Business Continuity and Risk Management: Your Complete Guide

Bcp risk management: complete guide.

You already know that risk management is vital to any competitive, responsible, and well-prepared company. But how does BCP fit into your risk management strategy? And what are the differences between BCP and risk management?

If you’re wondering how to improve your BCP (or create a BCP from scratch), check out our guide to learn the basics. We’ll answer your questions related to BCP and risk management for any size institution.

What Is BCP? (Simple Definition)

BCP stands for business continuity plan—a document that describes how an organization will carry on in the case of emergency, natural disaster, or other disruptions to typical operations.

A BCP is more extensive than a disaster recovery plan, outlining every possible situation that could occur in case of a disruption—and what the organization will do about it. The plan proposes ways to mitigate risks and details procedures to test all proposals.

Is BCP Part of Risk Management?

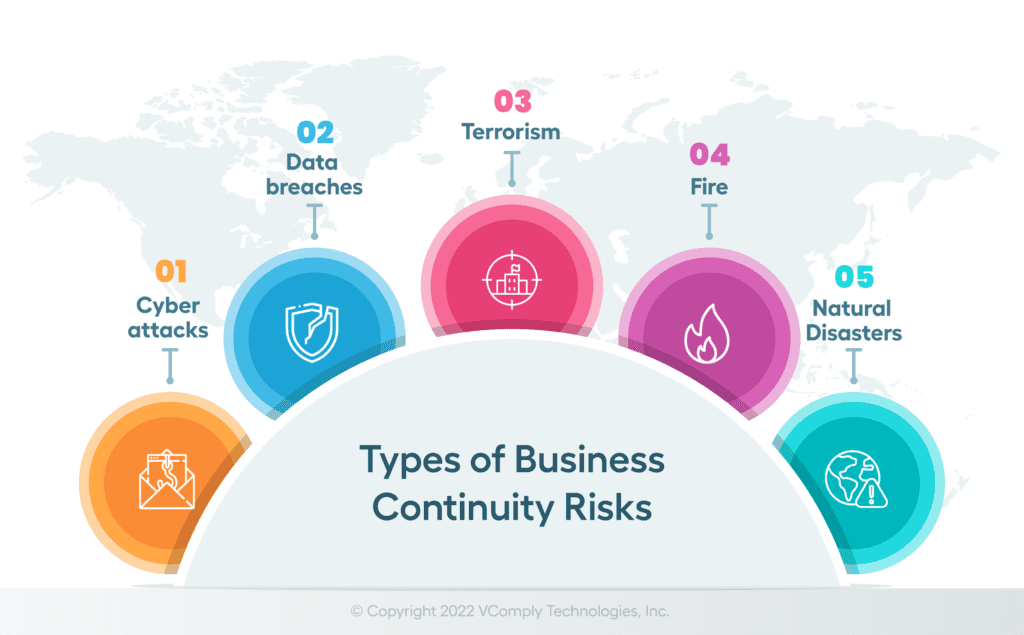

BCP is an important part of risk management. From cyberattacks to fires and floods, all organizations are vulnerable to unforeseen disruptions. But having a thorough BCP in place protects the organization, allowing them to quickly resume the most critical functions and ultimately bounce back faster even when faced with disaster.

Still, a BCP is only one aspect of risk management. In order to best mitigate risk, an organization should pair a BCP with a continuity program , disaster recovery plan , and ongoing risk assessments.

What Are the Differences Between BCP and Risk Management?

BCP is a sub-category of risk management, playing an important role in helping an organization get back up and running after a disruption.

While risk management focuses on mitigating problems from the outside, business continuity plans outline what a company should do in case they are faced with the worst possible outcome. Hence, organizations that invest in both risk management and BCP will be able to mitigate risk and be prepared for any scenario that may come their way.

How Does BCP Help Mitigate Risk?

A BCP helps to mitigate risk by making sure the organization is ready for any possible disruption to everyday operations. By having an outlined plan of how every department should respond to the disaster, the organization will be able to resume the most critical functions and return to typical business operations as quickly as possible, minimizing financial losses and other problems resulting from the disruption.

Who Is Responsible for BCP?

Organizations may hire continuity plan coordinators specifically tasked with the job of developing a BCPs. This job might also fall under the role of another administrative position that typically deals with risk management and mitigation.

Business continuity coordinators should work closely with all departments within the company to understand their unique processes and potential risks that could arise in case of a disaster or emergency. Once coordinators understand those risks, they should outline solutions and procedures to mitigate risk in the business continuity plan.

What Is the Primary Goal of Business Continuity Planning?

Business continuity planning offers many benefits to organizations, allowing them to be more agile, competitive, and prepared for any situation. But what is the primary goal of business continuity planning?

In short, the main focus of BCP is to allow organizations to continue operating as smoothly as possible when faced with any type of business disruption, such as a cyberattack or natural disaster. By keeping the organization running smoothly, a BCP could ultimately save the business a great deal of money, plus avoid serious short-term and long-term repercussions.

Ultimately, a BCP protects an organization’s main functions and assets, restores operations, and prevents and mitigates risk.

Manage Risk with Continuity Planning Software

It’s time to make sure your organization is prepared for anything that comes your way. Kuali Ready makes it easy to create thorough, effective BCPs with intuitive continuity planning software.

Contact us today to learn more about how higher education institutions are using Kuali Ready to improve resilience and amplify risk management efforts.

REQUEST A DEMO

Let's setup a time to see Kuali in action!

- Search Search Please fill out this field.

- Business Continuity Plan Basics

- Understanding BCPs

- Benefits of BCPs

- How to Create a BCP

- BCP & Impact Analysis

- BCP vs. Disaster Recovery Plan

Frequently Asked Questions

- Business Continuity Plan FAQs

The Bottom Line

What is a business continuity plan (bcp), and how does it work.

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Investopedia / Ryan Oakley

What Is a Business Continuity Plan (BCP)?

A business continuity plan (BCP) is a system of prevention and recovery from potential threats to a company. The plan ensures that personnel and assets are protected and are able to function quickly in the event of a disaster.

Key Takeaways

- Business continuity plans (BCPs) are prevention and recovery systems for potential threats, such as natural disasters or cyber-attacks.

- BCP is designed to protect personnel and assets and make sure they can function quickly when disaster strikes.

- BCPs should be tested to ensure there are no weaknesses, which can be identified and corrected.

Understanding Business Continuity Plans (BCPs)

BCP involves defining any and all risks that can affect the company's operations, making it an important part of the organization's risk management strategy. Risks may include natural disasters—fire, flood, or weather-related events—and cyber-attacks . Once the risks are identified, the plan should also include:

- Determining how those risks will affect operations

- Implementing safeguards and procedures to mitigate the risks

- Testing procedures to ensure they work

- Reviewing the process to make sure that it is up to date

BCPs are an important part of any business. Threats and disruptions mean a loss of revenue and higher costs, which leads to a drop in profitability. And businesses can't rely on insurance alone because it doesn't cover all the costs and the customers who move to the competition. It is generally conceived in advance and involves input from key stakeholders and personnel.

