What Is Budget Allocation and How to Allocate Budget Correctly

George Fullerton

Strategy & Operations

Get Our Financial Planning Blueprint

Your budgeting process requires strong collaboration from department heads and executive leadership. Yet if you’re only going to each department once, asking them what they need, and simply saying, “Here you go” once you get executive approval, then you haven’t done enough testing around your top-line goal metrics.

If you want to pave a path toward sustainable growth, you need to embrace agility and proactivity — and one way to do that is through budget allocation. Running a budget variance analysis and rolling forecast helps you set baselines and growth goals, but these processes can still take weeks to gather and manipulate data from multiple departments and source systems.

Here, we explore how quarterly budget allocation creates a path for more agile, strategic planning and spend.

Table of Contents

What Are Budget Allocations?

Budget allocations refer to the amount of money each department receives from the general fund to execute their strategic plans. Budget allocation breaks department spend down into an approved maximum amount each department can spend per resource, whether it’s on software, contractor or freelance assistance, or ad spend for a marketing campaign.

The Importance of Allocating Budgets

Budgeting, at its core, is an optimization and constraint problem. You need to optimize operational efficiency yet understand your constraints to ensure ample runway and team support as you track the company’s growth trajectory.

You dictate the company roadmap based on expected return on investment (ROI), which has to tie out at the department level. The R&D department is integral for Seed and Series A companies, yet once the product is ready to launch, you want to allocate budget to your sales and marketing teams. Once the budget goes toward sales and marketing, and you begin acquiring customers, you now have new constraints that impact your budget: your customer acquisition cost (CAC), CAC payback period , and your annual recurring revenue (ARR).

Budget allocation fuels overall efficiency, in that department leaders don’t need to ask for approval to expense individual tools, assign projects to freelancers, or add seats for software. By allocating budget to general categories, each department can cherry-pick when and how to apply the budget. Of course, departments need to ensure they use their budget. While saving money is generally seen as positive, departments may not receive the same budget allotment in the next cycle — which may be detrimental to department-level goals and planning.

If departments experience strain, such as requiring more seats on a specific tool or running into production issues, you run into employee retention issues that stem from operational efficiency and satisfaction. To hire more employees costs more, which digs into your runway. By keeping an eye on your goals and constraints, you can then proactively figure out where you’ll get the highest ROI.

How to Optimize Budget Allocations in 6 Steps

Knowing your startup costs (for each employee and desk space), fixed costs, and variable costs and how they impact your total budget is one thing — but to optimize budget management and allocation requires ample cross-collaboration to keep goals top of mind and realistic.

Your budget allocation strategy will depend on your industry, your growth stage, and overall macroeconomic environment. But here’s how you can optimize your budget allocation with more strategic and agile decision-making from everyone involved regardless of stage.

1. Set Company Goals and Priorities

While knowing your total budget is technically the first step, the real strategic insights begin with a simple question: What are your North Star metrics?

Naming your company goals and priorities is the key to driving how you think about and create departmental budgets across the company.

In ideal market conditions, many executive leaders say that their top priority is to grow at all costs. Yet during a market downturn, priorities shift toward keeping a closer eye on burn and preserving runway. Depending on how those priorities shake out, there’s two ways to approach budgeting:

- Growth goals: A focus on growth goals requires high confidence in achieving them. Your growth goal is the starting point, then you work backwards to allocate your budget to achieve that goal. A focus on top-line revenue growth leads to creating a sales and marketing budget around cost per lead and win rates/conversions. The question becomes “How much do I have to spend in order to get this growth goal?” which then spits out your sales and marketing budget.

- Capital efficiency : A more conservative approach begins by asking, “How much can I spend in order to only burn X number of dollars a month, or to make sure I have runway for 24 months into the future?” You can also focus on a certain set of unit economics, meaning you’d build your budget to hit a particular CAC number or set a payback period within a particular period of time.

Regardless of your approach, tying your budget back to goals (i.e. strategic budgeting ) and target metrics is critical. If you believe growth goals are most important, for example, then your ROI on spending additional sales and marketing dollars could be higher than hiring a different engineer where you may have a longer-term payoff.

2. Set Your Constraints

Your goals establish whether you’re approaching budget allocations from a bottom-line or top-line growth perspective. Utilizing both allows you to gain a sense of customer retention (with your top line) alongside expenses (bottom line), which helps you strike the right balance or priorities. Applying constraints to your goals allows you to set realistic expectations.

Company-wide, you want to keep an eye on runway and burn multiple. Yet when diving deeper into department budgets, you’ll need to focus on different metrics. For example, CAC payback period impacts your sales and marketing budget.

Your CAC payback period sets a precedent for how long potential customers stay in the sales funnel. Incorporating sales funnel metrics into this equation provides invaluable insights — and setting constraints around your payback period requires sales and marketing to scrutinize and optimize these metrics within the funnel.

3. Check Your Goals Around Budget Allocation Benchmarks

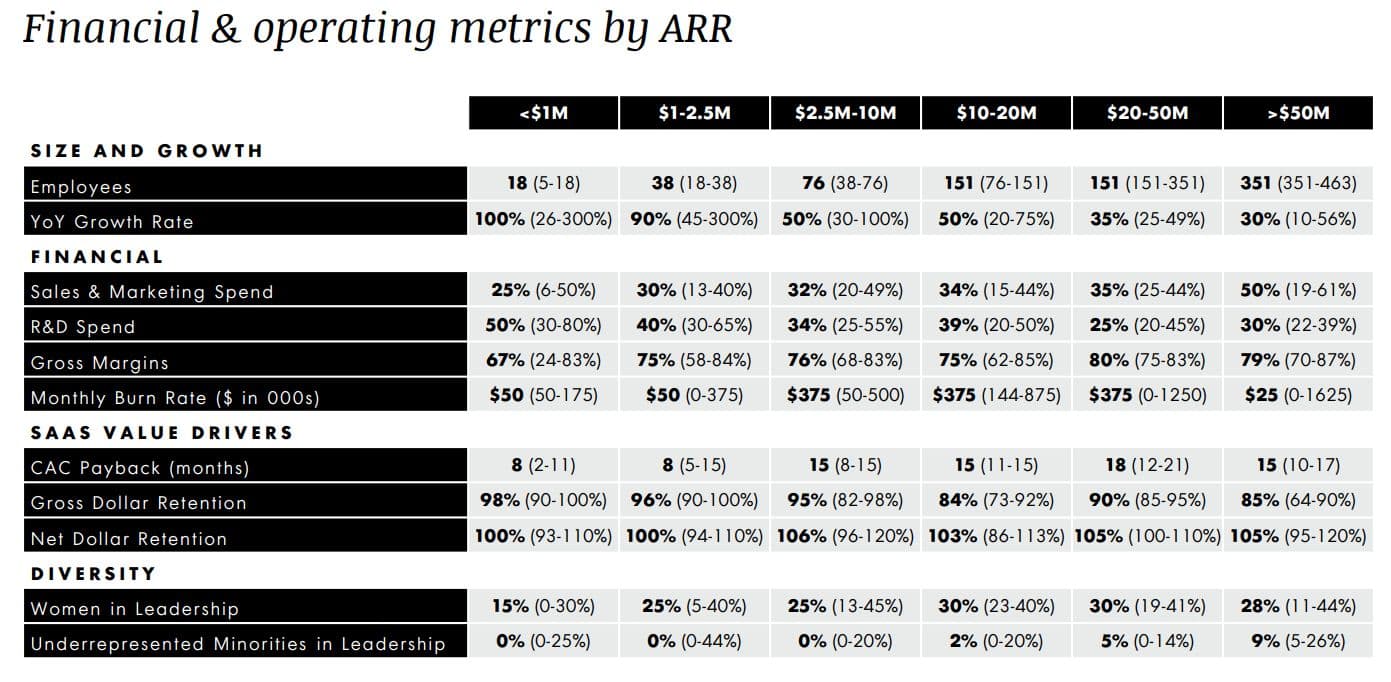

Your company’s growth stage impacts where your goals and constraints stay relevant and applicable to ensure strategic growth. OpenView runs a SaaS Benchmarks Survey that explores budgetary benchmarks in correlation with your growth stage. Here’s their chart from 2021:

OpenView SaaS Benchmarks Survey 2021 Results, courtesy of Curtis Townshend , Senior Director of Growth at OpenView.

