Livestock Farming Business Plan Template

Written by Dave Lavinsky

Livestock Farming Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their livestock farming companies. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a livestock farming business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Livestock Farm Business Plan?

A business plan provides a snapshot of your livestock farming business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Livestock Farm

If you’re looking to start a livestock farming business or grow your existing livestock farming company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your livestock farming business to improve your chances of success. Your livestock farming business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Livestock Farming Businesses

With regards to funding, the main sources of funding for a livestock farming business are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan (hand it to them in person or email to them as a PDF file) and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for livestock farming companies.

Finish Your Business Plan Today!

How to write a business plan for a livestock farming business.

If you want to start a livestock farming business or expand your current one, you need a business plan. The guide and sample below details the necessary information for how to write each essential component of your livestock farming business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of livestock farming business you are running and the status. For example, are you a startup, do you have a livestock farming business that you would like to grow, or are you operating several family-owned livestock farming businesses?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overv iew of the livestock farming industry.

- Discuss the type of livestock farming business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of livestock farming business you are operating.

For example, you m ight specialize in one of the following types of livestock farming businesses:

- Cattle Ranching : In order to effectively raise cattle until market-ready, ranchers must have enough land for cattle to roam and eat grass. The rancher must also provide supplemental food, medicines and a number of procedures to ensure cattle sent to market are healthy and at an optimum weight.

- Sheep Farming: Sheep farming is a process of maintaining order in the herd and corralling sheep when necessary. Farmers must feed and medicate sheep efficiently and they use sheep dogs to assist in many daily efforts. Sheep are prized for their wool and may be sent to slaughter as lambs if they are young. Sheep are often used on vacant fields to graze with an environmentally-friendly outcome.

- Chicken Farming: Chicken farmers need to provide water, food and medications to raise chickens until market-ready. Chickens may be free-range or kept in sheds during growth cycles. While hens produce eggs, roosters provide barnyard protection and enjoyment.

- Hog Farming: Hogs are notoriously expensive to raise, primarily due to food costs and medications; however, they demand high prices at sale and produce generous profits when sent to market. Hogs are grown in pens to control weight gain and are carefully assessed for market-readiness.

In addition to explaining the type of livestock farming business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of cattle sold each season, the number of sheep successfully shorn each year, reaching X number of ranches owned, etc.

- What is your legal business structure? Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the livestock farming industry. While this may seem unnecessary, it serves multiple purposes.

First, researching the livestock farming industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your livestock farming business plan:

- How big is the livestock farming industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your livestock farming business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your livestock farming business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: corporate buyers, stockyard owners, and individual buyers.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of livestock farming business you operate. Clearly, individuals would respond to different marketing promotions than stockyard owners, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers. Ideally you can speak with a sample of your target customers before writing your plan to better understand their needs.

Finish Your Livestock Farming Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are othe r livestock farming businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes specialty types of beef cattle, such as organic or grass-fed, imported lamb or beef, or eggs that are infused with additional supplements. You need to mention direct competition, as well.

For each direct competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of livestock farming business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide lower rates for stockyards despite fluctuating higher market prices?

- Will you offer beef cuts that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a livestock farming business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type o f livestock farming company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide uncured, smoked ham and bacon, pasteurized eggs, or free-range chicken?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of yo ur plan, yo u are presenting the livestock you offer and their prices.

Place : Place refers to the site of your livestock farming company. Document where your company is situated and mention how the site will impact your success. For example, does your cattle ranch contain grassy acreage, allowing cattle to eat naturally? Is your chicken ranch situated in a weather-friendly environment? Does your hog farm contain heated and cooled hog pens for the well-being of the hogs?

Promotions : The final part of your livestock farming marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to regional stockyards

- Distribute farmer newsletters to stockyards

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your livestock farming business; including caring for livestock, securing and maintaining food supplies and medications, planning transport to market, invoicing customers and paying bills.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to ship-to-market, or when you hope to reach $X in revenue. It could also be when you expect to expand your livestock farming business to a new ranch or farm.

Management Team

To demonstrate your livestock farming business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing livestock farming businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a livestock farming business or successfully running a livestock stockyard.

Financial Plan

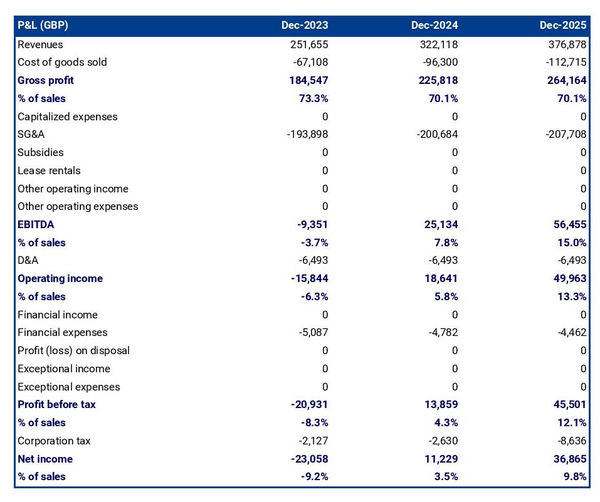

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance s heet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you ship 500,000 head of cattle this season, or will you expand your farm by several hundred acres? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

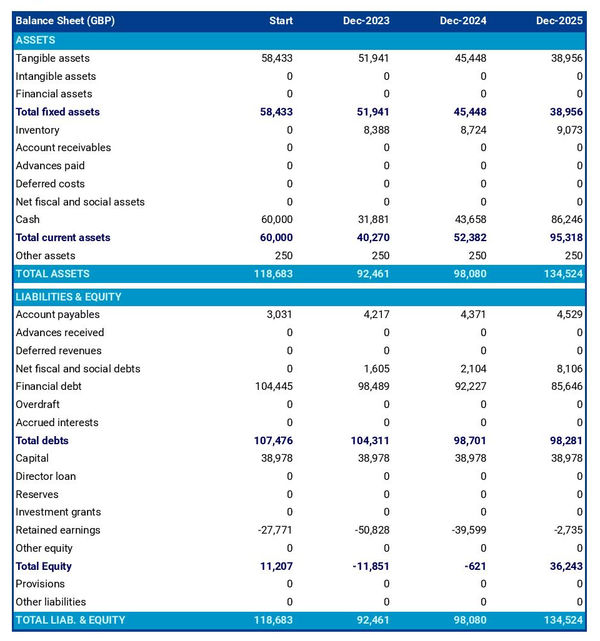

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your livestock farming business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a livestock farming business:

- Cost of breeder chickens, lambs, farrow pigs or calves

- Cost of farming equipment and vehicles

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your ranch deed of ownership or a list of buyers you partner with in buying and selling operations.

Writing a business plan for your livestock farming business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the livestock farming industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful livestock farming business.

Livestock Farming Business Plan FAQs

What is the easiest way to complete my livestock farming business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your livestock farming business plan.

How Do You Start a Livestock Farming Business?

Starting a livestock farming business is easy with these 14 steps:

- Choose the Name for Your Livestock Farming Business

- Create Your Livestock Farming Business Plan

- Choose the Legal Structure for Your Livestock Farming Business

- Secure Startup Funding for Your Livestock Farming Business (If Needed)

- Secure a Location for Your Business

- Register Your Livestock Farming Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Livestock Farming Business

- Buy or Lease the Right Livestock Farming Business Equipment

- Develop Your Livestock Farming Marketing Materials

- Purchase and Setup the Software Needed to Run Your Livestock Farming Business

- Open for Business

Where Can I Download a Free Business Plan Template PDF?

Click here to download the pdf version of our basic business plan template.

Our free business plan template pdf allows you to see the key sections to complete in your plan and the key questions that each must answer. The business plan pdf will definitely get you started in the right direction.