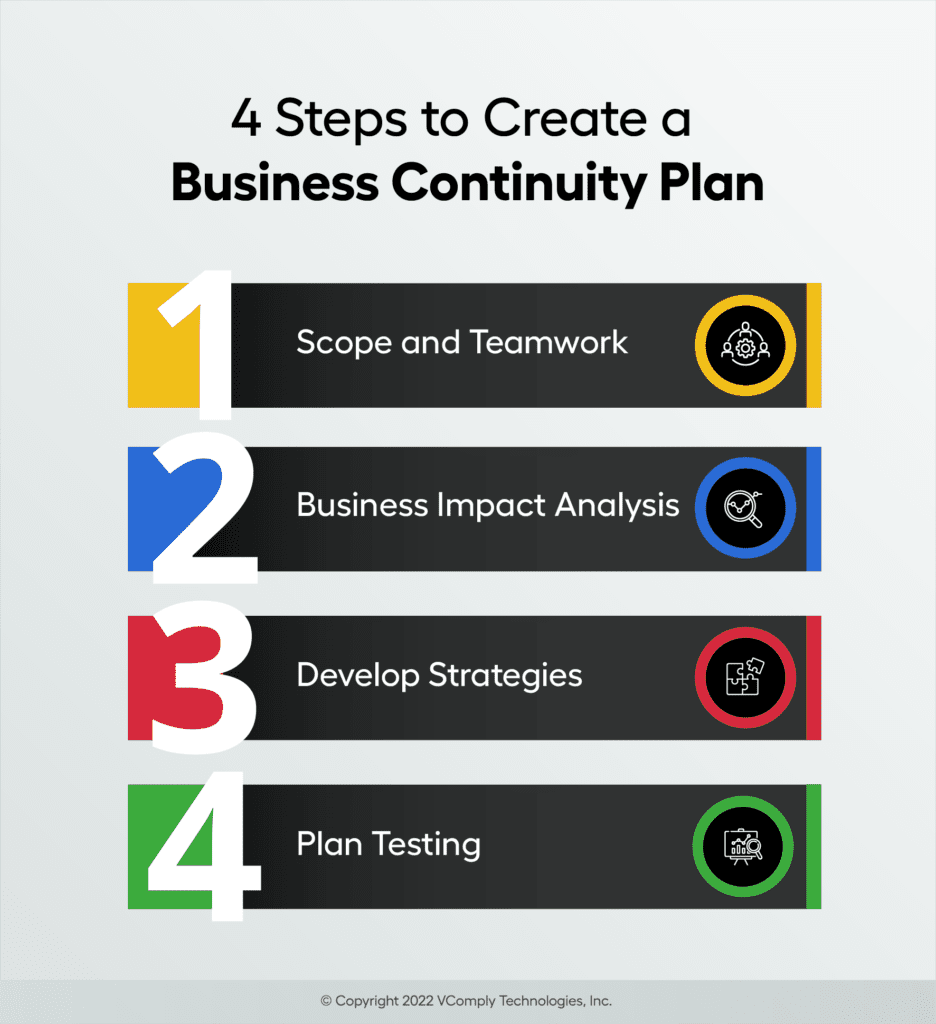

Business impact analysis, recovery, organization, and training are all steps corporations need to follow when creating a Business Continuity Plan.

Benefits of a Business Continuity Plan

Businesses are prone to a host of disasters that vary in degree from minor to catastrophic. Business continuity planning is typically meant to help a company continue operating in the event of major disasters such as fires. BCPs are different from a disaster recovery plan, which focuses on the recovery of a company's information technology system after a crisis.

Consider a finance company based in a major city. It may put a BCP in place by taking steps including backing up its computer and client files offsite. If something were to happen to the company's corporate office, its satellite offices would still have access to important information.

An important point to note is that BCP may not be as effective if a large portion of the population is affected, as in the case of a disease outbreak. Nonetheless, BCPs can improve risk management—preventing disruptions from spreading. They can also help mitigate downtime of networks or technology, saving the company money.

How To Create a Business Continuity Plan

There are several steps many companies must follow to develop a solid BCP. They include:

- Business Impact Analysis : Here, the business will identify functions and related resources that are time-sensitive. (More on this below.)

- Recovery : In this portion, the business must identify and implement steps to recover critical business functions.

- Organization : A continuity team must be created. This team will devise a plan to manage the disruption.

- Training : The continuity team must be trained and tested. Members of the team should also complete exercises that go over the plan and strategies.

Companies may also find it useful to come up with a checklist that includes key details such as emergency contact information, a list of resources the continuity team may need, where backup data and other required information are housed or stored, and other important personnel.

Along with testing the continuity team, the company should also test the BCP itself. It should be tested several times to ensure it can be applied to many different risk scenarios . This will help identify any weaknesses in the plan which can then be corrected.

In order for a business continuity plan to be successful, all employees—even those who aren't on the continuity team—must be aware of the plan.

Business Continuity Impact Analysis

An important part of developing a BCP is a business continuity impact analysis. It identifies the effects of disruption of business functions and processes. It also uses the information to make decisions about recovery priorities and strategies.

FEMA provides an operational and financial impact worksheet to help run a business continuity analysis. The worksheet should be completed by business function and process managers who are well acquainted with the business. These worksheets will summarize the following:

- The impacts—both financial and operational—that stem from the loss of individual business functions and process

- Identifying when the loss of a function or process would result in the identified business impacts

Completing the analysis can help companies identify and prioritize the processes that have the most impact on the business's financial and operational functions. The point at which they must be recovered is generally known as the “recovery time objective.”

Business Continuity Plan vs. Disaster Recovery Plan

BCPs and disaster recovery plans are similar in nature, the latter focuses on technology and information technology (IT) infrastructure. BCPs are more encompassing—focusing on the entire organization, such as customer service and supply chain.

BCPs focus on reducing overall costs or losses, while disaster recovery plans look only at technology downtimes and related costs. Disaster recovery plans tend to involve only IT personnel—which create and manage the policy. However, BCPs tend to have more personnel trained on the potential processes.

Why Is Business Continuity Plan (BCP) Important?

Businesses are prone to a host of disasters that vary in degree from minor to catastrophic and business continuity plans (BCPs) are an important part of any business. BCP is typically meant to help a company continue operating in the event of threats and disruptions. This could result in a loss of revenue and higher costs, which leads to a drop in profitability. And businesses can't rely on insurance alone because it doesn't cover all the costs and the customers who move to the competition.

What Should a Business Continuity Plan (BCP) Include?

Business continuity plans involve identifying any and all risks that can affect the company's operations. The plan should also determine how those risks will affect operations and implement safeguards and procedures to mitigate the risks. There should also be testing procedures to ensure these safeguards and procedures work. Finally, there should be a review process to make sure that the plan is up to date.

What Is Business Continuity Impact Analysis?

An important part of developing a BCP is a business continuity impact analysis which identifies the effects of disruption of business functions and processes. It also uses the information to make decisions about recovery priorities and strategies.

FEMA provides an operational and financial impact worksheet to help run a business continuity analysis.

These worksheets summarize the impacts—both financial and operational—that stem from the loss of individual business functions and processes. They also identify when the loss of a function or process would result in the identified business impacts.

Business continuity plans (BCPs) are created to help speed up the recovery of an organization filling a threat or disaster. The plan puts in place mechanisms and functions to allow personnel and assets to minimize company downtime. BCPs cover all organizational risks should a disaster happen, such as flood or fire.

Federal Emergency Management Agency. " Business Process Analysis and Business Impact Analysis User Guide ." Pages 15 - 17.

Ready. “ IT Disaster Recovery Plan .”

Federal Emergency Management Agency. " Business Process Analysis and Business Impact Analysis User Guide ." Pages 15-17.

:max_bytes(150000):strip_icc():format(webp)/BusinessPlanMeeting-570270145f9b5861953a6732.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Understanding Risk Management and Business Continuity Plans

- No Comments

We continue to urge all businesses and organizations to have a risk management plan . Further, what is termed a business continuity plan is also essential. However, many people confuse the two. True, they are related and typically work together to help keep organizations safe and, should an unfortunate incident occur, allows them to reopen and begin operating as quickly as possible. However, the two are not the same.

- A Risk Management Plan is about processes that are enacted before a disaster occurs. This means that a risk management plan is primarily concerned with protecting a business from risk by identifying potential vulnerabilities and defining a way to minimize their probability.

- On the other hand, a Business Continuity Plan is about processes that are designed to be enacted after a disaster has occurred. The goal of a business continuity plan is to maintain business operations after an actual disaster.

- Risk Management is primarily a strategic undertaking . It is focused on understanding and planning for a variety of hypothetical situations that could harm people, facilities, or data.

- A Business Continuity plan is tactical thinking . A business continuity plan focuses on the actual steps an organization can take after a business disruption occurs to get its operations up and running as quickly as possible.

Further, Nguyen offers the following advice to all those considering establishing or updating a current Risk Management or Business Continuity Plan:

- Conduct a business impact analysis to identify time-sensitive or critical business functions and processes and the resources that support them.

- Identify, document, and implement ways to recover critical business functions and processes.

- Organize a business continuity team and compile a business continuity plan to manage a business disruption.

- Conduct training for the business continuity team along with testing and exercises to evaluate recovery strategies and the plan.

“Finally, follow the guidelines put forth by ready.gov . This website offers solid, practical advice that every organization should follow, especially in today’s uncertain world.”

As you can see, there is quite a bit involved. Dealing with potential and unforeseeable risks and keeping a business operating should one occur is crucial for every organization. Many organizations attempt to put together a risk management and business continuity plan in-house. While these can be effective, this can be an extensive undertaking and not every organization has the resources to handle such a comprehensive task.

Furthermore, even when they do, they often need a fresh set of eyes to evaluate their situation. In today’s world, bringing in a fresh set of eyes such as Team-TAL Global or those at Prestige Analytics, Inc . can be one of the most effective and cost-saving steps any organization can take.

Click on the image below to request a review of your risk management/business continuity plans.

Search The Knowledge Center

Recent articles.