The top row indicates the stage of the business per million dollar revenue. The numbers in bold represent a median, with percentages assigned for how much each company would allocate per category. For example, a company with $1-2.5 million in revenue would allocate 30% of their budget to sales and marketing and 40% in R&D, while aiming for 75% in gross margins.

While the above table does not mention a ratio for general and administrative costs , the standard spend for SaaS companies is about 10-12% of your total budget.

After you establish your goals and constraints to ensure financial efficiency , you can approach your budget and measure against these benchmarks.

4. Establish Your Headcount Plans

Headcount accounts for 70% of overall company spend in SaaS, and each department has different ROI.

Sales and marketing headcount should directly produce returns — but to drive the sales and marketing machine, you need to continuously spend. You need to ensure you have a strong control and understanding of your product-market fit to keep the engine running. If the company is not at the point of understanding the output of each dollar spent across the sales funnel, the budget should focus on product or internal system process data.

Work closely with human resources partners to decide how much to set aside for workforce growth in every department. Decide how many full-time hires you’ll need in the next budget year, where it might be appropriate to hire out to contractors, and where your stakeholders need the most help.

5. Conduct Scenario Planning with Mosaic

Optimizing budget allocation helps you optimize ROI of operational initiatives by forcing you to constantly check where you think you’ll get the most out of your dollars and how that spend relates to company-level goals.

Mosaic’s financial modeling and scenario planning tool integrates with your source systems to offer scenario analysis that elevates the strategy behind your budget allocation. Scenario analysis examples include looking at how cutting a fixed cost (like office space) impacts your runway, or how your product release plan may hinge on engineer headcount or come down to asking, “ How much should you spend on ads to promote the product — and when?”

Being able to quickly see how adjustments to specific budgets affects your downstream metrics is extremely helpful. Mosaic syncs in real time so you can easily integrate your historical and actual data into your scenarios. If you want to see how increasing spend by $500,000 impacts your sales and marketing budget, you can simply apply the change in one model to see how it affects your CAC, CAC payback, burn multiple, and other key metrics.

You don’t need to build entirely new models or scenarios — instead, you can tweak your budget assumptions in different scenarios and see the immediate downstream effects on the metrics that you want to employ as your constraints.

Keep in mind that your strongest models align on two or three metrics: Too many inputs leads to an overlap in ideology, which causes clutter and slows you down.

6. Make Cross-Department Collaboration a One-Stop Shop

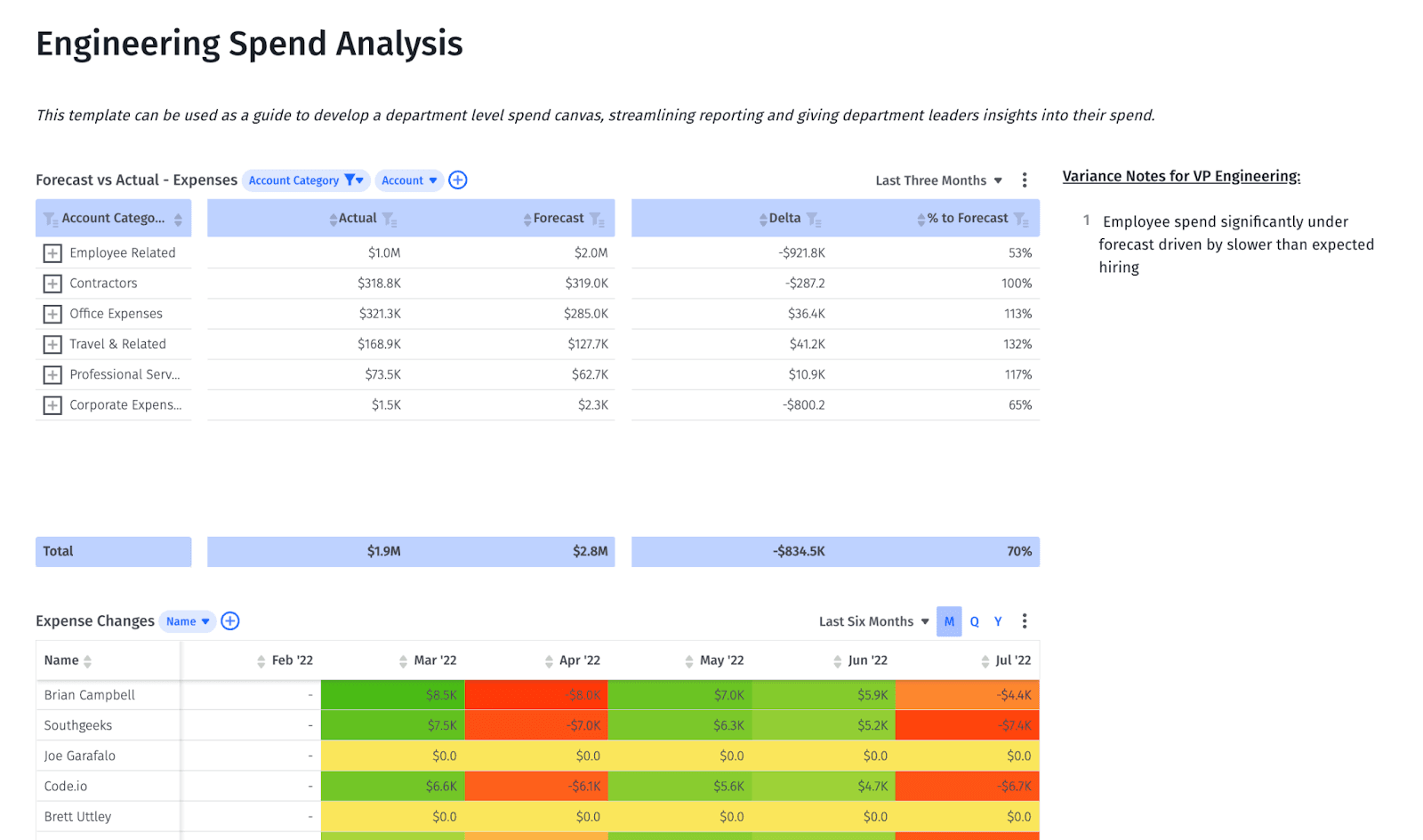

The budgeting process is notorious for multiple Excel sheets and communication across multiple emails or Zoom meetings. Mosaic allows you to create department-level dashboards that align leaders and give them one place to stay updated on budget allocation and spend.

Department leaders can look at a graph or table in Mosaic’s variance analysis software to see where their budget currently is and where it was spent. Mosaic can immediately generate a budget analysis that allows them to make strategic decisions on what they want to do with their remaining budget or where they need to cut back to hit their budget for the month or quarter.

Mosaic also allows reports to be easily accessible for department leaders. Since Mosaic offers real-time updates, finance teams can help establish one report that automatically updates so department leaders can make plans with actual numbers. This leads to not just saving time between going back and forth to establish numbers, but more proactive decision-making that keeps leader engagement high into understanding the “why” behind their budgeting line items.

Focus more on telling the story behind your numbers with this Financial Waterfall Template Bundle.

When to review budget allocations — and why you’re not doing it enough.

A “one and done” annual budget process doesn’t work for high-growth companies. A more adaptable or flexible budget approach is essential, especially for those experiencing rapid changes. Keeping it to even twice a year causes everyone to miss out on key drivers for overall success. Proactive budget development should happen at least on a quarterly schedule, where you can change resource allocation based on historical data from the previous year to last quarter.