We do offer a premium version of our business plan template. Click here to learn more about it. The premium version includes numerous features allowing you to quickly and easily create a professional business plan. Its most touted feature is its financial projections template which allows you to simply enter your estimated sales and growth rates, and it automatically calculates your complete five-year financial projections including income statements, balance sheets, and cash flow statements. Here’s the link to our Ultimate Business Plan Template.

Don’t you wish there was a faster, easier way to finish your Livestock Farming business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to learn about Growthink’s business plan writing services .

Other Helpful Business Plan Articles & Templates

Cattle Farming Business Plan Template

Written by Dave Lavinsky

Cattle Farming Business Plan

You’ve come to the right place to create your Cattle Farming business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their cattle farms.

Below is a template to help you create each section of your Cattle Farm business plan.

Executive Summary

Business overview.

Pleasant Hill Cattle Farm, located in Des Moines, Iowa, is a registered and licensed cattle farming company. The company operates a 500 acre farm that is home to over 300 cows, all of which are raised in an all-natural environment (no antibiotics, hormones, steroids, etc) and all animals are grass-fed. Pleasant Hill Cattle Farm is also fully equipped with the latest technology and equipment used in the cattle farming industry.

Pleasant Hill Cattle Farm is founded and run by Matthew Jones. Matthew has been a cattle farm operations manager for the past ten years, so he has in-depth knowledge and experience running a business in this industry. Matthew will run the general operations and administrative functions of the company and hire other employees to manage the sales and day-to-day operations.

Product Offering

Pleasant Hill Cattle Farm will be involved in the commercial breeding of cows to provide the following products:

- Ground Beef

Customer Focus

Pleasant Hill Cattle Farm will target all residents living in Des Moines, Iowa and the surrounding areas. We will also target supermarkets, restaurants, and other retailers who are interested in selling our products to the public.

Management Team

Pleasant Hill Cattle Farm’s most valuable asset is the expertise and experience of its founder, Matthew Jones. Matthew has been a cattle farm operations manager for the past ten years, so he has in-depth knowledge and experience running a business in this industry. Matthew will run the general operations and administrative functions of the company and hire other employees to manage the sales and day-to-day operations.

Success Factors

Pleasant Hill Cattle Farm will be able to achieve success by offering the following competitive advantages:

- Management: The company’s management team has years of business and marketing experience that allows them to market and serve customers in an improved and sophisticated manner than the competitors.

- Relationships: Having lived in the community for 20 years, Matthew Jones knows all of the local leaders, media, and other influencers. As such, it will be relatively easy for Pleasant Hill Cattle Farm to build brand awareness and an initial customer base.

- Quality products at affordable pricing: The company will provide quality products at affordable pricing, as it has high-quality equipment and uses the latest techniques.

- Good packaging: Pleasant Hill Cattle Farm will utilize product-oriented packaging materials that can reduce the damage in the products at the time of supply.

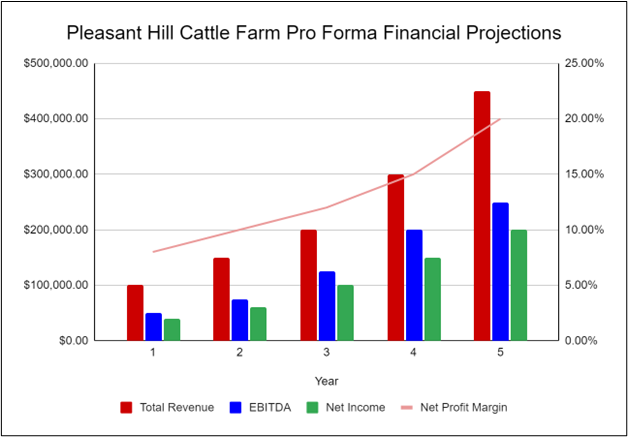

Financial Highlights

Pleasant Hill Cattle Farm is currently seeking $750,000 to start the company. The funding will be dedicated towards securing the farm land and purchasing the necessary equipment and supplies. Funding will also be dedicated towards three months of overhead costs to include payroll of the staff and marketing costs for the farm. The breakout of the funding is below:

- Land and Equipment: $250,000

- Cattle Care Supplies: $100,000

- Overhead Costs: $100,000

- Three Months of Overhead Expenses (Payroll, Rent, Utilities): $150,000

- Marketing Costs: $50,000

- Working Capital: $100,000

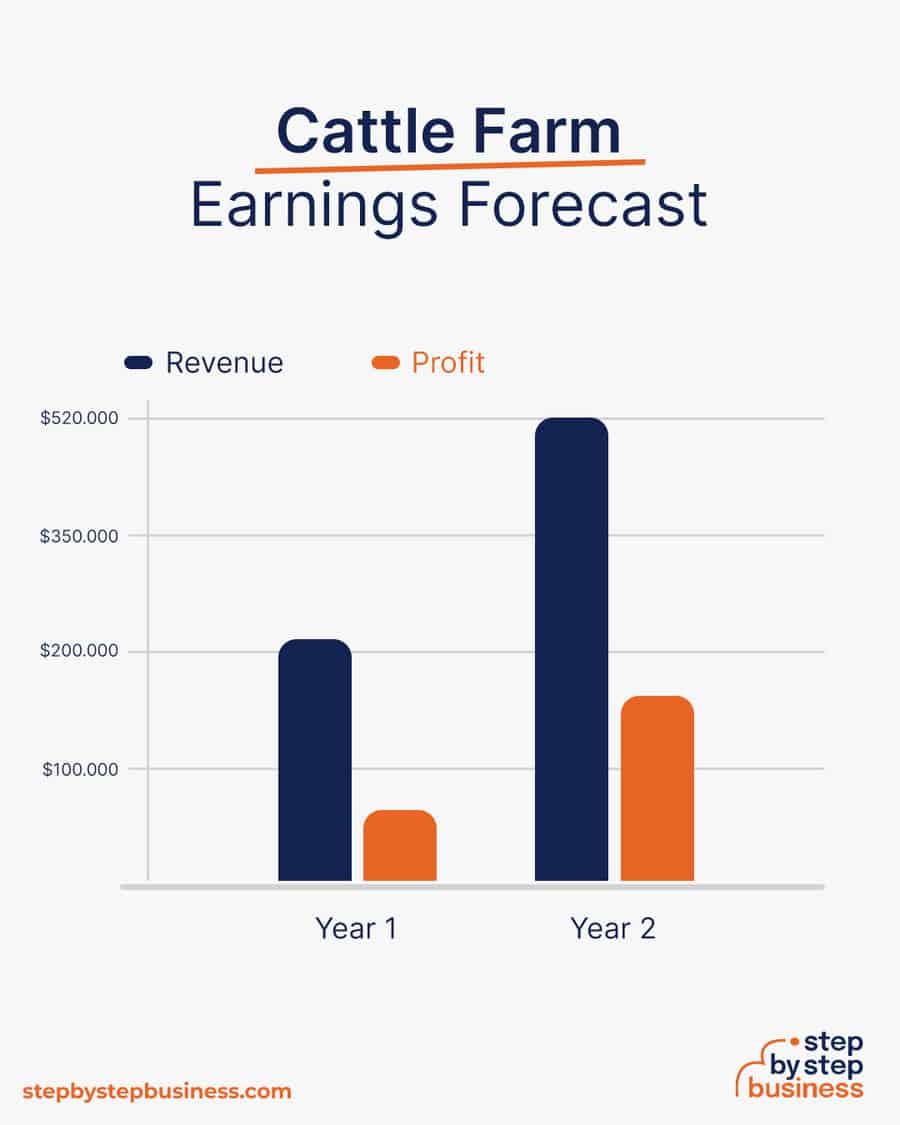

The following graph below outlines the pro forma financial projections for Pleasant Hill Cattle Farm.

Company Overview

Who is pleasant hill cattle farm.