- Critical Infrastructure Services

- Public Venues Services

- Corporate Services

- Knowledge Library

- White Papers

- Monthly Insights

- The Case of the Misleading Business Partner

- The Case of the Mysterious Investor

- The Case of the Billion-Dollar Game

- The Case of the Traveling Executive

- TAL Global: Decoding the OSHA General Duty Clause for Business Leaders April 4, 2024

- April Spotlight: Unpacking The OSHA General Duty Clause – Insights For All Organizations April 2, 2024

- Security in Houses of Worship: How TAL Global Can Help March 28, 2024

- Conviction in Church Parking Lot Murder: What Can We Learn to Strengthen Houses of Worship? March 26, 2024

TAL Global HQ 1999 South Bascom Ave., Suite 700 Campbell, CA 95008 USA

408.993.1300 [email protected]

© 2024 TAL Global. All Rights Reserved. Website powered by Lightdrop .

- Public Venues

- Critical Infrastructure

- TAL Global Perspective Video: Why Emergency Preparedness is Essential for Businesses

- TAL Global Perspective: Threat Assessments to Address Workplace Violence

- TAL Global Perspective: THE WORLD WE LIVE IN CAN BE A DANGEROUS PLACE

- TAL Global Perspective: Risk Management and Mitigating Risks

- TAL Global Perspective: Did California’s Prop 47 Help or Hinder?

- TAL Global Perspective: Physical Security Management and Risk Assessment

- TAL Global Perspective: How to Prepare for the Legal Ramifications of Security Incidents

- Crime Prevention & Its Complexities in a Retail Environment

- Quick Takes on Retail Crime Prevention

- FBI Report: Retail Crime and Things WE Should Know About Retail Crime Prevention

- Become a TAL Global Insider

- Case Studies

© TAL Global, 2019

Firm Business Continuity Planning and Risk Mitigation Strategies

This is the third article of a risk management series and focuses on business continuity planning and risk mitigation strategies. The first article Eight Steps to Establish a Firm Risk Management Program covered the benefits and steps of establishing risk management program and the second Ten Steps to Successful Firm Risk Management highlighted 10 key steps for successful risk management.

The articles are a result of discussions at recent IFAC’s SMP Committee meetings, which involves practitioners from around the world sharing their perspectives and insights. In February 2019 SMPC meeting featured a session about the Japanese accountancy professions involvement in disaster recovery support and reconstruction activities following the earthquake in 2011 .

Japan is one of the few nations that has an active disaster recovery support for small- and medium-sized entities (SMEs). It is well recognized that SMEs are critical to every countries economy, for innovation, employment and contribution to GDP. Hence, the continuation and sustainability of SMEs during and after any natural disaster is vital.

The Guide to Practice Management for Small- and Medium-Sized Practices (the PM Guide) includes a whole module on risk management including: professionalism and ethics, client engagement, quality control and business continuity planning and disaster recovery. In addition, practitioners are encouraged to use a Good Practice Checklist for Small Business as a marketing or diagnostic tool to help them determine the advice a small business client may need, and also help them in managing their own business. It includes a section on Environmental Management Tasks highlighting the necessity for SMEs to have a contingency plan for an emergency or disaster and contains a checklist on “how to respond to emergencies”.

Developing a Business Continuity Plan

The key to business continuity planning and disaster recovery is to look at it as an entire function as whole and complete in itself. The most effective way to coordinate planning in this area is to include the various components required in one central document. This is called a Business Continuity Plan. The purpose of developing a Business Continuity Plan is to ensure the continuation of the firm during and following any critical incident that results in disruption to the normal operational capability of the firm.

The Business Continuity Plan is based on the Prevention, Preparedness, Response and Recovery (PPRR) framework:

Prevention is all about risk management planning (please see Eight Steps to Establish a Firm Risk Management Program). This is where the likelihood and/or effects of risk associated with an incident are identified and managed. The key elements of the risk management processes are implemented at this stage, with threats identified and dealt with, or reduced to an acceptable level.

The key tool for the Preparedness element is the Business Impact Analysis. This is where the key activities of the firm that may be adversely affected by any disruptions are identified and prioritized.

The key function of the Response element is Incident Response Planning. This plan outlines the immediate actions to be taken to respond to an incident in terms of containment, control and minimizing of impacts.

The Recovery section focuses on recovery planning. The purpose is to outline the actions that are to be taken to recover from an incident in order to minimize disruption and recovery times.

Another important element of the Business Continuity Plan is the concept of regular updates and review. It is hoped that the firm will never need to use the plan, but if the need ever arises, staff should know the plan is up to date with current details, information and resources. This is important, as it should reflect the changing needs of the firm.

Key items the plan should include:

- Distribution list: An up-to-date list should be maintained of the people who have been supplied with a copy of the plan and their contact details. Remember to keep a copy of the plan in a safe off-site location.

- References and related documents: Make a list of all the documents that have a bearing on the Business Continuity Plan.

- Undertake a risk management assessment of the firm;

- Define and prioritize the firm’s critical practice functions;

- Detail the immediate response to a critical incident;

- Detail strategies and actions to be taken to enable the firm to continue operating; and

- Review and update this plan on a regular basis.

Ten Risk Mitigation Strategies

Each firm should have risk mitigation strategies to prepare in case of death, loss or injury of a partner.

1. Document Sensitive Information

It is important to document and keep in a safe place critical information that is necessary for the effective running and operation of the firm. This information may include:

- Client agreements and arrangements;

- Employee agreements and arrangements;

- Supplier agreements and arrangements;

- Personal guarantees provided and to whom;

- Bank and finance arrangements;

- Lawyer’s name and contact details;

- Intellectual property residing within or developed by the firm; and

- Recommendations for ongoing management of the firm.

2. Maintain Adequate Insurance

It is important to maintain adequate insurance to cover the firm. It is prudent to ensure that the firm has adequate insurance to cover each partner and to provide the funds to pay out the estate for the partner’s share of the firm in the event of their death. The prudent firm will insure their key human assets just as they do their physical assets.

Important insurance coverage to hold includes:

- “Key person” insurance;

- Partnership/shareholder insurance (this provides for payment to the survivors of the partner); and

- Business equity insurance (it is important that the business equity insurance policy is supported by a “buy/sell agreement,” as discussed below).

3. Ensure there is a Valid “Buy/Sell Agreement”

If there are partners in the firm, it is important to ensure there is a legally drawn and valid “buy/sell agreement.” This outlines the terms and conditions agreed upon between the partners for the purchase or sale of their share in the firm. It should be confirmed that it has been reconciled with the partnership/shareholder insurance coverage to ensure there is no shortfall.

4. Inform Bankers and Suppliers

It is important to consider beforehand what might be the reaction of bankers, other lenders and suppliers to the death or incapacitation of a partner of the firm. For instance, would they be prepared to continue with their financial arrangements, or would they call up their debt? Consideration would need to be given to whether the firm has sufficient financial reserves to cover such a situation.

5. Ensure Adequate Training of Staff

Appropriate training should be provided to staff in the key areas of management and the operation of the firm so that it is not totally dependent on one partner. The PM Guide includes a whole module ‘ People Power: Developing a People Strategy ’, which covers leadership, managing and retaining employees, recognition, training and development.

6. Ensure Procedures Manual Written and Maintained

It is vital to the ongoing operation of the firm that a procedures manual has been prepared which fully documents the procedures, processes and operations of the practice. It needs to be maintained and kept current. This means the firm is able to continue to operate during the death or incapacitation of the practitioner until certainty as to its future is known. The procedures manual also becomes a key document in any valuation process which is undertaken, as it tends to add value to the firm by reducing reliance on one partner.

7. Ensure Job Descriptions are Completed

It is important that job descriptions have been completed for all roles within the firm and that each staff member is clear on the tasks they are to perform.

8. Undertake Regular Staff Appraisals

Regular staff appraisals allow staff to stay informed of their progress and development within the firm and provides the opportunity to provide feedback on their performance. It also provides the opportunity to advise the staff member of the steps that should be taken if a partner were to die or become incapacitated.

9. Partnership Issues

If there are partners within the firm, it is important they clarify what will happen in the event of either their death or their incapacitation.

10. Other Business Relationships

It is important to understand whether the untimely death or incapacitation of a partner would unduly affect any other business relationship that the firm has. There should be a documented succession and continuity plan in place.

Monica Foerster

Partner at Confidor, Chair of IFAC's SMP Advisory Group

Monica Foerster became Chair of the IFAC SMP Advisory Group (SMPAG) in 2017, after serving as its Deputy Chair. A SMPAG member since 2014, she was nominated by Conselho Federal de Contabilidade (CFC) and Instituto dos Auditores Independentes do Brasil (IBRACON). With 20 years of experience in the accountancy profession, Ms. Foerster is a partner at Confidor, an accounting, tax, and law firm with offices in Porto Alegre and São Paulo, Brazil.

Monica is currently a member of the Board of Directors of Ibracon Brazil (where she was the SMP Director and coordinator of the SMP Working Group for 6 years), and a board member at the Accounting Council (where she was also the coordinator of the Committee of Audit Studies (CRCRS) for 4 years.

