- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated March 18, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information you need to cover in a business plan sometimes isn’t quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

If you’re looking for a free downloadable business plan template to get you started, download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

9 Min. Read

How to Create a Sales Plan for Your Business

1 Min. Read

How to Calculate Return on Investment (ROI)

4 Min. Read

How to Develop a Positioning Statement for Your Business

10 Min. Read

Use This Simple Business Plan Outline to Organize Your Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

Starting a Business | How To

How to Write a Business Plan in 7 Steps

Published February 2, 2024

Published Feb 2, 2024

WRITTEN BY: Mary King

Get Your Free Ebook

Your Privacy is important to us.

This article is part of a larger series on Starting a Business .

Starting A Business?

Step 1: Gather Your Information

Step 2: outline your business plan, step 3: write each section, step 4: organize your appendix, step 5: add final details, step 6: add a table of contents, step 7: get feedback, bottom line.

A solid business plan helps you forecast your future business and is a critical tool for raising money or attracting key employees or business partners. A business plan is also an opportunity to show why and how your business will become a success. Learning how to write a business plan successfully requires planning ahead and conducting financial and market research.

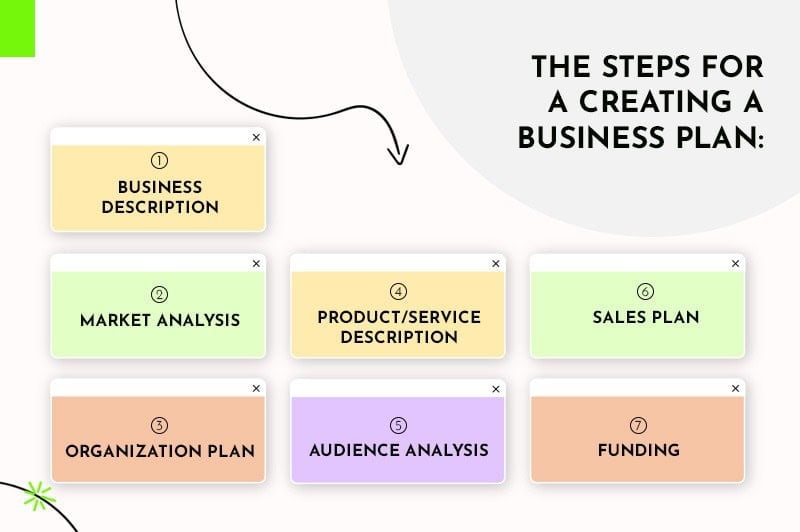

How to write a business plan step-by-step:

- Gather your information

- Outline your business plan

- Write each section

- Organize your appendix

- Add final details

- Add a table of contents

- Get feedback.

Your first step is to get organized by gathering all your relevant business information. This will save you time completing the various sections of your business plan. At a minimum, you’ll want to have the following handy:

- Business name, contact information, and address

- Owner(s) names, contact information, and addresses

- Names, contact information, and addresses of any business partners (if you will be working with partners)

- Resume and relevant work history for yourself and any key partners or employees

- Any significant sales, commerce, traffic, and financial data and forecasts

- Customer data (if applicable)

- Any significant data about your nearest competitors’ commerce, traffic, or finances

Now it’s time to outline your business plan, making note of the sections you need to include and what data you want to include in each section. You can create an outline on your own or use a business plan template to help. Whichever route you choose, it is common to include these sections in your business plan outline:

- Introduction

- Executive summary

- Company overview

- Products and services

- Market and industry analysis

- Marketing strategy

- Sales strategy

- Management and organization

- Financial data, analysis, and forecasts

Connect the data you gathered in step one to specific sections of your outline. Make a note if you need to convert some information into charts or images to make them more compelling for potential investors. For example, you’ll want to include relevant work history in your management section and convert your sales forecasts into charts for your financial data section.

Now it’s time to write your business plan. Attack this one section at a time, adding the relevant data as you go.

