When you use links on our website, we may earn a fee.

Best Small Business Accounting Software of 2023

Table of Contents

- Best Small Business Accounting Software

- Things To Consider When Buying

- How We Chose

Small business owners have specific needs when it comes to accounting. In particular, small business accounting software needs to make it easy to manage income and spending without taking too much time away from running the business. Small businesses come in all shapes and sizes, meaning that small business accounting software has to be versatile and customizable – or at least fit your specific needs.

In creating this article of small business accounting software, we looked at the features that are most important to small businesses and consulted with experts in the field.

- Best Overall: QuickBooks Online »

- Best Budget: Wave Accounting »

- Best for Freelancers: FreshBooks »

- Best for Non-Profit Organizations: Aplos »

- Best for E-commerce Businesses: Zoho Books »

- Best for Micro-Businesses: Xero »

- Best for Service-Based Businesses: Sage Intacct »

Best Overall: QuickBooks Online

Sleek design

Great support resources

Easy to share information

Slight learning curve

A little pricey

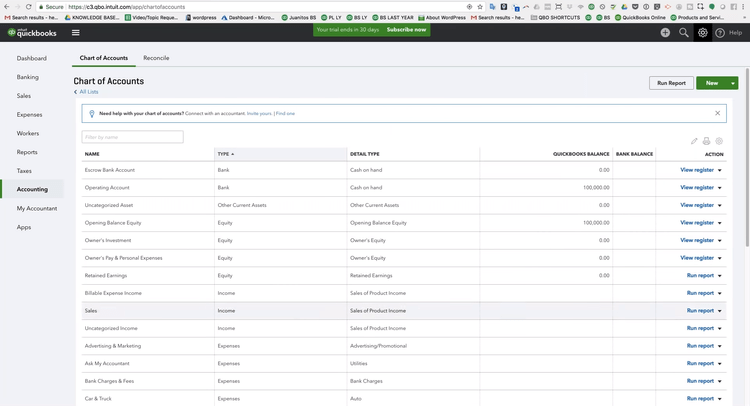

For years, QuickBooks has been the trusted choice for accountants — and the end result is the best accounting software for small businesses. Intuit began transitioning from QuickBooks Desktop to QuickBooks Online a few years ago, establishing the latter as the frequently updated standard for many accounting professionals. With its intuitive dashboard and versatile widgets, QuickBooks Online boasts many features for small business owners. These include automation tools, the capacity to support up to seven users under one license, e-filing capabilities, and many more.

While the interface is well-designed and the software is packed with great accounting features, newcomers might face a learning curve. Also, QuickBooks Online can be a little pricey; it operates on a monthly subscription model with plans like EasyStart, Essentials, Plus, and Advanced. However, for those willing to invest a bit more in their accounting solution, QuickBooks remains unmatched due to its extensive features – and to be clear, it’s still not overly expensive.

Specifications:

- Pricing: Monthly subscription

- Features: Automated transaction sorting, recurring invoices and credit card payments, reporting

- Compatibility: Web-based, Android and iOS app

- Integration: Amazon Business, PayPal, Square, Etsy, many more

- Customization: Dashboards, reporting

Best Budget: Wave Accounting

Unlimited users

Great reporting

Limited third-party integrations

Some features cost money

What’s more budget-friendly than free accounting software? Wave Accounting is an excellent budget accounting software option for small business owners. If you use only basic accounting and invoicing features, you won’t pay a cent. Additional accounting features, like payments and mobile receipts, are charged either per use or a monthly rate, so consider how often you use these features before signing up for Wave. Additionally, Wave offers excellent reporting tools, and it allows for unlimited users – something that many paid accounting platforms don’t have.

As you would expect from free accounting software, there are some limitations. Notably, third-party integrations are very limited – although if you use Zapier, you’ll unlock a series of additional integrations. Also, as mentioned, some features do cost money, so if you want access to more advanced features you may need to budget for that. Still, basic users who don’t want to pay for accounting software should be able to get much of what they need from the free version of the software.

- Pricing: Free for accounting and invoicing, additional features like payroll and payments can cost per use or monthly.

- Features: I ncome and expense tracking, unlimited users, customized invoices

- Integration: Zapier

- Customization: Customizable reports and invoices

Best for Freelancers: FreshBooks

Mostly simple interface

Invoicing is very easy

Good customer support

Tax features are a bit limited

Not as customizable as others

FreshBooks is the best accounting software for freelancers who want a feature-rich platform without breaking the bank. Unlike some pricier alternatives, FreshBooks offers an affordable monthly subscription, with most of its plans priced lower than similar plans from competitors. It offers excellent automation features and great reporting tools, helping freelancers in their daily business operations.

However, there are a few downsides to consider. FreshBooks allows only one user by default, with additional users incurring extra monthly fees – though most freelancers won’t need to add extra users anyway, so that may not be a huge issue. Its tax compliance functionalities, while capable of tracking sales tax, don't support e-filing tax forms like some competitors do. And while the mobile app is useful for tasks such as tracking mileage and invoicing, it isn't as comprehensive as the desktop version of the software. Nevertheless, for the price point, many freelancers will find FreshBooks offers an excellent balance of features and affordability.

- Features: Automated tax documentation, income statements, cash flow statements

- Integration: Acuity, FreshCurrencies, Zapier, more

- Customization: Customizable invoices, customizable email templates and more available in higher-end plans

Best for Non-Profit Organizations: Aplos

Excellent interface

Additional features for non-profits

Only two users free

Invoicing features are limited

If you're in search of an accounting tool tailored for a nonprofit, including churches, Aplos is the best choice. It's specifically designed for churches and nonprofits, simplifying the handling of donations and even helping with certain tax filings specific to nonprofits. Besides these specialized features, Aplos boasts great general accounting tools such as customizable reports, compatibility with various third-party platforms, and an intuitive user interface.

By default, Aplos only allows two users; to add more, you’ll have to pay extra. Additionally, it doesn’t necessarily excel at some functions that typical accounting software emphasizes, like invoicing and income management. But if your primary goal is to streamline nonprofit accounting, Aplos is our pick.

- Features: Automatic payroll, some e-file features, donor activities

- Compatibility: Web-based only

- Integration: WePay, Gusto, PayPal, more

- Customization: User roles, invoices, reports

Best for E-commerce Businesses: Zoho Books

Free plan available

Excellent e-commerce features

Excellent reporting

Slightly limited integrations

Slightly limited number of users

For those operating an e-commerce business and in need of great accounting software, Zoho Books is the way to go. Notably, Zoho offers both Books and Zoho Commerce, the latter being an expansive e-commerce solution that integrates with the company's accounting software. Zoho Commerce boasts a range of e-commerce features, such as a full-featured website builder and inventory management. Zoho Books is equipped with great accounting functionalities tailored specifically for e-commerce, including integration with payment gateways.

However, while Zoho Books does have good integration with payment gateways, its third-party integrations in general aren't as extensive as some rivals. Further, although premium plans can accommodate up to 15 users, those on basic plans might have to pay for extra users. But given its integration with Zoho's e-commerce platform and its competent e-commerce accounting tools — even for non-Zoho users — Zoho Books is the best choice for e-commerce entrepreneurs.

- Pricing: Free plan, monthly subscription for premium plans

- Features: Automatic categorization, customizable reporting, sales tax calculation

- Compatibility: Web-based, Android and iOS apps

- Integration: G Suite, PayPal, Stripe, Square, more

- Customization: Customizable reports, reports, more

Best for Micro-Businesses: Xero

Well-designed interface

Great selection of integrations

Limited customer support features

Micro-businesses have specific needs when it comes to accounting software, and that’s why Xero is the best choice for those ultra-small businesses. Xero is a no-fuss software that offers unlimited users without having to pay an additional fee, plus it has a very simple user interface that most users will be able to pick up relatively quickly. That’s handy for those who run a micro-business, and who might not be running their business full-time – and thus have less time to spend managing things like accounting.

Xero has some limitations though. Xero is easy to use, but there are limited customer support options if you do have an issue with the software. Additionally, base plans have limits around how many invoices you can generate – and while that may not be an issue for micro-businesses, some will still need to upgrade to a higher-end plan. All that considered, Xero is the best accounting software for micro-businesses considering its no-fuss interface and the fact its base plan should be enough for most users.

