dynamic.

Competition-Based Pricing Strategy in Marketing

Consumers are primarily looking for the best value which isn’t always the same as the lowest price. Pricing your products and services competitively in the market can put your brand in a better position to win a customer’s business. Competitive pricing works especially well when your business offers something the competition doesn’t — like exceptional customer service, a generous return policy, or access to exclusive loyalty benefits .

2. Cost-Plus Pricing Strategy

A cost-plus pricing strategy focuses solely on the cost of producing your product or service, or your COGS . It’s also known as markup pricing since businesses who use this strategy “markup” their products based on how much they’d like to profit.

To apply the cost-plus method, add a fixed percentage to your product production cost. For example, let’s say you sold shoes. The shoes cost $25 to make, and you want to make a $25 profit on each sale. You’d set a price of $50, which is a markup of 100%.

Cost-plus pricing is typically used by retailers who sell physical products. This strategy isn’t the best fit for service-based or SaaS companies as their products typically offer far greater value than the cost to create them.

Cost-Plus Pricing Strategy in Marketing

Cost-plus pricing works well when the competition is pricing using the same model. It won’t help you attract new customers if your competition is working to acquire customers rather than growing profits. Before executing this strategy, complete a pricing analysis that includes your closest competitors to make sure this strategy will help you meet your goals.

3. Dynamic Pricing Strategy

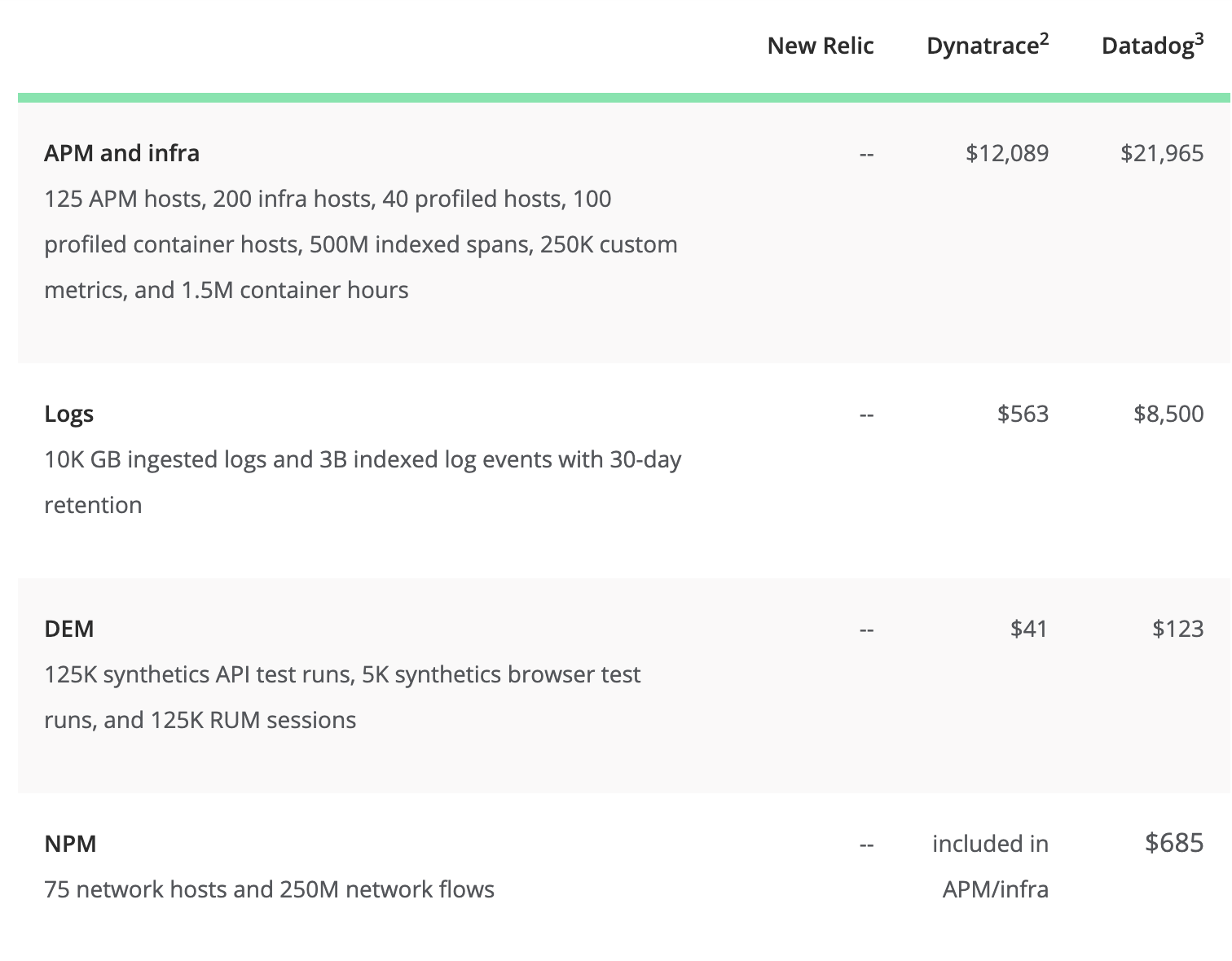

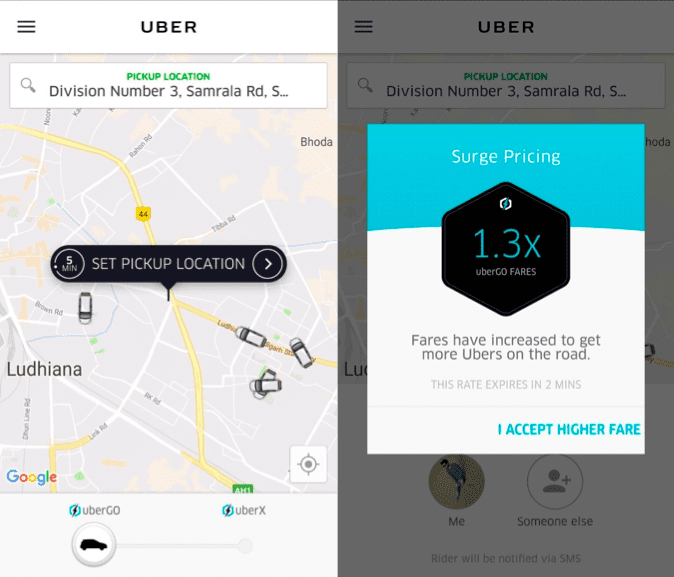

Dynamic pricing is also known as surge pricing, demand pricing, or time-based pricing. It’s a flexible pricing strategy where prices fluctuate based on market and customer demand.

Hotels, airlines, event venues, and utility companies use dynamic pricing by applying algorithms that consider competitor pricing, demand, and other factors. These algorithms allow companies to shift prices to match when and what the customer is willing to pay at the exact moment they’re ready to make a purchase.

Dynamic Pricing Strategy in Marketing

Dynamic pricing can help keep your marketing plans on track. Your team can plan for promotions in advance and configure the pricing algorithm you use to launch the promotion price at the perfect time. You can even A/B test dynamic pricing in real-time to maximize your profits.

4. High-Low Pricing Strategy

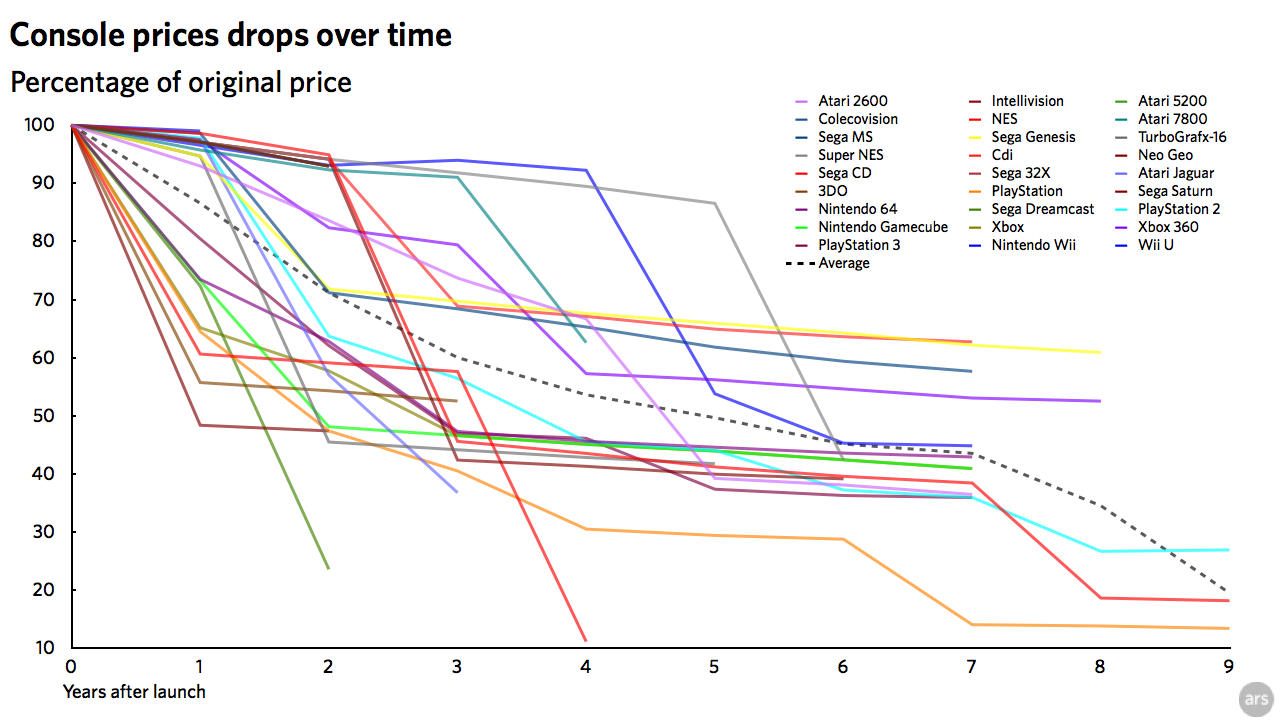

A high-low pricing strategy is when a company initially sells a product at a high price but lowers that price when the product drops in novelty or relevance. Discounts, clearance sections, and year-end sales are examples of high-low pricing in action — hence the reason why this strategy may also be called a discount pricing strategy.

High-low pricing is commonly used by retail firms that sell seasonal items or products that change often, such as clothing, decor, and furniture. What makes a high/low pricing strategy appealing to sellers? Consumers enjoy anticipating sales and discounts, hence why Black Friday and other universal discount days are so popular.

High-Low Pricing Strategy in Marketing

If you want to keep the foot traffic steady in your stores year-round, a high-low pricing strategy can help. By evaluating the popularity of your products during particular periods throughout the year, you can leverage low pricing to increase sales during traditionally slow months.

5. Penetration Pricing Strategy

Contrasted with skimming pricing, a penetration pricing strategy is when companies enter the market with an extremely low price, effectively drawing attention (and revenue) away from higher-priced competitors. Penetration pricing isn’t sustainable in the long run, however, and is typically applied for a short time.

This pricing method works best for brand new businesses looking for customers or for businesses that are breaking into an existing, competitive market. The strategy is all about disruption and temporary loss … and hoping that your initial customers stick around as you eventually raise prices.

(Another tangential strategy is loss leader pricing , where retailers attract customers with intentionally low-priced items in hopes that they’ll buy other, higher-priced products, too. This is precisely how stores like Target get you — and me.)

Penetration Pricing Strategy in Marketing

Penetration pricing has similar implications as freemium pricing — the money won’t come in overnight. But with enough value and a great product or service, you could continue to make money and scale your business as you increase prices. One tip for this pricing strategy is to market the value of the products you sell and let price be a secondary point.

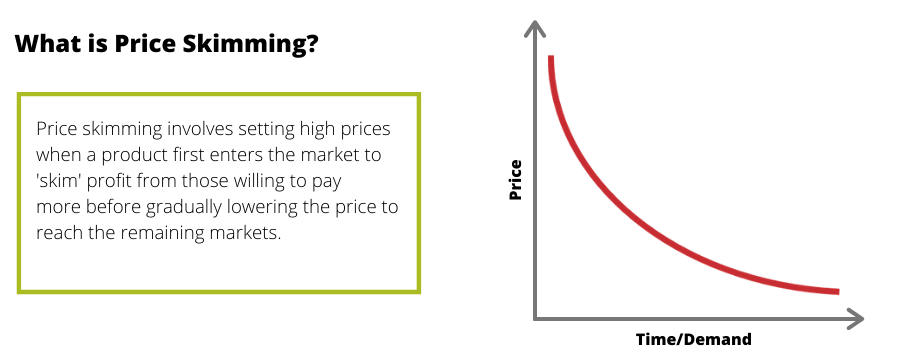

6. Skimming Pricing Strategy

A skimming pricing strategy is when companies charge the highest possible price for a new product and then lower the price over time as the product becomes less and less popular. Skimming is different from high-low pricing in that prices are lowered gradually over time.

Technology products, such as DVD players, video game consoles, and smartphones, are typically priced using this strategy as they become less relevant over time. A skimming pricing strategy helps recover sunk costs and sell products well beyond their novelty, but the strategy can also annoy consumers who bought at full price and attract competitors who recognize the “fake” pricing margin as prices are lowered.

Skimming Pricing Strategy in Marketing

Skimming pricing strategy can work well if you sell products that have products with varying life cycle lengths. One product may come in and out of popularity quickly so you have a short time to skim your profits in the beginning stages of the life cycle. On the flip side, a product that has a longer life cycle can stay at a higher price for more time. You’ll be able to maintain your marketing efforts for each product more effectively without constantly adjusting your pricing across every product you sell.

7. Value-Based Pricing Strategy

A value-based pricing strategy is when companies price their products or services based on what the customer is willing to pay. Even if it can charge more for a product, the company decides to set its prices based on customer interest and data.

If used accurately, value-based pricing can boost your customer sentiment and loyalty. It can also help you prioritize your customers in other facets of your business, like marketing and service.

On the flip side, value-based pricing requires you to constantly be in tune with your various customer profiles and buyer personas and possibly vary your prices based on those differences.

Value-Based Pricing Strategy in Marketing

Marketing to your customers should always lead with value, so having a value-based pricing model should help strengthen the demand for your products and services. Just be sure that your audiences are distinct enough in what they’re willing to pay for — you don’t want to run into trouble by charging more or less based on off-limits criteria .

8. Psychological Pricing Strategy

Psychological pricing is what it sounds like — it targets human psychology to boost your sales.

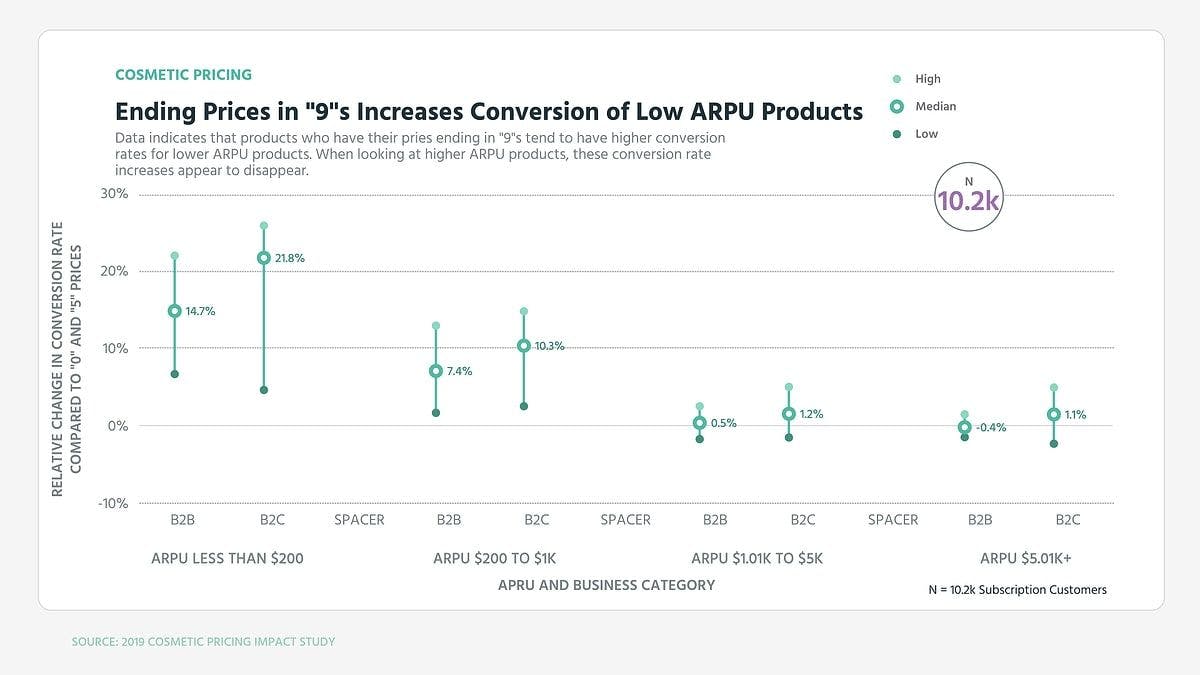

For example, according to the " 9-digit effect ", even though a product that costs $99.99 is essentially $100, customers may see this as a good deal simply because of the "9" in the price.

Another way to use psychological pricing would be to place a more expensive item directly next to (either, in-store or online) the one you're most focused on selling . Or offer a "buy one, get one 50% off (or free)" deal that makes customers feel as though the circumstances are too good to pass up on.

And lastly, changing the font, size, and color of your pricing information on and around your products has also been proven, in various instances, to boost sales.

Psychological Pricing Strategy in Marketing

Psychological pricing strategy requires an intimate understanding of your target market to yield the best results. If your customers are inclined to discounts and coupons, appealing to this desire through your marketing can help this product meet their psychological need to save money. If paying for quality is important to your audience, having the lowest price on the shelf might not help you reach your sales goals. Regardless of the motivations your customers have for paying a certain price for a product, your pricing and marketing should appeal to those motivations.

9. Geographic Pricing Strategy

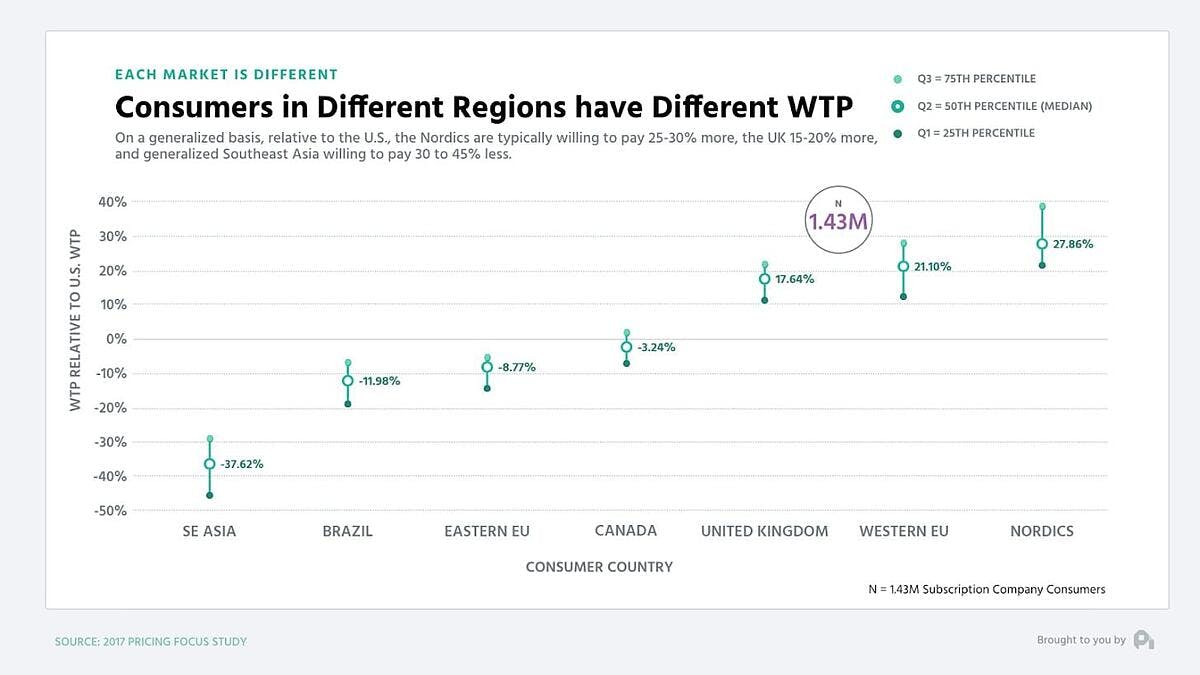

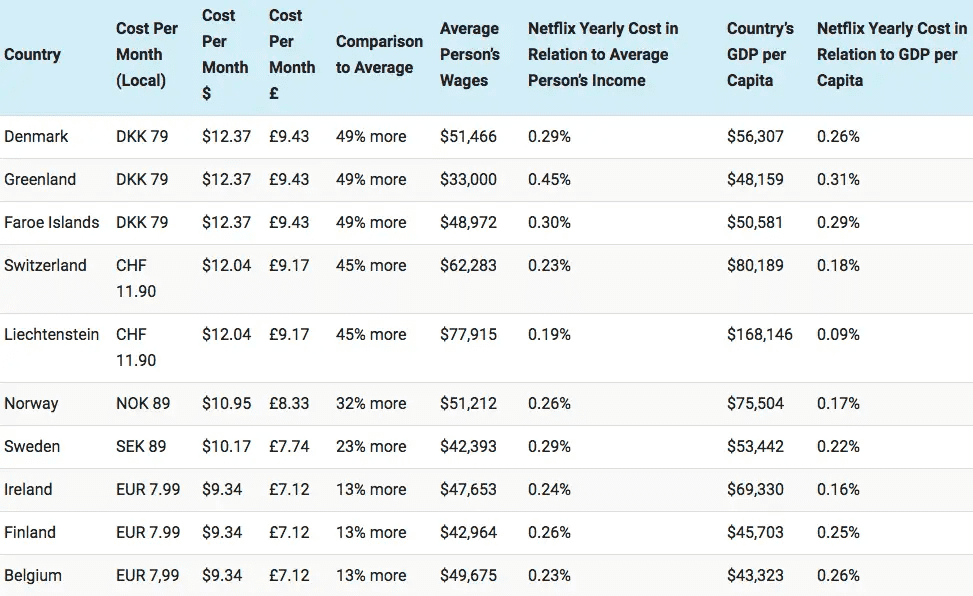

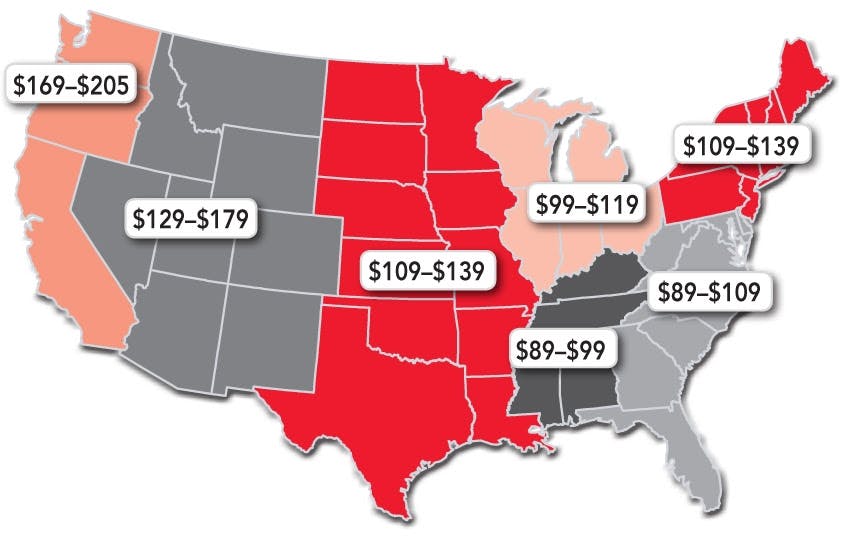

Geographic pricing is when products or services are priced differently depending on geographical location or market.

