Philippine Legal Resources

Philippine Legal Forms and Resources: Affidavit, Deed, Contract, Memorandum

Monday, July 13, 2020

- Deed of Assignment and Transfer of Rights

DEED OF ASSIGNMENT AND TRANSFER OF RIGHTS

Acknowledgement, popular posts.

- MOA on Sale of Lot

- Affidavit of Damage to Vehicle

- Contract of Lease of Commercial Building

- Affidavit of No Rental

- Affidavit of Consented Land Use

- Deed of Absolute Sale of Business

- Demand to Vacate

- Affidavit of Loss of High School Diploma

- Download Free Legal Forms

Privacy Policy

This privacy policy tells you how we use personal information collected at this site. Please read this privacy policy before using the site or submitting any personal information. By using the site, you accept the practices described here. Collection of Information We collect personally identifiable information, like names, email addresses, etc., when voluntarily submitted by our visitors. The information you provide is used to fulfill your specific request, unless you give us permission to use it in another manner, for example, to add you to one of our mailing lists. Cookie/Tracking Technology Our site may use cookies and tracking technology which are useful for gathering information such as browser type and operating system, tracking the number of visitors to the site, and understanding how visitors use the Site. Personal information cannot be collected via cookies and other tracking technology, however, if you previously provided personally identifiable information, cookies may be tied to such information. Third parties such as our advertisers may also use cookies to collect information in the course of serving ads to you. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. Distribution of Information We do not share your personally identifiable information to any third party for marketing purposes. However, we may share information with governmental agencies or other companies assisting us in fraud prevention or investigation. We may do so when: (1) permitted or required by law; or, (2) trying to protect against or prevent actual or potential fraud or unauthorized transactions; or, (3) investigating fraud which has already taken place. Commitment to Data Security Your personally identifiable information is kept secure. Only authorized staff of this site (who have agreed to keep information secure and confidential) have access to this information. All emails and newsletters from this site allow you to opt out of further mailings. Privacy Contact Information If you have any questions, concerns, or comments about our privacy policy you may contact us by email at [email protected]. We reserve the right to make changes to this policy. You are encouraged to review the privacy policy whenever you visit the site to make sure that you understand how any personal information you provide will be used.

Blog Archive

Featured post, minimum wage and rights of kasambahays (domestic workers in the philippines), affidavit, deed, acknowledgment & waiver, power of attorney, sale of personal property, corporation, real estate, donation & extrajudicial settlement, family law and annulment/nullity of marriage, credit and loan, other forms & pleadings, pageviews all time.

Deed of Sale Sample Philippines (Free Download)

You just finished talking to a buyer of your house and lot in Quezon City, so you need to draft a deed of sale. You are glad that, after intense negotiation, you have finally agreed on the contract price.

How do you then draft a deed of sale to ensure all the terms and conditions you agree to are reflected in the contract?

This guide will walk you through drafting a deed of sale.

DISCLAIMER : This article has been written for general informational purposes only and is not legal advice or a substitute for legal counsel. You should contact your attorney to obtain advice with respect to any particular issue or problem. The use of the information contained herein does not create an attorney-client relationship between the author and the user/reader.

Table of Contents

Free downloadable/editable deed of sale sample templates.

To save you the hassle of writing a deed of sale from scratch, you may download the following samples and edit the contents using the above guide:

1. Deed of Absolute Sale of Real Property

2. contract to sell real property, 3. deed of absolute sale of a motor vehicle, 4. deed of sale with pacto de retro, what is a deed of sale.

Under Article 1458 of the New Civil Code of the Philippines 3 , a deed of sale or a contract of sale is a document executed when one of the contracting parties (called the seller) obligates himself to transfer the ownership and to deliver a determinate thing (e.g., house and lot or motor vehicle), and the other (called the buyer) to pay the price certain in money or its equivalent.

A contract of sale may be absolute or conditional.

Deed of Absolute Sale vs. Deed of Conditional Sale vs. Contract To Sell: What’s the Difference?

1. deed of absolute sale.

The Supreme Court, in one case 4 provides that a contract of sale is absolute when :

- The title to the property passes to the buyer upon delivery of the property sold. Delivery is either actual (when the item is given to the buyer) or constructive (i.e., executing a Deed of Absolute Sale in the case of real property).

- The contract has no statement or condition that the property title remains with the seller until full payment of the purchase price.

- No provision in the contract gives the seller the right to cancel the contract unilaterally (meaning without the buyer’s consent) when the buyer fails to pay within the agreed period.

2. Deed of Conditional Sale and Contract to Sell

A conditional sale occurs when there is a condition in the contract of sale, and ownership of the property will only pass to the buyer upon fulfilling the condition.

On the other hand, in the contract to sell 5 , the prospective seller binds himself to sell the property exclusively to the prospective buyer upon fulfilling the conditions agreed upon, e.g., the full payment of the contract price. In a contract to sell, the agreement is about the promise to sell.

The ownership in both conditional sale and contract to sell remains with the seller and does not pass to the buyer.

However, in a deed of conditional sale (also known as a contract of conditional sale), the ownership is automatically transferred to the buyer when the condition is fulfilled. For example, you are the buyer, and the condition is the full payment of the contract price. Once you have fully paid the contract price, the ownership of the property is automatically transferred to you by operation of law without any further action to be done by the seller.

It is not the same in a contract to sell. Ownership is not automatically transferred even if the buyer fulfills the obligation, and the property may have already been delivered. The prospective seller still has to transfer the title to the prospective buyer by executing a deed of absolute sale because the agreement in the contract to sell is only a promise to sell and not yet a sale of the property.

Please note that if the contract contains a clause that the seller shall execute a Deed of Absolute Sale only after full payment of the purchase price, it is a contract to sell.

Is there a need to execute a Deed of Absolute Sale in a Deed of Conditional Sale?

Although jurisprudence says ownership is automatically transferred to the buyer by operation of law without any further action to be done by the seller, in practice, a Deed of Absolute Sale still has to be executed because one of the requirements in the Register of Deeds for the transfer of title of the real property is a Deed of Absolute Sale. This also confirms the buyer has fulfilled the condition.