Executive Summary

The executive summary is an overview of the business plan and should ideally be one, but no more than two, pages in length. Some investors actually only request the executive summary. So make it an informative, persuasive, and concise version of your business plan.

It can be easier to write the executive summary last, after the other sections. Then you can more clearly understand which sections of your business plan are the most important to highlight in the executive summary.

When learning how to write an executive summary for a business plan, remember to include the following:

- Business objectives : Your business objectives are specific and attainable goals for your business. Create at least four business objectives organized by bullet point. If you’re not sure how to phrase your objectives, read our SMART goals examples to understand how to do so.

- Mission statement: The mission statement discusses the aim, purpose, and values of your business. It’s typically a short statement from one sentence to several sentences in length. You may find that your mission statement evolves as your business grows. Learn more on how to write your mission statement in our guide.

Consider also including the following in your executive summary:

- Business description : Similar to a 30-second pitch, describing your business and what makes it unique

- Products and services : The type of products and services you’re providing and their costs

- Competitors : Your biggest competitors and why your business will succeed despite them

- Management and organization : The owners’ backgrounds and how they will help the business succeed; management structure within the business

- Business location (or facility) : Location benefits and the surrounding area

- Target market and ideal customer : Who your ideal customers are and why they’re going to purchase your products or services

- Financial data and projections : Provide brief financial data and projections relevant to your business, such as startup costs, at what month the business will be profitable, and forecasted sales data

- Financing needed : Explanation of the startup funding sources and the amount of financing being requested

The bullets above can be combined into several paragraphs. You can add or remove sections based on your business’ needs. For example, if you don’t have a physical location, you might remove that piece of information. Or, if a web presence is crucial to your success, include two to three sentences about your online strategy .

Company Overview

The company overview (sometimes also called a “business overview”) section highlights your company successes (if you’re already in business) or why it will be successful (if you’re a startup). In the opening paragraph or paragraphs, provide information like location, owners, hours of operation, products, and services.

How you structure this section depends on whether you’re a startup or an established business. A startup will discuss the general expenses and steps needed to open the business, such as permits, build-outs, rent, and marketing. An established business will briefly discuss the company’s financial performance over the past three years.

If you’re trying to raise capital from an investor or bank, include a chart listing the items your business will acquire with the capital. For example, if you’re purchasing equipment with the additional funding, list each piece of equipment and the associated cost. At the bottom of the chart, show the total of all expenses, which should be the requested amount of funding.

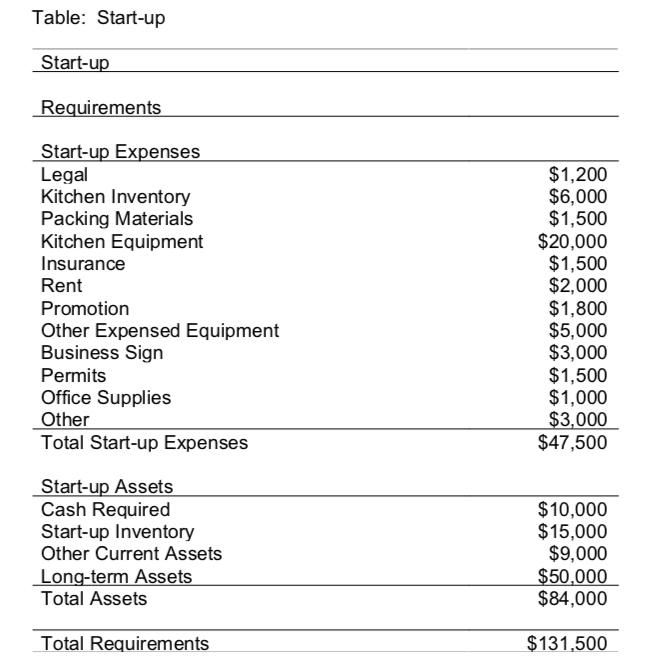

This startup cost table for a pizza restaurant separates startup expenses from startup assets.

