Request a live demo presentation

One of our sales representative will call you soon

By submitting this form you are acknowledging that you have read and understood our Privacy Policy .

We have generated thousand of leads for our happy customers

Loading ...

Private limited company (Ltd.)

3 Shareholders View all shareholders »

Management consultancy activities other than financial management (70229)

Business Services Management Services Project Management Services Business management consultants Consulting

BUSINESS FINANCE OPTIONS LTD is a Private limited company (Ltd.) company based in EIGHT BELLS HOUSE 14 CHURCH STREET, United Kingdom, which employs 2 people. The company started trading on 15 May 1997. The company registration number is 03371200, It’s main line of business activity is Management consultancy activities other than financial management, and the company is listed as Active. According to the latest confirmation statements submitted on the 2021-05-31, there are currently 2 directors.

Contact information

This information is available only for subscribed users.

EIGHT BELLS HOUSE 14 CHURCH STREET , GL8 8JG , GLOUCESTERSHIRE , United Kingdom

United Kingdom

Financial statements of BUSINESS FINANCE OPTIONS LTD

According to BUSINESS FINANCE OPTIONS LTD latest financial report submitted on 2021-05-31, the company has a Cash of £292.00 , Total-Assets of £292.00 while the Working-Capital is -£4,014.00 . Compared with the previous year, the company reported a Cash decrease of -291.1% , which is an equivalent of 850 . At the same time, the Total-Assets went down by -291.1% , or by 850 .

Consolidated A/cs

For more information you can

Turnover 2021

Reporting period, working capital, profit after tax, business finance options ltd business credit report.

A Business Credit Report for BUSINESS FINANCE OPTIONS LTD is available for instant download. The report will provide you with a credit score and credit limit recommendation for BUSINESS FINANCE OPTIONS LTD , payment trends, if the company pays their Invoices on time, whether or not the company has any court judgements, ownership and group structure, up to 5 years of financial statements and much more. When you buy a Credit Report from Global Database, you will also have a 7 days free trial to our B2B Sales Platform.

BUSINESS FINANCE OPTIONS LTD

Get this credit report.

Unlock Credit Report

Key features

- Credit Score and Credit Limit

- Financial accounts for the past 5 years

- Credit Officers

- Document Filing history

- Corporate Ownership

- Outstanding & Satisfied Mortgages

- Shareholder Information

- Company Identity

BUSINESS FINANCE OPTIONS LTD Directors and key executives

BUSINESS FINANCE OPTIONS LTD currently employs 2 people. Compared with the previous year, the company has reported a staff increase of 0% , which is an equivalent of 0 employees. In order to view contact information, including emails and phone numbers for all the employees working at BUSINESS FINANCE OPTIONS LTD and to export them in XL or to your existing CRM, you can subscribe to our platform here .

Total Employee Count

Total employees, management level.

Get direct emails & phone numbers for senior executives working at «BUSINESS FINANCE OPTIONS LTD»

Get in touch with 2 of contacts working at BUSINESS FINANCE OPTIONS LTD

BUSINESS FINANCE OPTIONS LTD Shareholders

There are currently 3 people with significant control at BUSINESS FINANCE OPTIONS LTD . One of of major shareholders of BUSINESS FINANCE OPTIONS LTD is MR ADAM MCKENZIE WYLIE , which owns 30000 ORDINARY shares, with a total value of 30,000 GBP and HILARY DAVID LAURENCE BISHOP , which owns 100000 ORDINARY shares, with a total value of 100,000 GBP and SUSAN BISHOP , which owns 100000 ORDINARY shares, with a total value of 100,000 GBP .

BUSINESS FINANCE OPTIONS LTD competitors:

Top 5 similar companies of BUSINESS FINANCE OPTIONS LTD are VISTRA (UK) LIMITED , THE BIRCHMAN GROUP LIMITED , DIAMOND DIESELS INVESTMENTS LIMITED , DYBALL ASSOCIATES LIMITED , EVOLUTION COMPLETE BUSINESS SALES LIMITED . View and export all the competitor list of BUSINESS FINANCE OPTIONS LTD by upgrading your account here .

VISTRA (UK) LIMITED

The birchman group limited, diamond diesels investments limited, dyball associates limited, evolution complete business sales limited, business finance options ltd news & activities:.

BUSINESS FINANCE OPTIONS LTD number of employees has decreased by 0% compared with previous year and now represents a total number of 2.

uk.globaldatabase.com

Frequently Asked Questions regarding BUSINESS FINANCE OPTIONS LTD

Where is business finance options ltd registered office.

BUSINESS FINANCE OPTIONS LTD is located at EIGHT BELLS HOUSE 14 CHURCH STREET, United Kingdom.

What is the website of BUSINESS FINANCE OPTIONS LTD?

BUSINESS FINANCE OPTIONS LTD website is http://businessfinanceoptions.com

How many people work at BUSINESS FINANCE OPTIONS LTD?

According to the latest account statement, there are currently 2 of employees working for BUSINESS FINANCE OPTIONS LTD.

What is the Business Credit Score of BUSINESS FINANCE OPTIONS LTD and how reliable is the company?

In order to check the business credit score of BUSINESS FINANCE OPTIONS LTD, you can request a credit report. You will view the latest credit limit information, ownership, group structure, court judgements and much more.

Does BUSINESS FINANCE OPTIONS LTD pay their invoices on time?

By requesting a Business Credit Report for BUSINESS FINANCE OPTIONS LTD, you will be able to gain more insights about the BUSINESS FINANCE OPTIONS LTD payment trends.

Search for International Credit Report

Credit Rating and Limit Recomendations

5 years of financial statements

Directors and shareholders

Court Judgements

Global Group Structure

Trade Payment

Unlimited reports

Everything include in one report, plus

Unlimited credit reports download

Unlimited users

CRM Integration

Dedicated account manager

Select your package

- About Global Database Platform

- Our Data Contact Us Terms and Conditions

- F.A.Q. Privacy Notice Database Cookies Policy GDPR Processors

Follow us on:

- Book free demo Request a call

Registered address: Artisans' House, 7 Queensbridge, Northampton, Northamptonshire, United Kingdom, NN4 7BF, All rights reserved

Business Finance Options Ltd

- Last Updated: {page_last_updated}

- {company_category}

- Company No. 03371200

Comprehensive Business Report

- What's included in this report?

- Credit Scores & Limits

- CCJ's, Gazette Notices & Charges

- All Director and Secretaries Information

- 5 Year Financial Accounts

- Shareholders & Group Structure

- Contact Data & Trading Addresses

- 7 Day Money Back Guarantee

- Includes Downloadable Report [ View Sample ]

Stay updated with Business Finance Options Ltd

Upgrade to view Credit Score and Limit

Upgrade to view Shareholders

Upgrade to view Group Structure

BUSINESS FINANCE OPTIONS LTD

BUSINESS FINANCE OPTIONS LTD is an active private limited company , incorporated on 15 May 1997 . The nature of the business is Management consultancy activities other than financial management . The company's registered office is on Church Street, Tetbury . The company's accounts were last made up to 31 May 2022 , are next due on 29 February 2024 , and fall under the accounts category: Unaudited Abridged . BUSINESS FINANCE OPTIONS LTD previously had the company name GRACECHURCH CLASSICS LIMITED . The company has no mortgage charges, outstanding or otherwise.

Company Information

Registered office, confirmation statement, nature of business (sic codes), company name history.

- Current Director

- Gives occupation as DIRECTOR

- Usually resident in ENGLAND

- Current Secretary

Shareholders

- Owns between 25% and 50% of the shares.

- Holds between 25% and 50% of the voting rights.

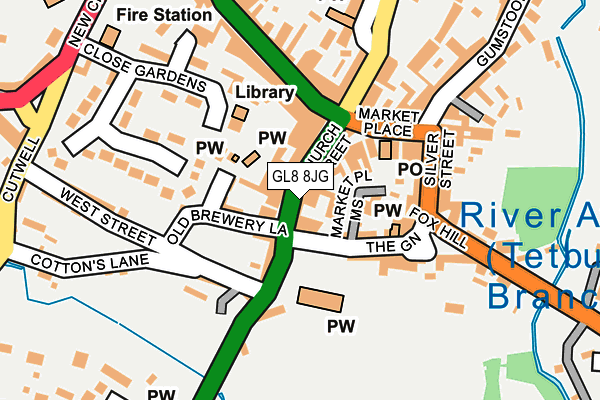

BUSINESS FINANCE OPTIONS LTD: Maps

Maps show the location of the postcode of the registered office, GL8 8JG.