While establishing a quarterly financial plan review is good in practice, you also need to allow for some flexibility. Here are some other reasons to perform financial audits on budget allocation:

- Macroeconomic events. Anything from a market downturn or industry collapse signals immediate action. Budget allocation should transition into a monthly schedule to stay as ahead as possible.

- Not hitting topline goals. You may need to redistribute your budget to ensure you get as high of an ROI as possible. You may need to allocate more budget toward supporting sales and marketing than hiring another engineer, for example.

- Runway cost. If you predict that you’ll burn $5 million, but realize that headcount needs to increase in the second half of the year, you need to factor that cost in. You also need to keep track of your burn and when it occurs: If it increases from $2 to $3 million in one month due to headcount, you carry this cost throughout the rest of the year. You can then take budget away to make up the costs — it’s much harder to try and get the budget back once people start spending it.

- Capital efficiency metrics are off. Analyzing capital efficiency metrics like burn multiple on a regular basis can help you proactively address inefficiencies in the business. Drill down into your expenses and see how you can reevaluate spend.

Embrace a Smarter Way to Allocate Budgets with Mosaic

Mosaic offers preloaded, out-of-the-box metrics, templates, and dashboards that allow you to cut the budget allocation and planning process from two weeks to two days. Mosaic offers a SaaS acquisition metrics dashboard that considers CAC and CAC payback alongside other important metrics, like your SaaS magic number , to gain granular insights that craft your company’s growth narrative. You can also customize financial reports to include other key metrics, such as your burn multiple and runway, to help establish and keep your benchmarks in mind.

With Mosaic, budget planning can be a quicker, more collaborative, strategic process that keeps your company moving along toward its goals. Request a personalized demo today .

Give Department Leaders Deep Financial Insights for Better Budgeting

Budget allocation FAQs

Why is budget allocation important.

Understanding your budget allocations and appropriations can help your company maximize ROI. Knowing where your money goes ahead of time reduces discretionary spending and leaves a strategic roadmap for spending and expenditures . And, since this is done ahead of time, departments can run more efficiently on their allocated budget.

What is an example of a budget allocation?

An example of budget allocation is a predetermined percentage of company funding that goes to research and development, or sales and marketing. This can be done monthly, per quarter, or per fiscal year . The percentage of the allocated budget is based on importance, productivity, company profits, and other considerations. If the department needs more funding, they can submit a budget request , but ultimately, the budget allocation should be taken care of beforehand.

What is the best way to allocate your budget?

There’s no one-size-fits-all answer here. To optimize your budget allocation you need to proactively and periodically review how you’re allocating resources and reassess your priorities. What are your goals? What are your budget constraints? What ROI are you getting on your current allocations? These are all questions you need to ask in collaboration with different teams and departments to ensure your budgets are allocated properly at all times.

Related Content

- The 12 Most Important Operational Metrics & KPIs to Track in SaaS

- How To Choose the Best Pricing Model for Your SaaS Business

- What Is Spend Forecasting and How Can It Benefit Your Business?

Never miss new content

Subscribe to keep up with the latest strategic finance content.

The latest Mosaic Insights, straight to your inbox

Own the of your business.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Prepare a Budget for an Organization: 4 Steps

- 16 Nov 2021

An organization’s budget dictates how it leverages capital to work toward goals. For this reason, the ability to prepare a budget is one of the most crucial skills for any business leader —whether a current or aspiring entrepreneur, executive, functional lead, or manager.

Before preparing your first organizational budget, it’s important to understand what goes into a budget and the key steps involved in creating one.

What Is a Budget?

A budget is a document businesses use to track income and expenses in a detailed enough way to make operational decisions.

Budgets are typically forward-looking in nature. Income is based on projections and estimates for the periods they cover, as are expenses. For this reason, organizations often create both short- (monthly or quarterly) and long-term (annual) budgets, where the short-term budget is regularly adjusted to ensure the long-term budget stays on track.

Access your free e-book today.

Most organizations also prepare what’s known as an “actual budget” or “actual report” to compare estimates against reality following the period covered by the budget. This allows an organization to understand where it went wrong in the budgeting process and adjust estimates moving forward.

Budget vs. Cash Flow Statement

If the definition above sounds similar to a cash flow statement , you’re right: Your organization’s budget and cash flow statement are similar in that they both monitor the flow of money into and out of your business. Yet, they differ in key ways.

First, a budget typically offers more granular details about how money is spent than a cash flow statement does. This provides greater context for making tactical business decisions, such as considering where to trim business expenses.

Related: The Beginner’s Guide to Reading & Understanding Financial Statements

Second, a budget is, quite literally, a tool used to direct work done within an organization. The cash flow statement plays a different role by offering a higher-level overview of how money moves into, throughout, and out of an organization.

Instead of thinking of the two documents as competing, view them as complementary, with each playing a role in driving your business’s performance.

Steps to Prepare a Budget for Your Organization

The steps below can be followed whether creating a budget for a project, initiative, department, or entire organization.

1. Understand Your Organization’s Goals

Before you compile your budget, it’s important to have a firm understanding of the goals your organization is working toward in the period covered by it. By understanding those goals, you can prepare a budget that aligns with and facilitates them.

Related: The Advantages of Data-Driven Decision-Making

For example, consider a business that regularly experiences year-over-year revenue growth that’s offset by rising expenses. That organization might benefit from focusing efforts on better controlling expenses during the budgeting process.

Alternatively, consider a company launching a new product or service. The company may invest more heavily in the fledgling business line to grow it. With this goal, the company may need to trim expenses or growth initiatives elsewhere in its budget.

2. Estimate Your Income for the Period Covered by the Budget

To allocate funds for business expenses, you first need to determine your income and cash flow for the period to the best of your ability.

Depending on the nature of your organization, this can be a simple or complicated process. For example, a business that sells products or services to known clients locked in with contracts will likely have an easier time estimating income than a business that depends on active sales activity. In the second case, it would be important to reference historical sales and marketing data to understand whether the market is changing in a way that might cause you to miss or exceed historical trends.

Related: How to Read & Understand an Income Statement

Beyond income from sales activity, you should include other income sources, such as returns on investments, asset sales, and bond or share offerings.

3. Identify Your Expenses

Once you understand your projected income for the period, you need to estimate your expenses. This process involves three main categories: fixed costs, variable expenses, and one-time expenses.

Fixed costs are any expenses that remain constant over time and don’t dramatically vary from week to week or month to month. In many cases, those expenses are locked in by some form of contract, making it easy to anticipate and account for them. This category usually includes expenses related to overhead, such as rent payments and utilities. Phone, data, and software subscriptions can also fall into this category, along with debt payments. Any expense that’s regular and expected should be included.

Related: 6 Budgeting Tips for Managers

Variable expenses are those your business incurs, which vary over time depending on several factors, including sales activities. Your shipping and distribution costs, for example, are likely to be higher during a period when you sell more product than one when you sell less product. Likewise, utilities such as water, gas, and electricity will be higher during periods of increased use. This is especially true for businesses that manufacture their own products. Sales commissions, materials costs, and labor costs are other examples of variable expenses.

Both fixed expenses and variable expenses are recurring in nature, making it easy to account for them (even if variable expenses must be projected). One-time expenses , also called “one-time spends,” don’t recur and happen more rarely. Purchasing equipment or facilities, developing a new product or service, hiring a consultant, and handling a security breach are all examples of one-time expenses. Understanding major initiatives—and what it will take to accomplish them—and what you’ve spent in previous years on similar expenses can help account for them in your budget, even if you’re unsure of their exact values.

4. Determine Your Budget Surplus or Deficit

After you’ve accounted for all your income and expenses, you can apply them to your budget. This is where you determine whether you have enough projected income to cover all your expenses.

If you have more than enough income to cover your expenses, you have a budget surplus. Knowing this, you should determine how to use additional funds best. You may, for example, move the money into a rainy day fund you can access should your actual income fall short of projections. Alternatively, you may deploy the funds to grow your business.