Monica holds an MBA in financial management, controllership and audit from the FGV – Fundação Getúlio Vargas, Brazil, and a degree in accounting from the Universidade Federal do Rio Grande do Sul – UFRGS, Brazil.

Christopher Arnold

Christopher Arnold is a Director at the International Federation of Accountants (IFAC). He leads activities on contributing to and promoting the development, adoption and implementation of high-quality international standards, including the Member Compliance Program, Intellectual Property and Translations. Christopher is also responsible for IFAC’s SME (small- and medium-sized entities), SMP (small- and medium-sized practices) and research initiatives, which include developing thought leadership, public policy and advocacy. He was previously an Audit Manager for Deloitte and qualified as a professional accountant in a mid-tier accountancy practice in London (now called PKF-Littlejohn LLP). Christopher started his career as a Small Business Policy Adviser at the Association of Chartered Certified Accountants (ACCA).

How to Write a Business Continuity Plan Step-by-Step: Our Experts Provide Tips

By Andy Marker | October 21, 2020 (updated August 17, 2021)

- Share on Facebook

- Share on LinkedIn

Link copied

In order to adequately prepare for a crisis, your company needs a business continuity plan. We’ve culled detailed step-by-step instructions, as well as expert tips for writing a business continuity plan and free downloadable tools.

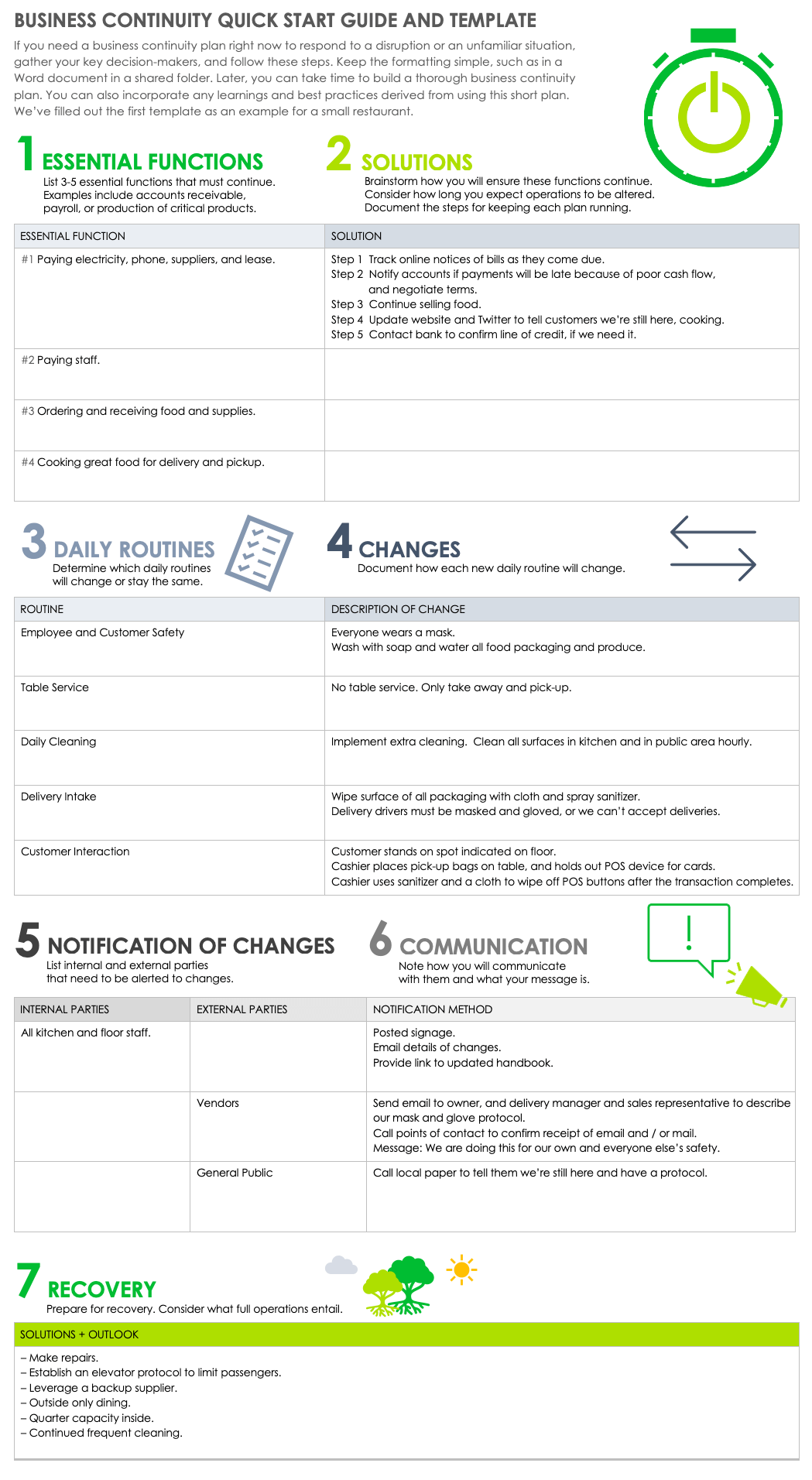

Included on this page, find the steps to writing a business continuity plan and a discussion of the key components in a plan . You’ll also find a business continuity plan quick-start template and a disruptive incident quick-reference card template for print or mobile, and an expert disaster preparation checklist .

Step by Step: How to Write a Business Continuity Plan

A business continuity plan refers to the steps a company takes to help it continue operations during a crisis. In order to write a business continuity plan, you gather information about key people, tools, and processes, then write the plan as procedures and lists of resources.

To make formatting easy, download a free business continuity plan template . To learn more about the role of a business continuity plan, read our comprehensive guide to business continuity planning .

- Write a Mission Statement for the Plan: Describe the objectives of the plan. When does it need to be completed? What is the budget for disaster and recovery preparation, including research, training, consultants, and tools? Be sure to detail any assumptions about financial or other resources, such as government business continuity grants.

- Set Up Governance: Describe the business continuity team. Include names or titles and role designations, as well as contact information. Clearly define roles, lines of authority and succession, and accountability. Add an organization or a functional diagram. Select one of these free organizational chart templates to get started.

- Write the Plan Procedures and Appendices: This is the core of your plan. There's no one correct way to create a business continuity document, but the critical content it should include are procedures, agreements, and resources.Think of your plan as lists of tasks or processes that people must perform to keep your operation running. Be specific in your directions, and use diagrams and illustrations. Remember that checklists and work instructions are simple and powerful tools to convey key information in a crisis. Learn more about procedures and work instructions . You should also note who on the team is responsible for knowing plan details.

- Set Procedures for Testing Recovery and Response: Create test guidelines and schedules for testing. To review the plan, consider reaching out to people who did not write the plan. Put together the forms and checklists that attendees will use during tests.

A business continuity plan is governed by a business continuity policy. You can learn more about creating a business continuity policy and find examples by reading our guide on developing an effective business continuity policy .

How to Create a Business Continuity Plan

Creating a business continuity plan (BCP) involves gathering a team, studying risks and key tasks, and choosing recovery activities. Then write the plan as a set of lists and guidelines, which may address risks such as fires, floods, pandemics, or data breaches.

According to Alex Fullick, your best bet is to create a simple plan. “I usually break everything down into three key categories: people, places, and things. If you focus on a couple of key pieces, you will be a lot more effective. That big binder of procedures is absolutely worthless. You need a bunch of guidelines to say what you do in a given situation: where are our triggers for deciding we’re in a crisis and we have to stop doing XYZ, and just focus on ABC.”

“Post-pandemic, I think new managers will develop more policies and guidelines of all types than required, as a fear response,” cautions Michele Barry.

Because every company is different, no two approaches to business continuity planning are the same. Tony Bombacino, Co-Founder and President of Real Food Blends , describes his company’s formal and informal business continuity approaches. “The first step in any crisis is for our nerve center to connect quickly, assess the situation, and then go into action,” he explains.

“Our sales manager and our marketing manager might discuss what’s going on, and say, ‘Are we going to say anything on social media? Do we need to reach out to any of our customers? The key things, like maintaining stock levels or what if somebody gets sick? What if there's a recall?’ Those plans we have laid out. But we're not a 5,000-person multi-billion-dollar company, so our business continuity plan is often in emails and Google Docs.”

“I've done planning literally for hundreds of businesses where we've just filled out basic forms,” says Mike Semel, President and Chief Compliance Officer of Semel Consulting . “For example, noting the insurance company's phone number — you know, on the back of your utility bill, which you never look at, there's an emergency number for if the power goes out or if the gas shuts off. We've helped people gather all that information and put it down. Even if there's no other plan, just having that information at their fingertips when they need it may be enough.”