This strategy may be used if a customer from another country is making a purchase or if there are disparities in factors like the economy or wages (from the location in which you're selling a good to the location of the person it is being sold to).

Geographic Pricing Strategy in Marketing

Marketing a geographically priced product or service is easy thanks to paid social media advertising. Segmenting by zip code, city, or even region can be accomplished at a low cost with accurate results. Even as specific customers travel or permanently move, your pricing model will remain the same which helps you maintain your marketing costs.

Download our free guide to creating buyer personas to easily organize your audience segments and make your marketing stronger.

Like we said above, these strategies aren’t necessarily meant to stand alone. We encourage you to mix and match these methods as needed.

Below, we cover more specific pricing models for individual products.

Pricing Models

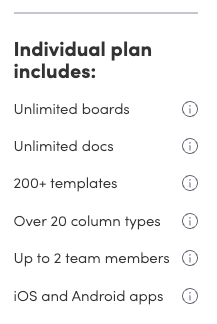

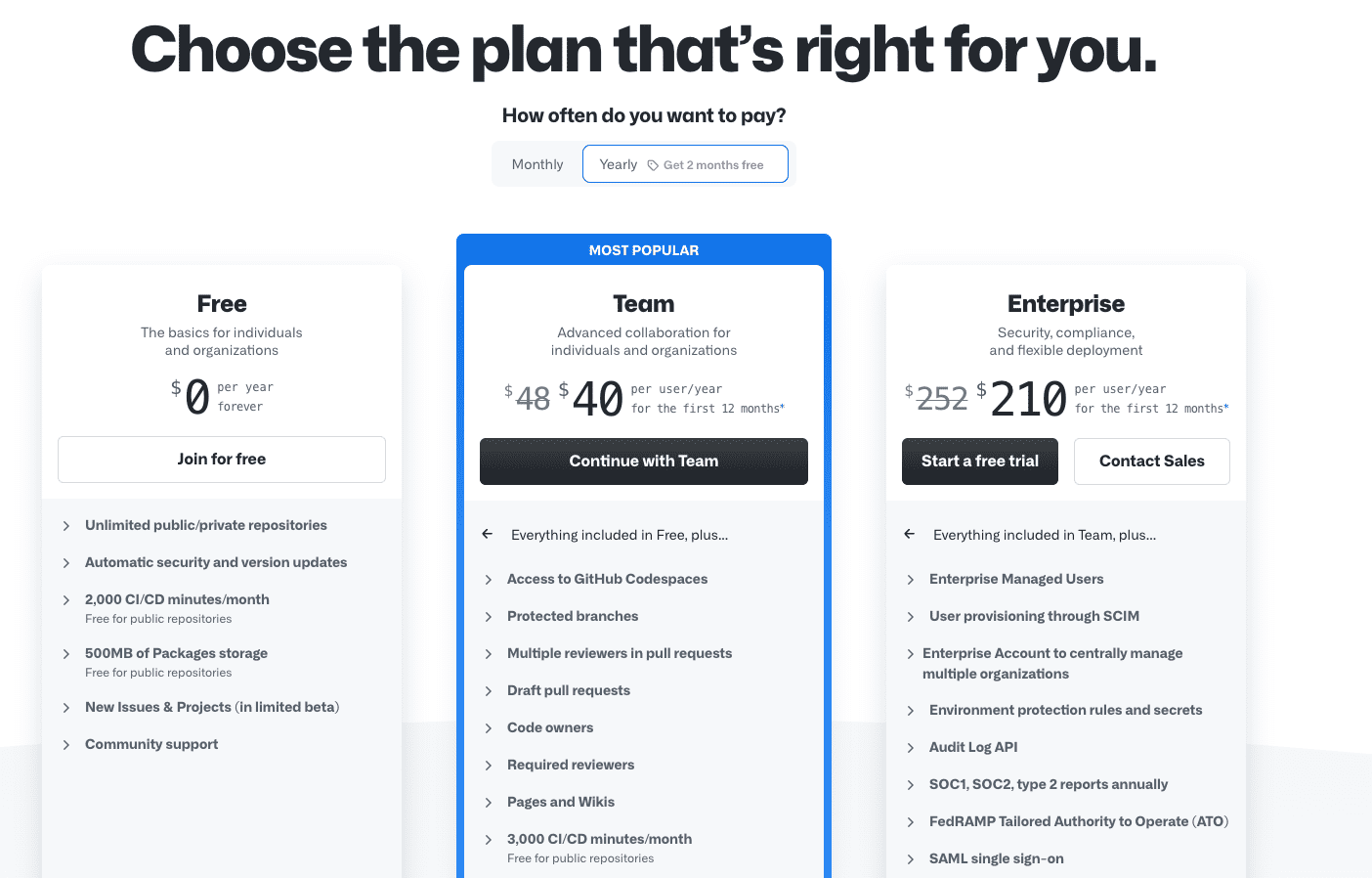

While your pricing strategy may determine how your company sets fees for its offerings overall , the below pricing models can help you set prices for specific product lines. Let's take a look.

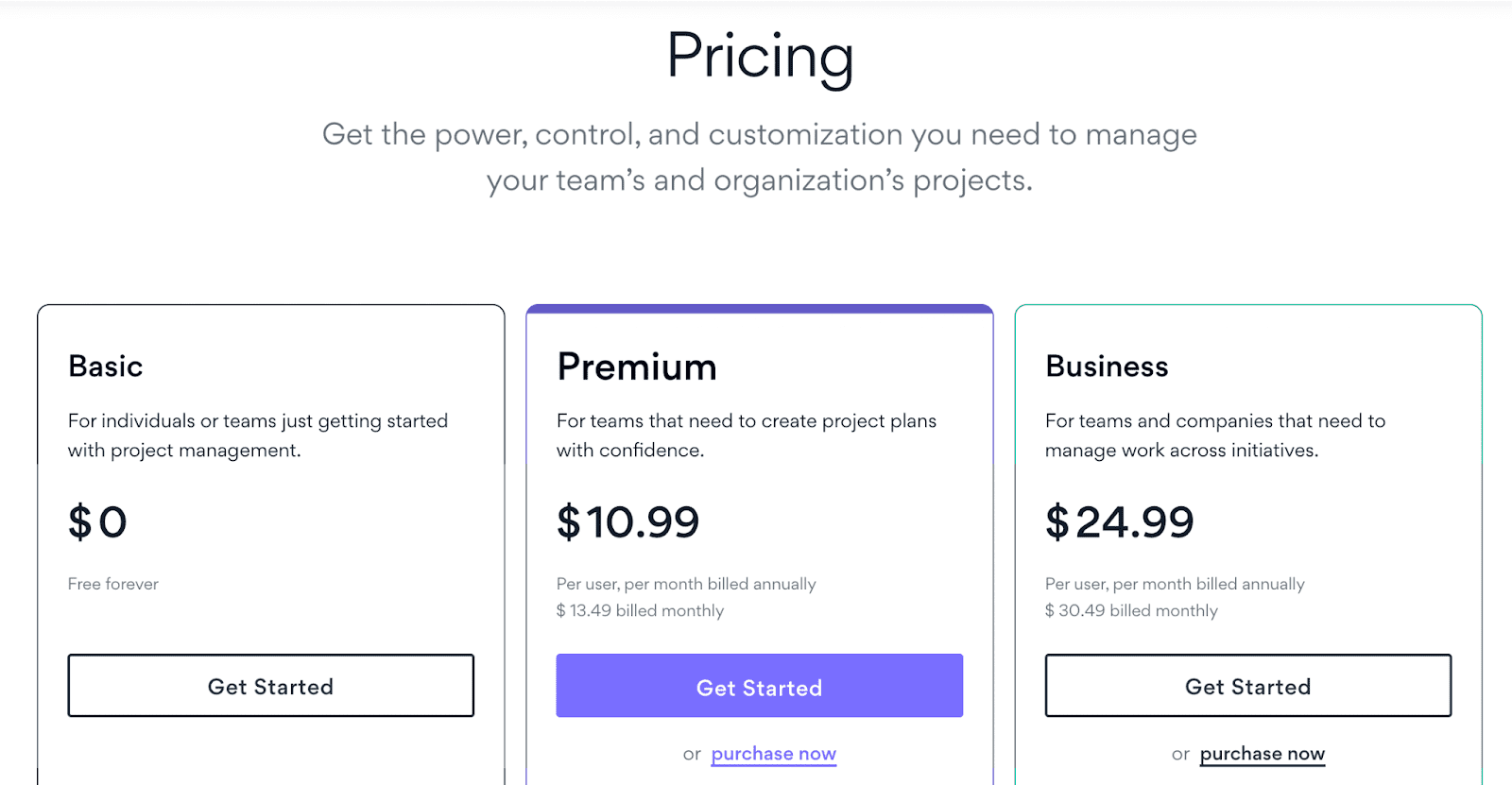

1. Freemium

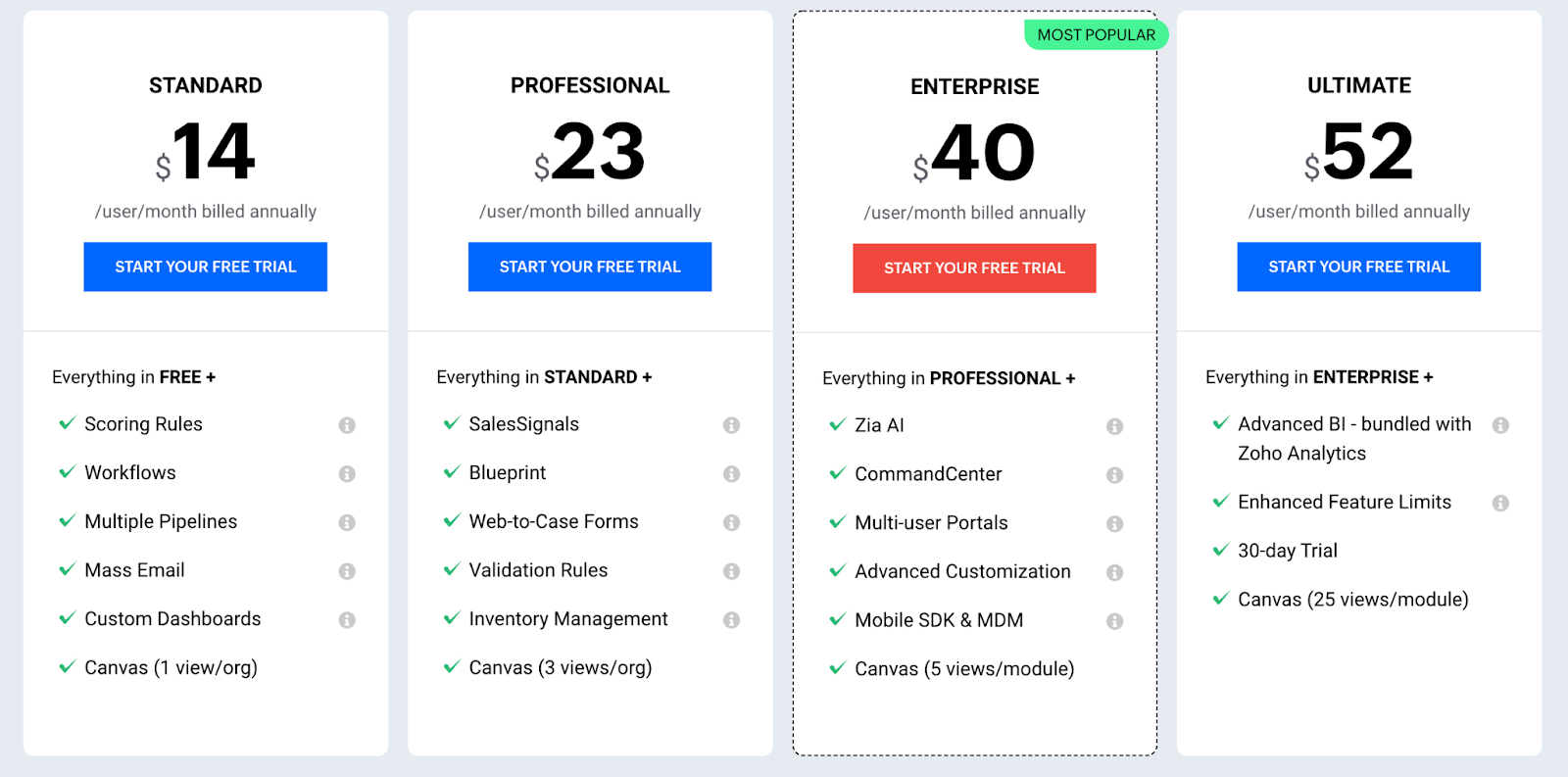

A combination of the words “free” and “premium,” freemium pricing is when companies offer a basic version of their product hoping that users will eventually pay to upgrade or access more features.

Unlike cost-plus, freemium is a pricing model commonly used by SaaS and other software companies. They choose this model because free trials and limited memberships offer a peek into a software’s full functionality — and also build trust with a potential customer before purchase.

With freemium, a company’s prices must be a function of the perceived value of their products. For example, companies that offer a free version of their software can’t ask users to pay $100 to transition to the paid version. Prices must present a low barrier to entry and grow incrementally as customers are offered more features and benefits.

Freemium Pricing in Marketing

Freemium pricing may not make your business a lot of money on the initial acquisition of a customer, but it gives you access to the customer which is just as valuable. With access to their email inboxes, phone number, and any other contact information you gather in exchange for the free product, you can nurture the customer into a brand loyal advocate with a worthwhile LTV .

2. Premium Pricing

Also known as prestige pricing and luxury pricing, a premium pricing model is when companies price their products high to present the image that their products are high-value, luxury, or premium. Prestige pricing focuses on the perceived value of a product rather than the actual value or production cost.

Prestige pricing is a direct function of brand awareness and brand perception. Brands that apply this pricing method are known for providing value and status through their products — which is why they’re priced higher than other competitors. Fashion and technology are often priced using this model because they can be marketed as luxurious, exclusive, and rare.

Premium Pricing in Marketing

Premium pricing is quite dependent upon the perception of your product within the market. There are a few ways to market your product in order to influence a premium perception of it including using influencers, controlling supply, and driving up demand.

3. Hourly Pricing

Hourly pricing, also known as rate-based pricing, is commonly used by consultants, freelancers, contractors, and other individuals or laborers who provide business services. Hourly pricing is essentially trading time for money. Some clients are hesitant to honor this pricing strategy as it can reward labor instead of efficiency.

Hourly Pricing in Marketing

If your business thrives on quick, high-volume projects, hourly pricing can be just the incentive for customers to work with you. By breaking down your prices into hourly chunks, customers can make the decision to work with you based on a low price point rather than finding room in their budget for an expensive project-based commitment.

4. Bundle Pricing

Bundle pricing is when you offer (or "bundle") two or more complementary products or services together and sell them for a single price. You may choose to sell your bundled products or services only as part of a bundle, or sell them as both components of bundles and individual products.

This is a great way to add value through your offerings to customers who are willing to pay extra upfront for more than one product. It can also help you get your customers hooked on more than one of your products faster.

Bundle Pricing in Marketing

Marketing bundle deals can help you sell more products than you would otherwise sell individually. It’s a smart way to upsell and cross-sell your offerings in a way that is beneficial for the customer and your revenue goals.

5. Project-Based Pricing

Project-based pricing is the opposite of hourly pricing — this approach charges a flat fee per project instead of a direct exchange of money for time. It is also used by consultants, freelancers, contractors, and other individuals or laborers who provide business services.

Project-based pricing may be estimated based on the value of the project deliverables. Those who choose this pricing model may also create a flat fee from the estimated time of the project.

Project-Based Pricing in Marketing

Leading with the benefits a customer will derive from working with your business on a project can make project-based pricing more appealing. Although the cost of the project may be steep, the one-time investment can be worth it. Your clients will know that they’ll be able to work with you until the project is completed rather than until their allotted hours are depleted.