- Features: Invoice creation, unlimited users, email notifications

- Integration: Stripe, Hubdoc, HubSpot, MailChimp, Shopify

- Customization: Invoices, reporting, dashboard

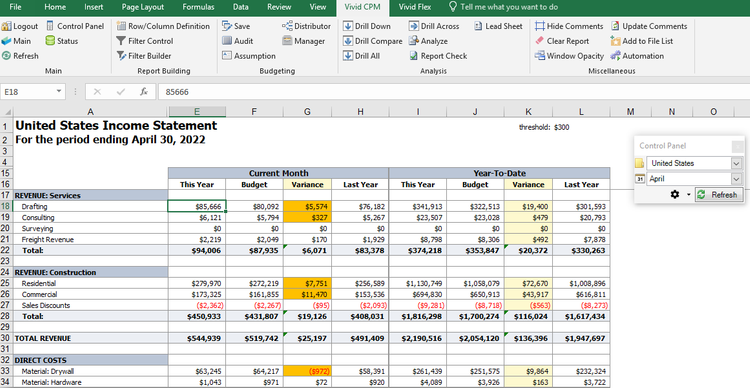

Best for Service-Based Businesses: Sage Intacct

Excellent reporting tools

Many third-party integrations

Range of features for service-based businesses

A learning curve

Very expensive

Sage Intacct is the best accounting software for service-based businesses. It delivers exceptional and adaptable reporting tools, ensuring you gain quick access to critical data when you need it. It's also compatible with numerous third-party services and equipped with features tailored specifically for service-oriented operations.

However, because Sage Intacct offers so many high-end tools, there's a steeper learning curve to using the software. In addition, the pricing is quite high and can be confusing, as potential users can't view costs directly on the company's website; reaching out to the company is necessary for a pricing quote. Nevertheless, for those in charge of a service-based business, Sage Intacct is the best choice.

- Features: Automated accounts payable, customizable reporting, tax calculation

- Compatibility: Web-based

- Integration: Tipalti, Expensify, Gusto, many more

- Customization: Customizable reports, dashboards, more

The Bottom Line

QuickBooks Online is the best solution for most small businesses, however, some accounting software might be better in certain scenarios. For example, Aplos is best for non-profit businesses, and Zoho is best for online companies. It's important to recognize the type of business you own and decide exactly how you'll be using the software before making a choice.

Things To Consider When Buying Small Business Accounting Software

Features: Different software for small business accounting offers different sets of features that can vary widely. As you might expect, most of them can help you categorize transactions and issue payment reminders, but other features include things like the ability to e-file taxes, integrate with third-party software, and more. Usually, free options don’t offer all of these advanced capabilities, so if you need access to them you may need to get a paid product. Make a list of the features you need from accounting software before you subscribe or buy it, so you can make sure your accounting solution meets your needs.

Integration with other business software or applications: If you use a range of software solutions for different aspects of your business, you may want software that can integrate with them. For example, you might want software that works with your company’s expensing service the payments platform you use to sell your goods. Not all accounting software offers a wide range of third-party integrations, so if that’s important to you, make sure that you find a platform that does. “Small businesses should look for an open platform that allows third-party integrations, so they can select from an ecosystem of third-party applications the tools they need to create best-of-breed technology,” says Ben Richmond, County Manager at Xero.

Reporting and analytics capabilities: In-depth reports can be very helpful for small business accounting. Most accounting software offers some level of reporting, but different software offers different kinds of reports. You’ll likely want reporting for the various types of income and spending in your business, but you may also want deeper analytics tools that are easy to access. “Great accounting software should be easy to use, optimized so small business users can spend less time inputting data and more time looking at the data and insights to help inform real-time decisions,” Richmond says.

Mobile accessibility and remote access options: Not every accounting platform works with a mobile app, so if that's something you need, be sure the software you're considering offers it. A mobile app can allow you to manage expenses and income wherever you are. Even if particular accounting software doesn’t have an app, you probably can still access your software through a web portal; most small business accounting software is web-based, rather than being a dedicated app on your computer.

Pricing structure: Accounting software can range from around $10 per month to hundreds of dollars per month, though the more expensive options are often targeted towards large corporations rather than small businesses. Subscription-based pricing structures are common, and all of the paid platforms on our list are available as part of a subscription rather than at a flat rate. There are some free options, as well as free versions of paid software, that might meet your needs. However, if you want to do anything beyond basic accounting, you’ll likely be stuck paying a monthly fee.

How We Chose the Best Small Business Accounting Software

Our contributor Christian de Looper consulted a number of accounting software experts in the process of building this list of the best small business accounting software. These included Ben Richmond, County Manager at Xero, and Faye Wang, Regional Accounting Director, Tipalti. Christian then narrowed down the list of small business accounting software by looking at the most important features that small businesses generally need.

For each small business accounting software option, Christian looked at the range of features it offers, how much it costs, and the third-party integrations that are on offer. Ultimately, there should be an accounting platform for all different kinds of small businesses, even those with small budgets.

WHY SHOULD YOU TRUST US?

Christian de Looper is a technology expert who has spent more than a decade reviewing and testing both software. As such, has a deep understanding of what makes great a software platform. Christian has used accounting software for his own small business, and he consulted experts in the field in an effort to gain a deeper understanding of what the most important small business accounting software features are.

Accounting is only one aspect of running a small business, but it’s a pretty important one. It’s also time-consuming. Great accounting software can save you countless hours, allowing you to spend less time categorizing transactions for tax time, and more time actually running your business. Not only that, but accounting software could end up saving you money, by gaining a deeper understanding of how your business runs and what you spend business money on, and by helping you better categorize your spend on tax forms when tax time comes along.

“Accounting software is beneficial for companies of all sizes, but it’s an especially useful tool for small businesses with limited resources, whether that’s budget or a workforce,” Wang says. “[Accounting is] oftentimes a laborious and time-consuming function of an organization that is prone to human errors and fraud, ultimately costing the company money and clients.”

Small business accounting software tracks the money you spend and the money you make, helping you categorize those transactions so you have a better understanding of the kinds of things you spend money on and where your income is coming from. Small business accounting software also can generate reports that can help you discover new trends in how your business runs, which can increase your revenue over time.

Small business accounting software can vary radically in price, but most cost around $10 to $20 per month (although you can spend hundreds a month). Some small business accounting software is actually free, giving you access to basic tools without having to pay for them.

Most accounting software is web-based, so all you’ll have to do is log in to the online portal in order to access it. You may have to install an accompanying app on your phone if one is available. This will involve going to the Google Play Store or Apple App Store (depending on your phone), and downloading the app like you would any other app.

You’ll know it’s time to start looking for new small business accounting software if you start to find that your current software doesn’t offer the features that you need to run your business effectively. As your business grows, you may need more advanced features – and if that happens, you may need to switch to a new platform in order to get them.

U.S. News 360 Reviews takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

- The Best Financial Management Software

Drawing from 25 years of software market expertise, we present a guide to the top financial management systems, catering to businesses of all sizes and financial needs.

- Robust Invoicing

- Efficient Reporting

- Simple Cloud Access

- Custom invoices

- Advanced reporting

- Complete ERP features if needed

- User-friendly interface

- Robust reporting

- Integrations with Microsoft applications

- 1 Sage Intacct

- 3 Dynamics 365 Business Central

- 4 Acumatica

- 5 AccountingSuite

- 6 Accounting Seed

- 7 Multiview

What are Financial Management Systems?

- Key Features

- System Benefits

- Software Integrations

- Functionality by Industry

- Price Guide

All Products

In our independent review of the top financial management systems, we ranked the best products based on cost-effectiveness, scalability, and key features like budgeting, forecasting, invoicing, and billing.