On the other hand, if your expenses exceed your income, you have a budget deficit. At this point, you must identify the best path forward to close the gap. Can you bring in additional funds by selling more aggressively? Can you lower your fixed or variable expenses? Would you consider selling bonds or shares of company stock to infuse the business with additional capital?

An Important Financial Statement

The person responsible for generating a budget varies depending on an organization’s nature and its budgetary goals. An entrepreneur or small business owner, for example, is likely to prepare an organizational budget on their own. Meanwhile, a larger organization may rely on a member of the accounting department to generate a budget for the entire business. Individual department heads or functional leads might also be called on to submit budget proposals for their teams.

With this in mind, anyone who aspires to start their own business or move into an organizational leadership position can benefit from learning how to prepare a budget.

Do you want to take your career to the next level? Consider enrolling in our eight-week Financial Accounting course or three-course Credential of Readiness (CORe) program to learn financial concepts that can enable you to unlock critical insights into business performance and potential. Not sure which course is right for you? Download our free flowchart .

About the Author

A Step-by-Step Guide to Budget Allocation

The business landscape is challenging and unpredictable, especially in Africa. This is why financial literacy is very important in running a successful business.

Many of us grasp the concept of constructing personal monthly budgets with relative ease. We allocate X for rent, Y for bills and groceries, and Z for leisure. Yet, when it comes to budget allocation for your business, the landscape alters significantly.

Suddenly, there are more zeros involved, diverse departments to consider, and complex questions to address:

- What should be earmarked for marketing?

- How do you handle HR expenses?

- How do you determine labor costs before a full team is hired?

- How do you reimburse employees for office expenses?

Some of these questions are ultimately answered in due time, and you may have to work with rough estimates.

In this article, we’ll talk about budget allocation—a tried and tested way to determine how to spread your budget across various departments to maximise returns.

Understanding Budget Allocation

Budget allocation forms the backbone of financial planning for businesses, outlining the distribution of funds across various departments. It generally operates at the department level, giving an overview of spending priorities.

For instance, instead of itemising every minor expense, a percentage of the budget is designated for each department. This allows department heads to manage their specific expenditures effectively without constant higher-level approvals.

This process is not exclusive to startups or SMEs, but is commonplace in organisations of all sizes.

With Bujeti, you have the power to create budgets and allocate funds to departments or projects, so you have precise control over your spending. See how it works here .

Steps for Effective Budget Allocation

Budget allocation can be complex but breaking it down into steps makes it manageable.

1 – Calculate Your Total Spending Requirements

Before dividing the budget, assess your expenses:

- Startup Costs: Initial expenses like equipment, property, and inventory.

- Fixed Costs: Regular, predictable expenses such as rent, salaries, website hosting, insurance, and utilities.

- Variable Costs: Fluctuating expenses tied to sales or production, e.g. advertising and marketing spend, sales commission, business income taxes, travel and transportation, contract vendors.

Consider using financial planning tools like Bujeti for accurate calculations.

2 – Identify Funding Sources

Know where your funds come from:

- Investments: Personal funds, family and friends, venture capital or angel investors.

- Revenue Model: Breakdown of funding sources (e.g., investment, revenue, expected growth).

Ensure your funding aligns with estimated costs; reassess if needed.

3 – Allocate Budget by Department

Divide your total calculated costs across key departments:

- Engineering

- Customer Success/Support

- Operations/Administration

Assign expenses to respective departments, calculating both spend and percentage of the total budget for each.

4 – Implement a Monitoring System

Tracking actual expenses against the budget is crucial:

- Use financial management platforms for forecasting cash flow, budget spend, and revenue growth.

- Maintain a financial metrics dashboard to monitor spend and make agile adjustments.

Budget Reallocation: Making Adjustments

Throughout the year, it’s likely that you’ll come to find that certain cost estimates were over or underestimated.

Budgets can fluctuate due to underestimated or overestimated costs in specific departments. When this happens, consider reallocating funds to balance the budget or adjust future spending accordingly.

Simplify Budget Allocation with Bujeti

The Bujeti team will be hosting a webinar with industry experts and entrepreneurs who have experience running and scaling businesses in Africa:

- Gerald Black (Tech Ecosystem Builder & Influencer, XConnect)

- Kolade Adewoye (Founder & CEO at Fusion Intelligence)

- Samy Chiba (COO, Bujeti)

We will cover:

- The strategies employed for financial resilience and survival during challenging economic climates.

- Approaches to financial management tailored for your business.

- Navigating the pitfalls of startup failures, even with funding.

- Key financial metrics crucial for assessing the health and potential growth of your business.

Register here https://live.zoho.com/siQK3gzeND

Allocating a budget, though daunting initially, can become manageable with Bujeti’s support.

Share this:

- Click to share on LinkedIn (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

Related Posts

Leave a reply cancel reply, discover more from bujeti.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Budgeting Method: Understanding the Essential Steps for Financial Planning

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Budgeting Method Definition

A budgeting method is a structured approach towards managing and allocating financial resources, either personal or corporate, by estimating income and expenses over a certain period. It includes various strategies to plan and control finances, aiming for optimal use of resources and ensuring financial stability.

Understanding Different Budgeting Methods

Budgeting methods are the different strategies businesses use to plan their future income and expenditure. These vary in complexity and levels of detail. The most common budgeting methods include zero-based, incremental, and activity-based budgeting.

Zero-based Budgeting

Zero-based budgeting (ZBB) is a method where every spending category starts from zero at the beginning of each budget period. No amounts roll over from one period to the next. Every expense must be justified and approved before it is included in the budget. Since this method requires a thorough examination of every cost, it can be time-consuming but it also offers the most accuracy and control over corporate finances.

Incremental Budgeting

Incremental budgeting, on the other hand, uses the previous period's budget as a base and adjusts it for the next period taking into account factors such as inflation and business growth. This method requires less effort compared to ZBB and is useful when expenses don't fluctuate significantly. However, it can perpetuate inefficiencies since it does not question the necessity of every expense.

Activity-based Budgeting

Finally, activity-based budgeting (ABB) involves identifying the different activities that incur costs within a business and allocating an appropriate budget to each. The basis for this type of budget is not the previous period's expenses, but the predicted level of activity for the next period. This approach encourages efficiency by linking resources directly to outputs and outcomes. However, it requires a deep understanding of the business's operations and can be complex to manage.

Understanding these budgeting methods, along with their advantages and disadvantages, can help a company select the best approach for its financial planning process. Each has its own strengths and are best suited to specific situations or types of businesses, so it's important to choose wisely based on operational needs and financial goals.

Choosing the Right Budgeting Method

Every organization requires a strategic budgeting method that matches their financial objectives and operational goals. It's essential that businesses don't simply choose a budgeting method that worked for another company or seems the easiest approach. Instead, they must take into account a range of factors specific to their organization to determine the best approach.

Your Organization's Financial Needs

Organizations with complex financial structures may require more comprehensive budgeting methods, such as activity-based or zero-based budgeting. Conversely, for smaller businesses with simpler financial mechanisms in place, a traditional or incremental budgeting method may suffice. Understanding your organization's financial needs and constraints is therefore crucial in effectively determining a suitable budgeting approach.

Size of the Organization

The size of an organization is another factor that may influence the choice of a budgeting method. Larger organizations may have various departments with different funding needs. These organizations might benefit from a decentralized budgeting method which allows each department to create its own budget. Smaller entities, on the other hand, may find it effective to implement a centralized budgeting method where the budget is decided at a higher level and allocated down.

Industry Type

The industry a company operates in could also affect the choice of a budgeting method. For instance, for industries with volatile income streams, such as retail, a flexible budgeting system may be ideal as it can adapt to unexpected fluctuations. In contrast, more stable industries, such as utilities, might find a fixed budgeting approach more appropriate.

Similarly, sectors that are innovation-centric like technology might opt for performance-based budgeting which focuses on goals and results, as opposed to merely the amount spent. Other sectors might see better results from value proposition budgeting which targets the benefits derived rather than the investment cost.