More Companies in GL8 8JG

Other companies with registered offices in GL8 8JG :

- GL8 IMPERIAL LTD

- THORNBURY AND PEARCE LIMITED

- FREER CONSULTANCY LTD

- MOTOIVA LTD

- CAPTAIN'S HOUSE HOLIDAY LETS LIMITED

- EYE ON DESIGN AND ANTIQUES LIMITED

- PRECISION ASSET MANAGEMENT LIMITED

- PREMIER LEASING & FINANCE LIMITED

- MARK POLLARD HEATING SERVICES LIMITED

- KHPR LIMITED

- Contains OS data © Crown copyright and database right (2024)

- Contains Royal Mail data © Royal Mail copyright and Database right (2024)

- Contains National Statistics data © Crown copyright and database right (2024)

- Data produced by Land Registry © Crown copyright (2024)

- Contains Environment Agency data licensed under the Open Government Licence v3.0

- Everything else © GetTheData Publishing Limited (2024)

GetTheData.com is owned and operated by GetTheData Publishing Limited. Company Number: 11075184 · Registered in England and Wales. Registered Office: Advantage, 87 Castle Street, Reading, Berkshire, England, RG1 7SN

By accessing our site you agree to us using cookies, and sharing information about your use of our site, in accordance with our privacy policy .

Company Records Privacy Notice

BUSINESS FINANCE OPTIONS LTD

- Key Financials

- Directors & Secretaries

- Same Postcodes

Mortgages and Charges

Similar companies.

- Significant Control

Registered Names

BUSINESS FINANCE OPTIONS LTD are a long established Private Limited Company . They've been in business for 27 years. They operate in the Management consultancy activities other than financial management sector, the SIC for which is 70229. Their registered office is located in the 14 CHURCH STREET area of TETBURY.

Their legal country of registration is United Kingdom. Private Limited Companys are required to file accounts on an annual basis and their last set of accounts was made up until 31/05/2021. BUSINESS FINANCE OPTIONS LTD are next due to file for year 2024 by the 28/02/2023

Their status at Companies House is Active which means they are more than likely to be trading. Their unique company number is 03371200. Their legal form is that of a Private Limited Company

Geolocation

Cash has reduced from 2020 by -19.33%, the ratio of cash to net worth is -1.63% which indicates dependence on creditors.

Net worth has changed by £22,676 which is a reduction of -31.06% from 2020

The quick ratio of current assets to current liabilities at nan represents a Dependence on creditors, always consider the absolute level of cash at £818 when looking at this ratio

The number of employees has remained unchanged by 0 since 2020

Cash has increased from 2019 by 55.05%, the ratio of cash to net worth is -1.39% which indicates dependence on creditors..

Net worth has changed by £29,587 which is a reduction of -28.84% from 2020

The quick ratio of current assets to current liabilities at nan represents a Dependence on creditors, always consider the absolute level of cash at £1,014 when looking at this ratio

The number of employees has remained unchanged by 0 since 2019

Cash has increased from 2018 by 235.38%, the ratio of cash to net worth is -0.64% which indicates dependence on creditors..

Net worth has changed by £17,438 which is a reduction of -14.53% from 2020

The quick ratio of current assets to current liabilities at nan represents a Dependence on creditors, always consider the absolute level of cash at £654 when looking at this ratio

Directors and Secretaries

is the longest serving director having been a member of the board of BUSINESS FINANCE OPTIONS LTD for 0 years

Companies in Same Postcode

Companies in same postcode prefix, description.

Company number 03371200 overview of filed records at companies house for BUSINESS FINANCE OPTIONS LTD brought to you free by Reporting Accounts

Related Companies

There are no related companies

- BUSINESS FINANCE INTERNATIONAL LTD

- BUSINESS FINANCE MARKET LTD

- BUSINESS FINANCE MATCH LIMITED

- BUSINESS FINANCE NOW LTD

- BUSINESS FINANCE PARTNERS LIMITED

- BUSINESS FINANCE PLUS LIMITED

- BUSINESS FINANCE PROVIDERS LTD

- BUSINESS FINANCE RESOLUTIONS LTD

Persons with Significant Control

Business finance options ltd credit report and business information.

Keep on top of your suppliers, your customers and your own business using real-time company credit Reports. Our detailed company insights and rating allow you to make informed decisions and reduce counterparty risk.

From as little as £14.99

This will not impact your credit rating!

HOW AN FD CAPITAL PORTFOLIO FINANCE DIRECTOR WILL BENEFIT YOUR BUSINESS

The role of a CFO or FD is always evolving - but one aspect remains the same. They play an integral role in the daily running of an organization and work closly with every part of your business, from sales to operations.

- BUSINESS FINANCE OPTIONS LTD

Company Accounts

Annual return.

REGISTERED ADDRESS AT GL8 8JG

Armadillo bookkeeping limited.

EIGHT BELLS HOUSE, 14 CHURCH STREET, TETBURY

INCHBROOK GARAGE LIMITED

EIGHT BELLS HOUSE, 14 CHURCH STREET, TETBURY Fomerly known as: BATH ROAD MOT CENTRE LIMITED

GYDYNAP GARAGE LIMITED

EIGHT BELLS HOUSE, 14 CHURCH STREET, TETBURY Fomerly known as: BATH ROAD MOTOR SERVICES LIMITED

BERNARD ATKINS LIMITED

Canopy insight limited.

EIGHT BELLS HOUSE, CHURCH STREET, TETBURY Fomerly known as: NATALIE EDWARDS SEMIOTICS LIMITED

CHESTER HOUSE TETBURY MANAGEMENT LIMITED

FLAT 3 CHESTER HOUSE, 25 CHURCH STREET, TETBURY

COLETHROP PROPERTIES LIMITED

Compass technology services (2011) limited, cotswold wealth solutions ltd, business builder ltd.

UNIT 1 - BATH LANE MILL FRIARS MILL, BATH LANE, LEICESTER

BUSINESS INTELLECT LTD

CHEDZOY BUTTERWORTH, 2 CHARTFIELD HOUSE, TAUNTON

Management consultancy activities other than financial management

Obac uk limited.

UNIT 9 BERRY COURT FARM BRAMLEY ROAD, LITTLE LONDON, TADLEY Fomerly known as: !OBAC FITTINGS LIMITED

"1 C O LIMITED"

FANE COURT, GREEN ROAD SHIPBOURNE, TONBRIDGE Fomerly known as: LAWGRA (NO.572) LIMITED

"PURPLE EMPEROR" LTD

COOMBEHAYES FARM, WADLEY HILL, UPLYME Fomerly known as: PURPLE EMPEROR PRODUCTIONS LIMITED

'WERTARBEIT.LONDON' LIMITED

THE OLD RECTORY, CHURCH STREET, WEYBRIDGE

00 NIGEL LIMITED

10 HIGH GABLES 1 SCOTTS AVENUE, 1 SCOTTS AVENUE, BROMLEY

001 FORMATION AGENT LTD

3RD FLOOR 207 REGENT STREET, 207 REGENT STREET, LONDON

4 CEDAR COURT, PARKWAY PORTERS WOOD, ST. ALBANS Fomerly known as: CORPORATE COST CONSULTANCY LIMITED

02 MEDICAL LIMITED

ORTON HOUSE, TILE BARN, WOOLTON HILL, NEWBURY

04S SOLUTIONS LIMITED

MARSTON HOUSE 5 ELMDON LANE, MARSTON GREEN, SOLHULL

071 LIMITED

ABC ACCOUNT CENTRE, ONE VICTORIA SQUARE, BIRMINGHAM

About GBR Business

Business directories, uk company search, quick links.

You know your business, we know business finance

It takes minutes to apply, there’s no obligation, and it’s easy to use.

Match with 120+ Lenders

It’s free to apply and it doesn’t affect your credit score

Expert help throughout the process

Loans from £1000 to £20M

Tide business services

Access a host of free smart business tools today.

Connect your existing business bank account to Tide today to get access to a host of smart tools for free, including Invoicing and *Tide Accounting. All designed to help small businesses save time on their finance admin.

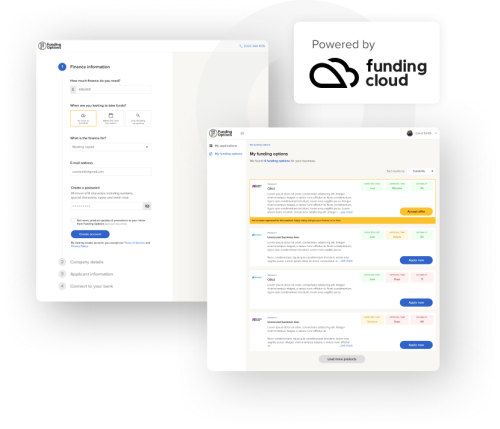

How does it work?

We break down funding barriers with a simple application process that empowers you. Our technology, Funding Cloud, accurately validates your business profile, matching you to the industry’s largest lender network. Funding results are uniquely tailored to each and every business.

Tell us how much you need

Tell us how much you need to borrow, what it's for and provide some basic information about your business.