Pleasant Hill Cattle Farm is founded and run by Matthew Jones. Matthew has been a cattle farm operations manager for the past ten years, so he has in-depth knowledge and experience running a business in this industry. Matthew will run the general operations and administrative functions of the company and hire other employees to manage the sales and day-to-day operations.

Pleasant Hill Cattle Farm History

Matthew Jones is an entrepreneur who seeks to contribute to the growing US economy through cattle farming. Pleasant Hill Cattle Farm will become a recognized cattle farming company in Des Moines, Iowa, ensuring a continuous supply of cattle, milk, meat, and other dairy products.

Matthew has selected an initial location and is currently undergoing due diligence on it and the local market to assess if it is a suitable location for a commercial cattle farm.

Since incorporation, the company has achieved the following milestones:

- Found a farm location

- Developed the company’s name, logo, and website

- Determined supply requirements

- Began recruiting key employees

Pleasant Hill Cattle Farm Services

Industry analysis.

Pleasant Hill Cattle Farm competes against large-scale cattle farmers in the U.S. With the largest fed-cattle industry in the world, the United States is also the world’s largest producer of beef, primarily high-quality, grain-fed beef for domestic and export use. According to the USDA, beef cattle production in the US is one of the largest agricultural industries, making up 17% of the agricultural sector. Though the industry has declined slightly in the past few years, the market size of the Beef Cattle Production industry is expected to increase by 4.5% over the next five years.

Improving the living standards of the people in the country has resulted in a shift in meat preferences, with most choosing beef-based products rather than products derived from pork and chicken. This trend has helped increase revenues and allowed the industry to grow. However, the beef cattle production industry faces many challenges including droughts, the price of feed, and the increasing popularity of plant-based diets.

Customer Analysis

Demographic profile of target market.

Pleasant Hill Cattle Farm will primarily serve local residents and retailers of cattle dairy products and meat within a 30-mile radius of the farm. These businesses typically gross from $5 million to $10 million in annual revenues and source their supplies from within a 30-mile radius of their facilities.

The precise demographics for Des Moines, Iowa are:

Customer Segmentation

Pleasant Hill Cattle Farm will primarily target the following customer profiles:

- Grocery Stores

- Local Residents

Competitive Analysis

Direct and indirect competitors.

Pleasant Hill Cattle Farm will face competition from other companies with similar business profiles. A description of each competitor company is below.

Shayla Farms

Shayla Farms is one of the large-scale cattle farms in the US, owning an 8,000 ha area. It has well-established relationships with local retailers. It has been in business for 32 years. Shayla Farms offers good quality dairy products and meat. It also has automated equipment and machines, which helps in improving its operations. Moreover, it is also known for delivering large orders at the right time without delay.

Crimson Cattle Farm

Crimson Cattle Farm has been operating since 1995 and is a well-known company that provides good quality beef with affordable pricing as it has effective and efficient cattle rearing machines. It majorly targets local companies and retailers and has a large distribution network that can serve customers up to a 500-mile radius. Crimson Cattle Farm also has a very effective distribution and supply chain network. However, Crimson Cattle Farm’s offerings are only limited to beef.

Cattle USA has been in business for the past 50 years and enjoys great success. It is one of the largest beef producers in the 200-mile area. It easily caters to local residents primarily due to its prime location. It provides beef and a variety of dairy products including: cheese, yogurt, meat and milk.

Competitive Advantage

Pleasant Hill Cattle Farm will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

Pleasant Hill Cattle Farm will offer the unique value proposition to its clientele:

- Efficient and effective delivery network

- Good packaging

- Quality products at affordable pricing

- Providing excellent customer service and customer experiences

Promotions Strategy

The promotions strategy for Pleasant Hill Cattle Farm is as follows:

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The company will use social media to develop engaging content, such as sharing pictures of the cows and creating educational content about the cattle farm industry.

Website/SEO

Pleasant Hill Cattle Farm will develop a professional website that showcases pictures of the farm and the cows. It will also invest in SEO so that the company’s website will appear at the top of search engine results.

Word of Mouth/Referrals

Matthew Jones has built up an extensive list of contacts over the years by living and working in the midwestern farming industry. Since a number of local cattle farms have ceased operations, they have committed to Matthew that Pleasant Hill Cattle Farm will be their cattle supplier. They trust his work ethic and commitment to the local community.

Pleasant Hill Cattle Farm will highlight our location, cows, and products on a major billboard facing the busiest highway in town. The billboard will provide the location of Pleasant Hill Cattle Farm and the website URL.

Pleasant Hill Cattle Farm’s pricing will be moderate, so customers feel they receive great value when availing of the products. Pricing will be about 50% lower than retail prices to allow wholesalers and retailers to earn their margins.

Operations Plan

Operation Functions: The following will be the operations plan for Pleasant Hill Cattle Farm.

- Matthew Jones will be the Owner and President of the company. He will oversee all staff and manage client relations. Matthew has spent the past year recruiting the following staff:

- Sue Smith – will oversee all administrative aspects of running the cattle farm. This will include bookkeeping, tax payments, and payroll of the staff.

- George Baird– Head Farmhand who will oversee the farming staff and day to day operations.

- Ben Brown– Assistant Farmhand who will assist George.

- Frank White– Distribution Manager who will oversee the packaging and distribution of all products.

Milestones:

Pleasant Hill Cattle Farm will have the following milestones complete in the next six months.

- 6/202X – Finalize purchase of farm land

- 7/202X – Purchase farm equipment, supplies and materials

- 8/202X – Finalize contracts for grocery store, chain, and restaurant clients

- 9/202X – Purchase initial set of cows

- 10/202X – Hire and train farm staff

- 11/202X – Pleasant Hill Cattle Farm begins farm operations

Financial Plan

Key revenue & costs.

Pleasant Hill Cattle Farm’s revenues will come from the sales of cattle meat and dairy products to its customers. The major costs for the company will be the cost of land and equipment. The staff will earn competitive salaries allowing Pleasant Hill Cattle Farm to hire experienced workers. In the initial years, the company’s marketing spend will be high, as it establishes itself in the market.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of Cows: 300

- Average Revenue per Animal: $500

- Number of Products Sold Per Year: 100,000

Financial Projections

Income statement, balance sheet, cash flow statement, cattle farming business plan faqs, what is a cattle farming business plan.

A cattle farming business plan is a plan to start and/or grow your cattle farming business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Cattle Farming business plan using our Cattle Farming Business Plan Template here .

What are the Main Types of Cattle Farming Businesses?

There are a number of different kinds of cattle farming businesses , some examples include: Cow-calf, Backgrounding, Finishing, and Specific Breed.

How Do You Get Funding for Your Cattle Farming Business Plan?

Cattle Farming businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Cattle Farming Business?

Starting a cattle farming business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Cattle Farming Business Plan - The first step in starting a business is to create a detailed cattle farming business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your cattle farming business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your cattle farming business is in compliance with local laws.

3. Register Your Cattle Farming Business - Once you have chosen a legal structure, the next step is to register your cattle farming business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your cattle farming business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Cattle Farming Equipment & Supplies - In order to start your cattle farming business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your cattle farming business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful cattle farming business:

- How to Start a Cattle Farm Business

We earn commissions if you shop through the links below. Read more

Cattle Farm

Back to All Business Ideas

How to Start a Cattle Farm

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on May 18, 2022 Updated on April 26, 2024

Investment range

$296,550-$959,100

Revenue potential

$208,000 - $520,000 p.a.

Time to build

6 -12 months

Profit potential

$62,000 - $156,000 p.a.

Industry trend

Many people find the idea of farm life alluring – wide open spaces and a slower pace, quality time with animals, and hard work that ultimately produces good food. Cattle farming is a massive and essential US industry; the beef and dairy farm markets are worth about $120 billion and experiencing steady growth.