Deed of Absolute Sale vs. Contract of Sale With Pacto De Retro : What’s the Difference?

Property ownership transfer is absolute without conditions in the Deed of Absolute Sale. In a contract of sale with pacto de retro, the buyer gives the seller the right to repurchase the property within the agreed timeline.

If you execute a pacto de retro sale , the ownership of the property is immediately transferred to the vendee a retro (the buyer). However, since the seller a retro is given the option to buy back the property, the ownership reverts to the seller when the latter exercises this right.

The parties can fix the date when the seller should repurchase the property, but the period should not be more than ten years from signing the contract. The default is four years from signing the document if the period is not stated.

How To Draft a Deed of Absolute Sale: 3 Steps

For this guide, we will be using the sale of real property as a sample, as it is the most common type of transaction.

1. Prepare the document

A Deed of Absolute Sale should contain the following parts:

- Title of the document . If it is an absolute sale, it should be titled as such

- Name of the seller , a statement that the latter is of legal age, civil status, citizenship, and residence address.

- Name of the buyer , a statement that the latter is of legal age, civil status, citizenship, and residence address.

- The identification of the real property , its address, and the technical description (can be found on the title of the property)

- The consideration or the purchase price .

- Warranty of the seller

- The signature of the parties

- Signature of the witnesses

- Acknowledgment before a notary public

2. Print at least 3-5 copies of the document

- One copy goes to the notary public

- One or two copies go to the seller

- One or two copies go to the buyer

3. Go to a notary public to have your document notarized

Don’t forget to bring valid IDs, as the notary will have to verify the identities of the parties.

Tips and Warnings

- In drafting a contract of sale, it is crucial to ascertain the real intention of the parties. Several cases have been decided by the Supreme Court whereby an agreement titled a Deed of Conditional Sale was ruled to be a Contract to Sell due to the clauses in the contract. This is because it is not the title of the contract that will prevail but the express terms and conditions that will determine whether you entered into an absolute contract of sale, conditional contract of sale, or a contract to sell.

Frequently Asked Questions

1. should a deed of sale of real property be notarized.

Yes. A sale deed of real property should be notarized per the requirements under Article 1358 of the New Civil Code, which provides that any contract that creates, transmits, modifies, or extinguishes rights over the real property should be in a public document.

The notarization of a private document converts it into a public record.

2. How much is the cost for the notarization of a Deed of Sale in the Philippines?

The cost varies depending on the location or the IBP (Integrated Bar of the Philippines) Chapter to which the notary public belongs. The going rate is around 1% of the contract price. In IBP Cebu Chapter 6 , the standard rate seems to be 2% of the actual amount of the contract but not less than Php 1,500 whichever is higher. On the other hand, in Dumaguete 7 , the standard rate is a minimum of Php 2,000 or 3% of the property’s fair market value, whichever is higher.

3. Who pays for the notarization of a Deed of Sale ?

Depending on both parties’ agreement during the negotiation process, it could be the seller or the buyer.

4. How can I sign the Deed of Sale in the Philippines if I am abroad?

You may appoint a person based in the Philippines to sign the Deed of Sale on your behalf by executing a Special Power of Attorney in favor of your agent in the Philippines.

5. Does a Deed of Sale have an expiration date?

A Deed of Sale has no expiration date per se, but it can be extinguished (canceled or nullified) by the same causes as all other obligations.

For example, in a Deed of Conditional Sale, the contract may be extinguished due to the non-payment of the contract price or breach of other obligations.

In a Deed of Sale with Pacto de Retro , the sale is extinguished by the redemption of the seller of the property sold.

6. What is the difference between a Deed of Sale and a Deed of Donation ?

In donation, the transfer of property is gratuitous (meaning for free), usually because of the donor’s love and affection for the donee or due to the good service of the latter. There is always a consideration in the sale: money or its equivalent.

Both transfers require payment of fees and taxes. In addition to transfer tax, documentary stamp tax, among others, a donation is subject to donor’s tax of 6% computed based on the total gifts over Php 250,000 exempt in a calendar year (effective 01 January 2018 based on RA 10963 or the TRAIN Law).

On the other hand, a sale is subject to an outright capital gains tax of 6% of the total contract price or the fair market value of the property, whichever is higher, which must be paid to the BIR within 30 days from the date of signing the Deed of Sale.

A deed of sale and a deed of donation are both modes of transferring property ownership. However, the rules on donation are governed by Title III, while Title VI of Book III of the New Civil Code of the Philippines governs a sale.

7. What is an Open Deed of Sale ? Is it valid?

An open deed of sale is just like a regular deed of sale, but the buyer’s name and other contract details, such as the price and the date of signing, are left blank or open.

This practice is common in selling second-hand motor vehicles or in a dealership where the dealer’s possession of the vehicle is temporary until the dealer finally finds a buyer. This scheme is done purportedly to avoid going through the rigorous process of transferring ownership of the vehicle and paying the transfer fees/taxes.

The Open Deed of Sale, on its face, is not a valid form of contract as there is no meeting of the minds between the buyer and the seller appearing on the document.

This practice is also risky for both parties. Under the law, the owner of a motor vehicle is the person whose name appears on the Certificate of Registration (CR) issued by the Land Transportation Office (LTO); hence, even if you have already sold the motor vehicle, if your name still appears on the CR, you remain responsible for it. If the motor vehicle injures a person or property, the victim will go after you, even if you are not driving the vehicle.

The same is true if you are the buyer. It will be hard to find out if the car has been involved in a crime, was carnapped, or is collateral of a loan without your knowledge.

It is best to avoid executing an open deed of sale; otherwise, you risk exposing yourself to the above-mentioned untoward scenarios.

- IBP Cebu releases minimum attorney fees table. (2020). Retrieved 6 October 2020, from https://abogado.com.ph/ibp-cebu-releases-minimum-attorney-fees-table/

- Dumaguete Lawyer - IBP Rates. (2020). Retrieved 6 October 2020, from http://www.dumaguetelawyer.com/rates/

- Republic Act No. 386: Civil Code of the Philippines (1949) .