Other Influencing Factors

There can also be additional factors that influence the choice of budgeting method. For example, an organization's culture and management style can play a significant role. If your organization encourages employee empowerment and you have a more democratic management style, then a participatory budgeting method might be the most effective approach.

Additionally, the current state of the economy can have a considerable impact on your budget strategy. In an uncertain economic climate, a budgeting method that allows flexibility and change could be more beneficial.

In conclusion, choosing the right budgeting method necessitates a deep understanding of your organization's internal and external conditions. There is no 'one size fits all' solution, it takes careful consideration, adaptation and occasionally, trial and error.

Benefits of Effective Budgeting

Efficient budgeting practices can result in a plethora of organizational benefits beyond just financial management.

Financial Control

First and foremost, adopting an effective budgeting method allows for superior financial control. Through regular monitoring and updating of the budget, organizations can reduce expenditure, enhance savings, and optimize income. By designating how finances ought to be allocated and spent, businesses can effectively avoid unnecessary expenses.

In turn, this system enables companies to decrease financial risks by having a clear plan in place, resulting in strengthened financial integrity and steadiness. An effective budgeting method also functions as a guideline that encourages financial responsibility and accountability amongst employees, thus fostering a mindset of fiscal discipline throughout the organization.

Forecasting Accuracy

An efficient budgeting approach also offers improved forecasting accuracy. Reliable financial forecasts facilitate strategic decision-making and planning, thereby bolstering the organization’s capacity to anticipate future costs and income. This enables businesses to plan for growth and expansion while also being adequately prepared for unforeseen financial challenges and hurdles.

Moreover, accurate forecasting aids in setting realistic financial objectives and benchmarks. Therefore, a properly forecasted budget can provide invaluable insights into the organization’s financial health and trajectory, which is crucial for informed decision-making and effective management.

Business Operations Efficiency

Incorporation of robust budgeting methods can enhance the efficiency of business operations. A structured budget offers a clear outlook of the company's financial position, including its income and expenses. Consequently, this clarity aids in streamlining operations, maximizing resource utilization, and steering the organization towards its financial and operational objectives.

Furthermore, an effective budgeting method prompts routine financial review and analysis. This invites the opportunity for businesses to pinpoint and rectify operational inefficiencies, therefore leading to enhanced productivity and revenue.

Strategic Alignment

Lastly, good budgeting practices can assist in achieving strategic alignment. A budget, essentially, is a financial expression of the company’s strategic plan. Hence, a well-aligned budget will reflect the organization’s strategic goals, thereby helping to guide operational decisions in the appropriate strategic direction.

A budget also serves as a communication tool for conveying the organization’s strategy throughout its hierarchy. This shared understanding of the company's strategy can foster unity and collective focus, thereby enhancing the organization’s capacity to work cohesively towards achieving its strategic goals.

Challenges and Limitations of Budgeting Methods

Time and resource intensive.

Implementing and maintaining a budgeting method can be a significant drain on an organization's time and resources. This is especially true for more complex methods, such as zero-based or activity-based budgeting. These methods require a detailed understanding of each department's functionalities and expenditures, leading to an extensive need for data compilation, analysis, and reconciliation.

Difficulty in Forecasting

Forecasting future income and expenditures, a fundamental aspect of budgeting, can be challenging. Many budgeting methods, including incremental and zero-based budgeting, rely heavily on making accurate predictions. However, unforeseen circumstances such as economic downturns, competitive pressures, or new regulations can drastically affect these predictions. In such situations, the chosen budgeting method may become less effective or even counterproductive.

Resistance to Change

For organizations used to traditional budgeting methods, transitioning to a new budgeting method can face significant resistance from employees. The transition often requires additional training and changes in workflows which can meet resistance from employees who are accustomed to their usual work procedures.

Arbitrary Cost Allocation

Many budgeting methods rely on spreading overhead costs across different departments based on some arbitrary factor such as headcount or square footage. However, this may not accurately reflect the actual usage of resources by each department, leading to potential inefficiencies and conflicts.

Restricted Flexibility

Finally, some budgeting methods enforce a rigid structure that can stifle innovation and flexibility. For instance, static budgeting does not allow for adjustments in response to changes in business conditions. This makes it harder for organizations to react quickly to market opportunities or challenges.

At their core, all budgeting methods are simplifications of reality and, thus, have their inherent limitations. No single method will be perfect for all organizations, and decisions on the appropriate method should consider the specific needs, constraints, and objectives of the organization.

Role of Budgeting in Decision Making

Resource allocation and strategic planning.

When examining resource allocation and strategic planning, budgeting methods prove crucial. These approaches allow businesses to decide which projects, departments, or initiatives to fund and how much capital to allot to each. Deciding where to allocate resources is not something you can take lightly as it dictates the various operations and projects a business can undertake. Thorough and well-formulated budgets provide a roadmap for these crucial decisions, offering a clearer picture of where a business will devote its resources.

Budgeting methods also play a pivotal role in strategic planning. They offer a vital snapshot of a business's financial health and future projection, consequently shaping strategic planning decisions. Through budgeting, organizations can identify areas where they are overspending and other areas where they can afford to invest more. This feeds into the broader strategic planning process, where businesses determine their mission, vision, and objectives for the future.

Informed Decision-Making

Budgeting methods are key tools in making informed decisions. They offer valuable insight into the financial state of the business, thus enabling management to make strategic decisions based on concrete data. By looking at the budget, a business can identify financial trends and patterns that can guide decision-making.

For example, if a budget reveals that a particular product line is not generating enough revenue to cover its costs, senior management can use this information to decide whether to improve the product or discontinue it. Conversely, if the budget shows that capital investment in a particular department has led to significant revenue growth, the management might decide to allocate even more resources to that area.

Through these examples, it’s evident that budgeting methods offer an empirical foundation on which informed decisions can be made. They lend businesses the ability to monitor their performance, plan for the future, and make key decisions with clarity and confidence.

Influence of Budgeting on CSR and Sustainability

If strategically used, budgeting methods can play an integral role in fostering Corporate Social Responsibility (CSR) and sustainability within an organization. Essentially, budgeting serves as a tool that ensures adequate allocation of funds for these endeavors. This provision of resources is vital as it helps organizations undertake projects that align with their CSR objectives and sustainable practices. For instance, a company might allocate a portion of its budget to invest in energy-efficient infrastructure or support local community programs, thereby indirectly promoting sustainability and socially responsible practices.

H3: Budgeting and Financial Implications

Apart from resource allocation, budgeting also proves beneficial when it comes to monitoring the financial implications of such endeavors. Organizations can use their budget reports to assess the financial outcome of their CSR and sustainability initiatives. By doing this, they can track their expenditures and evaluate whether the economic impact aligns with their goals. Any inconsistencies or deviations can be identified early, allowing for adjustments and corrections as needed.

Furthermore, the budgeting method can aid in incorporating sustainability and CSR into the company's strategic planning. The set budget can reflect the organization’s CSR goals, effectively intertwining financial planning and sustainability objectives. This not only guides decision-making processes but also communicates the organization's commitment towards CSR and sustainability to its stakeholders. It can serve as a testament to the organization’s dedication to these values even whilst adhering to budget constraints.

One crucial aspect to note is that while budgeting aids in financing and evaluating CSR and sustainability endeavors, it is not the sole determinant. Organizational commitment, progressive policies, and the active participation of all stakeholders are critical for the successful implementation of CSR and sustainable initiatives. Yet, the integral role of strategic budgeting in enabling these activities remains undeniable.

Thus, while budgeting is fundamentally a financial planning tool, its influence on CSR and sustainability is substantial. It ensures the allotment of necessary resources, tracks financial implications, and can reinforce an organization's commitment to these objectives.

Budgeting Method and Financial Performance

In assessing the impact of budgeting methods on the financial health and performance of an organization, it's clear that the right choice and execution can play a significant role.

Impact on Financial Health

A well-executed budgeting method enables an organization to set clear financial goals, gather and manage resources in the most effective way, and invest prudently in pursuit of these goals. Solid and regular performance in this regard enhances the financial health of an organization in the long run.