- Sage Intacct : Best Overall

- NetSuite : Strong Reporting Capabilities

- Business Central : Integrated Product Ecosystem

- Acumatica : Versatile Scalability

- AccountingSuite : Strong Inventory Control

- Accounting Seed : Best for Project Accounting

- Multiview : Extensive Audit Trail Capabilities

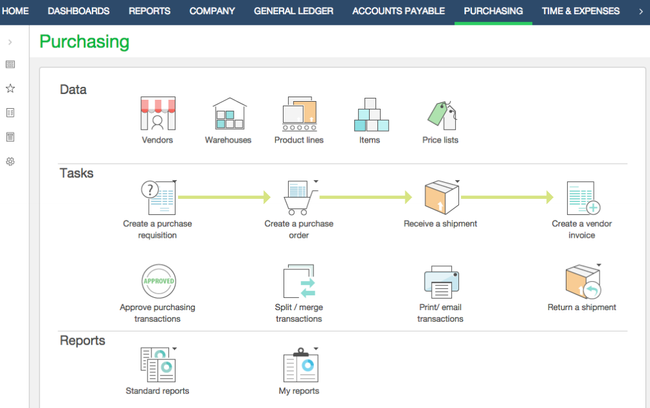

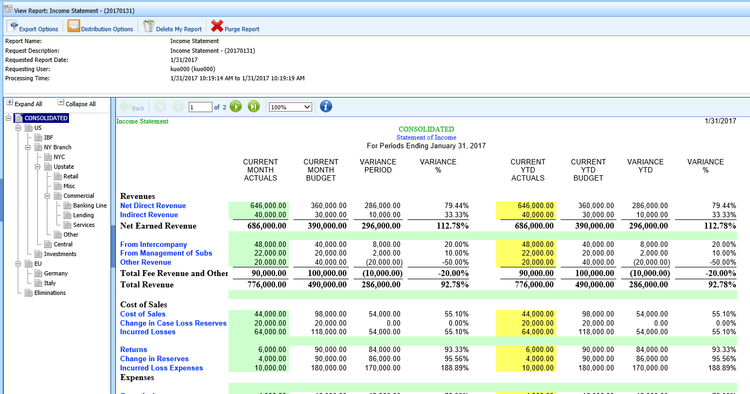

1 Sage Intacct - Best Overall

Why we chose it: Sage Intacct is our best overall pick due to its user-friendly interface and customizable templates. Users quickly create and send invoices to customers. The platform also offers automated reminders and tracks invoices and payments in real-time.

Another key benefit of Sage Intacct is its reporting capabilities. With over 150 pre-built reports and dashboards, you can quickly get insights into your expenses, revenue, and profitability. Users can easily customize reports using the intuitive drag-and-drop report builder.

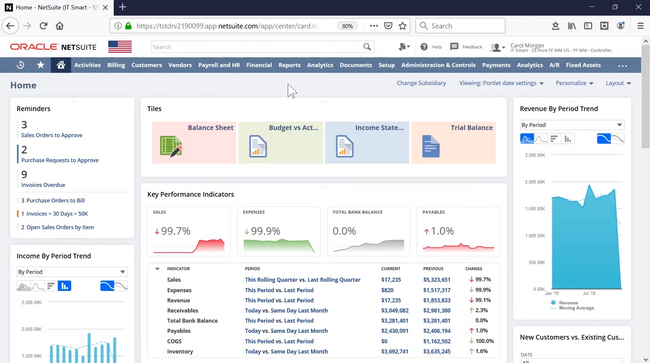

2 NetSuite - Strong Reporting Capabilities

Why we chose it: We picked NetSuite because its reporting module offers a range of pre-built financial reports. These include accounts receivable, accounts payable, and inventory. Users can also create custom reports that are tailored to their specific business needs.

NetSuite reporting module includes advanced financial analysis tools. Users can analyze budgeting and forecasting, trend analysis, and multi-currency reporting. NetSuite goes beyond pre-built reports by offering a highly customizable report builder. Users can create custom reports tailored to their specific business needs.

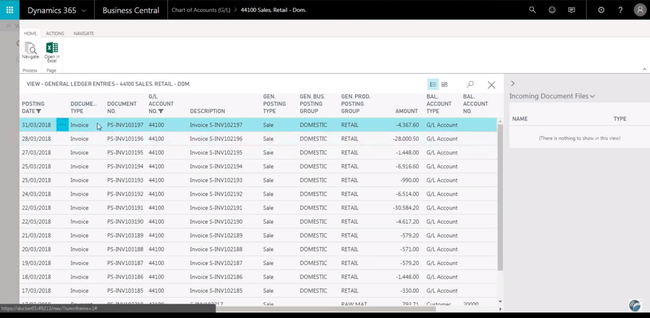

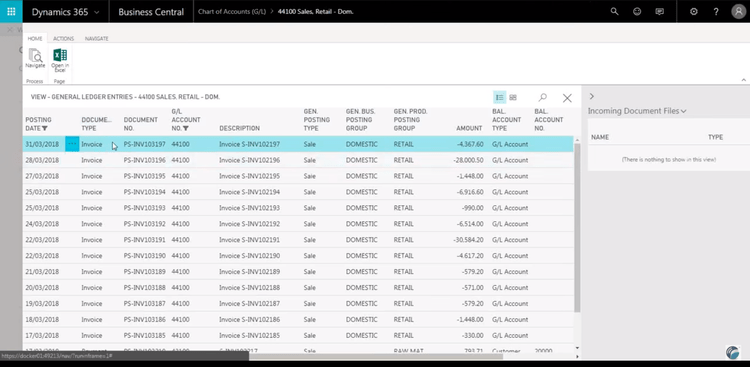

3 Business Central - Integrated Product Ecosystem

Why we chose it: Dynamics 365 Business Central made it into our top picks because it integrates seamlessly with other Microsoft applications like Office 365, Power BI, and Azure. Business Central provides a user-friendly and familiar interface, especially for users already accustomed to Microsoft products like Outlook, Word, or Excel. This familiarity can lead to a shorter learning curve for users and faster adoption of the ERP system.

As part of the Microsoft ecosystem, Business Central offers an end-to-end solution for businesses, covering finance, sales, customer service, and more. This can streamline operations by providing a unified platform for various business functions.

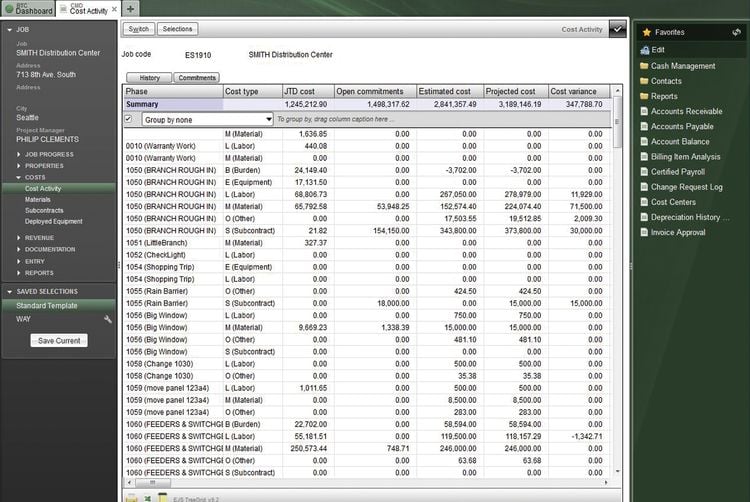

4 Acumatica - Versatile Scalability

Why we chose it: Acumatica secures its position as a top choice thanks to its versatility and ability to scale, making it a suitable solution for businesses of varying sizes. It has customizable workflows, empowering users to tailor processes to align with their unique business needs. This adaptability ensures that businesses can maintain efficiency and evolve with ease.

The platform also delivers real-time financial insights, enabling informed decision-making and real-time monitoring of financial health. For organizations with multiple entities or subsidiaries, Acumatica offers robust multi-entity management within a unified system.

5 AccountingSuite - Strong Inventory Control

Why we chose it: We went with AccountingSuite because it’s a great fit for companies with substantial inventory management needs. A key feature of AccountingSuite is its precise inventory tracking functionality, which allows businesses to meticulously monitor stock levels, optimize supply chain operations, and avoid the pitfalls of overstocking or understocking.

The software seamlessly integrates with popular eCommerce platforms, ensuring synchronization of online and offline sales data. Additionally, for businesses with multiple warehouses or locations, AccountingSuite offers comprehensive multi-location support.