Get an instant comparison

Our smart technology will compare up to 120+ lenders and match you with the right finance options for your needs.

Apply and get your funding

We'll help you through the process from application to receiving your funds.

Our products

Click below to find out more about each of our products

- Business Loans

Invoice Finance

Asset Finance

Property Finance

Commercial Mortgages

Working Capital

Business Cards

Financial product information

Representative example*

7.63% APR Representative based on a loan of £50,000 repayable over 24 months. Monthly repayment of £2,252.94. The total amount payable is £54,070.56

*Some lenders may apply fees during the application process, please note that these are set and provided by these entities.

Annual Percentage Rate

Rates from 2.75% APR

Repayment period

1 month to 30 years terms

funded to UK businesses

happy customers

All your business needs in one place

Connect your existing business bank account to Tide today to get access to a host of free smart tools.

Get paid faster using Tide’s free customisable invoice templates. it’s all set up for repeat use for you to invoice your customers with ease.

*Accounting

Automate your small business accounting and simplify your bookkeeping using Tide’s accounting software.

Green Finance initiative

Funding a greener future.

We’re driving sustainability into the SME lending market by connecting businesses to the funding they need to reach net zero.

Hear from our customers

Find out why they chose Funding Options

"Excellent first conversation, it made me feel like they might be able to do something for our business which was very positive. The person I spoke to was very helpful and explained the process in great detail."

"My small start up needed funding urgently to pay for inventory as sales increased suddenly. I got my loan within a week and at a great rate."

"Funding Options made everything so simple for us. They got us the funding we needed within a day, and it was a better deal than anyone else could give us. They also went above and beyond for us — they called the JCB dealer directly several times to make sure it was delivered in good time. They’re so on the ball!"

Our Partners

Our partners are some of the best in the industry. Together, we're able to help even more businesses access finance. If you're an accountant, consultant, broker or supplier with clients in need of our service, join our growing panel of partners today.

Want to know more?

Get in-depth information about financing your business.

Finance by type

Business loans

Invoice finance

Asset finance

Commercial property finance

Working capital finance

Revolving credit facilities

Merchant cash advances

Auction finance

Equipment finance

Trade finance

Structured Debt

Finance by situation

Loans for bad credit

Grow your small business

Dealing with late payments

Finance for non-homeowners

Refinance business debt

Business finance with a CCJ

Finance a tax bill

Mezzanine finance

How-to guides

Personal Guarantee

Buying property at auction

Overdraft alternatives

Managing cashflow

Tips for property developers

Secured vs. unsecured loans

Financing emergencies

Commercial loans

Bridging finance

Business Funding UK

Let us help you find the best business finance solutions in the market. We will guide you through the whole process and make sure you get the best deal.

- Terms of Service

- Treating Customers Fairly

- Cookies settings

- [email protected]

- 0333 344 1015

Disclaimer: Funding Options helps UK firms access business finance, working directly with businesses and their trusted advisors. We are a credit broker and do not provide loans ourselves. All finance and quotes are subject to status and income. Applicants must be aged 18 and over and terms and conditions apply. Guarantees and Indemnities may be required. Funding Options can introduce applicants to a number of providers based on the applicants' circumstances and creditworthiness. We are also able to make insurance introductions. Funding Options may receive a commission or finder’s fee for effecting such finance and insurance introductions. *Eligibility criteria apply - see Tide website for full details. Funding Options Ltd is incorporated and registered in England and Wales with company number 07739337 and registered office at 4th Floor The Featherstone Building, 66 City Road, London, EC1Y 2AL. © Funding Options Ltd · Authorised and Regulated by the Financial Conduct Authority · Reference Number 727867

- HR & Payroll

7 Business Financing Options—And When You Should Consider Them

66 percent of small firms report having financial difficulties, with 43 percent saying that paying operating expenditures is the biggest problem.

The saying you must spend money to create money often holds true in the world of entrepreneurship. You need to secure capital to launch your firm after you've produced a value proposition, discovered a market need, and developed an inventive business idea.

Keeping costs as low as possible is essential for business finance. You should also make sure that the money you invest is used to get direction on how to proceed.

Table of contents

What Is Financing for Businesses?

Why is it so challenging for small firms to obtain bank loans, who are financiers for startups, what are business cash advances, how should small businesses get ready to submit an application for alternative loan options, how can you identify choices for company financing, how to find a venture capitalist to finance your business, how to remain inspired throughout the financing process, mezzanine capital: what is it, what are the additional private funding options, what do small companies do before approaching investors, key takeaways.

- You'll undoubtedly need access to funds someday through business financing unless your company has Apple's balance sheet. Even a lot of large-cap businesses frequently look for cash to cover short-term needs.

- Finding an appropriate funding arrangement is crucial for small businesses. If you borrow money from the incorrect source, you risk losing a portion of your business or being subjected to repayment terms that will hinder your growth for many years to come.

Debt Financing: What Is It?

You probably know more about debt finance for your company than you believe. Do you currently have a mortgage or a car loan? These two are examples of debt finance. The same is true for your company, business financing options. The source of debt funding is a bank or another lending organisation. Although you might be able to get it from private investors, this is unusual.

Options for Small Business Financing

The process of starting your own business can be challenging but rewarding. While having a strong business strategy is essential for entrepreneurs, one of the most significant components a company needs to flourish is money, business financing options.

But for those with bad credit, financing a start-up or small business can be a challenging, protracted procedure, business financing options. Although there is no minimum credit score required to obtain a business loan, conventional lenders typically have a range they deem acceptable.

Consider an alternate loan if your credit is poor and you don't have any assets to pledge as security. This article examines the advantages of alternative lending, provides advice on how to finance your firm, and dissects small business funding methods.

Small firms find it challenging to obtain capital for a number of reasons. Banks want to lend to small businesses; they are not opposed to doing so, business financing options. However, conventional financial institutions have outmoded, labor-intensive lending procedures and regulations that are unfavourable to neighbourhood stores and small businesses.

Because many small firms requesting for loans are brand-new, it is more difficult to get capital because banks normally require at least a five-year profile of a healthy business (for example, five years of tax data) before making an offer.

Alternative funding - what is it?

Any strategy that allows business owners to raise funds without the help of conventional banks is known as alternative financing, business financing options. A funding option is typically considered an alternative financing technique if it is totally online-based. This term includes finance alternatives including crowdfunding, online lenders, and cryptocurrencies.

Options for financing a business outside of a typical bank

If your small business needs money but isn't eligible for a standard bank loan, you might be able to find the alternative financing you need from one of these lenders. The best financing solutions for new and small enterprises are listed here.

Institutions that finance community development

According to Jennifer Sporzynski, senior vice president for business and workforce development at Coastal Enterprises Inc., there are thousands of nonprofit community development finance institutions (CDFIs) across the nation that all offer capital to small business and microbusiness owners on reasonable terms (CEI).

Every week, a wide range of loan applications, many of them from aspirational startups cross Sporzynski's desk. As a mission-driven non-bank lender, we are aware from experience that many viable small businesses find it difficult to obtain the funding they require to launch, flourish, and grow.

Banks and lenders like CEI are different in a few respects. First off, a lot of lenders want a specific credit score, which disqualifies many companies, Business Financing Options. Banks will nearly always reject a business application if they detect bad credit. Credit scores are also considered by CDFI lenders, but in a different way, business financing options.

For instance, a borrower's accounting may be badly impacted by personal or family illness problems and job losses, yet each of those might be justified, Business Financing Options. Additionally, compared to a regular bank, CDFI lenders do not require nearly as much security. Lack of collateralized assets can be made up for in other ways, business financing options.

An external group known as venture capitalists (VCs) acquires a stake in a company in return for funding. The ownership to capital ratios are variable and typically determined by a company's valuation, Business Financing Options.

According to Sandra Serkes, CEO of Valora Technologies, this is an excellent option for companies who don't have physical collateral to serve as a lien to loan against for a bank. But it is only a fit if it has a proven high growth potential and a distinct competitive advantage, such as a patent or a captive audience, business financing options.

A VC offers advantages that go beyond financial gain. A VC relationship can give your company access to a wealth of information, connections in the industry, and a clear course for the future, Business Financing Options.

According to Chris Holder, CEO and founder of the $100 Million Run Group and author of Tips to Success, a lot of entrepreneurs lack the skills needed to grow a business, and even though they can make money through sales, understanding how to grow a company will always be a lost cause in the beginning. The finest thing is advice from an experienced investor group because mentoring is essential for everyone.

Partner financing

With strategic partner financing, a company from your sector invests in expansion in return for exclusive access to your resources, personnel, distribution rights, final sales, or some combination of those. This choice is typically disregarded, according to Serkes, business financing options.

Although it occasionally can be royalty-based, where the partner receives a portion of every product sale, strategic funding acts like venture capital in that it is usually an equity sale - not a loan, the expert continued.