At the core of a budget lies the delicate balance between revenue and expenditures. A properly chosen and executed budgeting method helps align revenue streams with spending commitments. The organization is thereby equipped with a valuable tool to avoid overspending and, ultimately, financial difficulties.

Effect on Financial Performance

Beyond the direct effects on financial health, budgeting methods also have an impact on organizational performance. Following a budgeting method guides your resource allocation decisions, enabling you to dedicate funds to performing sectors or to those needing support.

Additionally, stringent budget control supports an increase in fiscal discipline within the organization. Knowing there's a definite budget stimulates an economy of resource usage, which in turn boosts the performance indices.

The Power of Forecasting

A good budgeting method additionally provides the organization with the power of forecasting. By considering past trends and future projections, a carefully constructed budget helps anticipate revenue and expenses. This foresight aids in identifying potential challenges or opportunities ahead, and planning accordingly. Resultantly, this bolsters the financial performance of the organisation.

In summary, a fitting budgeting method serves as an essential navigational aid in the financial journey of an organization. From balancing income and expenditure to promoting fiscal discipline and enabling effective forecasting, the ripple effect of the right budgeting execution undoubtedly reflects positively on the organisation's financial health and performance.

Technological Advancements and Budgeting Method

Technological advances impact nearly every aspect of modern life, and budgeting is not an exception.

Utilization of Software Tools

Several high-quality softwares, platforms and digital tools are available that completely revolutionize the traditional way of budgeting. Companies such as Mint, Quicken and YNAB provide a plethora of options that automate many budgeting tasks which were hitherto performed manually. This has streamlined the budgeting process, making it much more efficient. For instance, these programs can track spending in real time, categorizing expenditures, and providing reports, trends and budget forecasts.

Real-Time Data Access

With the advent of technology, real-time access to data has become possible. Budgeting no longer needs to rely on outdated information or forecasts. Updated financial data can be reviewed and incorporated at any point in time, allowing for more accurate budget projections and adjustments. An inadequate prediction could lead a company to over- or under-invest in crucial areas. Consequently, this advancement has fostered more dynamic and adaptive budgeting strategies.

Automation and Efficiency

Technology and automation have significantly increased efficiency in budgeting. Automated data entry, calculation, and report generation have reduced human errors and improved accuracy of the results. Think about tedious tasks such as categorizing transactions, tracking spending habits, or making sure bills are paid on time – technology can handle all this automatically. In addition to time-saving, automation increases the accuracy of budgeting, making it easier to stick to a specified financial path.

Predictive Analysis

One of the most revolutionary tech developments in budgeting is predictive analysis. Advanced algorithms can examine past patterns, trends, and events to forecast future financial scenarios. This enables proactive budgeting and financial decision making, rather than relying on retrospective analysis.

Personalization

Another exciting development is the degree of personalization that technology allows in budgeting. Using data and analytics, budgeting tools can offer tailored advice based on individual's or organization's specific goals, preferences and spending habits. This means users can create a budget structure that truly fits their financial needs and capacities.

In conclusion, the intersection of finance and technology continues to redefine budgeting methods. Whether through increasing efficiency, real-time data access, predictive analytics, or personalized advice, these advances are proving highly beneficial in managing money better.

Share this article with a friend:

About the author.

Inspired Economist

Related posts.

Accounting Close Explained: A Comprehensive Guide to the Process

Accounts Payable Essentials: From Invoice Processing to Payment

Operating Profit Margin: Understanding Corporate Earnings Power

Capital Rationing: How Companies Manage Limited Resources

Licensing Revenue Model: An In-Depth Look at Profit Generation

Operating Income: Understanding its Significance in Business Finance

Cash Flow Statement: Breaking Down Its Importance and Analysis in Finance

Human Capital Management: Understanding the Value of Your Workforce

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Start typing and press enter to search

Mastering Budget Allocation Management for Finance Teams

Effectively managing budget allocations is crucial for the financial health and sustainability of any organization. Finance teams play a pivotal role in overseeing budget allocation , ensuring that spending aligns with strategic objectives and financial plans. In this article, we explore best practices for finance teams in the realm of budget allocation management.

Regular Monitoring of Budget Allocations

Finance teams should establish a routine for monitoring budget allocations to ensure adherence to the predefined spending plans. Regular reviews enable teams to identify deviations early on and take corrective action promptly. This practice helps prevent overspending and ensures that financial resources are allocated efficiently.

Creation of a Comprehensive Spending Record

Maintaining a detailed spending record is a fundamental practice for effective budget allocation management. This record should encompass all purchase orders and bills, providing a comprehensive overview of financial transactions. By having a centralized record, finance teams can easily track expenditures, compare them against budget allocations, and identify any discrepancies.

Comparison of Spending Against Budget Allocations

A key aspect of budget allocation management is the ongoing comparison of actual spending against the allocated budget. This involves regularly assessing the spending record and identifying areas where expenditures exceed or fall short of the budgeted amounts. This proactive approach allows finance teams to address budget variances promptly and make informed decisions to reallocate resources if necessary.

Promotion of Accountability

Creating a spending record not only facilitates tracking and comparison but also promotes accountability within the organization. Finance teams can use the spending record to verify whether procurement activities were conducted in accordance with established protocols. This transparency enhances accountability among teams and encourages responsible spending practices throughout the organization.

Insights for Future Budget Planning

A well-maintained spending record serves as a valuable resource for future budget planning. Finance teams can analyze historical spending patterns, identify trends, and use this information to refine future budget allocations. Understanding past expenditures provides insights into areas of potential optimization and aids in creating more accurate and realistic budgets.

Highlighting Saving Opportunities

Monitoring budget allocations and maintaining a spending record can uncover saving opportunities for the organization. By identifying areas where expenditures are consistently below budget, finance teams can explore cost-saving initiatives or reallocate resources to areas with higher priority. This strategic approach contributes to financial efficiency and optimization.

Collaborative Budget Review

Effective budget allocation management involves collaboration among different departments and teams within the organization. Finance teams should work closely with department heads and managers to review budget allocations, discuss spending needs, and ensure alignment with organizational goals. This collaborative effort enhances communication and fosters a shared understanding of budget priorities.

In the dynamic landscape of business, mastering budget allocation management is essential for financial stability and growth. Finance teams, through regular monitoring, comprehensive spending records, and collaborative efforts, can navigate the complexities of budget allocation successfully. By promoting accountability, gaining insights for future planning, and identifying saving opportunities, finance teams become key contributors to the overall financial health of the organization. Adopting these best practices ensures that budget allocation becomes a strategic tool for optimizing resources and achieving long-term financial objectives .

- Financial Analysis

- Investment Management

- Mergers & Acquisitions

- Risk and Compliance

- Business Plan Analysis

- Lease Agreement

- Private Placement Memo

- Real Estate Opportunity

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Monthly 50/30/20 Budget Calculator

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

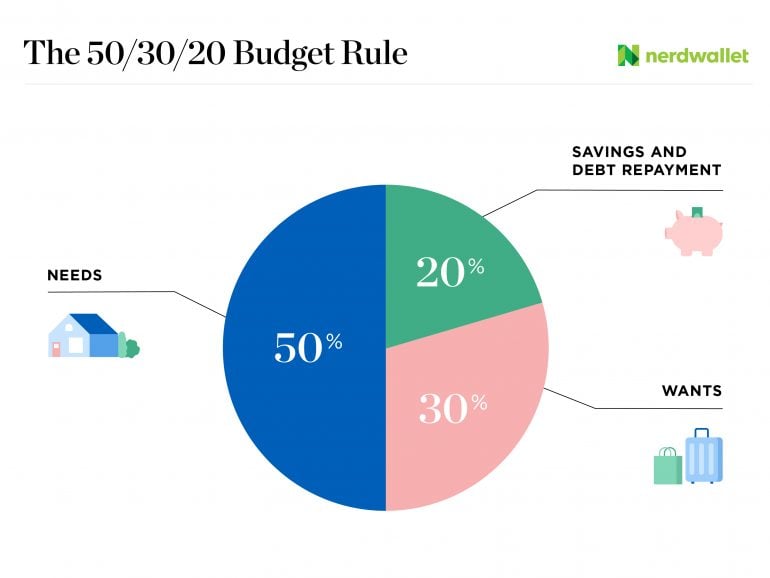

Use our 50/30/20 budget calculator to estimate how you might divide your monthly income into needs, wants and savings. This will give you a big-picture view of your finances. The most important number is the smallest: the 20% dedicated to savings . Once you achieve that, perhaps with an employer-sponsored retirement plan and other automated monthly savings transfers, the rest — that big 80% chunk — is up for debate.