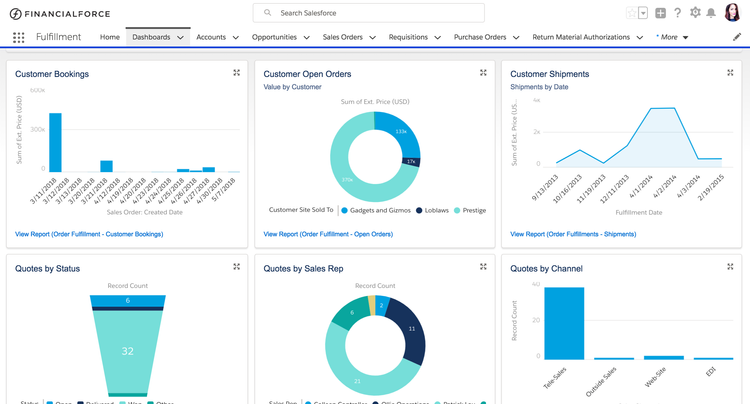

6 Accounting Seed - Best for Project Accounting

Why we chose it: Accounting Seed delivers project accounting, making it ideal for service-based industries or those with complex project management requirements. Its support for multiple currencies caters to international businesses dealing with diverse currency transactions.

Accounting Seed’s native integration with Salesforce makes it a good fit for companies relying on the platform for customer relationship management. This integration enhances efficiency by eliminating data silos and providing a holistic view of customer interactions and financial transactions.

Multiview - Extensive Audit Trail Capabilities

Why we chose it: Multiview has strong compliance features and comprehensive audit trail capabilities. These include Sarbanes-Oxley (SOX) compliance, ensuring that financial data adheres to regulatory requirements.

The platform also provides detailed audit trails, tracking every financial transaction, change, or access. Multiview also excels in vendor and expense management, simplifying the tracking and management of expenses, invoices, and payments.

Financial management systems help businesses track income and expenses and plan for growth. Commonly referred to as a subset of accounting software , these management systems go beyond simple bookkeeping to help businesses make better spending decisions, create accurate financial reports, and manage assets through advanced automation. These systems also have some human resources management, inventory control, and billing and invoicing functionality.

Financial management solutions are often an important part of a complete enterprise resource planning (ERP) system . Larger businesses benefit from ERP integrations which streamline business functions all from one shared system. Financial management software helps you create a system to find the data you need without switching between different workflows.

Key Features of Financial Management Systems

Advanced Features

Benefits of Financial Management Systems

Financial software helps businesses manage important information related to all financial processes, which leads to a lot of benefits:

Automate Processes

The system records real-time income and sales data. Outstanding balances are also tracked within the system. Automatic payment reminders can be sent for upcoming and overdue payments. The software also assists with creating invoices to be sent out after services are rendered.

Financial management systems also keep track of the money you owe to your vendors. Want to streamline payments? The system can automatically send recurring payments as needed to avoid accruing late fees.

Streamline Reporting and Analytics

Reporting and analytics functionality in financial software gives you a deeper look into your company’s overall financial operations. A comprehensive system allows you to break down sales by date range, best selling products and services, top performing sales reps, and more. This gives your finance teams the ability to clearly analyze sales data and make better business decisions based on historical trends.

Financial management systems also help businesses with reporting requirements laid out by the generally accepted accounting principles (GAAP). Compliant financial statements you can run include income statements, cash flow statements, and balance sheets.

EPM, CRM, and ERP Software

Financial management functionality is included in most ERP systems, as these solutions manage a variety of business processes within an organization. These systems link back-office operations with customer-facing functionality to keep businesses fully connected. Examples of ERP software with strong financial systems include Oracle ERP , Sage Intacct , and SAP Business One .

Along with ERP integration, financial management systems work best with enterprise performance management software and customer relationship management software . Better known as EPM or corporate performance management (CPM), these solutions monitor key performance indicators (KPI) related to your business, including financials. CRM solutions allow your company to build better customer relationships and accurately prepare invoices for any financial transactions.

Financial Systems by Industry

Industry-specific ERP options are available for managing financials unique to your industry. For example, international eCommerce shops will need the ability to facilitate transactions in multiple currencies and will need a single platform capable of making those exchanges. Some other examples include:

Financial Management System Pricing

Financial management software is priced based on a few specific variables, which include:

- Number of users

- Size of organization

- Functionality needed

- Number of languages and/or currencies needed

Most SaaS plans are available starting at $9 per month and reaching up to $180 per user per month . There are a few free, open source financial management systems available, though these solutions generally have limited functionality as they are geared more towards personal finance or startups and small businesses.

Sage Intacct

NetSuite ERP

Dynamics 365 Business Central

Acumatica Cloud ERP

AccountingSuite

Accounting Seed

Oracle ERP Cloud

FinancialForce

SAP Business One

CYMA Financial Management System

FMS ERP Software

Epicor Financial Management

UNIT4 Coda Financials

Deltek Vantagepoint

IDU-Concept

We searched and searched, but we couldn’t find any products in our database that match your criteria. Perhaps our team of software experts can help? They’d be happy to provide a list of free recommendations that meet your exact requirements.

Home > Finance > Accounting

The 9 Best Small-Business Accounting Software of 2023

Data as of post date. Offers and availability may vary by location and are subject to change. *Only available for businesses with an annual revenue beneath $50K USD **Current offer: 50% off for 3 mos. or 30-day free trial †Current offer: 50% off for three months or 30-day free trial ‡Current offer: 75% off for 3 mos. Available for new customers only

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

The bottom line: Xero is our favorite accounting service for small businesses. With free unlimited users, it's an excellent pick for collaborative businesses like multi-partner LLCs. Its low starting price and excellent app also make it a prime fit for freelancers, contractors, and other sole proprietors.

Wave Accounting is a good free accounting option for budget-cautious freelancers and small-business owners. QuickBooks Online works well for business owners who value solid reporting and tax tracking. Zoho Books affordably automates key tasks that can suck up business owners’ time. FreshBooks is a good alternative for business owners who want unlimited invoices.

- Wave : Budget pick

- Zoho Books : Best features

- Xero : Best overall accounting software

- QuickBooks : Most user-friendly

- FreshBooks : Best invoicing

If you're searching for accounting software that's user-friendly, full of smart features, and scales with your business, Quickbooks is a great option.

Compare the year's best accounting software

Wave is the most affordable accounting software.

Data as of post date. Offers and availability may vary by location and are subject to change.

For exactly $0, Wave presents you with a slick, user-friendly dashboard and a slew of features that rival those of paid accounting systems. For instance, Wave Accounting includes multi-currency support, expense tracking, unlimited invoicing, unlimited bank account connections and double-entry accounting —a more accurate method of accounting that FreshBooks' basic business accounting plan notably lacks.

Wave also lets you juggle multiple businesses with the same account. If you're an Amazon or eBay seller who also manages a small team of contractors, you can track both sets of finances without paying anything.

Even though Wave has a useful payroll tool , its accounting software isn't necessarily right for businesses with dozens of employees. Since Wave offers just one accounting plan, businesses can't scale up to plans that include more accounting tasks for growing businesses. And Wave's lack of inventory tracking makes it better matched to service-based solopreneurs and freelancers who don't need both accounting and inventory software.

Zoho Books is the most comprehensive accounting software

Data as of post date. Offers and availability may vary by location and are subject to change. *Only available for businesses with an annual revenue of <$50K USD. Paid plans start at $15.00 a month when billed annually.

Zoho Books automates the most common (and, let's face it, boring) bookkeeping tasks —which means you can dedicate more time to your business and customers and less time to the tedious task of data entry. Most notably, it lets you set automatic customer payment reminders, create recurring expense profiles, and manage 1099 contractors.

Plus, Zoho Books is just one piece of software in the larger suite of Zoho products. Each Zoho product integrates easily with the rest, which means that along with accounting, you can use Zoho for project management , inventory management , and customer relationship management (CRM)—just for a start.

Here's the best part: if you make under $50K a year, you can take advantage of Zoho Books' free plan . Otherwise, Zoho Books starts at $15 a month if you pay annually or $20 if you pay month to month. The cheapest plan includes three users, but you can also pay an extra $2.50 per month for each additional user. That’s a standout bargain, especially compared to FreshBooks' extra $10 per user per month. Zoho also offers discounts to nonprofits—one reason it's among our top financial management software picks for nonprofits that need true fund accounting .