The company you partner with is typically going to be a significant corporation and may even be in a comparable industry or an industry with an interest in your business, so partner financing is a viable choice, business financing options, Business Financing Options.

If your product or service is a compatible fit with what they already offer, which would surely be the case or there would be no incentive for them to invest in you, then you can immediately tap into the larger company's relevant customers, salespeople, and marketing programming, according to Serkes.

Angel investors

- There is one noticeable difference between angel investors and venture capitalists that many people overlook. An angel investor is a person who is more likely to invest in a startup or early-stage business that might not have the verifiable growth a VC would expect, as opposed to a venture capital firm, which is typically a large and established organisation that invests in your business in exchange for shares.

Similar to receiving investment from a VC, but on a more personal level, finding an angel investor can also be beneficial, business financing options.

According to Wilbert Wynnberg, a businessman and speaker based in Singapore, not only will they supply the finances, [but] they will typically coach you and assist you along the route. Keep in mind that borrowing money just to lose it later serves no purpose. These seasoned business people will end up saving you a tonne of cash.

Factoring or financing invoices

When you use invoice finance, sometimes referred to as factoring, a service provider advances you cash on your unpaid accounts receivable, which you pay back once consumers have paid their invoices. By doing this, you can ensure that your company has the cash flow it needs to function while you wait for clients to settle outstanding invoices, Business Financing Options.

These improvements, according to Eyal Shinar, CEO of Fundbox, a small business cash flow management startup, enable businesses to reduce the pay gap between billed work and payments to suppliers and contractors, business financing options, Business Financing Options.

Companies can accept new projects more rapidly if the salary gap is closed, according to Shinar. By assuring consistent cash flow, they hope to assist business owners in expanding their enterprises and adding additional employees.

Crowdfunding

Small enterprises may benefit financially from crowdsourcing on websites like Kickstarter and Indiegogo. Instead of looking for a single investment source, these platforms enable businesses to pool small investments from a number of individuals, business financing options.

Igor Mitic, co-founder of Fortunly, said: As an entrepreneur, you don't want to spend your investment alternatives and raise the danger of investing in your business at such a young age. You may raise the initial capital needed to get your firm through the development stage and prepared to pitch investors by using crowdsourcing.

Funds The government may award grants to companies that are involved in science or research. Grants are available through the Small Business Innovation Research and Small Business Technology Transfer programmes of the U.S. Small Business Administration (SBA). Grant recipients must have a strong chance of commercialization and meet federal research and development goals.

Market-based or peer-to-peer lending

Peer-to-peer (P2P) lending is a method of raising finance that connects lenders and borrowers via different websites. Two of the most well-known P2P lending platforms in the United States are Lending Club and Prosper, Business Financing Options.

According to Kevin Heaton, CEO and founder of i3, in its most basic form, a borrower registers an account on a peer-to-peer website that keeps records, transmits cash, and connects borrowers to lenders.

P2P lending, in particular given the post-recession credit market, can be a strong funding alternative for small businesses, according to the SBA. The fact that P2P financing is only accessible to investors in a few states is one disadvantage of this method.

This type of financing, made feasible by the internet, is a cross between marketplace lending and crowdsourcing. When platform lending initially appeared on the market, it enabled those with limited working capital to lend money to peers.

Years later, with their expanded activity, big businesses and banks started to supplant true P2P lenders, Business Financing Options. The phrase marketplace lending is more frequently used in nations with more established financial sectors.

Convertible debt

Convertible debt is when a company borrows money from a group of investors with the understanding that the debt will eventually be converted to equity.

According to Brian Cairns, CEO of ProStrategix Consulting, Convertible debt can be a terrific method to finance both a startup and a small firm, but you have to be comfortable with giving some control of the business to an investor. Until a specific date or an event that triggers an option to convert, these investors are promised a certain rate of return each year.

According to Cairns, another advantage of convertible debt is that it doesn't restrict cash flow while interest is accruing during the bond's duration. This sort of funding has the disadvantage that you give up some ownership or control of your company, Business Financing Options.

In terms of cost and structure, a merchant cash advance is the antithesis of a small company loan. Cash advances are a rapid way to get money, but due to their hefty costs, they should only be used as a last option. Check with your supplier to see if this might be a source of funding to consider since many of the best merchant services provide this option.

According to Priyanka Prakash, a Fundera loan and credit expert, a merchant cash advance is when a financial institution gives a lump-sum amount of finance and then purchases the rights to a portion of your credit and debit card transactions. The provider takes a tiny percentage of each credit or debit card sale the merchant performs until the advance is repaid, business financing options.

While it can seem easy, cash advances can be very expensive and problematic for your company's cash flow, according to Prakash business financing options. Only then should you think about this choice if you don't meet the requirements for a small company loan or any of the alternatives mentioned.

Small loans known as microloans (or microfinancing) are granted to business owners who have little or no collateral. Microloans primarily cover operational expenditures and working capital for equipment, furnishings, and supplies, while they may include restrictions on how you can use the funds, business financing options.

With microloans ranging from $2,000 to $250,000, Kabbage is one example of a small business microlender; read more about it in our Kabbage review. SBA microloans managed by nonprofit organisations are another illustration.

The advantages of nontraditional lending

According to Serkes, there are a few significant advantages for startups when obtaining capital from an unconventional source. She thinks that when a business owner uses alternative financing, they have a strong, committed partner who can connect them to new customers, analysts, media, and other relationships.

Market credibility: Working with a reputable investor gives the business the opportunity to borrow some of the reputation that the strategic partner has developed.

Help with infrastructure: The bigger partner probably has departments for marketing, IT, finance, and HR, all of which a startup may borrow or use at a discount, business financing options.

General business advice: As part of the investment, it's possible that the strategic partner will join your board. Keep in mind that they have a wealth of business expertise, making their counsel and perspective priceless.

A strategic partner is unlikely to be heavily involved in the startup's day-to-day operations because they still have their own businesses to run. They often only need periodic check-ins on your firm, such monthly or quarterly updates.

To succeed, every firm needs working money. Startup businesses are prone to failure without the proper business funding choices. It may seem impossible to avoid using a typical bank loan, but entrepreneurs have access to a wide range of small company funding solutions.

The likelihood that your firm will endure over the long term is increased by collecting the appropriate market data and putting into practise the best financing solution for your organisation.

Filling out an application is only one part of the funding application process. Small business entrepreneurs should conduct their research and have a plan in place to improve their chances of receiving financing, business financing options.

Be aware of how much you must borrow beforehand. When you apply for alternative business loans, you'll probably discover that there are many various loan amounts accessible, business financing options. Avoid taking out more debt than you really need to because there could be fees associated with early repayment or not making use of the entire amount.

Create a company strategy with projected financials. Although not all alternative financing sources will insist on seeing your business plan, many do, so you should start putting one together right away.

Do market research and understand the business environment in your sector. In expanding industries, lenders might be more likely to approve borrowers.

As a result, if you can demonstrate why your industry or target market is ideal for your company's growth and success, make sure to address this in your application, business financing options. Additionally, it exhibits your expertise as a business thinker and entrepreneur.

Understand your credit score

Even if your business is well-positioned for quick growth and you're making progress on loan repayment, a credit score below a particular threshold frequently results in an immediate disqualification for loan applications, business financing options. Before requesting funding, find out your credit score and take steps to raise it if it is too low.

Meet with a small business specialist and go to SBA-sponsored training. You shouldn't make this decision alone, as you should with any crucial small business choice, business financing options. Get advice from professionals and training on how to submit winning financing applications to grow your business.

Since lenders will also be looking at this data, you should build a strong online presence for your small business and pay attention to how it appears online, business financing options. Online review platforms like Yelp, Angie's List, and TripAdvisor provide an overview of your operations and act as a gauge for the health of your company as a whole. Social media ties with customers and social connections can influence a lender's choice to extend credit.

Finding funding for your startup can quickly become a full-time job. Financing is essential to the success of any firm, but it can take a lot of time, including networking with investors and other founders.

However, you may take significant steps toward funding your business by engaging with the appropriate investors and spending the time to craft a focused proposal. It will be challenging, but if you are thorough in your search, you can set yourself up for success.

Casey Berman, managing director of VC firm Camber Creek, asserts that the warm introduction is the secret to getting finance as a business. Entrepreneurs can try to uncover opportunities by looking within their own network, according to Berman, business financing options.

While there are some obvious options here, such as friends and family or other startup founders, it's also critical to take into account the professional services your business uses, business financing options. He explained that if you, for instance, work with a legal advisor or public relations firm, they might be able to assist you in finding money.

The secret, according to Berman, is to collaborate with a business that offers value to your enterprise, whether it's an investment firm or a payroll processing provider.

The friendly introduction actually goes a lot further than any other possible route, he claimed. The first place a company turns to try to get access to venture capital and a friendly introduction should unquestionably be any professionals who are around the company.