You can also approach your business continuity planning as including three types of responses:

- Proactive Strategies: Proactive approaches prevent crises. For example, you may buy an emergency generator to keep power running in your factory, or install a security system to prevent or limit loss during break-ins. Or you may create a bring-your-own-device (BYOD) policy and offer training for remote workers to protect your network and data security.

- Reactive Strategies: Reactive strategies are your immediate responses to a crisis. Examples of reactive methods include evacuation procedures, fire procedures, and emergency response strategies.

- Recovery Strategies: Recovery strategies describe how you resume operations to produce a minimum acceptable level of service. The recovery plan includes actions to stand up temporary processes. The plan also describes the longer-term efforts, such as relocation, data restoration, temporary workaround processes, or outsourcing tasks. Recovery strategies are not limited to IT and data recovery.

Quick-Start Guide Business Continuity Plan Template

If you don’t already have a business continuity plan in place, but need to create one in short order to respond to a disruption, use this quick-start business continuity template. This template is available in Word and Google Docs formats, and it’s simply formatted so that you can focus on brainstorming and problem-solving.

Download Quick-Start Guide Business Continuity Plan Template

Word | PDF | Google Docs | Smartsheet

For other most useful free, downloadable business continuity plan (BCP) templates please read our "Free Business Continuity Plan Templates" article.

Key Components of a Business Continuity Plan

Your company’s complete business continuity plan will have many details. Your plan may differ from other companies' plans based on industry and other factors. Each facility or business unit may also conduct an impact analysis and create disaster recovery and continuity plans . Consider adding these key components to your business plan:

- Contact Information: These pages include contact information for key employees, vendors, and critical third parties. Locate this information at the beginning of the plan.

- Business Impact Analysis: When you conduct business impact analysis (BIA), you evaluate the financial and other changes in a disruptive event (you can use one of these business impact templates to get started). Evaluate impact in terms of brand damage, product failure or malfunction, lost revenue, or legal and regulatory repercussions.

- Risk Assessment: In this section, assess the potential risks to all aspects of the organization’s operations. Look at potential risks related to such matters as cash on hand, stock levels, and staff qualifications. Although you may face an infinite number of potential internal and external risks, focus on people, places, and things to keep from becoming overwhelmed. Then analyze the effects of any items that are completely lost or need repairs. Also, understand that risk assessment is an ongoing effort that works in tandem with training and testing. Consider adding a completed risk matrix to your plan. You can create one using a downloadable risk matrix template .

- Critical Functions Analysis and List: As a faster alternative to a BIA, a critical functions analysis reveals what processes are critical to keeping your company running. Examples of critical functions include payroll and wages, accounts receivable, customer service, or production. According to Michele Barry, with a values-based approach to critical functions, you should consider who you really are as a company. Then decide what you must continue doing and what you can stop doing.

- Trigger and Disaster Declaration Criteria: Here, you should detail how your executive management will know when to declare an emergency and initiate the plan.

- Succession Plan: Identify alternate staff for key roles in each unit. Schedule time throughout the year to observe alternates as they make important decisions and complete recovery tasks.

- Alternate Suppliers: If your goods are regulated (i.e., food, toy, and pharmaceutical manufacturing), your raw resources and parts must always be up to standard. Source suppliers before a crisis to ensure that regulatory vetting and approval do not delay supplies.

- Operations Plan: Describe how your organization will resume and continue daily operations after a disruption. Include a checklist with such items as supplies, equipment, and information on where data is backed up and where you keep the plan. Note who should have copies of the plan.

- Crisis Communication Strategy: Detail how the organization will communicate with employees, customers, and third-party entities in the event of a disruption. If regular communications systems are disabled, make a plan for alternate methods. Download a free crisis communication strategy template to get started on this aspect.

- Incident Response Plan: Describe how your organization plans to respond to a range of likely incidents or disruptions, and define the triggers for activating the plan.

- Alternate Site Relocation: The alternate site is the location that the organization moves to after a disruption occurs. In the plan, you can also note the transportation and resources required to move the business and the processes you must maintain in this facility.

- Interim Procedures: These are the critical processes that must continue, either in their original or alternate forms.

- Restoration of Critical Data: Critical data includes anything you must immediately recover to maintain normal business functions.

- Vendor Partner Agreements: List your organization’s key vendors and how they can help you maintain or resume operations.

- Work Backlog: This includes the work that piles up when systems are shut down. You must complete this work first when processes start again.

- Recovery Strategy for IT Services: This section details the steps you take to restore the IT processes that are necessary to maintain the business.

- Recovery Time Objectives (RTO) and Recovery Point Objectives (RPO): RTO refers to the maximum amount of time that a company can stop its processes and the length of time without access to data before productivity substantially drops. Determine RTOs for each unit, factoring in people, places, and things.

- Backup Plans: What if plans, processes, or resources fail or are unavailable? Determine alternatives now, so you don't have to scramble. Decide on a backup roster for personnel who are unavailable.

- Manual Workarounds: This section details how a business can operate by hand, should all failsafe measures break down.

- External Audit Details: For regulated organizations, external audits may be compulsory. Your scheduled internal audits will prepare you for external audits.

- Test and Exercise Plan: Identify how and when you will test the continuity plan, including details about periodic tabletop testing and more complex real-world scenario testing.

- Change Management: Note how you will incorporate learnings from tests and exercises, disseminate changes, and review the plan and track changes.

Key Resources for Business Continuity

To fix problems, restore operations, or submit an insurance claim, you need readily available details of the human resources and other groups that can assist with business continuity. (Your organization's unique situation may also require specific types of resources.) Add this information to appendices at the back of your continuity plan.

Fullick suggests broadening the definition of human assets. "People are our employees, certainly. But we forget that the term ‘people’ includes executive management. Management doesn't escape pandemics or the flu or a car crash. Bad things can happen to them and around them, too."

Use the following list as a prompt for recording important information about your organization. Your unique situation may require other types of information.

- Lists of key employees and their contact information. Also, think beyond C-level and response team members to staff with long-term or specialized knowledge

- Disaster recovery and continuity team contact names, roles, and contact information

- Emergency contact number for police and emergency services for your location

- Non-emergency contact information for police and medical

- Emergency and non-emergency contact numbers for facilities issues

- Board member contact information

- Personnel roster, including family or emergency contact names and numbers for the entire organization

- Contractors for any repairs

- Client contact information and SLAs

- Insurance contacts for all plans

- Key regulatory contacts.

- Legal contacts

- Vendor contact information and partner agreements and SLAs

- Addresses and details for each office or facility

- Primary and secondary contact and information for each facility or office, including at least one phone number and email address

- Off-site recovery location

- Addresses and access information for storage facilities or vehicle compounds

- Funding and banking information

- IT details and data recovery information, including an inventory of apps and license numbers

- Insurance policy numbers and agent contact information for each plan, healthcare, property, vehicle, etc.

- Inventory of tangibles, including equipment, hardware, supplies, fixtures, and fittings (if you are a supplier or manufacturer, include an inventory of raw materials and finished goods)

- Lease details

- Licenses, permits, other legal documents

- List of special items that you use regularly, but don't order frequently

- Location of backup equipment

- Utility account numbers and contact information (for electric, gas, telephone, water, waste pickup, etc.)

Activities to Complete Before Writing the Business Continuity Plan

Before you write your plan, take these preliminary steps to assemble a team and gather background information.

- Incident Commander: This person is responsible for all aspects of an emergency response.

- Emergency Response Team: The emergency response team refers to the group of people in charge of responding to an emergency or disruption.

- Information Technology Recovery Team: This group is responsible for recovering important IT services.

- Alternate Site/Location Operation Team: This team is responsible for maintaining business operations at an alternate site.

- Facilities Management Team: The facilities management team is responsible for managing all of the main business facilities and determining the necessary responses to maintain them in light of a disaster or disruption.

- Department Upper Management: This includes key stakeholders and upper management employees who govern BCP decisions.

- Conduct business impact analysis or critical function analysis. Understand how the loss of processes in each department can affect internal and external operations. See our article on business continuity planning to learn more about BIAs.

- Conduct risk analysis. Determine the potential risks and threats to your organization.

- Identify the scope of the plan. Define where the business continuity plan applies, whether to one office, the entire organization, or only certain aspects of the organization. Use the BIA and risk analysis to identify critical functions and key resources that you must maintain. Set goals to determine the level of detail required. Set milestones to track progress in completing the plan. "Setting scope is essential," Barry insists. "You need to define the core and noncore aspects of the business and the minimum requirements for achieving continuity."