- Sps Ramos vs. Sps Heruela , G.R. No. 145330, October 14, 2005.

- Ventura et al vs. Heirs of Spouses Endaya , G.R. No. 190016, October 2, 2013

- Dumaguete Lawyer – IBP Rates. (2020). Retrieved 6 October 2020, from http://www.dumaguetelawyer.com/rates/

Written by Atty. Kareen Lucero

in Juander How , Legal Matters

Last Updated May 20, 2023 02:16 PM

Atty. Kareen Lucero

Kareen Lucero is a lawyer previously doing litigation before working for different agencies in the government and for a multinational corporation. She has traveled to 52+ countries including a 3-month solo backpacking in South East Asia and more than 1 year of solo traveling across four continents in the world. As part of giving back, she is passionate about sharing her knowledge of law and travel. She is currently doing consulting work for a government agency. For inquiries, you may reach her via Facebook Messenger (https://m.me/kareen.lucero.77) or email ( [email protected] ).

Browse all articles written by Atty. Kareen Lucero

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net

Deed of Assignment and Transfer of Rights

- Post author By Belle

- Post date June 14, 2022

Related Posts

- Tags real estate

- Now Trending:

- UNDERSTANDING TENANCIES ...

- THE SENIOR PARTNER OF PR...

- Dr. Prince O. Williams-J...

- How To Pick The Right Ho...

DEED OF ASSIGNMENT: EVERYTHING YOU NEED TO KNOW.

A Deed of Assignment refers to a legal document in which an assignor states his willingness to assign the ownership of his property to the assignee. The Deed of Assignment is required to effect a transfer of property and to show the legal right to possess it. It is always a subject of debate whether Deed of Assignment is a contract; a Deed of Assignment is actually a contract where the owner (the “assignor”) transfers ownership over certain property to another person (the “assignee”) by way of assignment. As a result of the assignment, the assignee steps into the shoes of the assignor and assumes all the rights and obligations pertaining to the property.

In Nigeria, a Deed of Assignment is one of the legal documents that transfer authentic legal ownership in a property. There are several other documents like a deed of gifts, Assent, etc. However, this article focuses on the deed of assignment.

It is the written proof of ownership that stipulates the kind of rights or interests being transferred to the buyer which is a legal interest.

Read Also: DIFFERENCE BETWEEN TRANSFER OF PROPERTY THROUGH WILLS AND DEED OF GIFT

CONTENTS OF A DEED OF ASSIGNMENT

Content of a Deed of Assignment matters a lot to the transaction and special skill is needed for a hitch-free transaction. The contents of a deed of assignment can be divided into 3 namely; the introductory part, the second (usually the operative part), and the concluding part.

- THE INTRODUCTORY PART: This part enumerates the preliminary matters such as the commencement date, parties in the transaction, and recitals. The parties mentioned in the deed must be legal persons which can consist of natural persons and entities with corporate personality, the name, address, and status of the parties must be included. The proper descriptions of the parties are the assignor (seller) and assignee (buyer). The Recitals give the material facts constituting the background to the current transaction in chronological order.

- THE SECOND PART (USUALLY THE OPERATIVE PART): This is the part where the interest or title in the property is actually transferred from the assignor to the assignee. It is more like the engine room of the deed of assignment. The operative part usually starts with testatum and it provides for other important clauses such as the consideration (price) of the property, the accepted receipt by the assignor, the description of the property, and the terms and conditions of the transaction.

- The testimonium : this shows that all the parties are involved in the execution of the deed.

- Execution : this means signing. The capacity of the parties (either individual, corporate bodies, illiterates) is of great essence in the mode of execution. It is important to note that the type of parties involved determines how they will sign. Example 2 directors or a director/secretary will sign if a company is involved. In the same way, if an association, couple, individual, illiterate, family land (omonile), firm, unregistered association, etc. is involved the format of signature would be different.

- Attestation : this refers to the witnessing of the execution of the deed by witnesses.

For a Deed of Assignment to be effective, it must include a column for the Governor of the state or a representative of the Government where the property is, to sign/consent to the transaction. By virtue of Sec. 22 of the Land Use Act, and Sec. 10 Land Instrument Registration Law, the Governor must consent to the transaction.

Do you have any further questions? feel free to call Ibejulekkilawyer on 08034869295 or send a mail to [email protected] and we shall respond accordingly.

Disclaimer: The above is for information purposes only and should not be construed as legal advice. Ibejulekkilawyer.com (blog) shall not be liable to any person(s) for any damage or liability arising whatsoever following the reliance of the information contained herein. Consult us or your legal practitioner for legal advice.

Only 22% of poorest Nigerian households have electricity access –World Bank

Related Posts

Create your Deed of Assignment in minutes.

Quick draft.

A document usually involves 2 parties and, for different reasons, the person drafting the document would want the terms to benefit one party over the other. With Quick Draft, as you answer the questions, we automatically pre-select the answer that benefits your preferred party. You can still change the pre-selected answer.

Step-by-step Assistance

Click the "Begin Here" button at the top of this page to start creating your document. Answer questions and download your customized document once finished.

Look for the following icons as you answer the Q&A to know more about the question and our suggested answer.

What is this?

Click this icon for information about the question.

Suggested Answer

Click this icon to know what is the recommended answer based on similar documents.

Things you need to know about Deed of Assignment.

Last updated on 8 January 2024

1. What is a Deed of Assignment?

A Deed of Assignment is a contract where the owner (the “assignor”) transfers ownership over property to another person (the “assignee”) by way of assignment. The assignee steps into the shoes of the assignor and assumes all the rights and obligations to the property.

If you will assign immovable property (e.g. land, house) then use this Deed of Assignment for Immovable Property instead.

2. When do you need a Deed of Assignment?

A Deed of Assignment is used when the owner wants to transfer ownership (and the rights and obligations) over property to another person.

3. What information do you need to create the Deed of Assignment?

To create your Deed of Assignment you’ll need the following minimum information:

- The type of assignor (e.g. individual or business) as well as name and details (e.g. nationality and address).

- The type of assignee (e.g. individual or business) as well as name and details (e.g. nationality and address).