This is how you can set your startup apart from the competition. The greatest way to provide your firm with the support it needs is to create a network of people who can lift it up, business financing options.

Because venture capitalists have extremely precise investment plans, want to invest for three to five years, and may want to be involved in your company's operations and choices, they may be the hardest to attract, business financing options. Additionally, VCs typically like to invest sums greater than a few million dollars.

The majority of firms receive early seed money from close friends and relations, angel investors, or accelerators. When looking for longer-term finance after moving passed this stage, it's critical to approach VC firms properly. Finding the appropriate investor for the stage your organisation is in, according to Kisch, is essential business financing options. There are a lot of venture capital businesses, so carefully consider your company and the best investors.

The greatest approach to have a successful connection, in Kisch's opinion, is to find the right investor who is at the proper stage for where your company is but [that] also has some exposure to the environment that you're going to be in.

It's time to establish a formal process once you've created a shortlist of venture capitalists (VCs) who invest in your industry and can offer the amount of coaching and additional value you're looking for, business financing options.

Berman advises spending one to two weeks attempting to make that initial contact with the company after you have your list in hand. After making contact, keep the business informed of any business advancements and other details that might be important to that investor, business financing options.

You may cultivate relationships with investors by having this constant conversation. You'll have to pitch the VC firms you've been in frequent contact with when it comes time to raise funds.

In order to locate the ideal partner, Berman advised, the CEO really needs to commit to raising money and executing what's called a roadshow to get in front of a big number of venture funds.

Plan ahead, said Berman, as the entire process from the first conversations to the final deal could take anywhere between 60 and 90 days, if not longer, business financing options. Additionally, he advised searching for money far in advance of your company's requirement.

The motivational factor plays a significant role throughout this procedure. Rejection is a necessary part of the path for a startup. Although it can be challenging, maintaining motivation during challenging times will be essential to the success of your company, business financing options.

Kisch has worked with several startups and has participated in five rounds of investment. He mentioned that he sought to have low expectations throughout the screening process so that rejection wouldn't overwhelm him as one thing that had been beneficial for him. Kisch views rejection as a necessary step in the process rather than a sign of failure.

He advised thinking of it this way: You're not being rejected because your concept or product is poor; rather, it can be somewhat enhanced, or you lack the expertise to present it in the most persuasive manner, business financing options. This prevents pressure from building up while keeping the responsibility in your hands. Everything is a labour in progress, and even the most prosperous businesses today formerly faced difficulties.

Investing in private equity for small businesses

According to Brian Cairns, CEO of ProStrategix Consulting, the first step for small businesses considering their financing alternatives is to differentiate between debt and equity funding. In contrast to equity funding, which is buying a stake in the company or a portion of the earnings, debt financing involves taking out a loan, business financing options.

Securing funding is particularly appealing for many entrepreneurs because it leaves no liabilities on the balance sheet. The main benefit of equity financing, according to Cairns, is that it has little to no impact on cash flow. Giving up some company control is the primary drawback.

In essence, private funding sources are non-bank lending sources. Family members, angel investors, venture capitalists, or private lending organisations can all be considered. It is a source of funding that a business owner can use to finance operations, expand their company, and take care of cash flow requirements. Small enterprises that might not normally be eligible for a bank loan benefit from the assistance of private finance sources.

Venture capital

Venture capital (VC) companies make financial investments in start-ups, typically in return for stock in the business. Before investing in a portfolio firm, venture capitalists evaluate business strategies, financial statements, and other financial information to estimate the overall expected return on investment.

Since VC firms often want to exit within five years, companies are more likely to obtain venture financing if they have an immediate possibility for growth, according to Cairns. They seek quick expansion since it will increase valuation.

Due to the significant risk associated with such fast-growing businesses, VCs demand a substantially larger return on investment from their portfolio companies than do other private equity firms.

Additionally, venture capitalists frequently offer mentoring, access to sales networks, and other development possibilities to start-up businesses.

Searching for more than just money is crucial if a company is looking for private capital, Berman added. The money may be more expensive in many cases than bank debt. However, the benefits of such cooperation much outweigh the disadvantages of a low interest rate.

Working with a VC firm has the drawback of requiring you to give up a portion of your company, just like any lender seeking equity does. Additionally, it implies that when your company develops and changes, you will have a third party to answer to.

Angel or seed funding

Angel investors finance companies in a similar manner as venture capitalists, typically in exchange for shares in the business. However, unlike venture capitalists, angel investors are private individuals who put their own money into the business.

Angel investors are better suited for slow-growth businesses since they have various ROI needs based on their level of risk tolerance. On the other hand, according to Berman, some venture capitalists anticipate annual growth of 100%.

An angel investor will arrange a deal differently than a venture capitalist, a private equity firm will structure a deal differently than an angel investor, and so on.

- Consider what it would be like to be the lender for a time. The lender seeks to obtain the greatest possible return on its investment with the least amount of risk. Debt financing has the drawback that the lender is not rewarded for the company's performance.

- It assumes the risk of default in exchange for nothing more than its money back with interest. By investing standards, that interest rate will not offer a particularly strong return. It's likely to provide returns in the single digits.

The best aspects of equity and debt financing are frequently combined in mezzanine capital. Debt capital typically offers the lending institution the right to convert the loan into an equity interest in the firm if you do not repay the loan on time or in whole, though there is no defined framework for this sort of business financing.

Off-Balance Sheet Financing

Consider your own financial situation for a moment. What if you found a way to establish a legal entity that removes your credit card, school loan, and auto loan debt while you were applying for a new home mortgage? Businesses are able to do that.

Financing that is off-balance sheet is not a loan. It primarily serves as a means of keeping significant investments (debts) off a company's balance sheet, making it appear stronger and less indebted.

For instance, if a business required expensive equipment, it might lease it rather than buy it or set up a special purpose vehicle (SPV) ,one of several alternative families that would carry the acquisition on its balance sheet. In order to make the SPV appear appealing in the event that it needs a loan to service its debt, the sponsoring firm frequently overcapitalizes the SPV.

Family and Friends' Support

If your finance requirements are modest, you might wish to start by looking at less formal lending options. Family members and close friends who support your company can provide favourable and clear repayment terms in exchange for creating a loan model that resembles some of the more formal types. For instance, you might give them equity in your business or repay them through a debt financing arrangement in which you make recurring payments with interest.

Personal investment: Some business owners might prefer to avoid taking on debt; instead, they utilise their savings (or sell an asset like a car) to get started. Some people dip into their retirement funds. It can be dangerous to use your own savings because you could lose them all if your business doesn't work out, business financing options.

Family and friends: Financial support from family or friends may come in the form of a gift, a loan, or an equity position in your company. But be cautious. If the investment doesn't work out or you can't pay back the loan, it could lead to enduring conflict with your loved ones.

Term loans and lines of credit are popular with small business owners. With a term loan, you make a fixed monthly payment to a bank, credit union, or online lender, business financing options. With a line of credit, you can draw money as you need it. How much money you can borrow and at what interest rate depends on your credit rating, number of years in business, and sales volume.

Crowdfunding: Entrepreneurs can raise money for their ideas on a number of crowdfunding websites. On websites like Kickstarter or Indiegogo, investors put money up front in exchange for their assistance in bringing products to market, business financing options.

Typically, the businesses give incentives in exchange for contributions. Although crowdfunding won't make you rich, it can also be used to gauge public interest in your idea.

Alternative financing: Small business entrepreneurs have access to other private funding options from lenders besides term loans and lines of credit. Microloans and merchant cash advances are further choices, business financing options.

Lenders provide money to a business owner in exchange for future sales through a merchant cash advance. Microloans are small loans for businesses that aren't likely to be approved by banks and other traditional lenders. They typically range from $50,000 to under $50,000.

Advantages and disadvantages of private funding:

The use of private lenders has both benefits and drawbacks. Although you might have quicker access to money, the interest rate might be higher, and your payment schedule might be difficult, business financing options.

Advantages of private financing: Small firms benefit greatly from private funding sources' more lenient lending criteria and prompt funding.

The money arrives in your hands much quicker than with bank loans. Bank loans often have drawn-out approval procedures. Usually, private funding choices don't follow the same rules, business financing options.

The additional advantage of being able to seek guidance from individuals who have seen it all exists if you use a venture capitalist or angel investor. Angel and venture capitalist investors frequently have extensive business management experience. When it comes to expertise and resources, they have a lot to give, business financing options.

Cons of private financing

Private business loans are not free; they have a cost. Private-sector loans could have a unique rate structure, extra fees, and other expenditures that aren't common with bank loans. Before signing the loan agreement, Goldenberg highlighted the necessity of reading and understanding it.