You could start your own cattle farm and help people get the food that they need while making good money. It will require hard work and a sizable investment, but there are many government programs available to help farmers get started.

You’ll also need to learn some serious business skills. Luckily, this step-by-step guide has you covered, with all the entrepreneurial insight you need to launch a successful cattle farm.

Looking to register your business? A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple.

Form your business immediately using ZenBusiness LLC formation service or hire one of the Best LLC Services .

Step 1: Decide if the Business Is Right for You

Pros and cons.

Starting a cattle farm has pros and cons to consider before deciding if it’s right for you.

- Rewarding – Provide essential foods

- High Demand – Most Americans consume beef and dairy products

- Pleasant Lifestyle – Slow down with life on the farm

- High Startup Costs – Starting a cattle farm from scratch takes $$$

- Hard Labor – Farm work is not an office job!

Cattle farm industry trends

Industry size and growth.

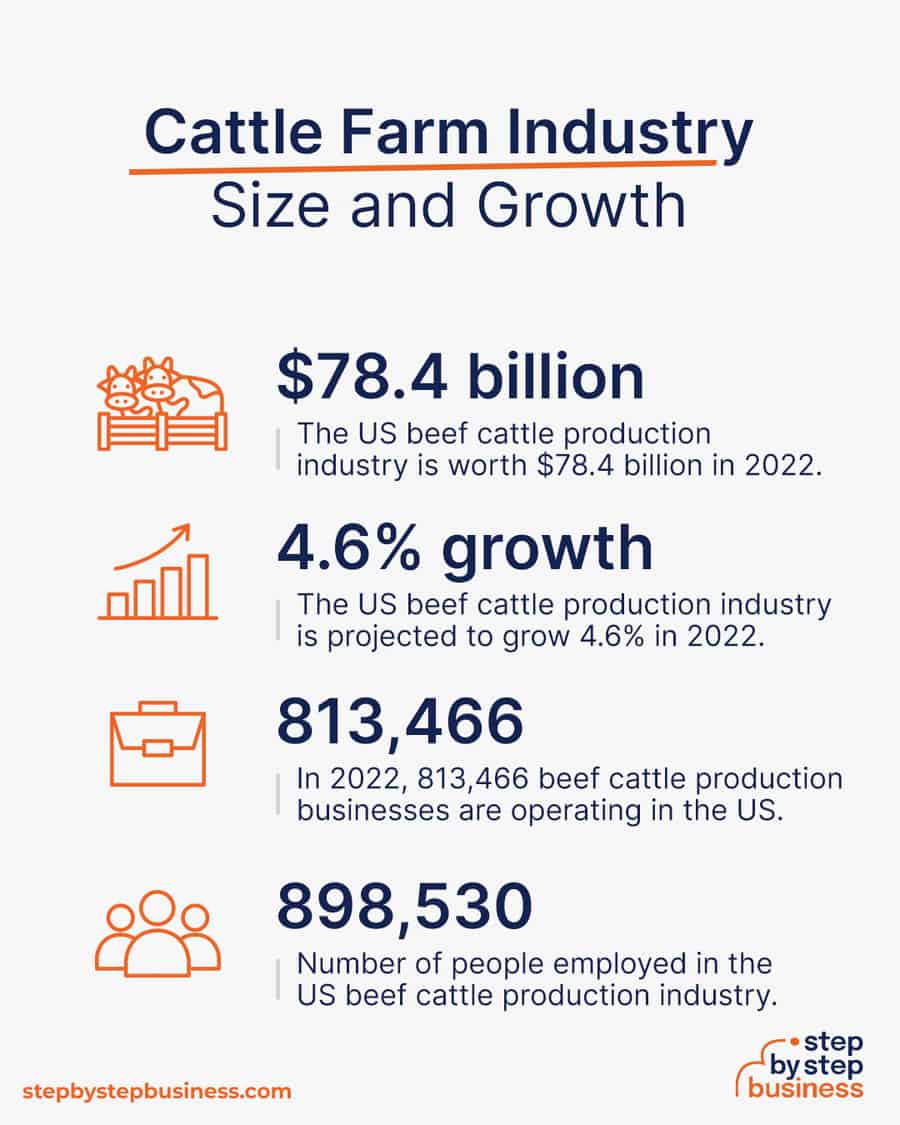

- Industry size and past growth – The US beef cattle production industry is worth $78.4 billion in 2022 after expanding 0.6% annually the last five years.(( https://www.ibisworld.com/industry-statistics/market-size/beef-cattle-production-united-states/ ))

- Growth forecast – The US beef cattle production industry is projected to grow 4.6% in 2022.

- Number of businesses – In 2022, 813,466 beef cattle production businesses are operating in the US.(( https://www.ibisworld.com/industry-statistics/number-of-businesses/beef-cattle-production-united-states/ ))

- Number of people employed – in 2022, the US beef cattle production industry employs 898,530 people.(( https://www.ibisworld.com/industry-statistics/employment/beef-cattle-production-united-states/ ))

Trends and challenges

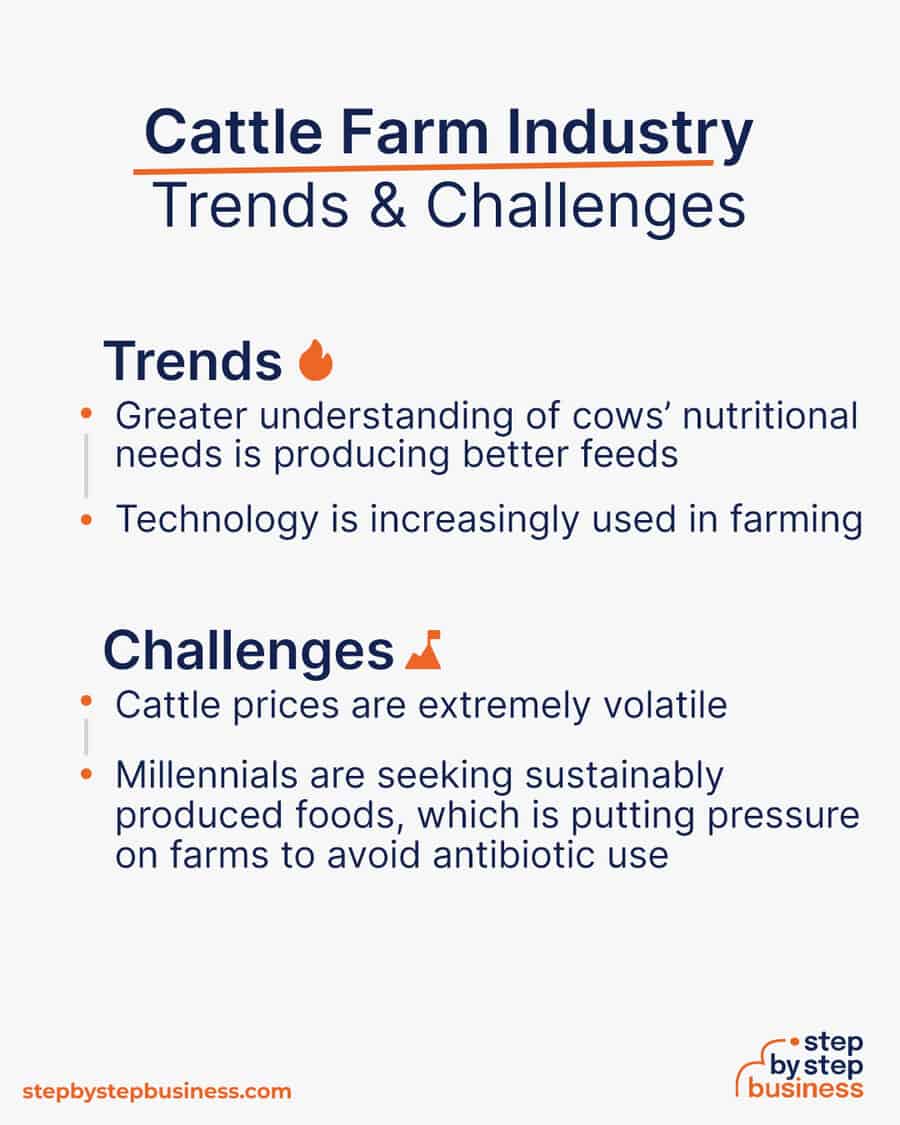

Trends in the cattle farm industry include:

- Greater understanding of cows’ nutritional needs is producing better feeds, which in turn means better yields.