- Brief description of the property to be assigned.

4. How much is the document?

The document costs PHP 400 for a one-time purchase. Once purchased you have unlimited use and revisions of this type of document.

You can also avail of Premium subscription at PHP 1,000 and get (a) unlimited use of our growing library of documents (from affidavits to contracts); and (b) unlimited use of our “ Ask an Attorney ” service, which lets you consult an expert lawyer anytime for any legal concern you have.

Related Documents.

Activities that involve a Deed of Assignment sometimes use the following documents. You may be interested in them:

Deed of Assignment for Immovable Property

Assign your rights to immovable property (e.g. house, land) to another person

Document Name

Cancel Save

9 Eymard Drive, New Manila Quezon City Owned and operated by JCArteche’s Online Documentation & Referral Services

Back to Top

- Terms of Service

- Privacy Policy

- Create Documents

- Ask An Attorney

- How It Works

- Customer Support

You are using an outdated browser. Please upgrade your browser to improve your experience.

SELECT CURRENCY

Realspeak: assignment, deed.

Posted date: September 11, 2020

RealSpeak is a series of informative blog posts that aims to broaden the knowledge of its readers – particularly the general public – regarding real estate matters.

ASSIGNMENT, DEED

In real estate, you will often hear the term “Deed of Assignment.” What does it mean, and what are the circumstances for it to arise? Let’s take a look at the legal definition of assignment and deed:

Assignment – The transfer of property or right and obligations over it in favor of another (The one who assigns or transfers a property is called ASSIGNOR while those to whom the property is assigned are called ASSIGNS or ASSIGNEE S). 1

Deed – A written instrument which, when properly executed and delivered, conveys title. 2

Basically, a Deed of Assignment is a document that states the transfer of property or rights and obligations from one person to another. The persons may be natural (individual) or legal (e.g. a private or public organization) persons.

To illustrate, a good example is when an individual (assignor) – who has bought a condominium unit during preselling period (prior to construction) – decides to sell the property prior to the completion of the building and turnover of the unit. Usually, there is a balance that needs to be paid during turnover. If the balance has not yet been paid and the individual finds a new buyer for the property, the obligation to pay the turnover balance will be transferred (assigned) to the new buyer (assignee). The developer of the condominium – if they allow such a process – will then produce the Deed of Assignment as proof of the transfer of ownership and obligation to pay.

You may ask: What’s the reason for selling prior to turnover? The individual bought the property to live in it, right?

The great thing about real estate property is you can buy it not just for residence, but also for investment. During preselling period, buyers are given a discount to acquire the properties that have yet to be constructed. During the course of construction, the value of the properties also appreciate. Often, when an individual decides to sell prior to turnover, s/he will be able to sell it at a price where s/he can recover all the costs paid prior to turnover AND earn from the sale as well due to value appreciation. That is one way of how real estate acquisition becomes a form of investment.

Interested in trying it out? Don’t hesitate to let us know, as we will assist you in finding the right real estate investment for you! We are accredited with several developers with preselling projects that you may find enticing to invest in!

1 Urban institute of Real Estate and Construction, Comprehensive Notes and Reviewer, Terminology: C-1

The information contained in this site is provided for informational purposes only, and should not be construed as legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this site without seeking legal or other professional advice.

Talk to a Property Specialist

Kindly Fill up the form below and we’ll get back to you as soon as possible.

I am Looking for

Type of Property *

SUBSCRIBE TO OUR NEWSLETTER

The Philippines, an archipelago in Southeast Asia, boasts a rich tapestry of culture, history, and legal traditions. Within its legal landscape, the process of transferring property is of paramount importance, and central to this process is the "Deed of Conveyance." This document plays a crucial role in ensuring secure and legal transactions involving real property.

What is a Deed of Conveyance?

In its essence, a Deed of Conveyance is a legal document used to transfer the title of real property from one person (the seller or donor) to another (the buyer or donee). It signifies the intent of the owner to convey the property and indicates that the transfer has been made willingly.

Types of Deed of Conveyance in the Philippines:

Deed of Absolute Sale : This is the most common type used when a property is sold, and ownership is transferred for a certain price. Upon payment, the seller conveys the property rights to the buyer without any conditions.

Deed of Donation : In this type, a property is given as a gift. The donor willingly transfers the property to the donee without expecting any monetary compensation in return.

Deed of Assignment : This is used for transferring rights, title, or interest in a particular property, often relating to mortgages.

Deed of Exchange : Here, properties are exchanged between two parties.

Essential Elements For a Deed of Conveyance to be valid, it must contain:

- Names and details of the parties involved (both the transferee and the transferor). - The legal description of the property being conveyed. - The consideration (which could be monetary or otherwise). - An assertion that the transferor has the legal right to convey the property. - The signatures of the parties involved.

Legal Processes and Requirements: After the Deed of Conveyance is executed, several steps need to be followed:

Notarization: This gives the document public trust. A notary public certifies that the parties appearing before them are the ones they claim to be and have executed the deed willingly.

Payment of Taxes: Before registering the sale with the Registry of Deeds, certain taxes, like the capital gains tax and documentary stamp tax, need to be settled.

Transfer of Title: The buyer must present the Deed of Conveyance to the local Registry of Deeds to apply for a new land title under their name.

Registration with the Local Government: After acquiring the new title, the buyer should register with the local assessor's office for tax declarations.

The Deed of Conveyance is an essential instrument in the Philippines, safeguarding the rights and interests of parties in real property transactions. It ensures clarity, legitimacy, and protection for both the buyer and seller. As with any legal process, it's crucial to understand the intricacies and seek legal counsel when engaging in property transfers to ensure that rights are protected and obligations are clearly defined.

This website uses cookies to ensure you get the best experience. By using our site, you acknowledge that you have read and understand our Cookie Policy and Privacy Policy .