Attorneys' fees, collection costs, and other significant fines may be imposed on an account that goes into default, according to some agreements, he said. Some lenders even go as far as asking the borrower to sign a confession of judgement, which would enable the court to quickly rule against the borrower in the case of default without a trial.

Venture capitalists or angel investors might include these terms and conditions in their agreements, and you're more likely to find them in contracts from online private lending institutions.

Additionally, private lenders may have stricter payment terms than a conventional bank loan. Consider the advantages and disadvantages before deciding whether private funding is the best choice for your company.

Additional loan application guidance

Networking is likely to be the key to obtaining a loan from an angel investor or venture capitalist. Although some businesses approach startups, it's a good idea to network and look for investors if you're establishing a business.

Along with conventional short- and long-term loans, if you need money right away you might be able to receive a merchant cash advance, where a lender gives you money against credit card receivables. Depending on the lender you choose, you might not receive the same level of mentoring and care as you would from angel or venture capitalists.

Small enterprises that are able to avoid debt may prefer equity finance, but it has the significant drawback of giving up control. However, few small businesses have the credit history or adequate assets to obtain a bank loan.

Small business owners may find alternative internet and fintech lenders to be excellent sources of capital. They offer high-interest, short-term business loans to business owners who want to get money quickly for expansion. However, the main attraction of these lenders is their adaptability.

Like angel investors or venture capital firms, alternative lenders hardly ever demand stock. Instead, they offer loan agreements that are similar to those offered by traditional banks but typically have higher interest rates and considerably more flexible qualification standards.

Invoice factoring, merchant cash advances, lines of credit, and equipment leasing are just a few of the several loan packages and types offered by alternative lenders. Alternative lenders are sometimes the most practical choice for businesses because of their flexibility.

High interest rates and sometimes onerous loan agreements are disadvantages of alternative lenders. Because of this, despite the fact that these loans may be simple to apply for, they work best for companies that have the cash flow to pay back short-term loans.

In comparison to venture capitalists, angel investors, traditional banks, and loans through the U.S. Small Business Administration programme, alternative lenders have the strictest loan terms and agreements. Although this may be a wonderful source of funding, it's crucial to consider the entire risk to your company.

Obtained debt financing

Given that both demand proof of future payback, the counsel for persuading lenders and investors is not dissimilar. Venture capitalists are said to invest more in people than in their ideas, according to a common belief. The same is true for small business lending, according to Alex Kaschuta, Fundsquire's lending manager.

Kaschuta bases her assessment of what she refers to as investability on the manager's reliability, the way they handle their business, and their expertise in the sector.

When it comes to the most typical pitching errors, Kaschuta, like Richardson, is frequently challenged with TMI.

- Knowing what you need the money for and which lender makes the most sense for you to work with will help you choose the best sort of financing for your company. A VC firm can provide you with the direction you need to launch your new business. Alternative lenders are the finest choice for quick, expensive loans for any kind of company.

The greatest approach to acquire money, regardless of the kind you require, is through networking and building relationships with different types of investors. After focusing on a select handful, you can associate with the most advantageous one for your company.

To manage your costs and expenses you can use many available online accounting software.

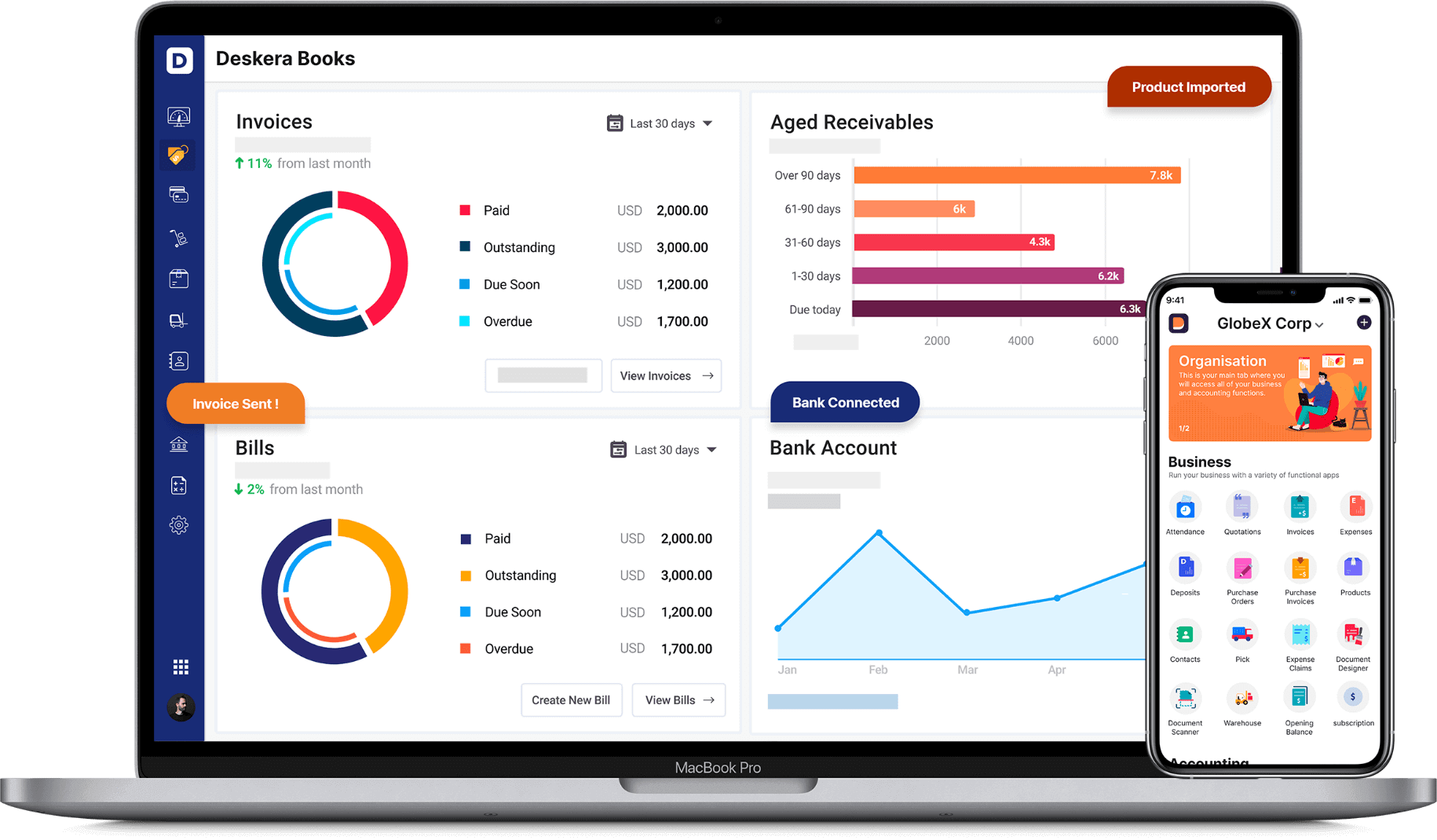

How Can Deskera Assist You?

Deskera Books can help you automate your accounting and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

- But for those with bad credit, financing a start-up or small business can be a challenging, protracted procedure. Although there is no minimum credit score required to obtain a business loan, conventional lenders typically have a range they deem acceptable.

- For instance, a borrower's accounting may be badly impacted by personal or family illness problems and job losses, yet each of those might be justified. Additionally, compared to a regular bank, CDFI lenders do not require nearly as much security. Lack of collateralized assets can be made up for in other ways.

- When you use invoice finance, sometimes referred to as factoring, a service provider advances you cash on your unpaid accounts receivable, which you pay back once consumers have paid their invoices. By doing this, you can ensure that your company has the cash flow it needs to function while you wait for clients to settle outstanding invoices.

- Be aware of how much you must borrow beforehand. When you apply for alternative business loans, you'll probably discover that there are many various loan amounts accessible. Avoid taking out more debt than you really need to because there could be fees associated with early repayment or not making use of the entire amount.

Related Articles

10 Tips for CFOs to Navigate Growth Complexities

Total Quality Management: A Comprehensive Guide to Quality Control Techniques

How can Firms Manage Quality Control while Scaling?

Hey! Try Deskera Now!

Everything to Run Your Business

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One .

BusinessFinancing.co.uk

Compare Business Bank Accounts & Loans

In partnership with: NerdWallet and Tide

27 Business Finance & Funding Options for Small Businesses

Loans and finance can help a business pay for essential improvements, invest in itself, and achieve big goals. With so many types of business finance and funding available with different costs and terms attached, it’s important to make the right choice for your small business. These 27 business finance and funding options can suit a variety of businesses with different funding needs.

Keep reading to find out which finance options could work for you and your business.

1. Government & Other Grants

- Available to businesses that need extra support or have been rejected for a loan.

- Usually awarded to businesses in a specific region or fulfilling a specific purpose.

- Access can be limited. Schemes will change as governments change.

- Include loans and grants.