Your company overview should cover the following:

- Location & Facilities : If you have a brick-and-mortar location or a facility, like a warehouse, describe it here. Detail the benefits of your location and the surrounding areas. Write about square footage, leases or ownership, the surrounding area, and a brief description of the population.

- Ownership : Briefly mention the company ownership team and their backgrounds. Show why these owners are likely to be successful in operating this business by providing certain details, such as each owner’s industry experience, previous employers, education, and awards. This will be discussed more in-depth in the management and organization section below.

- Competitive advantage : Ideally, your competitive advantage is what your business can do that your competitors cannot. It’s the one big differentiator that will make your company successful. Many investors are looking for specific competitive advantages, such as patents, proprietary tech, data, and industry relationships. If you don’t have these, describe the top aspect in which your business will do better than competitors, such as quality of products, quality of services, relationships with vendors, or marketing strategy.

Products & Services

The products and services section is the most flexible section because its structure depends on what your business sells. Regardless of what you’re selling, include a description of your business model to explain how your business makes money. Also include future products or services your business could provide one, two, or five years down the road.

List and describe all physical and digital products you plan to sell, as well as any services the business provides. Services don’t necessarily have to be sold for a cost—your business might offer entertainment, like live music or bar games as a free service.

Whether you’re selling products, services, or both, it’s important to discuss fulfillment, or how each will be delivered. If you make or sell physical products, describe how products will be sold, assembled, packed, and shipped. If your business is service-based, describe how a service, such as a window installation, will be ordered and completed. Where will the glass be purchased from and acquired, how will customers place orders, and how will the window be installed?

Market & Industry Analysis

The market and industry analysis section is where you analyze potential customers and the forces that influence your industry. This section is where you make the case as to why your business should succeed, ideally backed by data. You’ll want to do a deep dive into your competitors and discuss their challenges and successes. Learn more about sales targeting to improve how you approach your sales strategy.

Market Segmentation

Market segmentation, or your target market, consists of the customers who are most likely to purchase your products or services. Describe these groups of customers based on demographics, including attributes like age, income, location, and buying habits. Additionally, if you’ll be operating with a business-to-business (B2B) model, use characteristics to describe the ideal businesses to which you’ll sell.

Once your target market is segmented into groups, use market research data to show that those customers are physically located near your business (or are likely to do business with you if you’re online). If you’re opening a daycare, for example, you’ll want to show the data on how many families are in a certain mile radius around your business. You can obtain this kind of data from a free resource, like the U.S. Census and ReferenceUSA .

Once you have at least three segments, briefly outline the strategy you’ll use to reach them. Most likely it will be a combination of marketing, pricing, networking, and sales.

Learn the best approach to product pricing in our guide.

Industry Analysis

Take a look at your business’s industry and explain why it’s a great idea to start a business in that niche. If you’re in a growing industry, a bank is more likely to lend your business capital because it’s predicted to be in demand and have additional customers. Learn about how to find a niche market .

Find industry statistics from a free tool, like the Bureau of Labor Statistics , or a paid tool like the Hoovers Industry Research , which provides professionally curated reports for over 1,000 industries.

Competitor Research

Wrap up the market and industry analysis section by analyzing at least five competitors within a five-mile radius (expand the radius, if needed). Create a table with the five competitors and mention their distance from your business (if applicable), along with their challenges, and successes.

During your analysis, you’ll want to frame their challenges as something you can improve upon. Persuade your reader that your business will provide superior products and services than the competitors.

Marketing Strategy & Implementation Summary

In the opening paragraphs of your marketing strategy and implementation summary, give an overview of the subsections below.

Include any industry trends you may take advantage of. If applicable, include the advertising strategy and budget, stating specific channels. Mention who in the business will be responsible for overseeing the marketing.