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

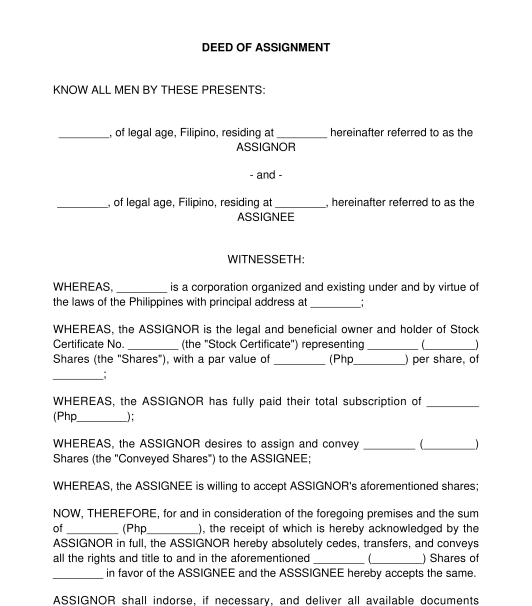

Deed of Assignment of Stock Subscription

Rating: 4.5 - 2 votes

A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties , the date of the transfer , the number of the stock certificate that represents the shares to be transferred, and the number of shares that will be transferred.

Only shares that have been fully paid are transferable. This means that if the assignor has not yet paid the full amount of the subscription, then the shares under the subscription cannot be transferred .

In order to transfer the shares, the stock certificate should be endorsed by the owner or any person legally authorized to make the transfer. Indorsement means signing the back of the stock certificate.

Finally, the transfer of shares will only be valid between the parties until it is recorded in the books of the corporation.

How to use this document

This document can be used by the registered owner of shares of stock of a corporation to transfer the shares (or part of the shares) to another person. It assumes that the purchase price for the shares has been fully paid .

The user should complete the document by entering the information required in the document. Once it is completed, the assignor and the assignee should sign the document .

This Deed of Assignment also includes an Acknowledgment. An Acknowledgment is an act of a person before a notary public stating that the signature on a document was voluntarily affixed by him and he executed the document as his free and voluntary act . Acknowledging a document before a notary public turns the document into a public document . Public documents are generally self-authenticating, meaning no other evidence will be needed to prove the execution of the document.

The Documentary Stamp Tax ("DST") and other applicable taxes, such as the Capital Gains Tax , should also be paid to the Bureau of Internal Revenue ("BIR") by the assignor or the assignee. The DST is required to be paid for any issuance or transfer of shares. The BIR shall issue a Certificate Authorizing Registration ("CAR") once the DST and other taxes are paid.

The assignor or assignee can then present the document, together with the endorsed stock certificate and the CAR , to the Corporate Secretary so the transfer can be recorded in the books of the corporation .

Applicable law

The Revised Corporation Code and the general laws of contracts and obligations found in the Civil Code govern the transfer of shares. However, other laws, their rules and regulations, and SEC rules may affect the conduct and transactions of the Corporation such as but not limited to the 1987 Constitution of the Philippines , the Securities Regulation Code, the Foreign Investment Act, the Republic Act 8179, specifically the Foreign Investment Negative List, the Anti-Money Laundering Act, and the Anti-Dummy Law may affect the ownership requirements of a corporation, depending on the business of the corporation. Tax laws may also affect the transfer of the shares.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- What to do after Creating a Contract?

- When and how to Notarize a Document?

Other names for the document:

Deed of Assignment, Deed of Assignment of Shares, Deed of Assignment of Stock, Deed of Assignment of Shares of Stock, Deed of Transfer of Stock Subscription

Country: Philippines

General Business Documents - Other downloadable templates of legal documents

- Acknowledgement Receipt

- Minutes of the Meeting of the Stockholders

- Notice for Non-Renewal of Contract

- Loan Agreement

- Secretary's Certificate

- Minutes of the Meeting of the Board of Directors

- Monetary Demand Letter

- Notice of Meeting

- Letter of Consent of Nominee

- Business Name Change Letter

- Release, Waiver, and Quitclaim (One-Way)

- Notice of Dishonor for Bounced Check

- Withdrawal of Consent of Nominee

- Request to Alter Contract

- Subscription Agreement for Shares of Stock

- Breach of Contract Notice

- Affidavit of Closure of Business

- Debt Assignment and Assumption Agreement

- Notice of Death or Insolvency of a Partner

- Other downloadable templates of legal documents

Deed of Assignment: Everything You Need to Know

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. 3 min read updated on January 01, 2024

Updated October 8,2020:

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date. In order to be valid, a deed of assignment must contain certain types of information and meet a number of requirements.

What Is an Assignment?

An assignment is similar to an outright transfer, but it is slightly different. It takes place when one of two parties who have entered into a contract decides to transfer all of his or her rights and obligations to a third party and completely remove himself or herself from the contract.

Also called the assignee, the third party effectively replaces the former contracting party and consequently assumes all of his or her rights and obligations. Unless it is stated in the original contract, both parties to the initial contract are typically required to express approval of an assignment before it can occur. When you sell a piece of property, you are making an assignment of it to the buyer through the paperwork you sign at closing.

What Is a Deed of Assignment?

A deed of assignment refers to a legal document that facilitates the legal transfer of ownership of real estate property. It is an important document that must be securely stored at all times, especially in the case of real estate.

In general, this document can be described as a document that is drafted and signed to promise or guarantee the transfer of ownership of a real estate property on a specified date. In other words, it serves as the evidence of the transfer of ownership of the property, with the stipulation that there is a certain timeframe in which actual ownership will begin.

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the “assignor,” while the party who is receiving the rights is called the “assignee.”

A deed of assignment is required in many different situations, the most common of which is the transfer of ownership of a property. For example, a developer of a new house has to sign a deed of assignment with a buyer, stating that the house will belong to him or her on a certain date. Nevertheless, the buyer may want to sell the house to someone else in the future, which will also require the signing of a deed of assignment.

This document is necessary because it serves as a temporary title deed in the event that the actual title deed for the house has not been issued. For every piece of property that will be sold before the issuance of a title deed, a deed of assignment will be required.

Requirements for a Deed of Assignment

In order to be legally enforceable, an absolute sale deed must provide a clear description of the property being transferred, such as its address or other information that distinguishes it from other properties. In addition, it must clearly identify the buyer and seller and state the date when the transfer will become legally effective, the purchase price, and other relevant information.