- Strategize recovery approaches: Strategize how your business should respond to a disruption, based on your risk assessment and BIA. During this process, you determine the core details of the BCP, add the key components and resources, and determine the timing for what must happen before, during, and after a disruptive event.

Common Structure of a Business Continuity Plan

Knowing the common structure should help shape the plan — and frees you from thinking about form when you should be thinking about content. Here is an example of a BCP format:

- Business Name: Record the business name, which usually appears on the title page.

- Date: The day the BCP is completed and signed off.

- Purpose and Scope: This section describes the reason for and span of the plan.

- Business Impact Analysis: Add the results of the BIA to your plan.

- Risk Assessment: Consider adding the risk assessment matrix to your plan.

- Policy Information: Include the business continuity policy or policy highlights.

- Emergency Management and Response: You can detail emergency response measures separately from other recovery and continuity procedures.

- The Plan: The core of the plan details step-by-step procedures for business recovery and continuity.

- Relevant Appendices: Appendices can include such information as contact lists, org charts, copies of insurance policies, or any supporting documents relevant in a crisis.

Keep in mind that every business is different — no two BCPs look the same. Tailor your business continuity plan to your company, and make sure the document captures all the information you need to keep your business functioning. Having everything you need to know in an emergency is the most crucial part of a BCP.

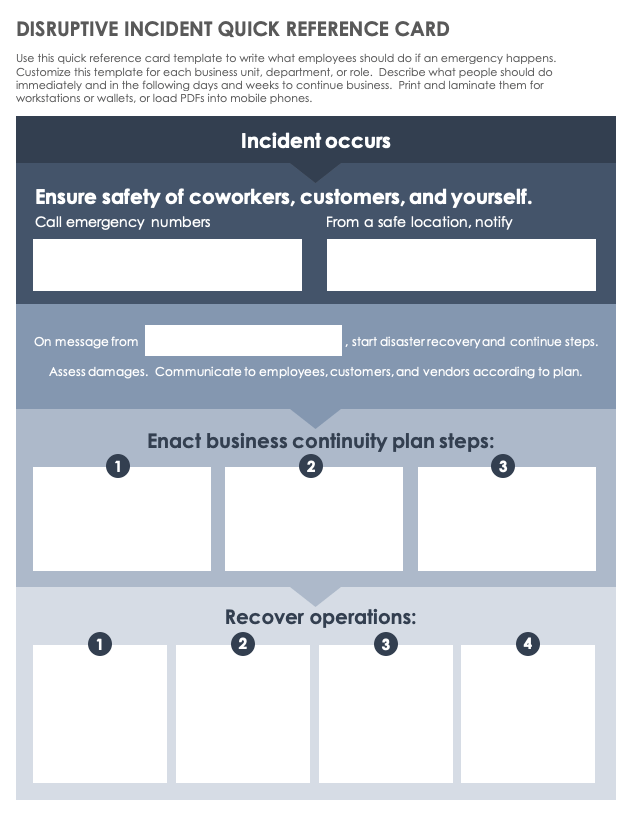

Disruptive Incident Quick-Reference Card Template

Use this quick-reference card template to write the key steps that employees should take in case of an emergency. Customize this template for each business unit, department, or role. Describe what people should do immediately and in the following days and weeks to continue the business. Print PDFs and laminate them for workstations or wallets, or load the PDFs on your mobile phone.

Download Disruptive Incident Quick-Reference Card Template

Expert Disaster Preparation Checklist

Business continuity and disaster planning aren’t just about your buildings and cloud backup — it’s about people and their families. Based on a document by Mike Semel of Semel Consulting, this disaster checklist helps you prepare for the human needs of your staff and their families, including food, shelter, and other comforts.

Tips for Writing a Business Continuity Plan

With its many moving parts and considerations, a business continuity plan can seem intimidating. Follow these tips to help you write, track, and maintain a strong BCP:

- Take the continuity management planning process seriously.

- Interview key people in the organization who have successfully managed disruptive incidents.

- Get approval from leadership early on and seek their ongoing championship of continuity preparedness.

- Be flexible when it comes to who you involve, what resources you need, and how you achieve the most effective plan.

- Keep the plan as simple and targeted as possible to make it easy to understand.

- Limit the plan to practical disaster response actions.

- Base the plan on the most up-to-date, accurate information available.

- Plan for the worst-case scenario and broadly cover many types of potential disruptive situations.

- Consider the minimum amount of information or resources you need to keep your business running in a disaster.

- Use the data you gather in your BIA and risk analysis to make the planning process more straightforward.

- Share the plan and make sure employees have a chance to review it or ask questions.

- Make the document available in hard copy for easy access, or add it to a shared platform.

- Continually test, review, and maintain your plan to keep it up to date.

- Keep the BCP current with organizational and regulatory changes and updates.

Empower Your Teams to Build Business Continuity with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Enterprise Risk Management vs. Business Continuity Management: What’s the Difference?

A lot of organizations that are just embarking upon their enterprise risk management journey have questions about the basic terminology involved. In this blog post, we want to tackle some basic terms that are often—incorrectly!—used interchangeably. Enterprise risk management vs. business continuity management: Let’s break it down.

How to define enterprise risk management and business continuity?

In our webinar with Sphera [formerly riskmethods] customer Clariant, we got asked a very interesting question from one of the participants: “What’s the difference between enterprise risk management and business continuity management?”

Great question. And, like most great questions, the answer is a little fuzzy.

At the end of the day, enterprise risk management and business continuity management are tightly linked. The best way to think about it is probably this: Enterprise risk management (ERM) is about processes that are enacted before a disaster occurs, because enterprise risk management is concerned with protecting a business from risk by identifying the existence of vulnerabilities and defining a way to minimize their probability.

Business continuity management (BCM), on the other hand, is about processes that are designed to be enacted after a disaster has occurred, because business continuity management is the process of maintaining business operations during or after an actual disaster, which is executed through the use of business continuity plans.

To put a different spin on it, let’s use a hiking analogy. Enterprise risk management is the part of the hike where you pack your survival kit full of flares—and business continuity management is the part of the hike where you shoot off those flares because you’ve broken your leg and can’t move.

The difference between ERM and BCM

One of the key differences between ERM and BCM is their approaches. Due to the preventive nature of ERM programs, enterprise risk management is a largely strategic undertaking—it’s focused on understanding and planning for hypothetical situations. Business continuity management, on the other hand, is much more tactical—it’s focused on the actual way that an organization should act when a business disruption occurs.

How ERM and BCM work together?

In many organizations, enterprise risk management and business continuity management are likely managed by the same team, since they’re so tightly intertwined—after all, it’s not possible to create a business continuity plan for a risk event if you don’t have a good sense of what risk events are likely to occur. By the same token, it’s not possible to adequately protect a business against disruption without a plan to address it when it happens. In other words: if your business has risk managers and business continuity managers, you better make sure they’re the best of friends.

But regardless of how your company is set up, here’s the bottom line: risk management and business continuity management are both critical functions if you want to keep your organization running. And although ERM and BCM are large topics that encompass a number of types of risk, a significant chunk of those risks have to do with your organization’s ability to produce its product—which is heavily impacted by your supply network.

riskmethods was acquired by Sphera in October 2022. This content originally appeared on the riskmethods website and was slightly modified for sphera.com.

Want to speak with an expert?

- Environment, Health, Safety & Sustainability

Operational Risk Management

Sustainability consulting, product stewardship.

- Productivity

- Sustainability

Copyright © 2022 Sphera. All rights reserved. / Cookies Policy / Privacy Policy / Terms of Use / Imprint

- Innovation, Information & Insights

ESG & Sustainability

- SpheraCloud

Environment, Health, Safety & Sustainability

Supply chain transparency.

- All Solutions

Sphera's integrated Environmental, Social, and Corporate Governance (ESG) solution aims to help companies achieve their sustainability goals. The scalable platform and personalized configuration pave the way for compliance, reporting and performance improvement. It brings together disparate data from systems, sensors, and human-derived activities to provide a normalized, real-time view of ESG performance.

Corporate Sustainability Product Sustainability Sustainability Consulting Health & Safety Management Chemical Management Supply Chain Sustainability

Connect more information and insights across your enterprise with Sphera’s innovative, integrated risk management platform. SpheraCloud® gets the right information to the right people at the right time, but also offers an Integrated Risk Management approach that breaks down information silos.

Corporate Sustainability Environmental Accounting Health & Safety Management Advanced Risk Assessment Control of Work Master Data Management Chemical Management Operational Compliance Supply Chain Sustainability Supply Chain Risk Management

EHS&S professionals can simplify compliance obligations and optimize performance across the enterprise with Sphera’s responsive, configurable and intuitive cloud-based EHS software platform built on deep domain and industry expertise.