Unfortunately, even though it’s a solid accounting tool, Zoho Books has one huge flaw: Zoho doesn't offer a payroll plan integration unless you live in California, Texas, or India. And it doesn't integrate with third-party payroll providers either. Instead, you have to manually update the payroll-related aspects of your books, which detracts from Zoho's primary perk of automation in a big way.

Similarly, Zoho Books’s cheapest plan doesn’t include automatic journal entry creation. Instead, whenever you debit or credit an account, you’ll have to manually create an entry. If you log more than a few transactions a month, the lack of automation adds major time and hassle—you’ll want the $40 a month (or $50, billed monthly) Professional plan instead.

Xero is the best overall accounting software

Data as of post date. Offers and availability may vary by location and are subject to change. *Current promotion: 75% off for three months. Offer available for new customers only.

We love Xero for its robust features and low starting price. For the regular price of just $13 a month, Xero lets you send custom invoices, reconcile bank transactions , capture receipts for easier record keeping, and track inventory.

But as a small-business accounting tool, Xero really stands out on the collaboration front. Unlike nearly every other accounting solution (including QuickBooks and FreshBooks ), all of Xero's accounting and inventory software plans include unlimited users. You don't have to pay extra to delegate responsibilities like bank reconciliation or expense tracking to another team member: time-saving collaboration is built into your price.

However, Xero's $13 a month plan limits you to entering only five bills and sending only 20 invoices a month. You can send unlimited invoices and quotes with only the Growing and Established plans, which start at $37 and $70 a month, respectively. Plus, you can only track expenses with the priciest plan. In contrast, both QuickBooks and FreshBooks offer small-business expense tracking up front.

By signing up I agree to the Terms of Use and Privacy Policy .

QuickBooks Online is the most user-friendly accounting software

Data as of post date. Offers and availability may vary by location and are subject to change. *30-day free trial or 50% off for three months. Price increases to $30.00/mo. after promotional period.

QuickBooks is easily one of the most popular financial, tax, and accounting software options in the world. And while QuickBooks Desktop (especially the fairly comprehensive, comparatively affordable QuickBooks Pro Plus) is still an option for those who prefer desktops, QuickBooks Online is Intuit’s cloud-accounting software solution.

The basic Intuit QuickBooks Online plan includes typical features like invoicing, billing, and receipt scanning along with more comprehensive tracking than many competitors:

- Mileage tracking

- Sales tax tracking

- Automatic tax deduction categorization

- 1099 contractor payment tracking

- Thorough reporting, including accounts receivable

QuickBooks also has the absolute best mobile accounting app you can find. The app can do basically everything the software can (a rarity for any software provider, no matter the industry). If you work on the go, QuickBooks's app, which includes mobile mileage tracking, might make it a good fit.

Intuit QuickBooks's online reporting and tracking features come at a price, though: its cheapest small-business plan starts at $30 a month and restricts you to one user plus an accountant. The priciest plan, which includes 25 users, starts at $200 a month.

At $15 a month, QuickBooks Self-Employed is a cheaper financial management option. However, QuickBooks Self-Employed targets freelancers with just a few clients and limited expenses. Instead, it's primarily an invoicing, mileage-tracking, and tax-tracking plan. That means it helps sole proprietors who file Schedule C forms maximize their tax returns, but it's not a fully featured bookkeeping or accounting app for other business owners.

FreshBooks is the best software for invoicing

Data as of post date. Offers and availability may vary by location and are subject to change. *30-day free trial or 50% off for 3 mos. Price increases to $17.00/mo. when promotional period ends.

FreshBooks’s combination of stellar features, customizable invoices, and well-reviewed mobile apps make it pretty much perfect—especially for freelancers. Unlike Xero , FreshBooks lets you send an unlimited number of invoices and estimates with every plan. Each plan also includes time tracking for easier, more accurate client billing. FreshBooks’s built-in small-business expense tracking helps you maintain a balanced budget. And, like QuickBooks Online, FreshBooks includes built-in mileage tracking—a must for freelancers who plan to claim mileage expenses on their year-end tax forms.

But while FreshBooks doesn’t limit your invoices, it does limit the number of customers you can bill each month. You can send your customers an unlimited amount of invoices, but the cheapest plan limits that client number to just five.

Additionally, FreshBooks doesn’t include bank reconciliation with its cheapest plan. Since bank reconciliation is an absolutely foundational accounting task, we can only recommend FreshBooks’s cheapest plan to freelancers or brand-new startups with just a few transactions a month.

Accounting software honorable mentions

Not sold on our top picks? Here are five more small-business accounting software options that could work better for you.

- Sage Accounting : Best user experience runner-up

- OneUp : Best for sales teams

- Kashoo : Easiest setup

- ZipBooks : Most affordable runner-up

Top feature comparison: Accounting software honorable mentions

Sage business cloud accounting: best user-experience runner-up.

Sage Business Cloud Accounting’s cheapest plan lets you create invoices, track amounts owed, and automatically reconcile your bank accounts . If you’re willing to pay a bit more ($25 a month), Sage Accounting adds unlimited users, quotes, estimates, cash flow forecasting, and purchase invoice management.

Unfortunately, Sage charges extra for receipt scanning, a feature competitors like Wave, FreshBooks, Xero, and QuickBooks include for free. And Sage’s pricier plan has built-in features than, say, Xero’s cheapest plan. (On the other hand, Sage's accounting system doesn’t limit your monthly invoice amount).

If you're looking for industry-specific accounting software, Sage some standout solutions beyond Sage Business Cloud Accounting. For instance, Sage 100 Contractor is a preferred accounting option for professionals in the construction business . And Sage Intacct is one of the best accounting services for nonprofits.

Sage Business Cloud is currently offering new customers 70% off for their first six months of Sage Accounting—which typically costs $25 a month. With the discount, your price goes down to $7.50 for six months. If you're considering Sage, we highly recommend taking advantage of the discount to save more than $100.

OneUp: Best for sales teams

All of OneUp's plans include customer relationship management (CRM) features, which makes it perfectly suited to sales teams that frequently follow up with customers. Plus, it's affordable: pricing for one user starts at $9 per month. If you’re a Mac user, though, you’re out of luck: OneUp works only for Windows users. And while every OneUp plan includes all of OneUp’s features, its plans limit your user numbers. Only the priciest plan, which starts at $169 a month, includes unlimited users.

Kashoo: Easiest setup

Got a minute to spare? You can set up Kashoo in 60 or so seconds, and the app immediately starts to categorize your expenses and learn your business spending habits. Like Zoho Books, Kashoo's automation is its selling point—and unlike Zoho Books, it syncs with SurePayroll , one of our top payroll providers .

Kashoo's accounting software starts at $20 a month. If you’re looking for a cheaper solution, Kashoo offers an invoice-centric plan for $0.00. Along with sending invoices, you can use the free plan to track expenses, accept online payments, and send estimates. We're not sure if the free plan lets you track income and expenses or not—Kashoo's site gives contradictory answers.

Either way, though, it looks like Kashoo is planning on developing expense and income tracking for its free plan, if it doesn't include those two features already.

ZipBooks: Most affordable runner-up

If you don't need quite as many features as Wave offers, ZipBooks is a solid free accounting software alternative . Even though it's free, it doesn't limit the number of invoices you can send (like Xero) or clients you can bill (like FreshBooks) per month—you can access unlimited customizable invoices and accept payments too. ZipBooks' paid plan starts at $15 a month and offers better bookkeeping and automation features than its free accounting plan. But if you prefer your accounting tools on the go, look elsewhere. ZipBooks' iOS app has disappeared from the App Store, and it's never had a Google Play app worth mentioning.

The takeaway

If you want fully featured accounting software with an excellent app, clean dashboard, and affordable price, we recommend Xero . Based on its features and pricing alone, it's a great bookkeeping and accounting company for most business types, from freelancers to LLCs.

All of our other picks have something to offer too, so if you find Xero isn't a good fit, try one of these alternatives:

- QuickBooks Online is an extremely comprehensive accounting solution with one of the best accounting apps and most thorough financial statements you can find. With up to 25 users, its most expensive plan suits bigger businesses with large, collaborative accounting teams.

- FreshBooks easily offers the best invoicing of any provider on our list. Its invoice, estimate, and payment acceptance features make it ideal for on-the-go contractors and freelancers who frequently collaborate with clients.