In today's real estate transactions, contracting parties usually use an ancillary real estate sale contract in an attempt to cram all the required information into a deed. Nonetheless, the information found in the contract must be referenced by the deed.

Information to Include in a Deed of Assignment

- Names of parties to the agreement

- Addresses of the parties and how they are binding on the parties' successors, friends, and other people who represent them in any capacity

- History of the property being transferred, from the time it was first acquired to the time it is about to be sold

- Agreed price of the property

- Size and description of the property

- Promises or covenants the parties will undertake to execute the deed

- Signatures of the parties

- Section for the Governors Consent or Commissioner of Oaths to sign and verify the agreement

If you need help understanding, drafting, or signing a deed of assignment, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Define a Deed

- Contract for Deed California

- Contract for Deed in Texas

- Assignment Law

- Deed Contract Agreement

- Assignment Of Contracts

- Legal Assignment

- Deed vs Agreement

- Assignment Legal Definition

- Contract for a Deed

Philippine Legal Forms

Deed of assignment of shares of stock sample.

Philippine Legal Forms Tags: Deed of Assignment , Deed of Assignment of Shares of Stock , Deed of Assignment Sample

Business Tips Philippines: Business Owners and Entrepreneurs’ Guide

Business Tips Philippines, an online entrepreneurship, management & marketing guide for Filipinos, business owners, leaders & entrepreneurs around the world.

How to Compute Documentary Stamp Tax (DST) on Transfer of Real Property

July 5, 2011 Vic 19 Comments

How to compute Documentary Stamp Tax (DST) on transfer of real property in the Philippines? When we sell or buy real property , we execute a contract or deed of absolute sale, where the selling price, parties, details of property and other stipulations are stated. The deed of sale is a document, and it is included by the tax code, regulated by the Bureau of Internal Revenue (BIR), as a document subject to documentary stamp tax. Now if you are selling or buying real property (i.e., land and improvement therein), the following guidelines, steps, procedures and other information in computing DST should help you.

What is a Documentary Stamp Tax?

Documentary Stamp Tax (DST) is a tax on documents, instruments, loan agreements and papers evidencing the acceptance, assignment, sale or transfer of an obligation, right or property incident thereto.

What is the BIR Form used in filing DST?

For filing and payment of DST on sale or transfer of real property, the form to be used is BIR Form No. 2000-OT (Documentary Stamp Tax Return/Declaration for One Time Transactions). One time transactions include transfer of Real Property classified as capital asset, transfer of Real Property classified as ordinary asset, and transfer of shares of stock not traded through the local stock. Please click here to download the Form .

Who are required to file BIR Form 2000-OT?

This return shall be filed in triplicate by the following person making, signing, issuing, accepting or transferring the document or facility evidencing transaction:

1. Every natural or juridical person, resident or non-resident, for sale, barter, exchange or other onerous disposition of shares of stock in a domestic corporation, classified as capital asset , not traded in the local stock exchange; 2. Every withholding agent/buyer/seller on the sale, transfer or exchange of real property classified as capital asset . The “sale” includes pacto de retro sale and other forms of conditional sale; and 3. Every withholding agent/buyer/seller on the sale, transfer or exchange of real property classified as ordinary asset.

Whenever one party to the taxable document enjoys exemption from the tax herein imposed, the other party thereto who is not exempt shall be the one directly liable for the tax.

How to Compute DST on transfer of real property?

In computing the DST on transfer of real property or Deed of Sale and conveyance of real property, the following DST tax rate is used:

1.5% x Selling Price/Consideration or Fair Market Value, whichever is higher

Notes: -The 1.5% rate is based on the DST fractional rate of Php15 per P1,000 taxable amount or P15/1,000. -When the sale is thru mortgage foreclosure sale or when one of the contracting parties is the Government, the tax herein imposed shall be based on the actual consideration. -In case of sale of real property paid under installment payment or deferred payment basis, the payment of documentary stamp tax (DST) shall accrue upon the execution of the Deed of Absolute Sale but the basis for the imposition -Per Revenue Regulations No. 13-2004, the following instruments, documents and papers shall be exempt from the DST: Transfer of property pursuant to Section 40(C)(2) of the National Internal Revenue Code of 1997, as amended.

Sample computation of DST on transfer of real property

Example: A residential lot in Pasig City with a floor area of 200sqm has a Selling Price of P3 Million. The Deed of Sale stipulated that the buyer shall shoulder DST. The following are the fair market value information of the real property:

1. Fair Market Value as determined by BIR Commissioner (Zonal Value/BIR Rules): 1a. Land: P1,600,000 (let us say BIR Zonal value is P8,000/sqm [200 x 8,000=1,600,000]) 1b. Improvement: P1,200,000

2. Fair Market Value as determined by Provincial/City Assessor’s (per latest Tax Declaration): 2a. Land: P1,400,000 2b. Improvement: P1,300,000

Question: How much is the DST?

Answer/solution:

Step 1. Determine the highest fair value (FMV):

Total FMV1 (1a + 1b): P2,800,000 Total FMV2 (2a + 2b): P2,700,000 Total FMV3 (1a + 2b): P2,900,000 Total FMV4 (2a + 1b): P2,600,000

The Highest FMV is FMV3: P2,900,000. This is the FV we will use in the step 2.

Step 2. Determine the higher between FMV and Selling Price:

FMV = P2,900,000 Selling Price = P3,000,000

The higher value is the selling price P3,000,000. This is our tax base for computing DST.

Step 3. Calculate DST.

DST = P3,000,000 x 1.5% DST = P45,000

When and where to file and or pay the BIR Form 2000-OT?

The return shall be filed and the tax paid wit hin five (5) days after the close of the month when the taxable document was made, signed, issued, accepted or transferred.

The return shall be filed with and the tax paid to the Authorized Agent Bank (AAB) within the territorial jurisdiction of Revenue District Office (RDO) where the seller/transferor is required to be registered or where the property is located in case of sale of real property. In places where there are no AAB’s, the return shall be filed directly with and tax paid to the Revenue Collect ion Officer (RCO) or duly Authorized City or Municipal Treasurer within the RDO where the seller/transferor is required to be registered or where the property is located in case of real property.