Include any platforms and tools the business will use, like your website, social media, email marketing, and video. If you’re hiring a company to do any online work, like creating a website or managing social media, briefly describe them and the overall cost (you can elaborate more on costs in the financial data section ).

Don’t forget to include a subsection for your traditional marketing plan. Traditional marketing encompasses anything not online, such as business cards, flyers, local media, direct mail, magazine advertising, and signage.

Sales Strategy

If sales is an important component of your business, include a section about your sales strategy. Describe the role of the salesperson (or persons), strategies they’ll use to close the deal with clients, lead follow-up procedures, and networking they’ll attend. Also, list any training your sales staff will attend.

Sales Forecast Table

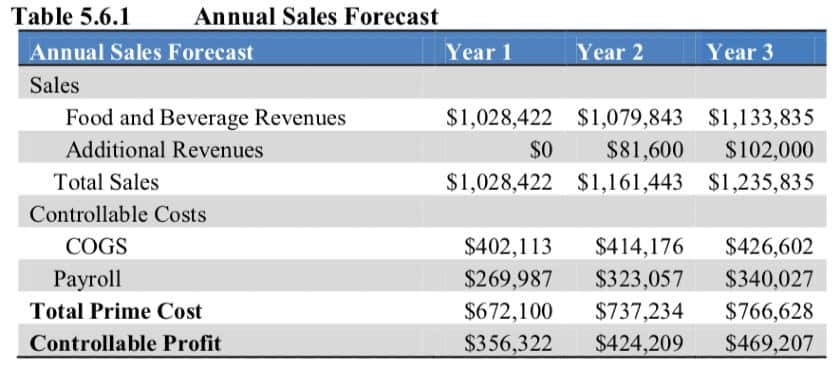

A sales forecast table gives a high-level summary of where you expect your sales and expenses to occur for each of the next three years in business. In the paragraph before the table, state where you expect growth to come from and include a growth percentage rate. The annual sales forecast chart will be broken down further in the financial projections section below.

The annual sales forecast for this restaurant summarizes sales, cost, and profit for the first three years in business.

Pricing Strategy

In the pricing strategy section, discuss product/service pricing, competitor pricing, sales promotions , and discounts—basically anything related to the pricing of what you sell. You should discuss pricing in relation to product and service quality as well. Consider including an overview of pricing for specific products, e.g., pizza price discounts when ordering a specific number of pizzas for catering.

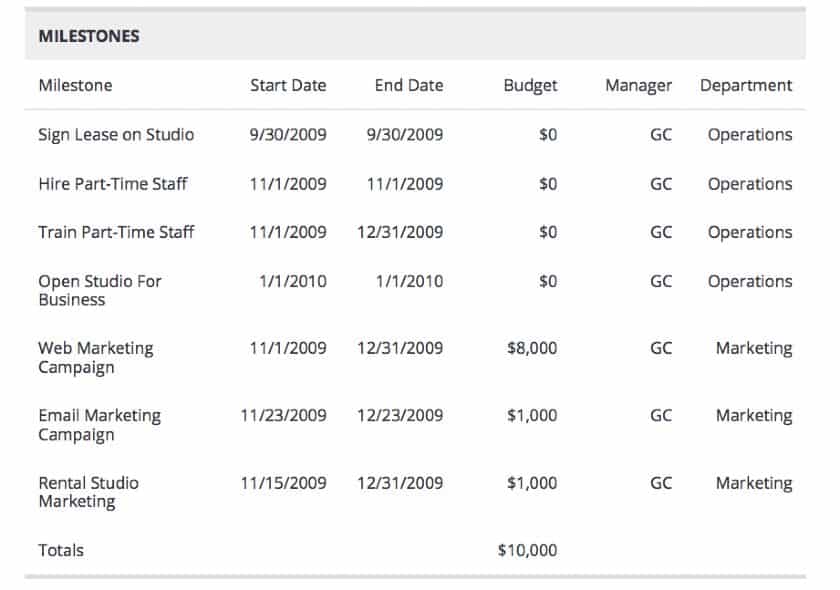

Milestones in a business plan are typically displayed in a table. They outline important tasks to do before the business opens (or expands, if already in business). For each milestone, include the name, estimated start and completion date, cost, person responsible, and department responsible (or outside company responsible). List at least seven milestones.