- Technology is increasingly used in farming, including robotics for feeding and even herder bots. Drones are also being used to track and monitor herds.

Challenges in the cattle farm industry include:

- Cattle prices are extremely volatile and income can be unpredictable.

- Millennials are seeking sustainably-produced foods, which is putting pressure on cattle farms to avoid antibiotic use and growth promoters.

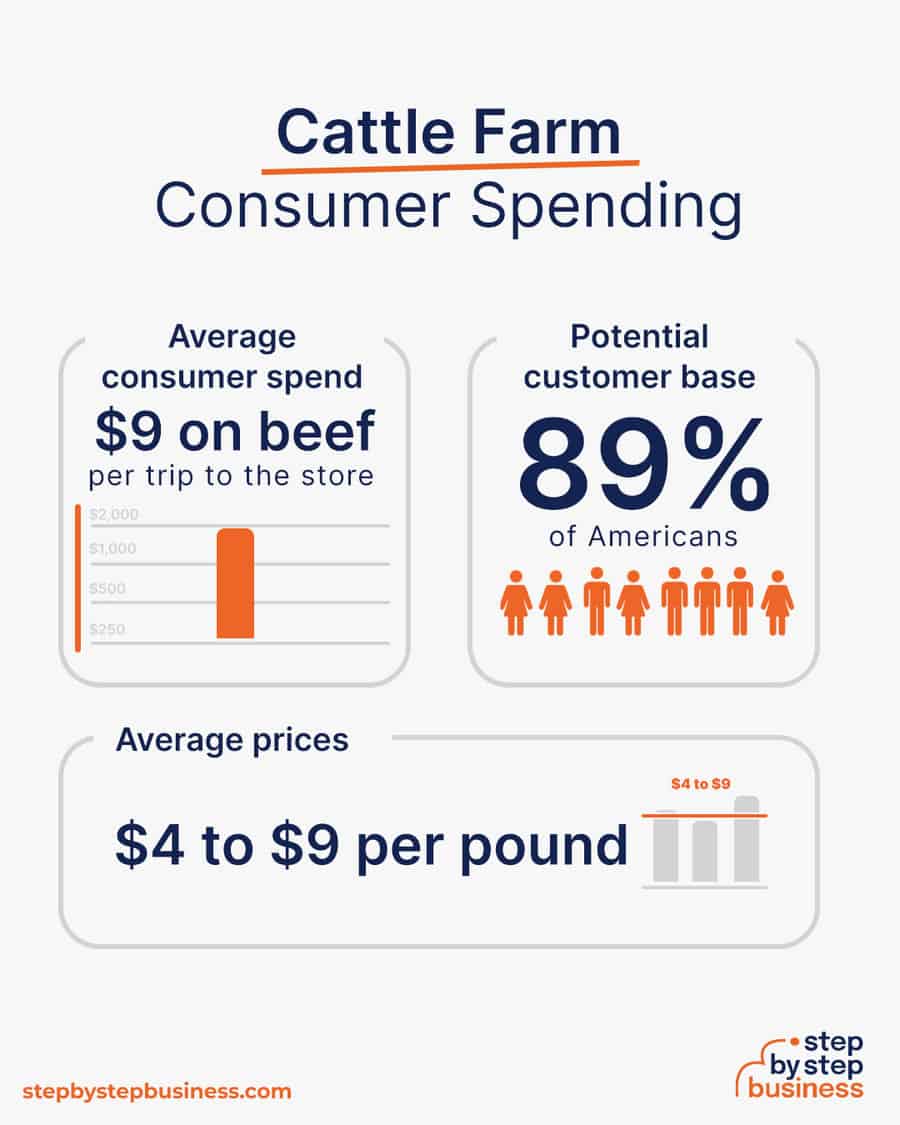

Consumer spending

- Average consumer spend – The average consumer in the U.S. spends over $9 on beef per trip to the grocery store.(( https://www.statista.com/statistics/1086365/household-expenditure-on-meat-products-us/ ))

- Potential customer base – 89% of people in the US consume meat.(( https://www.ipsos.com/en-us/news-polls/nearly-nine-ten-americans-consume-meat-part-their-diet ))

- Average prices – Beef prices range from $4 to $9 per pound.(( https://www.bls.gov/regions/mid-atlantic/data/averageretailfoodandenergyprices_usandmidwest_table.htm ))

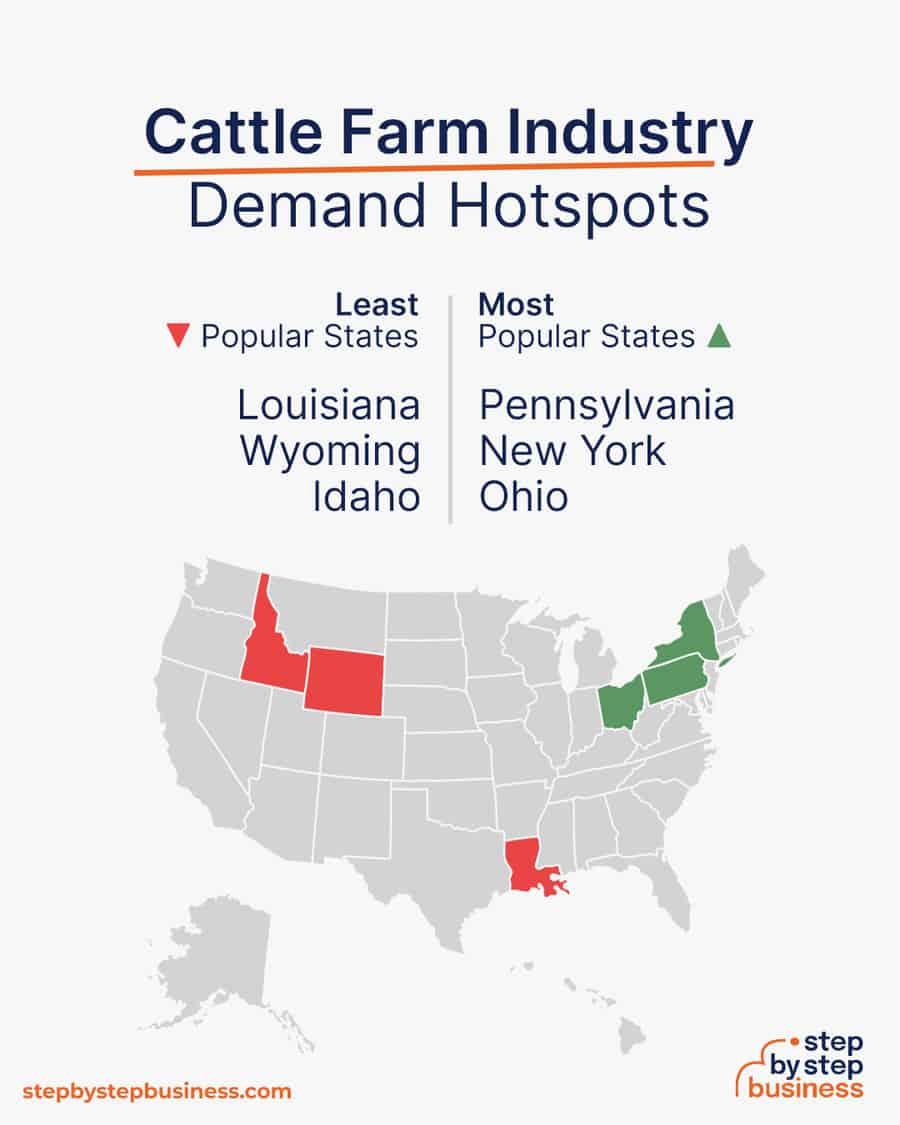

Demand hotspots

- Most popular states – The most popular states for farmers are Pennsylvania, New York, and Ohio. (( https://www.zippia.com/farmer-jobs/best-states/ ))

- Least popular states – The least popular states for farmers are Louisiana, Wyoming, and Idaho.