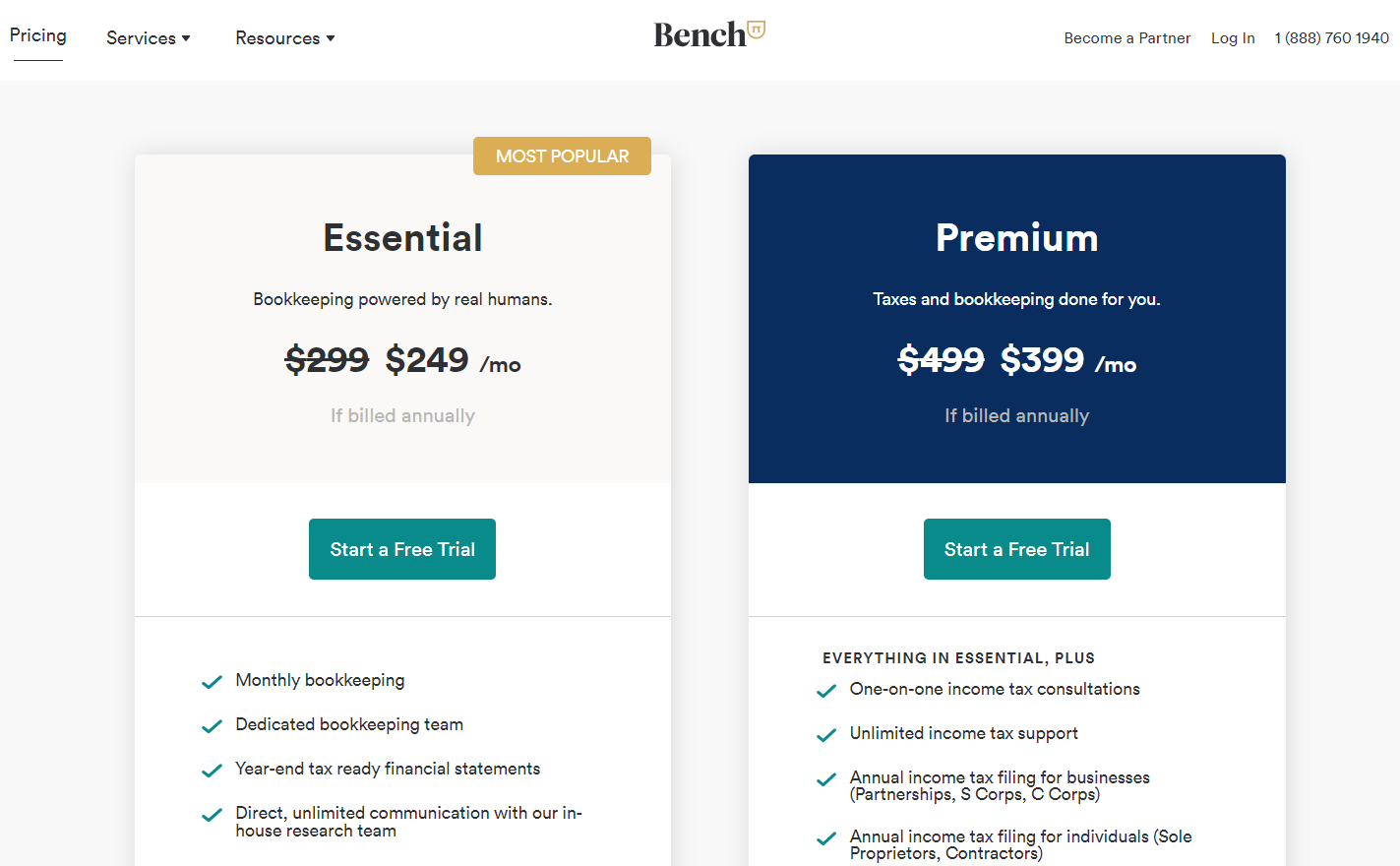

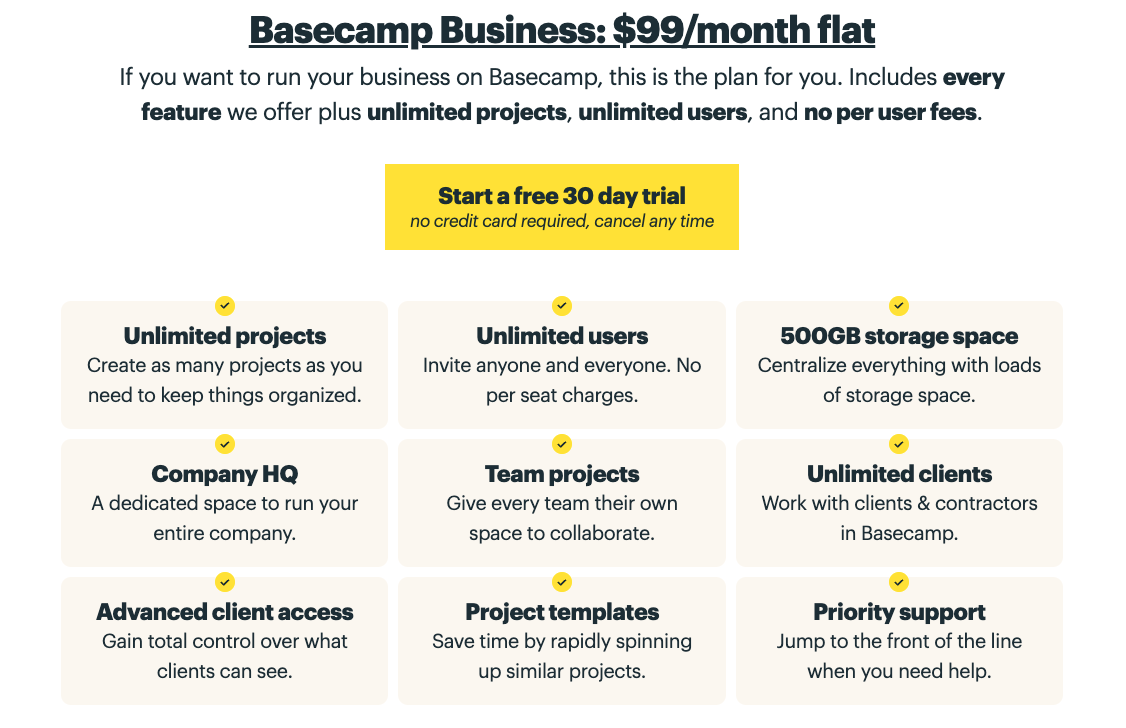

6. Subscription Pricing

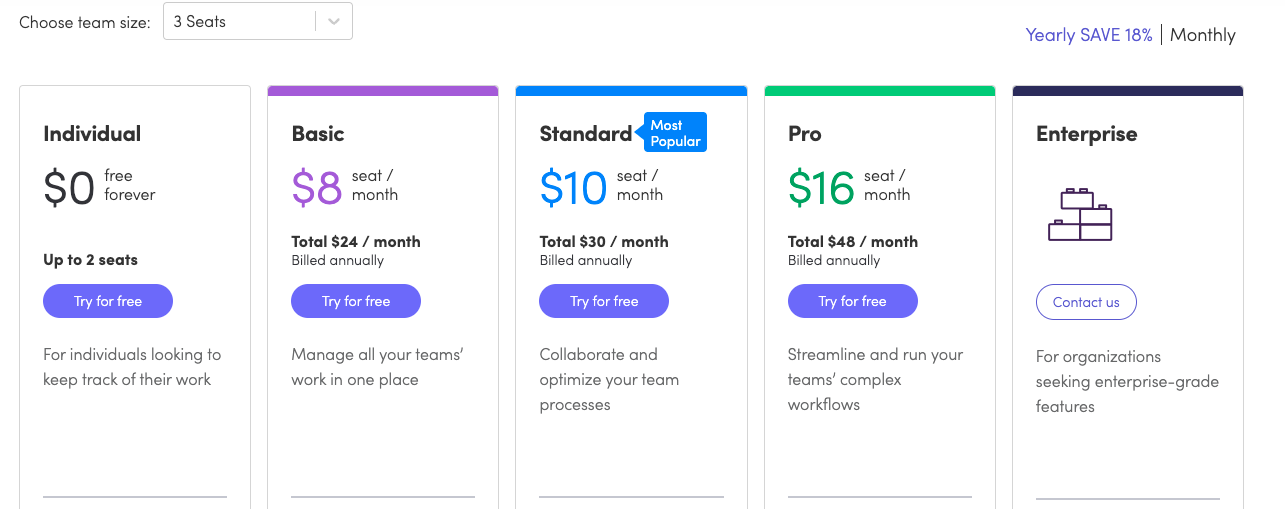

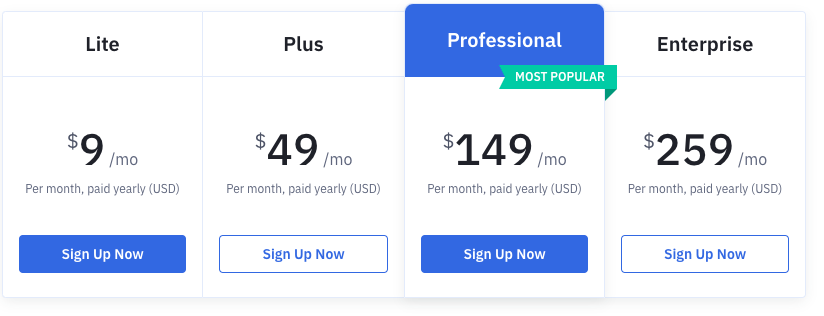

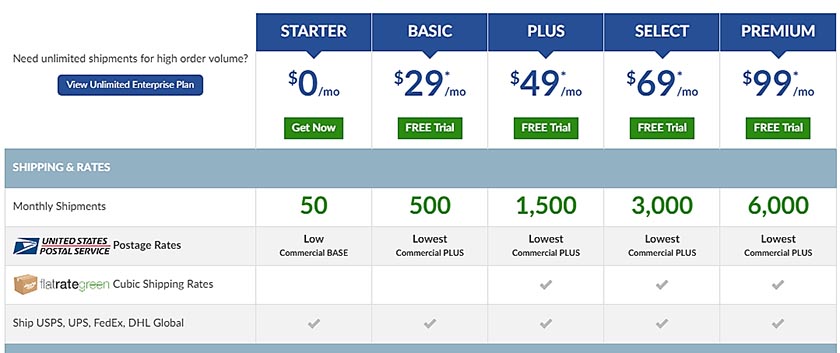

Subscription pricing is a common pricing model at SaaS companies, online retailers, and even agencies who offer subscription packages for their services.

Whether you offer flat rate subscriptions or tiered subscriptions, the benefits of this model are endless. For one, you have all but guaranteed monthly recurring revenue (MRR) and yearly recurring revenue. That makes it simpler to calculate your profits on a monthly basis. It also often leads to higher customer lifetime values .

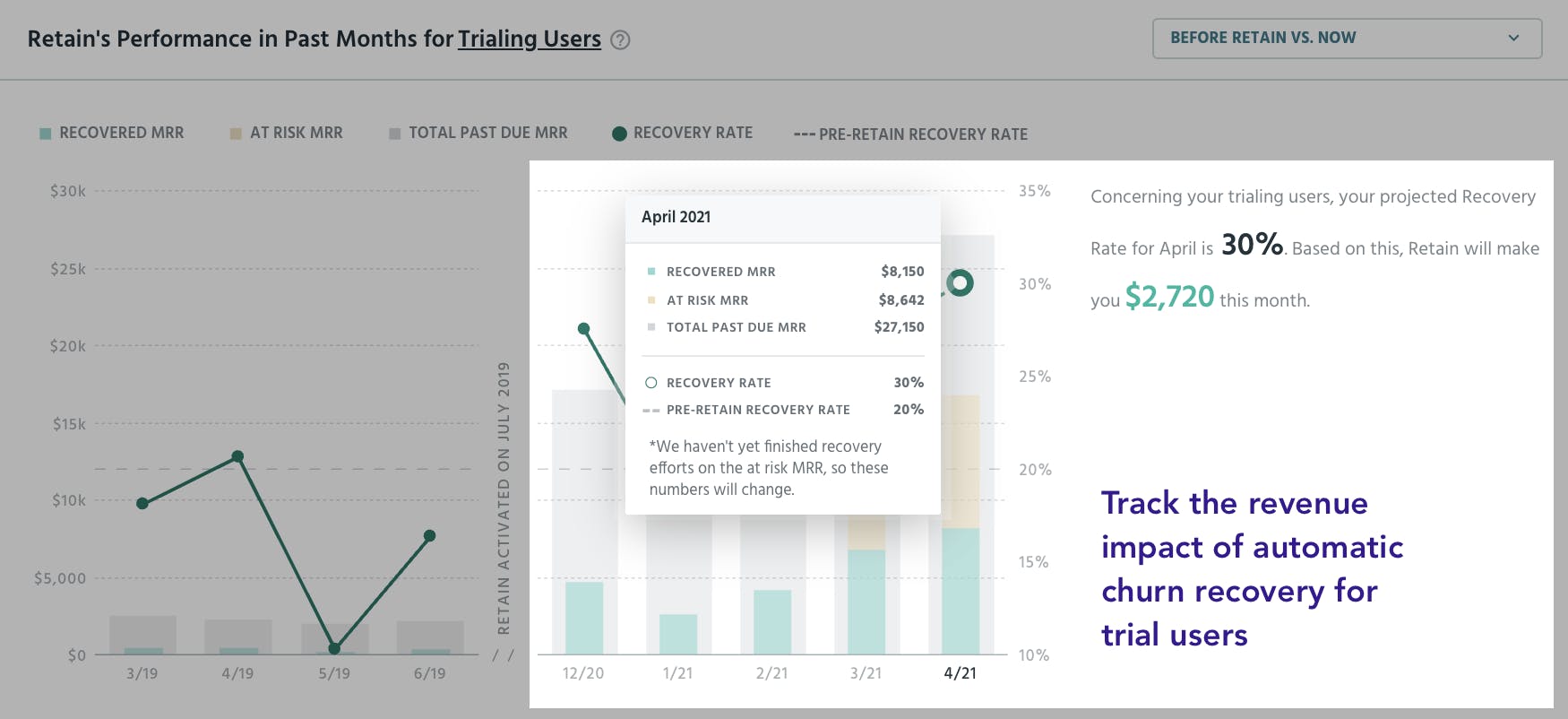

The one thing to be wary of when it comes to subscription pricing is the high potential for customer churn . People cancel subscriptions all the time, so it's essential to have a customer retention strategy in place to ensure clients keep their subscriptions active.

Subscription Pricing in Marketing

When marketing your subscription products, it's essential to create buyer personas for each tier. That way, you know which features to include and what will appeal to each buyer. A general subscription that appeals to everyone won't pull in anyone.

Even Amazon, which offers flat-rate pricing for its Prime subscription, includes a membership for students. That allows them to market the original Prime more effectively by creating a sense of differentiation.

Now, let’s discuss how to build a pricing strategy of your own liking.

1. Evaluate pricing potential.

You want to make a strategy that is optimal for your unique business. To begin, you need to evaluate your pricing potential. This is the approximate product or service pricing your business can potentially achieve in regard to cost, demand, and more.

Some factors that can affect your pricing potential include:

- Geographical market specifics

- Operating costs

- Inventories

- Demand fluctuations

- Competitive advantages and concerns

- Demographic data

We’ll dive deeper into demographic data in the next step.

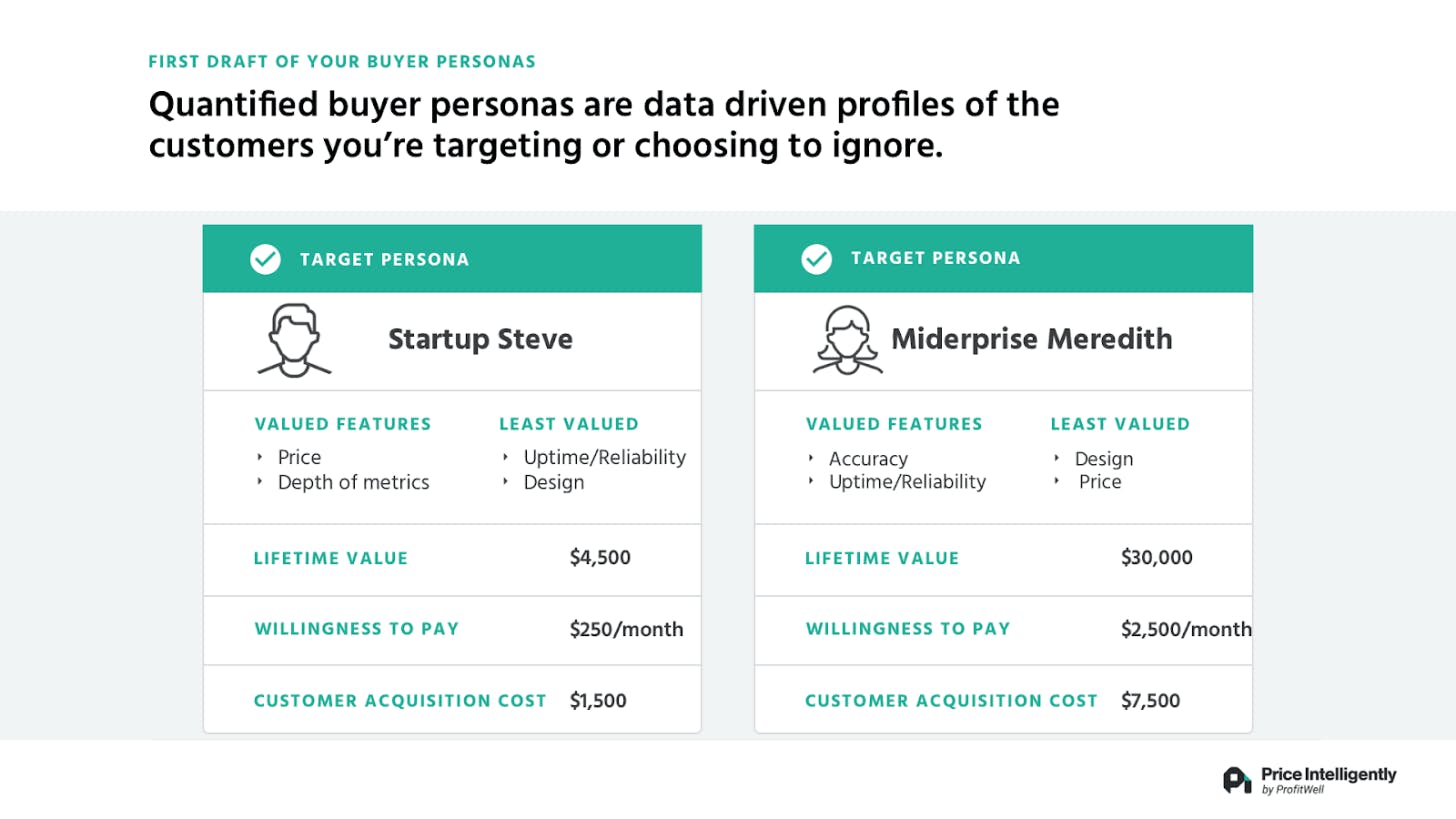

2. Determine your buyer personas.

You have to price your product on the type of buyer persona that’s looking for it. When you look at your ideal customer, you’ll have to look at their:

- Customer Lifetime Value

- Willingness to Pay

- Customer Pain Points

To aid in this process, interview customers and prospects to see what they do and like, and ask for your sales team’s feedback on the best leads and their characteristics.

3. Analyze historical data.

Take a look at your previous pricing strategies. You can calculate the difference in closed deals, churn data , or sold product on different pricing strategies that your business has worked with before and look at which were the most successful.

4. Strike a balance between value and business goals.

When developing your pricing strategy, you want to make sure the price is good to your bottom line and your buyer personas. This compromise will better help your business and customer pool, with the intentions of:

- Increasing profitability

- Improving cash flow

- Market penetration

- Expanding market share

5. Look at competitor pricing.

You can’t make a pricing strategy without conducting research on your competitors’ offerings. You’ll have to decide between two main choices when you see the price difference for your same product or service:

- Beat your competitors’ price - If a competitor is charging more for the same offering as your brand, then make the price more affordable.

- Beat your competitors’ value - Also known as value-based pricing , you can potentially price your offering higher than your competitors if the value provided to the customer is greater.

To see the competition’s full product or service offering, conduct a full competitive analysis so you can see their strengths and weaknesses, and make your pricing strategy accordingly.

So we’ve gone over how to create a pricing strategy, now let’s discuss how to apply these steps to different businesses and industries.

Not every pricing strategy is applicable to every business. Some strategies are better suited for physical products whereas others work best for SaaS companies. Here are examples of some common pricing models based on industry and business.

Product Pricing Model

Unlike digital products or services, physical products incur hard costs (like shipping, production, and storage) that can influence pricing. A product pricing strategy should consider these costs and set a price that maximizes profit, supports research and development, and stands up against competitors.

👉🏼 We recommend these pricing strategies when pricing physical products : cost-plus pricing, competitive pricing, prestige pricing, and value-based pricing.

Digital Product Pricing Model

Digital products, like software, online courses, and digital books, require a different approach to pricing because there’s no tangible offering or unit economics (production cost) involved. Instead, prices should reflect your brand, industry, and overall value of your product.

👉🏼 We recommend using these pricing strategies when pricing digital products: competition-based pricing, freemium pricing, and value-based pricing.

Restaurant Pricing Model

Restaurant pricing is unique in that physical costs, overhead costs, and service costs are all involved. You must also consider your customer base, overall market trends for your location and cuisine, and the cost of food — as all of these can fluctuate.

👉🏼 We recommend using these pricing strategies when pricing at restaurants: cost-plus pricing, premium pricing, and value-based pricing.

Event Pricing Model

Events can’t be accurately measured by production cost (not unlike the digital products we discussed above). Instead, event value is determined by the cost of marketing and organizing the event as well as the speakers, entertainers, networking, and the overall experience — and the ticket prices should reflect these factors.

👉🏼 We recommend using these pricing strategies when pricing live events: competition-based pricing, dynamic pricing, and value-based pricing.

Services Pricing Model

Business services can be hard to price due to their intangibility and lack of direct production cost. Much of the service value comes from the service provider’s ability to deliver and the assumed caliber of their work. Freelancers and contractors , in particular, must adhere to a services pricing strategy.

👉🏼 We recommend using these pricing strategies when pricing services: hourly pricing, project-based pricing, and value-based pricing.

Nonprofit Pricing Model

Nonprofits need pricing strategies, too — a pricing strategy can help nonprofits optimize all processes so they’re successful over an extended period of time.

A nonprofit pricing strategy should consider current spending and expenses, the breakeven number for their operation, ideal profit margin, and how the strategy will be communicated to volunteers, licensees, and anyone else who needs to be informed. A nonprofit pricing strategy is unique because it often calls for a combination of elements that come from a few pricing strategies.

👉🏼 We recommend using these pricing strategies when pricing nonprofits: competitive pricing, cost-plus pricing, demand pricing, and hourly pricing.

Education Pricing Model

Education encompasses a wide range of costs that are important to consider depending on the level of education, private or public education, and education program/ discipline.

Specific costs to consider in an education pricing strategy are tuition, scholarships, additional fees (labs, books, housing, meals, etc.). Other important factors to note are competition among similar schools, demand (number of student applications), number and costs of professors/ teachers, and attendance rates.

👉🏼 We recommend using these pricing strategies when pricing education: competitive pricing, cost-based pricing, and premium pricing.

Real Estate Pricing Model

Real estate encompasses home value estimates, market competition, housing demand, and cost of living. There are other factors that play a role in real estate pricing models including potential bidding wars, housing estimates and benchmarks (which are available through real estate agents but also through free online resources like Zillow ), and seasonal shifts in the real estate market.

👉🏼 We recommend using these pricing strategies when pricing real estate: competitive pricing, dynamic pricing, premium pricing, and value-based pricing.

Agency Pricing Model

Agency pricing models impact your profitability, retention rates, customer happiness, and how you market and sell your agency. When developing and evolving your agency’s pricing model, it’s important to take into consideration different ways to optimize it so you can determine the best way to boost the business's profits.

👉🏼 We recommend using these pricing strategies when pricing agencies: hourly pricing, project-based pricing, and value-based pricing.

Manufacturing Pricing Model

The manufacturing industry is complex — there are a number of moving parts and your manufacturing pricing model is no different. Consider product evolution, demand, production cost, sale price, unit sales volume, and any other costs related to your process and product. Another key part to a manufacturing pricing strategy is understanding the maximum amount the market will pay for your specific product to allow for the greatest profit.

👉🏼 We recommend using these pricing strategies when pricing manufacturing: competitive pricing, cost-plus pricing, and value-based pricing.

Ecommerce Pricing Model

Ecommerce pricing models are how you determine the price at which you’ll sell your online products and what it'll cost you to do so. Meaning, you must think about what your customers are willing to pay for your online products and what those products cost you to purchase and/or create. You might also factor in your online campaigns to promote these products as well as how easy it is for your customers to find similar products to yours on the ecommerce sites of your competitors.

👉🏼 We recommend using these pricing strategies when pricing ecommerce: competitive pricing, cost-based pricing, dynamic pricing, freemium pricing, penetration pricing, and value-based pricing.

Pricing Analysis

Pricing analysis is a process of evaluating your current pricing strategy against market demand. Generally, pricing analysis examines price independently of cost. The goal of a pricing analysis is to identify opportunities for pricing changes and improvements.

You typically conduct a pricing analysis when considering new product ideas, developing your positioning strategy, or running marketing tests. It's also wise to run a price analysis once every year or two to evaluate your pricing against competitors and consumer expectations — doing so preemptively avoids having to wait for poor product performance.

How to Conduct a Pricing Analysis

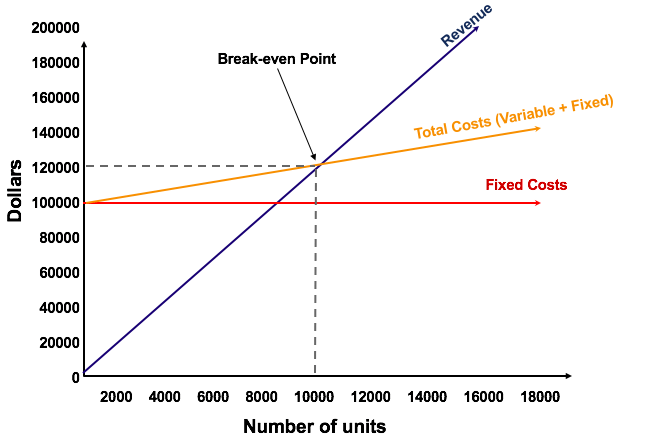

1. determine the true cost of your product or service..

To calculate the true cost of a product or service that you sell, you’ll want to recognize all of your expenses including both fixed and variable costs. Once you’ve determined these costs, subtract them from the price you’ve already set or plan to set for your product or service.

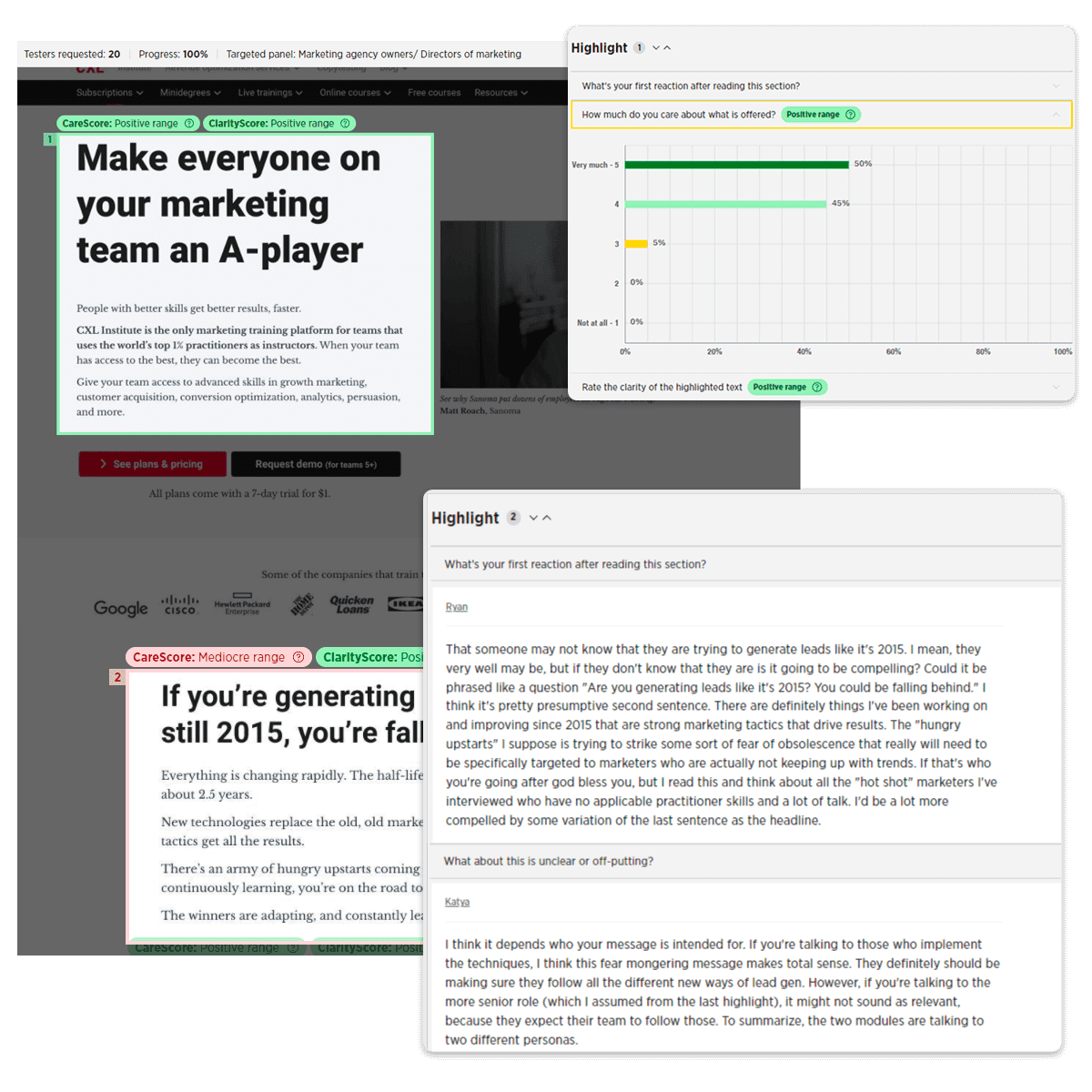

2. Understand how your target market and customer base respond to the pricing structure.

Surveys, focus groups, or questionnaires can be helpful in determining how the market responds to your pricing model. You’ll get a glimpse into what your target customers value and how much they’re willing to pay for the value your product or service provides.