Milestones for this commercial photography business include hiring staff and completing marketing campaigns.

Management & Organization Summary

The management and organization summary is an in-depth look at the ownership background and key personnel. This is an important section because many investors say they don’t invest in companies, they invest in people. In this section, make the case why you and your team have the experience and knowledge to make this business a success.

Ownership Background

Discuss the owners’ backgrounds and place an emphasis on why that background will ensure the business succeeds. If you don’t have experience managing a retail business, consider finding a co-owner who does. Typically, banks won’t lend to someone who doesn’t have experience in the type of business they’re trying to open.

Management Team Gaps

If there are any experience or knowledge gaps within the management team, state them. List the consultants or employees you will hire to cover the gaps. Investors who know your industry well may recognize gaps within your business plan, and it’s important to state the gaps without waiting for the investor to bring it up. This makes it appear that you know the industry well.

Personnel Plan

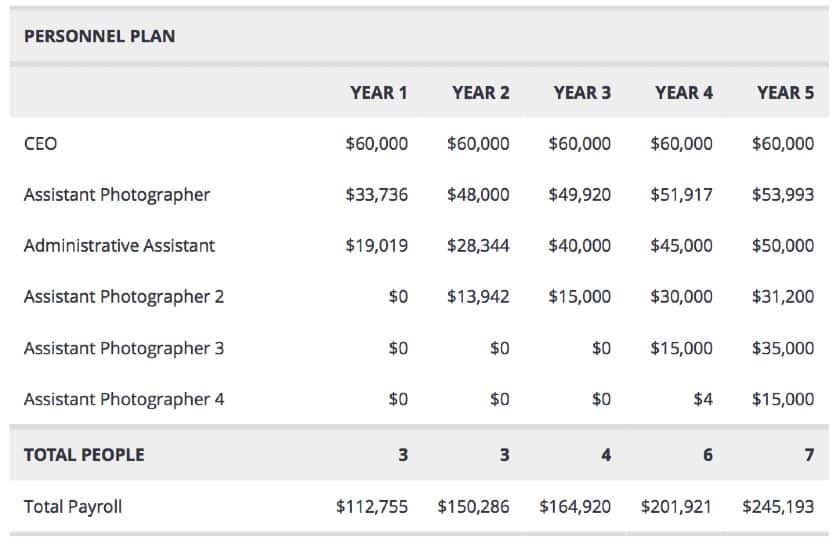

The personnel plan outlines every position within your business for at least the next three years. In the opening paragraph, discuss the roles within the company and who will report to whom. Include a table with at least three years of salary projections for each employee in your business. Include a total salary figure at the bottom. This table may be broken down further into salaries for each month in the financial projections or appendix.

This commercial photography business has the CEO at the same salary every year, with their employees’ salaries increasing year over year.

Financial Data & Analysis

The financial data and analysis section is the most difficult part of a business plan. This section requires you to forecast income and expenses for the next three years. You’ll need a working knowledge of common financial statements, like the profit and loss statement, balance sheet, and cash flow statement.

In the opening paragraphs of the financial data and analysis section, give an overview of the sections below. Discuss the break-even point and the projected profit at the first, second, and third year in business. State the assets and liabilities from the projected balance sheet as well.

If you’re getting a loan from a bank, say how long and from what source the loan will be repaid. One of the main pieces of information bankers want to ascertain from financial forecasting is if they will be paid back and how likely that is to happen.