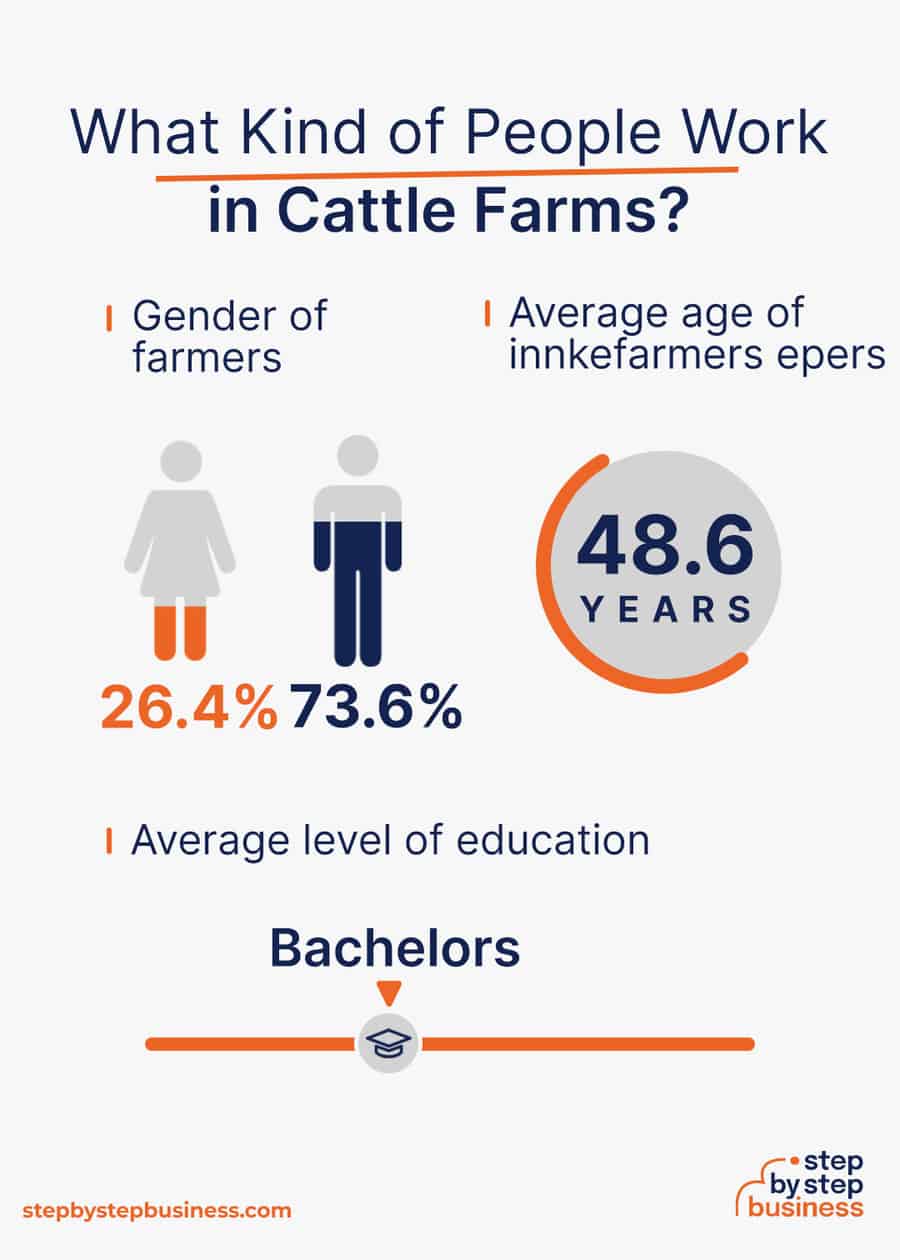

What kind of people work in cattle farms?

- Gender – 26.4% of farmers are female, while 73.6% are male. (( https://www.zippia.com/farmer-jobs/demographics/ ))

- Average level of education – The average farmer has a bachelor’s degree.

- Average age – The average farmer in the US is 48.6 years old.

How much does it cost to start a cattle farm?

Startup costs for a cattle farm range from $300,000 to $1 million. Costs include the land, land preparation, equipment, starter cattle, and an initial operating budget.

To learn cattle farming, you can get an associate’s or bachelor’s degree in agriculture. You can also get an online agribusiness degree from established institutions like Penn State . Another option is to work as an intern or volunteer for a local cattle farmer to learn the business.

You’ll need a handful of items to successfully launch your cattle farm business, including:

- Watering system

- Cattle health care equipment

- Cattle handling equipment

- Cattle trailers

How much can you earn from a cattle farm business?

You should be able to bring in $2,000 per cow once they’ve reached full maturity. It will take a year or two to get your calves to that point, so you won’t see a profit for at least 12 months. Your profit margin after all expenses should be about 30%.

In your first year or two after cows reach their ideal weight, you could sell two cows per week, bringing in $208,000 in annual revenue. This would mean $62,000 in profit, assuming that 30% margin. As your herd grows, sales could climb to five cows per week. With annual revenue of $520,000, you’d make a healthy profit of $156,000.

What barriers to entry are there?

There are a few barriers to entry for a cattle farm. Your biggest challenges will be:

- The high startup costs of starting a farm from scratch

- Learning the skills necessary to succeed

Related Business Ideas

How to Start a Farm

How to Start a Fish Farming Business

How to Start a Mushroom Farm

Step 2: hone your idea.

Now that you know what’s involved in starting a cattle farm, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research cattle farms in your area to examine their products/services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing an organic dairy farm or a sustainable, grass-fed beef farm.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as black Angus cows or longhorn cows, or fully organic and chemical-free beef and dairy.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Define cattle types and methods for raising them

You’ll just need to decide what types of cattle you want to raise. You could raise dairy cows, or you can raise cows for beef. You could raise them with chemicals and growth hormones or go fully organic and sustainable. You could also raise other livestock like chickens and pigs for additional revenue.

How much should you charge for cattle?

Prices for cows are very volatile, so it will depend on the market at any given time. Cows are sold by their total weight. They are currently being sold for about $130 per 100 pounds. You should aim for a profit margin after operating expenses of about 30%.

Once you know your costs, you can use our profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

Your target market will be food production companies, butchers, grocery stores, and restaurants. You can find those business owners and connect with them on LinkedIn, but your best bet is to find them on Google or Yelp and call them directly.

Where? Choose your cattle farm location

Selecting the right location for your cattle farm is essential for its success. Look for a spot with abundant pastureland, access to clean water, and good drainage. Consider accessibility and convenience, ensuring that the location is easily reachable by transportation vehicles and has easy access to veterinary services and other supplies.

Additionally, assess the local regulations and zoning laws to ensure compliance and obtain any necessary permits. By strategically choosing the right location, you can establish a thriving and profitable cattle farm that produces high-quality meat and dairy products.

Step 3: Brainstorm a Cattle Farm Name

Your business name is your business identity, so choose one that encapsulates your objectives, services, and mission in just a few words. You probably want a name that’s short and easy to remember, since much of your business, and your initial business in particular, will come from word-of-mouth referrals.