3. Analyze the prices set by your competitors.

There are two types of competitors to consider when conducting a pricing analysis: direct and indirect.

Direct competitors are those who sell the exact same product that you sell. These types of competitors are likely to compete on price so they should be a priority to review in your pricing analysis.

Indirect competitors are those who sell alternative products that are comparable to what you sell. If a customer is looking for your product, but it’s out of stock or it’s out of their price range, they may go to an indirect competitor to get a similar product.

4. Review any legal or ethical constraints to cost and price.

There’s a fine line between competing on price and falling into legal and ethical trouble. You’ll want to have a firm understanding of price-fixing and predatory pricing while doing your pricing analysis in order to steer clear of these practices.

Analyzing your current pricing model is necessary to determine a new (and better!) pricing strategy. This applies whether you're developing a new product, upgrading your current one, or simply repositioning your marketing strategy.

Next, let’s look at some examples of pricing strategies that you can use for your own business.

Dynamic Pricing Strategy: Chicago Cubs Freemium Pricing Strategy: HubSpot Penetration Pricing Strategy: Netflix Premium Pricing: AWAY Competitive Pricing Strategy: Shopify Project-Based Pricing Strategy: Courtney Samuel Events Value-Based Pricing Strategy: INBOUND Bundle Pricing: State Farm Geographic Pricing: Gasoline

Pricing models can be hard to visualize. Below, we’ve pulled together a list of examples of pricing strategies as they’ve been applied to everyday situations or businesses.

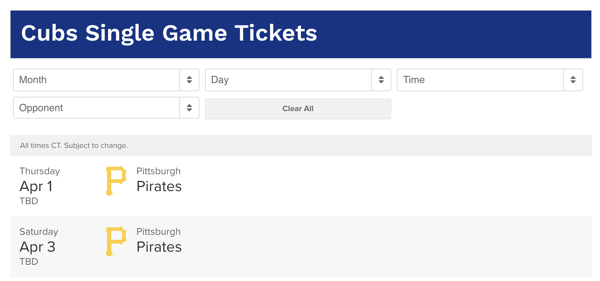

1. Dynamic Pricing Strategy: Chicago Cubs

I live in Chicago five blocks away from Wrigley Field, and my friends and I love going to Cubs games. Finding tickets is always interesting, though, because every time we check prices, they’ve fluctuated a bit from the last time. Purchasing tickets six weeks in advance is always a different process than purchasing them six days prior — and even more sox pricing at the gate.

This is an example of dynamic pricing — pricing that varies based on market and customer demand. Prices for Cubs games are always more expensive on holidays, too, when more people are visiting the city and are likely to go to a game.

(Another prime example of dynamic pricing is INBOUND , for which tickets get more expensive as the event nears.)

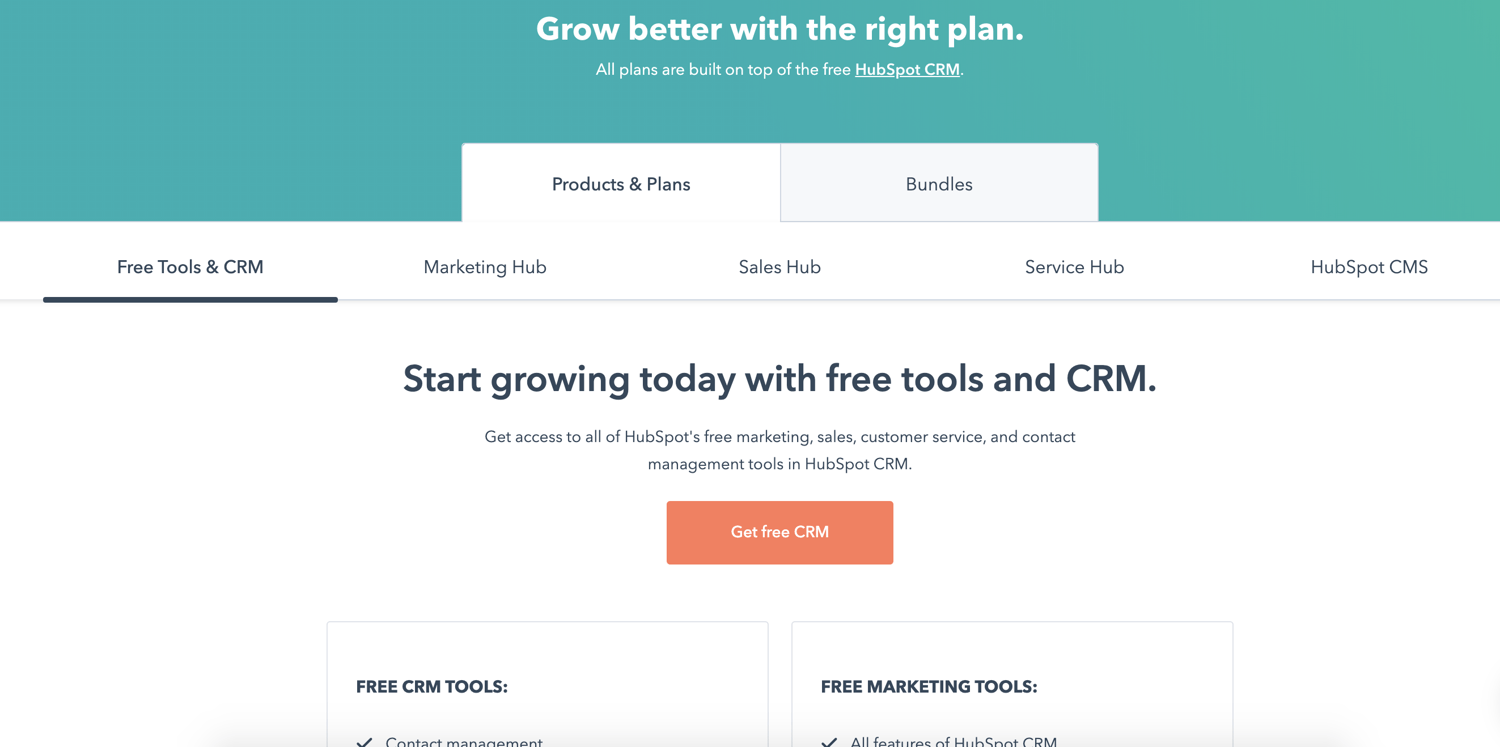

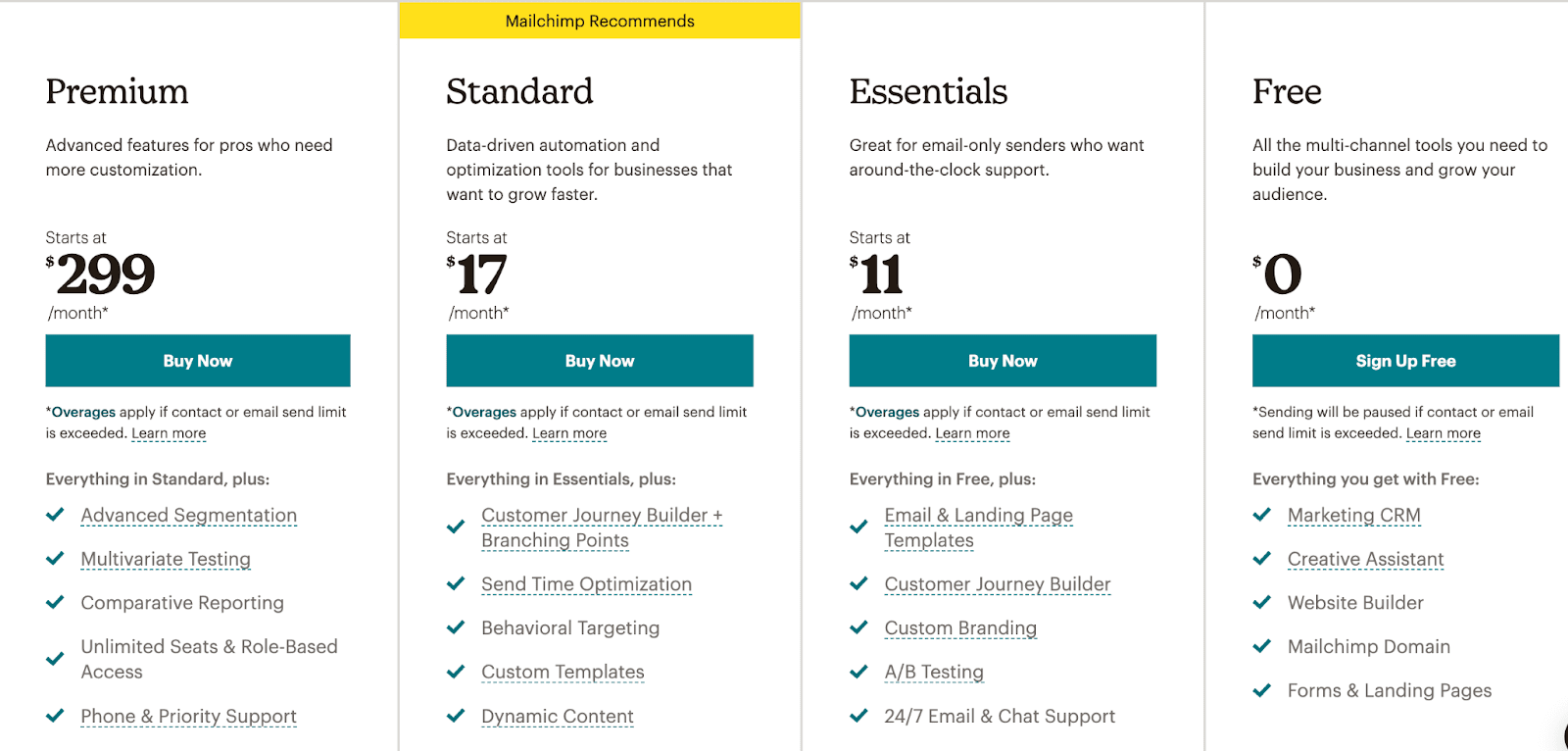

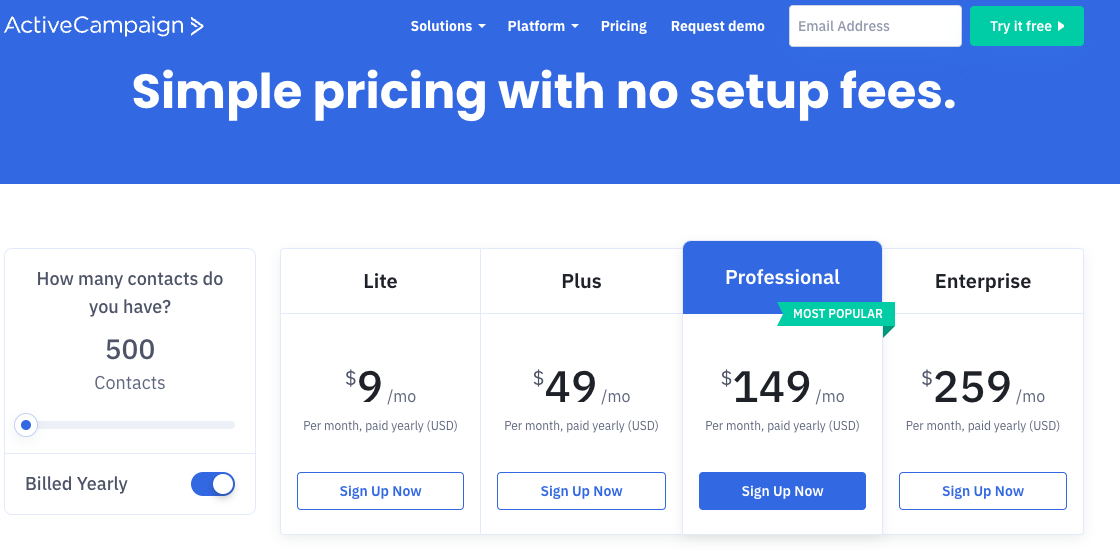

2. Freemium Pricing Strategy: HubSpot

HubSpot is an example of freemium pricing at work. There's a free version of the CRM for scaling businesses as well as paid plans for the businesses using the CRM platform that need a wider range of features .

Moreover, within those marketing tools, HubSpot provides limited access to specific features. This type of pricing strategy allows customers to acquaint themselves with HubSpot and for HubSpot to establish trust with customers before asking them to pay for additional access.

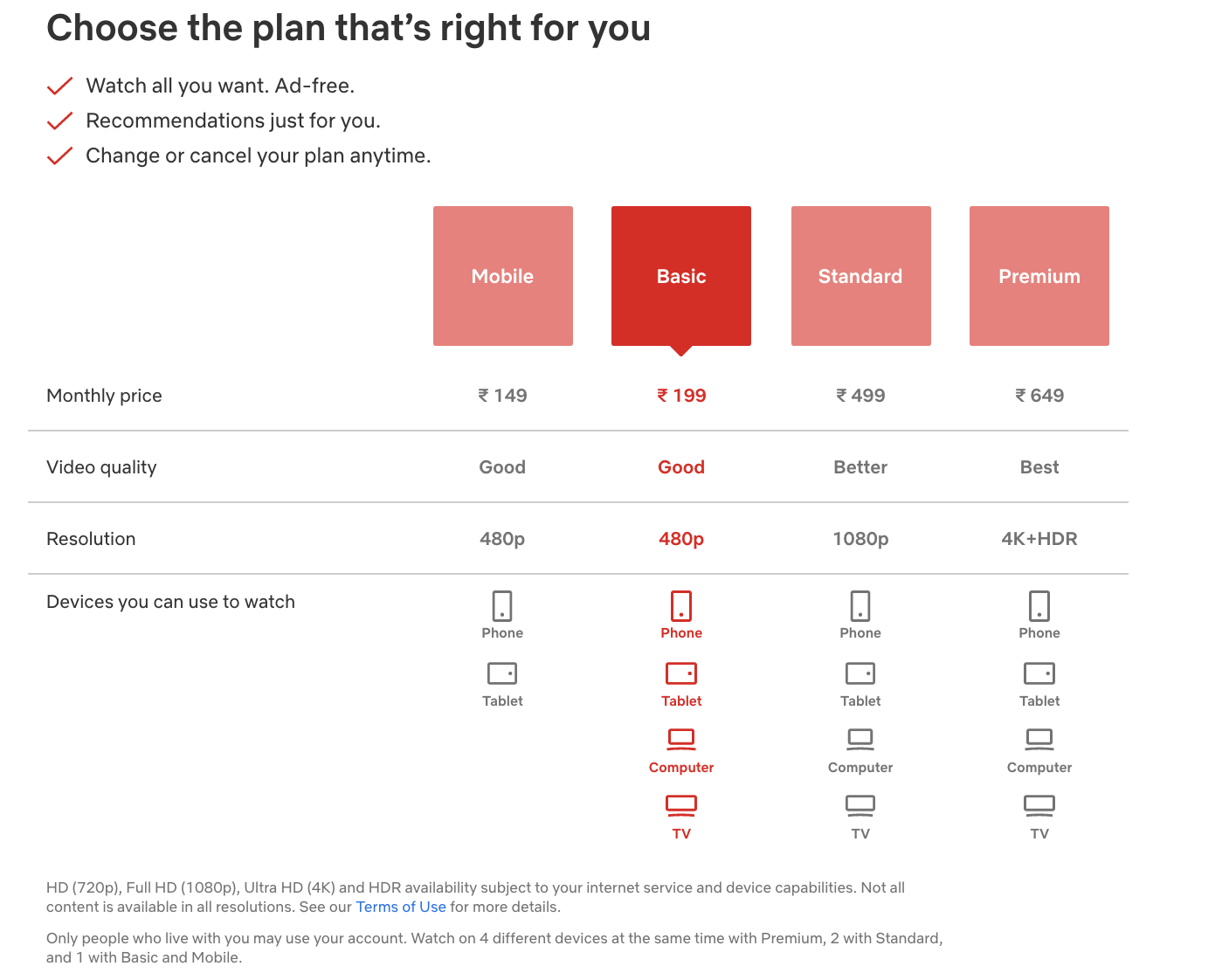

3. Penetration Pricing Strategy: Netflix

Netflix is a classic example of penetration pricing : entering the market at a low price (does anyone remember when it was $7.99?) and increasing prices over time. Since I joined a couple of years ago, I’ve seen a few price increase notices come through my own inbox.

Despite their increases, Netflix continues to retain — and gain — customers. Sure, Netflix only increases their subscription fee by $1 or $2 each time, but they do so consistently. Who knows what the fees will be in five or ten years?

4. Premium Pricing: AWAY

There are lots of examples of premium pricing strategies … Rolex, Tesla, Nike — you name it. One that I thought of immediately was AWAY luggage .

Does luggage need to be almost $500? I’d say no, especially since I recently purchased a two-piece Samsonite set for one-third the cost. However, AWAY has still been very successful even though they charge a high price for their luggage. This is because when you purchase AWAY, you’re purchasing an experience. The unique branding and the image AWAY portrays for customers make the value of the luggage match the purchase price.

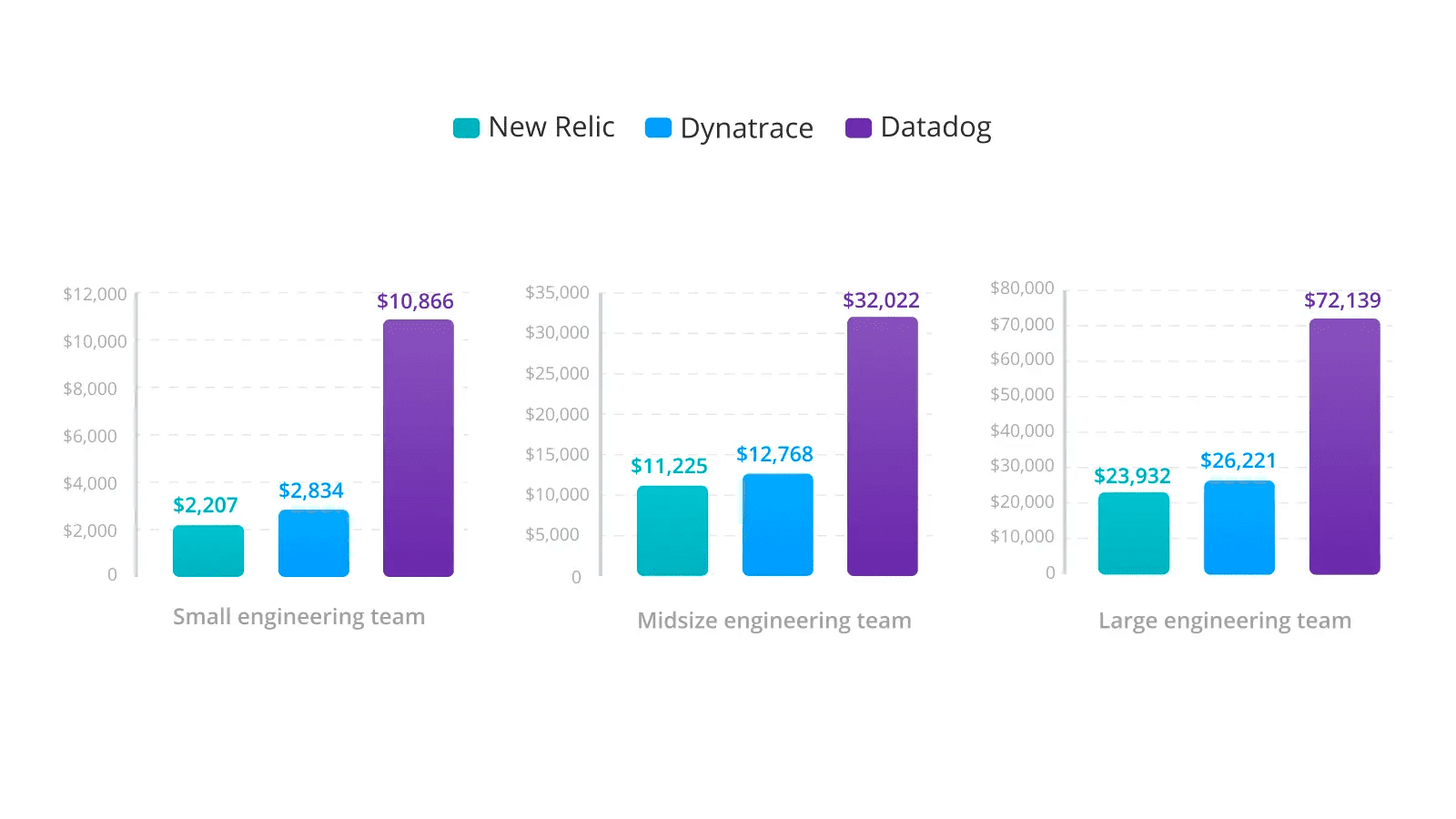

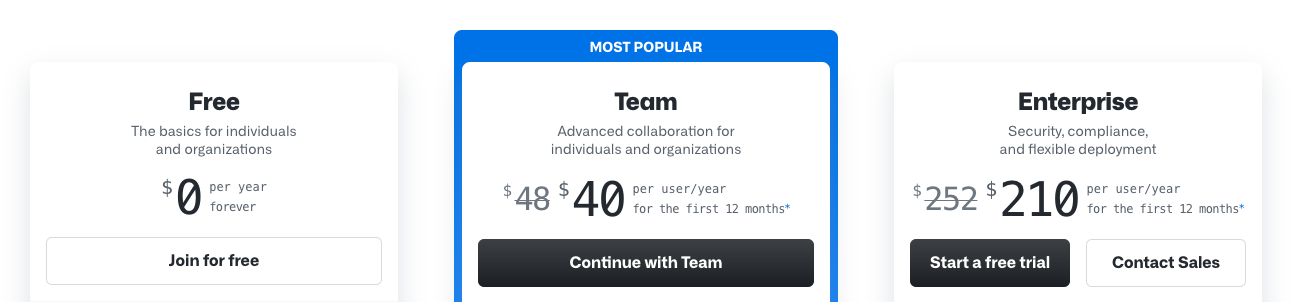

5. Competitive Pricing Strategy: Shopify

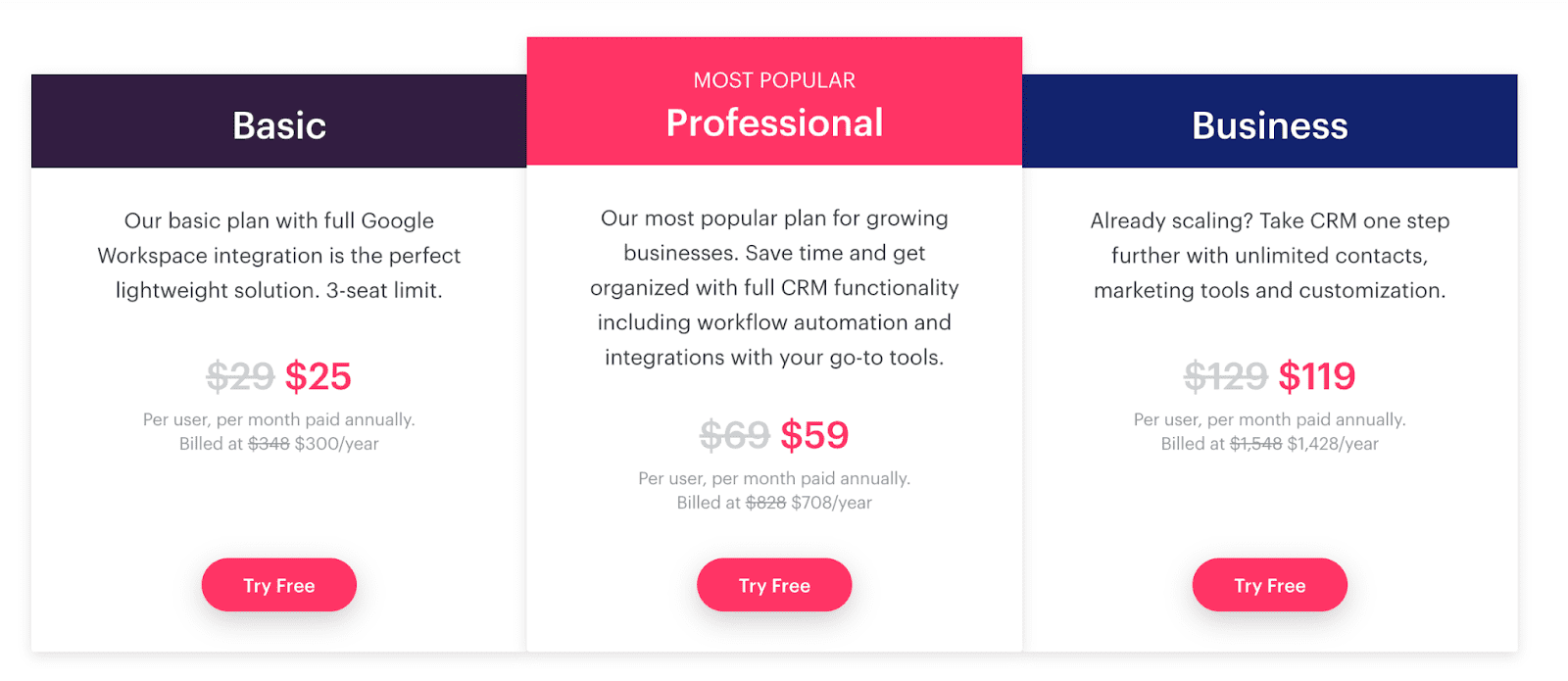

Shopify is an ecommerce platform that helps businesses manage their stores and sell their products online. Shopify — which integrates with HubSpot — has a competitive pricing strategy.