You might also include the following financial reports:

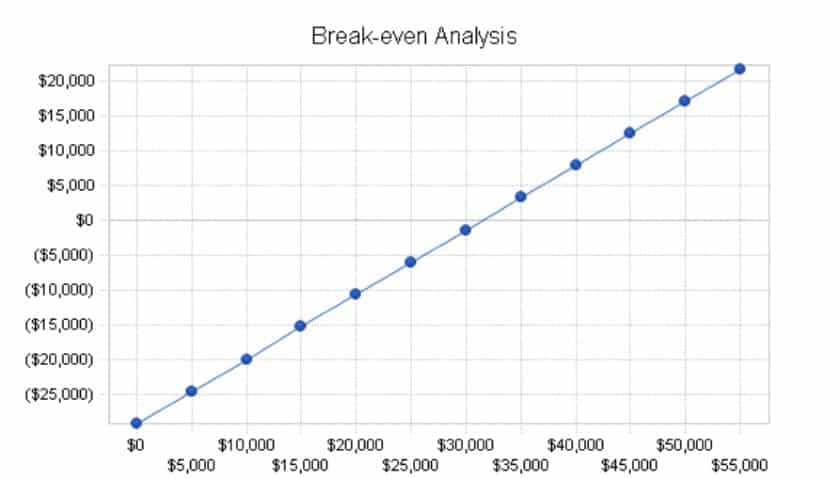

- Break-even analysis : Break-even is when your business starts to make money. Break-even analysis is where you illustrate the point at which your revenue exceeds expenses and a profit occurs. In this section’s opening paragraph, state your monthly fixed costs and average percent variable costs (cost that changes with output, like labor or cost of goods). In the example below, variable costs increase 8% for every additional dollar made.

The break-even point for this document shredding business is $31,500 in a month.

- Projected profit & loss: The profit and loss table is a month-by-month breakdown of income and expenses (including startup expenses). Typically, you should expect your business to show a profit within the first year of operating and increase in years two and three. Be sure to show income and expenses month-by-month for the first two years in operation. Create a separate chart that shows income and expenses year-by-year for the first three years.

- Projected cash flow : The cash flow section shows your business’s monthly incoming and outgoing cash. It should cover the first two years in business. Mention what you plan to do with excess cash. See how to run a statement cash flow in QuickBooks Online .

- Projected balance sheet: The balance sheet shows the net worth of the business and the financial position of the company on a specific date. It focuses on the assets and liabilities of the business. Ideally, the balance sheet should show that the net worth of your business increases. Prepare a projected year-by-year balance sheet for the first three years.

- Business ratios: Also called financial ratios, these are a way to evaluate business performance. It’s helpful to compare your projected business ratios to the industry standard. Project your business ratios by year for the first three years.

The appendix is where you put information about the business that doesn’t fit in the above categories. What you put here largely depends on the type of business you’re creating. It’s a good idea to put any visual components in the appendix. A restaurant might add an image of the menu and an artist rendering of the interior and exterior, for example.

Consider including the following items in your business plan appendix:

- Artist mock-up of interior

- Building permits

- Equipment documentation

- Incorporation documents

- Leases and agreements

- Letters of recommendation

- Licenses and permits

- Marketing materials

- Media coverage

- Supplier agreements

An appendix isn’t required in a business plan, but it’s highly recommended for additional persuasion. Documents like media coverage, agreements, and equipment documentation show the investor and banker you’re serious about the business. If your appendix is more than 10 pages, consider creating a second table of contents just for the appendix.

Detailed Financial Projections

Put the more detailed projections in the appendix. The financial projections in the previous section is typically a year-by-year breakdown for three years in the future. But many bankers and investors want to see the first two years broken down month-by-month for at least the profit and loss statement, balance sheet, cash flow, and personnel plan.

Typically, you can print out the spreadsheet in smaller font and include it in the appendix. You don’t need to create additional charts for the appendix.