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “cattle farm” or “Grade-A beef”, boosts SEO

- Name should allow for expansion, for ex: “Legacy Cattle Farms” over “Wagyu Beef Producers”

- Avoid location-based names that might hinder future expansion

Discover over 250 unique cattle farm name ideas here . If you want your business name to include specific keywords, you can also use our cattle farm business name generator. Just type in a few keywords and hit “generate” and you’ll have dozens of suggestions at your fingertips.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Cattle Farm Business Plan

Every business needs a plan. This will function as a guidebook to take your startup through the launch process and maintain focus on your key goals. A business plan also enables potential partners and investors to better understand your company and its vision:

- Executive Summary: Brief summary outlining the core elements of the cattle farm business, including its objectives, target market, and financial projections.

- Business Overview: Comprehensive introduction to the cattle farm, encompassing its mission, vision, and key operational details such as location and scale.

- Product and Services: Details on the specific types of cattle to be raised, breeding practices, and any additional services offered, such as consulting or educational programs.

- Market Analysis: Examination of the demand for beef products, consumer trends, and potential challenges and opportunities within the local and broader market.

- Competitive Analysis: Assessment of other cattle farms in the region, highlighting strengths, weaknesses, and distinctive features to identify the farm’s competitive edge.

- Sales and Marketing: Strategies for promoting the cattle farm, reaching target customers, and maximizing sales, including online presence, advertising, and promotional activities.

- Management Team: Profiles of key individuals responsible for running the cattle farm, outlining their expertise and roles in ensuring effective business operations.

- Operations Plan: Detailed plan outlining day-to-day activities involved in cattle farming, covering feeding, breeding, healthcare, and other essential processes.

- Financial Plan: Comprehensive financial projections, including startup costs, revenue forecasts, and break-even analysis, providing a clear picture of the business’s financial viability.

- Appendix: Supplementary materials, such as permits, licenses, and additional documentation supporting the information presented in the business plan.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to cattle farms.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your cattle farm will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC , which just need to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization , and answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number , or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

You can visit the USDA website to find various loan and grant programs for startup farms. That’s probably your best bet for financing, although bank loans may also be an option.

Step 8: Apply for Cattle Farm Business Licenses and Permits

Starting a cattle farm business requires obtaining a number of licenses and permits from local, state, and federal governments.

You should contact your state’s department of agriculture to find out if any specific cattle farm licenses or permits are required in your state.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account .

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your cattle farm business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as CattleMax , folio3 , or muddyboots , to manage your herds, quality, sales, and reports.

- Popular web-based accounting programs for smaller businesses include Quickbooks , Freshbooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using website builders . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are some powerful marketing strategies for your future business:

- Local SEO — Optimize your website to highlight sustainable cattle farming and ethical practices, boosting visibility in local search results. Regularly update your Google My Business and Yelp profiles to strengthen your local search presence.

- Professional Branding — Ensure all branding reflects your farm’s commitment to quality and ethical standards, from logo to packaging.

- Direct Outreach — Forge relationships with local butchers, restaurants, and farmers’ markets to secure a consistent demand for your products.

- Social Media Engagement — Use platforms like Facebook, Instagram, and LinkedIn to showcase your cattle rearing practices and farm life.

- Farm Life Blog — Publish engaging content about daily operations and sustainable farming techniques.

- Educational Content — Produce videos and infographics to educate on the benefits of grass-fed beef and sustainable practices.

- Farm Tours and Events — Invite the public to tour your farm, enhancing transparency and customer trust.

- Direct Sales Model — Offer beef directly to consumers through sales or subscription services to build loyalty.

- Referral Programs — Encourage word-of-mouth marketing with a referral program rewarding loyal customers.

- Targeted Advertising — Place ads in local and regional publications that align with your target demographics.

- Email Personalization — Segment your email list to provide tailored updates and promotions to different customer groups.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that sets it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your cattle farm meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your cattle farm could be:

- 100% grass-fed, sustainably-raised beef

- The best Angus beef you’ve ever tasted

- Top quality free-range veal, from our home to yours

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a cattle farm business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in cattle farms for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in cattle farms. You’ll probably generate new customers or find companies with which you could establish a partnership.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a cattle farm business include:

- Farm Hands – assist with farm chores

- Farm Manager – herd management, accounting

- Marketing Lead – SEO strategies, social media

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Run a Cattle Farm – Start Making Money!

If you’ve always dreamed of farm life, your dream can become a reality. You can join an important and thriving industry, make a good living, and provide quality foods to growing families. It will take time, diligence, and a significant investment, but if you have a passion for farming and for producing good food, you can build a lucrative cattle operation.

You’ve got a good understanding of the business now, so it’s time to put on your work boots, roll up your sleeves, and launch your successful cattle farm.

- Cattle Farm Business FAQs

Yes, a cattle farm can be profitable. It will take time to start making money since you have to wait until the cattle get to their ideal weight to sell them, but after a few years, you should be turning a nice profit.

Prices for cows are very volatile, so it will depend on the market at any given time. Cows are sold by their total weight, with the price set per 100 pounds.

Kansas , Oklahoma , and Texas are good states for cattle farming because they have a solid infrastructure to support farmers. Land in those states is also inexpensive.

Montana, Oklahoma, and Wyoming have the cheapest farmland prices. South Dakota and North Dakota are also affordable.

You can’t start a cattle farm with no money. Costs are at least $300,000. However, the USDA can help you access financial resources, and they offer other support services to help beginning farmers.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Decide if the Business Is Right for You

- Hone Your Idea

- Brainstorm a Cattle Farm Name

- Create a Cattle Farm Business Plan

- Register Your Business

- Register for Taxes

- Fund your Business

- Apply for Cattle Farm Business Licenses and Permits

- Open a Business Bank Account

- Get Business Insurance

- Prepare to Launch

- Build Your Team

- Run a Cattle Farm - Start Making Money!

Subscribe to Our Newsletter

Featured resources.

57 Best Service Business Ideas

David Lepeska

Published on December 1, 2022

The services sector is undoubtedly the biggest economic sector in the US as it accounts for nearly 70% of the country’s gross domestic product. It ...

19 Profitable Agriculture Business Ideas

Published on November 4, 2022

Many young people today think it’s not cool to go into agriculture so they shy away from anything related to farms. Well, they’re missing a lot. ...

18 Pet Business Ideas for Animal Lovers

Esther Strauss

Published on July 14, 2022

Americans are spending more on pet care and products as the pet humanization trend, which treats pets as family members, takes root. Annually, anown ...

No thanks, I don't want to stay up to date on industry trends and news.

How to write a business plan for a cattle farm?

Are you an aspiring cattle farmer looking to start up a business, or an existing one looking to expand and become more profitable? If so, then writing a business plan for your cattle farm is essential.

A well-crafted business plan can help you identify potential opportunities and risks associated with running a cattle farm, as well as guide you on how best to manage the operations of the farm.

In this in-depth guide, we’ll explore why it’s important to write a business plan for your cattle farm, what information is required to create one, what should be included in the document itself, and which tools are available that can make the process easier.

Let’s get started!

In this guide:

Why write a business plan for a cattle farm?

- Information needed to create a business plan for a cattle farm

- What goes into your cattle farm financial forecast?

- The written part of a cattle farm business plan

- What tool should I use to write my cattle farm business plan?

To draw up a roadmap

A business plan for a cattle farm helps you define your objectives and set goals for the next 3-5 years, which can be incredibly useful for achieving success in the long run.

The writing process of a business plan requires careful consideration of all aspects of running your cattle farm, from financial management to sales & marketing strategies and operational procedures.

Having these clear objectives laid out ahead of time will help ensure that your cattle farming venture runs smoothly and achieves its desired outcomes.

To compare financials and track progress

One of the main benefits of writing a business plan for a cattle farm is to be able to regularly compare your actual financial performance against what you planned in your forecast, and make adjustments where needed.