There are a number of ecommerce software options on the market today — Shopify differentiates itself by the features they provide users and the price at which they offer them. They have three thoughtfully-priced versions of their product for customers to choose from with a number of customizable and flexible features.

With these extensive options tailored to any ecommerce business' needs, the cost of Shopify is highly competitive and is often the same as or lower than other ecommerce platforms on the market today.

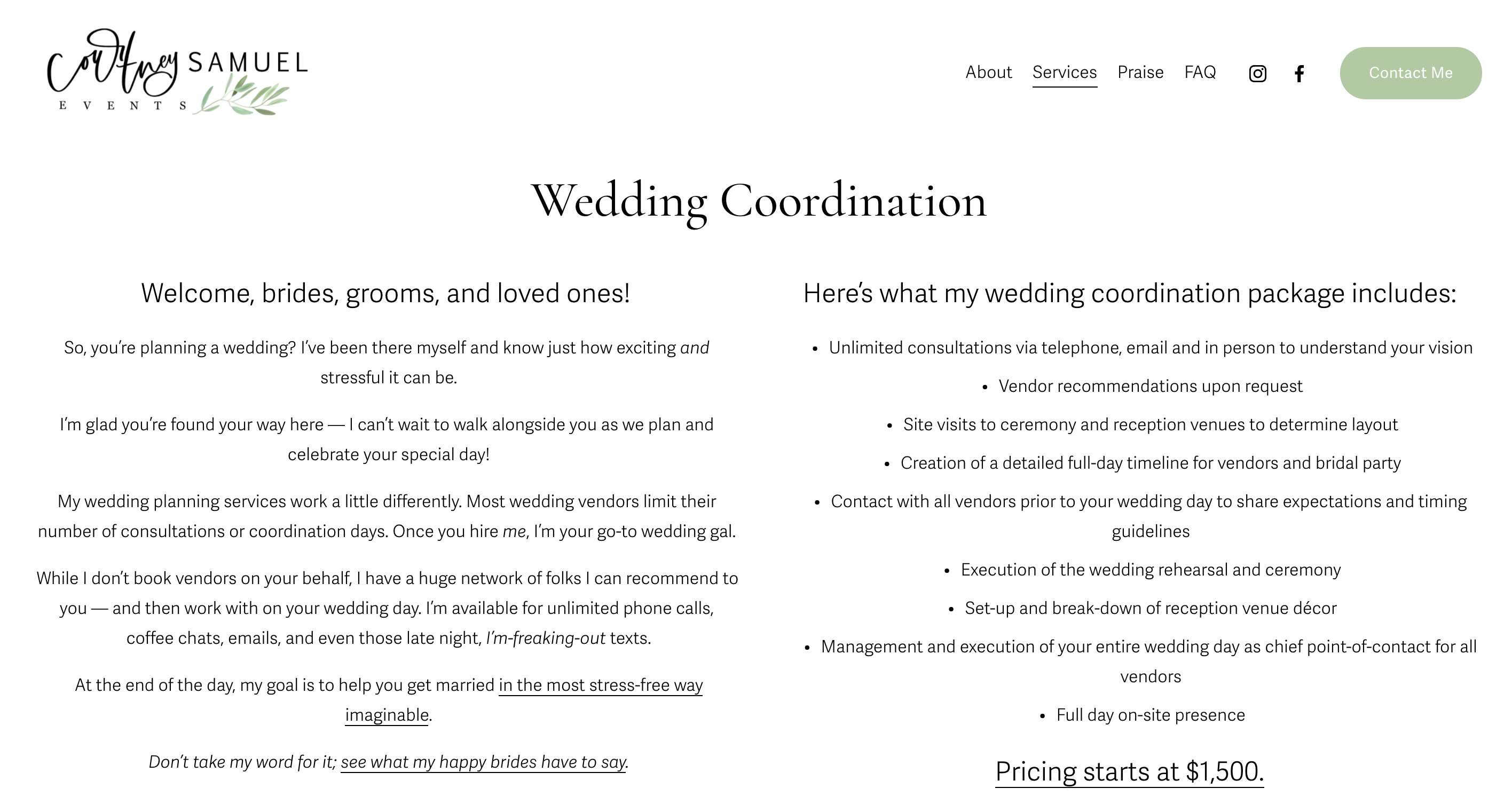

6. Project-Based Pricing Strategy: Courtney Samuel Events

Anyone who's planned a wedding knows how costly they can be. I'm in the midst of planning my own, and I've found that the bundled, project-based fees are the easiest to manage. For example, my wedding coordinator Courtney charges one flat fee for her services. This pricing approach focuses on the value of the outcome (e.g., an organized and stressless wedding day) instead of the value of the time spent on calls, projects, or meetings.

Because vendors like Courtney typically deliver a variety of services — wedding planning, day-of coordination, physical meetings, etc. — in addition to spending time answering questions and providing thoughtful suggestions, a project-based fee better captures the value of her work. Project-based pricing is also helpful for clients and companies who'd rather pay a flat fee or monthly retainer than deal with tracked hours or weekly invoices.

7. Value-Based Pricing Strategy: INBOUND

While INBOUND doesn't leave the ultimate ticket price up to its attendees, it does provide a range of tickets from which customers can choose. By offering multiple ticket "levels," customers can choose what experience they want to have based on how they value the event.

INBOUND tickets change with time, however, meaning this pricing strategy could also be considered dynamic (like the Cubs example above). As the INBOUND event gets closer, tickets tend to rise in price.

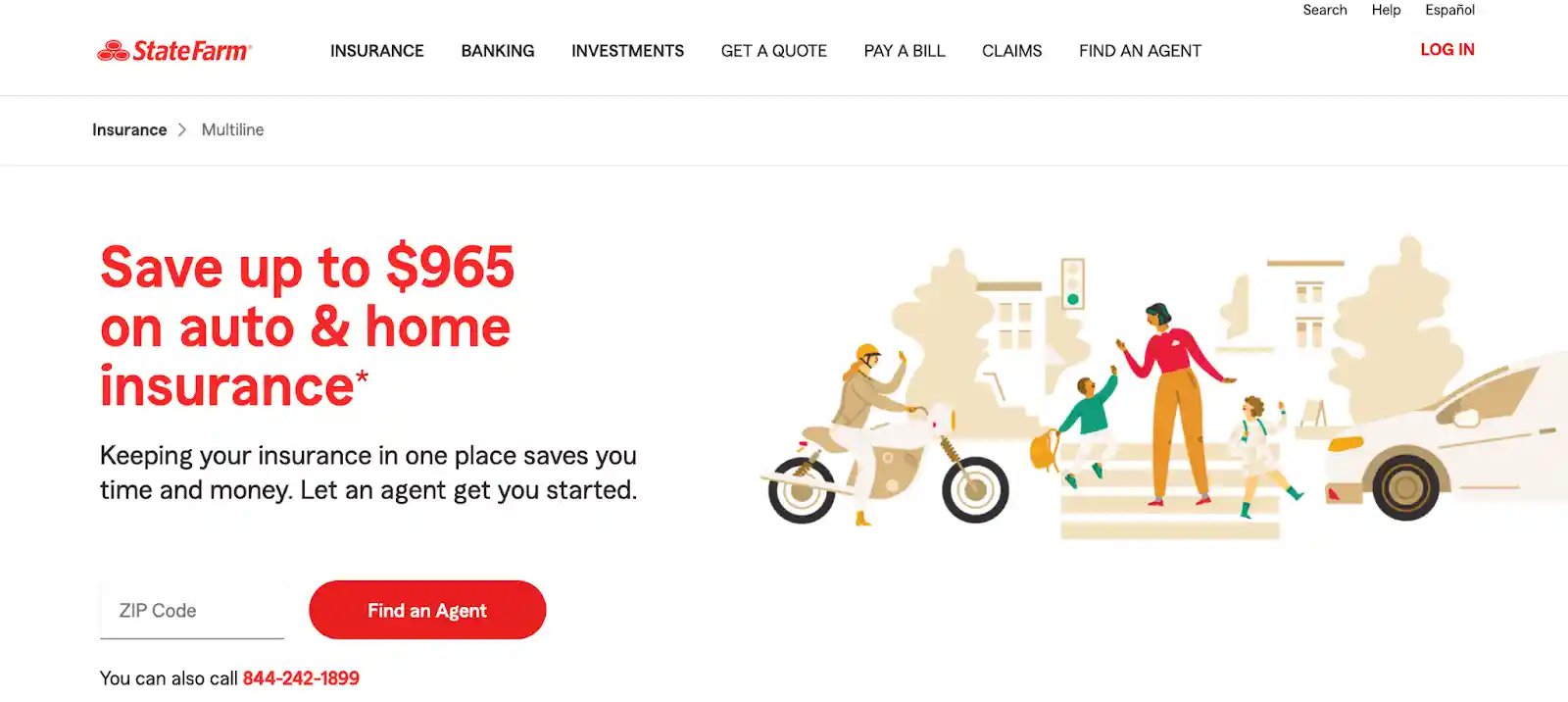

8. Bundle Pricing: State Farm

State Farm is known for its tongue-in-cheek advertisements and its bundle deals for home and auto insurance. You can receive a quote on one or the other, but getting a quote on both can save you money on your premiums.

State Farm benefits from bundle pricing by selling more policies, and consumers benefit by paying less than they normally would if they used two different insurance providers for home and auto coverage.

9. Geographic Pricing: Gasoline

Gasoline is notorious for having a wide range of prices around the world, but even within the United States, prices can vary by several dollars depending on the state you live in. In California for example, gas prices have consistently hovered around $3 in the summer months for the past 10 years. On the other hand, gas prices in Indiana have been in the $2 range during the same time period. Laws, environmental factors, and production cost all influence the price of gasoline in California which causes the geographic disparity in the cost of the fuel.

Get Your Pricing Strategy Right

Thinking about everything that goes into pricing can make your head spin: competitors, production costs, customer demand, industry needs, profit margins … the list is endless. Thankfully, you don’t have to master all of these factors at once.

Simply sit down, calculate some numbers (like your COGS and profit goals), and figure out what’s most important for your business. Start with what you need, and this will help you pinpoint the right kind of pricing strategy to use.

More than anything, though, remember pricing is an iterative process. It’s highly unlikely that you’ll set the right prices right away — it might take a couple of tries (and lots of research), and that’s OK.

Editor's note: This post was originally published in March 2019 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

Want to Build A Subscription Business? Ask Yourself These 3 Questions

Competition-Based Pricing: The Ultimate Guide

How To Price A SaaS Product

Penetration Pricing: Meaning, Goals, Top Tips, & Examples

![pricing strategies in business plan Price Skimming: All You Need To Know [+ Pricing Calculator]](https://blog.hubspot.com/hubfs/price-skimming-strategy.jpg)

Price Skimming: All You Need To Know [+ Pricing Calculator]

Psychological Pricing and the Big-Time Boost It Offers Businesses

How to Price a Product That Your Sales Team Can Sell

![pricing strategies in business plan B2B Pricing Models & Strategies [+ Pros and Cons of Each]](https://blog.hubspot.com/hubfs/b2b-pricing-models-and-strategies.jpg)

B2B Pricing Models & Strategies [+ Pros and Cons of Each]

What Is Captive Product Pricing?

Everything You Need to Know About Value-Based Pricing

Determine the best pricing strategy for your business with this free calculator.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

The pricing strategy guide: Choosing pricing strategies that grow (not sink) your business

Choosing the pricing strategy for your business requires research, calculation, and a good amount of thought. Simply guessing may put you out of business. Here's what you need to know.

Definition of pricing

What are pricing strategies.

- Importance of pricing strategy

Top 7 pricing strategies

- 3 real-world examples

- How to create your strategy

- Determine value metric

- Customer profiles & segments

- User research & experiments

- Bonus: 10 data-driven tips

- Industry differences

- Final takeaway

Pricing strategies FAQs

Join our newsletter for the latest in saas.

By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

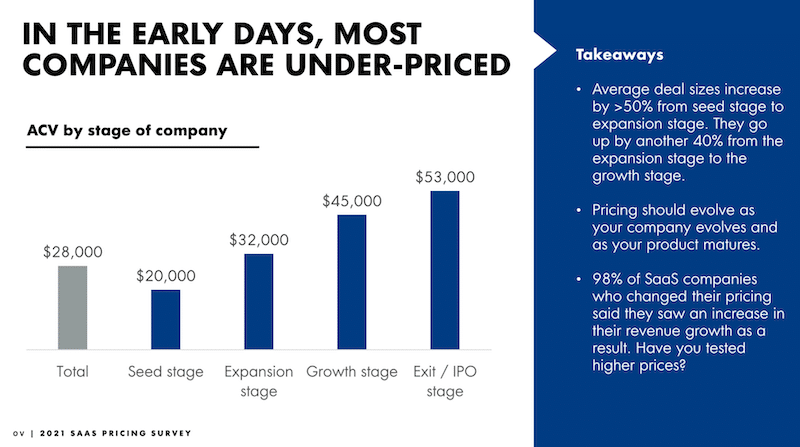

Too many businesses set their pricing without putting much thought into it. This is a mistake causing them to leave money on the table from the beginning. The good news is that taking the time to get your product pricing right can act as a powerful growth lever. If you optimize your pricing strategy so that more people are paying a higher amount, you'll end up with significantly more revenue than a business who treats pricing more passively. This sounds obvious, but it's rare for businesses to put much effort into finding the best pricing strategy.

This guide will cover everything you need to know about setting a pricing strategy that works for your business.

Check out this introduction video made by the Paddle Studios team.

Price Intelligently is Paddle’s dedicated team of pricing and packaging experts for SaaS and subscription companies. We combine unrivaled expertise and first-party data to solve your unique pricing challenges, break the mold, and catapult your growth. Learn more

Pricing is defined as the amount of money that you charge for your products, but understanding it requires much more than that simple definition. Baked into your pricing are indicators to your potential customers about how much you value your brand, product, and customers. It's one of the first things that can push a customer towards, or away from, buying your product. As such, it should be calculated with certainty.

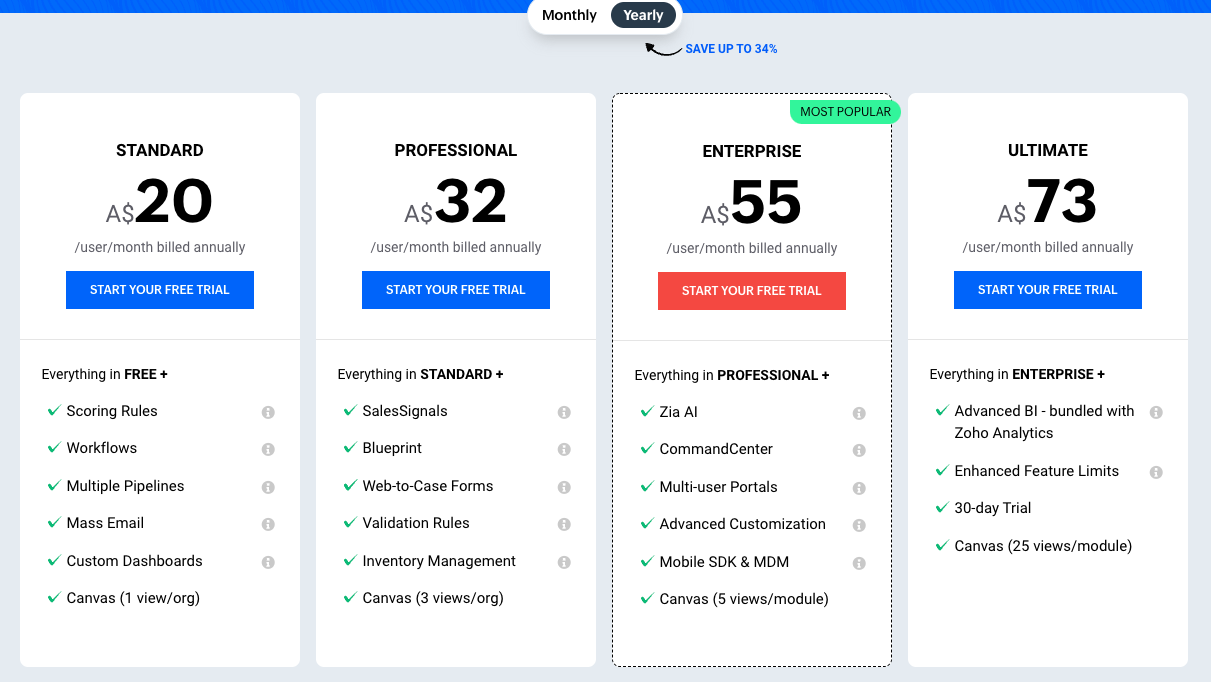

Pricing strategies refer to the processes and methodologies businesses use to set prices for their products and services. If pricing is how much you charge for your products, then product pricing strategy is how you determine what that amount should be. There are different pricing strategies to choose from but some of the more common ones include:

- Value-based pricing

- Competitive pricing

- Price skimming

- Cost-plus pricing

- Penetration pricing

- Economy pricing

- Dynamic pricing

Pricing is an underutilized growth lever

Many companies focus on acquisition to grow their business, but studies have shown that small variations in pricing can raise or lower revenue by 20-50%. Despite that, even among Fortune 500 companies, fewer than 5% have functions dedicated to setting the best price possible. There's a missed opportunity in the business world to see immediate growth for relatively little effort.

Navigating PLG billing and pricing? Read our latest guide on product-led SaaS

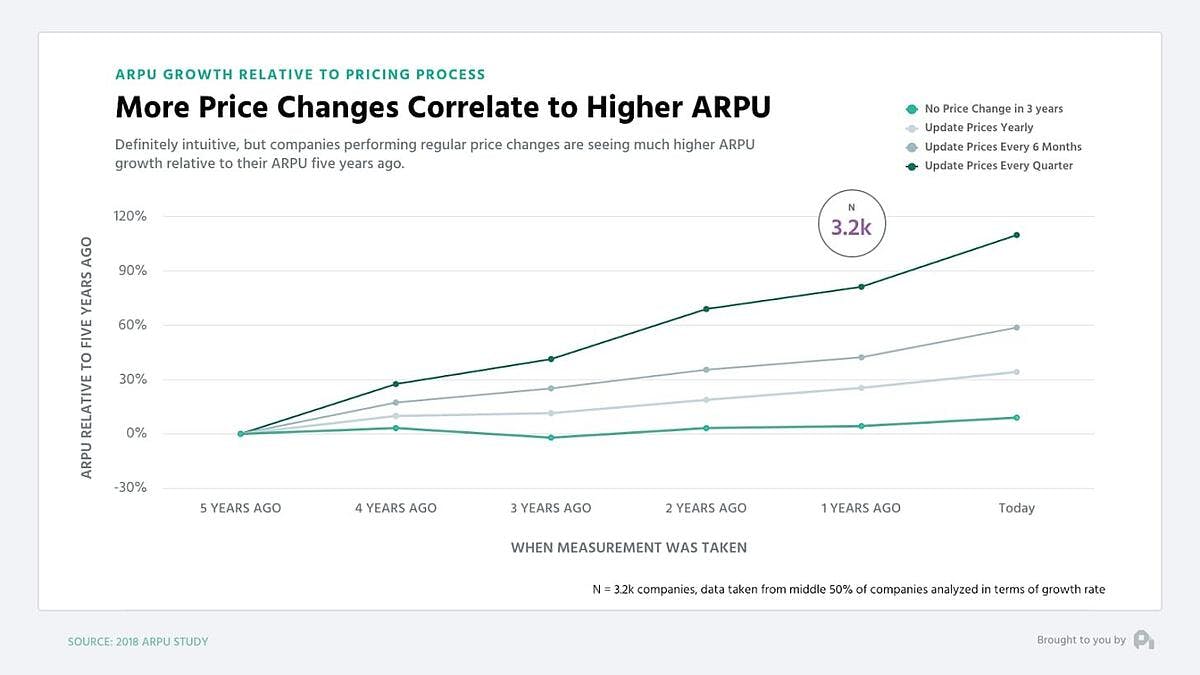

Because most businesses spend less than 10 hours per year thinking about pricing, there's a lot of untapped growth potential in optimizing what you charge. In fact, choosing the best pricing method is a more powerful growth lever than customer acquisition. In some cases, it can be up to 7.5 times more powerful than acquisition.