For the attachments required, please see BIR Form 2000-OT. For computing Capital Gains Tax on transfer of real property, classified as capital asset, in the Philippines, please read our article “ How to Compute Capital Gains Tax on Sale of Real Property “.

Source: BIR Revenue Regulations No. 13-2004, BIR website , BIR Form 200-OT, NIRC of the Philippines

Disclaimer: This article was published for informational use only. Subsequent and new laws, regulations, issuances and rulings may render the whole or part of the article obsolete or incorrect. For more clarifications and inquiries, please the visit the BIR RDO in your jurisdiction.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

July 5, 2011 at 1:31 pm

Nice Vic. This is the tax type that is common but neglected by some. Common to brokers and realtors but neglected by some real property owners who seldom sells, but because buyers cannot transfer title under their name without the Certificate Authorizing Registration (CAR), then, they became aware as soon as they process with the BIR for such CAR. For sellers, you can pass this tax to buyers because any of the parties may be held liable, or that they can agree on who should pay this tax.

July 5, 2011 at 4:20 pm

Thanks Gar, this is actually a supporting article on our post about registering real property in the Philippines. BTW, you can register at Gravatar ot get a gravatar so that you can have a photo beside you comments everywhere in the blogosphere. You can also make your gravatar the logo of your firm. 🙂

July 7, 2011 at 2:01 am

Thanks Vic. Finally, I found the gravatar and made one.

August 20, 2011 at 11:32 am

I have a question maybe you can help me. We bought a house and lot in 2009 for installment in one of Sta. Lucia subdivisions and then we wanted to transfer our payment to PAG-IBIG. One requirement when applying housing loan in PAG-IBIG is transfer of title.

My question is: Who should pay for DST? Me or Sta. Lucia?

Also, about the capital gain tax on your other article, is it applicable in my case. Will I shoulder the capital gain tax or not?

August 22, 2011 at 2:07 am

Please see my view below.

My question is: Who should pay for DST? Me or Sta. Lucia? Ans. DST could be contractual which means that the parties may agree who will shoulder. Please check it out on the contract, though in practice, it is the buyer who shoulders but the seller normally takes care of the remittance. Check also with them, they might have taken cared of this already.

Also, about the capital gain tax on your other article, is it applicable in my case. Will I shoulder the capital gain tax or not? Ans. On the sale to you, capital gains tax (CGT) does not apply because the property is an ordinary asset on the part of Sta. Lucia, the seller. Normal income tax applies and not CGT. Nevertheless, CGT is imposed upon the seller and not the buyer.

August 22, 2011 at 12:11 pm

Thanks for your answers. Sometimes it’s hard to know these things especially if you are first-time buyer.

March 28, 2017 at 7:44 am

Hi Sir. Vic, Our broker was asking us to pay for the CGT for the property that we’ve bought from Sunvar.And Sunvar is engage in a real property business, therefore the property that they sold is considered as an ordinary asset? does this mean there would be no more taxes to be paid? since the normal income tax for this will be shouldered by the seller? please answer..thank you in advance.

August 25, 2011 at 2:24 pm

Yes Gil. Tax is not that is easy the way it was intended by them. it would take sometime to learn the technical aspect of it.

January 13, 2012 at 4:28 am

We are planning on buying the apartment unit we are currently renting. My question is, is the property being sold consider as capital asset or ordinary asset? The lessor is a registered property corporation but is not registrated under HLURB. The nature of their business is home rental. Thanks

January 14, 2012 at 6:20 am

IMO, if you’re the buyer and you will use it for residential purposes, then it’s a capital asset for you.

January 16, 2012 at 9:43 am

The seller is asking us the buyer to shoulder the capital gain tax. We are not sure if the property is subject to 6% capital gain tax or it be subjected to corporate tax since the company selling the property is a real property company engaged in leasing, which I’ve read in one of the article in this site that property held by real estate dealer, developer are considered as ordinary asset.

January 28, 2012 at 11:16 pm

When is a seller required to pay Vat when selling real property?

August 12, 2012 at 7:08 am

Sir im planning to buy a lot to be loaned at pagibig from my friend, who will shoulder for the CGT? me as buyer or the seller?

May 21, 2013 at 2:28 pm

Hi, I am planning to buy a residential house and lot through bank financing. Who will shoulder the capital gains tax? And I believe I’m the one who will shoulder the DST, right? Thanks!

August 7, 2015 at 7:53 am

BIR Form to use for Transfer Tax Payment, please reply asap…

January 12, 2016 at 8:19 am

Hi , I’m planning to go into build and sell of apartment and register the business as a real estate developer at HLURB. I plan to buy a vacant lot and execute a deed of assignment . Question 1. If the bought property is not yet transferred to me, do i need to pay CGT? Question 2. If I subdivide the property into 4 lots, since there was no property transfer yet, is the property still be in the name of the original owner? I was advised since I will be in the business of buy and sell of properties, I need not transfer the title to me. I will just execute Deed of Assignment. Is this an acceptable practice?

August 18, 2016 at 3:03 am

Good morning! I just wanna ask what is the tax base of DST for Lease Contract? is it Net of VAT & Withholding Tax? Or Gross Amount of contract?

October 24, 2018 at 2:12 am

Can you share more information regarding penalties, surcharge and compromise? Also, if we execute the DOAS, when should we file it to BIR to avoid such penalties.

November 27, 2018 at 6:08 am

Hello Paolo. BIR Form No. 2000-OT shall be filed and the applicable tax shall be paid within five (5) days after the close of the month when the DOAS was made, signed, issued, accepted or transferred. For example if your DOAS is made on November 10, 2018, you have to file the return and pay the tax on or before December 5, 2018.

When it comes to penalties, there are 3 kinds of penalties imposed on late filing and payment of tax, namely Interest, Surchange, and Compromise. Basically, interest is 20% per anum, surchange is 25% outright, and compromise will be determined by the BIR examiner. It is better to visit the BIR in your area to let them compute your penalties since in some RDOs, you cannot file your tax return without an official computation of penalties from a revenue officer.