With all of your information organized, now it’s time to add the final details, like cover pages and a nondisclosure agreement (NDA).

- Cover Page: The cover page provides contact information about the business and its owner. The cover page should have the business name and who prepared it, including your name, address, phone number, and email address. Additionally, if the registered company name with the state is different from the business name, you may want to add that as a “company name.”

- Nondisclosure Agreement: An NDA ((also called a confidentiality agreement) is a legal document that safeguards business information. You’d want someone to sign it before reading your business plan if you believe they could use the information to their advantage and your disadvantage, such as to steal your business idea or marketing strategy.

Fit Small Business provides a free non-disclosure agreement.

Once your final details are added, proofread all the sections of your business plan, ensuring that the information is accurate and that all spelling and grammar are correct. If there are any illustrations, projections, or additional information you forgot to include, now is the time to add it.

The final step is adding a table of contents so that bankers and potential investors can easily navigate your business plan. A table of contents lists the sections and subsections of your business plan. All of the headers above (Executive Summary, Business Objectives, Company Overview, Products and Services, and so on) are considered sections of a business plan. You can number the sections for additional organization. For example, 1.0 is the executive summary, 1.1 is the business objectives, and 1.2 is the mission statement.

Editing and formatting can change the pagination of your business plan. So you’ll save yourself work if you finalize the business plan content first, then arrange the table of contents at the end.

Congratulations! You’ve captured your business idea and plan for profitability on paper. Before you send this business plan to loan officers and potential investors, ask friends, family, and other supportive business owners to read it and provide feedback. They may notice typos or other errors that you missed. They may also identify details you can add to make your business plan more persuasive.

Frequently Asked Questions (FAQs) About How to Write a Business Plan

These are the most common questions I hear about writing a business plan.

What needs to be in a business plan?

What you should put in a business plan depends on its purpose and your industry. If you’re seeking funding from a bank or investor, you’re going to need most of the sections above, with a strong focus on your financial projections. If you are using your business plan to attract key employees (like a chef for your restaurant), mock-ups and vendor agreements will be more useful. Think about the information that will help your target reader make a decision about whether to get involved with your business—whether that is a location, a business model, or product idea—and be sure your business plan includes that information.

How do you write a business plan for a startup?

The business plan for a startup is similar to a business plan for an established business. The startup business plan will include startup costs, which will be listed by item and factored into the financial projections. Additionally, since your business hasn’t proven it can be successful yet, you may need additional information about the ownership, business model, market, and industry to convince the reader your business will succeed.

How long does it take to write a business plan?

A simple business plan may only take a couple of hours. However, for the business plan provided with this template, which includes financial projections, it may take over 60 hours to research the income and costs associated with running your business. You also have to format those costs into a chart, because it’s best to showcase the data with easy-to-understand charts.

Is writing a business plan hard?

Creating a business plan for funding from a bank or investor is a detailed process. Unless you have a background in financial statements, the financial projections may be difficult for the average business owner. But you can ask for help; it is common to hire a bookkeeper or accountant to assist you with financial projects to ensure your math is correct. Outside of the projections, most other business plan sections are simple, though you’ll want to give yourself time to make each section persuasive.

Every type of business, whether it’s a side hustle or a multimillion-dollar business, should have a business plan. The industry analysis and market segmentation sections validate your business idea. Researching and forecasting financial projections helps you logically think through income and expenses, which lessens the risk of business failure. Remember to get feedback on your business plan from business employees and associates. If necessary, have them sign an NDA before they review the plan.

About the Author

Find Mary On LinkedIn Twitter

Mary King is an expert restaurant and small business contributor at Fit Small Business. With more than a decade of small business experience, Mary has worked with some of the best restaurants in the world, and some of the most forward-thinking hospitality programs in the country. Mary’s firsthand operational experience ranges from independent food trucks to the grand scale of Michelin-starred restaurants, from small trades-based businesses to cutting-edge co-working spaces.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.