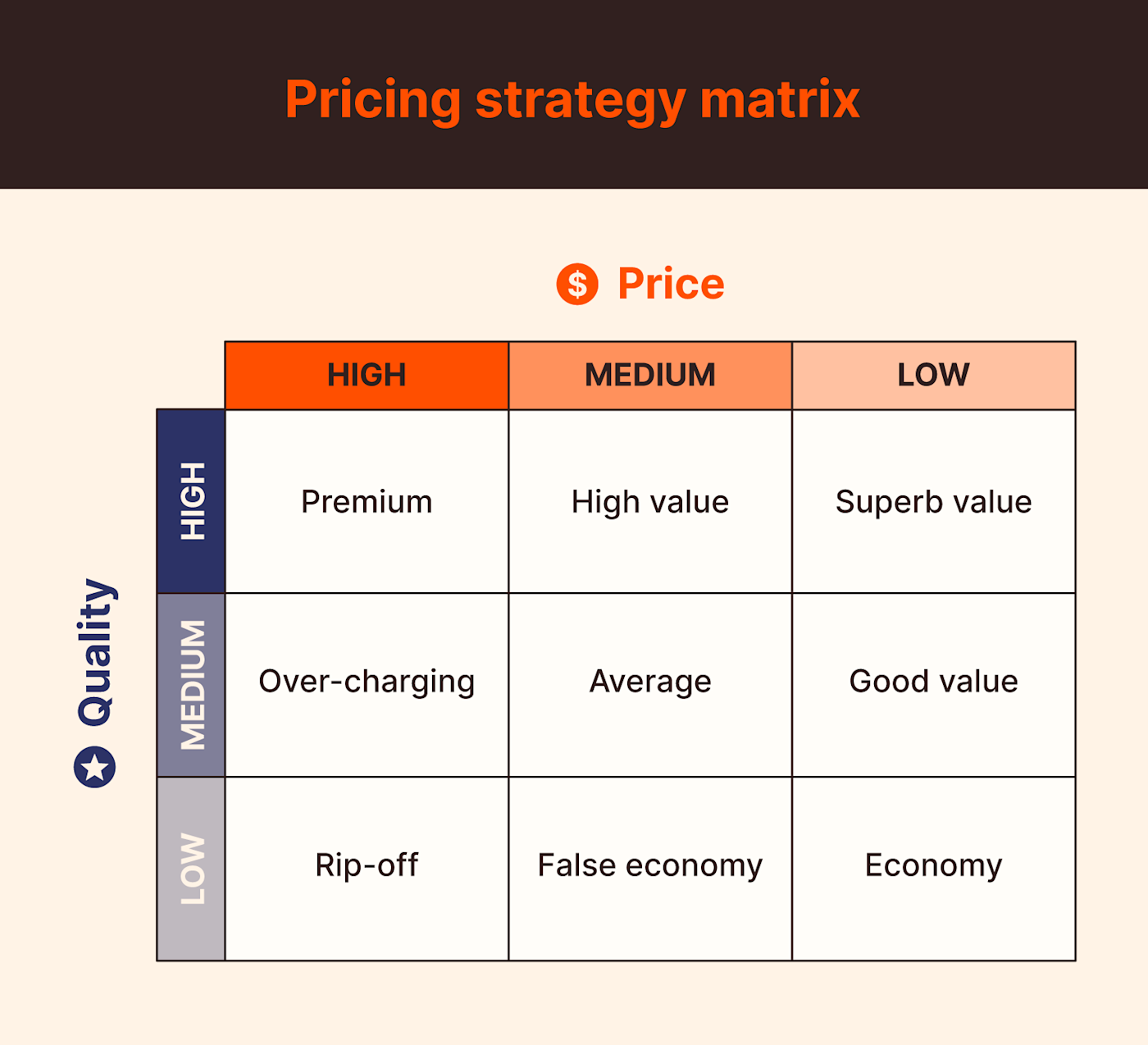

The importance of nailing your pricing strategy

Having an effective pricing strategy helps solidify your position by building trust with your customers, as well as meeting your business goals. Let's compare and contrast the messaging that a strong pricing strategy sends in relation to a weaker one.

A winning pricing strategy:

- Portrays value

The word cheap has two meanings. It can mean a lower price, but it can also mean poorly made. There's a reason people associate cheaply priced products with cheaply made ones. Built into the higher price of a product is the assumption that it's of higher value.

- Convinces customers to buy

A high price may convey value, but if that price is more than a potential customer is willing to pay, it won't matter. A low price will seem cheap and get your product passed over. The ideal price is one that convinces people to purchase your offering over the similar products that your competitors have to offer.

- Gives your customers confidence in your product

If higher-priced products portray value and exclusivity, then the opposite follows as well. Prices that are too low will make it seem as though your product isn't well made.

A weak pricing strategy:

- Doesn't accurately portray the value of your product

If you believe you have a winning product, and you should if you are selling it, then you need to convince customers of that. Setting prices too low sends the opposite message.

- Makes customers feel uncertain about buying

Just as the right price is one that customers will pull the trigger on quickly, a price that's too high or too low will cause hesitation.

- Targets the wrong customers

Some customers prefer value, and some prefer luxury. You have to price your product to match the type of customer it is targeted towards.

Let's now take a closer look at the seven most common pricing strategies that were outlined above with more from Paddle Studios .

Click on any of the links below for a more in-depth guide to that particular pricing strategy.

1. Value-based pricing

With value-based pricing, you set your prices according to what consumers think your product is worth. We're big fans of this pricing strategy for SaaS businesses.

2. Competitive pricing

When you use a competitive pricing strategy, you're setting your prices based on what the competition is charging. This can be a good strategy in the right circumstances, such as a business just starting out , but it doesn't leave a lot of room for growth.

3. Price skimming

If you set your prices as high as the market will possibly tolerate and then lower them over time, you'll be using the price skimming strategy. The goal is to skim the top off the market and the lower prices to reach everyone else. With the right product it can work, but you should be very cautious using it.

4. Cost-plus pricing

This is one of the simplest pricing strategies. You just take the product production cost and add a certain percentage to it. While simple, it is less than ideal for anything but physical products.

5. Penetration pricing

In highly competitive markets, it can be hard for new companies to get a foothold. One way some companies attempt to push new products is by offering prices that are much lower than the competition. This is penetration pricing. While it may get you customers and decent sales volume, you'll need a lot of them and you'll need them to be very loyal to stick around when the price increases in the future.

6. Economy pricing

This strategy is popular in the commodity goods sector. The goal is to price a product cheaper than the competition and make the money back with increased volume. While it's a good method to get people to buy your generic soda, it's not a great fit for SaaS and subscription businesses.

7. Dynamic pricing

In some industries, you can get away with constantly changing your prices to match the current demand for the item. This doesn't work well for subscription and SaaS business, because customers expect consistent monthly or yearly expenses.

Three real-world pricing strategy examples

Real-world pricing strategy examples are the best way for a business to better understand the above-listed pricing strategies. Evaluating other businesses' approaches can be a good starting point but keep in mind that the right pricing strategy is based on math, market research, and consumer insights. For now, let’s look at the pricing strategy examples of some of the biggest brands of today:

1. Streaming services

Have you noticed that you pay roughly the same amount for Netflix, Amazon Prime Video, Disney+, Hulu, and other streaming services? That's because these companies have adopted competitive pricing , or at least a form of it, called market-based pricing .

2. Salesforce

When Salesforce first came out, they were the only CRM in the cloud. (It wasn't even called 'the cloud' back then!) Armed with ground-breaking deployment and a target customer of a large enterprise, Salesforce could charge what they wanted. Later, after they'd grown, they were able to lower prices so small businesses could sign up. This is a classic example of price skimming .

3. Dollar Shave Club

At one time, you couldn't turn on your TV without an ad for Dollar Shave Club telling you how much cheaper they were than razors at the store. Although an aggressive marketing strategy and advertising like that is unusual for the pricing model, they were nevertheless employing economy pricing. It worked out well for them. They were acquired by Unilever in 2016 for a reported $1 billion.

How to create a winning pricing strategy

In the beginning, the actual number you're charging isn't that important.

There are some exceptions, but for the most part, you should first be figuring out the range you're in: a $10 product, $100 product, $1k product, etc. Don't waste time debating $500 vs. $505, because this doesn't matter as much until you have a stronger foundation beneath you.

Instead, understanding the following is much more important:

- Finding your value metric

- Setting your ideal customer profiles and segments

- Completing user research + experimentation

This video from Paddle Studios goes deep on mastering a winning pricing strategy.

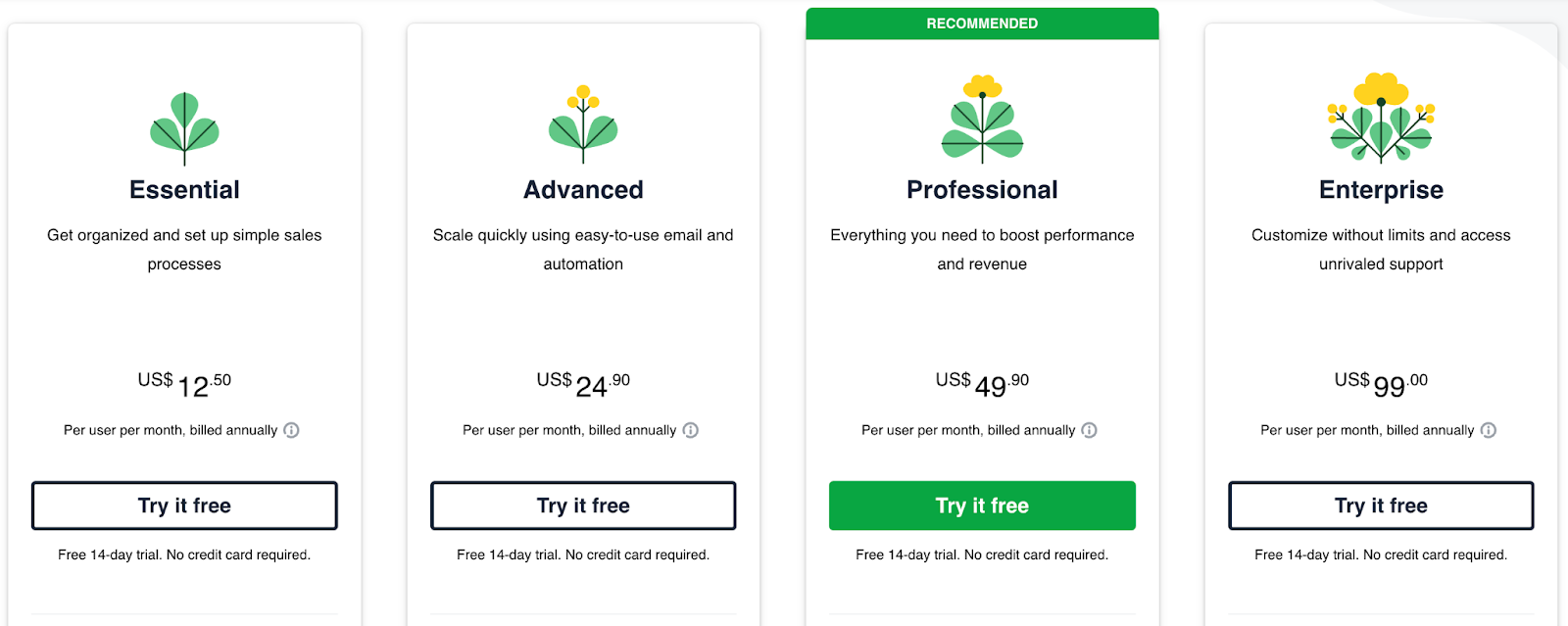

Step 1: Determine your value metric

A “ value metric ” is essentially what you charge for. For example: per seat, per 1,000 visits, per CPA, per GB used, per transaction, etc.

If you get everything else wrong in pricing, but you get your value metric right, you'll do ok . It's that important. Partly because it bakes lower churn and higher expansion revenue into your monetization.

A pricing strategy based on a value metric (vs. a tiered monthly fee) is important because it allows you to make sure you're not charging a large customer the same as you'd charge a small customer.

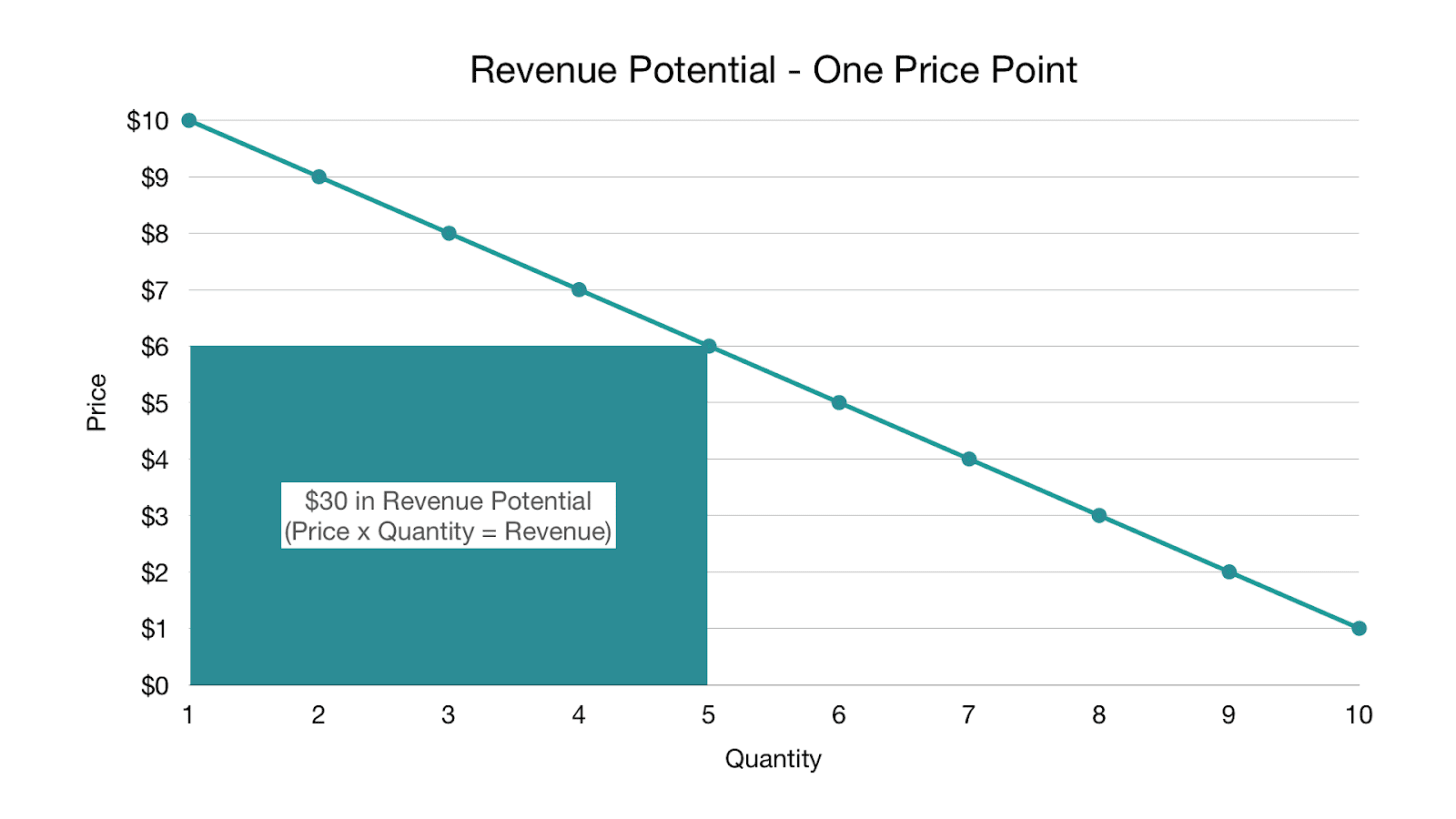

If you remember your high school or college economics class, the professor put a point on a demand curve for the perfect price and said “the revenue a firm gets is the area under that point.” The problem here is: what about all that other area under the curve? You’re missing out on that revenue by charging a flat monthly fee.

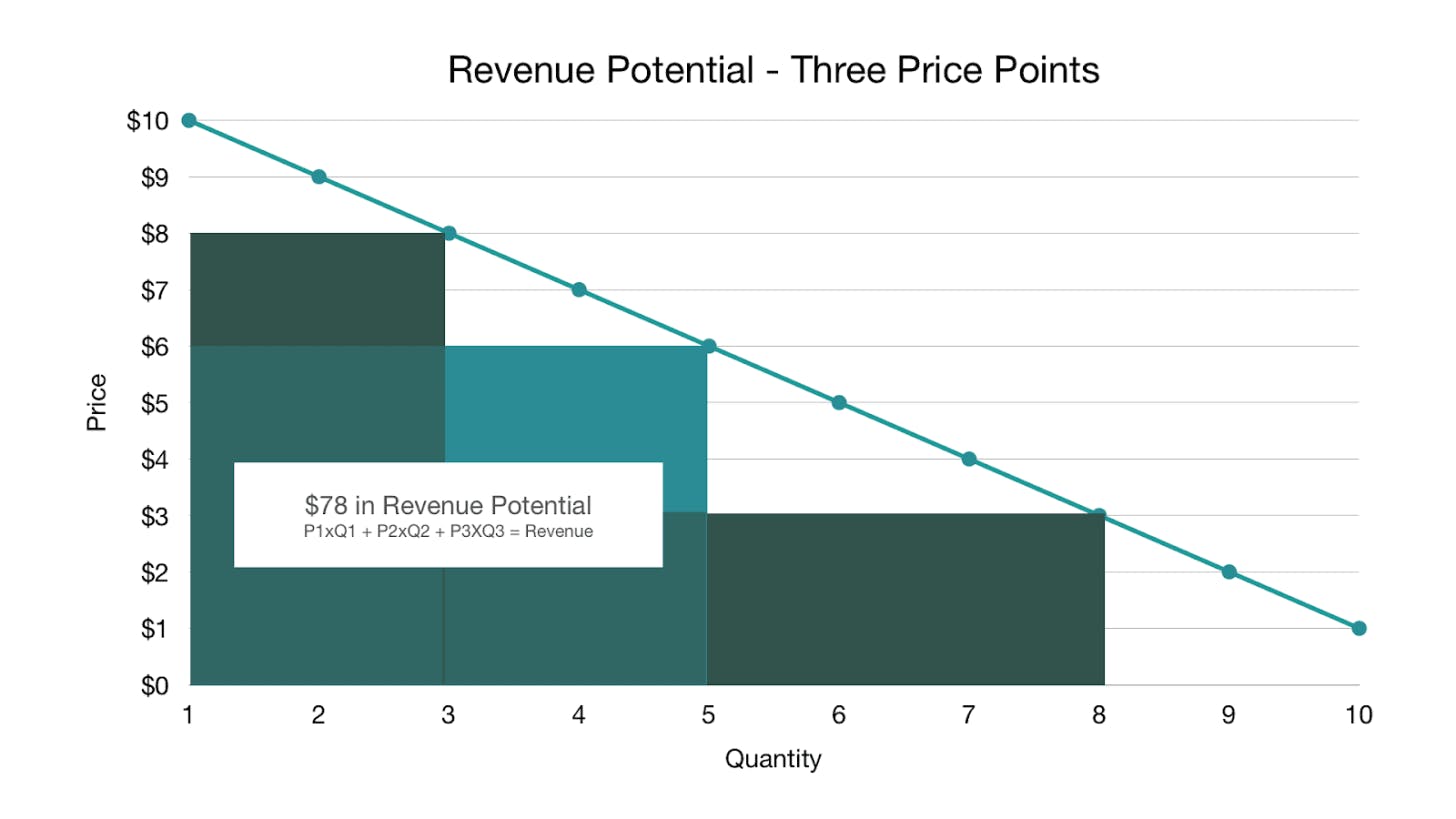

“Good, better, best” pricing strategy is a bit more advantageous, because you end up with three points on our trusty demand curve, and thus more revenue potential. You see this problem among many eCommerce businesses and retailers whose products are constrained by being physical goods—the car with the basic package vs. the car with the stereo and sunroof vs. the car with everything. In software, it’s thankfully dying out, but you’ll still see it with mass-market products: Netflix, Adobe Creative Cloud, etc.

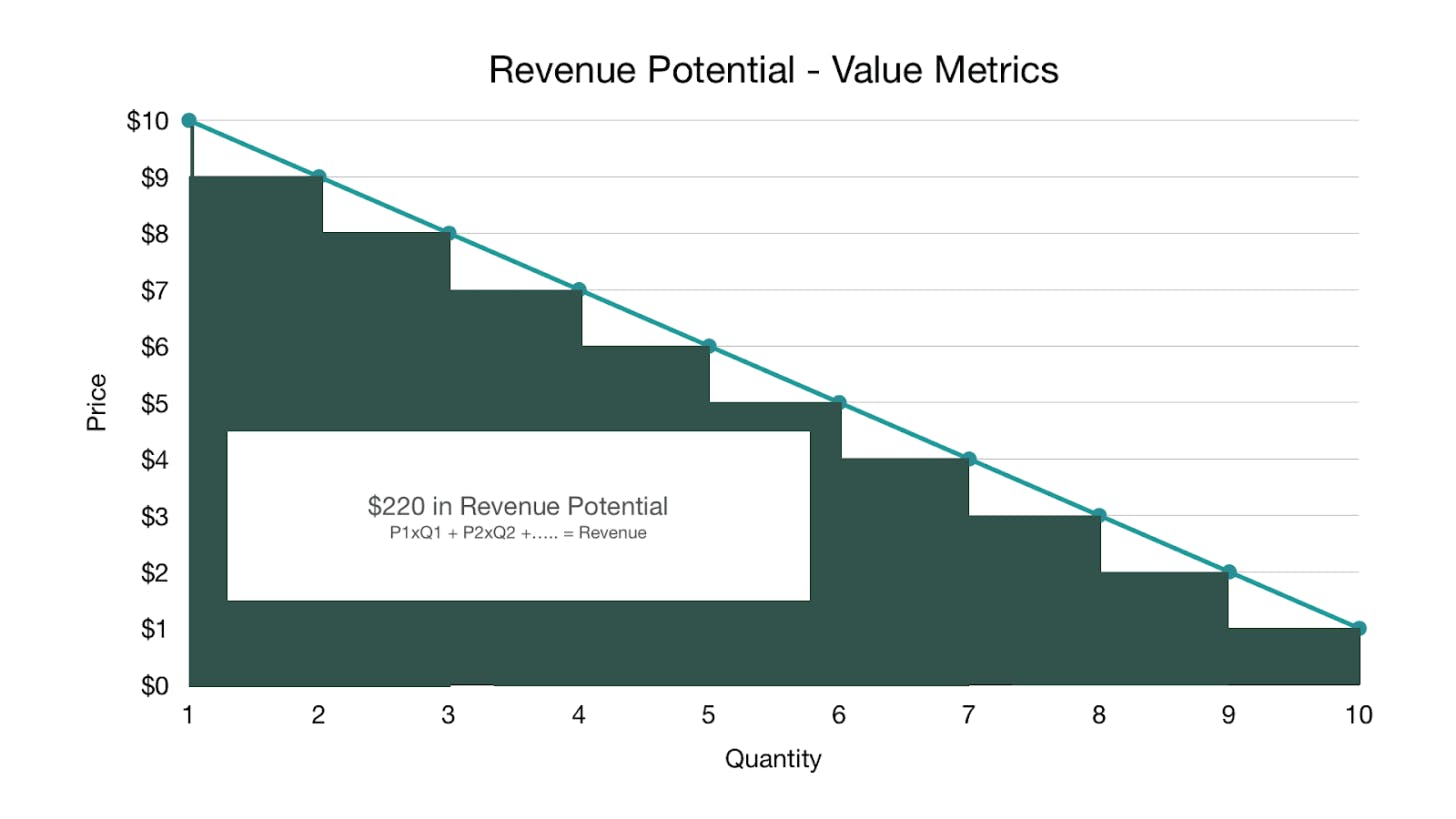

A value metric, however, allows you to have essentially infinite price points—maximizing your revenue potential. In practice, you’ll never show infinite price points on your pricing page , sales deck, or mobile conversion page, but you may have a new customer come in at a certain level and then grow.