Small business success is vital to the British economy, so the government often provides grants and loans for brand new enterprises and business owners that need it. A loan will have to be repaid but could have favourably low interest rates or accessible terms. A grant doesn’t have to be repaid at all.

Accessing government grants and loans can be difficult because they’re designed to help the most in need. Your business will be assessed and means tested and there could be restrictions based on your location, size, and sector. Schemes will often be limited and may not be available on an ongoing basis.

To find current government grant and loan schemes, search the finance and support database .

Finance examples:

- Business Growth Grant – Grants from £2,000 to £25,000 for capital projects based in specific regions of the UK.

- Business Start-up Grant Scheme – Grants for new businesses based in specific regions.

- BCRS Business Loans – Loans of £10,000 to £150,000 for small and medium businesses that have been rejected by their bank.

2. Startup & New Businesses Loans

- For brand new businesses.

- Government-backed finance available.

- Fewer options available from banks.

New businesses often need a helping hand. Startup and new business loans are designed for brand new enterprises with a limited financial history. Startup loans are available from private loan companies and some mainstream traditional banks, including NatWest . Some entrepreneurs choose to take out a personal loan to support their new business idea, which means repayment is your personal responsibility instead of the business’.

The government-backed Start Up Loans scheme is funded by the Department for Business, Energy and Industrial Strategy (BEIS), giving businesses trading for less than two years the opportunity to borrow up to £25,000 and repay at a fixed interest rate of 6%. Free mentoring and support is also available. Since its launch in 2012, the scheme had lent over £600m to over 68,500 entrepreneurs outside of London.

- Start Up Loans – A government-backed scheme with fixed interest rates for brand new businesses.

- Virgin Start Up loans – A personal loan of £500 to £25,000.

- NatWest – £1,000 to £50,000 available at a fixed rate of interest.

3. Loans for Existing Businesses

- Wide range of options for businesses with a few years’ history.

- Specialist loan companies and banks have products for small businesses with some trading history.

- Interest rates and terms can vary widely.

Existing businesses with a few years behind them can often take their pick of loans, providing their financial history and projected future is fairly healthy. Mainstream banks like Barclays , NatWest, Santander , Co-operative , HSBC , and more, offer small business loans, as well as private loan companies specialising in business finance.

The range of options is quite wide, so it’s important to compare interest rates, repayment terms, and any other fine print before you commit. Before your business is approved for a loan, there will also be a credit check.

- HSBC – Loans from between £1,000 and £25,000 available with fixed monthly repayments.

- Barclays – Loans available up to £100,000.

- NatWest – Borrow from £1,000 to £50,000 and choose your repayment period.

4. Unsecured vs Secured Loans

- Unsecured finance isn’t secured on your business’ property or equipment.

- A secured loan will ask for your property as ‘security’ in case you can’t repay the full loan.

Business finance products can be secured or unsecured. Unsecured loans are separate from your business’ property, while secured loans use your business’ property as security. Many business loans are unsecured, but it might be necessary to use security if the loan is a high amount, or there’s greater risk attached to it.

Security is usually valuable equipment, buildings, vehicles, and anything else high value. If your business couldn’t repay the finance, the security would be taken to cover the cost of the loan.

- Unsecured loans – Many banks and loan companies offer unsecured loans, including Funding Circle , Barclays, NatWest, and more.

- Secured loans – Loans are available from many of the same funding providers, usually starting at £25,000+.

5. Short-Term Loans

- Often repaid in a few weeks or months, instead of years.

- A short term solution for businesses that need quick cash.

- Usually unsecured.

If you need to make something happen fast, a short-term loan could be the right solution for your business. Short-term loans are usually repaid over months instead of years, and can be helpful for boosting cash flow, paying for essentials, covering one-off costs, and fast growth.

If you’re taking out a short-term loan, it’s important to make sure the repayments stay affordable for the full term of the loan, whether it’s 1 month or 12.

- Iwoca – Borrow £1,000 to £200,000 and repay over 1-12 months.

- Capify – Borrow £5,000+ and repay over 6 months+.

- Funding Circle – Borrow from £10,000to £500,000 and choose to repay in 6 months+.

6. Bridging Loans

- Bridges the gap between making a purchase and receiving the funds.

- Usually for property or an expensive purchase.

- A type of short-term loan.

Bridging finance is commonly used to buy property or move commercial premises, often when there’s a shortfall in funds. This type of finance makes it possible for a business to move, refinance, finish, or sell an asset. Lenders can usually provide funds quite quickly once the applying business has gone through the necessary checks.

This type of finance isn’t too dissimilar to a mortgage, so there can be legal fees and arrangement fees to pay. The term of the loan is usually 12 months or less.

- WestOne – Loans from £75k for terms from 1 month.

- Clifton Private Finance – Bridging loan service from £100,000 to £100m.

7. VAT & Tax Loans

- Designed to pay owed VAT and tax quickly.

VAT and tax loans are for businesses with HMRC bills to pay. The lender will help you cover quarterly VAT payments, payroll , corporation tax , and other bills if you don’t have enough cash flow at the time to pay them yourself. This can happen when businesses lose revenue , make incorrect calculations, or have unexpected expenses.

These bills are important and shouldn’t be ignored. Some lenders won’t lend to businesses that have outstanding payments to HMRC, but lenders specialising in VAT and tax loans will. A VAT and tax loan can help make payments more manageable.

- Rangewell – Tax bills can become easier monthly payments.

- Cubefunder – Borrow from £5,000-£100,000 over 3 to 12 months.

8. Bad Credit Loans

- Designed for businesses with lower credit scores .

- An alternative for businesses that struggle to access finance from their bank.

- Interest rates and approval processes can vary.

Not every business has a perfect credit rating, but that doesn’t have to stop them from getting the finance they need. Some loans are designed for businesses that struggle to get approval for finance. These loans can sometimes be secured on your business’ assets , including property, vehicles, and equipment.

If you’ve already tried to get finance from a bank or mainstream lender, a loan for businesses with poor credit could give you access to the cash you need.

- Boost Capital – Loans available for small businesses with a trading history of at least 3 years.

- Capify – Offers business loans and merchant cash advance options based on your card payments.

9. Business Expansion Loans

- Covers the cost of moving to a new premises or extending current premises.

- Makes it easier to afford growth and expansion.

Business expansion loans are exactly what they say on the tin – finance to help pay for expanding your business. This type of finance can be used to buy a new premises or a franchise, set up a new site, hire new staff, buy equipment and resources, or invest in a new vehicle.

Most loans are designed with expansion in mind. Many mainstream banks offer business loans to help small businesses afford whatever they need to grow. Private loan companies also offer many different loan products for business expansion.

- Santander – Borrow £2,000 to £25,000 over 1-5 years and repay in fixed monthly payments.

- Barclays – Borrow from £1,000 to over £100,000.

- 365 Business Finance – Merchant Cash Advance for £5,000 to £200,000.

10. Working Capital Loans

- Short-term loans to boost day-to-day cashflow.

- Helpful for paying for everyday essentials.

A working capital loan is designed to improve your business’ immediate cash flow, covering everyday expenses. If you’re struggling to pay for staff wages or essential stock, a working capital loan will pay for the important stuff until more cash comes into your business.

Working capital loan providers include traditional banks, private loan companies, and alternative online lenders.

- Funding Circle – Working capital loans up to £500,000.

- Capify – Raise from £5,000 with a working capital loan.

- PayPal – Working capital for businesses processing cash through PayPal .

11. Cashflow Loans

- Loans designed to improve cashflow in your business.

- Can bridge the gap between essential expenses and invoices or bills being paid.

Cash flow is essential for running a healthy business. If your business is waiting for several invoices or bills to be paid, a cash flow loan can help improve liquidity in the meantime. Cash flow loans are usually unsecured and funds can be accessed quickly once approved.

Everyday expenses can include staff wages, stock and inventory , costs associated with premises, paying bills, covering emergencies, and anything else that needs to be covered now and paid for later.

- Liberis – Funding from £2,500 to £300,000, repaid through customer card payments.

- Just Cashflow – Borrow from £10,000 to cover expenses.

12. Credit Cards

- An accessible way to pay for business expenses.

- Available with most business bank accounts .

A business credit card can be a simple and fast way to cover large and small business expenses online and in person. Most banks offer the option of a credit card with their business current account, but your business will need a credit check before it’s approved. Your card will have a monthly spending limit.

Credit cards can sometimes have a higher interest rate than loans and overdrafts , so it’s important to compare before you commit. If your business will be able to repay the balance in full each month, you won’t pay any interest at all.

- Barclaycard – Two business credit cards are available from Barclays.

- Santander – Credit card includes 1% cashback on purchases.

- American Express – Offers a range of six business credit cards.

13. Overdrafts

- An optional part of your business current account.

- Interest is charged based on how much of your overdraft you use.