- Zoho Books has about as many features as QuickBooks at a lower price and a low additional user fee. Its free plan is perfect for freelancers who want solid reporting and financial tracking without any overwhelming bells and whistles (for instance, QuickBooks' dozens of customizable reports).

- Wave Accounting is the best free accounting solution for most freelancers, contractors, and other small-business owners. While it has fewer financial reports than other accounting systems, it's perfect if you juggle multiple businesses, want to add multiple users, or need unlimited expense tracking.

Finding the best online accounting software for your small business can seriously transform your working life. With less time spent on data entry, you have more time for the things you like most about small-business ownership, whether that's getting to know customers or making products you're proud of.

Most of our top accounting software picks include a free trial, so don't be shy about trying a few different brands if you don't hit on your favorite right away.

Need to pair payroll software with your new small-business bookkeeping and accounting software? Head over to our piece on the best payroll software for small businesses.

Still not sure which accounting provider is right for you? Answer some questions about your small business and we'll pair you with customized software options.

How to choose accounting software

We're going to walk you through the 10 best accounting software solutions below, but these are the best options out there—so how can you decide which one will work best for your business? First of all, you should talk to your accountant or financial professional for their input. Then work with your accountant to evaluate software based on the following criteria:

- Price . Accounting software costs as little as nothing and as much as several hundred dollars a month. Free software usually offers fewer features than paid software, so we recommend it primarily to freelancers, solopreneurs, and businesses with few employees. Bigger businesses should plan on spending quite a bit more per month—or even on outsourcing to a virtual accountant .

- Accounting and bookkeeping features . At minimum, accounting software should sync with your business bank accounts to help you track each financial transaction. Even the most bare-bones financial software should include features like invoicing, expense and income tracking, bank reconciliation , and mileage tracking .

- Automation . Most paid accounting solutions will automatically generate journal entries for your chart of accounts every time you accept a payment or pay a bill. Some automatically reconcile your bank accounts, and still others automatically sync with your payroll software to keep your accounts in order. The more automation, the more time saved (hypothetically, at least)—but the more you'll pay for your software too.

- User-friendly interface . If you can't figure out how to use your software, the amount of bookkeeping features it has doesn't matter. Before you commit to a plan, sign up for a demo or a free trial to get the hang of the software and find out if the interface simplifies your financial life or complicates it.

- Number of users . If you're a sole proprietor, you probably don't need to worry about finding software that lets you add multiple users. (Typically, even the cheapest base plans should include access for both you and an accountant for free.) But if you aren't the only person responsible for your business's finances, you'll want to look into software that lets you add multiple users, potentially with different permission levels.

Want to learn a little more about bookkeeping and accounting before you dive into our top reviews? Start out with our small-business accounting guide .

Accounting software FAQ

Xero offers fantastic accounting features at a reasonable starting price, but the best accounting software option for you depends on your business’s unique needs and budget. For instance, Wave works very well for freelancers on a budget, QuickBooks helps small-business owners who travel a lot for work, and FreshBooks’s customizable invoices are great for business owners who frequently collaborate with clients. Do you work off a Mac? Check out the best small business accounting software for Macs .

QuickBooks Online is definitely among the most popular accounting software for small businesses, and its thorough accounting features definitely make it the best accounting software for many users.

However, being popular isn't the same as being the best. Sure, QuickBooks could be the best software for your small business, or you might find its prices too high and its features too limited. Depending on what you need, another bookkeeping software pick like FreshBooks or Sage could be better for your business. Not sure what your other options are? Check out our list of the year's best QuickBooks alternatives to get started.

What is the easiest accounting software to use?

QuickBooks Online has a longstanding reputation as one of the easiest accounting software programs to use. The dashboard is well organized with clear graphics for each feature and easy-to-read reports that simplify finances for non-accountant business owners.

That said, all five of the best accounting software for small-business owners on our list are impressively user friendly. We especially want to call attention to Xero and Zoho Books: Zoho Books' automation nicely complements its accessible dashboard, and Xero's integration with over 1,000 third-party apps simplifies business processes immensely.

What is accounting software?

Accounting software is software that automates the most important bookkeeping tasks for small businesses. Depending on the type of accounting software you invest in, the software will help you create and send invoices, track projects and spending, and much more.

Most small-business owners don't have an accounting background but need to carefully track their business's finances to make sure they're turning a profit. User-friendly accounting software was built specifically for non-accountant business owners, and it automatically tracks finances for you so you can spend your time on tasks you like more, such as finding customers and completing projects.

Accounting software also generates financial reports for you, which is a crucial part of creating a small business that many first-time business owners aren't aware of. You usually need to submit financial documents like profit and loss reports as part of your business taxes each year. Additionally, you need thorough documentation to secure a small-business loan or appeal to eventual shareholders.

While you can track data and create financial documents by hand, accounting software can do it for you—and while requiring less time, effort, and energy on your part.

What are the benefits of small-business accounting software?

The most important benefit of small-business accounting software is probably the time it saves. Once you sync your bank account and credit cards to your accounting program, the software automatically imports your financial transactions. This ensures you're always working with the most up-to-date numbers as you're making crucial business decisions.

Most accounting software also streamlines traditionally time-consuming tasks like these:

- Invoicing, including sending invoices and late-payment reminders

- Automating bill payments

- Reminding you of quarterly tax deadlines

- Pre-filling some tax forms

- Generating common financial documents that help you (and related parties like lenders and shareholders) see where your business stands

- Tracking mileage to simplify end-of-year tax write-offs

- Uploading receipts for easier categorization

- Automatic expense categorization

Most accounting software also syncs with payroll software so you don't have to transfer your paycheck data into your general ledger by hand.

If you don't use accounting software, you'll probably catalogue your financial transactions by hand using a spreadsheet . This method can be cheaper, but it means you're doing every financial task on your own. Not only will you spend hours of your time painstakingly entering and categorizing data, but you'll have a harder time catching mistakes.

In other words, doing accounting by hand is possible—but it's also more complicated, time consuming, and error-prone.

How much does accounting software for small businesses cost?

Business accounting software can cost as little as $0. Free accounting software options like Wave Accounting and Zoho Books (which has a free plan for businesses that make less than $50K USD in revenue per year) remove the hassle of by-hand financial data entry without subtracting cash from your bottom line.

If you want more features than just the basics, accounting software typically starts around $10 to $15 a month. Xero, for instance, charges $13 for its most basic plan while FreshBooks starts at $15. QuickBooks Online generally has the highest starting prices in the industry at $30 a month for a basic plan.

What accounting software do bookkeepers use?

Many bookkeepers and accountants use QuickBooks to track their clients' finances, including both QuickBooks Online and QuickBooks Desktop . However, while QuickBooks is still the most popular accounting software for small-business owners and bookkeepers alike, a growing number of CPAs use QuickBooks alternatives like Xero, FreshBooks, and Sage Business Cloud to collaborate with their clients.

Additionally, many outsourced bookkeeping companies use proprietary in-house software to keep their customers' books.

What is the best free accounting software for small businesses?

Wave Accounting is one of the most fully featured free accounting software options for small businesses. Its user-friendly dashboard, low learning curve, and easy expense tracking make it ideal for freelancers and small-business owners who don't mind finding another app to manage inventory. It’s also a lot more comprehensive than most other free cloud-accounting software options.

But if Wave doesn’t have the right features for your small business, you do have other free accounting options— ZipBooks , SlickPie , or another free accounting software provider could work better for you.

Can I use accounting software with payroll software?

Most accounting software providers sync with one or more popular payroll providers (Zoho Books, which doesn’t sync with most payroll software, is a notable exception). Xero, FreshBooks, and QuickBooks all sync with Gusto , our favorite payroll provider for small businesses. At $39 plus $6 per user per month, Gusto is also fairly reasonably priced.

Of the accounting software providers listed here, only QuickBooks and Wave offer payroll plans in all 50 states. Of the two, we recommend Wave Payroll over QuickBooks Payroll , which is on the pricier end and doesn’t offer a tax-filing guarantee—a key industry standard you should expect from any payroll provider.