Value metrics also bake growth directly into how you charge because as usage or the amount of value received goes up (and those are not the same thing), the customer pays more. If they end up using or consuming less, they pay less (and thus avoid churning). This is why companies using value metrics are typically growing at double the rate with half the churn and 2x the expansion revenue when compared to companies that charge a flat fee or where the only difference between their pricing tiers are features.

To determine your value metric, think about the ideal essence of value for your product—what value are you directly providing your customer?

In B2B, it's likely going to be money saved, revenue gained, time saved, etc. In DTC , it may be the joy you bring them, fitness achieved, increased efficiency, etc. Obviously, we can't measure all of these, but if you can, and your customer trusts your measurement (meaning you say you saved them $100 and they agree you saved them $100), that’s your value metric.

As an example, the perfect value metric for Paddle Retain (our churn recovery product) is how much churn we recover for you. We can measure this, and our customers agree to the measurement, so we can charge on that axis. Other pure value metric products include MainStreet , which handles government paperwork to automatically get you back tax credits—you pay a percentage of the money saved.

Most of you won't have a pure value metric, so the next step is to find a proxy for that metric. Take for example HubSpot ’s marketing product. Their pure value metric is the amount of revenue their tool drives for your business. This is hard to measure and hard for the customer to agree to in terms of what percentage of credit HubSpot deserves for revenue from a blog post. Proxies for HubSpot are things like the number of contacts, number of visits, number of users, etc.

To find the right proxy metric, you want to come up with 5-10 proxies and then talk to your customers and prospects. You’ll typically find 1-2 of these pricing metrics will be most preferred amongst your target customers. You then want to make sure those 1-2 also make sense from a growth perspective. Your larger customers should be using/getting more of the metric, whereas your smaller customers should be using/getting less of the metric. You also want to make sure the metric encourages retention.

When we look at HubSpot, if they were to primarily price on “number of seats”, folks could share a login and HubSpot wouldn’t make much more money on large customers vs. small. Ironically they wouldn’t get as many people invested in HubSpot, because there’d be friction to adding additional seats. Instead, if they give unlimited seats and price based on “number of contacts” there’s minimal friction to getting as many people into HubSpot as possible to do activities (e.g., blog posts, email campaigns , landing pages, etc.) that then produce contacts.

The result: HubSpot’s marketing product’s value metric is “contacts”, which ensures growth is baked directly into how they make money. The usage drives the metric, which therein drives revenue. Most importantly customers small, medium, and large are all paying at the point they see the value and then can grow.

Some other examples:

- Wistia charges by the number of videos or channels you use/have

- Zapier invented the concept of zap (connection of software) and charge based on time to connect

- Theater in Barcelona charged based on the number of laughs

- Husqvarna charges based on time for lawn care products vs. making you buy them

- Rolls Royce charges per mile for airplane engines. They own the engines on the plane you own and do all the maintenance. Cool model.

- Fresh Patch charges based on the amount of grass you want per month for your dog—yes they deliver grass to you monthly

As a side note, you should stop pricing based on seats for products where each seat doesn’t provide a unique experience. For instance, imagine you're an AE using a CRM. If you log into the account of the AE sitting next to you, you can’t really do your work because you are only seeing their leads and accounts. Conversely, if you were a marketing exec and were to log in to another marketing manager’s account in HubSpot, you could do all the work you need to. Thus, for the latter, seats are not the right value metric.

Per-seat pricing is a relic of the perpetual license era when we couldn’t measure usage or value enough within our products. We’re beyond that point, so use the above as a good litmus test.

Step 2: Determine your customer profiles and segments

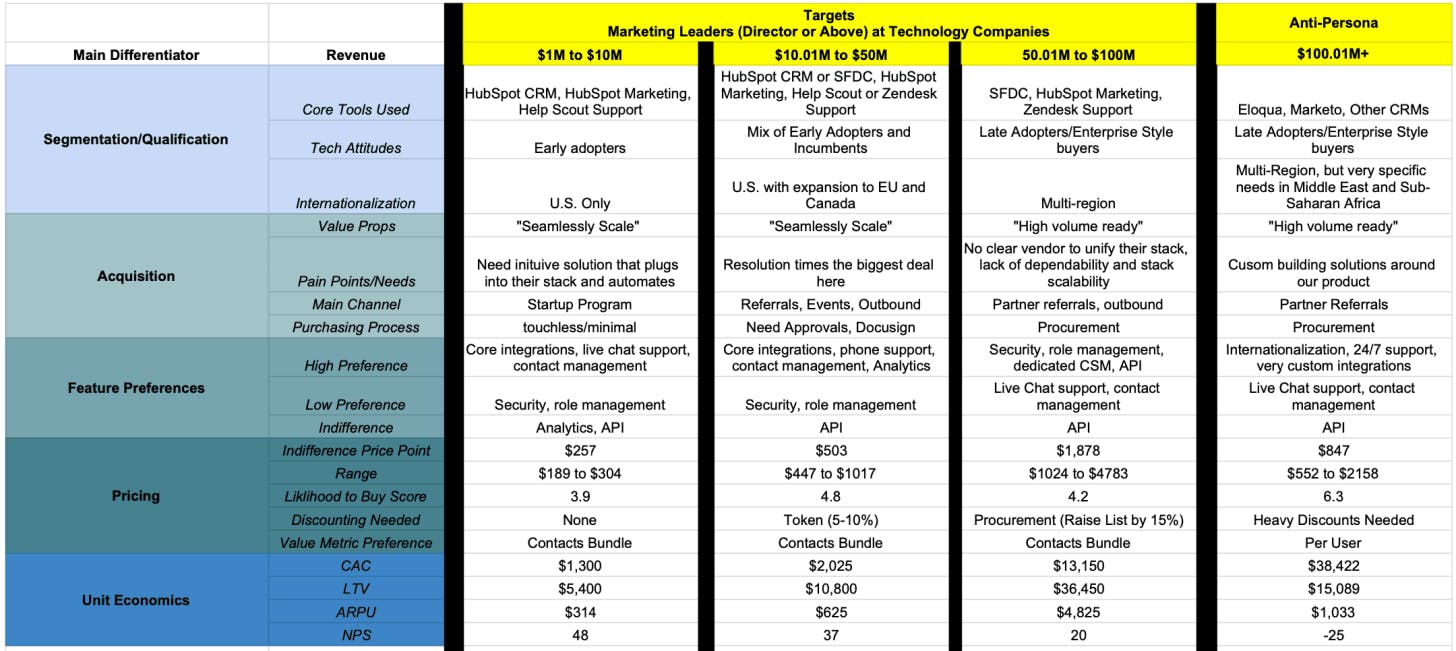

The second key component of your pricing strategy is determining your target segment and ideal customer profile. We've all heard about personas, and you may be rolling your eyes at the concept, but most personas are useless because they aren’t quantitative enough. When used properly, quantified personas and segments are beautiful tools. The information needs to go beyond just cute names like “Startup Steve" with a cute avatar, and cute meetings where people tell you they’re targeting "developers."

To get quantified personas, you need to pull out a spreadsheet. Here’s a template you can use.

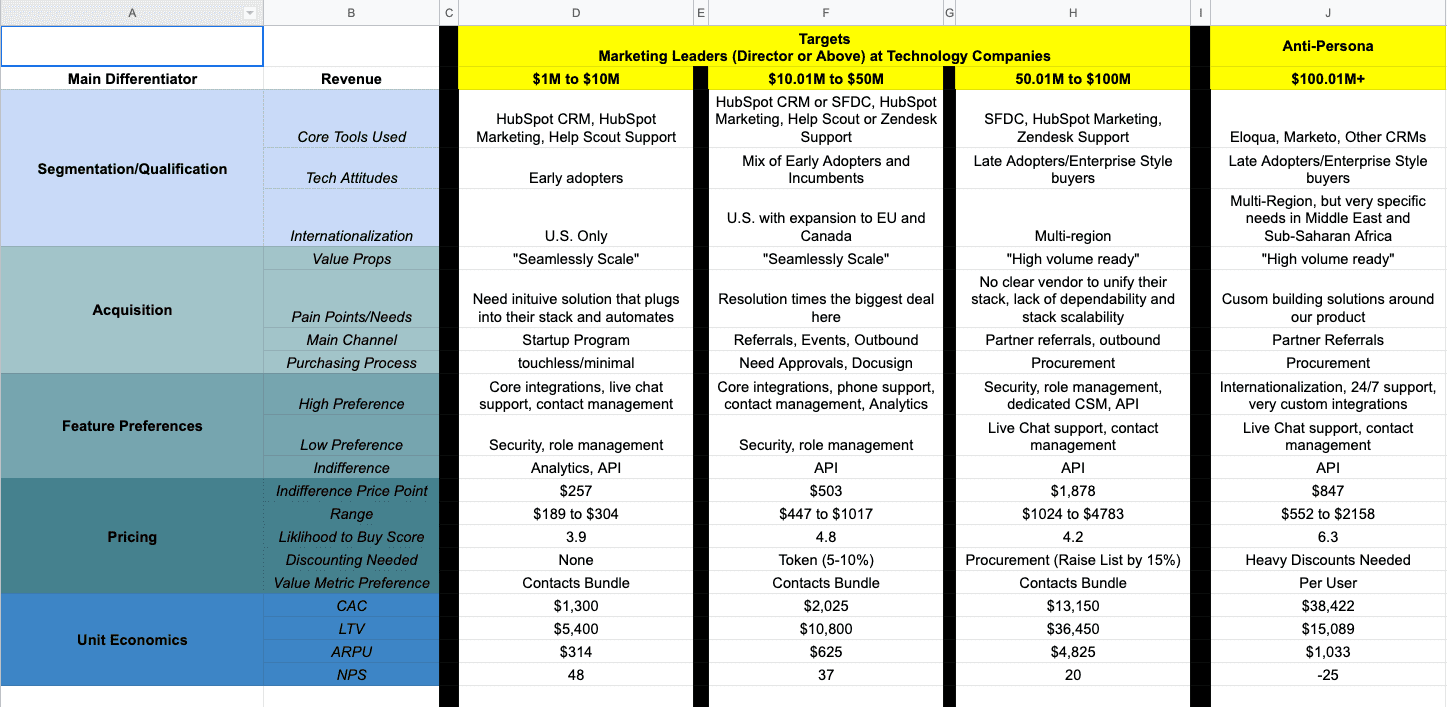

1. Columns: Customer profiles you're targeting

These can take many forms, but the ultimate goal is to be as specific as possible so that you not only know who you’re targeting but how to monetize and retain them. Pragmatically, you typically separate these customer profiles based on size or role (or both). For example, a marketing automation product may target the following profiles:

- Marketing leaders (Director and higher) at companies $1M to $10M

- Marketing leaders (Director and higher) at companies $10.01M to $50M

- Marketing leaders (Director and higher) at companies $50.01M to $100M

The point is you can’t be everything to all people and you need to understand who you’re targeting in order to make better decisions.

2. Rows: Characteristics of each profile to help you differentiate between them

- Most valued features

- Least valued features

- Willingness to pay

- Lifetime value (LTV)

- Customer acquisition costs (CAC)

- ... and any other metric or category you think could be useful

If you're just starting out or you don't have some of this data, it’s fine. Still fill it out though with your hypotheses. You know something about your customers.

Next, you then need to validate (or invalidate) the most pressing hypothesis in that spreadsheet based on the decisions you’re going to make. If you're going to validate a new feature for a particular segment, then that's where you should start. Price point the biggest question? Start by researching the price point with each of these roles/segments.

If you don't know who your key roles/segments are, there's no way in hell you’ll set up an efficient growth flywheel, let alone an optimized pricing strategy. Personas act as a constitution within your business to centralize your focus and arguments about direction.

If you don't do segment and persona analysis, you better be able to raise a ton of money. I guarantee you there's some persona or segment on some vision document or in that euphoric part of your entrepreneurial brain that is completely wrong for your business. I see it all the time. Even I—someone who thinks about segments and customer research all the time—fall prey to being an absolute idiot with who we should target.

When we built ProfitWell Metrics (our free subscription metrics tool) I thought we were geniuses who were going to be billionaires. Turns out analytics products are terrible. Willingness to pay for them is terrible; retention for them is terrible; NPS is terrible. Everything is just terrible, mainly because customers don't appreciate graphs or at least aren't willing to pay much for them. When we did our research this became obvious and put us 18 months ahead of our competitors, pushing us to change up the positioning of the product to freemium, which has fueled our business ever since (oh and our NPS is 70, because we massively over-deliver a free product better than the paid competition).

Never underestimate the power of focusing on the customer through research. You should never, ever just do what they ask, but you need to be an anthropologist who knows them better than anyone else.

Step 3: User research + experimentation

Beyond your value metric and core segments, the monetization game becomes extremely tactical and research-based. Figuring out your price point involves researching those segments and then making decisions in the field. Same with discounting, add-on, and packaging strategies. The point: monetization is never finished because it’s the very essence of translating your value into an optimal framework for your target customer segments.

Practically this is why you should be experimenting with your monetization every quarter. Experimentation can get tricky and have a few quirks, but you’ll find it’s similar to most growth frameworks out there (which are all versions of the scientific method).

Here’s a good prioritization list of what business owners should attack in optimizing their monetization strategy once they have the core segments and value metric figured out:

Priority 1: Foundational [see above]

- Core customer segments

- Value metrics

Priority 2: Core

- Order of magnitude price point (are you a $10 product vs. a $500 product)

- Positioning and value props

Priority 3: Optimizations

- Add-on strategy

- Specific price point (are you a $10 product vs. a $11 product)

- Price localization/internationalization

- Discounting strategy

- Contract Term optimization

Priority 4: Growth accelerators

- Market expansion (going up or down market)

- Vertical expansion

- Multi-Product

Your true order of operations with monetization will vary, but for the most part, all companies should work through the foundational and core sections before moving to the optimizations and growth accelerators. If you’re larger or there’s a fire, you may start with an optimization. In fact, this is sometimes a good idea. Something more scoped like “price localization” can help get momentum, be a forcing function to clean up tech and experimentation stacks, and mitigate political conversations. Remember, monetization is something that’s important, uncomfortable, and something you likely don’t know much about, so progress is better than nothing. Start small. You can (and should) always do more.

Bonus: 10 rapid-fire pricing strategy tips rooted in data⚡

In case you're still hungry for more tips on nailing your pricing strategy and achieving maximum profitability, look no further. We've got you covered:

1. You should localize your pricing to the currency and willingness to pay of the prospect's region

- Revenue per customer is 30% higher when you just use the proper currency symbol

- Having different price points in different regions increases revenue per customer further, and is justified based on different consumer demands in different regions

2. Freemium is an acquisition model, not a part of pricing

- Think of freemium as a premium ebook driving leads, not another pricing tier

- Don't do freemium until you truly understand how to convert leads to customers, because you’ll end up increasing noise or false positives when you’re trying to figure out your segment beachheads. The best folks who deploy free typically don’t implement freemium until two to three years into their business. The exceptions to this notion are if you have a very specific need or network effect (eg., marketplaces, social networks, etc.) or if you have a top 50 growth person on your team.

- To be clear, we're not saying DON’T do freemium. we're saying it's a scalpel, not a sledgehammer that requires thought. A lot of people end up reading our articles on freemium and end up going, “Cool, let’s do freemium and we’ll be a unicorn.” I’m being pragmatic in that you need to realize freemium is fantastic, but doing freemium properly takes a lot of effort and nuance.

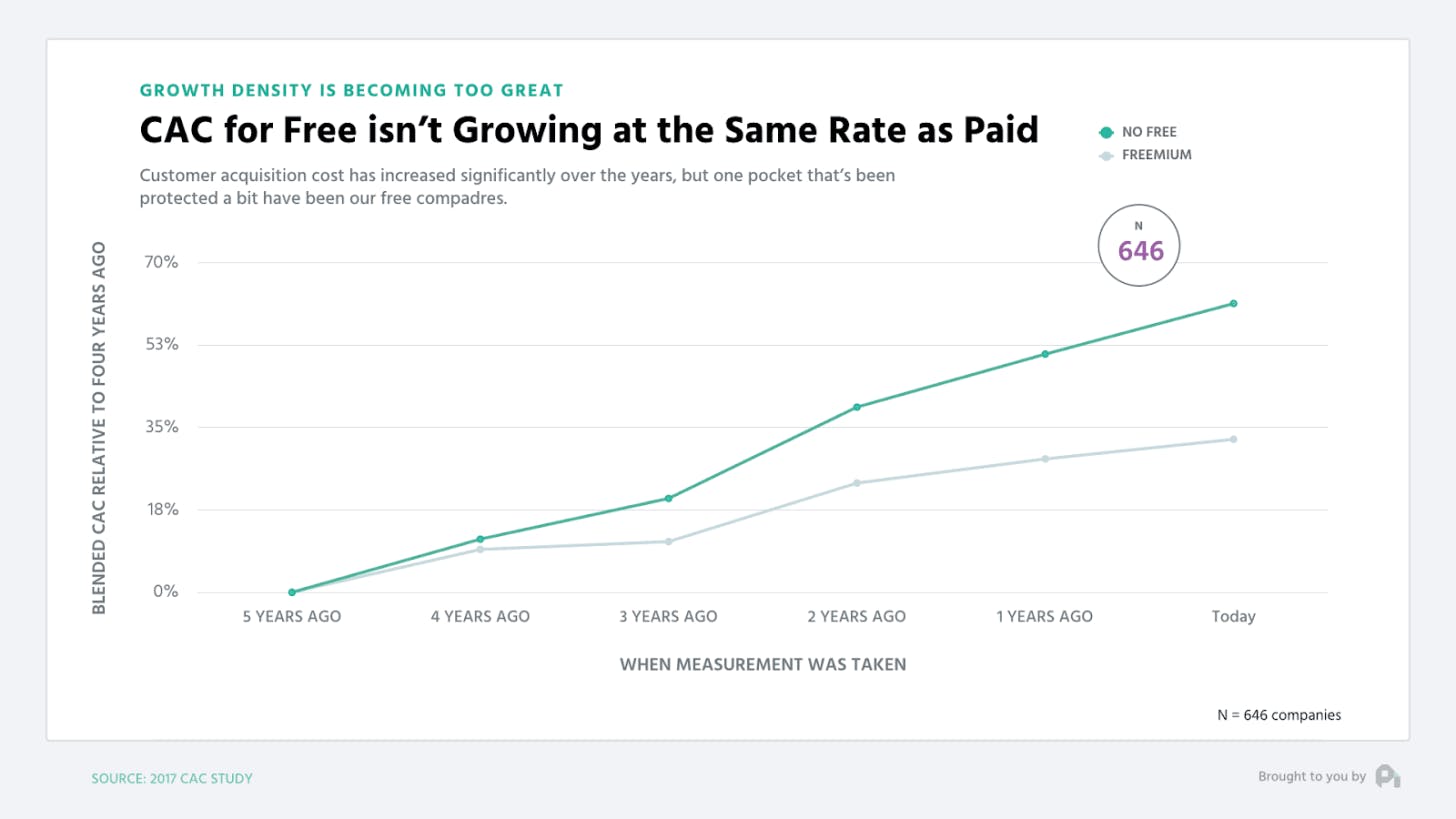

- Paid users who convert from free tend to have higher NPS, better retention, and much lower CAC .