That leaves 50% for needs and 30% for wants, but these are parameters you can tweak to suit your reality. For example, if you live in an expensive housing market, your monthly mortgage or rent payment might spill a bit into your "wants" budget. Budgets are meant to bend but not be broken.

50/30/20 budget calculator

Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment.

The 50/30/20 budget

Find out how this budgeting approach applies to your money.

Your 50/30/20 numbers:

Necessities

Savings and debt repayment

Do you know your “want” categories?

Become a NerdWallet member to track your monthly spending trends, including how much you're allocating to needs and wants.

What is the 50/30/20 rule?

The 50/30/20 rule is a popular budgeting method that splits your monthly income among three main categories. Here's how it breaks down:

Monthly after-tax income

Before you can slice up your 50/30/20 budget, you need to calculate your monthly take-home income . This figure is your income after taxes have been deducted. It's likely you'll have additional payroll deductions for things like health insurance, 401(k) contributions or other automatic payments taken from your salary. Don't subtract those from your gross (before tax) income. If you've lumped them in with your taxes, you'll want to separate them out — subtract only taxes from your gross income.

50% of your income: needs

Necessities are the expenses you can’t avoid. This portion of your budget should cover required costs such as:

Transportation.

Basic utilities.

Minimum loan payments. Anything beyond the minimum goes into the savings and debt repayment bucket.

Child care or other expenses that need to be covered so you can work.

30% of your income: wants

Distinguishing between needs and wants isn’t always easy and can vary from one budget to another. Generally, though, wants are the extras that aren’t essential to living and working. They’re often for fun and may include:

Monthly subscriptions.

Entertainment.

20% of your income: savings and debt

Savings is the amount you sock away to prepare for the future . Devote this chunk of your budget to paying down existing debt and creating a financial cushion.

How, exactly, to use this part of your budget depends on your situation, but it will likely include:

Starting and growing an emergency fund .

Saving for retirement through a 401(k) and perhaps an individual retirement account.

Paying off debt, beginning with high-interest accounts like credit cards.

Get more help with monthly budget planning

For more budgeting advice, including how to prioritize your savings and debt repayment, review our tips for how to build a budget and utilize our financial calculators . Then, consult our personal finance guide.

Not sure how to start budgeting? Downloading a budget app or personal finance software may help, or get informed with a budgeting book .

Or become a NerdWallet member for free . We’ll track your spending in one place and identify areas where you can save. Compare NerdWallet vs. Mint , and learn how our app uses the 50/30/20 budget.

on Capitalize's website

13 effective tips to allocate budget across departments

Sabrinthia Donnelly

To build a sustainable and profitable business, you need to know how to allocate budget across multiple departments.

As you can imagine, this can be a tricky process to get right. Everyone wants a bigger piece of the pie, and you can’t always please everyone. Instead, you must find a way to balance competing priorities with overarching business objectives – all while forecasting future needs.

So, how can you do that effectively?

This article highlights 13 tips for successful budget allocation across departments and covers:

- What we mean by ‘budget allocations'

- Why companies need to budget

- How to allocate budgets

- Roles responsible for budget management

13 tips to allocate budget across multiple departments

- How to allocate marketing budgets

- What types of budget allocation can be changed

How to create a budget allocation model

What are ‘budget allocations’.

Budget allocation is the process of designating specific amounts of money to each department within a company.

How much money each group receives depends on:

- Company priorities

- Revenue projections

- Departmental needs

These allocated budgets set spending limits for each department's operational costs, including:

- 🖥️ Software

- 💬 Marketing campaigns

- 🛠️ Equipment

- 📈 Projects tied to their goals

Done right, budget allocation provides clarity on available funds and is used to monitor spending.

Why do we need budget allocation?

The purpose of budget allocation is to guide spending and distribute financial resources.

It won’t come as a surprise to learn that most businesses have limited budgets. As much as you’d like to give every department the freedom to spend as much as they want, that's just not realistic. Budgets force departments to prioritize their needs and allocate resources efficiently. Without budgets, costs would likely spiral out of control and lead to overspending.

Some more reasons why budget allocation is so important include:

- Financial control

- Optimal resource use

- Risk mitigation

- Strategic alignment

- Operational efficiency

But what does ‘successful budget allocation’ look like?

How do companies allocate budgets?

Many companies start with an analysis of historical spending and revenue patterns . They’ll collect financial and operational data from all departments and use key performance indicators to help guide decisions.

Company-wide objectives and initiatives are confirmed by leadership to help construct budgets that align with those goals.

Collaboration is very important and you may find that you’ll work closely with department heads and other stakeholders to better understand their monetary requirements, operational challenges, and strategic importance.

From there, you may employ a certain budgeting methodology such as:

Each offers a unique approach to budgeting. The next step is to draft a preliminary budget , which will be reviewed by senior management. You may need to revise the budget plan before it's implemented.

Larger, more complex companies often take a bottoms-up approach – gathering proposed budgets from departments first. Small companies may use a top-down allocated amount to each group.

It’s worth noting that budget distribution can occur as a single annual allocation or be staged across the year.

Who is responsible for budget management?

Typically, budget management involves multiple roles and stakeholders within an organization, such as:

- CFO - The Chief Financial Officer is ultimately responsible for high-level budget strategy, financial planning, and oversight of the overall budget. This holds true across multiple industries with McKinsey reporting that 72% of CFOs say they're the most involved executives in allocating financial resources.

- Finance Department - The finance team manages day-to-day budget tracking, reporting, analysis, and controls. They also develop budget allocation models and processes.

- Department Heads - Leaders of business units are involved in budget requests, planning, and managing budgets for their departments.

- Controller - The controller plays a key role in budget control and variance analysis and often enforces compliance with budgets.

- Budget Analysts - Analysts assist with budget forecasts, data analysis, and preparation of budgets.

- Project Managers - Project leads maintain budgets for specific projects and initiatives.

- Executives - The CEO, COO, and other executives weigh in on high-level budget direction aligned to business strategy.

While the CFO may be the ultimate budget owner, effective budget management requires collaboration across these different roles to develop, track, control, and optimize budget performance.

Here are 13 tips for effectively allocating budget across multiple departments.

1. Involve department heads in the budgeting process

Have them provide input on their resource needs and strategic priorities. This buy-in helps to create shared ownership.

2. Employ a standardized approach

Implement a standardized budgeting process throughout the company to maintain consistency and fair allocation while considering each department’s unique needs.

3. Analyze historical spending

Search spending history to help identify trends and seasonal fluctuations. Use this data to forecast future budget needs.

4. Set organization-wide goals and communicate strategic priorities

Departmental budgets should align with these overarching objectives. This alignment not only ensures financial coherence but also enhances operational synergy.

5. Tie budgets to realistic forecasts

Allocate the budget in the context of revenue projections, not last year's numbers. By aligning budgets with realistic forecasts, you’ll ensure a more adaptive and forward-looking financial strategy positioned to navigate through evolving market conditions and emerging challenges.

6. Reserve a percentage of the total budget for discretionary spending

This buffers against unforeseen expenses arising mid-year. Reserving some of the budget for a rainy day could prove to be vital for mitigating risks and safeguarding against financial strain.

7. Prioritize ROI-driven activities

Allocate more significant budget portions to departments or projects that exhibit higher Return on Investment (ROI), ensuring funds are applied in areas that create value.