You may check this page from the BIR for more details of tax penalties.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Analysis of real estate market in Moscow Oblast, Russia:

IMAGES

VIDEO

COMMENTS

Deed of Assignment and Transfer of Rights. KNOW ALL MEN BY THIS PRESENTS: This deed, made and entered into this 23rd of July 2019 at the City of Cebu, Philippines, by and between: (NAME OF ASSIGNOR), Filipino, of legal age, single/married to (Name of Spouse, if any) and a resident of (Address of Residence), hereinafter referred to as the ...

A Deed of Assignment is a contract where the owner (the "assignor") transfers ownership over property to another person (the "assignee") by way of assignment. The assignee steps into the shoes of the assignor and assumes all the rights and obligations to the property. 2. When do you need a Deed of Assignment?

How To Draft a Deed of Absolute Sale: 3 Steps. For this guide, we will be using the sale of real property as a sample, as it is the most common type of transaction. 1. Prepare the document. A Deed of Absolute Sale should contain the following parts: Title of the document.

Deed of Assignment and Transfer of Rights KNOW ALL MEN BY THIS PRESENTS: This deed, made and entered into this ___ day of _____, 20__ at the City of Manila, by and between: (Name), Filipino Citizen, of legal age, married to Juanita de la Cruz with residence and postal address at (Address), hereinafter referred to as the "ASSIGNOR" -and- (Name), Filipino Citizen, of legal age, married to ...

The Deed of Assignment is required to effect a transfer of property and to show the legal right to possess it. It is always a subject of debate whether Deed of Assignment is a contract; a Deed of Assignment is actually a contract where the owner (the "assignor") transfers ownership over certain property to another person (the "assignee ...

A Deed of Assignment is a contract where the owner (the "assignor") transfers ownership over property to another person (the "assignee") by way of assignment. The assignee steps into the shoes of the assignor and assumes all the rights and obligations to the property.

period of sixty (60) days from commencement thereof, the Parties shall exclusivley resolve the dispute. before the proper courts of Taguig City, Metro Manila, Philippines. 2. f IN WITNESS WHEREOF, this DEED OF ASSIGNMENT has been signed this 25th day of October. 2019 at Taguig City, Philippines. Assignor Assignee.

Deed - A written instrument which, when properly executed and delivered, conveys title.2. Basically, a Deed of Assignment is a document that states the transfer of property or rights and obligations from one person to another. The persons may be natural (individual) or legal (e.g. a private or public organization) persons.

DEED OF ASSIGNMENT KNOW ALL MEN BY THIS PRESENTS: This deed made and entered into this ___ day of _____, 20__ at the City of Manila, by and between: ... (P_____), PHILIPPINE CURRENCY, which the ASSIGNOR hereby acknowledged to have received in the form of a Back-to-Back loan from the ASSIGNEE, the ASSIGNOR hereby assigns, transfers and conveys ...

The Deed of Conveyance is an essential instrument in the Philippines, safeguarding the rights and interests of parties in real property transactions. It ensures clarity, legitimacy, and protection for both the buyer and seller. As with any legal process, it's crucial to understand the intricacies and seek legal counsel when engaging in property ...

This DEED OF ASSIGNMENT (the "Assignment" or "Deed") duly executed by: The undersigned party/ies duly identified as the "ASSIGNOR" and/or "DEBTOR" set forth under Schedule "A" and made an integral part hereof; ... Deposit Act of the Philippines of 1974), as amended, and other laws/regulations relative to the confidentiality ...

Size 2 to 3 pages. Fill out the template. A Deed of Sale of Real Property is a document that sets forth the agreement between two parties called the buyer and the seller to transfer the ownership of the seller over a real property to the buyer in exchange for a purchase price. This document provides the terms and conditions of the sale.

WHEREAS, the SECOND PARTY intended to purchase the property described above to which the FIRST PARTY agreed but the latter inadvertently sold via a Deed of Absolute Sale to the former another property different from what they have agreed upon which property the FIRST PARTY likewise owns in fee simple with the buildings and

The encumbrance of the property may be deemed as an exercise of their right of ownership over the property considering that, under the law, only owners of certain properties may mortgage the same.23 By mortgaging a piece of property, a debtor merely subjects it to a lien but ownership thereof is not parted with.24 As a result, notwithstanding ...

Size 2 to 3 pages. 4.5 - 2 votes. Fill out the template. A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties, the date of the transfer, the number of the stock ...

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date. In order to be valid, a deed of assignment must contain certain ...

Account No. 111-222-333. Type of Shares: Common Shares. Number of Shares: 1000. Par Value: 1 peso/share. The ASSIGNEE hereby accepts the assignment. IN WITNESS WHEREOF, the parties have signed this deed on 7 July 2014 at Pasay City, Philippines. MARIA S. SANTOS MARIO C. CRUZ. ASSIGNOR ASSIGNEE. SIGNED IN THE PRESENCE OF:

In computing the DST on transfer of real property or Deed of Sale and conveyance of real property, the following DST tax rate is used: 1.5% x Selling Price/Consideration or Fair Market Value, whichever is higher. Notes: -The 1.5% rate is based on the DST fractional rate of Php15 per P1,000 taxable amount or P15/1,000.

Find company research, competitor information, contact details & financial data for IST MIL, PAO of Elektrostal, Moscow region. Get the latest business insights from Dun & Bradstreet.

Real-time trigger alerts. Comprehensive company profiles. Valuable research and technology reports. Get a D&B Hoovers Free Trial. Financial Statements. Dun & Bradstreet collects private company financials for more than 23 million companies worldwide. Find out more. Get a D&B credit report on this company .

RLT24 - information resource about Russian real estate. Real estate in Noginsk, Moscow Oblast, Russia. Main Price analysis Advert: Русский(RU) Average apartments price in Russia Moscow : 4 234 $/m² ↓-1.96%: Saint Petersburg: 2 157 $/m² ↓ ...

Find company research, competitor information, contact details & financial data for AVANGARD, OOO of Elektrostal, Moscow region. Get the latest business insights from Dun & Bradstreet.