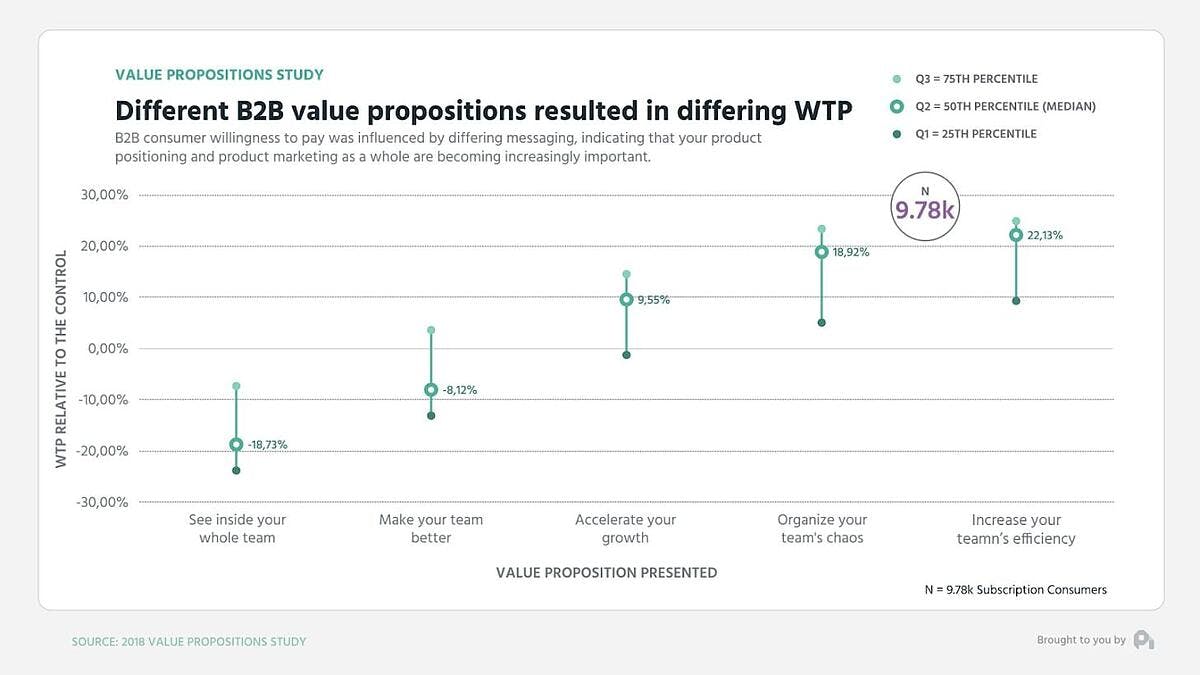

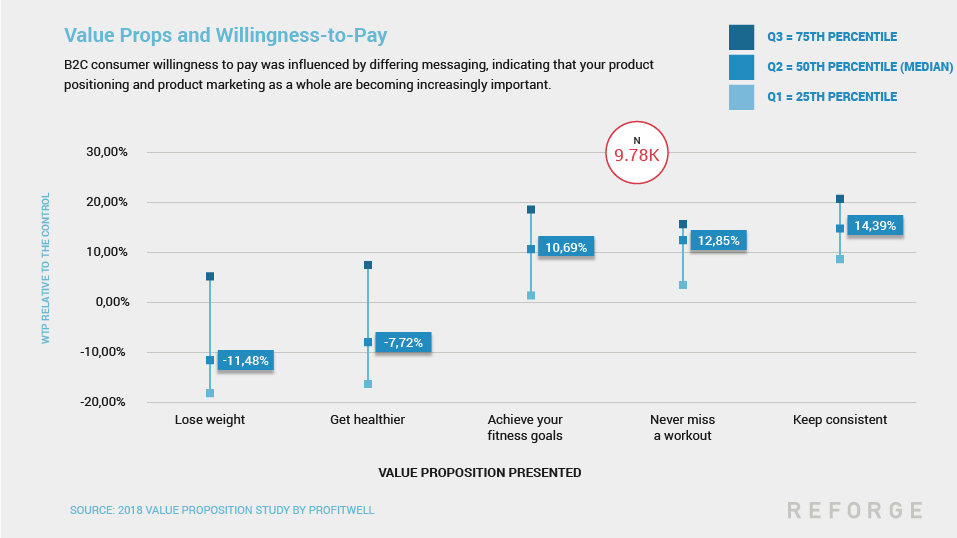

3. Value propositions matter oh so much

In B2B value propositions can swing willingness to pay ±20%, in DTC it's ±15%

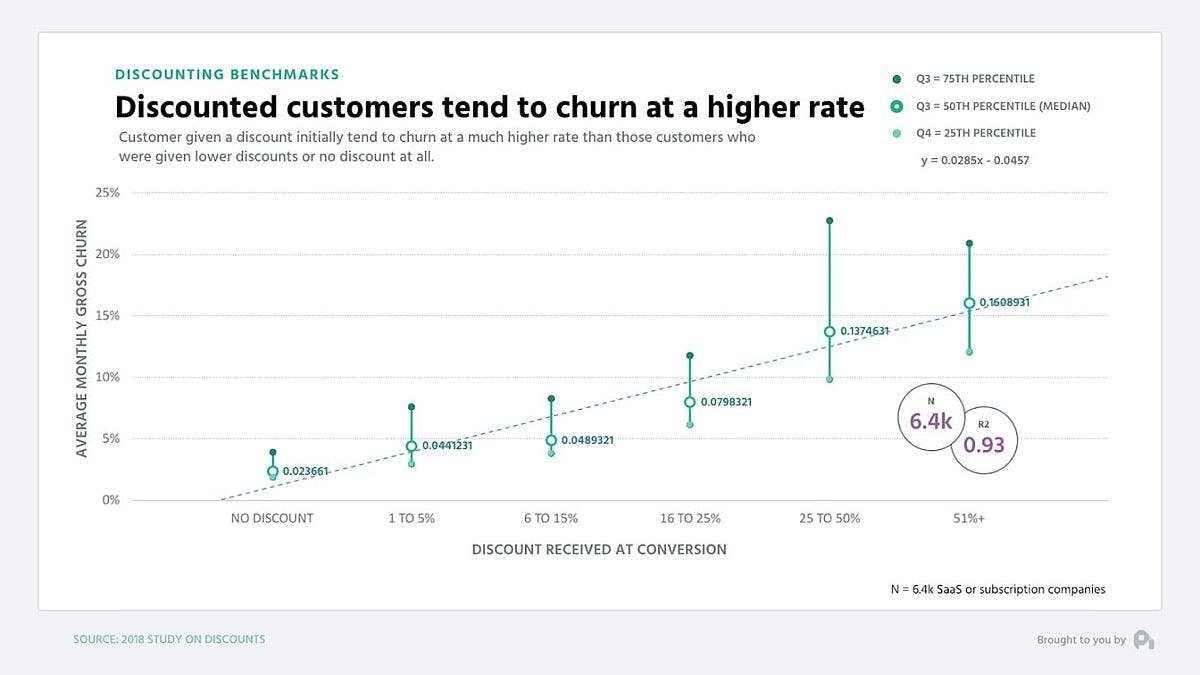

4. Don't discount over 20%

In some verticals discounting over 20% may be fine, but you're likely not in one of them (although you may think you are), but the size of the discount almost perfectly correlates with higher churn. Large discounts get people to convert, but they don't stick around.

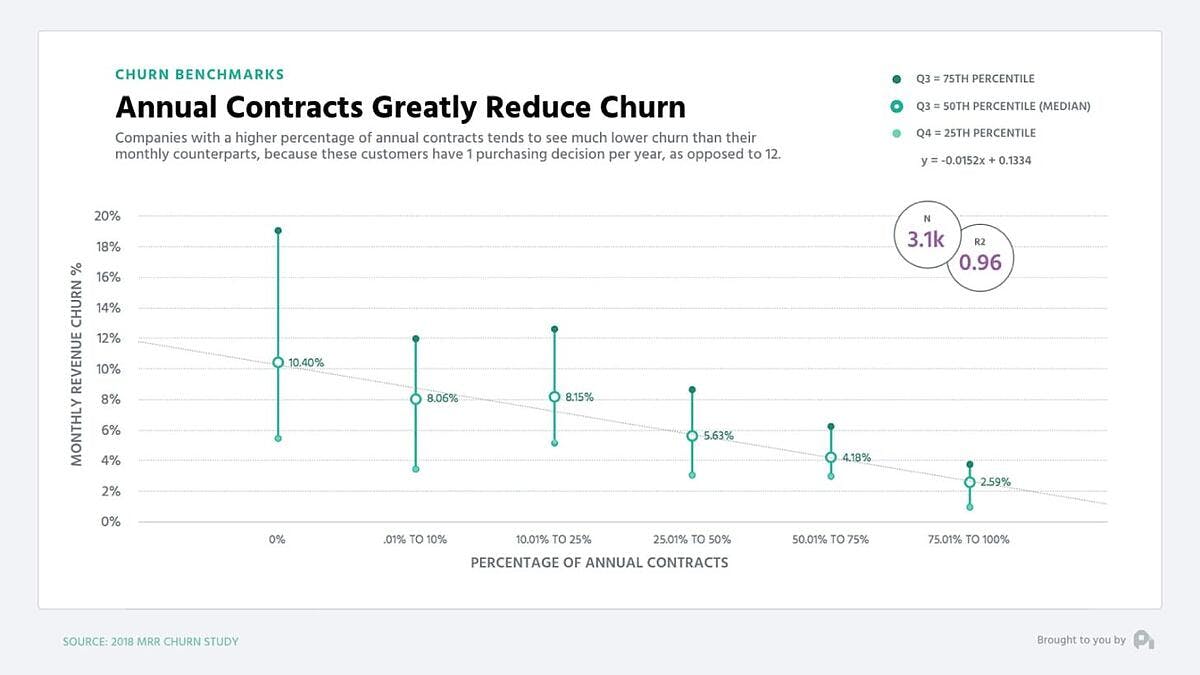

5. For upgrades to annual discounts, don't use percentages and try offers

Percentages don't work as well as whole dollar amounts for discounts (ie., "one month" will work better than "X percent off"). Annuals see much lower churn rates.

6. Should you end your price in 9s or 0s? Depends on your price point

Ending your prices in 9s evokes a discount brand, making the customer feel like they're getting something. Ending in 0 evokes luxury or premium, making them feel like they're getting a high-end product. Studies on this for technology products are inconclusive. We have seen it increase conversion in lower-cost products, but retention isn't as good with those customers.

7. You should experiment with your pricing in some manner every quarter

This doesn't mean change you should the price point each quarter, but experiment with variable costs. More changes correlate with increasing revenue per customer. Like all things, focusing on something makes you improve it.

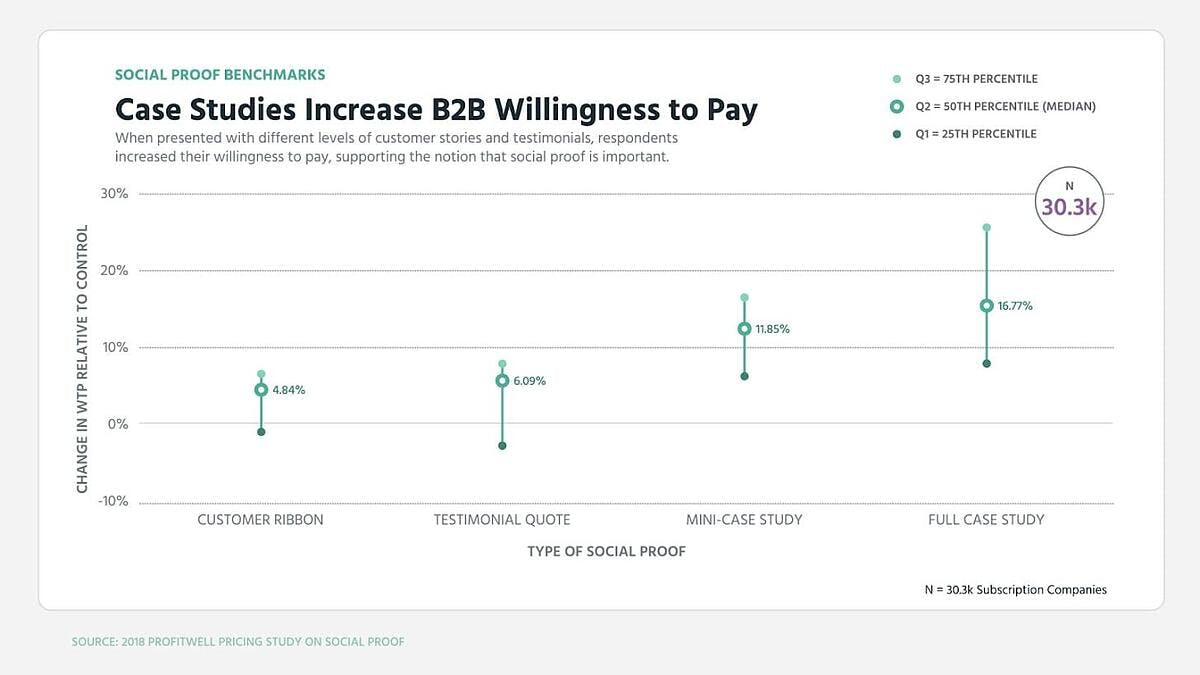

8. Case studies boost willingness to pay quite a bit

Social proof is important. Case studies that offer proof of the high quality of your products can boost willingness to pay by 10-15% in both B2B and in DTC.

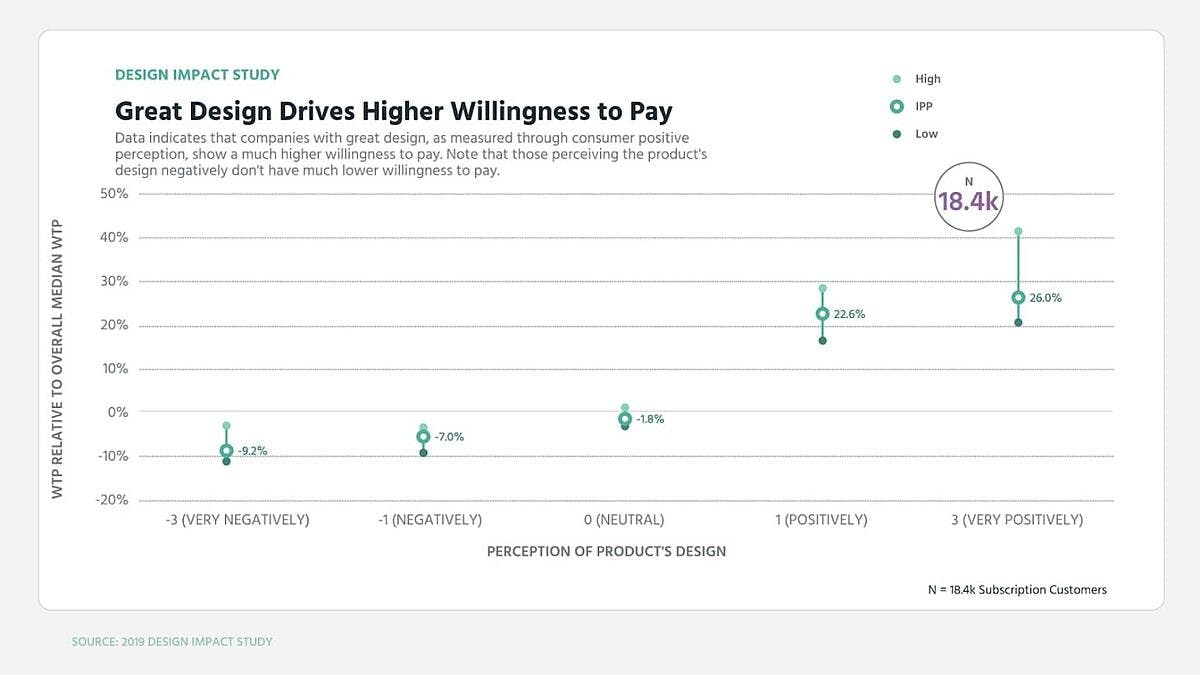

9. Design helps boost willingness to pay by 20%

This graph didn't look this way 10 years ago when design didn't do much for willingness to pay. Today, affinity for a company's design can boost willingness to pay considerably.

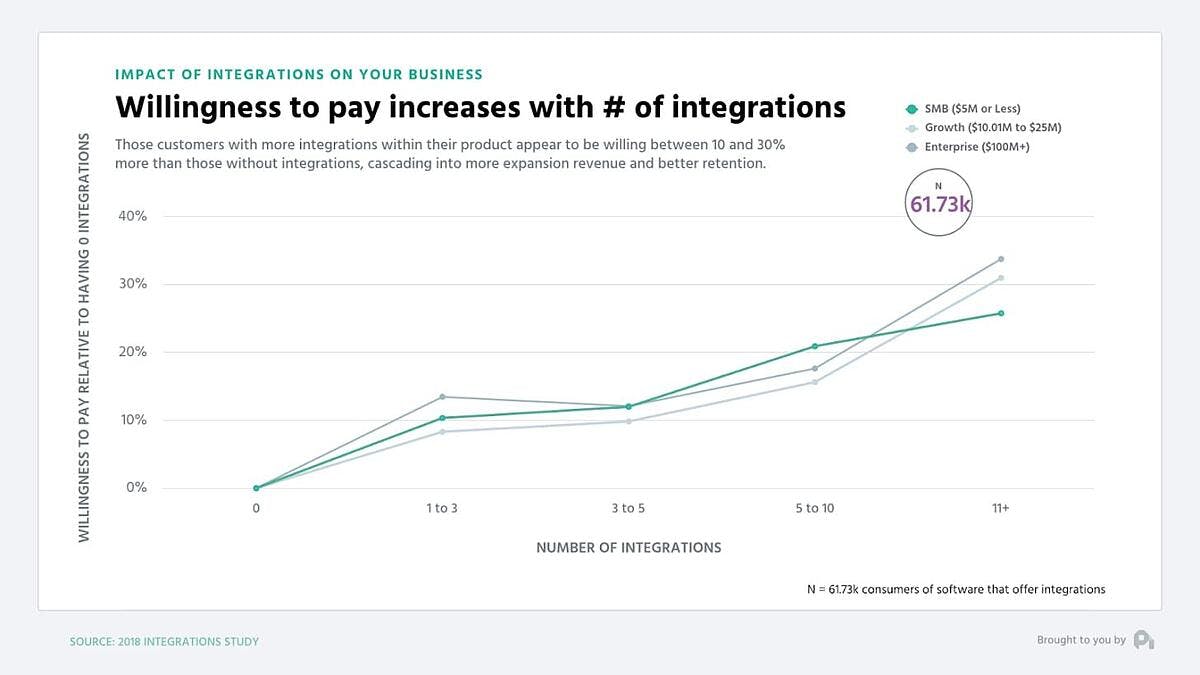

10. Integrations boost retention and willingness to pay

The more integrations a customer is using, typically the higher their willingness to pay and the better their retention. I wouldn't charge for the integrations, but I'd use this as a tool to get people hooked in and paying more or buying different add-ons.

Pricing strategies for different industries

Pricing strategies are not one size fits all. Finding the proper pricing strategy is dependent on your industry, as well as your company's unique objectives. But to give you an idea, we've listed a couple of industries and strategies that are well suited for each other.

SaaS/Subscriptions

For SaaS and subscription-based businesses, value-based pricing is the winner hands down. As long as your customers are willing to pay, you can charge much more than your competitors. Because your price is based on how much customers will spend, it isn't artificially lowered like other methods that fail to account for that.

We also like value-based pricing for B2B companies. Value-based pricing requires you to look outward and understand your customers better. This is good for finding the optimal price, but it's also good for building optimal relationships that will also help grow your company.

No more price guessing, just pricing that works

Accurately pricing your product for maximum growth requires a lot of market research and even more expertise on how to conduct and analyze that research. Our Price Intelligently service combines our years of experience in the field with powerful machine learning tools to understand your target customer base and what makes them tick. We know the data to collect, the questions to ask, and the people to ask them of. This is important because businesses in different stages of growth need different strategies for evaluating pricing. Additionally, every business has a unique set of potential selling points and a unique target audience to pitch to.

You need someone in your corner who knows how to evaluate pricing options for your specific businesses. With our help, you can be confident that your pricing strategy and chosen price points will unlock growth levers at your company that have been sitting idle, because they'll be tailored to finding and maximizing the value propositions that are unique to your business.

Which pricing strategy is best?

This depends on your business model. For SaaS and subscription companies, as well as many others, we recommend value-based pricing.

How do you determine the selling prices of a product?

First, find a pricing strategy that fits well with your business model and product. As you've seen, pricing strategies differ, but they all give clear instructions for how to use them to set prices.

What is the simplest pricing strategy?

Since you only need to add up the cost to make your product and add a percentage to it, cost-plus pricing is the simplest form of pricing to use.

What is a pricing curve?

A pricing curve is a graph that shows you the number of people who are willing to pay a given price for a product.

What are the 4 major pricing strategies?

Value-based, competition-based , cost-plus, and dynamic pricing are all models that are used frequently, depending on the industry and business model in question.

Related reading

Take a look at all our Webinars and Events!

Elevate Pricing with Elasticity

Optimise Pricing with Sensitivity

Blogs & articles, how to write a pricing strategy for my business plan.

In this blog you will learn about the importance of choosing the right pricing strategy for a successful business plan.

Why is a pricing strategy important for a business plan?

A business plan is a written document outlining a company’s core business practices – from products and services offered to marketing, financial planning and budget, but also pricing strategy. This business plan can be very lengthy, outlining every aspect of the business in detail. Or it can be very short and lean for start ups that want to be as agile as possible.

This plan can be used for external investors and relations or for internal purposes. A business plan can be useful for internal purposes because it can make sure that all the decision makers are on the same page about the most important aspects of the business.

A 1% price increase can lead to an 8% increase in profit margin.

A business plan could be very lengthy and detailed or short and lean, but in all instances, it should have a clear vision for how pricing is tackled. A pricing strategy ultimately greatly determines the profit margin of your product or service and how much revenue the company will make. Thorough research of consultancy agencies also show that pricing is very important. McKinsey even argues that a 1% prices increase can lead up to an 8% increase in profits. That is a real example of how small adjustments can have a huge impact!

It is clear that each business plan should have a section about pricing strategies. How detailed and complicated this pricing strategy should be depends for each individual business and challenges in the business environment. However, businesses should at least take some factors into account when thinking about their pricing strategy.

What factors to take into account?

The pricing strategy can best be explained in the marketing section of your business plan. In this section you should describe what price you will charge for your product or service to customers and your argumentation for why you ask this. However, businesses always balance the challenging scale of charging too much or too little. Ideally you want to find the middle, the optimal price point.

The following questions need to be answered for writing a well-structured pricing strategy in your business plan:

What is the cost of your product or service?

Most companies need to be profitable. They need to pay their expenses, their employees and return a reasonable profit. Unless you are a well-funded-winner-takes-all-growth-company such as Uber or Gorillas, you will need to earn more than you spend on your products. In order to be profitable you need to know how much your expenses are, to remain profitable overall.

How does your price compare to other alternatives in the market?

Most companies have competitors for their products or services, only few companies can act as a monopoly. Therefore, you need to know how your price compares to the other prices in the market. Are you one of the cheapest, the most expensive or somewhere in the middle?

Why is your price competitive?

When you know the prices of your competitors, you need to be able to explain why your price is better or different than that of your competitions. Do you offer more value for the same price? Do you offer less, but are you the cheapest? Or does your company offer something so unique that a premium pricing strategy sounds fair to your customer? You need to be able to stand out from the competition and price is an efficient differentiator.

What is the expected ROI (Return On Investment)?

When you set your price, you need to be able to explain how much you are expeciting to make. Will the price you offer attract enough customers to make your business operate profitable? Let’s say your expenses are 10.000 euros per month, what return will your price get you for your expected amount of sales?

Top pricing strategies for a business plan

Now you know why pricing is important for your business plan, “but what strategies are best for me?” you may ask. Well, let’s talk pricing strategies. There are plenty of pricing strategies and which ones are best for which business depends on various factors and the industry. However, here is a list of 9 pricing strategies that you can use for your business plan.

- Cost-plus pricing

- Competitive pricing

- Key-Value item pricing

- Dynamic pricing

- Premium pricing

- Hourly based pricing

- Customer-value based pricing

- Psychological pricing

- Geographical pricing

Most of the time, businesses do not use a single pricing strategy in their business but rather a combination of pricing strategies. Cost-plus pricing or competitor based pricing can be good starting points for pricing, but if you make these dynamic or take geographical regions into account, then your pricing becomes even more advanced!

Pricing strategies should not be left out of your business plan. Having a clear vision on how you are going to price your product(s) and service(s) helps you to achieve the best possible profit margins and revenue. If you are able to answer thoughtfully on the questions asked in this blog then you know that you have a rather clear vision on your pricing strategy.

If there are still some things unclear or vague, then it would be adviceable to learn more about all the possible pricing strategies . You can always look for inspiration to our business cases. Do you want to know more about pricing or about SYMSON? Do not hesitate to contact us!

Do you want a free demo to try how SYMSON can help your business with margin improvement or pricing management? Do you want to learn more? Schedule a call with a consultant and book a 20 minute brainstorm session!

Get your CEO Book for Intelligent Pricing

- How to become a Hyperlearning organisation

- How to develop your organisational processes

- How to choose an algorithm that fits your business

Get your playbook for behavior-Based Pricing and using AI Driving Tooling

- Increase margin & revenue

- Become a Frontrunner in your market

- Be agile, use AI pricing software & learn from it to become a Hyperlearning Organisation

HAVE A QUESTION?

Frequently asked questions, related blogs.

Leverage Ethical Pricing and Discount Strategies with SYMSON's AI-Powered Solutions

Pricing strategies: how to determine the selling or sale price of a product

Pricing Strategies: Pricing Strategies for Launching New Products

The STP Marketing Model: A Comprehensive Guide to Mastering Market Dynamics

7 Factors Affecting Price Elasticity of Demand

How To Implement Competitive Pricing

Hyperlearning

Search Product category Any value Sample Label 1 Sample Label 2 Sample Label 3

Pricing Strategy in a Business Plan: Deep Dive

- March 21, 2024

- Business Plan , How to Write

In this blog post, we’re diving into how to choose and explain your pricing strategy in your business plan. We’ll cover different pricing models like penetration, premium, and value-based. We’ll also dive into how to present your pricing strategy in your business plan.