Methodology

To find and rank the best accounting software for freelancers and small-business owners, we carefully examined each accounting company's performance in a few crucial areas:

- Bookkeeping and accounting features , such as bank reconciliation, journal entry generation, charts of accounts, receipt scanning, invoicing, and expense and invoice tracking

- Pricing , including the number of features with each plan, user limits, and additional fees

- Scalability for growing businesses , including the number. of plans and user limits included with each plan

- Customer support , including customer service hours, means of contact, and overall customer reputation on consumer review sites like Trustradius, Trustpilot, and the Better Business Bureau

- User-friendliness , including learning curve, mobile app access, dashboard functionality, setup tutorials, and overall interface design

We weighted each category equally to derive our star ratings, along with our accounting expert's opinion and advice. Star ratings are subject to frequent review and may change.

Related reading

- Wave vs. QuickBooks Online

- FreshBooks vs. Xero

- FreshBooks vs. QuickBooks Online

- Accounting 101: A Guide for Small-Business Owners

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

- Search Search Please fill out this field.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

- Small Business

Best Accounting Software for Small Businesses for May 2024

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-04-16at9.42.46AM-1beaef8ee93e48c9804df98304eba81d.png)

According to our research, QuickBooks Online is the best accounting software for small business due to its popularity with accountants, active user base, and broad collection of helpful tools and resources to help you master the software—and your business finances.

The best software accounting packages are easy to use, offer robust tracking and planning tools and reports, integrate with other software, and are easy to share with outside bookkeepers and accountants. Despite these benefits, 51% of small businesses with 19 or fewer employees rely on spreadsheets or non-digital methods to manage and track their funds, according to one recent survey. These software systems can help you manage business finances more efficiently, and set you up to transfer to more complex systems later as your business grows.

We researched 19 different business accounting software products, and evaluated them based on their cost, scalability, ease of use, reputation, and accounting features.

- Best Overall: QuickBooks Online

- Best for Micro-Business Owners: Xero

- Best for Service-Based Businesses: FreshBooks

- Best for Part-Time Freelancers: QuickBooks Solopreneur

- Best Free Software: Wave

Our Pick for Micro-Business Owners

Xero: accounting software born in the cloud.

Try Xero for free for 30 days. Get set-up with free onboarding support, connect with any of our 1,000+ app partners, and choose which of our 3 subscriptions is best for you

- Early at $15 per month

- Growing at $42 per month

- Established at $78 per month

- Our Top Picks

QuickBooks Online

- QuickBooks Solopreneur

- See More (2)

The Bottom Line

- Compare Software

- How to Choose

- Alternatives

Frequently Asked Questions

- Methodology

Best Overall : QuickBooks Online

- Price : $30 per month and up

- Cloud-based : Yes

- Mobile app : Yes (iOS & Android)

We picked QuickBooks Online because of its wide use among small business accounting professionals and its numerous online training resources and forums to get support when you need it. Plus all accounting tools and features can be conveniently accessed through one main dashboard, making bookkeeping more fluid and efficient.

Commonly used by accounting professionals

Integration with third-party applications

Cloud-based

Has mobile app

Upgrade required for more users

Occasional syncing problems with banks and credit cards

Intuit’s QuickBooks Online is one of the most familiar names in accounting software, widely used by small businesses and their bookkeeping and tax professionals. The cloud-based software can be accessed through a web browser or a mobile app.

There are four options for monthly subscription plans:

- Simple Start ($30 per month)

- Essentials ($60 per month)

- Plus ($90 per month)

- Advanced ($200 per month)

You can select to have a 30-day free trial, but if you elect to skip it, you'll receive 50% off the first three months.

The monthly subscription for this software can be upgraded as a business grows. The feature-packed mobile app can be used to receive payments, send invoices, capture an image of a receipt, provide estimates, and more. For businesses looking for a payroll solution, QuickBooks Payroll fully integrates with QuickBooks Online.

Each plan offers more advanced features like inventory management , time tracking, additional users, and cash flow. Most service-based small businesses will find that Simple Start meets all of their needs. Essentials adds additional features for bill and time management. For product-based small businesses, Plus will have more options for inventory and customizations.

The Advanced subscription adds many features including expense management, exclusive premium apps, a dedicated account team, and on-demand training. All plans allow integration with third-party apps such as Stripe or PayPal. QuickBooks Online’s app store breaks down all of its apps by function and provides helpful examples of the benefits of each app.

Intuit, the company that produces QuickBooks, is a small business accounting and services behemoth, with more than 17,000 employees, and a roster of brands that includes QuickBooks, TurboTax, Mailchimp, and Credit Karma. It is headquartered in Mountain View, California.

Best for Micro-Business Owners : Xero

- Price : $15 a month and up

We chose Xero for really small "micro-business" that have just a few invoices and bills per month. For businesses of that size, Xero's "Early" subscription plan may be a good fit. At just $15 per month, it's limited to just 20 invoices (or quotes) and five bills per month. The plan also offers a receipt capture tool and a cashflow tool.

Payroll integration with Gusto

Third-party app marketplace

Simple inventory management

Limited reporting

Fees charged for ACH payments

Limited customer service

Xero offers three monthly subscription options and a full-service payroll add-on:

The company offers 50% off for the first three months. The full-service payroll option is offered through Gusto and starts at an additional $40 per month, plus $6 per employee. You can try Gusto free for three months.

The Early plan limits usage and only allows entry for 20 invoices or quotes and five bills per month. This limited plan may be suitable for a micro-business with high-ticket transactions but only a few per month, such as a consulting or small service provider.

Both the Growing and Established plans offer unlimited invoices and bills. The only difference between the two is that the Established plan has additional features like multi-currency, expense management, and project costing. All three plans offer Hubdoc, a bill and receipt capture solution.

Xero was founded in 2006 in New Zealand and now has over 3.5 million subscribers worldwide. This accounting software is popular in New Zealand, Australia, and the United Kingdom. Xero has over 4,500 employees and is growing rapidly in the U.S., as well.

Best for Service-Based Businesses : FreshBooks

- Price : $19 a month and up

We like FreshBooks for service-based businesses because it excels at producing proposals, tracking time on projects, and receiving payments—all key processes for service-based businesses. FreshBooks's primary function is sending, receiving, printing, and paying invoices, but it can also handle a business’s basic bookkeeping needs.

User-friendly interface

Third-party app integration

Advanced invoicing features

Reporting features not available in mobile app

Additional users cost extra

There are four different Freshbooks plans to choose, and businesses can get a 10% discount if they choose to pay yearly rather than monthly. Additionally, FreshBooks often offers discounts for your first months of membership.

- Lite ($19/monthly)

- Plus ($33/monthly)

- Premium ($60/monthly)

- Select, which is a custom service with custom pricing

The main difference between the four plans is the number of different clients that can be billed per month. In the Lite plan, up to five clients can be billed per month. In the Plus plan, up to 50 clients can be billed per month. In the Premium plan, unlimited clients can be billed per month.

The Select plan also does not have a limitation on the number of clients that can be billed per month but adds unique features. It costs an additional $10 per month for multiple team members to use the accounting software, and it includes the advanced payment feature for free ($20 extra each month with other plans), which allows users to charge a credit card in real-time or set up a recurring credit card charge for a client.

Many third-party app integrations are available, such as Gusto, G Suite, and more. A unique feature of FreshBooks is that invoices can be highly stylized and customized for a professional look and feel. FreshBooks is a great tool for budgeting out projects, sending estimates or proposals, and collecting customer payments.

Founded in 2003 in Toronto, FreshBooks started as just an invoicing tool. Over time, more features have been added, and as of 2023, FreshBooks has over 30 million users.

Best for Part-Time Freelancers : QuickBooks Solopreneur

- Price : $20 a month and up

This is our top choice for part-time freelancers and independent contractors who primarily want to track their income and expenses for their tax returns. It's designed for business owners who file a Schedule C on their individual tax returns and need help separating business and personal transactions.

QuickBooks Solopreneur replaces QuickBooks Self-Employed, which is no longer available to new subscribers. Existing Self-Employed subscribers can continue to use the older product. QuickBooks has also created a FAQ page that explains the differences between the two.

Mobile app available

Tracks mileage

Differentiates between business and personal expenses

Syncs with TurboTax

Somewhat difficult to upgrade to QuickBooks Online

Relatively expensive for limited tools

QuickBooks Solopreneur is another Intuit product with a cloud-based online interface and a mobile app. This software was created to help freelancers stay organized each year for tax season. Features of QuickBooks Solopreneur include tracking mileage, sorting expenses, organizing receipts, and estimating and filing taxes through TurboTax.