Corporate Sustainability Environmental Accounting • Refrigerant Compliance Health & Safety Management Operational Compliance

Industry operators striving for Operational Excellence can rely on Sphera to help establish a unified, integrated, technology-driven strategy for control of work, risk assessment, supply chain risk management and master data management processes.

Advanced Risk Assessment • PHA-Pro • FMEA-Pro Control of Work Master Data Management • MRO Master Data

Enterprise procurement and sustainability leaders aiming for supply chain excellence can rely on Sphera’s comprehensive solution. It provides multifaceted insights, real-time risk monitoring, compliance management, and proactive supplier performance improvement to ensure unparalleled control and resilience across the supply chain.

Supply Chain Sustainability Supply Chain Risk Management

Safety, compliance and sustainability leaders can protect their employees, the environment and their bottom line with Sphera’s purpose-built software, industry-leading regulatory content, and our team of experienced Product Stewardship experts.

Chemical Management Government Services Product Compliance Product Sustainability • LCA for Experts Software • Managed LCA Content (Database) • LCA for Packaging

Industry leaders understand that increasing market pressure from investors, consumers and regulators requires a new approach to sustainability and trust Sphera’s team of consultants to support them with proven experience, technology and data, adapted to meet their unique ESG and sustainability goals.

Sustainability Strategy Guidance Sustainability Performance Improvement Sustainability Communication & Reporting Corporate Sustainability Software Product Sustainability Software

Use an Integrated Environmental, Social and Governance (ESG) performance and Risk Management approach to break down information silos and empower decision-making with powerful predictive and prescriptive capabilities. Sphera offers SpheraCloud as well as on-premise solutions to meet customers’ needs in the areas of Environment, Health, Safety & Sustainability (EHS&S), Operational Risk Management and Product Stewardship solutions.

Building & Construction

Chemicals & life sciences, manufacturing, metals & mining, oil & gas, energy & mobility, retail and consumer goods.

Integrate sustainability and risk management throughout the building and construction value chain so you can navigate the challenges posed by climate change, urbanization, resource scarcity and demographic shifts.

Advanced Risk Assessment Chemical Management Sustainability Health & Safety Management Product Compliance Master Data Management Supply Chain Risk Management Supply Chain Sustainability

Comply with complex regulations and proactively identify, connect and manage risk across the entire life cycle of your chemical and life sciences products, including R&D, engineering, distribution, sales and marketing and production.

Chemical Management Control of Work Sustainability Health & Safety Management Product Compliance Master Data Management Advanced Risk Assessment Supply Chain Risk Management Supply Chain Sustainability

Efficiently manage complex environmental regulations for the acquisition, handling and disposal of hazardous materials, when you connect information, innovation and insights to reduce risk and costs across your operations.

Government Services Sustainability

Manage quality and risk across the entire lifecycle of your products to mitigate costly errors and reduce operational complexities to keep your employees, your operations and your reputation safe

Advanced Risk Assessment Chemical Management Control of Work Sustainability Health & Safety Management Master Data Management Supply Chain Risk Management Supply Chain Sustainability

Find and mitigate risks that pose a threat to operations, employees or the community while meeting operating margin goals and responding to the new market dynamics driven by increased pressure for Sustainable Development.

Advanced Risk Assessment Control of Work Sustainability Health & Safety Management Master Data Management Supply Chain Risk Management Supply Chain Sustainability

Proactively manage risk, achieve compliance, drive sustainable performance and keep your people and assets safe with solutions that help consistently assess and manage risk across the enterprise and deliver an accurate view of system conditions.

Advanced Risk Assessment Sustainability Control of Work Health & Safety Management Master Data Management Supply Chain Risk Management Supply Chain Sustainability

Respond to regulatory requirements, lower operating margins, aging technology and new business models with technology that helps you understand and manage risk to improve operational efficiency and financial performance.

Meet increasing consumer demand for safe and sustainable products and reduce the risk of plant shutdowns and product recalls by connecting productivity, safety and sustainability risks across your enterprise.

Chemical Management Sustainability Health & Safety Management Master Data Management Supply Chain Risk Management Supply Chain Sustainability

- Solution Insights

- Regulatory Updates

- Our Approach to ESG

- Careers – English

- Customer Advisory Board

- Customer Care

- Begin Your ESG & Sustainability Journey

- Corporate Sustainability Software

- Environmental Accounting Software

- Health & Safety Management Software

- Operational Compliance

- Failure Mode Effects Analysis Software (FMEA-Pro)

- PHA-Pro Software

- Control of Work Software

- Master Data Management Software

- Supply Chain Sustainability

- Supply Chain Risk Management

- Chemical Management Software

- Hazardous Material Management for the U.S. Government

- Product Compliance Software

- Product Sustainability Solutions Software

- Sustainability Strategy Guidance

- Sustainability Performance Improvement

- Sustainability Communication & Reporting

- Spark Ideas

- Careers – English

Privacy Overview

Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features.

This website uses Google Analytics to measure content performance and improve our service.

- CFO Services

- Financial Assessment

- Controller Services

- Executive Search Services

- Executive Search Process

- Executive Search Team

- Executive Search Clients

- Retained Executive Search FAQs

- Submit Resume

- NonProfit CFO Services

- NonProfit Controller Services

- NonProfit Team

- NonProfit Clients

- Past Grantees

- Foundation Board

- In the News

- Contact Foundation

Testimonials

- Diversity, Equity and Inclusion

- Perspective

- Western Washington

- Oregon & SW Washington

- Eastern Washington

The CFO'S Perspective

Business continuity planning and risk management.

by CFO Selections Team , on Jul 9, 2020

One of your most important tasks as a business leader and manager is mitigating risk. Understanding what kind of risk exists, planning for the impact of this risk, and executing continuity plans to keep the organization operational during a disruption is of paramount importance. The earlier risk can be identified, assessed, managed, and integrated into strategic planning, the better.

Typically, this burden falls on the C-Suite, but leaders at all levels should be included in the planning stage to ensure buy-in across the company. According to CFO Magazine , CFOs have seen risk management fall under their umbrella more over the last decade. They explain,

“The CFO’s role has expanded in recent years, perhaps most notably in the area of risk management. Finance chiefs frequently took charge of assessing and guarding against risk during the financial crisis, and as the economy has slowly recovered, few have relinquished the task. More than half of the finance executives responding to CFO’s latest Deep Dive Survey say their responsibility for risk management has increased.”

Not much has changed in the years since, with CFOs taking more ownership of risk than ever before, whether they want to spearhead this role or not.

While it is easy to task an individual with overseeing risk management, ideally, it should not roll up to a single person. An emphasis on risk mitigation should be ingrained across the organization with alignment and compliance at every level. CFOs leading the charge can get their organizations on board to share the responsibility by taking a four-step approach to business continuity planning.

Identify Risk Factors

The cornerstone of risk management is identifying all possible risk scenarios. Knowing what kind of risk exists sets a foundation for business continuity planning. Risk can come from inside or outside an organization, and falls within four main areas:

- Financial Risk – The most apparent threat to a business is financial risk. Cash flow, regulatory guidelines, tax filings, fraudulent activity, lender obligations, contract stipulation, and other financial elements create dangers that all organizations need to navigate. Subsequently, these are the kinds of risks that businesses usually plan for first. However, these are, by no means, the only risks that your company may encounter.

- Operational Risk – Regardless of industry or size, a company’s operations will inherently be subject to their own risks as well. Employee turnover, manufacturing processes, materials costs, compliance requirements, and transportation logistics all provide places where risk can threaten your organization.

- Cyber Risks – Cyber risks can arise both internally and externally. Data leaks, trade secret disclosures, computer hacking, NDA breaches, and privacy infringements can pose severe risks to companies and their brands, especially in this heightened digital age. Even companies that outsource their IT functions are susceptible to cyber risk.

- Catastrophic Risk – Finally, no organization is immune to catastrophic risk. Things like natural disasters, pandemics, wars, violent acts, terrorism, embargos, and other unforeseen events can dramatically affect your business. Whether the catastrophe is a single-impact event like a fire inside a business or a widespread event like a global pandemic, these occurrences represent the worst - case scenarios for your company.

A CFO must help business leaders identify risk and understand the scope of these risks by classifying and triaging them to know how best to respond. Organizations accustomed to focusing solely on financial risk may need to be recalibrated to expand their risk horizon view.

Plan to Mitigate Risks

The goal is for a CFO to insure the business against adverse outcomes by planning for a wide variety of risk factors. Maintaining financial reserves is one of the best ways for organizations to protect themselves against not only financial risk, but also operational and catastrophic risks. As the financial head of the company, a CFO is uniquely positioned to manage this initiative. Additionally, a CFO has the skillset needed to model how the business will respond strategically to moderately or highly probable risks. Continuity planning will reduce your subsequent financial and operational impacts.