8. Require departments to justify requests exceeding historical allocations

Scrutinize large variances before approving. This helps ensure that any significant deviations from past spending are thoroughly vetted and aligned with strategic objectives.

9. Stage budget distributions

Granting each department funds quarterly or monthly versus upfront. This improves oversight. Plus, allocating budgets in installments rather than lump sums allows closer monitoring of spending patterns and burn rates.

10. Establish policies on budget transfers between departments

Policies that allow flexibility while maintaining control enable resources to be shifted to higher-priority needs when necessary.

11. Compare the allocated budget to actual spending and hold department heads accountable

Regular check-ins on budget versus actuals reveal if departments are lagging or outpacing their plan. It’s also important to hear from department heads so that actuals vary from the budget by higher than expected, they can explain, and you can analyze root causes together.

12. Leverage technology

Implement budget management software and analytical tools to streamline the allocation process. If done right, technology can help ensure accurate tracking, and provide actionable insights that inform future allocations.

13. Review budgets regularly

Continually track budget usage against set benchmarks and revisit allocations if company priorities shift mid-year. Revising budgets is one of the biggest priorities of modern-day CFOs according to PwC , who say CFOs prefer to work closely with colleagues across the C-suite to adjust budgets and revisit pricing models.

How to allocate marketing budgets across channels

When it comes to allocating marketing budgets across channels, you might find the marketing team asking for your input and advice. Since it’s a common occurrence for many of our finance community members, we thought we’d address it here.

The most effective approach is to start by auditing historical performance data for each marketing channel and assessing engagement, conversions, and attributable revenue or pipeline. Look at both returns on ad spend and overall contribution to goals.

Based on the audit findings, prioritize the budget for the initiatives delivering the strongest results and ROI. Avoid spreading the budget too thin across marginal channels. Consolidate dollars into high-traction initiatives.

Balance short-term lead generation priorities with longer-term brand-building channels. Seek overall alignment to revenue goals while maintaining ROI accountability. Continuously evaluate new channel opportunities by funding initial tests out of existing budgets.

The key is taking a data-driven approach to fund the right mix of channels optimized for customer acquisition and financial return. And don’t forget to adjust allocations based on results.

Digital marketing budget allocation

For digital marketing budget allocation specifically, focus spending on platforms with the lowest CPA and highest conversion rates per your analytics.

Then, continue optimizing digital budget allocation based on campaign performance and emerging trends.

B2B marketing budget allocation

When it comes to B2B marketing budget allocation, prioritize high-touch channels like events and sales enablement .

Ensure a sufficient budget for product marketing and research. Invest in thought leadership content and account-based tactics.

What budget allocation can be changed?

While certain fixed costs like rent and payroll are less flexible, most discretionary spending budgets can be adjusted as business conditions and priorities evolve.

Areas, where budget allocation is typically more fluid, include:

- Marketing - Budget can shift across channels and campaigns based on performance.

- Technology - Upgrades can be accelerated or deferred; new tools funded.

- Travel - Conferences and other travel can be relatively easy to adapt to needs.

- Training/Development - Programs can expand or contract as capabilities shift.

- Contractors/Services - External spending can be reduced or surged as needed.

- Inventory - Purchases and production can align with demand forecasts.

- Capital Expenditures - Major equipment purchases can be postponed or funded faster.

A budget allocation model provides a structured framework for distributing financial resources across an organization's departments, divisions, projects, and other entities.

Key components of a budget allocation model include:

- Revenue forecasts: Projected sales and income provide the spending boundary.

- Historical data: Prior budgets and actuals inform future allocations.

- Performance metrics: KPIs help determine departmental budget sizes.

- Management input: Leaders provide top-down strategy and bottom-up requests.

- Allocation method: A proportional, incremental, zero-based, or activity-based approach.

- Policies: Guidelines for transfers, overages, contingencies, and processes.

Revisit and adjust the model regularly based on results and changing internal and external factors. Evolve the model of each cycle.

Want more finance tips and insights?

Subscribe to the Monthly Balance newsletter and stay up-to-date with the latest industry news, updates, events, and more – all sent straight to your inbox each month.

Keep up with the latest releases on the Finance Alliance blog and podcast and be the first to know about upcoming events, reports, and industry news!

Written by:

Sabrinthia is the Senior Copywriter at Finance Alliance and host of the Two Cents podcast. She's always happy to connect with new people in finance, so if you want to get involved, please reach out!

Get industry insights

- Media Guide

- Privacy Policy

- Terms of Service

- Search Search Please fill out this field.

20%: Savings

Importance of savings.

- Benefits of the Rule

- How to Adopt the Rule

The Bottom Line

- Budgeting & Savings

The 50/30/20 Budget Rule Explained With Examples

:max_bytes(150000):strip_icc():format(webp)/MHP-ChipHeadshot-2-d1d3928ade0f496abeb7411d3b2e1d4f.jpg)

U.S. Sen. Elizabeth Warren popularized the 50/20/30 budget rule in her book, All Your Worth: The Ultimate Lifetime Money Plan. The rule is to split your after-tax income into three categories of spending: 50% on needs, 30% on wants, and 20% on savings.

This intuitive and straightforward rule can help you draw up a reasonable budget that you can stick to over time in order to meet your financial goals.

Key Takeaways

- The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do.

- The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).

- The rule is a template that is intended to help individuals manage their money, to balance paying for necessities with saving for emergencies and retirement.

- People who follow the 50/30/20 rule can simplify it by setting up automatic deposits, using automatic payments, and tracking changes in income.

Needs are the bills that you absolutely must pay and the things necessary for survival. Half of your after-tax income should be all that you need to cover those needs and obligations. If you are spending more than that on your needs, you will have to either cut down on wants or try to downsize your lifestyle, perhaps to a smaller home or more modest car. Maybe carpooling or taking public transportation to work is a solution, or cooking at home more often. Examples of "needs" include but aren't limited to:

- Rent or mortgage payments

- Car payments

- Insurance and health care

- Minimum debt payments

Wants are all the things you spend money on that are not absolutely essential. Anything in the "wants" bucket is optional if you boil it down. For example, you can work out at home instead of going to the gym, cook instead of eating out, or watch sports on TV instead of getting tickets to the game.

This category also includes those upgrade decisions you make, such as choosing a costlier steak instead of a less expensive hamburger, buying a Mercedes instead of a more economical Honda, or choosing between watching television using an antenna for free or spending money to watch cable TV. Basically, wants are all those little extras you spend money on that make life more enjoyable and entertaining. In general, examples of "wants" include but aren't limited to:

- New unnecessary clothes or accessories like handbags or jewelry

- Tickets to sporting events

- Vacations or other non-essential travel

- The latest electronic gadget (especially an upgrade over a fully functioning prior model)

- Ultra-high-speed Internet beyond your streaming needs

Finally, try to allocate 20% of your net income to savings and investments. You should have at least three months of emergency savings on hand in case you lose your job or an unforeseen event occurs. After that, focus on retirement and meeting more distant financial goals. Examples of savings could include:

- Creating an emergency fund

- Making IRA contributions to a mutual fund account

- Investing in the stock market

- Setting aside funds to buy physical property for long-term holding

- Making debt repayments beyond minimum payments

If emergency funds are ever used, the first allocation of additional income should be to replenish the emergency fund account.

Americans are notoriously bad at saving, and the nation has extremely high levels of debt. As of December 2023, the average personal savings rate for individuals in the United States was just 3.7%.

The 50-30-20 rule is intended to help individuals manage their after-tax income, primarily to have funds on hand for emergencies and savings for retirement . Every household should prioritize creating an emergency fund in case of job losses, unexpected medical expenses, or any other unforeseen monetary cost. If an emergency fund is used, a household should focus first on replenishing it.

Saving for retirement is also a critical step as individuals are living longer. Calculating how much you will need for retirement, beginning at a young age, and working towards that goal will ensure a comfortable retirement.