There is a 50% discount for the first three months.

Solopreneur also gives you access to a tax expert to answer questions throughout the year and during tax season.

The mobile app makes it easy to track mileage while driving and capture photos of receipts for business expenses. Most accounting software is not designed to separate business transactions from personal transactions, but a special feature of QuickBooks Solopreneur provides an option to mark each transaction as business or personal. This is helpful for freelancers who don’t have a separate bank account for their business activity.

What's the difference between QuickBooks Online and QuickBooks Solopreneur? In short, Online is the more comprehensive and robust option, meant for businesses with lots of vendors, employees, and clients. Solopreneur lacks Online's reporting, inventory, and sales tracking tools. Both track expenses and can help you at tax time. If you're working a side hustle or run a micro business, Solopreneur can help you track receipts and expenses (and keep them separate from your non-business expenses), and it can help you meet your quarterly tax filing requirements.

Best Free Software : Wave

- Price : Free invoicing and expense tracking, plus some paid features; $16 per month Pro plan with additional features

Wave is a good choice for a service-based small business that sends simple invoices and doesn’t need to run payroll. Best of all, it's free (for the basics). At year-end, accountants can pull the necessary reports from Wave to prepare a business’s tax return .

Free accounting and invoicing

No transaction or billing limits

Run multiple businesses in one account

Unlimited number of users

Integrations only through Zapier

Higher fees for credit card payments

Full-service payroll is limited to only 14 states

Receipt scanning costs $8/month

This free software includes the foundational accounting features that most small businesses need, such as income and expense tracking, financial reporting, sending invoices, and scanning receipts. These features can be accessed online or via the mobile app.

There's also a more robust "Pro" plan for $16 per month.

Wave makes its money to support its free offering on its payment gateway. To process a credit card payment from a customer, Wave charges 2.9% plus 60¢ per transaction for Visa, Mastercard, and Discover and 3.4% plus 60¢ per transaction for American Express. These fees are slightly higher than other accounting software. (The Pro plan includes 10 credit card transactions with no transaction or "swipe" fees per month.) Additionally, Wave charges 1% per transaction with a $1 minimum fee to process an ACH payment rather than a credit card.

Wave offers two payroll plans as an add-on service. The first plan is $20 per month plus $6 per employee or contractor. In this plan, Wave will process payroll and prepare payroll tax calculations, but the user is responsible for manually completing payroll tax forms and submitting tax payments. The second plan is $40 per month plus $6 per employee or contractor. In this plan, payroll is full-service, meaning that all tax filings and payments are managed by Wave. It is only available in 14 states.

Wave was founded in 2010 and is based in Toronto. Nine years later, it was purchased by H&R Block and has over 250 employees.

QuickBooks Online topped our list for its scalability, training resources, and mobile app. But micro-businesses may find their needs more affordably met by Xero, and self-employed individuals will appreciate the ability to categorize personal and business expenses with QuickBooks Solopreneur. Service-based businesses that want the best invoicing tools and customization will be best-served by FreshBooks. And if you’re looking for a free solution to business’s invoicing and accounting needs, Wave is a good option.

Compare the Best Accounting Software for Small Businesses

What is accounting software for small business.

Accounting software packages are specialized computer programs that help businesses, track invoices, generate reports, and record and report financial transactions. Large firms may choose complex, customized accounting software packages that track inventory, manage accounts payable and accounts receivable, and handles payroll. For smaller businesses, off-the-shelf packages like those highlighted here can accomplish most or all of the firm's accounting needs.

Accounting software reduces the amount of time spent on manual data entry by allowing users to sync their business bank accounts and credit cards with the software. Once synced, bank transactions will flow into the accounting software, which can be categorized into various accounts. This process can also reduce human error, and make a time consuming task more efficient.

Most accounting software is easy to use, but a general understanding of accounting practices will help ensure that financial reports are prepared correctly. For this reason, many small business owners hire bookkeepers or accountants to maintain or review their books. Cloud-based accounting software makes it convenient for businesses to share their accounting data with their bookkeepers or accountants.

Many accounting software packages allow third-party application integrations. For example, if a business owner uses a point of sale (POS) system to capture sales transactions, the POS system could potentially integrate with the accounting software to record specific transactions, sales tax liabilities, sales by subcategories, and more. In a service-based business, a time-tracking application could integrate with the accounting software to add labor to a client invoice.

Why Use Accounting Software?

Accounting, and accounting software, can often seem like dull chores that take away from the "real work" of running and growing a business, like marketing or sales or delivering your product or service. But avoiding the accounting can be a mistake, especially for businesses that have grown beyond the "micro business" stage.

Accounting software can make the process more efficient and less tedious. And it can help your business in other, more strategic ways:

- A broader view of business performance : Your accounting software can show where your company stands, financially speaking, and help you develop goals, and track your progress toward them.

- Simplified reconciliation processes : Reconciling bank transactions or matching vendor invoices against payments can be tricky. Accounting software can help you do it more efficiently.

- Better cash flow management : Greater insight in your financial situation overall also means a better view of cash flow, and how to manage it.

- Identification of profitable (and unprofitable) clients and practices : Accounting software can show you which clients and business segments are most profitable, and which are not, so you can prioritize your resources accordingly.

Types of Accounting Software

Accounting software can be divided into a handful of categories.

- Commercial Off-the-Shelf Software : Widely available, general purpose accounting software designed to be used by a broad range of businesses and organizations. This is the kind of software reviewed here. Customization options are few (if available at all). Some packages feature special functions and reports designed for specific industries. Software may be installed on business computers or delivered online via the internet ("cloud-based" software).

- Enterprise Resource Planning Software (ERP) : An ERP is a complex software package that ties together all of a firm's systems, including accounting. It's primarily used by large enterprises.

- Custom Accounting Software : For businesses with highly particular accounting, reporting, and other needs, a custom system may be required. Development time can be extensive, and the upfront cost can also be significant.

How to Choose the Best Accounting Software for Small Business

Start your search by understanding your business and what it needs from accounting software.

- Your budget : Free business accounting software is available and the subscription packages reviewed here cost a few dollars per month. Can your budget support a paid option?

- Business-specific needs : Do you need specialized software such as for a restaurant or retail store or will a basic software system work for your business?

- Accounting needs : Do you need more than the basics (income and expense tracking, basic financial reports, budgeting, tax reporting and filing)? What about later, as your business grows?

- Usability : How easy is the software to use? Will you or someone on your staff be able to use it efficiently?

- Integration and collaboration : Does the software sync with your existing or planned systems (such as payroll, or inventory, or point-of-sale). Is it easy to share details and reports with your accountant or bookkeeper?

- Customer support : Does the vendor provide adequate resources to help you understand the software, and the underlying accounting and bookkeeping practices such as how-to articles, a knowledge base, or a community forum? Can you get live customer support over the phone or via webchat?

Essential Features of Accounting Software for Small Business

Depending on the accounting software you choose, you may have access to some of the following features:

- Income and Expense Tracking : Most accounting software allows you to track and categorize your income and expenses, sometimes through third-party app integrations. You can typically also take photos of your receipts for digital storage.

- Invoicing : Accounting software allows you to customize and create invoices. The best accounting software also allows for automation of recurring invoices and payment reminders and enables payments directly from the invoice.

- Receiving Payments : Accounting software can make it easy to accept credit card payments and ACH transfers. Some allow for app payments as well.

- Paying Bills : Accounting software lets you organize your bills so you don’t miss your due date. You can often pay multiple contractors at once with the right software.

- Project Estimates : With the right software, you can customize project estimates and even collect mobile signatures.

- Time and Mileage Tracking: Some accounting software allows you to enter time for your employees and independent contractors or provide them with access to clock in and out from their phones. You can often use your phone’s GPS to automatically track mileage as well.

- Financial Reporting : Financial reporting helps you get a clear picture of your business finances, from cash flow planning to estimating project profitability to providing profit and loss reports to stakeholders.

- Payroll : Some accounting software includes payroll features, which may allow you to automate paying your employees with direct deposit.

- Inventory : Businesses that stock products need accounting software to keep track of when inventory is low. You may also use software to create purchase orders and manage vendors.

Alternatives to Small Business Accounting Software