Continuously Monitor Risks

Reassess to update risk probabilities and impact scenarios periodically. While a CFO can oversee risk management, one person cannot be tasked with understanding every possible risk area when other individuals are closer to a threat. Widespread adoption of risk management enables continuous risk management, equipping your business to act swiftly when a possible risk turns into a reality.

Report and Track Risk Levels

Empower employees company-wide to identify possible risks and ensure the proper chain of command is in place to get information to analysts and key decision-makers quickly. When feedback is coming from employees on the front-line, take it seriously and track it to identify emerging trends. Where credible risk exists, weave it into your organization’s risk mitigation efforts, and give credit to the individuals or teams responsible for identifying it. Protect (and even reward) employees who report risk to encourage ongoing contribution at all levels.

Use our free financial risk assessment tool to understand where your organization stands. This assessment can help you develop a plan to manage business risk and mitigate its impact.

A financial risk assessment can make all the difference for your business. Preparing to take advantage of opportunities and eliminate potential landmines makes good business sense.

Get instant access to our free finance and accounting risk assessment here !

Related posts

Topics: Planning , Risk Management , Transition

Subscribe to Email Updates

Access free .

Most Recent Articles

"I felt we could completely trust your guidance as you’d really taken the time to understand us and our needs, at a very detailed level. Your insights and recommendations were so spot on, and I really appreciated the time you took to “get” what we needed. I’ve never had quite that experience with a search partner before and this was the best search experience I’ve had in a very long time. Thank you very much for closing out a very well executed, high quality search. We are beyond thrilled to have been able to attract a talent such as Kim, and you were a big part of that."

- Angie Peterson | CHRO | CAR∙TOYS Inc. & Wireless Advocates LLC

Read more >

Honored by:

View More >

FREE KPIs A Comprehensive Guide eBook

Insights to better understand key performance indicators.

FREE Finance & Accounting Risk Assessment

Get insights about your organization’s current level of risk

Recent News

Most popular articles, articles by tag.

- About Us (1)

- Accounting (11)

- Accounting Software (2)

- Accounting System (2)

- Accounts Receivable (4)

- Analysis (13)

- Artificial Intelligence (1)

- Assessment (5)

- Automation (2)

- Banking (3)

- Bankruptcy (1)

- Book Review (1)

- Bookkeeping (3)

- Budgeting (13)

- Business Controls (2)

- Cash Flow (20)

- CFO Responsibilities (31)

- CFO Selections (3)

- Change Management (17)

- client spotlight (1)

- Colorado (1)

- Community (1)

- Company Culture (9)

- Company Spotlight (1)

- Controller (5)

- Controller Responsibilities (3)

- Cost Allocation (3)

- COVID-19 (10)

- Cybersecurity (2)

- Data Analysis (2)

- Debt Management (2)

- Due Diligence (3)

- Economic Trends (11)

- Expenses (8)

- Finance (9)

- Financial Process (7)

- Financial Projections (9)

- Financial Reports (12)

- Financing (6)

- Forecasting (19)

- Funding (5)

- Hiring (30)

- Integrity (4)

- Interim CFO (11)

- Inventory Management (1)

- Invoicing (1)

- Leadership (55)

- Manufacturing (12)

- Mergers and Acquisitions (4)

- Metrics (1)

- Non Profit Organizations (28)

- Personal Development (5)

- Philanthropy (5)

- Planning (62)

- Portland (12)

- Profit Margin (3)

- Recruiting (27)

- Resources (3)

- Risk Management (20)

- Salaries (2)

- Search Services (7)

- Security (8)

- Service Providers (3)

- Staffing (16)

- Start-up (2)

- Strategy (21)

- Success Stories (2)

- Success Story (4)

- Supply Chain (3)

- Technology (6)

- This is Us (6)

- Transition (15)

- Trends (11)

- Vendor Management (1)

Articles by Author

- Alex de Soto (11)

- Alisha Gomez (1)

- Becky Todd (6)

- Bill Palmer (7)

- CFO Selections Team (133)

- Charlotte Morin (6)

- Dave Lenox (1)

- Dave Saporta (4)

- Eric Moore (4)

- Gary Christianson (2)

- Jacki Lorenz (1)

- Jeff Dunn (5)

- Jen Girard (2)

- Kevin Briscoe (11)

- Kevin Krieger (1)

- Kurt Maass (5)

- Larry Breitbarth (4)

- Larry Numata (4)

- Mark Westerheide (1)

- Michael Newsome (2)

- Nancy Smith (6)

- Roger Johnson (6)

- Scott Fowle (2)

- Sheri Ferguson (2)

- TheASPTeam (1)

- Todd Kimball (11)

- Tom Broetje (4)

- Tom Varga (2)

- USI Team (1)

- Valtas Group (1)

- Vega Tom (2)

Sign up for email alerts:

Recent articles.

CFO Selections ® LLC - Headquarters 3150 Richards Road Suite 150 Bellevue WA 98005 Home Office Seattle & Western Washington 206-686-4480 Fax: 425-588-3807

Oregon & SW Washington 1155 SW Morrison St. Suite #317 Portland, OR 97205 503-715-5117

Colorado 1550 Larimer St. Suite 244 Denver, CO 80202 720-572-8211

ASP Professional Accounting Services & Recruiting www.theASPteam.com Toll-Free (800) 931-6557

Valtas Group Guiding Leadership Transition for Social Enterprises www.valtasgroup.com 425-516-7888

Connect With Us

- Skip to right header navigation

- Skip to main content

- Skip to secondary navigation

- Skip to footer

Business Continuity and Crisis Management Consultants

Integration of Business Continuity and Enterprise Risk Management: A Guide

Explore strategies for the successful integration of business continuity and enterprise risk management.

August 17, 2023 By // by Bryan Strawser

Integration of business continuity and enterprise risk management has become crucial for organizations striving to manage risks effectively. As a seasoned professional, I have observed that aligning these two strategic processes can bolster the organization’s resilience against potential threats.

This article will explore how successful enterprise risk management (ERM) and solid business continuity plan work hand-in-hand to mitigate risks. You’ll learn about the benefits of integrating ERM with your broader business continuity planning, including improved decision-making capabilities and resource allocation.

We will also discuss establishing transparent governance by setting risk management roles, which is critical in ensuring accountability across all levels within an organization. A successful ERM program requires a standardized infrastructure for managing risks.

Furthermore, you’ll gain insights on developing unified strategies for managing different types of risks such as activating disaster recovery plans or implementing intelligent contingency routing plans based on built-in business rules. Lastly, we’ll explore ways to monitor and report progress regularly to ensure continuous improvement.

Benefits of Integrating Business Continuity and Enterprise Risk Management

In the contemporary corporate sphere, companies confront a plethora of hazards. But fear not. Integrating business continuity with enterprise risk management is like having a superhero duo that can save the day.

This dynamic duo creates a unified approach to managing risks, ensuring your business is as solid as a rock. With this comprehensive strategy, you can anticipate disruptions before they hit you like a ton of bricks and take action to minimize their impact.

A Comprehensive Approach Towards Risk Management:

- Better Visibility: By combining business continuity planning (BCP) with enterprise risk management (ERM), you’ll have the vision of a hawk, spotting potential threats and making informed decisions on handling them.

- Improved Efficiency: With a single integrated system, you’ll avoid the chaos of duplication and streamline your efforts in identifying, assessing, monitoring, and controlling risks. Efficiency, baby.

- Risk Mitigation: An integrated approach lets you identify risks and prioritize your response strategies based on their severity. Keep your critical functions running smoothly, even in the face of chaos.

This unified strategy is especially crucial in today’s digital age, where cyber threats are as common as a Kardashian selfie. According to IBM’s 2023 Cost of Data Breach Report , companies take an average of 280 days even to realize they’ve been breached. Yikes. That’s why having robust BCPs and effective ERM practices is more critical than ever.

To successfully integrate business continuity planning with enterprise risk management, you need a plan as solid as Dwayne “The Rock” Johnson. Establish clear roles and responsibilities, and make sure everyone’s on the same page about what constitutes a risk. We’ll dive deeper into this in our next section: Establishing Risk Governance.

Key Takeaway:

Integrating business continuity and enterprise risk management creates a powerful approach to managing risks, allowing organizations to anticipate disruptions and minimize their impact. This comprehensive strategy provides better visibility of potential threats, improves efficiency by avoiding duplication, and enables prioritized response strategies for risk mitigation in today’s digital age where cyber threats are prevalent.

Establishing Risk Governance

In a well-functioning organization, everyone knows their role in managing risks, from the C-suite to frontline employees. It’s like a well-choreographed dance but with fewer jazz hands.