This enables you to maintain visibility on your future cash flows and make informed decisions about investments to grow your farm.

To secure funding

If you want to receive capital from investors or banks, you must have a comprehensive cattle farm business plan.

Financiers will be looking closely at your venture's growth prospects, profitability, and cash flow to estimate the possible returns on their investment.

Now that you know why it’s important to write a business plan for a cattle farm, let's look at the information needed to create one.

Create your cattle farm business plan online!

Think your cattle farm could be profitable? Find out how with a business plan!

What information is needed to create a business plan for a cattle farm?

Carrying out market research for a cattle farm.

Conducting market research is an essential step before creating a business plan for a cattle farm. Market research can help you to estimate revenues and provide insights into potential areas of growth or decline.

When you embark on market research of your cattle business, you seek to answer the following questions:

- Is the cattle industry growing?

- What segments (processed milk products, beef processing and packaging, breeding services, and cowhide sale) of the market are most attractive?

- Who is the competition?

- How long does it take from calving to sales?

- What is the best time for breeding?

- What are sales and profit margins like?

- What are the major trends in the cattle industry? For example, consumers are more interested in organic-bred cattle than those bred using hormones, steroids, and antibiotics.

This information will help you create and communicate in your business plan the strategies that will give your farm the best chance for success.

Developing the marketing plan for a cattle farm

Creating a sales & marketing plan for your cattle farm is the next step.

Having a concrete action plan in place will be necessary to create an accurate budget for sales and marketing expenses in your business plan, and to ensure that you have sufficient resources to deliver your sales forecast.

The staffing and equipment needs of a cattle farm

Before starting a cattle farm business plan, it is also key to take into consideration the investments and recruitment plan.

This will ensure that all necessary costs are accounted for and that sufficient capital is available to launch or grow the venture.

Some of the costs you must be aware of includes:

- Land purchase

- Fencing the land

- Land preparation

- Water source or supplies

- Tools and equipment costs

- Cattle shelter

- Cattle purchases

- Licenses and permits

Once you have gathered all the necessary information to create the business plan for your cattle farm, it is time to start building the financial forecast.

What goes in the financial forecast for a cattle farm?

The financial forecast of a cattle farm’s business plan will include important information like the Profit and Loss (P&L) statement, balance sheet, cash flow statement, and sources and uses table.

Let’s have a look at each table in a bit more detail.

The projected P&L statement

The projected P&L statement of a cattle farm business plan shows how much revenues it is expected to generate, how sales will evolve and how profitable it can be in the future.

The projected balance sheet of your cattle farm

The balance sheet of a cattle farm is an essential financial statement that provides a snapshot of the farm’s financial position at any given time.

It records the assets, liabilities, and equity of the farm and serves as a valuable tool for owners, investors, and lenders to understand the overall financial health of the venture.

Assets are what a business owns and uses to make money. Examples of assets for a cattle farm include:

- Machinery and equipment

Liabilities on the other hand are what the business owes, they include things like:

- Accounts payable (money owed to suppliers)

- Tax payables

When total liabilities are deducted from total assets, what is left is the owner’s equity which represents the net worth of the business for the owners.

The projected cash flow statement

A projected cash flow statement for a cattle farm is a financial document that shows how much cash the farm will generate and spend in the future.

All transactions that involve the inflow and outflow of cash from a business are recorded in the cash flow statement.

This statement makes it easy for financiers to understand how much money your business produces (or will produce) and how much cash it will need for smooth operations.

The initial financing plan

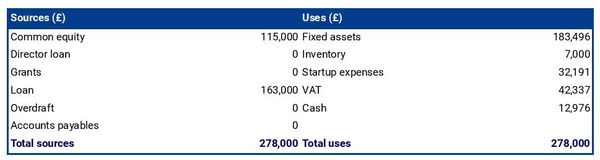

An initial financing plan is important when writing a cattle farm business plan. It is also called sources and uses table.

This table helps you figure out how much money you will need to start your farm, where it will come from, and what it will be used for.

Having this information all in one place makes it easier to plan your finances and prepare for the future of your business.

A solid financial forecast is the foundation for any successful cattle farm business plan. But to understand how relevant this financial data is, it's essential to provide context within the written part of the plan.

What goes in the written part of a cattle farm business plan?

The written part of a cattle farm business plan consists of 7 main sections:

The executive summary

The presentation of the company, the products and services section, the market analysis, the strategy section, the operations section, the financial plan.

The executive summary section of your cattle farm’s business plan should be a one-page (two-page maximum) summary presented in such a way that will convince investors and banks to read the rest of the plan.

The executive summary of your cattle farm business plan should begin with an overview of the farm itself, including key points such as the purpose of the business, its legal structure, its management team, and any pertinent information about the geographic area in which it operates.

After this should come a quick market overview highlighting who the farm sells to and who it competes with.

Then you should include key financials such as forecasted sales, growth, and profit, as well as expected cash flow projections and capital requirements.

This section of your business plan should include details about the ownership and legal structure of your cattle farm, your farm’s location, and information about the management team.

When writing about the legal structure, you should include information about the legal entity that owns the farm, such as whether it is a sole proprietorship, limited liability company, partnership, or other type of legal ownership.

You should also list the shareholders (people with a stake in the business) and the percentage of ownership each one holds.

The location section should provide an overview of the geographical area where the farm is located, with information about nearby cities and towns, access to major roads and highways, availability of water sources, climate considerations, and any other factors that could influence the success of the farm.

Then you should continue with the presentation of the management team which provides an in-depth look at who is running the farm’s day-to-day operations, including information about each individual's experience, education, and qualifications for their specific roles on the farm.

When writing the products and services section of your business plan for a cattle farm, it is important to clearly describe what breed of cattle (lisrace lumberjack, bos taurus, Angus cattle, etc.) you will raise and any other related services or products that you may offer.

This should include information about the size and quality of the herd, as well as any specialized breeds or special care practices used in raising them.

It is also important to outline any additional sources of income such as selling hay, feed, or providing agricultural consulting services.

Additionally, outlining plans for expansion into new markets could help convince investors that this is an enterprise with growth potential.

When presenting the conclusion of your market analysis in your cattle farm business plan, you should touch on demographic and segmentation information, your target market and competitors, and details about any barriers to entry and relevant regulations that you must comply with.

The demographic and segmentation section should include information about the different customer segments on the market and their purchasing habits for each of the main categories of products and services.

The target market section then zooms in on the segments you intend to serve and why your products and services match what customers are looking for.

Then you should explain who your main competitors are, and how your products and services compare to theirs.

You should also consider any potential barriers that can impede entry into the market (such as a limited availability of farm land for example) and relevant regulations that must be adhered to for compliance purposes.

In the strategy section of your cattle farm's business plan, you should explain your competitive advantage, price strategy, marketing plan, milestones, and risks and mitigants.

To demonstrate the financial viability of your farm, you must be able to clearly explain what your competitive advantage is - i.e. how you intend to compete in an already crowded marketplace.

In addition, you should include details of your pricing strategy and show that it is profitable for you and attractive for customers.

Then comes your sales and marketing plan which outlines how you will reach your target markets, followed by any important and realistic milestones which are achievable within specified time frames.

Finally, you must detail any potential risks associated with your farm and possible solutions or mitigations for these risks.

The operations section of your cattle business plan should provide an overview of the functions and activities of your cattle farm.

It should cover information such as the staffing team, roles of staff members, recruitment plan, operating hours, key assets, and intellectual property needed to operate the farm.

A cattle farm may have the following type of staff on its payroll:

- Farm manager

- Slaughterer

- Veterinarian

For example, if you plan on hiring a veterinary technician or farm manager, explain their experience requirements and how they will contribute to the operation of your business.

You should also include your schedule and operating hours to give investors an idea of what a typical business day for your farm looks like, as well as information on the main assets and intellectual property that the business requires to operate.