Most business current accounts include the option of an overdraft, which gives you the freedom to spend more than your balance when you need to. There’ll be a set overdraft limit with an agreed interest rate, and your business will usually only be charged for how much it uses.

Overdrafts are usually fairly simple to secure, and there will often be a credit check beforehand. For certain amounts, there will often be an arrangement fee and the limit will be reviewed every 12 months. Overdrafts can be secured or unsecured.

- Lloyds Bank – Overdrafts up to £25,000 available.

- Co-operative Bank – Overdrafts up to £250,000 available.

- HSBC – Flexible overdrafts available.

14. Business Line of Credit & Revolving Credit Facility

- Borrow up to a certain limit and only pay interest on the outstanding balance.

- Can be an alternative to a credit card or business loan.

A business line of credit gives you access to a credit limit to help pay for whatever your business needs. Just like a credit card or overdraft, you’ll only repay what you’ve used.

A revolving credit facility is particularly useful for businesses that regularly need access to credit and want to keep paying it off. It’s helpful for emergency purchases, everyday costs, and quick business expansion expenses.

- Boost Capital – A line of credit from £3,000 available.

- Liberis – £2,500 to £300,000 available in flexible funding.

15. Commercial Mortgages

- Just like any other mortgage, but specifically for commercial property.

- Offered by some banks and private lenders.

Commercial mortgages are just like a personal mortgage for a private residence, except they’re specific to commercial properties and businesses. Some traditional banks, like Barclays and NatWest, offer commercial mortgages to businesses, as well as private lenders specialising in business finance products.

The benefits of owning a commercial property are similar to owning a home – less reliance on renting, more equity , and more flexibility in terms of renovation. You may need a deposit and monthly payments and interest rates will often be pre-agreed and stretched over a period of years. It’s also possible to remortgage existing property to free up cash to spend on the business.

- NatWest – Commercial mortgages from £25,001.

- Barclays – Commercial mortgages available from £25,000, interest rates fixed for 1-10 years.

- Aldermore – £50,000 to £25 million available for mortgages and remortgages.

16. Property Development Finance

- For property developers and property related businesses.

- Used to build, renovate, and develop property before a sale.

- One of the more complex types of finance.

Property developers can access finance to develop and renovate properties in their portfolio. The aim is to cover the immediate costs of developing a property and preparing it for sale to make a profit later. Property development finance can be available to individual property developers as well as property businesses.

Many finance providers offer finance for renovations as well as ‘ground-up’ developments where the buyer wants to purchase land to build on or demolish an old property and rebuild.

- Shawbrook Bank – Property development loans from £2.5 million.

- Barclays Corporate Finance – Specialist property development finance for corporate businesses.

Other types of business finance and funding

17. merchant cash advance.

- For businesses taking payments from customers through a card terminal.

- Raise finance like a normal loan.

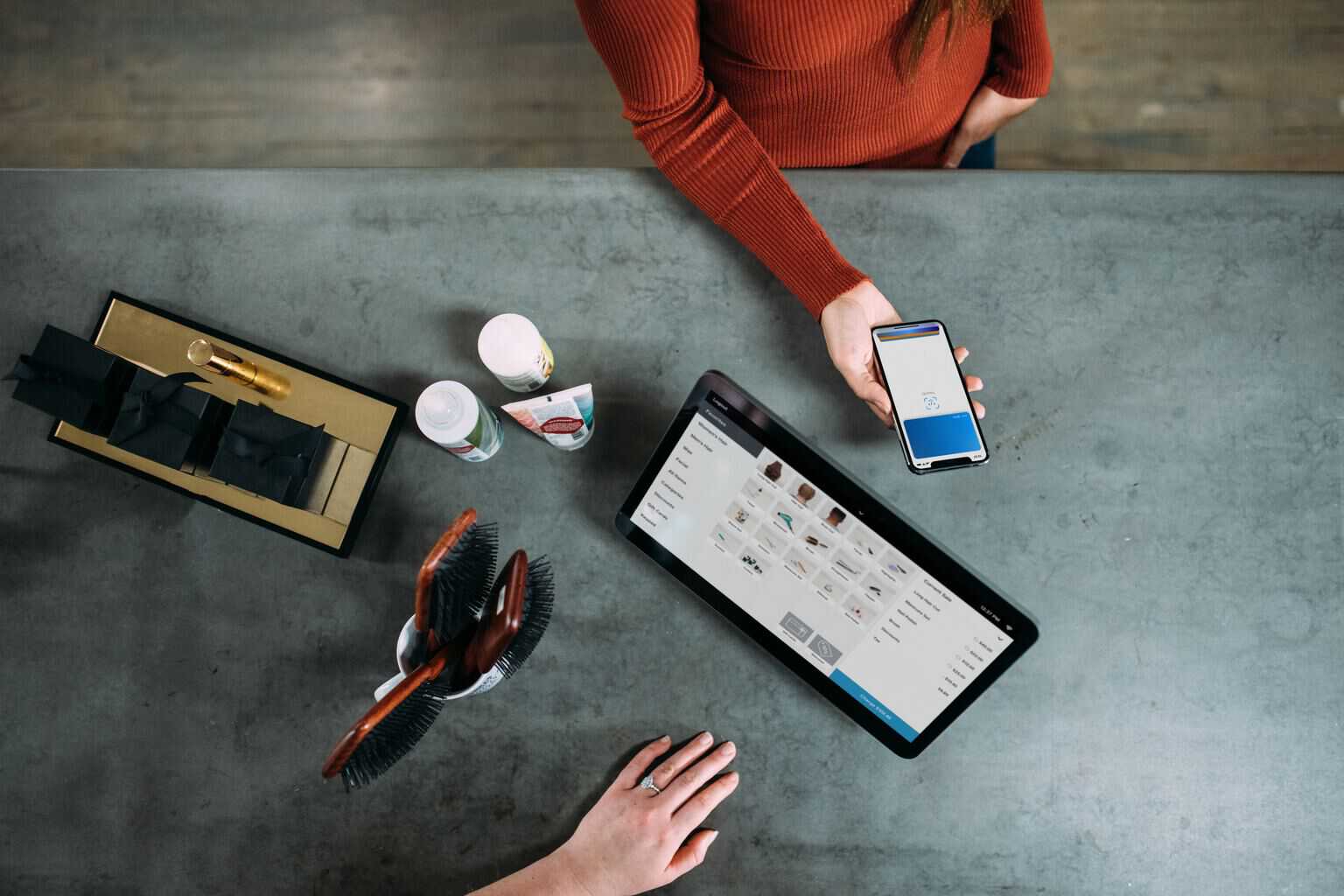

- Repay through a percentage of customer card payments.

The Merchant Cash Advance is a type of finance designed for businesses taking card payments from their customers, including retailers , restaurants, and other customer service businesses. It can be a manageable and predictable way to raise and repay business finance. Payments aren’t fixed and will change depending on how much income your business processes.

Your business will usually be able to raise several thousand pounds after a credit check. Some Merchant Cash Advance lenders will give businesses the ability to raise a percentage of their average monthly turnover , so repayments are structured around what they can afford.

- Capify – Raise £5,000 to over £500,000.

- 365 Business Finance – Raise from under £5,000 to more than £200,000.

- Merchant Cash Express – Raise £5,000 to £500,000.

18. Asset Finance

- Finance for equipment, vehicles, and materials essential to business growth.

- Includes hire purchase and equipment leases.

- A flexible source of finance for businesses in need of specific assets.

Many businesses need equipment, materials, and machinery to operate successfully, but these items are expensive to buy up front. Asset finance provides the cash your business needs to pay for essential equipment. Repayments will usually be spread out over the lifetime of the asset, so you’re not paying for something that’s out of date or non-functional.

Leasing is another type of asset finance, giving businesses the opportunity to rent equipment and return it when they’re ready to upgrade, or buy it outright if they want to keep it.

- Close Brothers – Asset finance, refinancing, and leasing available.

- Asset Finance UK – Asset finance covering commercial vehicles, plant machinery, and other business assets.

19. Invoice Finance, Factoring & Discounting

- A third party buys your unpaid invoices and collects the payment for a fee.

- Factoring and discounting also available.

Unpaid invoices can be a big problem for many businesses, and chasing them takes time. Invoice finance , factoring and discounting can take the burden of chasing invoices away from the business owner, but they’re all quite different. Invoice factoring means the finance company chases invoices for you for a percentage of the total amount. Your invoice gets paid and the invoice finance company takes its cut.

Finance and discounting are slightly different. The business can borrow the value of an invoice that’s yet to be paid, giving them instant cash flow instead of waiting for the customer to pay. When the customer does pay, they’ll be able to repay the finance. The business is still responsible for chasing the invoice, however.

- Close Brothers – Invoice discounting and factoring available.

- Bibby Financial Services – Invoice discounting available.